Retail Electricity Market Liberalization: An Overview of International Experience and Effects on the Chilean Regulated Tariff

Abstract

1. Introduction

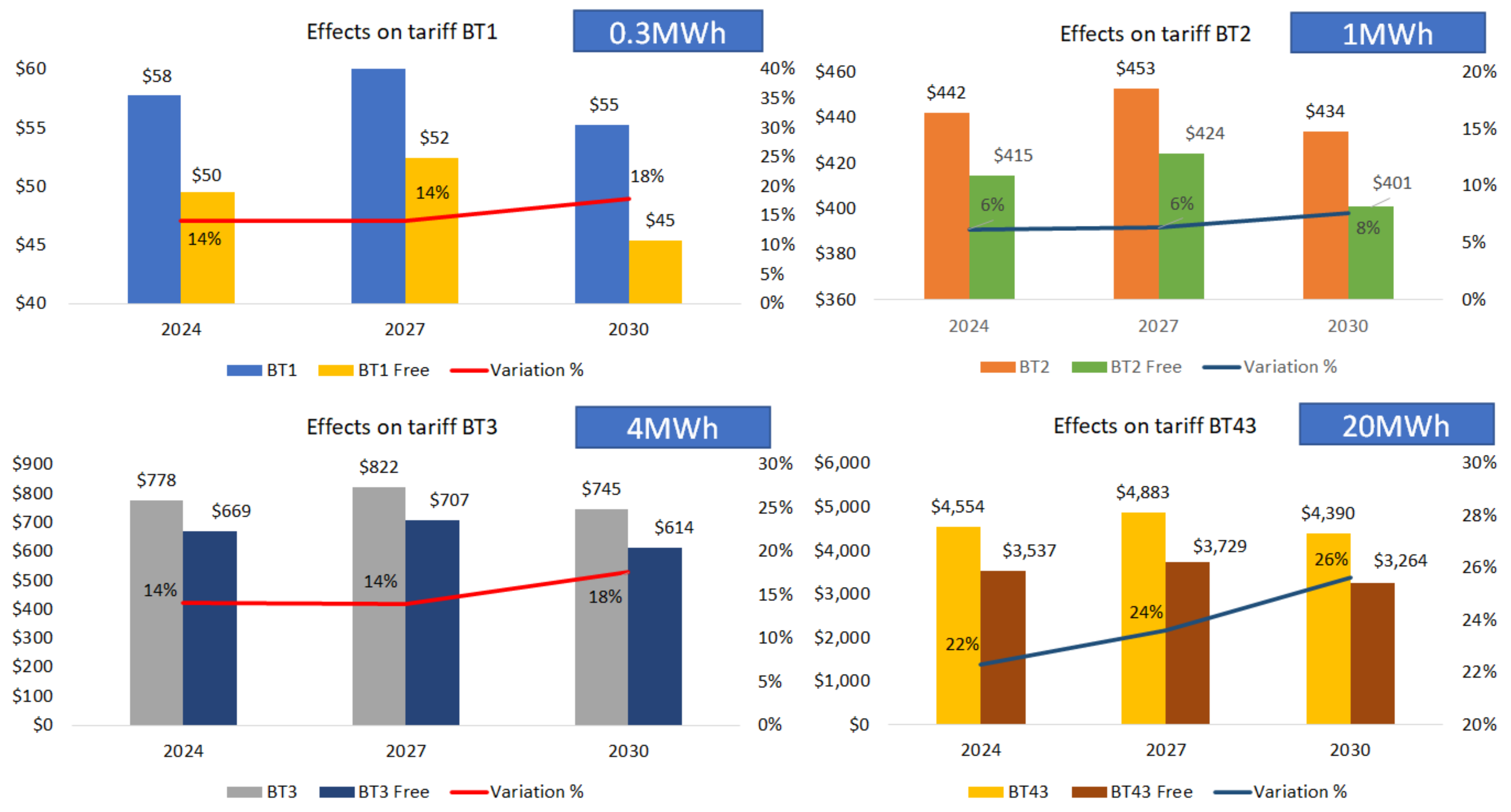

- An approximation forecast is presented for the regulated customers’ tariff for the next 15 years, based on tenders awarded and the current mechanisms to stabilize the customers’ price.

- The savings generated by the eventual migration of residential and commercial customers from a regulated tariff to a free tariff scheme is measured, considering the power required to access them.

