Yield Management—A Sustainable Tool for Airline E-Commerce: Dynamic Comparative Analysis of E-Ticket Prices for Romanian Full-Service Airline vs. Low-Cost Carriers

Abstract

1. Introduction

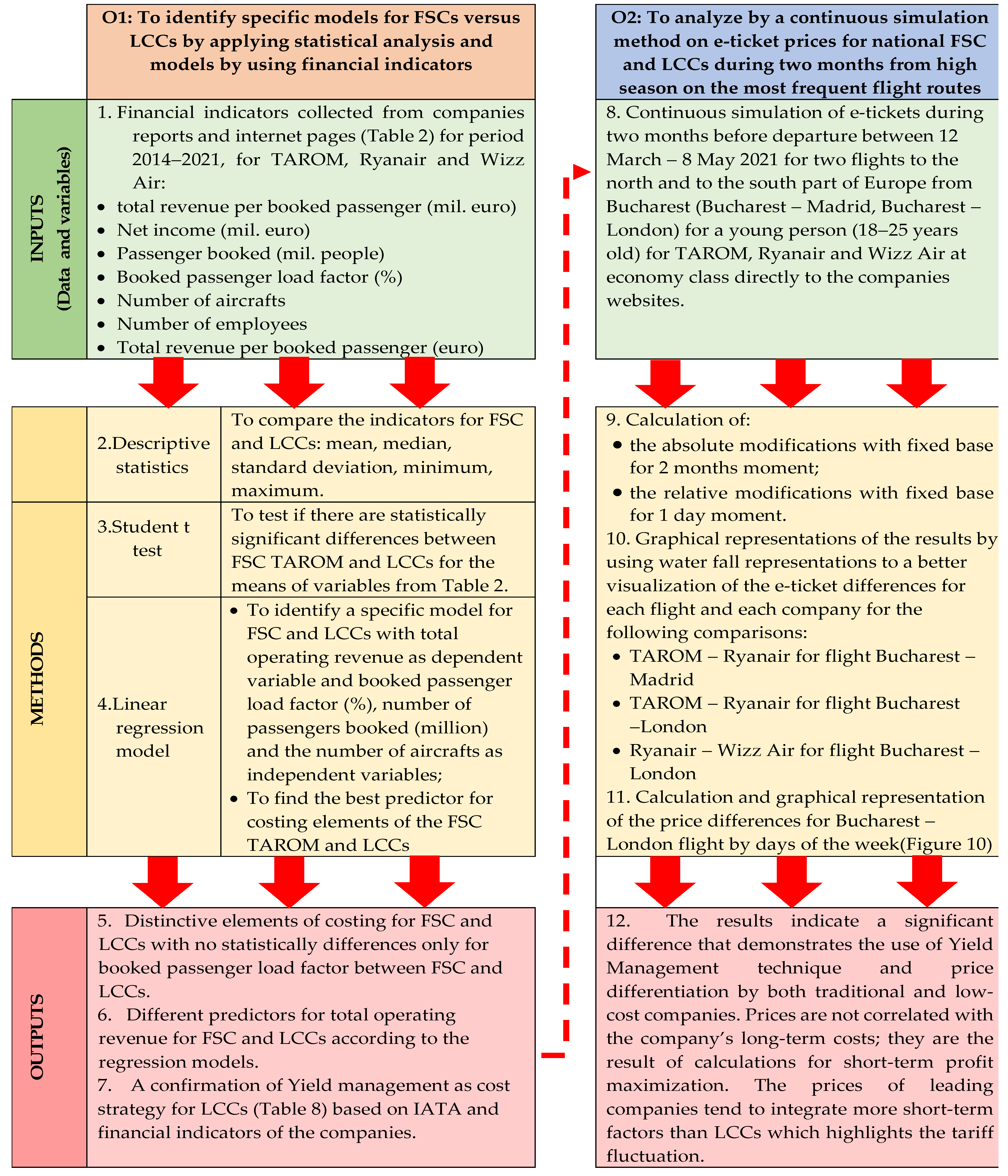

- to identify specific models for FSCs versus low-cost airlines by applying statistical analysis and models by using financial indicators;

- to analyze by a continuous simulation method e-ticket prices for national FSC (TAROM) and LCCs (Ryanair and Wizz air) during two months in high season on the most frequent flight routes.

