Disclosure of Information in Risk Reporting in the Context of the Sustainable Development Concept

Abstract

:1. Introduction

2. Literature Review

2.1. Previous Literature on the Determinants of the Quality of Disclosure of Information Related to Risk

- Disclosure of information regarding risks in various types of reporting.

- Disclosure of information in reporting on certain types of risks.

- Risk as an object of accounting and risk management issues based on the estimated values of accounting statements, and various types of reporting.

- Issues of risk assessment and analysis based on the information disclosed in the financial statements.

- (1)

- the main prospects regarding the disclosure of information regarding risks considered in the selected articles relate to accounting and accounting (financial) statements in accordance with the requirements of Russian legislation;

- (2)

- there are no articles summarizing the best practices in terms of risk disclosure in the integrated report and reporting or the formation on its basis of recommendations for improving the disclosure of information regarding risks, taking into account industry specifics.

- (1)

- insufficient elaboration of issues related to the practice of risk disclosure in relation to integrated reporting;

- (2)

- methodological aspects related to the synthesis of best practices on risk disclosure in order to improve integrated reporting.

2.2. Hypothesis Development: Factors Influencing the Format and Quality of Information Disclosure in Reporting and the Role of Integrated Reporting in Improving the Quality of Risk Disclosure

3. Research Design

4. Results and Discussion

4.1. Factors Affecting the Format and Quality of Risk Disclosure

- In most commercial organizations, information regarding risks is generated and disclosed within the framework of (financial) accounting and reporting, and only a small proportion of organizations disclose information in non-financial reporting. This is due to the insignificant spread of non-financial reporting in most organizations. This type of reporting in the Russian Federation is formed, as a rule, in large organizations.

- In the conditions of the digital economy, high dynamism of the external environment, and increased uncertainty, there has been a trend associated with the use of planning and forecasting, which is confirmed by the results of the survey, indicating an increase in the number of commercial organizations using planning and forecasting, which is relevant from the standpoint of accounting and control of the value creation process and requires improved risk management and disclosure of information regarding them in reporting.

- Regarding the use of digital technologies, most organizations use cloud accounting.

- (1)

- Organizational factors of the internal environment of the organization, in particular, the size of the organization. The larger the size of the organization, the more fully information about risks is disclosed. In organizations using simplified accounting methods, such information may not be disclosed. The larger the organization, the more complex its accounting system is, as a rule, and the more diverse the types of reporting that are generated. In large organizations, there is a tendency to form integrated reporting in order to harmonize various types of reporting and disclosed information, including information regarding risks.

- (2)

- Technological, in particular, the use of digital technologies that allows you to visualize information regarding risks on the organization’s website, generate an interactive report, etc.

- (3)

- Cultural, in particular, customer orientation; orientation to the information needs of stakeholders is manifested in a more complete and qualitative disclosure of information regarding risks.

- (4)

- Economic, in particular, the specifics of the activities carried out affect the formation of an accounting system within which both financial and managerial accounting can be used, as well as various modifications of economic information such as environmental accounting, human resources accounting, strategic accounting, etc., which contributes to the quality of disclosure of information regarding risks.

- (5)

- Legal factors, particularly regulations containing the requirements for both the risk management system for certain types of organizations (in the Russian Federation—joint-stock companies) and disclosure of information regarding risks.

4.2. The Role of Integrated Reporting in Improving the Quality of Disclosure of Information regarding Risks to Stakeholders

- report on sustainable development activities;

- annual report;

- integrated report.

5. Limitations and Future Research

6. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

Appendix A

| No. | Questions | Answers | ||

| Yes | No | Your answer option | ||

| 1 | 2 | 3 | 4 | 5 |

| 1. | Location of your organization | |||

| 2. | Organizational and legal form of your organization | |||

| 3. | What kind of reporting is compiled in your organization? | |||

| - accounting statements | ||||

| - management reporting | ||||

| - strategic reporting | ||||

| - non-financial reporting | ||||

| - other | ||||

| 4. | What indicators are used in your organization to assess equity? | |||

| - profit | ||||

| - capital cost | ||||

| - profit + capital cost | ||||

| - net asset value | ||||

| - other | ||||

| 5. | What tools do you use when forming management information about risks? | |||