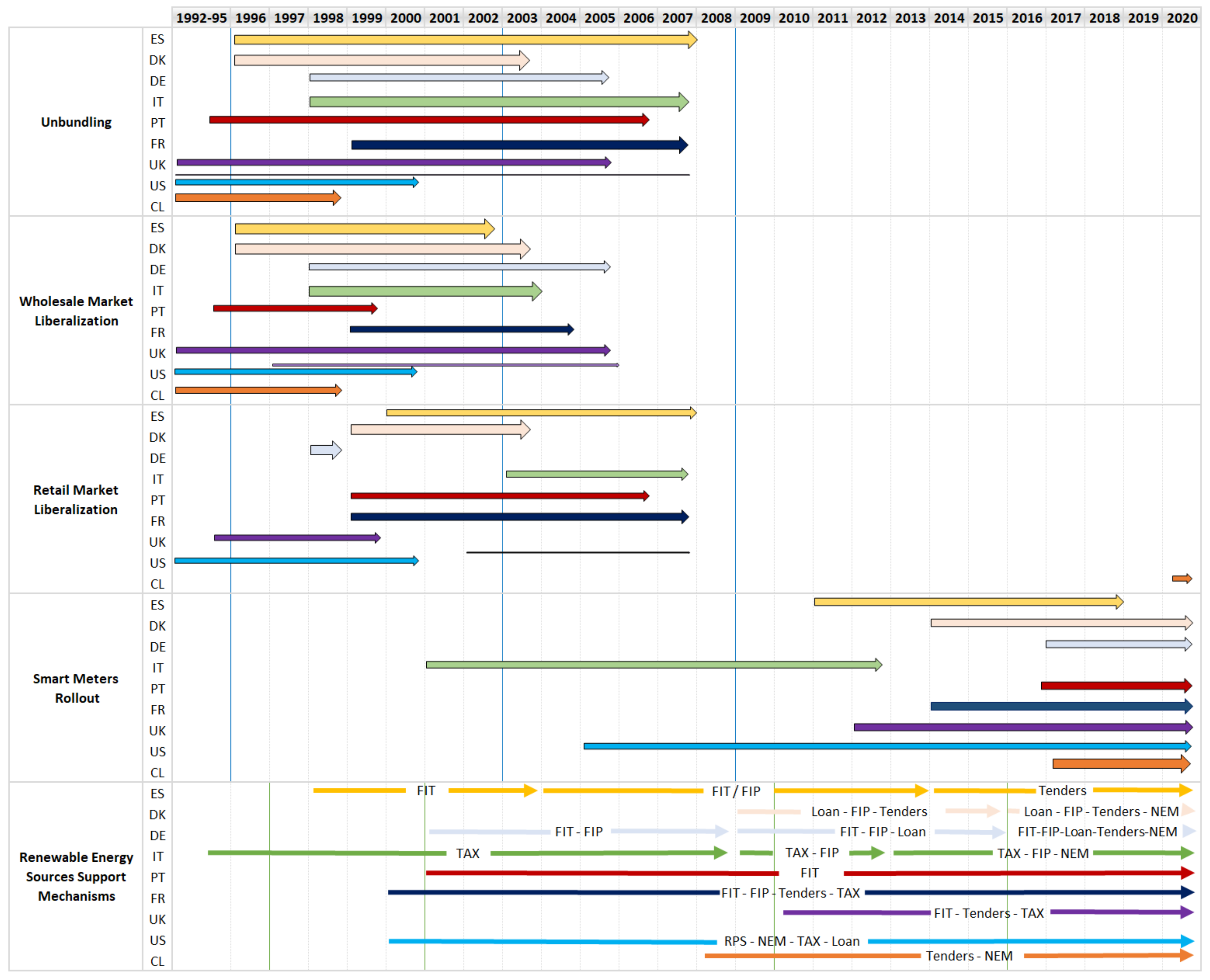

- An overview of the international experience in the electricity market liberalization process is presented, considering three axes: the unbundling steps, data management policy, and renewable energy sources incentives.

2. Overview of International Experience

2.1. Unbundling

2.2. Smart Meters

2.3. Renewable Energy Sources

3. Retail Market Competitiveness and Pricing

3.1. Liberalization Effects on Pricing

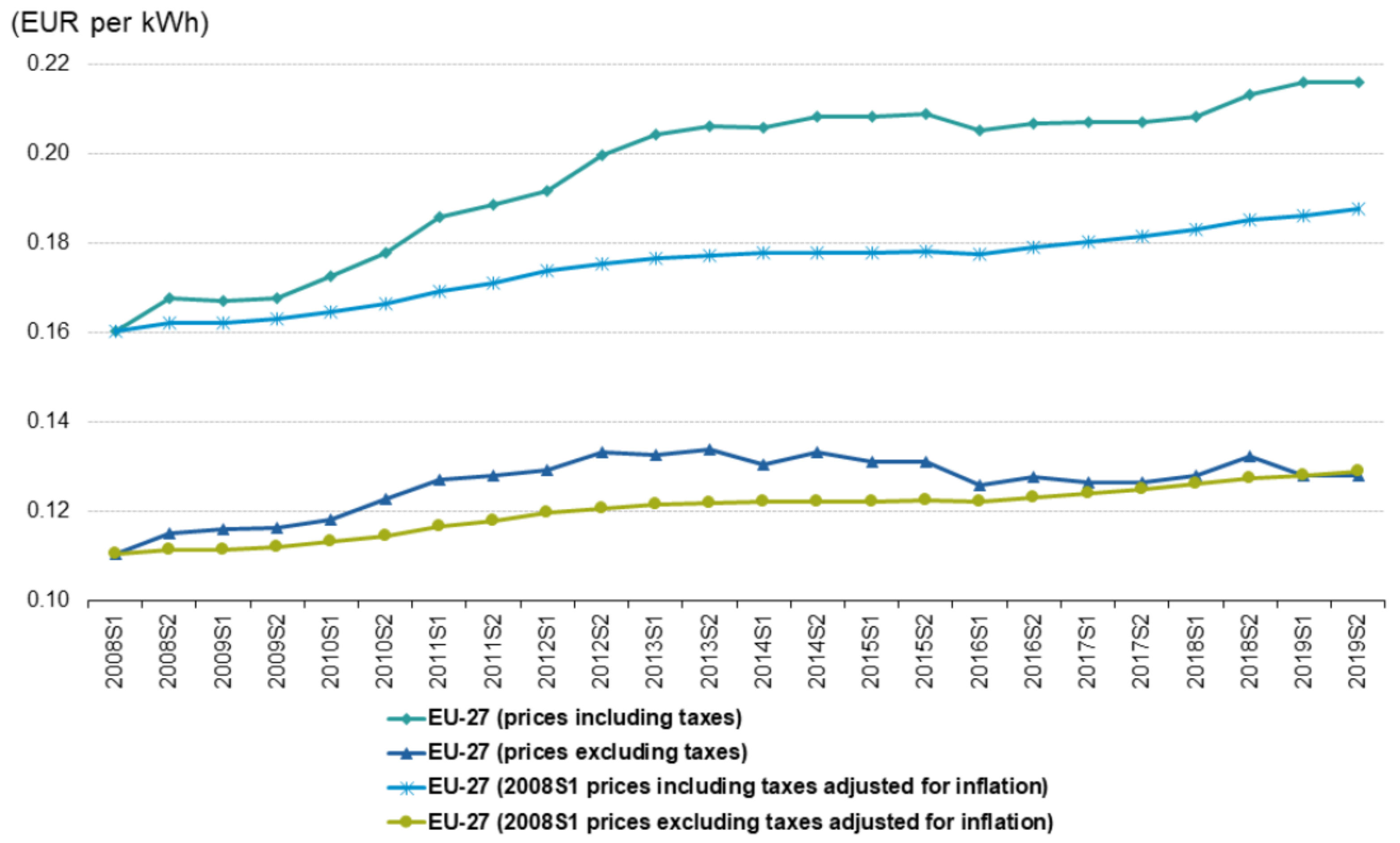

- The taxes/levies and network costs are the main drives that explain the higher prices. Specifically, despite a decreasing trend in wholesale electricity price, which was more significant in countries with high distributed energy sources penetrations, this trend is not reflected in the retail prices due to different network tariff regulations, fragmenting internal market, taxes, levies, network distribution systems, and uncoordinated national energy policies.

