Abstract

Sustainable food production is an important foundation for a country’s development. With the accelerated pace of China’s economic development, many farmers are relocating to cities. This change in farmers’ part-time employment may lead to a shortage of agricultural labor supply and can result in insufficient food production. Therefore, the government implemented grain subsidies to promote food production. This study investigates the impact of grain subsidies on the labor supply of farm households, using panel data from fixed observations in rural China. The results show that grain subsidies increase the agricultural labor time of incompletely divided part-time farmers, especially the time spent growing food. This increase is because the members of these households are more likely to be engaged in temporary-seasonal-nonfarm work, and they can switch between nonfarm and agricultural work more easily. Moreover, this study finds that as the total amount of subsidies received by farmers increases, the effect of per-unit subsidies becomes more pronounced. These findings may provide evidence of subsidy effects and present policy implications for ensuring adequate food supply and sustainable agricultural development in the future.

1. Introduction

The sustainability of food security is an important issue of global concern because of its special significance and role in the political economy of countries [1]. As a large-population country, China relies heavily on grain, which is the most important agricultural product in the country. Since ancient times, grain has been related to national security and livelihood. Building up food security is a solid foundation to effectively withstand all kinds of challenges and ensure the stability of the general situation of the country. Agriculture is a weak industry with low comparative efficiency. With the acceleration of China’s economic market-oriented reform process and the increase in nonfarm- employment opportunities [2,3], many rural laborers have started to shift to nonagricultural industries [4,5,6,7,8]. The part-time work behavior of the “farming during farming and working during farming” habit has long existed in China [9,10,11]. The quantity and quality of farmers engaged in agricultural production has significantly decreased, which poses a certain risk to agricultural development and the future food security of the country [12,13,14].

To encourage and support the development of agriculture and food production, the central government has implemented a series of grain-subsidy policies that started in 2004. The “three subsidies” in agriculture is the largest policy in terms of funding, and its impact is also the most far-reaching [15]. Considering the target orientation of the subsidy policy, implementation cost, WTO constraints, and agroecological needs, the central government merged the “three subsidies” policy into the “agricultural support and protection subsidy” in 2016. The funds for the “three subsidies” in agriculture increased from 14.45 billion RMB in 2004 to 144.2 billion RMB in 2021. The proportion of the “three subsidies” in the national financial “three agricultural” input has increased from the initial 6.18% to 22.52% (calculated using data published by the Ministry of Finance and the Ministry of Agriculture and Rural Affairs of the People’s Republic of China). Such decoupled subsidies increase farmers’ income and ease the financial constraints farmers face in production [16,17,18]. It is conducive to more inclusive and sustainable agricultural development [19]. However, do the subsidies really change farmers’ labor decisions and improve farmers’ enthusiasm for growing grain? What is the mechanism of its influence? Can future policy design be optimized? Answers to these questions are important for future sustainable food security and agricultural modernization.

The role of grain subsidy in agriculture has been examined in the literature. Firstly, from the perspective of farmers’ income, agricultural-subsidy policy, as a transfer payment, will directly increase farmers’ income [17,18,19]. However, due to the increase in production factors, the income effect brought by subsidies is easily offset. One of the most important concerns is the rise in land rents. Existing theoretical studies show that almost all subsidies will be capitalized into land rent [20]. But more empirical research confirms that landowners do not get all the subsidies. Subsidies are distributed between landowners and actual operators, and the ratio varies greatly among the different studies within a country or between countries [21,22,23]. Another aspect of research is the effect of direct- agricultural-subsidy policies on food output [24,25,26,27,28]. The output effect of subsidies mainly depends on the change of farmers’ production behavior, including the change of crop-planting area, input of agricultural-production means, and agricultural-labor decision. Some studies show that the direct-subsidy policy has a significant incentive effect on the increase of farmers’ planting area and other inputs [17,28,29]. Using tracking survey data, Li et al. find that agricultural subsidies can significantly increase the sown area of farmers in poverty-stricken areas [28]. But other scholars dispute these conclusions, arguing that decoupled transfer payments do not distort production, and therefore, do not change decisions [30,31,32,33]. The theory behind this conclusion is that the markets are perfect; farmers’ production and consumption activities are separated. Giving cash to farmers will only change their consumption-behavior decisions [19].

Subsidies may also lead to a redistribution of household-labor resources. A relatively small number of studies have sought to address the impacts of grain subsidies on labor supply. There are empirical results showing that farmers tend to devote more time to agricultural production and less time off-farm after receiving subsidies [19,34,35,36,37]. Some studies even find that subsidies have a negative effect on the off-farm employment of farm households, regardless of whether the subsidy is decoupled or coupled [38,39,40]. Moreover, decoupled subsidies have a smaller effect on off-farm labor disincentives than coupled subsidies [37]. That is, the reduction in off-farm labor time is lower under the decoupling policy. It is worth noting that farm households’ perceptions of decoupled subsidies should also be considered when analyzing the impact of agricultural subsidies on labor supply. A study of Irish farm households finds that decoupled direct-subsidy policies tend to increase farm-nonfarm employment and promote an increase in nonfarm employment hours [41]. However, some scholars dispute the above findings. They argue that subsidy policies have no effect on farm households’ labor-supply decisions, and previous studies have likely exaggerated the economic benefits of subsidies for farm households [27,42,43,44,45,46,47]. The results of a simulation of the off-farm labor supply of farmers and their spouses using a semiparametric model show that neither direct nor indirect government subsidies have an impact on the off-farm employment of producers [42].

From the literature mentioned above, a number of studies have examined the effects of subsidies on food production. They provide important reference value for our research. However, there are still several weaknesses in the research on the effect of subsidies on labor supply. First, most studies on China are based on cross-sectional data and small- sample microdata for specific regions. However, China is a vast country, and the analysis of a specific sample does not describe the entire picture. Therefore, it makes sense that scholars have reached different conclusions from their analyses. Second, it is important to note that the subsidy effects often have a lag. Farmers’ production decisions cannot be adjusted instantaneously with the change in subsidy standards, and the long-run and short-run effects of subsidy policies may be different [32,48]. The cross-sectional data may not achieve realistic and valid conclusions. Third, the designs of previous studies have not fully considered the endogenous problems in the model, which can lead to biased estimates. In addition, few studies have considered the issue from the perspective of farm- household differentiation, especially without considering the division of labor within the family. With the continuous acceleration of factor mobility between urban and rural areas, the division of farm households has become the norm in Chinese rural society [49,50]. On the one hand, traditional farming households are gradually differentiated into pure farmers or part-time farmers. On the other hand, through the aggregation of land and other factors, some farmers have become large-scale households [51]. The above different types of farm households differ in terms of resource endowment, management capacity, and the degree of importance and dependence on agricultural production [52,53,54,55,56]. Based on this, it is necessary to study the impact of agricultural subsidy policies on farmers’ labor behavior from the perspective of farm-household differentiation.

