1. Introduction

Remanufacturing is the process of taking back and repairing used products with a warranty that their performance is equivalent to or better than that of newly manufactured products. Remanufactured goods allow producers to considerably lessen their capital production costs and give consumers access to like-new products at lower prices than new goods. For instance, Xerox saved 40–65% on manufacturing costs through a green remanufacturing program [

1]. Moreover, remanufacturing has lower environmental impacts than producing new goods, since it requires less material and energy. Because of the economic and environmental benefits, many independent remanufacturers (IRs) seized the opportunity faster than OEMs and started remanufacturing [

2]. However, despite these economic benefits, few OEMs have entered the remanufacturing market. The decision to pursue remanufacturing is a challenge because the OEM’s remanufactured products may cannibalize the demand for their new products.

Whether OEMs are willing to produce remanufactured products or not, they have to make choices in the face of the competitive threat from remanufactured products produced by IRs. Moreover, examples from industries show that there is a big market for remanufactured products. The value of all manufactured products in the European remanufacturing-intensive sectors is EUR 1.5 trillion [

3]. The production value of remanufactured goods in the United States was at least USD 43 billion in 2011 [

4]. Increasing environmental, legislative, and social pressures are forcing OEMs to take a fresh view of the impact of remanufacturing. Different OEMs have different remanufacturing strategies. Some OEMs sets up their own remanufacturing program and compete with IRs, such as Lexmark [

2], Xerox, and Kodak [

5]. Other OEMs are authorizing IRs to remanufacture their used products because their brand can attract more consumers [

2]. For example, Caterpillar is a preferred supplier for Land Rover’s remanufacturing products and services, providing key elements of core management and remanufactured product development and product supply [

6]. The main goal of this article is to understand why OEMs choose different remanufacturing strategies.

- (1)

When will OEMs choose to compete with remanufacturers, and when will they authorize IRs, or do nothing?

- (2)

Under what conditions will IRs accept the manufacturer’s authorization?

- (3)

For OEMs, is a higher license fee better?

- (4)

Will OEMs provide technical support for IRs?

- (5)

What impact do OEMs’ competition and authorization strategies have on consumer interest and environmental protection?

To develop an in-depth understanding of these important research questions, the key trade-offs governing the decision-making process of OEMs and IRs need to be identified.

Therefore, the first step is to characterize the strategic behavior of OEMs and IRs. Without losing generality, a two-period situation was studied. In the first period, OEMs monopolize the production of new products. The remanufactured products in the second period come from the used items in the first period. This means that remanufactured products face supply constraints. Customers value remanufactured products less than new products. Additionally, products remanufactured by OEMs or their authorized factories are purchased at relatively higher prices than products remanufactured by third parties because of the seller’s reputation [

7]. In the second period, OEMs have several strategic options: not to remanufacture and authorize, to manufacture their remanufactured goods, and to authorize IRs to collect authorization fees. IRs may choose to accept or decline the manufacturer’s authorization.

First of all, a static model (Model B) was used as a benchmark in which an OEM produces new products, and an IR produces remanufactured items. Then, two remanufacturing decision models were formulated and analyzed: (i) Model C, in which the OEM also produces remanufactured items by itself, meaning that there are three types of products in the same market, namely, high, middle, and low; (ii) Model A, in which the OEM authorizes the IR to remanufacture using its brands, and the IR pays an authorization fee. After comparing the Nash equilibrium results of the three models, it was found that the OEM’s strategic choice depends on two key factors: the cost savings of remanufacturing and the authorization fees.

When the cost saved by the OEM through remanufacturing is very small, the OEM will not remanufacture the used goods; instead, it will authorize the IR or keep the original state. Only when the cost saving of the OEM is greater than a certain value will the OEM choose to compete with the IR by producing remanufactured products, or cooperate with the IR by authorizing it. When remanufacturing saves a lot of costs, the OEM will produce remanufactured products itself and will not cooperate with the IR. In addition, because of the cannibalization of new products by remanufactured products, the increase in the cost saving of the IR usually leads to a decline in the OEM’s profits. Unexpectedly, it was found that, in Model A, when the authorization fee is greater than a certain threshold, the OEM’s profit is positively correlated with the IR’s cost saving, which means that the OEM will help the IR save costs to obtain more profit. Subsequently, our research showed that when OEMs compete with IRs, the increase in the cost saving of OEMs can reduce the price of remanufactured products and increase their quantity, which is beneficial to consumers and also conducive to environmental protection. When OEMs authorize IRs, the increase in the authorization fees will lead to a decrease in the number of remanufactured products and an increase in the price, which is detrimental to consumer interests and environmental protection.

To help the readers understand this paper more clearly, the research method diagram of this paper is shown in

Figure 1.

The rest of this paper is organized as follows. In the next section, the current literature and the contributions of this paper will be briefly discussed.

Section 3 is devoted to the assumptions of the modeling framework. The formulations and analysis are presented in

Section 4.

Section 5 compares the optimal solution of the three scenarios and analyzes the impact of competition and authorization. Then, how an OEM chooses its remanufactured strategies is discussed.

Section 6 is devoted to a discussion of the results, management implications, and possible directions for future research.

