Abstract

The performance of banks is a great barometer of the sustainability of the economy, particularly for emerging economies. In the expansion of its economy, over the last decade, Vietnam has entered a series of free trade agreements, such as the European Union–Vietnam Free Trade Agreement (EVFTA) in 2020. In that context, this study assesses the performance of Vietnam’s banks in the period of 2020–2021 and explores the relationship between performance and various demographic and environmental variables. This study utilizes data envelopment analysis with two disposability concepts where desirable outputs (e.g., return on equity) are maximized while undesirable outputs (e.g., non-performing loan ratio) are minimized. Subsequently, Tobit and bootstrap truncated regression analyses are conducted for the testing of two hypotheses: (1) EVFTA’s commitments, including the updating of the Fintech system, may be positively associated with bank’s performance, and (2) Locations of banks, encumbered by heterogeneous levels of urban concentration and real estate development in different regions, may be associated with the banks’ performance. The findings are twofold: (1) While EVFTA can contribute to Vietnamese banks’ financial profit performance through foreign trading and hedging activities, it may harm banks’ financial health performance due to Fintech-originated bad debts and a lack of relevant regulations; and (2) Banks in southern Vietnam outperform those in northern Vietnam in managing their credit risk by better controlling of bad debts, which result primarily from the volatility of the real estate market and from better positive externalities, in terms of economic, cultural, and political conditions.

1. Introduction

As environmental, social, and government (ESG) investment attracts more and more attention, the finance sector plays an unprecedentedly important role in sustainable development [1]. Particularly for developing economies with scant resources, the banking industry helps to promote economic, social, and environmental activities [2]. As a fast-growing economy which has transformed from a centrally planned to a market economy, Vietnam has made enormous efforts on the reconstruction of the banking system; this has been particularly facilitated through foreign investments [3]. With globalization, free trade agreements (FTAs) became new sources of foreign direct investments (FDIs) [4].

Once Vietnam joined the World Trade Organization (WTO), foreign portfolio investment inflows doubled from USD 0.9 billion in 2005 to USD 1.9 billion in 2006 [5]. Also, the capitalization of the Vietnam stock market had soared from 1% over the 2000–2005 period to 27% in 2006. It suggests that the banking system in Vietnam has benefited substantially from FTAs and FDIs. In 2020, the European Union–Vietnam Free Trade Agreement (EVFTA) between Vietnam and European Union (EU) members was announced. It was considered a springboard for economic progress with the prospect of bringing great opportunities to domestic exporters. EVFTA is expected to expand Vietnam’s exports to the EU in both light-manufacturing (e.g., textile and leather) and medium-manufacturing sectors (e.g., motor vehicle and transport) by USD 4.9 billion and USD 1.3 billion, respectively [6]. An increase in investments and net exports, along with consumption and government spending, tends to bring about economic growth.

With a rise in the real gross domestic product (GDP) by 8.1% (USD 11 billion), Vietnam’s financial sector is predicted to prosper accordingly because economic growth takes place in conjunction with the recapitalization of state-owned banks and the development of the securities market, both of which fund state-owned and private enterprises as well as finance infrastructure projects. The expansion of the financial sector (and the subsequent abundance of credit), as well as the rapid transition toward urbanization raise concerns about the real estate bubble in Vietnam [7]. Other macroeconomic factors, such as inflation and exchange rate, also influence its banking industries [8].

Taking such Vietnam’s contexts into account, this study investigates the performance of Vietnam’s banks after the EVFTA. While Vietnam has signed multiple FTAs, particularly in the 2010s, the EVFTA enabled Vietnam to open its economy significantly to many European countries. It culminated in the lift of international trade-related measures such as tariffs. Immediately after EVFTA was signed, the EU eliminated 85.6% of tariff lines, meaning 70.3% of Vietnam’s export turnover to the EU; Vietnam has removed 48.5% of all tariff lines, equivalent to 64.5% of EU export turnover to Vietnam [9]. Furthermore, expectations of tariff holidays between two parties in the near future may substantially boost business activities, particularly exporting companies, and expand the financial market. Given the criticality of EVFTA in terms of the breadth, depth, and immediacy of its economic impact, we assume that EVFTA has had an immediate effect on the banking sector.

While some studies assessed banks’ performance in Vietnam, a majority of them only looked into financial profitability, ignoring the financial health of banks [10]. Moreover, studies on the benefits of EVFTA only targeted generalized areas, such as intellectual property and pharmaceutical importation [11]; they were limited to qualitative and theoretical approaches [12]. Also, there is a paucity of literature on more recent performance assessments due to limitations of the data collection process, stemming from the operational delays amid the COVID-19 pandemic and time gaps from the merger and acquisition (M&A) process. To close those gaps in the extant literature, this study associates the banking sector’s performance with economic contexts, particularly the EVFTA.

This study contributes to the existing literature in the following ways. Firstly, we incorporate non-performing loans as an undesirable output in our data envelopment analysis (DEA) model. DEA has been a favorite method in measuring the banks’ performance [13]. However, conventional DEA models have considered only desirable outputs in the production function; although some recent DEA models include undesirable outputs, they demonstrated shortcomings by just ignoring them, dealing with them as inputs, or transforming them. This is critical since non-performing loans may lead to credit risk and incur financial health and sustainability issues in banking. In this study, we employ two disposability concepts (i.e., natural disposability and managerial disposability), proposed by Ref. [14], where the concept of natural disposability renders the maximization of desirable outputs prioritized, whereas that of managerial disposability deals with the minimization of undesirable outputs prioritized. This approach has some advantages over others. Drawing on the two different concepts, for instance, we can simultaneously measure financial health performance (by minimizing credit risk, such as non-performing loans) as well as financial profit performance (by maximizing return or income). This is particularly useful for decision-makers who need to consider both types of performance when assessing their organization’s performance. Since the managerial disposability concept is based on the belief that undesirable outputs are byproducts of production processes, furthermore, we can regard banks as an entity that is capable of decreasing inputs to reduce undesirable outputs.

Second, we look into the EVFTA as a noteworthy event for the Vietnamese economy that has not been sufficiently studied yet in a quantitative manner. Considering the potentially substantial impacts of the EVFTA on Vietnam’s banking sector, we shed light on how such an event is related to the bank’s two types of performance (financial profit and health). To that end, we apply bootstrap truncated regression analysis (B-TRA) in addition to conventional Tobit regression analysis (C-TRA), both of which have been widely used in the subsequent stage of DEA. As argued by Ref. [15], B-TRA produces more unbiased estimates for environmental variables than C-TRA does.

Lastly, we discuss the prospects of the EVFTA using more recent data and provide policy suggestions for governmental bodies in terms of the sustainable development of Vietnam’s banking sector.

The remaining sections of this research are organized as follows. Section 2 describes the whole picture of Vietnam’s financial achievements under FTAs, along with the potential benefits of the EVFTA. Section 3 surveys previous studies on the evaluation of the banking systems at a national and international level. Section 4 delineates the methodology for data analysis. Section 5 summarizes the empirical results of the models. Section 6 provides discussions based on the analysis results. Lastly, Section 7 concludes this study with a summary, limitations, and future research.

2. Study Context

2.1. An Overview of the Vietnam’s Financial System and Signed FTAs

Before 1991, the Vietnamese banking sector was operated as a one-tier system where the State Bank of Vietnam (SBV) served as both the central bank and the sole commercial bank that governs all banking services [16]. After the collapse of the credit fund system, in May 1990, two Banking Ordinances, the Ordinance on the State Bank of Vietnam and the Ordinance on Banks, Credit Cooperatives and Financial Companies officially changed the operating mechanism of the financial system from a one-tier to a two-tier system. The new system was comprised of one central bank and four additional state-owned commercial banks (SOCBs) [17]. The State Bank performed (a) the task of state management over monetary, credit, payment, foreign exchange, and banking activities, and (b) the duties of a central bank as the only bank that can issue money. Its counterparts (banking and non-banking financial institutions) carried out money circulation, foreign trade, foreign exchange, and public expenditure management in the whole national economy [18].

After 1991, Vietnam’s banking system has undergone incremental changes towards a “modern two-tier banking system” and achieved major milestones. One of them was the signing of the Vietnam–U.S. Trade Agreement in 2000 under which Vietnam’s financial and banking market became gradually open to U.S. businesses, and by 2010, U.S. financial institutions were treated equally to Vietnamese ones; many financial organizations were established, including the State Securities Board in 1996, HCM Stock Exchange Center in 1998, and the Deposit Insurance of Vietnam (DIV) in 1999 [19]. Until 2021, Vietnam has signed 13 FTAs and is negotiating 3 additional FTAs [20]. Table 1 summarizes FTAs which Vietnam has signed since 1991, along with information about the validated year and member countries. It includes two new generations of FTAs, such as the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) and the EVFTA, both of which were ratified by Vietnam’s National Assembly in 2018 and 2019, respectively.

