Key Sustainable Factors of the Pawnbroking Industry: An Empirical Study in Taiwan

Abstract

1. Introduction

2. Main Concepts

3. Study Methods

3.1. Participants and Data Collection

3.2. Data Analysis

- Step 1:

- Building a paired comparison matrix

- Step 2:

- Calculation of eigenvalues and eigenvectors

- Step 3:

- Consistency test

4. Results and Discussion

4.1. Study Results

4.2. Discussions

- (1)

- Feeling safe in the transaction

- (2)

- Renewing the contract

- (3)

- Legal certificate

- (4)

- More business customers

- (5)

- Credit checking

- (6)

- Simple process

5. Limitations and Further Research

6. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Idrus, M.S.; Hadiwidjojo, D.; Aisjah, S.; Rahardjo, H. Factors that Determines the Success of Corporate Sustainability Management. J. Manag. Study 2013, 5, 1–16. [Google Scholar]

- Thomas, A.T.; Kyveli, E.M.; Koulouriotis, D.; Ioannis, E.N. New challenges for corporate sustainability reporting: United Nations’ 2030 Agenda for sustainable development and the sustainable development goals. Corp. Soc. Responsib. Environ. Manag. 2020, 27, 1617–1629. [Google Scholar]

- Lozano, R. A holistic Perspective on Corporate Sustainability Drivers. Corp. Soc. Responsib. Environ. Manag. 2015, 22, 32–44. [Google Scholar] [CrossRef]

- Das, M.; Rangarajan, K.; Dutta, G. Corporate sustainability in SMEs: An Asian perspective. J. Indian Bus. Study 2020, 14, 109–138. [Google Scholar] [CrossRef]

- Weber, O. Corporate sustainability and financial performance of Chinese banks. Sustain. Account. Manag. Policy J. 2017, 8, 358–385. [Google Scholar] [CrossRef]

- Annunziata, E.; Zanni, L.; Frey, M.; Pucci, T. The role of organizational capabilities in attaining corporate sustainability practices and economic performance: Evidence from Italian wine industry. J. Clean. Prod. 2018, 171, 1300–1311. [Google Scholar] [CrossRef]

- Camilleri, M.A. Corporate sustainability and responsibility: Creating value for business, society and the environment. Asian J. Sustain. Soc. Responsib. 2017, 2, 59–74. [Google Scholar] [CrossRef]

- Stahl, G.K.; Brewster, C.J.; Collings, D.G.; Hajro, A. Enhancing the role of human resource management in corporate sustainability and social responsibility: A multi-stakeholder, multidimensional approach to HRM. Hum. Resour. Manag. Rev. 2020, 30, 100708. [Google Scholar] [CrossRef]

- Moldavska, A.; Welo, T. A Holistic approach to corporate sustainability assessment: Incorporating sustainable development goals into sustainable manufacturing performance evaluation. J. Manuf. Syst. 2019, 50, 53–68. [Google Scholar] [CrossRef]

- Wijethilake, C. Proactive sustainability strategy and corporate sustainability performance: The mediating effect of sustainability control systems. J. Environ. Manag. 2017, 196, 569–582. [Google Scholar] [CrossRef]

- Baumgartner, R.J.; Raute, R. Strategic perspectives of corporate sustainability management to develop a sustainable organization. J. Clean. Prod. 2017, 140, 81–92. [Google Scholar] [CrossRef]

- Lozano, R.; Carpenter, A.; Huisingh, D. A review of ‘Theories of the Firm’ and their contributions to corporate sustainability. J. Clean. Prod. 2015, 106, 430–442. [Google Scholar] [CrossRef]

- Kantabutra, S.; Ketprapakorn, N. Toward a theory of corporate sustainability: A theoretical integration and exploration. J. Clean. Prod. 2020, 270, 122292. [Google Scholar] [CrossRef]

- Grewatsch, S.; Kleindienst, I. When Does It Pay to be Good? Moderators and Mediators in the Corporate Sustainability—Corporate Financial Performance Relationship: A Critical Review. J. Bus. Ethics 2017, 145, 383–416. [Google Scholar] [CrossRef]

- Patchenkov, O.; Schrader, H. “Let’s Go”—The History of a Post-Soviet Pawnshop in St. Petersburg and Its Chairman; Working Paper; Universität Bielefeld: Bielefeld, Germany, 2012; Available online: http://ssrn.com/abstract=2149575 (accessed on 8 June 2022).

