Abstract

The aims of this paper are: (1) to examine the extent of corporate governance disclosure on the websites of Indonesian and Malaysian FinTech companies using the coercive isomorphism tenet, and (2) to determine whether variation in the extent of corporate governance disclosure is influenced by the country and type of FinTech services. The websites of 148 Indonesian and 159 Malaysian corporations were subjected to content analysis using a Modified Corporate Governance Disclosure Index (MoCGOvDi). The MoCGovDi was constructed using the ASEAN Corporate Governance Scorecard and previous research. The level of corporate governance disclosure is higher among Malaysian FinTech companies, possibly due to stronger coercive pressure by government regulation in Malaysia. Overall, the level of corporate governance disclosure is low in both countries (7 and 9 items out of 50 total items for Indonesia and Malaysia, respectively), which may delay the achievement of SDG No 16. Several implications are provided in this paper to advocate the corporate governance disclosure of FinTech companies in Indonesia and Malaysia to achieve SDG No 16.

1. Introduction

Sustainability is an important agenda at various levels, i.e., individuals, organizations, and nations. Organizations are doing their best to advance the 17 United Nations 2030 sustainable development goals (SDGs). One of the ways implemented by organizations is by carrying out good corporate governance practices. Corporate governance practice is highly associated with SDG No. 16, i.e., peaceful, just, and inclusive societies. In order to foster peaceful, just, and inclusive societies and to ensure sustainable development, SDG 16 outlines the crucial roles that governance and the rule of law play. This paper is developed based on Conway et al. [1], which incorporates the broader perspective of corporate governance that highlights the need to be accountable to stakeholders. This is possibly done through disclosure or reporting. Corporate governance reporting has received acceptance by scholars, with a variety of clarifications of the justification of such disclosure [1]. Corporate governance disclosure refers to how transparently an organization communicates to stakeholders its governance practices and strategies [2].

Based on the OECD general guidelines on corporate governance [3,4], corporate governance information would be communicated via platforms that are equal, timely, and accessible. Improved disclosure of corporate governance information would increase the monitoring capabilities of shareholders and the board of directors. Studies relating to corporate governance and websites found that websites are useful channels for communication with stakeholders. The research also found low levels of corporate governance practices disclosed on the company website, which might be because there is not enough oversight [1]. This indicates a lack of accountability which possibly hinders the realization of SDG No. 16. Various companies, including FinTech companies, implement the corporate governance disclosure.

FinTech refers to companies that combine innovative technologies with financial services [5]. FinTech investments increased globally from less than USD 10 billion annually before 2013 to USD 215 billion in 2019 before declining to about USD 122 billion in 2020. The amount invested in FinTech by the first half of 2021 was already USD 98 billion [6].

FinTech is considered one of the most important breakthroughs in the financial sector. The FinTech evolution is accelerated by the auspicious rule and information technology. FinTech promises to disrupt and transform the financial sector by improving the superiority of fiscal provisions, reducing costs, and establishing a numerous diverged and steady financial environment [5,7]. With the rapid evolution of underlying advanced tools, for example, blockchain and artificial intelligence, and their widespread application in various financial-business contexts, FinTech has emerged as a crucial force in the transformation and innovation of the financial industry [8]. In addition, websites, just like blockchain, can be used to accelerate the SDG progress [9].

Interestingly, the FinTech market has the spirit of increasing financial inclusion by reaching out to people who have difficulty accessing conventional financial institutions. The problem of FinTech in Indonesia has had an impact not only on the economic aspects of society but has transformed into a form of disruptive innovation that changes the style of people’s transactions [10]. FinTech delivers support to the business sphere in reducing inadequacies in their payment scheme through mobile payments, peer-to-peer (P2P) lending, robotic investment advice, blockchain technology, artificial intelligence, and machine learning [11].

FinTech companies are developing rapid evolution in recent years and have had a significant impact on society [12]. FinTech companies have already started to close the financial enclosure disparity by ways of providing facilities to the unbanked at the base (bottom) of the pyramid, made possible by new business models and information and communication technologies (ICT) [5,12]. Research on FinTech companies is pivotal because these emerging digital financial services rely on investors’ funds to establish and expand their businesses. Therefore, providing effective and accountable information by FinTech companies is crucial for the achievement of SDG No 16 by carrying out effective corporate governance practices.

FinTech is the disruption in the financial industry that aims to ease access to the financial services provider and makes an effective and efficient service delivery. However, FinTech might carry some risks that are not negligible. According to KPMG [13], the FinTech industry carries three kinds of risks: risks to consumers and investors, risks to financial services firms, and risks to financial stability.

FinTech comes with risks that may harm consumers, such as the lack of consumer understanding of the nature of FinTech and its operation. The tech-savvy people might be easy to understand, but the non-tech-savvy and older people might find difficulties in understanding the services offered by FinTech. Moreover, consumers are vulnerable to losing their data and may not know how it is used. Therefore, data privacy, security, and protection are essential for consumers because when using the FinTech solution, consumers are requested to give up their data to the FinTech provider. The unauthorized use of technology poses a threat since it is possible to track people without their consent [14]. Issues of data privacy and data security regarding consumer information and protection negatively impact individuals as well as the soundness and stability of strong institutions (SDG 16) [15].

The other risks are that the boards and senior management of FinTech firms may not have sufficient awareness and understanding of FinTech and FinTech-related risks, and may, therefore, be unable to identify, measure, manage and control these risks effectively. Responsibilities and accountabilities for FinTech and risk management may also not be sufficiently clear. FinTech developments also have increased the competitive pressures on many financial services firms. Some will struggle to survive. Forbes [16] reported that in Fintech, 2022 is becoming the year of layoffs. Through LinkedIn research and speaking directly with companies and industry insiders, Forbes identified nine FinTech businesses that have apparently shrunk their labor forces recently without any announcement or public reporting of their downsizing. Therefore, the implementation of good corporate governance is pivotal for the FinTech industry.

