Abstract

The agricultural futures market plays an extremely important role in price discovery, hedging risks, integrating agricultural markets and promoting agricultural economic growth. China is the largest apple producer and consumer in the world. In 2017, Chinese apple futures were listed on the Zhengzhou Commodity Exchange (CZCE) as the first fruit futures contract globally. This paper aims to study the efficiency of the apple futures market by using the Wild Bootstrapping Variance Ratio model to estimate the price discovery function, the ARIMA-GARCH model to estimate the risk-hedging function, and the ARDL-ECM model to estimate the cointegration relationship of the futures and spot market. Experimental results firstly demonstrate that the apple futures market conforms to the weak-form efficiency, which indicates that it is efficient in price discovery. Secondly, the apple futures market is not of semi-strong efficiency because it generated abnormal profit margins amid China–US trade friction, climate disaster, and COVID-19; in terms of the degree of impact, the COVID-19 pandemic had the greatest impact, followed by the rainstorm disaster and trade friction. Thirdly, the results of this study indicate that the cointegration relationships exist between the futures market and the spot markets of the main producing areas. This paper is not only conducive to sustainable development of the global fresh or fruit futures market, but also has potential and practical importance for China in developing the agricultural futures market, strengthening market risk management and promoting market circulation.

1. Introduction

Since 1978, the market-oriented economic transformation has brought remarkable achievements in China: laws and policies on the market development have been gradually perfected, the diversified market competition pattern has been formed and the circulation level increased significantly, thus, the Chinese commodity markets have formed the harmonious coexistence of a tangible market and intangible market, the wholesale market and retail market, spot market and futures market and the city market and the rural market. The futures market is the most important information distribution and risk management market in the modern market system, collects various risk factors that affect the price fluctuations and has an important price discovery and risk hedging function for the spot market [1,2,3]. After 30 years of evolution and development, there are more than 30 agricultural futures and options in China. According to the Statistics of the Futures Industry Association of the United States (FIA), in the past 10 years, the trading volume of Chinese commodity futures has ranked the first in the world. In 2020, among the top 20 trading volumes of global agricultural products’ futures, China occupies 14 seats, and Chinese varieties occupy the top 10 [4].

In China, both the production and consumption of apples account for more than 50% of the global total, which means that China has become the largest apple producer and consumer in the world [5]. The statistics of the U.S. Department of Agriculture (USDA) shows that in the past five years, the planting area, the output and the total output value in China have remained at 2 million hectares, 40 million tons, and 220 billion yuan [6]. Apples are the fruit crop with the largest acreage and the highest production value in China and have been the dominant income source for farmers in the two main apple production regions—the Bohai Gulf region and the Loess Plateau region [7].

Although China has the advantage of a super large market and huge potential in domestic demand, it faces structural imbalances in industrial transformation and upgrading, violent fluctuations in market prices and unstable income of apple planters, a sign that market prices have experienced a roller-coaster ride since 2006. At present, the overcapacity of apples in China is prominent; particularly since the outbreak of COVID-19, most exports have been sold domestically. Fruit enterprises face greater operational risks and the upgrading of industrial structures to high quality and standardization is slowing. Since apple production has the characteristics of small cropping behavior, small planting scale, a decentralized market and industrial fragmentation, resulting in smallholder farmers usually facing several complex production and marketing constraints such as high transaction costs of accessing inputs and output markets, unavailability of modern technologies and poor access to credit services [8], they face more difficulties in alleviating poverty.

In this context, the apple futures listed on the Zhengzhou Commodity Exchange (CZCE) on 22 December 2017, which is the first fruit futures in the world, are beneficial to the market participants for using the agricultural futures market to resolve production risks caused by price fluctuations. The launch of apple futures has enriched China’s agricultural commodity market system, and its operation effect has also gone through a stage from controversial to gradual confirmation. According to the CZCE statistics, since the listing of the apple futures, the trading volume has been active. Until December 2021, the cumulative trading volume exceeded 300 million, with a turnover of 18.1235 trillion yuan [9]. Hence, this paper aims at answering the question of whether the apple futures market is effective, specifically including three aspects: weak and semi-strong validity based on the efficient market hypothesis theory and the cointegration relationships based on general equilibrium theory.

This study contributes to academia in the following ways: First, it examines the price discovery efficiency of the apple futures market by the wild bootstrapping variance ratio method, which satisfies the uncorrelated increment of the random walk and the heteroscedasticity conditions. Second, it evaluates the impacts of different risks on the apple futures market, which find that the shock of different types of risk on the market is asymmetrical. COVID-19 has the biggest negative shock, followed by the climate disaster of rainstorms and the China–US trade friction. Finally, this paper tests the cointegration relationships between the futures market and the spot market in Shandong and Shaanxi provinces, which are the largest growing area in the world. The findings of this study will contribute to the policy implications of the agricultural futures market for price discovery, risk hedging and market circulation mechanisms.

The rest of the paper is organized as follows: Section 2 provides a literature review on the efficiency of the agricultural futures markets. Section 3 provides methodology with the sampling procedure, data description and empirical model. Section 4 reports the estimation results. Section 5 summarizes the conclusion.