- Razak, A.A.; Muhammad, F.; Hussin, M.Y.M.; Mahjom, N.; Hadi, F.S.A.; Zainol, Z. Modeling Financial Inclusion in the Ar-Rahn’s Financing as Imperatives for Economic Well-Being in Malaysia. Int. J. Acad. Study Bus. Soc. Sci. 2019, 9, 1203–1223. [Google Scholar] [CrossRef]

- Bos, M.; Carter, S.P.; Skiba, P.M. The Pawn Industry and Its Customers: The United States and Europe; Vanderbilt Law and Economics Study Paper No. 12–26; Vanderbilt Law School: Nashville, TN, USA, 2012; Available online: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=2149575 (accessed on 20 September 2022).

- Prager, R.A. Determinants of the Locations of Alternative Financial Service Providers. Rev. Ind. Organ. 2014, 45, 21–38. [Google Scholar] [CrossRef]

- Fass, S.M.; Francis, J. Where Have All the Hot Goods Gone? The Role of Pawnshops. J. Study Crime Delinq. 2004, 41, 156–179. [Google Scholar] [CrossRef]

- Texas Office of Consumer Credit Commissioner. Pawnshop and Pawnshop Employee Administrative Action Report: 1 September 2017–31 August 2018; Texas Office of Consumer Credit Commissioner: Austin, TX, USA, 2018. [Google Scholar]

- Ali, N.A.M.; Johari, Y.C.; Fatah, M.M.A. Ar-Rahnu: A review of Literature and Future Study. In SHS Web of Conferences; EDP Sciences: Les Ulis, France, 2017. [Google Scholar]

- Mebratu, D. Sustainability and Sustainable Development: Historical and Conceptual Review. Environ. Impact Assess. Rev. 1998, 18, 493–520. [Google Scholar] [CrossRef]

- Dyllick, T.; Hockerts, K. Beyond the Business Case for Corporate Sustainability. Bus. Strategy Environ. 2002, 11, 130–141. [Google Scholar] [CrossRef]

- Moore, S.B.; Manring, S.L. Strategy development in small and medium sized enterprises for sustainability and increased value creation. J. Clean. Prod. 2009, 17, 276–282. [Google Scholar] [CrossRef]

- Berisha, G.; Pula, J.S. Defining Small and Medium Enterprises: A Critical Review. Acad. J. Bus. Adm. Law Soc. Sci. 2015, 1, 17–28. [Google Scholar]

- Ahmad, N.Z.; Ismail, A.G. Pawnshop as an Instrument of Microenterprise Credit in Malaysia. Int. J. Soc. Econ. 1997, 24, 1343–1352. [Google Scholar]

- OECD. Enhancing the Contributions of SMEs in a Global and Digitalised Economy. In Meeting of the OECD Council at Ministerial Level; OECD: Paris, France, 2017; Available online: https://www.oecd.org/industry/C-MIN-2017-8-EN.pdf (accessed on 8 June 2022).

