Abstract

The rapid rise of China on the global stage has promoted a widely held concern about the country’s political intention behind its expanding overseas economic activities. This paper attempts to shed new light on this old question: Is the abundance of natural resources in Africa the primary motivation for Chinese economic engagement in the continent? To this end, we investigate the nexus of China’s direct investment in 54 African countries and its international trade with the region between 2003 and 2014 to estimate how and to which extent Chinese investment affects its trade with the continent. This empirical task is facilitated using a transaction-level trade database from Chinese customs, which allows us to trace the trade records by product, destination, and exporting firm. Our empirical results support the trade-promoting effect of China’s foreign direct investment in the region, and this effect is found to be more significant for China’s exports of consumption and processed goods to the continent than for China’s imports of primary goods from this same region. Furthermore, we do not find systematic evidence that these investment activities lead to more primary goods being imported by Chinese state-owned enterprises. While these findings do not rule out the existence of resource-seeking motivation, they cast doubt on that being a primary driving force behind Chinese investment in Africa.

1. Introduction

The emergence of China as the second most influential global power has generated a large variety of debates on the causes and implications of its global economic engagement [1,2,3,4,5]. Among them, a range of discussions has centred on the economic involvement of China in Africa, as Africa has been one of China’s major sources of imports, its second largest overseas construction project contract market, and its fourth largest investment destination [6]. Apart from purely economic considerations, China’s global policies, not surprisingly, can also affect Chinese economic activities [3,4]. Thus, a great deal of attention has been paid to those policies that extend China’s global reach, as well as unfolding the institutional factors that are influencing China’s economic involvement [7]. Some studies have criticised Chinese multinational enterprises’ (MNEs’) investment as a way to extract the natural resources in African countries, given the abundance of natural resources in the continent [8,9]. However, most of these existing discussions have been developed based on research on limited aspects of economic activities without a systematic overhaul of Chinese economic engagement with detailed quantitative evidence. To the authors’ knowledge, few studies have investigated the political considerations behind China’s economic engagement through the lens of the nexus between foreign direct investment (FDI) and international trade in this resource-rich continent.

The Chinese economy has been undergoing impressive growth for the last five decades because of the implementation of the Reform and Opening-up Policy and Go Global policies. According to the National Bureau of Statistics of China (NBSC), the Chinese economy experienced double-digit annual gross domestic product (GDP) growth over the period from 2000 to 2014. Apart from being a major recipient country of FDI in the world, China has also gradually increased its overseas investments in other countries since 2004. Thus, arguably, these bi-directional investment flows enable China to hold a prominent role in the global financial market [10]. It would be empirically inappropriate to examine the global economic system without considering the dramatic shifts in China’s economy. Therefore, this paper aims to unveil more facts about Chinese economic activities and their impacts on the global market.

The Sino-Africa relationship has benefited from several visits by Chinese Presidents to African countries since 1996 [11]. Noteworthily, there is an upward trend in China’s OFDI into Africa, with a sum of $5.49 billion in 2009. Meanwhile, China has been the largest trade partner of Africa, with trade reaching almost $220 billion in 2014, through steady and solid growth. Although the Sino-Africa “Win-Win” approach could be enhanced by these economic activities, it is also necessary to further conduct a systematic overhaul of Chinese economic engagement with detailed quantitative evidence.

This paper seeks to provide an empirical answer to the following questions: How does Chinese foreign trade respond to the increase in China’s outward foreign direct investment (OFDI) in African countries? Is there a trade-promoting effect of China’s OFDI in Africa, especially for the imports of primary commodities from African countries, an indicator of natural resource extraction motivation of China’s economic engagement in this continent?

In doing so, we attempt to provide clarity by investigating the political considerations behind China’s economic engagement in the African continent using evidence from the FDI-Trade Nexus. We seek to uncover how China’s FDI in African countries affects its exports and imports, separately, by using various levels of data including country-level and product-level data. Then, we move onto the political and economic role of Chinese state-owned firms in these African countries. We attempt to examine whether the trade-promoting effect of China’s OFDI is consistent across Chinese firms of different ownership structures in the African continent. Evidently, our research can extend the knowledge about China’s role and political incentives in Africa through the lens of its international economic activities.

Using panel data on China’s FDI and trade (including exports and imports) disaggregated by the receiving country and year, our first set of results confirms the trade-promoting effect of China’s OFDI in Africa. Moreover, after disaggregating our export and import data based on the standards of the Board Economic Categories (BEC), our further analysis reveals that the main objective of Chinese OFDI is to promote its exports to African countries to take advantage of the promising market potential in Africa. Whereas, the demand for natural resources or primary goods was not the primary goal of the Chinese firms’ economic engagement in Africa. After further splitting our data based on the ownership of Chinese firms, our analysis of China’s state-owned firms is also consistent with our above argument that China’s OFDI into Africa has a more significant impact on promoting China’s exports of consumption and processed goods to the continent than China’s imports of primary goods from this same region.

The above results have important policy implications for policymakers in African countries as well as in other countries. To the best of our knowledge, to date, no empirical analysis has been conducted to unveil how China’s economic engagement with African countries (including trade and OFDI) explains China’s proclaimed global policies. Our research highlights the importance of going beyond evaluating a general shift in China’s economic involvement in the African continent and exploring the political considerations behind this shift, which is related to the types of products being traded and the Chinese firms’ political connections. By using product- and ownership-level data, our empirical results, consequently, revive the political debates on whether Chinese economic involvement in the African continent aims to extract natural resources and satisfy the needs of China’s domestic market. It also rekindles the debate on whether the Chinese state-owned firms bear more considerable political responsibilities in the African continent. Certainly, our empirical results will offer valuable insights into the knowledge about China’s role in the African continent.

The paper is structured as follows. Section 2 provides an overview of Chinese economic involvement in African countries including China’s OFDI and trade. Based on this evidence, Section 3 provides a literature review to gain insights into how the FDI-Trade Nexus uncovers China’s political considerations in this continent. In this section, we discuss, in-depth, several crucial global policies of China, which significantly influence its economic involvement in the African continent. On the basis of this literature review, we develop four hypotheses related to our research questions. Section 4 presents the empirical approach, data used, and empirical results. Finally, Section 5 summarises our findings and concludes.