The SDG’s 16 goal is “Promote peaceful and inclusive societies for sustainable development, provide access to justice for all and build effective, accountable and inclusive institutions at all levels”. To build strong institutions requires strong governance as well. The four principles of good governance are accountability, transparency, openness, and the rule of law. This study elaborates on how FinTech institutions present corporate governance disclosure. The FinTech industry was chosen because it is an industry that is experiencing rapid growth. The public responds positively to FinTech companies. The Fintech industry is considered a solution for demographic bonuses, a solution to reduce unemployment rates. The government immediately responded by preparing regulations and various policies to encourage the development of this FinTech industry. Therefore, it is important and interesting how the FinTech company’s governance is, whether the FinTech company has also disclosed it on their website. There is limited research on the disclosure of governance in FinTech companies. Several studies on corporate disclosure were conducted in publicly listed companies using ASEAN CG Scorecard. Therefore, this study developed the Modified Corporate Governance Disclosure Index (MoCGOvDi) to better reflect FinTech companies’ characteristics.

It is worth comparing the Indonesian and Malaysian contexts because the two nations have similarities and differences in their history and culture [17]. Besides geographical proximity, both countries are categorized as emerging economies and develop FinTech as a financial industry. Based on Singapore and Malaysia FinTech News Portal, Indonesia has 181 fintech companies, while based on Malaysia Fintech Portal, Malaysia has 201 fintech companies. However, after excluding unavailable, restricted, and duplicate websites, the authors found that Indonesia and Malaysia have 148 and 159 FinTech companies, respectively, which are included in this paper.

1.1. Corporate Governance in Malaysia

The corporate governance reformation in Malaysia has been strengthened throughout time. The 2016 Companies Act sets the regulatory framework for Malaysian corporations. Introduced in 2000, the Malaysian Code on Corporate Governance (MCCG) has been an important institutional foundation for corporate governance reform and has had a favorable impact on the corporate governance practices of corporations. The MCCG incorporates worldwide concepts and widely recognized practices of corporate governance that exceed the minimum requirements established by statute, regulation, or Bursa Malaysia Berhad (the stock exchange of Malaysia). The revision of MCCG took place in 2007, 2012, and 2017 to ensure its continued relevance and alignment with internationally recognized best practices and standards. The MCCG was modified in April 2021 to adopt a new strategy to encourage the internalization of corporate governance culture.

Bursa Malaysia Berhad’s Corporate Governance Guide aims to enhance the adoption and implementation of corporate governance procedures by preparing listed issuers with useful assistance. The Guide was created to represent the latest ways of thinking and the “CARE” (C—Comprehend; A—Apply; Re—Report) principle that drives the MCCG. The Guide provides an understanding of good corporate governance practices and how such principles might be used and actualized in content instead of form to assist organizations in creating sustainable value [18].

1.2. Corporate Governance in Indonesia

In Indonesia, limited liability corporations are governed by Law No. 40 of 2007 on Limited Liability Companies (Company Law). The Company Law outlines the general responsibilities of a company’s shareholders, boards of directors, boards of commissioners, employees, commercial partners, and the general public.

The Financial Services Authority (Otoritas Jasa Keuangan or OJK) additionally controls corporate governance for specific forms of organizations and companies. OJK regulations oversee corporate governance conditions for the financial sectors and public companies.

The Coordinating Ministry for Economic Affairs set up the National Committee on Governance (NGC) through the Decree of Coordinating Ministry for Economic Affairs No. KEP-49/M.EKON/11/TAHUN 2004. Subsequently, this ruling was revised by Coordinating Ministry for Economic Affairs Decree No. KEP-14/M.EKON/03/Year 2008. According to the NGC’s stated mission, the Indonesian Code of Good Corporate Governance was formulated, promoted, and made easier to apply and enforce.

In 2006, the GCG Code was firstly issued. It was clearly stated that the GCG Code is not a lawful document and, intrinsically, corporations in Indonesia are not bound by it. The GCG Code is a methodology that gives corporate governance implementation guidelines for businesses [19].

1.3. FinTech Regulation in Indonesia and Malaysia

According to the Cambridge Centre for Alternative Finance (CCAF), Indonesia and Malaysia are among the leading ASEAN nations in terms of the number of FinTech enterprises [20]. Bank Indonesia (BI) is the Central Bank and is responsible for all aspects of financial stability and supervision. The Indonesian Financial Services Authority (OJK) regulates the financial services industry, which includes the registration, security, and licensing of FinTech companies [21].

In the case of Malaysia, there are two primary regulatory agencies. Bank Negara Malaysia (BNM), the country’s central bank, oversees the nation’s financial establishments, credit system, and fiscal plan. Securities Commission Malaysia (SC) is a statutory agency charged with regulating and systematizing the development of Malaysia’s capital markets [21]. Table 1 summarizes the FinTech regulations in both countries.

Table 1.

FinTech Regulation in Indonesia and Malaysia.

There is evidence from prior research that good corporate governance practices can promote company transparency by increasing voluntary disclosure levels [22]. Disclosure studies have been carried out extensively for big corporations and publicly traded firms, but studies using FinTech companies, which are often less regulated, are scarce [23]. FinTech companies are not often large publicly traded corporations; instead, they are mainly start-ups, which may explain why there is a limited study on their disclosure, which in turn, affect the achievement of SDG No. 16. FinTech clients are small enterprises and individuals who have little access to information other than what these companies supply on their websites. As a result, the website’s information serves a vital purpose for stakeholders and society [23], which provides the motivation for this paper. Correspondingly, the research questions posited in this paper are:

- RQ1—What is the extent of corporate governance disclosure in both Malaysian and Indonesian FinTech companies?

- RQ2—Do the country and type of FinTech services affect the extent of corporate governance disclosure in both Malaysian and Indonesian FinTech companies?

In prior research, the industrial sector has been identified as a significant factor in determining whether a high or low level of information is disclosed [24]. Arguably, different practices exist in each country. The rationale for studying this variable is that organizations in the same industrial sector or service have similar information-disclosure policies. In this paper, each FinTech service represents a distinct FinTech Business sector.