Therefore, this study contributes to the literature in several ways. First, using data from fixed-rural-observation sites in nine Chinese provinces, we comprehensively estimated the impact of subsidies on labor supply in China. Second, panel data spanning ten years (from 2003, 2006, 2009, and 2012) allowed us to consider the lag of subsidies and to analyze the long- and short-run effects of subsidies. Additionally, the robustness of the findings can be verified. Third, we tried to use the fixed-effects method of Heckman’s two-stage model to solve two types of endogeneity problems, which may exist in the research problems. Fourth, this study proposed a new classification of the criteria for part-time farmers. This is one of the innovations we are most proud of, and it is particularly important for us to reveal the mechanism of subsidies. The current definition of part-time households is mainly based on the proportion of nonfarm income in total income [57,58,59]. In the above studies, the division of labor within farm households is in a “black-box” state. Following the analytical framework of emerging classical economics to endogenize division of labor, we classify farm households into full-time farmers, fully-divided part-time farmers and incompletely-divided part-time farmers. This division helps us to understand farmers’ labor behavior more accurately and provides additional information to explain the mechanism of the impact of subsidy policies.

The remainder of the study is arranged as follows: Section 2 introduces China’s grain subsidy policy. Section 3 puts forward the theoretical-analysis framework of the effect of subsidies on labor supply and describes the data and the methods. Section 4 analyzes the result and provides a discussion. We conclude the study and discuss policy implications in Section 5.

2. The Grain Subsidy Overview

China’s agricultural-subsidy policy has gradually improved. The policy objective has shifted from ensuring supply and promoting income generation to considering ecology. The scope of the policy also extends from the middle of production to the entirety of the industrial chain. After 70 years of exploration and reform, China has gradually established an agricultural-support-and-protection system suited to its national conditions [27,60].

This study focuses on income-support policies, and the income-support policies summarized here mainly refer to the “three subsidies”. Specifically, they refer to direct subsidies for grain farmers, seed subsidies, and comprehensive agricultural subsidies. The initial goal of seed subsidies was to encourage farmers to use superior seeds, but farmers need to buy the seed themselves. The seed subsidies increased from 100 million RMB in 2002 to 22.6 billion RMB in 2013. Since 2004, the state has implemented direct subsidies for grain farmers, a policy that focuses on the main grain-producing areas to subsidize actual grain farmers [22,43]. The two policies have high implementation costs, as more than 200 million producers are small farmers in China. As a result, subsidies have evolved from production-related payments to payments based on the area of the contracted land. In 2006, the domestic price of fertilizer and diesel increased sharply due to international-market influences. Under this circumstance, the central government invested funds to implement comprehensive agricultural subsidies for farmers [27,30]. In the original policy design, the “three subsidies” were linked to food production. However, the actual cost of operation was too high, so the “three subsidies” gradually evolved into a form of income support. These subsides are decoupled from grain cultivation and are paid according to only the contracted-taxable area of the farmers.

The reform of “three subsidies in one” has defined “three subsidies” as a type of income support at the policy level. China began a pilot reform of its three-subsidy system to address its unclear policy objectives and high administrative costs, and to better meet the requirements of the WTO. In 2016, the country combined the “three subsidies” policy into “agricultural support protection subsidies”. Among them, 80% of the stock of comprehensive agricultural subsidies, direct subsidies for grain cultivation, and seed subsidies are called “arable land protection subsidies”, and 20% of the stock of comprehensive agricultural subsidies plus incremental funds are known as “subsidies for moderate scale operations of grain” [50,61]. The purpose of the “Arable Land Conservation Subsidy” is to guide farmers to protect arable-land resources, and thus realizing the strategic goal of storing food in the land. It also promotes the transformation of agricultural policies from “yellow box” to “green box”, expands the policy space to support agricultural production, and increases farmers’ income. The “subsidy for moderate scale operation of grain” is to encourage farmers to operate on a large scale and realize agricultural specialization, intensification, and modernization.

To ensure the steady progress of the grain-subsidy reform, the government initially selected five provinces to carry out the pilot reform in 2015. The five provinces are Anhui, Shandong, Hunan, Sichuan, and Zhejiang. Then, the province selects some counties to carry out the pilot work of “three subsidies” for agriculture. In 2016, the Ministry of Finance and the Ministry of Agriculture comprehensively promoted the reform of “three subsidies” nationwide on the basis of summarizing the pilot reform in 2015. The subsidies were paid directly into farmers’ accounts. By adjusting and improving the “three subsidies” policy, the policy has become much more targeted and precise. The policy reform also increased support for appropriate-scale grain production and improved the effectiveness of agricultural subsidies [60,62].

Table 1 shows the total amount of input from the central government for the “three subsidies” since 2004.

Table 1.

“Three subsidies” payments (billion RMB), 2004–2015.

3. Theoretical Analysis, Data and Methodology

3.1. Theoretical Analysis

Following the farm-household literature, the general model of subsidies and labor supply provides an important theoretical basis for the analysis of this study [63]. The farmers maximize its utility function, , where is the total household income (including agricultural income, nonagricultural income, and other nonlabor income) and means leisure. The agricultural-production function is , where denotes agricultural output, is agricultural labor input, is employed agricultural labor, and is some other fixed inputs, such as land. The wage of the farm worker is and the wage of the off-farm worker is . We assume that the off-farm wage is higher than the wage of the farm worker, which is reported as . Given the assumption that both utility functions and production functions are twice continuously differentiable and strictly concave [64].

The model considers two scenarios, one with perfect labor markets and the other with imperfect markets.

In the first case, the optimal-production decision of farmers does not depend on the consumption decision, and farmers can freely hire agricultural labor or choose nonagricultural labor. Farmers divide their total time among agricultural labor , nonagricultural labor , and leisure . The equation of household income is:

where is the price of agricultural products; is time for the employment of agricultural labor; is transfer payments.

Substituting Equation (1) into the utility function, we obtain:

Maximizing the utility equation, and given , we have

As seen from Equation (3), in a perfect and unconstrained labor market, the increase in government subsidies does not affect the household and hired-agricultural-labor input, but increases leisure and reduces the supply of nonfarm labor.

The other case is a constrained labor market. This part postulates that the nonfarm-labor market is a limited situation, which means that, because of high switching costs (such as looking for work and transportation costs) or limited employment opportunities, non-farm labor supply is unable to adjust according to actual conditions, and can only be a fixed ; therefore, the utility equation becomes:

Maximizing the utility equation, and given , we have

where , and are agricultural labor input, agricultural employees, and leisure at equilibrium.

This indicates that in a constrained labor market, an increase in government subsidies will lead to a decrease in the agricultural labor supply, and the impact on agricultural employees depends on the relationship between agricultural employees and the input of their own agricultural labor. If there is a complementary relationship between agricultural employees and owned-agricultural-labor input, the increase in subsidies will reduce agricultural employees; otherwise, the agricultural employees will increase.

The impact analysis of agricultural subsidies on labor decisions should also consider farmers’ perception. That is, whether it is considered agricultural income or ordinary government-transfer income. In the above analysis, the decoupled subsidy is treated as an ordinary-transfer income. Thus, there is only an income effect that increases leisure and decreases labor time in agriculture or off-farm. However, if the farmer treats the decoupled subsidy as an income for agricultural production, the relative marginal returns to agricultural labor will increase. Assuming that farmers are rational producers, they will choose to increase the time spent in agricultural production, which is called the substitution effect. At the same time, the decoupled subsidy will also increase the household’s income and relax the budget constraint of the farm household, so there is also an income effect. Farmers will reduce off-farm and farm labor supply, and increase leisure time. The effect of the final subsidy on farmers’ labor-time decisions depends on the size of the two types of effects. If the substitution effect is greater than the income effect, farmers will increase their employment hours. Conversely, farmers will choose to enjoy more leisure [41].