2. Overview of China’s Economic Engagement in the African Continent

The economic ties between China and African countries can be dated back to the beginning of the last century and have been much closer since the implementation of China’s Go Global policy and the first Summit of the Forum on China-Africa Cooperation (FOCAC) in 2000 (as shown in Figure 1). So, it is noted that China’s OFDI into, and overseas trade with, Africa have undergone remarkable shifts.

Figure 1.

FDI into Africa (UK, USA, and China). Source: Yearly Bulletin of China’s Foreign Direct Investment (2003–2014) and International Monetary Fund (from 2000 to 2013).

A stable increase in China’s OFDI in Africa has been observed since 2009, reaching $3.2 billion in 2014. Most importantly, because of the Industrial and Commercial Bank of China’s merger and acquisition with the Standard Bank of South Africa in 2009, China’s OFDI in the African continent reached a historical peak, with an amount of $5.49 billion, thus, resulting in China’s appearance at the top of the rankings of inward FDI received by the African continent [9]. Moreover, by the end of 2014, Chinese investment had entered 52 African countries, among which Algeria, Chad, the Democratic Republic of the Congo, Egypt, Ethiopia, Ghana, Kenya, Mauritius, Mozambique, Nigeria, South Africa, Sudan, Tanzania, Uganda, Zambia, and Zimbabwe account for the lion’s share of the FDI flows and stocks). For instance, the share of China’s OFDI in Algeria dramatically increased from 3.3% in 2003 to 20.8% in 2014, due to the end of its civil war and subsequent need for infrastructure development and other investments [12]. A similar tendency could also be seen in Zambia. However, it is worth mentioning that China’s OFDI has remained marginal with a share of 2.4% of the total FDI inflows into Africa in 2014.

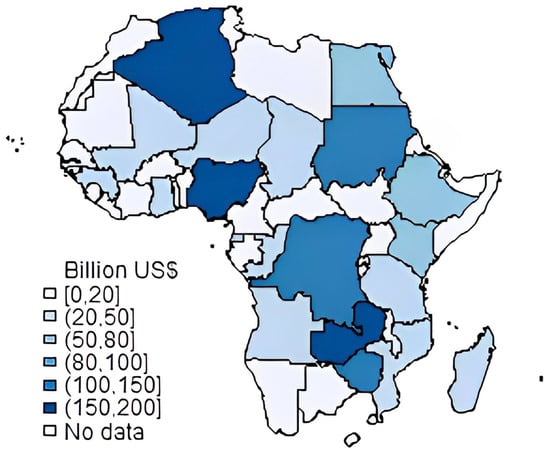

Furthermore, China’s FDI in the African continent is also increasingly diversified in terms of its location of distribution (as shown in Figure 2). By the end of 2014, Chinese MNEs had developed their overseas investments in almost 90% of African countries. However, there has been a significant shift in the distribution of China’s investment in the African continent. In the early phase, whether African countries had abundant natural resources was a vital factor for Chinese MNEs to conduct their investment activities. Thus, the majority of their economic activities were concentrated in Sudan, Egypt, and South Africa. On the contrary, Chinese OFDI over the past decades has been distributed in the entire African continent (as shown in Figure 2). Especially, Algeria, Congo (Dem.), and Kenya received increasing FDI from China over the period between 2003 and 2014. Furthermore, China’s economic activities in Algeria are no longer confined to the mining development and production sector. Instead, Chinese enterprises have also been seen in the petroleum industry and equipment manufacturing sectors [12].

Figure 2.

The Geographic Distribution of China’s OFDI in the African Continent (2003–2014). Source: Yearly Bulletin of China’s Foreign Direct Investment (2003–2014).

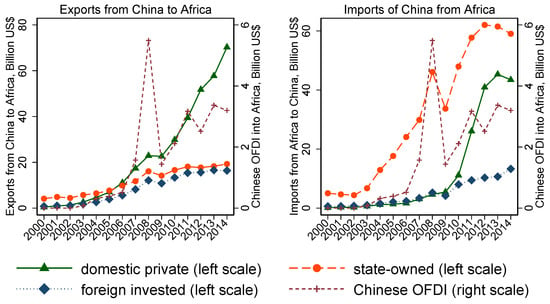

Similarly, China’s overseas trade with African countries has also experienced an unprecedented shift, since the first Summit of the Forum on China-Africa Cooperation (FOCAC) in 2000. The inaugural FOCAC summit represented a landmark in Sino-African cooperation, triggering soaring bilateral political and economic interactions between China and African countries. With the increasingly tight trade relationship between China and African countries, China has been the largest trade partner of Africa, with trade reaching almost $220 billion in 2014, through steady growth. In the early 2000s, China’s share of Algeria’s foreign trade was negligible. Over the last 10 years, however, Sino-Algerian trade ties have become increasingly close. China has overtaken France as Algeria’s largest source of imports. Indeed, Algeria-China transactions are now settled in Chinese yuan instead of U.S. dollars [12]. Regarding exports from China to Africa, there is also robust growth, almost 13.2% on a yearly basis, 8.3 percentage points higher than China’s export growth over the same period. Based on the classification standards of the Broader Economic Categories (BEC), most of China’s exports to Africa have centred on consumption goods, followed by processed goods for industrial supply (as shown in Figure 3). In particular, exports of technical equipment to Africa made a breakthrough. For instance, Chinese enterprises signed a supply contract for locomotives with South Africa, with the purpose of exporting electric locomotives with a total value of $3 billion, hitting an order record of China’s vehicle exports of high-end railway transportation equipment.

Figure 3.

Exports from China to Africa. Source: China Customs Trade Statistics Database.

Conversely, imports from Africa to China have had a different tendency. The greatest increase lies in the imports of primary goods for industrial supply, followed by consumption goods, which also saw a dramatic increase after 2009. The smallest change could be found in the imports of capital goods. Because Africa is a continent with rich resources and China could be considered an energy-supported economy, it is essential for China to import resources from Africa, as well as worldwide, to secure sufficient energy, such as oil and fuels, and sustain its long-term domestic economic growth. Also, the increase in China’s imports of primary goods from Africa implicitly reflects China’s geopolitics, such as its global resource demand policies.