2. Literature Review

Since the Efficient Market Hypothesis was proposed by Fama (1970) [10], the main thread of the study on the efficiency of the futures market is in paying attention to the functions of price discovery and risk management, which economists have generally believed are the basic functions of the futures market. According to “A Study of the Effects on the Economy of Trading in Futures Options” published by the Committee on Agriculture of the United States in 1985, the futures market has the functions of price discovery, pricing benchmarks and risk hedging. The price discovery of the global futures market presents different characteristics in different time periods, and the efficiency level “varies by variety” [11,12,13,14,15]. In the Chinese transition from the planned economy to the market economy, the futures market already has functions of price discovery [16]. Judging by market activity and price fluctuations, the Chinese futures market does not appear to be overreacted to information [17]. Affected by factors such as spot market dependence, contract maturity and trading activity, the corn and soybean futures markets are the most efficient, while the wheat futures market is relatively ineffective [18].

The uncertainty of financial risks, energy risks, monetary policy adjustments, trade frictions, agricultural support policies and climate changes have periodic and cyclical impacts on the agricultural futures market [19,20,21,22,23,24]. However, compared to other factors, climate risks are the most important factor impacting the agricultural futures market [25], this view can be supported by (Atems and Sardar, 2021) and (Cashin et al., 2017) who studied the shock of El Niño on agricultural market prices [26,27]. Recently, the influence of the COVID-19 pandemic crisis on dynamic return and volatility connectedness for dominant agricultural commodity markets was studied by (Umar et al., 2022), compared with the grain and soft agricultural commodity market, the livestock market seems to be the most affected [28]. In terms of China, the impact of financial risks, natural disasters, or political events on the agricultural futures market has significant asymmetric characteristics. During the period of sharp fluctuations in crude oil market prices, Chinese soybean, corn, cotton and palm oil futures markets also produced significant negative profit margins [18], among which the economic crop market was more fragile [29]. Zhang and Qu (2014) used the ARJI-GARCH model to study global oil price shocks in Chinese agricultural markets. They found that oil price shocks had different effects on agricultural commodities: the strong wheat, corn, soybeans, bean pulp and cotton markets were greatly influenced, but natural rubber was least affected [29]. The economic policy uncertainty during the financial crisis in 2008, the post-crisis era in 2011 and the stock market disaster period in 2015 had both positive and negative impacts on Chinese agricultural futures prices. Among them, the 2015 stock market disaster had the longest duration and the greatest impact on the futures market [30]. Although there are herd behavior and price bubbles in the futures market during major risk events, contracts of different varieties respond differently. The price bubble in the Chinese agricultural futures market is generally controllable, which is considered the limited arbitrage market [31,32].

The highly integrated relationship among agricultural markets is established mainly through the information induction mechanism and trade system. Cointegration models were usually used to test the integration relationship between agricultural futures markets in different countries or regions. The long-term integration relationship between agricultural markets would change positively or negatively due to the impact of the heterogeneity of risk events. Dawson and Sanjuán (2006) found that there was a long-term integration relationship between the wheat futures markets of the US and Canada from 1974 to 2001 using the Johansen cointegration test model, and the US agricultural export promotion programs in 1985 and 1995 contributed to the integration in both countries [33]. Ayadi et al. (2021) used the DCC-GARCH model and the International Capital Asset Pricing Model (ICAPM) to study the impact of the global financial crisis, Irish banking crisis, European financial crisis and Brexit crisis on the integration relationship among the agricultural futures markets of the US, Western Europe and BRIC countries. The integration relationship is found to have different segmentation or convergence trends due to the heterogeneity of risk events [34].

In terms of China, some scholars believe that there is a high degree of integration between domestic and foreign agricultural futures markets [35,36,37]. The other view is that it does not show a significant integration relationship between China and international agricultural futures markets [38,39]. Although the two types of study have produced different results, they all illustrate the disadvantages and drawbacks of the separation of the Chinese market from the international market, affirm the positive impact of price synergy on economic growth and advocate for increasing the openness of the agricultural market to foreign countries.

In fact, empirical studies based on cointegration theory came mostly from the general equilibrium theory established by Alfred Marshall (1920) [40]. It is clarified that the price is the link between the spot market and futures market, and the major functions of the futures market depends on the relationship between the prices of futures contracts and cash commodities [41]. The convergence of futures and spot prices largely determines the risk management performance of market participants [42]. Scholars generally believed that the degree of integration relationship between the futures market and spot market is relatively high. Although irrational speculation, oligopoly or local industry protection have impacted the efficiency of wholesale spot markets, especially due to comparative advantages of information accessibility, the prices of the spot and futures show the trend of long-term fluctuations in the same direction, and futures markets have a Granger effect on spot markets [43,44].

The existing literature is worthy of reference; however, there are the following shortcomings. First of all, there are structural contradictions in the existing literature on the research of price discovery, risk-hedging and cointegration efficiency in the futures market, and the logical relationship between them is not fully defined. In fact, when the futures market has the price discovery efficiency, the research on the risk-hedging efficiency and cointegration efficiency will be more meaningful. On the contrary, if the futures market does not meet the weak efficient market hypothesis, then the conclusion about whether the futures market has hedging efficiency or there is a cointegrated relationship between the futures market and the spot market is not of rigorous scientific value. In addition, the research objects mainly focus on bulk agricultural products, as the first fruit agricultural futures—“the apple futures” is quite different from traditional contracts in terms of system design, investor’s structure and delivery process. The empirical study on the efficiency of Chinese apple futures market can enrich the existing research field system. In the era of comprehensive development of the global agricultural futures market, this study is of important theoretical and practical significance to promote the sustainable development of the futures market and the transformation or upgrading of the Chinese apple industry.