| - control | ||||

| - forecasting | ||||

| - budgeting | ||||

| - planning | ||||

| - other | ||||

| 6. | Are digital technologies used in your organization? | |||

| - blockchain technology | ||||

| - cloud accounting | ||||

| - mobile apps | ||||

| - artificial intelligence | ||||

| - four data analytics types (descriptive, diagnostic, predictive and prescriptive) | ||||

| - other | ||||

| 7. | When managing risks in your organization, the following are applied: | |||

| - the risk management system is absent | ||||

| - development of risk monitor procedures | ||||

| - management is done through insight | ||||

| - identification of risks | ||||

| - assessment and review of significant risks | ||||

| - creation of risk maps | ||||

| - other | ||||

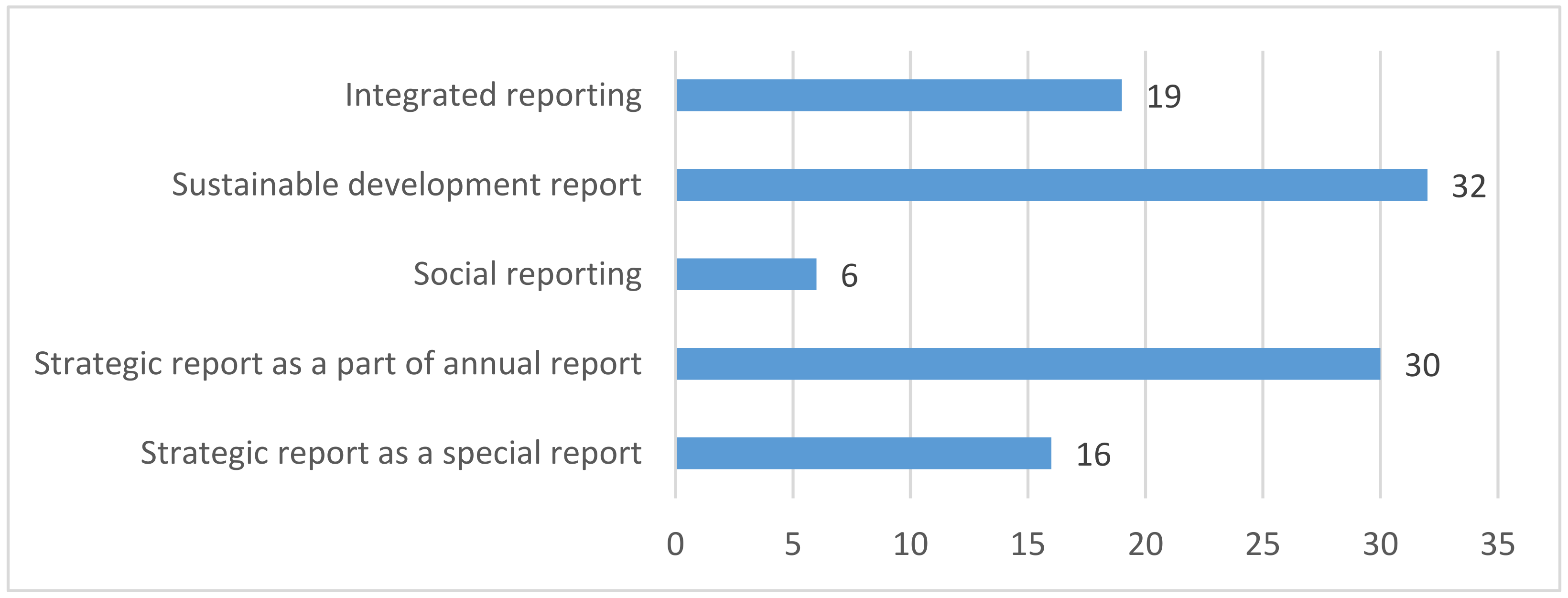

| 8. | Types of integrated reporting generated by commercial organizations | |||

| - integrated reporting | ||||

| - sustainable development report (SDR) | ||||

| - social reporting (SR) | ||||

| - strategic report as a part of annual report | ||||

| - strategic report as a special report | ||||

References

- Venturelli, A.; Caputo, F. Informativa non Finanziaria e Regulation: Tendenze Evolutive e Relative Implicazioni Alla Luce Dell’emanazione del D. Lgs 254/16; McGraw Hill: Milano, Italy, 2017. [Google Scholar]