This paper adds to the literature in several significant ways. First, the application of a Modified Corporate Governance Disclosure Index (MoCGOvDi) is expected to expand the corpus of research on corporate governance in FinTech companies. The research’s novelty is demonstrated by the index derived from the ASEAN Corporate Governance Scorecard and prior literature. Most studies examined corporate governance information disclosure using other guidelines such as AAOIFI and IFSB involving Islamic banks [25,26]; banks [27]; Guidance on Good Practices in Corporate Governance Disclosure’ issue by the ISAR (International Standards of Accounting and Reporting) [28], companies and ASX corporate governance guidelines [1], banks using the Code of Corporate Governance for Public Companies in Nigeria, 2011 and the Code of Corporate Governance for Banks and Discount Houses 2014 [29]; Islamic financial institutions the corporate governance for licensed Islamic banks (GP1-i) issued by the Bank Negara Malaysia (BNM) in 2007, guiding principles on corporate governance for institutions offering only Islamic services (excluding Islamic insurance [Takaful] institutions and Islamic mutual funds) introduced by IFSB [30]. Consequently, the results may serve as a point of reference for future studies tracing any changes to corporate governance regulations.

Second, from the perspective of coercive isomorphism under the institutional theory, this study contributes to the insight into the corporate governance disclosures practice of FinTech companies in Indonesia and Malaysia, in which there is a dearth of investigation in this field, which is also related to SDG No. 16. According to the authors’ knowledge, the specific governance-related information is among the first research on corporate governance in FinTech companies. The remaining sections of the paper are organized as follows. Section 2 is a discussion of the literature review and the study’s theoretical framework. Section 3 covers the methodology, while Section 4 covers the results and discussions. Lastly, Section 5 concludes the paper.

2. Literature Review

2.1. Past Studies Relating to Corporate Governance Disclosure

Corporate governance has long been a source of concern for scholars. Several scandals have captured headlines in recent years, along with the Enron, Lehman Brothers, and Volkswagen scandals. This instance is frequently mentioned in studies on the necessity of effective corporate governance. In line with the study’s findings, transparency, leadership, and organizational culture define strong corporate governance [31]. According to research relating to corporate governance, three clusters exist, first, corporate social responsibility and reporting; second, corporate governance strategies; and third, board composition [32].

If corporate governance is defined as a firm control system that involves a series of relationships between its stakeholders with the goal of boosting economic efficiency [32], [33]. In that case, corporate governance disclosure is described as a tool to reveal corporate governance information. The organization’s openness to reveal management practices, financial reporting, and other vital information is an example of transparency that fosters trust among stakeholders. This phenomenon has lately increased studies on corporate governance disclosure. Accountability, honesty, and openness are all enhanced by corporate disclosures. The corporation shares essential information with all its stakeholders through Corporate Disclosures [33]. Corporate disclosure study was conducted using publicly available stock exchange data [34]. Several studies have been conducted to determine what kinds of data are transparent. The scope of the study varies, involving organizations such as profit companies’ businesses, non-profits, and state-owned enterprises, with national or worldwide regions of interest, or comparing nations.

Today’s world is familiar with the financial technology business, which is in accordance with the century of technological growth. FinTech signifies the application of technology into financial services corporations’ contributions to improve their procedure and supply to customers. This is achievable by unbundling such organizations’ contributions and creating new markets for them. This industry is rapidly expanding and is popular among millennials. FinTech, a new business with a significant turnover, is also essential to practice good governance. Unfortunately, certain unfavorable cases hurt the population; thus, testing and in-depth investigations to determine the cause are required. There is still a scarcity of studies on the subject. Several studies on FinTech are related to the topic of business models. Six FinTech business models, including payments, wealth management, crowdfunding, loans, capital market, and insurance services, have been adopted by the expanding number of FinTech start-ups [35].

2.2. Past Studies Relating to Corporate Governance Disclosure on Websites

The study of information disclosure on the website is also becoming more popular. Most website observations are used to learn about financial statements, good governance, and corporate social responsibility for publicly traded firms [36,37], governments [38], and other institutions. Only Herrador-Alcaide and Hernández-Solís [23] studied FinTech companies and found that there are not any effects due to the type of service (Banking and data analytics, payments, capital markets technology, financial management) or the geographical area (Europe, North America, Worldwide, Asia-Pacific) on the disclosure of FinTech companies.

2.3. Past Studies Relating to Factors Affecting the Extent of Corporate Governance Disclosure

Joseph et al. [39] examined the level of integrity framework information disclosed on the websites of 51 Malaysian and 34 Indonesian local governments. The findings suggested that the disclosures of the 34 Indonesian local governments were superior to those of Malaysia’s 51 city and municipal councils. On average, Indonesia published 29 out of 47 studied items on their websites, while Malaysia disclosed only four items. Another study using the sample of government websites conducted by Stewart et al. [38] examined corporate governance disclosures on the websites of 36 state government departments in Australia. It was revealed from the study that both the level of disclosure and the accessibility of the information disclosed vary considerably. In addition, the study identified a lack of agreement over the definition of governance and what it entailed, as well as the requirement for an extra organized way to share governance info with stakeholders. Gandía [37] investigated the corporate governance information provided online by 92 non-financial firms listed on the Spanish capital market. It was revealed that the level of disclosure depends on the extent to which businesses are observed by analysts, their age of listing, their media presence, and their involvement in the communications and information services industry. Mulyadi [40] studied the corporate governance disclosure practices of the 50 top-listed family-owned enterprises in Indonesia and the extent to which company websites supplement or replace annual reports that include corporate governance disclosures. The study found that Indonesia’s disclosure policies were still inadequate, particularly those of family-owned businesses. Using 21 disclosure items from the United Nations Conference on Trade and Development’s corporate governance disclosure benchmark that are required in Indonesia, the study discovered that only three firms publish corporate governance information in their annual reports and none on their websites. Using the sample of banks, Feldioreanu and Seria [27] studied the influence of culture, company size, and profitability on corporate governance disclosure practices using 34 banks in Romania and Malaysia. The study found that Romanian banks disclose less information regarding corporate governance than Malaysian banks. However, the quality of websites for Romanian banks is higher. This study illustrates the likelihood of better-performing banks releasing more corporate governance information than fewer profitable financial institutions. Last but not least, Herrador-Alcaide and Hernández-Solís [23] carried out an investigation based on the analysis of information disclosed by firms on two FinTech top lists. Using data from 91 FinTech companies across Europe, Asia, and North America, the study concluded that neither the type of services nor the geographic location had any effect on the disclosure of FinTech companies.

2.4. Theoretical Framework

This paper uses the institutional theory to support the corporate governance disclosures by Indonesian and Malaysian FinTech companies. Corporate governance disclosure is an organizational practice that is shaped by the institutional environments in which the organizations operate [41,42]. Wijayati [42] argued that the institutional theory could explain the corporate governance disclosure practices in Indonesia and Malaysia due to the differences in corporate governance practices in both countries. According to Wijayati [42], a country with a specific institutional framework undergoes isomorphic processes that cause corporate governance practices to become increasingly uniform among enterprises.