2. Literature Review

3. Short Presentation of the Investigated Companies—TAROM and Low-Cost Companies

4. Materials and Methods

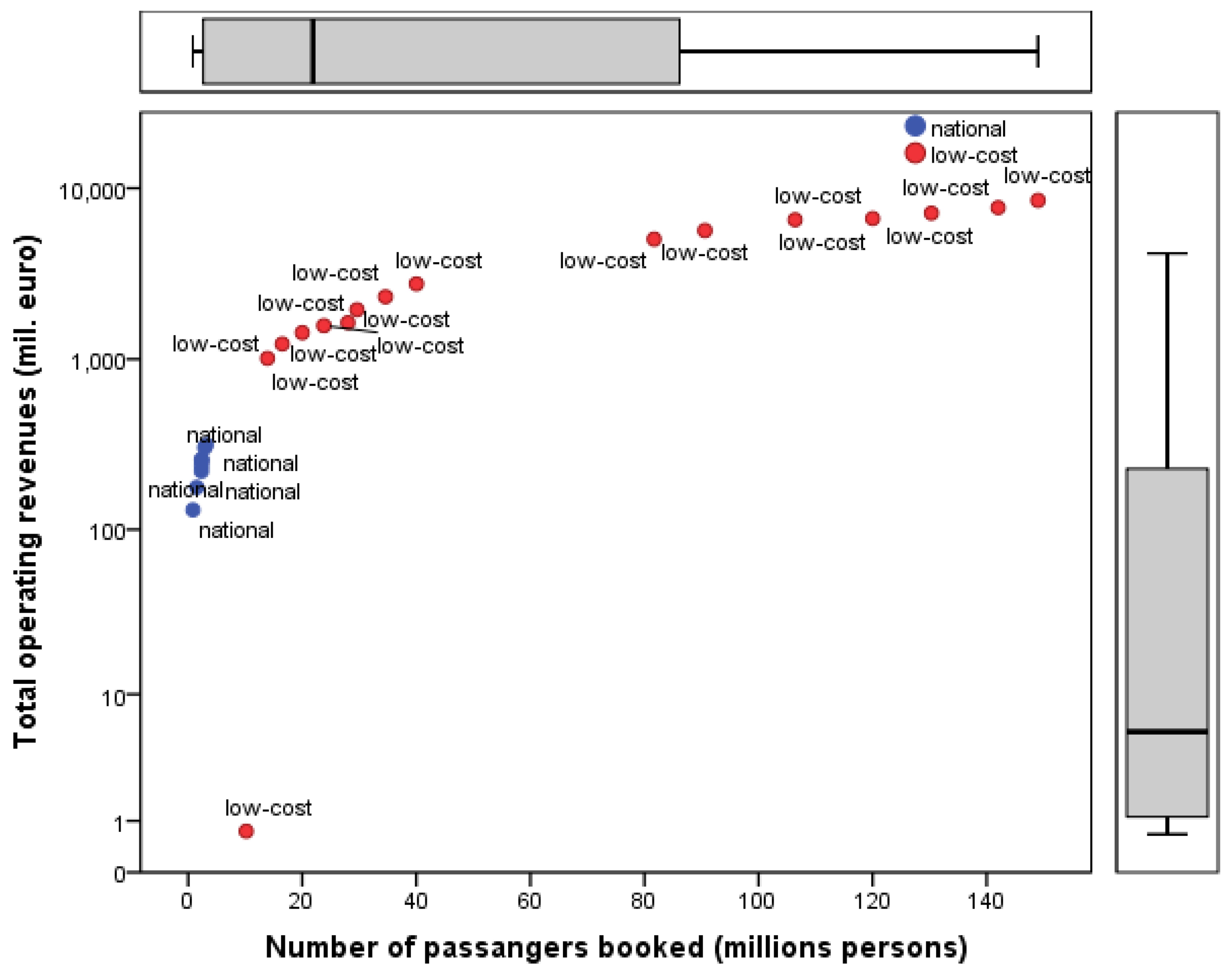

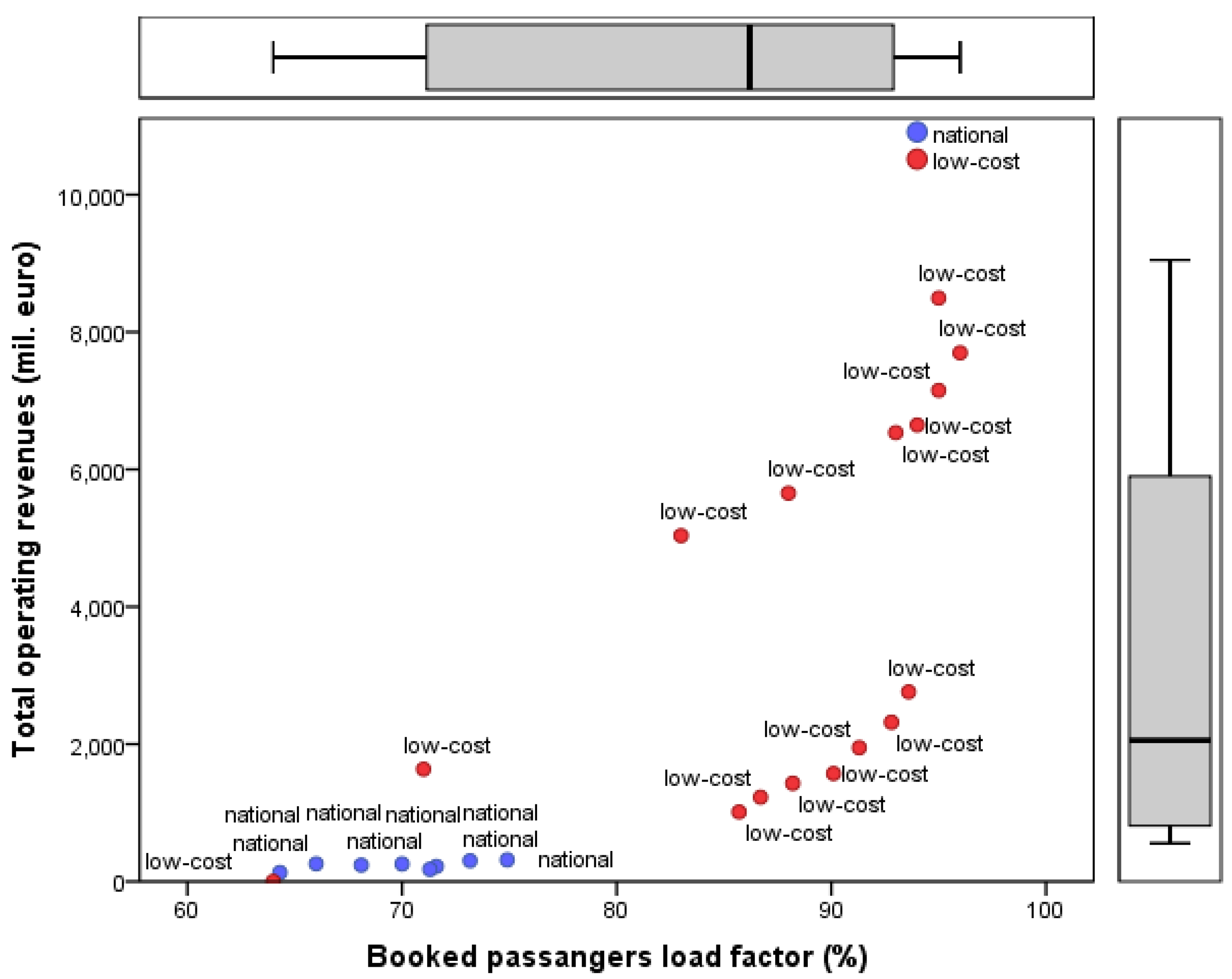

- Comparative analysis of the investigated companies air transport models for two important elements, network used and costing, and linked to the costs, the pricing policies [29]. These results are presented in Section 5.1. Conventionally, comparative analysis based on the statistical methods are used for the explanation of statistically significant differences and/or the explanation of similarities. The Student t test was applied to test if there are statistically significant differences between means of variables from Table 2 for FSC TAROM and LCCs. The linear regressions with Enter method was used to identified specific models for FSC TAROM and LCCs. For the regression models, the total operating revenue was established as dependent variable. The independent variables for models were booked passenger load factor (%), number of passengers booked (million), and the number of aircrafts. Comparative analysis is conducted mainly to explain and gain a better understanding of the causal processes involved in the creation of an event, feature, or relationship usually by bringing together variations in the explanatory variable or variables [61]. The results are presented in Section 5.1.

