Green Microfinance and Women’s Empowerment: Why Does Financial Literacy Matter?

Abstract

1. Introduction

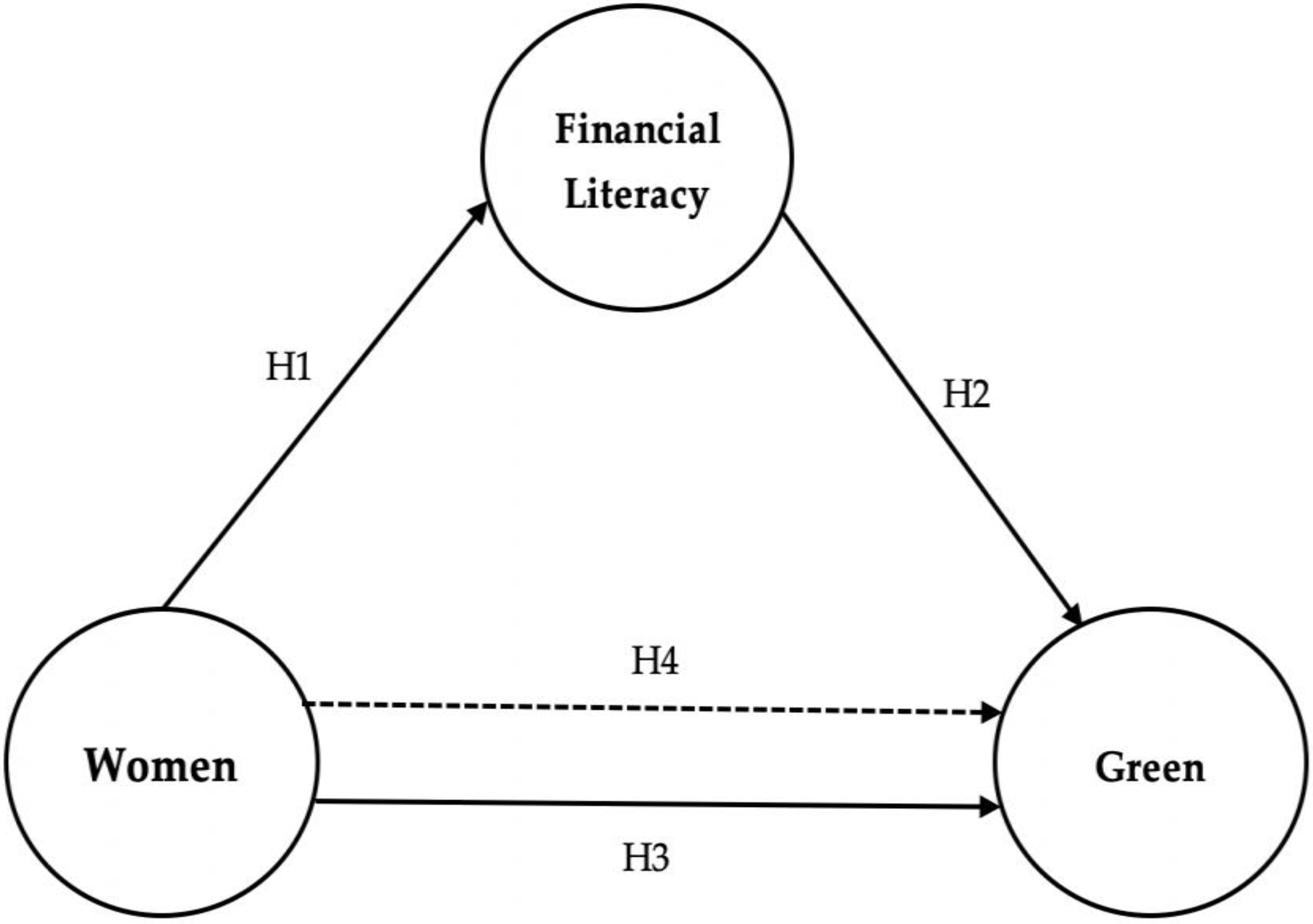

2. Literature Review and Hypothesis Development

2.1. Women’s Empowerment and Financial Literacy

2.2. Financial Literacy and Green Microfinance

2.3. Women’s Empowerment and Green Microfinance

2.4. Women’s Empowerment, Green Microfinance, and Financial Literacy

3. Methods

4. Results

5. Discussion

6. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Atahau, A.D.R.; Huruta, A.D.; Lee, C.-W. Rural microfinance sustainability: Does local wisdom driven—Governance work? J. Clean. Prod. 2020, 267, 22153. [Google Scholar] [CrossRef]