- There are still high market concentration levels and low switching rates, which is translated into lower retail market competitiveness.

- A regulated retail price tends to be detrimental to competition in the retail markets, discouraging investment entry and new competitors. Thus, the energy price increased 4% (above inflation) every year from 2008 to 2012; the network cost went up 18.5% from 2008 to 2012; and the taxes/levies have risen by 36%.

3.2. Competitiveness

3.3. Chilean Retail Electricity Tariff (Fee)

4. Materials and Methods

- 1.

- Energy projected: annual energy projection provided by the national energy commission for future supply tenders in regulated customers;

- 2.

- Expected price: corresponds to the price that should be transferred to regulated customers if the stabilization mechanism had not been implemented;

- 3.

- PEC: price to be transferred to regulated customers based on the Tariff Stabilization Law;

- 4.

- Dollar: average dollar value of the last six months. The six-month methodology is established by regulation converting the price from USD/MWh to CLP/KWh;

- 5.

- Amount to collect and the amount collected: CLP monetary quantification considering the energy projected, the expected price, and the PEC;

- 6.

- Balance: difference in CLP between the amount to be collected without the PEC Law versus what was collected based on the PEC regulations;

- 7.

- Exchange rate: At this point, the regulated price is updated using the difference between the last six-month average dollar with the current month’s dollar value. Therefore, the accumulated bag (BA) is updated to USD considering this difference;

- 8.

- Final accumulated bag, which could take positive or negative values;

- 9.

- PEC stage review: the PEC regulations consider that if the BA is greater or equal to 1350 MMUSD, the PEC will be equal to the expected price (Pe) in order not to continue accumulating balances. Otherwise, the price of energy to be transferred to free customers considers four stages:

- (a)

- The first stage is considered from June 2019 to December 2020, in which the PEC considered corresponds to Decree 20T, which sets energy and power prices for the first half of 2019.

- (b)

- The second stage, which runs from January 2021 to June 2023, considers that the price to be transferred to regulated clients is decree 20T, but increased by the Chilean CPI.

- (c)

- The third stage, which runs from July 2023 to June 2024, establishes that the price to be transferred is the Expected Price so that, in this period, it does not continue to generate BA.

- (d)

- Finally, the fourth stage that considers the period between July 2024 and December 2027 indicates that the price to be transferred will be Decree 20T plus IPC and a Factor that will be explained in the process.

- 10.

- After reviewing the stage that considers the PEC Law, it generates input for the prices in the new iteration;

- 11.

- Corresponds to an adjustment factor applied by the CNE to ensure the total debt payment before 2027.

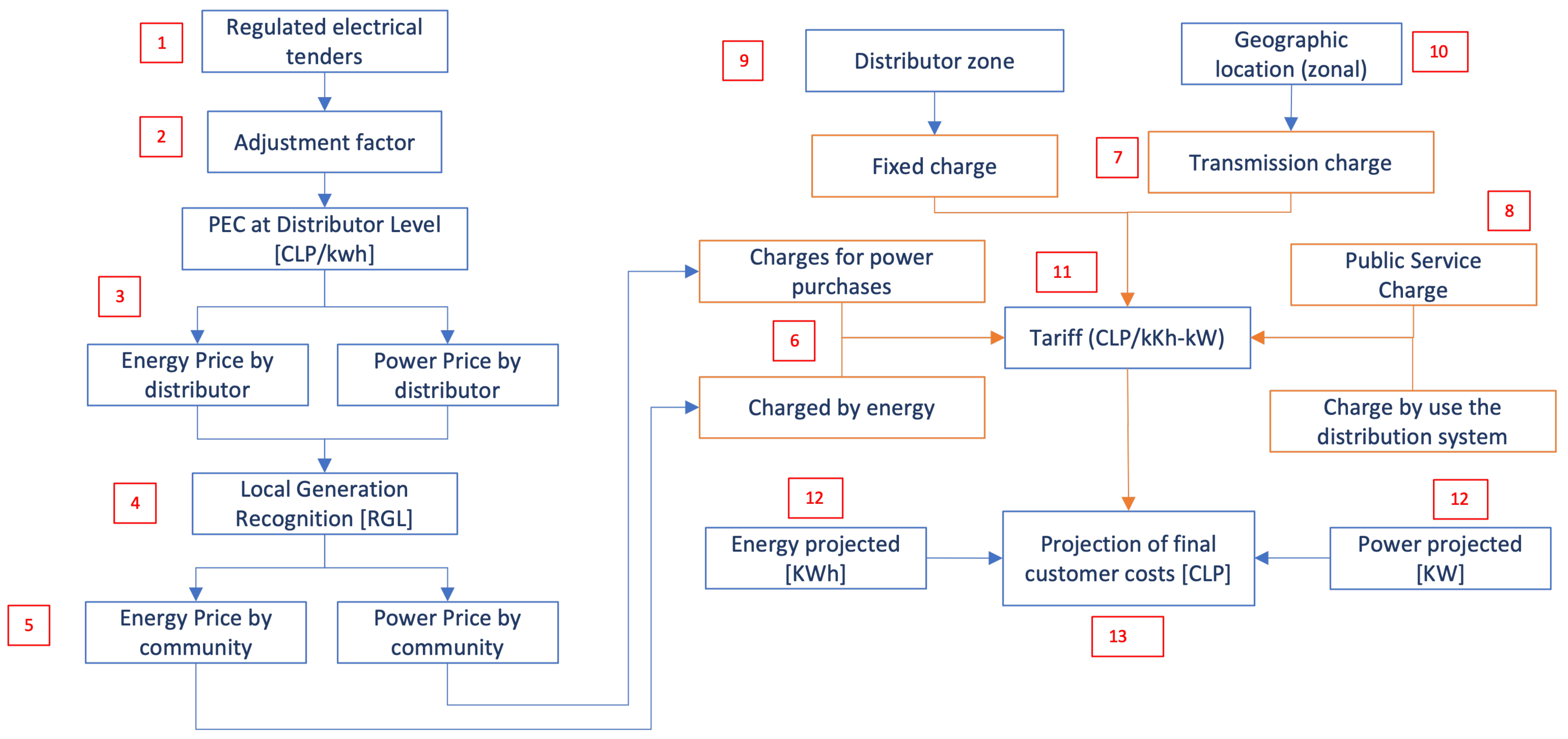

- 1.

