The Importance of Agricultural Export Performance on the Economic Growth of Indonesia: The Impact of the COVID-19 Pandemic

Abstract

1. Introduction

2. Conceptual Framework

3. Materials and Methods

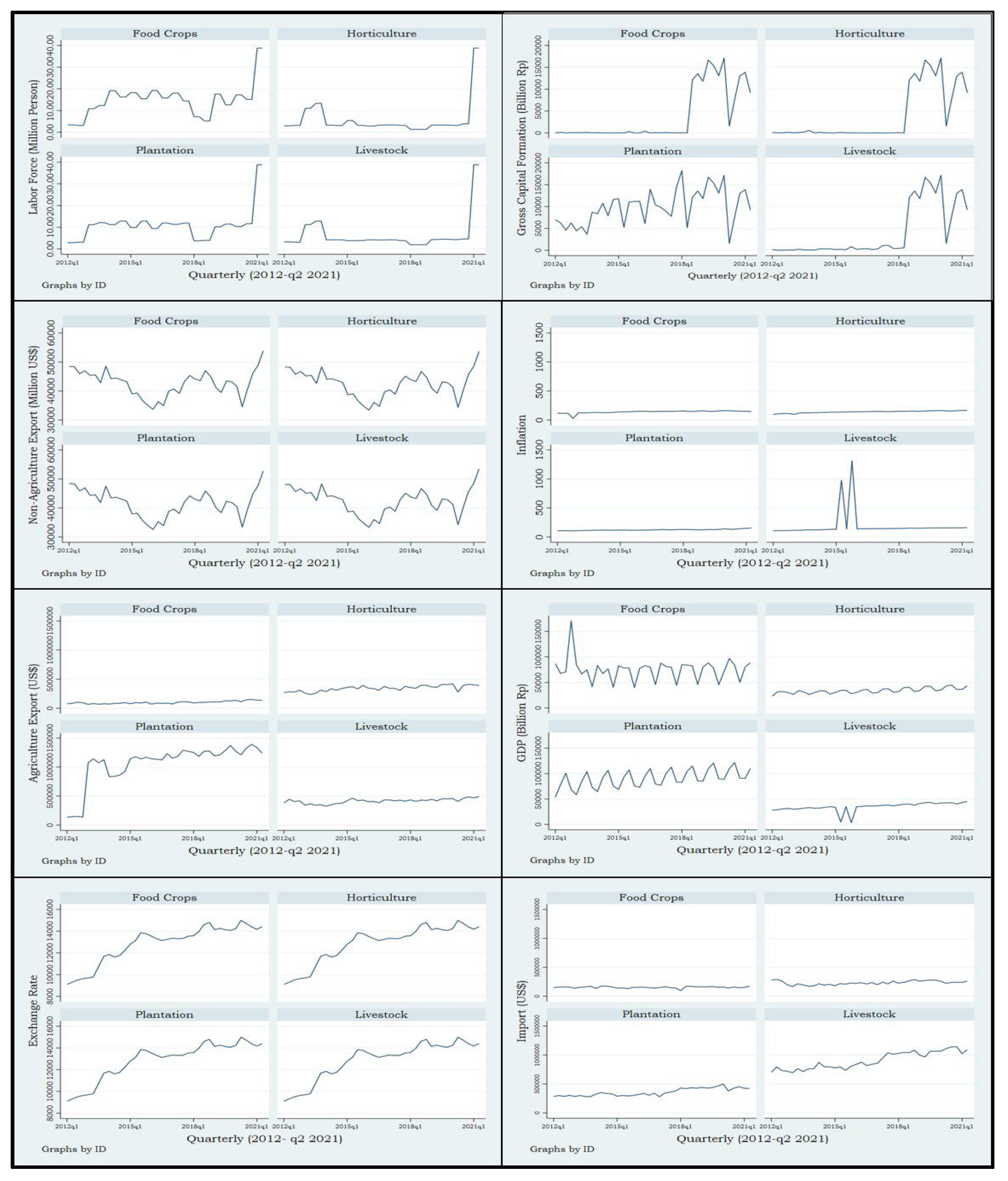

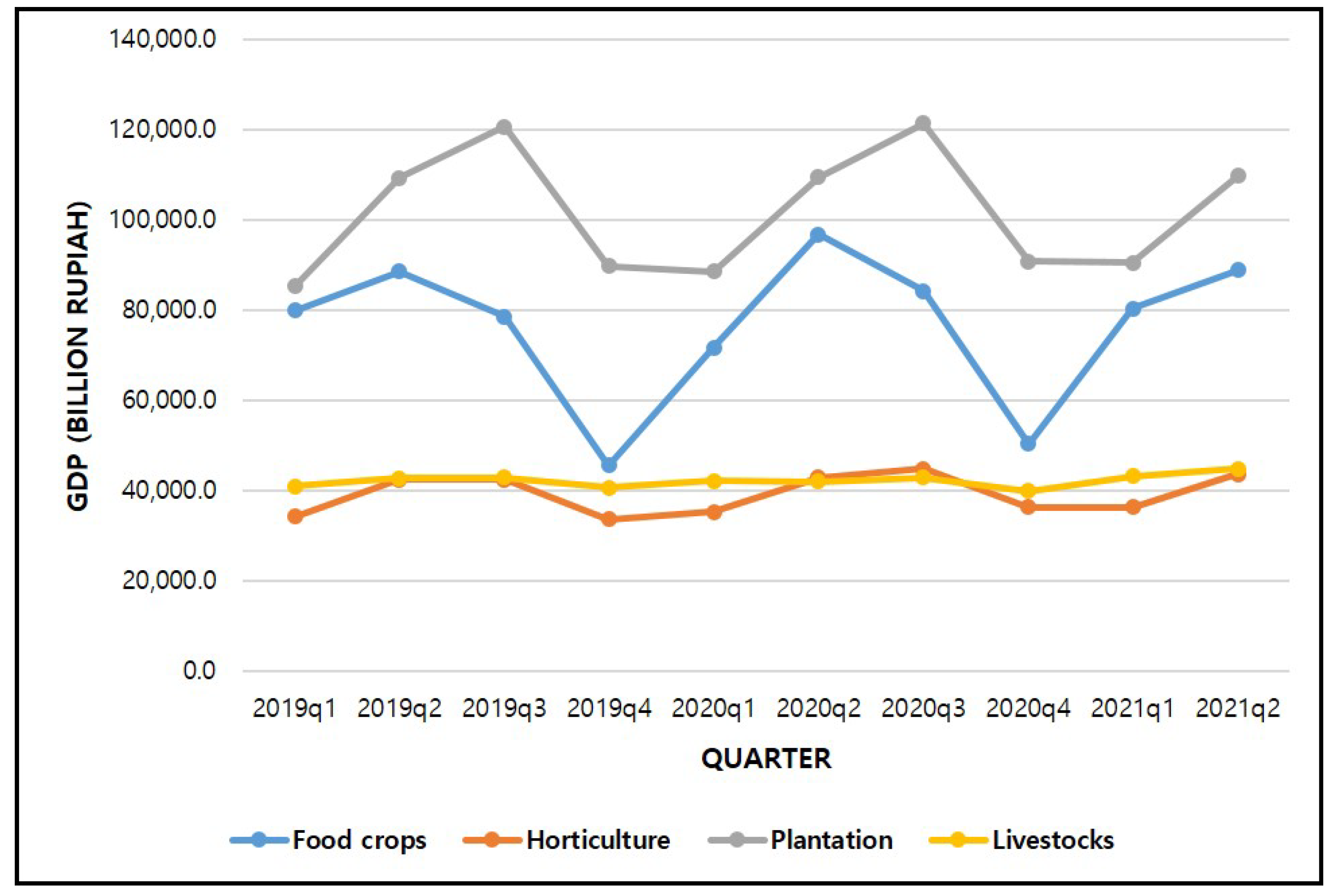

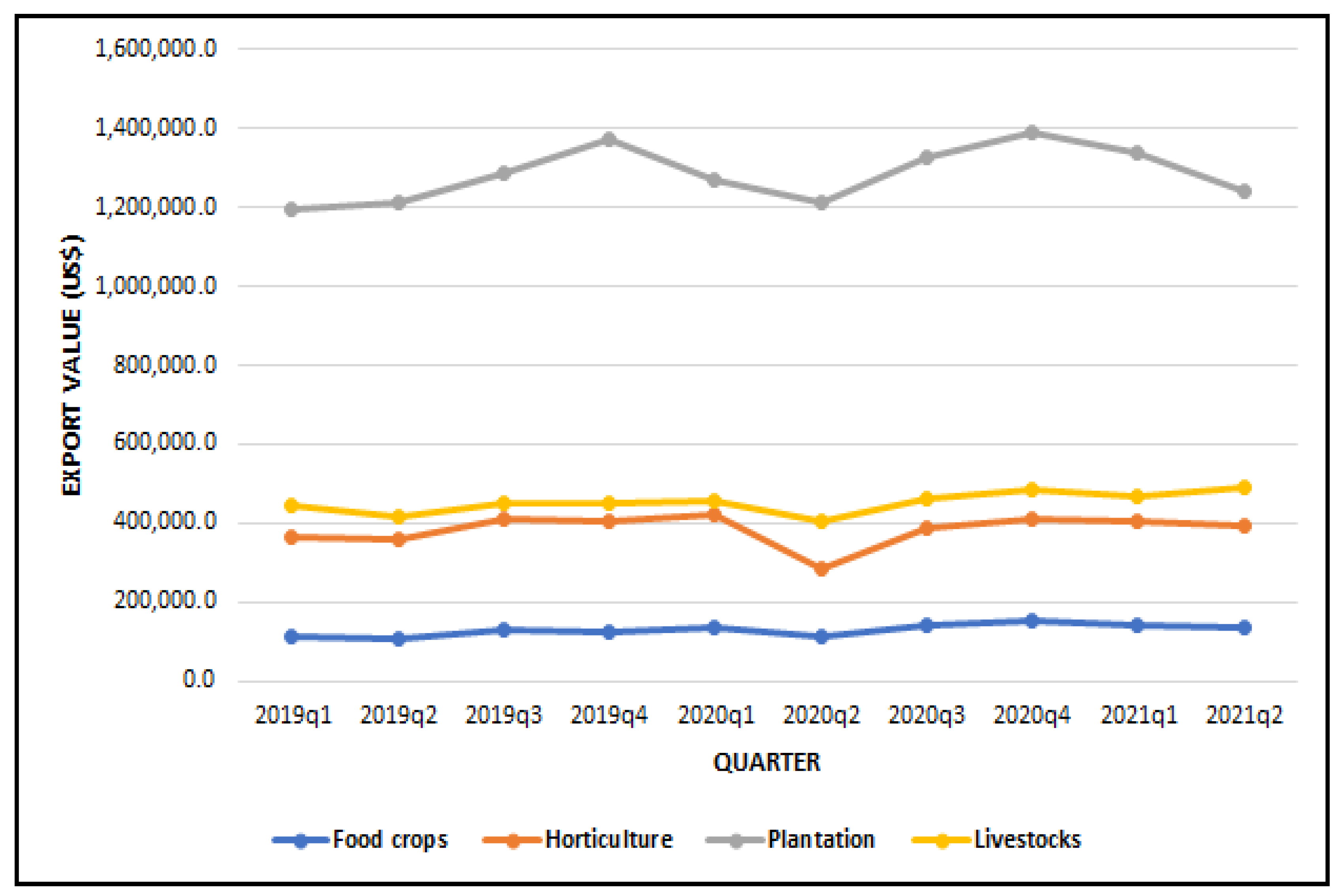

3.1. Materials

3.2. Methods

4. Results and Discussion

4.1. Unit Root Test, the Test of Heteroscedasticity, Serial Correlation, and Cross-Sectional Dependence

4.2. Estimates from FGLS, FE, and RE

4.3. Post Estimation Test for 2 SLS

5. Conclusions, Recommendations, and Implications

5.1. Conclusions

5.2. Recommendations and Implications

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- World Health Organization. WHO Coronavirus (COVID-19) Dashboard. 2021. Available online: https://covid19.who.int/ (accessed on 5 May 2021).

- Satuan Tugas Penanganan COVID-19. Analisis Data COVID-19 Indonesia (Issue April). 2021. Available online: https://covid19.go.id/id/p/berita/analisis-data-covid-19-indonesia-update-25-april-2021 (accessed on 5 May 2021).