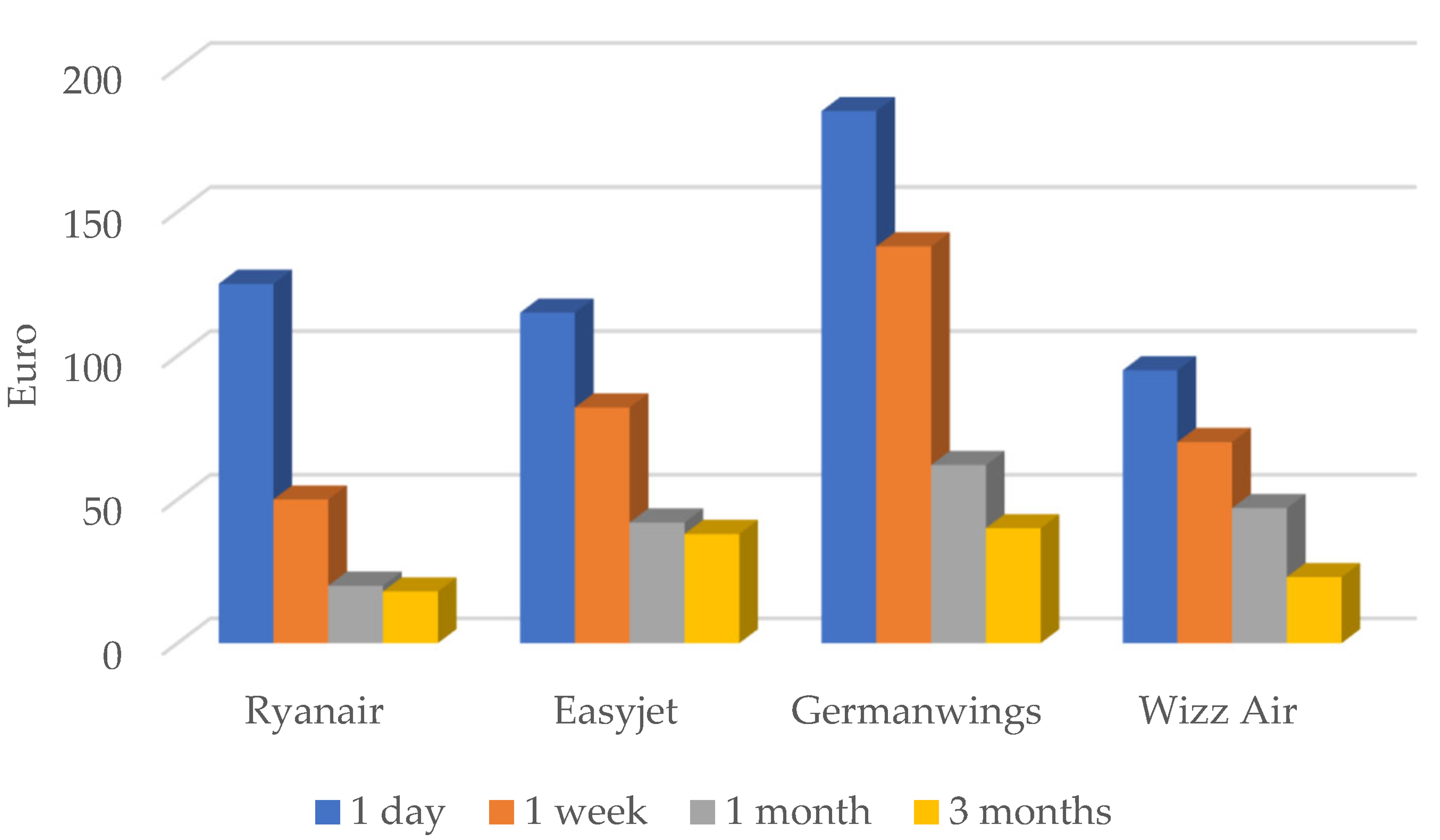

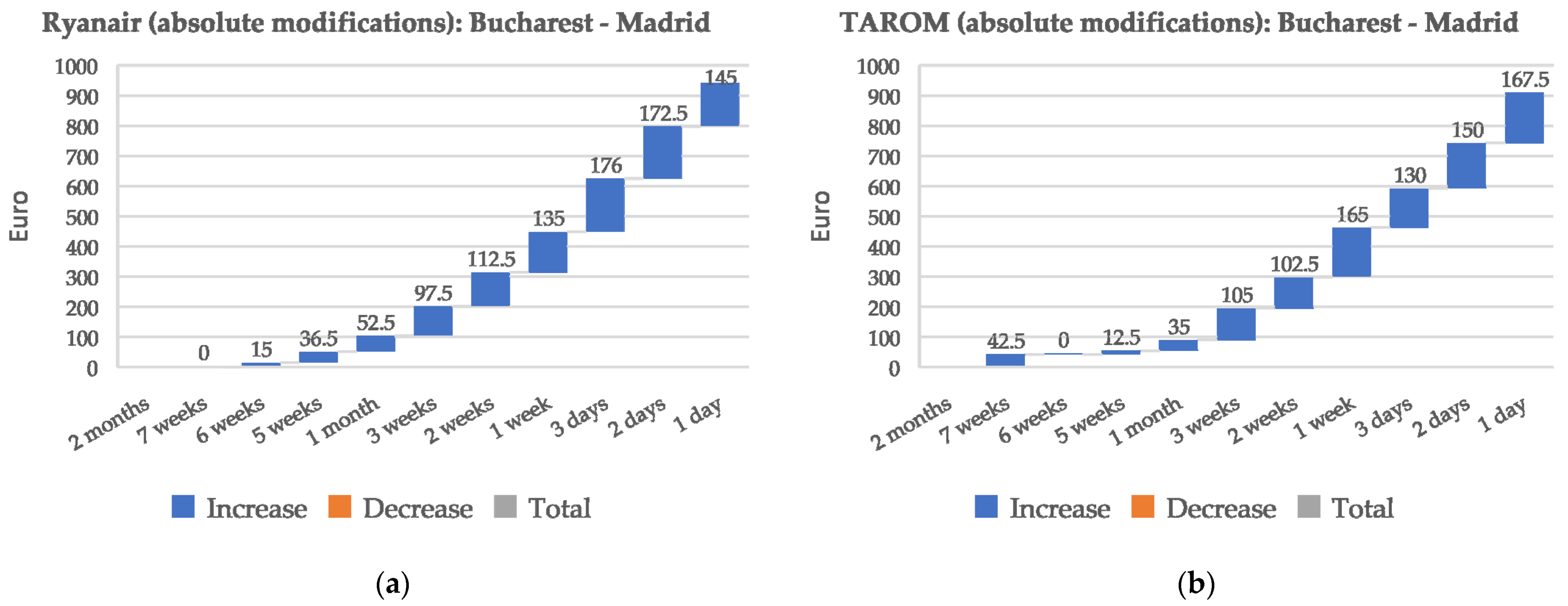

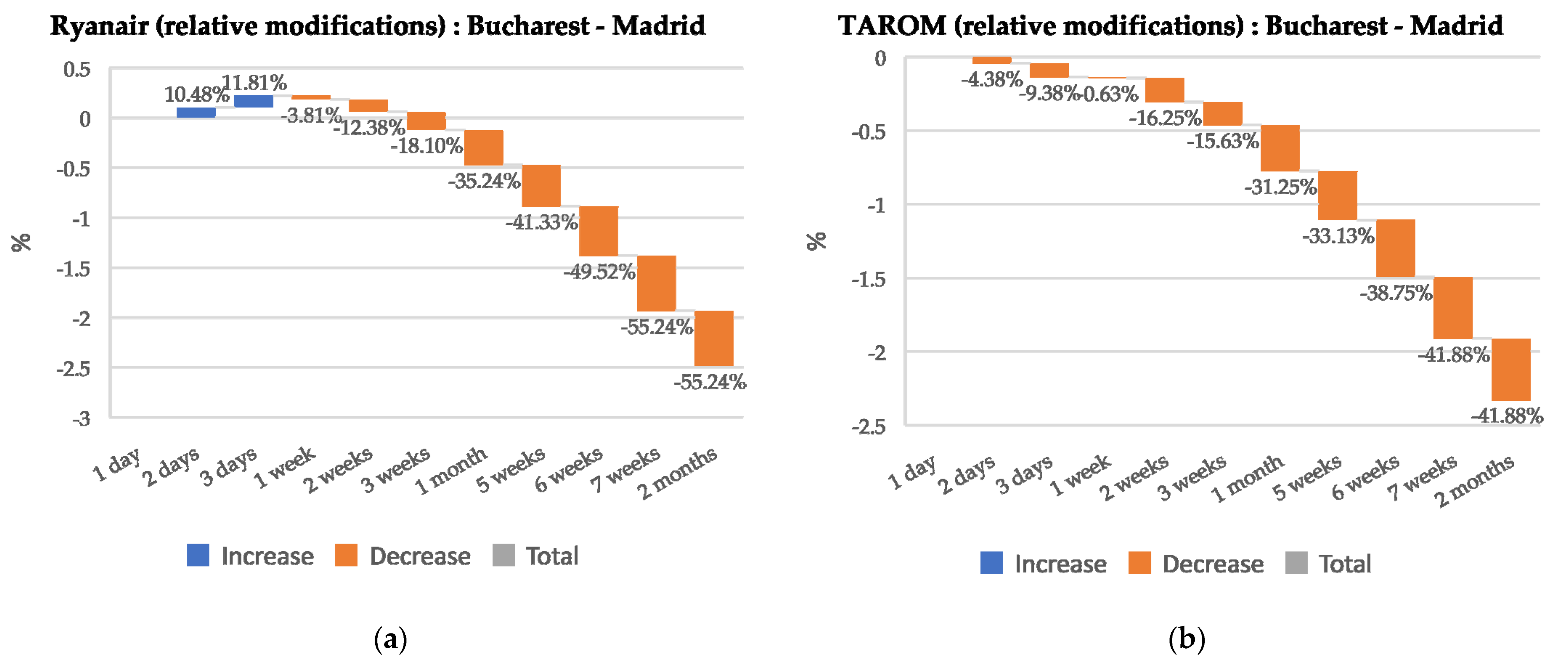

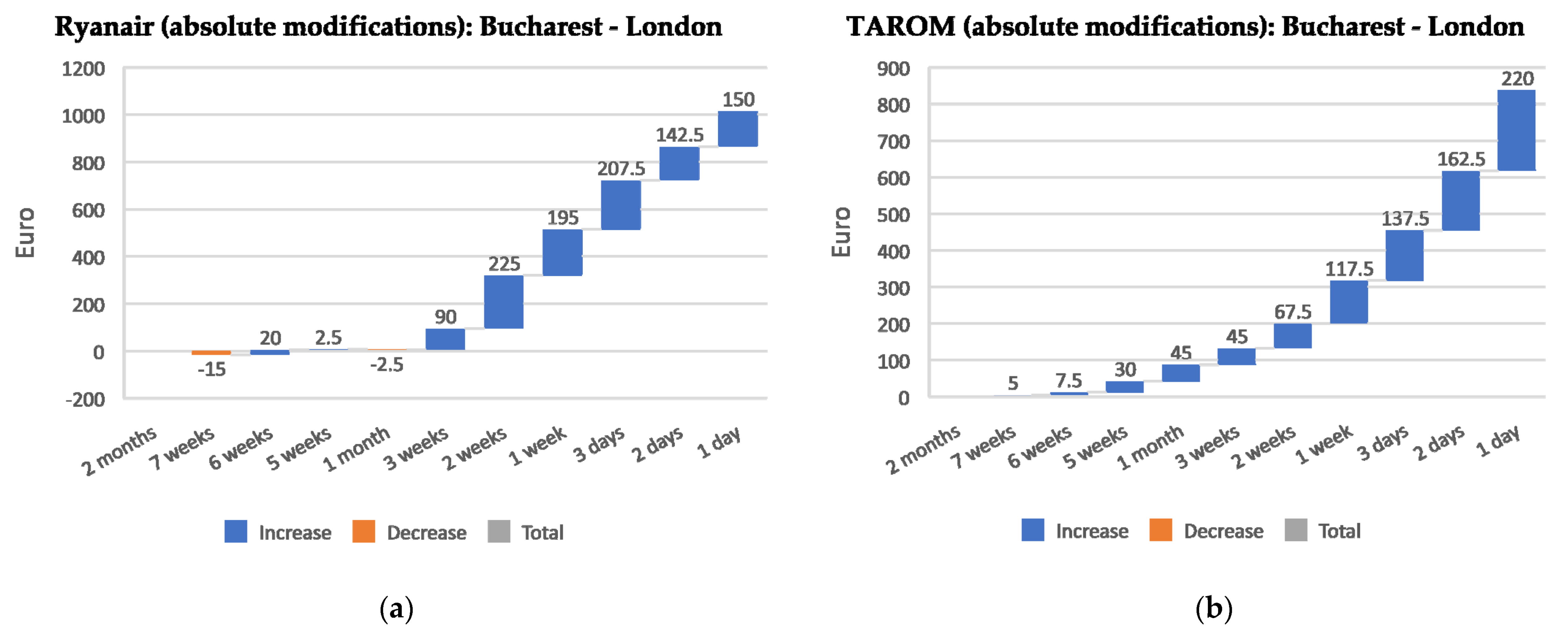

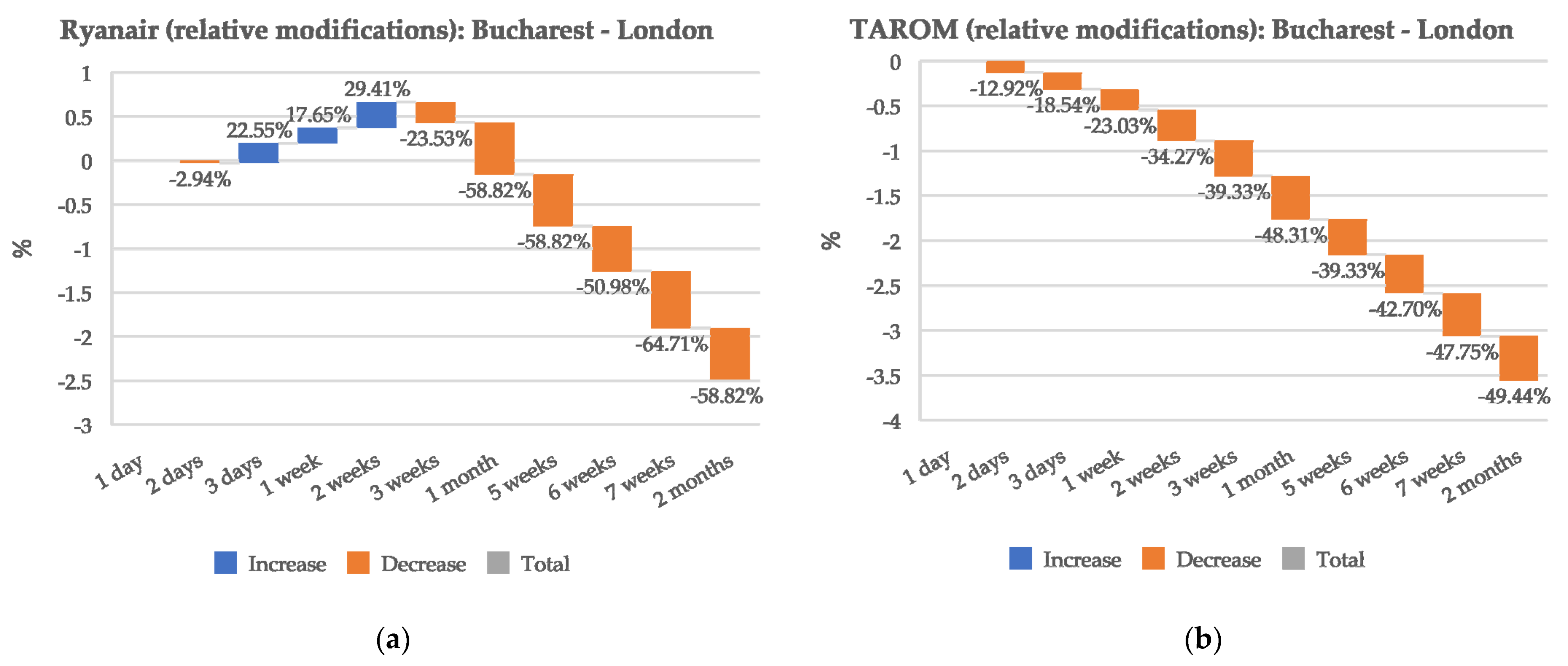

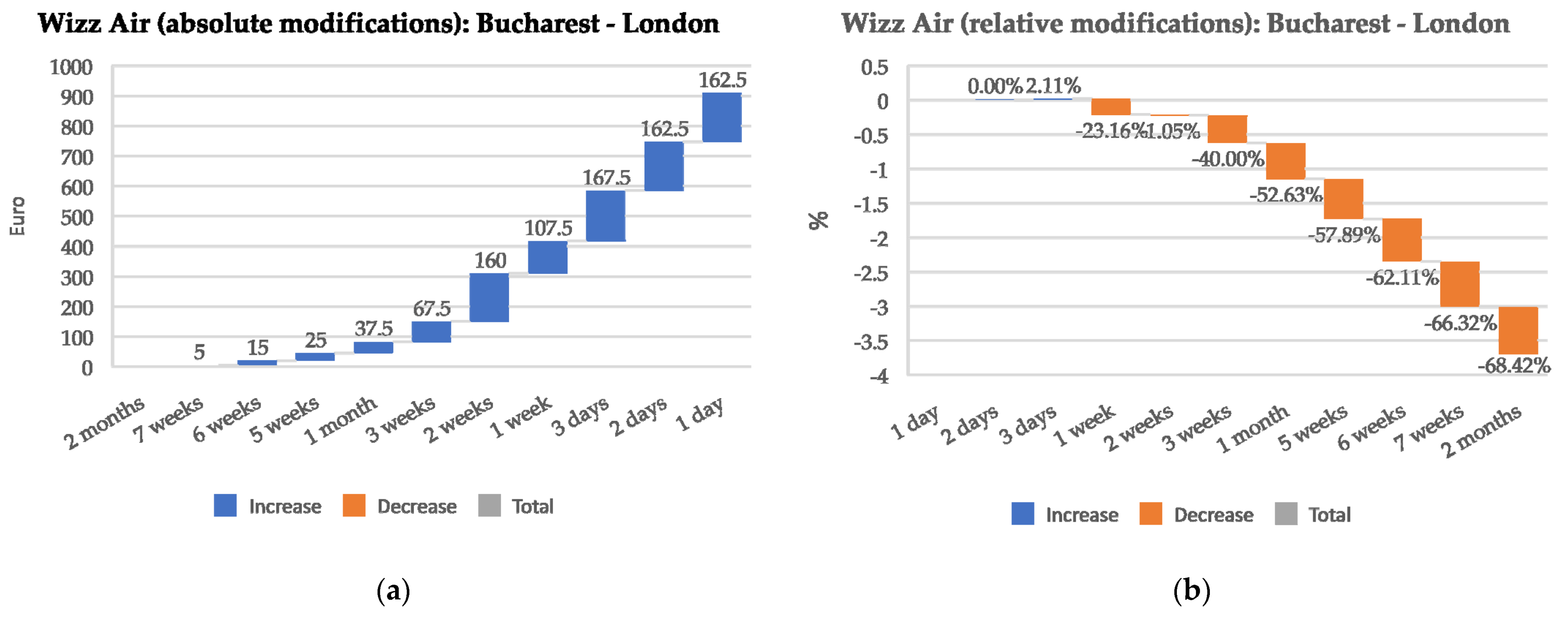

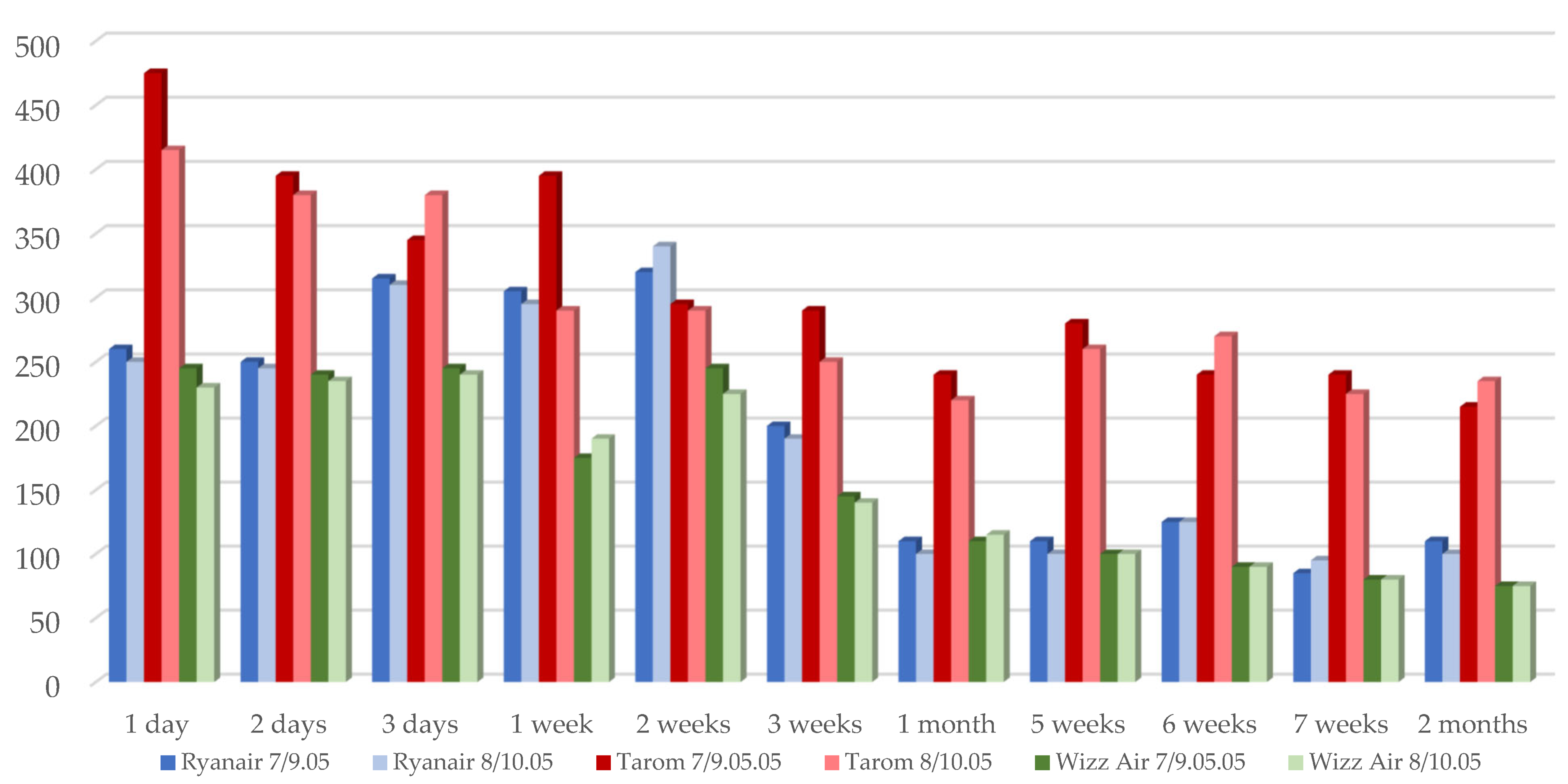

- Dynamic pricing analysis [45,60] for the two types of the investigated airline companies, taking into consideration an important factor of the pricing strategies for airlines—the reservation moment [2,7]—because the reservation moment or the time of purchase substantially influences the prices for the same flight [33,62]. Dynamic pricing uses data to understand and act upon any number of changing market conditions, maximizing the opportunity for revenue management and implicitly for yield management strategy. To emphasize the differences between e-tickets prices during the two months, for graphical representations, the water fall graphics was chosen. The results are presented in Section 5.2.

5. Results

5.1. Comparative Analysis of Air Transport Models: FSCs versus LCCs

5.2. Dynamic Pricing Analysis of FSC TAROM versus LCCs

- the absolute modifications with fixed base for 2 months moment;

- the relative modifications with fixed base for 1 day moment.

6. Discussion and Conclusions

- offering only direct point-to-point flights without the possibility of correspondence, still having major airports, for example Dublin for Ryanair;

- implantation on secondary airports, often regional airports, not frequented by FSCs, away from large urban centers; a traveler who wants to cross from point A to C is obliged to buy two independent tickets).

- a discrepancy between the multiple prices for the same fare category and the same traveled distance;

