The Cost Benefit Analysis of Commercial 100 MW Solar PV: The Plant Quaid-e-Azam Solar Power Pvt Ltd.

Abstract

:1. Introduction

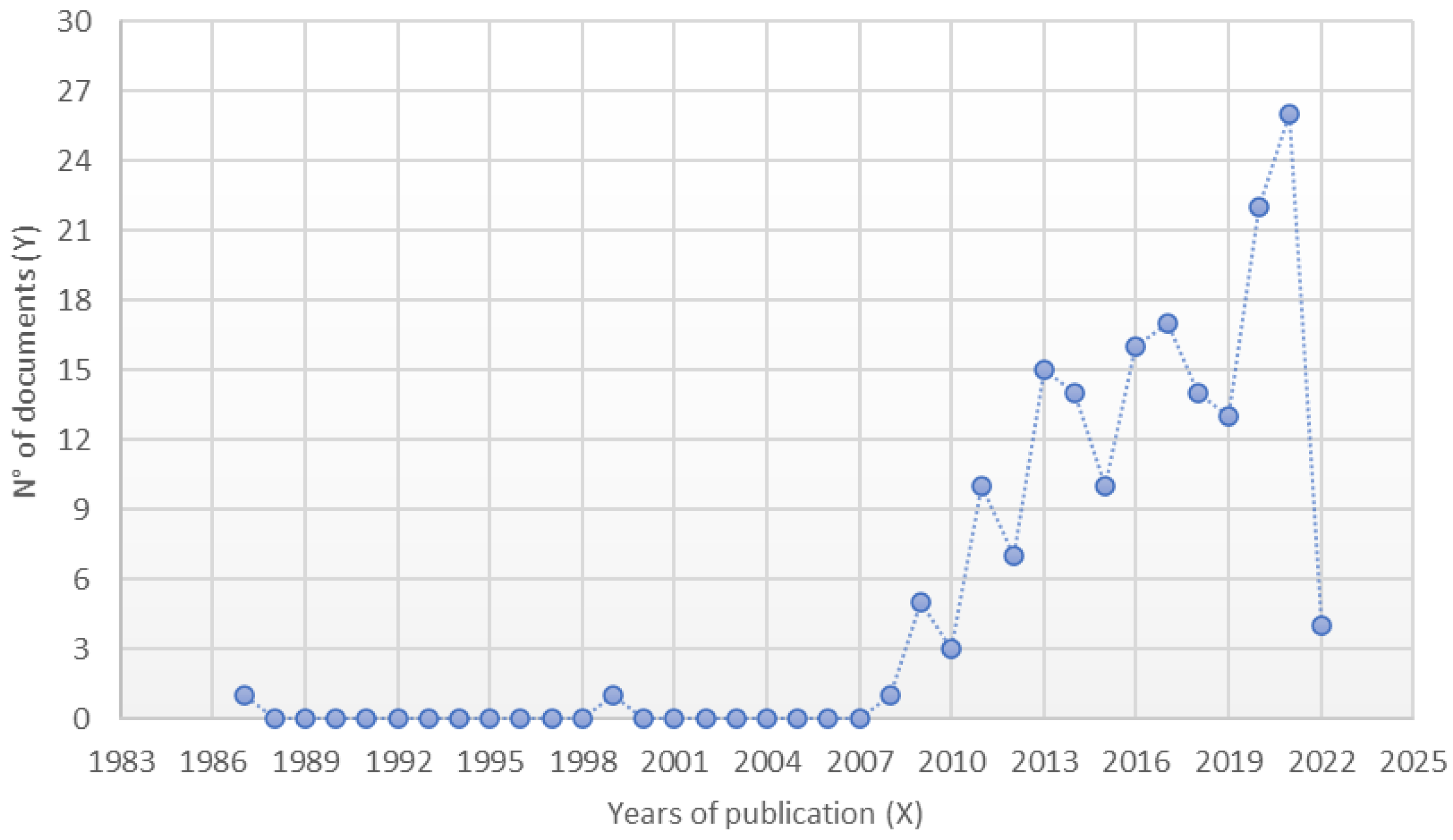

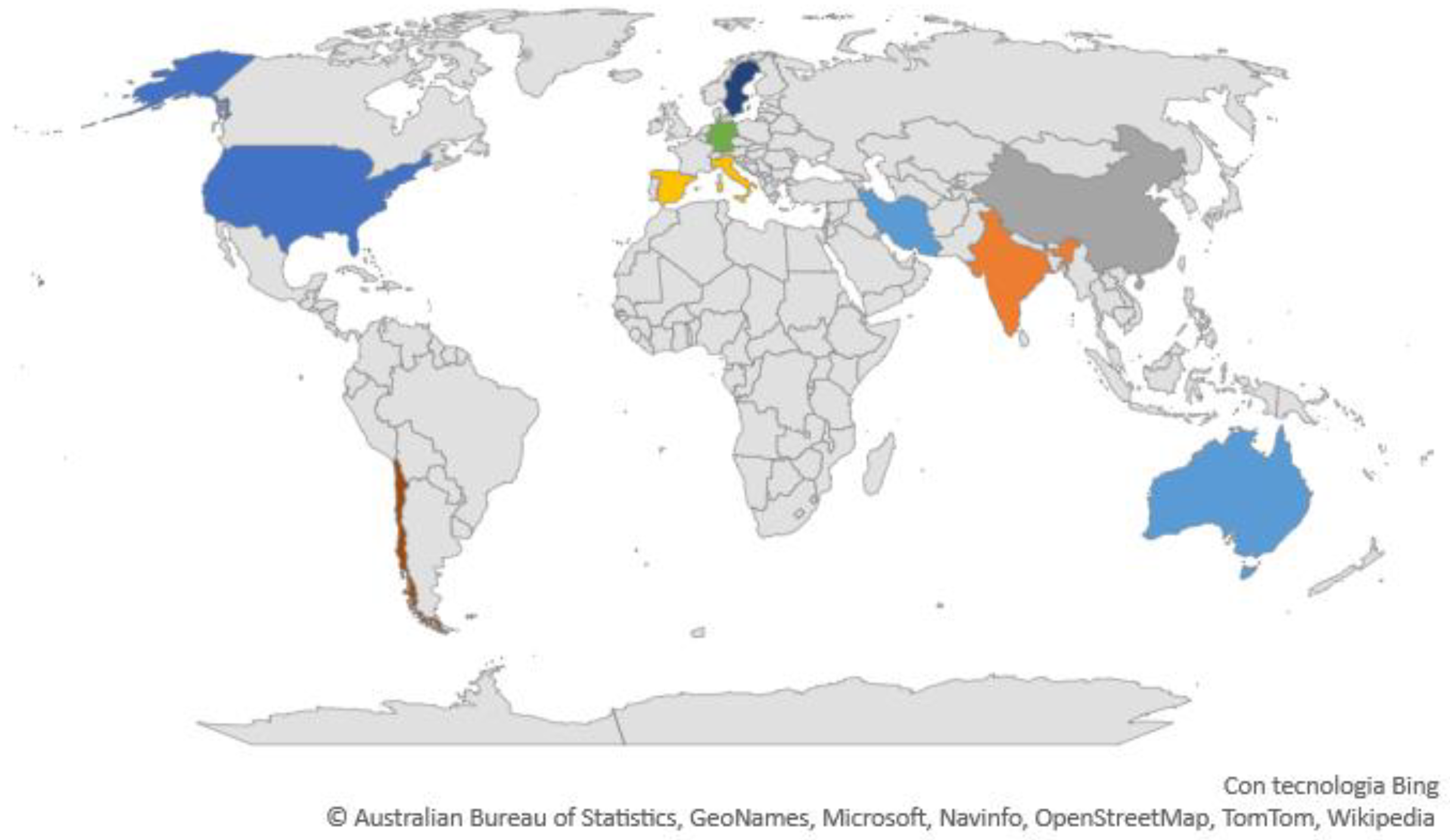