- Caputo, F.; Veltri, S.; Venturelli, A. Sustainability strategy and management control systems in family firms. Evidence from a case study. Sustainability 2017, 9, 977. [Google Scholar] [CrossRef] [Green Version]

- Clarkson, M. A Stakeholder framework for analysing and evaluating corporate social performance. Acad. Manag. Rev. 1995, 20, 92–117. [Google Scholar] [CrossRef]

- Clarkson, M. Principles of Stakeholder Management; Clarkson Centre For Business Ethics: Toronto, ON, Canada, 1999. [Google Scholar]

- Evan, W.M.; Freeman, R.E. A Stakeholder Theory of Modern Corporation Kantian Capitalism in Ethical Theory and Business; Prentice Hall: Englewood Cliffs, NJ, USA, 1993; pp. 75–84. [Google Scholar]

- Freeman, R.E. The politics of stakeholder theory: Some future directions. Bus. Ethics Q. 1994, 4, 409–421. [Google Scholar] [CrossRef]

- Freeman, R.E.; Harrison, J.S.; Wicks, A.C. Managing for stakeholder. In Survival, Reputation and Success; New Haven & London: New Haven, CT, USA; Yale University Press: London, UK, 2007. [Google Scholar]

- Wicks, A.; Freeman, R.E. Organization studies and new pragmatism: Positivism, antipositivism and the search for ethics. Organ. Sci. 1998, 9, 134–140. [Google Scholar] [CrossRef]

- Spallini, S.; Milone, V.; Nisio, A.; Romanazzi, P. The Dimension of Sustainability: A Comparative Analysis of Broadness of Information in Italian Companies. Sustainability 2021, 13, 1457. [Google Scholar] [CrossRef]

- Husted, B.W.; Allen, D.B. Is it ethical to use ethics as strategy? J. Bus. Ethics 2000, 27, 21–32. [Google Scholar] [CrossRef] [Green Version]

- Crane, A.; Palazzo, G.; Spence, L.J.; Matten, D. Contesting the value of Creating Shared Value. Calif. Manag. Rev. 2014, 26, 130–153. [Google Scholar] [CrossRef]

- Unerman, J.; Bebbington, J.; O’Dwyer, B. Corporate reporting and accounting for externalities. Account. Bus. Res. 2018, 48, 497–522. [Google Scholar] [CrossRef] [Green Version]

- Catino, V.; Del Valle, A.; Fiandrino, S.; Busso, D. The level of compliance with the Italian Legislative Decree No 254/2016 and its determinants: Insights from Italy. Financ. Rep. 2019, 113–143. [Google Scholar] [CrossRef]

- Raucci, D.; Tarquinio, L. Sustainability Performance Indicators and Non Financial Information Reporting. Evidence from The Italian Case. Adm. Sci. 2020, 10, 13. [Google Scholar] [CrossRef] [Green Version]

- Global Reporting Initiative. GRI 101: Foundation, Amsterdam. 2018. Available online: www.globalreporting.org (accessed on 11 July 2021).

- On approval of the Accounting Regulations “Accounting Statements of the Organization” PBU 4/99: Order of the Ministry of Finance of the Russian Federation Dated 6 July 1999 N 43n. Available online: http:/www.consultant.ru/online (accessed on 10 November 2021).

- Novo Nordisk Rethinks Its Value Creation Process with Integrated Thinking. Available online: https://www.integratedreporting.org/news/novo-nordisk-rethinks-its-value-creation-process-with-integrated-thinking/ (accessed on 10 November 2021).

- IFRS Foundation Announces International Sustainability Standards Board. Available online: https://www.valuereportingfoundation.org/news/ifrs-foundation-announcement/ (accessed on 3 November 2021).

