How Do Investors Value Sustainability? A Utility-Based Preference Optimization

Abstract

1. Introduction

2. Theoretical Foundation

3. Data and Methodology

3.1. Data

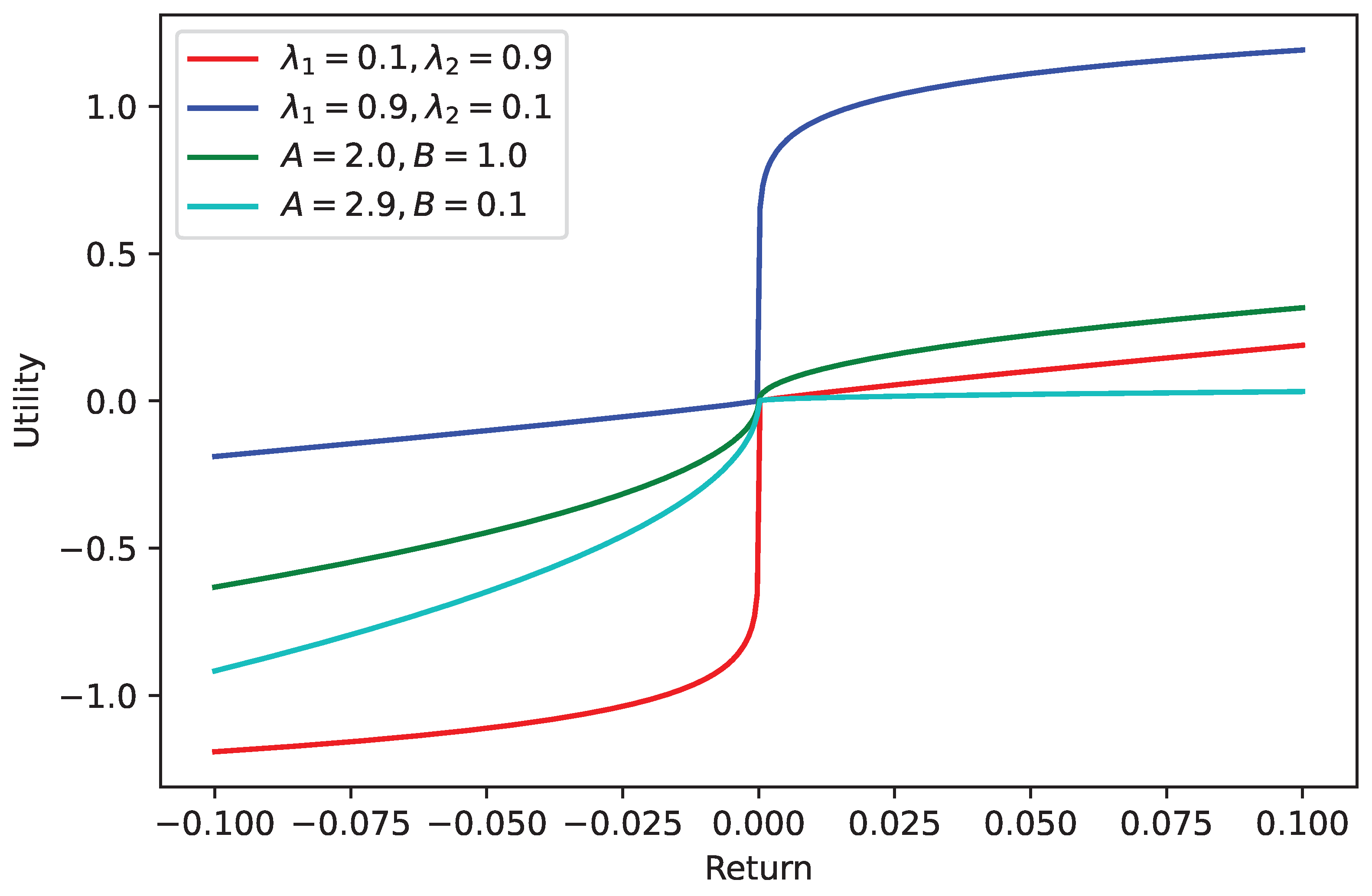

3.2. Investor Utility and Sustainability Preference

3.3. Differential Evolution

4. Results

5. Robustness

6. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Stroebel, J.; Wurgler, J. What do you think about climate finance? J. Financ. Econ. 2021, 142, 487–498. [Google Scholar] [CrossRef]

- EU. Taxonomy: Final Report of the Technical Expert Group on Sustainable Finance. Tech. Rep. 2020. Available online: https://ec.europa.eu/info/sites/default/files/business_economy_euro/banking_and_finance/documents/200309-sustainable-finance-teg-final-report-taxonomy_en.pdf (accessed on 1 September 2022).