2. Literature Review

This paper is related to CLSC (closed-loop supply chain) and teleology licensing. One of the main streams of the literature on remanufacturing is the competition between OEMs and independent remanufacturers. This competition stems from the cannibalization effect of remanufactured products on new products. Majumder and Groenevelt [

2] presented a two-period model to explain the behavior of the OEM and IR. The OEM wants to increase the remanufacturing cost for the local remanufacturer (L), but L has incentives to reduce the OEM’s remanufacturing cost, in effect inducing it to produce more in the first period. Debo et al. [

8] studied joint technology selection and pricing decisions for new and remanufactured products. They found that the optimal level of remanufacturability offered by the manufacturer in the competitive model is lower than in the monopoly model and decreases as the number of competing remanufacturers increases. Heese et al. [

9] used a Stackelberg duopoly model to analyze the profitability of remanufacturing under direct OEM competition. Their findings showed that the first firm to offer take-back can increase both profit margins and sales. Ferrer and Swaminathan [

10] analyzed new and remanufactured products in monopoly and duopoly scenarios and identified thresholds that help managers of remanufacturing operations to choose effective policies for their product lines. Ferguson and Toktay [

5] analyzed two entry-deterrent strategies of an OEM: remanufacturing and preemptive collection. They found that when collection is the major portion of the total remanufacturing cost, the unit manufacturing cost increases, or consumer acceptance of the remanufactured product increases, the relative advantage of the remanufacturing strategy increases. Atalay Atasu et al. [

11] provided an approach that considers the impact of green segments, OEM competition, and product life cycle on remanufacturing. Their results showed that under competition, remanufacturing can become an effective marketing strategy for an OEM to defend its market share via price discrimination; otherwise, the low-valuation consumer segments would be lost to low-cost OEM competitors. Guide and Li [

12] used empirical methods to study the potential for market cannibalization of new product sales by remanufactured products. They found that, for the consumer product, the risk of cannibalization is minimal since there is scant overlap in bidders between the new and remanufactured products. For the commercial product, the potential for cannibalization exists with a certain degree of overlap of the consumers of the new and remanufactured products. Ovchinnikov [

13] presented a new stylized model of how a firm makes pricing and remanufacturing decisions. Their results showed that the optimal strategy of OEMs depends on the size/elasticity of the low-price segment. Since a fraction of consumers who switch from new to remanufactured products have an inverted U shape, OEMs charge a lower price for remanufactured products only when this pricing strategy can decrease consumer switching and attract many new low-price-only customers. Agrawal et al. [

14] used behavioral experiments to investigate the effect of remanufactured products and the identity of the remanufacturer on the perceived value of an OEM’s new products. They found that the negative effect of OEM-remanufactured products may be stronger for high-quality brands than for low-quality products. However, the presence of third-party-remanufactured products has a positive effect on the perceived value of the new product.

This research also involves consumers’ heterogeneous demand for different products. Anderson and Ginsburgh [

15] pointed out that consumers have heterogeneous demand for new products and used products when studying the second-hand market. In the existing literature, most authors believe that consumers have heterogeneous demand for new and remanufactured products. Only Majumder and Groenevelt [

2] as well as Ferrer and Swaminathan [

4] assumed that consumers’ demand for new products and remanufactured products produced by OEMs is homogeneous. However, in the paper by Ferrer and Swaminathan [

16], they still assumed that consumers have heterogeneous demand for different products produced by OEMs.

Most of the existing literature focused on the heterogeneous demand for new and remanufactured products in the same market, and less research has focused on the heterogeneous demand for different remanufactured products. Subramanian and Subramanyam [

7] examined drivers of price differentials between new and remanufactured products using data on purchases made on eBay. Their analysis showed that seller reputation significantly explains the price differentials between new and remanufactured products. They also found that products remanufactured by original equipment manufacturers or their authorized factories are purchased at relatively higher prices than products remanufactured by third parties.

To sum up, in this paper, it is assumed that consumers have heterogeneous demand for new products and remanufactured products. Moreover, according to the research results of Subramanian and Subramanyam [

7], it is also assumed that consumers have heterogeneous demand for remanufactured products produced by OEMs or authorized manufacturers and third-party manufacturers.

The literature on the cooperation of OEMs and IRs in technology licensing is discussed next. Savaskan et al. [

1] researched remanufacturing cooperation between OEMs and third parties. They found that the retailer is the most effective undertaker of the product collection activity for OEMs. Nektarios Oraiopoulos et al. [

17] developed a durable goods model where the OEM can directly affect the resale value of its product through a relicensing fee charged to the buyer of the refurbished equipment. Abdulrahman et al. [

18] investigated the remanufacturing strategies of Chinese auto part firms and found that Chinese firms are keen to adopt in-house remanufacturing practices compared to outsourcing. Zou et al. [

19] compared the two modes of authorization and outsourcing between OEMs and third-party remanufacturers. The results indicated that when consumers perceive the remanufactured products with a low value, the 3PR (the third-party remanufacturer) prefers the authorization approach; otherwise, the 3PR prefers the outsourcing approach. Huang and Wang [

20] developed three hybrid remanufacturing models related to OEMs, distributors, and third parties to help achieve the best method of hybrid remanufacturing in a closed-loop supply chain. Hong et al. [

21] investigated two licensing patterns, namely, fixed-fee and royalty, and found that royalty licensing is dominated by fixed-fee licensing from the viewpoints of both the consumer surplus and environmental protection. Huang and Wang [

22] considered the scenario where the OEM licenses the third party to undertake remanufacturing activities in the presence of strategic consumers. The results showed that the OEM charges a higher authorization fee from the third party to avoid profit loss due to strategic consumer behavior. Moreover, the manufacturer prefers the third-party remanufacturing mode rather than the manufacturer remanufacturing mode if the third-party remanufacturing cost is relatively low. Rau [

23] found that royalty licensing is the better technology licensing strategy compared to the fixed-fee licensing strategy in terms of costs. Rabbani et al. [

24] presented three multi-level leader–follower Stackelberg game models to investigate whether a manufacturer, in addition to manufacturing new products, should also remanufacture or set a fee for the technology licensing of distributors and cooperate with them in remanufacturing. The results showed that cooperating is a more profitable option for the manufacturer, and that the OEM must pay attention to allow the licensee to use the technology but not transfer the technology and use it for itself. Zhao et al. [

25] developed decision models of three different remanufacturing roles and technology authorizations: manufacturer remanufacturing (MR), retailer remanufacturing after paying for the technology authorization fee per unit product (UR), and retailer remanufacturing after paying for fixed technology authorization fees (FR). They found that the FR remanufacturing mode not only encourages the retailer to improve the product service level but also enables the third party to improve the recovery rate. Sabbaghnia, A. and Taleizadeh, A. A. [

26] studied three common technology licensing scenarios, namely, fixed-fee, royalty cost, and two-part tariff. The analytical and numerical results indicated that the two-part tariff scenario dominates the other two licensing scenarios. However, for the middle ranges of the collection competition intensity, the royalty cost scenario is dominated by the fixed-fee scenario. Zou et al. [

27] found that remanufacturing through technology licensing only increases the profit of the manufacturer while decreasing the profit of the supplier.

