Club Convergence in R&D Expenditure across European Regions

Abstract

:1. Introduction

2. Literature Review

3. Data and Methods

- Calculation of cross-sectional variance ratios H1/Ht (t = 1, 2, …, T).

- Estimation of the following regression:where r ∈ (0, 1). Considering the results of their simulations, Phillips and Sul [26] suggest the use of r ∈ [0.2, 0.3]. In the case of a small T, r = 0.2 is preferred, and if T is large, r = 0.3 is a better decision.

- Application of autocorrelation and a heteroskedasticity robust one-sided t test to verify the null hypothesis applying and a HAC standard error. At a standard significance level (0.05), the null hypothesis is rejected if .

4. Results

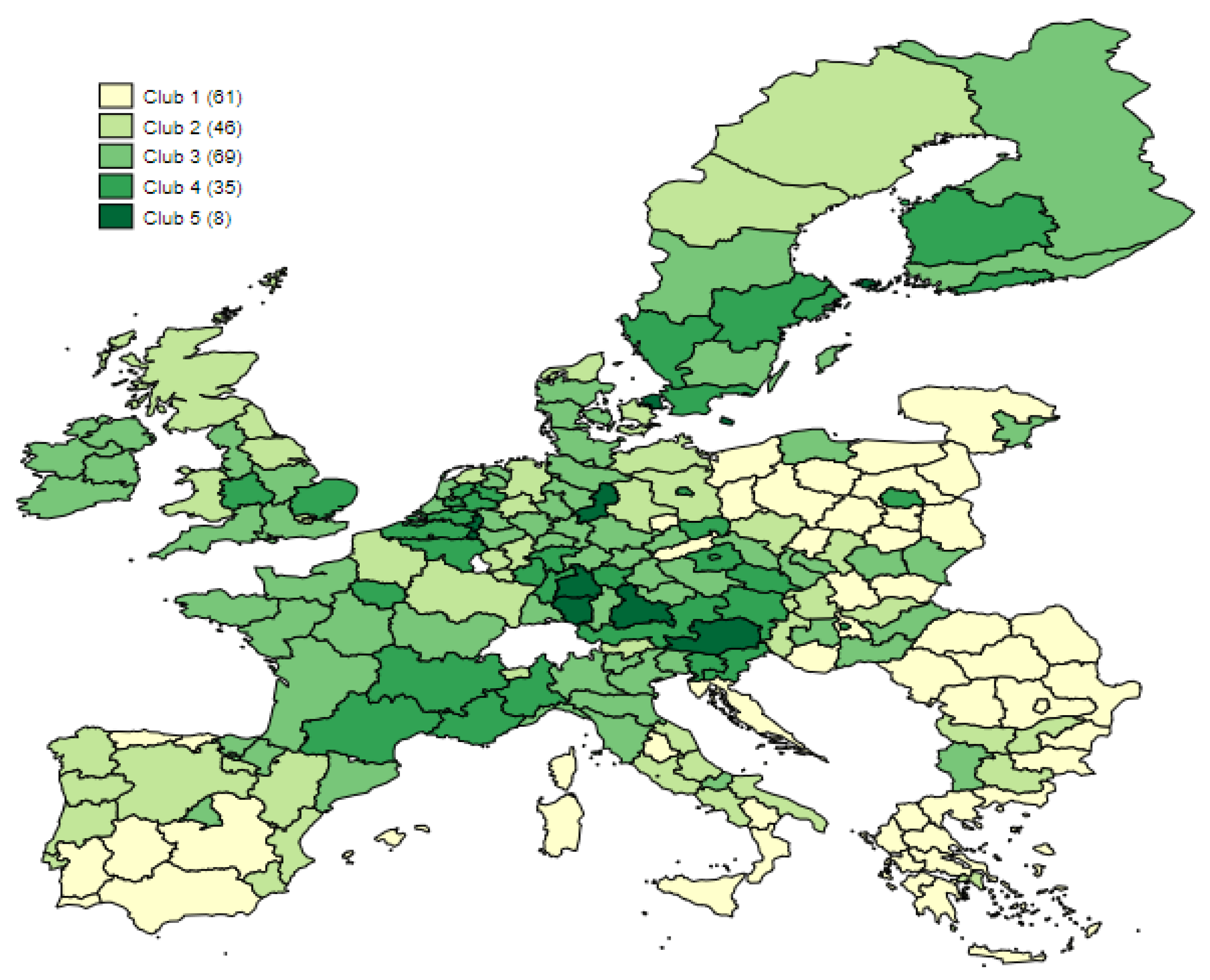

4.1. Convergence Clubs Identification

4.2. Determinants of Club Membership

5. Discussion

6. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Appendix A

| Country | Number of Regions at NUTS Level | Regions (NUTS Code) | |

|---|---|---|---|

| 1 | 2 | ||

| Belgium | 3 | Région de Bruxelles-Capitale/Brussels Hoofdstedelijk Gewest (BE1) *, Vlaams Gewest (BE2), Région wallonne (BE3) | |