According to DiMaggio and Powell [43], the situation that explains the standardization of organizational practices is isomorphism. Isomorphism could be classified into coercive, normative, and mimetic. The highly noticeable institutional pressure is coercive isomorphism. Based on DiMaggio and Powell [43], forces can be exercised by another corporation on which a corporation may be dependent, in addition to cultural beliefs inside the organization’s operating environment. This paper uses the coercive isomorphism tenet to explain the extent of corporate governance disclosure in both Indonesian and Malaysian FinTech companies. This paper discusses the coercive pressures from the regulatory authority monitoring and regulating corporate governance practices.

Mimetic isomorphism constitutes the second institutional pressure. Mimetic isomorphism encourages copying the best practices of legitimate and successful organizations [43]. The copying behavior is likely to occur if the organizations have doubts about executing specific best practices that lead to mimicking behavior among members in the same organizational field.

Normative isomorphism is the third isomorphism. This pressure usually arises from professionals and occupational groups [39]. This is normally the sharing of norms, beliefs, and culture involving the organizational practices throughout the corporations.

3. Methodology

The data in this study were collected based on a content analysis of the disclosure of corporate governance information on the websites of Malaysian and Indonesian FinTech companies. Since websites offer the maximum openly accessible information that could be employed as a credible supply of data, the disclosures on the website were examined [39]. In addition, Malaysia and Indonesia are implementing voluntary disclosure of corporate governance information on their FinTech companies’ websites.

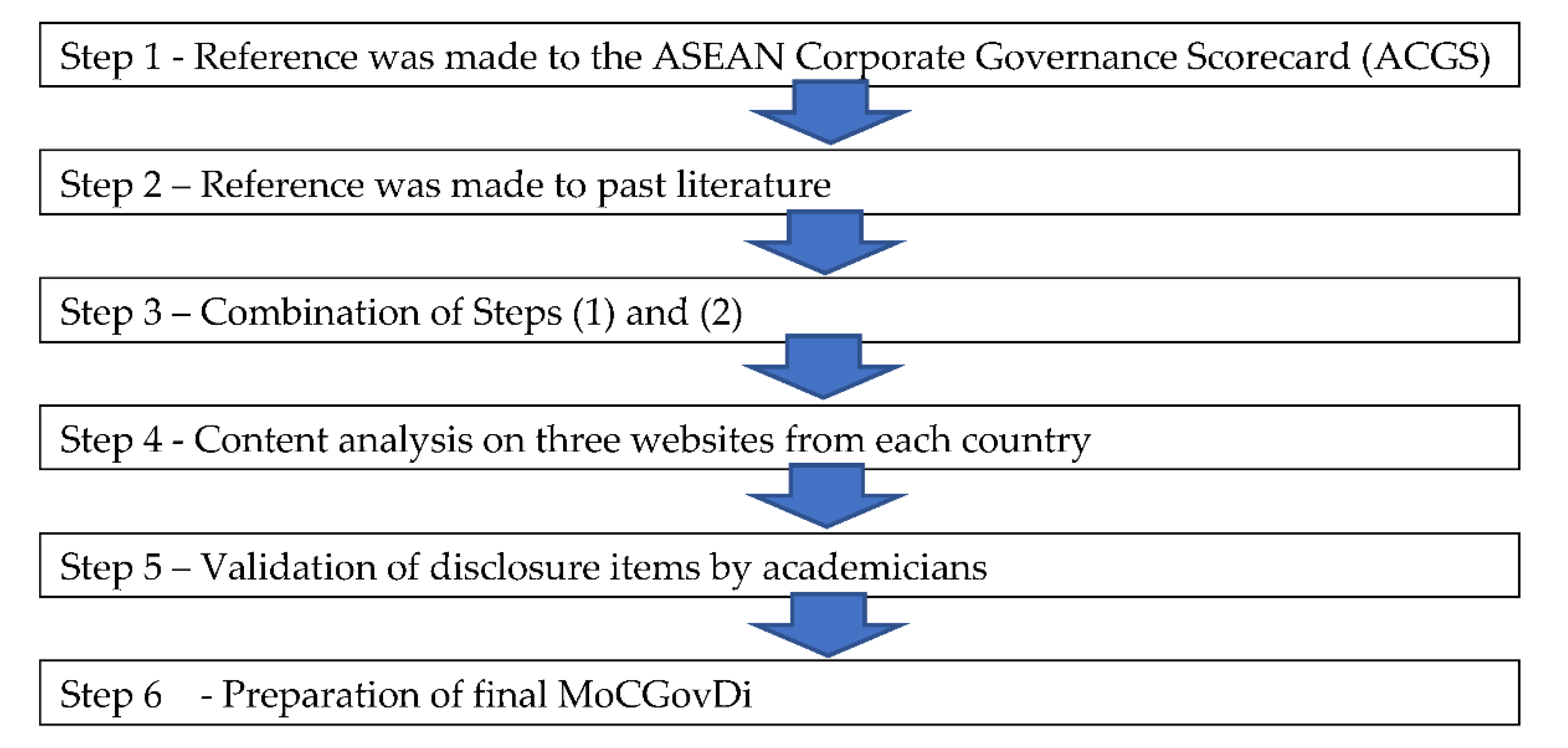

Content analysis has been extensively carried out in disclosure studies, for example, Joseph et al. and Midin et al. [39,44]. One of the effective ways to quantify qualitative data is through content analysis, which enables us to analyze practices through disclosures [45]. The Modified Corporate Governance Disclosure Index (MoCGovDi) was developed based on several steps.

- Step 1

Reference was made to the ASEAN Corporate Governance Scorecard (ACGS), which has two levels of scoring for corporate governance practice. The measurement of governance ratings is prepared based on the methodology applied in the ASEAN countries and multilateral institutions such as the OECD. The ACGS is a scorecard of the good corporate governance evaluation and ranking for public companies in ASEAN. This scorecard is a provincial effort from the ASEAN Capital Market Forum (ACMF) in cooperation with the Asian Development Bank (ADB) since 2011 [46]. This paper refers to the first level of scoring, comprised of five categories (146 items) based on the principles of governance by the OECD. All the questions in the five parts are refined as disclosure items in the development of the Modified Corporate Governance Disclosure Index (MoCGovDi). Originally, the details in five parts of level 1 scoring are:

- Part A: Rights of Shareholders—21

- Part B: Equitable Treatment of Shareholders—15

- Part C: Role of Stakeholders—13

- Part D: Disclosure and Transparency—32

- Part E: Responsibilities of the Board—65

- 2.