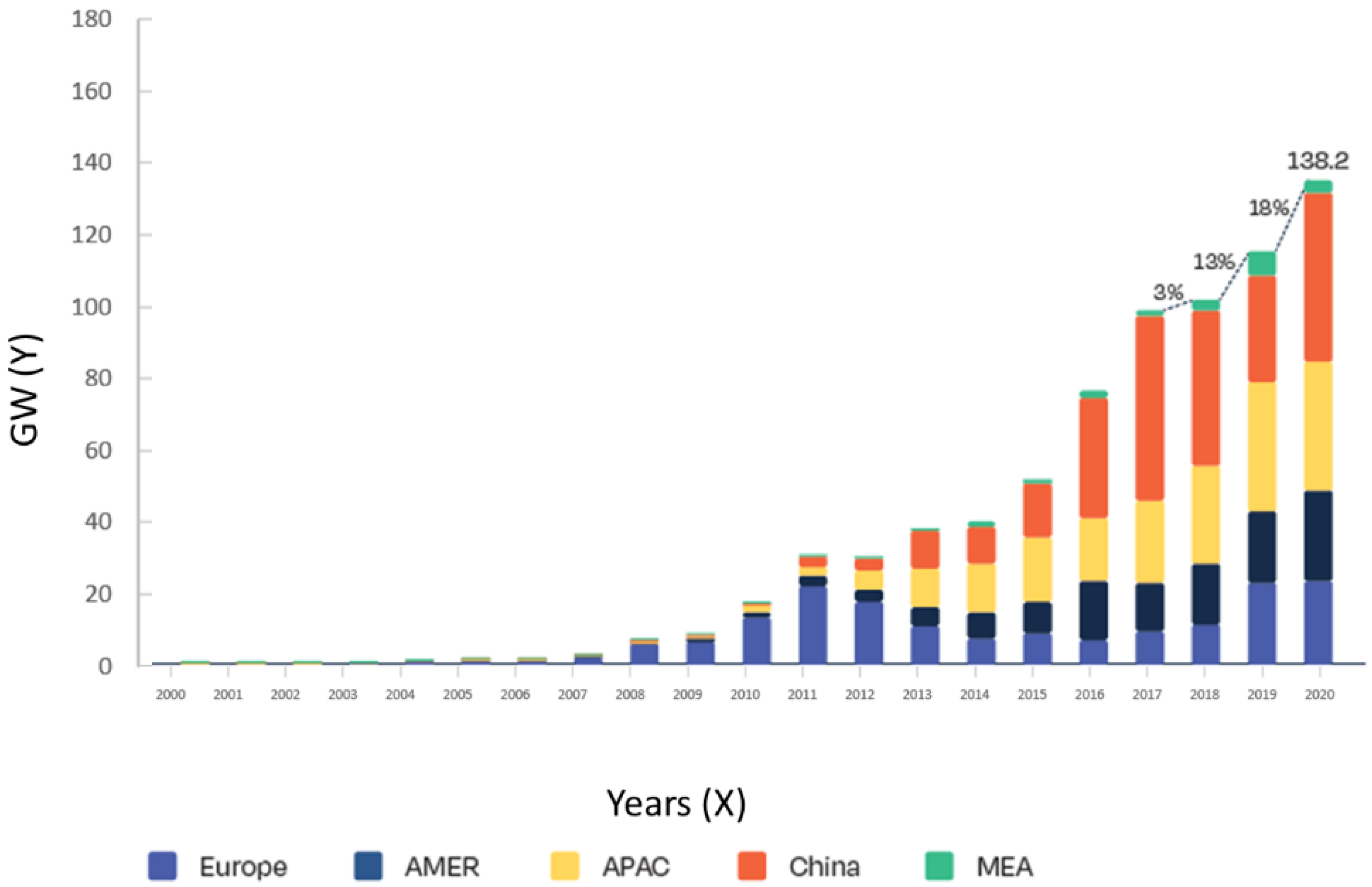

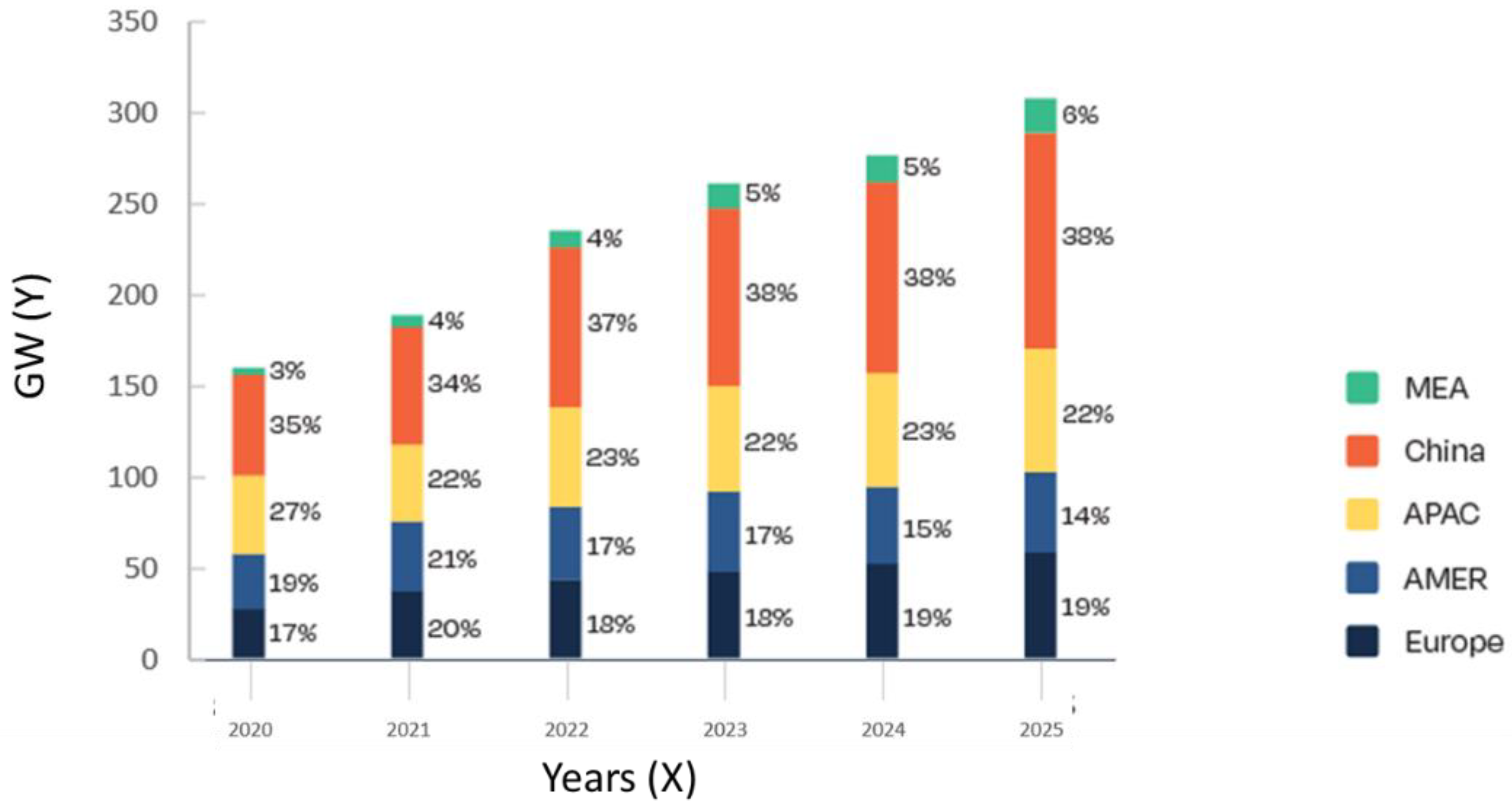

2. Literature Review

3. Materials and Methods

4. Results

5. Discussion

6. Directions for Further Research

7. Conclusions

- The installation of the 100 MW solar PV power plant for Bahawalpur is an example of decentralization of the power sector.

- A high potential for solar energy can help ameliorate the energy crisis in Pakistan and substantially decrease GHG emissions.