- Chatterjee, S.; Dutta, G.S.; Upadhyay, P. Sustainability of Microenterprises: An Empirical Analysis. Benchmarking Int. J. 2018, 25, 919–931. [Google Scholar] [CrossRef]

- Das, M.; Rangarajan, K.; Dutta, G. Corporate sustainability in small and medium-sized enterprises: A literature analysis and road ahead. J. Indian Bus. Study 2020, 12, 271–300. [Google Scholar] [CrossRef]

- Akimova, L.; Lysachok, A. Lending on the Pawnshop Services Market. Int. J. New Econ. Public Adm. Law 2018, 1, 58–66. [Google Scholar]

- Gross, M.B.; Hogarth, J.M.; Manohar, A.; Gallegos, S. Who Uses Alternative Financial Services, and Why? Consum. Interests Annu. 2012, 58, 2012–2057. [Google Scholar]

- Skully, M.T. The Development of the Pawnshop Industry in East Asia. In Financial Landscapes Reconstructed, 1st ed.; Bouman, F.J.A., Hospes, O., Eds.; Taylor & Francis: New York, NY, USA, 1994; pp. 21.1–21.9. [Google Scholar]

- Lloret, A. Modeling corporate sustainability strategy. J. Bus. Study 2016, 69, 418–425. [Google Scholar] [CrossRef]

- Azhari, A. Effect of Service Quality on Customer Satisfaction in PT. Pawnshop Syariah Tempe Unit Wajo District. Int. J. Manag. Prog. 2019, 1, 53–68. [Google Scholar] [CrossRef]

- Watson, G.F., IV; Beck, J.T.; Henderson, C.M.; Palmatier, R.W. Building, measuring, and profiting from customer loyalty. J. Acad. Mark. Sci. 2015, 43, 790–825. [Google Scholar] [CrossRef]

- Van Marrewijk, M. Concepts and Definitions of CSR and Corporate Sustainability: Between Agency and Communion. J. Bus. Ethics 2003, 44, 95–105. [Google Scholar] [CrossRef]

- Kim, K.T.; Lee, J.; Lee, J.M. Exploring Racial/Ethnic Disparities in the Use of Alternative Financial Services: The Moderating Role of Financial Knowledge. Race Soc. Probl. 2019, 11, 149–160. [Google Scholar] [CrossRef]

- Lee, Y.; Hales, E. The “Unbanked” and “Underbanked” in the US: Who Are They and How Are They Different? Consum. Interests Annu. 2021, 67, 1–2. [Google Scholar]

- Davies, S.; Finney, A. Pawnbroking Customers in 2020: A Survey of Pawnbroking Customers; University of Bristol Personal Finance Study Centre: Bristol, UK, 2020. [Google Scholar]

- Miller, G.; Hanke, S.A.; Di, H. Pawnshops Regulatory Environment: A Readability Analysis. J. Account. Bus. Manag. 2018, 25, 50–61. [Google Scholar] [CrossRef]

- Adams, P.; Burke, C.; Chesterfield, A.; Parmar, B.; Smart, L.; Whicher, A. Sitting on a Gold Mine: Getting What’s Owed to Pawnbroking Customers; Occasional Paper; Financial Conduct Authority: London, UK, 2021. [Google Scholar]

- Fowler, C.S.; Kleit, R.G.; Cover, J. The Geography of Fringe Banking. J. Reg. Sci. 2014, 54, 688–710. [Google Scholar] [CrossRef]

- Özkan, P.; Süer, S.; Keser, İ.K.; Kocakoç, İ.D. The Effect of Service Quality and Customer Satisfaction on Customer Loyalty the Mediation of Perceived Value of Services, Corporate Image, and Corporate Reputation. Int. J. Bank Mark. 2020, 38, 384–405. [Google Scholar] [CrossRef]

- Carter, S.P.; Skiba, P.M. Pawnshops, Behavioral Economics, and Self-Regulation. Rev. Bank. Financ. Law 2012, 32, 193. Available online: https://scholarship.law.vanderbilt.edu/faculty-publications/1019 (accessed on 2 September 2022).