Table 1.

Vietnam’s FTAs signed since 1991.

While there were worldwide trends such as global value/supply chain and open innovation which promote FTAs, there was a unique window of opportunity for Vietnam in managing to sign an array of FTAs. For example, the ASEAN Free Trade Area (AFTA), signed in 1992 in Singapore, was a part of the agreement when Vietnam joined the Association of Southeast Asian Nations (ASEAN). The agreement was a multilateral FTA with ASEAN-6 nations at that time, including Brunei, Indonesia, Malaysia, Philippines, Singapore, and Thailand. On the other hand, the Vietnam–Korea FTA (VKFTA) was signed in 2015 on the occasion of the Special Summit to celebrate the 25th Anniversary of the Establishment of ASEAN–Korea Dialogue Relations.

The participation and implementation of the FTAs have contributed to promoting export growth, diversifying export markets, and avoiding dependence on a traditional market. Ref. [21] also described the booming of FTAs in the ASEAN region as an incentive to trade expansion and a means to participate in Asia’s advanced production networks. It has been proven that well-designed and comprehensive FTAs benefit participating nations with preferential tariffs, market access, and new business opportunities. As a foreign policy, in addition, nations’ participation in FTAs can lead to multilateralization and diversification, enlisting the support of partner countries.

2.2. An Overview of the EVFTA

On 30 June 2019, the EVFTA between Vietnam and the EU was officially signed and was expected to accelerate the recovery of Vietnam’s economy, especially its financial-banking sector. While the EVFTA is similar to previous FTAs, it stands out from others in several ways [22]. Firstly, it may have an immediate impact on the Vietnamese banking sector. Within the first 5 years after the validation of the EVFTA, Vietnam commits to allowing EU credit institutions to buy up to 49% of shares in two joint-stock commercial banks, except for four state-owned joint-stock commercial banks (BIDV, Vietinbank, Vietcombank, and Agribank). On a short-term basis, this commitment will attract a modest flow of capital from Europe, at the same time integrating modern technology and management apparatus as well as modern banking–finance products. This is also explained as the “spillover effect” by Ref. [23] where foreign strategic investors (FSIs) can eliminate credit risks in domestic banks via external financing and accumulated financial knowledge.

In addition, it may stimulate Vietnamese banks’ financial services, particularly through financial technology (Fintech). Vietnam commits to opening the market for practical financial services, through which the foreign providers are allowed to transfer information in and out of Vietnam, meaning that providers have better options in using access, investment services as well as available financing and refinancing methods. This commitment is forecasted to elevate the quality of the financial technology (Fintech) sector and mobile banking sector with more assessable and cost-effective digital banking services, while at the same time challenging the prospect of the domestic financial products, especially the retail banking segment [24]. In general, this transformation is expected to allow room for the accumulation of technological knowledge and rejuvenate old-fashioned domestic firms through collaborative activities and partial integration between financial and non-financial firms [25,26].

The implementation of the EVFTA will bring opportunities to the financial-banking sector. Like other FTAs, the EVFTA is expected to promote the attraction of FDI to Vietnam and allow space for technology transfer from multinational corporations (MNCs) via production setup assistance, technical support, and vocational training [27]. As an indirect ramification, it encourages institutional reform and perfects the legal framework, thus elevating the quality of the workforce in the financial-banking sector. On the other hand, the EVFTA may pose some challenges. Firstly, the benefits from EVFTA may be heterogeneous across regions. Second, a relatively low level of technological and managerial competitiveness of Vietnamese commercial banks may show their vulnerability to the risk of being annexed or merged into the leading EU financial institutions. Lastly, the lack of a Vietnamese legal framework related to Fintech may create social problems.

3. Literature Review

This section is organized in the following order: a literature review on the topic (i.e., banks’ performance), the method (i.e., DEA), the EVFTA, and research hypotheses. Given the substantial role of banks in the economy, the performance of banks has been a favorite topic for academic researchers, many of whom have taken various quantitative approaches. Some studies, for instance, used hierarchical linear modeling (HLM) to incorporate both fixed effects and random effects. Maudos et al. used HLM to analyze the cost and profit efficiency of banks among 10 EU countries over the period of 1993–1996 [28]. The same method was applied by Ref. [29] to measure the correlation between internet banking services and banks’ profitability in Vietnam. In a similar vein, Ref. [30] studied banks’ credit risk, profitability, and solvency in Vietnam.

Another popular method for assessing banks’ performance is DEA, which is a non-parametric approach to measure efficiency based on a set of inputs and outputs. Based on geographical categorization, Table 2 briefly describes the previous literature that employed DEA for the assessment of banks’ performance. Within Vietnam or ASEAN, Ref. [31] measured the retail banking efficiency of Vietcombank’s branches in the Mekong Delta region, Ref. [32] measured the efficiency of banks in Vietnam over the period of 1995–2011, Ref. [33] evaluated the performance of banks in Vietnam from 1999 to 2009, Ref. [34] assessed the cost efficiency of the Vietnamese banking industry according to different ownership levels, and Ref. [35] evaluated the impact of financial liberalization on the banking ecosystem in Vietnam. At the international level, we also looked into other developing economies. In China, Ref. [36] measured regional performance in the banking sector, while Ref. [37] compared the efficiency of banks among Greater China’s sub-regions. In India, Ref. [38] used Multi-activity Data Envelopment Analysis (MDEA) to measure the efficiency of banks.

Table 2.

Applications of DEA to the Banking Sector.

The potentially significant impacts of the EVFTA on Vietnam’s economy have caught the attention of Vietnamese researchers. However, as this agreement touches on a broader spectrum of economic segments, a great body of the previous literature tended to discuss various topics and adopt a qualitative, rather than quantitative, approach. For instance, Ref. [11] argued the limitations of intellectual property policies in Vietnam in meeting the EVFTA commitments and attaining sustainable development. Furthermore, Ref. [39] evaluated the potential impact of EVFTA on the imports of the automobile in Vietnam by employing a single market partial equilibrium simulation tool (SMART). Ref. [9] shed light on the benefits and challenges of the EVFTA for Vietnam’s pharmaceutical trading based on its commitment to the reduction of tariffs for pharmaceutical products from the EU.

In this vein, we measure the efficiency of Vietnam’s financial sector via banks’ performance under EVFTA. Based on the two-stage analysis framework, we incorporate one undesirable output (non-performing loan) into the DEA model by adopting the disposability concepts suggested by Ref. [14]. To our best knowledge, no prior research on Vietnamese banks has applied this approach to measure banks’ performance. We also contribute a novelty to the extant literature by exploring the effects of EVFTA-related factors on the performance of banks through B-TRA and C-TRA models. Additionally, we bring up a comparative study on the performance of banks with regards to the regional difference between the Northern and Southern regions of Vietnam. To address our research questions, we developed the following two hypotheses:

Hypothesis 1 (H1).

EVFTA commitments, particularly upgrades in the Fintech system, may be positively associated with banks’ performance.

According to the National Statistics Office in Vietnam, about 70% of the population has access to online social networks. With the advanced generations of portable smartphones, the majority of customers can make transactions or stock trading at their disposal, which renders FTPs more popular with investors. Companies with Fintech applications may have phenomenal innovations with streamlined banking technology to a broader base of customers and investors through mobile-orientated applications; they can meet market needs better in the areas with a lack of financial services [40]. With the help of FTPs, banks can also collect large data samples and offer a personalized experience based on customers’ investment patterns and personal preferences, which results in building trust and growing customer loyalty [41]. Given those potentials, it is worthwhile measuring the benefits to commercial banks from the EVFTA as well as Fintech.

Hypothesis 2 (H2).

Location of banks, due to heterogeneous levels of socio-economic development and real estate boom in different regions, may be associated with bank’s performance.

Banks are under stringent constraints from spatial differences. Except for big-4 banks, many small and medium-sized banks that are headquartered in either the Northern or Southern region will deploy the majority of their branches in the same region [42,43,44,45,46,47] to create a “home bias” condition [48] in which they are physically closer to their borrowers [47,48,49]. However, there are always variations in the regional context, so the financial firms based in the South will have different operating conditions from their Northern counterparts. These business scenarios may be politically driven [50,51], dependent on socio-economic progress [52,53] or influenced by the explosion of the real estate market [54,55].

