1. Introduction

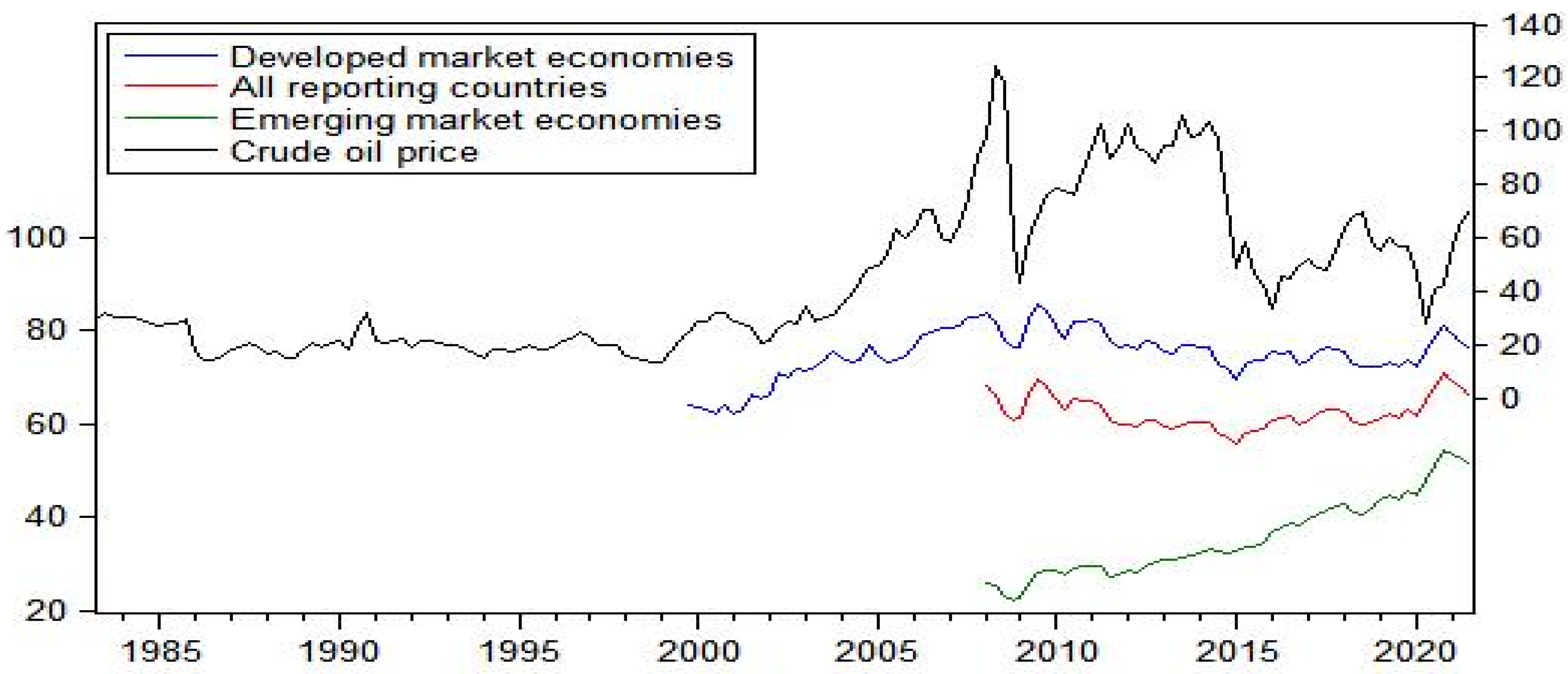

Economies around the world were significantly impacted as the COVID-19 outbreak reached epidemic proportions. Meanwhile, debt began to accumulate. On 15 December 2021, according to a study published by the International Monetary Fund (IMF), global debt as a percentage of GDP increased by 28%, representing the fastest rise in a year since the Second World War. In February 2022, the report “Global Debt Monitor” by the Institute of International Finance (IIF) demonstrated that total global debt rose from $226 trillion in 2020 to $300 trillion in 2021. As public debt grew, so did household debt. The rapid rise in global household debt has changed from being driven by demand to being driven by supply constraints, with tightened credit severely increasing economic fragility, according to an IMF report. Making matters worse, the Russia–Ukraine war triggered geopolitical risk and caused the oil prices to shoot up, with the barrel price of oil hitting $130. What, then, does all this mean for world economic growth?

The oil price, household debt, and economic growth are expected to have been significantly impacted by the COVID-19 epidemic. In this context, their relationships have gained importance, especially with all the interest in the relation between debt and economic growth and the connection of economic growth to the oil price. However, at the level of the economy, a degree of uncertainty remains about the effects of household debt and the oil price shocks on economic growth. Debt means leverage, which finances investment and helps promote economic growth. However, the rapid growth of debt leads to resource mismatch and inefficiency, and excessive indebtedness is a real, long-term problem that could depress economic confidence and growth prospects. As consumers try to pay down debt, the result will be sluggish demand and thus slower growth. For economists, the debate about whether the household debt stock enhances or follows economic growth is crucial and is the cornerstone of abundant literature [

1].