- Regulated electricity tenders: establishes the base of contracts signed to date to have the price at the distributor level to transfer to regulated customers;

- 2.

- Adjustment factor: factor to ensure that the electricity price for regulated customers is within the PEC Law ranges;

- 3.

- PEC at the distributor level: calculation of the energy and power price at distributor level considering the customers regulated prices obtained in the previous step;

- 4.

- Local generation recognition (LGR): discount applied to the zones/communities, which have local energy generation;

- 5.

- Price per commune: once the LGR per commune is obtained, these are applied to the prices of the three processes, and the energy and power prices are accepted at the communal level for the National Electric System.

- 6.

- Rate charges for power and energy: after obtaining the power and energy prices at the community level, these are used to obtain the costs associated with the final customer rate, which are used for power purchases and energy charges;

- 7.

- Charge for the distribution system uses: the distributor acts by charging the rate to regulated customers as a financial collector; therefore, this mentioned charge is the remuneration of the distributor for providing the electricity distribution service. These amounts are calculated in the four-year processes and are reflected in the calculation formula of Decree 11T;

- 8.

- Charge for public service: the charge that is transferred to the final client regarding the energy consumption of the latter and has as its objective the remuneration of the National Electrical Coordinator, the panel of experts, and the strip study. This charge is then transferred in CLP/kWh and is calculated annually by the CNE in November of each year;

- 9.

- Fixed charge: value transferred to the final customer that is not subject to minimum energy or power consumption and varies according to the specific area of the distribution company;

- 10.

- Transmission charge: the charge paid at the final customer level concerning the energy consumed is calculated by the CNE on a semi-annual basis and varies from one customer to another based on the zonal location of each of them;

- 11.

- Tariff: the grouping of each of the charges mentioned makes up the final rate paid by the regulated customer;

- 12.

- Projection: energy and power projection by segments (residential, industrial, and farming, among others) based on the obtained tariff;

- 13.

- Projection of final customer costs: finally, based on the cost of the projected rate and both projected energy and power, the projection of costs to be paid by final customers is obtained.

