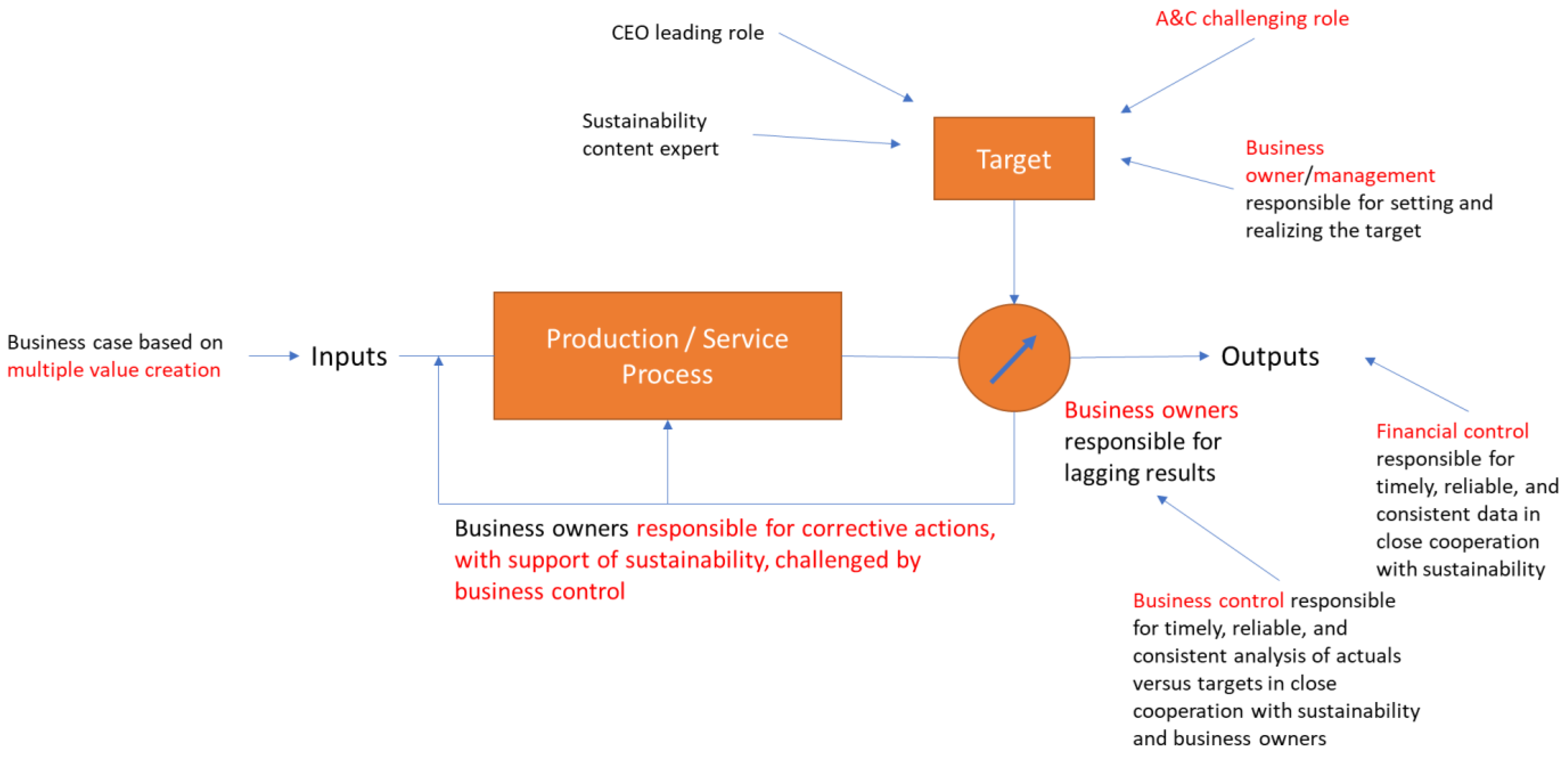

1. Introduction

Research shows that the accounting and control professionals’ (ACPs’) level of involvement in monitoring and controlling sustainability is low and that there is a broad consensus in academia and practice that ACPs need a more significant role to embed sustainability in corporate strategy and practice. We have defined the ACP as the internal finance professional responsible for financial accounting and management accounting, also referred to as the financial controller and the business controller, respectively. The involvement of the ACP in monitoring and controlling sustainability becomes even more relevant due to upcoming regulation like the Corporate Sustainability Reporting Directive (CSRD) of the European Union. The CSRD obligates large organizations to include a sustainability section in the annual report in accordance with the European Sustainability Reporting Standards. Also, the vast majority of investors conduct a structured and formal review of ESG disclosures [

1], confirming the relevance of the topic.

In our previous empirical study (as part of a PhD research project) on the design of management control systems focused on the creation of sustainable value, we concluded that the level of involvement of the ACP is particularly low in relation to the diagnostic control system, being one of Simons’ four levers of control. According to Simons, a diagnostic control system is defined as follows [

2]:

“The ability to measure the outputs of a process (1), the existence of predetermined standards against which actual results can be compared (2), and the ability to correct deviations from standards”.

(p. 59)

Based on the above we have defined the following research question:

What could be the role of Accounting & Control Professionals regarding diagnostic control systems focused on sustainable value creation?

The research question will be answered by making a gap analysis between the current role and the desired role of the ACP, followed by recommendations on how to implement this desired role.

Our research demonstrates that ACPs should play an active role in monitoring and controlling sustainable value. Our findings indicate that ACPs should have a challenging position in the target-setting process, be responsible for the reliability and compliance of the actuals, and analyze and monitor the actuals’ progress against the targets. Based on our results, we argue that the most crucial obstacle to implementing this essential role is the current mindset of the accounting and control professional, which is mainly focused on financial value. In our discussion, we further detail and clarify the factors impacting the needed mindset change, distinguishing between internal and external factors. In doing so, we have also included the role of belief systems in our discussion.

This work contributes to sustainability accounting and management accounting literature. In general, it advances our understanding of designing a sustainable diagnostic control system as part of the management control system, answering the call for more management accounting and control research in the area [

3,

4,

5]. In particular, it responds to the call in literature to perform empirical research on the role of ACPs in sustainability accounting and control [

6,

7,

8], enabling us to deepen and nuance our understanding of the topic. Based on our empirical investigation, we explain the nature and characteristics of this role, its activities, the possible criticalities ACPs may face, and the competencies (technical and soft) that should be developed when taking this role. Furthermore, the study provides tools for practitioners to design and use a diagnostic control system to support the transformation of organizational practices that can contribute to realizing sustainable goals.

The remainder of the paper is organized as follows. In the next section we analyze current literature on our research topic, followed by our methodological section, where we explain how the empirical data were collected, analyzed, and validated. After that, we present the empirical findings and discuss how they augment extant limited understandings about the role of ACPs regarding diagnostic control systems, focusing on sustainable value. In our conclusions, we explain our contribution to the current literature, acknowledge the study’s limitations and offer directions for further research.