Crude oil is the world’s largest energy source, accounting for approximately 31.2% of global primary energy consumption in 2020. An increase in the price of oil is bad for the economic growth of oil importing countries. According to the theory of irreversible investment under uncertainty [

2,

3], the oil price uncertainty leads some investors to delay or abandon investments that they regard as irreversible during periods of uncertainty, eventually leading to declines in total output. It also prompts consumers to postpone purchases [

4]. Additionally, note that the COVID-19 pandemic has aggravated the liquidity and debt sustainable crises [

5,

6], with the rising the oil price casting a cloud over future economic growth.

Most related studies are about the economic effects of public debt or private debt, while there is scant research that thoroughly examines the relationship of household debt with economic growth. In the context of the COVID-19 pandemic and the Russia–Ukraine war, which greatly increased the oil price, few scholars have examined the interrelations among household debt, the oil price, and economic growth.

Drawing on the theoretical foundations of the debt–growth nexus [

4,

7,

8,

9], our paper explores the effects of household debt and the oil price shocks on economic growth, which have received much attention recently [

10,

11]. To understand the relationship between household debt, the oil price, and output growth, it is important to analyze the interdependence among them. With respect to theory and previous literature, our paper contributes in two respects. First, using an unbalanced panel of country-level data, we apply an unrestricted panel vector autoregression (VAR) model to effectively solve the endogeneity problem, and the pandemic uncertainty index enters the model as an exogenous variable with significant negative effects on the oil price and economic growth and positive effects on household debt, which confirms the theoretical prediction. To the best of our knowledge, this is the first paper to apply the unrestricted panel VAR model to examine the relations between household debt, the oil price, and economic growth and includes the pandemic uncertainty index as the exogenous variable. Second, as the main contribution of our paper, we seek to establish a causal link between the oil price and household debt to economic growth by exploiting the temporal lag between shocks to output and the rational response by borrowers within an unbalanced panel unrestricted VAR framework. The assumption behind our approach is that neither public policy nor private action responds contemporaneously to innovations in aggregate economic activity [

1], but does so after one quarter, in which case an unrestricted panel VAR model is a suitable choice.

The rest of the paper is organized in the following way. In

Section 2, we present a review of the literature, and describe important literature of household debt, the oil price, and their effects on economic. We then discuss in

Section 3 how we empirically test and analyze the effects of household debt and the oil price shocks on economic growth in the shadow of the pandemic. In

Section 4, the robustness tests are presented, which provides further complementary evidence. In

Section 5, the alternative estimators are presented, we build panel error correction models (ECMs) of a long-run cointegrating relationship among household debt, the oil price, and economic growth. In

Section 6, we present further research on the relationship between bank credit and household debt. In

Section 7, some concluding remarks and policy implications are offered.

2. Literature Review

Questions about the debt growth nexus and oil price growth nexus in developed and developing countries are not novel. However, the conclusions of the empirical tests on the nexus may be different due to the empirical methods, sample interval, and data processing methods applied. Panizza and Presbitero’s [

12] research, using theoretical models, produced some results on the debt–growth nexus and concluded that the question is an empirical one. Most of the present research about the debt–growth nexus, including the works by Mite and Matz [

13]; Eberhardt and Presbitero [

14]; Lof and Malinen [

15]; and Panizza and Presbitero [

12], among others, found that debt had a significantly negative correlation with economic growth, although the latter paper finds that this effect disappears once endogeneity is accounted for.

A broader conception of the definition of debt seems to be creeping into several papers. There is some literature on growth and financial development that considers the relationship between economic growth and the availability of private debt [

16]. Crucially, their findings were often due to between-country variations in financial depth rather than the sort of within-country dynamics that give rise to our results. Other literature has dealt with private debt, focusing on financial stability and other issues rather than broader macroeconomic performance. Schularick and Taylor [

17] found that credit booms have predictive power for business cycles. Cecchetti et al. [

18] investigated the effect of private debt on growth and reported negative effects. In contrast to the findings of previous studies that used a linear or threshold model, such as Baum et al. [

19]; Cecchetti et al [

18] and Schmitt-Grohé and Uribe [

20], the effects of private debt on growth were found to change from positive to negative when the private debt-to-GDP ratio reaches 100% [

16]. Bank credit to the private sector is not a positive factor for economic growth [

21] and may have harmful effects on growth [

22].

There are a few noteworthy aspects of the household debt–growth nexus. Some empirical studies have focused on the links between rapid household debt growth and financial crises in the advanced world [

23,

24], and part of this literature has found unconditional negative correlations between household debt changes and future growth based on the panel data of developed and developing countries [

8,

25]. Liaqat and Ahmed [

26] used a panel vector autoregressive model to study the differential effects of components of private debt on income growth for a large panel of countries. The result showed that household debt growth in a given period generally has a positive impact on income and that this effect is much stronger for countries with relatively lower incomes and household debt-to-GDP ratios.