3. Materials and Methods

3.1. Sampling Procedure and Data Description

Select the daily closing prices of the CZCE apple futures market and the average daily trading price of Qixia city from Shandong Province in the Bohai Bay region and Luochuan city from Shaanxi Province in the Loess Plateau region, which are the two largest advantage producing areas in the world. To reduce the estimation error caused by the different quality of apples, the spot market selection index is consistent with the futures delivery standard, which means red Fuji apples in paper bags with a diameter of 80 mm. In these regions, the standardized of apple production is advanced, the development of agricultural markets is mature, and moreover, apple futures delivery agencies are located here. The time period covered is 22 December 2017 through 31 December 2021, including 980 observations.

Table 1 reports the descriptive statistics; , and are prices of future market, Shandong and Shananxi spot markets. The average, maximum and minimum of futures prices are 8330, 16,500 and 4988, respectively. The average prices in the Shandong and Shaanxi spot market are 6000 and 6400, and the correlation coefficients with futures prices are 0.8164 and 0.8453. It is preliminarily judged that the apple futures market and the spot markets have a correlation above a medium level.

Table 1.

Summary statistics of Chinese apple prices in yuan/ton.

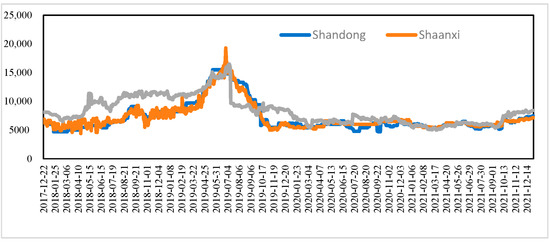

Apple futures prices and spot prices have roughly the same trend; most of the time, futures prices are higher than spot prices. The second and third quarters of each year are the most volatile ranges for apple prices. During this period, the storages in the previous year are about to be sold out, and many areas have no supply of apples. The change in supply and demand leads to periodicity and seasonal fluctuation in the price of apples (Figure 1).

Figure 1.

Chinese apple prices trend in yuan/ton. The grey line—Futures.

Additionally, when studying the efficiency of risk-hedging of the apple futures market, the daily price time series of 15 agricultural futures are selected to reflect the complete returns of the Chinese agricultural futures market, and the varieties are as follows: soybean No. 1, soybean No. 2, corn, wheat, strong wheat, japonica rice, japonica, soybean oil, soybean meal, rapeseed oil, rapeseed meal, cotton, sugar, fiberboard and apple (Table 2).

Table 2.

Summary statistics of Chinese agricultural futures prices.

3.2. Empirical Model

Due to financial time series data generally having the characteristic of sharp peak and fat tail, we apply the logarithmic difference of apple prices to represent market returns. Its calculation equation is as follows:

where represents the price of apple market on the day, is the return rate of the market, , and are denoted as the return rates of the futures market and the spot market in Shandong province and Shaanxi province, respectively.

3.2.1. Wild Bootstrapping Variance Ratio Tests

The variance ratio test has evolved from the basic variance ratio test to a wild bootstrap variance ratio test [45,46]. The basic variance ratio test implies that the q-order regression variance of the return should be q times of the first-order regression variance.

where and represent the q-order regression variance and the first-order regression variance, and the q-order variance ratio statistic is calculated as Equation (3):

In Equation (3), and is the k-order autocorrelation coefficient of the sequence . According to the study of Fama (1991), there are three forms of random walk: RWI, RWII and RWIII. Distributions of price changes are different in three forms: independent and identically distributed in the RWI, independent increment in the RWII and unrelated increment in the RWIII. The RWIII is the most efficient market form, which is consistent with the reality of the financial market to the greatest extent [47]. Under the assumption of random walk RWI, the variance ratio statistic is:

Under the assumption of homoskedasticity, the variance of the variance ratio is asymptotically distributed:

After being standardized, it can be expressed as:

Considering the factor of homoskedasticity, when the sample size is large enough, the standard normal statistic is used to test the random walk RWIII hypothesis.

However, because this method replaces the sample distribution with the asymptotic distribution of the statistic, the test results will be overly dependent on the asymptotic distribution of the statistic. The wild bootstrap test relaxes the assumptions, which can satisfy the nonnormal distribution and homoskedasticity of time series. The improved algorithm is implemented through the following steps: first, construct a Wild Bootstrap sample with a capacity of , which is a random sequence with a mean of 0 and a variance of 1; second, use the constructed Wild Bootstrap sample to calculate ; third, repeat step 1 and step 2 for times and construct ; fourth, use the original sample to calculate the boundary value ; last, calculate the ratio that greater than .

3.2.2. ARIMA-GARCH Model

To test the function of risk-hedging in the apple futures market, the event study method is used to test cumulative abnormal returns (CAR) during different types of risks. First, the trade friction between China and the US occurred in September 2018 when the US announced a list of additional tariffs on agricultural products from China, in which apples are also included (category HS07-08 includes vegetables, fruits and nuts). According to the data of the United States Department of Agriculture (USDA-Foreign Agricultural Service), China’s apple exports in the 2018–2019 production season were 1.05 million tons, which decreased by 18.10% compared to the previous season. Second, the outbreak of COVID-19 in January 2020 impacted the international trade of the Chinese apple market. Due to lockdown policies, the food supply chain was disrupted and most of the export share has been sold domestically. Third, according to the data from the national natural disaster management system, the rainstorm disaster occurred in July 2021 in Henan province, which is one of the main areas of apple production, causing crop disaster area of 1021.4 thousand hectares and economic losses totaled 88.534 billion yuan. This period is the critical stage for apple growth, and the disaster seriously affected the cultivation, quantity and quality of apples. The above three events have affected the supply and demand balance and price volatility of the apple market, which are important cases for testing the efficiency of the apple futures market.