2. Literature Review

Although a growing body of empirical research has emerged over the last decade on sustainability in relation to accounting and control [

9,

10,

11,

12], knowledge of how companies design or use management control to support sustainability strategy appears to be limited, providing considerable scope for further research [

5,

10,

13,

14]. In particular, the role of the ACP in this respect is underexplored in the literature [

6,

7], although there is a broad consensus in academia and practice that ACPs need a more significant role to embed sustainability in corporate strategy and practice. A recent systematic literature review on our research topic by Ascani et al. [

6] clearly shows the current low involvement of the ACP in sustainability accounting and reporting versus a potential for high involvement in the future in the literature. So, while there is a consensus that ACPs should or may play a role in sustainability accounting and reporting, there is uncertainty regarding the role that ACPs should play [

15,

16]. In this regard, Schaltegger and Zvezdov [

7] argue that “accountants are involved in sustainability accounting in a way that has not been investigated in literature to date” (p. 350) and suggest that “the main implication for future research is investigating how accountants could be more strongly involved in sustainability accounting and reporting” [

7] (p. 353). Ascani et al. [

6] highlight that “further research should be undertaken for an in-depth investigation into the nature and the characteristics of this role, the activities related to it, the possible criticalities a management accountant may face, and the competencies (technical and soft) that should be developed when playing this role” (p. 19).

There is also ambiguity as to why this role is currently not taken by ACPs. Williams [

17] suggests that the low involvement of management accountants could be due to the current inadequacy of their skill sets; management accountants need to be skilled in sustainability to be able to “measure, evaluate, record, interpret, and report organizational sustainability information” (p. 282). In this regard, Egan and Tweedie [

16] show that ACPs also lack the mindset needed to support sustainability practices and struggle to find a common vocabulary with other organizational actors, such as engineers. Furthermore, the authors show that when ACPs engage in sustainability initiatives, they appear reluctant to embrace innovations: they support non-accountants in the data collection and reporting, but they do not work creatively with colleagues of other departments to develop innovative accounting solutions. Schaltegger [

18] argues that ACPs do not play a role in decisions about what sustainability information should be collected and created. This may be because conventional management accounting systems are not able to provide sustainability information, while non-accountants have developed a new range of measurement and management tools to explicitly address sustainability issues.

To avoid ambiguity in our research on “monitoring and controlling” and “sustainable value”, we have defined these multiple interpretable concepts in our study. Our monitoring and controlling concept is based on the diagnostic control system, being one of Simons’ [

2] four levers of control, as defined in our introduction.

We realize that the four levers of control of Simons [

2] function together in one control framework, and therefore, analyzing one lever in isolation seems problematic from a methodological perspective. Simons [

2] posits that in the LOC framework, all four control systems, working together, are necessary to provide an effective control environment. These four control systems are briefly explained in

Table 1.

However, the diagnostic control system can also be seen as a standalone control framework as first introduced by Anthony [

19], with a primary focus on the cybernetic control mechanism, allowing us to further zoom in on the particular conclusion of our prior empirical study and create focus in our research approach. We have chosen the diagnostic control system of Simons because Simons uses the diagnostic control system to implement strategy using critical performance variables. This connection of strategy to the diagnostic control system is crucial for the successful implementation of a sustainable strategy. Another reason for choosing Simons is that his framework is one of the most widely used management control frameworks in management accounting literature.

Sustainable value is a concept open to many interpretations and is often seen as a clichéd term. We have defined the creation of sustainable value as finding a balance between creating ecological, social, and economic value [

20], referring to the Triple Bottom Line approach that comprises these three pillars of sustainability [

21,

22]. According to this definition, companies are challenged to behave in an environmentally sustainable and socially responsible manner while maintaining and improving shareholder value.

4. Findings

One of the joint conclusions of the FGD is to assign the responsibility of this process to ACPs, since this process is a core ACP competency. However, several obstacles were recognized during the FGDs which clarify why this role is currently not taken by ACPs. The current ACP mindset was mentioned as the biggest hurdle to transitioning this role from the sustainability department to the ACP. The first indication for this argument became apparent while analyzing the output of the axial coding process and was later confirmed by the qualitative analysis of the selective coding process. We grouped the codes and fragments of the open coding process in code groups during the axial coding process. A code group in the axial coding group consists of codes and fragments of the open coding process with a common theme and is further divided into sub code groups. One of the code groups was labeled “obstacles ‘Soll’ role ACP”. The outcome of this code group is summarized in

Table 2.

The table states that 74 selected fragments refer to the ACP mindset as an obstacle for ACPs to take ownership over the sustainable accounting and reporting process, which is more than half of the selected fragments for this code group. We realize that we cannot draw firm conclusions based on this quantitative analysis due to our qualitative approach. However, we consider this a strong indication that the current ACP mindset might be the most essential obstacle for them to take ownership of the sustainable accounting and reporting process, which will be further analyzed and confirmed in our following qualitative analysis.