In sum, existing research on remanufacturing often only discusses the competition between OEMs and IRs or discusses the cooperation between the two. This research studies both the competition and the cooperation of OEMs and IRs and finds out the key conditions that influence OEMs and IRs in choosing a competitive strategy or a cooperative strategy. Second, most of the literature on OEM and IR competition only analyzes the competition of two products (new products from an OEM and remanufactured products from an IR). In this paper, a competition model of three products (new products, remanufactured products produced by an OEM, and remanufactured products produced by an IR) is established, which not only shows that consumers’ willingness to pay for new products and remanufactured products is different but also shows that consumers’ willingness to pay for remanufactured goods from different manufacturers is heterogeneous. The model takes a step towards understanding the mixed market in which new products and different remanufactured products coexist. Although Subramanian and Subramanyam [

7] found that customers have heterogeneous demand for the three products through empirical research, they did not model this. A comparison of this study with the related research is presented in

Table 1.

3. Modeling Assumptions

To understand how the OEM makes strategic remanufacturing choices, a two-period model was introduced: the OEM produces the new product in the first phase, and in the second phase, the OEM still produces the new product and can choose not to produce the remanufactured product, produce the remanufactured product, or authorize the IR to produce the remanufactured product, and the IR produces the remanufactured product. It is assumed that the quantity of new products in the first period is not affected by the decision of the second period. Customers can distinguish between new and remanufactured products, and also between remanufactured products from different manufacturers. For brand reasons, consumers are more receptive to remanufactured products produced by the OEM than those produced by an IR. At first, a two-period model with no OEM involvement in remanufacturing was used as a benchmark model to keep the analysis simple and gain sharper insights. Then, the analysis was extended to two situations where the OEM competes in remanufacturing or authorizes the IR to produce the remanufactured product.

In the rest of this paper, the notation in

Table 2 is used.

Two of these parameters, namely, the remanufacturing savings Sk and the collection yield γk, characterize the firm’s ability to perform key activities in the remanufacturing process. It is assumed that firms only collect old products that maximize their profits and select the remanufacturing savings Sk as the key parameter to define the strategy space in each scenario because it seems to be the parameter over which managers can have the greatest impact through strategic management of the facility’s resources. Another key parameter is . The value of the parameter is completely determined by the manufacturer, and it is the key to the success of the authorization strategy and maximizing profits.

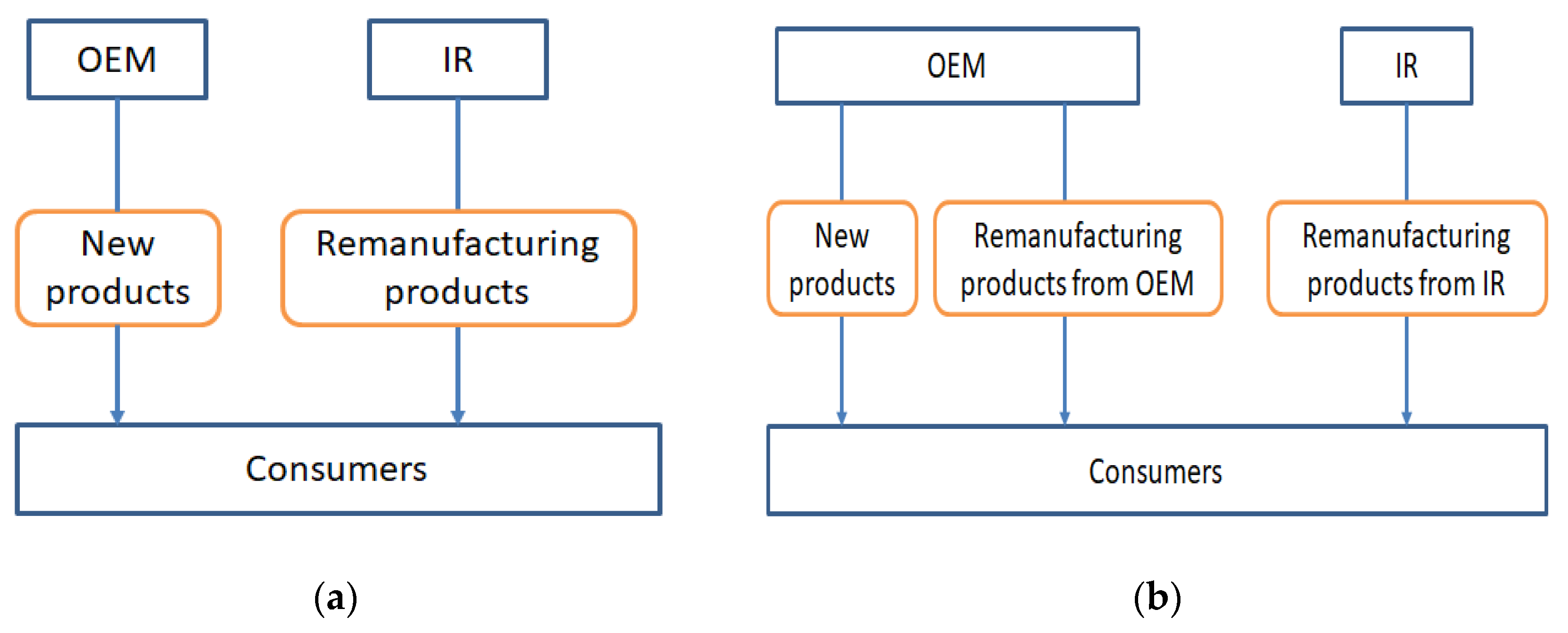

In Model B, the OEM produces new products in both the first and second periods and does not produce remanufactured goods (

Figure 2). The IR produces remanufactured goods in the second period. The OEM decides the prices and quantities of the new product, and the IR decides the prices and quantities of the remanufactured product. Remanufactured products cannibalize new products. The IR chooses its core collection yield that maximizes profit. Model B is the benchmark model, while Models A and C are extended.