- Edwards, L.; Lomx, W. Financial Credit and Social Discredit: The Pawn Broking Dilemma. J. Financ. Serv. Mark. 2017, 22, 77–84. [Google Scholar] [CrossRef]

- Zhou, L.M. The Financing of Small and Medium Enterprise in China: A Case Study of China’s Pawn-Broking Industry. In Proceedings of the 2015 International Conference on Industrial Technology and Management Science, Tianjin, China, 27–28 March 2015. [Google Scholar]

- Sheehy, B. Defining CSR: Problems and Solutions. J. Bus. Ethics. 2015, 131, 625–648. [Google Scholar] [CrossRef]

- Sarkar, S.; Searcy, C. Zeitgeist or chameleon? A quantitative analysis of CSR definitions. J. Clean. Prod. 2016, 135, 1423–1435. [Google Scholar] [CrossRef]

- Melo, T.; Garrido-Morgado, A. Corporate Reputation: A Combination of Social Responsibility and Industry. Corp. Soc. Responsib. Environ. Manag. 2012, 19, 11–31. [Google Scholar] [CrossRef]

- Plewa, C.; Conduit, J.; Quester, P.G.; Johnson, C. The Impact of Corporate Volunteering on CSR Image: A Consumer Perspective. J. Bus. Ethics 2015, 127, 643–659. [Google Scholar] [CrossRef]

- Blumberg, I.; Lin-Hi, N. The Link between (not) Practicing CSR and Corporate Reputation: Psychological Foundations and Managerial Implications. J. Bus. Ethics 2018, 150, 185–198. [Google Scholar]

- Primandaru, T. Application of Analytical Hierarchy Process in Choosing the Best Pawnshop. J. Mantik 2020, 4, 505–510. [Google Scholar]

- Teknomo, K. Analytic Hierarchy Process (AHP) Tutorial; Academia: San Francisco, CA, USA, 2006. [Google Scholar]

- Schrader, H. The Role of Pawnshops in the Life Strategies of Lower Income Groups—A Preliminary Study in St. Petersburg/Russia; Universität Bielefeld: Bielefeld, Germany, 1999. [Google Scholar]

- Saaty, T.L. Decision making with the analytic hierarchy process. Int. J. Serv. Sci. 2008, 1, 83–98. [Google Scholar] [CrossRef]

- Ismoilov, S.A. Development of Legislation on Pawnshops. Sci. Prog. 2021, 2, 1241–1244. [Google Scholar]