| Bulgaria | 6 | Severozapaden (BG31), Severen tsentralen (BG32), Severoiztochen (BG33), Yugoiztochen (BG34), Yugozapaden (BG41), Yuzhen tsentralen (BG42) | |

| Czechia | 8 | Praha (CZ01), Střední Čechy (CZ02), Jihozápad (CZ03), Severozápad (CZ04), Severovýchod (CZ05), Jihovýchod (CZ06), Střední Morava (CZ07), Moravskoslezsko (CZ08) | |

| Denmark | 5 | Hovedstaden (DK01), Sjælland (DK02), Syddanmark (DK03), Midtjylland (DK04), Nordjylland (DK05) | |

| Germany | 9 | 29 | Stuttgart (DE11), Karlsruhe (DE12), Freiburg (DE13), Tübingen (DE14), Oberbayern (DE21), Niederbayern (DE22), Oberpfalz (DE23), Oberfranken (DE24), Mittelfranken (DE25), Unterfranken (DE26), Schwaben (DE27), Berlin (DE3) *, Brandenburg (DE4) *, Bremen (DE5) *, Hamburg (DE6) *, Darmstadt (DE71), Gießen (DE72), Kassel (DE73), Mecklenburg-Vorpommern (DE8) *, Braunschweig (DE91), Hannover (DE92), Lüneburg (DE93), Weser-Ems (DE94), Düsseldorf (DEA1), Köln (DEA2), Münster (DEA3), Detmold (DEA4), Arnsberg (DEA5), Koblenz (DEB1), Trier (DEB2), Rheinhessen-Pfalz (DEB3), Saarland (DEC) *, Dresden (DED2), Chemnitz (DED4), Leipzig (DED5), Sachsen-Anhalt (DEE) *, Schleswig-Holstein (DEF) *, Thüringen (DEG) * |

| Ireland | 3 | Northern and Western (IE04), Southern (IE05), Eastern and Midland (IE06) | |

| Greece | 1 | 12 | Attiki (EL3) *, Voreio Aigaio (EL41), Notio Aigaio (EL42), Kriti (EL43), Anatoliki Makedonia, Thraki (EL51), Kentriki Makedonia (EL52), Dytiki Makedonia (EL53), Ipeiros (EL54), Thessalia (EL61), Ionia Nisia (EL62), Dytiki Ellada (EL63), Sterea Ellada (EL64), Peloponnisos (EL65) |

| Spain | 2 | 17 | Galicia (ES11), Principado de Asturias (ES12), Cantabria (ES13), País Vasco (ES21), Comunidad Foral de Navarra (ES22), La Rioja (ES23), Aragón (ES24), Comunidad de Madrid (ES3) *, Castilla y León (ES41), Castilla-la Mancha (ES42), Extremadura (ES43), Cataluña (ES51), Comunitat Valenciana (ES52), Illes Balears (ES53), Andalucía (ES61), Región de Murcia (ES62), Ciudad de Ceuta (ES63), Ciudad de Melilla (ES64), Canarias (ES7) * |

| France | 14 | Île de France (FR1) *, Centre - Val de Loire (FRB) *, Bourgogne-Franche-Comté (FRC), Normandie (FRD), Hauts-de-France (FRE), Grand Est (FRF), Pays de la Loire (FRG) *, Bretagne (FRH) *, Nouvelle-Aquitaine (FRI), Occitanie (FRJ), Auvergne - Rhône-Alpes (FRK), Provence-Alpes-Côte d’Azur (FRL) *, Corse (FRM) *, RUP FR—Régions ultrapériphériques françaises (FRY) | |