Many studies have focused on the impact of oil price fluctuations on economic growth [

27]; however, fluctuations in the price of oil will impact the macroeconomy, which in turn leads to further oil price fluctuations. The first study by Hamilton [

28] explored the impact of the oil price on the macroeconomy. Further studies have found a significant relationship between the oil price and the macroeconomy [

29,

30,

31], and a rising oil price was found to have a significant negative impact on UK GDP growth. However, Akinlo and Apamisile [

32] actually found the opposite, showing that fluctuations in the oil price have a positive and significant effect on economic growth for oil exporting countries. This is due to precautionary saving motives; investors may increase investments and raise economic growth. Mlaabdai et al. [

33] assessed the interaction of the economic growth of the national economy and oil industry factors. Some recent research has considered the high oil price and COVID-19 to have a potentially negative influence on economic growth, as described in Abaas [

34]; Akimova et al. [

35]; Umaña-Hermosilla [

36]; Kaminsky et al. [

37] and so on.

In general, a degree of uncertainty remains about household debt’s precise contribution to economic growth, and oil price fluctuations tend to have a negative impact on economic growth. Most studies focus on specific or isolated factors, trying to explain the evolution of household debt. This paper is different from previous studies in which the impacts of household debt and the oil price on economic growth were investigated separately in that it explores the essential interplay between household debt, oil price shocks, and economic growth. We want to provide a more comprehensive study of these connections. We analyze the effects of household debt and oil price shocks on economic growth in the shadow of the pandemic in a more systemic way based on an unrestricted panel VAR model. Undoubtedly, the COVID-19 pandemic had dramatic negative effects on world economic growth and triggered a massive increase in household debt to such an extent that these variables could be on unsustainable paths.

