The Implication of Energy Consumption, Corruption, and Foreign Investment for Sustainability of Income Distribution in Indonesia

Abstract

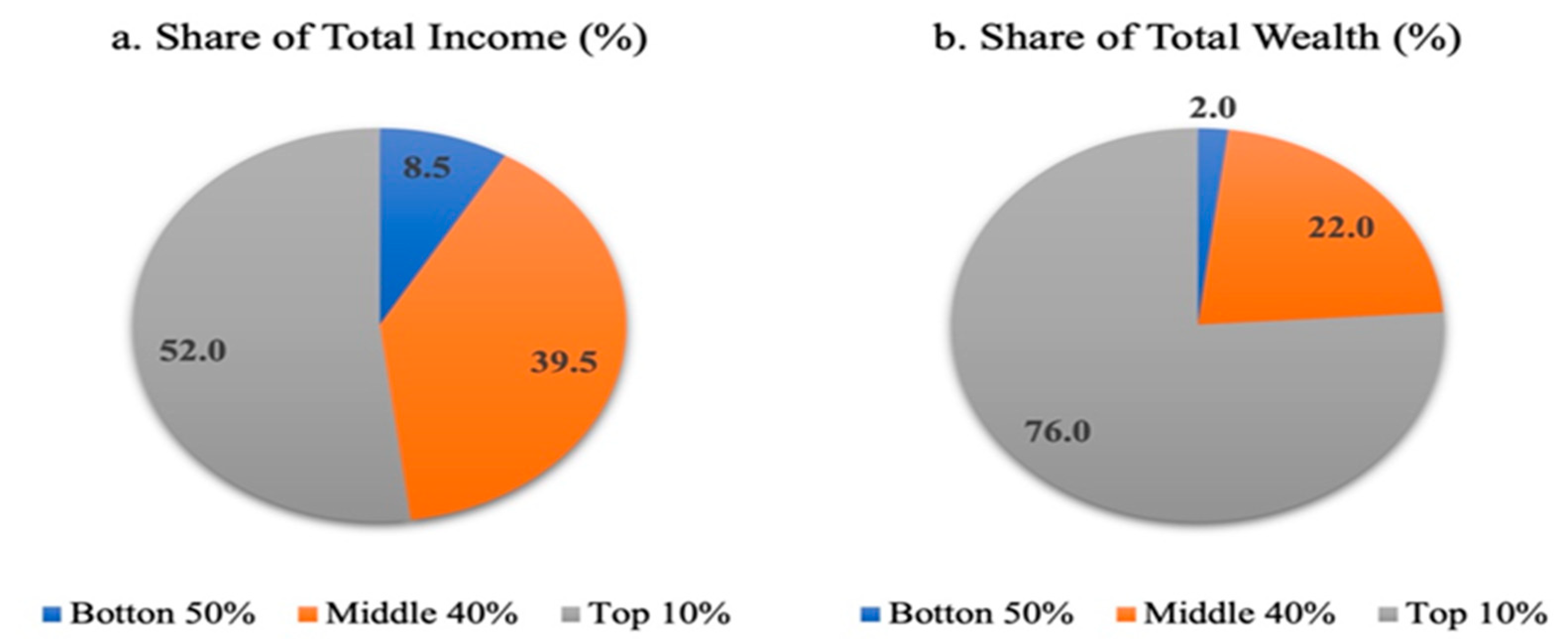

1. Introduction

2. Theoretical Background and Literature Review

2.1. The Conceptual Impacts of Energy Consumption on Income Inequality

2.2. The Conceptual Impacts of Corruption and Income Equality

2.3. The Conceptual Impacts of FDI and Income Equality

3. Research Methodology

3.1. Data and Variables Explanation

3.2. Estimation Procedures

- GINIt represents income distribution,

- GDPt represents economic growth,

- CORt represents corruption,

- FDIt represents foreign direct investments inflows,

- FDt represents financial sector development,

- CO2t represents environmental quality.