- Step 2

Reference was made to past literature to ascertain the additional items to be incorporated into the MoCGovDi, i.e., (1) Feldioreanu & Seria; (2) Suwaidan et al. [47]; (3) Hassan [48]; (4) Shahar et al. [30]. The modification to the current standard measurement of corporate governance disclosure is important because this study aims to examine the actual disclosures available on websites. In addition, the study takes into consideration the disclosure items that are available for FinTech companies in both countries and, at the same time, determines whether the disclosure is in line with past literature, which is commonly performed in the disclosure index development, e.g., see Joseph et al. [49].

- 3.

- Step 3

Steps 1 and 2 are combined. The total number of items is equal to 157.

- 4.

- Step 4

Referring to items in Step 3, the content analysis on three websites from each country was conducted. The actual disclosed items were identified and added to the MoCGovDi. The 102 non-disclosed items were eliminated from the MoCGovDi. Five overlapping items were also deleted from the checklist.

- 5.

- Step 5

The MoCGovDi is sent for validation by academicians specializing in corporate governance.

- 6.

- Step 6

The final MoCGovDi consists of five categories and 50 items. Figure 1 summarizes the steps.

Figure 1.

Steps in the Development of Modified Corporate Governance Disclosure Index (MoCGovDi).

- Part A: Rights of Shareholders—3

- Part B: Equitable Treatment of Shareholders—2

- Part C: Role of Stakeholders—13

- Part D: Disclosure and Transparency—10

- Part E: Responsibilities of the Board—22

In this study, data was collected in each country by coders, who assigned scores of 1 for relevant disclosure and 0 for no disclosure, following Joseph et al. [39]. Nevertheless, the analysis of data for both countries was merged. In order to lessen bias and increase trustworthiness, the two coders in each country performed the content analysis. Between 26 June and 11 July 2022, coders collected and tabulated the disclosure information from the websites. The Statistical Package for Social Science (SPSS) was used to compute and analyze the frequency of sub-categorizations. The sample selection of this research was based on the websites https://fintechnews.sg/fintech-startups-in-indonesia/ (accessed on 26 June 2022) for Indonesian FinTech companies and https://fintechnews.my/list-fintech-startup-malaysia-fintech-companies-malaysia-directory/ (accessed on 3 July 2022) for Malaysian FinTech companies. To answer the first research question, descriptive tests were performed. The independent t-test and ANOVA were performed to answer the second research question.

4. Results and Discussion

The descriptive tests are carried out to answer the first research question. Table 2 shows that the total sample of Indonesian and Malaysian FinTech companies are 148 and 159, respectively. The mean of disclosure for Indonesian FinTech companies is 6.74, while the mean of disclosure for Malaysian FinTech companies is 8.5. It shows that Malaysian FinTech companies disclose more information than their Indonesian counterparts. However, Malaysian FinTech companies have greater dispersion of disclosure. It was indicated by a higher standard deviation score than Indonesia.

Table 2.

Descriptive Statistics.

The highest amount of disclosure items by Indonesian FinTech companies is 44 items, while the highest amount of disclosure items by Malaysian FinTech companies is 46 items. The company with the highest amount of disclosure is a payment FinTech, i.e., Cashlez. Cashlez disclosed many items due to its status as a listed company on the Indonesian Stock Exchange. Therefore, Cashlez is obliged to implement good corporate governance practices. Moreover, the same thing happens in the Malaysian FinTech industry. XOX Mobile, the company with the highest disclosure, is also listed in Bursa Malaysia. Some companies with a high amount of disclosure, such as Grabkios, Paypal, Samsungpay, TM One, and Rakuten Trade, are due to their websites being integrated with their parent companies. This clearly indicates that the parent company is responsible to coerce the requirements for subsidiary companies to implement the SDG 16 initiatives that include the disclosure of corporate governance information on websites.

In terms of the most disclosed items, the two items that are the most disclosed by FinTech companies in Indonesia and Malaysia are the items of the company’s activity and company’s policy and practices to address customers’ welfare. Both items focused on customer services and overall information about the firm. It shows that as an emerging and growing industry, FinTech companies are more concerned about the business aspect than the governance aspect. Therefore, the lack of accountability due to low disclosure of corporate governance information might hamper the achievement of SDG No 16. This indicates that Fintech companies in both countries are not fully ready to contribute to global governance through their external engagement with other stakeholders. Thus, more awareness of the importance of SDG 16 via corporate governance disclosure should be promoted, as SDG 16 permits firms to communicate their broader role in shaping societies and institutions.

The second research question in this study is: do the country and type of FinTech services affect the extent of corporate governance disclosure in both Malaysian and Indonesian FinTech companies? Previous studies have deemed that the country is a critical factor influencing the disclosure level [50,51]. The second research question is answered by the t-test. The p-value in the t-test takes 0.044 < 0.05 (Sig. level). Thus, country has a significant effect on the corporate governance disclosure of FinTech companies. Therefore, the findings suggest a statistical association between the countries and the amount of corporate governance disclosure on the websites.

According to the result of the t-test in Table 3, this study found that Malaysian FinTech companies disclose more corporate governance information than their Indonesian counterparts. The possible reason for this difference might be due to Malaysian Code of Corporate Governance (MCCG) came earlier in 2000 than the Indonesian GCG Code in 2006. Therefore, MCCG is more embedded in Malaysian companies. Besides that, according to the coercive isomorphism tenet, it might imply that Malaysia’s government uses its coercive powers to pressure businesses to disclose corporate governance information rather than Indonesia’s government. This finding is incompatible with the study conducted by Joseph et al. [39] that indicated Indonesian local authorities or provinces exceeded Malaysia’s city and municipal councils’ disclosures. Thus, it is maintained that the push towards achieving SDG 16 via disclosure practices differs based on the functions of organizations. Undeniably, the close tie between local authority and community assists in advancing SDG 16 as compared to role of business organizations such as FinTech companies in maximizing profits. In addition, different priorities in certain sectors in different countries also potentially influence the variation in corporate governance disclosure that affects the realization of SDG 16.