5. Results

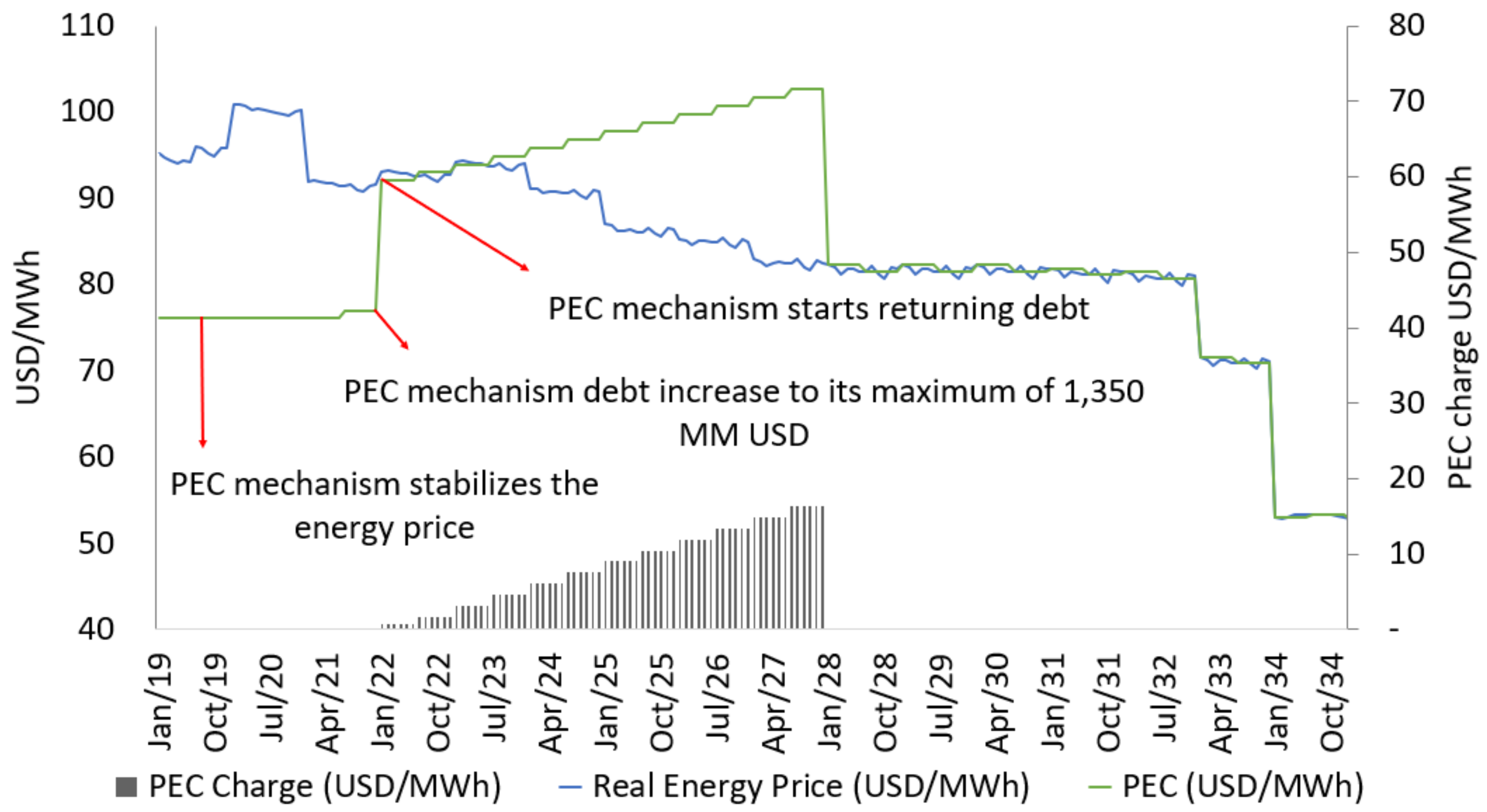

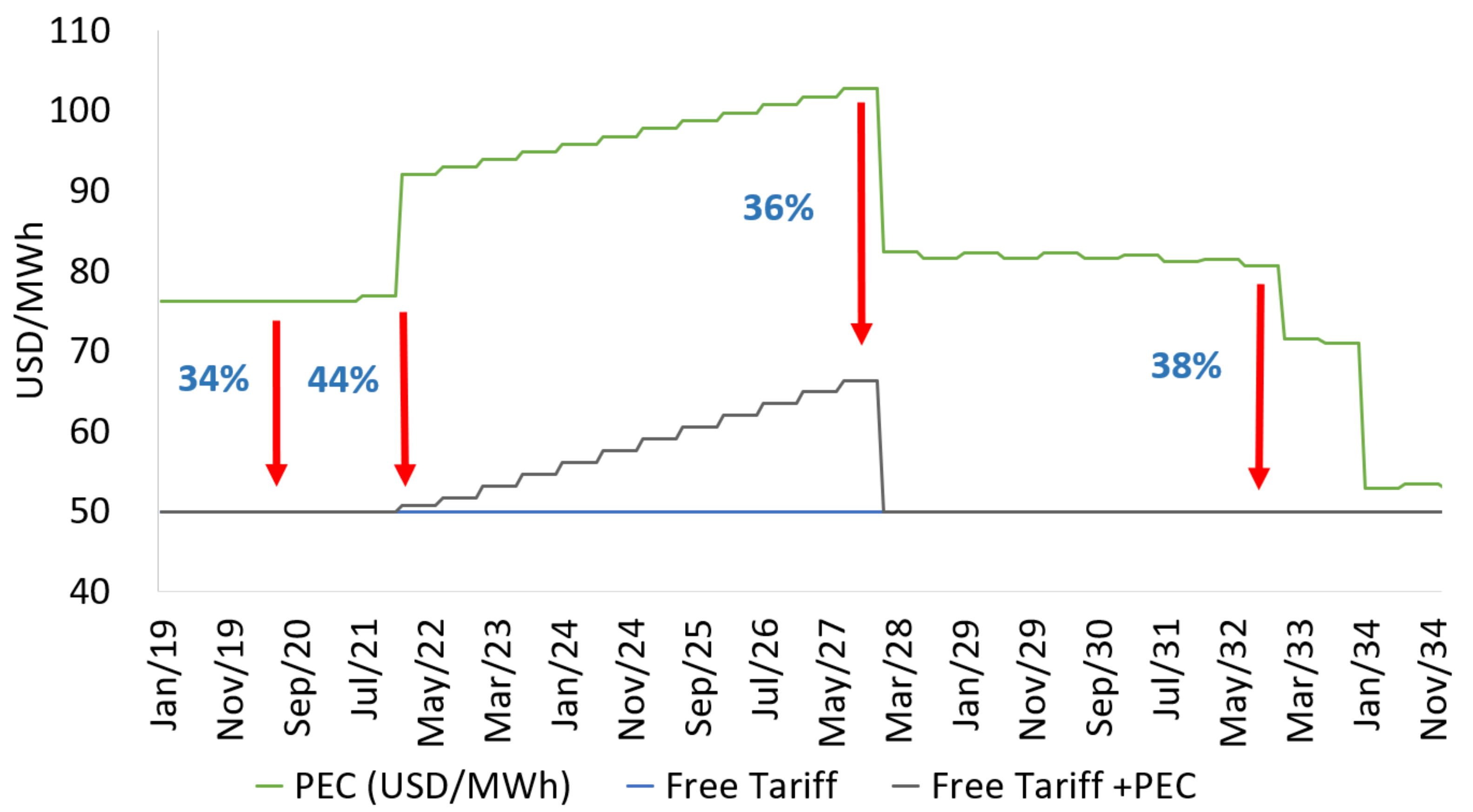

- Due to the debt stock saturation, a significant increase in the price perceived by the customers is expected for 2022.

- At the end of 2027, the expected electricity price and the PEC are equal, such as established Law 21.185. However, due to the final price distortion produced by the PEC mechanism implementation, the price until 2028 will be higher than the real price presented in 2019, also affecting the price reduction by the generation tenders based on renewable resources.

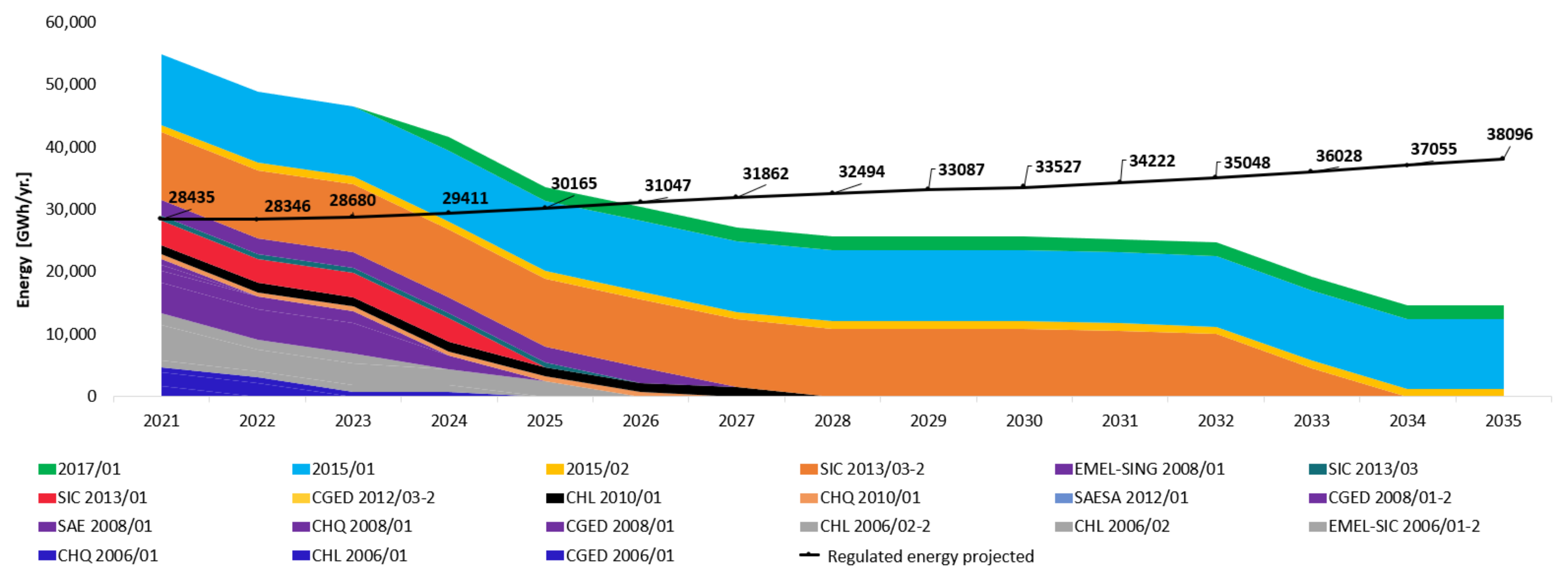

- The real electricity price will not drop significantly until 2032 because, in that year, the contracts awarded with high prices will be finished, specifically the 2013-03/2 tender.