- Adhariani, D.; De Villiers, C. Sustainability Accounting, Management and Policy Journal. Bingley 2019, 1, 126–156. [Google Scholar]

- Adhariani, D.; De Villiers, C. Integrated reporting: Perspectives of corporate report preparers and other stakeholders. Sustain. Account. Manag. Policy J. 2019, 1, 126–156. [Google Scholar] [CrossRef] [Green Version]

- Favato, K.J.; Neumann, M.; Sanches, S.L.R.; Branco, M.C.; Nogueira, D.R. Integrated Thinking and Reporting Process: Sensemaking of Internal Actors in the Case of Itaú Unibanco. J. Risk Financ. Manag. 2021, 14, 245. [Google Scholar] [CrossRef]

- Adams, C.A.; Potter, B.; Singh, P.J.; York, J. Exploring the implications of integrated reporting for social investment (disclosures). Br. Account. Rev. 2016, 48, 283–296. [Google Scholar] [CrossRef] [Green Version]

- Goncharova, L.V.; Naidenko, A.V. On risk indicators and their disclosure in annual accounting statements. Econ. Manag. XXI Century Dev. Trends 2016, 32, 173–177. Available online: https://www.elibrary.ru/download/elibrary_27341147_97601907.pdf (accessed on 10 November 2021).

- Derevyashkin, S.A. Requirements for the reflection of risks in accordance with International Financial Reporting Standards. Innov. Dev. Econ. 2017, 3, 141–145. Available online: https://www.elibrary.ru/download/elibrary_29747139_24601876.pdf (accessed on 1 November 2021).

- Dombrovskaya, E.N. Disclosure of information in accounting (financial) statements taking into account risk factors. Account. Healthc. 2021, 5, 14–24. [Google Scholar] [CrossRef]

- Kozhabergenova, Z.K. Reflection of the Company’s Risks in the Annual Financial Statements/Actual Problems of Our Time. Available online: https://www.elibrary.ru/download/elibrary_34905523_77653481.pdf (accessed on 2 November 2021).

- Listopad, E.E. Required and voluntary disclosure of information on risks in financial statements: Incentives and obstacles. Econ. Sci. 2019, 172, 131–137. Available online: https://www.elibrary.ru/download/elibrary_38224119_12860238.pdf (accessed on 5 November 2021).

- Mikheev, P.N. On regulatory and legislative requirements for disclosure of information about risks in the reporting of public companies. Econ. Entrep. 2017, 10–12, 552–555. [Google Scholar]

- Nikitina, V.Y. Risks of the organization: Definition of types and disclosure of information in the reporting. Accounting 2019, 1, 60–67. [Google Scholar]

- Pashkovskaya, L.V. Corporate reporting: Assessment of the state and directions of improvement in the context of risk management and economic growth. Account. Analysis 2019, 8, 3–12. [Google Scholar]

- Sapozhnikova, N.G. Formation of information about risks in corporate accounting and reporting. Account. Anal. Audit 2021, 5, 41–54. Available online: https://www.elibrary.ru/download/elibrary_46667527_90620095.pdf (accessed on 14 June 2021).

- Stafievskaya, M.V.; Krylova, D.A. Disclosure of information about risks in accounting (financial) statements. Innov. Sci. 2016, 240–242. Available online: https://www.elibrary.ru/download/elibrary_26241105_20513589.pdf (accessed on 25 June 2021).

- Tchaikovskyay, L.A. Actual issues of accounting and disclosure of information in the reporting of Russian organizations. Econ. Manag. Probl. Solut. 2017, 6, 62–67. [Google Scholar]

- Chechetkin, S.A. Requirements of accounting and reporting standards for risk assessment in accounting in accordance with Russian Accounting Standards and IFRS. Business in law. Econ. Leg. J. 2016, 2, 83–86. Available online: https://www.elibrary.ru/download/elibrary_25903397_11606423.pdf (accessed on 1 November 2021).

- Sigidov, Y.I.; Melnikova, A.N.; Yasmenko, G.N. Assessment of the risk of interruption of the organization’s activities and disclosure of information about it in the reporting. Account. Agric. 2021, 8, 18–25. [Google Scholar]

- Safonova, I.V. Environmental risks as a global trend of increasing information transparency of companies’ reporting. Econ. Taxes Right 2021, 4, 121–129. Available online: https://www.elibrary.ru/download/elibrary_46538573_48911874.pdf (accessed on 14 November 2021). [CrossRef]

- Nikiforova, E.V.; Ivanova, A.N. Disclosure of financial risks in the financial statements of the organization. Vector Econ. 2019, 4, 4. Available online: https://www.elibrary.ru/download/elibrary_38096132_14582345.pdf (accessed on 14 October 2021).

