The Effect of Operating Cash Flow on the Likelihood and Duration of Survival for Marginally Distressed Firms in Taiwan

Abstract

1. Introduction

2. Literature Review and Hypotheses Development

2.1. Related Literature on Determinants and Consequences of Finicial Distress

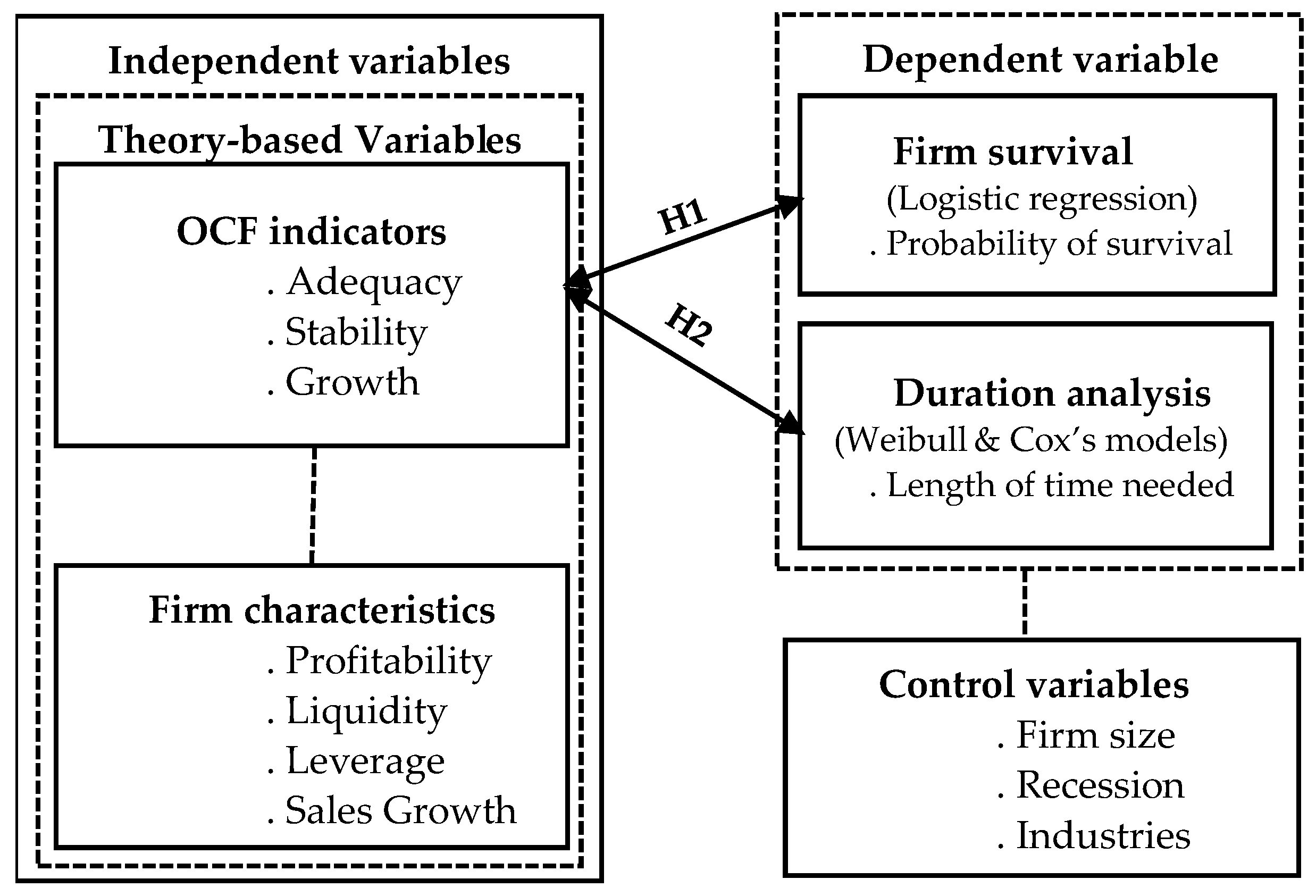

2.2. Hypotheses Development

3. Data and Methodology

3.1. Data and Sample Selection

3.2. Methodology and Variables

4. Empirical Results

4.1. Sample Distribution, Descriptive Statistics, and Correlation Analysis

4.2. Univariate Analysis

4.3. Multiple Regression Results

4.3.1. Determinants of Survival for Marginally Distressed Firms

4.3.2. Factors of Duration in Firm Survival

4.4. Robustness Test

5. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Appendix A

| Variables | Definition |

|---|---|

| Indicators of changes in OCF: | |

| Adequacy of changes in OCF (ΔOCFadequacy1) | [(OCF/total assets) in period t − (OCF/total assets) in period t − x)]/ ABS(OCF/total assets) in period t − x where the period t refers to the last year of the three consecutive years (i.e., firm survival year) in which operating profits return to positive value, and the period t-x refers to the year before the two consecutive years (i.e., the pre-distress year) in which operating profit is a negative value. However, if the firm is a non-surviving firm, the firm survival year would be set for the year 2021, as closely as possible to the end of this research period. Additionally, the denominator takes an absolute value. A higher value shows a greater size of OCF generated from a firm’s assets, with a higher ability to repay debts. |