3. Hypotheses

Within international business research, the determinants of FDI location have been investigated through a large variety of empirical and theoretical studies. The well-known theoretical analysis approach was the eclectic paradigm put forward by Dunning [13]. By amalgamating the major imperfect market-based theories (e.g., internationalisation theories of FDI), he suggested that an MNE would engage in overseas investment if three advantages were fulfilled, that is the ownership, location, and internationalisation advantages (OLI advantages). Through comprehensively investigating these three advantages of MNEs, Dunning’s OLI approach identifies a set of factors influencing the activities of MNEs and suggests four common motivations of FDI, namely resource-seeking, market-seeking, efficiency-seeking, and strategy-seeking. Dunning’s approach to analysing FDI has gained wide acceptance. Thereafter, based on Dunning’s OLI approach, an increasing number of studies have been developed to explore the corporate behaviours and decisions of MNEs [14]. However, these theories have mainly explained the movement of investment from developed countries/regions to other economies. They have failed to capture the phenomenon of investment from developing countries to other countries, as several developing economies have emerged on the map of international investors over the past two decades, such as China and India. MNEs from these developing countries have established themselves in every sphere of the global economy. Therefore, explaining the essence of MNEs’ investment from these developing countries has become vital to develop a theory that is consistent with their investment behaviours.

Similar to developed countries, the abundant natural resources in the African continent are also the crucial attraction of China’s OFDI. Deng [15] segregates five factors that motivate Chinese firms to explore investment including natural resources, markets, technology, diversification, and strategic assets. His findings were supported by a wide range of existing empirical studies on China’s OFDI. For example, Kolstad and Wiig [16], using UNCTACD data, ran a cross-country regression with 29 observations and found an association of Chinese FDI with natural resource exports. Meanwhile, they also found that China’s MNEs were more likely to develop their investment activities in countries with poor governance.

Apart from natural resources (discussed below), a large number of Chinese MNEs have decided to conduct their economic activities in Africa with the aim of gaining access to this promising market. The Go Global policy further urged Chinese firms to take advantage of booming world trade to invest in global markets. An increasing number of Chinese enterprises, including state-owned enterprises (SOEs) and private enterprises, have ventured into investing and operating abroad. The Go Global policy has set several goals: moving from an investment to an innovation-driven economy, increasing Chinese outward foreign direct investment, and promoting the competitiveness of Chinese companies in global markets [17]. The Go Global strategy puts emphasis on China’s OFDI, which is supposed to enable China to better integrate into the global economy and improve access to domestically scarce raw materials [18]. Eventually, China’s OFDI surpassed its inbound FDI for the first time in 2014, reaching a historical record of $123.12 billion. Under the impact of the Go Global policy, the same tendency has also been found for China’s overseas trade, particularly for China’s exports, which undoubtedly improve the competitiveness of Chinese companies and products. Thus, it is essential to investigate how China’s OFDI exerts an impact on its trade with the African continent.

Apart from Dunning’s OLI approach, the proximity-concentration trade-off model, which is proposed by Brainard [19], also plays an essential role in studies on international business. He also mentions the importance of “distance” or “transaction costs” in the analysis of international business. Carr et al. [20] and Bergstrand and Eggar [21], subsequently confirmed the substitution between FDI and exports, as they found a negative effect of geographical distance on FDI. Also, the higher monitoring costs, which increase with the physical distance, could reduce FDI, but encourage exports between countries. However, unlike the conventional proximity-concentration trade-off model, Lankhuizen and de Groot [22] argue that FDI does not merely substitute for trade. Conversely, their research indicates that the larger economies engage relatively more in outward FDI, and size and potential of the foreign market can significantly affect exports. Therefore, it can be concluded that how FDI affects international trade remains vague. In particular, the majority of research on international business employs evidence from developed economies. It is essential to further test the relationship between FDI and trade by using the evidence from emerging economies.

Therefore, our first two hypotheses thus read as follows:

Hypothesis 1.

China’s OFDI into Africa leads to a higher value of trade between China and Africa.

Hypothesis 2.

China’s OFDI into Africa leads to a higher value of exports of consumption goods from China to Africa.

In addition to the Go Global” policy, which urges Chinese firms to integrate into the global market and gain more development opportunities, Chinese MNEs’ economic decisions are also influenced by China’s global resource demand policies. These resource-related policies should not be neglected when investigating China’s economic engagement in Africa, as Africa is well-known for its abundant natural resources.

China has experienced an unprecedented economic boom over the past few decades. This sharp economic increase has also fuelled China’s need for resources, such as oil and raw materials. Due to the lack of sufficient resources, the Chinese government has put forward a set of foreign and energy-related policies to secure long-term energy supplies, which are essential to sustain its industrialisation. Therefore, it is considered that China has been experiencing energy-supported economic growth [23]. For the sake of sustainable economic growth, these global resource-related policies have made China an active player and generous lender in Africa, Central Asia, Latin America, Russia, and Southeast Asia.

Numerous aspects of China’s recent engagement with Africa have attracted much attention to what some observers refer to as China’s “oil diplomacy.” Although China’s MNEs have been more active in Africa, an increasing amount of oil has been imported to China, and China has surpassed the US as the world’s largest importer of oil in recent years. The International Energy Agency’s World Energy Outlook 2014 [24] projected that China would become the world’s largest consumer of oil by the early 2030s. Angola, for example, is playing the dominant role of being a crude oil supplier to China. During 2018, $24.9 billion in crude oil was imported from Angola to China, accounting for about 10.4% of total oil exports from Angola. Moreover, Libya has been one of the fastest-growing suppliers of China’s imported crude oil since 2017, with an increase of 248.1% [25].

Apart from the implementation of so-called “oil diplomacy” in African countries, China has also cooperated with the African authorities to build special economic zones (SEZ) in African countries or regions with the purpose of enhancing its influence and securing the supply of necessary energy and resources. Established by the Angolan government in 2009, the Luanda-Bengo Special Economic Zone is a state-owned enterprise covering an area of about 840,000 hectares. In this SEZ, the latest investment project belongs to CITIC Construction, a Chinese state-owned conglomerate, which will invest $40 million in an aluminium smelter to reduce imports of these materials covering an area of 19.6 hectares. This factory is expected to produce 8000 tons of profile products and 2,000 tons of door and window products per year, which could then be exported back to China and satisfy China’s domestic needs [26].