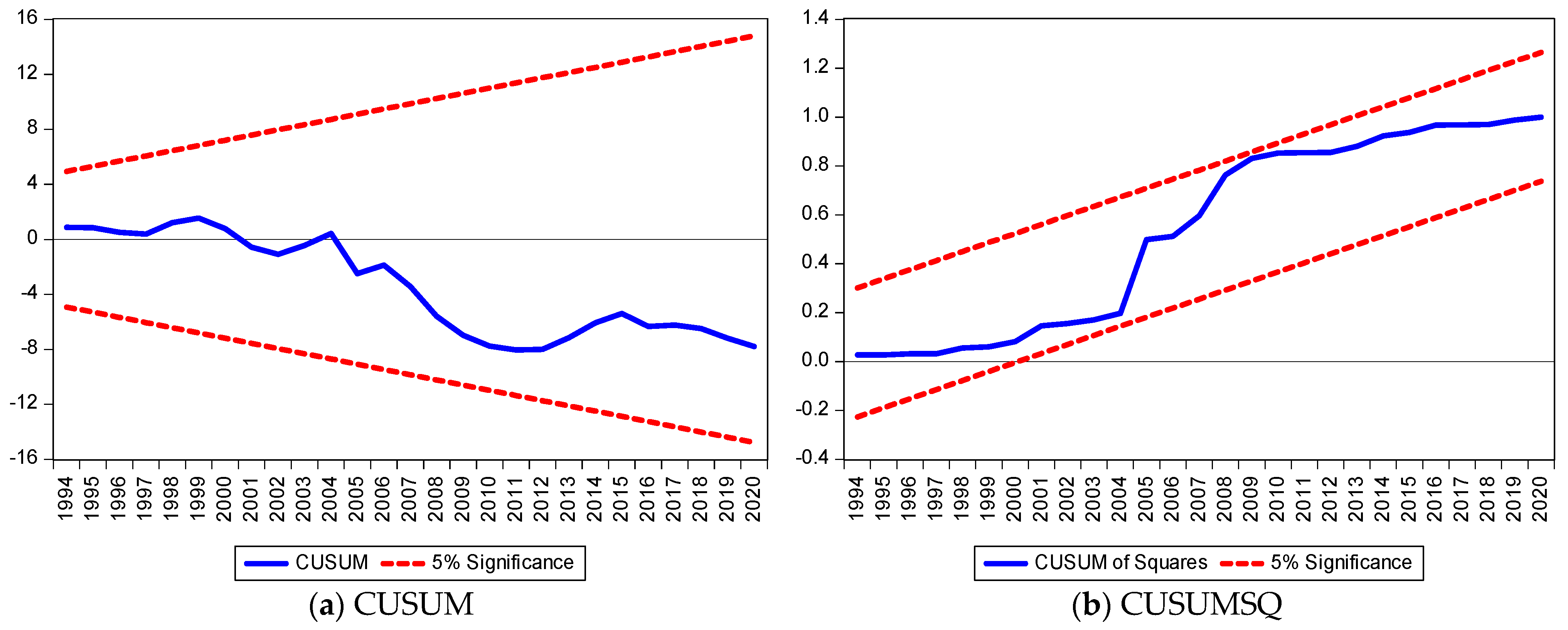

4. Empirical Results

5. Summary and Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- WEF. World Inequality Report 2022. 2022. Available online: https://wir2022.wid.world/executive-summary/ (accessed on 3 September 2022).

- Basri, C.; Hill, H. Making economic policy in a democratic Indonesia: The first two decades. Asian Econ. Policy Rev. 2020, 15, 214–234. [Google Scholar] [CrossRef]

- Setyowati, A.B. Mitigating inequality with emissions? Exploring energy justice and financing transitions to low carbon energy in Indonesia. Energy Res. Soc. Sci. 2021, 71, 101817. [Google Scholar] [CrossRef]

- Kusumawardani, D.; Dewi, A.K. The effect of income inequality on carbon dioxide emissions: A case study of Indonesia. Heliyon 2020, 6, e04772. [Google Scholar] [CrossRef] [PubMed]

- World Bank. Having Maintained Political Stability, Indonesia is One of East Asia Pacific’s Most Vibrant Democracies, Emerging as a Confident Middle-Income Country. The World Bank in Indonesia. 2022. Available online: https://www.worldbank.org/en/country/indonesia/overview (accessed on 3 September 2022).