This paper establishes the time window that refers to the study of Kothari (2007) [48], which defines the event window as 30 days, indicating the time interval is [−10, 20], and defines the event estimation window as 200 trading days, indicating the time interval is [−191, −9]. The specific time range is shown in Table 3.

Table 3.

Event window period.

Based on the algorithm of the ‘Agricultural Products Futures Index’ issued by the China Futures Margin Monitoring Center, the returns of the selected agricultural futures contracts are weighted to reflect the complete returns of the Chinese agricultural futures market. The Agricultural Products Futures Index includes 11 mature agricultural futures listed on CZCE and DCE, which selects the main contract price of each variety. The weight of each contract is completely based on the futures market information, weighted by the proportion of the average daily amount held in the previous three years and adjusted on the fifth trading day of January every year. On this basis, we estimate the expected returns (ER) of apple futures markets in the absence of the risks with the ARIMA-GARCH model. It can be expressed as:

where ) is the expected return rate of apple futures market on the day, C is a constant, and are parameters to be estimated and the residual follows an independent and identically distributed white noise process.

Since financial time series usually show the phenomenon of fluctuation cluster, the residual after ARIMA modeling may have the ARCH effect (conditional heteroscedasticity), so it is necessary to establish the GARCH model of error variance to estimate the relationship between the conditional variance of the error term and the past error term over time, which can be expressed as:

where represents all known information sets up to t − 1 day, , and are conditional variance, conditional variance lag term and lag order, and are, respectively, residual lag term and lag order. The GARCH model requires , ; ; , i = 0, 1, 2, … p’, j = 0, 1, 2, … q’ to ensure that the variance is positive and that the unconditional variance of the perturbation term is finitely convergent.

Finally, the T test is performed on the abnormal return rate and the cumulative abnormal return rate , is the difference between the actual rate of return and the expected rate of return in the event window (Equation (10)), and the is the sum of the in the event window period (Equation (11)).

If the value is significantly 0, it indicates that the event has no influence on the market. If the is significantly negative, it indicates that the event has a negative effect on the market, leading to a price decline and abnormal losses. If the is significantly positive, it indicates that this event has a positive effect on the market, promoting price increase and abnormal profits.

3.2.3. ARDL-ECM Model

The autoregressive distributed lag model (ARDL) is used to test the cointegration relationship between different apple markets. This model is suitable for variables of the same order of single integer ( or I (1)) or a mixture of and I (1). When there is an endogeneity problem between the variables, unbiased estimation of the model can be effective. The ARDL model to test the cointegration relationship between apple future market and spot markets can be expressed as follows.

where , and are the parameters to be estimated, is constant terms, is the random error term. The null and alternative hypotheses are: , .

If the results show that there is a long-term integration relationship between the variables, the error correction model (ECM) can be derived through linear transformation, which reflects the degree of short-term fluctuation deviates from the long-term equilibrium. Setting to the first order difference, the ECM model can be expressed as:

where is constant terms, is the random error term and , and are the parameters to be estimated, which reflects the degree of short-term fluctuation that deviates from the long-term equilibrium.

4. Results

4.1. Unit Root Test Results

Empirical content is implemented by Spss, Eviews and Microfit software. In order to avoid the pseudo-regression among variables, the ADF method is used to test the stationarity of the variables, and the trend item is selected according to the AIC information criterion. The test results show that the ADF values of the unit root test of , and are −1.98, −0.78 and −2.05, respectively. After the first difference, the return series of , and are: −29.02, −21.32 and −27.10, which indicates that the price series are stationary I (1) at the 1% significance level.

4.2. Results from Wild Bootstrapping Variance Ratio Tests for Price Discovery

In the process of testing whether the apple futures market conforms to the random walk hypothesis, the data of four years are divided into two stages. Stage 1: From 22 December 2017 to 31 December 2019 with 491 next-day trading data, which were listed during the first two years. Stage 2: from 1 January 2020 to 31 December 2021 with 489 next-day trading data in the third and fourth years of apple futures listing. Then, the Wild Bootstrap Variance Ratio test was performed on the two sub-samples and the whole sample. The test repetition times are defined as 1000, and is defined as (80, 180, 280, 380, 480, 580, 680, 780, 880, 980).

The results show that when the window width is set to two years, the tested value is less than 1% within 80 days of the listing of apple futures and greater than 1% in other periods. In the third or fourth year of the apple futures market, all tested p values are greater than 1%. Therefore, at the significance level of 1%, the apple futures market with two sub-samples follows the null hypothesis of random walk process. When the window width is set to four years, all p values are greater than 1%. Therefore, the null hypothesis that the apple futures market follows a random walk process is accepted at a significance level of 1%. In summary, when the window width is set as two years and four years, respectively, the apple futures market satisfies the assumption of random walk process, can reflect all historical information and the price discovery function is remarkable (Table 4).

Table 4.

Results of Wild Bootstrap Variance Ratio.

4.3. Results from ARIMA-GARCH Model for Risk-Hedging

The ARIMA optimal models are ARIMA (1,1,1), ARIMA (2,1,2) and ARIMA (1,1,1), respectively, which are judged by ACF, PACF and SBC information guidelines. The ARCH effect test with a lag order of 10 is performed on the residual series. The result is as follows: the values of F statistics are 9.0081, 7.6550 and 8.5122. The concomitances of Obs* R-Squared statistics are all less than 0.05 and LM statistics are significant, which indicates that the ARCH effect exists in the residual sequences.

