Assessing How Big Insurance Firms Report and Manage Carbon Emissions: A Case Study of Allianz

Abstract

:1. Introduction

2. Results

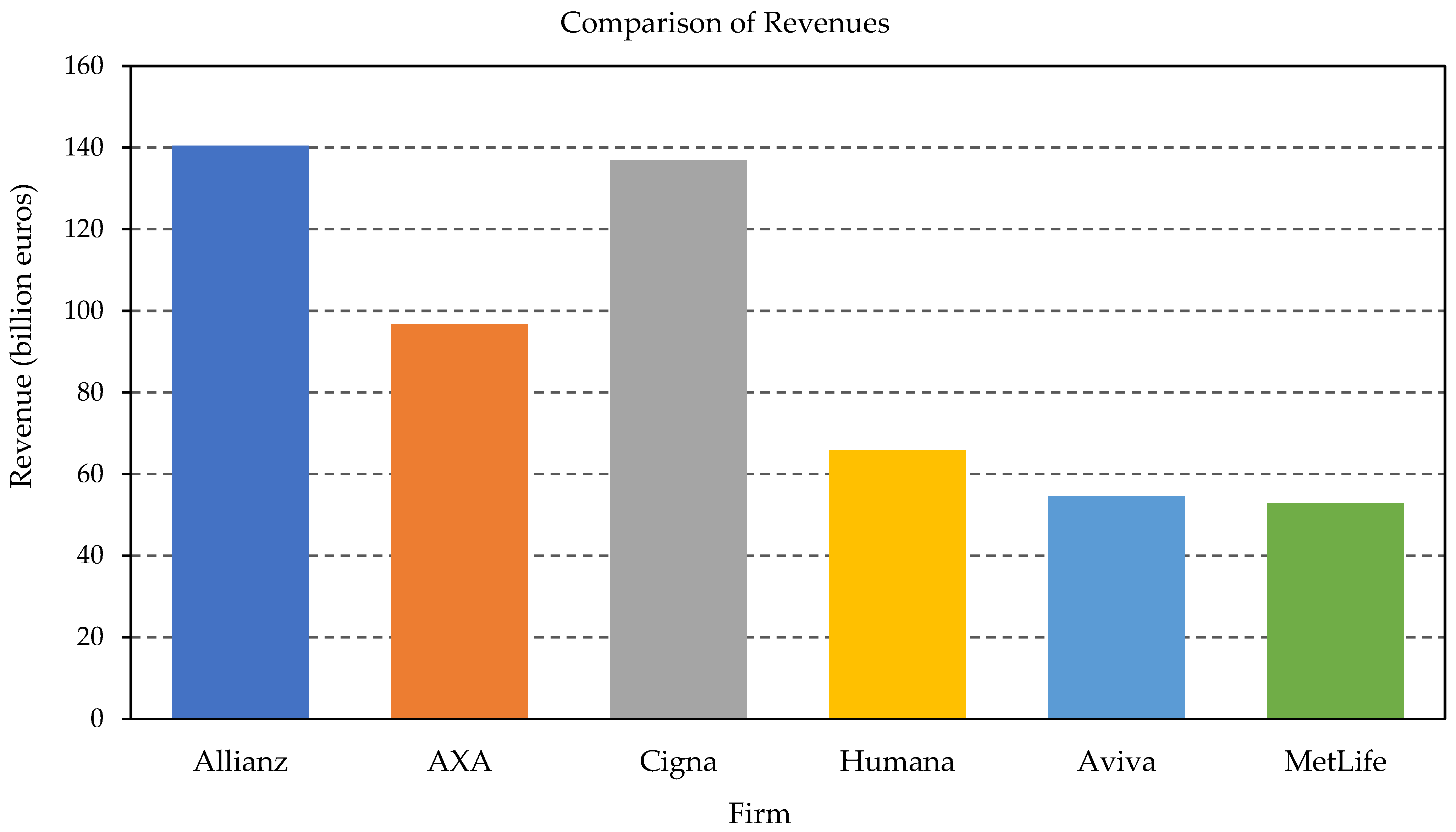

2.1. The Firm

2.2. Pledges

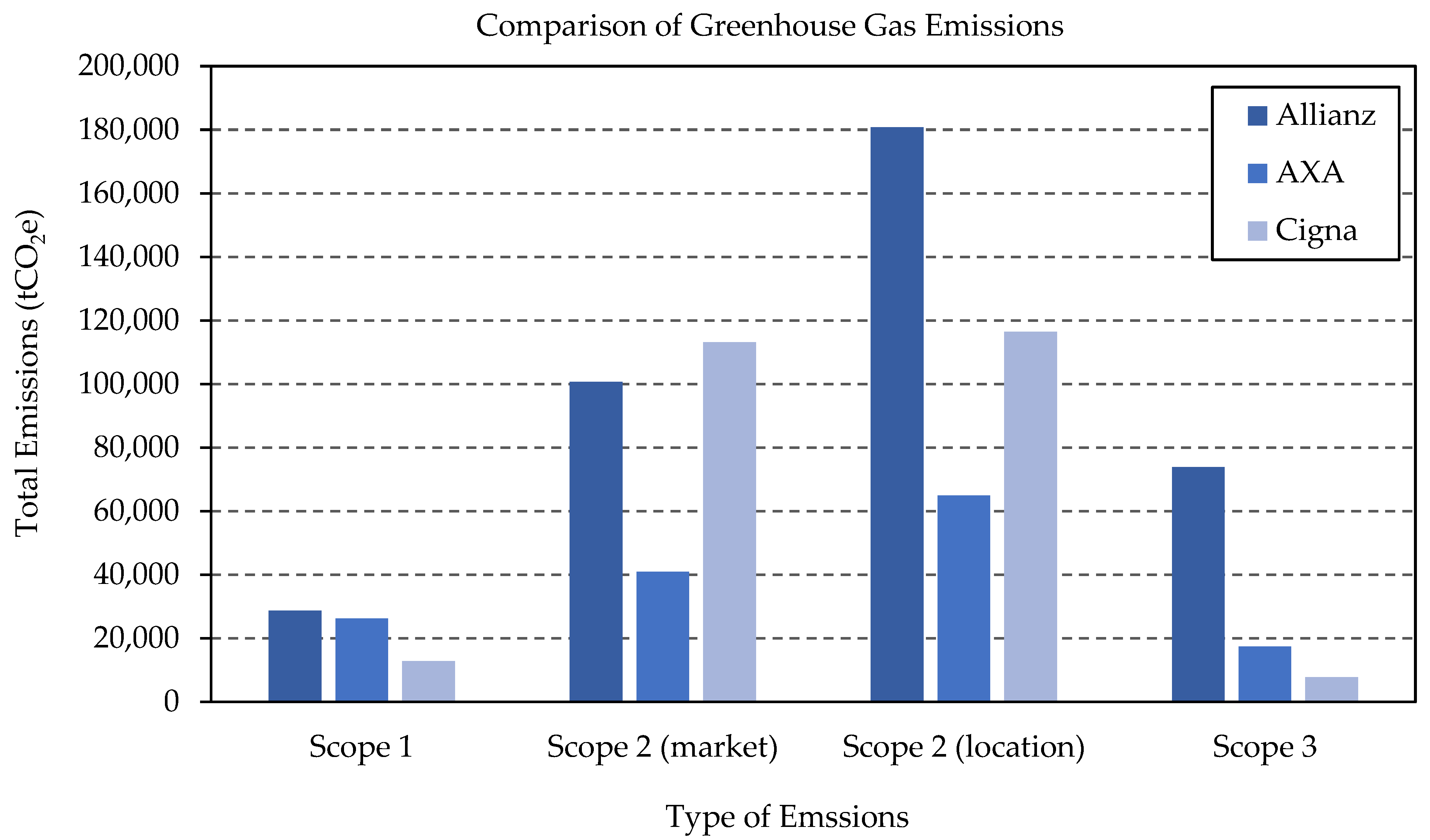

2.3. Emissions Estimates

| Type of Emissions | Source | Units | 2020 | 2019 | 2018 |

|---|---|---|---|---|---|

| Scope 1 | Direct GHG emissions | tCO2e | 26,292 | 37,889 | 38,778 |

| Scope 2 | Indirect GHG emissions (market based) | tCO2e | 40,894 | 67,765 | 69,260 |