- World Bank. Gini Index-Indonesia. World Bank. 2021. Available online: https://data.worldbank.org/indicator/SI.POV.GINI?locations=ID (accessed on 28 August 2022).

- Sulaeman, F.H. Poverty Rate Drops in INDONESIA but Inequality Does Not. The Jakarta Post. 2022. Available online: https://www.thejakartapost.com/business/2022/07/19/poverty-rate-drops-in-indonesia-but-inequality-does-not.html (accessed on 27 August 2022).

- Fernando, D. Poverty and Inequality are Rising amid the Pandemic. Institut Teknologi Bandung. 2021. Available online: https://www.sbm.itb.ac.id/2021/03/26/poverty-and-inequality-are-rising-amid-the-pandemic/ (accessed on 1 September 2022).

- Muryani, N.A.; Esquivias, M.A. Factors influencing the gender gap in poverty: The Indonesian case. World Rev. Entrep. Manag. Sustain. Dev. 2021, 17, 103. [Google Scholar] [CrossRef]

- Purwono, R.; Wardana, W.W.; Haryanto, T.; Khoerul Mubin, M. Poverty dynamics in Indonesia: Empirical evidence from three main approaches. World Dev. Perspect. 2021, 23, 100346. [Google Scholar] [CrossRef]

- Erlando, A.; Riyanto, F.D.; Masakazu, S. Financial inclusion, economic growth, and poverty alleviation: Evidence from eastern Indonesia. Heliyon 2020, 6, e05235. [Google Scholar] [CrossRef]

- Van Leeuwen, B.; Földvári, P. The development of inequality and poverty in Indonesia, 1932–2008. Bull. Indones. Econ. Stud. 2016, 52, 379–402. [Google Scholar] [CrossRef]

- United Nations. Secretary-General to Global Development Centre: Energy Is the Golden Thread; United Nations: New York, NY, USA, 2012; Available online: https://press.un.org/en/2012/sgsm14242.doc.htm (accessed on 15 August 2022).

- Indonesia Window. Indonesia Needs US$36 Billion for Renewable Energy Investment. Available online: https://indonesiawindow.com/en/indonesia-needs-us36-billion-for-renewable-energy-investment/2013 (accessed on 1 September 2022).

- Kennedy, S.F. Indonesia’s energy transition and its contradictions: Emerging geographies of energy and finance. Energy Res. Soc. Sci. 2018, 41, 230–237. [Google Scholar] [CrossRef]

- Esquivias, M.A.; Harianto, S.K. Does competition and foreign investment spur industrial efficiency? Firm-level evidence from Indonesia. Heliyon 2020, 6, e04494. [Google Scholar] [CrossRef]

- de Silva, I.; Sumarto, S. Dynamics of growth, poverty and human capital: Evidence from indonesian sub-national data. J. Econ. Dev. 2015, 40, 1–33. [Google Scholar] [CrossRef]

- Lee, J.-W.; Wie, D. Technological change, skill demand, and wage inequality: Evidence from Indonesia. World Dev. 2015, 67, 238–250. [Google Scholar] [CrossRef]

- De Zwart, P. Globalization, inequality and institutions in West Sumatra and West Java, 1800–1940. J. Contemp. Asia 2021, 51, 564–590. [Google Scholar] [CrossRef]

- Musibau, H.O.; Yusuf, A.H.; Gold, K.L. Endogenous specification of foreign capital inflows, human capital development and economic growth. Int. J. Soc. Econ. 2019, 46, 454–472. [Google Scholar] [CrossRef]

- Kábrt, T.; Brůna, K. Asymmetric effects of foreign capital on income inequality: The case of the Post-China 16 countries. Econ. Anal. Policy 2022, 76, 613–626. [Google Scholar] [CrossRef]

- Das, M.U.S.; Papaioannou, M.M.G.; Trebesch, C. Sovereign Default Risk and Private Sector Access to Capital in Emerging Markets. International Monetary Fund. 2010. Available online: https://www.imf.org/en/Publications/WP/Issues/2016/12/31/Sovereign-Default-Risk-and-Private-Sector-Access-to-Capital-in-Emerging-Markets-23510 (accessed on 15 August 2022).