In Model C, if the OEM’s cost savings are large enough to profit from remanufactured goods, it will produce both new and remanufactured products in the second period. There are three products in the market: new products, remanufactured goods produced by OEMs, and remanufactured goods produced by IRs. These three products have different prices and compete in the market. Because recycling requires a lot of money, the amount of recycled old products from OEMs and IRs depends on the quantity of remanufactured products when profits are maximized.

In Model A, the OEM considers another possible strategy, that is, it does not produce remanufactured products itself and authorizes the IR to produce remanufactured products. Due to the branding effect, the IR can benefit from consumers’ greater acceptance of OEM-authorized remanufactured products than IR-remanufactured products. The OEM’s authorization will charge a fee. The OEM and IR play games concerning the size of the fees and finally achieve a Nash equilibrium.

4. Model Formulation and Solution

In this section, starting with Model B, the general formulations and solutions to the models of the OEM’s remanufacturing strategies are presented.

Consider that the OEM only produces new products in Period 1, and its decision is not affected by the second period. The OEM’s objective function in the first period is , which is maximized by . Price is , and the profit is given by .

4.1. Model B

In the first period, only the new product is offered. At the end of the first period, some units are collected by an independent remanufacturer. The OEM produces in the first period, not considering the competition of the second period. The IR responds with a lower price, knowing that, other things equal, customers prefer the OEM’s brand. The following lemma identifies the demand as a function of the quantities of two vertically differentiated products.

In the second period, the OEM only produces new products, and the IR remanufactures all old products it collects.

is the remanufacturing saving for the IR. The OEM collects a fraction

of all units produced in Period 1. The OEM’s objective function is

, and the IR’s objective function is

.

is replaced by its expression in (3), and

is replaced by its expression in (4). Because the remanufacturing output is equal to the amount of collection of old products,

. The cost of collection of old products is

. (To characterize the diminishing returns to investment, we use the cost structure, where B is a scaling parameter.) Similar forms of response functions have been widely used in the advertising response models of consumer retention and product awareness [

28], and in sales force effort response models, in the marketing literature [

29]. In the operations literature, Fine and Porteus [

30] used similar investment functions to investigate opportunities for process improvement and lot sizing by investing in setup cost reduction. This paper investigates trade-offs similar to those in the above studies in a remanufacturing context. According to Lemma 1, the OEM’s and IR’s objective functions are

According to the KKT optimization conditions, there exist three optimal policies for the OEM and the IR: (1) the OEM produces new products in Period 2, and the IR does not produce any products; (2) the OEM produces new products in Period 2, and the IR produces remanufactured products with ; (3) the OEM produces new products in Period 2, and the IR produces remanufactured products with . Only case (2) was considered in this paper. Because, in real life, IRs will produce remanufactured goods, it is almost impossible to collect all the old products of the first period. The simultaneous solution of the KKT conditions results in

Proposition 1. If, there is a unique Nash equilibrium between the OEM and IR. The quantity and price of new products and remanufactured goods are In this scenario, in the second cycle, new products and remanufactured products compete in the market. The IR decides whether or not to produce remanufactured goods and how many remanufactured goods to produce based on the cost savings of remanufacturing and the number of new products. The cost savings of remanufacturing are a key factor.

4.2. Model C

As remanufactured products compete with new products, the ‘EM’s profits are affected. OEMs can produce remanufactured products to respond to IR competition. Although the ‘EM’s remanufactured product will impact the new product, as long as the cost saving of remanufacturing is high enough, the ‘EM’s overall profits will increase. OEM involvement in remanufacturing is discussed below.

In the second period, the OEM produces new products and remanufactured goods, and the IR also produces remanufactured goods. Therefore, there are three products in the market. Lemma 2 identifies the demand as a function of the quantities of three vertically differentiated products.

Considering that the OEM produces two products and needs to pay for collection in Period 2, the OEM’s objective function is

. The IR only produces one product, and its objective function is

. According to Lemma 2,

is replaced by its expression in

,

is replaced by its expression in

, and

is replaced by its expression in

. Additionally,

and

are replaced. The OEM’s and IR’s objective functions and constraints are

The constraints mean that the old products collected by the OEM and IR should not be greater than the output of the new product in Period 1. According to the KKT optimization conditions, only the scenario where the OEM and IR both produce remanufactured goods, but the total quantity of remanufactured goods is less than the output of new products produced in Period 1, was considered. The simultaneous solution of the KKT conditions leads to the theorem that describes their optimal policies.

Proposition 2. If, the OEM will participate in remanufacturing competition. The quantity of new products, core collection by the OEM, and core collection by the IR are The prices of new products and remanufactured goods are

The savings parameter is a key factor in whether OEMs choose to remanufacture. When is large enough, the ’EM’s profit from remanufacturing is more than the lost profits of cannibalizing with new products. The following corollaries can be obtained:

Corollary 1. (1) The higher cost saving of remanufactured products produced by the OEM (higher) increases the quantity of remanufactured goods produced by the OEM.

(2) The higher cost saving of remanufactured products produced by the OEM (higher) reduces the quantity of remanufactured goods produced by the IR.