- Atahau, A.D.R.; Sakti, I.M.; Huruta, A.D.; Kim, M.-S. Gender and renewable energy integration: The mediating role of green-microfinance. J. Clean. Prod. 2021, 318, 128536. [Google Scholar] [CrossRef]

- Yunus, M. Poverty alleviation: Is economics any help? Lessons from the Grameen Bank experience. J. Int. Aff. 1998, 52, 47–65. [Google Scholar]

- Yunus, M. Banker to the Poor: Micro-Lending and the Battle against World Poverty; PublicAffairs: New York, NY, USA, 1999. [Google Scholar]

- Yunus, M. The grameen bank. Sci. Am. 1999, 281, 114–119. [Google Scholar] [CrossRef]

- García-Pérez, I.; Muñoz-Torres, M.J.; Fernández-Izquierdo, M.Á. Microfinance literature: A sustainability level perspective survey. J. Clean. Prod. 2017, 142, 3382–3395. [Google Scholar] [CrossRef]

- García-Pérez, I.; Muñoz-Torres, M.J.; Fernández-Izquierdo, M.Á. Microfinance institutions fostering sustainable development. Sustain. Dev. 2018, 26, 606–619. [Google Scholar] [CrossRef]

- García-Pérez, I.; Fernández-Izquierdo, M.Á.; Muñoz-Torres, M.J. Microfinance institutions fostering sustainable development by region. Sustainability 2020, 12, 2682. [Google Scholar] [CrossRef]

- Lindahl, P.; Mokvist, L. Accessing Microfinance Through Financial Literacy: A Case Study of Hand in Hand Eastern Africa’s Operations in Kenya. Master’s Thesis, Umeå University, Umeå, Sweden, 2020. [Google Scholar]

- Marini, L.; Andrew, J.; van der Laan, S. Accountability practices in microfinance: Cultural translation and the role of intermediaries. Acc. Audit. Account. J. 2018, 31, 1904–1931. [Google Scholar] [CrossRef]

- Nawaz, F. Microfinance, financial literacy, and household power configuration in rural Bangladesh: An empirical study on some credit borrowers. Voluntas 2015, 26, 1100–1121. [Google Scholar] [CrossRef]

- Rahman, S.; Junankar, P.N.; Mallik, G. Factors influencing women’s empowerment on microcredit borrowers: A case study in Bangladesh. J. Asia Pac. Econ. 2009, 14, 287–303. [Google Scholar] [CrossRef]

- Rahman, M.M.; Khanam, R.; Nghiem, S. The effects of microfinance on women’s empowerment: New evidence from Bangladesh. Int. J. Soc. Econ. 2018, 44, 1745–1757. [Google Scholar] [CrossRef]

- Shakti, S. Why Financial Literacy Matters. Available online: https://www.pyxeraglobal.org/financial-literacy-matters/ (accessed on 19 January 2022).

- Marek, H. Should Access to Credit Be a Right? Universite Libre de Bruxelles: Brussels, Belgium, 2007. [Google Scholar]

- Khavul, S.; Bruton, G.D.; Wood, E. Informal family business in Africa. Entrep. Theory Pract. 2009, 33, 1219–1238. [Google Scholar] [CrossRef]

- Boehe, D.M.; Cruz, L.B. Gender and microfinance performance: Why does the institutional context matter? World Dev. 2013, 47, 121–135. [Google Scholar] [CrossRef]

- Garikipati, S. Microcredit and women’s empowerment: Through the lens of time-use data from rural India. Dev. Chang. 2012, 43, 719–750. [Google Scholar] [CrossRef]

- Khandker, S.R. Microfinance and poverty: Evidence using panel data from Bangladesh. World Bank Econ. Rev. 2005, 19, 263–286. [Google Scholar] [CrossRef]

- Nawaz, N.; Jahanian, A.; Manzoor, S.W. Empowering women through microcredit: A case study of tameer. J. Econ. Sustain. Dev. 2012, 3, 17–25. [Google Scholar]