3.2. Model

Previous studies on the relationship between subsidies and labor supply mainly use the least-square model and propensity-score-matching model. [19,27] The disadvantages of the least-squares model are obvious because it cannot solve an endogeneity problem. There may be two types of endogeneity problems in this study: the first type is due to omitted variable bias. The implementation of subsidy policies and the determination of subsidy standards are not exogenous. There are some observed and unobserved factors (such as local financial resources, planting structure, geographical location, and cultural traditions) that can affect both subsidies and farmers’ labor decisions. If we cannot add all of these variables to the model as control variables, we will have an endogeneity problem in the model [65]. The second type is selection bias. Whether farmers are engaged in agricultural or non-agricultural activities is a strategic choice. This choice is not exogenous, but a conscious choice made by farmers according to their own characteristics (such as ability, personality, work experience, and opportunities). Therefore, if the previous potential selection process is not taken into account, the labor-time equation will be accidentally broken off the tail. In this case, sample-selection bias will occur [66].

For the first type of endogeneity problem, the more commonly used method is propensity score matching (PSM). PSM allows us to measure the probability of being selected as a pilot subsidy (propensity score) in each region of the country, and then select the regions closest to the probability of subsidy implementation (propensity score) as a control. By using PSM, researchers can control for observed-confounding factors between the control group and the treated group. Therefore, a quasi-random experimental environment is constructed to analyze the real effect of the policy [67]. However, the disadvantage of PSM is that, when calculating propensity score, only observed influencing factors are included in the model, but not unobserved ones [68]. Fixed-effects model can improve this deficiency. The fixed-effects model is designed to control the problem of all unobserved factors that do not change over time [69]. For example, political resources and cultural factors in a region will affect the formulation of subsidy standards, as well as farmers’ employment choices. If these factors are not controlled, the results will be biased. Fortunately, we can consider these factors to be time-invariant in the short run. This allows us to take advantage of our panel data and solve this endogenous problem using a fixed-effects model.

For another endogeneity problem caused by sample-selection bias, the main correction methods are Heckman’s two-stage model and instrumental-variable method. Heckman’s two-stage model is aimed at the relation between the error terms of the selection model and the master model. The principle of the instrumental-variable method is to estimate the fitting value of the endogenous-explanatory variable through the instrumental variable, and then replace the endogenous-explanatory variable with its fitting value. Thus, the fitting value is not related to the compound error term [66]. The instrumental-variable method is effective for correcting the endogeneity problems caused by selection bias, but it is not as targeted as Heckman’s two-stage model because it does not take into account the selection model and its relation to the master model [70].

Therefore, the fixed-effect method of Heckman’s two-stage model is adopted in this study to analyze the impact of subsidies on labor supply. The first stage is whether the farmer participates in labor. The second stage is the choice of labor time by the farmer who participates in labor. Specifically, in the first step, the inverse Mills ratio is estimated for each sample using the probit model to estimate whether farmers participate in labor. During the second step, an OLS regression is performed on the sample of farmers who participate in labor. The explanatory variables in the second-stage regression need to include the inverse Mills ratio derived in the first step. If the results of the inverse Mills ratio in the second-step regression are significant, it indicates that Heckman’s two-stage model should be used to correct for sample-selection bias. Otherwise, OLS estimation can be used directly.

The two-step estimation method is that the error of the first step is carried directly into the second step. Its estimation efficiency is not as good as the overall estimation of MLE. Therefore, MLE is used to estimate the model in this study. The final model is:

where Equation (6) is the selection equation and Equation (7) is the result equation. The subscripts and represent the farmer and year, respectively; is the binary-treatment indicator of whether the farmer works; is the labor time of the farmer; is the subsidy variable; is the other control variables; is the estimated coefficient of the subsidy and other control variables; is the farmer fixed effect; is the random disturbance term.

3.3. Data Description

This study uses microdata of farm households from fixed-rural-observation sites. The database is surveyed by the Ministry of Agriculture and Rural Development. The database uses a stratified sampling method to conduct the survey, which covers 31 provinces nationwide and investigates a sample of approximately 20,000 farm households per year. The questionnaire includes three parts: peasant household, family members, and economic and geographical environment of the village. The survey covers the composition of household members, land, fixed assets, production and management of households, the sale of agricultural products, the purchase of planting-production materials, the annual income and expenditure of households, rural economic overview, rural population, farmers, enterprises and grass-roots organizations, labor force, collective fixed assets, social development, and other aspects.

Considering the topographical characteristics, economic development level, and grain production in different regions, we selected farm-household-tracking data spanning ten years from 2003, 2006, 2009, and 2012 in nine provinces, including Shanxi, Liaoning, Zhejiang, Anhui, Jiangxi, Guangdong, Sichuan, Yunnan, and Shaanxi, with a total of 32,859 farm-household samples. The reason for choosing the samples of these nine provinces is that the geographical distribution of these nine provinces belongs to eastern (Liaoning, Zhejiang, Guangdong), central (Shanxi, Anhui, Jiangxi) and western (Sichuan, Yunnan, Shanxi) China, respectively. China’s eastern, central, and western regions have certain differences in the levels of economic development, resource endowment, and marketization. The eastern part is the coastal city, which is the most-developed area in China. The central region belongs to the grain-production base and has abundant energy resources. Most of the western regions have complicated geographical environments and backward economic development. By removing samples with missing variables, we retain the unbalanced panel data of 20,938 household samples.

In this study, farmers are classified in two ways. The first classification of farmers is determined by the individual’s part-time employment. Individuals engaged in off-farm work for less than 30 days, 30–300 days, and more than 300 days are defined as pure farm labor, part-time labor, and nonfarm labor, respectively. If all laborers in the household are pure farm laborers, the household is defined as “full-time farmers”. If there are both pure farm laborers and nonfarm laborers in the household but no part-time laborers, the household is defined as “fully divided part-time farmers”. If there are part-time laborers in the household, the household is defined as “incompletely divided part-time farmers”. If all laborers in the household are nonfarm laborers, the household is defined as a nonfarm household, which is not included in this study. Another classification is to classify farmers according to their cultivated area: “small-scale”, “medium-scale”, and “large-scale farmers” refer to farmers whose cultivated area is less than or equal to 2.3 mu (1 mu = 0.1647 acres), 2.3–8 mu, and more than 8 mu, respectively. This classification is based on the quartiles of the cultivated area of all farmers.

Referring to previous studies and theoretical models, this study adds other key factors affecting labor supply, such as individual farmer characteristics, household characteristics and external characteristics, as well as some other control variables. The statistical description of the main variables is shown in Table 2.

Table 2.

Definition and summary statistics, 2003–2012.

Off-farm labor time refers to the time that all laborers in farm households participate in off-farm work. Specifically, it is the sum of the off-farm work time of all family members in the township and the time spent outside. Farm labor time is the total amount of labor invested in agricultural production by farm households, and the time invested in food crops (wheat, rice, corn, soybeans, potatoes, etc.) cash crops (cotton, oilseeds, sugar, hemp, tobacco, sericulture, vegetables, etc.). Food labor time is the time invested in food production, including owned labor and hired labor. Total household income and village per capita income in Table 2 are actual values for the year. In the final regression, the total household income and village per capita income are the logarithm values after deflating the price index from the 2012 base period. We can see from the data in Table 2 that farm households spend more time on off-farm work. The off-farm labor time is three times as much as the farm labor time, and the time invested in food production is half of the total agricultural time.