In this regard, it is also necessary to further test whether acquiring and importing natural resources from Africa to China is an important consideration behind China’s economic engagement in this continent. Conventional studies on the FDI of developed countries highlight the importance of natural resources for international investors [13,14,15,16]. However, can their arguments be supported by firm-level and product-level evidence from China, the largest emerging economy around the world? This question needs to be further discussed and explored.

Therefore, our third hypothesis was developed as follows:

Hypothesis 3.

China’s OFDI into Africa leads to a higher value of imports of primary goods by China from Africa.

The last strand of the literature related to this paper is on the soft budget constraints of Chinese SOEs. In a 2007 study, Buckley et al. [27] examined Chinese OFDI over the period 1984-2001, a time when it could be “regarded as being state-owned”. They found that the institutional constraints imposed by the Chinese government, via its state’s OFDI approval mechanisms, effectively prohibited private Chinese firms from internationalisation, but enhanced the economic activities of its state-owned MNEs in the global market. They concluded that the institutional factors at home were surmised to encourage Chinese state-owned FDI, including government policy support (relating initially to support given to export promotion efforts), national imperatives to secure the supplies of natural resources, and possibly strategic asset acquisitions overseas [18].

A well-known phenomenon in socialist and transition economies is that, when SOEs incur losses, the state normally cannot restrain itself from bailing them out by providing additional subsidies or credits. The phenomenon is known as the soft budget constraints [28,29]. There are several factors resulting in the soft budget constraints, including the paternalism of socialist government, highly centralised system of socialist economies, and public ownership of socialist economies. Recently, some scholars also found that policy burdens on enterprises could be a crucial cause of the soft budget constraints in socialist and transition economies. In particular, this phenomenon is more obvious in Chinese state-owned MNEs [29].

Economic considerations are entangled with the political considerations [30]. This is reflected in the regulations. Instead of giving directions directly from the state to enterprises, there are regulatory mechanisms that try to influence the investment decisions of China’s state-owned MNEs without making them compulsory. All investments are coordinated and regulated by the Ministry of Commerce; they have a list of preferable countries and industries. If an enterprise decides to invest in a particular sector that is listed in that catalogue, it is easier for them to apply for funding and special treatment. The second instrument to influence the investment decision made by China’s state-owned MNEs is through a comprehensive package of financial instruments. These consist of development funds, investment funds, concessional loans, and export credit insurance. There are more instruments for financing foreign investment in areas that are government approved. Although these financial packages and support could enable Chinese state-owned MNEs to achieve their economic outcomes to a large extent, their operation should be in accordance with the political objectives. Therefore, China’s state-owned MNEs are more likely to conduct their overseas economic activities in the government’s favour, with the aims of achieving certain political objectives but at the expense of their performance, according to the phenomenon of soft budget constraints [28,29,30]. However, few studies employ quantitative evidence to further illustrate this phenomenon in China, the largest socialist and transaction economy around the world. It is essential to explore whether Chinese state-owned firms develop their economic activities with the political considerations in Africa.

Therefore, along these lines, we expect the trade-promoting effect of China’s OFDI to be more significant for Chinese state-owned firms if we disaggregate our data into different categories based on the ownership of Chinese firms:

Hypothesis 4.

China’s OFDI into Africa leads to a higher value of trade between China and Africa, but more so for consumption goods exported by Chinese stated-owned firms.

4. Empirical Analysis

4.1. Method and Data

In this paper, we investigate econometrically the political considerations of China’s engagement in the African continent by considering the FDI-trade nexus. Thus, we employ the gravity model as our econometric model to explain bilateral trade flows, because of its extraordinary stability [31].

Although the first gravity model was proposed based on Newton’s Law to explain the interaction between two stars, it is also widely used to analyse international trade and economic aggregates [32]. Taking the trade flows between two countries as the independent variable, the gravity model of international trade can be shown:

where stands for the trade volume between two countries, and imply the total GDP of country and country , respectively. Transaction cost is replaced by the distance () between two countries in the gravity model of international trade.

Generally, the gravity model assumes that bilateral trade is proportional to the product of the trading partner’s economic masses, proxied by GDP, and inversely proportional to the geographic distance between them. However, it is important to control for other trade determining factors such as population and exchange rate [33,34]. In order to control for country heterogeneity, we make use of partner fixed effects.

Considering our research aims and hypotheses, mentioned above, we run the following econometric model:

where represents the total volume of bilateral trade (measured by the sum of exports and imports) between China and African countries; we use the bilateral geographical distance as a proxy for the bilateral trade cost; refers to the log of China’s outward FDI into the African country ; is the log of the gross domestic product in current US dollars of the African country ; stands for other variables that also influence the trade between China and African states; and represent the time and country fixed effects, respectively; is the error term. What is also needed to mention that we should consider several control variables when we analyse the impact of China’s OFDI on its trade. For instance, it is essential to take into account the influence of the population of these African states, their exchange rates, and their trade relationships with countries other than China. Likewise, considering the characteristics of the African continent, we should also take into account the natural resources rent as a factor influencing China’s foreign trade with African countries, which is measured by the share of total natural resources in GDP in the African continent.

Our variable of interest is , whose coefficient captures the impact of China’s outward FDI on the bilateral trade between China and African countries. Table 1 shows the in-detail explanation of our data and the data sources:

Table 1.

List of Variables.

Our dataset covers the period 2003 to 2014. The reason for having 2014 as the end year is because the China Customs Trade Statistics (CCTS) Database, which is a transaction-level proprietary database covering the universe of customs transactions, is only available for years up to 2014. As far as we are aware, this is the only trade data available which gives detailed trade information at the firm-product-destination level. Such detailed information at this level of disaggregation is crucial for the purpose of this research. Some recently published papers also use this data for a similar period [35,36,37,38]). Furthermore, we also hypothesise that the goods traded of different categories are affected differently by Chinese OFDI; therefore, we also need to further divide our dataset into four categories of goods based on the BEC standards. So, there are four categories of goods traded which could be examined in this research, namely consumption goods, primary goods for industry, processed goods for industry and capital goods. Regarding this, we run the following econometric model to test our Hypothesis 2:

where refers to the category of goods traded according to the BEC standards and refers to the volume of exported goods from China to African countries. Equation (2) can be used to test our Hypothesis 2, which is looking at the effect of China’s OFDI on China’s exports of consumption goods to African countries.