| Croatia | 1 | Jadranska Hrvatska (HR03) | |

| Italy | 21 | Piemonte (ITC1), Valle d’Aosta/Vallée d’Aoste (ITC2), Liguria (ITC3), Lombardia (ITC4), Provincia Autonoma Bolzano/Bozen (ITH1), Provincia Autonoma Trento (ITH2), Veneto (ITH3), Friuli-Venezia Giulia (ITH4), Emilia-Romagna (ITH5), Toscana (ITI1), Umbria (ITI2), Marche (ITI3), Lazio (ITI4), Abruzzo (ITF1), Molise (ITF2), Campania (ITF3), Puglia (ITF4), Basilicata (ITF5), Calabria (ITF6), Sicilia (ITG1), Sardegna (ITG2) | |

| Lithuania | 2 | Sostinės regionas (LT01), Vidurio ir vakarų Lietuvos regionas (LT02) | |

| Hungary | 8 | Budapest (HU11), Pest (HU12), Közép-Dunántúl (HU21), Nyugat-Dunántúl (HU22), Dél-Dunántúl (HU23), Észak-Magyarország (HU31), Észak-Alföld (HU32), Dél-Alföld (HU33) | |

| Netherlands | 12 | Groningen (NL11), Friesland (NL12), Drenthe (NL13), Overijssel (NL21), Gelderland (NL22), Flevoland (NL23), Utrecht (NL31), Noord-Holland (NL32), Zuid-Holland (NL33), Zeeland (NL34), Noord-Brabant (NL41), Limburg (NL42) | |

| Austria | 3 | Ostösterreich (AT1), Südösterreich (AT2), Westösterreich (AT3) | |

| Poland | 17 | Małopolskie (PL21), Śląskie (PL22), Wielkopolskie (PL41), Zachodniopomorskie (PL42), Lubuskie (PL43), Dolnośląskie (PL51), Opolskie (PL52), Kujawsko-Pomorskie (PL61), Warmińsko-Mazurskie (PL62), Pomorskie (PL63), Łódzkie (PL71), Świętokrzyskie (PL72), Lubelskie (PL81), Podkarpackie (PL82), Podlaskie (PL84), Warszawski stoleczny (PL91), Mazowiecki regionalny (PL92) | |

| Portugal | 2 | 5 | Norte (PT11), Algarve (PT15), Centro (PT16), Lisboa (PT17), Alentejo (PT18), Região Autónoma dos Açores (PT2) *, Região Autónoma da Madeira (PT3) * |

| Romania | 8 | Nord-Vest (RO11), Centru (RO12), Nord-Est (RO21), Sud-Est (RO22), Sud-Muntenia (RO31), Bucuresti-Ilfov (RO32), Sud-Vest Oltenia (RO41), Vest (RO42) | |

| Slovenia | 2 | Vzhodna Slovenija (SI03), Zahodna Slovenija (SI04) | |

| Slovakia | 4 | Bratislavský kraj (SK01), Západné Slovensko (SK02), Stredné Slovensko (SK03), Východné Slovensko (SK04) | |

| Finland | 1 | 4 | Helsinki-Uusimaa (FI1B), Etelä-Suomi (FI1C), Länsi-Suomi (FI19), Pohjois-ja Itä-Suomi (FI1D), Åland (FI2) * |

| Sweden | 8 | Stockholm (SE11), Östra Mellansverige (SE12), Småland med öarna (SE21), Sydsverige (SE22), Västsverige (SE23), Norra Mellansverige (SE31), Mellersta Norrland (SE32), Övre Norrland (SE33) | |

| United Kingdom | 12 | North East (UKC), North West (UKD), Yorkshire and The Humber (UKE), East Midlands (UKF), West Midlands (UKG), East of England (UKH), London (UKI), South East (UKJ), South West (UKK), Wales (UKL), Scotland (UKM), Northern Ireland (UKN) * | |

Appendix B

| Club 1 | BG33, BG34, CZ04, DED5, EL52, EL42, EL43, EL62, EL64, EL61, EL63, EL54, EL53, EL65, EL51, EL41, ES61, ES63, ES42, ES12, ES64, ES43, ES13, ES53, ES7, FRY, FRM, HR03, HU23, HU12, ITF6, ITF5, ITG1, ITG2, ITI2, LT02, PL52, PL72, PL92, PL62, PL41, PL43, PL81, PL84, PL42, PL61, PL71, PT3, PT2, PT15, PT18, RO12, RO42, RO21, RO31, RO11, RO41, RO22, RO32, SK04, SK03 |

