Abstract

Eliminating hunger and ensuring food security is one of the specific goals of sustainable development of the United Nations in 2030, and food production is of great significance to food availability. Based on this, this paper investigates the impact of digital inclusive finance on food security by constructing a fixed effects model using panel data for 30 Chinese provinces from 2011 to 2020. The results found that: (1) Digital inclusive finance significantly and positively affects food security, and the results remain robust after robustness tests and endogeneity tests. (2) The scale of farmland operations plays a positive mediating role in the effect of digital inclusive finance on food security, and the level of agricultural machinery positively moderates the effect of digital inclusive finance on food security. (3) Heterogeneity tests show that there is a positive effect of digital inclusive finance on food security in eastern China, and a non-significant effect of digital inclusive finance on food security in central and western regions;. There is a significant positive effect of digital inclusive finance on food security in China’s main grain marketing areas and balanced production and marketing areas, and a non-significant effect of digital inclusive finance on food security in the main grain producing areas.

1. Introduction

Eliminating hunger and ensuring food security is one of the specific goals of the United Nations sustainable development in 2030 [1]. Despite the best efforts of the international community to address global food insecurity, the number of undernourished people worldwide began to slowly increase again in 2015 after decades of steady decline. According to statistics, in 2019, 2 billion people in the world have been unable to get safe, nutritious, and adequate food regularly. With this trend, the number of people affected by hunger in the world will exceed 840 million by 2030 [1]. The COVID-19 pandemic aggravates the food security crisis. Large food producing countries restrict food exports, which weakens the availability of food imports. Countries with high dependence on food imports are in danger of food shortage [2,3]. It is thus clear that food security must be domestically based and that it is significant for countries to increase agricultural productivity to ensure food security. In China, although food is generally safe in the short term, it still faces pressure in the long term. According to data from the General Administration of Customs of China, China’s grain imports exceed 160 million tons in 2021, which is equivalent to 24.1% of the total domestic grain production value. According to the data of China Rural Statistical Yearbook, although the total domestic grain output reaches 669,492,000 tons in 2020, the grain sown area shows a decreasing trend year by year from 2016 to 2019, and the grain sown area in 2020 decreases by 2462 thousand hectares compared with 2016, and it is urgent to stabilize the domestic grain production and keep the supply.

Increasing agricultural output is an important step to ensure food security. Rural finance supports the growth of agricultural output by meeting the financial needs of agricultural production through credit assistance, which allows farmers to increase agricultural investments, e.g., in fertilizers [4,5]. Osabohien et al. (2020) explored the impact of agricultural finance on food production in Nigeria and found that a 1% increase in farmers’ access to agricultural finance would increase food production by 0.002–0.006% [6]. Seven and Tumen (2020) validate the relationship between rural finance and agricultural productivity using 104 country-level data from 1991–2014 and find that doubling agricultural credit can increase agricultural productivity by 4–5% [7]. However, due to the fragility and risk of agriculture and the inability of farmers to provide collateral, traditional finance cannot completely cover agriculture and farmers [5,8].

In the International Microcredit Year of 2005, the United Nations officially introduced the concept of “inclusive finance”, which means a financial system that effectively and comprehensively serves all segments and groups of society [9]. Its purpose is to solve the widening global gap between the rich and the poor and the gradually unbalanced allocation of financial resources [10]. Financial inclusiveness can be defined as a process that helps the poor and vulnerable remove barriers to accessing formal financial services and have access to and use low-cost, fair, and safe formal financial services when they are needed [11]. With the development of digital technology, digital inclusive finance has emerged to help rural residents save the cost of long-distance payments, solve the problems of information asymmetry and difficulty in collateral, enhance the level of financial services, and make it easier for farmers in remote areas to access financial services [12,13]. In China, the practice of financial inclusive has expanded from the initial public welfare microfinance to a comprehensive financial service with multiple businesses, such as payment and credit, and with the application of digital technology and innovative digital finance to create a strong correlation [14]. Based on this, we will verify whether digital inclusive finance has a role in promoting food security in China. Because China is the most advanced country in terms of digital finance in the world [15], and also the largest developing country in the world, studying the effect of digital inclusive finance on food security in China is an important reference for policy makers considering the implementation of hunger eradication.

This paper examines the impact of digital financial inclusion on food security, with the following main contributions. First, this paper places food security and digital inclusion finance in the same analytical framework for the first time to verify whether digital inclusion finance has the effect of enhancing food security. Second, considering the uneven regional economic development and differences in regional natural conditions, this paper divides the sample into main grain producing areas, main marketing areas, balanced production and marketing areas, and eastern, central, and western China to study the heterogeneous impact of digital inclusive finance on food security. Third, we find that the effect of digital inclusive finance to enhance food security can be achieved by scaling up agricultural production. Fourth, we find that mechanical advances have an enhancing effect on digital inclusive finance to improve food security.

The rest of the paper is organized as follows. Section 2 describes the current state of research and reviews the relevant studies on food security and digital inclusive finance. Section 3 analyzes the role of digital inclusive finance on food security from a theoretical perspective and proposes the research hypothesis accordingly. Section 4 presents the model design, indicator selection and data sources, including the construction of the mediating and moderating models. Section 5 shows the results of the empirical tests, such as baseline regression, robustness test, endogeneity test, and heterogeneity analysis of the variables. Section 6 summarizes and discusses the findings of the study and proposes policy recommendations based on the findings.

2. Literature Review

The concept of food security was first introduced by the Food and Agriculture Organization of the United Nations in 1974, and the definition of food security has been revised in due course since then, proposing “all people, at all times, have physical, social and economic access to sufficient, safe and nutritious food that meets their dietary needs and food preferences for an active and healthy life” [16]. According to this definition proposed by the FAO, food security consists of four dimensions: food availability, economic and physical access to food, food utilization and stability over time [16]. Ma et al. divided food security into macro level and micro level. The macro-level global food accessibility depends on the total global food production, while national food security is mainly reflected in the national food availability, including the amount of food production, food reserves, and net food imports of the country [17]. In this study, we focus on national food availability and measure food security in terms of food production.

At present, studies on food security have focused on three aspects, including the construction of food security-related indicator systems [18,19,20], the current situation of food security and security early warning [21,22,23], and the influencing factors of food security [24,25,26,27,28]. In the context of food status and security early warning, Arduin and Kabeche have focused on the role of digital systems, proposing that dignity in food aid logistics is also a knowledge management and digital matter [29]. Herrington and Mix first focused on dignity in snack food security, exploring how everyday experiences of food access and food pathways affect feelings of dignity [30]. In terms of factors influencing food, existing studies have found that large-scale operations [26], labor migration [31], policy subsidies [32], and advances in agricultural technology [33] can affect food security. Although food security and digital inclusion have not been analyzed under the same framework, studies have focused on the relationship between food security and finance and digital technology. In regards to the financial aspect, Wang and Chen found that financial support for the seed industry helps to ensure national food security, but the availability and sustainability of rural financial loans still needs to be improved, and the mismatch between the demand and supply of financial services for seed enterprises is prominent [34]. Using a spatial econometric model, Zhang et al. found that policy finance and cooperative finance have significant positive spatial spillover effect on food security, while commercial finance has negative spatial spillover effect on food security because of its profit-seeking nature [8]. Cai conducted a literature review and pointed out that the development of rural credit markets and agricultural insurance markets is important for the moderate expansion of food and agriculture operations [35]. In terms of digital technology, Sutherland and Jarrahi found that concepts from the literature on digital platforms would be useful in exploring the technological components of the sharing economy [36]. Katsamakas et al. explored how public good platforms create value and suggested the possibility of their digital transformation [37]. Bonina et al. discussed the importance and impact of digital platforms on development, noting that digital platforms can make a significant contribution to the Sustainable Development Goals [38]. Hao and Tang use provincial panel data to prove that digital rural construction is helpful to improve the resilience of food systems [39]. Therefore, it is possible to promote food security with digital inclusive finance as a new tool.