Likewise, as our Hypothesis 3 is used to investigate the impact of China’s OFDI on imports from Africa to China, we can run a similar econometric model, which uses instead of to represent the volume of China’s imports from Africa over the period from 2003 to 2014. Thus, we can develop an econometrical equation for the third hypothesis as follows:

Hypothesising that Chinese companies with different ownership also differentiate in terms of the impact of their OFDI on trade, we further split our dataset into three different types according to the ownership of Chinese firms, namely domestic private, state-owned, and foreign invested companies. Thus, to test our fourth hypothesis, our econometrical form could be run as the following:

where stands for the type of ownership of Chinese firms. In this equation, our variables of interest are also , whose coefficient captures the impact of OFDI on China’s trade in Africa.

4.2. Main Results

4.2.1. The Trade-Promoting Effect of China’s OFDI in Africa

We now begin to examine the overall impact of China’s OFDI on the bilateral trade between China and African countries. Table 2 presents the results of estimating Equation (2) by using the ordinary linear squares (OLS) estimation and fixed effect estimation. The total volume of bilateral trade between China and African countries is used as independent variables in this equation, and then we explore the impact of China’s OFDI on exports and imports, respectively.

Table 2.

The Effect of China’s OFDI on bilateral trade with African countries.

We find a positive coefficient of our investment variable, which is , when we used the sum of exports and imports to measure the total volume of Chinese foreign trade volume in the African continent. Also, this coefficient is positive at a one per cent significance level. This positive coefficient refers to the fact that China’s OFDI in Africa could promote its bilateral trade relationship with these African countries. In other words, the more Chinese firms invest in African countries, the more active the international trade interaction between China and these countries is. This result seems to support Neary [39] and Hailu [40] who both concluded a pronounced and positive effect of FDI on international trade. Neary [39] stated that foreign firms established plants in one country as export platforms to serve the block as a whole.

Columns (4) and (5) report the regression results by disaggregating foreign trade into two categories, and that is China’s exports to Africa and China’s import from Africa. As we mentioned in the earlier section, certain control variables should be considered when analysing the impacts of China’s OFDI on trade. Time-invariant country characteristics are captured by the country fixed effects and year fixed effects. After having included five control variables in our baseline regression to further test our regression, the effect of China’s OFDI on its exports to African countries is more pronounced compared with the effects on imports from African countries. Thus, it can be said that most Chinese MNEs choose to develop their African businesses because of the huge market potential in Africa. OFDI from China also, to some extent, affects China’s imports from Africa, but not as significant as exports. Summing up this point, the empirical results demonstrated a trade-promoting effect of China’s OFDI in Africa, and more so for China’s exports to African countries.

4.2.2. China’s OFDI and Exports to African Countries

In order to test our Hypothesis 2, which aims to investigate whether China’s OFDI in Africa leads to a higher value of exports of consumption goods from the country to the African continent, we run a modified version of the basic regression for the relevant time period (2003–2014) (see Table 3). We disaggregate the total volume of exports into exports of consumption goods, exports of primary goods, exports of processed goods for industry supply, and exports of capital goods from China to African countries to further analyse which type of exported goods is affected more significantly by China’s OFDI (Columns 2–5).

Table 3.

China’s OFDI and exports to Africa.

Our regression results confirm our Hypothesis 2 that the positive impact of China’s OFDI on its exports to African countries masks heterogeneities associated with the categories of exported products. We find that China’s OFDI has a more significant and positive impact on the exports of Chinese consumption goods and processed goods to African countries, compared with the exports of primary goods. These positive and significant coefficients suggest that the more Chinese MNEs invest in African countries, the more consumption goods and capital goods African countries import from China, such as machinery and technical equipment.

There are several explanations. Firstly, the Go Global strategy puts emphasis on the outward FDI as a means to better integrate China into the global economy. So, an increasing number of Chinese enterprises, including state-owned enterprises and private enterprises, have ventured to invest and operate abroad. In order to develop their international businesses, Chinese firms need to import some necessary equipment from China to initiate their projects. This interesting phenomenon is more obvious for China’s firms in the African continent where the industrial development is relatively left behind. For instance, in recent years, China has emerged as an automobile manufacturing powerhouse, and Algeria as a lucrative export market. In fact, China exported more cars in 2012 and 2013 to Algeria than to any other country [12]. Second, considering that most of the Chinese investments centre on infrastructure projects with Chinese government support, they give the most incentives to import processed goods and capital goods to accomplish Chinese overseas projects and improve the competitiveness of these Chinese companies. Third, because China is one of the typical export-driven economies, the potential of the African market and requirements of domestic economic growth could also stimulate China’s outbound investment in these African countries.

Therefore, China’s OFDI in African countries has more significant impacts on the exports of consumption goods and capital goods, which is in line with China’s global policies. Compared with these two export products, China’s OFDI does not exert a significant impact on the export of primary goods to African countries, which also complies with our expectation, as Africa itself has diverse resources.

4.2.3. China’s OFDI and Imports from African Countries

To test our Hypothesis 3, which focuses on the impact of China’s OFDI on its imports from African countries, we also split our import data into four categories according to the BEC standards, namely China’s imports of consumption goods, China’s imports of primary goods, China’s imports of processed goods, and China’s imports of capital goods (as shown in Table 4).

Table 4.

China’s OFDI and imports from African countries.

Compared with the results for China’s exports, we find several different impacts on China’s imports from African countries. Based on Table 4, it can be found that China’s OFDI does not exert an impact on China’s imports of primary goods for industry supply, which is not in line with our expectation. Whilst there is a positive impact of China’s OFDI on its imports of primary goods, this impact is not significant at any level.

As mentioned in an earlier section, African countries are known for their rich natural resources. China could be considered an energy-driven economy that needs to secure its energy supply to sustain long-term economic growth. Table 4 demonstrates certain surprising results. However, some facts are also expected to explain these results. First, there is an impressive shift in the location selection of China’s OFDI in Africa. Although natural resources were important for the early phrase of China’s economic engagement in Africa, this motive is not getting stronger over time. Cheung and Qian [41] found a weakening effect of fuel in African countries on China’s economic involvement in Africa. Moreover, Zhang et al. [42] argue that more Chinese MNEs engage in the manufacturing and services than in agricultural and mining sectors. This shift in their choices of overseas business sectors has also weakened the role of natural resources in China’s economic activities in Africa. Shan et al. [8], furthermore, confirm that those countries with greater quantities of natural resources may not necessarily attract more of China’s economic activities.