In Vietnam, the government often overplays the banks’ role in promoting economic progress at sub-state levels [56,57]. As Vietnam is entering a new wave of massive urbanization [58,59], banks often offer incentives for different impoverished groups of the population for effective transformation. Additionally, banks that experience government intervention often outperform private banks [33]. Furthermore, in Vietnam, default risk is more responsive to fluctuations in the real estate market which is considered a priority category for borrowing [60,61,62]. The banks’ policies are even more supportive with the belief that the booming of real estate transactions will escalate the liquidity level. For that reason, as these two regions are not identical in the number of urbanized districts, the intensity of state intervention at local banks, or real estate transaction volume, the operating performance of banks on both sides may fail to meet cost-efficiency parity.

4. Methodology

4.1. Data

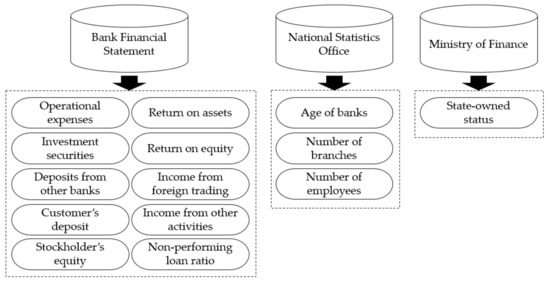

This study focuses on 31 commercial banks in Vietnam that appeared in the General Statistics Office of Vietnam in 2021. As we seek to measure the magnitude of the effects of the EVFTA on the market on a short-term basis, we prioritized 4 financial giants with over 50% equity from the state that can provide an immediate response from the EVFTA, including BIDV, Agribank, Vietinbank, and Vietcombank, which all account for 47% of the credit market from 2016 to 2020. In addition, the operational transformations of domestic banks pose a competitive impact on foreign banks that have branches in Vietnam, so we add the case of HSBC, an international flagship, into the model. The data is collected from each bank’s financial statements, in junction with the statistical announcements from the National Statistics Office and the Ministry of Finance in Vietnam. Figure 1 describes the various data sources of input and output factors as well as demographic/environmental variables.

Figure 1.

Data Sources of Variables.

It is noteworthy that our data is insufficient in terms of the number of banks covered in this study. We wanted to extend our sample, but it was not possible due to data limitations. Since we use the latest data following the EVFTA, we could only sample 31 banks. In this regard, the bootstrapping technique is employed in the second-stage analysis. Also, our future study is anticipated to revisit this topic with more exhaustive data.

In our analysis framework with multiple inputs and outputs, there are 5 inputs: opex (operating expenses), invse (investment securities), depfob (deposits from other banks), cusde (customer’s deposit), and stoeq (stockholder’s equity), all of which were measured in million Vietnamese Dong (VND) as the national currency. In addition, there are 4 desirable outputs including roa (return on assets), roe (return on equity), icfft (income from foreign trading), and incfoa (income from other activities); apart from roa and roe which are ratios, the other outputs were also measured in million VND. We also consider one undesirable output of npl (non-performing loan) which is also a ratio.

For environmental variables, we included age (age of bank) as a control variable and integrated regloc (whether the headquarters are in Northern or Southern Vietnam), fintech (whether a bank makes Fintech innovations), croom (whether a bank increases its credit room) and staow (whether the bank has over 50% equity from the state) which take the form of dummy variables (0 and 1). Companies whose headquarters are in the Northern region are valued at 1; otherwise, they are valued at zero; the same logic is applied to banks that possess over 50% equity from the states. Banks that make innovations in FTPs are valued at 1; otherwise, they are valued at 0. Banks that shift up their credit room level will be valued at 1, while those that reduce credit room will be valued at zero. Table 3 summarizes the descriptive statistics of input and output factors as well as environmental variables.

Table 3.

Descriptive Data Statistics.

4.2. Variables and Proxies

This study screens input and output factors based on the following three approaches: operating, intermediation, and value-added. The operating approach considers the bank as a business unit with profit maximization as a paramount objective [63] in which all revenue-generating factors (e.g., interest and non-interest income) are categorized as outputs whereas expense-incurring factors (e.g., interest and non-interest expenses) are categorized as inputs. In this vein, we filter opex as an input and incfft and incfoa as outputs (see Refs. [64,65] as examples). The intermediation approach allows us to identify banks as intermediate entities bridging savers to borrowers, in which fixed assets and deposits are common inputs whereas loans and unconventional assets are outputs. From this lens, we define depfob, invse, cusde, and stoeq as input factors and npl as an output factor (see Ref. [66] as an example). Finally, we adopt the value-added approach which navigates balance-sheet-related categories as outputs, to which roa and roe belong [67].

Drawing on the three approaches, details about inputs and outputs are given as follows:

Input factors:

- Operating expenses (opex) are all expenses that a business is obliged to incur to smooth the operational structure, including staff payroll, rent premium, and insurance fee. It reflects the financial health of a company and is subject to minimization.

- Investment securities (invse) are bonds and shares that are purchased as a proxy for future investments; the profit will be extracted from dividends on an accumulated basis.

- Deposits from other banks (depfob) are often defined as “interbank deposit,” meaning an arrangement of both sides where one bank possesses an account in another. The corresponding bank will hold the due to account from the holding bank; transactions will include deposits and loans as normal.

- Customer’s deposit (cusde) refers to a client’s money that is placed into banks for safekeeping and is categorized as saving or checking accounts. Customers are eligible to withdraw or deposit additional amounts to their balance, whereas it performs as a liability to financial institutions.

- Stockholder’s equity (stoeq) is the remaining assets for shareholders after all liabilities have been processed; it includes paid-in capital, treasury stocks, or retained earnings. It is expected that this equity remains positive, which indicates the bank’s sustainability in financial health and capability to cover debts.

Output factors:

- Return on assets (roa) measures the profit that a company receives from its assets after the operation. Investors are interested in this ratio because it is an indicator of a firm’s operational efficiency (5% is marked as good and over 20% is marked as excellent). Return on equity (roe) measures the profits generated from stockholder’s equity; this ratio is often used in conjunction with the retention ratio to measure a firm’s growth rate.

- Income from foreign trading (incfft) refers to the bank’s profitability in trading currencies, as for now, the Forex market is a large electronic network with enormous trading volume.

- Income from other activities (incfoa) includes profits from the sale of investments or treasury income and also covers the charge and fees from electronic banking services or maintenance.

- Non-performing loan ratio (npl) measures the level of default risk and outstanding loans; there is a threshold established by Basel III to standardize the acceptable NPL to smooth the bank’s operation and avoid substantial loss.

Furthermore, details about environmental variables are given as follows:

- Financial technology (fintech) indicates whether a bank makes Fintech innovations. While there are two broad categories of Fintech—digital payment and digital financing services—this study focuses on the latter rather than the former, since the former has been already developed domestically even prior to the EVFTA (e.g., cooperation between Techcombank and Fintech Fastacash, and between Vietcombank and M_Service) whereas the latter is still at the embryonic stage. The latter includes customer-centric services such as robo-advisor for investment, (re)financing service, or P2P lending, which tend to require more advanced and large-scale technologies that can be brought in by the EVFTA.

- Credit room (croom) indicates whether a bank increases its credit room. This study defines credit room from angles of not only real estate, but also foreign credit room or foreign ownership limits (FOL), which are more related to the EVFTA’s effects. Considering the importance of foreign investment, a bank’s ability to vie for foreign equity or to raise FOL can influence its competitive advantage by increasing the inflow of investment and decreasing the risk of a merger.

- Regional location (regloc) indicates whether the headquarters of a bank are located in Northern or Southern Vietnam. While a few large banks have a national presence, a majority of banks in our list are small and medium-sized banks that are slated to primarily serve customers in geographical proximity. The operation of Nam A, a bank headquartered in Southern Vietnam, for example, is concentrated in the Southern region; it has 86 branches in the South out of a total of 98 branches. In this study, we assume that the business environment for a bank may vary between two regions due to their different contexts.

- State-owned status (staow) indicates whether the bank has over 50% equity from the state.

4.3. Two-Stage Analytic Framework

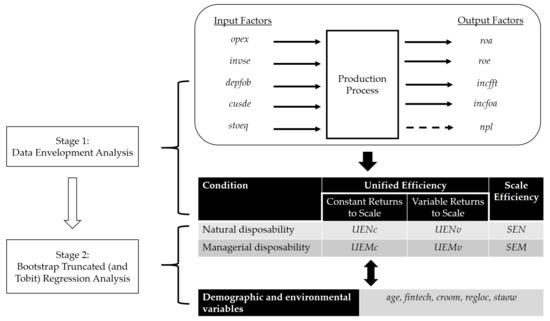

To address the aforementioned hypotheses, we conducted a two-stage analysis. Figure 2 describes the overall analytic framework. At the first stage, we applied the concepts of managerial and natural disposability. Drawing on DEA models developed by Ref. [68], specifically, we figured out unified efficiencies (UENc, UEMc, UENv, UEMv) and scale efficiencies under natural disposability (SEN) and scale efficiency under managerial disposability (SEM). Detailed descriptions of DEA models and steps for the analysis are presented in Appendix A.