- Pedersen, L.; Fitzgibbons, S.; Pomorski, L. Responsible investing: The ESG-efficient frontier. J. Financ. Econ. 2021, 142, 572–597. [Google Scholar] [CrossRef]

- Pástor, L.; Stambaugh, R.; Taylor, L. Sustainable investing in equilibrium. J. Financ. Econ. 2021, 142, 550–571. [Google Scholar] [CrossRef]

- Dorfleitner, G.; Utz, S. Safety first portfolio choice based on financial and sustainability returns. Eur. J. Oper. Res. 2012, 221, 155–164. [Google Scholar] [CrossRef]

- Dorfleitner, G.; Nguyen, M. A new approach for optimizing responsible investments dependently on the initial wealth. J. Asset Manag. 2016, 18, 81–98. [Google Scholar] [CrossRef]

- Baker, M.; Bergstresser, D.; Serafeim, G.; Wurgler, J. Financing the Response to Climate Change: The Pricing and Ownership of U.S. Green Bonds. NBER Work. Pap. 2018. Available online: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3275327 (accessed on 1 September 2022).

- Saleem, A.; Setiawan, B.; Bárczi, J.; Sági, J. Achieving Sustainable Economic Growth: Analysis of Islamic Debt and the Islamic Equity Market. Sustainability 2021, 13, 8319. [Google Scholar] [CrossRef]

- Hamilton, S.; Jo, H.; Statman, M. Doing Well while Doing Good? The Investment Performance of Socially Responsible Mutual Funds. Financ. Anal. J. 1993, 49, 62–66. [Google Scholar] [CrossRef]

- Bello, Z. Socially responsible investing and portfolio diversification. J. Financ. Res. 2005, 28, 41–57. [Google Scholar] [CrossRef]

- Auer, B.; Schuhmacher, F. Do socially (ir)responsible investments pay? New evidence from international ESG data. Q. Rev. Econ. Financ. 2016, 59, 51–62. [Google Scholar] [CrossRef]

- Galema, R.; Plantinga, A.; Scholtens, B. The stocks at stake: Return and risk in socially responsible investment. J. Bank. Financ. 2008, 32, 2646–2654. [Google Scholar] [CrossRef]

- Fama, E.; French, K. Disagreement, tastes, and asset prices. J. Financ. Econ. 2007, 83, 667–689. [Google Scholar] [CrossRef]

- Merton, R. A simple model of capital market equilibrium with incomplete information. J. Financ. 1987, 42, 483–510. [Google Scholar] [CrossRef]

- Heinkel, R.; Kraus, A.; Zechner, J. The Effect of Green Investment on Corporate Behavior. J. Financ. Quant. Anal. 2001, 36, 431–449. [Google Scholar] [CrossRef]

- Luo, H.; Balvers, R. Social Screens and Systematic Investor Boycott Risk. J. Financ. Quant. Anal. 2017, 52, 365–399. [Google Scholar] [CrossRef]

- Hong, H.; Kacperczyk, M. The price of sin: The effects of social norms on markets. J. Financ. Econ. 2009, 93, 15–36. [Google Scholar] [CrossRef]

- Sloan, R. Do Stock Prices Fully Reflect Information in Accruals and Cash Flows about Future Earnings? Account. Rev. 1996, 71, 289–315. [Google Scholar]

- Gompers, P.; Ishii, J.; Metrick, A. Corporate Governance and Equity Prices. Q. J. Econ. 2003, 118, 107–156. [Google Scholar] [CrossRef]

- Edmans, A. Does the stock market fully value intangibles? Employee satisfaction and equity prices. J. Financ. Econ. 2011, 101, 621–640. [Google Scholar] [CrossRef]