- a continuous decrease of the average income per passenger compared to the regular fare, due to the multiplication of reduced fares determined by competition, the desire to maintain a competitive advantage by costs, and the use of promotional fares to attract new categories of passengers.

- the use of yield management techniques and price differentiation by airlines; its main instruments: ticket class, service restriction, and reservation moment—allowing airlines to divide consumers into groups according to their elasticity [7].

- the fare offer is the result of competition, the tendency to cover costs and maximize profit, considering the filling quota of the aircraft and the total generated revenue.

- the existence of a multitude of tariffs on different days of the week for the same flight, even for the same services, within the same company; thus, our research results confirm the results of Mantin and Koo [72] regarding the strong weekend effects for airfare dispersion, but not for price level.

- low prices of LCCs are not always as low as they claim, and the last-minute price of the LCCs is at least equal to the price of the traditional company bought in advance;

- low-cost companies tend to charge on long-term and expect a lower variation of the approached tariffs, respectively the reverse in the case of FSCs;

- companies carry out promotional campaigns on similar or complementary routes, where tariffs for the central segments are adapted to regulate traffic for the entire network.

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Conflicts of Interest

References

- Szopinski, T.S.; Nowacki, R. The Influence of Purchase Date and Flight Duration over the Dispersion of Airline Ticket Prices. Contemp. Econ. 2015, 9, 353–366. [Google Scholar] [CrossRef][Green Version]

- Lohmeier, V.; Hess, S. Airline Pricing Strategies. 2009. Available online: https://www.diva-portal.org/smash/get/diva2:158427/FULLTEXT01.pdf (accessed on 5 May 2020).