| Club 2 | BG32, BG31, BG42, DEB2, DEB1, DE94, DE4, DEE, DEC, DE8, DEA3, DK02, DK05, EL3, ES41, ES23, ES24, ES11, ES62, ES52, FRF, FRE, HU31, HU22, ITI3, ITC2, ITF4, ITH1, ITF3, ITF1, ITI4, NL12, PL51, PL22, PT11, PT17, PT16, SE33, SE32, SK02, SK01, UKL, UKI, UKM, UKC, UKE |

| Club 3 | BE1, BG41, CZ01, CZ05, CZ03, CZ08, CZ07, DE6, DE5, DEA4, DED4, DE92, DEA5, DE26, DE13, DE73, DEG, DE23, DE24, DEA1, DE72, DEF, DEA2, DE93, DE27, DE22, DK04, DK03, ES3, ES51, ES21, ES22, FI1D, FI1C, FRC, FRD, FRG, FRH, FRI, FRB, HU32, HU21, HU33, IE06, IE05, IE04, ITF2, ITH4, ITI1, ITH2, ITH5, ITC3, ITH3, ITC4, LT01, NL13, NL33, NL11, NL32, PL82, PL63, PL21, SE21, SE31, UKD, UKK, UKF, UKJ, UKN |

| Club 4 | AT1, AT3, BE2, L BE3, CZ02, CZ06, DE12, DE25, DE3, DE71, DEB3, DED2, FI19, FI1B, FR1, FRJ, FRK, FRL, HU11, ITC1, NL21, NL22, NL23, NL31, NL34, NL41, PL91, SE11, SE12, SE22, SE23, SI03, SI04, UKG, UKH |

| Club 5 | AT2, DE11, DE14, DE21, DE91, DK01, FI2, NL42 |

References

- Chapman, S.; Meliciani, V. Behind the Pan-European Convergence Path: The Role of Innovation, Specialisation and Socio-Economic Factors. Growth Chang. 2017, 48, 61–90. [Google Scholar] [CrossRef]

- Bilbao-Osorio, B.; Rodríguez-Pose, A. From R&D to Innovation and Economic Growth in the EU. Growth Chang. 2004, 35, 434–455. [Google Scholar] [CrossRef]

- Cameron, G.; Proudman, J.; Redding, S. Technological Convergence, R&D, Trade and Productivity Growth. Eur. Econ. Rev. 2005, 49, 775–807. [Google Scholar] [CrossRef]

- Sokolov-Mladenović, S.; Cvetanović, S.; Mladenović, I. R&D Expenditure and Economic Growth: EU28 Evidence for the Period 2002–2012. Econ. Res.-Ekon. Istraživanja 2016, 29, 1005–1020. [Google Scholar] [CrossRef] [Green Version]

- Sterlacchini, A. R&D, Higher Education and Regional Growth: Uneven Linkages among European Regions. Res. Policy 2008, 37, 1096–1107. [Google Scholar] [CrossRef]

- Furková, A.; Chocholatá, M. Interregional R and D Spillovers and Regional Convergence: A Spatial Econometric Evidence from the EU Regions. Equilibrium. Q. J. Econ. Econ. Policy 2017, 12, 9–24. [Google Scholar] [CrossRef] [Green Version]

- Romer, P.M. Increasing Returns and Long-Run Growth. J. Political Econ. 1986, 94, 1002–1037. [Google Scholar] [CrossRef] [Green Version]

- Romer, P.M. Endogenous Technological Change. J. Political Econ. 1990, 98, S71–S102. [Google Scholar] [CrossRef] [Green Version]

- Aghion, P.; Howitt, P. A Model of Growth Through Creative Destruction. Econometrica 1992, 60, 323–351. [Google Scholar] [CrossRef]

- Aghion, P.; Howitt, P. Endogenous Growth Theory; MIT Press: Cambridge, MA, USA, 1998; ISBN 978-0-262-52846-7. [Google Scholar]

- Cohen, W.M.; Levinthal, D.A. Innovation and Learning: The Two Faces of R&D. Econ. J. 1989, 99, 569–596. [Google Scholar]

- Cohen, W.M.; Levinthal, D.A. Absorptive Capacity: A New Perspective on Learning and Innovation. Adm. Sci. Q. 1990, 35, 128–152. [Google Scholar] [CrossRef]

- Martín, C.; Mulas-Granados, C.; Sanz, I. Spatial Distribution of R&D Expenditure and Patent Applications across EU Regions and Its Impact on Economic Cohesion. Investig. Reg. 2005, 6, 41–61. [Google Scholar]