On the contrary, the effect on imports of consumption goods from African countries is negatively affected by FDI from China at the five per cent significance level. It can also be explained by the fact that China is a country with a well-developed manufacturing industry. Chinese companies’ own-made products, to some extent, can satisfy the needs of China’s domestic market. Also, FDI-driven economic growth in China makes it possible for Chinese consumers or businesses to import goods from other countries. Compared with developed countries, African countries have extremely limited consumption products to export to China.

Brautigem et al. [43], through analysing China’s FDI inflows into Africa, also confirmed that growth in FDI inflows in some African non-resource-rich countries (e.g., Burkina Faso, Ethiopia) had been rapid in the most recent period. On the other hand, FDI flows to Nigeria fell sharply between 2012–2015 and 2004–2011, which implies that natural resource-seeking FDI would be difficult to sustain over the long term.

Therefore, whilst natural resources were an important factor in attracting more Chinese economic involvement in the last century, our empirical results find a weakening role of natural resources in Africa. Moreover, our empirical results do not support the fact that China’s OFDI in Africa leads to a higher value of imports of primary goods by country from the African continent.

4.2.4. The Role of SOEs in China’s Economic Involvement in the African Continent

Economic considerations are found to be frequently entangled with political considerations, as all of the economic activities of Chinese state-owned firms not only pursue economic performance but are also associated with some international political objectives. Meanwhile, while respecting multiple political objectives, the soft budget constraints are quite obvious in Chinese state-owned firms. In other words, these state-owned firms are more likely to operate in the government’s favour and at the expense of performance. Thus, it can be found that the widespread portrait of China’s economic engagement with Africa is related to state-directed behaviours. SOEs are the main agents of the Chinese government that are used to realise its policies. It is necessary to investigate the political connections of China’s state-owned firms through investigating their economic engagement in Africa. In order to test our Hypothesis 4, which focuses on the role of Chinese state-owned firms in Chinese economic engagement in the African continent, we further split our data based on the ownership of Chinese firms, which is Chinese domestic private firms, Chinese state-owned firms, and foreign-invested firms in China.

Before we show our empirical analysis of Hypothesis 4, it is necessary to explain the basic role of Chinese state-owned firms compared with other forms of different ownerships. As shown in Figure 4, Chinese domestic private firms are more active in exports from China to African countries. Conversely, China’s state-owned firms saw a significant increase in their imports from African countries. Meanwhile, the imports from African countries to China, generated by Chinese domestic private firms, have also been experiencing an upward tendency. Although these two figures, to some extent, show the role of SOEs in China’s economic involvement in the African continent, it is essential to analyse this role econometrically. We estimate Equation (5) to test Hypothesis 4, and the results are shown in Table 5.

Figure 4.

The impact of ownership on China’s overseas trade. Source: China Customs and Trade Statistics Database.

Table 5.

The Role of SOEs in China’s economic involvement in the African continent.

Based on our statement above on the phenomenon of the soft budget constraint of Chinese SOEs, the coefficient showing the relationship between the imports generated by Chinese state-owned firms and China’s OFDI is of interest. According to Table 5, it is clearly found that Chinese state-owned firms generate a more significant impact in comparison with firms of other types of ownership. In particular, the impacts on “consumption goods and processed goods” are expected to be closely associated with the ownership of firms involved, as the main consideration of the increase in Chinese FDI is to gain access to African countries and enjoy its market potential, so as to secure long-term economic growth in China. Also, some researchers believed that Chinese firms regard the African market as a platform through which they can gain access to the global market and enjoy cheap labour in that continent [27,41,42]. Thus, it can be concluded that the trade-promoting effect of FDI predominantly exists for those consumption goods and processed goods for industrial supply in the course of Chinese state-owned firms developing their business in African countries.

Conversely, we cannot find a significant and positive effect of China’s OFDI on China’s imports of primary goods, although the security of energy is relatively crucial for sustaining China’s long-term economic growth. Currently, plenty of articles have criticised Chinese state-owned firms over their economic involvement in Africa, as they believe that acquiring resources is the main purpose of their economic activities. However, our findings refute their accusations.

There are two explanations for this insignificant coefficient. Firstly, considering the need to obtain more of the resources, Chinese businesses have placed more of an emphasis on the market opportunities in African countries, especially in today’s globalisation age with increasingly fierce competition [44]. Chinese state-owned firms cannot only develop their business in the African continent, but also make use of these African countries to get access to a much wider global market, for example, the EU market or the American market, so as to enhance their competitiveness and international influence. Additionally, the development and utilisation of new energy could also reduce the imports of natural resources from African countries. This shift can also be found if we look at the shifts in location choice of Chinese FDI. Over the last decade, more Chinese firms locate their African plants where they can more easily get access to the local market. Therefore, the market-seeking motive has been increasingly important for China’s economic engagement in Africa. According to our empirical results, it cannot be concluded that China’s OFDI stimulate its imports of natural resources from African countries.

It should be noted that our empirical work does not equate with the findings of most research on Chinese investments in Africa, which put more emphasis on the importance of natural resources [45,46]. Our research highlights that the market potential of African countries could be the main consideration behind Chinese economic engagement in the African continent in the current turbulent global environment. The subsequent empirical analysis on Chinese state-owned firms in African countries also confirms the attractiveness of the African market to Chinese investors. Concerning the political importance of Chinese state-owned firms, our research using evidence of Chinese state-owned firms can, to some extent, reflect the political considerations behind Chinese economic engagement in Africa, namely, getting access to and enjoying the potential of the African market.

5. Conclusions

Our article contributes to the literature on the political considerations of economic activities through an assessment of the relationship between OFDI and foreign trade. The Chinese government has been frequently accused of the extraction and import of natural resources from African countries with the aims to satisfy the needs of its domestic economic growth. Using data on China’s FDI and overseas trade in the African continent over the period from 2003 to 2014, we run a gravity model to shine insight into the political considerations of Chinese economic decisions in the African continent. All models are estimated using country and time fixed effects with clustered standard errors. Considering the political and economic influence of Chinese state-owned firms, we further split our dataset based on the ownership of the Chinese firms that are involved in the African continent.

