1. Introduction

China’s reform and opening-up have brought remarkable economic growth but resulted in a severe increase in environmental pollution. In order to solve environmental problems, the mode of human production must be changed. Leading enterprises toward a green transition while preserving economic rewards has become a critical problem [

1]. Green innovation not only improves the competitive advantage of enterprises [

2,

3] but is also the main force for achieving a green transformation of the economy [

4,

5]. Hence, this study analyzes whether the issuance of green bonds can encourage green innovation by enterprises and, if so, through which mechanism.

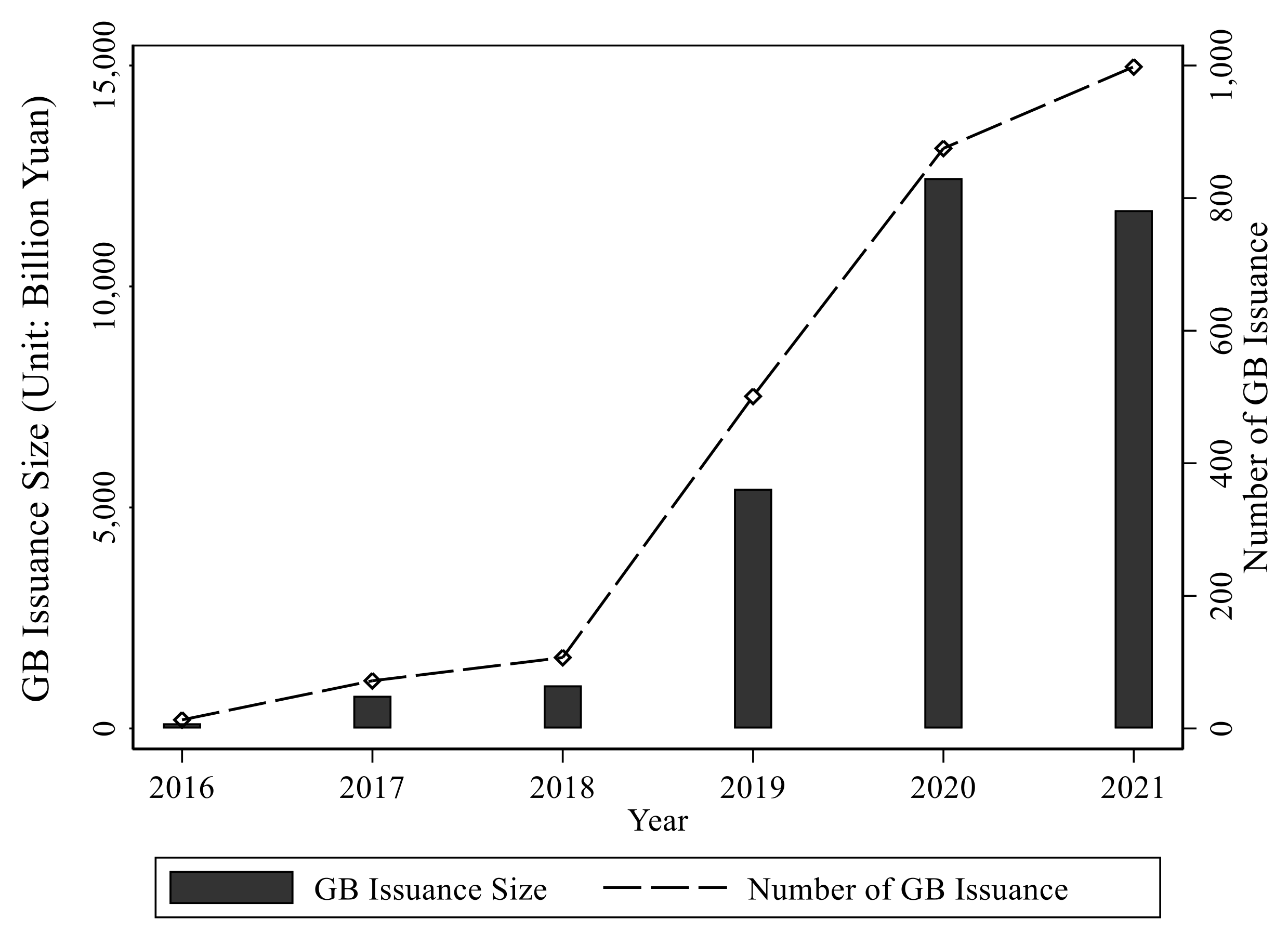

With the policy of carbon peaking and carbon neutrality, the size of China’s green bond market reached 1.24 trillion RMB in 2020 and 1.73 trillion RMB by the end of 2021. Thus, its effects on enterprises have received great academic attention [

6,

7]. Recent research on green bonds has focused on asset pricing [

8], financing costs [

9,

10,

11,

12], the interaction with the financial market [

13], and the economic effects [

10,

14,

15,

16,

17]. However, it is unknown whether the issuance of green bonds has a lasting impact on the green innovation of enterprises, which is the main driving force for attaining environmental protection and green economic growth [

18,

19]. Empirical research has shown that green finance policy may stimulate green innovation in enterprises through incentive or constraint mechanisms [

20,

21,

22], achieving a low-carbon green economy [

23]. Green bonds are an essential product of green finance, and their capacity to stimulate green innovation in enterprises is crucial, as it determines the effectiveness of green bonds in green economic growth. The factors that affect the green innovation of enterprises are focus on government environmental regulations [

21,

24], government support and subsidies [

25,

26,

27], and R&D investment [

28,

29]. Nevertheless, few studies have provided direct evidence showing that green bonds affect green innovation in micro-enterprises.

Based on this, our study empirically investigated the impact of green bonds on corporate green innovation using a multi-temporal difference-in-difference model and conducted a series of robustness tests and endogeneity tests. At the same time, we used the mediation test to explore the plausible channels through which green bonds influence corporate green innovation. Finally, the heterogeneity test of the green bonds