4. Results and Discussion

4.1. Impact of the Availability of Subsidies on Labor Supply

Table 3 presents the effects of agricultural subsidies on the labor time of different types of farm households. The key explanatory variable here is whether the farm household receives the subsidy. The first three columns show the effects of subsidies on off-farm labor time, agricultural labor time, and food labor time of pure farm households. The last six columns show the effects of agricultural subsidies on labor time of fully divided and incompletely divided part-time households. The coefficient of the inverse Mills ratio is significant in the models for off-farm labor time and food labor time. This indicates the existence of self-selectivity in the sample. Therefore, it is necessary to use Heckman’s two-step regression. Only the results of the second step of the model are shown here, without the results of the first step of the regression (same as below). According to the regression results, the availability of subsidies does not have a significant effect on the labor-time supply of pure and fully divided part-time farmers. However, there is a positive effect on both agricultural and food production time of incompletely divided part-time farmers. Having subsidies increases the agricultural labor time of incomplete part-time households by 29.25 days and the food labor time by 24.29 days. This means that almost all the increased agricultural labor time is invested in the production of food. Agricultural subsidies do not reduce labor time but increase farm labor time. This lack of reduction indicates that farmers do not consider agricultural subsidies as ordinary-transfer income but as income related to agricultural production, especially food production. In terms of other variables, the household-labor-force size, agricultural acreage, and household income are all important factors affecting the labor supply of farmers.

Table 3.

Impact of the availability of subsidies on labor supply (farmer types), 2003–2012.

Table 4 presents the effects of agricultural subsidies on the labor time of farm households of different operation sizes. The coefficient of the inverse Mills ratio is significant in the models for off-farm labor time and food labor time. The inverse Mills ratio also has significant coefficients in the models for off-farm labor time and food labor time. We continue to use Heckman’s two-step correction model. Based on the regression results, access to subsidies can promote agricultural-labor and food-labor time for all three types of farmers, while the effect on off-farm labor is not significant. Specifically, access to subsidies increases agricultural-labor time by 26.68, 22.04, and 52.10 days, and food production time by 13.90, 14.24, and 49.35 days for small-, medium-, and large-scale farmers, respectively.

Table 4.

Impact of the availability of subsidies on labor supply (operation scale of farms), 2003–2012.

4.2. Impact of Subsidy Rates on Labor Supply

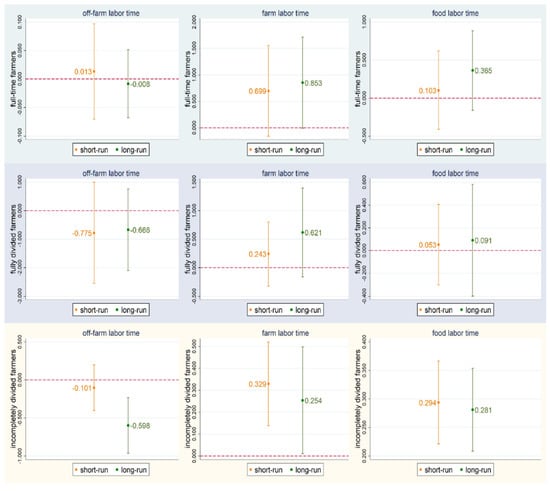

In the previous section, we analyzed the effect of having subsidies on the labor-time supply of farm households. In this section, we discuss the relationship between the subsidy rates and labor time. This study analyzes the short- and long-run effects of subsidy policies using data from 2006 and 2009, and 2006 and 2012, respectively. Figure 1 is used to demonstrate the effect of subsidy rates on the labor time of different operation types of farm households. To make the results more intuitive, only the coefficients of the subsidy variables and their 95% confidence intervals are plotted here, which are of interest to us.

Figure 1.

Impact of subsidy rates on labor supply of farmers with different operation types (short-run: 2006 and 2009; long-run: 2006 and 2012).

The three rows of results in Figure 1 show the effect of subsidies on the labor time of full-time farmers, fully divided, and incompletely divided part-time farmers from top to bottom. As shown in Figure 1, the subsidy effects are close in the short- and long-run. The subsidy rates only influence the labor-allocation decision of part-time farmers with incomplete division of labor, which is consistent with the effect of the availability of subsidies. It also proves the robustness of the regression results. Specifically, for each unit of increase in the subsidy, the agricultural labor time of incomplete part-time farmers increases by 0.33 and 0.25 days in the short- and long-run, respectively, and the food labor time increases by 0.29 and 0.28 days in the short- and long-run.

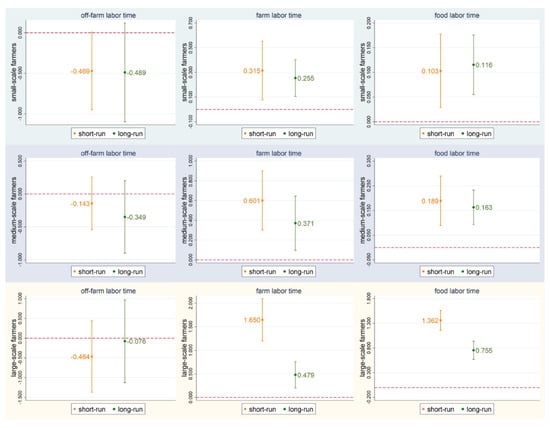

Figure 2 shows the effect of subsidies on the labor time of farmers of different operation sizes. The three rows of results in the figure show the effects of subsidies on the labor time of small-, medium- and large-scale farmers. According to the results, the subsidy rates significantly contribute to the agricultural-labor and food-labor input of all three types of farmers, but have no significant effect on nonfarm labor, which is consistent with the conclusions in Table 4. For each 1-unit increase in the subsidy rates, small-scale farmers’ agricultural-labor time increases by 0.32 and 0.26 days in the short- and long-run, medium-scale farmers increases by 0.60 and 0.37 days, and large-scale farmers increases by 1.65 and 0.48 days. The short- and long-run effects of the subsidy rates on small-scale farmers’ food labor are 0.10 and 0.12, the effects on medium-scale farmers’ food labor are 0.19 and 0.16, and the effects on large-scale farmers are 1.36 and 0.76. Overall, the results are robust. The long-run effects of subsidies are slightly smaller than the short-run effects. The subsidy effect increases as the scale of operation increases. This correlating increase may be due to the different subsidy effects under different total subsidy amounts. Large-scale farmers receive more total subsidies, and the effect of subsidy income is more pronounced for every 1-unit increase in the subsidy rates. This conjecture needs to be further evaluated.

Figure 2.

Impact of subsidy rates on labor supply of farmers with different operation scales (short-run: 2006 and 2009; long-run: 2006 and 2012).

4.3. Analysis of the Impact Mechanism

If we want to clarify the mechanism of the effect of subsidies on labor time, we need to answer the following two questions: (1) Why subsidies only affect the working hours of some farmers? (2) Why do subsidies affect labor time in different degrees?