- Zueva, D.S. Assessment of financial risks of a joint-stock company based on financial analysis of accounting statements. Sci. Alm. 2019, 37–43. Available online: https://www.elibrary.ru/download/elibrary_41586041_91161172.pdf (accessed on 28 October 2021).

- Ivanova, A.N. Disclosure of financial risks in the financial statements of the organization. Innov. Sci. Educ. 2020, 15, 117–121. Available online: https://www.elibrary.ru/download/elibrary_43796649_25951821.pdf (accessed on 7 October 2021).

- Kharitonova, V.V.; Biktemirova, M.H. The role of financial statements of a manufacturing enterprise in assessing risks and threats to foreign economic activity. Sci. Soc. Econ. Law 2019, 3, 110–117. Available online: https://www.elibrary.ru/download/elibrary_41216890_44367654.pdf (accessed on 17 October 2021).

- Tkachev, A. Differences in the assessment of individual credit risk of corporate clients on the basis of financial statements compiled in accordance with IFRS and NSB. Bank. Bull. 2019, 6, 33–39. Available online: https://www.elibrary.ru/download/elibrary_38533885_83454263.pdf (accessed on 24 October 2021).

- Gracheva, N.P.; Sysoev, N.L.; Remizova, A.A. Assessment of tax risks based on the accounting statements of JSC “Agrofirma Yekaterinoslavskaya” of the Sherbakulsky district of the Omsk region. Top. Issues Mod. Econ. 2020, 6, 267–274. Available online: https://www.elibrary.ru/download/elibrary_43606717_47891518.pdf (accessed on 24 October 2021).

- Volkova, Y.B. Methodological support of disclosure of information about market risks in the financial statements of the organization. Mod. Trends Dev. Sci. Technol. 2016, 10, 19–23. Available online: https://www.elibrary.ru/download/elibrary_27336991_83999459.pdf (accessed on 9 October 2021).

- Belonogov, A.N. Presentation of risks of mineral exploration and evaluation activities in financial statements. Audit Financ. Anal. 2016, 1, 67–71. [Google Scholar]

- Karzayeva, N.N.; Tryashtsina, N.Y.; Vorozheikina, T.M. Disclosure of information on personnel risks in the reporting of agricultural organizations. Account. Agric. 2016, 6, 48–59. [Google Scholar]

- Kuvaldina, T.B.; Lobachev, E.V. Disclosure of information on liquidity risk in accounting (financial) statements. Econ. Humanit. Sci. 2017, 6, 49–57. [Google Scholar]

- Efimova, O.V.; Rozhnova, O.V. Strategy of harmonization of financial and non-financial reporting in the field of climate risk disclosure. Part 1. Account. Anal. Audit 2020, 4, 6–17. Available online: https://www.elibrary.ru/download/elibrary_43877468_73080422.pdf (accessed on 6 October 2021).

- Khoruzhiy, L.I.; Tryashtsina, N.Y. Formation of information in integrated reporting for assessment of reputational risks. Account. Agric. 2018, 3, 64–71. [Google Scholar]

- Borodenkova, M.A. The problem of interest rate risk of a commercial bank and its disclosure in financial statements. High Sch. 2017, 3, 18–19. [Google Scholar]

- Gulluscio, C.; Puntillo, P.; Luciani, V.; Huisingh, D. Climate Change Accounting and Reporting: A Systematic Literature Review. Sustainability 2020, 12, 5455. [Google Scholar] [CrossRef]

- Bebbington, J.; Larrinaga-Gonzalez, C. Carbon trading: Accounting and reporting issues. Eur. Account. Rev. 2008, 17, 697–717. [Google Scholar] [CrossRef]

- Linnenluecke, M.K.; Birt, J.; Griffiths, A. The role of accounting in supporting adaptation to climate change. Account. Financ. 2015, 55, 607–625. [Google Scholar] [CrossRef]

- Milne, M.J.; Grubnic, S.; Solomon, J.F.; Solomon, A.; Norton, S.D.; Joseph, N.L. Private climate change reporting: An emerging discourse of risk and opportunity. Account. Audit Account. J. 2011, 24, 1119–1148. [Google Scholar]

- Andreeva, L.Y. Risk-oriented management model in the corporate financial system based on operational and managerial accounting and reporting. Proc. Rostov State Univ. Railw. 2016, 5, 5–7. Available online: https://www.elibrary.ru/download/elibrary_32654026_32264840.pdf (accessed on 16 October 2021).