- Wang, J.; Shao, W.; Kim, J. Analysis of the impact of COVID-19 on the correlations between crude oil and agricultural futures. Chaos Solitons Fractals 2020, 136, 109896. [Google Scholar] [CrossRef] [PubMed]

- Rozaki, Z. COVID-19, agriculture, and food security in Indonesia. Rev. Agric. Sci. 2020, 8, 243–261. [Google Scholar] [CrossRef] [PubMed]

- Badan Pusat Statistik. Pertumbuhan Ekonomi Indonesia Triwulan II-2020. 2020. Available online: www.bps.go.id (accessed on 8 May 2021).

- Statistic Indonesia. Indonesian Economic Growth in Q3-2020. Badan Pusat Statistik: Jakarta Indonesia 2020, 85/11/Th.XXIII, 1–10. [Google Scholar]

- BPS. Keadaan Ketenagakerjaan Indonesia Agustus 2020; Badan Pusat Statistik: Jakarta, Indonesia, 2020; XXiI, 05 N(91); pp. 1–20. [Google Scholar]

- Maliszewska, M.; Mattoo, A.; van der Mensbrugghe, D. The Potential Impact of COVID-19 on GDP and Trade: A Preliminary Assessment; World Bank Group: Washington, DC, USA, 2020. [Google Scholar] [CrossRef]

- Yofa, R.D.; Erwidodo, E.S. Dampak Pandemi COVID-19 Terhadap Ekspor dan Impor; Iaard Press: Jakarta, Indonesia, 2020. [Google Scholar]

- Andenew, Y.; Woldeyohannes, B. The Impact of Agricultural Export Commodity Prices on Nigeria’s Economic Growth. J. Integr. Mark. Comm. Digital Mark. 2020, 25–42. [Google Scholar] [CrossRef]

- Kyaw, A.M.M. 2017. Agricultural Export and Economic Growth In ASEAN Countries. Master’s Thesis, KDI School of Public Policy and Management, Sejong, Republic of Korea. Available online: www.idpublications.org (accessed on 5 October 2021).

- Lin, B.X.; Zhang, Y.Y. Impact of the COVID-19 pandemic on agricultural exports. J. Integr. Agric. 2020, 19, 2937–2945. [Google Scholar] [CrossRef]

- Balassa, B. Exports and economic growth. Further evidence. J. Dev. Econ. 1978, 5, 181–189. [Google Scholar] [CrossRef]

- Siamwalla, A.; Setboonsarng, S.; Werakarnjanapongs, P. Changing Comparative Advantage in Thai Agriculture. In OECD Development Centre Working Paper No.35; OECD Publishing: Paris, France, 1991; Volume 35, pp. 9–52. [Google Scholar]

- Feder, G. On exports and economic growth. J. Dev. Econ. 1983, 12, 59–73. [Google Scholar] [CrossRef]

- Ram, R. Exports and Economic Growth in Developing Countries: Evidence from Time-Series and Cross-Section Data. Econ. Dev. Cult. Change 1987, 36, 51–72. [Google Scholar] [CrossRef]

- Vohra, R. Export and economic growth: Further time series evidence from less-developed countries. Int. Adv. Econ. Res. 2001, 7, 345–350. [Google Scholar] [CrossRef]

- Ahmad, J.; Kwan, A.C.C. Causality between exports and economic growth. Empirical evidence from Africa. Econ. Lett. 1991, 37, 243–248. [Google Scholar] [CrossRef]

- Chow, P.C.Y. Empirial Evidence from the NICs. J. Dev. Econ. 1987, 26, 55–63. [Google Scholar] [CrossRef]

- Sephton, P.S. Causality Between Export Growth and Industrial Development. J. Dev. Econ. 1989, 31, 413–415. [Google Scholar] [CrossRef]

- Matsuyama, K. Agricultural productivity, comparative advantage, and economic growth. J. Econ. Theory 1992, 58, 317–334. [Google Scholar] [CrossRef]

- Sanjuán-López, A.I.; Dawson, P.J. Agricultural Exports and Economic Growth in Developing Countries: A Panel Cointegration Approach. J. Agric. Econ. 2010, 61, 565–583. [Google Scholar] [CrossRef]

- Siaw, A.; Jiang, Y.; Pickson, R.B.; Dunya, R. Agricultural Exports and Economic Growth: A Disaggregated Analysis for Ghana. Theor. Econ. Lett. 2018, 8, 2251–2270. [Google Scholar] [CrossRef]

- Negem, S.H. Simultaneity Problem of Exports and Economic Growth: A Panel Data Analysis of the European Union. China-USA Bus. Rev. 2016, 15, 577–601. [Google Scholar] [CrossRef]