issued by enterprises in different scales, different property rights, and different industries on green innovation empowerment effects was analyzed. After empirical tests, this paper concludes that green bonds significantly and positively impact corporate green innovation. In terms of the mechanism of action, the green bond can enhance green innovation by easing the financial constraints of enterprises. Furthermore, the enhancement in green innovation due to green bonds is found to be stronger in enterprises with a large scale, low pollution, and state ownership. Our findings provide strong evidence that the issuance of green bonds indeed has a positive impact on enterprises’ green innovation and offers more reason to encourage governments to develop the green bonds market, which assists in achieving carbon-neutral goals of slowing climate deterioration and reducing environmental pollution. In addition, our study reveals that high-pollution enterprises have weaker incentives to issue green bonds for green innovation. However, green innovation by high-pollution enterprises is the top priority for achieving green development. Therefore, green bond issuance policies should be more favorable to high-pollution enterprises.

This study contributes to the literature in the following ways. First, the literature on green bonds is mainly concerned with asset pricing [

8], the cost of capital [

9,

10], and the economic effects [

10,

14,

15,

16], leading to limited knowledge about the long-term effects of green bonds on corporate green innovation. This study fills the research gap by suggesting that green bonds can encourage corporations to engage in green innovation. Second, many studies have shown that external financing is a crucial funding source for corporations that engage in innovation [

30,

31,

32]. As a novel financing instrument, the impact of green bonds on corporate green innovation has not been examined in the literature. This paper discusses the impact of green innovation from the perspective of green bonds and enriches the literature on the relationship between external financing and corporate innovation. Third, we analyze whether the effect of green bond issuance on enterprises’ green innovation is heterogeneous. Enterprises were first categorized using measures including the nature of property rights, firm scale, and pollution level, and then were independently regressed to assess the heterogeneous impact of green bonds on their green innovation. This outcome offers new evidence to revise future green bond issuing policies.