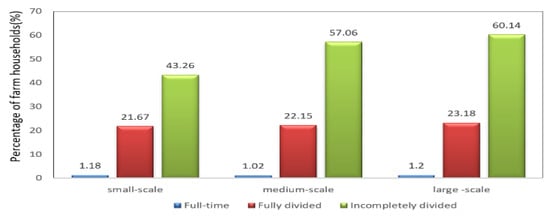

We begin with a short analysis of the first question. According to the analytical conclusion in Section 4.1 and Section 4.2, when disaggregated by farm-household operation type, subsidies have an effect only on incompletely divided part-time farmers. However, when divided by different operation sizes, subsidies influence all sizes of farm households. The analysis also finds that the proportion of full-time, fully part-time, and incompletely part-time farmers in different scales shows the same pattern, with the proportion of incompletely part-time farmers accounting for more than 50% (as shown in Figure 3). Therefore, the first hypothesis is proposed: subsidies may influence incomplete part-time farmers, and thus, reflecting the agricultural-labor effect of subsidies in the sample of farmers of different operation sizes.

Figure 3.

The Distribution among farmers of different operation scales, 2012.

The results in Figure 2 show that the labor effect of subsidies becomes larger as the scale of operation increases. From the data in Table 5, we can see that there is no difference in the subsidy rates for the three types of farmers. Instead, the total-average-household subsidy increases with the expansion of the operation scale. This leads to the second hypothesis: the larger the total subsidy is, the greater the incentive effect generated by each unit increase in the subsidy.

Table 5.

Description of subsidy funds (RMB), 2012.

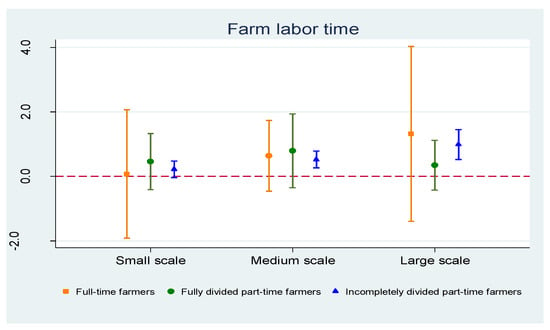

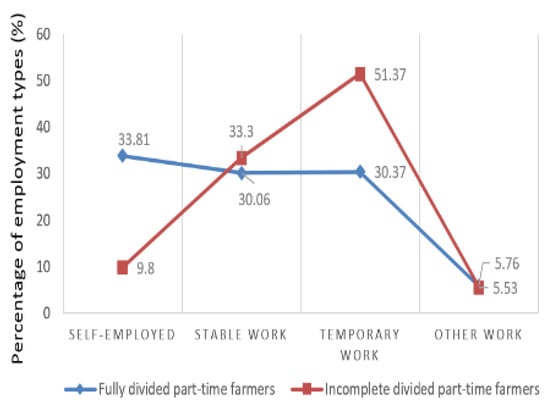

The first hypothesis is tested: whether subsidies have an effect on incomplete part-time farmers. The sample of small-scale, medium-scale, and large-scale farmers is subdivided according to the operation type of farmers, and then the effect of subsidies on the farm-labor time of farmers is analyzed in subsamples. Figure 4 shows the subsidy effects. In Figure 4, the first set of regressions shows the subsidy effects for full-time, fully divided part-time, and incompletely divided part-time farmers within the small-scale farmers’ group, and the second and third sets of regressions show the results within the medium-scale and large-scale groups. The regression coefficients of incompletely divided part-time farmers are significant at the 5% level in all three regression groups, while subsidies have no significant effect on the other two groups (full-time and fully divided part-time farmers). Therefore, the true effect of subsidies on the agricultural-labor supply of farmers is on incompletely divided part-time farmers. A plausible explanation would be that incompletely part-time farmers switch more easily between nonfarm and farm work because most of the household members are engaged in temporary and seasonal off-farm activities. The results in Figure 5 can provide some support for this argument. More than 50% of the heads of incompletely divided part-time farming households go out for odd jobs, while only 30% of the heads of fully divided part-time farming households go out for odd jobs.

Figure 4.

Subsample regression results under different operation scales, 2006 and 2012.

Figure 5.

Employment types of different part-time farmers, 2012.

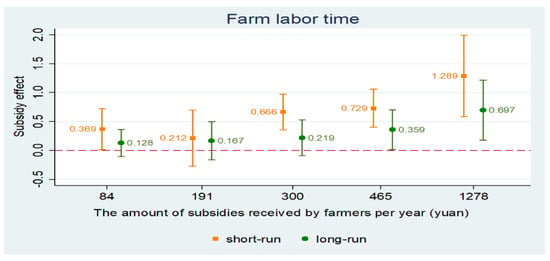

The second hypothesis is that the labor effect of subsidies increases as the total amount of subsidies increases. The sample of farmers is divided into five equal parts according to the total amount of subsidies they received in 2012. Figure 6 shows the regression results of the effect of subsidies on agricultural-labor supply for the five subsamples. The horizontal coordinate is the total-average-household subsidy in 2012 for each sample group. The data in the figure show that, the regression coefficients do not pass the 5% significance test in the first and second groups of regressions. However, the regression coefficients gradually become significant in the third group. The value of the short-run effect increases from 0.67 in the third group to 1.29 in the fifth group, and the long-run impact has the same trend. Thus, the labor effect of subsidies increases as the total level of subsidies received by farmers increases. According to this conclusion, to improve the effect of subsidies in promoting production, the subsidy funds should be inclined to large households as much as possible.

Figure 6.

Regression results of sub-samples under different subsidy amounts (short-run: 2006 and 2009; long-run: 2006 and 2012).

Our findings about the impact of grain subsidies on labor supply could have broader implications. The increasing migration of rural farmers has led to an inadequate supply of farm labor, which is directly related to sustainable food supply. Our research shows that grain subsidies have an effect on encouraging farmers to engage in agriculture, but only in a limited way. This evidence is consistent with the findings of some scholars [19,35,37]. Daione et al. have analyzed the data from different countries in sub-Saharan Africa and found that the effects of policies vary depending on the characteristics of the policies and the specific circumstances of the country. For example, subsidies reduce farmers’ off-farm supplies and allow farmers to work more on their own farm in Kenya. However, subsidies have the opposite effect in Ghana, as farmers shift their labor time from farms to paid work. More detailed research shows that subsidies in Kenya have been increasing year after year and that most farmers have received such subsidies, similar to the situation in China.

However, compared to some other studies, we seem to reach quite different conclusions [27,42,43]. Yi et al. have also used the data from fixed observation points in rural China. Their results show that subsidies have no effect on labor input per unit of land. This is not contrary to our results, because the dependent variable in this study is the total- household labor input. One of our further research manuscripts also finds that subsidies would increase farmers’ planting area, which proves that our research results and Yi’s could complement each other. Pandit’s study uses a semi-parametric model to estimate off-farm hours for farm operators and their spouses. Contrary to previous studies, they found that government subsidies have no effect on farmers’ supply of off-farm labor. In our study, there is also a large amount of evidence that the impact of subsidies on non-agricultural labor supply is not obvious (see Figure 2). However, when we divide farmers into different operation types, subsidies have an effect on the off-farm labor supply of incompletely divided part-time households in the long run (see Figure 1). This could be because Americans work less part-time and have more specialized jobs.