(3) The higher cost saving of remanufactured products produced by the OEM (higher) increases the total quantity of remanufactured goods.

Corollary 2. (1) The higher cost saving of remanufactured products produced by the OEM (higher) reduces the price of remanufactured goods produced by the OEM.

(2) The higher cost saving of remanufactured products produced by the OEM (higher) reduces the price of remanufactured goods produced by the IR.

The above corollaries indicate that the higher remanufacturing saving of the OEM better responds to the competition of the IR. The prices and output of their products both decline and profits decrease. However, the total amount of remanufactured goods increases, and the price decreases. Consumers obtain benefits, and more old cores are collected and put back into the market. This means that OEMs participating in remanufacturing competition and improving remanufacturing savings are beneficial to society and the environment.

In addition to the cost savings of remanufactured products, consumers’ tolerance for remanufactured goods is another key factor affecting remanufacturing (see Corollary 3).

Corollary 3. Higher consumer tolerance for remanufactured goods produced by an OEM enhances the OEM’s willingness to remanufacture.

4.3. Model A

Let us consider another strategy where the OEM does not remanufacture but authorizes the IR to remanufacture. Because consumers are more tolerant of remanufactured products produced by the OEM, the IR can sell remanufactured products at a higher price by accepting authorization. The OEM, on the other hand, can compensate for the losses caused by competition in remanufactured goods by charging authorization fees.

In the scenario of authorization, there are only two products on the market in Period 2. According to Lemma 1, the demand functions are as follows:

The OEM’s objective function is

. The IR only produces one product, and its objective function is

.

is replaced by its expression in (5), and

is replaced by its expression in (6).

is also replaced. The OEM’s and IR’s objective functions and constraints are

Similar to Model B, in the second period, the OEM only manufactures new products, while the IR produces remanufactured products with . The difference is that the OEM charges authorization fees. Proposition 3 is obtained by solving equations.

Proposition 3. If, the optimal price and quantity and core collection rate are The value of is the key to deciding whether the authorization strategy can be implemented. If the value of is too small, the authorization fee charged by the OEM is not sufficient to compensate for the loss caused by the competition of the remanufactured goods. The OEM refuses the authorization. If the value of is too large, the profit obtained by the IR from the authorization is less than the authorization fee paid to the OEM. The IR will not accept the authorization. The OEM and IR always want to maximize profits. They play games with each other and finally reach a Nash equilibrium.

The following corollary can be drawn:

Corollary 4. A higherreduces the core collection and increases the prices of remanufactured goods.

Proposition 4. If other parameters are fixed, the ‘EM’s profit increases at first and then decreases with the increase in. When the manufacturer’s profit is maximized, the value ofisAt the same time, a higherreduces the profit of the IR. The above corollary shows that the greater the value of , the less profitable the IR will be. However, as long as the profit in the authorization scenario is greater than that in the unauthorized scenario, the IR will pay the authorization fee. On the other hand, for OEMs, it is not better to charge higher authorization fees for the unit product. As the value of becomes larger, the IR will reduce the output of remanufactured goods and increase the price of remanufactured goods to maximize profits. The OEM’s profits consist of two parts: one is the profit of new products, and the other is the authorization fees. The greater the value of required by the OEM, the larger the profit gained from the new product, but the total authorization fees for the OEM will increase at first and then decrease. Therefore, it is not a good idea for the OEM to charge as large a unit authorization fee as possible. Excessive authorization fees reduce the output of remanufactured products, which has a negative impact on environmental protection. At the same time, higher prices of remanufactured goods have reduced consumer surplus and cause a negative impact on social welfare.

5. Comparison and Discussion

In this section, the best remanufacturing strategy for the OEM will be discussed. Responding to the competition of remanufactured goods, the OEM can choose to maintain the status quo, charge authorization fees, or produce remanufactured goods by itself. The remanufacturing cost saving of the OEM is one of the key factors affecting the decision. With different remanufacturing cost savings, the strategies which can be chaired by the OEM are different. First, the thresholds for the OEM to choose different strategies are discussed, and then, the OEM’s behavior in different strategies and its impact on environmental protection and social welfare are analyzed.

5.1. The Choice of Remanufacturing Strategy of OEMs and IRs

Comparing the profits of the OEM and IR in Models A, B, and C, the following two propositions can be obtained.

Proposition 5. If, the OEM and IR have two strategies to choose from: maintain the status quo, or choose to authorize.

- (1)

If , the OEM and IR choose authorization strategies.

- (2)

If or , the OEM and IR maintain their status quo.

The management implications of Proposition 5 are as follows: For a low value of , the OEM’s remanufacturing gains are less than the loss of cannibalization. The OEM does not remanufacture and chooses the appropriate strategy based on how far the IR is willing to pay for the authorization fee of the unit product. For a low value of , the IR is willing to pay the authorization fee, but the OEM is reluctant to authorize because the authorization reduces the total profit. For a high value of , the OEM is willing to authorize the IR, but the IR is not willing to pay an exorbitant authorization fee. In both of the above cases, since the OEM and IR cannot reach an agreement, they have to keep the previous state. Only when does the authorization strategy increase profits for both the OEM and IR, and an authorization policy can be implemented.

For a high value of , the remanufacturing cost saving makes up for the losses caused by the cannibalization of remanufactured goods. The OEM can obtain greater profits by producing remanufactured products and competing with the IR.

Proposition 6. If, the OEM has two strategies to choose from: produce remanufactured products itself and compete with the IR, or authorize the IR to produce remanufactured products. The IR can choose to accept or decline the authorization.

- (1)

When , if , manufacturers choose the competitive strategy (because the profits from the competition are greater than the maximum profits authorized).

- (2)

When , if

If , the OEM is reluctant to authorize and chooses to compete with remanufacturers.

If , the OEM chooses to authorize the remanufacturer and the IR accepts the authorization.