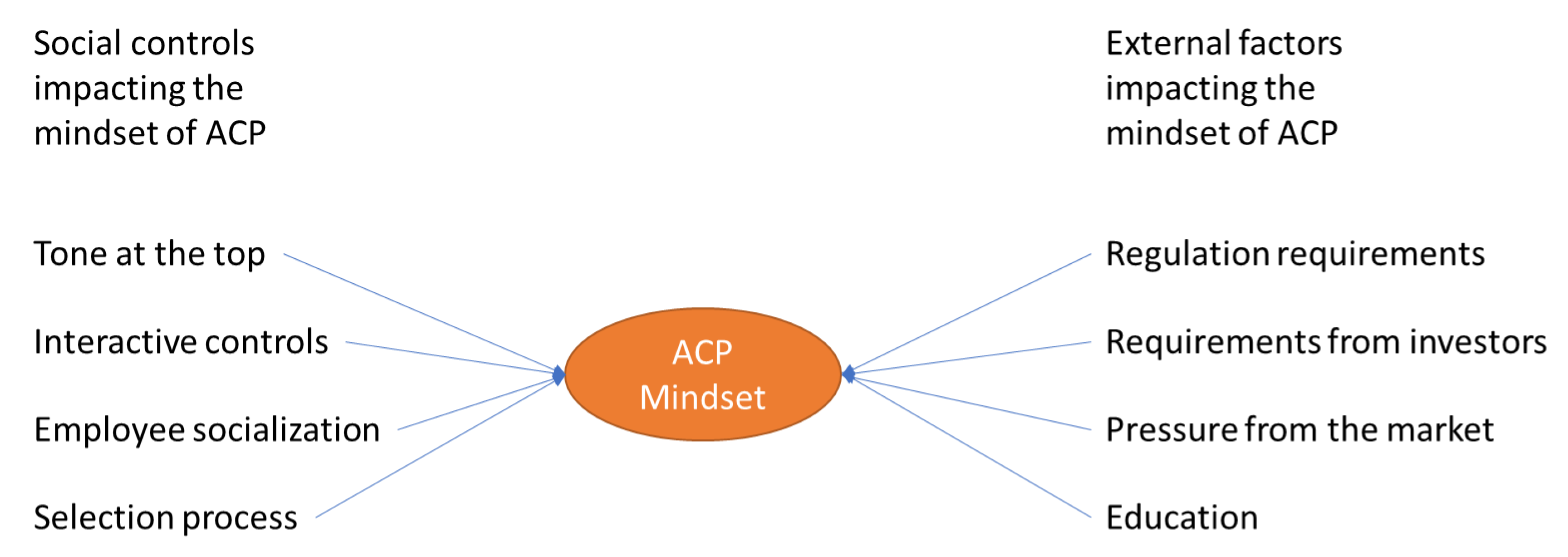

Apart from obstacles, some elements were also identified to accelerate the involvement of ACPs in the accounting and reporting process of sustainable value. Although these elements will contribute to ACPs’ transition to the “Soll” role, it is also confirmed that more fundamental changes are needed to change the ACPs’ mindset towards realizing the complete transition to this role. The appropriate tone at the top is a decisive factor in embedding sustainability in the ACP mindset, but constructive cooperation between the sustainability department and the ACPs is also crucial in this respect.

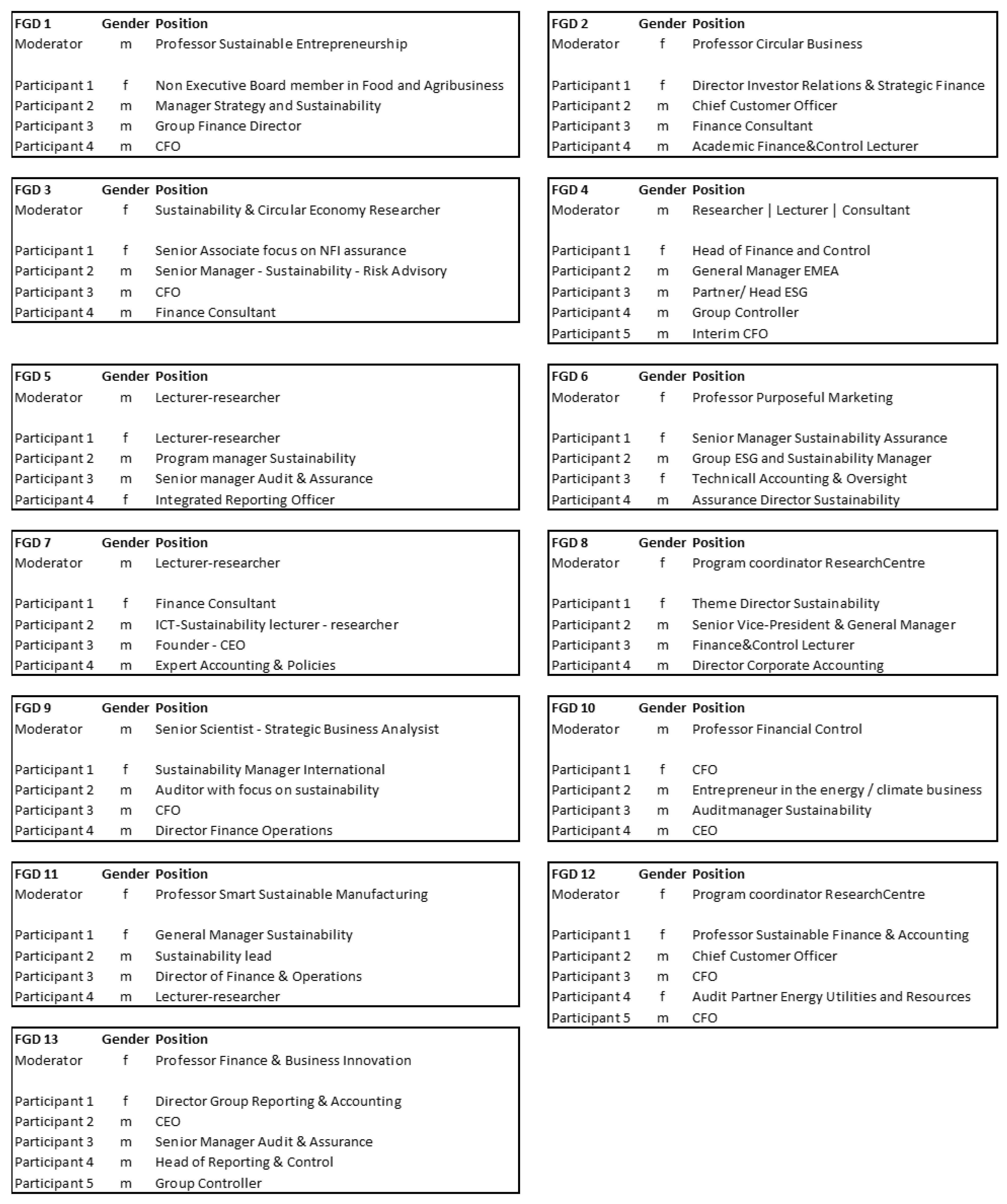

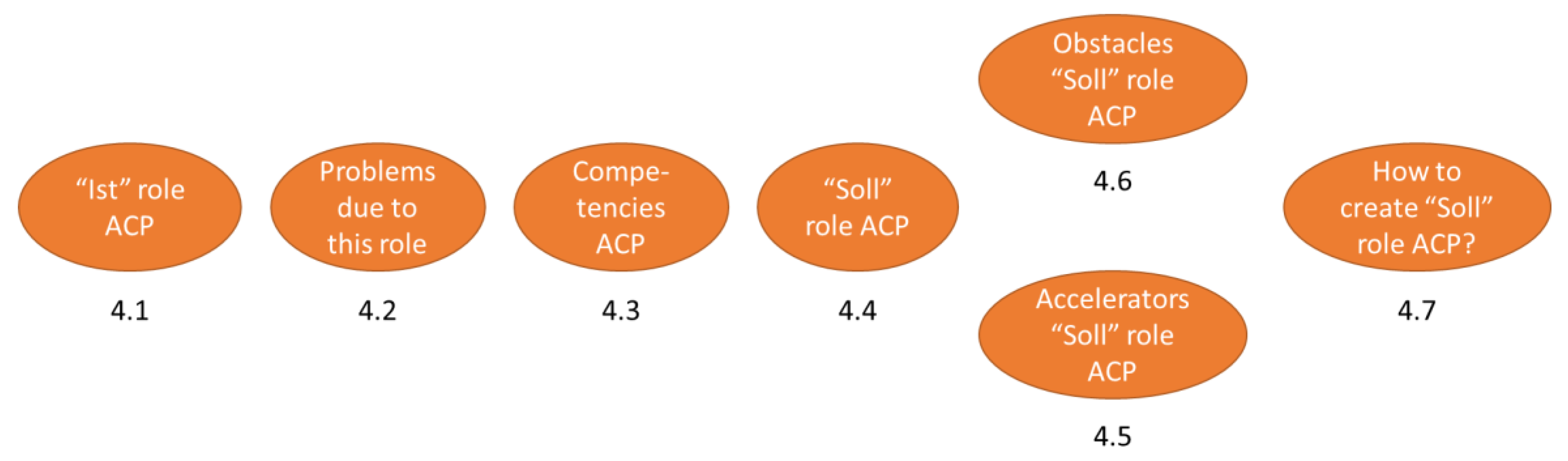

Figure 1 represents an overview of our empirical findings on the role of the ACP concerning the diagnostic control system focused on sustainable value.