- QA Solar Power is a lucrative project established by the government aimed at a rated capacity of 1000 MW of which the first 100 MW QASP is running and supplying energy to the grid.

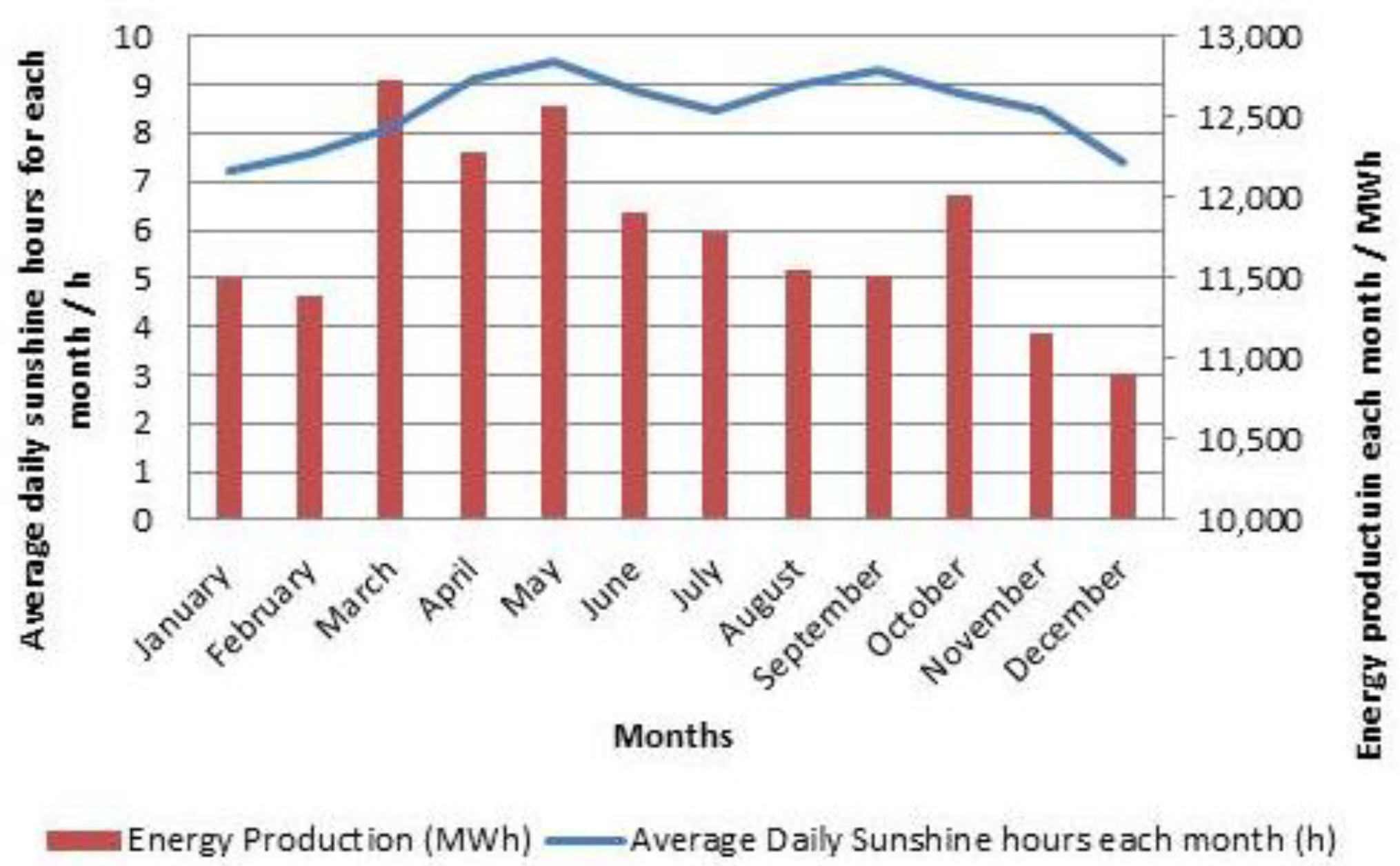

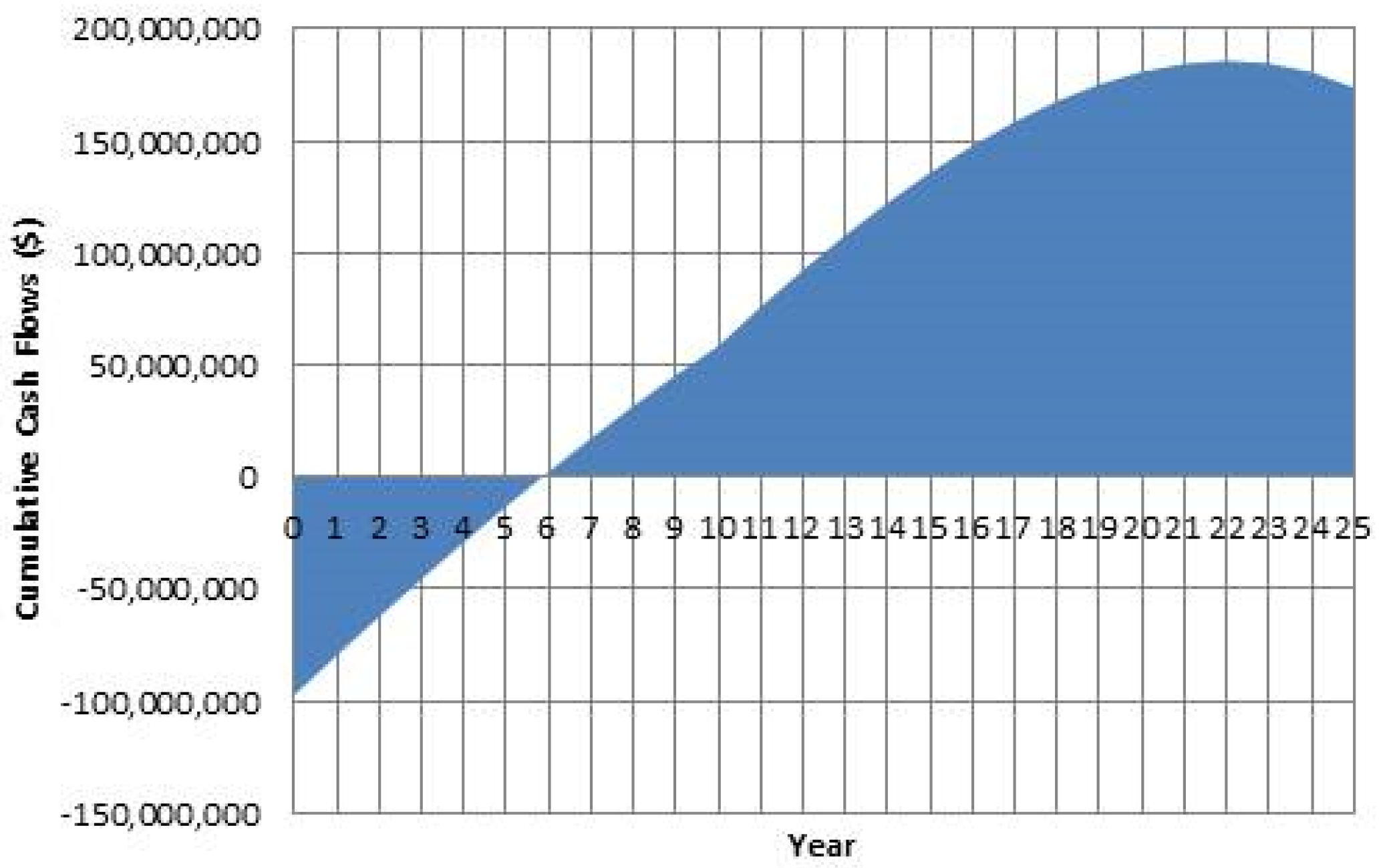

- Through RETScreen software, a cost benefit analysis of the project shows that it has a simple payback of 5.6 years and BCR of 1.33. This project will generate 141,306 MWh per year and prevent about 90,570t CO2 emissions. This high return shows that such a solar PV based projects can be very successful in Pakistan and can help the country to not only eliminate its energy issues but also strengthen its economy in the long run.

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- An, J.; Mikhaylov, A. Russian energy projects in South Africa. J. Energy S. Afr. 2020, 31, 58–64. [Google Scholar] [CrossRef]

- Khosa, A.A.; Rashid, T.-U.; Shah, N.-U.-H.; Usman, M.; Khalil, M.S. Performance analysis based on probabilistic modelling of Quaid-e-Azam Solar Park (QASP) Pakistan. Energy Strategy Rev. 2021, 29, 100479. [Google Scholar] [CrossRef]

- Sannikova, L. Legal Framework for Green Finance in the EU and Russia. Financ. J. 2021, 13, 29–43. [Google Scholar] [CrossRef]

- Kessides, I.N. Chaos in power: Pakistan’s electricity crisis. Energy Policy 2013, 55, 271–285. [Google Scholar] [CrossRef]