If , the IR does not accept the authorization, and the OEM competes with the IR.

If is high enough, the profit that the OEM obtains from producing remanufactured goods is greater than that from authorizing the IR. The OEM chooses to produce remanufactured goods by itself. If the OEM’s profit in the competitive strategy is lower than the highest profit obtained in the authorization strategy, the OEM may choose one of the above two strategies. For a very low or a very high value of , similar to Proposition 4, either the OEM or the IR does not accept the authorization strategy. Therefore, in addition to producing new products, the OEM also produces remanufactured products. New products, remanufactured goods produced by the OEM, and remanufactured goods produced by the IR compete with each other in the market. Only when can both the OEM and IR obtain higher profits from authorization policies, and authorization policies can be implemented.

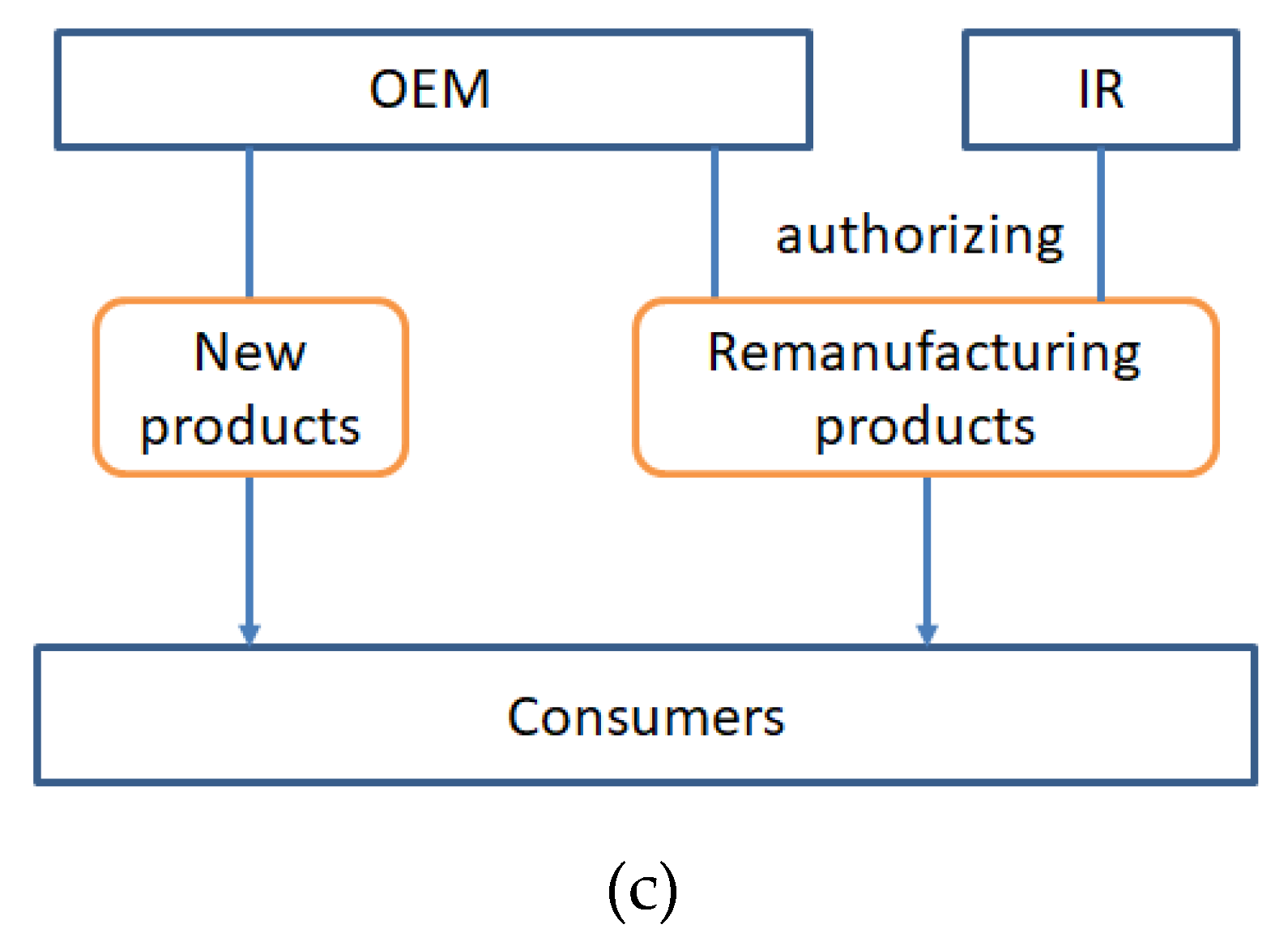

Here are two examples. The profits of manufacturers and remanufacturers in the competitive and authorization scenarios are shown in

Figure 3.

Case 1.

,

,

(according to the literature [

1,

5], the relationship between the core collection cost and core collection rate is similar to the input–output in advertising, i.e.,

, and

; is the coefficient of the unit core collection),

,

,

, and

.

Figure 3a shows the profits of the OEM and the IR calculated from these parameters. It can be seen in

Figure 3a that the manufacturer earns higher profits in the competitive scenario than in the authorization scenario, so the OEM will not authorize the IR to produce remanufactured products

Case 2.

,

,

,

,

,

, and

. From these parameters, the profits of the OEM and IR were calculated, as shown in

Figure 3b. From

Figure 3b, it can be found that as the value of

increases, the OEM’s profit increases and gradually becomes higher than its profit in the competitive scenario, while the IR’s profit decreases but is always higher than its profit in the competitive scenario. In the area between the two dashed lines (

; within this area, the thresholds for the OEM and IR to adopt authorization strategies are met and they are guaranteed positive prices and quantities for all products), the OEM authorizes the IR to produce remanufactured products.