- Moser, R.M.B.; Gonzalez, L. Green microfinance: A new frontier. Rev. Adm. Empresas 2016, 56, 242–250. [Google Scholar] [CrossRef][Green Version]

- Akinsemolu, A.A.; Olukoya, O.A.P. The vulnerability of women to climate change in coastal regions of Nigeria: A case of the Ilaje community in Ondo State. J. Clean. Prod. 2020, 246, 119015. [Google Scholar] [CrossRef]

- Bucher-Koenen, T.; Alessie, R.; Lusardi, A.; van Roiij, M. Fearless Woman: Financial Literacy and Stock Market Participation; NBER Working Paper Series; NBER: Cambridge, MA, USA, 2021. [Google Scholar]

- Demirguc-Kunt, A.; Klapper, L.; Singer, D.; van Oudheusden, P. The Global Findex Database 2014: Measuring Financial Inclusion around the World; World Bank: Washington, DC, USA, 2015. [Google Scholar]

- Allgood, S.; Walstad, W.B. The effects of perceived and actual financial literacy on financial behaviors. Econ. Inq. 2016, 54, 675–697. [Google Scholar] [CrossRef]

- Haque, A.; Zulfiqar, M. Women’s economic empowerment through financial literacy, financial attitude and financial wellbeing. Int. J. Bus. Soc. Sci. 2016, 7, 78–88. [Google Scholar]

- Organisation for Economic Co-operation and Development. Women and Financial Literacy: OECD/INFE Evidence, Survey and Policy Responses; OECD: Paris, France, 2013.

- Soegiono, L.; Atahau, A.D.R.; Harijono, H.; Huruta, A.D. Local wisdom in rural microfinance: A descriptive study on villagers of East Sumba. Entrep. Sustain. Issues 2019, 6, 1485–1496. [Google Scholar] [CrossRef]

- German Sparkassenstiftung Role of Microfinance Institutions in Green Financing. Available online: https://sparkassenstiftung-easternafrica.org/media/detail/role-of-microfinance-institutions-in-green-financing-1039# (accessed on 20 January 2022).

- Microfinance Centre watch: Advancing Green Microfinance—Entering Green Finance Space by MFIs. Available online: https://mfc.org.pl/advancing-green-microfinance-entering-green-finance-space-by-mfis-join-us-for-the-webinar-on-2nd-march-2021/ (accessed on 21 January 2022).

- United Nations. The World’s Women 2015: Trends and Statistics; United Nations: New York, NY, USA, 2015. [Google Scholar]

- Agrawala, S.; Carraro, M. Assessing the Role of Microfinance in Fostering Adaptation to Climate Change; OECD: Paris, France, 2010.

- Hammill, A.; Matthew, R.; McCarter, E. Microfinance and climate change adaptation. IDS Bull. 2008, 39, 113–122. [Google Scholar] [CrossRef]

- Salman, A.; Nowacka, K. Innovative Financial Products and Services for Women in Asia and the Pacific; ADB Sustainable Development Working Paper Series; Asian Development Bank: Mandaluyong, Philippines, 2020. [Google Scholar]

- Wen, C.; Lovett, J.C.; Rianawati, E.; Arsanti, T.R.; Suryani, S.; Pandarangga, A.; Sagala, S. Household willingness to pay for improving electricity services in Sumba Island, Indonesia: A choice experiment under a multi-tier framework. Energy Res. Soc. Sci. 2022, 88, 102503. [Google Scholar] [CrossRef]

- Hair, J.F.; Hult, G.T.M.; Ringle, C.M.; Sarstedt, M. A Primer on Partial Least Squares Structural Equation Modeling (PLS-SEM), 2nd ed.; Sage: Thousand Oaks, CA, USA, 2017. [Google Scholar]

- Cohen, J. A power primer. Psychol. Bull. 1992, 112, 155–159. [Google Scholar] [CrossRef] [PubMed]

- Hayes, A.F. Introduction to Mediation, Moderation, and Conditional Process Analysis: A Regression-Based Approach, 1st ed.; Guilford Press: New York, NY, USA, 2013. [Google Scholar]