- Ahmad, U.; Khan, M.A. Energy Demand in Pakistan: A Disaggregate Analysis. Pak. Dev. Rev. 2008, 47, 437–455. [Google Scholar]

- Kazmi, H.; Mehmood, F.; Tao, Z.; Riaz, Z.; Driesen, J. “Electricity load-shedding in Pakistan: Unintended consequences, opportunities and policy recommendations. Energy Policy 2019, 128, 411–417. [Google Scholar] [CrossRef]

- Pasha, H.A.; Saleem, W. The Impact and Cost of Power Load Shedding to Domestic Consumers. Pak. Dev. Rev. 2013, 52, 355–373. [Google Scholar] [CrossRef] [Green Version]

- Sakrani, H.; Butt, T.T.; Hassan, M.; Hameed, S.; Amin, I. Implementation of load shedding apparatus for energy management in Pakistan. Commun. Comput. Inf. Sci. 2012, 281, 421–431. [Google Scholar]

- Awan, A.B.; Khan, Z.A. Recent progress in renewable energy—Remedy of energy crisis in Pakistan. Renew. Sustain. Energy Rev. 2014, 33, 236–253. [Google Scholar] [CrossRef]

- Irfan, M.; Zhao, Z.-Y.; Ahmad, M.; Mukeshimana, M. Solar Energy Development in Pakistan: Barriers and Policy Recommendations. Sustainability 2019, 11, 1206. [Google Scholar] [CrossRef] [Green Version]

- Mirza, U.K.; Maroto-Valer, M.M.; Ahmad, N. Status and outlook of solar energy use in Pakistan. Renew. Sustain. Energy Rev. 2003, 7, 501–514. [Google Scholar] [CrossRef]

- Pakistan to Unveil First Domestically Produced Solar Panels. Available online: https://www.saurenergy.com/solar-energy-news/pakistan-to-unveil-first-domestically-produced-solar-panels (accessed on 21 October 2021).