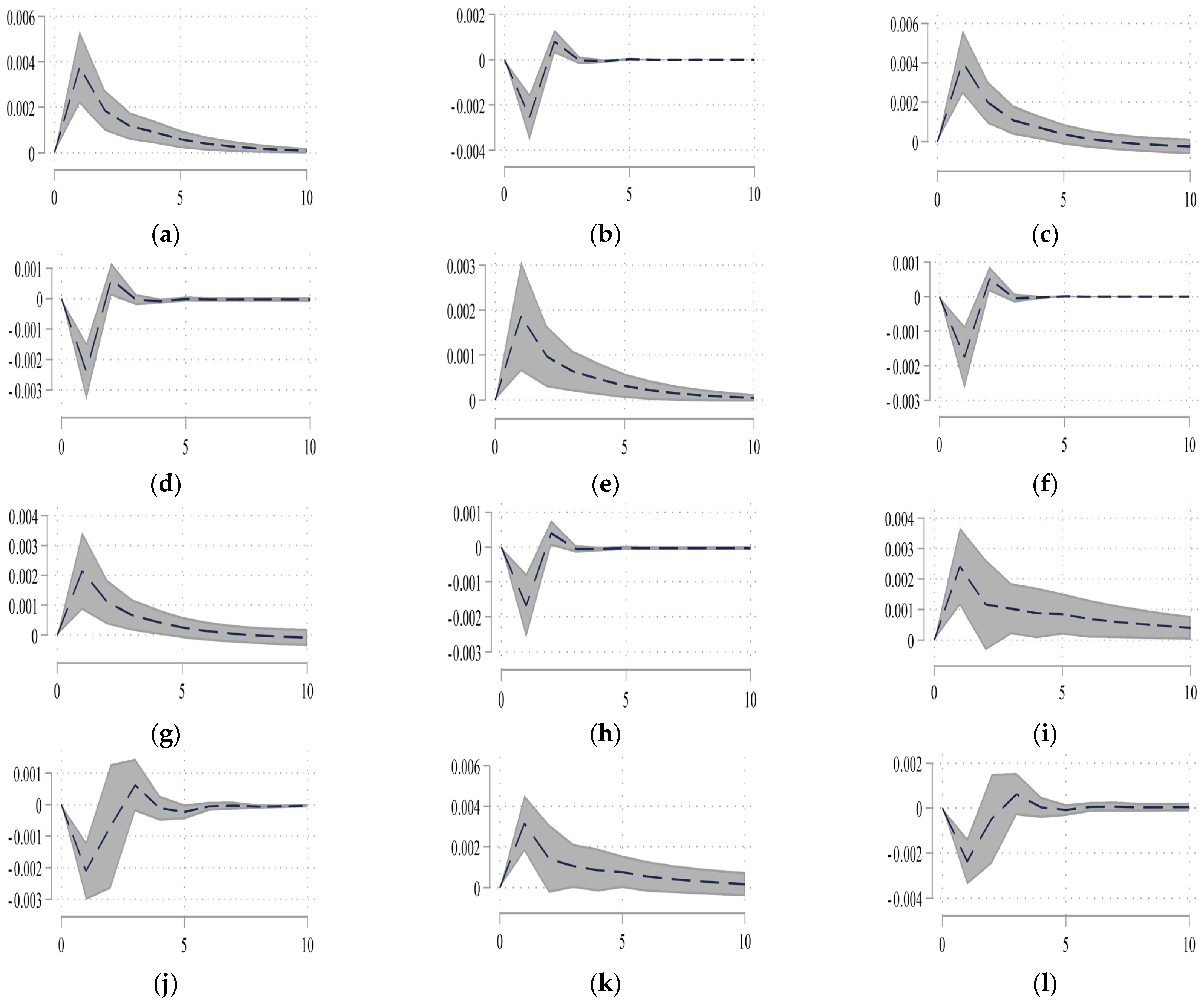

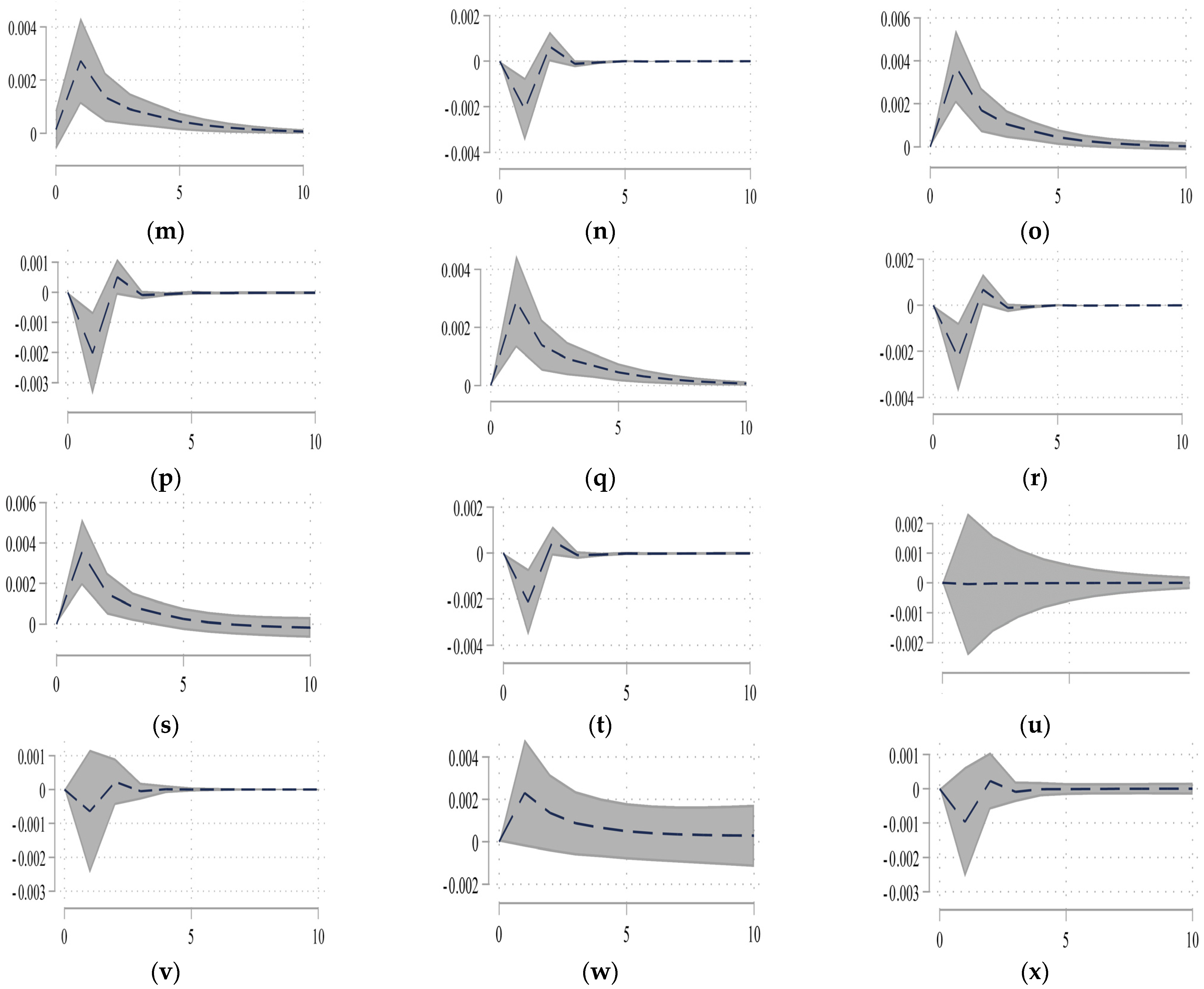

4. Robustness Test

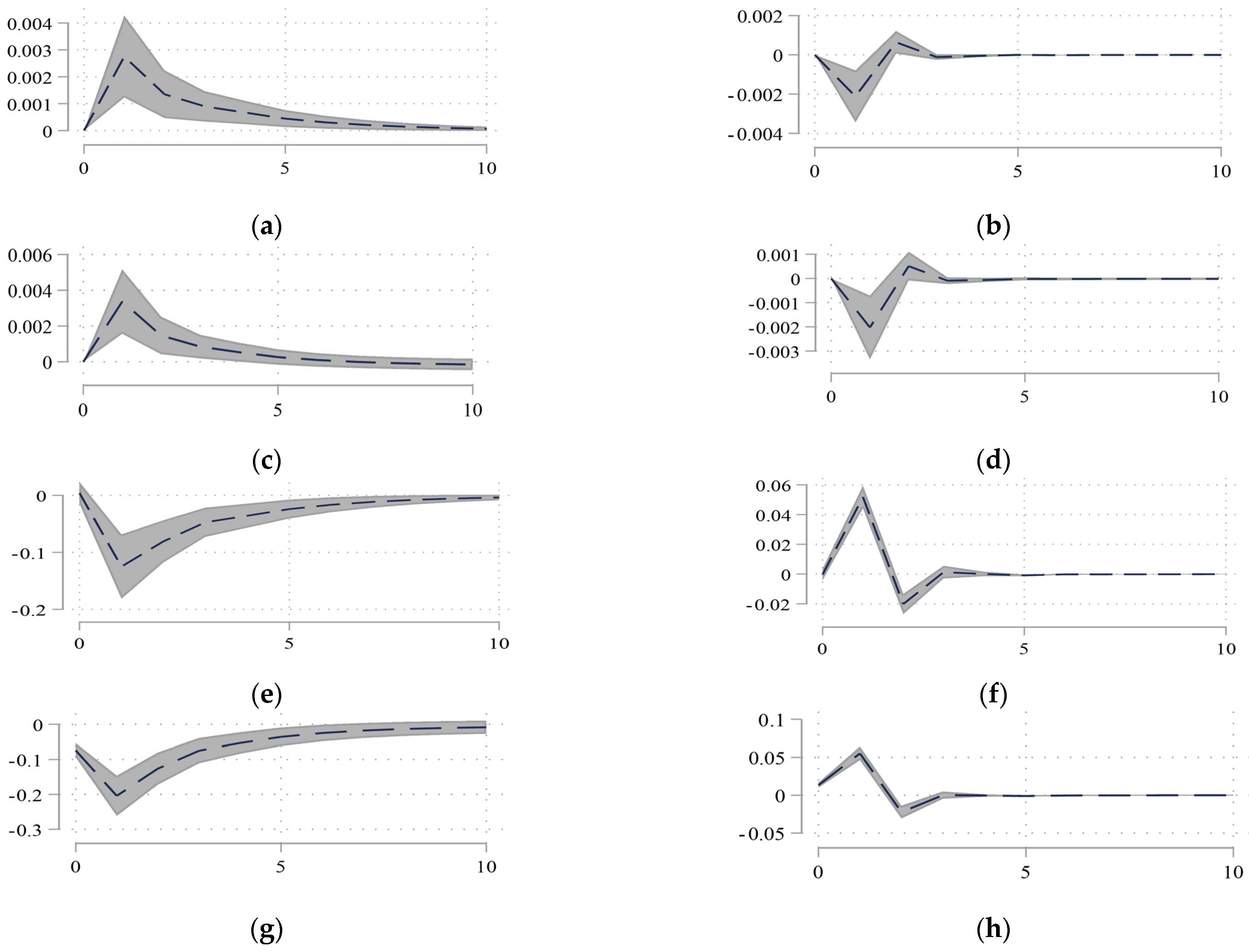

To display the reliability of the results, the empirical estimates are subjected to more stringent standards. Unless not applicable, we include the impulse response functions (IRFs) from both the parsimonious and comprehensive models in an attempt to develop the model. In this section, some endogenous variables are replaced or new exogenous variables are added, and the model results are compared with the baseline.

In

Figure 5a–d, we analyze the impulse response for household debt and the oil price on economic growth for the parsimonious (P) and comprehensive (C) models with the exogenous variable of the government quality index (GQI). On balance, including the GQI as a control does increase the maximum value of the positive effects of household debt on economic growth, but it does not alter the effects of the oil price on economic growth. This result also suggests that exogenous improvements in the efficiency of social governance arising from government quality upgrades reduce corruption and transaction costs and increase economic efficiency and government quality thereby having a positive effect on household performance.

In

Figure 5e–h, we further condition the unrestricted panel VAR with the exogenous effects of financial development. The impulse response shows that including the exogenous variable of financial development as a control weakens the effects of household debt on economic growth. These differences can be explained by the theory that financial development can help improve the efficiency of resource allocation, which lowers the interest rate and risk. Of course, it might persuade consumers to save less and spend more, which likely leads to reduced financial capital accumulation and thereby slows economic growth [

40]. Another important finding is that the negative effect of the oil price on economic growth can be alleviated by financial development as an exogenous variable in the parsimonious and comprehensive models. This result also suggests that economic growth is protected by financial development from the impact of oil price shocks.