- MacKinnon, D.P.; Lockwood, C.M.; Brown, C.H.; Wang, W.; Hoffman, J.M. The intermediate endpoint effect in logistic and probit regression. Clin. Trials 2007, 4, 499–513. [Google Scholar] [CrossRef] [PubMed]

- Cronbach, L.J. Coefficient alpha and the internal structure of tests. Psychometrika 1951, 16, 297–334. [Google Scholar] [CrossRef]

- Dijkstra, T.K.; Henseler, J. Consistent partial least squares. MIS Quart. 2015, 39, 297–316. [Google Scholar] [CrossRef]

- Werts, C.E.; Linn, R.L.; Jöreskog, K.G. Intraclass reliability estimates: Testing structural assumptions. Educ. Psychol. Meas. 1974, 34, 25–33. [Google Scholar] [CrossRef]

- Fornell, C.; Larcker, D.F. Evaluating structural equation models with unobservable variables and measurement error. J. Mark. Res. 1981, 18, 39–50. [Google Scholar] [CrossRef]

- Henseler, J.; Ringle, C.M.; Sarstedt, M. A new criterion for assessing discriminant validity in variance-based structural equation modeling. J. Acad. Mark. Sci. 2015, 43, 115–135. [Google Scholar] [CrossRef]

- Cifci, I. Testing self-congruity theory in Bektashi faith destinations: The roles of memorable tourism experience and destination attachment. J. Vacat. Mark. 2022, 28, 3–19. [Google Scholar] [CrossRef]

- Ali, F.; Ryu, K.; Hussain, K. Influence of experiences on memories, satisfaction and behavioral intentions: A study of creative tourism. J. Travel Tour. Mark. 2016, 33, 85–100. [Google Scholar] [CrossRef]

- Dahal, A.; Krisjanti, M.N. Effect of individual entrepreneurship orientation on export intention in micro and small enterprises: The moderating role of access to finance. Ekonoski Vjesn. 2021, 34, 87–99. [Google Scholar] [CrossRef]

- Preacher, K.J.; Hayes, A.F. SPSS and SAS procedures for estimating indirect effects in simple mediation models. Behav. Res. Methods Instr. Comput. 2004, 36, 717–731. [Google Scholar]

- Barrios, L.M.; Prowse, A.; Vargas, V.R. Sustainable development and women’s leadership: A participatory exploration of capabilities in Colombian Caribbean fisher communities. J. Clean. Prod. 2020, 264, 121277. [Google Scholar] [CrossRef]

- Chirambo, D. Enhancing climate change resilience through microfinance: Redefining the climate finance paradigm to promote inclusive growth in Africa. J. Dev. Soc. 2017, 33, 150–173. [Google Scholar] [CrossRef]

- Soeriadiredja, P. Tatanan Hidup Orang Sumba (Studi Etnografis di Sumba Timur); Universitas Udayana: Denpasar, Indonesia, 2016. [Google Scholar]

- Djohan, D.; Machairas, I.; Iswarani, W.P.; van Lienden, K. MDP Project: Water, Sanitation and Hygiene in East Sumba; Delft University of Technology: Delft, The Netherlands, 2019. [Google Scholar]

- Chhabra, D.; Healy, R.; Sills, E. Staged authenticity and heritage tourism. Ann. Tour. Res. 2003, 30, 702–719. [Google Scholar] [CrossRef]

| Component | Code | Indicators |

|---|---|---|

| Women | Women1 | Women’s economic engagement in MFIs increases as their financial literacy improves. |

| Women2 | After gaining adequate financial literacy, women play an important part in MFI decision-making. | |

| Women3 | The members of MFIs who have good financial literacy can earn more money. | |

| Women4 | Increased financial participation by women due to improved financial knowledge can help MFIs grow. | |

| Women5 | MFIs’ financial capability can be increased by increasing the income of their female members. | |

| Literacy | Literacy1 | My business will be benefitted by a low-interest loan. |

| Literacy2 | It is necessary to set up funds for unplanned expenses. | |

| Literacy3 | Purchasing life insurance will protect you from the risk of accidents and other disasters. | |

| Literacy4 | The debit side records incoming funds, while the credit side records outgoing funds. | |

| Literacy5 | Making a financial budget is important for determining funding priorities. | |

| Literacy6 | Saving money in a variety of assets reduces the risk of losing money. | |