The GARCH (1, 1) model based on the generalized error distribution (GED distribution) has the best fitting effect, and the ARCH-LM test with lag order of 1–10 is carried out on the residual series of the equations. The results show that the values of F statistics are 1.0092, 0.8791 and 1.5020, the concomitant probabilities of Obs* R-Squared statistics are all greater than 0.05 and LM statistics are not significant, which indicates that the ARCH effect does not exist in the residual sequences. The estimation equations of the three models are as follows:

- ①

- E(Rt) during the trade friction event: ARIMA (1,1,1)-GARCH (1,1)The mean equation:The variance equation:

- ②

- E(Rt) during the COVID-19 event: ARIMA (2,1,2)-GARCH (1,1)The mean equation:The variance equation:

- ③

- E(Rt) during the rainstorm disaster event: ARIMA (1,1,1)-GARCH (1,1)The mean equation:The variance equation:

Table 5 reports the results of estimated parameters of the conditional mean and variance equations, which estimate not only the expected average rate of return, but also the relationship between the conditional variance of the error term and the past error term over time. The coefficients of the variance equations are all greater than 0, and the sum of the coefficients is less than 1, which satisfies the parameter requirements of the model. This implies that the estimation of the ARIMA-GARCH model performs well and the result is accurate and reliable.

Table 5.

ARIMA-GARCH model estimation results.

According to Equations (10) and (11), the normal return rate of apple futures markets is predicted, the cumulative abnormal return rate (CAR) is calculated, and the t-test is performed. The test results show that: first, 10 days before the US announced the imposition of tariffs on Chinese agricultural products, the CAR value of the apple futures market was positive, and the day before the announcement, the market was barely affected, indicating that the trade war information has not been transferred to it. However, on the day of the announcement, the CAR value changed from positive to negative, and, then, the abnormal market profit rate continued to decline. In the event window of [1, 5] and [6, 10], the CAR values were −10.65% and −12.03%, which means the negative impact on the market is obvious. As the situation develops, the confidence of the market gradually recovered; in the event window of [11, 15] and [16, 20], the decline in the CAR value slowed. During the event window of [0, 20], a total of −9.03% abnormal market return was generated.

Second, at the peak of the COVID-19 epidemic, the apple futures market suffered big losses. In the event window of [−10, −6], the CAR value was positive, indicating that the epidemic information had not yet been transmitted to it. However, the negative abnormal profit rate generated the fifth day before the event due to the city lockdown measures in Wuhan city implemented by the Chinese government. Subsequently, from the [−10, −6] to [−10, −1] period of the event window, the CAR values increased negatively. At this stage, China has entered an emergency period of comprehensive blockade and anti-epidemic. The supply and demand of agricultural products markets have been interrupted, investor nervousness rose and the market responded quickly and strongly. From the range of [−10, −6] to [−5, −1], the CAR values dropped from 0.33% to −12.85%. Since then, the daily average abnormal return rate has been concentrated around −10%. In the event window of [1, 5], the CAR value was as low as −35%. Gradually, in the event window of [6, 10] and [11, 15], the confidence of the market gradually retreated, the decline in market returns slowed, the negative impact of the epidemic decreased and the value of the CAR reduced to −12.00% in the event window of [16, 20]. In short, during the epidemic period, the CAR value of the apple futures market showed a trend from positive to negative: before the official declaration of WHO, it was not negatively affected; after the confirmation of “the human-to-human transmission” of COVID-19 by the Chinese government, the information spread quickly to the financial market and the apple futures market suffered a major shock. During the event window of [0, 20], a total of −28.93% abnormal market return was generated.

Third, the market profit was positive and fluctuated within the normal and reasonable range before the rainstorm disaster in Henan province. However, on the day of the event, the abnormal margin was −3.67%, and this trend continues, reducing to −5.15% the next day. In the event window of [0, 10], the CAR value was −22.11%, indicating that within about 10 days of the event, the market losses were heavy. Subsequently, following effective flood control and relief measures by the government, the decline in market profit slows and the CAR value reached −7% in the event window of [10, 20]. During the event window of [0, 20], a total of −16.72% abnormal market return was generated (Table 6).

Table 6.

Test results of CAR values.

4.4. Results from ARDL Model for Cointegration

The boundary test was used to estimate whether there is a cointegration relationship between the apple futures market and the spot market according to the F statistics. The judgment criteria are as follows: if the value of the F statistic is greater than the upper boundary value, the null hypothesis that there is no integration relationship between variables is rejected. If the value of the F statistic is less than the lower boundary value, the null hypothesis that there is no integration relationship between variables cannot be rejected. If the value of the F statistic is in the interval between the lower boundary value and the upper boundary value, it is impossible to judge whether there is an integration relationship between variables [49].

The integration relationship of the apple futures market and the spot market with the F statistics of 9.36, which is higher than the upper critical value of 1% from Table 7. Hence, the null hypothesis was rejected, confirming the existence of integration among the apple futures market and the spot market.

Table 7.

ARDL bounds test for integration.

If the variables exist in the cointegration in the long-run, the maximum likelihood method can be used to estimate the elasticity, and the ECM model can be used to estimate the speed of adjustment coefficient in the short-run. The optimal lag orders of the ARDL models for the futures market and spot markets are ARDL (1, 1, 1). The results show that the elasticity of the futures market and the spot market in Shandong is −0.17 in the long-run, and the error correction coefficient between and is −0.12; therefore, when there is a divergence in the futures market and the spot market in Shandong, they can achieve cointegration at a convergence speed of 12%. The elasticity of the futures market and the spot market in Shaanxi is −0.13 in the long-run, and the error correction coefficient between and is −0.10; therefore, when there is a divergence in the futures market and spot market in Shaanxi, they can achieve cointegration at a convergence speed of 10% (Table 8).