- Wehner, C.; Lopez- Bonilla, J.M.; Santos, J.A. State of the art of pricing policy in air transport &network carries vs. Low-cost airlines. Tour. Manag. Stud. 2018, 14, 32–40. [Google Scholar]

- Forsyth, P. The gains from the liberalisation of air transport—A review of reform. J. Transp. Econ. Policy 1998, 32, 73–92. [Google Scholar]

- IATA. Economic Performance of the Airline Industry—2019 End-Year Report. 2019. Available online: www.iata.org/economics (accessed on 5 May 2020).

- Goeldner, C.R.; Ritchie, J.R.B. Tourism, Principles, Practices, Philosophies, 11th ed.; John Wiley & Sons Inc.: Hoboken, NJ, USA, 2009. [Google Scholar]

- Belova, A. Price Strategy of the International Airline Market. Working Paper. 2015. Available online: http://paneldataconference2015.ceu.hu/Program/Alexandra-Belova.pdf (accessed on 5 May 2020).

- Kraemer, A.; Friesen, M.; Shelton, T. Are airline passengers ready for personalized dynamic pricing? A study of German consumers. J. Rev. Pricing Manag. 2018, 17, 115–120. [Google Scholar] [CrossRef]

- Sonnenschein, J.; Smedby, N. Designing air ticket taxes for climate change mitigation: Insights from a Swedish valuation study. Clim. Policy 2019, 19, 651–663. [Google Scholar] [CrossRef]

- Gheorghilaș, A. Geografia Turismului. Metode de Analiză în Turism (Tourism Geography. Analisys Methods for Tourism), 3rd ed.; Editura Universitară: Bucharest, Romania, 2014; p. 188. [Google Scholar]

- Snak, O.; Baron, P.; Neacșu, N. Economia Turismului (Tourism Economy); Editura Expert: Bucharest, Romania, 2003; p. 309. [Google Scholar]

- Gheorghe, C. Transporturi Turistice Aeriene și Ticketing (Air Transport and Ticheting); Editura Pro Universitară: Bucharest, Romania, 2012; p. 12. [Google Scholar]

- UNWTO. Tourism Highlights. 2018. Available online: https://www.slovenia.info/uploads/dokumenti/unwto_tourism_highlights_2018.pdf (accessed on 5 May 2020).