With the vigorous development of digital technology, scholars have paid attention to the role of digital Inclusive Finance in rural development. First, digital inclusive finance helps to alleviate farmers’ credit constraints [40], improves their access to formal credit by reducing transaction costs, mitigating information asymmetries and lowering collateral requirements, and reduces their vulnerability by alleviating their financial constraints and information constraints [41]. Second, digital inclusive finance helps to reduce the urban-rural gap [13,42,43], and plays an important role in rural poverty reduction and economic development [15]. Third, digital inclusive finance helps promote agricultural industrialization [44] and rural industrial integration [45]. Although no research has paid attention to the relationship between digital inclusive finance and food production, some studies have found that there is an important relationship between digital inclusive finance and agricultural production factor input, and digital inclusive finance has an important impact on agricultural mechanization, land circulation, labor input and agricultural total factor productivity. In detail, Yan et al. found that digital inclusive finance has the same inclusive value in the agricultural production chain, and the higher the level of digital inclusive finance, the more it can promote agricultural mechanization [46]. Sun et al. argue that digital inclusive finance will not only promote agricultural mechanization directly, but also indirectly by increasing farmers’ income and promoting investment in fixed assets [47]. Zhang points out that digital inclusive finance can drive farm land transfers out through off-farm employment, risk appetite, and job stability, and promote farm land transfers in through farming scale, long-term lending, and transaction costs [48]. Liu used provincial panel data to empirically test that digital Inclusive finance can improve regional agricultural total factor productivity by improving technical efficiency of agricultural production and operation activities [49]. Zhou empirically found an inverted “U” shape effect of digital inclusive finance on labor mobility based on a panel of 208 prefecture-level cities in China [50].

In summary, the current discussion on the influencing factors of food security mainly focuses on food production factors such as irrigated area, fertilizer input, machinery input, and labor mobility, and the discussion on the influencing factors of food security needs further depth. Research on digital inclusive finance is still in its infancy, and research topics focus on discussing the role of digital inclusive finance on regional economic development and farmers’ income increase. Based on this, this study focuses on the agricultural sector, confronts the issue of food security, directly places digital inclusive finance and food security in the same analytical framework, verifies the direct effect of digital inclusive finance on food security, and explores the mechanism of the generation of this effect, which has important theoretical and practical significance for digital inclusive finance to become a new tool for food security.

3. Theoretical Analysis

3.1. Direct Effects: The Direct Effects of Digital Inclusive Finance on Food Security

Agricultural production is often faced with financing difficulties, financing expensive, financing complicated and other problems [47]. This has led to a relative lack of capital for agricultural production, constraining high-quality agricultural development. In the context of rapid development of digital technology, the development of fintech technology not only improves financial inclusion, but also becomes a new possible way to drive food production. Agricultural credit and agricultural insurance are important products of rural inclusive finance. On the one hand, the development of digital inclusive finance breaks geographical constraints and provides farmers with more credit products with low interest rates and multiple varieties, significantly increasing the availability of formal credit to farmers and the scale of formal credit [51]. The effective satisfaction of formal credit demand has contributed to farmers’ ability to invest more in production factors such as machinery, labor, and fertilizer, directly enhancing grain production, and scholars have found that grain output is expected to increase by 14.6% if the formal credit demand of constrained farmers is fully satisfied [52]. On the other hand, digital inclusive finance enhances the development of agricultural insurance. On the supply side, digital technology breaks down information barriers and reduces the cost of insurance companies to collect information from policyholders. On the demand side, farmers receive risk management education through the internet, cultivate risk prevention awareness, and enhance the convenience of insurance participation through digital technology. Digital inclusive finance promotes the development of agricultural insurance [53], thus improving the income security of farmers, increasing the expected returns of farmers engaged in food production, and increasing the incentive to grow food [54]. Based on this, hypothesis 1 is proposed:

Hypothesis 1.

Digital inclusive finance significantly affects food security, and with the development of digital inclusive finance, it helps to increase food production and ensure food security.

3.2. The Farmland Scale Effect of Digital Inclusive Finance

The moderate scale operation of agriculture is an important way of modern agricultural development [55]. Differences in the efficiency of farmers’ land output will affect farmers’ food production when their willingness to have land inflows and outflows is not met [56], and expanding the scale of land operations has a positive effect on increasing food production [57]. Zhou and Li use national provincial balanced panel data and find that there is a “U” shaped relationship between the scale of farmland operations and the food output rate of cultivated land, and that the scale of farmland operations is currently not optimal in most provinces, i.e., increasing the scale of farmland operations contributes to national food security [26]. Moreover, farmland scale can also affect food security through the structure of cultivation, as fragmented arable land promotes farmers’ willingness to “non-food” cultivation and cultivation scale [25], and farmers’ willingness to “non-food” cultivation will decrease as the scale of agricultural land management increases [58]. Therefore, expanding farmland scale will play a positive role in increasing food production. Digital inclusive finance is more accessible than traditional finance, and credit availability affects the level of off-farm employment and productive investment of farm households, which in turn affects land transfer [59], and although fewer existing studies have focused directly on the role of digital inclusive finance on the scale of farmland operations, many scholars have argued that rural financial development affects the scale of farmland operations [35]. For example, Lu and Xiong measured agricultural green efficiency using 11 provinces and cities in the Yangtze River Economic Belt from 2001–2018, and found that there was a significant mediating effect of farmland scale in the process of rural finance affecting agricultural green efficiency [60]. The expansion of farmland scale requires more production factor inputs, and the availability of digital inclusive finance meets this need. Based on this, hypothesis 2 is proposed:

Hypothesis 2.

Digital inclusive finance can contribute to national food security by scaling up farmland.

3.3. Moderating Effect of Agricultural Machinery Progress

Agricultural mechanization is the most direct manifestation of the strategy of “storing food in technology”, and agricultural machinery input affects the allocation efficiency of agricultural resources [61]. Compared to the traditional human and animal production methods, the use of agricultural machinery releases rural labor and changes farming methods. Deep plowing and deep loosening of agricultural machinery helps promote soil rotation, allowing crops to absorb more nutrients from the soil, improving crop yields and reducing inputs of chemical fertilizers and pesticides, etc. Farmers have access to production funds through digital inclusive finance, and with high levels of agricultural mechanization, production resource factors are allocated more efficiently, thus helping to increase the incentive to grow food and food production. Agricultural mechanization is also affected by the endowment of land parcels. Fine and uneven land is more difficult to produce mechanically, and the cost of agricultural production will increase at this time. After farmers obtain production funds through digital inclusive finance, they will prefer to plant cash crops or engage in non-farm employment in consideration of production costs and abandon agricultural land that is difficult to put into mechanical production. Based on this, hypothesis 3 is proposed.