Table 8.

Long-run and short-run coefficients of apple markets.

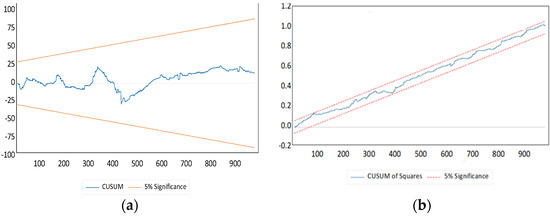

In order to avoid functional form misspecification caused by the volatility of the time series data, the stability test for the parameters is required. The cumulative sum (CUSUM) and cumulative sum of squares (CUSUMSQ) tests are employed to verify the stability of the parameters in ECM model. As shown in Figure 2, both the CUSUM plots and CUSUMSQ plots lie within the critical bounds at the five percent significance level, which confirms the stability of the parameters. Accordingly, the model and the corresponding parameters for future market return and spot market return are reliable.

Figure 2.

Plot of CUSUM (a) and CUSUMSQ (b).

5. Conclusions and Policy Implications

As the first fresh fruit futures in the world, the Chinese apple futures market can be of great practical importance for smooth domestic and international circulation. This paper is based on the efficient market hypothesis and general equilibrium theory to study the Chinese apple futures market efficiency, for which the wild bootstrapping variance ratio model, the ARIMA-GARCH model and the ARDL-ECM model were used to estimate the function of the price discovery, the risk-hedging and the cointegration. Experimental results demonstrate that the Chinese apple futures market conforms to the weak efficient market hypothesis of random walk, and its price has included past historical information which can effectively reflect the relationship of market supply and demand. However, it was not semi-efficient during major risk events. The shock of different types of risk on the market is asymmetrical: COVID-19 has the greatest negative impact, followed by the climate disaster of rainstorms and the China–US trade friction. Furthermore, there is an equilibrium relationship between the apple futures market and spot markets of Shandong and Shaanxi provinces, which are the largest apple-producing regions in the world. With the promotion and application of advanced technologies such as the internet, electronic commerce and information platforms, the first electronic trading market for apples was established in Shandong province, and the national wholesale market for apples was established in Shaanxi province, which improved the transmission efficiency of price signals and the convergence speed of price differences in futures and spot markets.

The existing literature holds that the price discovery efficiency of different agricultural commodity futures markets is different in China. The research conclusion of this paper shows that the world’s first fruit futures market—the “apple futures market”—satisfies the hypothesis of weak form validity, and its price has already contained the historical information which has played the role of a price benchmark. Besides, the existing literature believes that the impact of different types of major risk events on the futures market is asymmetric. This paper supplements this view from the perspective of the China–US trade friction, COVID-19 and the flood disaster, and the conclusions are the same as the existing research. Finally, scholars generally believe that the apple markets in China are relatively scattered, so it is difficult to form a unified large market. However, the research in this paper shows that the spot markets in the main apple producing areas are not separated from the futures market, the price convergence trend between them is obvious and they can achieve an effective integration state.

According to the research conclusions, this article presents the following suggestions: In order to cultivate and develop the apple futures market, it is necessary to create a comprehensive public opinion orientation for investors, agribusiness and apple planters, which requires the construction of an information monitoring and publishing platform by the government, the futures exchange and the relevant financial institutions. More information and data on production, consumption and stocks of the apple market should be regularly collected and published. Therefore, a reliable information resource can be provided to market participants, violent price fluctuations can be reduced, investor sentiment can be stabilized and the environment of public opinion can be optimized.

During the major risks period, the CAR values of the apple futures market all showed a trend from positive to negative, which means that it suffered heavy losses. In order to reduce losses caused by risks, it is urgent to establish a systematic risk warning and control mechanism that can strengthen the assessment and early warning of market risks. Similarly, regulators should monitor the interference of hot money in the apple futures market and prevent price bubbles caused by excessive speculation.

The futures market is the standardized contract in which the quality and delivery of products have strict standards that require the improvement of the standardized production and utilization of advanced technology by apple planters. Therefore, the government should focus on the current situation and the realistic dilemma of spot markets, which means that the industrial policy guidance in optimizing regional resources and promoting standardized planting should be implemented; thus, the difficulties of excess capacity and the unbalanced quality structure that exist in upgrading the apple industry can be effectively alleviated, and the efficiency of domestic circulation of the apple market can be promoted. Furthermore, the futures exchange should adjust the apple futures contract system and the delivery system, which are based on the measurement of the price gap between the apple futures market and the spot market in different regions, and the spot price of more areas can be reflected in a larger range by a reasonable discount.

Author Contributions

Conceptualization, X.H. and T.L.; methodology, X.H.; software, X.H.; validation, S.F., T.L. and P.Z.; formal analysis, X.H.; investigation, X.H., P.Z. and B.Y; resources, X.H.; data curation, X.H.; writing—original draft preparation, X.H; writing—review and editing, X.H., S.F. and P.Z.; visualization, S.F., P.Z. and B.Y.; supervision, T.L.; project administration, T.L.; funding acquisition, T.L. All authors have read and agreed to the published version of the manuscript.

Funding

This research was funded by The National Natural Science Foundation of China (Major Program, No. 71933005); The Earmarked Fund for China Agriculture Research System (No. CARS-27) and National Natural Science Foundation of China (NSFC) “Research Fund for International Young Scientists” (Grant No. 72250410374).