- Adnan, S.; Khan, A.H.; Haider, S.; Mahmood, R. Solar energy potential in Pakistan. J. Renew. Sustain. Energy 2012, 4, 032701. [Google Scholar] [CrossRef]

- Khan, S.; Shaikh, F.; Siddiqui, M.M.; Hussain, T.; Kumar, L.; Nahar, A. Hourly Forecasting of Solar Photovoltaic Power in Pakistan Using Recurrent Neural Networks. Int. J. Photoenergy 2022, 2022, 7015818. [Google Scholar] [CrossRef]

- Jamil, S.R.; Wang, L.; Tang, C.; Khan, H.M.S.; Che, D. The role and impact of costing method in the decision-making of energy project: A comparative assessment between levelized cost of energy and benefit-to-cost ratio analysis. Int. J. Energy Res. 2021, in press. [CrossRef]

- Kranina, E.I. China on the way to achieving carbon neutrality. Financ. J. 2021, 13, 51–61. [Google Scholar] [CrossRef]

- Luo, Y.; Wang, Z.; Zhu, J.; Lu, T.; Xiao, G.; Chu, F.; Wang, R. Multi-objective robust optimization of a solar power tower plant under uncertainty. Energy 2022, 238, 121716. [Google Scholar] [CrossRef]

- Europe Solar Power. SolarPower Europe, Global Market Outlook for Solar Power 2021–2025; Solar Power Europe: Brussels, Belgium, 2021. [Google Scholar]

- Ullah, I.; Rasul, M.G.; Sohail, A.; Islam, M.; Ibrar, M. Feasibility of a solar thermal power plant in Pakistan. In Thermal Power Plants—Advanced Applications; InTech: London, UK, 2013. [Google Scholar]

- Irfan, M.; Zhao, Z.Y.; Ahmad, M.; Rehman, A. A techno-economic analysis of off-grid solar PV system: A case study for Punjab Province in Pakistan. Processes 2019, 7, 708. [Google Scholar] [CrossRef] [Green Version]

- Xu, L.; Wang, Y.; Solangi, Y.A.; Zameer, H.; Shah, S.A.A. Off-grid solar PV power generation system in Sindh, Pakistan: A techno-economic feasibility analysis. Processes 2019, 7, 308. [Google Scholar] [CrossRef] [Green Version]

- Shah, S.A.A.; Valasai, G.D.; Memon, A.A.; Laghari, A.N.; Jalbani, N.B.; Strait, J.L. Techno-economic analysis of solar PV electricity supply to rural areas of Balochistan, Pakistan. Energies 2018, 11, 1777. [Google Scholar] [CrossRef] [Green Version]

- Sadiq, M. Solar water heating system for residential consumers of Islamabad, Pakistan: A cost benefit analysis. J. Clean. Prod. 2018, 172, 2443–2453. [Google Scholar] [CrossRef]

- Wazir, R.; Khan, Z.A.; Siddique, S. Techno-economic study for 50 MW wind farm in gawadar coastal city of Balochistan-Pakistan using ARIMA model and RETScreen. In Proceedings of the 17th IEEE International Multi Topic Conference: Collaborative and Sustainable Development of Technologies, Bahria University, Karachi Campus, Pakistan, 8–10 December 2014; pp. 417–421. [Google Scholar]

- Mehmood, A.; Shaikh, F.A.; Waqas, A. Modeling of the solar photovoltaic systems to fulfill the energy demand of the domestic sector of Pakistan using RETSCREEN software. In Proceedings of the 2014 International Conference and Utility Exhibition on Green Energy for Sustainable Development (ICUE), Pattaya, Thailand, 19–21 March 2014. [Google Scholar]

- Zandi, M.; Bahrami, M.; Eslami, S.; Gavagsaz-Ghoachani, R.; Payman, A.; Phattanasak, M.; Nahid-Mobarakeh, B.; Pierfederici, S. Evaluation and comparison of economic policies to increase distributed generation capacity in the Iranian household consumption sector using photovoltaic systems and RETScreen software. Renew. Energy 2017, 107, 215–222. [Google Scholar] [CrossRef]

- Vollaro, R.d.; Vollaro, E.d. Informing on Best Practices Using Design Builder and RET Screen to Calculate Energetic, Financial, and Environmental Impacts of Energy Systems for Buildings. Int. J. Adv. Res. Eng. 2018, 4, 11. [Google Scholar] [CrossRef]

- Yuce, M.I.; Yuce, S.; Yuce, I.M. Pre-feasibility Assessment of Small Hydropower Projects in Turkey by RETScreen. J. Am. Water Work. Assoc. 2016, 108, E269–E275. [Google Scholar] [CrossRef]

- Oxford Reference. Payback Period Method. Available online: https://www.oxfordreference.com/view/10.1093/oi/authority.20110803100311879 (accessed on 2 January 2022).

- Investopedia. How to Calculate Net Present Value (NPV) and Formula. Available online: https://www.investopedia.com/ask/answers/032615/what-formula-calculating-net-present-value-npv.asp (accessed on 31 January 2022).