| Adequacy of changes in OCF (ΔOCFadequacy2) | [(OCF/total liabilities) in period t − (OCF/total liabilities) in period t − x)]/ ABS(OCF/total liabilities) in period t − x where the period t refers to the last year of the three consecutive years (i.e., firm survival year) in which operating profits return to positive value, and the period t-x refers to the year before the two consecutive years (i.e., the pre-distress year) in which operating profit is a negative value. However, if the firm is a non-surviving firm, the firm survival year would be set for the year 2021, as closely as possible to the end of this research period. Additionally, the denominator takes an absolute value. A higher value represents a greater amount of OCF for a distressed firm to repay its debts. |

| Stability of changes in OCF (ΔOCFstability) | (average OCF)/σ(OCF) where it adopts a three-year rolling time window to calculate average OCF and σ(OCF). σ(OCF) denotes the standard deviation of OCF. The three-year rolling window begins from the first of the three consecutive years in which operating profit returned to a positive value. However, if the firm is a non-surviving firm, the firm survival year would be set for the year 2021, as close as possible to the end of this research period. A higher value suggests a higher level of stability in the OCF of the firm, or alternatively speaking, a lower exposure to the liquidity risk of the firm. |

| Growth of changes in OCF (ΔOCFgrowth) | (OCF of period t − OCF of period t + 2)/ ABS(OCF of period t) where it adopts a three-year window to calculate the OCF growth ratio for a given year. The period t refers to the first year of the positive operating profit for three consecutive years. However, if the firm is a non-surviving firm, the firm survival year would be set for the year 2021, as close as possible to the end of this research period. The denominator must take an absolute value. A higher value represents a higher growth of OCF for a distressed firm. |

| Firm characteristic variables: | |

| Firm profitability | Return on assets, i.e., net income over total assets in the year before the negative operating profit for two consecutive years. |

| Firm liquidity | Liquidity ratio, i.e., current assets over current liabilities in the year before the negative operating profit for two consecutive years. |

| Firm leverage | Total labilities over total assets in the year before the negative operating profit for two consecutive years. |

| Firm growth | Sales growth ratio for a given year as well as the year before the negative operating profit for two consecutive years, defined as follows: (net sales of period t − net sales of period t − 1)/ (net sales of period t) |

| Control variables: | |

| Firm size | The natural log of total assets in the year before the negative operating profit for two consecutive years. |

| Recession dummy | A dummy variable takes the value of one if the financial distress occurred during the period 2007–2009 (the global economic contraction). |

| Industry1 dummy | A dummy variable takes the value of one if a distressed firm belongs to the manufacturing industry. |

| Industry2 dummy | A dummy variable takes the value of one if a distressed firm belongs to the construction industry. |

| Industry3 dummy | A dummy variable takes the value of one if a distressed firm belongs to the “new economy”, e.g., the electronics and high-tech industries |

| Robustness test variables: | |

| Changes in OCF to equities (ΔOCFequity) | [(OCF/equities) in period t − (OCF/equities) in period t − x)]/ ABS(OCF/equities) in period t − x where the period t refers to the last year of the three consecutive years (i.e., firm survival year) in which operating profit returns to positive value, and the period t-x refers to the year before the two consecutive years (i.e., the pre-distress year) in which operating profit is a negative value. However, if the firm is a non-surviving firm, the firm survival year would be set for the year 2021, as close as possible to the end of this research period. The denominator takes an absolute value. A higher value shows a greater amount of OCF. |

| Changes in OCF to net income (ΔOCFnet income) | [(OCF/net income) in period t − (OCF/net income) in period t-x)]/ ABS(OCF/net income) in period t − x where the period t refers to the last year of the three consecutive years (i.e., firm survival year) in which operating profit returns to a positive value, and the period t-x refers to the year before the two consecutive years (i.e., the pre-distress year) in which operating profit is a negative value. However, if the firm is a non-surviving firm, the firm survival year would be set for the year 2021, as close as possible to the end of this research period. The denominator takes an absolute value. A higher value shows a greater amount of OCF. |

| Changes in OCF to sales (ΔOCFsales) | [(OCF/sales) in period t − (OCF/sales) in period t-x)]/ ABS(OCF/sales) in period t − x where the period t refers to the last year of the three consecutive years (i.e., firm survival year) in which operating profits return to a positive value, and the period t-x refers to the year before the two consecutive years (i.e., the pre-distress year) in which operating profit is a negative value. However, if the firm is a non-surviving firm, the firm survival year would be set for the year 2021, as close as possible to the end of this research period. Additionally, the denominator takes an absolute value. A higher value shows a greater amount of OCF. |

| Stability of changes in OCF (ΔOCFstability_5yrs) | (average OCF)/σ(OCF) where it adopts a five-year rolling time window to calculate average OCF and σ(OCF). σ(OCF) denotes the standard deviation of OCF. The five-year rolling window begins from the first of the three consecutive years in which operating profit returned to a positive value. However, if the firm is a non-surviving firm, the firm survival year would be set for the year 2021, as close as possible to the end of this research period. A higher value suggests a higher level of stability in the OCF of the firm. |

| Growth of changes in OCF (ΔOCFgrowth_5yrs) | (OCF of period t − OCF of period t + 4)/ ABS(OCF of period t) where it adopts a five-year window to calculate the OCF growth ratio for a given year. The period t refers to the first year of the positive operating profit for three consecutive years. However, if the firm is a non-surviving firm, the firm survival year would be set for the year 2021, as close as possible to the end of this research period. The denominator must take an absolute value. A higher value represents a higher growth of OCF for a distressed firm. |

References

- Habib, A.; D’Costa, M.; Huang, H.J. Determinants and consequences of financial distress: Review of the empirical literature. Account. Financ. 2020, 60, 1023–1075. [Google Scholar] [CrossRef]

- Das, S.; LeClere, M. The Survival of Marginally-Distressed Firms: Evidence on the Duration of Turnaround. 2003, Working Paper. Available online: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=481342 (accessed on 15 June 2022).