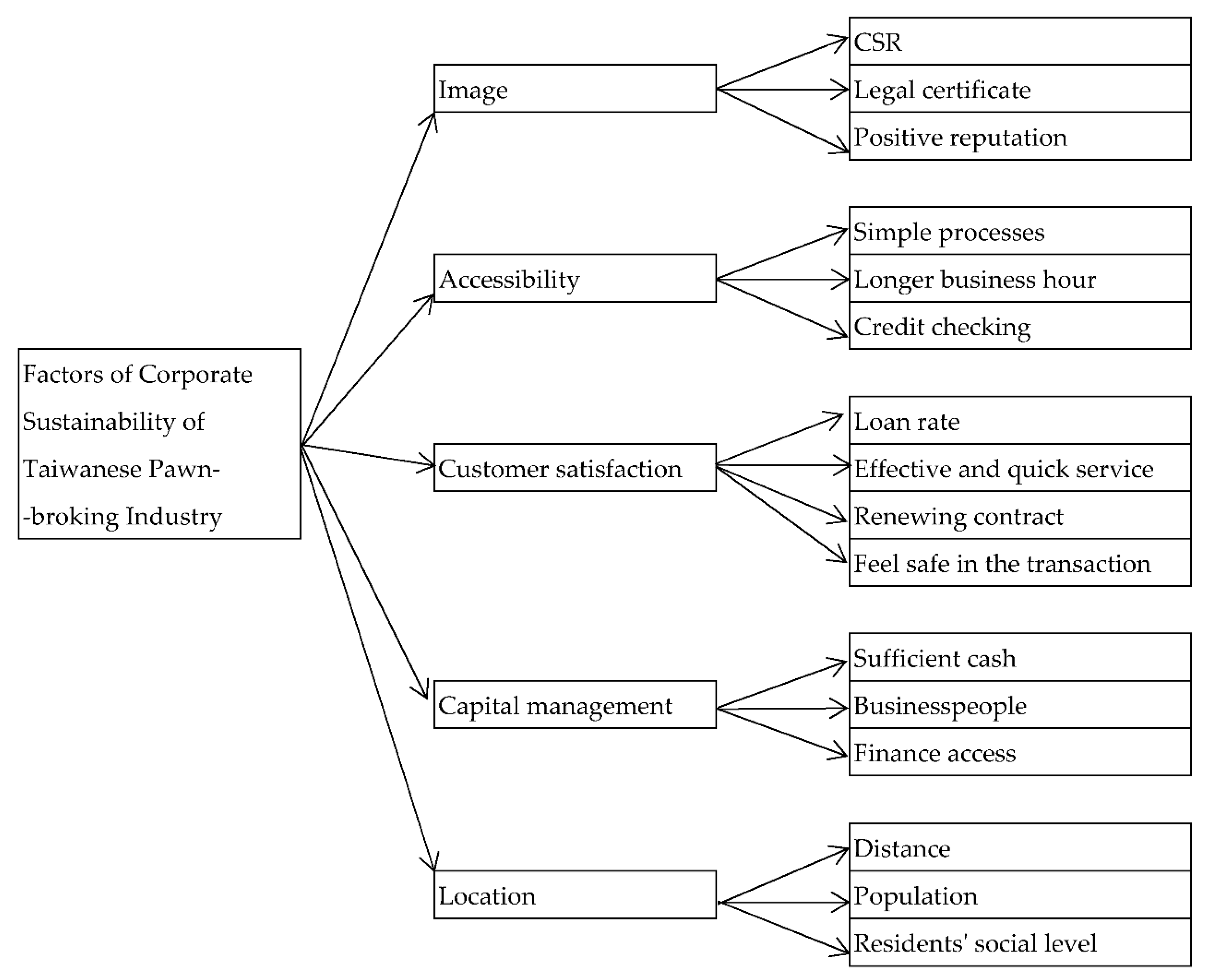

| Dimension | Factor | Description | Sources |

|---|---|---|---|

| A. Image | A1 CSR | CSR is the intermediary to achieving the sustainability of enterprises. | [32,36,47,49] |

| A2 Legal certificate | Pawnshops with valid legality are preferred; the license must be issued by government. | [18,48] | |

| A3 Positive reputation | Positive reputation represents a sustained competitive advantage. | [3,23,35,49,50] | |

| B. Accessibility | B1 Simple processes | Loaning from pawnshops is a convenient and quick financial service without complicated processes. | [15,30,32,39] |

| B2 Longer business hours | The pawnshops remain open during the hours that customers prefer. | [26,31,32] | |

| B3 Credit checking | An extensive credit check is not required when customers provide collateral and access credit rapidly. | [26,33,39,41] | |

| C. Customer Satisfaction | C1 Loan rate | The greater the interest rate, the more the pawnbroker is avoided. | [17,39,46,48] |

| C2 Effective and quick service | Loaning from pawnshops is convenient, efficient, and without complicated processes. | [38,39] | |

| C3 Renewing contract | Renewing loans is critical. | [39] | |

| C4 Feel safe in the transaction | Pawn shops must equip suitable safety and other related facilities to make customers feel safe in the transaction because, in general, the mortgaged goods are valuable objects. | [46,52] | |

| D. Capital Management | D1 Sufficient cash | Abundant capital is essential to a pawnshop who offers cash to its customers. Pawnshops provide loans secured by highly liquid assets. | [22,30,41] |

| D2 More business customers | More and more SMEs or micro-enterprises come to pawnbrokers for investment. | [26,46] | |

| D3 Finance access | Pawnbrokers are refused loans from formal financial organizations; therefore, private finance access or cash flow preparation is important. | [28] | |