- IATA. Available online: https://t2t.ro/statistici-iata-2017-record-de-peste-4-1-miliarde-de-pasageri-pe-zboruri/ (accessed on 14 May 2019).

- Marcus, B.; Anderson, C.K. Revenue management for low-cost providers. Eur. J. Oper. Res. 2008, 188, 258–272. [Google Scholar] [CrossRef]

- Button, K. Wings across Europe. In Towards an Efficient European Air Transport System; Routledge: Hampshire, UK, 2017. [Google Scholar]

- Fu, X.; Oum, T.H.; Zhang, A. Air Transport Liberalization and Its Impacts on Airline Competition and Air Passenger Traffic. Transp. J. 2010, 49, 24–41. [Google Scholar] [CrossRef]

- Malighetti, P.; Paleari, S.; Redondi, R. Pricing strategies of low-cost airlines: The Ryanair case study. J. Air Transp. Manag. 2009, 15, 195–203. [Google Scholar] [CrossRef]

- Ageron, P.; Zembri, P. Le Transport Aérien:Une Mondialisation Réussie; La Documentation Française: Paris, France, 2016. [Google Scholar]

- Tinard, Y. Le Tourisme, Economie et Management; Ediscience International: Paris, France, 1994. [Google Scholar]

- Fedorco, L.; Hospodka, J. Airline Pricing Strategies in European Airline Market. 2013. Available online: http://pernerscontacts.upce.cz/30_2013/FeMArco.pdf (accessed on 5 May 2020).

- Liao, C.-N.; Chen, Y.-J. Role of exchangeable tickets in the optimal menu design for airline tickets. OMEGA Int. J. Manag. Sci. 2019, 89, 151–163. [Google Scholar] [CrossRef]

- Kontsas, S.; Mylonakis, J. Pricing competition policy in the European airlines industry: A firm behavior model proposal. Innov. Mark. 2008, 4, 23–27. [Google Scholar]

- RYANAIR. Available online: https://investor.ryanair.com/wp-content/uploads/2018/07/Ryanair-FY-2018-20F.pdf (accessed on 10 April 2019).

- Smyth, M.; Pearce, B. Airline Cost Performance. An Analysis of the Cost Base of Leading Network Airlines Versus No-Frills, Low-Cost Airlines (LCCs); IATA Economics Briefing; IATA: Montreal, QC, Canada, 2018. [Google Scholar]

- Vasigh, B.; Fleming, K.; Tacker, T. Introduction to Air Transport Economics: From Theory to Applications, 2nd ed.; Ashgate Publishing Limited: Hampshire, UK, 2008. [Google Scholar]

- Law, C.C.H. The Impact of Long Haul, Low Cost Flights: Linking Thailand to Japan And South Korea. Tour Hosp. Manag. Croat. 2022, 28, 211–231. [Google Scholar] [CrossRef]

- Gallego, G.; Lee, H. Callable products with dependent demand. Nav. Res. Logist. 2020, 67, 185–200. [Google Scholar] [CrossRef]

- Schlumberger, C.E.; Weisskopf, N. Ready for Takeoff? The Potential for Low-Cost Carriers in Developing Countries; The World Bank: Washington, DC, USA, 2014. [Google Scholar]

- Kelemen, M.; Pilát, M.; Makó, S.; Rozenberg, R.; Tobisová, A. Pricing policy aspects in competitive fight between low-cost airlines on Kosice airport. J. KONBiN 2019, 49, 331–341. [Google Scholar] [CrossRef]

- Fageda, X.; Luis Jimenez, J.; Perdiguero, J. Price rivalry in airline markets: A study of a successful strategy of a network carrier against a low-cost carrier. J. Transp. Geogr. 2011, 19, 658–669. [Google Scholar] [CrossRef]

- Georgescu, B.; Nistoreanu, P.; Anghel, L.D.; Negoi, R.; Moise, D. Identifying the optimum price—strategy of airlines companies for customers attraction and loyalty. In Proceedings of the 7th International Conference on Management of Technological Changes, Alexandroupoli, Greece, 1–3 September 2011; Book 1. pp. 141–144. [Google Scholar]

- Escobari, D.; Rupp, N.G.; Meskey, J. An analysis of dynamic price discrimination in airlines. South. Econ. J. 2019, 85, 639–662. [Google Scholar] [CrossRef]

- Otero, D.F.; Escallon, M.; Lopez, C.; Akhavan-Tabatabaei, R. Optimal timing of airline promotions under dilution. Eur. J. Oper. Res. 2019, 277, 981–995. [Google Scholar] [CrossRef]

- Maung, Y.S.Y.; Douglas, I.; Tan, D. Identifying the drivers of profitable airline growth. Transp. Policy 2022, 115, 275–285. [Google Scholar] [CrossRef]

- Avogadro, N.; Malighetti, P.; Redondi, R.; Salanti, A. A tale of airline competition: When full-service carriers undercut low-cost carriers fares. J. Air Transp. Manag. 2021, 92, 102027. [Google Scholar] [CrossRef]

- Available online: https://www.dlr.de/dlr/desktopdefault.aspx/tabid-10002/ (accessed on 12 June 2019).

- Zhu, C.; Hu, J.Q. Revenue management games with government mandate. OMEGA Int. J. Manag. Sci. 2020, 93, 102103. [Google Scholar] [CrossRef]

- Merkert, R.; Webber, T. How to manage seasonality in service industries—The case of price and seat factor management in airlines. J. Air Transp. Manag. 2018, 72, 39–46. [Google Scholar] [CrossRef]

- Lardeux, B.; Sabatier, G.; Delahaye, T.; Boudia, M.; Tonnet, O.; Mathieu, P. Yield optimizations for airlines from ticket resell. J. Rev. Pricing Manag. 2019, 18, 213–227. [Google Scholar] [CrossRef]

- McAfee, R.P.; Te Velde, V. Dynamic pricing in the airline industry forthcoming. In Handbook on Economics and Information Systems; Hendershott, T.J., Ed.; Elsevier: Amsterdam, The Netherlands, 2006. [Google Scholar]

- Gaggero, A.A.; Piga, C.A. Airline market power and intertemporal price dispersion. J. Ind. Econ. 2011, 59, 552–577. [Google Scholar] [CrossRef]

- Vinod, B. The Evolution of Yield Management in the Airline Industry; Springer International Publishing: Berlin/Heidelberg, Germany, 2021. [Google Scholar] [CrossRef]

- Williams, K. The welfare effects of dynamic pricing: Evidence from airline markets. Econometrica 2022, 90, 831–858. [Google Scholar] [CrossRef]

- Narangajavana, Y.; Garrigos-Simon, F.J.; García, J.S.; Forgas-Coll, S. Prices, prices and prices: A study in the airline sector. Tour. Manag. 2014, 41, 28–42. [Google Scholar] [CrossRef]

- Wang, Y. Dynamic pricing considering strategic customers. In Proceedings of the 2016 International Conference on Logistics, Kraków, Poland, 1–3 June 2016; Informatics and Service Sciences (LISS): Sydney, NSW, Australia, 2016; pp. 1–5. [Google Scholar]

- Abdella, J.A.; Zaki, N.M.; Shuaib, K.; Khan, F. Airline ticket price and demand prediction: A survey. J. King Saud. Univ. Comput. Inf. Sci. 2021, 33, 375–391. [Google Scholar] [CrossRef]

- Schubert, D.; Sys, C.; Macario, R. Customized airline offer management: A conceptual architecture. J. Revenue Pricing Manag. 2022, 21, 553–563. [Google Scholar] [CrossRef]

- TAROM. Available online: https://www.tarom.ro/sites/default/files/sf_31.12.2017.pdf (accessed on 8 April 2019).

- TAROM. Available online: https://www.tarom.ro/&files/situatiile-financiare-tarom-2015_1.pdf (accessed on 8 April 2019).

- RYANAIR. Available online: https://corporate.ryanair.com/about-us/history-of-ryanair/ (accessed on 8 April 2019).

- RYANAIR. Available online: https://www.ryanair.com/ro (accessed on 10 April 2019).

- RYANAIR. Available online: https://investor.ryanair.com/wp-content/uploads/2022/07/Ryanair-2022-Annual-Report.pdf (accessed on 20 August 2022).