- Henneberry, S.R.; Khan, M.E. An analysis of the linkage between agricultural exports and economic growth in Pakistan. Cross-Natl. Cross Cult. Issues Food Mark. 2014, 10, 13–30. [Google Scholar] [CrossRef]

- Hayakawa, K.; Mukunoki, H. The impact of COVID-19 on international trade: Evidence from the first shock. J. Jpn. Int. Econ. 2021, 60, 101135. [Google Scholar] [CrossRef]

- Beckman, J.; Countryman, A.M. The Importance of Agriculture in the Economy: Impacts from COVID-19. Am. J. Agric. Econ. 2021, 103, 1595–1611. [Google Scholar] [CrossRef]

- Osabohien, R.; Iqbal, B.A.; Osabuohien, E.S.; Khan, M.K.; Nguyen, D.P. Agricultural trade, foreign direct investment and inclusive growth in developing countries: Evidence from West Africa. Transnatl. Corp. Rev. 2021, 14, 244–255. [Google Scholar] [CrossRef]

- Maulana, A.S.; Nubatonis, A. Dampak Pandemi COVID-19 terhadap Kinerja Nilai Ekspor Pertanian Indonesia. Agrimor 2020, 5, 69–71. [Google Scholar] [CrossRef]

- Chenery, H.B.; Strout, A.M. American Economic Association Foreign Assistance and Economic Development: Reply. Communications 2009, 58, 912–916. [Google Scholar]

- Michalski, W. Exports and economic growth. Intereconomics 1970, 5, 209–211. [Google Scholar] [CrossRef][Green Version]

- Osabohien, R.; Akinpelumi, D.; Matthew, O.; Okafor, V.; Iku, E.; Olawande, T.; Okorie, U. Agricultural Exports and Economic Growth in Nigeria: An Econometric Analysis. IOP Conf. Ser. Earth Environ. Sci. 2019, 331, 012002. [Google Scholar] [CrossRef]

- Barua, S. Munich Personal RePEc Archive COVID-19 pandemic and world trade: Some analytical notes COVID-19 pandemic and world trade: Some analytical notes. Munich Pers. RePEc Arch. 2020, 99761, 1–36. [Google Scholar]

- Hoechle, D. Robust standard errors for panel regressions with cross-sectional dependence. Stata J. 2007, 7, 281–312. [Google Scholar] [CrossRef]

- Zahir, M. Contribution of agricultural exports to economic growth in Pakistan. Pak. J. Commer. Soc. Sci. 2012, 6, 133–146. [Google Scholar]

- Levin, A.; Raut, L.K. Complementarities between exports and human capital in economic growth: Evidence from the semi-industrialized countries. Econ. Dev. Cult. Change 1998, 46, 155–174. [Google Scholar] [CrossRef]

- Badan Pusat Statistik. Republik Indonesia. Ekonomi Indonesia 2019 Tumbuh 5,02 Persen; Badan Pusat Statistik: Jakarta, Indonesia, 2020; 17/02/Th. XXIV; pp. 1–12. [Google Scholar]

- Bakari, S.; Mabrouki, M. (2017). The Effect of Agricultural Exports on Economic Growth in South-Eastern Europe: An Empirical Investigation Using Panel Data. J. Smart Econ. Growth 2017, 2, 49–64. [Google Scholar]

- Ocran, M.K.; Biekpe, N. Primary commodity export and economic growth in sub Sahara Africa: Evidence from panel data analysis. S. Afr. J. Econ. Manag. Sci. 2008, 11, 465–474. [Google Scholar] [CrossRef]

- Gyimah-Brempong, K. Export Instability and Economic Growth in Sub-Saharan Africa. Econ. Dev. Cult. Change 1991, 39, 815–828. [Google Scholar] [CrossRef]

- Adams, F.G.; Behrman, J.R.; Roldan, R.A. Measuring the Impact of Primary Commodity Fluctuations on Economic Development: Coffee and Brazil. Am. Econ Rev. 2017, 69, 164–168. [Google Scholar]

- Sule, O.; Harrigan, J. Export Instabillity and Growth. In UCLA Economics Working Papers 486; UCLA Department of Economics: Los Angeles, CA, USA, 1988; pp. 1–28. [Google Scholar]