- Benson, K.; Humphrey, J. Socially responsible investment funds: Investor reaction to current and past returns. J. Bank. Financ. 2008, 32, 1850–1859. [Google Scholar] [CrossRef]

- Avramov, D.; Cheng, S.; Lioui, A.; Tarelli, A. Sustainable investing with ESG rating uncertainty. J. Financ. Econ. 2022, 145, 642–664. [Google Scholar] [CrossRef]

- Dupré, D.; Girerd-Potin, I.; Kassoua, R. Adding an ethical dimension to portfolio management. Financ. India 2004, 18, 625–642. [Google Scholar] [CrossRef]

- Ballestero, E.; Bravo, M.; Pérez-Gladish, B.; Arenas-Parra, M.; Plà-Santamaria, D. Socially responsible investment: A multicriteria approach to portfolio selection combining ethical and financial objectives. Eur. J. Oper. Res. 2012, 216, 487–494. [Google Scholar] [CrossRef]

- Steuer, R.; Wimmer, M.; Hirschberger, M. Overviewing the transition of Markowitz bi-criterion portfolio selection to tri-criterion portfolio selection. J. Bus. Econ. 2013, 83, 61–85. [Google Scholar] [CrossRef]

- Hirschberger, M.; Steuer, R.; Utz, S.; Wimmer, M.; Qi, Y. Computing the non-dominated surface in tri-criterion portfolio selection. Oper. Res. 2013, 61, 169–183. [Google Scholar] [CrossRef]

- Utz, S.; Wimmer, M.; Hirschberger, M.; Steuer, R. Tri-criterion inverse portfolio optimization with applicatino to socially responsible mutual funds. Eur. J. Oper. Res. 2014, 234, 491–498. [Google Scholar] [CrossRef]

- Schmidt, A.B. Optimal ESG portfolios: An example for the Dow Jones Index. J. Sustain. Financ. Invest. 2020, 12, 529–535. [Google Scholar] [CrossRef]

- Escobar-Anel, M. Multivariate risk aversion utility, application to ESG investments. N. Am. J. Econ. Financ. 2022, 63, 101790. [Google Scholar] [CrossRef]

- Becker, G. The Economics of Discrimination; The University of Chicago Press: Chicago, IL, USA, 1957. [Google Scholar]

- Phelps, E. The statistical theory of racism and sexism. Am. Econ. Rev. 1972, 62, 659–661. [Google Scholar]

- Lewis, A.; Mackenzie, C. Morals, money, ethical investing and economic psychology. Hum. Relations 2000, 53, 179–191. [Google Scholar] [CrossRef]

- Nilsson, J. Segmenting socially responsible mutual fund investor: The influence of financial return and social responsibility. Int. J. Bank Mark. 2009, 27, 5–31. [Google Scholar] [CrossRef]

- Dorfleitner, G.; Utz, S. Profiling German-speaking socially responsible investors. Qual. Res. Financ. Mark. 2014, 6, 118–156. [Google Scholar] [CrossRef]

- Kahnemann, D.; Tversky, A. Prospect theory: An analysis of decision under risk. Econometrica 1979, 47, 263–291. [Google Scholar] [CrossRef]

- Hagströmer, B.; Binner, J.M. Stock portfolio selection with full-scale optimization and differential evolution. Appl. Financ. Econ. 2009, 19, 1559–1571. [Google Scholar] [CrossRef]

- Storn, R.; Price, K. Differential evolution—A simple and efficient heuristic for global optimization over continuous spaces. J. Glob. Optim. 1997, 11, 341–359. [Google Scholar] [CrossRef]

- Bollen, N. Mutual fund attributes and investor behavior. J. Financ. Quant. Anal. 2007, 42, 683–708. [Google Scholar] [CrossRef]

- Jessen, P. Optimal responsible investment. Appl. Financ. Econ. 2012, 22, 1827–1840. [Google Scholar] [CrossRef]