- Burtseva, K.A. Accounting risks, their impact on the quality of reporting and management decisions based on it. Audit Financ. Anal. 2016, 4, 34–39. [Google Scholar]

- Gonchar, E.A.; Skripacheva, S.S. Assessment of assets, liabilities and capital in the system of forming two-dimensional financial statements based on a risk-based approach. Bull. South Ural. State Univ. Ser. Econ. Manag. 2018, 2, 114–122. Available online: https://www.elibrary.ru/download/elibrary_35171562_55043618.pdf (accessed on 13 October 2021).

- Eremeeva, O.S. Information about future events in reporting: Risk as an object of accounting. Audit Statements 2020, 1, 27–34. [Google Scholar]

- Ilysheva, N.N.; Krylov, S.I. Accounting (financial) reporting in financial risk management. Econ. Manag. Probl. Solut. 2017, 8, 145–152. [Google Scholar]

- Loseva, E.S.; Poplavskaya, A.A. Reflection of the consequences of the risks of financial and economic activity of economic entities in the accounting and reporting system. Theory Pract. Mod. Sci. 2018, 3, 256–262. [Google Scholar]

- Malisova, S.A. Analysis of the impact of accounting risks on the reliability of financial statements. Sib. Financ. Sch. 2018, 1, 88–92. [Google Scholar]

- Serebryakova, T.Y.; Suglobov, A.E.; Fedosenko, T.V. Problems of business risk management based on estimated values of accounting statements. Russ. J. Manag. 2020, 2, 56–60. [Google Scholar] [CrossRef]

- Sigidov, Y.I.; Shchetkina, E.A. The impact of risks on the indicators of accounting financial statements. Polythematic Online Electron. Sci. J. Kuban State Agrar. Univ. 2016, 119, 403–414. Available online: https://www.elibrary.ru/download/elibrary_26148582_42465646.pdf (accessed on 23 October 2021).

- Alekseeva, I.E.; Noskova, A.R.; Kylosova, V.V.; Knyazeva, A.I. New applications of risk assessment tasks based on the analysis of accounting statements. Math. Comput. Model. Econ. Insur. Risk Manag. 2018, 3, 8–13. Available online: https://www.elibrary.ru/download/elibrary_42577212_99385812.pdf (accessed on 24 October 2021).

- Al-Asadi, Z.S.S.; Ushakova, N.V. Analysis of currency risks in the context of the transition to international financial reporting standards. Bull. Int. Inst. Manag. LINK 2016, 12, 82–84. [Google Scholar]

- Bardina, I.V. Definition of risks of economic activity and their analysis according to the annual accounting statements. Financ. Econ. 2019, 10, 567–569. [Google Scholar]

- Gorbunova, N.A. Risk analysis of investing in securities of a joint-stock company based on public reporting indicators. Bull. V.N. Tatishchev Volga State Univ. 2017, 4, 97–104. Available online: https://www.elibrary.ru/download/elibrary_30671580_27411630.pdf (accessed on 25 October 2021).

- Zubarev, I.S. Analysis of emerging risks of financial sector companies obtained from financial statements. Econ. Res. Dev. 2017, 5, 36–41. Available online: http://edrj.ru/article/33-05-17 (accessed on 2 October 2021).

- Ivanov, A.V. Analysis of country reporting indicators for assessing tax risks of an international group of companies. Econ. Entrep. 2018, 5, 112–114. [Google Scholar]

- Kupriyanova, L.M.; Golysheva, N.I. Risk analysis based on accounting financial statements. Econ. Bus. Cans 2016, S10, 40–55. [Google Scholar]

- Moryashova, V.V. Methodology for calculating the supplier’s price risk in the field of public procurement using accounting statements. Forum Young Sci. 2018, 2, 722–725. [Google Scholar]

- Naniz, K.R. A comprehensive method for assessing financial risks based on financial reporting data. Audit Statements 2018, 1, 39–47. [Google Scholar]

- Poleshchuk, S.S.; Chumarova, L.S. Assessment of the impact of risks on the investment attractiveness of companies based on financial statements. Student 2019, 20–24, 69–71. [Google Scholar]

- Prosvirina, I.I.; Proskurina, V.V. Optimization of the company’s capital by minimizing the level of financial risks according to accounting statements. Sci. Anal. Econ. J. 2016, 9, 3. Available online: https://www.elibrary.ru/download/elibrary_27643236_12543008.htm (accessed on 21 October 2021).