- WIZZ AIR. Available online: https://corporate.WizzAir.com/en-GB/investor_relations/governance (accessed on 8 April 2019).

- WIZZ AIR. Available online: https://WizzAir.com/ro-ro/informatii-si-servicii/despre-noi/noutati/#/ (accessed on 8 April 2019).

- WIZZ AIR. Available online: Wizz_Air_Holdings_Plc_Annual_report_and_accounts_2018.pdf (accessed on 8 April 2019).

- Deschinkel, K.; Farges, J.L.; Delahaye, D. Optimizing and assigning price levels for air traffic management. Transp. Res. Part E-Logist. Transp. Rev. 2002, 38, 221–237. [Google Scholar] [CrossRef]

- Pels, E.; Njegovan, N.; Behrens, C. Low-cost airlines and airport competition. Transp Res. Part E-Logist. Transp. Rev. 2009, 45, 335–344. [Google Scholar] [CrossRef]

- Koenigsberg, O.; Muller, E.; Vilcassim, N.J. EasyJet (R) pricing strategy: Should low-fare airlines offer last-minute deals? QME Quant. Mark. Econ. 2008, 6, 279–297. [Google Scholar] [CrossRef]

- Skare, V.; Gospic, D. Dynamic pricing and customers’ perceptions of price fairness in the airline industry. Tourism 2015, 63, 515–528. [Google Scholar]

- Pickvance, C. The four varieties of comparative analysis: The case of environmental regulation. J. Ho. Built. Envirn. 2005, 16, 7–28. [Google Scholar] [CrossRef]

- Groves, W.; Gini, M. On Optimizing Airline Ticket Purchase Timing. ACM Transac. Intell. Sys. Tech. 2015, 7, 1–28. [Google Scholar] [CrossRef]

- Bilotkach, V.; Gorodnichenko, Y.; Talavera, O.; Zubenko, I. Are airlines’ price-strategies different? J. Air Transp. Manag. 2006, 16, 1–6. [Google Scholar] [CrossRef]

- Chiu, C.C.; Tsao, C. The optimal airline overbooking strategy under uncertainties. In Lecture Notes in Computer Science; Springer: Berlin/Heidelberg, Germany, 2004; pp. 937–945. [Google Scholar]

- Straka, M.; Hurna, S.; Bozogan, M.; Spirkova, D. Using continuous simulation for identifying bottlenecks in specific operation. Int. J. Sim. Model. 2019, 18, 408–419. [Google Scholar] [CrossRef]

- Kunnumkal, S.; Topalogu, H. Simulation-based methods for booking control in network revenue management. In Proceedings of the 2010 Winter Simulation Conference, Baltimore, MD, USA, 5–8 December 2010; pp. 1890–1897. [Google Scholar]

- Decker, M. Structures et stratégies des compagnies aériennes à bas coùts. In Le Tourbulences du « Low-Cost » dans le Ciel Européen; Chaos International: Strasbourg, France, 2009. [Google Scholar]

- Available online: http://www.senat.fr/rap/r15-180/r15-180_mono.html (accessed on 13 April 2019).

- Gőnenç, R.; Nicoletti, G. Le transport aérien de passagers: Réglementation, structure du marché et performance. Rev. Économique De L’ocde 2001, 32, 203–254. [Google Scholar] [CrossRef]

- Gayle, P.G. Does Price Matter? Price and Non-Price Competition in the Airline Industry. 2004. Available online: http://fmwww.bc.edu/repec/esNASM04/up.6683.1074879536.pdf (accessed on 28 April 2019).

- Mumbower, S.; Garrow, L.A. Using Online Data to Explore Competitive Airline Pricing Policies Case Study Approach. Transp. Res. Rec. 2010, 2184, 1–12. [Google Scholar] [CrossRef]

- Mantin, B.; Koo, B. Weekend effect in airfare pricing. J. Air Transp. Manag. 2010, 16, 48–50. [Google Scholar] [CrossRef]

- Available online: https://centreforaviation.com/analysis/reports/european-aviation-wizz-air—Ryanair-exceed-pre-crisis-fleets-593558 (accessed on 10 September 2022).

| FSCs | LCCs | |

|---|---|---|

| Generic strategy | differentiation | cost leadership |

| Flight plan | many connecting flights | only direct flights |

| Collaboration | yes | no |

| Airports served | big hubs, medium-sized | primarily small |

| Geographical coverage | worldwide | continental |

| Fleet | heterogeneous | homogeneous |

| Indicator | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 |

|---|---|---|---|---|---|---|---|---|

| TAROM | ||||||||

| Total revenue per booked passenger (mil. euro) | 258 | 256 | 239 | 221 | 303 | 315 | 130.5 | 177.3 |

| Net income (mil. euro) | −26 | −6.3 | −10.5 | −37.7 | −34.2 | −33.9 | −87.9 | −65.5 |

| Passenger booked (mil. people) | 2.33 | 2.39 | 2.33 | 2.34 | 2.88 | 3.16 | 0.84 | 1.5 |

| Booked passenger load factor (%) | 66.0 | 70.0 | 68.1 | 71.6 | 73.17 | 74.90 | 64.31 | 71.30 |

| Number of aircrafts | 23 | 23 | 21 | 23 | 25 | 25 | 29 | 29 |

| Number of employees | 1969 | 1880 | 1841 | 1776 | 1794 | 1790 | 1532 | 1305 |

| Total revenue per booked passenger (euro) | 110.7 | 107.1 | 102.6 | 94.1 | 105.21 | 99.68 | 155.35 | 118.20 |

| Ryanair | ||||||||

| Total revenue per booked passenger (mil. euro) | 5036 | 5654 | 6535 | 6647 | 7151 | 7697 | 8494 | 1635.8 |

| Net income (mil. euro) | 522 | 866 | 1559 | 1315 | 1450 | 885 | 648.7 | 1015.1 |

| Passenger booked (mil. people) | 81.7 | 90.6 | 106.4 | 120 | 130.3 | 142 | 149 | 28 |

| Booked passenger load factor (%) | 83 | 88 | 93 | 94 | 95 | 96 | 95 | 71 |

| Number of aircrafts | 297 | 308 | 341 | 383 | 431 | - | - | 471 |

| Number of employees | 8992 | 9394 | 11,458 | 13,026 | 14,583 | 16,840 | 17,268 | 15,016 |

| Number of destinations | 186 | 189 | 200 | 207 | 216 | 219 | 242 | 225 |

| Total revenue per booked passenger (euro) | 61.6 | 62.4 | 61.42 | 55.40 | 54.88 | 54.17 | 57.17 | 59.5 |

| Wizz Air | ||||||||

| Total revenue per booked passenger (mil. euro) | 1011.8 | 1227.3 | 1429.1 | 1571.2 | 1948 | 2319.1 | 2761.3 | 0.739 |

| Net income (mil. euro) | 87.7 | 183.2 | 192.9 | 225.3 | 275.1 | 291.6 | 281.1 | 576 |

| Passenger booked (mil. people) | 13.9 | 16.5 | 20.0 | 23.8 | 29.6 | 34.6 | 40.02 | 10.18 |

| Booked passenger load factor (%) | 85.7 | 86.7 | 88.2 | 90.1 | 91.3 | 92.8 | 93.6 | 64.0 |

| Number of aircrafts | 46 | 55 | 67 | 79 | 93 | 112 | 121 | 137 |

| Number of employees | 1650 | 2040 | 2396 | 3033 | 3686 | 4550 | 4400 | 3960 |

| Total revenue per booked passenger (euro) | 65.1 | 64.7 | 62.6 | 65.73 | 65.43 | 58.9 | 54.6 | 44.1 |

| National/Low-Cost Airline Company | Total Operating Revenues (mil. euro) | Net Income (mil. euro) | Number of Employee (Number) | Number of Passengers Booked (Million Persons) | Booked Passenger Load Factor (%) | Number of Aircraft | Average_Income_Per Passenger | ||

|---|---|---|---|---|---|---|---|---|---|

| national | N | Valid | 8 | 8 | 8 | 8 | 8 | 8 | 8 |

| Missing | 0 | 0 | 0 | 0 | 0 | 0 | 0 | ||

| Mean | 237.475000 | −37.7500 | 1735.88 | 2.2213 | 69.9225 | 24.75 | 111.6628 | ||