- Ullah, S.; Zaefarian, G.; Ullah, F. How to use instrumental variables in addressing endogeneity? A step-by-step procedure for non-specialists. Ind. Mark. Manag. 2021, 96, A1–A6. [Google Scholar] [CrossRef]

- Gujarati, D.N. Basic Econometrics; McGraw-Hill: New York, NY, USA, 2004. [Google Scholar]

- Abu-lila, Z.M.; Alghazo, A.; Ghazo, A. The Impact of Export Instability on Economic Growth: Evidence from Jordan. J. Asian Financ. Econ. Bus. 2021, 8, 13–19. [Google Scholar] [CrossRef]

- Bashayreh, A.G.; Alomari, M.W.; Abdelhadi, S. The impact of export instability on economic growth: Sample of MENA countries. Int. J. Econ. Bus. Res. 2019, 18, 429–435. [Google Scholar] [CrossRef]

| No | Variable | Description | Source | Definition and Measurement |

|---|---|---|---|---|

| 1 | AEXP | Agriculture export (constant USD) | Database of the Ministry of Agriculture | Agricultural raw material products are based on the total value of HS code and country destination. |

| 2 | GDP | Constant Gross Domestic Product at 2010 national price (in billion rupiahs) | Central Bureau of Statistics (BPS) | In this study, GDP is the constant gross domestic product in four primary agriculture subsectors (food crop, horticulture, plantation, and livestock) based on the year 2010. |

| 3 | LF | Labor force, number of persons engaged | Central Bureau of Statistics (BPS) | The labor force is the total number of people working in four agriculture subsectors (food crop, horticulture, plantation, and livestock). It is calculated as the proportion of the population above the age of 15. |

| 4 | GCF | Gross capital formation (billion rupiahs) | Investment Coordinating Boards. | Gross capital formation is the total value of the investment resulting from domestic and foreign investment in agricultural sectors. |

| 5 | NAEXP | Non-agriculture Export (Constant USD) | Database of the Ministry of Agriculture based on Central Bureau of Statistics (BPS) data | Non-agriculture export is the amount of export for other sectors. It measures the total export minus agriculture export in four subsectors. |

| 6 | INF | Inflation rate with GDP deflator 2010 = 100 | Central Bureau of Statistics (BPS) | × 100 |

| 7 | ER | Exchange rate | Database of the Ministry of Trade based on Central Bureau of Statistics (BPS) | The exchange rate is defined as the price of Rupiah in USD. This rate is measured as the average rate for the period. |

| 8 | IMP | Import (Constant USD) | Database of the Ministry of Agriculture based on Central Bureau of Statistics (BPS) data | Agricultural raw material products based on the total value of HS code and the country destination. |

| 9 | DCOV | Dummy Variable of the COVID-19 pandemic. | 1: year COVID-19 0: year non COVID-19 | This dummy variable reflects the number of years since the COVID-19 pandemic began. |

| Variable | Mean | Std. Dev. | Min | Max | Observations | |

|---|---|---|---|---|---|---|

| Agriculture export | overall | 480,123.9 | 398,213.5 | 67,054.9 | 1,391,506 | N = 152 |

| (USD) | between | 411,794.4 | 99,615.1 | 1,063,842 | n = 4 | |

| within | 174,787.7 | −449,019.8 | 807,787.3 | T = 38 | ||

| Gross Domestic Product | overall | 58,624.2 | 29,068.7 | 3626.3 | 170,614.5 | N = 152 |

| (Billion Rp) | between | 28,652.3 | 33,985.4 | 90,480.1 | n = 4 | |

| within | 15,006.5 | 21,632.9 | 154,036.9 | T = 38 | ||

| Labor Force | overall | 9.6 | 8.63 | 1.4 | 38.8 | N = 152 |

| (Million people) | between | 4.15 | 5.9 | 14.7 | n = 4 | |

| within | 7.84 | −2.1 | 42.4 | T = 38 | ||

| Gross Capital Formation | overall | 5407.9 | 6167.5 | 0.6 | 18,233.5 | N = 152 |

| (Billion Rp) | between | 2980.7 | 3859.8 | 9877.3 | n = 4 | |

| within | 5597.4 | −2898.4 | 18,681.1 | T = 38 | ||

| Non-agriculture export | overall | 42,327.7 | 4559.3 | 32,567.3 | 53,831.5 | N = 152 |