Therefore, the results of this study are credible. Even a subsidy policy that is decoupled from current production will change farmers’ labor decisions. Subsidies do not simply have a wealth effect but encourage farmers to allocate more time to farming. Of course, this is only for certain groups. However, the significance for China cannot be ignored because most farming families have part-time jobs. We need to explore how policies can better guide farmers’ productive behavior. This is very important for ensuring food supply and increasing farmers’ income.

5. Conclusions

Sustainable food production is an important foundation for a country’s development, and labor input is an important factor affecting food output. This study analyzes the impact of agricultural subsidies on farmers’ labor decisions in two dimensions, different types and scales, using data from the Ministry of Agriculture’s fixed rural observation site research in 2003, 2006, 2009, and 2012, including nine provinces in China. The results show that grain subsidies tend to increase the hours farmers work on producing food. The main conclusions are as follows:

First, subsidies affect the labor decisions of some farmers. When classified by operation type, the subsidy only has a positive and significant effect on the agricultural labor time and food labor time of the incompletely divided part-time farmers. When classified according to the scale of operation, it can promote the agriculture and food labor time of the three types of farmers. It is worth noting that the availability of subsidies and the subsidy rates affect labor supply in the same direction. The short- and long-run effect coefficients of the subsidy rates are close. This closeness also provides evidence for the robustness of the results.

Second, this study explores the mechanism of subsidies affecting labor. The results reveal that subsidies affect labor arrangements of part-time farm households with incomplete division of labor. This is because household members are mainly engaged in temporary and seasonal off-farm production, and they can switch between off-farm and agricultural labor more easily. Another finding is that the labor effect of subsidies becomes more pronounced as the total amount of subsidies increases, which may be explained by the fact that the larger the subsidy is, the larger the substitution effect. Thus, subsidies increase the supply of agricultural labor for farmers.

Based on the main findings of this study, we draw some policy implications. First, the government should implement targeted subsidies, especially pay attention to the incremental part of subsidies. We find that the subsidy policy affects the production behavior of some farmers, or arguably has a greater output effect on them. Therefore, in the future, the incremental subsidy funds (e.g., funds for moderate-scale grain management) can be targeted to specific farmers, such as incompletely divided part-time farmers and large-scale farmers. Second, better models should be explored to combine with or replace cash subsidies. This will allow the government to promote agricultural production, ensure food security, and increase farmers’ income to the greatest extent possible within a limited fiscal budget. For smallholder farmers, the basic form of agricultural production in China, it is necessary and important to promote their organic connection with the development of modern agriculture. For example, it is important to provid agricultural-technical guidance and agricultural-machinery services. For large-scale farmers or new types of agricultural businesses, direct-transfer payments may have a great effect on them (see Table 4, Figure 2 and Figure 6). However, the important problems they face are production risks and capital constraints. Insurance or mortgage-like support may be better alternatives. Finally, support for agriculture also requires the participation and cooperation of relevant enterprises. The government should guide the related enterprises to play a role in agricultural development. Financial institutions can innovate suitable financial products to meet the capital requirements of various agricultural entities. Starting from supporting agriculture and preventing risks, financial institutions can scientifically formulate credit lines, and guarantee methods and loan interest rates suitable for each type of agricultural subject. Other enterprises should also work with farmers in various ways. For example, they can develop the agricultural industry and ensure local employment for farmers. According to the results, the subsidy policy helps farmers, who engage in temporary off-farm activities, increase their agricultural labor supply. Agricultural production is seasonal. Enterprises can hire local workers preferentially or help migrant workers to start businesses in the village. In this way, even if farmers work part-time, it is possible to ensure the succession of agricultural development and guarantee the sustainability of food production.

Due to data limitations, we only have data available until 2012. However, this lack of data will not seriously bias the conclusions we make. The most critical question that this study seeks to answer is whether direct subsidies will change the labor supply of farmers. If so, what is the mechanism? From 2012 to the present, the “three subsidies” have always been an income support, and the amount of subsidy funds has remained the same. Therefore, using the data up to 2012 to evaluate the subsidy policy still has a strong practical significance. Given the changes in the economic and social context over the decades, the implications for current policy should be taken with caution.

In the future, based on updated data, we would like to further explore the impact of direct-grain subsidies on farmers’ production behaviors. We hope that future research can provide empirical support for the adjustment and optimization of direct subsidies and further improve the leverage effect of subsidies on food production.

Author Contributions

Conceptualization, N.X. and L.Z.; methodology, N.X.; software, N.X. and X.L.; validation, N.X. and L.Z.; formal analysis, N.X.; data curation, N.X. and X.L.; writing—original draft preparation, N.X. and X.L.; writing—review and editing, N.X. and L.Z.; visualization, N.X.; supervision, L.Z. All authors have read and agreed to the published version of the manuscript.

Funding

This study was supported by the Research Foundation for Youth Scholars of Beijing Technology and Business University (No. 19008022181).

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

Not applicable.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Barrett, C.B. Overcoming global food security challenges through science and solidarity. Am. J. Agric. Econ. 2021, 103, 422–447. [Google Scholar] [CrossRef]

- Liu, Y.S.; Wang, J.Y.; Long, H.L. Analysis of arable land loss and its impact on rural sustainability in southern Jiangsu Province of China. J. Environ. Manag. 2010, 91, 646–653. [Google Scholar] [CrossRef] [PubMed]

- Long, H.L.; Li, Y.R.; Liu, Y.S.; Woods, M.; Zou, J. Accelerated restructuring in rural China fueled by ‘increasing vs. decreasing balance’ land-use policy for dealing with hollowed villages. Land Use Policy 2012, 29, 11–22. [Google Scholar] [CrossRef]

- Knight, J.; Deng, Q.H.; Li, S. The puzzle of migrant labour shortage and rural labour surplus in China. China Econ. Rev. 2012, 22, 585–600. [Google Scholar] [CrossRef]

- Cai, F. The Great Exodus How agricultural surplus laborers have been transferred and reallocated in China’s reform period? China Agric. Econ. Rev. 2018, 10, 3–15. [Google Scholar] [CrossRef]

- Jiang, X.; Zhong, S.H.; Huang, C.C.; Guo, X.X.; Zhao, J.J. Blessing or curse? The impacts of non-agricultural part-time work of the large farmer households on agricultural labor productivity. Technol. Econ. Dev. Econ. 2022, 28, 26–48. [Google Scholar] [CrossRef]

- Zhang, L.X.; Dong, Y.Q.; Liu, C.F.; Bai, Y.L. Off-farm employment over the past four decades in rural China. China Agricu. Econ. 2018, 10, 90–214. [Google Scholar] [CrossRef]

- Hu, X.Y. Effects and Appraisal of Grain Subsidy Policy Based on Statistical Analysis. Math. Probl. Eng. 2022, 2022, 2893486. [Google Scholar] [CrossRef]

- Zhao, Y.H. Leaving the countryside: Rural-to-urban migration decisions in China. Am. Econ. Rev. 1999, 89, 281–286. [Google Scholar] [CrossRef]

- Giles, J.; Mu, R. Village political economy, land tenure insecurity, and the rural to urban migration decision: Evidence from China. Am. J. Agric. Econ. 2018, 100, 521–544. [Google Scholar] [CrossRef]