This paper is organized as follows.

Section 2 introduces the background and literature review.

Section 3 develops our testable hypotheses.

Section 4 discusses the data sources and our regression model.

Section 5 presents the analysis of the main empirical results, including robustness tests and plausibility tests.

Section 6 examines the moderating effects in different backgrounds of the firm. Finally,

Section 7 concludes this paper and provides detailed discussions.

3. Hypotheses

In recent years, the environmental challenges associated with the deterioration of the global climate have become increasingly severe, compelling governments to focus on environmental protection issues and consistently enhance environmental management. Realizing low-carbon development in business is the key to resolving the problem of global climate deterioration [

36]. Green innovation is the main driving force in firms’ efforts to increase green productivity and can contribute to low-carbon development [

4,

37,

38]. Corporate managers deeply influence corporate innovation [

39], but corporate innovation depends on funding, and external financing is the primary funding source [

30,

31,

32]. However, the development of green finance in China is relatively slow at this stage. Some financial resources tilt toward brown enterprises, with high pollution and energy consumption, further aggravating the environmental pollution problem [

40].

It has been shown that broadening corporate financing tools and access can significantly enhance firms’ willingness to innovate [

41,

42]. However, whether issuing green bonds can encourage innovation among firms is unknown. In addition, the green bond issuance policy favors green projects such as energy saving and emission reduction technology renovation, clean energy utilization, and pollution prevention technologies. Under the guidance of the green bond issuance policy, enterprises are more likely to allocate financial resources to developing green innovation. Therefore, the issuance of green bonds can help enterprises acquire external sources of capital and promote green innovation. As such, the following hypothesis is proposed.

Hypothesis 1. Green bonds can significantly encourage companies to engage in green innovation.

The financing behavior of enterprises is crucial for technical innovation and sustainability, as they need substantial and long-term financial support [

43]. According to the Pecking Order Theory, when internal financing is restricted, corporations will choose to obtain external financing through debt financing to support technology development [

44]. Among the exogenous financing, bank credit financing has an important impact on the innovation activities of enterprises [

30,

45,

46,

47,

48]. The lack of bank credit significantly reduces firms’ investment in innovation activities [

45]. Nevertheless, easing bank lending restrictions can promote firm innovation [

48].

Bond financing provides another choice of external financing. When compared with bank credit financing, bond financing has the characteristics of longer debt maturity and a lower financing cost. Therefore, bond financing can provide long-term financial support for the technological innovation activities of enterprises. However, at present, bank credit financing in China is dominant, there is severe credit rationing, and enterprises generally face financing constraints [

49]. When compared to conventional innovation, green innovation is characterized by a high failure rate, a lengthy cycle time, and substantial investment. Therefore, green innovation projects are prone to suffer from a shortage of external financing [

50].

On the contrary, the issuance of green bonds can alleviate the financing constraints faced by enterprises and thus promote their green innovation. First, compared to bank credit and conventional bonds, green bonds have a longer debt maturity, from three to five years, which fits well with the long cycle of green innovation and the requirement for stable financial support. Secondly, unlike the indirect financing method of bank credit, bond financing is a direct financing method, and enterprises are not required to pay excessive intermediary fees. In addition, because of their green characteristics, corporations can issue green bonds at a lower cost than conventional bonds [

14] and easily acquire favorable policies such as decreased policy subsidies and tax benefits. This further improves the enterprise’s performance [

51,

52] and enhances innovation. Based on this, the following hypothesis is proposed.

Hypothesis 2. Enterprises’ issuance of green bonds eases financing constraints and thus promotes corporate green innovation.

The effect of green bonds on green innovation must account for the heterogeneous characteristics of enterprises. It may differ due to their characteristics, mainly reflected in three aspects: the nature of property rights, the scale of enterprises, and the characteristics of industries with heavy pollution.