- Islam, N. Productivity Dynamics in a Large Sample of Countries: A Panel Study; Social Science Research Network: Rochester, NY, USA, 2003. [Google Scholar]

- Dettori, B.; Marrocu, E.; Paci, R. Total Factor Productivity, Intangible Assets and Spatial Dependence in the European Regions. Reg. Stud. 2012, 46, 1401–1416. [Google Scholar] [CrossRef] [Green Version]

- Gómez-Tello, A.; Murgui-García, M.J.; Sanchis-Llopis, M.T. Exploring the Recent Upsurge in Productivity Disparities among European Regions. Growth Chang. 2020, 51, 1491–1516. [Google Scholar] [CrossRef]

- Beugelsdijk, S.; Klasing, M.J.; Milionis, P. Regional Economic Development in Europe: The Role of Total Factor Productivity. Reg. Stud. 2018, 52, 461–476. [Google Scholar] [CrossRef]

- Olejnik, A.; Olejnik, J. Increasing Returns to Scale, Productivity and Economic Growth—A Spatial Analysis of the Contemporary EU Economy. Argum. Oeconomica 2019, 1, 273–293. [Google Scholar] [CrossRef]

- Rakic, R.; Correia, A.; Larsson, J.; Bilbao-Osorio, B.; Borunsky, L.; Bruno, N.; de Nul, L.; Dumitrescu, A.; Fabbri, O.; Kadunc, M.; et al. Fostering R&D Intensity in the European Union: Policy Experiences and Lessons Learned”, Case Study Contribution to the OECD TIP Project on R&D Intensity. 2021. Available online: https://community.oecd.org/community/cstp/tip/rdintensity (accessed on 15 November 2021).

- Varga, A.; Pontikakis, D.; Chorafakis, G. Metropolitan Edison and Cosmopolitan Pasteur? Agglomeration and Interregional Research Network Effects on European R&D Productivity. J. Econ. Geogr. 2014, 14, 229–263. [Google Scholar] [CrossRef] [Green Version]

- Wang, E.C. Determinants of R&D Investment: The Extreme-Bounds-Analysis Approach Applied to 26 OECD Countries. Res. Policy 2010, 39, 103–116. [Google Scholar] [CrossRef]

- Cabrer-Borrás, B.; Serrano-Domingo, G. Innovation and R&D Spillover Effects in Spanish Regions: A Spatial Approach. Res. Policy 2007, 36, 1357–1371. [Google Scholar] [CrossRef]

- Rodríguez-Pose, A.; Crescenzi, R. Research and Development, Spillovers, Innovation Systems, and the Genesis of Regional Growth in Europe. Reg. Stud. 2008, 42, 51–67. [Google Scholar] [CrossRef]

- Bednář, P.; Halásková, M. Innovation Performance and R&D Expenditures in Western European Regions: Divergence or Convergence? J. Int. Stud. 2018, 11, 210–224. [Google Scholar] [CrossRef] [Green Version]

- Barrios, C.; Flores, E.; Martínez, M.Á. Club Convergence in Innovation Activity across European Regions. Pap. Reg. Sci. 2019, 98, 1545–1565. [Google Scholar] [CrossRef]

- Phillips, P.C.B.; Sul, D. Transition Modeling and Econometric Convergence Tests. Econometrica 2007, 75, 1771–1855. [Google Scholar] [CrossRef] [Green Version]

- McKelvey, R.D.; Zavoina, W. A Statistical Model for the Analysis of Ordinal Level Dependent Variables. J. Math. Sociol. 1975, 4, 103–120. [Google Scholar] [CrossRef]

- Galor, O. Convergence? Inferences from Theoretical Models. Econ. J. 1996, 106, 1056–1069. [Google Scholar] [CrossRef]

- Barro, R.; Sala-i-Martin, X. Convergence across States and Regions. Brook. Pap. Econ. Act. 1991, 22, 107–182. [Google Scholar] [CrossRef] [Green Version]

- Sala-i-Martin, X. The Classical Approach to Convergence Analysis. Econ. J. 1996, 106, 1019–1036. [Google Scholar] [CrossRef]

- BOYLE, G.E.; McCARTHY, T.G. Simple Measures of Convergence in per Capita GDP: A Note on Some Further International Evidence. Appl. Econ. Lett. 1999, 6, 343–347. [Google Scholar] [CrossRef]