- Kane, G.; Richardson, F.M.; Velury, U. The relevance of stock and flow-based reporting information in accessing the likelihood of emergence from corporate financial distress. Rev. Quant. Financ. Account. 2006, 26, 5–22. [Google Scholar] [CrossRef]

- Lee, J.E.; Glasscock, R.; Park, M.S. Does the ability of operating cash flows to measure firm performance improve during periods of financial distress? Account. Horiz. 2017, 31, 23–35. [Google Scholar] [CrossRef]

- Almeida, H.; Campello, M.; Weisbach, S. The cash flow sensitivity of cash. J. Financ. 2004, 59, 1777–1804. [Google Scholar] [CrossRef]

- Karas, M.; Reznakova, M. Cash flow indicators in the prediction of financial distress. Eng. Econ. 2020, 31, 525–535. [Google Scholar] [CrossRef]

- Beaver, W.H. Financial ratios as predictors of failure. J. Account. Res. 1966, 4, 71–111. [Google Scholar] [CrossRef]

- Zang, A.Y. Evidence on the trade-off between real activities manipulation and accrual-based earnings management. Account. Rev. 2012, 87, 675–703. [Google Scholar] [CrossRef]

- Shirabe, Y.; Nakano, M. Does integrated reporting affect real activities manipulation? Sustainability 2022, 14, 11110. [Google Scholar] [CrossRef]

- Yang, D.; Kim, H. Managerial overconfidence and manipulation of operating cash flow: Evidence from Korea. Financ. Res. Lett. 2020, 32, 101343. [Google Scholar] [CrossRef]

- Jones, S. A cash flow-based model of corporate bankruptcy in Australia. J. Appl. Manag. Account. Res. 2016, 3, 21–35. [Google Scholar]

- Kamaluddin, A.; Ishak, N.; Mohammed, N.F. Finicial distress prediction through cash flow ratios analysis. Int. J. Financ. Res. 2019, 10, 63–76. [Google Scholar] [CrossRef]

- Yazdanfar, D.; Ohman, P. Finicial distress determinants among SMEs: Empirical evidence from Sweden. J. Econ. Stud. 2020, 47, 547–560. [Google Scholar] [CrossRef]

- Putri, P.A.D.W. The effect of operating cash flows, sales growth, and operating capacity in predicting financial distress. Int. J. Innov. Sci. Res. Technol. 2021, 6, 2165–2456. [Google Scholar]

- Rodríguez-Masero, M.; López-Manjón, J.D. The usefulness of operating cash flow for predicting business bankruptcy in medium-sized firms. R. Bras. Gest. Neg. 2020, 22, 917–931. [Google Scholar] [CrossRef]

- Altman, E.I. Finicial ratios, discriminant analysis and the prediction of corporate bankruptcy. J. Financ. 1968, 23, 589–609. [Google Scholar] [CrossRef]

- Ohlson, J.A. financial ratios and the probabilistic prediction of bankruptcy. J. Account. Res. 1980, 18, 109–131. [Google Scholar] [CrossRef]

- Zmijewski, M.E. Methodological issues related to the estimation of financial distress prediction models. J. Account. Res. 1984, 22, 59–82. [Google Scholar] [CrossRef]

- Gilson, S.C.; John, K.; Lang, L.H. Troubled debt restructurings: An empirical study of private reorganization of firms in default. J. Financ. Econ. 1990, 27, 315–353. [Google Scholar] [CrossRef]

- Alderson, M.J.; Betker, B.L. Liquidation costs and capital structure. J. Financ. Econ. 1995, 39, 45–69. [Google Scholar] [CrossRef]

- Hothkiss, E.S. Postbankruptcy performance and management turnover. J. Financ. 1995, 50, 3–21. [Google Scholar] [CrossRef]

- Sanchez-Lasheras, F.; De Andres, J.; Lorca, P.; De Cos Juez, F.C. A hybrid device for the solution of sampling bias problems in the forecasting of firm’s bankruptcy. Expert Syst. Appl. 2012, 39, 7512–7523. [Google Scholar] [CrossRef]

- Shumway, T. Forecasting bankruptcy more accurately: A sample hazard model. J. Bus. 2001, 74, 101–124. [Google Scholar] [CrossRef]

- Sudarsanam, S.; Lai, J. Corporate financial distress and turnaround strategies: An empirical analysis. Br. J. Manag. 2001, 12, 183–199. [Google Scholar] [CrossRef]

- Chava, S.; Jarrow, R.A. Bankruptcy prediction with industry effects. Rev. Financ. 2004, 8, 537–569. [Google Scholar] [CrossRef]

- Hillegeist, S.A.; Keating, E.K.; Cram, D.P.; Lundstedt, K.G. Assessing the probability of bankruptcy. Rev. Account. Stud. 2004, 9, 5–34. [Google Scholar] [CrossRef]

- Bharath, S.T.; Shumway, T. Forecasting default with the Merton distance to default model. Rev. Financ. Stud. 2008, 21, 1339–1369. [Google Scholar] [CrossRef]

- Campbell, J.Y.; Hilscher, J.; Szilagyi, J. In search of distress risk. J. Financ. 2008, 63, 2899–2939. [Google Scholar] [CrossRef]