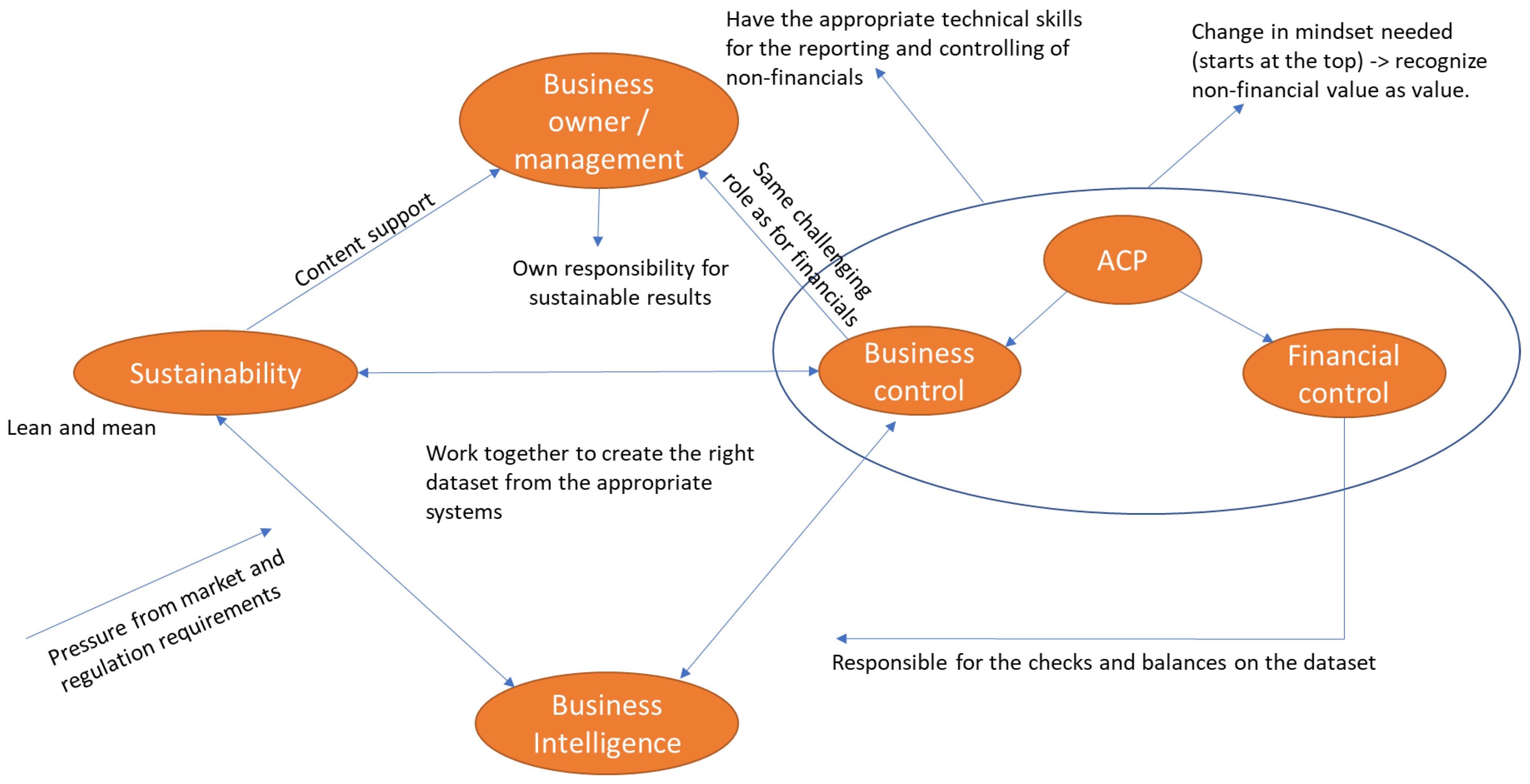

4.1. “Ist” Role ACP

Our findings indicate that currently, ACPs mainly focus on financial information and that they do not see sustainability as part of their responsibility, as is explained by P4 (Group Controller), FGD4:

“Well, I think because the role of the finance professional is still seen today as that you are not concerned with sustainability KPIs or pre-financial KPIs. You just look at topics like turnover. That’s what you’re dealing with.”

All other selected quotes regarding the current role of the ACP show a similar picture. In our FGD there is a common understanding that ACPs currently consider the sustainability manager or department responsible for the sustainability data, reporting, and analysis, as explained by P4 (Academic Finance & Control Lecturer), FGD2:

“Well, I think that finance will mainly stay in that traditional finance role. Traditional financial reporting and analysis. And that they would like to leave the other part that is about sustainability to departments that deal with sustainability.”

4.2. Problems Due to This Role

Our findings demonstrate that the sustainability manager is generally not considered an accounting and control expert, as shown by the following quote from P4 (Group Controller), FGD4:

“And what you did see is that the sustainability report was often organized by sustainability people, who simply have less affinity with numbers and accounting.”

Therefore, sustainability managers leading the accounting and reporting process of sustainable information often leads to a highly manual process, leading to higher risks of mistakes in the sustainability information and accounting process. The following quote from P1 (Senior Associate with focus on NFI assurance), FGD3, who works as an auditor on non-financial assurance, illustrates this risk:

“For example, for one client where they [sustainability department] measure the change in CO2 compared to a certain year, they have a very complicated calculation in Excel, where data come from different systems. And there’s one person who owns that KPI and says, here you are, this is the calculation. When we go through this, we see mistakes and we go back … but nobody from the organization had taken a second look. So they hadn’t seen it themselves. You encounter a lot less mistakes like this in the financial processes.”

In this case, the mistakes were unintentional and due to inaccuracy. However, other errors are made due to insufficient awareness of the basic accounting rules and policies; for example, restating one’s comparative information in case of significant business changes like mergers and acquisitions, as expressed by P1 (Director Investor Relations & Strategic Finance), FGD2:

“If you look at the figures purely from the perspective of a sustainability team, I occasionally hear, ‘Oh, we sold a business unit, so we are going to achieve our objectives [lower footprint].’ That’s not how we [finance] look at numbers.”