| Green | Green1 | MFIs offer soft loans for eco-friendly businesses. |

| Green2 | Live pharmacy is encouraged by MFIs. | |

| Green3 | MFI members follow the principle of affordability by performing tasks efficiently. | |

| Green4 | MFIs help to reduce grassland and forest fires. | |

| Green5 | In MFIs, utensils are used repeatedly. | |

| Green6 | MFIs have a recycling policy. |

| No. | Demographic Factor | Frequency | % |

|---|---|---|---|

| 1 | Gender | ||

| Female | 71 | 100.0 | |

| 2 | Age | ||

| 21–25 years old | 15 | 21.1 | |

| 26–30 years old | 6 | 8.5 | |

| 31–35 years old | 13 | 18.3 | |

| 36–40 years old | 7 | 9.9 | |

| >40 years old | 30 | 42.3 | |

| 3 | Education | ||

| No education | 24 | 33.8 | |

| Elementary school | 16 | 22.5 | |

| Junior high school | 12 | 16.9 | |

| Senior high school | 17 | 23.9 | |

| Bachelor | 2 | 2.8 | |

| 4 | Occupation | ||

| Teacher | 1 | 1.4 | |

| Housewife | 25 | 35.2 | |

| Entrepreneur | 3 | 4.2 | |

| Farmer | 42 | 59.2 | |

| 5 | Monthly income | ||

| <US$200 | - | - | |

| ≥US$200–500 | 68 | 95.8 | |

| >US$500 | 3 | 4.2 |

| Component | AVE | CR | CA | rho_A | Reflective Model | Outer Loadings |

|---|---|---|---|---|---|---|

| Women’s Empowerment | 0.613 | 0.885 | 0.835 | 0.868 | Women1 ← Women | 0.878 |

| Women2 ← Women | 0.881 | |||||

| Women3 ← Women | 0.867 | |||||

| Women4 ← Women | 0.670 | |||||

| Women5 ← Women | 0.566 | |||||

| Green Microfinance | 0.630 | 0.909 | 0.879 | 0.906 | Green1 ← Green | 0.727 |

| Green2 ← Green | 0.662 | |||||

| Green3 ← Green | 0.655 | |||||

| Green4 ← Green | 0.882 | |||||

| Green5 ← Green | 0.904 | |||||

| Green6 ← Green | 0.890 | |||||

| Financial Literacy | 0.519 | 0.864 | 0.833 | 0.895 | Literacy1 ← Literacy | 0.799 |