Due to their close relationships with the government, state-owned enterprises tend to take on some social responsibilities [

53]. Unlike non-SOEs, SOEs are responsible for national strategies, and when the government proposes an initiative for energy saving and emission reduction, SOEs tend to participate actively. Therefore, SOEs are more capable than non-SOEs of performing technical innovation to benefit society. Non-SOEs have a poorer innovation base than SOEs, although they are strongly motivated to innovate [

54]. Due to their lack of innovation resources, low level of internal management, and risk aversion, non-SOEs have difficulty engaging in technological innovation, particularly green technology innovation. In addition, managers of state-owned enterprises regularly have the status of officials and have more centralized decision-making power [

55]. With concerns about their political future, managers of state-owned enterprises are more willing to meet the demands of local governments for low-carbon green development and thus actively engage in green technology innovation. Based on this, the following hypothesis is proposed.

Hypothesis 3. Compared to non-SOEs, green bonds issued by SOEs have a more significant effect on promoting green innovation.

Large-scale enterprises usually have better resource endowments. Large enterprises usually have an advantage in talent, facilities, and capital. Due to their privileged position and scale effect, large enterprises have closer commercial relationships with financial institutions and are more likely to secure the necessary funds for technological innovation. In addition, according to the Bearbitt Hypothesis, there is a positive relationship between firm size and innovation, i.e., the larger the firm, the more innovative it is. Larger enterprises are more likely to be observed and monitored by the government, the media, and the public [

21]. As a result, larger enterprises will respond more actively to the government’s call for green innovation and thus achieve low-carbon development. Based on this, the following hypothesis is proposed.

Hypothesis 4. Green bonds issued by large enterprises significantly impact green innovation more than those issued by small enterprises.

Green innovation in high-pollution enterprises is often characterized by long R&D cycles, substantial investment amounts, and high uncertainty, causing it to rely on long-term debt support greatly. However, the green finance policy will restrict the allocation of financial resources for high-pollution enterprises [

22] because they are major restriction targets of green finance. Thus, this exacerbates high-pollution industries’ financing difficulties and makes them frequently face external financing constraints. Therefore, low-pollution enterprises are more likely to gain support from green financing than high-pollution businesses.

Hypothesis 5. Green bonds issued by low-pollution enterprises significantly impact green innovation more than those issued by high-pollution enterprises.