- Beaver, W.H.; Correia, M.; McNichols, M.F. Finicial statement analysis and the prediction of financial distress. Found. Trends Account. 2010, 5, 99–173. [Google Scholar] [CrossRef]

- Zhou, F.; Fu, L.; Li, Z.; Xu, J. The recurrence of financial distress: A survival analysis. Int. J. Forecast. 2022, 38, 1100–1115. [Google Scholar] [CrossRef]

- Aknon, H.; Nwaeze, E.T. Why and how firms use operating cash flow in compensation. Account. Bus. Res. 2018, 48, 400–426. [Google Scholar] [CrossRef]

- Bhandari, S.B.; Iyer, R. Predicting business failure using cash flow statement based measures. Manag. Financ. 2013, 39, 667–676. [Google Scholar]

- Fawzi, N.S.; Kamaluddin, A.; Sanusi, Z.M. Monitoring distressed companies through cash flow analysis. Proc. Econ. Financ. 2015, 28, 136–144. [Google Scholar] [CrossRef]

- Khong, L.Y.; Low, C.S.; Tee, L.P.; Wan Lim, L. Corporate failure prediction in Malaysia. J. Res. Bus. Econ. Manag. 2015, 4, 343–375. [Google Scholar]

- Cole, R.; Sokolyk, T. How do firms choose legal form of organization? In Proceedings of the 31st Australasian Finance and Banking Conference, Sydney, Australia, 13–15 December 2018. [Google Scholar]

- Lee, J.; Kim, E. Foreign monitoring and predictability of future cash flow. Sustainability 2019, 11, 4832. [Google Scholar] [CrossRef]

- Ong, S.W.; Choong Yap, V.; Khong, R.W. Corporate failure prediction: A study of public listed companies in Malaysia. Manag. Financ. 2011, 37, 553–564. [Google Scholar] [CrossRef]

- White, M. Bankruptcy liquidation and reorganization. In Handbook of Modern Finance; Warren, Gorham and Lamont: Boston, MA, USA, 1984. [Google Scholar]

- Pelaez-Verdet, A.; Loscertales-Sanchez, P. Key ratios for long-term prediction of hotel financial distress and corporate default: Survival analysis for an economic stagnation. Sustainability 2021, 13, 1473. [Google Scholar] [CrossRef]

- Bryan, D.; Tiras, S.; Wheately, C. The interaction of solvency with liquidity and its association with bankruptcy emergence. J. Bus. Financ. Account. 2002, 29, 935–965. [Google Scholar] [CrossRef]

- Campbell, S. Predicting bankruptcy reorganization for closely held firms. Account. Horiz. 1996, 10, 12–25. [Google Scholar]

- Casey, C.; McGee, V.; Stickney, C. Discriminating between reorganized and liquidated firms in bankruptcy. Account. Rev. 1986, 61, 249–262. [Google Scholar]

- Casey, C.; Bartczak, N. Using operating cash flow data to predict financial distress: Some extensions. J. Account. Res. 1985, 23, 384–401. [Google Scholar] [CrossRef]

- Cox, D.R. Regression models and life-tables. J. R. Stat. Soc. 1972, 34, 187–220. [Google Scholar] [CrossRef]

- Ongena, S.; Smith, D.C. The duration of bank relationships. J. Financ. Econ. 2001, 61, 449–475. [Google Scholar] [CrossRef]

- Huang, J.C.; Huang, C.S. Bank relationships and firm private debt restructuring: A duration analysis. Banks Bank Sys. 2009, 4, 39–49. [Google Scholar]

- Huang, J.C.; Huang, C.S.; You, C.F. Bank relationships and the likelihood of filing reorganization. Int. Rev. Econ. Financ. 2015, 35, 278–291. [Google Scholar]

- Brunner, A.; Krahnen, J.P. Multiple lenders and corporate distress: Evidence on debt restructuring. Rev. Econ. Stud. 2008, 75, 415–442. [Google Scholar] [CrossRef]

- Anginer, D.; Yildizhan, C. Is There a Distress Risk Anomaly? Pricing of Systematic Default Risk in the Cross Section of Equity Returns. World Bank Policy Research Working Paper No. 5319. 2010. Available online: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=1616477 (accessed on 10 August 2022).

- Tobin, J. Estimation of relationships for limited dependent. Econometrica 1958, 26, 24–36. [Google Scholar] [CrossRef]

| Panel A: Distribution of the Sample by Year of Firm Survival (n = 309) | |||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| Year | Distressed Firms (and %) | Surviving Firms (and %) | Successful Survival (%) | ||||||||

| 2003 | 13 (4.21) | 10 (4.59) | 76.92 | ||||||||

| 2004 | 15 (4.85) | 11 (5.05) | 73.33 | ||||||||

| 2005 | 20 (6.47) | 15 (6.88) | 75.00 | ||||||||

| 2006 | 22 (7.12) | 17 (7.80) | 77.27 | ||||||||

| 2007 | 27 (8.74) | 17 (7.80) | 62.96 | ||||||||

| 2008 | 40 (12.94) | 25 (11.47) | 62.50 | ||||||||

| 2009 | 30 (9.71) | 18 (8.26) | 60.00 | ||||||||

| 2010 | 17 (5.50) | 12 (5.50) | 70.59 | ||||||||

| 2011 | 21 (6.80) | 16 (7.34) | 72.73 | ||||||||

| 2012 | 19 (6.15) | 14 (6.42) | 73.68 | ||||||||

| 2013 | 20 (6.47) | 14 (6.42) | 70.00 | ||||||||

| 2014 | 14(4.53) | 11 (5.05) | 78.57 | ||||||||

| 2015 | 18 (5.83) | 14 (6.42) | 77.78 | ||||||||

| 2016 | 19 (6.15) | 14 (6.42) | 73.68 | ||||||||

| 2017 | 14 (4.53) | 10 (4.59) | 76.92 | ||||||||

| Total | 309 (100.00) | 218 (100.00) | 70.55 | ||||||||

| Panel B: Distribution of Firms by Years Required to Return to Profitability (n = 218) | |||||||||||