- Lu, Y.F.; Chen, M.Q.; Weng, Z.L. Drivers of the peasant households’ part-time farming behavior in China. J. Rural Stud. 2022, 93, 112–121. [Google Scholar] [CrossRef]

- Zhang, L.; Tan, S.K.; Liu, C.W.; Wang, S.L. Influence of labor transfer on farmland sustainable development: A regional comparison of plain and hilly areas. Qual. Quant. 2018, 52, 431–443. [Google Scholar] [CrossRef]

- He, Q.S.; Tan, S.K.; Yin, C.H.; Zhou, M. Collaborative optimization of rural residential land consolidation and urban construction land expansion: A case study of huangpi in wuhan, China. Computers, Comput. Environ. Urban Syst. 2019, 74, 218–228. [Google Scholar] [CrossRef]

- Zhang, H.; Zhang, Y.M.; Wu, S.; Cai, R. The effect of labor migration on farmers’ cultivated land quality protection. Sustainability. 2020, 12, 2953. [Google Scholar] [CrossRef]

- Qian, J.R.; Ito, S.; Mu, Y.Y.; Zhao, Z.J.; Wang, X.J. The role of subsidy policies in achieving grain self-sufficiency in China: A partial equilibrium approach. Agric. Econ. 2018, 64, 23–35. [Google Scholar]

- Yi, F.J.; Sun, D.Q.; Zhou, Y.H. Grain subsidy, liquidity constraints and food security—Impact of the grain subsidy program on the grain-sown areas in China. Food Policy. 2015, 50, 114–124. [Google Scholar] [CrossRef]

- Goodwin, B.K.; Mishra, A.K. Another look at decoupling: Additional evidence on the production effects of direct payments. Am. J. Agric. Econ. 2005, 87, 1200–1210. [Google Scholar] [CrossRef]

- Kirwan, B.E.; Roberts, M.J. Who really benefits from agricultural subsidies? Evidence from field-level data. Am. J. Agric. Econ. 2016, 98, 1095–1113. [Google Scholar] [CrossRef]

- Daidone, S.; Davis, B.; Handa, S.; Winters, P. The household and individual -level productive impacts of cash transfer program in Sub-Saharan Africa. Am. J. Agric. Econ. 2019, 101, 1401–1431. [Google Scholar] [CrossRef]

- Ciaian, P.; Swinnen, J.F.M. Land market imperfections and agricultural policy impacts in the New EU Member States: A partial equilibrium analysis. Am. J. Agric. Econ. 2006, 88, 799–815. [Google Scholar] [CrossRef]

- Guastella, G.; Moro, D.; Sckokai, P.; Veneziani, M. The capitalisation of CAP payments into land rental prices: A panel sample selection approach. J. Agric. Econ. 2018, 69, 688–704. [Google Scholar] [CrossRef]

- Lin, W.S.; Huang, J.K. Impacts of agricultural incentive policies on land rental prices: New evidence from China. Food Policy. 2021, 104, 102125. [Google Scholar] [CrossRef]

- Salhofer, K.; Feichtinger, P. Regional differences in the capitalisation of first and second pillar payments of the CAP into land rental prices. Eur. Rev. Agric. Econ. 2021, 48, 8–41. [Google Scholar] [CrossRef]

- Zhang, D.; Wang, H.; Lou, S. Research on grain production efficiency in China’s main grain-producing areas from the perspective of grain subsidy. Environ. Technol. Innov. 2021, 22, 101530. [Google Scholar] [CrossRef]

- Chandio, A.A.; Akram, W.; Sargani, G.R.; Twumasi, M.A.; Ahmad, F. Assessing the impacts of meteorological factors on soybean production in China: What role can agricultural subsidy play? Ecol. Inform. 2022, 71, 101778. [Google Scholar] [CrossRef]

- Garrone, M.; Emmers, D.; Lee, H.; Olper, A.; Swinnen, J. Subsidies and agricultural productivity in the EU. Agric. Econ. 2019, 50, 803–817. [Google Scholar] [CrossRef]

- Yi, F.J.; Lu, W.Y.; Zhou, Y.H. Cash transfers and multiplier effect: Lessons from the grain subsidy program in China. China Agric. Econ. Rev. 2016, 8, 81–99. [Google Scholar] [CrossRef]

- Li, C.Y.; Sha, Z.H.; Sun, X.Q.; Jiao, Y. The Effectiveness Assessment of Agricultural Subsidy Policies on Food Security: Evidence from China’s Poverty-Stricken Villages. Int. J. Environ. Res. Public Health 2022, 19, 13797. [Google Scholar] [CrossRef]

- Wang, C.; Deng, M.Z.; Deng, J.F. Factor reallocation and structural transformation implications of grain subsidies in China. J. Asian Econ. 2020, 71, 101248. [Google Scholar] [CrossRef]

- Huang, J.K.; Wang, X.B.; Zhi, H.Y.; Huang, Z.R.; Rozelle, S. Subsidies and distortions in China’s agriculture: Evidence from producer-level data. Aust. J. Agric. Resour. Econ. 2011, 55, 53–71. [Google Scholar] [CrossRef]

- Han, X.; Xue, P.; Zhang, N. Impact of Grain Subsidy Reform on the Land Use of Smallholder Farms: Evidence from Huang-Huai-Hai Plain in China. Land 2021, 10, 929. [Google Scholar] [CrossRef]

- Jayne, T.S.; Mason, N.M.; Burke, W.J.; Ariga, J. Taking stock of Africa’s second-generation agricultural input subsidy programs. Food Policy. 2018, 75, 1–14. [Google Scholar] [CrossRef]

- Anríquez, G.; Foster, W.; Ortega, J. Rural and agricultural subsidies in Latin America: Development costs of misal-located public resources. Dev. Policy Rev. 2020, 38, 140–158. [Google Scholar] [CrossRef]

- Mishra, A.K.; Goodwin, B.K. Farm Income Variability and the Supply of Off-Farm Labor. Am. J. Agric. Econ. 1997, 79, 880–887. [Google Scholar] [CrossRef]

- Olagunju, K.O.; Patton, M.; Feng, S. Estimating the impact of decoupled payments on farm production in Northern Ireland: An instrumental variable fixed effect approach. Sustainability 2020, 12, 3222. [Google Scholar] [CrossRef]

- Garrone, M.; Emmers, D.; Olper, A.; Swinnen, J. Jobs and agricultural policy: Impact of the common agricultural policy on EU agricultural employment. Food Policy 2019, 87, 101744. [Google Scholar] [CrossRef]

- Asfaw, S.; Davis, B.; Dewbre, J.; Handa, S.; Winters, P. Cash Transfer Programme, Productive Activities and Labour Supply: Evidence from a Randomised Experiment in Kenya. J. Dev. Stud. 2014, 50, 1172–1196. [Google Scholar] [CrossRef]

- Covarrubias, K.; Davis, B.; Winters, P. From protection to production: Productive impacts of the Malawi social cash transfer scheme. J. Dev. Eff. 2012, 4, 50–77. [Google Scholar] [CrossRef]

- Ahearn, M.C.; El-Osta, H.S.; Dewbre, J. The impact of coupled and decoupled government subsidies on off-farm labor participation of U.S. farm operators. Am. J. Agric. Econ. 2006, 88, 393–408. [Google Scholar] [CrossRef]