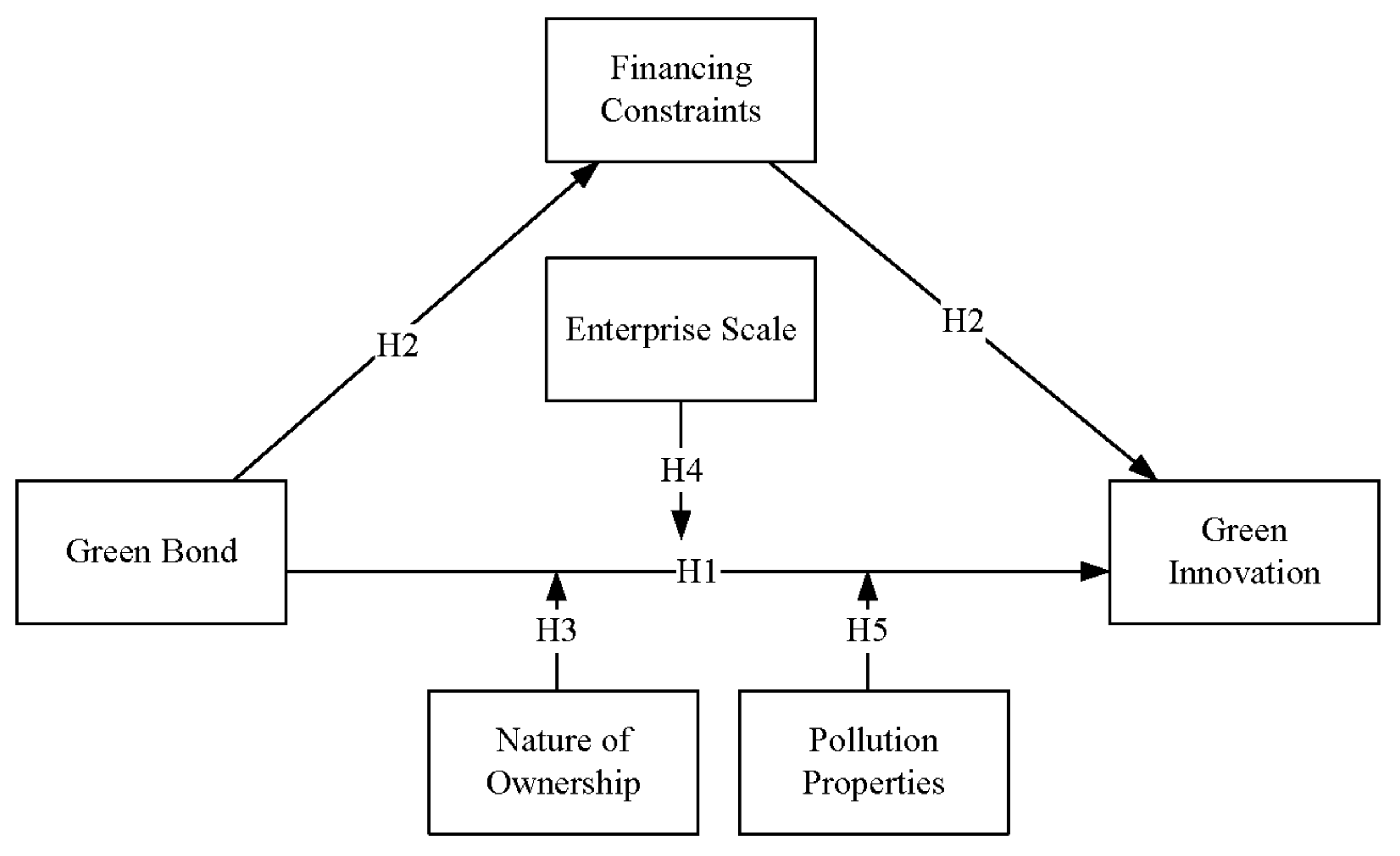

Based on the above theoretical analysis and research hypothesis, we determined the theoretical framework diagram shown in

Figure 2.