| Years Required to Eliminate Distress | |||||||||||

| Year | Firms | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | Avg. Length for Recovery (Year) |

| 2003 | 10 | 5 | 2 | 1 | 2 | 0 | 0 | 0 | 0 | 0 | 4.00 |

| 2004 | 11 | 6 | 2 | 0 | 1 | 1 | 1 | 0 | 0 | 0 | 4.27 |

| 2005 | 15 | 3 | 3 | 1 | 3 | 2 | 2 | 1 | 0 | 0 | 5.53 |

| 2006 | 17 | 1 | 2 | 2 | 4 | 3 | 2 | 3 | 0 | 0 | 6.41 |

| 2007 | 17 | 1 | 1 | 2 | 5 | 1 | 3 | 2 | 1 | 1 | 6.88 |

| 2008 | 25 | 1 | 2 | 2 | 6 | 3 | 3 | 5 | 2 | 1 | 7.12 |

| 2009 | 18 | 2 | 3 | 2 | 4 | 1 | 1 | 3 | 2 | 0 | 6.33 |

| 2010 | 12 | 6 | 2 | 1 | 0 | 2 | 0 | 0 | 1 | 0 | 4.58 |

| 2011 | 16 | 7 | 3 | 1 | 2 | 2 | 0 | 1 | 0 | 0 | 4.56 |

| 2012 | 14 | 5 | 3 | 2 | 0 | 1 | 1 | 2 | 0 | 0 | 5.00 |

| 2013 | 14 | 6 | 4 | 1 | 1 | 0 | 2 | 0 | 0 | 0 | 4.36 |

| 2014 | 11 | 5 | 2 | 1 | 2 | 1 | 0 | 0 | 0 | 0 | 4.27 |

| 2015 | 14 | 5 | 2 | 4 | 3 | 0 | 0 | 0 | 0 | 0 | 4.36 |

| 2016 | 14 | 5 | 4 | 5 | 0 | 0 | 0 | 0 | 0 | 0 | 4.00 |

| 2017 | 10 | 6 | 4 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 3.40 |

| Total | 218 | 64 | 39 | 25 | 33 | 17 | 15 | 17 | 6 | 2 | 5.25 |

| Variables | Mean | St. Dev. | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 | 13 | 14 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 1. Dependent variable (Survival = 1) | 0.71 | 0.46 | 1.00 | |||||||||||||

| 2. ΔOCFadequacy1 | 1.08 | 1.61 | 0.41 | 1.00 | ||||||||||||

| 3. ΔOCFadequacy2 | 1.27 | 1.37 | 0.35 | 0.84 | 1.00 | |||||||||||

| 4. ΔOCFstability | 0.74 | 1.04 | 0.44 | 0.40 | 0.30 | 1.00 | ||||||||||

| 5. ΔOCFgrowth | 0.11 | 0.61 | 0.42 | 0.28 | 0.25 | 0.20 | 1.00 | |||||||||

| 6. Profitability | 1.36 | 1.06 | 0.20 | 0.09 | 0.10 | 0.17 | 0.21 | 1.00 | ||||||||

| 7. Liquidity | 2.19 | 1.63 | 0.19 | 0.11 | 0.07 | 0.13 | 0.13 | −0.02 | 1.00 | |||||||

| 8. Leverage | 0.42 | 0.17 | −0.12 | −0.05 | −0.01 | −0.10 | −0.16 | −0.08 | −0.48 | 1.00 | ||||||

| 9. Growth | 0.28 | 0.21 | 0.33 | 0.11 | 0.08 | 0.03 | 0.32 | −0.07 | 0.28 | −0.18 | 1.00 | |||||

| 10. Firm size | 14.59 | 1.65 | 0.19 | 0.10 | 0.08 | 0.19 | −0.05 | 0.29 | −0.28 | 0.31 | −0.12 | 1.00 | ||||

| 11. Recession | 0.31 | 0.46 | 0.06 | 0.02 | −0.01 | −0.07 | −0.10 | 0.02 | −0.03 | 0.06 | 0.03 | 0.08 | 1.00 | |||

| 12. Industry1 | 0.09 | 0.29 | −0.09 | −0.05 | −0.04 | −0.01 | −0.17 | −0.05 | −0.08 | 0.05 | −0.09 | 0.13 | 0.01 | 1.00 | ||

| 13. Industry2 | 0.17 | 0.38 | −0.05 | 0.05 | 0.01 | −0.00 | 0.01 | −0.03 | 0.03 | −0.07 | 0.04 | −0.11 | 0.02 | −0.02 | 1.00 | |

| 14. Industry3 | 0.13 | 0.34 | −0.11 | −0.04 | −0.02 | −0.08 | −0.02 | −0.02 | 0.01 | 0.16 | 0.15 | 0.17 | 0.17 | −0.09 | −0.18 | 1.00 |