- The PEC price for the first semester should be equal to the PNP; however, the dollar used to set the PEC price was significantly lower (USD 640.82) than the real dollar projections. Thus, the transfers rate to regulated customers considers a low exchange rate compared to the real exchange rate, one of the main reasons for the rapid balance increase of USD 1350 MM.

Short-Term Proposal to Face the Regulated Tariff

6. Discussion

7. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

Nomenclature

| EU | European Union |

| EC | European Commission |

| DSO | Distribution system operator |

| TSO | Transmission system operator |

| SM | Smart meters |

| RES | Renewable energy sources |

| FIT | Feed-in tariff |

| FIP | Feed-in premiums |

| GC | Green certificates |

| NEM | Net-metering |

| RPS | Renewable portfolio standard |

| RD | Royal decree |

| DL | Decree law |

| SME | Small- and medium-sized enterprises |

| CEER | Council of European Energy Regulators |

| CNE | Energy national commission |

| PNP | Average knot price |

| PEC | Price for regulated costumers |

References

- Chao, H.-P. Chao Global electricity transformation: The critical need for integrated market design and risk management research. Energy 2006, 31, 923–939. [Google Scholar] [CrossRef]

- Commission, E. Energy Prices and Costs in EUROPE. In Mitigation And Adaptation Strategies For Global Change. 2014, pp. 71–89. Available online: https://ec.europa.eu/commission/presscorner/detail/en/ip_22_5489 (accessed on 5 September 2022).

- Fatras, N.; Ma, Z.; Duan, H.; Jørgensen, B. A systematic review of electricity market liberalisation and its alignment with industrial consumer participation: A comparison between the Nordics and China. Renew. Sustain. Energy Rev. 2022, 167, 112793. Available online: https://www.sciencedirect.com/science/article/pii/S1364032122006773 (accessed on 1 August 2022). [CrossRef]

- Jensen, S.; Meibom, P. Investments in liberalised power markets: Gas turbine investment opportunities in the Nordic power system. Int. J. Electr. Power Energy Syst. 2008, 30, 113–124. Available online: https://www.sciencedirect.com/science/article/pii/S0142061507000841 (accessed on 1 August 2022). [CrossRef][Green Version]

- Itaoka, K.; Chapman, A.; Farabi-Asl, H. Underpinnings of consumer preferences and participation in Japan’s liberalized energy market. Util. Policy 2022, 76, 101379. Available online: https://www.sciencedirect.com/science/article/pii/S0957178722000443 (accessed on 1 August 2022). [CrossRef]

- Lee, B.; Chang, H.; Wang, S. Solar power promotion plans, energy market liberalization, and farmland prices—Empirical evidence from Taiwan. Energy Econ. 2021, 99, 105317. Available online: https://www.sciencedirect.com/science/article/pii/S0140988321002231 (accessed on 1 August 2022). [CrossRef]

- Feng, G.; Niu, P.; Wang, J.; Liu, J. Capital market liberalization and green innovation for sustainability: Evidence from China. Econ. Anal. Policy 2022, 75, 610–623. Available online: https://www.sciencedirect.com/science/article/pii/S0313592622000959 (accessed on 1 August 2022). [CrossRef]

- Papadaskalopoulos, D.; Ye, Y.; Qiu, D.; Li, J.; Strbac, G. Review of Electricity Market Design Challenges and Recommendations. March 2019. Available online: https://www.centrica.com/media/4381/review-of-electricity-market-design-challenges-and-recommendations.pdf (accessed on 5 September 2022).

- Galetovic, A.; Muñoz, C. Regulated electricity retailing in Chile. Energy Policy 2011, 39, 6453–6465. [Google Scholar] [CrossRef]

- Palacios, M.S.; Saavedra, P.E. Alternative policies for the liberalization of retail electricity markets in Chile. Util. Policy 2017, 49, 72–92. [Google Scholar] [CrossRef]

- Green, R. Electricity liberalisation in Europe-how competitive will it be? Energy Policy 2006, 34, 2532–2541. [Google Scholar] [CrossRef]

- Shukla, U.; Thampy, A. Analysis of competition and market power in the wholesale electricity market in India. Energy Policy 2011, 39, 2699–2710. [Google Scholar] [CrossRef]

- Tishler, A.; Newman, J.; Spekterman, I.; Woo, C. Assessing the options for a competitive electricity market in Israel. Util. Policy 2008, 16, 21–29. [Google Scholar] [CrossRef]

- Pollitt, M.; Brophy Haney, A. Dismantling a Competitive Retail Electricity Market: Residential Market Reforms in Great Britain. Electr. J. 2014, 27, 66–73. [Google Scholar] [CrossRef]

- Hellmer, S.; Waarell, L. On the evaluation of market power and market dominance-The Nordic electricity market. Energy Policy 2009, 37, 3235–3241. [Google Scholar] [CrossRef]

- Financiero, D.; Peña, K. Gobierno Prevé Ingreso de Reforma a la Distribución Eléctrica al Congreso en 2023: Diario Financiero. Available online: https://www.df.cl/empresas/energia/claudio-huepeministro-de-energiagobierno-preve-ingreso-de-reforma-a-la (accessed on 1 September 2022).

- Ministerio de Industria y Energía Ley 54/1997, de 27 de Noviembre, del Sector Eléctrico. Boe. 1997, pp. 35097–35126. Available online: http://www.boe.es/diarioboe/txt.php?id=BOE-A-1997-25340 (accessed on 1 September 2022).