Figure 2.

Description of Analytic Framework.

Before explaining the second-stage analysis, we briefly provide our rationales to employ DEA with a disposability concept. While there are two streams of frontier analyses—a nonparametric/deterministic approach and a parametric/stochastic approach—the former (particularly DEA) has advantages over the latter (particularly stochastic frontier analysis) in terms of no assumption on a functional form, such that DEA has been widely used to assess the performance of banks [69,70]. In our study with a limited number of observations, particularly, DEA is preferred as a nonparametric analysis over a parametric analysis because it can still provide the point estimates of each decision-making unit (DMU) without any concerns about error distribution.

Moreover, our study incorporates the concept of disposability into DEA models to address undesirable outputs. Generally, there are four ways to treat undesirable outputs: (1) ignore them, (2) include them as inputs, (3) deal with them as normal outputs, and (4) transform them [71]. We take the third approach because other approaches may create different efficient frontiers which lead to biased efficiency scores [72]. In our study, specifically, a non-performing loan is regarded as a byproduct of banks’ production processes, and banks act as an active DMU that can adjust the amount of an input factor to reduce the amount of non-performing loans. That is enabled by incorporating the disposability concept, where we can treat undesirable outputs as normal outputs.

At the second stage, we utilized B-TRA as well as C-TRA to examine statistical relationships between banks’ performance and demographic/environmental variables such as age (age), state-owned status (staow), and regional location (regloc). A detailed procedure of B-TRA is given in Appendix B.

5. Results

Table 4 briefly summarizes the results of the first stage analysis, including the unified efficiencies (UENc, UEMc, UENv, UEMv) and scale efficiencies (SEN & SEM) of the models under natural disposability and managerial disposability. In general, banks operate efficiently, as shown by the relatively high average scores of the unified efficiencies. Meanwhile, UEN scores tend to be higher than UEM ones (UENc = 0.832 > UEMc = 0.718; UENv = 0.884 > UEMv = 0.811), implying that Vietnam’s banks take more care over financial profit rather than financial health. There is also a gap in the scale efficiency between SEN (0.938) and SEM (0.877), indicating a slightly inferior effort to control the escalation of bad debts (npl) when it comes to business expansion. To some degree, this is an inevitable outcome when bad debts have a positive relationship with credit growth, where faster loan growth is interlinked with higher loan losses via “supply shifts” [73].

Table 4.

Results of Data Envelopment Analyses.

Banks often expand their lending by two methods: reducing interest rates or lowering minimum credit standards for new loans. In Vietnam, banks are encouraged to reduce interest rates to support businesses’ short-term capital and develop production activities through new medium and long-term investment projects (via a 4% reduction in loan interest rates). The prioritized sectors/subjects are agriculture and rural areas, export, supporting industry, small and medium enterprises (SMEs), and high-tech application enterprises [74]. As a result, with the booming of SMEs in these prioritized industries, flexible regulations in credit expansion management are underlying not only precedent default risks but also outstanding debts.

Table 5 and Table 6 provide the results of the second-stage analysis where we used B-TRA to examine the determinants to the banks’ unified efficiencies under the CRS condition. In addition, we employed C-TRA to determine the potential bias in the coefficients. The analysis is divided into four sub-models, in which Models 1a and 1b are based on C-TRA while Models 2a and 2b are on B-TRA. As mentioned in the previous section, banks’ demographic and environmental variables were integrated into Models 1b and 2b while Models 1a and 2a include input and output factors only. The values of AIC and BIC suggest that Models 1a and 2a are slightly better than Models 1b and 2b. The potential biases in coefficients (i.e., differences in coefficients of Models 1b and 2b) are larger in UENc than UEMc.

Table 5.

Results of Tobit and Bootstrap Truncated Regression Analyses: UENc.

Table 6.

Results of Tobit and Bootstrap Truncated Regression Analyses: UEMc.

Overall, some output factors, such as roa, incfft, incfoa, and npl, were statistically significant across four models. In both UEN and UEM, particularly under the CRS condition, roa, incfft, and incfoa were positively associated with the performance score, whereas npl was negatively associatted. Also, stoeq was negatively associated with the performance score in UENc only; opex and depfob were negatively associated in UEMc only. It is noticeable that no demographic and environmental variables were statistically related to UENc, whereas age, regloc, and fintech were negatively associated with UEMc. Detailed interpretations and discussions follow in the next section.

To examine determinants of the optimal size of banks, we also applied B-TRA and C-TRA to scale efficiency measures, SEN and SEM. The results are presented in Table A1 and Table A2 of Appendix C.

6. Discussion

The second-stage analysis results demonstrate that UENc is positively associated with roa, incfft, and incfoa but negatively associated with stoeq and npl; UEMc is positively associated with roa and incfoa but negatively associated with opex, depfob, age, regloc, and fintech. Of statistically significant variables, we focus on the interpretation of incfft, incfoa, and npl while the discussion of regloc and fintech is made in relation to the hypotheses.

Generally, incfft comes from financial assets held for foreign trading such as a higher balance of foreign currency-denominated trading securities; incfoa stems from non-banking activities such as exchange differences (e.g., hedging activities), gains on the disposal of assets, rental income, and dividend income; npl results from impairment for loans or credit risk. With a series of FTAs, it turned out that an increase in incfft and incfoa and decrease in npl are positively correlated with the financial profit of Vietnam’s banks; an increase in incfoa is also positively correlated with financial health. This particularly implies that banks’ product diversity or portfolio is associated not only with financial profit but also financial health. The implication is supported by some studies (e.g., the case of Italian banks [75]) but not by other studies (e.g., the case of Chinese banks [76]); thus, it has some limitations in generalization to other countries.

Hypothesis 1, As discussed above, FTA-related factors such as incfft and incfoa are associated with banks’ performance, particularly their financial profit performance. Under this hypothesis, furthermore, we discuss the relationship between fintech (as a primary ramification of the EVFTA) and bank performance measures. As briefed in Section 2, the EVFTA may encourage the development of FTPs in Vietnam, which stimulates heterogeneous banks to enter the race for high-tech innovations in internet banking add-on services, digital currencies, wholesale electronic payment, and robo-advisor technology. In Vietnam, banks are providing mobile internet banking along with an E-wallet (a third-party payment application), which aid in the transaction of electronic bills, including charges on air-conditioning, schooling, and maintenance fees [77,78]. Moreover, the EVFTA may be able to introduce the upgrades of Fintech 3.0 facilities, in which the bank’s capabilities are not limited to screening customers’ transaction history only, but can also utilize big-data manipulation for credit-risk management.

However, this was not the case according to our analysis results, where fintech was not statistically significant with UENc; it was negatively associated with UEMc. In terms of a faint relationship between fintech and UENc, we conjecture that there may be a slow economic response from the banking sector ahead of the Fintech innovations. Because of the modest level of technological capacity and qualified engineering, wide technological spillover has not materialized yet in Vietnam like other emerging countries [79,80]. According to the Information and Communication Technology Development Index 2017, Vietnam fell behind, ranking 108th, when compared to neighboring countries such as Malaysia (62nd), Thailand (78th), and China (80th). Another explanation is that a relatively low willingness of Vietnamese banks to adopt Fintech may hinder any imminent benefits. As shown in Refs. [81,82], state-owned banks take advantage of their size and a larger share of the market, but are less competitive and efficient because of their high agency costs and bureaucratic culture when compared to private banks. As shown in Appendix C, staow is positively related to SEN, implying that banks with a higher intensity of governmental equity enjoy their scale efficiency more. Additionally, Fintech may be embraced by large-scale financial intermediations only without technological spillovers to small and medium-sized banks. A few large banks monopolize the benefits of Fintech while a majority of small banks have difficulty infusing Fintech innovations into their operations.

In regard to a negative relationship between fintech and UEMc, we offer some probable rationales. Basically, the adverse association suggests that the cost side of Fintech may loom larger than the benefit side. One rationale is that Fintech may cause more bad debts of customers, which leads to the higher credit risk of banks. As shown in the case of Indonesia, the absence of a sound legal regulation of Fintech and appropriate consumer protection brought about soaring bad debts through illegal P2P lending, investment firms, and pawnbrokers [83]. Vietnam’s legal framework for Fintech and its stakeholders may not be fully formulated and implemented yet.