| Variables | Mean (Median) | Differences of Surviving and Non-Surviving Firms | |||

|---|---|---|---|---|---|

| Surviving Firms | Non-Surviving Firms | Differences | t-Test t-St. (p-Value) | Wilcoxon Test z-St. (p-Value) | |

| ΔOCFadequacy1 | 1.77 (1.53) | −0.57 (−0.27) | 2.34 (1.80) | 7.91 (0.00 ***) | 7.42 (0.00 ***) |

| ΔOCFadequacy2 | 2.02 (1.47) | −0.53 (−0.11) | 2.55 (1.58) | 6.43 (0.00 ***) | 6.70 (0.00 ***) |

| ΔOCFstability | 1.13 (0.99) | −0.22 (−0.12) | 1.35 (1.11) | 8.59 (0.00 ***) | 8.95 (0.00 ***) |

| ΔOCFgrowth | 0.54 (0.46) | −0.92 (−0.63) | 1.46 (1.09) | 7.98 (0.00 ***) | 7.87 (0.00 ***) |

| Profitability | 2.16 (2.45) | −0.54 (1.20) | 2.70 (1.25) | 3.63 (0.00 ***) | 4.09 (0.00 ***) |

| Liquidity | 2.38 (1.75) | 1.71 (1.64) | 0.67 (0.11) | 3.36 (0.00 ***) | 3.64 (0.00 ***) |

| Leverage | 0.41 (0.42) | 0.45 (0.47) | −0.04 (−0.05) | −2.16 (0.03 **) | −2.18 (0.03 **) |

| Growth | 0.41 (0.22) | −0.03 (−0.03) | 0.44 (0.25) | 6.21 (0.00 ***) | 8.98 (0.00 ***) |

| Firm size | 14.79 (14.78) | 14.11 (14.19) | 0.68 (0.59) | 3.33 (0.00 ***) | 3.34 (0.00 ***) |

| Recession | 0.33 (0.00) | 0.26 (0.00) | 0.07 (0.00) | 1.15 (0.19) | 1.07 (0.28) |

| Industry1 | 0.07 (0.00) | 0.13 (0.00) | −0.06 (0.00) | −1.63 (0.10) | −1.62 (0.10) |

| Industry2 | 0.16 (0.00) | 0.08 (0.00) | 0.08 (0.00) | 1.87 (0.06 *) | 1.86 (0.06 *) |

| Industry3 | 0.16 (0.00) | 0.20 (0.00) | −0.04 (0.00) | −0.89 (0.37) | −0.90 (0.37) |

| Sample size | 218 | 91 | |||

| Variables | (1) | (2) | (3) |

|---|---|---|---|

| Intercept | −9.154 *** (2.585) | −9.304 *** (2.559) | −8.913 *** (2.572) |

| Changes in OCF to total assets (ΔOCFadequacy1) | 0.306 *** (0.114) | ||

| Changes in OCF to total liabilities (ΔOCFadequacy2) | 0.194 ** (0.092) | ||

| Intensity of changes in OCF (ΔOCFintensity) | 0.564 *** (0.210) | ||

| Stability of changes in OCF (ΔOCFstability) | 0.863 *** (0.245) | 0.954 *** (0.243) | 0.895 *** (0.245) |

| Growth of changes in OCF (ΔOCFgrowth) | 0.404 *** (0.150) | 0.396 *** (0.145) | 0.397 *** (0.147) |

| Firm profitability | 0.054 (0.040) | 0.052 (0.038) | 0.053 (0.039) |

| Firm liquidity | 0.492 ** (0.236) | 0.515 *** (0.255) | 0.499 ** (0.253) |

| Firm leverage | −0.523 (1.399) | −0.408 (1.380) | −0.508 (1.389) |

| Firm growth | 4.152 *** (0.851) | 4.188 *** (0.842) | 4.157 *** (0.846) |

| Firm size | 0.562 *** (0.166) | 0.564 *** (0.164) | 0.564 *** (0.165) |

| Recession dummy | 0.631 (0.439) | 0.705 (0.436) | 0.673 (0.439) |

| Industry1 dummy | −0.499 (0.636) | −0.548 (0.636) | −0.529 (0.637) |

| Industry2 dummy | 0.437 (0.680) | 0.303 (0.653) | 0.365 (0.662) |

| Industry3 dummy | −0.589 (0.543) | −0.573 (0.541) | −0.584 (0.542) |

| Sample size | 309 | 309 | 309 |

| Pseudo R-sq. | 0.530 | 0.526 | 0.530 |

| Variables | Weibull Model | Cox’s Model | ||||

|---|---|---|---|---|---|---|

| (1) | (2) | (3) | (4) | (5) | (6) | |

| Intercept | 2.025 *** (0.280) | 2.010 *** (0.277) | 2.044 *** (0.279) | |||

| Changes in OCF to total assets (ΔOCFadequacy1) | −0.027 *** (0.011) | 1.064 ** (0.032) | ||||

| Changes in OCF to total liabilities (ΔOCFadequacy2) | −0.022 *** (0.007) | 1.049 *** (0.016) | ||||

| Intensity of changes in OCF (ΔOCFintensity) | −0.051 ** (0.222) | 1.120 ** (0.054) | ||||

| Stability of changes in OCF (ΔOCFstability) | −0.053 *** (0.020) | −0.056 *** (0.020) | −0.055 ** (0.021) | 1.121 ** (0.058) | 1.132 ** (0.057) | 1.127 ** (0.056) |