- Durlauf, S.; Quah, D. The New Empirics of Economic Growth; Santa Fe Institute: Santa Fe, NM, USA, 1998. [Google Scholar]

- Baumol, W. Productivity Growth, Convergence, and Welfare: What the Long-Run Data Show. Am. Econ. Rev. 1986, 76, 1072–1085. [Google Scholar]

- Solow, R. A Contribution to the Theory of Economic Growth. Q. J. Econ. 1956, 70, 65–94. [Google Scholar] [CrossRef]

- Gerschenkron, A. Economic Backwardness in Historical Perspective. In The Progress of Underdeveloped Areas; Hoselitz, B.F., Ed.; University of Chicago Press: Chicago, IL, USA, 1952. [Google Scholar]

- Abramovitz, M. Rapid Growth Potential and Its Realization. In Thinking about Growth: And Other Essays on Economic Growth and Welfare; Cambridge University Press: Cambridge, UK, 1989; pp. 187–219. ISBN 978-0-521-33396-2. [Google Scholar]

- Lucas, R.E. On the Mechanics of Economic Development. J. Monet. Econ. 1988, 22, 3–42. [Google Scholar] [CrossRef]

- Grossman, G.M.; Helpman, E. Innovation and Growth in the Global Economy; MIT Press: Cambridge, MA, USA, 1993; ISBN 978-0-262-57097-8. [Google Scholar]

- de la Fuente, A. Convergence Across Countries and Regions: Theory and Empirics; Social Science Research Network: Rochester, NY, USA, 2000. [Google Scholar]

- Howitt, P. Endogenous Growth and Cross-Country Income Differences. Am. Econ. Rev. 2000, 90, 829–846. [Google Scholar] [CrossRef]

- Howitt, P.; Mayer-Foulkes, D. R/D, Implementation, and Stagnation: A Schumpeterian Theory of Convergence Clubs. J. Money Credit. Bank. 2005, 37, 147–177. [Google Scholar] [CrossRef] [Green Version]

- Mulas-Granados, C.; Sanz, I. The Dispersion of Technology and Income in Europe: Evolution and Mutual Relationship across Regions. Res. Policy 2008, 37, 836–848. [Google Scholar] [CrossRef]

- Archibugi, D.; Filippetti, A. Is the Economic Crisis Impairing Convergence in Innovation Performance across Europe? J. Common Mark. Stud. 2011, 49, 1153–1182. [Google Scholar] [CrossRef]

- Kijek, T.; Matras-Bolibok, A. Innovativeness of European Regional Space: Convergence or Divergence? Acta Sci. Pol. Oeconomia 2018, 17, 59–65. [Google Scholar] [CrossRef]

- Blanco, F.A.; Delgado, F.J.; Presno, M.J. R&D Expenditure in the EU: Convergence or Divergence? Econ. Res.-Ekon. Istraživanja 2020, 33, 1685–1710. [Google Scholar] [CrossRef]

- Verspagen, B. European “Regional Clubs”: Do They Exist, and Where Are They Heading? On Economic and Technological Differences between European Regions; Edward Elgar Publishing: Cheltenham, UK, 1999. [Google Scholar]

- Capello, R.; Lenzi, C. Territorial Patterns of Innovation and Economic Growth in European Regions. Growth Chang. 2013, 44, 195–227. [Google Scholar] [CrossRef]

- Durlauf, S.N.; Johnson, P.A. Multiple Regimes and Cross-Country Growth Behaviour. J. Appl. Econom. 1995, 10, 365–384. [Google Scholar] [CrossRef]

- Azariadis, C.; Drazen, A. Threshold Externalities in Economic Development. Q. J. Econ. 1990, 105, 501–526. [Google Scholar] [CrossRef]

- Redding, S. The Low-Skill, Low-Quality Trap: Strategic Complementarities between Human Capital and R & D. Econ. J. 1996, 106, 458–470. [Google Scholar] [CrossRef]

- Charlot, S.; Crescenzi, R.; Musolesi, A. Econometric Modelling of the Regional Knowledge Production Function in Europe. J. Econ. Geogr. 2015, 15, 1227–1259. [Google Scholar] [CrossRef] [Green Version]

- Moreno, R.; Paci, R.; Usai, S. Spatial Spillovers and Innovation Activity in European Regions. Environ. Plan. A Econ. Space 2005, 37, 1793–1812. [Google Scholar] [CrossRef]

- Kijek, T.; Matras-Bolibok, A. Knowledge-Intensive Specialisation and Total Factor Productivity (TFP) in the EU Regional Scope. Acta Univ. Agric. Silvic. Mendel. Brun. 2020, 68, 181–188. [Google Scholar] [CrossRef] [Green Version]

- Eurostat Database. Available online: https://ec.europa.eu/eurostat/data/database (accessed on 5 November 2021).