Hypothesis 3.

Advances in agricultural machinery have an enhancing effect on digital financial inclusion impacting food security.

4. Empirical Methods and Data Description

4.1. Baseline Regress

This study constructs a model of the direct impact of digital inclusion on food security, set as follows, and to eliminate the effect of heteroskedasticity, variables in the model are logarithmically treated.

where PEFit is the explanatory variable, which is the per capita food possession in province i in year t, with i denoting province and t denoting time; DFIit is the digital financial inclusion index in province i in year t; CONXit is the control variable, including real rural disposable income (INCO), fertilizer input per land (FERT), degree of natural disasters (DISA), industrial structure (INDUS), the level of county economic development (PGDP), and the level of fiscal support to agriculture (FINAN); λi and γt denote province fixed effects and time fixed effects, respectively; and ε it denotes the random error term. From the model, it is clear that α1 is the parameter to focus on in this study, and a positive value of α1 is expected.

4.2. Intermediary Model Construction

The mediation model was constructed by referring to Weng et al. [62], and the mediation effect model was constructed as follows.

In Equations (2)–(4), scaleit is the mediating variable, i.e., the scale of farmland operation, where α, β and δ denote the regression coefficients of Equations (2)–(4), respectively, and εit, φit and ωit are the random error terms in Equations (2)–(4), respectively. Equation (2) is the total effect model, Equation (3) is the estimated model of the scale effect of digital inclusive finance farmland operations, and Equation (4) is the model considering both digital inclusive finance and intermediation effects. The regression coefficient α1 indicates the total effect of digital inclusive finance on food security; the regression coefficient β1 indicates the effect of digital inclusive finance on mediating variables; the regression coefficient δ1 indicates the direct effect of digital inclusive finance on food security after controlling for the effect of mediating variables; and δ2 is the effect of farmland scale on food security after controlling for the effect of digital inclusive finance on food security. If β1 and δ2 are significant, the indirect effect is significant. If δ1 is significant, it means that the mediating effect of farmland operation scale is partially mediated. Otherwise it is fully mediated.

4.3. Moderating Effect Model Construction

To verify the moderating effect of agricultural machinery advancement, with reference to Fang et al.’s study [63], we construct a moderating effect model:

In Equation (5), machineit denotes the level of agricultural machinery progress, lnDFIit×lnamchineit denotes the interaction term between digital inclusive finance and the level of agricultural machinery progress, and the regression coefficient α4 of the interaction term is the parameter of focus, and if α4 is significant, it indicates the existence of a moderating effect. To exclude the possibility that the interaction terms may introduce bias due to the interference of multicollinearity, the interaction terms are centralized.

4.4. Variable Selection

(1) Explanatory variable: food security, expressed using per capita food possession (PFE, kg/person). Food quantity security is a prerequisite for food security, and the degree to which food production satisfies the provincial units in the study area is better reflected in food per capita possession than in food production. Considering the scientific and operability of variable selection, this study refers to Zhang et al. [8], and uses per capita food possession to express food security.

(2) Explanatory variable: Digital Financial Inclusive (DFI), expressed using the China Digital Financial Inclusive Index [14]. The index is compiled by the Center for Digital Inclusive Finance of Peking University, covering 31 provinces, 337 cities above prefecture level and about 2800 counties in China. The index consists of one primary index, “Total Digital Inclusive Finance Index”, and three secondary indexes, “Coverage Breadth”, “Usage Depth”, and “Digitization Level”, which can generally reflect the current situation and evolution trend of digital inclusive finance development in China.

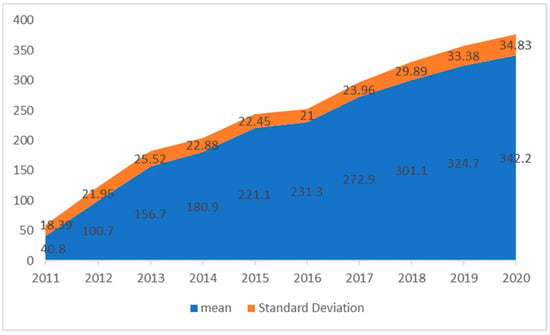

Before conducting the baseline regression, this study plots the trend of the mean and standard deviation of the total digital inclusive finance index from 2011 to 2020 (as shown in Figure 1) to more clearly demonstrate the development trend of digital inclusive finance in China. From the change trend of the mean value, China’s digital inclusive finance as a whole shows a continuous development from 2011 to 2020, with two rapid development phases from 2011 to 2013 and from 2016 to 2018. In terms of the trend of the change of standard deviation, the overall trend shows a rise, then a decline, and then a rise again. It indicates that with the improvement of the level of digital inclusive finance, the gap in the development level of digital inclusive finance among Chinese provinces gradually began to increase from 2011 to 2013, and this gap began to narrow by 2014, and widened again by 2017.

Figure 1.

Trend of the total digital inclusive finance index in China, 2011–2020.

(3) Mediating variable: The scale of farmland operation (scale, thousand hectares per 10,000 people) is measured by the average labor area of grain sown in this paper with reference to Tian and Zhu’s study [64], and is expressed by the ratio of primary industry employees to grain sown area (scale, thousand hectares per 10,000 people) due to the lack of data on the number of plantation laborers at the provincial level.

(4) Moderating variable: Agricultural machinery progress (machine), referring to the study of Deng et al. [65], is expressed by the level of agricultural machinery. Referring to the Evaluation Index System of Demonstration Counties for the Whole Process Mechanization of Major Crop Production (for Trial Implementation) issued by the Ministry of Agriculture and Rural Affairs of China, the machine plowing area, machine sowing area, and machine harvesting area were compared to the grain sowing area, and then assigned weights of 0.4, 0.3, and 0.3, respectively, so as to calculate the comprehensive agricultural machinery level.

(5) Control variables. Based on the available studies, the following control variables were selected. The actual disposable income of rural residents (INCO, Yuan/person) is expressed by the disposable income of rural residents, reflecting the economic condition of farmers in the region; the average fertilizer input (FERT, tons/1000 ha) is expressed by the fertilizer application amount and crop sowing area, reflecting the level of agricultural production factor inputs; the degree of natural disasters (DISA) is expressed by the disaster area and crop sowing area, reflecting the natural conditions of the region; the industrial structure (INDUS) is expressed by the ratio of secondary and tertiary industries to GDP, and the level of county economic development (PGDP) is expressed by the regional GDP per capita, reflecting the regional economic development and industrial development. The level of natural disasters (DISA) is expressed in terms of disaster area and crop sown area, reflecting the natural conditions of the region; the industrial structure (INDUS) is expressed in terms of the ratio of the sum of secondary and tertiary industries to GDP, and the level of county economic development (PGDP) is expressed in terms of GDP per capita, reflecting the regional economic development and industrial development. The level of financial support to agriculture (FINAN) is expressed in terms of the ratio of expenditure on agriculture, forestry, and water affairs to general budget expenditure, reflecting the importance the government attaches to the development of agricultural production. The level of financial support to agriculture (FINAN) is expressed as the ratio of expenditure on agriculture, forestry, and water affairs to general budget expenditure, reflecting the degree of importance the government attaches to the development of agricultural production.