| (Million USD) | between | 411.9 | 41,743.8 | 42,708.5 | n = 4 | |

| within | 4545.2 | 33,151.2 | 53,450.7 | T = 38 | ||

| Inflation (GDP deflator) | overall | 148 | 118.4 | 26.1 | 1310.6 | N = 152 |

| between | 29.6 | 122.9 | 190.9 | n = 4 | ||

| within | 115.6 | 35.3 | 1267.6 | T = 38 | ||

| Exchange rate | overall | 12,834.5 | 1732.1 | 9100 | 14,989.7 | N = 152 |

| (Rupiah) | between | 0 | 12,834.5 | 12,834.5 | n = 4 | |

| within | 1732.1 | 9100 | 14,989.7 | T = 38 | ||

| Import | overall | 411,402.5 | 304,803.2 | 98,289.7 | 1144,9 | N = 152 |

| (USD) | between | 338,181.2 | 153,953.3 | 902,846.5 | n = 4 | |

| within | 81,006.3 | 202,731.3 | 653,512.4 | T = 38 | ||

| Dummy COVID-19 Pandemic | overall | 0.2 | 0.4 | 0 | 1 | N = 152 |

| between | 0 | 0.2 | 0.2 | n = 4 | ||

| within | 0.4 | 0 | 1 | T = 38 |

| Unit | Agriculture Export | Gross Domestic Product | Labor Force | Gross Capital Formation | Non-Agriculture Export | Inflation | Exchange Rate | Import | |

|---|---|---|---|---|---|---|---|---|---|

| Food Crops | Mean | 99,615.07 | 75,201.82 | 14.74 | 3859.79 | 42,708.54 | 138.91 | 12,834.46 | 153,953.3 |

| St.Dv | 22,232.15 | 22,628.39 | 7.70 | 23.03 | 4558.92 | 10.95 | 1749.53 | 15,123.53 | |

| Horticulture | Mean | 342,722.1 | 33,985.38 | 5.96 | 3863.05 | 42,464.93 | 139.28 | 12,834.46 | 231,454.5 |

| St.Dv | 49,770.46 | 5205.63 | 8.38 | 6131.46 | 4564.82 | 18.33 | 1749.53 | 33,722.4 | |

| Plantation | Mean | 1,063,842 | 90,480.07 | 11.09 | 9877.31 | 41,743.81 | 122.94 | 12,834.46 | 357,355.7 |

| St.Dv | 346,470 | 17,484.11 | 7.42 | 4037.94 | 4678.57 | 10.95 | 1749.53 | 65,662.68 | |

| Livestock | Mean | 414,316.1 | 34,829.58 | 6.48 | 4031.40 | 42,393.33 | 190.99 | 12,834.46 | 902,846.5 |

| St.Dv | 40,831.23 | 8613.90 | 8.17 | 6028.85 | 4560.72 | 231.33 | 1749.53 | 145,267.4 |

| FE Heteroscedasticity Test |

|---|

| H0: sigma(i)2 = sigma2 for all chi2 (4) = 211.45 Prob > chi2 = 0.000 |

| RE Heteroscedasticity Test |

| Ho: Panel Homoscedasticity Ha: Panel Groupwise Heteroscedasticity Lagrange Multiplier LM Test = 104.1831 p-Value > Chi2(3) 0.0000 Likelihood Ratio LR Test = 28.5354 p-Value > Chi2(3) 0.0000 Wald Test = 1117.1115 p-Value > Chi2(4) 0.0000 |

| Serial Correlation test |

| H0: no first-order autocorrelation F (1, 3) = 0.873 Prob > F = 0.4191 |

| Cross-Sectional Dependence Test |

| Pesaran’s test of cross-sectional independence = 6.238, Pr = 0.0000 Average absolute value of the off-diagonal elements = 0.413 |

| Variables | FGLS | Fixed Effect | Random Effect | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Coefficient | Std. Error | p-Value | Coefficient | Std. Error | p-Value | Coefficient | Std. Error | p-Value | |

| Constant | 3.327 * | 1.808 | 0.066 | 3.773 | 3.773 | 0.169 | 4.852 | 2.952 | 0.100 |

| Agricultural export | −0.046 | 0.030 | 0.131 | −0.131 ** | 0.053 | 0.015 | −0.058 | 0.050 | 0.248 |