- Regional Innovation Scoreboard. Available online: https://ec.europa.eu/info/research-and-innovation/statistics/performance-indicators/regional-innovation-scoreboard_en (accessed on 11 November 2021).

- Phillips, P.C.B.; Sul, D. Economic Transition and Growth. J. Appl. Econom. 2009, 24, 1153–1185. [Google Scholar] [CrossRef] [Green Version]

- Enhancing Regional Convergence in the European Union; OECD Economics Department Working Papers; OECD Publishing: Paris, France, 2021; Volume 1696.

- Iammarino, S.; Rodriguez-Pose, A.; Storper, M. Regional Inequality in Europe: Evidence, Theory and Policy Implications. J. Econ. Geogr. 2019, 19, 273–298. [Google Scholar] [CrossRef]

- Capello, R.; Lenzi, C. Knowledge, Innovation and Productivity Gains across European Regions. Reg. Stud. 2015, 49, 1788–1804. [Google Scholar] [CrossRef]

- Škrinjarić, T. R&D in Europe: Sector Decomposition of Sources of (in)Efficiency. Sustainability 2020, 12, 1432. [Google Scholar] [CrossRef] [Green Version]

- Constantin, M.; Dinu, M.; Pătărlăgeanu, S.R.; Chelariu, C. Sustainable Development Disparities in the EU-27 Based on R&D and Innovation Factors. Amfiteatru Econ. 2021, 23, 948–963. [Google Scholar] [CrossRef]

- European Commission. Communication from the Commission to the European Parliament, the European Council, the Council, the European Economic and Social Committee and the Committee of the Regions: ‘The European Green Deal’; European Commission: Brussels, Belgium, 2019; Volume COM/2019/640. [Google Scholar]

- Moreno, R.; Paci, R.; Usai, S. Geographical and Sectoral Clusters of Innovation in Europe. Ann. Reg. Sci. 2005, 39, 715–739. [Google Scholar] [CrossRef] [Green Version]

- Alexiadis, S. Convergence Clubs and Spatial Externalities: Models and Applications of Regional Convergence in Europe; Springer Science & Business Media: Berlin/Heidelberg, Germany, 2012; ISBN 978-3-642-31626-5. [Google Scholar]

- de Dominicis, L.; Florax, R.J.G.M.; de Groot, H.L.F. Regional Clusters of Innovative Activity in Europe: Are Social Capital and Geographical Proximity Key Determinants? Appl. Econ. 2013, 45, 2325–2335. [Google Scholar] [CrossRef]

- Mancha-Navarro, T.; Garrido-Yserte, R. Regional Policy in the European Union: The Cohesion-Competitiveness Dilemma. Reg. Sci. Policy Pract. 2008, 1, 47–66. [Google Scholar] [CrossRef]

- Muscio, A.; Reid, A.; Rivera Leon, L. An Empirical Test of the Regional Innovation Paradox: Can Smart Specialisation Overcome the Paradox in Central and Eastern Europe? J. Econ. Policy Reform 2015, 18, 153–171. [Google Scholar] [CrossRef]

- Tödtling, F.; Trippl, M. One Size Fits All?: Towards a Differentiated Regional Innovation Policy Approach. Res. Policy 2005, 34, 1203–1219. [Google Scholar] [CrossRef]

| Author(s) | Units (Period) | Convergence Approach (Model) | Main Findings |

|---|---|---|---|

| Mulas-Granados and Sanz (2008) [42] | 177 EU regions (1990–2002) | Absolute convergence (sigma convergence) | Both R&D expenditure and patents converged among regions. |

| Archibugi and Filippetti (2011) [43] | 27 EU countries (2004–2008) | Absolute convergence (beta convergence) | Convergence occurred in the seven European Innovation Scoreboard dimensions apart from the “Innovators” dimension. “Finance and Support” and “Throughputs” dimensions showed the fastest rates of convergence. |

| Kijek and Matras-Bolibok (2018) [44] | 220 European regions (2009–2017) | Absolute convergence (sigma and gamma convergence) | Sigma divergence took place in the Regional Innovation Index—RII and there was the lack of gamma convergence of RII among regions. |