- Bogliaccini, J.A.; Egan, P.J.W. Foreign direct investment and inequality in developing countries: Does sector matter? Econ. Politics 2017, 29, 209–236. [Google Scholar] [CrossRef]

- McLaren, J.; Yoo, M. FDI and inequality in Vietnam: An approach with census data. J. Asian Econ. 2017, 48, 134–147. [Google Scholar] [CrossRef]

- Stewart, C.P.; Iannotti, L.; Dewey, K.G.; Michaelsen, K.F.; Onyango, A.W. Contextualizing complementary feeding in a broader framework for stunting prevention. Matern. Child Nutr. 2013, 9, 27–45. [Google Scholar] [CrossRef]

- Mushtaq, M.; Ahmad, K.; Ahmed, S.; Nadeem, M. Impact of FDI on Income Distribution in Selected SAARC Countries. J. Appl. Environ. Biol. Sci. 2014, 4, 1–10. [Google Scholar]

- Ucal, M.; Haug, A.A.; Bilgin, M.H. Income inequality and FDI: Evidence with Turkish data. Appl. Econ. 2016, 48, 1030–1045. [Google Scholar] [CrossRef]

- Fazaalloh, A.M. Is foreign direct investment helpful to reduce income inequality in Indonesia? Econ. Sociol. 2019, 12, 25–36. [Google Scholar] [CrossRef]

- Kuncoro, M.; Murbarani, N. Regional inequality in Indonesia, 1994–2012. Bus. Manag. Rev. 2016, 8, 38. [Google Scholar]

- Kozminski, K.; Baek, J. Can an oil-rich economy reduce its income inequality? Empirical evidence from Alaska’s Permanent Fund Dividend. Energy Econ. 2017, 65, 98–104. [Google Scholar] [CrossRef]

- Lee, C.-C.; Xing, W. The impact of energy security on income inequality: The key role of economic development. Energy 2022, 248, 123564. [Google Scholar] [CrossRef]

- Topcu, M.; Tugcu, C.T. The impact of renewable energy consumption on income inequality: Evidence from developed countries. Renew. Energy 2020, 151, 1134–1140. [Google Scholar] [CrossRef]

- Aperc, A. Quest for Energy Security in the 21st Century: Resources and Constraints; Asia Pacific Energy Research Centre: Tokyo, Japan, 2007; Available online: https://aperc.or.jp/file/2010/9/26/APERC_2007_A_Quest_for_Energy_Security.pdf (accessed on 25 August 2022).

- Kaygusuz, K. Energy services and energy poverty for rural regions. Energy Sources Part B: Econ. Plan. Policy 2010, 5, 424–433. [Google Scholar] [CrossRef]

- Wicaksono, E.; Amir, H.; Nugroho, A. The source of income inequality in Indonesia: A Regression-Based Inequality Decomposition. 2017. Available online: https://www.adb.org/sites/default/files/publication/229411/adbi-wp667.pdf (accessed on 25 August 2022).