| Labor force | 0.031 ** | 0.015 | 0.037 | 0.030 | 0.025 | 0.024 | 0.058 | 0.051 | 0,238 |

| Gross Capital Formation | 0.0049 | 0.004 | 0.259 | 0.00 | 0.007 | 0.460 | 0.007 | 0.008 | 0.383 |

| Non-agricultural export | 0.1297 | 0.106 | 0.222 | −0.072 | 0.162 | 0.656 | 0.043 | 0.183 | 0.815 |

| Inflation | −1.003 *** | 0.011 | 0.000 | −0.951 *** | 0.055 | 0.000 | −0.976 *** | 0.065 | 0.000 |

| Exchange rate | 1.227 *** | 0.132 | 0.000 | 1.023 *** | 0.176 | 0.000 | 1.163 *** | 0.178 | 0.000 |

| Import | 0.017 | 0.230 | 0.820 | 0.347 ** | 0.125 | 0.006 | −0.002 | 0.094 | 0.988 |

| COVID-19 Pandemic | 0.084 ** | 0.039 | 0.032 | 0.098 ** | 0.048 | 0.043 | 0.109 ** | 0.055 | 0.048 |

| Horticulture | −0.654 *** | 0.087 | 0.000 | ||||||

| Plantation | 0.192 ** | 0.087 | 0.028 | ||||||

| Livestock | −0.609 *** | 0.131 | 0.000 | ||||||

| Wald Chi-Square Test | 11,186.81 | ||||||||

| R-Square | 0.717 | 0.670 | |||||||

| p-value of Chi-Square | 0.000 | 0.000 | |||||||

| p-Value of F-statistics | 0.000 | ||||||||

| Hausman test | chi2 (8) = 66.40 prob > chi2 = 000 | ||||||||

| Variables | 1st Stage | 2nd Stage | ||||

|---|---|---|---|---|---|---|

| Coefficient | Std. Error | p-Value | Coefficient | Std. Error | p-Value | |

| Constant | −5.583 | 4.225 | 0.189 | 7.940 ** | 3.002 | 0.008 |

| Agricultural export | 0.730 *** | 0.229 | 0.001 | |||

| Labor force | 0.132 ** | 0.066 | 0.048 | −0.085 ** | 0.045 | 0.059 |

| Gross Capital Formation | −0.011 | 0.011 | 0.307 | 0.009 | 0.011 | 0.413 |

| Non-agricultural export | −0.163 | 0.198 | 0.934 | |||

| Inflation | −0.093 | 0.094 | 0.322 | −0.862 *** | 0.130 | 0.000 |

| Exchange rate | 1.313 *** | 0.318 | 0.000 | |||

| Import | 0.420 ** | 0.203 | 0.040 | −0.063 | 0.203 | 0.757 |

| COVID-19 Pandemic | −0.052 | 0.074 | 0.485 | 0.153 ** | 0.074 | 0.038 |

| Horticulture | 1.235 *** | 0.0817 | 0.000 | −1.731 *** | 0.282 | 0.000 |

| Plantation | 1.985 *** | 0.200 | 0.000 | −1.534 *** | 0.530 | 0.004 |

| Livestock | 0.862 *** | 0.312 | 0.007 | −1.734 *** | 0.384 | 0.000 |

| R-Square | 0.899 | 0.721 | ||||

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Arifah, K.F.; Kim, J. The Importance of Agricultural Export Performance on the Economic Growth of Indonesia: The Impact of the COVID-19 Pandemic. Sustainability 2022, 14, 16534. https://doi.org/10.3390/su142416534

Arifah KF, Kim J. The Importance of Agricultural Export Performance on the Economic Growth of Indonesia: The Impact of the COVID-19 Pandemic. Sustainability. 2022; 14(24):16534. https://doi.org/10.3390/su142416534

Chicago/Turabian StyleArifah, Khilda Faoziyah, and Jonghwa Kim. 2022. "The Importance of Agricultural Export Performance on the Economic Growth of Indonesia: The Impact of the COVID-19 Pandemic" Sustainability 14, no. 24: 16534. https://doi.org/10.3390/su142416534

APA StyleArifah, K. F., & Kim, J. (2022). The Importance of Agricultural Export Performance on the Economic Growth of Indonesia: The Impact of the COVID-19 Pandemic. Sustainability, 14(24), 16534. https://doi.org/10.3390/su142416534