- Mousa, M.; Saleem, A.; Sági, J. Are ESG shares a safe haven during COVID-19? Evidence from the arab region. Sustainability 2021, 14, 208. [Google Scholar] [CrossRef]

| Financial Returns | Sustainable Returns | |||||

|---|---|---|---|---|---|---|

| Statistic | Min. | Mean | Max. | Min. | Mean | Max. |

| Mean | −1.4119 | 0.0582 | 0.4948 | −0.3714 | −0.0002 | 0.2588 |

| Volatility | 0.0194 | 0.2179 | 2.0781 | 0.0097 | 0.1140 | 0.9067 |

| Skewness | −1.1541 | −0.2100 | 1.1306 | −1.1545 | 0.0187 | 1.1461 |

| Kurtosis | −1.9993 | −1.1758 | −0.6671 | −1.9977 | −1.1245 | −0.6668 |

| Risk Aversion Parameter | Sustainability Preference (%) | |

|---|---|---|

| A | ||

| 1 | 0.0 | 0.0 |

| 2 | 0.0 | 0.0 |

| 3 | 12.2 | 0.0 |

| 4 | 36.8 | 0.0 |

| 5 | 51.5 | 0.0 |

| 6 | 61.3 | 0.0 |

| 7 | 68.5 | 5.0 |

| 8 | 73.3 | 20.8 |

| 9 | 77.4 | 31.0 |

| 10 | 80.7 | 40.3 |

| Curvature Parameters | Sustainability Preference (%) | |||||

|---|---|---|---|---|---|---|

| A | B | z (%) | ||||

| 1.5 | 1.5 | 0.1 | 0.9 | 0 | 0.0 | 0.0 |

| 1.5 | 1.5 | 0.2 | 0.8 | 0 | 0.0 | 0.0 |

| 1.5 | 1.5 | 0.3 | 0.7 | 0 | 0.0 | 0.0 |

| 1.5 | 1.5 | 0.4 | 0.6 | 0 | 0.0 | 0.0 |

| 1.5 | 1.5 | 0.5 | 0.5 | 0 | 0.0 | 0.0 |

| 1.5 | 1.5 | 0.6 | 0.4 | 0 | 0.0 | 0.0 |

| 1.5 | 1.5 | 0.7 | 0.3 | 0 | 0.0 | 0.0 |

| 1.5 | 1.5 | 0.8 | 0.2 | 0 | 0.0 | 0.0 |

| 1.5 | 1.5 | 0.9 | 0.1 | 0 | 0.0 | 0.0 |

| 2.0 | 1.0 | 0.5 | 0.5 | 0 | 0.0 | 0.0 |

| 2.1 | 0.9 | 0.5 | 0.5 | 0 | 0.0 | 0.0 |

| 2.2 | 0.8 | 0.5 | 0.5 | 0 | 0.0 | 0.0 |

| 2.3 | 0.7 | 0.5 | 0.5 | 0 | 52.8 | 0.0 |

| 2.4 | 0.6 | 0.5 | 0.5 | 0 | 75.2 | 0.0 |

| 2.5 | 0.5 | 0.5 | 0.5 | 0 | 83.2 | 0.0 |

| 2.6 | 0.4 | 0.5 | 0.5 | 0 | 86.6 | 0.0 |

| 2.7 | 0.3 | 0.5 | 0.5 | 0 | 88.2 | 44.6 |

| 2.8 | 0.2 | 0.5 | 0.5 | 0 | 88.8 | 85.3 |

| 2.9 | 0.1 | 0.5 | 0.5 | 0 | 89.1 | 93.5 |

| Curvature Parameters | Sustainability Preference (%) | |||||

|---|---|---|---|---|---|---|

| A | B | z (%) | ||||

| 1.5 | 1.5 | 0.1 | 0.9 | 5 | 0.0 | 0.0 |

| 1.5 | 1.5 | 0.2 | 0.8 | 5 | 0.0 | 0.0 |

| 1.5 | 1.5 | 0.3 | 0.7 | 5 | 0.0 | 0.0 |

| 1.5 | 1.5 | 0.4 | 0.6 | 5 | 0.0 | 0.0 |

| 1.5 | 1.5 | 0.5 | 0.5 | 5 | 0.0 | 0.0 |

| 1.5 | 1.5 | 0.6 | 0.4 | 5 | 0.0 | 0.0 |

| 1.5 | 1.5 | 0.7 | 0.3 | 5 | 0.0 | 0.0 |

| 1.5 | 1.5 | 0.8 | 0.2 | 5 | 0.0 | 0.0 |