- Berggren, N.; Bjørnskov, C. Corruption, judicial accountability and inequality: Unfair procedures may benefit the worst-off. J. Econ. Behav. Organ. 2020, 170, 341–354. [Google Scholar] [CrossRef]

- Fakir, A.M.S.; Ahmad, A.U.; Hosain, K.M.M.; Hossain, M.R.; Gani, R.S. The comparative effect of corruption and Piketty’s second fundamental law of capitalism on inequality. Econ. Anal. Policy 2017, 55, 90–105. [Google Scholar] [CrossRef]

- Gupta, S.; Davoodi, H.; Terme, R. Does corruption affect income inequality and poverty? Econ. Gov. 2002, 3, 23–45. [Google Scholar] [CrossRef]

- Policardo, L.; Carrera, E.J.S. Corruption causes inequality, or is it the other way around? An empirical investigation for a panel of countries. Econ. Anal. Policy 2018, 59, 92–102. [Google Scholar] [CrossRef]

- Policardo, L.; Sanchez Carrera, E.J.; Risso, W.A. Causality between income inequality and corruption in OECD countries. World Dev. Perspect. 2019, 14, 100102. [Google Scholar] [CrossRef]

- Saha, S.; Beladi, H.; Kar, S. Corruption control, shadow economy and income inequality: Evidence from Asia. Econ. Syst. 2021, 45, 100774. [Google Scholar] [CrossRef]

- Li, B.; Cheng, S.; Xiao, D. The impacts of environmental pollution and brain drain on income inequality. China Econ. Rev. 2020, 62, 101481. [Google Scholar] [CrossRef]

- Pujiati, A.; Murniawaty, I.; Nihayah, D.M.; Muarrifah, I.; Damayanti, N. A simulated policy towards green public transportation in a metropolitan in Indonesia. Int. J. Energy Econ. Policy 2022, 12, 162–168. [Google Scholar] [CrossRef]

- Pujiati, A.; Nihayah, D.M.; Bowo, P.A.; Adzim, F. Towards sustainable transportation in urban areas: A case study. Int. J. Sustain. Dev. Plan. 2022, 17, 1285–1296. [Google Scholar] [CrossRef]

- Le, Q.H.; Do, Q.A.; Pham, H.C.; Nguyen, T.D. The impact of foreign direct investment on income inequality in Vietnam. Economies 2021, 9, 27. [Google Scholar] [CrossRef]

- Ofori, I.K.; Gbolonyo, E.Y.; Dossou, T.A.M.; Nkrumah, R.K. Remittances and income inequality in Africa: Financial development thresholds for economic policy. Res. Glob. 2022, 4, 100084. [Google Scholar] [CrossRef]

- Pujiati, A.; Nihayah, D.M.; Bowo, P.A. Strategies of urban development based on environment. Adv. Sci. Lett. 2017, 23, 7123–7126. [Google Scholar] [CrossRef]

- Sundram, V.P.K.; Hashim, N.; Shariff, S.H.; Pujiati, A.; Ardiansari, A. Sustainable transportation on university campus: A Case at UiTM Selangor, Puncak Alam Campus, Malaysia and Universitas Negeri Semarang, Indonesia. Asian J. Univ. Educ. 2021, 17, 262–272. [Google Scholar] [CrossRef]

- Huang, K.; Sim, N.; Zhao, H. Does FDI actually affect income inequality? insights from 25 years of research. J. Econ. Surv. 2020, 34, 630–659. [Google Scholar] [CrossRef]

- Wu, J.-Y.; Hsu, C.-C. Foreign direct investment and income inequality: Does the relationship vary with absorptive capacity? Econ. Model. 2012, 29, 2183–2189. [Google Scholar] [CrossRef]

- Dzioubinski, O.; Chipman, R. Trends in Consumption and Production: Household Energy Consumption. Discussion Paper of the United Nations Department of Economic and Social Affairs (DESA). 1999. Available online: https://sustainabledevelopment.un.org/content/documents/esa99dp6.pdf (accessed on 1 September 2022).