Table 3.

T-test for Country.

The results shown in Table 4 show that payment FinTech is the most prominent type of FinTech company in Indonesia and Malaysia (115 companies), followed by lending FinTech (42 companies). The mean of disclosure for payment and lending FinTech companies is also the largest among the sector, with scores of 8.6 and 8.3, respectively. However, payment FinTech companies have greater dispersion of disclosure than lending FinTech companies. It is indicated by the higher score of the standard deviation of payment FinTech companies. It is possible since payment and lending FinTech companies as the most popular type of FinTech. Both service types gained the most active users in Indonesia and Malaysia. Therefore, there might be enforcement by BI, BNM, OJK, and SC as the regulators of payment and lending FinTech companies to disclose more rather than their counterparts. It indicates that coercive isomorphism from relevant authorities such as BI, BNM, OJK, and SC might force both service types to comply more with the corporate governance code.

Table 4.

Descriptive Statistics.

BNM and BI regulate digital payment and e-money. Meanwhile, SC and OJK regulate the other fintech sector such as crowdfunding, peer-to-peer lending, and the like. The regulators have introduced The Regulatory Sandbox to facilitate and encourage FinTech innovation. It is a formal regulatory program that allows FinTech firms to test their business model in actual business practice, subject to certain safeguards and oversight. The regulators need to be flexible to welcome new entrants and take a more business-friendly approach in allowing financial innovation and sectorial growth. However, they also must be cautious in their licensing and approval processes, where only new operators with proper capability and resources will be selected to ensure adequate safeguards and system integrity are in place and to prevent over-crowding in the FinTech space in Indonesia and Malaysia.

The second research question has been tested using ANOVA. The relationship between each group of FinTech companies by service type and the extent of information disclosed is shown in Table 5. The p-value in the ANOVA = 0.236 > 0.05 (Sig. Level), indicating the means between groups are similar. Consequently, the type of FinTech service does not influence the total quantity of disclosure.

Table 5.

ANOVA test for Service Type of FinTech.

Based on the result of the ANOVA test, this study is in line with Herrador-Alcaide and Hernández-Solís [23], which found no significant relationship between service type and the amount of disclosure. Therefore, the type of FinTech service has no significant influence on corporate governance disclosure though the means of corporate governance disclosure are higher for payment and lending FinTech companies. This finding implies that the type of FinTech service is not a factor that determines the disclosure level of corporate governance information. As a result, it is impossible to distinguish between disclosures made by various FinTech subsectors on the websites. It shows that there might be a lack of pressure from regulators on specific FinTech companies. Even the two most popular and prominent types of FinTech companies, namely payment and lending FinTech companies, have no significant difference from other FinTech service types in disclosing corporate governance information.

5. Conclusions

This paper has achieved the intended objectives and has answered the research questions. The findings show that FinTech companies provide around 7 to 9 out of 50 disclosure items. This paper cannot figure out the existence of a homogeneous disclosure structure in Indonesian and Malaysian FinTech companies. On the other hand, this study identifies a similar disclosure practice among FinTech companies in any service type. FinTech companies also lack a habit of voluntarily disclosing corporate governance information. This disclosure is more inclined toward the promotion of the business. FinTech companies might focus more on the business rather than the governance aspect. Hence, the information is emphasized on services in FinTech and general information about the company. This low corporate governance disclosure will inhibit the distribution of pivotal information to shareholders. Therefore, this lack of disclosure will hinder the attainment of SDG No 16, which campaigns for the provision of access to justice for all and for building effective and accountable institutions.

To conclude, there is a variation in the total volume of disclosure of FinTech companies in both countries. Malaysian FinTech companies disclose more information than their Indonesian counterparts. However, in terms of service type, there is no difference in the level of disclosure when taking into account the type of service provided.

The findings of this study have implications. To demonstrate their accountability to stakeholders, particularly their shareholders who provide the capital to run the business, it suggests that FinTech companies in Indonesia and Malaysia need to enhance their corporate governance disclosures on their websites. Since the corporate governance disclosures were low (around 7 to 9 out of 50 disclosure items), FinTech companies must enhance their accountability by communicating corporate governance information on their websites. Simultaneously, it will help realize SDG No 16 in achieving sustainable and accountable institutions.

This study also suggests that all service types of FinTech companies need to demonstrate their accountability by disclosing more corporate governance items. Especially, the two most popular and prominent fintech services, namely payment and lending FinTech companies. Since both service types gained the most active users and financial transactions, thus, the findings from this study can be used by FinTech companies to improve transparency and accountability by using websites to share corporate governance information. The findings also become valuable input for regulators to formulate a policy to increase compliance with the code of corporate governance for FinTech companies, which in turn will assist the achievement progress of SDG No 16.

Just like any other study, this study has its limitations. The content analysis technique at all time deal with the inevitable problem of bias [52]. However, as this study used more than one coder to assign scores, subjectivity could be reduced, and the accuracy of assigning scores increased. Because the study’s focus was solely on website disclosures, the results should only be interpreted considering the time frame in which it was conducted, given that website content is constantly changing.

Future research could continue this study by using interviews to understand better the motivations behind disclosed and undisclosed corporate governance information. Future studies will also find it fascinating to provide information on factors affecting the level of disclosures in corporate governance information.

Author Contributions

Conceptualization, E.S., C.J., V.V. and I.Y.; methodology: C.J. and V.V.; data curation, V.V.; formal analysis, investigation, validation, E.S., C.J., V.V. and I.Y.; writing—original draft, E.S., V.V. and I.Y.; writing—review and editing, C.J. All authors have read and agreed to the published version of the manuscript.

Funding

This study was carried out with the collaboration of Universitas Pembangunan Nasional Veteran Jawa Timur and UiTM Cawangan Serawak. This research was funded under the scheme of Kerjasama Luar Negeri, UPN Veteran Jawa Timur, grant number SPP/85/UN.63.8/LT/IV/2022, and the APC was funded by UPN Veteran Jawa Timur.