| Scope 2 | Indirect GHG emissions (location based) | tCO2e | 64,924 | 88,558 | 95,476 |

| Scope 3 | Other indirect GHG emissions | tCO2e | 17,460 | 90,584 | 64,948 |

| Type of Emissions | Source | Units | 2020 | 2019 | 2018 |

|---|---|---|---|---|---|

| Scope 1 | Direct GHG emissions | tCO2e | 12,814 | 16,894 | 10,961 |

| Scope 2 | Indirect GHG emissions | tCO2e | 116,420 | 119,427 | 58,992 |

| Scope 3 | Other indirect GHG emissions | tCO2e | 7765 | 23,693 | 21,371 |

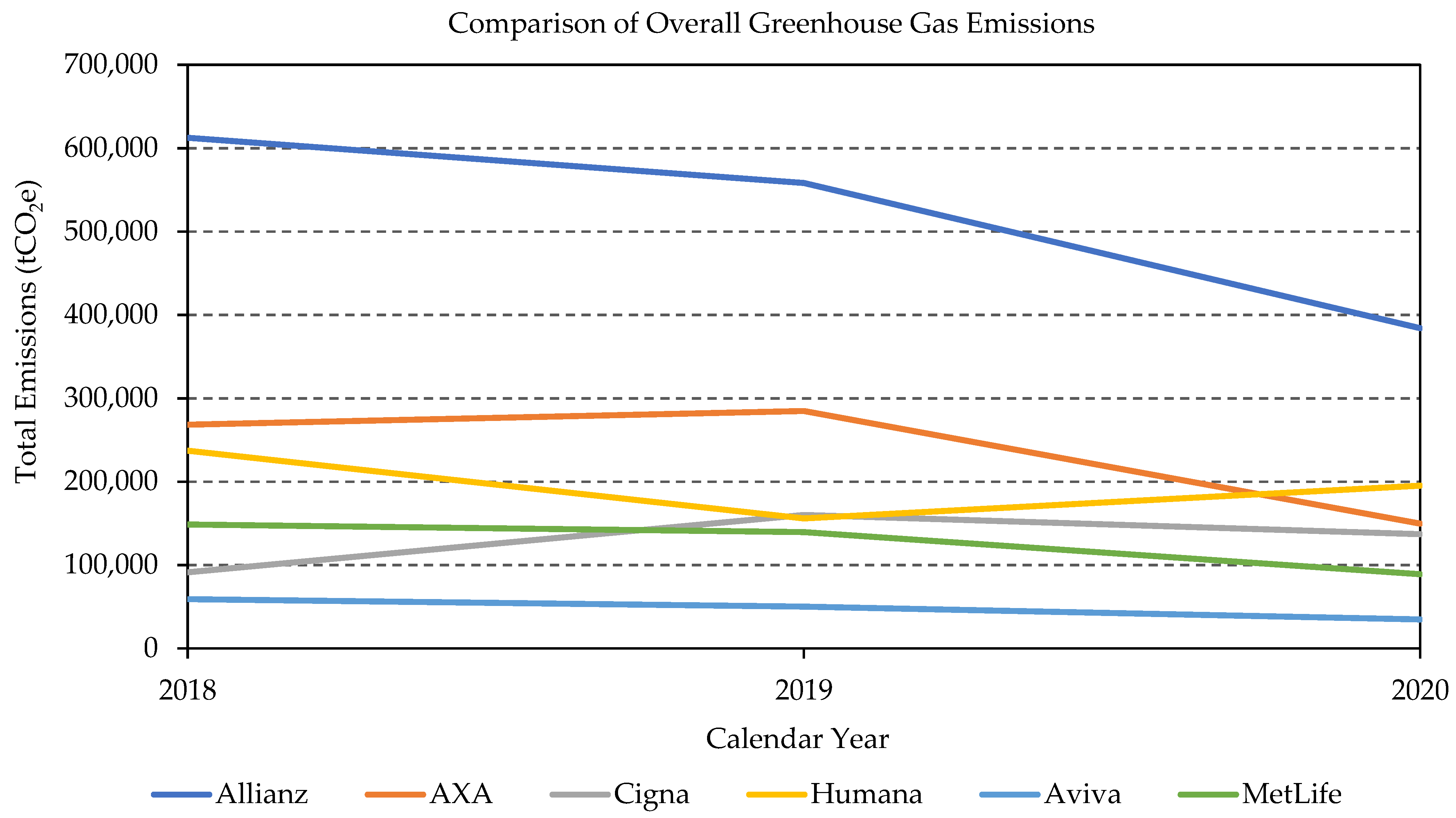

2.4. Emissions Reductions

3. Discussion

4. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Duscha, V.; Denishchenkova, A.; Wachsmuth, J. Achievability of the Paris Agreement targets in the EU: Demand-side reduction potentials in a carbon budget perspective. Clim. Policy 2018, 19, 161–174. [Google Scholar] [CrossRef] [Green Version]

- Stuhlmacher, M.; Patnaik, S.; Streletskiy, D.; Taylor, K. Cap-and-trade and emissions clustering: A spatial-temporal analysis of the European Union Emissions Trading Scheme. J. Environ. Manag. 2019, 249, 109352. [Google Scholar] [CrossRef] [PubMed]

- Lee, S.-Y.; Klassen, R.D. Firms’ Response to Climate Change: The Interplay of Business Uncertainty and Organizational Capabilities. Bus. Strategy Environ. 2016, 25, 577–592. [Google Scholar] [CrossRef]

- Giannarakis, G.; Zafeiriou, E.; Sariannidis, N. The Impact of Carbon Performance on Climate Change Disclosure. Bus. Strategy Environ. 2017, 26, 1078–1094. [Google Scholar] [CrossRef]

- Kreibich, N.; Hermwille, L. Caught in between: Credibility and feasibility of the voluntary carbon market post-2020. Clim. Policy 2021, 21, 939–957. [Google Scholar] [CrossRef]