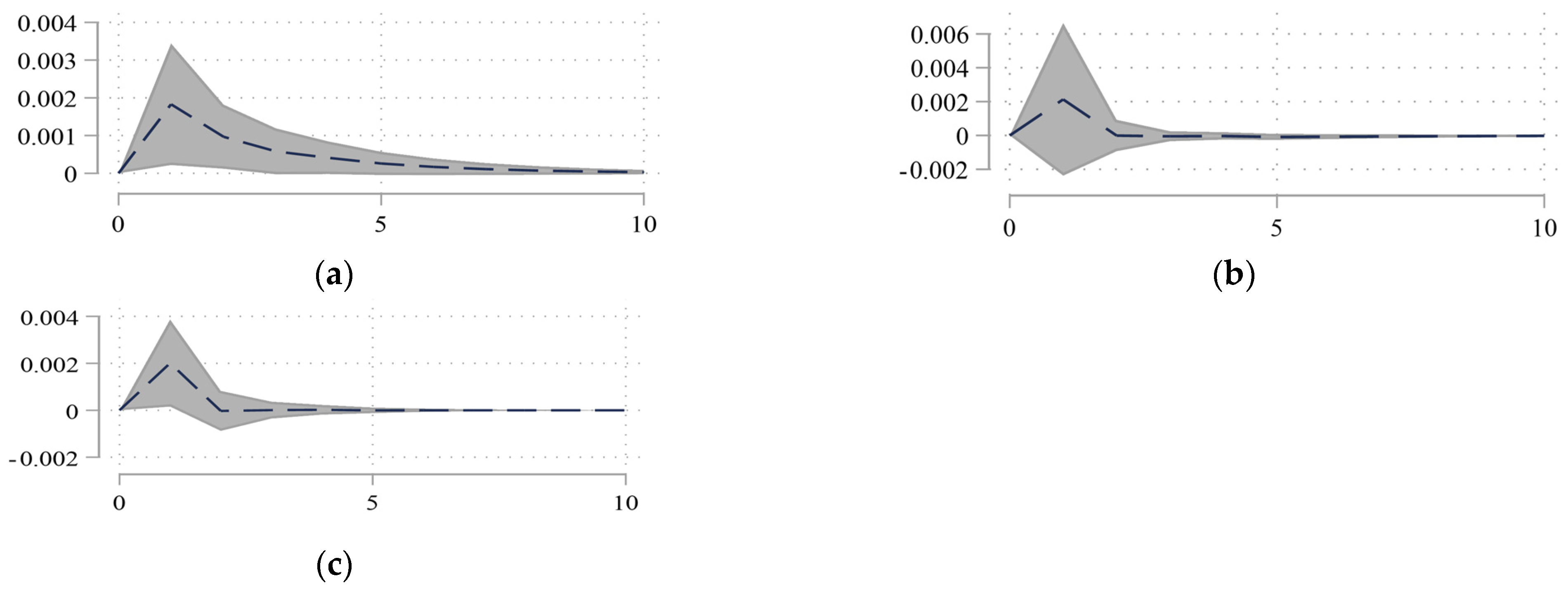

Another set of tests involves increasing the lag count to the higher order VAR (2) systems based on the AIC (

Figure 5i–l). The results show that the maximum values of the effects of debt on real output decrease as the number of lags increases and are smoother for the parsimonious and comprehensive models; however, the economic growth response remains positive for a longer time. The impulse response function of the oil price on economic growth leads to a similar conclusion. Next, we alter the order between economic growth and debt for the parsimonious model (

Figure 5m,n) or the order between the real exchange rate and the oil price (

Figure 5o,p). As the results show in

Figure 5m–p, the impulse response functions do not change much. We also control for oil-producing and oil-importing countries. In order to provide a criterion for the division, based on whether this country belonged to OPEC+ countries, 34 countries fell into two groups: OPEC+ countries and non-OPEC+ countries. The empirical test result is shown in

Figure 5q–x, and the results show that the approach is valid and robust.

5. Alternative Estimators

We then built panel error correction models (ECMs) of a long-run cointegrating relationship between household debt and economic growth. For consistency with our baseline, the error correction model is:

where

is economic growth and

is the

vector of endogenous variables excluding economic growth. The error-correction speed of adjustment parameter

and the long-run coefficients

are of primary interest.

is a country fixed effect,

and

are the short-run coefficients to be estimated, and

is an error term. We estimate the pooled mean group (PMG), mean group (MG), and dynamic fixed effect (DFE) estimators for model (2), which we summarize in

Table 3. One would expect

(the error correction term) to be negative if the variables exhibit a return to long-run equilibrium; in the results shown in

Table 3,

confirms this expectation. In columns 1–4, the PMG and MG results are estimated: the estimated long-run household debt elasticity is significantly positive, as expected, and the estimated oil price elasticity is significantly negative. Additionally, all estimates reach the 1% significance level.