- Semenova, E.D.; Tarasova, K.I. Accounting and analytical support for statistical risk assessment at enterprises. Econ. Financ. 2017, 4, 47–56. Available online: https://www.elibrary.ru/download/elibrary_30517135_14960000.pdf (accessed on 21 October 2021).

- Sidorova, E.I.; Glubokova, N.Y. Analysis of financial statements for tax risks. Econ. Bus. Financ. 2019, 4, 13–16. Available online: https://www.elibrary.ru/download/elibrary_37355846_25137460.pdf (accessed on 1 October 2021).

- Sovkova, Y.V.; Ivanova, E.V. Logic and procedures for assessing liquidity risks based on cash flow statement data, taking into account the requirements of Russian international Financial Reporting Standards. Russ. Econ. Online Mag. 2018, 4, 104. Available online: http://www.e-rej.ru/Articles/2018/Sovkova_Ivanova.pdf (accessed on 11 October 2021).

- Stafievskaya, M.V. Accounting reporting as a form of information support for the analysis of economic risks. Econ. Entrep. 2016, 8, 1014–1017. [Google Scholar]

- Sudakova, E.V. The use of financial reporting data for risk assessment and analysis in order to make managerial and other types of decisions (on the example of PJSC “Transneft”). Econ. Entrep. 2017, 10, 981–984. [Google Scholar]

- Urakova, Y.A. The use of consolidated financial statements to assess the risks of the business group. Sci. Discuss. Counc. Guarant. Leg. Issues Account. Audit. 2016, 1, 3. Available online: http://study.garant.ru/cookiesdisabled#/document/57285446 (accessed on 3 October 2021).

- Khodarinova, N.V.; Ishchenko, O.V.; Aksenova, Z.A. Risk assessment of trade organizations based on accounting statements. Bull. Acad. Knowl. 2018, 5, 357–364. Available online: https://www.elibrary.ru/download/elibrary_36555413_40140664.pdf (accessed on 18 October 2021).

- Shcherbinina, A.G. Criteria for the Formation and Analysis of Management Reporting from the Perspective of Accounting for the Risks of Financial and Economic Activities of Enterprises/The Successes of Modern Science and Education. Available online: https://www.elibrary.ru/download/elibrary_29822026_11848122.PDF (accessed on 2 October 2021).

- Yakimova, V.A.; Ivko, K.V. Management reporting as an information base for identification and assessment of financial risks. Manag. Account. Financ. 2016, 4, 286–308. [Google Scholar]

- Anton, S.G.; Nucu, A.E.A. Enterprise Risk Management: A Literature Review and Agenda for Future Research. J. Risk Financ. Manag. 2020, 13, 281. [Google Scholar] [CrossRef]

- Stubbs, W.; Colin, H. Stakeholders Perspectives on the Role of Regulatory Reform in Integrated Reporting. J. Bus. Ethics 2018, 147, 489–508. [Google Scholar] [CrossRef]

- De Luca, F.; Cardoni, A.; Phan, H.-T.-P.; Kiseleva, E. Does Structural Capital Affect SDGs Risk-Related Disclosure Quality? An Empirical Investigation of Italian Large Listed Companies. Sustainability 2020, 12, 1776. [Google Scholar] [CrossRef] [Green Version]

- Maniora, J. Is integrated reporting really the superior mechanism for the integration of ethics into the core business model? An empirical analysis. J. Bus. Ethics 2017, 140, 755–786. [Google Scholar] [CrossRef]

- Lodhia, S. Exploring the Transition to Integrated Reporting Through a Practice Lens: An Australian Customer Owned Bank Perspective. J. Bus. Ethics 2015, 129, 585–598. [Google Scholar] [CrossRef]