Although we can also consider this inconsistency in comparative information to be an unintentional error, the border to greenwashing is a thin line, especially when one takes into account that the regular segregation of duties and other checks and balances are often not in place, as explained by a senior manager audit and assurance, P3 (Senior Manager Audit and Assurance), FGD5:

“…what you often see in large SMEs—200 million plus turnover—there are often only one or two people in the sustainability department who really have to push and pull such an organization to determine those [sustainable] KPIs. Then, to speak with your example, it is the sales department that sets its own targets.”

Lastly, when decision-making is based on inaccurate (either intentional or unintentional) information, it impedes the process of taking the appropriate corrective actions to improve results.

4.3. Competencies ACP

When we consider the ability to measure the outputs of a process, our participants have a common understanding that this is one of the core ACP competencies, with a long tradition of designing accounting processes to report reliable and compliant information. Although it is recognized that the ACP’s primary focus is measuring financial output, measuring non-financial output is another of their capabilities, as recognized by P3 (Finance Consultant), FGD2:

“I also do compare it a bit with the balanced scorecard. That was—at one point, every company had a balanced scorecard. The financial part was always easy. And then you had the project, and people, and external markets…That was much more vague, but yes, you just start measuring. And then finally…you see a trend.”

Regarding the existence of predetermined standards against which actual results can be compared, it is noted as one of the ACPs’ strengths by P4 (Director Finance Operations), FGD9 (confirmed by the sustainability manager (P1) of this FGD):

“So when we talk about setting goals, measuring achievements, making analyses, initiating and monitoring possible improvement actions—yes, that’s basically our [ACPs’] strength”

During several FGDs it was argued that ACPs are seen as important professionals in this process because they have a critical mindset from an independent position. They do not just take information for granted but will critically review the reliability of reported information and challenge set goals, which also has a positive impact on the accuracy of the management information.

One last relevant competency mentioned was the ACPs’ IT skills, as stated by P3 (Group Finance Director), FGD1:

“…but why can we facilitate this well? Because we [finance] are very familiar with the IT environment to set up reports…”

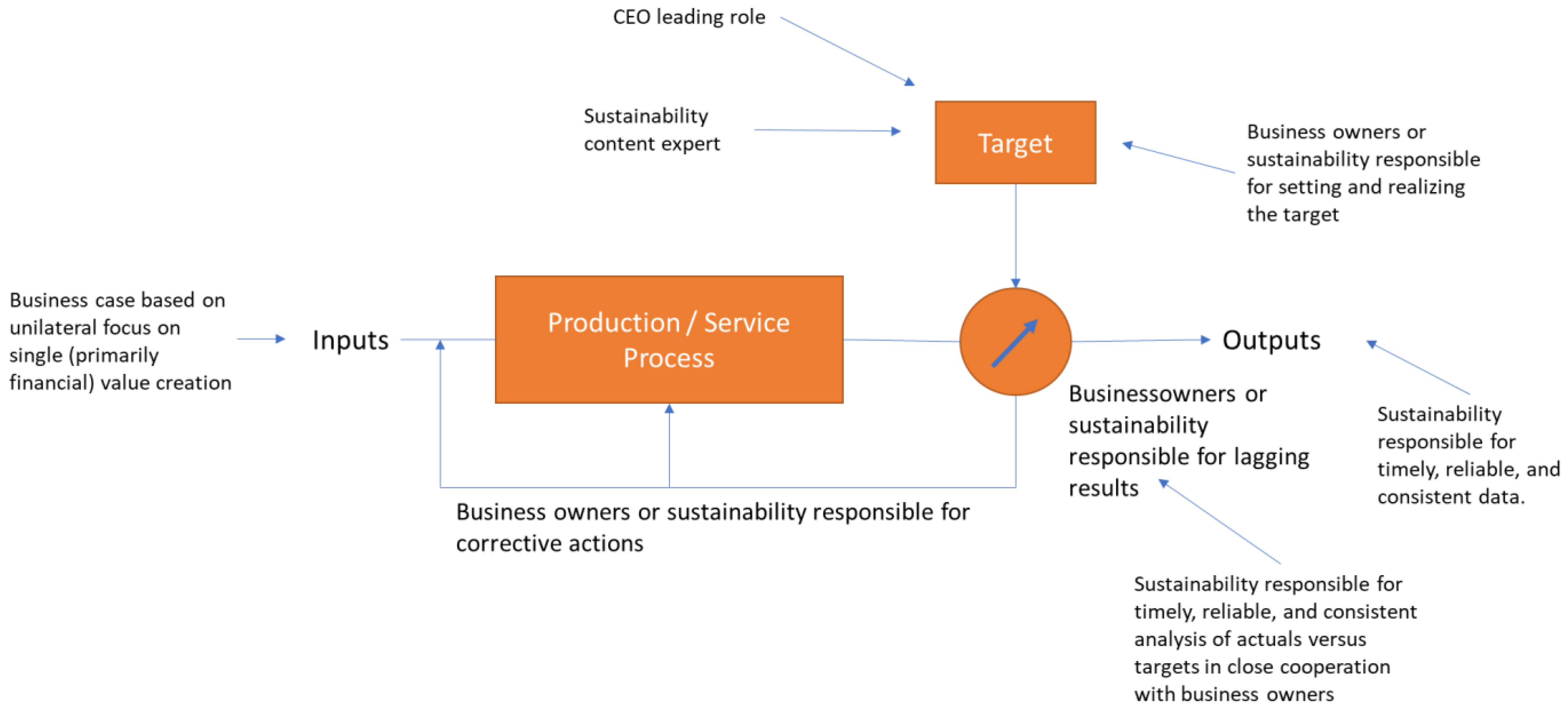

4.4. “Soll” Role ACP

The general understanding in the FGDs is that ACPs should be responsible for measuring the results of sustainability, but what this responsibility entails differs per FGD. Some participants argue that ACPs should measure and report the sustainable values, as explained by P1 (Director Group Reporting & Accounting), FGD13:

“Measuring and reporting [of sustainable information] is beyond any doubt simply the role of accounting & control.”

However, the common understanding is that who is measuring is not so relevant and should be approached pragmatically. It is argued that in some cases measuring sustainable information requires specialized sustainable knowledge, which is often missing in ACPs. In that case, it makes more sense to let the sustainability department measure the outputs. In other cases, specialized IT knowledge is necessary to access and unlock sustainable data. The business intelligence department is often referred to as the department with the specialized IT knowledge. However, apart from these differences in the practical application of measuring, there is a common understanding that ACPs are responsible for the checks and balances, as in the financial process, to make sure that the measured output is reliable and compliant with reporting standards or regulations, as expressed by P1 (Senior Associate with focus on NFI assurance), FGD3:

“I think they can also play a major role in setting up processes and guaranteeing the quality of data. Because what I often see now is that within the financial processes there are segregation of duties, different reviews, many different controls that are in place. And then you have the sustainability information, and someone prepares this info and sends it to you and just hopes that it is without mistakes.”