- Feng, Z.-H.; Zou, L.-L.; Wei, Y.-M. The impact of household consumption on energy use and CO2 emissions in China. Energy 2011, 36, 656–670. [Google Scholar] [CrossRef]

- Biesiot, W.; Noorman, K.J. Energy requirements of household consumption: A case study of The Netherlands. Ecol. Econ. 1999, 28, 367–383. [Google Scholar] [CrossRef]

- Wang, S. Differences between energy consumption and regional economic growth under the energy environment. Energy Rep. 2022, 8, 10017–10024. [Google Scholar] [CrossRef]

- Walheer, B. Labour productivity growth and energy in Europe: A production-frontier approach. Energy 2018, 152, 129–143. [Google Scholar] [CrossRef]

- Mutumba, G.S.; Odongo, T.; Okurut, N.F.; Bagire, V. A survey of literature on energy consumption and economic growth. Energy Rep. 2021, 7, 9150–9239. [Google Scholar] [CrossRef]

- Schulte, I.; Heindl, P. Price and income elasticities of residential energy demand in Germany. Energy Policy 2017, 102, 512–552. [Google Scholar] [CrossRef]

- Tebaldi, E.; Mohan, R. Institutions and poverty. J. Dev. Stud. 2010, 46, 1047–1066. [Google Scholar] [CrossRef]

- Dincer, O.C.; Gunalp, B. Corruption and income inequality in the United States. Contemp. Econ. Policy 2012, 30, 283–292. [Google Scholar] [CrossRef]

- Pedauga, L.E.; Pedauga, L.D.; Delgado-Márquez, B.L. Relationships between corruption, political orientation, and income inequality: Evidence from Latin America. Appl. Econ. 2017, 49, 1689–1705. [Google Scholar] [CrossRef]

- Keneck-Massil, J.; Nomo-Beyala, C.; Owoundi, F. The corruption and income inequality puzzle: Does political power distribution matter? Econ. Model. 2021, 103, 105610. [Google Scholar] [CrossRef]

- OECD. Foreign Direct Investment for Development; OECD: Paris, France, 2002; Available online: https://www.oecd-ilibrary.org/finance-and-investment/foreign-direct-investment-for-development_9789264199286-en (accessed on 1 September 2022).

- Pan-Long, T. Foreign direct investment and income inequality: Further evidence. World Dev. 1995, 23, 469–483. [Google Scholar] [CrossRef]

- Völlmecke, D.; Jindra, B.; Marek, P. FDI, human capital and income convergence: Evidence for European regions. Econ. Syst. 2016, 40, 288–307. [Google Scholar] [CrossRef]

- Bhandari, B. Effect of inward foreign direct investment on income inequality in transition countries. J. Econ. Integr. 2007, 22, 888–928. [Google Scholar] [CrossRef]

- Song, Y.; Paramati, S.R.; Ummalla, M.; Zakari, A.; Kummitha, H.R. The effect of remittances and FDI inflows on income distribution in developing economies. Econ. Anal. Policy 2021, 72, 255–267. [Google Scholar] [CrossRef]

- Shahbaz, M.; Hye QM, A.; Tiwari, A.K.; Leitão, N.C. Economic growth, energy consumption, financial development, international trade and CO2 emissions in Indonesia. Renew. Sustain. Energy Rev. 2013, 25, 109–121. [Google Scholar] [CrossRef]

- Mundell, R.A. International trade and factor mobility. Am. Econ. Rev. 1957, 47, 321–335. [Google Scholar]

- Greenwood, J.; Jovanovic, B. Financial Development, Growth, and the Distribution of Income. J. Political Econ. 1989, 98, 1076–1107. [Google Scholar] [CrossRef]

- United Nations Economic and Social Commission for Asia and the Pacific. Inequality in Asia and the Pacific in the Era of the 2030 Agenda for Sustainable Development. Bangkok, Thailand, 2018. Available online: https://www.unescap.org/publications/inequality-asia-and-pacific-era-2030-agenda-sustainable-development (accessed on 20 August 2022).