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

The data presented in this study are available on request from the corresponding author. The data are not publicly available due to data management.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Working, H. Theory of the inverse carrying charge in futures markets. J. Farm Econ. 1948, 30, 1–28. [Google Scholar] [CrossRef]

- Acharya, V.V.; Lochstoer, L.A.; Ramadorai, T. Limits to arbitrage and hedging: Evidence from commodity markets. J. Financ. Econ. 2013, 109, 441–465. [Google Scholar] [CrossRef]

- Chinn, M.D.; Coibion, O. The predictive content of commodity futures. J. Futures Mark. 2014, 34, 607–636. [Google Scholar] [CrossRef]

- Global Futures and Options Trading Reaches Record Level in 2019. Available online: https://www.fia.org/resources/global-futures-and-options-trading-reaches-record-level-2019 (accessed on 16 January 2020).

- China: Fresh Deciduous Fruit Annual. Available online: https://apps.fas.usda.gov/newgainapi/api/Report/DownloadReportByFileName?fileName=Fresh%20Deciduous%20Fruit%20Annual_Beijing_China%20-%20Peoples%20Republic%20of_11-01-2020 (accessed on 3 November 2020).

- Data Source: US Department of Agriculture “Open Data”. Available online: https://www.usda.gov/topics/data (accessed on 10 January 2022).

- Wang, L.; Huo, X. Transaction costs comparison between cooperatives and conventional apple producers: A case study of North-western China. Ann. Public Coop. Econ. 2014, 85, 233–255. [Google Scholar]

- Ma, W.; Renwick, A.; Yuan, P.; Ratna, N. Agricultural cooperative membership and technical efficiency of apple farmers in china: An analysis accounting for selectivity bias. Food Policy 2018, 81, 122–132. [Google Scholar] [CrossRef]

- Data Source: Zhengzhou Commodity Exchange “ZCE Monthly Report”. Available online: http://www.czce.com.cn/cn/rootfiles/2022/01/14/1640083238286134-1640083238361608.pdf (accessed on 31 December 2021). (In Chinese).

- Fama, E.F. Efficient capital markets: A review of theory and empirical work. J. Financ. 1970, 25, 383–417. [Google Scholar] [CrossRef]

- Aulton, A.J.; Ennew, C.T.; Rayner, A. Efficiency tests of futures markets for UK agricultural commodities. J. Agric. Econ. 1997, 48, 408–424. [Google Scholar] [CrossRef]

- Dou, Y.; Li, Y.; Dong, K.; Ren, X. Dynamic linkages between economic policy uncertainty and the carbon futures market: Does COVID-19 pandemic matter? Resour. Policy 2022, 75, 102455. [Google Scholar] [CrossRef]

- Kristoufek, L.; Vosvrda, M. Commodity futures and market efficiency. Energy Econ. 2014, 42, 50–57. [Google Scholar] [CrossRef]

- Santos, J. Did futures markets stabilise US grain prices? J. Agric. Econ. 2002, 53, 25–36. [Google Scholar] [CrossRef]

- Sheldon, I.M. Testing for weak form efficiency in new agricultural futures markets: Some UK evidence. J. Agric. Econ. 1987, 38, 51–64. [Google Scholar] [CrossRef]

- Wang, H.H.; Ke, B. Efficiency tests of agricultural commodity futures markets in China. Aust. J. Agric. Resour. Econ. 2005, 49, 125–141. [Google Scholar] [CrossRef]

- Liu, Q.; Luo, Q.; Tse, Y.; Xie, Y. The market quality of commodity futures markets. J. Futures Mark. 2020, 40, 1751–1766. [Google Scholar] [CrossRef]

- Ronghua, J.; Zhiling, Y. Assessing the functional efficiency of agricultural futures markets in China. China Agric. Econ. Rev. 2018, 11, 431–442. [Google Scholar] [CrossRef]

- Algieri, B.; Kalkuhl, M.; Koch, N. A tale of two tails: Explaining extreme events in financialized agricultural markets. Food Policy 2017, 69, 256–269. [Google Scholar] [CrossRef]

- Alam, M.R.; Gilbert, S. Monetary policy shocks and the dynamics of agricultural commodity prices: Evidence from structural and factor-augmented VAR analyses. Agric. Econ. 2017, 48, 15–27. [Google Scholar] [CrossRef]

- Gozgor, G.; Lau, C.K.M.; Bilgin, M.H. Commodity markets volatility transmission: Roles of risk perceptions and uncertainty in financial markets. J. Int. Financ. Mark. Inst. Money 2016, 44, 35–45. [Google Scholar] [CrossRef]

- Hoffman, L.A.; Etienne, X.L.; Irwin, S.H.; Colino, E.V.; Toasa, J.I. Forecast performance of WASDE price projections for US corn. Agric. Econ. 2015, 46, 157–171. [Google Scholar] [CrossRef]

- Indriawan, I.; Martinez, V.; Tse, Y. The impact of the change in USDA announcement release procedures on agricultural commodity futures. J. Commod. Mark. 2021, 23, 100149. [Google Scholar] [CrossRef]

- Bilal, A.; Hongxing, Y.; Hafiz, M. Examining the efficiency and herding behavior of commodity markets using multifractal detrended fluctuation analysis. Empirical evidence from energy, agriculture, and metal markets. Resour. Policy 2022, 77, 102715. [Google Scholar]