Our empirical results confirm the trade-promoting effect of China’s OFDI in the African continent, especially more so for the exports of Chinese consumption and processed goods to African countries. However, our results contradict the criticism of Chinese economic involvement, which puts an emphasis on the extraction of natural resources from the African continent. The trade-promoting effect of China’s OFDI is merely significant on the exports of Chinese consumption and processed goods, instead of the imports of African primary goods to China. Furthermore, we find no additional evidence to support the impacts of Chinese state-owned firms on its imports, although Chinese state-owned firms should bear several political responsibilities. Therefore, it can be said that the main consideration behind Chinese economic activities in the African continent could be to further enhance the global influence of Chinese products and gain access to the African market and its huge market potential.

Obviously, the noteworthy takeaway from our empirical research is to respond to the “Natural Resource Extraction” criticism of Chinese economic engagement in Africa. Also, according to our research work, we suggest that Chinese policymakers should shoulder more responsibilities in the African continent to further strengthen the “Win-Win” relationship between China and Africa.

The Sino-Africa relationship is vital for the development of China and Africa, both economically and politically. Therefore, when initiating an investment project in the African continent, Chinese government and investors should more carefully and comprehensively examine the impacts of their activities on the African market. Although there are still various criticisms of Chinese economic involvement in this resource-rich continent, the Chinese government should continue to encourage local and foreign investors to develop their projects, which are beneficial to economic development and poverty reduction in African countries. Therefore, this paper opens some new avenues for future research on the impacts of Chinese economic engagement on economic development and poverty reduction in African countries. In particular, the United Nations considers poverty reduction as one of the crucial goals of Sustainable Development Goals (SDGs). How China’s OFDI plays a role in the poverty reduction of African countries should be further investigated. Also, it should be noted that future research should be conducted to corroborate the findings in this research and the conclusions derived.

Author Contributions

Conceptualization, Z.W.; Methodology, Z.W.; Validation, Q.Z., Z.W. and G.O.; Investigation, Q.Z., Z.W. and G.O.; Resources, Z.W.; Data curation, Q.Z. and Z.W.; Writing—original draft, Q.Z.; Writing—review & editing, Z.W. and G.O.; Project administration, Z.W. All authors have read and agreed to the published version of the manuscript.

Funding

This research was funded by the National Natural Science Foundation of China grant number [71973121].

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

The data presented in this study are available on request from the corresponding author.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Abdullah, Z.B.; Daud, S.B. China’s Economic Engagement in Vietnam and Vietnam’s Response. Int. J. China Stud. 2020, 11, 51–71. [Google Scholar]

- Clement, T. China’s Economic Engagement Strategy towards Special Economic Zones: From North Korean Experiences to CPEC. J. Political Stud. Spec. Conf. Issues 2019, 271, 285. [Google Scholar]

- Liang, W. China’s Soft Power in Africa: Is Economic Power Sufficient? Asian Perspect. 2012, 9, 667–692. [Google Scholar] [CrossRef]

- Buckley, P.J.; Yu, P.; Liu, Q.; Munjal, S.; Tao, P. The Institutional Influence on the Location Strategies of Multinational Enterprises from Emerging Economies: Evidence from China’s Cross-Border Mergers and Acquisitions. Manag. Organ. Rev. 2016, 12, 425–445. [Google Scholar] [CrossRef]

- Leslie, A.N. China-Africa Relations: Political and Economic Engagement and Media Strategies. Afr. Stud. Q. 2016, 16, 1. [Google Scholar]

- Dong, Y.; Fan, C. The Effects of China’s Aid and Trade on its ODI in African Countries. Emerg. Mark. Rev. 2017, 33, 1–18. [Google Scholar] [CrossRef]

- Meyersson, E.; Padro, G.; Lse, M.; Qian, N. The Rise of China and the Natural Resource Curse in Africa. Available online: https://www.researchgate.net/publication/228775991 (accessed on 12 November 2021).

- Shan, S.; Lin, Z.; Li, Y.; Zeng, Y. Attracting Chinese FDI in Africa: The Role of Natural Resources, Market Size and Institutional Quality. Crit. Perspect. Int. Bus. 2018, 14, 139–153. [Google Scholar] [CrossRef]

- Liu, R.; Li, H. Efficiency Analysis of Cross-Border M&A of Chinese Banks—An Empirical Study Based on DEA Method. Advances in Economics. Bus. Manag. Res. 2018, 60, 1082–1089. [Google Scholar]

- Fang, J.; Collins, A.; Yao, S. On the Global COVID-19 Pandemic and China’s FDI. J. Asian Econ. 2021, 74, 101300. [Google Scholar] [CrossRef]

- Claudio-Quiroga, G.; Gil-Alana, L.; Maiza-Larrarte, A. The Impacts of China’s FDI on Economic Growth: Evidence from Africa with a Long Memory Approach. Emerg. Mark. Finance Trade 2022, 58, 1753–1770. [Google Scholar] [CrossRef]

- John, C. Sino-Algerian Relations: On a Path to Realizing Their Full Potential? Available online: https://www.mei.edu/publications/sino-algerian-relations-path-realizing-their-full-potential (accessed on 10 November 2021).

- Dunning, J. The Eclectic (OLI) Paradigm of International Production: Past, Present and Future. Int. J. Econ. Bus. 2001, 8, 173–190. [Google Scholar] [CrossRef]

- Zhang, Y.; Roelfsema, H. Unravelling the Complex Motivations Behind China’s Outward FDI. J. Asia Pac. Econ. 2014, 19, 89–100. [Google Scholar] [CrossRef]

- Deng, P. Outward Investment by Chinese MNCs: Motivations and Implications. Bus. Horiz. 2004, 47, 8–16. [Google Scholar] [CrossRef]

- Kolstad, I.; Wiig, A. Better the Devil you Know? Chinese Foreign Direct Investment in Africa. J. Afr. Bus. 2011, 12, 31–50. [Google Scholar] [CrossRef]

- Bellabona, P. Moving from Open Door to Go Global: China Goes on the World Stage. Int. J. Chin. Cult. Manag. 2007, 1, 93–107. [Google Scholar] [CrossRef]

- Buckley, P. China Goes Global: Provenance, Projection, Performance and Policy. Int. J. Emerg. Mark. 2017, 14, 6–23. [Google Scholar] [CrossRef]