- Bojnec, S.; Ferto, I. Do different types of Common Agricultural Policy subsidies promote farm employment? Land Use Pol. 2022, 112, 105823. [Google Scholar] [CrossRef]

- Hennessy, T.C.; Rehman, T. Assessing the impact of the “decoupling” reform of the common agricultural policy on Irish farmers’ off-farm labor market participation decisions. J. Agric. Econ. 2008, 59, 41–56. [Google Scholar] [CrossRef]

- Pandit, M.; Paudel, K.P.; Mishra, A.K. Do agricultural subsidies affect the labor allocation decision? comparing parametric and semiparametric methods. J. Agric. Resour. Econ. 2013, 38, 1–18. [Google Scholar]

- Huang, J.K.; Wang, X.B.; Rozelle, S. The subsidization of farming households in China’s agriculture. Food Policy 2013, 41, 124–132. [Google Scholar] [CrossRef]

- Gilligan, D.O.; Hoddinott, J.; Taffesse, A.S. The Impact of Ethiopia’s Productive Safety Net Programme and its Linkages. J. Dev. Stud. 2009, 45, 1684–1706. [Google Scholar] [CrossRef]

- Banerjee, A.V.; Hanna, R.; Kreindler, G.E.; Olken, B.A. Debunking the Stereotype of the Lazy Welfare Recipient: Evidence from Cash Transfer Programs. World Bank Res. Observ. 2017, 32, 155–184. [Google Scholar] [CrossRef]

- Salehi-Isfahani, D.; Mostafavi-Dehzooei, M.H. Cash transfers and labor supply: Evidence from a large-scale program in Iran. J. Dev. Econ. 2018, 135, 349–367. [Google Scholar] [CrossRef]

- Puntsagdorj, B.; Orosoo, D.; Huo, X.X.; Xia, X.L. Farmer’s Perception, Agricultural Subsidies, and Adoption of Sustainable Agricultural Practices: A Case from Mongolia. Sustainability 2021, 13, 1524. [Google Scholar] [CrossRef]

- Staniszewski, J.; Borychowski, M. The impact of the subsidies on efficiency of different sized farms. Case study of the Common Agricultural Policy of the European Union. Agric. Econ. 2020, 66, 373–380. [Google Scholar] [CrossRef]

- Long, H.L.; Tu, S.S.; Ge, D.Z.; Li, T.T.; Liu, Y.S. The allocation and management of critical resources in rural China under restructuring: Problems and prospects. J. Rural Stud. 2016, 47, 392–412. [Google Scholar] [CrossRef]

- Zhao, L.Q.; Liu, S.Y.; Zhang, W. New trends in internal migration in China: Profiles of the new-generation migrants. China World Econ. 2018, 26, 18–41. [Google Scholar] [CrossRef]

- Bi, Q.S.; Chen, W.Q.; Li, L.; Wang, X.L.; Cai, E.X. Agricultural population supported in rural areas under traditional planting mode based on opportunity cost analysis. Land 2022, 11, 1340. [Google Scholar] [CrossRef]

- Sun, X.S.; Zhang, Z.S.; Zhang, Y.Y. Factors influencing farmer’s decision-making behavior on rural construction land transformation. Sustainability 2018, 10, 4288. [Google Scholar] [CrossRef]

- Tong, Y.; Niu, H.P.; Fan, L.X. Willingness of farmers to transform vacant rural residential land into cultivated land in a major grain-producing area of central China. Sustainability 2016, 8, 1192. [Google Scholar] [CrossRef]

- Xu, F.; Ho, H.C.; Chi, G.Q.; Wang, Z.Q. Abandoned rural residential land: Using machine learning techniques to identify rural residential land vulnerable to be abandoned in mountainous areas. Habitat Int. 2019, 84, 43–56. [Google Scholar] [CrossRef]

- Zhang, X.L.; Han, L. Which factors affect farmers’ willingness for rural community remediation? A tale of three rural villages in China. Land Use Pol. 2018, 74, 195–203. [Google Scholar] [CrossRef]

- Peng, L.Y.; Zhou, X.H.; Tan, W.X.; Liu, J.J.; Wang, Y.S. Analysis of dispersed farmers’ willingness to grow grain and main influential factors based on the structural equation model. J. Rural Stud. 2022, 93, 375–385. [Google Scholar] [CrossRef]

- Xu, H.Z.; Tong, C.T. Impact of farmers’ differentiation on farmland-use efficiency: Evidence from household survey data in rural China. Agric. Econ. 2013, 59, 227–234. [Google Scholar]

- Wang, C.; Wang, L.P.; Jiang, F.X.; Lu, Z.W. Differentiation of rural households’consciousness in land use activities: A case from bailin village, shapingba district of Chongqing municipality, China. Chin. Geogr. Sci. 2015, 251, 124–136. [Google Scholar] [CrossRef]

- Chang, X.; Liu, L.M. Characterizing rural household differentiation from the perspective of farmland transfer in eastern China using an agent based model. Hum. Ecol. 2018, 46, 875–886. [Google Scholar] [CrossRef]

- Huang, J.K.; Yang, G.L. Understanding recent challenges and new food policy in China. Glob. Food Secur. Agric. Policy 2017, 12, 119–126. [Google Scholar]

- Zou, B.L.; Mishra, A.K.; Luo, B.L. Grain subsidy, off-farm labor supply and farmland leasing: Evidence from China. China Econ. Rev. 2020, 62, 101293. [Google Scholar] [CrossRef]

- Huang, J.K.; Ding, J.P. Institutional innovation and policy support to facilitate small-scale farming transformation in China. Agric. Econ. 2017, 47, 227–237. [Google Scholar] [CrossRef]

- Chang, Y.M.; Huang, B.W.; Chen, Y.J. Labor supply, income, and welfare of the farm household. Labour Econ. 2012, 19, 427–437. [Google Scholar] [CrossRef]

- Mishra, A.K.; Sandretto, C.L. Stability of farm income and the role of nonfarm income in U.S. agriculture. Rev. Agric. Econ. 2002, 24, 208–221. [Google Scholar] [CrossRef]

- Antonakis, J.; Bendahan, S.; Jacquart, P.; Lalive, R. On making causal claims: A review and recommendations. Leadersh. Q. 2010, 21, 1086–1120. [Google Scholar] [CrossRef]

- Heckman, J. Sample Selection Bias as a Specification Error. Econometrica 1979, 47, 153–161. [Google Scholar] [CrossRef]

- Imbens, G.W.; Wooldridge, J.M. Recent Developments in the Econometrics of Program Evaluation. J. Econ. Lit. 2009, 47, 5–86. [Google Scholar] [CrossRef]

- Bascle, G. Controlling for endogeneity with instrumental variables in strategic management research. Strateg. Organ. 2008, 6, 285–327. [Google Scholar] [CrossRef]

- Surroca, J.; Tribo, J.A.; Waddock, S. Corporate responsibility and financial performance: The role of intangible resources. Strateg. Manag. J. 2010, 31, 463–490. [Google Scholar] [CrossRef]

- Larcker, D.F.; Rusticus, T.O. On the use of instrumental variables in accounting research. J. Account. Econ. 2010, 49, 186–205. [Google Scholar] [CrossRef]

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).