4.5. Data Source

The data used in this study are at the level of 30 provinces (municipalities) in China from 2011 to 2020, and Tibet, Taiwan, Hong Kong, and Macao are excluded in consideration of data availability. The data were mainly obtained from China Rural Statistical Yearbook, China Statistical Yearbook, China Agricultural Machinery Statistical Yearbook, China Agricultural Statistical Yearbook, and the statistical yearbooks of each province in the past years. The results of descriptive statistics reporting for each variable are shown in Table 1.

Table 1.

Variable statistical description.

5. The Empirical Results

5.1. Baseline Regression Analysis Results

The appropriate model needs to be selected before conducting regression analysis, so the pooled model, random effects model, and fixed effects model were compared. The pooled model was first compared with the fixed effects model, and the result of F-test was 294.73 with a p-value of 0.000. Using the LSDV method, most of the individual dummy variables were found to be highly significant, indicating the existence of individual effects, and the pooled model was rejected. Further comparing the random effects model with the fixed effects model, a Hausman test was performed, resulting in a chi-square value of 21.35 and a p-value of 0.0063, rejecting the random effects model and finally supporting the fixed effects model.

Table 2 reports the results of the regression analysis. Model (1) is a regression model without considering control variables, and the regression results show that digital inclusive finance significantly and positively affects food security at the 5% statistical level with a regression coefficient of 0.434, indicating that digital inclusive finance has a catalytic effect on food security. Model (2) adds control variables, and the regression analysis results still indicate that there is a significant positive effect of digital inclusive finance on food security. From the regression results of the control variables, the negative effects of rural residents’ disposable income, average fertilizer input, and county economic development level on food security may be due to the fact that farmers in areas with high disposable income of rural residents and high county economic development level are more inclined to part-time business or non-farm employment, and are less motivated to grow food; the negative effects of average fertilizer input on food security may be due to the negative effects of chemical fertilizer The negative effect of overuse of chemical fertilizers on food security may be due to the negative effect of chemical fertilizers on the land, warning of the need to change the structure of chemical fertilizer application and develop organic fertilizers. The effects of natural disasters, industrial structure, and the level of financial support to agriculture on food security were not significant. In summary, hypothesis 1 was verified.

Table 2.

The impact of digital inclusive finance on food security.

5.2. Robustness Tests

This study uses the explanatory variable substitution method for robustness testing. Model (3) replaces the explanatory variables, referring to Gao et al. [66]. The total grain production (FE, tons) in each province was used to replace the per capita grain possession, which includes rice, wheat, corn, sorghum, grain, and mixed grains, as well as potatoes and soybeans. The regression results are shown in model (3) in Table 3, where digital inclusive finance positively affects food security at a statistical level of 5%, again validating the contribution of digital inclusive finance to food security.

Table 3.

Robustness test of the model.

For more rigorous results, the explanatory variables were replaced with the first-order (L.lnDFI) and second-order lagged terms (L2.lnDFI) of digital inclusive finance, respectively, and regression analysis was performed again. The regression results are shown in models (4) and (5) in Table 3, where both the first- and second-order lagged terms of digital inclusive finance have a positive effect on food security at the 5% statistical level, verifying that the effect of digital inclusive finance on food security is robust.

5.3. Endogenous Discussion

The study may have two endogeneity problems. First, although a series of factors that may affect food security have been considered, there may be other factors affecting food security in the residuals, so the study may have endogeneity bias due to omitted variables. Second, the increase in food production may have “forced” the production agents to raise funds to increase the input of production factors, so the study may have endogeneity bias due to reverse causality. To this end, this study mitigates the endogeneity problem by selecting instrumental variables for the core explanatory variables, and the results of the endogeneity test are shown in Table 4. Models (6) and (7) selected first-order and second-order lagged terms of digital inclusive finance as instrumental variables, respectively, to assess whether digital inclusive finance in the previous year affects food security in the current period, and the results show that digital inclusive finance has a positive effect on food security at 5% and 1% significant levels, respectively. Digital inclusive finance is a product of the development of the internet to a certain period of time, and with reference to Huang et al. [67], the development history of internet access technology in China is used as the background for the selection of instrumental variables. Before the popularization of fixed-line telephones, people mainly contacted each other through post offices, so the number of local post offices would affect the access of fixed-line telephones and thus the efficiency of Internet access. The number of landlines and post offices are selected as instrumental variables to satisfy the requirement that there is a correlation between them and digital inclusive finance, and the number of histories is selected to satisfy the requirement that they are exclusive. Therefore, referring to the studies of Huang et al. [67] and Chen et al. [68], the number of landlines per million people and the number of post offices per million people in 1984 were used as instrumental variables for digital inclusive finance. Considering that the sample of this study is balanced panel data, instrumental variables will be difficult to measure due to the application of fixed effects models. We refer to Nunn and Qian [69], and construct as instrumental variables the interaction terms of the number of landlines per million people and the number of post offices per million people in 1984 with the index of the average index of digital financial inclusion in that year, and test the results as shown in model (8) in Table 4. From the regression results, it is clear that there is a positive effect of digital inclusive finance on food security at the 1% significant level. We used Kleibergen-Paap rk LM statistics to determine the problem of under-identification of the tool variables. The critical values of the Cragg–Donald Wald F statistic and the Stock–Yogo weak ID test were compared to determine whether the instrumental variables were weak instrumental variables. The Hansen J statistic was used to determine whether the instrumental variables were exogenous and over-identified, and the results showed that the selected instrumental variables were not identified. The results show that the selected instrumental variables are not under-identified, not weakly instrumental, exogenous, and not over-identified. Thus, the above test results again verify that the results of the benchmark regression are robust.

Table 4.

Results of the endogeneity test.

5.4. Heterogeneity Analysis

5.4.1. Perspectives of Main Grain Producing Areas, Main Marketing Areas and Balanced Production and Marketing Areas

The division of main grain producing areas, main marketing areas, and balanced production and marketing areas originated from China’s 2001 grain distribution system reform. According to the natural resource endowment and grain production status of each province in China, the 31 provinces (autonomous regions and municipalities) are divided into three functional areas, including the main grain producing area, the balanced production and marketing area, and the main grain marketing area (excluding Hong Kong, Macao and Taiwan). This study examines the impact of digital inclusive finance on food security in different functional zones. The results of the study are shown in Table 5 that the main food marketing areas and balanced production and marketing areas promote food security at 5% and 10% significant levels, respectively, and the impact of digital inclusive finance on food security in the main food marketing areas is not significant. The reason for this may be that the main grain producing areas have strong grain production capacity, huge land planting scale and frequent agricultural activities. Compared with the main grain selling areas and the balanced production and marketing areas, the main grain producing areas already have relatively perfect agricultural machinery and equipment, forming more large agricultural planters and professional farmers who rely on grain planting as their main income. Therefore, the effect of the funds provided by digital inclusive finance on increasing production factor inputs is not obvious for farmers in the main grain marketing areas where production conditions are more complete and the scale is huge.