- Makkonen, A.; Vallström, D.; Uddin, G.S.; Rahman, M.L.; Haddad, M.F.C. The effect of temperature anomaly and macroeconomic fundamentals on agricultural commodity futures returns. Energy Econ. 2021, 100, 105377. [Google Scholar] [CrossRef]

- Atems, B.; Sardar, N. Exploring asymmetries in the effects of El Niño-Southern Oscillation on US food and agricultural stock prices. Q. Rev. Econ. Financ. 2021, 81, 1–14. [Google Scholar] [CrossRef]

- Cashin, P.; Mohaddes, K.; Raissi, M. Fair weather or foul? The macroeconomic effects of El Niño. J. Int. Econ. 2017, 106, 37–54. [Google Scholar] [CrossRef]

- Zaghum, U.; Francisco, J.; Ana, E. Dynamic return and volatility connectedness for dominant agricultural commodity markets during the COVID-19 pandemic era. Appl. Econ. 2022, 54, 1030–1054. [Google Scholar]

- Zhang, C.; Qu, X. The effect of global oil price shocks on China’s agricultural commodities. Energy Econ. 2015, 51, 354–364. [Google Scholar] [CrossRef]

- Xiao, X.; Tian, Q.; Hou, S.; Li, C. Economic policy uncertainty and grain futures price volatility: Evidence from China. China Agric. Econ. Rev. 2019, 11, 642–654. [Google Scholar] [CrossRef]

- Li, J.; Li, C.; Chavas, J.P. Food price bubbles and government intervention: Is China different? Can. J. Agric. Econ. 2017, 65, 135–157. [Google Scholar] [CrossRef]

- Mao, Q.; Ren, Y.; Loy, J.-P. Price bubbles in agricultural commodity markets and contributing factors: Evidence for corn and soybeans in China. China Agric. Econ. Rev. 2020, 13, 91–122. [Google Scholar] [CrossRef]

- Dawson, P.; Sanjuán, A.I. Structural breaks, the export enhancement program and the relationship between Canadian and US hard wheat prices. J. Agric. Econ. 2006, 57, 101–116. [Google Scholar] [CrossRef]

- Ayadi, A.; Gana, M.; Goutte, S.; Guesmi, K. Equity-commodity contagion during four recent crises: Evidence from the USA, Europe and the BRICS. Int. Rev. Econ. Financ. 2021, 76, 376–423. [Google Scholar] [CrossRef]

- Arnade, C.; Cooke, B.; Gale, F. Agricultural price transmission: China relationships with world commodity markets. J. Commod. Mark. 2017, 7, 28–40. [Google Scholar] [CrossRef]

- Ge, Y.; Wang, H.H.; Ahn, S.K. Cotton market integration and the impact of China’s new exchange rate regime. Agric. Econ. 2010, 41, 443–451. [Google Scholar] [CrossRef]

- Zhang, X.; Liu, Y. The dynamic impact of international agricultural commodity price fluctuation on Chinese agricultural commodity prices. Int. Food Agribus. Manag. Rev. 2020, 23, 391–409. [Google Scholar] [CrossRef]

- De, Z.; Koemle, D. Price transmission in hog and feed markets of China. J. Integr. Agric. 2015, 14, 1122–1129. [Google Scholar]

- Jia, R.-L.; Wang, D.-H.; Tu, J.-Q.; Li, S.-P. Correlation between agricultural markets in dynamic perspective—Evidence from China and the US futures markets. Phys. A Stat. Mech. Appl. 2016, 464, 83–92. [Google Scholar] [CrossRef]

- Marshall, A. Equilibrium of Normal demand and supply. In Principles of Economics, 8th ed.; Macmillan: London, UK, 1920; Chapter III; Volume V, pp. 212–221. [Google Scholar]

- Garbade, K.D.; Silber, W.L. Price Movements and Price Discovery in Futures and Cash Markets. Rev. Econ. Stat. 1983, 65, 289–297. [Google Scholar] [CrossRef]

- Li, J.; Chavas, J.P. A dynamic analysis of the distribution of commodity futures and spot prices. Am. J. Agric. Econ. 2022, 3, 1–22. [Google Scholar] [CrossRef]

- Lingyun, H.; Wen-Si, X. Who has the final say? Market power versus price discovery in China’s sugar spot and futures markets. China Agric. Econ. Rev. 2012, 3, 379–390. [Google Scholar]

- Demir, M.; Martell, T.F.; Wang, J. The trilogy of China cotton markets: The lead–lag relationship among spot, forward, and futures markets. J. Futures Mark. 2018, 39, 522–534. [Google Scholar] [CrossRef]

- Kim, J.H. Automatic variance ratio test under conditional heteroskedasticity. Financ. Res. Lett. 2009, 6, 179–185. [Google Scholar] [CrossRef]

- Kim, J.H. Wild bootstrapping variance ratio tests. Econ. Lett. 2006, 92, 38–43. [Google Scholar] [CrossRef]

- Fama, E.F. Efficient capital markets: II. J. Financ. 1991, 46, 1575–1617. [Google Scholar] [CrossRef]

- Kothari, S.P.; Warner, J.B. Handbook of empirical corporate finance. In Econometrics of Event Studies; Espen Eckbo, B., Ed.; Elsevier: Amsterdam, The Netherlands, 2007; Volume 1, pp. 3–36. [Google Scholar]

- Pesaran, M.H.; Shin, Y.; Smith, R.J. Bounds testing approaches to the analysis of level relationships. J. Appl. Econom. 2001, 16, 289–326. [Google Scholar] [CrossRef]

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).