Comparing Case 1 and Case 2, all parameters are the same except for the remanufacturing cost savings of the OEM and IR. Since consumers have a greater preference for remanufactured products produced by OEMs, when the IR’s remanufacturing cost savings are significantly greater than the OEM’s remanufacturing cost savings, the OEM is willing to authorize the IR to achieve a win–win situation. Conversely, the OEM will not authorize the IR to produce remanufactured goods.

Notice that the final value of is determined by the game between the OEM and IR. In order to maximize their own interests, the OEM and IR will not choose a very low or a very high value of . Therefore, in addition to the scenario with a very high cost saving of remanufactured products produced by the OEM, the authorization strategy can enable the OEM and IR to achieve a win–win situation. Because of the cooperation between the OEM and IR, remanufactured goods are sold at higher prices, increasing their profits. However, considering consumers’ welfare, this strategy may not be a good choice due to the reduction in consumer surplus.

Based on the above conclusions,

Table 3 shows the boundary conditions for the OEM and IR to choose different remanufacturing strategies.

5.2. The Relationship between Remanufacturing Cost Saving and Profit

Comparing the impact of remanufacturing cost savings on OEM profits in Model A, Model B, and Model C, Proposition 7 can be obtained.

Proposition 7. (1) In the benchmark scenario (Model B), a higher reduces the OEM’s profits and increases the IR’s profits.

(2) In the competition scenario (Model C), a higher reduces the OEM’s profits and increases the IR’s profits.

(3) In the authorization scenario (Model A), when , a higherincreases both the OEM’s and IR’s profits.

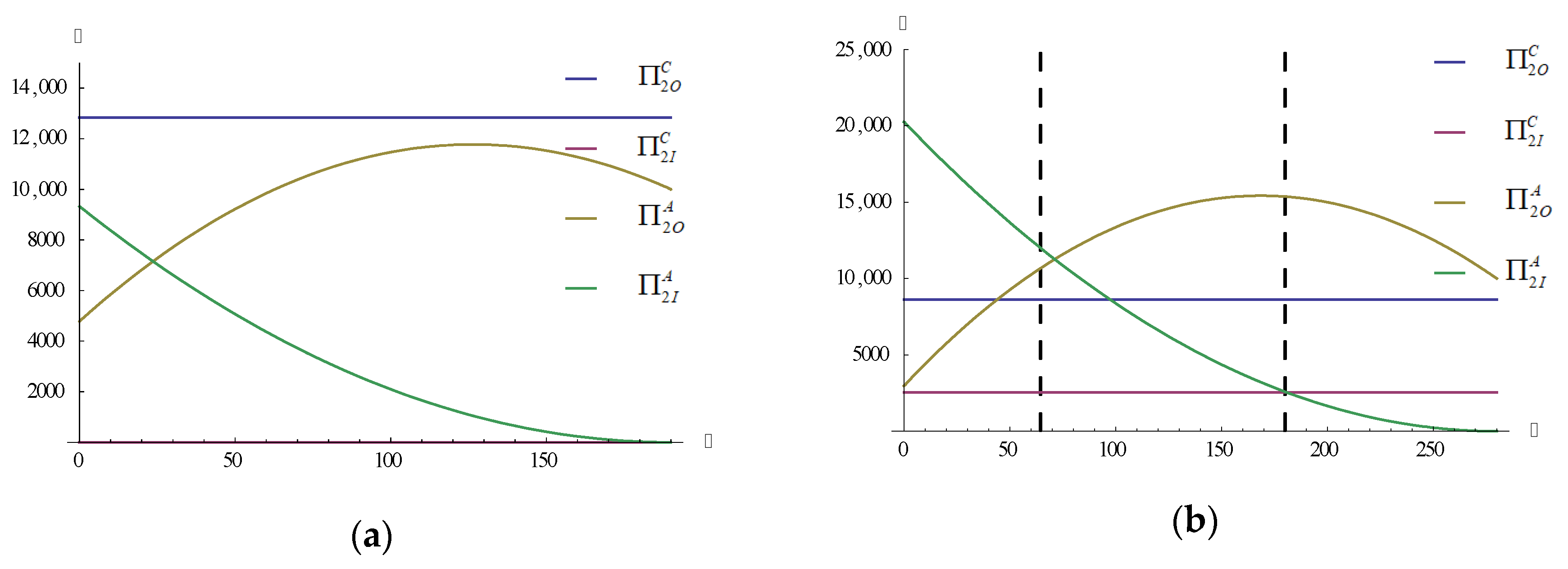

The following four examples are used to verify the result of Proposition 7. As above, assume that

,

,

,

, and

Figure 4a–d show how the profits of the OEM and IR vary with

in different scenarios. In

Figure 4a, the OEM is not involved in remanufacturing. In

Figure 4b, the OEM produces remanufactured products in competition with the IR and

. In

Figure 4c, the OEM authorizes the IR to produce remanufactured products, and

(

). In

Figure 4d, the manufacturer authorizes the remanufacturer to produce remanufactured products, and

(

).

The above four graphs show that, in any case, the IR’s profits move in the same direction as . In the initial scenario, competitive scenario, and authorization scenario and when , the OEM’s profits decrease with the increase in , but in the authorization scenario and when , the OEM’s profits increase with the increase in .

In Model B and Model C, the OEM and IR always compete with each other. The higher remanufacturing cost savings of the IR increase the quantity of remanufactured goods at lower prices. The OEM’s market share decreases, and profits decline. However, in Model A, the OEM and IR cooperate to produce remanufactured goods. The more remanufactured goods produced by the IR, the more the total license fees charged by the OEM. The OEM will weigh the impact of the cannibalization of remanufactured products and the collection of authorization fees on its profits, and its behavior may change. Proposition 7 means that, in the case of authorization, when the authorization fee is higher than a certain value, the OEM may help the IR to improve remanufacturing cost savings, which leads to lower remanufacturing costs and a higher collection rate of used products. With lower remanufacturing costs, the OEM and IR can obtain higher profits. The increased collection rate of used products benefits environmental protection.