- Chaparro-Peláez, J.; Acquila-Natale, E.; Hernández-García, Á.; Iglesias-Pradas, S. The Digital Transformation of the Retail Electricity Market in Spain. Energies 2020, 13, 2085. Available online: https://www.mdpi.com/1996-1073/13/8/2085 (accessed on 1 September 2022). [CrossRef]

- Jefaturadel, E. Ministerio de la Presidencia, Relaciones con las Cortes y Memoria Democrática del Estado Ley 34/1998, de 7 de octubre, del sector de hidrocarburos. Boletín Estado 1998, 241, 33517–33549. Available online: https://boe.es/buscar/doc.php?id=BOE-A-1998-23284 (accessed on 1 August 2022).

- Danish Energy Agency Liberalisation of the Danish Power Sector. 2020. Available online: https://ens.dk (accessed on 1 August 2022).

- Ostuni, M.; Bellia, L.; Andrea, G. The Energy Regulation and Markets Review: Italy. Law Rev. 2013, 221–238, Chapter 19. Available online: https://www.clearygottlieb.com/~/media/organize-archive/cgsh/files/italy-chapter-the-energy-regulation-and-markets-review-5th-edition.pdf (accessed on 1 August 2022).

- Stagnaro, C.; Amenta, C.; Di Croce, G.; Lavecchia, L. Managing the Liberalization of Italy’s Retail Electricity Market: A Policy Proposal. Energy Policy 2020, 137, 111150. [Google Scholar] [CrossRef]

- Grandclément, C.; Nadaï, A. Devising the consumer of the competitive electricity market: The mundane meter, the unbundling doctrine, and the re-bundling of choice. J. Cult. Econ. 2018, 11, 440–457. [Google Scholar] [CrossRef]

- Bauby, P.; Varone, F. Europeanization of the French electricity policy: Four paradoxes. J. Eur. Public Policy 2007, 14, 1048–1060. [Google Scholar] [CrossRef]

- Ferreira, P.; Araújo, M.; O’Kelly, M. An overview of the Portuguese electricity market. Energy Policy 2007, 35, 1967–1977. [Google Scholar] [CrossRef]

- Thomson Reuters Electricity Regulation in Portugal: Overview Reform. 2019. Available online: https://uk.practicallaw.thomsonreuters.com/6-564-1565?transitionType=Default&contextData=(sc.Default)&firstPage=true (accessed on 1 August 2022).

- Britz, G. ’Self-regulating cooperation’ and ’moderating regulation’, two concepts of the German Energy Industry Act (EnWG); “Selbstregulative Zusammenarbeit” und “moderierende Regulierung” im EnWG Energienetz. Zeitschrift Fuer Neues Energierecht 2006, 10, 91–96. [Google Scholar]

- Rodionova, I.A.; Shuvalova, O.V.; Erokhina, E.I. Liberalization of Electricity Market in Germany. In Proceedings of the ADVED 2018—4th International Conference on Advances in Education and Social Sciences, Istanbul, Turkey, 15–17 October 2018; pp. 446–453. [Google Scholar]

- Brandt, T. Liberalisation, privatisation and regulation in the German electricity sector. In Privatisation Of Public Services And The Impact On Quality, Employment and Productivity (PIQUE); Catholic University of Leuven: Leuven, Belgium, 2006. [Google Scholar]

- Woo, C.; Lloyd, D.; Tishler, A. Electricity market reform failures: UK, Norway, Alberta and California. Energy Policy 2003, 31, 1103–1115. [Google Scholar] [CrossRef]

- Massie, K.; England, J. Electricity Regulation in the United Kingdom: Overview. 2021. Available online: https://uk.practicallaw.thomsonreuters.com/w-029-0803?transitionType=Default&contextData=(sc.Default)&firstPage=true (accessed on 5 September 2022).

- Lee, N. When competition plays clean: How electricity market liberalization facilitated state-level climate policies in the United States. Energy Policy 2020, 139, 111308. [Google Scholar] [CrossRef]

- Wakiyama, T.; Zusman, E. The impact of electricity market reform and subnational climate policy on carbon dioxide emissions across the United States: A path analysis. Renew. Sustain. Energy Rev. 2021, 149, 111337. [Google Scholar] [CrossRef]

- Joskow, P. Markets for Power in the United States: An Interim Assessment. SSRN Electron. J. 2011. [Google Scholar] [CrossRef]

- Nacional, B. Biblioteca del Congreso Nacional: Ley DFL 1 Chile. Available online: https://www.bcn.cl/leychile/navegar?idNorma=3410 (accessed on 5 September 2022).

- Serra, P. Chile’s electricity markets: Four decades on from their original design. Energy Strategy Rev. 2022, 39, 100798. Available online: https://www.sciencedirect.com/science/article/pii/S2211467X21001814 (accessed on 1 August 2022). [CrossRef]

- Directive European Union 2006/32/EC of the European Parliament and of the Council of 5 April 2006 on energy end-use efficiency and energy services and repealing Council Directive 93/76/EEC (Text with EEA relevance). Off. J. Eur. Union 2006, 2006, 64–85.

- Commission, E.; Energy, D.; Alaton, C.; Tounquet, F. Benchmarking Smart Metering Deployment in the EU-28: Final Report; Publications Office: Luxembourg, 2020; Available online: https://data.europa.eu/doi/10.2833/492070 (accessed on 1 August 2022).

- USmartConsumer, European Commision; EASME. European Smart Metering Landscape Report “Utilities and Consumers”. Imprint 2016, 2, 1–168. [Google Scholar]

- Chawla, Y.; Kowalska-Pyzalska, A.; Silveira, P. Marketing and communications channels for diffusion of electricity smart meters in Portugal. Telemat. Inform. 2020, 50, 101385. [Google Scholar] [CrossRef]

- Rose, E. Smart meters and federal law: What is the role of federal law in the united states in the deployment of smart electricity metering? Electr. J. 2014, 27, 49–56. [Google Scholar] [CrossRef]

- Cooper, A.; Shuster, M. Electric Company Smart Meter Deployments: Foundation for a Smart Grid (2021 Update); The Edison Foundation Institute for Electric Innovation: Washington, DC, USA, April 2021. [Google Scholar]

- Schöpe, M. Renewable energy directive. Eur. Wind Energy Conf. Exhib. 2008, 1, 32–38. [Google Scholar]

- EPC. European Environment Agency. Directive 2001/77/EC on the promotion of electricity produced from renewable energy sources in the internal energy market. Eur. Parliam. Counc. OJ L 283/33 2001, 6, 12–25. [Google Scholar]

- Tornquist, S.; Jur, J. Energy for the Future: Renewable Sources of Energy; Commission of the European Communities: Brussels, Belgium, 1996. [Google Scholar]

- European Commission, The Directorate-General for Energy (DG ENER). Clean Energy for All Europeans; Publications Office: Luxembourg, 2019; Available online: https://data.europa.eu/doi/10.2833/9937 (accessed on 1 August 2022).