Table 5.

The impact of each dimension on food security.

5.4.2. Eastern, Central and Western Perspectives

The eastern part of China was the first province to implement the coastal opening policy and has a high level of economic development; the central part is the second most economically developed region; and the western part is the less economically developed region. This paper examines the impact of digital financial inclusion on food security in the eastern, central, and western regions. The results are shown in Table 5 that digital inclusive finance in the eastern region has a positive impact on food security at the 5% significant level, while the impact of digital inclusive finance on food security in the central and western regions is not significant. The reason for this may be that the development of digital inclusive finance in the eastern region started earlier, has a higher level of development, and has a better technical support system. Digital inclusive finance is more accessible, and its integration with advanced technologies, such as big data and cloud computing, helps reduce credit risks and makes credit funds more easily available to farmers. This inspires us to pay attention to the central and western regions when developing digital inclusive finance, improve their digital inclusive finance development level, and strive to achieve a high level of digital inclusive finance development.

5.5. Intermediation Mechanism and Moderating Effect Test

5.5.1. Test of Farmland Scale Effect

Table 6 shows the results of the test of farmland scale effect. As can be seen from the table, farmland scale passes the test at the 5% significant level, indicating that digital inclusive finance can promote food security through farmland scale, and hypothesis 2 passes the test. At this point, the scale of farmland plays a partial mediating role between digital inclusive finance and food security, and 47.10% of the mediating effect is obtained by calculating β1·δ2/α1. Digital inclusive finance provides sufficient funds for the expansion of farmland scale, which leads to the expansion of farmland scale, improves production efficiency, and expands planting area, which in turn affects food security.

Table 6.

Digital inclusive finance and farmland scale.

5.5.2. Further Discussion: A Test of the Moderating Effect of Progress in Agricultural Machinery

Table 7 shows the results of the test of moderating effect of agricultural machinery advancement. From the test results, the coefficient of the interaction term between digital inclusive finance and agricultural machinery progress is significant at the 5% statistical level and the regression coefficient is 0.367, indicating that agricultural machinery progress plays an enhanced role in digital inclusive finance positively affecting food security, and hypothesis 3 passes the test. Digital inclusive finance provides farmers with capital to improve production factor inputs, and agricultural machinery advancement promotes the rational allocation of production factors to increase food production.

Table 7.

Digital inclusive finance and agricultural machinery advancement.

6. Conclusions

This study uses panel data for 30 Chinese provinces from 2011 to 2020 to construct a fixed-effects model to explore the impact of digital inclusive finance on food security. Results: (1) There is a significant positive effect of digital inclusive finance on food security. We perform robustness tests by replacing variables. The interaction terms of the first- and second-order lagged terms of digital inclusive finance, the number of telephone calls per million people and the number of post offices per million people in 1984, and the average index of digital inclusive finance in the current period are constructed as instrumental variables for endogeneity tests. The results indicate that the contribution of digital inclusion finance to food security is robust. (2) Digital inclusive finance can promote food security by expanding farmland scale; agricultural machinery advances play an enhanced role in the role of digital inclusive finance for food security. (3) Digital inclusive finance in the eastern region has a significant contribution to food security, while the effect of digital inclusive finance on food security in the western and central regions is not significant, reflecting sideways that the effect of digital inclusive finance on food security has not yet played a role in the central and western regions. (4) The effect of digital inclusive finance on food security in the main grain producing areas is not significant, and there is a significant positive effect of digital inclusive finance on food security in the main grain selling areas and balanced production and marketing areas.

Digital inclusive finance will be a new tool for stable food production and supply and play an important role in food security, according to which the following recommendations are made. First, traditional financial institutions are encouraged to develop digital technology, develop digital inclusive finance, expand the coverage of digital inclusive finance to reach the countryside, and guide financial institutions to innovate financial tools to provide financial support for farmers’ food production and provide better financial services to achieve food security. Second, the effect of digital inclusive finance and farming scale should be brought into play. The rural credit market and rural insurance market should be developed and improved to provide multi-species and low-interest credit products to grain farmers who are willing to expand their planting scale, and guide large grain farmers to reduce their business risks through rural insurance, thus promoting grain scale operations. Third, special funds should be set up for agricultural scientific research and transformation of achievements, to encourage scientific research activities to enhance agricultural productivity, actively promote the development of agricultural machinery, promote the use of agricultural machinery, and enhance the level of socialized services of agricultural machinery. Fourth, the development of digital inclusive finance in the central and western regions should be vigorously enhanced. Playing the role of village banks, financial institutions should be encouraged to promote the sinking of financial services and deliver inclusive finance to farmers.

The role of the development of financial instruments and digital technologies on agricultural production has been found in previous studies, although the existence of a facilitating role of digital inclusive finance on food security has not been addressed. For example, Zheng et al. found a significant positive impact of Internet use on farmers’ food production [70]. He et al. suggested that climate change has a negative impact on agricultural production, but digital inclusive finance can help farmers to increase their resilience to climate change [71]. Moreover, several studies have confirmed the role of rural insurance and rural credit among financial instruments on food production [52,53]. The findings obtained in this study are a useful complement to the role of digital inclusion finance on agricultural production, which can be further explored in depth in the future. In terms of farmland scale, the findings of this study support that digital inclusive finance can promote food production by expanding the scale of farmland operations, but there is still no consistent answer to the discussion of farmland operation scale in existing studies, with some scholars suggesting that there is a “U” shaped relationship between farmland operation scale and arable land food output rate [26], while others point out that the rice yield of small-scale farmers is higher than that of large-scale farmers, but the average economic efficiency of rice production of large-scale farmers is higher than that of small-scale farmers [72]. Therefore, the question of which is better, large-scale or small-scale farming, remains to be tested in a different context.

Although the findings of the study support the existence of an important role of digital inclusive finance in promoting food security, the findings can only be considered as a preliminary validation and have some limitations. First, in the measurement of food security, the grain production counted in the study mainly includes grain, wheat, corn, sorghum, cereals, other miscellaneous grains, potatoes, and soybeans, and the data currently do not cover vegetables, fruits, and meat, and the caliber of grain can be further expanded in subsequent studies. Second, this study mainly focuses on the yield of grain, but the concept of food security is multidimensional, and further attention can be paid to the feasibility of grain in subsequent studies by focusing on elements such as the price of grain. Third, this study finds a mediating role of farmland scale in the role of digital inclusive finance on food security, but there are other mediating variables to be further discovered. Fourth, this paper uses data at the provincial level in China, which cover a long period of years, and has initially verified the role of digital inclusive finance in ensuring food security. In the follow-up study, considering the relatively large differences within Chinese provinces, county-level data can be considered for in-depth mining. Fifth, in the follow-up study, the threshold effect of digital inclusive finance on food security can be further considered to investigate its role in ensuring food security changes under different levels of development of digital inclusive finance, which will be of reference value to developing countries with different levels of digital inclusive finance development.