Regarding comparing actual results against predetermined standards or targets, we distinguish between setting the targets and analyzing the actual results against the targets. In setting targets, different opinions were discussed in the FGDs. In a minority of the FGDs, it was argued that ACPs should play an active role in actually setting sustainable targets. Other participants stated that ACPs only play a supporting role in setting the targets. However, the most common understanding in the FGDs is that management or business owners are responsible for setting sustainable targets, but that ACPs should play a challenging role in the target-setting process. The following quote from P4 (CFO), FGD1 reflects this common understanding and the discussion about the exact role of ACPs in this process:

“I notice that in my position [CFO] I am quite busy with it [sustainability], but also the people who report to me. They challenge the sustainable targets which are set by other departments, including assisting these department to improve lagging actual results, just like you do with a commercial department. So I think the facilitating role, or the reporting role, is a bit too modest.”

This quote also represents the general understanding of ACPs’ role in analyzing the actual results against the targets and their role in correcting deviations from standards. In particular, the “just like you do with a commercial department” part explains the key message of this quote, referring to the role ACPs play in setting targets, analyzing actual results, and monitoring progress in the regular financial streams. Parallel to this process, ACPs should challenge and check the explanations for lagging sustainable results on reasonability and reliability, whereas the business owner remains responsible for the results. This also means that the business owner is responsible for initiating corrective actions for lagging results, but ACPs will monitor and challenge the progress and should also facilitate the analysis. The core competencies of ACPs regarding the diagnostic control system as described in

Section 4.3 are measuring, reporting, analyzing, and having a critical and independent mindset and IT skills. These competencies match thoroughly to the activities described as the ACPs’ “Soll” role regarding diagnostic control systems. These competencies generally do not belong to sustainability professionals as described in

Section 4.2. From that perspective, it seems obvious that a dominant role regarding the diagnostic control systems is attributed to ACPs and generally recognized in other FGDs as well.

Our last main finding of the ACPs’ “Soll” role relates to the distinction between financial control and business control. This distinction is not discussed in all FGDs. However, the general opinion is that financial control is mainly responsible for the checks and balances of the actuals to assure reliability and compliance of the data. On the other hand, business control should be responsible primarily for the challenging and analyzing role.

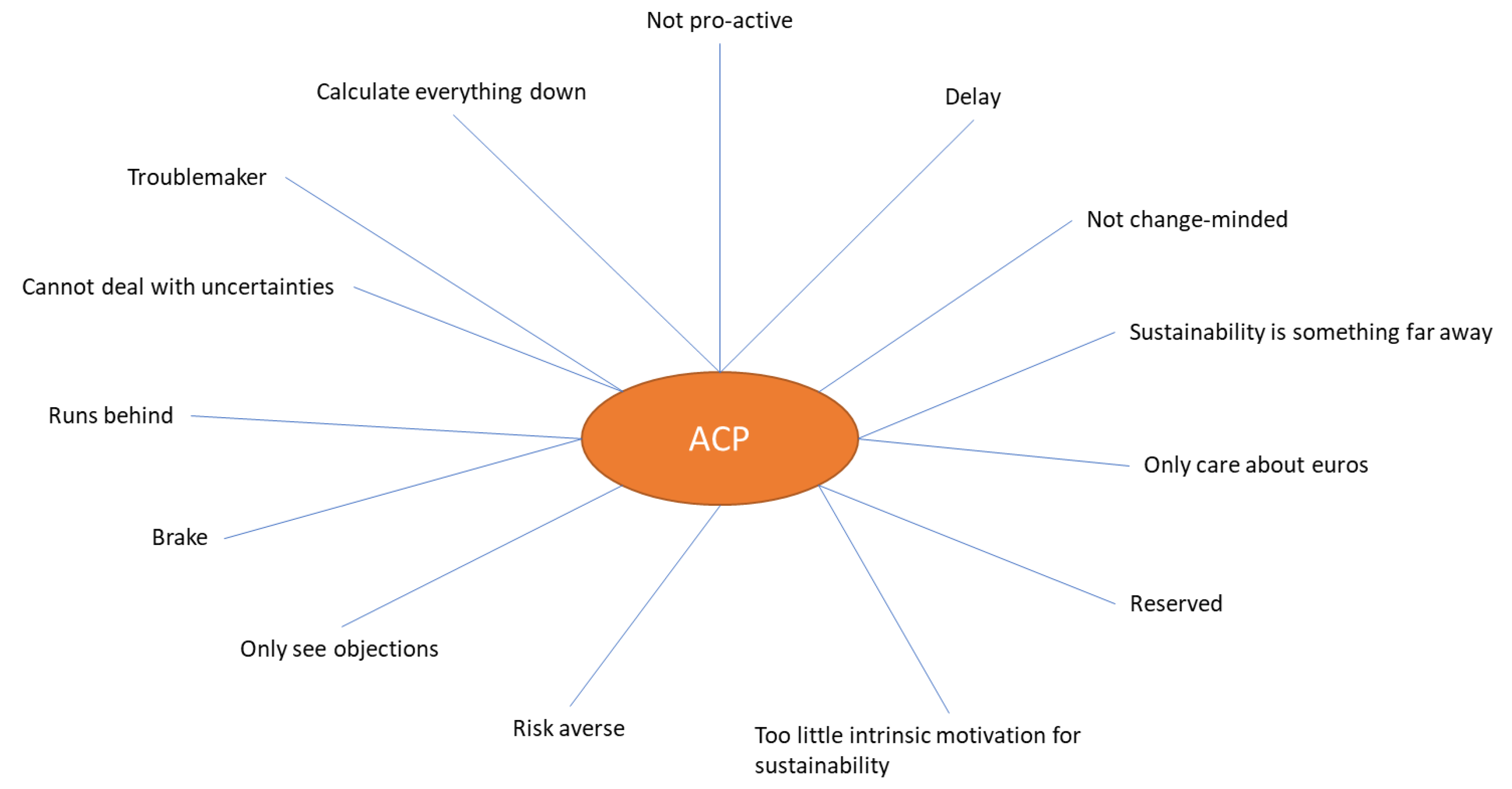

4.5. Obstacles to the ACPs’ “Soll” Role

Although in our FGD several obstacles were identified, the most dominant barrier in our findings refers to the current ACP mindset, as shown in

Table 2. If we further zoom in on obstacles in the ACP’s way of thinking, the ACP characterizations, as shown in

Figure 2, were recognized in the FGDs.