Institutional Review Board Statement

The study was conducted in accordance with the Declaration of Helsinki and approved by the Ethics Committee of Universitas Pembangunan Nasional Veteran Jawa Timur (21 September 2022).

Informed Consent Statement

Not applicable.

Data Availability Statement

Not applicable.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Conway, S.L.; Wilmshurst, T.; Williams, B. Guidelines for corporate governance disclosure—Are Australian listed companies conforming? J. Asia-Pac. Cent. Environ. Account. 2012, 18, 5–24. [Google Scholar]

- United Nations. Corporate Governance Disclosure in Emerging Markets; United Nations: Geneva, Switzerland, 2011. [Google Scholar]

- OECD. OECD Principles of Corporate Governance; OECD Publications Service: Paris, France, 2004. [Google Scholar]

- OECD. G20/OECD Principles of Corporate Governance; OECD Publications Service: Paris, France, 2015. [Google Scholar]

- Moro-Visconti, R.; Rambaud, S.C.; Pascual, J.L. Sustainability in FinTechs: An Explanation through Business Model Scalability and Market Valuation. Sustainability 2020, 12, 10316. [Google Scholar] [CrossRef]

- World Bank Group. Fintech and the Future of Finance; World Bank Group: Washington, DC, USA, 2022; Available online: https://www.worldbank.org/en/publication/fintech-and-the-future-of-finance (accessed on 18 October 2022).

- Vergara, C.C.; Agudo, L.F. Fintech and Sustainability: Do They Affect Each Other? Sustainability 2021, 13, 7012. [Google Scholar] [CrossRef]

- Yuan, K.; Xu, D. Legal Governance on Fintech Risks: Effects and Lessons from China. Asian J. Law Soc. 2020, 7, 275–304. [Google Scholar] [CrossRef]

- Aysan, A.; Bergigui, F.; Disli, M. Using Blockchain-Enabled Solutions as SDG Accelerators in the International Development Space. Sustainability 2021, 13, 4025. [Google Scholar] [CrossRef]

- Amboningtyas, D.; Seputro, A.; Anjar Wicaksono, A. Critical Review of Fintech Management. J. Mantik 2020, 4, 1321–1325. [Google Scholar]

- Meiling, L.; Yahya, F.; Waqas, M.; Shaohua, Z.; Ali, S.A.; Hania, A. Boosting Sustainability in Healthcare Sector through Fintech: Analyzing the Moderating Role of Financial and ICT Development. Inq. J. Health Care Organ. Provis. Financ. 2021, 58, 1–11. [Google Scholar] [CrossRef]

- Rosavina, M.; Rahadi, R.A.; Kitri, M.L.; Nuraeni, S.; Mayangsari, L. P2P lending adoption by SMEs in Indonesia. Qual. Res. Financ. Mark. 2019, 11, 260–279. [Google Scholar] [CrossRef]

- KPMG International. Regulation and Supervision of Fintech: Ever-Expanding Expectations; KPMG International: Amstelveen, The Netherlands, 2019. [Google Scholar]

- Dobrowolski, Z. Internet of Things and Other E-Solutions in Supply Chain Management May Generate Threats in the Energy Sector—The Quest for Preventive Measures. Energies 2021, 14, 5381. [Google Scholar] [CrossRef]

- Foster, K.; Blakstad, S.; Bos, M.; Gazi, S.; Melkun, C.; Shapiro, B. Annex 1-6 Technical Paper 1.1: BigFintechs and Their Impacts on Sustainable Development. 2021. Available online: https://www.undp.org/sites/g/files/zskgke326/files/2021-06/UNDP-UNCDF-TP-1-1-BigFintechs-and-Their-Impacts-on-Sustainable-Development-EN.pdf (accessed on 23 August 2022).

- Kauflin, J. In Fintech, 2022 Is Becoming the Year of Layoffs. 2022. Available online: https://www.forbes.com/sites/jeffkauflin/2022/07/28/in-fintech-2022-is-becoming-the-year-of-layoffs/?sh=5390559220f3 (accessed on 12 October 2022).

- Yuhertiana, I.; Zakaria, M.; Suhartini, D.; Sukiswo, H.W. Cooperative Resilience during the Pandemic: Indonesia and Malaysia Evidence. Sustainability 2022, 14, 5839. [Google Scholar] [CrossRef]

- ECGI. Corporate Governance in Malaysia. 2020. Available online: https://ecgi.global/content/corporate-governance-malaysia (accessed on 23 August 2022).

- ECGI. Corporate Governance in Indonesia. 2020. Available online: https://ecgi.global/content/corporate-governance-indonesia (accessed on 23 August 2022).

- Diniyya, A.A.; Aulia, M.; Wahyudi, R. Financial Technology Regulation in Malaysia and Indonesia: A Comparative Study. Ihtifaz J. Islam. Econ. Financ. Bank. 2020, 3, 67–87. [Google Scholar] [CrossRef]

- CCAF; ADBI; FintechSpace. The Asean Fintech Ecosystem Benchmarking Study; Cambridge Centre for Alternative Finance: Cambridge, UK, 2019. [Google Scholar]

- Haniffa, R.; Cooke, T.E. Culture, Corporate Governance and Disclosure in Malaysian Corporations. Abacus 2002, 38, 317–349. [Google Scholar] [CrossRef]

- Herrador-Alcaide, T.-C.; Hernández-Solís, M. Topics of Disclosure on the Websites: An Empirical Analysis for FinTech Companies. In Modeling, Dynamics, Optimization and Bioeconomics III; Springer International Publishing: New York, NY, USA, 2018; Volume 224, pp. 187–203. [Google Scholar] [CrossRef]

- Fernández, A.G. La Divulgacion De Informacion Financiera en La Web Corporativa De Empresas Cotizadas: Un Estudio Evolutivo. 2009. Available online: http://www.aeca1.org/pub/on_line/comunicaciones_xvcongresoaeca/cd/98g.pdf (accessed on 23 August 2022).