Author Contributions

Conceptualization, Q.L.; methodology, Q.L.; software, Q.L.; validation, X.D.; formal analysis, Q.C.; investigation, X.D. and Q.L.; data curation, Q.L., and Q.C.; writing—original draft preparation, W.L. and Q.L.; writing—review and editing, W.L.; funding acquisition, W.L. All authors have read and agreed to the published version of the manuscript.

Funding

2021 Fujian Provincial Social Science Planning Youth Project (FJ2021C092); Fujian Agriculture and Forestry University on the 2018 Annual Social Science National Research Project Cultivation Plan Project (xpy201808); Reform of University-Enterprise Collaborative Cultivation Model for Graduate Students of Business Degree, 2020 General Project of Postgraduate Education and Teaching Reform of Fujian Agriculture and Forestry University; The Base Projcet of Hangzhou Philosophy and Social Science Planning Project in 2021 (2121JD46); The first batch of cooperative education project of industry university cooperation of the Ministry of education in 2020 (202002168035).

Data Availability Statement

All data are available via email from the corresponding author.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Martin Goal 2: Zero Hunger. Available online: https://www.un.org/sustainabledevelopment/hunger/ (accessed on 22 September 2022).

- Haque, M.K.; Zaman, M.R.U.; Rahman, M.A.; Hossain, M.Y.; Shurid, T.I.; Rimi, T.A.; Arby, H.; Rabbany, M.G. A Review on Impacts of COVID-19 on Global Agricultural System and Scope for Bangladesh after Pandemic. Environ. Sci. Pollut. Res. 2022, 29, 54060–54071. [Google Scholar] [CrossRef] [PubMed]

- Erokhin, V.; Gao, T. Impacts of COVID-19 on Trade and Economic Aspects of Food Security: Evidence from 45 Developing Countries. IJERPH 2020, 17, 5775. [Google Scholar] [CrossRef] [PubMed]

- Jing, X.; Jiang, R.; Chen, Z.; Deng, Z. Agricultural output effect of rural finance: An extended regression approach. E+M. Ekon. A Manag. Econ. Manag. 2022, 25, 4–22. [Google Scholar] [CrossRef]

- Kassouri, Y.; Kacou, K.Y.T. Does the Structure of Credit Markets Affect Agricultural Development in West African Countries? Econ. Anal. Policy 2022, 73, 588–601. [Google Scholar] [CrossRef]

- Osabohien, R.; Adeleye, N.; Alwis, T.D. Agro-Financing and Food Production in Nigeria. Heliyon 2020, 6, e04001. [Google Scholar] [CrossRef]

- Seven, U.; Tumen, S. Agricultural Credits and Agricultural Productivity: Cross-Country Evidence. Singap. Econ. Rev. 2020, 65, 161–183. [Google Scholar] [CrossRef]

- Zhang, X.; Wang, Z.; Wang, Z. An empirical test of the spatial spillover effects of rural finance on food security. Stat. Decis. 2020, 36, 78–81. [Google Scholar] [CrossRef]

- Jiao, J.; Huang, T.; Wang, T.; Zhang, S.; Wang, Z. The Development Process and Empirical Study of Inclusive Finance in China. Shanghai Financ. 2015, 12–22. [Google Scholar] [CrossRef]

- Gong, Q.; Cheng, X. Digital Financial Inclusion, Rural Poverty and Economic Growth. Gansu Soc. Sci. 2018, 139–145. [Google Scholar] [CrossRef]

- Chakravarty, S.R.; Pal, R. Financial Inclusion in India: An Axiomatic Approach. J. Policy Modeling 2013, 35, 813–837. [Google Scholar] [CrossRef]

- Huang, Z.; Wang, P. The Role of Digital Financial Inclusion in the Development of Digital Agriculture. Issues Agric. Econ. 2022, 27–36. [Google Scholar] [CrossRef]

- Ji, X.; Wang, K.; Xu, H.; Li, M. Has Digital Financial Inclusion Narrowed the Urban-Rural Income Gap: The Role of Entrepreneurship in China. Sustainability 2021, 13, 8292. [Google Scholar] [CrossRef]

- Guo, F.; Wang, J.; Wang, F.; Kong, T.; Zhang, X.; Cheng, Z. Measuring China’s Digital Financial Inclusion: Index Compilation and Spatial Characteristics. China Econ. Q. 2020, 19, 1401–1418. [Google Scholar] [CrossRef]

- Chen, B.; Zhao, C. Poverty Reduction in Rural China: Does the Digital Finance Matter? PLoS ONE 2021, 16, e0261214. [Google Scholar] [CrossRef] [PubMed]

- World Health Organization. The State of Food Security and Nutrition in the World 2021; FAO: Rome, Italy, 2021; ISBN 978-92-5-134325-8.

- Ma, J.; Zhang, X.; Gu, H. A Study of Grain Safety Measurement and of the Warning Indicator System. Manag. World 2001, 154–162. [Google Scholar] [CrossRef]

- Gao, J.; Li, H.; Shao, J. A DEA model-based assessment of China’s grain industry security. Stat. Decis. 2020, 36, 61–65. [Google Scholar] [CrossRef]

- Qi, D.; Qi, H.; Fan, Q. Construction of evaluation index system for high-quality development of food industry. Stat. Decis. 2022, 38, 106–110. [Google Scholar] [CrossRef]

- Brown, M.E.; Tondel, F.; Essam, T.; Thorne, J.A.; Mann, B.F.; Leonard, K.; Stabler, B.; Eilerts, G. Country and Regional Staple Food Price Indices for Improved Identification of Food Insecurity. Glob. Environ. Chang. 2012, 22, 784–794. [Google Scholar] [CrossRef]

- Peng, Y.; Hirwa, H.; Zhang, Q.; Wang, G.; Li, F. Dryland Food Security in Ethiopia: Current Status, Opportunities, and a Roadmap for the Future. Sustainability 2021, 13, 6503. [Google Scholar] [CrossRef]

- Kaluski, D.N.; Ophir, E.; Amede, T. Food Security and Nutrition—The Ethiopian Case for Action. Public Health Nutr. 2002, 5, 373–381. [Google Scholar] [CrossRef] [PubMed]

- Zhang, Y.; Liu, C.; Guo, L. Appraisal and Strategic Consideration on Food Security Status of China. China Rural Surv. 2015, 1, 2–14. [Google Scholar]

- Zhu, Y. International Trade and Food Security: Conceptual Discussion, WTO and the Case of China. China Agric. Econ. Rev. 2016, 8, 399–411. [Google Scholar] [CrossRef]

- Xie, H.; Ouyang, Z.; Chen, Q. Does Cultivated Land Fragmentation Promote “Non-grain” Utilization of Cultivated Land: Based on a Micro Survey of Farmers in the Hilly and Mountainous Areas of Fujian. China Land Sci. 2022, 36, 47–56. [Google Scholar]

- Zhou, J.; Li, H. Analysis of the impact of large-scale management on the food output rate of arable land in China. Agric. Econ. 2022, 3–5. [Google Scholar] [CrossRef]