| Literacy2 ← Literacy | 0.855 | |||||

| Literacy3 ← Literacy | 0.695 | |||||

| Literacy4 ← Literacy | 0.628 | |||||

| Literacy5 ← Literacy | 0.708 | |||||

| Literacy6 ← Literacy | 0.604 |

| HTMT | Original Sample | Bias | 2.5% | 97.5% |

|---|---|---|---|---|

| Green → Literacy | 0.791 | 0.009 | 0.686 | 0.878 |

| Women → Literacy | 0.599 | 0.019 | 0.400 | 0.730 |

| Women → Green | 0.833 | −0.001 | 0.651 | 0.964 |

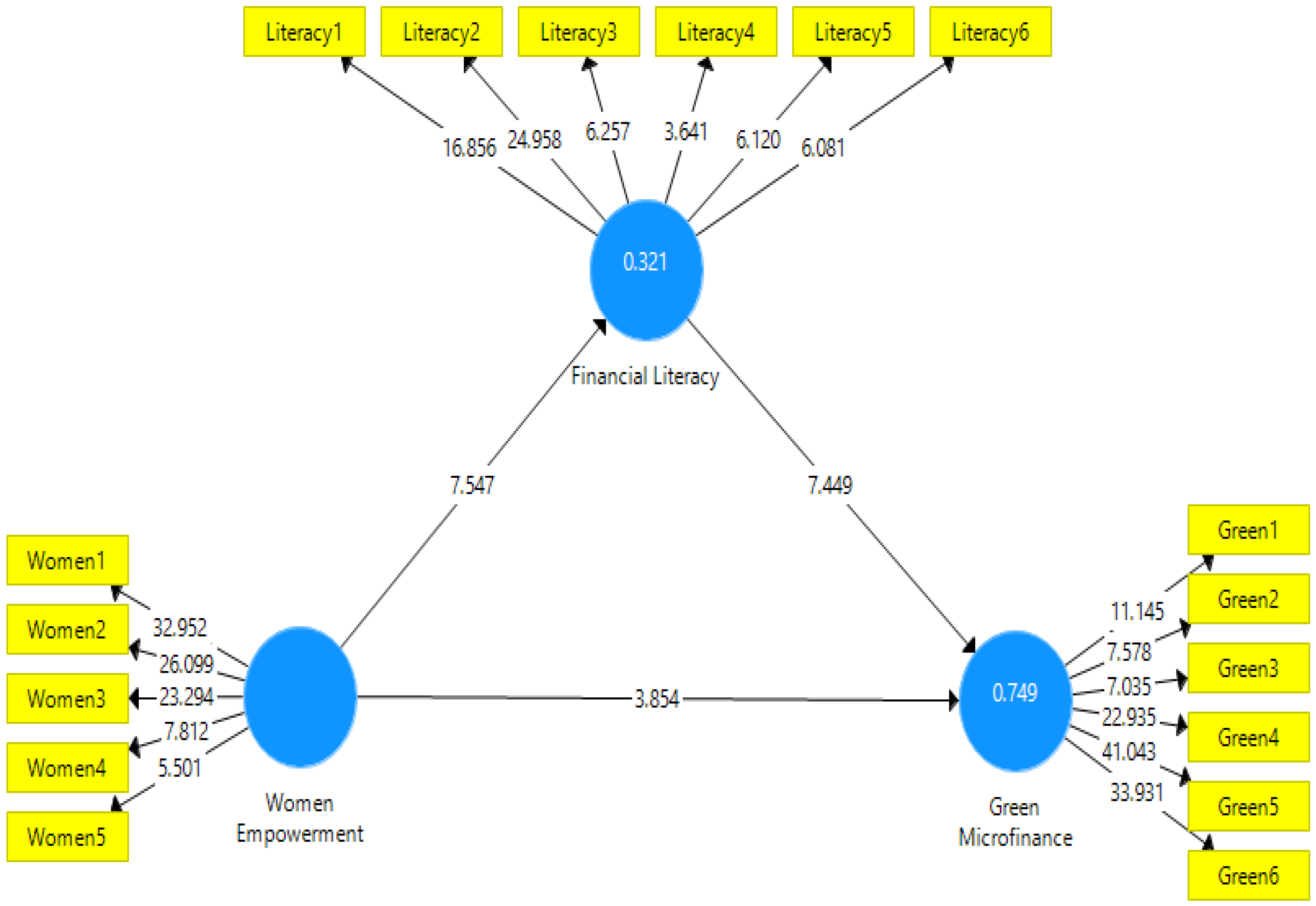

| Hypothesis | Effect | β | p-Value | Decision |

|---|---|---|---|---|

| 1 | Women → Literacy | 0.566 | 0.000 *** | H1 is supported |

| 2 | Literacy → Green | 0.604 | 0.000 *** | H2 is supported |

| 3 | Women → Green | 0.365 | 0.000 *** | H3 is supported |

| 4 | Women → Literacy → Green | 0.342 | 0.000 *** | H4 is supported |

| Mediation | Test statistic | Std. Error | p-value | Decision |

| Sobel test | 5.304 | 0.064 | 0.000 *** | Mediation is supported |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Lee, C.-W.; Huruta, A.D. Green Microfinance and Women’s Empowerment: Why Does Financial Literacy Matter? Sustainability 2022, 14, 3130. https://doi.org/10.3390/su14053130

Lee C-W, Huruta AD. Green Microfinance and Women’s Empowerment: Why Does Financial Literacy Matter? Sustainability. 2022; 14(5):3130. https://doi.org/10.3390/su14053130

Chicago/Turabian StyleLee, Cheng-Wen, and Andrian Dolfriandra Huruta. 2022. "Green Microfinance and Women’s Empowerment: Why Does Financial Literacy Matter?" Sustainability 14, no. 5: 3130. https://doi.org/10.3390/su14053130

APA StyleLee, C.-W., & Huruta, A. D. (2022). Green Microfinance and Women’s Empowerment: Why Does Financial Literacy Matter? Sustainability, 14(5), 3130. https://doi.org/10.3390/su14053130