| Barrios et al. (2019) [25] | 180 European regions (2002–2012) | Club convergence (the log t-test) | The results support the club convergence in patenting activity. |

| Blanco et al. (2020) [45] | 28 EU countries | Absolute convergence (sigma convergence) and club convergence (the log-t test) | The results show both absolute convergence and club convergence in regional R&D expenditures. |

| Club | No. of Regions | SE | t | |

|---|---|---|---|---|

| 1 | 61 | −0.2944 | 0.3162 | −0.9310 |

| 2 | 46 | −0.3010 | 0.3579 | −0.8410 |

| 3 | 69 | −0.1249 | 0.3142 | −0.3975 |

| 4 | 35 | −0.0239 | 0.2094 | −0.1142 |

| 5 | 8 | −0,2800 | 0.3672 | −0.7625 |

| Variable | Coef. | Std. Err. | z | P > |z| |

|---|---|---|---|---|

| HC | 0.142 | 0.029 | 4.84 | 0.000 |

| SK | 0.319 | 0.373 | 0.86 | 0.392 |

| KIS | 0.353 | 0.049 | 7.26 | 0.000 |

| ERD | −0.664 | 0.428 | −1.55 | 0.121 |

| EP | 0.222 | 0.117 | 1.90 | 0.058 |

| Pseudo R2 = 0.2883, LR chi2(5) = 169.87 | ||||

| Variable | dy/dx | Std. Err. | z | P > z |

|---|---|---|---|---|

| Club 1 | ||||

| HC | −0.014 | 0.003 | −5.37 | 0.000 |

| SK | −0.032 | 0.0379 | −0.85 | 0.397 |

| KIS | −0.035 | 0.004 | −9.65 | 0.000 |

| ERD | 0.067 | 0.043 | 1.53 | 0.125 |

| EP | −0.022 | 0.012 | −1.86 | 0.062 |

| Club 2 | ||||

| HC | −0.005 | 0.001 | −4.39 | 0.000 |

| SK | −0.012 | 0.0138 | −0.87 | 0.385 |

| KIS | −0.013 | 0.003 | −4.95 | 0.000 |

| ERD | 0.025 | 0.016 | 1.57 | 0.116 |

| EP | −0.008 | 0.004 | −1.98 | 0.048 |

| Club 3 | ||||

| HC | 0.005 | 0.001 | 3.75 | 0.000 |

| SK | 0.012 | 0.0143 | 0.81 | 0.420 |

| KIS | 0.013 | 0.003 | 3.77 | 0.000 |

| ERD | −0.024 | 0.017 | −1.41 | 0.159 |

| EP | 0.008 | 0.005 | 1.69 | 0.092 |

| Club 4 | ||||

| HC | 0.011 | 0.002 | 4.33 | 0.000 |

| SK | 0.025 | 0.0291 | 0.86 | 0.388 |

| KIS | 0.028 | 0.004 | 6.31 | 0.000 |

| ERD | −0.052 | 0.034 | −1.54 | 0.123 |

| EP | 0.017 | 0.009 | 1.88 | 0.060 |

| Club 5 | ||||

| HC | 0.003 | 0.001 | 3.01 | 0.003 |

| SK | 0.001 | 0.001 | 0.85 | 0.398 |

| KIS | 0.008 | 0.002 | 3.41 | 0.001 |

| ERD | −0.015 | 0.010 | −1.48 | 0.139 |

| EP | 0.005 | 0.003 | 1.77 | 0.077 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Kijek, T.; Kijek, A.; Matras-Bolibok, A. Club Convergence in R&D Expenditure across European Regions. Sustainability 2022, 14, 832. https://doi.org/10.3390/su14020832

Kijek T, Kijek A, Matras-Bolibok A. Club Convergence in R&D Expenditure across European Regions. Sustainability. 2022; 14(2):832. https://doi.org/10.3390/su14020832

Chicago/Turabian StyleKijek, Tomasz, Arkadiusz Kijek, and Anna Matras-Bolibok. 2022. "Club Convergence in R&D Expenditure across European Regions" Sustainability 14, no. 2: 832. https://doi.org/10.3390/su14020832

APA StyleKijek, T., Kijek, A., & Matras-Bolibok, A. (2022). Club Convergence in R&D Expenditure across European Regions. Sustainability, 14(2), 832. https://doi.org/10.3390/su14020832