- Xi, Y.; Liu, J.; Chang, M. Impact of water-saving irrigation on the planting of food crops based on the regulation effect of agricultural labor resources. Chin. J. Eco-Agric. 2022, 30, 458–469. [Google Scholar]

- Wang, R.; Wang, Y.; Zeng, H. An Empirical Test of Factors Influencing High-Quality Development of Food Industry. Stat. Decis. 2021, 37, 103–107. [Google Scholar] [CrossRef]

- Arduin, P.-E.; Saïdi-Kabeche, D. Dignity in Food Aid Logistics Is Also a Knowledge Management and Digital Matter: Three Inspiring Initiatives in France. Sustainability 2022, 14, 1130. [Google Scholar] [CrossRef]

- Herrington, A.; Mix, T.L. Invisible and Insecure in Rural America: Cultivating Dignity in Local Food Security Initiatives. Sustainability 2021, 13, 3109. [Google Scholar] [CrossRef]

- Zhong, F.; Lu, W.; Xu, Z. Is rural labor migration detrimental to food production? An Analysis of Factor Substitution and Planting Restructuring Behavior of Farmers and Constraints. Chin. Rural Econ. 2016, 36–47. Available online: https://kns.cnki.net/kcms/detail/detail.aspx?dbcode=CJFD&dbname=CJFDLAST2016&filename=ZNJJ201607005&uniplatform=NZKPT&v=l1prXrguAATj4R9Q7XVYcC7DQbbtpZ4T8P0jQRn8sHETmd8W760xHEsXmLcgt_lK (accessed on 22 September 2022).

- Wen, X.; Yang, S. Evaluation of the Effect of Fiscal Subsidy Policy on Increasing Production and Income in Major Grain Producing Areas—Take Henan Province as an example. Price Theory Pract. 2022, 91–95. [Google Scholar] [CrossRef]

- Magrini, E.; Vigani, M. Technology Adoption and the Multiple Dimensions of Food Security: The Case of Maize in Tanzania. Food Secur. 2016, 8, 707–726. [Google Scholar] [CrossRef]

- Wang, Y.; Chen, J. Research on the Practical Difficulties and Policy Recommendations of Financial Support for the Development of Modern Seed Industries. Southwest Financ. 2021, 67–77. Available online: https://kns.cnki.net/kcms/detail/detail.aspx?dbcode=CJFD&dbname=CJFDLAST2021&filename=SCJR202110006&uniplatform=NZKPT&v=ztVL_ngqb6SruY-NkEUtWKkvvLtJV5G17bzqzxofRxjUynZ-gjPgzokzkYjSKxal (accessed on 22 September 2022).

- Cai, J.; Xu, S.; Mi, Y. Influence of rural financial market development on the formation of large grain producers: Literature review and theoretical analysis. J. China Agric. Univ. 2019, 24, 230–238. [Google Scholar]

- Sutherland, W.; Jarrahi, M.H. The Sharing Economy and Digital Platforms: A Review and Research Agenda. Int. J. Inf. Manag. 2018, 43, 328–341. [Google Scholar] [CrossRef]

- Katsamakas, E.; Miliaresis, K.; Pavlov, O.V. Digital Platforms for the Common Good: Social Innovation for Active Citizenship and ESG. Sustainability 2022, 14, 639. [Google Scholar] [CrossRef]

- Bonina, C.; Koskinen, K.; Eaton, B.; Gawer, A. Digital Platforms for Development: Foundations and Research Agenda. Inf. Syst. J. 2021, 31, 869–902. [Google Scholar] [CrossRef]

- Hao, A.; Tan, J. Impact of Digital Rural Construction on Food System Resilience. J. South China Agric. Univ. (Soc. Sci. Ed.) 2022, 21, 10–24. [Google Scholar]

- Fan, W. Does Digital Financial Inclusion Improve Farmers’ Access to Credit? J. Huazhong Agric. Univ. (Soc. Sci. Ed.) 2021, 109–119, 179. [Google Scholar] [CrossRef]

- Peng, P.; Xu, Z. Can Digital Inclusive Finance Reduce the Vulnerability of Peasant Households? Econ. Rev. 2021, 82–95. [Google Scholar] [CrossRef]

- Yu, N.; Wang, Y. Can Digital Inclusive Finance Narrow the Chinese Urban-Rural Income Gap? The Perspective of the Regional Urban-Rural Income Structure. Sustainability 2021, 13, 6427. [Google Scholar] [CrossRef]

- Zhao, H.; Zheng, X.; Yang, L. Does Digital Inclusive Finance Narrow the Urban-Rural Income Gap through Primary Distribution and Redistribution? Sustainability 2022, 14, 2120. [Google Scholar] [CrossRef]

- Zhang, C.; Hong, Z.; Wang, L. Research on the Impact of Rural Inclusive Finance on Agricultural Industrialization. J. Guizhou Univ. Financ. Econ. 2021, 35–44. [Google Scholar] [CrossRef]

- Zhang, Y.; Zhou, Y. Digital Financial Inclusion, Traditional Financial Competition, and Rural Industry Integration. J. Agrotech. Econ. 2021, 68–82. [Google Scholar] [CrossRef]

- Yan, G.; He, Y.; Zhang, X. Can the Development of Digital Inclusive Finance Promote Agricultural Mechanization—Based on the Perspective of the Development of Agricultural Machinery Outsourcing Service Market. J. Agrotech. Econ. 2022, 51–64. [Google Scholar] [CrossRef]

- Sun, X.; Yu, T.; Yu, F. The Impact of Digital Finance on Agricultural Mechanization: Evidence from 1869 Countries in China. Chin. Rural Econ. 2022, 76–93. Available online: https://kns.cnki.net/kcms/detail/detail.aspx?dbcode=CJFD&dbname=CJFDLAST2022&filename=ZNJJ202202005&uniplatform=NZKPT&v=CREj9z6n57QoNohZTUW-gytGYpBUCBFSt0c32pLvgo7bt1n844C7em5p9Hnwun43 (accessed on 22 September 2022).

- Zhang, Y. Study on the Influence and Mechanism of Digital Inclusive Finance on Rural Land Transfer: Empirical Evidence from CFPS and PKU-DFIIC. Econ. Manag. 2022, 36, 30–40. [Google Scholar]

- Liu, Y. The Impact of Digital Inclusive Finance on Total Factor Productivity in Agriculture. Stat. Decis. 2021, 37, 123–126. [Google Scholar] [CrossRef]

- Zhou, T. Digital Inclusive Finance, Factor Price and Labor Mobility. Contemp. Econ. Manag. 2022, 44, 77–87. [Google Scholar] [CrossRef]

- Xu, Y.; Peng, Z.; Sun, Z.; Zhan, H.; Li, S. Does Digital Finance Lessen Credit Rationing—Evidence from Chinese Farmers. Res. Int. Bus. Financ. 2022, 62, 101712. [Google Scholar] [CrossRef]

- Wang, J.; Bi, S.; Li, Y.; Lyu, K. The Effect of Formal Credit Constraint on Grain Production. J. Agrotech. Econ. 2018, 28–39. [Google Scholar] [CrossRef]

- Hu, X.; Wang, Z.; Liu, J. The Impact of Digital Finance on Household Insurance Purchases: Evidence from Micro Data in China. Geneva Pap. Risk Insur.-Issues Pract. 2022, 47, 538–568. [Google Scholar] [CrossRef]

- Zhou, J.; Zhang, W.; Chen, Y. Evaluation of Agricultural Insurance Subsidy Effect and Policy Optimization in Major Grain-Producing Areas-Based on Food Security Perspective. Rural Econ. 2018, 69–75. Available online: https://kns.cnki.net/kcms/detail/detail.aspx?dbcode=CJFD&dbname=CJFDLAST2018&filename=NCJJ201808013&uniplatform=NZKPT&v=9j5F5kiFR9bxrl4RejoEnKSEBEjh6quy85sJd3dHnODFyTjovsHPNgHzxCsC4lJ3 (accessed on 22 September 2022).