| E. Location | E1 Distance | Distance is the first reason for customers to choose the pawnshop. The distance between the pawnshop and their place of residence will affect their smooth access to the pawnshop. | [18,32,52] |

| E2 Population | The locations of the pawnshops are influenced by the number of residents. | [18,37,40,42] | |

| E3 Resident social level | AFSPs are more likely to locate where the population is poor, includes minorities, and is poorly educated. | [17,18,42,44] |

| Score | Importance | Equivalent Judgement |

|---|---|---|

| 1 | Equal | Both criteria are equally important |

| 3/ or 1/3 | Moderately | One criterion is moderately more or less important than the other |

| 5/ or 1/5 | Strong | One criterion is strongly more or less important than the other |

| 7/ or 1/7 | Very Strong | One criterion is very strongly more or important than the other |

| 9/ or 1/9 | Extreme | One criterion is extremely more or less important than the other |

| 2,4,6,8 | Intermediate Values | Compromise is needed sometimes |

| Scale | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 |

| R.I value | 0.00 | 0.00 | 0.58 | 0.90 | 1.12 | 1.24 | 1.32 | 1.41 | 1.45 | 1.49 |

| Goal | Image | Accessibility | Customer Satisfaction | Capital Management | Location | |

|---|---|---|---|---|---|---|

| C.R. Value | 0.01357 | 0.00516 | 0.01618 | 0.02003 | 0.00358 | 0.02669 |

| Dimension | Weight (Rank) | Key Sustainable Factors | Weight (Rank) | Integrated Ranking of Weight |

|---|---|---|---|---|

| Image | 0.1428 (4) | CSR | 0.2350 (3) | 0.0336 (13) |

| Legal certificate | 0.4207 (1) | 0.0601 (7) | ||

| Positive reputation | 0.3433 (2) | 0.0492 (9) | ||

| Accessibility | 0.2057 (3) | Simple processes | 0.3794 (2) | 0.0780 (4) |

| Longer business hours | 0.1599 (3) | 0.0329 (14) | ||

| Credit checking | 0.4607 (1) | 0.0948 (3) | ||

| Customer Satisfaction | 0.3024 (1) | Loan rate | 0.1199 (4) | 0.0363 (12) |

| Effective and quick service | 0.1525 (3) | 0.0461 (10) | ||

| Renewing contract | 0.2449 (2) | 0.0740 (5) | ||

| Feel safe in the transaction | 0.4827 (1) | 0.1459 (1) | ||

| Capital Management | 0.2487 (2) | Sufficient cash | 0.2628 (2) | 0.0654 (6) |

| More business customers | 0.5580 (1) | 0.1388 (2) | ||

| Finance access | 0.1793 (3) | 0.0446 (11) | ||

| Location | 0.1004 (5) | Distance | 0.2055 (3) | 0.0206 (16) |

| Population | 0.5476 (1) | 0.0550 (8) | ||

| Resident social level | 0.2469 (2) | 0.0248 (15) |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Hung, T.-C.; Lin, C.-Y. Key Sustainable Factors of the Pawnbroking Industry: An Empirical Study in Taiwan. Sustainability 2022, 14, 12669. https://doi.org/10.3390/su141912669

Hung T-C, Lin C-Y. Key Sustainable Factors of the Pawnbroking Industry: An Empirical Study in Taiwan. Sustainability. 2022; 14(19):12669. https://doi.org/10.3390/su141912669

Chicago/Turabian StyleHung, Tzu-Chiao, and Chieh-Yu Lin. 2022. "Key Sustainable Factors of the Pawnbroking Industry: An Empirical Study in Taiwan" Sustainability 14, no. 19: 12669. https://doi.org/10.3390/su141912669

APA StyleHung, T.-C., & Lin, C.-Y. (2022). Key Sustainable Factors of the Pawnbroking Industry: An Empirical Study in Taiwan. Sustainability, 14(19), 12669. https://doi.org/10.3390/su141912669