- Lister, J. The Policy Role of Corporate Carbon Management: Co-regulating Ecological Effectiveness. Glob. Policy 2018, 9, 538–548. [Google Scholar] [CrossRef]

- Allianz, S.E. Allianz Group Annual Report 2020; Allianz Group: Munich, Germany, 2021; pp. 1–256. [Google Scholar]

- Doda, B.; Gennaioli, C.; Gouldson, A.; Grover, D.; Sullivan, R. Are Corporate Carbon Management Practices Reducing Corporate Carbon Emissions? Corp. Soc. Responsib. Environ. Manag. 2016, 23, 257–270. [Google Scholar] [CrossRef] [Green Version]

- UN Environment Program. The Net-Zero Insurance Alliance; United Nations: Nairobi, Kenya, 2021; pp. 1–4. [Google Scholar]

- Allianz, S.E. People Fact Book 2020; Allianz Group: Munich, Germany, 2021; pp. 1–57. [Google Scholar]

- ADV Ratings. Top Insurance Companies in Europe. Available online: https://www.advratings.com/insurance/top-insurance-companies-in-europe (accessed on 16 September 2021).

- Commercial Insurance. Top 10 Global Insurance Companies By Revenues. 2020. Available online: https://www.iii.org/publications/commercial-insurance/rankings (accessed on 16 September 2021).

- Allianz, S.E. Allianz Starter Kit: Group Investor Relations; Allianz Group: Munich, Germany, 2021; pp. 1–15. [Google Scholar]

- Allianz, S.E. Collaborating for a Sustainable Future; Allianz Group: Munich, Germany, 2021; pp. 1–133. [Google Scholar]

- Rojas, M. Allianz Affirms Commitment to Addressing Climate Change. Available online: https://www.allianz.com.au/media/news/2021/allianz-affirms-commitment-to-addressing-climate-change (accessed on 16 September 2021).