Another rationale is related to the rapidly increasing number of small and medium enterprises (SMEs) in Vietnam. Fintech is taking the place of traditional banks that have reduced their loans to SMEs after the financial crisis; however, the SME loan market has been always uncertain, and risks incurring bad debts [84]. Actually, the number of SMEs is skyrocketing with an aggregate growth of 12.5% annually. Considering SMEs’ vulnerability to the business cycle and their position as a substantial customer of Fintech products, the recent stagnating economy can influence banks’ credit risk negatively.

Hypothesis 2, Like fintech, a geographic variable, regloc, is not statistically significantly associated with UENc; however, it is negatively associated with UEMc. This means that banks headquartered in the southern region tend to take better care of credit risk than those in the northern region. There are some rationales for that. Firstly, there is regional variation in economic conditions between the two regions. According to the General Statistics Office of Vietnam, as of 2020, poverty rates in the northern region are much higher than that of the southern region: Northern midlands and mountain areas (14.4%), Central highlands (11%), North central and central coastal areas (6.5%), Mekong river delta (4.2%), Red river delta (1.3%), and South east (0.3%). According to the Vietnam Seaport Association, as of 2020, the total sea cargo throughput of the northern region is much smaller than that of the southern region: Northern (131.13 million metric tons), Central (42.62 million metric tons), and Southern (223.74 million metric tons). Such superior economic conditions in the southern region may contribute to the financially healthier performance.

Secondly, there are also differences in the cultural/political context of the two regions. The northern region tends to be more bureaucratic and conservative, whereas the southern region tends to be more democratic and liberal. The former tends to rely more on state-owned enterprises (SOEs) while the latter tends to depend more on private and foreign enterprises [85]. As a result, FDI-driven industrialization was realized earlier in the southern region than in the northern region. Banks in the northern region relied more on SOEs and provided preferential treatment to them [86]. The problem was that SOEs often suffered from their poor operational management, which brought about huge losses, bad debt, and corruption. In particular, the northern region, including Hanoi, Hai Phong, and Ha Tay, was affected more adversely by corruption than the southern region [87].

Lastly, the analysis results can be explained from a lens of the real estate market, since excessive lending to real estate is often one of the major sources of credit risk; this is also true in Vietnam [88]. As shown in the financial crisis, the excessive expansion of the real estate market due to massive capital inflow may be volatile and exposed to the risk of the plummeting value of real estate resulting from economic recession, which may lead to a crisis of the banking sector [89]. For instance, a considerable number of Vietnam’s State Civil Engineering Construction Corporations suffered extensive losses, creating bad debt and impacting the banking industry negatively [83]. According to the General Statistics Office of Vietnam, as of 2019, most construction of social houses and apartments took place in the northern region. The number of completed projects in the Red River Delta was 10,025, followed by the Southeast (1856) and Mekong River Delta (1409).

7. Conclusions

The success of the banking system is the root of sustainable economic development. In Vietnam, the EVFTA, along with the previous FTAs, opened a window of opportunity for the banking sector. On that basis, this study evaluated the overall efficiency of banks and investigated the potential impacts stemming from significant economic events. Specifically, we employed DEA models taking into account two types of disposability concepts, in conjunction with B-TRA and C-TRA, to test our hypotheses. Drawing on the statistical results, we reached two important conclusions: (1) while the EVFTA can contribute to Vietnamese banks’ financial profit performance through foreign trading and hedging activities, it may harm banks’ financial health performance due to Fintech-originated bad debts and a lack of relevant regulations; and (2) banks in southern Vietnam outperform those in northern Vietnam in managing their credit risk by better controlling bad debts, which result primarily from the volatility of the real estate market (including massive loss of construction-related SOEs). These findings provide some policy insights. Since Vietnam is not fully equipped with Fintech-related technological capability and legal framework, decision-makers in the relevant government agencies or the banking sector need to pay attention to the dark side of Fintech to mitigate its negative impacts on the financial health performance of banks. Policymakers also need to attempt to close regional gaps, particularly to alleviate bad debt issues in northern Vietnam.

While this study contributes to the extant literature in many ways, there are also some limitations. Firstly, it is recommended that the selection of inputs should be more reflective when it comes to explaining the operational performance of banks. To some degree, it was inevitable because the limitation of supporting information owing to the time gap and lack of coincidence between banks’ financial statements led to our selection of more generalized descriptive variables. Secondly, a broader selection of banks should be used to provide more objective results. In our analysis, we prioritized banks that have both public and foreign factors without collecting more data for foreign-based and 100% state-owned financial bodies. Lastly, more time may be needed to fully understand the effects of the EVFTA, because such a pivotal economic event will have longer-lasting and broader impacts on Vietnam’s banking sector, particularly when considering Vietnam’s dynamic economic growth.

Author Contributions

Conceptualization, H.N.; methodology, Y.R.; software, H.N. and Y.R.; validation, Y.R.; formal analysis, H.N.; investigation, H.N. and Y.R.; resources, Y.R.; data curation, H.N.; writing—original draft preparation, H.N.; writing—review and editing, Y.R.; visualization, Y.R.; supervision, Y.R.; project administration, Y.R.; funding acquisition, Y.R. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Conflicts of Interest

The authors declare no conflict of interest. The funders had no role in the design of the study; in the collection, analyses, or interpretation of data; in the writing of the manuscript, or in the decision to publish the results.

Appendix A. Data Envelopment Analysis with Undesirable Output

Production factors include as m-element input vectors, as s-element desirable output vectors and as h-element undesirable output vectors. Under this convention, financial operation and financial sustainability possibility sets under natural (N) and managerial (M) disposability are presented as follows:

where and represent the production possibility sets under constant RTS and constant DTS, respectively. The subscript (c) indicates constant RTS and DTS. Converting to variable RTS and DTS from constant ones leads to the following production possibility sets:

where the subscript (v) indicates variable RTS and DTS.

Under natural disposability (N), the financially operational performance is the first priority and sustainable performance is the second one; the opposite applies to managerial disposability (M). The concept of natural and managerial disposability proposes two production frontiers through the process of increasing desirable outputs and/or decreasing undesirable outputs.

With that assumption, the nomenclatures of this study are summarized as follows:

: an observed i-th input of the j-th DMU (i = 1, …, m and j = 1, ..., n),

: an observed r-th desirable output of the j-th DMU (r = 1, ..., s and j = 1, ..., n),

: an observed f-th undesirable output of the j-th DMU (f = 1, ..., h and j = 1, ..., n),

: an unknown slack variable of the i-th input,

: an unknown slack variable of the r-th desirable output,

: an unknown slack variable of the f-th undesirable output,

: an unknown column vector of intensity (or structural) variables,

: a prescribed very small number and

J: a set of all DMUs.

The unified performance of the jth DMU measures operational activities in producing both desirable and undesirable outputs out of a defined amount of inputs. Consider m inputs xij = (x1j, x2j, ..., xmj)T > 0 and s good outputs grj = (g1j, g2j, …, gsj)T > 0 and h bad ouputs bfj = (b1j, b2j, …, bhj)T > 0 with (j = 1, 2, …, n and T is a vector transpose). Under natural disposability, the unified efficiency is measured by the following formula under RTS:

where and represent the distance between the efficiency frontier and the observed vector, both of which are set with the maximum score of 1; takes the value of 0.0001 for computational convenience. Also, , , and stand for data ranges defined for avoiding an occurrence of zero in multipliers and their specifications are as follows:

On that ground, the unified efficiency under natural disposability of the kth DMU () is determined as follows:

Similarly, we measure the unified efficiency under managerial disposability as follows:

The unified efficiency of the kth DMU under managerial disposability () as follows:

For variable RTS and DTS, is integrated into models (A3) and (A6), respectively; two unified efficiency scores ( and ) are determined as follows:

Using the concept of scale efficiency, we combine Model (A5) & Model (A8) to produce the scale efficiency measure under natural disposability and Model (A7) & Model (A9) for scale efficiency under managerial disposability as follows:

Appendix B. Bootstrap Truncated Regression Analysis

The B-TRA was proposed in DEA context to address potential bias when applying the traditional linear regression model, = ziβ + ξi. Ref. [15] offered two bootstrap procedures for the estimation: Algorithm 1 and Algorithm 2. Taking advantage of the DEA results at the first stage (i.e., unified efficiency scores), our analysis followed the procedure below:

- Retrieve UENc and UEMc from the first stage and generate a truncated regression to get coefficients of β and the estimates of σ.

- Repeat the following steps 2,000 times to compute bootstrap estimates of and . For i = 1, …, m < n observations, draw εi from the N(0, ) with left truncated at 1 − zi. Again, for each i = 1, …, m, compute = zi + εi. Use the maximum likelihood method to estimate the truncated regression of on zi, yielding estimates and .

- Use the bootstrapped values and the original estimates and to construct estimated confidence intervals for each element of β and σ.