- Ridzuan, A.R.; Zakaria, S.; Fianto, B.; Mohamed Yusoff, N.Y.; Che Sulaiman, N.F.; Md Razak, M.I.; Siswantini; Lestari, A. Nexus between financial development and income inequality before Pandemic COVID-19: Does financial kuznets curve exist in Malaysia, Indonesia, Thailand and Philippines? Int. J. Energy Econ. Policy 2021, 11, 260–271. [Google Scholar] [CrossRef]

- Jun, Y.; Yang, Z.; Sheng, P. Income distribution, human capital and environmental quality: Empirical study in China. Energy Procedia 2011, 5, 1689–1696. [Google Scholar] [CrossRef]

- Bouincha, M.; Karim, M. Income inequality and economic growth: An analysis using a panel data. Int. J. Econ. Financ. 2018, 10, 242. [Google Scholar] [CrossRef][Green Version]

- Dollar, D.; Kray, D. Growth is Good for the Poor; Development Research Group Papers: Washington, DC, USA, 2000; Available online: http://www.sfu.ca/~akaraiva/e455/dollar_poor.pdf (accessed on 24 August 2022).

- Sylwester, K. Foreign direct investment, growth and income inequality in less developed countries. Int. Rev. Appl. Econ. 2005, 19, 289–300. [Google Scholar] [CrossRef]

- Angelsen, A.; Jagger, P.; Babigumira, R.; Belcher, B.; Hogarth, N.J.; Bauch, S.; Börner, J.; Smith-Hall, C.; Wunder, S. Environmental income and rural livelihoods: A global-comparative analysis. World Dev. 2014, 64, S12–S28. [Google Scholar] [CrossRef] [PubMed]

- Setyadharma, A.; Oktavilia, S.; Utami, S.; Rizka Noormalitasari, A. Impacts of education and environmental sustainability on rural income inequality in Indonesia. E3S Web Conf. 2021, 232, 04003. [Google Scholar] [CrossRef]