| Median | 247.500000 | −34.0500 | 1792.00 | 2.3350 | 70.6500 | 24.00 | 106.1565 | ||

| Std. Deviation | 61.4195583 | 27.20882 | 214.245 | 0.73771 | 3.59060 | 2.915 | 19.04193 | ||

| Minimum | 130.5000 | −87.90 | 1305 | 0.84 | 64.31 | 21 | 94.44 | ||

| Maximum | 315.0000 | −6.30 | 1969 | 3.16 | 74.90 | 29 | 155.36 | ||

| low-cost | N | Valid | 16 | 16 | 16 | 16 | 16 | 14 | 16 |

| Missing | 0 | 0 | 0 | 0 | 0 | 2 | 0 | ||

| Mean | 3819.896188 | 648.3563 | 8268.25 | 64.7875 | 87.9625 | 210.07 | 59.2313 | ||

| Median | 2540.200000 | 549.0000 | 6771.00 | 37.3100 | 90.7000 | 129.00 | 60.4600 | ||

| Std. Deviation | 2826.0140520 | 482.63066 | 5699.770 | 50.84816 | 8.90579 | 153.497 | 5.72049 | ||

| Minimum | 0.7390 | 87.70 | 1650 | 10.18 | 64.00 | 46 | 44.10 | ||

| Maximum | 8494.0000 | 1559.00 | 17268 | 149.00 | 96.00 | 471 | 65.73 | ||

| Levene’s Test for Equality of Variances | t-Test for Equality of Means | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| F | Sig. | t | df | Sig. (2-Tailed) | Mean Difference | Std. Error Difference | 95% Confidence Interval of the Difference | |||

| Lower | Upper | |||||||||

| Total operating revenues (mil. euro) | EVA | 49.412 | 0.000 | −3.545 | 22 | 0.002 | −3582.4211 | 1010.5483 | −5678.1702 | −1486.6721 |

| EVNA | −5.068 | 15.028 | 0.000 | −3582.4211 | 706.8371 | −5088.7616 | −2076.0807 | |||

| Net income (mil. euro) | EVA | 18.162 | 0.000 | −3.973 | 22 | 0.001 | −686.1062 | 172.69178 | −1044.2470 | −327.9654 |

| EVNA | −5.668 | 15.190 | 0.000 | −686.1062 | 121.04054 | −943.8172 | −428.3952 | |||

| Number of employee (number) | EVA | 35.697 | 0.000 | −3.204 | 22 | 0.004 | −6532.375 | 2038.616 | −10760.205 | −2304.545 |

| EVNA | −4.578 | 15.085 | 0.000 | −6532.375 | 1426.954 | −9572.371 | −3492.379 | |||

| Number of passenger booked (millions persons) | EVA | 46.217 | 0.000 | −3.441 | 22 | 0.002 | −62.5662 | 18.1815 | −100.2725 | −24.8599 |

| EVNA | −4.921 | 15.013 | 0.000 | −62.5662 | 12.7147 | −89.6650 | −35.4674 | |||

| Booked passenger load factor (%) | EVA | 2.160 | 0.156 | −5.462 | 22 | 0.000 | −18.0400 | 3.3028 | −24.8896 | −11.1903 |

| EVNA | −7.039 | 21.475 | 0.000 | −18.0400 | 2.5629 | −23.3627 | −12.7172 | |||

| Number of aircraft | EVA | 50.963 | 0.000 | −3.378 | 20 | 0.003 | −185.321 | 54.853 | −299.743 | −70.900 |

| EVNA | −4.516 | 13.016 | 0.001 | −185.321 | 41.037 | −273.965 | −96.678 | |||

| average_income_passenger | EVA | 5.339 | 0.031 | 10.319 | 22 | 0.000 | 52.4315 | 5.0809 | 41.8943 | 62.9686 |

| EVNA | 7.618 | 7.639 | 0.000 | 52.4315 | 6.8825 | 36.4287 | 68.4343 | |||

| National/Low-Cost Airline Company | Model | R | R Square | Adjusted R Square | Std. Error of the Estimate |

|---|---|---|---|---|---|

| national | 1 | 0.994 a | 0.988 | 0.979 | 8.9065289 |

| low-cost | 2 | 0.995 a | 0.989 | 0.986 | 289.6254814 |

| National/Low-Cost Airline Company | Model | Sum of Squares | df | Mean Square | F | Sig. | |

|---|---|---|---|---|---|---|---|

| national a | 1 | Regression | 26,089.230 | 3 | 8696.410 | 109.628 | 0.000 b |

| Residual | 317.305 | 4 | 79.326 | ||||

| Total | 26,406.535 | 7 | |||||

| low-cost a | 2 | Regression | 7,6854,239.442 | 3 | 25,618,079.814 | 305.403 | 0.000 b |

| Residual | 838,829.194 | 10 | 83,882.919 | ||||

| Total | 77,693,068.636 | 13 | |||||

| National/Low-Cost Airline Company | Model | Unstandardized Coefficients | Standardized Coefficients | t | Sig. | Collinearity Statistics | |||

|---|---|---|---|---|---|---|---|---|---|

| B | Std. Error | Beta | Tolerance | VIF | |||||

| national a | 1 | (Constant) | 200.372 | 85.436 | 2.345 | 0.079 | |||

| Number of passengers booked (million persons) | 115.227 | 11.860 | 1.384 | 9.715 | 0.001 | 0.148 | 6.755 | ||

| Booked passenger load factor (%) | −5.287 | 1.877 | −0.309 | −2.817 | 0.048 | 0.249 | 4.008 | ||

| Number of aircraft | 6.093 | 2.120 | 0.289 | 2.874 | 0.045 | 0.297 | 3.371 | ||

| low-cost a | 2 | (Constant) | −2197.711 | 1222.691 | −1.797 | 0.102 | |||

| Number of passengers booked (million persons) | 52.002 | 4.588 | 0.911 | 11.334 | 0.000 | 0.167 | 5.990 | ||

| Booked passenger load factor (%) | 28.816 | 14.240 | 0.106 | 2.024 | 0.071 | 0.390 | 2.561 | ||

| Number of aircraft | 0.636 | 1.133 | 0.040 | 0.561 | 0.587 | 0.213 | 4.690 | ||

| Cost Reduction | Weight Share | |

|---|---|---|

| The cost supported by the FSCs | 100% | |

| Factors that reduce cost | ||

| Higher seat density | −15% | 85% |

| Increasing aircraft productivity | −5% | 80% |

| Low crew costs | −3% | 77% |

| Fewer ground teams | −4% | 73% |

| Low airport and landing costs | −6% | 67% |

| Unique type of aircraft fleet | −2% | 65% |

| Reduced station/outsourced handling costs | −10% | 55% |

| No free board service | −6% | 49% |

| Lack of commission | −3% | 46% |

| Low sales and booking costs | −3% | 43% |

| Reduced administrative expenses | −2% | 41% |

| Higher seat density | −15% | 85% |

| The cost supported by the LCCS | 41% |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Gabor, M.R.; Kardos, M.; Oltean, F.D. Yield Management—A Sustainable Tool for Airline E-Commerce: Dynamic Comparative Analysis of E-Ticket Prices for Romanian Full-Service Airline vs. Low-Cost Carriers. Sustainability 2022, 14, 15150. https://doi.org/10.3390/su142215150

Gabor MR, Kardos M, Oltean FD. Yield Management—A Sustainable Tool for Airline E-Commerce: Dynamic Comparative Analysis of E-Ticket Prices for Romanian Full-Service Airline vs. Low-Cost Carriers. Sustainability. 2022; 14(22):15150. https://doi.org/10.3390/su142215150

Chicago/Turabian StyleGabor, Manuela Rozalia, Mihaela Kardos, and Flavia Dana Oltean. 2022. "Yield Management—A Sustainable Tool for Airline E-Commerce: Dynamic Comparative Analysis of E-Ticket Prices for Romanian Full-Service Airline vs. Low-Cost Carriers" Sustainability 14, no. 22: 15150. https://doi.org/10.3390/su142215150

APA StyleGabor, M. R., Kardos, M., & Oltean, F. D. (2022). Yield Management—A Sustainable Tool for Airline E-Commerce: Dynamic Comparative Analysis of E-Ticket Prices for Romanian Full-Service Airline vs. Low-Cost Carriers. Sustainability, 14(22), 15150. https://doi.org/10.3390/su142215150