Appendix C. Results of Regression Analyses on Scale Efficiency Measures

Table A1 and Table A2 show the results of Tobit and B-TRA on SEN and SEM. Of input and output factors, invse and cusde are negatively related to SEN while roe and incfft are positively related; cusde is negatively related to SEM while incfft is positively related. Of environmental variable, staow is positively related to SEN only.

Table A1.

Results of Tobit and Bootstrap Truncated Regression Analyses: SEN.

Table A1.

Results of Tobit and Bootstrap Truncated Regression Analyses: SEN.

| Var | Tobit | Bootstrap Truncated | Difference (2b − 1b) | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Model 1a | Model 1b | Model 2a | Model 2b | ||||||

| opex | −0.0030 | (−0.28) | 0.0084 | (0.80) | −0.0030 | (−0.28) | 0.0084 | (0.80) | 0.0000 |

| invse | −0.1592 ** | (−2.39) | −0.1089 | (−1.72) | −0.1592 ** | (−2.41) | −0.1089 * | (−1.72) | 0.0000 |

| depfob | −0.0280 | (−0.67) | −0.0105 | (−0.26) | −0.0280 | (−0.69) | −0.0105 | (−0.25) | 0.0000 |

| cusde | −0.1514 * | (−1.73) | −0.2197 ** | (−2.61) | −0.1514 * | (−1.70) | −0.2197 *** | (−2.68) | 0.0000 |

| stoeq | 0.1952 * | (1.89) | 0.1818 | (1.68) | 0.1952 * | (1.84) | 0.1818 * | (1.67) | 0.0000 |

| roa | −0.1812 | (−1.54) | −0.1821 | (−1.57) | −0.1812 | (−1.50) | −0.1821 | (−1.58) | 0.0000 |

| roe | 0.1873 * | (1.77) | 0.1891 * | (1.88) | 0.1873 * | (1.75) | 0.1891 * | (1.89) | 0.0000 |

| incfft | 0.0504 * | (2.00) | 0.0251 | (0.78) | 0.0504 ** | (2.01) | 0.0251 | (0.77) | 0.0000 |

| incfoa | 0.0575 | (1.55) | 0.0361 | (0.94) | 0.0575 | (1.54) | 0.0361 | (0.93) | 0.0000 |

| npl | −0.0259 | (−0.62) | −0.0586 | (−1.17) | −0.0259 | (−0.60) | −0.0586 | (−1.15) | 0.0000 |

| age | 0.1085 | (0.96) | 0.1085 | (0.94) | 0.0000 | ||||

| regloc | 0.0371 | (1.07) | 0.0371 | (1.05) | 0.0000 | ||||

| croom | 0.0292 | (0.90) | 0.0292 | (0.88) | 0.0000 | ||||

| fintech | −0.0600 | (−1.45) | −0.0600 | (−1.45) | 0.0000 | ||||

| staow | 0.0986 * | (1.78) | 0.0986 * | (1.80) | 0.0000 | ||||

| AIC | 392.173 | 392.070 | 392.173 | 392.070 | |||||

| BIC | 409.381 | 416.448 | 409.381 | 416.448 | |||||

Note. *** significant at 1%, ** significant at 5%, * significant at 10%; values in the parenthesis: z score; AIC: Akaike’s Information Criteria; BIC: Bayesian Information Criteria.

Table A2.

Results of Tobit and Bootstrap Truncated Regression Analyses: SEM.

Table A2.

Results of Tobit and Bootstrap Truncated Regression Analyses: SEM.

| Var | Tobit | Bootstrap Truncated | Difference (2b − 1b) | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Model 1a | Model 1b | Model 2a | Model 2b | ||||||

| opex | −0.0025 | (−0.22) | −0.0029 | (−0.24) | −0.0025 | (−0.22) | −0.0029 | (−0.24) | 0.0000 |

| invse | −0.0549 | (−0.78) | −0.0435 | (−0.60) | −0.0549 | (−0.76) | −0.0435 | (−0.61) | 0.0000 |

| depfob | −0.0682 | (−1.54) | −0.0574 | (−1.24) | −0.0682 | (−1.55) | −0.0574 | (−1.24) | 0.0000 |

| cusde | −0.1449 | (−1.56) | −0.1852 * | (−1.92) | −0.1449 | (−1.55) | −0.1852 * | (−1.88) | 0.0000 |

| stoeq | 0.0897 | (0.82) | 0.0942 | (0.76) | 0.0897 | (0.81) | 0.0942 | (0.76) | 0.0000 |

| roa | −0.0772 | (−0.62) | −0.0656 | (−0.49) | −0.0772 | (−0.61) | −0.0656 | (−0.49) | 0.0000 |

| roe | 0.1428 | (1.27) | 0.1321 | (1.15) | 0.1428 | (1.26) | 0.1321 | (1.14) | 0.0000 |

| incfft | 0.0495 * | (1.85) | 0.0559 | (1.52) | 0.0495 * | (1.90) | 0.0559 | (1.56) | 0.0000 |

| incfoa | 0.0602 | (1.52) | 0.0525 | (1.19) | 0.0602 | (1.53) | 0.0525 | (1.22) | 0.0000 |

| npl | 0.0444 | (1.00) | 0.0526 | (0.92) | 0.0444 | (1.00) | 0.0526 | (0.91) | 0.0000 |

| age | −0.0361 | (−0.28) | −0.0361 | (−0.29) | 0.0000 | ||||

| regloc | 0.0387 | (0.97) | 0.0387 | (0.99) | 0.0000 | ||||

| croom | −0.0069 | (−0.18) | −0.0069 | (−0.18) | 0.0000 | ||||

| fintech | −0.0535 | (−1.13) | −0.0535 | (−1.13) | 0.0000 | ||||

| staow | 0.0593 | (0.93) | 0.0593 | (0.95) | 0.0000 | ||||

| AIC | 395.902 | 400.504 | 395.902 | 400.504 | |||||

| BIC | 413.110 | 424.881 | 413.110 | 424.881 | |||||

Note. * significant at 10%; values in the parenthesis: z score; AIC: Akaike’s Information Criteria; BIC: Bayesian Information Criteria.

References

- De Carvalho Ferreira, M.C.R.; Sobreiro, V.A.; Kimura, H.; de Moraes Barboza, F.L. A systematic review of literature about finance and sustainability. J. Sustain. Financ. Investig. 2016, 6, 112–147. [Google Scholar] [CrossRef]

- Ntarmah, A.H.; Kong, Y.; Gyan, M.K. Banking system stability and economic sustainability: A panel data analysis of the effect of banking system stability on sustainability of some selected developing countries. Quant. Financ. Econ. 2019, 3, 709–738. [Google Scholar] [CrossRef]

- Dutta, M. Vietnam: Marketization and internationalization of its economy. J. Asian Econ. 1995, 6, 311–326. [Google Scholar] [CrossRef]

- Yoo, J.-G. An Economic Effect Analysis of ASEAN FTA on FDI Flows into the ASEAN Countries. J. Distrib. Sci. 2016, 14, 39–49. [Google Scholar]

- Narayan, P.K.; Narayan, S. Modelling the impact of oil prices on Vietnam’s stock prices. Appl. Energy 2010, 87, 356–361. [Google Scholar] [CrossRef]

- Kikuchi, T.; Yanagida, K.; Vo, H. The effects of Mega-Regional Trade Agreements on Vietnam. J. Asian Econ. 2018, 55, 4–19. [Google Scholar] [CrossRef]

- Tien, N.H.; Vu, N.T.; Dung, H.T.; Duc, L. Determinants of real estate bubble in Vietnam. Int. J. Res. Financ. Manag. 2019, 2, 75–80. [Google Scholar]

- Huy, D.T.N.; Nhan, V.K.; Bich, N.T.N.; Hong, N.T.P.; Chung, N.T.; Huy, P.Q. Impacts of Internal and External Macroeconomic Factors on Firm Stock Price in an Expansion Econometric model—A Case in Vietnam Real Estate Industry. In Data Science for Financial Econometrics; Springer: Berlin/Heidelberg, Germany, 2021; pp. 189–205. [Google Scholar]

- Vu, H.T. Assessing potential impacts of the EVFTA on Vietnam’s pharmaceutical imports from the EU: An application of SMART analysis. SpringerPlus 2016, 5, 1–22. [Google Scholar] [CrossRef] [PubMed]

- Le, C.; Šević, A.; Tzeremes, P.G.; Ngo, T. Bank efficiency in Vietnam: Do scale expansion strategies and non-performing loans matter? Int. J. Financ. Econ. 2020, 1–22. [Google Scholar] [CrossRef]