- Reniers, G.; Talarico, L.; Paltrinieri, N. Cost-benefit analysis of safety measures. In Dynamic Risk Analysis in the Chemical and Petroleum Industry; Butterworth-Heinemann: Oxford, UK, 2016. [Google Scholar]

- RETScreen. Available online: https://www.nrcan.gc.ca/maps-tools-and-publications/tools/modelling-tools/retscreen/7465 (accessed on 2 January 2022).

- Ganoe, R.E.; Stackhouse, P.W.; Deyoung, R.J. RETScreen® Plus Software Tutorial; NASA: Hampton, VA, USA, 2014. [Google Scholar]

- Khan, H.A.; Iqbal, M. Feasibility Study Report 10 MW Solar PV Power Project in Quaid E Azam Solar Park. Available online: https://www.qasolar.com/annual-reports/ (accessed on 2 January 2022).

- Annual Report 2020–2021 100 MW Solar Power Plant Bahawalpur. 2020. Available online: https://qasolar.com/app/download/12897951699/Annual+Report+of+QASPL+2020.pdf?t=1631704346 (accessed on 2 January 2022).

- National Electric Power Regulatory Authority (NEPRA). Available online: https://nepra.org.pk/publications/Annual%20Reports/Annual%20Report%202020-21.pdf (accessed on 2 January 2022).

- Rahman, M.M.; Hasanuzzaman, M.; Rahim, N.A. Effects of various parameters on PV-module power and efficiency. Energy Convers. Manag. 2015, 103, 348–358. [Google Scholar] [CrossRef]

- Verma, S.; Mohapatra, S.; Chowdhury, S.; Dwivedi, G. Cooling techniques of the PV module: A review. Mater. Today Proc. 2020, 38, 253–258. [Google Scholar] [CrossRef]

- Li, C. Comparative performance analysis of grid-connected PV power systems with different PV technologies in the hot summer and cold winter zone. Int. J. Photoenergy 2018, 2018, 8307563. [Google Scholar] [CrossRef]

- Agyekum, E.B. Techno-economic comparative analysis of solar photovoltaic power systems with and without storage systems in three different climatic regions, Ghana. Sustain. Energy Technol. Assess. 2021, 43, 100906. [Google Scholar] [CrossRef]

- Comstock, O. Construction Costs for Most Power Plant Types Have Fallen in Recent Years. 2017. Available online: https://www.eia.gov/todayinenergy/detail.php?id=31912# (accessed on 2 January 2022).

- Castillo-Ramírez, A.; Mejía-Giraldo, D.; Muñoz-Galliano, N.; Castillo-Ramírez, A.; Mejía-Giraldo, D.; Muñoz-Galeano, N. Large-Scale Solar PV LCOE Comprehensive Breakdown Methodology. CTF Cienc. Tecnol. Futur. 2017, 7, 117–126. [Google Scholar] [CrossRef]

- Pillai, U. Drivers of cost reduction in solar photovoltaics. Energy Econ. 2015, 50, 286–293. [Google Scholar] [CrossRef]

- NREL. What Is the Energy Payback for PV? 2004. Available online: https://www.nrel.gov/docs/fy04osti/35489.pdf (accessed on 31 January 2022).

- Behi, B.; Baniasadi, A.; Arefi, A.; Gorjy, A.; Jennings, P.; Pivrikas, A. Cost-benefit analysis of a virtual power plant including solar PV, flow battery, heat pump, and demand management: A Western Australian case study. Energies 2020, 13, 2614. [Google Scholar] [CrossRef]

- Ortiz-Barrios, M.; Miranda-De la Hoz, C.; López-Meza, P.; Petrillo, A.; De Felice, F. A case of food supply chain management with AHP, DEMATEL, and TOPSIS. J. Multi-Criteria Decis. Anal. 2020, 27, 104–128. [Google Scholar] [CrossRef]

- Petrillo, A.; Carotenuto, P.; Baffo, I.; De Felice, F. A web-based multiple criteria decision support system for evaluation analysis of carpooling. Environ. Dev. Sustain. 2018, 20, 2321–2341. [Google Scholar] [CrossRef]

- Figueira, J.R.; Greco, S.; Roy, B. ELECTRE-SCORE: A first outranking based method for scoring actions. Eur. J. Oper. Res. 2022, 297, 986–1005. [Google Scholar] [CrossRef]

- Chai, Q.; Li, H.; Tian, W.; Zhang, Y. Critical Success Factors for Safety Program Implementation of Regeneration of Abandoned Industrial Building Projects in China: A Fuzzy DEMATEL Approach. Sustainability 2022, 14, 1550. [Google Scholar] [CrossRef]

- Serafim, O.; Gwo-Hshiung, T. The Compromise solution by MCDM methods: A comparative analysis of VIKOR and TOPSIS. Eur. J. Oper. Res. 2004, 156, 445–455. [Google Scholar]

- Hwang, C.L.; Lai, Y.J.; Liu, T.Y. A new approach for multiple objective decision making. Comput. Oper. Res. 1993, 20, 889–899. [Google Scholar] [CrossRef]

- Saaty, T.L. A scaling method for priorities in hierarchical structures. J. Math. Psychol. 1977, 15, 234–281. [Google Scholar] [CrossRef]