- Council of European Energy Regulators Status Review of Renewable Support Schemes in Europe for 2016 and 2017. 2018. Available online: https://www.ceer.eu/documents/104400/-/-/80ff3127-8328-52c3-4d01-0acbdb2d3bed (accessed on 1 August 2022).

- EC.European Union. 2018/2001 Directive (EU) 2018/2001 of the European Parliament and of the Council on the promotion of the use of energy from renewable sources. Off. J. Eur. Union 2018, 2018, 82–209. [Google Scholar]

- Ciarreta, A.; Pizarro-Irizar, C.; Zarraga, A. Renewable energy regulation and structural breaks: An empirical analysis of Spanish electricity price volatility. Energy Econ. 2020, 88, 104749. [Google Scholar] [CrossRef]

- Carley, S. The Era of State Energy Policy Innovation: A Review of Policy Instruments. Rev. Policy Res. 2011, 28, 265–294. [Google Scholar] [CrossRef]

- Aquila, G.; Pamplona, E.; Queiroz, A.; Rotela Junior, P.; Fonseca, M. An overview of incentive policies for the expansion of renewable energy generation in electricity power systems and the Brazilian experience. Renew. Sustain. Energy Rev. 2017, 70, 1090–1098. [Google Scholar] [CrossRef]

- Adami, V.; Antunes Júnior, J.; Sellitto, M. Regional industrial policy in the wind energy sector: The case of the State of Rio Grande do Sul, Brazil. Energy Policy 2017, 111, 18–27. [Google Scholar] [CrossRef]

- Iimura, A.; Cross, J. The impact of renewable energy on household electricity prices in liberalized electricity markets: A cross-national panel data analysis. Util. Policy 2018, 54, 96–106. [Google Scholar] [CrossRef]

- Silva, P.; Cerqueira, P. Assessing the determinants of household electricity prices in the EU: A system-GMM panel data approach. Renew. Sustain. Energy Rev. 2017, 73, 1131–1137. [Google Scholar] [CrossRef]

- Hyland, M. Restructuring European electricity markets—A panel data analysis. Util. Policy 2016, 38, 33–42. [Google Scholar] [CrossRef]

- Moreno, B.; López, A.; García-álvarez, M. The electricity prices in the European Union. The role of renewable energies and regulatory electric market reforms. Energy 2012, 48, 307–313. [Google Scholar] [CrossRef]

- European Union, C. Report from the Commission to the European Parliament, the Council, the European Economic and Social Committee and the Committee of the Regions on the Implementation of the EU Action Plan 2017–2019 on Tackling the Gender Pay Gap. Brussels, 6 March 2020. Available online: https://www.europa-nu.nl/id/vl6r892eqey6/report_from_the_commission_to_the (accessed on 1 August 2022).

- Council of European Energy Regulators Monitoring Report on the Performance of European Retail Markets in 2018 CEER Report Monitoring Retail Markets WS of Customers and Retail Markets WG. 2019. Available online: https://www.ceer.eu/documents/104400/-/-/5c492f87-c88f-6c78-5852-43f1f13c89e4 (accessed on 1 August 2022).

- Agency for the Cooperation of Energy Regulatiors. Annual Report on the Results of Monitoring the Internal Electricity and Natural Gas Markets in 2014; Agency for the Cooperation of Energy Regulatiors: Ljubljana, Slovenia, 2014. [Google Scholar]

- CNE Comisión Nacional de Energía de Chile—Tarificación. 2021. Available online: https://www.cne.cl/tarificacion/electrica/ (accessed on 1 September 2021).

- Fredes, H.V.; Acosta, B.; Olivares, M.; García-Muñoz, F.; Tobar, F.; Toro, V.; Smith, C.; Becker, C. Impact of Energy Price Stabilization Mechanism on Regulated Clients’ Tariffs: The Case of Chile. Sustainability 2021, 13, 11870. Available online: https://www.mdpi.com/2071-1050/13/21/11870 (accessed on 1 August 2022). [CrossRef]

- Nacional, B. Biblioteca del Congreso Nacional: Ley 20. 936 Chile. Available online: https://www.bcn.cl/leychile/navegar?i=1092695&f=2017-02-09 (accessed on 1 August 2022).

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Verdejo-Fredes, H.; García-Muñoz, F.; Tobar, F.; Becker, C.; Olivares, M.; Zolezzi, J.; Guzmán, G. Retail Electricity Market Liberalization: An Overview of International Experience and Effects on the Chilean Regulated Tariff. Sustainability 2022, 14, 13996. https://doi.org/10.3390/su142113996

Verdejo-Fredes H, García-Muñoz F, Tobar F, Becker C, Olivares M, Zolezzi J, Guzmán G. Retail Electricity Market Liberalization: An Overview of International Experience and Effects on the Chilean Regulated Tariff. Sustainability. 2022; 14(21):13996. https://doi.org/10.3390/su142113996

Chicago/Turabian StyleVerdejo-Fredes, Humberto, Fernando García-Muñoz, Francisco Tobar, Cristhian Becker, Mauricio Olivares, Juan Zolezzi, and Guillermo Guzmán. 2022. "Retail Electricity Market Liberalization: An Overview of International Experience and Effects on the Chilean Regulated Tariff" Sustainability 14, no. 21: 13996. https://doi.org/10.3390/su142113996

APA StyleVerdejo-Fredes, H., García-Muñoz, F., Tobar, F., Becker, C., Olivares, M., Zolezzi, J., & Guzmán, G. (2022). Retail Electricity Market Liberalization: An Overview of International Experience and Effects on the Chilean Regulated Tariff. Sustainability, 14(21), 13996. https://doi.org/10.3390/su142113996