- Wang, J.; Gu, F.; Liu, Y.; Fan, Y.; Guo, J. Bidirectional interactions between trading behaviors and carbon prices in European Union emission trading scheme. J. Clean. Prod. 2019, 224, 435–443. [Google Scholar] [CrossRef]

- Global Reporting Initiative. GRI 302: Energy 2016; GRI Standards: Amsterdam, The Netherlands, 2016; pp. 1–16. [Google Scholar]

- Global Reporting Initiative. GRI 305: Emissions 2016; GRI Standards: Amsterdam, The Netherlands, 2016; pp. 1–23. [Google Scholar]

- Allianz, S.E. Environmental Management at Allianz Group; Allianz Group: Munich, Germany, 2021; pp. 1–5. [Google Scholar]

- AXA. Climate Report: The Decisive Decade; AXA Group: Paris, France, 2021; pp. 1–82. [Google Scholar]

- Cigna. The Power of Purpose; Cigna Connects: Bloomfield, CT, USA, 2021; pp. 1–146. [Google Scholar]

- MetLife. 2020 Sustainability Report; MetLife Services and Solutions: New York, NJ, USA, 2021; pp. 1–168. [Google Scholar]

- Aviva. Creating a Better Tomorrow; Aviva Insurance Limited: London, UK, 2021; pp. 1–37. [Google Scholar]

- Humana. Corporate Social Responsibility Report; Humana Incorporated: Louisville, KY, USA, 2021; pp. 1–19. [Google Scholar]

- AXA. Universal Registration Document 2020; AXA Group: Paris, France, 2021; pp. 1–488. [Google Scholar]

- Liesen, A.; Figge, F.; Hoepner, A.; Patten, D.M. Climate Change and Asset Prices: Are Corporate Carbon Disclosure and Performance Priced Appropriately? J. Bus. Financ. Account. 2017, 44, 35–62. [Google Scholar] [CrossRef]

- Schiemann, F.; Sakhel, A. Carbon Disclosure, Contextual Factors, and Information Asymmetry: The Case of Physical Risk Reporting. Eur. Account. Rev. 2018, 28, 791–818. [Google Scholar] [CrossRef]

- Secinaro, S.; Brescia, V.; Calandra, D.; Saiti, B. Impact of climate change mitigation policies on corporate financial performance: Evidence-based on European publicly listed firms. Corp. Soc. Responsib. Environ. Manag. 2020, 27, 2491–2501. [Google Scholar] [CrossRef]

| Type of Emissions | Source | Units | 2020 | 2019 | 2018 |

|---|---|---|---|---|---|

| Scope 1 | Direct GHG emissions | tCO2e | 28,714 | 42,011 | 46,734 |

| Scope 2 | Indirect GHG emissions (market based) | tCO2e | 100,722 | 142,563 | 159,181 |

| Scope 2 | Indirect GHG emissions (location based) | tCO2e | 180,826 | 224,315 | 239,132 |

| Scope 3 | Other indirect GHG emissions | tCO2e | 73,916 | 149,459 | 167,533 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Dawson, C.; Dargusch, P.; Hill, G. Assessing How Big Insurance Firms Report and Manage Carbon Emissions: A Case Study of Allianz. Sustainability 2022, 14, 2476. https://doi.org/10.3390/su14042476

Dawson C, Dargusch P, Hill G. Assessing How Big Insurance Firms Report and Manage Carbon Emissions: A Case Study of Allianz. Sustainability. 2022; 14(4):2476. https://doi.org/10.3390/su14042476

Chicago/Turabian StyleDawson, Chloe, Paul Dargusch, and Genia Hill. 2022. "Assessing How Big Insurance Firms Report and Manage Carbon Emissions: A Case Study of Allianz" Sustainability 14, no. 4: 2476. https://doi.org/10.3390/su14042476

APA StyleDawson, C., Dargusch, P., & Hill, G. (2022). Assessing How Big Insurance Firms Report and Manage Carbon Emissions: A Case Study of Allianz. Sustainability, 14(4), 2476. https://doi.org/10.3390/su14042476