| Variables | Description | Sources |

|---|---|---|

| LNGINI | Gini coefficient index (GINI) | UTIP |

| LNGDP | GDP per capita (constant 2015 US$) | WDI |

| LNCOR | Corruption perception index | Transparency International |

| LNFDI | Foreign direct investment, net inflows (% of GDP) | WDI |

| LNFD | Financial sector development | WDI |

| LNCO2 | CO2 emissions (metric tons per capita) | WDI |

| LNENC | Energy use | WDI |

| Level I (0) | ADF Unit Root | PP Unit Root | ||

|---|---|---|---|---|

| Intercept | Intercept and Trend | Intercept | Intercept and Trend | |

| LNGINI | −2.192 (1) | −3.762 (0) ** | −3.695 (4) *** | −3.929 (4) ** |

| LNGDP | −0.434 (0) | −2.426 (1) | −0.434 (0) | −1.948 (1) |

| LNCOR | −1.448 (0) | −1.959 (0) | −1.762 (2) | −2.380 (2) |

| LNFDI | −2.106 (0) | −2.211 (0) | −2.310 (2) | −2.436 (2) |

| LNFD | −2.208 (1) | −2.207 (1) | −3.299 (2) ** | −3.105 (1) |

| LNCO2 | −1.320 (0) | −2.712 (0) | −1.649 (12) | −2.711 (2) |

| LNENC | −2.206 (0) | −1.931 (0) | −4.925 (18) *** | −1.769 (8) |

| First difference I (1) | ADF Unit Root | PP Unit Root | ||

| Intercept | Intercept and Trend | Intercept | Intercept and Trend | |

| LNGINI | −9.321 (0) *** | −9.215 (0) *** | −9.524 (1) *** | −9.408 (1) *** |

| LNGDP | −4.234 (0) *** | −4.142 (0) ** | −4.216 (2) *** | −4.119 (2) ** |

| LNCOR | −4.148 (0) *** | −4.085 (0) ** | −4.162 (1) *** | −4.099 (1) ** |

| LNFDI | −5.358 (0) *** | −5.276 (0) *** | −5.359 (1) *** | −5.277 (1) *** |

| LNFD | −3.379 (0) ** | −3.082 (0) | −3.275 (5) ** | −2.930 (5) |

| LNCO2 | −5.207 (1) *** | −5.269 (1) *** | −6.834 (9) *** | −7.688 (12) *** |

| LNENC | −6.222 (0) *** | −6.834 (0) *** | −6.222 (1) *** | −7.439 (12) *** |

| Model | Lag Order | F Statistics |

|---|---|---|

| LNGINI = f (LNGDP, LNCOR, LNFDI, LNFD, LNCO2, LNENC) | (1, 0, 0, 0, 0, 0, 1) | 3.652 ** |

| LNGDP = f (LNGINI, LNCOR, LNFDI, LNFD, LNCO2, LNENC) | (1, 2, 0, 1, 1, 1, 1) | 3.773 ** |

| LNCOR = f (LNGDP, LNGINI, LNFDI, LNFD, LNCO2, LNENC) | (2, 1, 2, 1, 1, 1, 0) | 9.770 *** |

| LNFDI = f (LNGDP, LNCOR, LNGINI, LNFD, LNCO2, LNENC) | (1, 1, 0, 0, 0, 1, 0) | 1.485 |

| LNFD = f (LNGDP, LNCOR, LNFDI, LNGINI, LNCO2, LNENC) | (1, 0, 0, 0, 0, 0, 0) | 6.321 *** |

| LNCO2 = f (LNGDP, LNCOR, LNFDI, LNFD, LNGINI, LNENC) | (2, 1, 0, 0, 0, 2, 1) | 9.559 *** |

| LNENC = f (LNGDP, LNCOR, LNFDI, LNFD, LNCO2, LNGINI) | (1, 0, 0, 0, 0, 0, 0) | 1.7767 |

| Critical Values for F stat | Lower I (0) | Upper (1) |

| 10% | 2.26 | 3.35 |

| 5% | 2.62 | 3.79 |

| 1% | 3.41 | 4.68 |

| (A) | (B) | (C) | (D) |

|---|---|---|---|

| Serial Correlation [p-Value] | Functional Form [p-Value] | Normality [p-Value] | Heteroscedasticity [p-Value] |

| 1.042 | 0.205 | 2.023 | 1.342 |

| [0.367] | [0.654] | [0.363] | [0.265] |

| Short-Run Elasticities | Long-Run Elasticities | ||

|---|---|---|---|

| Variables | Coefficient | Variables | Coefficient |

| D(LNGDP) | −0.422 ** | LNGDP | −0.342 ** |

| D(LNCOR) | −0.130 ** | LNCOR | −0.106 *** |

| D(LNFDI) | −0.078 *** | LNFDI | −0.064 *** |

| D(LNENC) | −0.417 | LNENC | −0.339 |

| D(LNFD) | 0.093 | LN | 0.075 |

| D(LNCO2) | 0.435 * | LNCO2 | 0.594 *** |

| CointEq(−1) | −1.230 *** | C | 3.669 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Handayani, B.D.; Yanto, H.; Pujiati, A.; Ridzuan, A.R.; Keshminder, J.S.; Shaari, M.S. The Implication of Energy Consumption, Corruption, and Foreign Investment for Sustainability of Income Distribution in Indonesia. Sustainability 2022, 14, 15915. https://doi.org/10.3390/su142315915

Handayani BD, Yanto H, Pujiati A, Ridzuan AR, Keshminder JS, Shaari MS. The Implication of Energy Consumption, Corruption, and Foreign Investment for Sustainability of Income Distribution in Indonesia. Sustainability. 2022; 14(23):15915. https://doi.org/10.3390/su142315915

Chicago/Turabian StyleHandayani, Bestari Dwi, Heri Yanto, Amin Pujiati, Abdul Rahim Ridzuan, J. S. Keshminder, and Mohd Shahidan Shaari. 2022. "The Implication of Energy Consumption, Corruption, and Foreign Investment for Sustainability of Income Distribution in Indonesia" Sustainability 14, no. 23: 15915. https://doi.org/10.3390/su142315915

APA StyleHandayani, B. D., Yanto, H., Pujiati, A., Ridzuan, A. R., Keshminder, J. S., & Shaari, M. S. (2022). The Implication of Energy Consumption, Corruption, and Foreign Investment for Sustainability of Income Distribution in Indonesia. Sustainability, 14(23), 15915. https://doi.org/10.3390/su142315915