These characterizations do not only come from non-financial participants but are often brought up by financial professionals themselves. For example, the following statement is from a head of finance and control (P1, FGD4):

“And I think we are very quickly inclined to only think in euros, because we have been doing that for decades…”

We realize that a mindset is difficult to grasp. It is often more a feeling than something concrete. P3 (Group Finance Director), FGD1 clearly explains this feeling about the ACP mindset:

“But we, financial people, are often black-and-white-thinking people. We struggle to step over our own shadow. I’ve noticed this with reports in the past as well. If it contained non-financial figures or KPIs, the enthusiasm to deal with them diminished. A lot of bookkeepers, accountants and controllers are like, that’s not ours. We are just financial people. That’s what you also get with sustainable information. It makes a lot of sense for the finance professional to be responsible, but there’s something, maybe in the education or the personality of people who work in the finance department, that takes them out of their comfort zone.”

This “feeling” represents a common conclusion in most of the FGDs.

The next obstacle mentioned in the FGD is a lack of uniform reporting standards. Although the general understanding of the FGD is that a lack of uniform reporting standards is a relevant reason that ACPs are not yet involved in the process of measuring sustainable value, a few participants indicate that there are standards, but that they are not used for some reason. P1 (CFO), FGD10 states:

“There is a well-developed standard for CO2 emissions, but not many companies report on this yet.”

Based on the general understanding of the FGD, there is a lack of uniform reporting standards. However, one can also conclude that the majority of ACPs are not aware of the current standards, since there is this well-developed standard for a material topic like CO

2 emissions. This is also confirmed by P2 (Senior Manager—Sustainability—Risk Advisory), FGD3, who called the introduction of the CSRD “the best-kept business secret”. We argue that this unfamiliarity of ACPs with current sustainability reporting regulations and standards also refers to the ACP mindset. We will further reflect on this in our discussion section (

Section 5).

The following identified obstacle is the lack of ACPs’ knowledge about sustainability. Although a common understanding of the FGD is that ACPs need to close their knowledge gap by additional training and education, some participants doubt whether ACPs are capable of mastering sustainability knowledge because of the specialized knowledge required. For example, an audit partner at Energy Utilities and Energy (P4, FGD12) expressed this as follows:

“I agree with you on that. But the man or woman in the factory who explains the difference between CO2 emissions firing at 1200 and 800 degrees to me—you can tell me anything. So the question is whether a finance function can actually test and validate this.”

The last two mentioned obstacles were a lack of capacity within the finance department and limitations of the IT system. The highly manual process of current sustainability accounting makes integrating accounting and control and sustainability very time-consuming. However, it is recognized that large software suppliers are currently heavily investing in accounting practices regarding sustainability, as expressed by P3 (Partner & Head ESG), FGD4:

“I recognize what you say about the spreadsheet culture. But you also see now that SAP has invested hundreds of millions in recent months in building a number of modules very quickly that should help in sustainability accounting.”

4.6. Accelerators to the ACP “Soll” Role

Next to obstacles, we also recognized accelerators in our findings for our defined ACP “Soll” role. The most frequently mentioned accelerator is upcoming regulation (e.g., CSRD) which will obligate many companies to report on their sustainable activities. These reports also need to be provided with an audit opinion. Since the sustainability information needs to comply with regulations, including an audit trail, the common understanding is that ACPs can no longer hide from taking this responsibility, as expressed by P4 (Assurance Director Sustainability), FGD6:

“I was also always in the financial audit, and then I moved into sustainability. I’m now five and a half years in sustainability, and I think over the past two/three months I have had as many CFO conversations as I had in the five years before that, and yes, driven by CSRD, EU taxonomy, those kind of stuff.”

However, since many ACPs are not aware of the CSRD, as mentioned in the previous section, it is questionable how this regulation will impact ACPs’ activities on short notice. Another accelerator which was often mentioned is pressure from investors or banks to provide sustainable information, supported by the following quote from P4 (Group Controller), FGD4:

“We have included sustainability targets in our bank covenants. In the field of waste separation, CO2 emissions, car use, etc.”

It is expected that the additional bank requirements have a significant impact on the CFO’s awareness of sustainability accounting and control, especially when a company needs to be (re)financed, since the CFO mostly runs financing activities. The last common recognized accelerator is pressure from the market (either from the end consumer or in the value chain) to report on sustainable results transparently. Pressure from the value chain also implicates that not only do large companies need to provide sustainable information, but also that the SMEs are forced to do so, as is stated by an auditor with a focus on sustainability, specialized in SMEs (P2, FGD9):

“What I see in the market for that is that yes, now they [the SME entrepreneurs] are becoming more receptive to that, since they also receive more questions from the value chain.”

4.7. How to Create the ACP’s “Soll” Role

As explained in earlier sections, our findings show a gap between the ACPs’ “Ist” and “Soll” roles regarding sustainability. Based on our analysis, we explain in the current section how to deal with this gap to develop the “Soll” role in the future. The most dominant obstacle for the “Soll” role refers to the current ACP mindset. Therefore, we will start to explain the participants’ views on how to change this mindset. On top of this mindset obstacle, directions to deal with some more instrumental obstacles (lack of knowledge, capacity, and tools) were explained. These instrumental tools and solutions also partly contribute to changing the ACP mindset.

One of the most crucial elements mentioned to create the “Soll” role is excellent cooperation between ACPs and sustainability professionals within the organization, as stated by P4 (Assurance Director Sustainability), FGD6:

“I think we also said that working with the sustainability experts is quite key as well. Yeah, and utilizing the competencies that they have and we [ACPs] bring in the methodology, and the thinking about the way accounting and control works with the numbers.”

This seems obvious, but appears to be more complicated than expected. First of all, the characterizations of ACPs and sustainability professionals do not seem to match. As described in

Section 4.4, the ACP mindset is characterized by words like “not change-minded”, “risk averse”, “runs behind”, etc., while their competencies are described as “data experts”, “strong analytical skills”, “used to compliance”. On the other hand, the sustainability professional seems to be the opposite and is described as “a sustainable entrepreneur” (P2 (Program Manager Sustainability), FGD5) with “less affinity with numbers” (P4 (Group Controller), FGD4). These conflicting characters often frustrate the cooperation between these two groups. Another complicating factor is the lack of capacity within the finance department, making the finance department reluctant to take on additional responsibility. The sustainability professional seems reluctant to transfer the responsibility of the accounting and control process of sustainable data to ACPs due to a lack of sustainability knowledge and affinity with ACPs. The consequence of this dynamic is that the sustainability manager adopts the responsibility for this accounting and control process and invests in additional capacity and knowledge. As a result, the sustainability department grows and runs the risk of becoming a separate silo in the organization. This risk is recognized in our findings, as stated by P1 (Senior Manager Sustainability Assurance), FGD6:

“I agree with P4 (Assurance Director Sustainability). What I have seen at a lot of companies is that ESG and people involved in ESG are completely separate from the financial team. If you have any questions, you are not directed to the financial team”.