| 1.5 | 1.5 | 0.9 | 0.1 | 5 | 0.0 | 0.0 |

| 2.0 | 1.0 | 0.5 | 0.5 | 5 | 0.0 | 0.0 |

| 2.1 | 0.9 | 0.5 | 0.5 | 5 | 0.0 | 0.0 |

| 2.2 | 0.8 | 0.5 | 0.5 | 5 | 0.0 | 0.0 |

| 2.3 | 0.7 | 0.5 | 0.5 | 5 | 0.0 | 0.0 |

| 2.4 | 0.6 | 0.5 | 0.5 | 5 | 0.0 | 0.0 |

| 2.5 | 0.5 | 0.5 | 0.5 | 5 | 0.0 | 0.0 |

| 2.6 | 0.4 | 0.5 | 0.5 | 5 | 38.1 | 0.0 |

| 2.7 | 0.3 | 0.5 | 0.5 | 5 | 54.0 | 0.0 |

| 2.8 | 0.2 | 0.5 | 0.5 | 5 | 59.0 | 45.6 |

| 2.9 | 0.1 | 0.5 | 0.5 | 5 | 60.6 | 75.2 |

| Curvature Parameters | Sustainability Preference (%) | |||||

|---|---|---|---|---|---|---|

| A | B | z (%) | ||||

| 1.5 | 1.5 | 0.1 | 0.9 | −5 | 94.3 | 94.9 |

| 1.5 | 1.5 | 0.2 | 0.8 | −5 | 94.5 | 0.0 |

| 1.5 | 1.5 | 0.3 | 0.7 | −5 | 95.3 | 0.0 |

| 1.5 | 1.5 | 0.4 | 0.6 | −5 | 0.0 | 0.0 |

| 1.5 | 1.5 | 0.5 | 0.5 | −5 | 0.0 | 0.0 |

| 1.5 | 1.5 | 0.6 | 0.4 | −5 | 0.0 | 0.0 |

| 1.5 | 1.5 | 0.7 | 0.3 | −5 | 0.0 | 0.0 |

| 1.5 | 1.5 | 0.8 | 0.2 | −5 | 100.0 | 0.0 |

| 1.5 | 1.5 | 0.9 | 0.1 | −5 | 100.0 | 100.0 |

| 2.0 | 1.0 | 0.5 | 0.5 | −5 | 98.1 | 0.0 |

| 2.1 | 0.9 | 0.5 | 0.5 | −5 | 98.1 | 0.0 |

| 2.2 | 0.8 | 0.5 | 0.5 | −5 | 98.1 | 0.0 |

| 2.3 | 0.7 | 0.5 | 0.5 | −5 | 98.1 | 0.0 |

| 2.4 | 0.6 | 0.5 | 0.5 | −5 | 98.1 | 95.7 |

| 2.5 | 0.5 | 0.5 | 0.5 | −5 | 98.1 | 95.7 |

| 2.6 | 0.4 | 0.5 | 0.5 | −5 | 98.1 | 95.7 |

| 2.7 | 0.3 | 0.5 | 0.5 | −5 | 98.1 | 95.7 |

| 2.8 | 0.2 | 0.5 | 0.5 | −5 | 98.1 | 95.7 |

| 2.9 | 0.1 | 0.5 | 0.5 | −5 | 98.1 | 95.7 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Aslan, A.; Posch, P.N. How Do Investors Value Sustainability? A Utility-Based Preference Optimization. Sustainability 2022, 14, 15963. https://doi.org/10.3390/su142315963

Aslan A, Posch PN. How Do Investors Value Sustainability? A Utility-Based Preference Optimization. Sustainability. 2022; 14(23):15963. https://doi.org/10.3390/su142315963

Chicago/Turabian StyleAslan, Aydin, and Peter N. Posch. 2022. "How Do Investors Value Sustainability? A Utility-Based Preference Optimization" Sustainability 14, no. 23: 15963. https://doi.org/10.3390/su142315963

APA StyleAslan, A., & Posch, P. N. (2022). How Do Investors Value Sustainability? A Utility-Based Preference Optimization. Sustainability, 14(23), 15963. https://doi.org/10.3390/su142315963