- Saaty, T.L. Applications of analytical hierarchies. Math. Comput. Simul. 1979, 21, 1–20. [Google Scholar] [CrossRef]

| Month | Air T °C | Rel. Humid% | Daily Solar Radiation n-Horizontal kWh/m2/Day | Atmosp. P | Wind Speed | Earth T °C | Heating Days °C-d | Cooling Days °C-d |

|---|---|---|---|---|---|---|---|---|

| January | 12.6 | 42.4 | 3.61 | 99.6 | 3.0 | 13.5 | 168 | 80 |

| February | 15.4 | 35.8 | 4.47 | 99.4 | 3.3 | 17.1 | 72 | 152 |

| March | 21.9 | 27.8 | 5.25 | 99.0 | 3.5 | 24.9 | 0 | 367 |

| April | 27.7 | 26.5 | 5.99 | 98.5 | 3.7 | 32.1 | 0 | 531 |

| May | 31.9 | 28.8 | 6.53 | 98.1 | 3.9 | 36.5 | 0 | 679 |

| June | 33.7 | 40.6 | 6.67 | 97.6 | 4.0 | 38.0 | 0 | 712 |

| July | 32.0 | 59.0 | 6.21 | 97.7 | 3.6 | 35.8 | 0 | 682 |

| August | 30.3 | 65.6 | 5.67 | 97.9 | 3.2 | 33.1 | 0 | 631 |

| September | 29.4 | 52.0 | 5.31 | 98.4 | 3.2 | 31.9 | 0 | 581 |

| October | 25.6 | 30.2 | 4.65 | 98.9 | 3.1 | 27.5 | 0 | 483 |

| November | 19.8 | 29.2 | 3.84 | 99.4 | 3.0 | 20.7 | 0 | 295 |

| December | 14.5 | 36.3 | 3.34 | 99.7 | 2.9 | 15.1 | 108 | 140 |

| Annual | 24.6 | 39.6 | 5.13 | 98.7 | 3.4 | 27.2 | 348 | 5333 |

| Equipment | Technical Specifications | ||

|---|---|---|---|

| Solar PV Module | Specifictaions | ||

| Total Capacity Solar Plant (MWp) | 100 | Model | JA Solar JAP(BK) 60/225/3BB |

| Quantity of Arrays | 9804 | Type | Polycrystalline |

| Quantity of Modules in a string | 20 | Rated Max. Power at STC | 255 W ± 5 W |

| Quantity of Modules | 400,000 | Module Efficiency | 15.59% |

| Quantity of Inverters | 100 | Class of Module | A |

| Quantity of DC Combiner Boxes | 1300 | Dimensions | 1650 × 991 × 40 mm |

| Quantity of 33 kV Box Type Transformers | 100 | Degradation Gradient | 0.7%/year |

| Quantity of 132 kV Transformers (1000 MVA each) | 2 | Warranty | 25 years linear power output |

| Inverter Specifications | Inverter Specifications | ||

| Manufacturer | TBEA | Model | TBEA-TC500KH |

| Input parameters | Output parameters | ||

| Rated DC Input Power | 618 KW | Rated AC Output Power | 500 kW |

| Max. DC Input Voltage | 1000 V | Max. AC Voltage Power | 600 kW |

| DC Voltage Range | 450–1000 V | Rated AC Voltage Range | 270-350 V |

| MPP Voltage Range | 500–820 V | Rated Grid Voltage | 315 V |

| Max. DC Current | 1236A | Rated Output Current | 916 A |

| 33 kV Transformer Specifications | 132 kV Transformer Specifications | ||

| Manufacturer | TBEA | Manufacturer | TBEA |

| Model | ZGS11-1000/33 | Model | SFZ-100,000/132 |

| Rating Power | 1000/(500-500) kVA | Rated Power | 100 MVA |

| Rated Voltage | 33.5/0/315 kV | Rated Voltage | 33/132 kV |

| Financial Viability Parameters | Value |

|---|---|

| IRR—Equity | 15.1% |

| IRR—Assets | 8.1% |

| Simple Payback | 5.6 years |

| Equity Payback | 5.8 years |

| Net Present Value (NPV) | $31,661,157 |

| Annual Life Savings | $3,488,049/year |

| Benefit-Cost Ratio (BCR) | 1.33 |

| Debt Services Coverage | 4.40 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Asad, M.; Mahmood, F.I.; Baffo, I.; Mauro, A.; Petrillo, A. The Cost Benefit Analysis of Commercial 100 MW Solar PV: The Plant Quaid-e-Azam Solar Power Pvt Ltd. Sustainability 2022, 14, 2895. https://doi.org/10.3390/su14052895

Asad M, Mahmood FI, Baffo I, Mauro A, Petrillo A. The Cost Benefit Analysis of Commercial 100 MW Solar PV: The Plant Quaid-e-Azam Solar Power Pvt Ltd. Sustainability. 2022; 14(5):2895. https://doi.org/10.3390/su14052895

Chicago/Turabian StyleAsad, Muhammad, Farrukh Ibne Mahmood, Ilaria Baffo, Alessandro Mauro, and Antonella Petrillo. 2022. "The Cost Benefit Analysis of Commercial 100 MW Solar PV: The Plant Quaid-e-Azam Solar Power Pvt Ltd." Sustainability 14, no. 5: 2895. https://doi.org/10.3390/su14052895

APA StyleAsad, M., Mahmood, F. I., Baffo, I., Mauro, A., & Petrillo, A. (2022). The Cost Benefit Analysis of Commercial 100 MW Solar PV: The Plant Quaid-e-Azam Solar Power Pvt Ltd. Sustainability, 14(5), 2895. https://doi.org/10.3390/su14052895