- Brainard, S.L. An Empirical Assessment of the Proximity-Concentration Trade-off between Multinational Sales and Trade. Am. Econ. Rev. 1997, 87, 520–544. [Google Scholar]

- Carr, D.L.; Markusen, J.R.; Maskus, K.E. Estimating the Knowledge-Capital Model of the Multinational Enterprise. Am. Econ. Rev. 2001, 91, 693–708. [Google Scholar] [CrossRef]

- Bergstrand, H.H.; Egger, P. A Knowledge-and-Physical-Capital Model of International Trade Flows, Foreign Direct Investment, and Multinational Enterprises. J. Int. Econ. 2007, 73, 278–308. [Google Scholar] [CrossRef]

- Lankhuizen, M.; de Groot, H.L.F.; Linders, G.M. The Trade-Off between Foreign Direct Investment and Exports: The Role of Multiple Dimensions of Distance. World Econ. 2011, 34, 1395–1416. [Google Scholar] [CrossRef]

- Caceres, B.; Ear, S. The Geopolitics of China’s Global Resources Quest. Geopolitics 2012, 17, 47–79. [Google Scholar] [CrossRef]

- IEA. World Energy Outlook 2014. Available online: https://www.iea.org/reports/world-energy-outlook-2014. (accessed on 1 December 2021).

- China-Lusophone Brief, China’s Oil Imports from Angola Continue Recovery. Available online: https://chinaafricaproject.com/analysis/chinas-oil-imports-from-angola-continue-recovery/ (accessed on 20 December 2021).

- M2.com. Angola’s Special Economic Zone, Provides New Services to National and Foreign Investors with the Inauguration of the GAI—Investor Support Office. Available online: https://www.proquest.com/docview/2597407086?parentSessionId=vDGb55IoqK5hpspJXTCRabwv%2F3Jpx0e2LRQzNKYSY7o%3D&pq-origsite=summon&accountid=10472 (accessed on 10 December 2021).

- Buckley, P.J.; Clegg, J.; Cross, A.; Liu, X.; Voss, H. The Determinant of Chinese Outward Foreign Direct Investment. J. Int. Bus. Stud. 2007, 38, 499–518. [Google Scholar] [CrossRef]

- Kornai, J. Hard and Soft Budget Constraint. Acta Oecon. 1980, 25, 231–245. [Google Scholar]

- Lin, J.; Li, Z. Policy Burden, Privatization and Soft Budget Constraint. J. Comp. Econ. 2008, 36, 90–102. [Google Scholar] [CrossRef]

- Patrick, M.; Wagner, R. From Mixed Economy to Entangled Political Economy: A Paretian Social-theoretic Orientation. Public Choice 2015, 164, 103–116. [Google Scholar] [CrossRef]

- Yotov, Y.; Piermartini, R.; Monteiro, J. An Advanced Guide to Trade Policy Analysis; WTO UNCTAD: Geneva, Switzerland, 2012. [Google Scholar]

- Zhang, Y. Influence Effects of Internet on the Optimization of China’s International Trade Based on Gravity Model. Math. Probl. Eng. 2022, 2022, 4771947. [Google Scholar] [CrossRef]

- Banik, B.; Roy, C.K. Effect of Exchange Rate Uncertainty on Bilateral Trade Performance in SAARC Countries: A Gravity Model Analysis. Int. Trade Politics Dev. 2021, 5, 32–50. [Google Scholar] [CrossRef]

- Ghosh, S. The Gravity Model in International Trade: Advances and Applications. Rev. Int. Econ. 2011, 19, 975–981. [Google Scholar] [CrossRef]

- Chor, D.; Manova, K.; Yu, Z. Growing like China: Firm Performance and Global Production Line Position. J. Int. Econ. 2021, 130, 103445. [Google Scholar] [CrossRef]

- Deng, Y.; Wu, Y.; Xu., H. Emission Reduction and Value-added Export Nexus at Firm Level. World Econ. accepted. 2022. [Google Scholar] [CrossRef]

- Li, G.; Egger, P.; Li, J.; Wu, H. Exporting Firms’ Factor and Product-quality Adjustments in Response to Employment Protection Legislation: Evidence from China. China Econ. Rev. 2022, 73, 101801. [Google Scholar] [CrossRef]

- Zhu, Y.; Sun, C. Carbon Reduction, Pollution Intensity, and Firms’ Ratios of Value Added in Exports: Evidence from China’s Low-Carbon Pilot Policy. Sustainability 2022, 14, 2687. [Google Scholar] [CrossRef]

- Neary, P. Trade costs and Foreign Direct Investment. Int. Rev. Econ. Finance 2009, 18, 207–218. [Google Scholar] [CrossRef]

- Hailu, Z. Impact of Foreign Direct Investment on Trade of African Countries. Int. J. Econ. Financ. 2010, 2, 122–133. [Google Scholar] [CrossRef]

- Cheung, Y.; Qian, X. Empirics of China’s Outward Direct Investment. Pac. Econ. Rev. 2009, 14, 201–220. [Google Scholar] [CrossRef]

- Zhang, J.; Wei, W.; Liu, Z. Strategic Entry and Determinants of Chinese Private Enterprises into Africa. J. Afr. Bus. 2013, 14, 96–105. [Google Scholar] [CrossRef]

- Brautigam, D.; Diao, X.; McMillan, M.; Silver, J. Chinese Investment in Africa: How Much Do We Know? PEDL Synth. Pap. Ser. 2017. Available online: https://pedl.cepr.org/publications/chinese-investment-africa-how-much-do-we-know-0 (accessed on 12 December 2021).

- Cheung, Y.; Haan, J.D.; Qian, X.Y.; Yu, S. China’s Outward Direct Investment in Africa. Rev. Int. Econ. 2012, 20, 201–220. [Google Scholar] [CrossRef]

- Wang, X.L.; Yu, D.L.; Yuan, C.H. Complementary Development between China and Sub-Sahara Africa: Examining China’s Mining Investment Strategies in Africa. Sustainability 2021, 13, 1678. [Google Scholar] [CrossRef]

- Luke, P. Learning in Africa: China’s Overseas Oil Investment in Sudan and South Sudan. J. Contemp. China 2017, 26, 756–768. [Google Scholar]

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).