The DFE estimator, like the PMG estimator, restricts the coefficients of the cointegrating vector to be equal across all panels [

41]. The coefficients from the DFE model are similar to the PMG and MG estimates; however, some coefficients are insignificant in the DFE model. In the DFE model, the simultaneous equation bias from the endogeneity between the error term and the lagged dependent variable can be measured by the Hausman test. The result of the Hausman test, in

Table 5, shows that the DFE model is preferred over the MG model. Across all these estimators, the research findings show that the oil price has a negative long-term effect and a positive short-term effect on economic growth. The results also show that household debt has a significantly positive long-term effect on economic growth under the PMG and MG estimates.

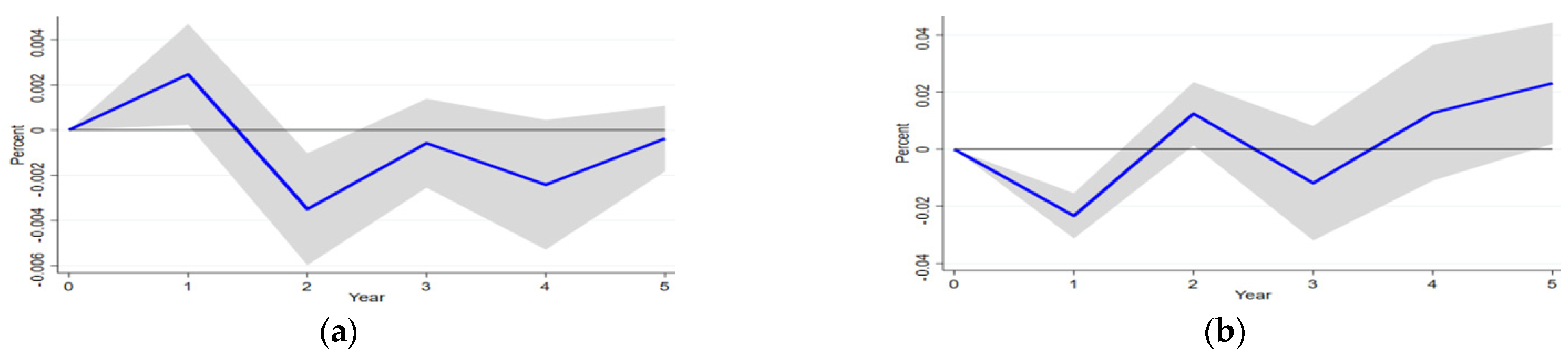

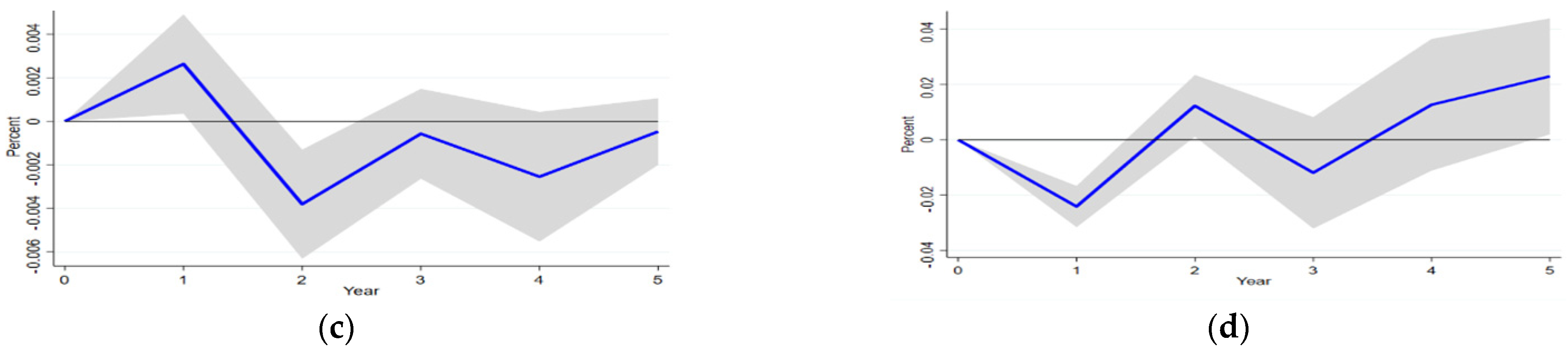

For local projection, this paper discusses the possibility of introducing the pandemic uncertainty index into the model as an exogenous variable. The estimating model is as follows:

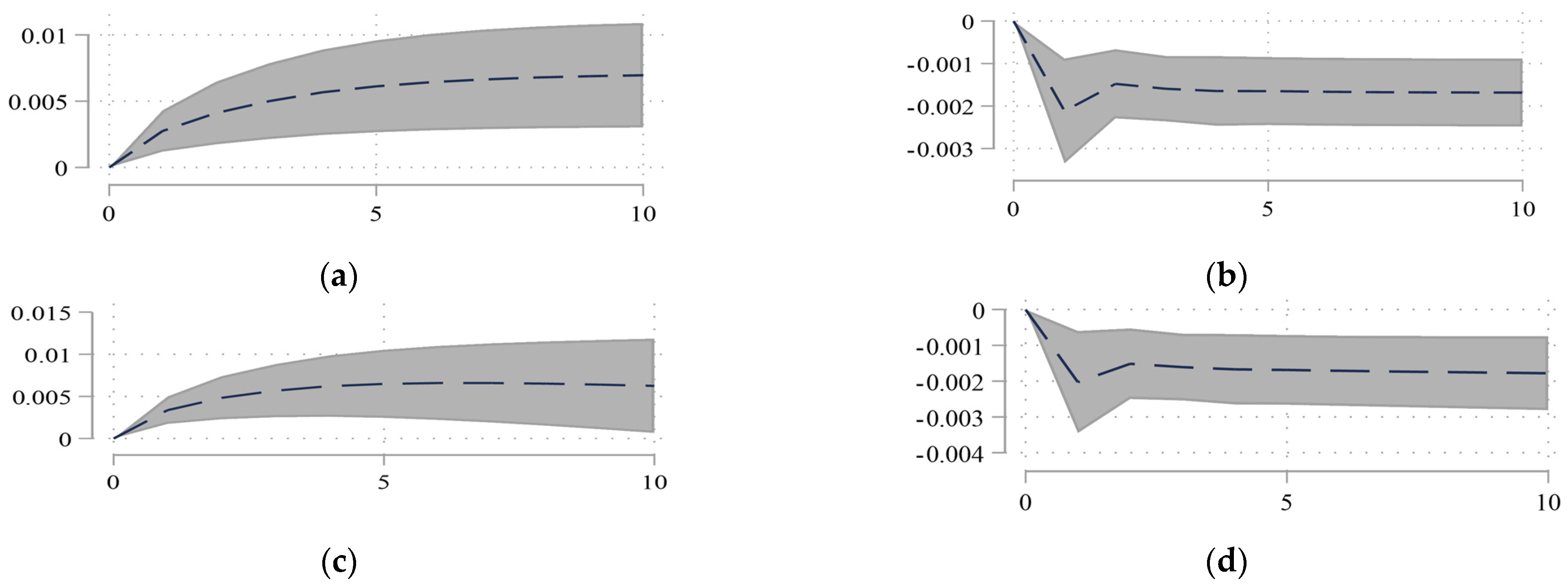

The IRFs of economic growth to household debt and the oil price are shown in

Figure 6 and

Table 6, estimated via local projections, for the parsimonious model and comprehensive model. The results show that the positive response of household debt to economic growth and the negative response of the oil price to economic growth are significant for about one quarter, which is consistent with the results from the VAR model. However, in the second quarter, household debt and the oil price also have a significant influence on economic growth, but the influence direction changes, while it is significant only through approximately two quarters.

7. Conclusions

We contribute to the vast literature on the effects of household debt and oil price on economic growth, and we formulate an unrestricted homogeneous panel VAR model, error correction model, and local projection model. We find that household debt has a positive impact on economic growth; this impact is lagged and gradually decreases, while oil price shocks have a dramatic negative effect on economic growth. In addition, the pandemic uncertainty index has an obvious and positive effect on household debt, while it has an obvious and negative effect on economic growth and oil price. The IRFs and cumulative orthogonal impulse responses for household debt and oil price to economic growth for the parsimonious and comprehensive models tend to decrease over time, especially in an open economy setting. The results from local projections show that household debt alone may only have short-term positive effects on the economy; it should be an addition to stimulus policies, not a substitute for traditional stimulus, such as monetary policy and fiscal policy [

36,

45]. These conclusions are further confirmed by robustness tests, and these results correspond with the initial hypothesis. This paper’s research results agree with those of literature, such as Liaqat and Ahmed [

26] and Wei [

30], and show that the methods are robust and stable.

At present, there are many mature papers that focus on public debt; our paper is a first step to understanding the relation between household debt, oil price, and economic growth in the shadow of pandemic. We have considered the simplified model and focused on one key aspect of the pandemic—as exogenous shocks to economic activity. This strategy has allowed us to focus on the interactions between endogenous variables. Although the unrestricted VAR results are very sensitive to misspecification concerns, the validity of these results for a set of perturbations is verified by the results shown in

Section 4. Meanwhile, the long-term effects of household debt and the oil price are another important and ongoing area of study. We have made some meaningful advances in this regard, and the results are shown in

Table 3.

According to the research conclusion, from a policy perspective, it should be noted that the oil price raising clearly impedes on economy, and especially so for non-OPEC+ countries. In attempts to help promote economic growth, governments need to formulate energy policies that bring energy costs down. The increase of household debt is influenced by a number of factors, government and financial institutions should create services to meet the demand with household debt; the household debt of sustainable development would benefit economic growth. The impacts of the pandemic on household debt, oil price, and economic growth cannot be overlooked [

5,

6,

27]. Notably, several crises occurred during 1965Q1–2021Q3. We agree that the behavior of household debt and oil prices during crises is worth studying. A single topic from different methodological points of view is needed according to which our team want to dig into the problem and take the work a step further for future study.