- Ng, I.C.L.; Wakenshaw, S.Y.L. The internet-of-things: Review and research directions. Int. J. Res. Mark. 2017, 34, 3–21. [Google Scholar] [CrossRef] [Green Version]

- Hafeez, K.; Zhang, Y.; Malak, N. Core competence for sustainable competitive advantage: A structured methodology for identifying core competence. IEEE Trans. Eng. Manag. 2002, 49, 28–35. [Google Scholar] [CrossRef] [Green Version]

- Paschou, T.; Rapaccini, M.; Adrodegari, F.; Saccani, N. Digital servitization in manufacturing: A systematic literature review and research agenda. Ind. Mark. Manag. 2020, 89, 278–292. [Google Scholar] [CrossRef]

- Hoffman, D.L.; Novak, T.P. Customer and object experience in the internet of things: An assemblage theory approach. J. Cust. Res. 2017, 44, 1178–1204. [Google Scholar]

- About the Consolidated Financial Statements: Federal Law No. 208 F L Dated 27 July 2010. Available online: https://www.garant.ru/products/ipo/prime/doc/71573686/ (accessed on 13 October 2021).

- The Tax Code of the Russian Federation: Feder. The Law: Parts One and Two (ed. of 02.07.2021) [Electronic Resource]: [Adopted by the State Duma on 16.07.1998 and 19.07.2000]. Available online: https://www.garant.ru/products/ipo/prime/doc/71573686/ (accessed on 10 October 2021).

- Chen, Y. Integrated and intelligent manufacturing: Perspectives and enablers. Engineering 2017, 3, 588–595. [Google Scholar] [CrossRef]

- On Disclosure of Information about the Risks of the Organization’s Economic Activities in the Annual Accounting Statements: Information of the Ministry of Finance of the Russian Federation N PZ-9/2012. Available online: http://www.consultant.ru/document/cons_doc_LAW_135436/ (accessed on 21 October 2021).

- Financial Instruments: Disclosure of information: International Financial Reporting Standard (IFRS) 7. Available online: https://www.minfin.ru/common/upload/library/2017/01/main/MSFO_IFRS_7.pdf (accessed on 29 October 2021).

- Application Dynamics Business Surveillance. Available online: https://www.appdynamics.com (accessed on 2 October 2021).

- Lavrov, D.A. Development of accounting and control support for equity management in commercial organizations. Diss. Degree Candidate Econ. Sci. 2021, 203. [Google Scholar]

- Lavrov, D.A. Modern methodological approaches to disclosure of information about equity in integrated reporting. Bull. Prof. Account. 2020, 4, 33. [Google Scholar]

- International Standard for Integrated Reporting: International Standard (Official Translation into Russian). Available online: http://www.theiirc.org/wp-content/uploads/2014/04/13-12-08-THE-INTERNATIONAL-IRFRAMEWORK.docx_en-US_ru-RU.pdf (accessed on 11 July 2021).

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Bogataya, I.; Evstafyeva, E.; Lavrov, D.; Korsakova, E.; Mukhanova, N.; Solyannikova, S. Disclosure of Information in Risk Reporting in the Context of the Sustainable Development Concept. Sustainability 2022, 14, 2300. https://doi.org/10.3390/su14042300

Bogataya I, Evstafyeva E, Lavrov D, Korsakova E, Mukhanova N, Solyannikova S. Disclosure of Information in Risk Reporting in the Context of the Sustainable Development Concept. Sustainability. 2022; 14(4):2300. https://doi.org/10.3390/su14042300

Chicago/Turabian StyleBogataya, Irina, Elena Evstafyeva, Denis Lavrov, Ekaterina Korsakova, Natalya Mukhanova, and Svetlana Solyannikova. 2022. "Disclosure of Information in Risk Reporting in the Context of the Sustainable Development Concept" Sustainability 14, no. 4: 2300. https://doi.org/10.3390/su14042300

APA StyleBogataya, I., Evstafyeva, E., Lavrov, D., Korsakova, E., Mukhanova, N., & Solyannikova, S. (2022). Disclosure of Information in Risk Reporting in the Context of the Sustainable Development Concept. Sustainability, 14(4), 2300. https://doi.org/10.3390/su14042300