| Growth of changes in OCF (ΔOCFgrowth) | −0.042 ** (0.017) | −0.039 ** (0.015) | −0.042 *** (0.016) | 1.093 ** (0.040) | 1.098 *** (0.038) | 1.103 *** (0.039) |

| Firm profitability | −0.012 ** (0.005) | −0.010 ** (0.005) | −0.013 *** (0.004) | 1.026 ** (0.012) | 1.023 * (0.012) | 1.028 ** (0.010) |

| Firm liquidity | −0.042 *** (0.013) | −0.041 *** (0.013) | −0.040 *** (0.013) | 1.088 *** (0.031) | 1.087 *** (0.032) | 1.081 *** (0.031) |

| Firm leverage | 0.067 (0.214) | 0.069 (0.213) | 0.056 (0.214) | 0.995 (0.776) | 0.881 (0.693) | 0.853 (0.520) |

| Firm growth | −0.106 *** (0.031) | −0.101 *** (0.032) | −0.099 *** (0.031) | 1.261 *** (0.089) | 1.247 *** (0.091) | 1.237 *** (0.088) |

| Firm size | −0.001 (0.021) | −0.001 (0.020) | −0.006 (0.021) | 1.032 (0.995) | 1.002 (0.993) | 1.010 (0.046) |

| Recession dummy | 0.130 *** (0.050) | 0.125 ** (0.050) | 0.125 ** (0.050) | 0.731 ** (0.092) | 0.743 ** (0.093) | 0.742 ** (0.092) |

| Industry1 dummy | 0.111 (0.097) | 0.107 (0.096) | 0.115 (0.093) | 0.801 (0.826) | 0.826 (0.838) | 0.789 (0.775) |

| Industry2 dummy | 0.092 (0.078) | 0.079 (0.077) | 0.077 (0.076) | 0.840 (0.530) | 0.864 (0.549) | 0.867 (0.513) |

| Industry3 dummy | 0.080 (0.065) | 0.075 (0.064) | 0.083 (0.066) | 0.834 (0.569) | 0.845 (0.657) | 0.833 (0.628) |

| Scale (σ) | 1.099 *** (0.048) | 1.087 *** (0.046) | 1.097 *** (0.047) | |||

| Log likelihood | −91.339 | −90.382 | −92.820 | −972.371 | −971.645 | −982.770 |

| Sample size | 218 | 218 | 218 | 218 | 218 | 218 |

| Variables | (1) | (2) | (3) |

|---|---|---|---|

| Intercept | −1.386 ** (0.704) | −1.433 ** (0.705) | −1.304 * (0.704) |

| Changes in OCF to total assets (ΔOCFadequacy1) | 0.088 *** (0.027) | ||

| Changes in OCF to total liabilities (ΔOCFadequacy2) | 0.057 *** (0.021) | ||

| Intensity of changes in OCF (ΔOCFintensity) | 0.166 *** (0.052) | ||

| Stability of changes in OCF (ΔOCFstability) | 0.218 *** (0.052) | 0.244 *** (0.052) | 0.225 *** (0.052) |

| Growth of changes in OCF (ΔOCFgrowth) | 0.208 *** (0.047) | 0.207 *** (0.047) | 0.205 *** (0.047) |

| Firm profitability | 0.005 (0.010) | 0.004 (0.010) | 0.005 (0.011) |

| Firm liquidity | 0.151 ** (0.076) | 0.159 ** (0.077) | 0.153 ** (0.076) |

| Firm leverage | −0.229 (0.387) | −0.222 (0.389) | −0.233 (0.388) |

| Firm growth | 1.099 *** (0.209) | 1.133 *** (0.211) | 1.108 *** (0.209) |

| Firm size | 0.147 *** (0.046) | 0.149 *** (0.058) | 0.148 *** (0.046) |

| Recession dummy | 0.166 (0.132) | 0.189 (0.133) | 0.177 (0.182) |

| Industry1 dummy | −0.172 (0.182) | −0.181 (0.184) | −0.179 (0.182) |

| Industry2 dummy | 0.164 (0.207) | 0.118 (0.207) | 0.138 (0.206) |

| Industry3 dummy | −0.191 (0.158) | −0.189 (0.158) | −0.191 (0.158) |

| Sample size | 309 | 309 | 309 |

| Pseudo R-sq. | 0.378 | 0.373 | 0.378 |

| Panel A: Determinants of the Likelihood of Survival for Marginally Distressed Firms—Logistic Regression | ||||||

| Variables | (1) | (2) | (3) | |||

| Intercept | −8.262 *** (2.552) | −8.435 *** (2.658) | −8.893 *** (2.659) | |||

| Changes in OCF to equitis (ΔOCFequity) | 0.209 ** (0.083) | |||||

| Changes in OCF to net income (ΔOCFnet income) | 0.181 ** (0.073) | |||||

| Changes in OCF to sales (ΔOCFsales) | 0.147 ** (0.072) | |||||

| Stability of changes in OCF (ΔOCFstability_5yrs) | 0.852 *** (0.284) | 0.984 *** (0.292) | 0.851 *** (0.287) | |||

| Growth of changes in OCF (ΔOCFgrowth_5yrs) | 0.442 *** (0.135) | 0.479 *** (0.133) | 0.478 *** (0.134) | |||