- Mei, F.; Ma, K. The Dispute over the Path of Moderate Scale Management of Agriculture: Land Scale or Service Scale. Econ. Surv. 2022, 39, 46–56. [Google Scholar] [CrossRef]

- Liu, T. The Impact of Inadequate Farmland Transfer on Grain Yield: Evidence from Wheat Production in Huang-huai-hai District in China. Chin. Rural Econ. 2018, 103–116. Available online: https://kns.cnki.net/kcms/detail/detail.aspx?dbcode=CJFD&dbname=CJFDLAST2019&filename=ZNJJ201812007&uniplatform=NZKPT&v=PANjRb4Ogq0-vx4oEz1dDgIBusBD3fNP3cQy_5aqR7IY9lbQxYJJqBgXeFxw0icJ (accessed on 22 September 2022).

- Kang, X.; Liu, X. Analysis of technical efficiency of grain production in China—Based on stochastic frontier analysis method. China Rural Surv. 2005, 25–32. Available online: https://kns.cnki.net/kcms/detail/detail.aspx?dbcode=CJFD&dbname=CJFD2005&filename=ZNCG200504002&uniplatform=NZKPT&v=tGJ0vzZ0mHiuWpvqGARs_08bk9t0tsa2BM3Bx4XCUjrNBZe9zSC0rdI-81i2NziS (accessed on 22 September 2022).

- Zhang, Z.; Du, Z. Does land transfer necessarily lead to “de-fooding”? An empirical analysis based on the monitoring data of 1740 family farms in China. Econ. Perspect. 2015, 63–69. Available online: https://kns.cnki.net/kcms/detail/detail.aspx?dbcode=CJFD&dbname=CJFDLAST2015&filename=JJXD201509007&uniplatform=NZKPT&v=Qa5HER4SswbVlgVyHcaJQdlnsbq-q9wCizKofvxLbrnsSH34s9mwpoTJsi6wBPOW (accessed on 22 September 2022).

- Yin, H.; Zhang, B.; Xu, Z. The Impact of Credit Availability on Farmers’ Farmland Transfer Behavior—An Empirical Analysis Based on Mediating Effect Model. World Econ. Pap. 2020, 89–104. Available online: https://kns.cnki.net/kcms/detail/detail.aspx?dbcode=CJFD&dbname=CJFDLAST2020&filename=SZWH202005006&uniplatform=NZKPT&v=8Is5WkOg7KQMp2VJ4sbb16YKAb8M1lnZBtiypKMpdxB5FSbe0qTXkGE9aegSMhk5 (accessed on 22 September 2022).

- Lu, S.; Xiong, J. Rural Finance, Agricultural Land Scale Management and Agricultural Green Efficiency. J. South China Agric. Univ. (Soc. Sci. Ed.) 2021, 20, 63–75. [Google Scholar]

- Zheng, J.; Gao, M. A Study on the Effects of Agricultural Mechanization and Rural Labor Transfer on Total Factor Productivity in Agriculture—An Empirical Test Based on Panel Data of 31 Provinces (Cities and Autonomous Regions) in Mainland China. Fujian Trib. (Humanit. Soc. Sci. Bimon.) 2021, 59–71. Available online: https://kns.cnki.net/kcms/detail/detail.aspx?dbcode=CJFD&dbname=CJFDLAST2021&filename=FJLW202108006&uniplatform=NZKPT&v=0GyqqW8OgKJNrwUEWV3khDH573Wmdxe9sDGP3C3QBY2c1vb9kbO-Sng28LkAzmp8 (accessed on 22 September 2022).

- Wen, Z.; Ye, B. Analyses of Mediating Effects: The Development of Methods and Models. Adv. Psychol. Sci. 2014, 22, 731–745. [Google Scholar] [CrossRef]

- Fang, J.; Wen, Z.; Liang, D.; Li, N. Moderation Effect Analyses Based on Multiple Linear Regression. J. Psychol. Sci. 2015, 38, 715–720. [Google Scholar] [CrossRef]

- Tian, H.; Zhu, Z. Rural Labor Migration, Scale of Operation and Environmental Technical Efficiency of Grain Production. J. South China Agric. Univ. (Soc. Sci. Ed.) 2018, 17, 69–81. [Google Scholar]

- Deng, X.; Zhang, K.; Xi, Y. Does Cultural Differences Hinder Agricultural Technology Diffusion? Evidence from Rural Dialect Distance and Agricultural Mechanization. China Econ. Stud. 2019, 58–71. [Google Scholar] [CrossRef]

- Gao, Y.; Zhang, Z.; Wei, S.; Wang, Z. Impact of urbanization on food security: Evidence from provincial panel data in China. Resour. Sci. 2019, 41, 1462–1474. [Google Scholar] [CrossRef]

- Huang, Q.; Yu, Y.; Zhang, S. Internet Development and Upgrading of Manufacturing Industry Productivity: Internal Mechanism and China’s Experience. China Ind. Econ. 2019, 5–23. [Google Scholar] [CrossRef]

- Chen, Z.; Chen, Z.; Tan, W. On Mechanism Analysis and Effect of Digital Economy on the Promotion of High-quality Economic Development. J. Guangdong Univ. Financ. Econ. 2022, 37, 4–20. [Google Scholar]

- Nunn, N.; Qian, N. US Food Aid and Civil Conflict. Am. Econ. Rev. 2014, 104, 1630–1666. [Google Scholar] [CrossRef]

- Zheng, Y.; Fan, Q.; Jia, W. How Much Did Internet Use Promote Grain Production?—Evidence from a Survey of 1242 Farmers in 13 Provinces in China. Foods 2022, 11, 1389. [Google Scholar] [CrossRef]

- He, C.; Qiu, W.; Yu, J. Climate Change Adaptation: A Study of Digital Financial Inclusion and Consumption Among Rural Residents in China. Front. Environ. Sci. 2022, 10, 889869. [Google Scholar] [CrossRef]

- Wang, J.; Chen, P.; Chen, F. A Comparative Study of Farming Behavior of Different Land Scale Farmers and Their Economic Benefits: A Case Study of Rice Farmers’ Survey Data in Yangtze River Basin. World Surv. Res. 2012, 34–37. [Google Scholar] [CrossRef]

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).