7. Conclusions

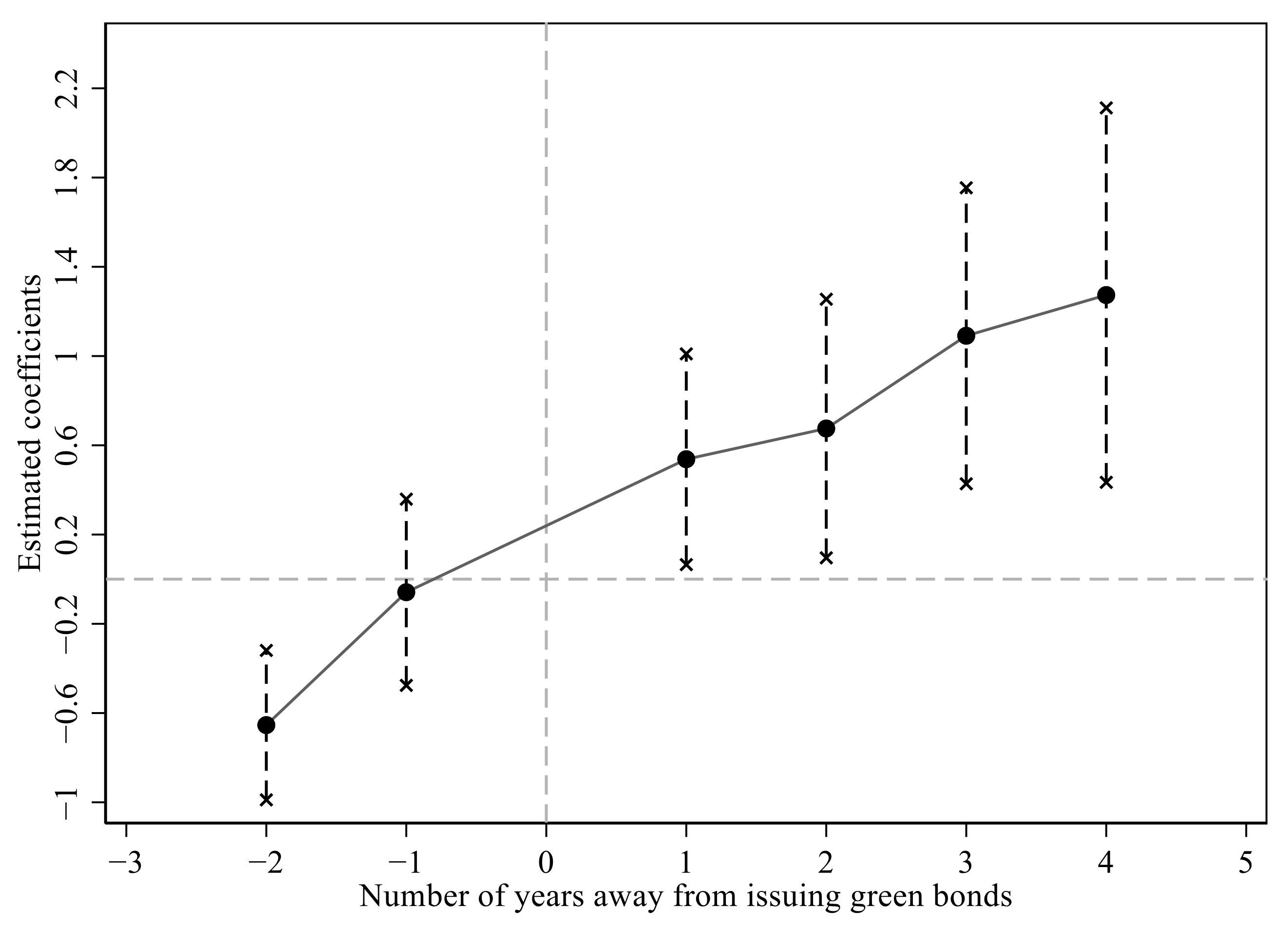

This paper investigated the impact of green bonds on corporate green innovation and the mechanism of its effect, using a sample of Chinese listed companies and taking 2017 to 2019 as the observation period, and yields various exciting findings. First and foremost, a significant positive relationship exists between issuing green bonds and corporate green innovation, indicating that green bonds can promote corporate green innovation. This result considers the endogeneity issue and passes a series of robustness tests. Second, the mechanism test demonstrates that enterprises alleviate financing constraints by issuing green bonds, which stimulates green innovation. Thus, we can conclude that alleviating financing constraints is a mediating path for green bonds to promote green innovation. Third, we group firms according to the nature of property rights, firm size, and industrial pollution attributes and then regress each group of samples. The results show that the issuance of green bonds by state-owned enterprises, large enterprises, and low-pollution enterprises has a more significant effect on green innovation than non-state-owned enterprises, small enterprises, and high-pollution enterprises.

This paper provides strong evidence that green bonds positively impact corporate green innovation and provide more confidence and reason to encourage governments to develop the green bonds market. Our study also reveals that high-pollution enterprises have weaker incentives to issue green bonds for green innovation. However, green innovation by high-pollution enterprises is the top priority for achieving green development. Therefore, green bond issuance policies should be more favorable to high-pollution enterprises. According to our results, the government needs to improve the green bond issuance policy further to enhance the allocation efficiency of financial resources and provide timely funding for corporate green innovation.