| Firm profitability | 0.028 (0.029) | 0.022 (0.028) | 0.019 (0.029) | |||

| Firm liquidity | 0.465 ** (0.217) | 0.554 ** (0.225) | 0.512 ** (0.218) | |||

| Firm leverage | −0.160 (1.519) | −0.164 (1.428) | −0.117 (1.517) | |||

| Firm growth | 4.181 *** (0.976) | 4.463 *** (0.957) | 4.488 *** (1.131) | |||

| Firm size | 0.505 *** (0.157) | 0.498 *** (0.169) | 0.547 *** (0.164) | |||

| Recession dummy | 0.435 (0.396) | 0.467 (0.383) | 0.410 (0.397) | |||

| Industry1 dummy | −0.684 (0.610) | −0.830 (0.662) | −0.840 (0.669) | |||

| Industry2 dummy | 0.456 (0.609) | 0.498 (0.558) | 0.327 (0.601) | |||

| Industry3 dummy | −0.298 (0.433) | −0.339 (0.412) | −0.321 (0.422) | |||

| Sample size | 309 | 309 | 309 | |||

| Pseudo R-sq. | 0.466 | 0.468 | 0.466 | |||

| Panel B: Factors of the Duration of Survival for Marginally Distressed Firms | ||||||

| Variables | Weibull Model | Cox’s Model | ||||

| (1) | (2) | (3) | (4) | (5) | (6) | |

| Intercept | 2.090 *** (0.262) | 2.080 *** (0.266) | 2.076 *** (0.261) | |||

| Changes in OCF to equities (ΔOCFequity) | −0.024 ** (0.012) | 1.087 ** (0.027) | ||||

| Changes in OCF to net income (ΔOCFnet income) | −0.021 ** (0.011) | 1.069 ** (0.021) | ||||

| Changes in OCF to sales (ΔOCFsales) | −0.026 ** (0.014) | 1.044 ** (0.013) | ||||

| Stability of changes in OCF (ΔOCFstability_5yrs) | −0.071 * (0.038) | −0.072 * (0.038) | −0.065 * (0.040) | 1.183 ** (0.100) | 1.189 ** (0.102) | 1.171 * (0.104) |

| Growth of changes in OCF (ΔOCFgrowth_5yrs) | −0.043 *** (0.015) | −0.044 *** (0.015) | −0.040 *** (0.015) | 1.096 *** (0.038) | 1.099 *** (0.038) | 1.091 ** (0.037) |

| Firm profitability | −0.010 ** (0.005) | −0.011 ** (0.005) | −0.012 ** (0.006) | 1.011 ** (0.011) | 1.011 ** (0.011) | 1.011 ** (0.011) |

| Firm liquidity | −0.045 *** (0.014) | −0.045 *** (0.013) | −0.044 *** (0.014) | 1.096 *** (0.034) | 1.098 *** (0.034) | 1.095 *** (0.034) |

| Firm leverage | 0.046 (0.237) | 0.045 (0.238) | 0.047 (0.235) | 0.970 (0.605) | 0.978 (0.611) | 0.946 (0.608) |

| Firm growth | −0.095 *** (0.032) | −0.095 *** (0.031) | −0.101 *** (0.031) | 1.231 *** (0.090) | 1.227 *** (0.088) | 1.243 *** (0.091) |

| Firm size | −0.011 (0.020) | −0.010 (0.020) | −0.010 (0.020) | 1.016 (0.045) | 1.016 (0.044) | 1.013 (0.044) |

| Recession dummy | 0.132 *** (0.050) | 0.132 *** (0.051) | 0.134 *** (0.050) | 0.730 ** (0.091) | 0.731 ** (0.093) | 0.727 ** (0.091) |

| Industry1 dummy | 0.133 (0.084) | 0.130 (0.085) | 0.129 (0.086) | 0.740 (0.147) | 0.741 (0.148) | 0.747 (0.153) |

| Industry2 dummy | 0.078 (0.070) | 0.079 (0.070) | 0.082 (0.073) | 0.859 (0.139) | 0.856 (0.138) | 0.856 (0.143) |

| Industry3 dummy | 0.062 (0.069) | 0.065 (0.072) | 0.067 (0.069) | 0.876 (0.140) | 0.876 (0.143) | 0.866 (0.137) |

| Scale (σ) | 1.077 *** (0.043) | 1.078 *** (0.043) | 1.080 *** (0.444) | |||

| Log likelihood | −99.137 | −99.122 | −98.406 | −986.316 | −986.347 | −985.892 |

| Sample size | 218 | 218 | 218 | 218 | 218 | 218 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Huang, J.-C.; Lin, H.-C.; Huang, D. The Effect of Operating Cash Flow on the Likelihood and Duration of Survival for Marginally Distressed Firms in Taiwan. Sustainability 2022, 14, 17024. https://doi.org/10.3390/su142417024

Huang J-C, Lin H-C, Huang D. The Effect of Operating Cash Flow on the Likelihood and Duration of Survival for Marginally Distressed Firms in Taiwan. Sustainability. 2022; 14(24):17024. https://doi.org/10.3390/su142417024

Chicago/Turabian StyleHuang, Jiang-Chuan, Hueh-Chen Lin, and Daniel Huang. 2022. "The Effect of Operating Cash Flow on the Likelihood and Duration of Survival for Marginally Distressed Firms in Taiwan" Sustainability 14, no. 24: 17024. https://doi.org/10.3390/su142417024

APA StyleHuang, J.-C., Lin, H.-C., & Huang, D. (2022). The Effect of Operating Cash Flow on the Likelihood and Duration of Survival for Marginally Distressed Firms in Taiwan. Sustainability, 14(24), 17024. https://doi.org/10.3390/su142417024