- Huu, N.D. Challenges in Intellectual Property Policy in Vietnam Participating in the EU-Vietnam Free Trade Agreement (EVFTA). Rev. GEINTEC 2021, 11, 595–609. [Google Scholar] [CrossRef]

- Fforde, A.J. Luck, policy or something else entirely? Vietnam’s economic performance in 2009 and prospects for 2010. J. Curr. Southeast Asian Aff. 2009, 28, 71–94. [Google Scholar] [CrossRef]

- Thanassoulis, E. Data envelopment analysis and its use in banking. Compos. Interfaces 1999, 29, 1–13. [Google Scholar] [CrossRef]

- Sueyoshi, T.; Goto, M. Environmental Assessment on Energy and Sustainability by Data Envelopment Analysis; John Wiley & Sons: Hoboken, NJ, USA, 2018. [Google Scholar]

- Simar, L.; Wilson, P.W. Estimation and inference in two-stage, semi-parametric models of production processes. J. Econom. 2007, 136, 31–64. [Google Scholar] [CrossRef]

- Packard, L.A.T.; Thurman, S.S. A Model Design for Vietnam as an Open Economy in Transition. ASEAN Econ. Bull. 1996, 13, 241–261. [Google Scholar] [CrossRef]

- Anwar, S.; Nguyen, L.P. Channels of monetary policy transmission in Vietnam. J. Policy Model. 2018, 40, 709–729. [Google Scholar] [CrossRef]

- Nguyen, T.N.; Steward, C. Vietnamese banking system between 1999 and 2009: A structural model approach. J. Financ. Regul. Compliance 2013, 21, 268–283. [Google Scholar] [CrossRef]

- Manyin, M.E. The Vietnam-US Bilateral Trade Agreement; U.S. Congressional Research Service: Washington, DC, USA, 2001.

- Barai, M.K.; Le, T.A.L.; Nguyen, N.H. Vietnam: Achievements and challenges for emerging as a FTA hub. Transnatl. Corp. Rev. 2017, 9, 51–65. [Google Scholar] [CrossRef]

- Kawai, M.; Wignaraja, G. Asian FTAs: Trends, prospects and challenges. J. Asian Econ. 2011, 22, 1–22. [Google Scholar] [CrossRef]

- Le, G.; Bui, H. Vietnamese Exporters in the Midst of Rules of Origin Under FTAs. Glob. Trade Cust. J. 2020, 15, 164–167. [Google Scholar]

- Cheng, M.; Geng, H.; Zhang, J. Chinese commercial banks: Benefits from foreign strategic investors? Pac. Basin Finance J. 2016, 40, 147–172. [Google Scholar] [CrossRef]

- Phan, D.H.B.; Narayan, P.K.; Rahman, R.E.; Hutabarat, A.R. Do financial technology firms influence bank performance? Pac. Basin Financ. J. 2020, 62, 101210. [Google Scholar] [CrossRef]

- Jun, J.; Yeo, E. Entry of FinTech firms and competition in the retail payments market. Asia-Pac. J. Financ. Stud. 2016, 45, 159–184. [Google Scholar] [CrossRef]

- Anagnostopoulos, L. Fintech and regtech: Impact on regulators and banks. J. Econ. Bus. 2018, 100, 7–25. [Google Scholar] [CrossRef]

- Büthe, T.; Miller, H.V. The politics of foreign direct investment into developing countries: Increasing FDI through international trade agreements? Am. J. Pol. Sci. 2008, 52, 741–762. [Google Scholar] [CrossRef]

- Maudos, J.; Pastor, J.M.; Perez, F.; Quesada, J. Cost and profit efficiency in European banks. J. Int. Financ. Mark. Inst. Money 2002, 12, 33–58. [Google Scholar] [CrossRef]

- Van Dinh, U.L.; Le, P. Measuring the Impacts of Internet Banking to Bank Performance: Evidence from Vietnam. J. Internet Bank. Commerce 2015, 20, 1–14. [Google Scholar]

- Dang, V. The effects of loan growth on bank performance: Evidence from Vietnam. Manag. Sci. Lett. 2019, 9, 899–910. [Google Scholar] [CrossRef]

- Le, T.T.D. Determinants of Retail Banking Efficiency: A Case of Vietcombank Branches in the Mekong-Delta Region. J. Asian Financ. Econ. Bus. 2020, 7, 439–451. [Google Scholar] [CrossRef]

- Nguyen, T.P.T.; Roca, E.; Sharma, P. How efficient is the banking system of Asia’s next economic dragon? Evidence from rolling DEA windows. Appl. Econ. Lett. 2014, 46, 2665–2684. [Google Scholar] [CrossRef]

- Stewart, C.; Matousek, R.; Nguyen, T.N. Efficiency in the Vietnamese banking system: A DEA double bootstrap approach. Res. Int. Bus. Financ. 2016, 36, 96–111. [Google Scholar] [CrossRef]

- Vu, H.T.; Turnell, S. Cost efficiency of the banking sector in Vietnam: A Bayesian stochastic frontier approach with regularity constraints. Asian Econ. J. 2010, 24, 115–139. [Google Scholar] [CrossRef]

- Le, P.T.; Harvie, C.; Arjomandi, A.; Borthwick, J. Financial liberalization, bank ownership type and performance in a transition economy: The case of Vietnam. Pac. Basin. Financ. J. 2019, 57, 101182. [Google Scholar] [CrossRef]

- Wu, D.D.; Yang, Z.; Liang, L. Efficiency analysis of cross-region bank branches using fuzzy data envelopment analysis. Appl. Math. Comput. 2006, 181, 271–281. [Google Scholar] [CrossRef]

- Shyu, J.; Lieu, P.T.; Chang, W. How the environment determines banking efficiency: A comparison of banking firms in Taiwan, Hong Kong, and Mainland China. Int. Trans. Oper. Res. 2015, 22, 757–770. [Google Scholar] [CrossRef]

- Wijesiri, M.; Martinez-Campillo, A.; Wanke, P. Is there a trade-off between social and financial performance of public commercial banks in India? A multi-activity DEA model with shared inputs and undesirable outputs. Rev. Manag. Sci. 2019, 13, 417–442. [Google Scholar] [CrossRef]

- Minh, D.N.; Dat, P.M. European-Vietnam Free Trade Agreement (EVFTA) impacts on imports: A case study. J. Secur. Sustain. Issues 2020, 9, 56–68. [Google Scholar]

- Guild, J. Fintech and the Future of Finance. Asian J. Public Aff. 2017, 10, 12–17. [Google Scholar] [CrossRef]

- Chen, X.; You, X.; Chang, V. FinTech and commercial banks’ performance in China: A leap forward or survival of the fittest? Technol. Forecast. Soc. Chang. 2021, 166, 120645. [Google Scholar] [CrossRef]

- Preston, H.H. Branch banking with special reference to California conditions. J. Polit. Econ. 1922, 30, 494–517. [Google Scholar] [CrossRef][Green Version]

- Boone, C.; Özcan, S. Ideological purity vs. hybridization trade-off: When do Islamic banks hire managers from conventional banking? Organ. Sci. 2016, 27, 1380–1396. [Google Scholar] [CrossRef]

- Deng, S.; Elyasiani, E. Geographic diversification, bank holding company value, and risk. J. Money Credit. Bank. 2008, 40, 1217–1238. [Google Scholar] [CrossRef]

- Eckardt, H.M.P. Branch Banking among the State Banks. Ann. Am. Acad. Pol. Soc. Sci. 1910, 36, 148–161. [Google Scholar] [CrossRef]

- Zhao, S.X.; Zhang, L.; Wang, D.T. Determining factors of the development of a national financial center: The case of China. Geoforum 2004, 35, 577–592. [Google Scholar] [CrossRef]

- Berger, A.N.; DeYoung, R. The effects of geographic expansion on bank efficiency. J. Financ. Serv. Res. 2001, 19, 163–184. [Google Scholar] [CrossRef]

- Ptak, S.A. Geographical Analysis of Commercial Lending by US Banks: A Study of Knowledge-Intensive Business Services. Ph.D. Thesis, State University of New York at Buffalo, Buffalo, NY, USA, January 2016. [Google Scholar]

- Jiménez, G.; Salas, V.; Saurina, J. Organizational distance and use of collateral for business loans. J. Bank. Financ. 2009, 33, 234–243. [Google Scholar] [CrossRef]

- Belkhir, M.; Grira, J.; Hassan, M.K.; Soumaré, I. Islamic banks and political risk: International evidence. Q. Rev. Econ. Financ. 2019, 74, 39–55. [Google Scholar] [CrossRef]

- Athari, S.A. Domestic political risk, global economic policy uncertainty, and banks’ profitability: Evidence from Ukrainian banks. Post-Communist Econ. 2021, 33, 458–483. [Google Scholar] [CrossRef]