6. Research Conclusions, Implications, and Future Research

This paper developed insights for OEMs who have to make choices about remanufacturing strategies. OEMs can produce remanufactured products to compete with IRs. Due to the remarkable reputation of OEMs, the purchase price of remanufactured products by OEMs or their authorized factories is relatively high compared with third-party-remanufactured products [

7]. OEMs can also cooperate with IRs by authorizing the production of remanufactured products. Different OEMs have different options for remanufacturing strategies. For example, Xerox [

5] and some Chinese companies choose to produce remanufactured products by themselves [

18], while Land Rover authorizes Caterpillar to refurbish used products [

6]. To discuss the main factors that influence OEMs’ choice of remanufacturing strategies, three two-period models were designed. In the first period, only OEMs produce new products. In the second period, the three models are different: Model B describes the scenario of the OEM producing new products and the IR producing remanufactured products. Model C discusses the scenario in which the OEM both generates new products and remanufactures products by itself in order to compete with the IR. In Model A, the OEM produces new products and authorizes the IR to produce remanufactured products.

By comparing the three models, the results show the following:

- (1)

OEMs choose reasonable remanufacturing strategies based on the cost savings of their remanufactured products and the authorization fee. If the OEM’s remanufacturing cost saving is very low, the OEM will not produce remanufactured products. It has two options: ignore the cannibalization caused by remanufactured products, or authorize the IR to remanufacture products. If the cost saving is higher than a certain value, the OEM has two options: produce remanufactured products to compete with the IR, or authorize the IR to remanufacture products. When the cost saving of remanufactured products is very high and the benefits of the OEM from remanufacturing are much greater than those from cooperation with the IR, the OEM will not choose to cooperate.

Whether the OEM and IR can cooperate depends on the negotiation of the authorization fee. If the authorization fee is too high, the IR will not accept the authorization, and if the authorization fee is too low, the OEM is unwilling to authorize. Cooperation is possible only when authorization can allow the OEM and IR to achieve a win–win situation.

- (2)

Since the cannibalization of new products by remanufactured products will lead to a decrease in OEMs’ profits, usually, OEMs will not help IRs to improve their remanufacturing technology. However, in the case of authorization, when the authorization fee is greater than a certain value, the OEM’s profit will increase with the cost saving of the IR’s remanufactured products. The OEM will help the IR to improve its remanufacturing technology, thereby increasing the profits of the OEM and IR, and increasing the recycling of used products, which is good for environmental protection.

- (3)

In the authorization scenario, as the license fee increases, the OEM’s profit first increases and then decreases, so there is an optimal license fee. The authorization fee charged by OEMs is not as high as possible.

- (4)

In the competitive scenario, as the cost saving of the OEM’s remanufactured products increases, the price of its remanufactured products decreases, and so does the price of the IR’s products. Because of the lower price, the total demand for remanufactured products increases. This means that OEMs participating in remanufacturing competition and improving remanufacturing technology can increase consumer surplus and benefit the environment.

6.1. Research Implications

These findings make two major theoretical contributions to the research in the field of remanufacturing. First, unlike a large number of studies that only discussed one of the strategies of competition or cooperation between OEMs and IRs, this paper studied both competitive and cooperation strategies between OEMs and IRs, and it set the threshold for OEMs to choose different remanufacturing strategies. Secondly, based on the empirical research of Subramanian and Subramanyam [

7], a competition model of three products (new products, remanufactured products from OEMs, and remanufactured products from IRs) was established, in which consumers’ willingness to pay for the three products is heterogeneous. With this model, the OEM’s behavior in remanufacturing competition can be analyzed more accurately, which helps managers understand how the OEM should make strategic remanufacturing choices.

The methodology of this paper can be generalized to any multi-product market where consumers have different levels of willingness to pay for different products. Manufacturers of high-grade products, for example, face competition from low-grade products with similar functions, thereby losing some customers. Manufacturers of high-grade products can develop products of a slightly lower quality to cope with the competition of low-grade product manufacturers, and they can also cooperate with low-grade product manufacturers to serve price-sensitive customer groups.

6.2. Managerial Implications

The research in this paper provides the following management insights for OEMs’ remanufacturing practices. First, the research conclusions of this paper give specific guidance on which remanufacturing strategy OEMs should choose in different situations (

Table 3). Second, higher authorization fees can motivate OEMs to help IRs improve their remanufacturing technology, but authorization fees should not be as high as possible. Third, OEMs do not cooperate with IRs when their remanufacturing cost savings are very high, which is consistent with the interview results of Abdulrahman et al. [

18]. Abdulrahman et al. found that, since outsourcing does not bring cost advantages, Chinese firms are keen to adopt in-house remanufacturing practices.

The conclusions in this paper can also provide some management insights for policymakers: whether in authorization scenarios or competitive scenarios, improvements in remanufacturing technology by OEMs can expand the output of remanufactured products, which is beneficial to environmental protection, so policies should be developed to encourage OEMs to improve remanufacturing technology.

6.3. Future Research Opportunities

This paper can further expand the research in the following ways. First, like most of the literature, this study assumed that there is only one OEM and one IR in the market. However, in reality, there are often multiple IRs remanufacturing used products from the same OEM. It is necessary to extend the models of this paper to one OEM and multiple IRs in future research. Second, this paper mainly considered the impact of two cost-related factors, namely, remanufacturing cost saving and authorization fees, on the choice of remanufacturing strategies by OEMs. Future researchers can further expand the research in this paper to service quality and used product recycling. Finally, this paper did not consider the impact of policy on OEMs’ remanufacturing strategy choices. In the future, the research in this paper can be further expanded by considering the impact of environmental protection policies (such as carbon emissions).