- Meutia, I.; Soediro, A. Disclosure of Governance Practice by Islamic Banks in Indonesia. Int. J. Islam. Econ. Financ. Stud. 2019, 5, 72–89. [Google Scholar] [CrossRef]

- Sulaiman, M.; Majid, N.A.; Arifin, N.M. Corporate governance of Islamic financial institutions in Malaysia. Asian J. Bus. Account. 2015, 8, 65–93. [Google Scholar]

- Feldioreanu, I.-A.; Seria, C. Corporate governance disclosure of banks in Romania and Malaysia and the quality of the web sites. Account. Manag. Inf. Syst./Contab. si Inform. Gestiune 2015, 14, 193–216. [Google Scholar]

- Panchasara, B.M.; Bharadia, M.H.S. Corporate Governance Disclosure Practices and Firm Performance: Evidence from Indian Banks. Paradigm 2013, 17, 88–98. [Google Scholar] [CrossRef]

- Herbert, W.E.; Agwor, T.C. Corporate governance disclosure and corporate performance of Nigerian banks. J. Res. Emerg. Mark. 2021, 3, 14–36. [Google Scholar] [CrossRef]

- Shahar, N.A.; Nawawi, A.; Salin, A.S.A.P. Shari’a corporate governance disclosure of Malaysian IFIS. J. Islam. Account. Bus. Res. 2020, 11, 845–868. [Google Scholar] [CrossRef]

- Napitupulu, S.; Primiana, I.; Nidar, S.R.; Effendy, N.; Puspitasari, D.M. The Effect of Management Capabilities in Implementing Good Corporate Governance: A Study from Indonesia Banking Sector. J. Asian Financ. Econ. Bus. 2020, 7, 159–165. [Google Scholar] [CrossRef]

- E-Vahdati, S.; Zulkifli, N.; Zakaria, Z. A Moderated Mediation Model for Board Diversity and Corporate Performance in ASEAN Countries. Sustainability 2018, 10, 556. [Google Scholar] [CrossRef]

- Shrivastav, S.M.; Kalsie, A. The Relationship between Foreign Ownership and Firm Performance in India:An Empirical Analysis. Artha Vijnana J. Gokhale Inst. Politi. Econ. 2017, 59, 152. [Google Scholar] [CrossRef]

- Le Minh, T.; Walker, G. Corporate Governance of Listed Companies in Vietnam. Bond Law Rev. 2008, 20, 5520. [Google Scholar] [CrossRef]

- Giglio, F. Fintech: A Literature Review. Int. Bus. Res. 2022, 15, 1–80. Available online: https://ideas.repec.org/a/ibn/ibrjnl/v15y2022i1p80.html (accessed on 23 August 2022).

- Basuony, M.A.K. Corporate governance: Does it matter for corporate social responsibility disclosure via website and social media by top listed UK companies? Corp. Ownersh. Control 2021, 19, 84–93. [Google Scholar] [CrossRef]

- Gandía, J.L. Determinants of internet-based corporate governance disclosure by Spanish listed companies. Online Inf. Rev. 2008, 32, 791–817. [Google Scholar] [CrossRef]

- Stewart, J.; Asha, F.; Shulman, A.; Ng, C.; Subramaniam, N. Governance Disclosure on the Internet: The Case of Australian State Government Departments. Aust. J. Public Adm. 2012, 71, 440–456. [Google Scholar] [CrossRef]

- Joseph, C.; Gunawan, J.; Madi, N.; Janggu, T.; Rahmat, M.; Mohamed, N. Realising sustainable development goals via online integrity framework disclosure: Evidence from Malaysian and Indonesian local authorities. J. Clean. Prod. 2019, 215, 112–122. [Google Scholar] [CrossRef]

- Mulyadi, M.S. Do corporate webs substitute annual reports for corporate governance disclosures in large Indonesian family corporations? Int. J. Web Based Communities 2017, 13, 311. [Google Scholar] [CrossRef]

- Brammer, S.; Jackson, G.; Matten, D. Corporate Social Responsibility and institutional theory: New perspectives on private governance. Socio-Econ. Rev. 2011, 10, 3–28. [Google Scholar] [CrossRef]

- Wijayati, N. Form over Substance: The Board Governance Practices in Indonesia. Indones. J. Account. Res. 2022, 25, 1–28. [Google Scholar] [CrossRef]

- DiMaggio, P.J.; Powell, W.W. The Iron Cage Revisited: Institutional Isomorphism in Organizational Fields. Am. Sociol. Rev. 1983, 48, 147–160. [Google Scholar] [CrossRef]

- Midin, M.; Joseph, C.; Mohamed, N. Promoting societal governance: Stakeholders’ engagement disclosure on Malaysian local authorities’ websites. J. Clean. Prod. 2017, 142, 1672–1683. [Google Scholar] [CrossRef]

- Krippendorff, K. Content Analysis: An Introduction to Its Methodology; Sage Publications: Beverly Hills, CA, USA, 1980. [Google Scholar]

- Asian Development Bank. ASEAN Corporate Governance Scorecard Country Reports and Assessments 2015: Joint Initiative of the ASEAN Capital Markets Forum and the Asian Development Bank; Asian Development Bank Institute: Mandaluyong, Philippines, 2017. [Google Scholar]

- Suwaidan, M.S.; Al-Khoury, A.F.; Areiqat, A.Y.; Cherrati, S.O. The Determinants of Corporate Governance Disclosure: The Case of Jordan. Acad. Account. Financ. Stud. J. 2021, 25, 1–12. [Google Scholar]

- Hassan, M.K. A disclosure index to measure the extent of corporate governance reporting by UAE listed corporations. J. Financ. Rep. Account. 2012, 10, 4–33. [Google Scholar] [CrossRef]

- Joseph, C.; Rahmat, M.; Yusuf, S.N.S.; Janang, J.T.; Madi, N. The ethical value disclosure index from the lens of SDG 16 and institutional theory. Int. J. Ethic Syst. 2022. ahead of print. [Google Scholar] [CrossRef]

- Gray, S.J.; Meek, G.K.; Roberts, C.B. International Capital Market Pressures and Voluntary Annual Report Disclosures by U.S. and U.K. Multinationals. J. Int. Financ. Manag. Account. 1995, 6, 43–68. [Google Scholar] [CrossRef]

- Sultana, S. Corporate Governance Disclosures—A Comparative Analysis of Countries at Different Stages of Economic Development. Ph.D. Thesis, Curtin Graduate School of Business, Perth, Australia, 2015. [Google Scholar]

- Gunawan, J. Corporate social disclosures in Indonesia: Stakeholders’ influence and motivation. Soc. Responsib. J. 2015, 11, 535–552. [Google Scholar] [CrossRef]

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).