- Lisle-Williams, M. Beyond the market: The survival of family capitalism in the English merchant banks. Br. J. Sociol. 1984, 35, 241–271. [Google Scholar] [CrossRef]

- Glynos, J.; Speed, E. Varieties of co-production in public services: Time banks in a UK health policy context. Crit. Policy Stud. 2012, 6, 402–433. [Google Scholar] [CrossRef]

- Ba, T.L. Determinants of credit risk management in Vietnam. J. Financ. Monet. Mark. 2018, 6, 25. [Google Scholar]

- Alodayni, S. Oil prices, credit risks in banking systems, and macro-financial linkages across GCC oil exporters. Int. J. Financ. Stud. 2016, 4, 23. [Google Scholar] [CrossRef]

- Anwar, S.; Nguyen, L.P. Financial development and economic growth in Vietnam. J. Econ. Financ. 2011, 35, 348–360. [Google Scholar] [CrossRef]

- Malesky, E.J.; Taussig, M. Where is credit due? Legal institutions, connections, and the efficiency of bank lending in Vietnam. J. Law Econ. Organ. 2009, 25, 535–578. [Google Scholar] [CrossRef]

- Ha, N.M.; Le, N.D.; Kien, P.T. The impact of urbanization on income inequality: A study in Vietnam. J. Risk Financ. 2019, 12, 146. [Google Scholar] [CrossRef]

- Smith, D.W.; Scarpaci, J.L. Urbanization in transitional societies: An overview of Vietnam and Hanoi. Urban Geogr. 2000, 21, 745–757. [Google Scholar] [CrossRef]

- Thu, T.T.; Perera, R. Consequences of the two-price system for land in the land and housing market in Ho Chi Minh City, Vietnam. Habitat Int. 2011, 35, 30–39. [Google Scholar]

- Quigley, J.M. Real estate and the Asian crisis. J. Hous. Econ. 2001, 10, 129–161. [Google Scholar] [CrossRef]

- Nguyen, M.; Skully, M.; Perera, S. Bank market power and revenue diversification: Evidence from selected ASEAN countries. J. Asian Econ. 2012, 23, 688–700. [Google Scholar] [CrossRef]

- Leightner, J.E.; Lovell, C.K. The impact of financial liberalization on the performance of Thai banks. J. Econ. Bus. 1998, 50, 115–131. [Google Scholar] [CrossRef]

- Sufian, F. Determinants of bank efficiency during unstable macroeconomic environment: Empirical evidence from Malaysia. Res. Int. Bus. Financ. 2009, 23, 54–77. [Google Scholar] [CrossRef]

- Salim, R.; Arjomandi, A.; Seufert, J.H. Does corporate governance affect Australian banks’ performance? J. Int. Financ. Mark. Inst. Money 2016, 43, 113–125. [Google Scholar] [CrossRef]

- Minh, N.K.; Long, G.T.; Hung, N.V. Efficiency and super-efficiency of commercial banks in Vietnam: Performances and determinants. Asia-Pac. J. Oper. Res. 2013, 30, 1250047. [Google Scholar] [CrossRef]

- Drake, L.; Hall, M.J.; Simper, R. The impact of macroeconomic and regulatory factors on bank efficiency: A non-parametric analysis of Hong Kong’s banking system. J. Bank. Financ. 2006, 30, 1443–1466. [Google Scholar] [CrossRef]

- Sueyoshi, T.; Ryu, Y. Performance Assessment of the Semiconductor Industry: Measured by DEA Environmental Assessment. Energies 2020, 13, 5998. [Google Scholar] [CrossRef]

- Berger, A.N.; Humphrey, D.B. Efficiency of financial institutions: International survey and directions for future research. Eur. J. Oper. Res. 1997, 98, 175–212. [Google Scholar] [CrossRef]

- Ho, T.H.; Nguyen, D.T.; Ngo, T.; Le, T.D. Efficiency in Vietnamese banking: A meta-regression analysis approach. Int. J. Financ. Stud. 2021, 9, 41. [Google Scholar] [CrossRef]

- Halkos, G.; Petrou, K.N. Treating undesirable outputs in DEA: A critical review. Econ. Anal. Policy 2019, 62, 97–104. [Google Scholar] [CrossRef]

- Dyson, R.G.; Allen, R.; Camanho, A.S.; Podinovski, V.V.; Sarrico, C.S.; Shale, E.A. Pitfalls and protocols in DEA. Eur. J. Oper. Res. 2001, 132, 245–259. [Google Scholar] [CrossRef]

- Keeton, W.R. Does faster loan growth lead to higher loan losses? Fed. Reserve Bank Kansas City Econ. Rev. 1999, 84, 57–75. [Google Scholar]

- The State Bank of Vietnam Prescribing Lending Transactions of Credit Institutions and/or Foreign Bank Branches with Customers. 2016. Available online: https://english.luatvietnam.vn/circular-no-39-2016-tt-nhnn-dated-december-30-2016-of-the-state-bank-of-vietnam-prescribing-lending-transactions-of-credit-institutions-and-or-forei-112177-Doc1.html (accessed on 1 October 2021).

- Chiorazzo, V.; Milani, C.; Salvini, F. Income Diversification and Bank Performance: Evidence from Italian Banks. J. Financ. Serv. Res. 2008, 33, 181–203. [Google Scholar] [CrossRef]

- Berger, A.N.; Hasan, I.; Zhou, M. The effects of focus versus diversification on bank performance: Evidence from Chinese banks. J. Bank. Financ. 2010, 34, 1417–1435. [Google Scholar] [CrossRef]

- Phuong, N.N.D.; Luan, L.T.; Dong, V.V. Examining Customers’ Continuance Intentions towards E-wallet Usage: The Emergence of Mobile Payment Acceptance in Vietnam. J. Asian Financ. Econ. Bus. 2020, 7, 505–516. [Google Scholar] [CrossRef]

- Phan, T.N.; Ho, T.V.; Le-Hoang, P.V. Factors Affecting the Behavioral Intention and Behavior of Using E-Wallets of Youth in Vietnam. J. Asian Financ. Econ. Bus. 2020, 7, 295–302. [Google Scholar] [CrossRef]

- Long, N.D.; Ogunlana, S.; Quang, T.; Lam, K.C. Large construction projects in developing countries: A case study from Vietnam. Int. J. Proj. Manag. 2004, 22, 553–561. [Google Scholar] [CrossRef]

- Nong, D.; Wang, C.; Al-Amin, A.Q. A critical review of energy resources, policies and scientific studies towards a cleaner and more sustainable economy in Vietnam. Renew. Sust. Energ. Rev. 2020, 134, 110117. [Google Scholar] [CrossRef]

- Williams, J.; Nguyen, N. Financial liberalization, crisis, and restructuring: A comparative study of bank performance and bank governance in South East Asia. J. Bank. Financ. 2005, 29, 2119–2154. [Google Scholar] [CrossRef]

- Shen, C.H.; Hasan, I.; Lin, C.Y. The government’s role in government-owned banks. J. Financ. Serv. Res 2014, 45, 307–340. [Google Scholar] [CrossRef]

- Kharisma, D.B. Urgency of financial technology (Fintech) laws in Indonesia. Int. J. Law Manag. 2021, 63, 320–331. [Google Scholar] [CrossRef]

- Magnuson, W. Regulating Fintech. Vanderbilt Law Rev. 2018, 71, 1167. [Google Scholar]

- Vietnam: America Lost, Capitalism Won. The Economist, 30 April 2005, 950. Available online: https://www.economist.com/asia/2005/04/28/america-lost-capitalism-won (accessed on 1 November 2021).

- Masina, P.P.; Cerimele, M. Patterns of industrialisation and the state of industrial labour in post-WTO-accession Vietnam. Eur. J. East. Asian Stud. 2018, 17, 289–323. [Google Scholar] [CrossRef]

- Nguyen, T.T.; Van Dijk, M.A. Corruption, growth, and governance: Private vs. state-owned firms in Vietnam. J. Bank. Financ. 2012, 36, 2935–2948. [Google Scholar] [CrossRef]

- Phan, H.T.; Hoang, T.N.; Dinh, L.V.; Hoang, D.N. The Determinants of Listed Commercial Banks’ Profitability in Vietnam. J. Asian Financ. Econ. Bus. 2020, 7, 219–229. [Google Scholar] [CrossRef]

- Bentick, B.L.; Lewis, M.K. Real Estate Speculation as a Source of Banking and Currency Instability: Some Different Lessons from the Asian Crisis. Econ. Labour Relat. Rev. 2004, 14, 256–275. [Google Scholar] [CrossRef]

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).