The following question is: How do we realize the finance column to be involved in sustainability and facilitate constructive cooperation between ACPs and the sustainability professionals? An essential element in this regard is the tone at the top. In several FGDs it is recognized that the (supervisory) board needs to embed sustainability in their strategy and confirm its importance. Although tone at the top starts with the CEO, the FGDs emphasize that the CFO in particular also needs to embrace sustainability and empower and support the finance department to take the responsibility for the accounting and control process of sustainable data. This tone at the top should facilitate and stimulate constructive cooperation between ACPs and sustainability professionals. Instead of seeing themselves as opposite conflicting characters, which leads to silo thinking, they should view themselves as having complementary competencies, and they should be convinced that they need each other to successfully account and control for sustainable value. In this cooperation, ACPs should be responsible for the accounting and control process regarding sustainable value, whereas the sustainability professional must support and facilitate the ACPs with sustainable knowledge. This also changes the current role of the sustainable professional from leading in the accounting and control process to being supportive and encouraging. Oft-heard statements in the FGDs are that the sustainability department should aim to embed sustainability in the organization’s business processes instead of taking operational responsibilities, which leads to a growing sustainability department. To force this “limited” role, the sustainability department should be as small as possible. This becomes apparent in the following discussion in FGD6:

P4 (Assurance Director Sustainability): “I had an interesting conversation with one of my clients this week. He is a sustainability manager at the company, and he said ‘I’m the only person in my unit within sustainability, and I don’t allow other team members. I just don’t want other team members because the organization has to do it.’”

Apart from the tone at the top facilitating this critical cooperation between the sustainability professionals and ACPs, some more instrumental elements are also required to create the ACPs’ defined “Soll” role. To close the ACPs’ sustainable knowledge gap, it is suggested that they be provided with additional education and training on sustainability. Education and training are not only related to the current ACPs in practice, but also concern including sustainability in the curricula of academic education related to ACPs, as stated by P1 (Lecturer–researcher), FGD5:

“Whether it is in the Accountancy or the Finance & Control program, but we have to start with the young people and that we have to increase the sense of urgency there. And that they then follow their program with a different mindset and that we can make big steps together.”

What also becomes apparent in this quote is that education and training not only aim to close the knowledge gap, but also contribute to changing the ACP mindset towards sustainability.

The last, more instrumental element to create the ACPs’ “Soll” role is to invest in additional capacity within the finance & control department and IT systems. The tone at the top, especially support from the CFO, is also crucial here to realize these expansions, as stated by P2 (Program Manager Sustainability), FGD5:

“There is never capacity until a director says there is capacity, which helps a lot.”

4.8. Summary of Findings and Preliminary Conclusions

Based on our findings, we conclude that ACPs should play a leading role in the diagnostic control process focusing on sustainable value creation. In this process, ACPs should challenge objectives, take the responsibility for the checks and balances on the actuals, and monitor progress of actuals against targets. The current ACP mindset, lack of sustainable knowledge, and lack of uniform reporting standards are recognized as the most important obstacles to fulfilling this role. To overcome these obstacles, support from the top (tone at the top), constructive cooperation between the sustainability department and ACPs, and additional investments in IT and ACP capacity are crucial. The findings in

Section 4 are visually summarized in

Appendix B. The implication of our conclusions to the relevant literature will be discussed in the following section.

6. Conclusions and Directions for the Future

Although there is a broad consensus in academia and practice that ACPs should or may play a role in sustainability accounting and reporting, there is uncertainty regarding the role that ACPs should play [

15,

16]. This study responds to this uncertainty by answering the following research question:

What could be the role of Accounting & Control Professionals regarding diagnostic control systems focusing on sustainable value creation?

Our research contributes to the literature in several ways. As stated in the literature review, Ascani et al. [

6] highlight that “further research should be undertaken for an in-depth investigation into the nature and the characteristics of this role, the activities related to it, the possible criticalities a management accountant may face, and the competencies (technical and soft) that should be developed when playing this role” (p. 19). These recommendations form the core of our empirical study. We also answer the call from Schaltegger and Zvezdov [

7] that “the main implication for future research is investigating how accountants could be more strongly involved in sustainability accounting and reporting” (p. 353). The distinction between technical and soft competencies to be developed appeared to be crucial in our findings. We conclude that a fundamental change in the ACP ethos is essential to fulfilling this role adequately, referring to soft competencies. We also recognize a need to develop technical skills. However, we argue that without a different way of thinking, these technical skills will not materialize. On the other hand, we perceive that technical skills and external factors contribute to overcoming the continued dominance of the ACPs’ financial discourse. Apart from the specific role of the ACPs, our study provides insights on how to design and organize a diagnostic control system focusing on sustainability as part of a management control system, answering the call for more management accounting research in this area [

3,

4,

5]. Next to the diagnostic control system, this study also includes interactive controls and belief systems in the discussion, extending the theoretical conceptualization and dynamics of Simons’ LOC [

2] regarding sustainability, thereby further deepening the study and conclusions of Narayanan and Boyce [

50]. It does so by explaining the interaction and cooperation between top management, the sustainability department, and ACPs regarding these three LOC, incorporating the yin and yang principle into the discussion.

This paper also has important managerial and practical implications. It provides ACPs and other practitioners with rich insights into the challenges and recommendations of configuring a sustainable diagnostic control system. It draws attention to how ACPs can engage in driving the sustainability agenda and identifies specific resources and processes that organizations might use to encourage such engagement. It shows that enabling ACPs to participate in sustainability initiatives is a fundamental process and requires sufficient economic–organizational material and symbolic capitals and time to allow engagement with novel tasks and other professionals. It also demonstrates that adapting ACPs’ habitus may depend on the ability of both ACPs, sustainability managers, and top management to develop the “feel for the game” that comes from engaging with other professional outlooks, further specifying the analysis of Egan and Tweedie [

16].

Although the results from this exploratory study are illuminating, there are of course limitations to the research which call for further empirical investigations. It is inherent to FGDs that participants’ experiences cannot be further questioned, analyzed, or discussed by the researcher, as can be done with in-depth interviews. Further research, performing in-depth interviews at frontrunner companies where the cooperation between ACPs and the sustainability department is successfully organized, could help in deepening and enhancing our findings. This also opens possibilities to analyze the impact of the other levers of control on the diagnostic control system regarding sustainability, as well as other interdependencies between the four levers. Due to the specific aim of our FGDs, a couple of interesting topics could only briefly be discussed. The impact of the CSRD on ACPs, developments in sustainable IT tools, and the necessary changes in accounting education are a few of those topics in which further empirical research could be very insightful and could also contribute to the design of the ACP’s role in the future. Finally, given the relative novelty and rapid developments of the topic, it would also seem necessary to examine the further development of the role of ACPs in sustainable diagnostic control systems in corporate practice over time.