Rural Social Security, Precautionary Savings, and the Upgrading of Rural Residents’ Consumption Structure in China

Abstract

1. Introduction

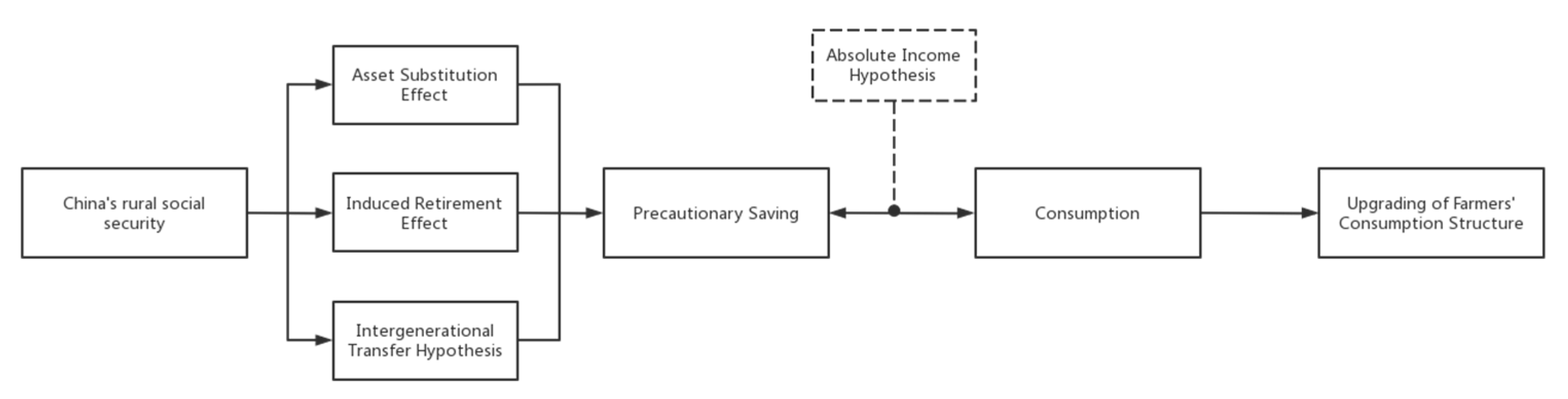

2. Theoretical Mechanisms and Research Hypotheses

2.1. Logic of the Impact of Rural Social Security on the Upgrading of the Consumption Structure of Rural Residents

2.2. Influence Logic of Rural Social Security, Precautionary Savings, and the Upgrading of Rural Residents’ Consumption Structure

3. Models, Variables, and Data

3.1. Econometric Model Construction

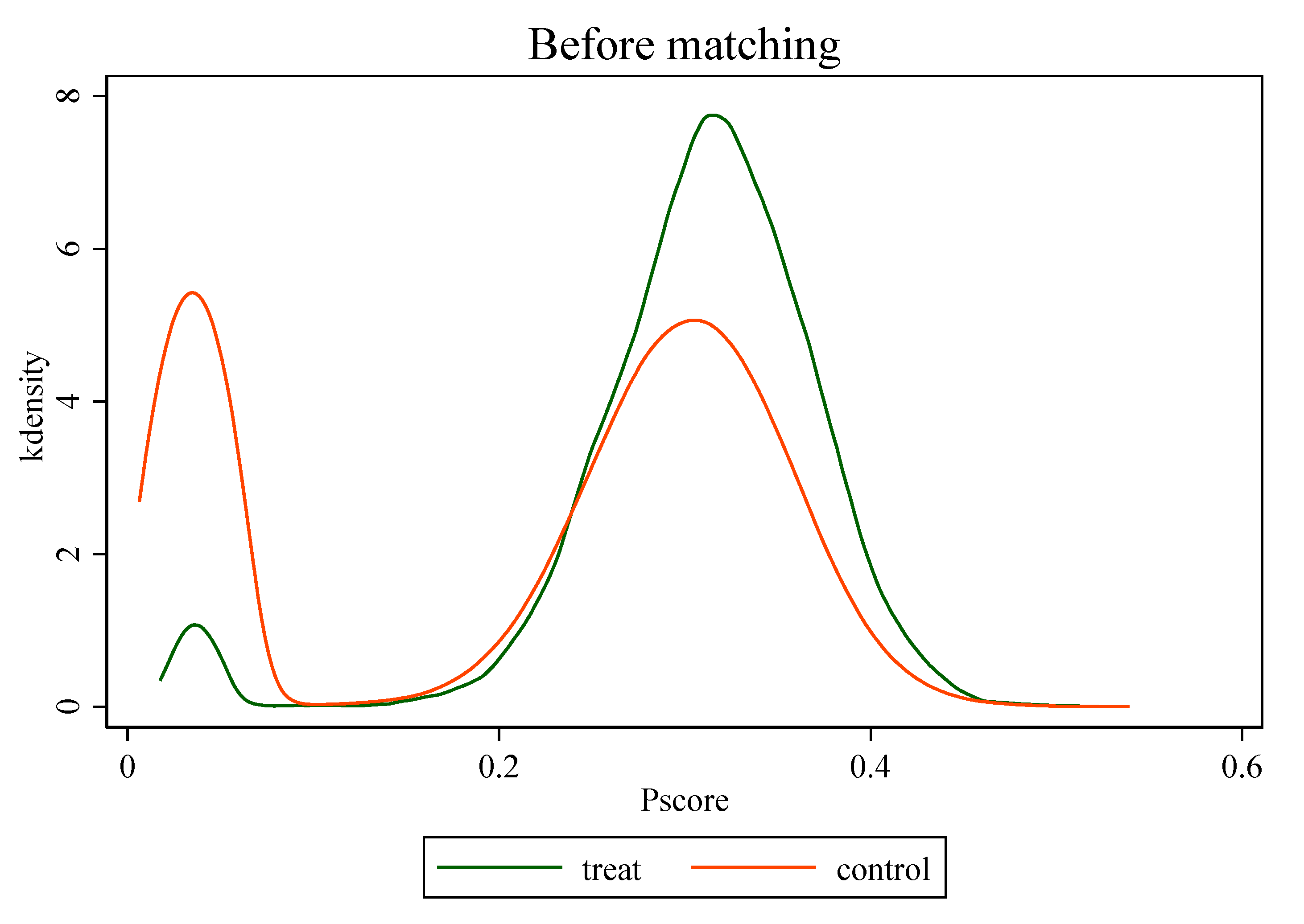

3.1.1. Double Differential Propensity-Score Matching (PSM-DID)

3.1.2. Mediation Effect Model

3.2. Variable Selection

3.2.1. Explanatory Variables

3.2.2. Core Explanatory Variables

3.2.3. Control Variables

3.2.4. Mediating Variables

3.3. Data Source and Description

4. Analysis of Empirical Results

4.1. Analysis of PSM-DID Model Results

4.2. Analysis of Mediation Effect Model Results

4.3. Analysis of Robustness Test Results

4.3.1. Robustness Test Based on Matching Method

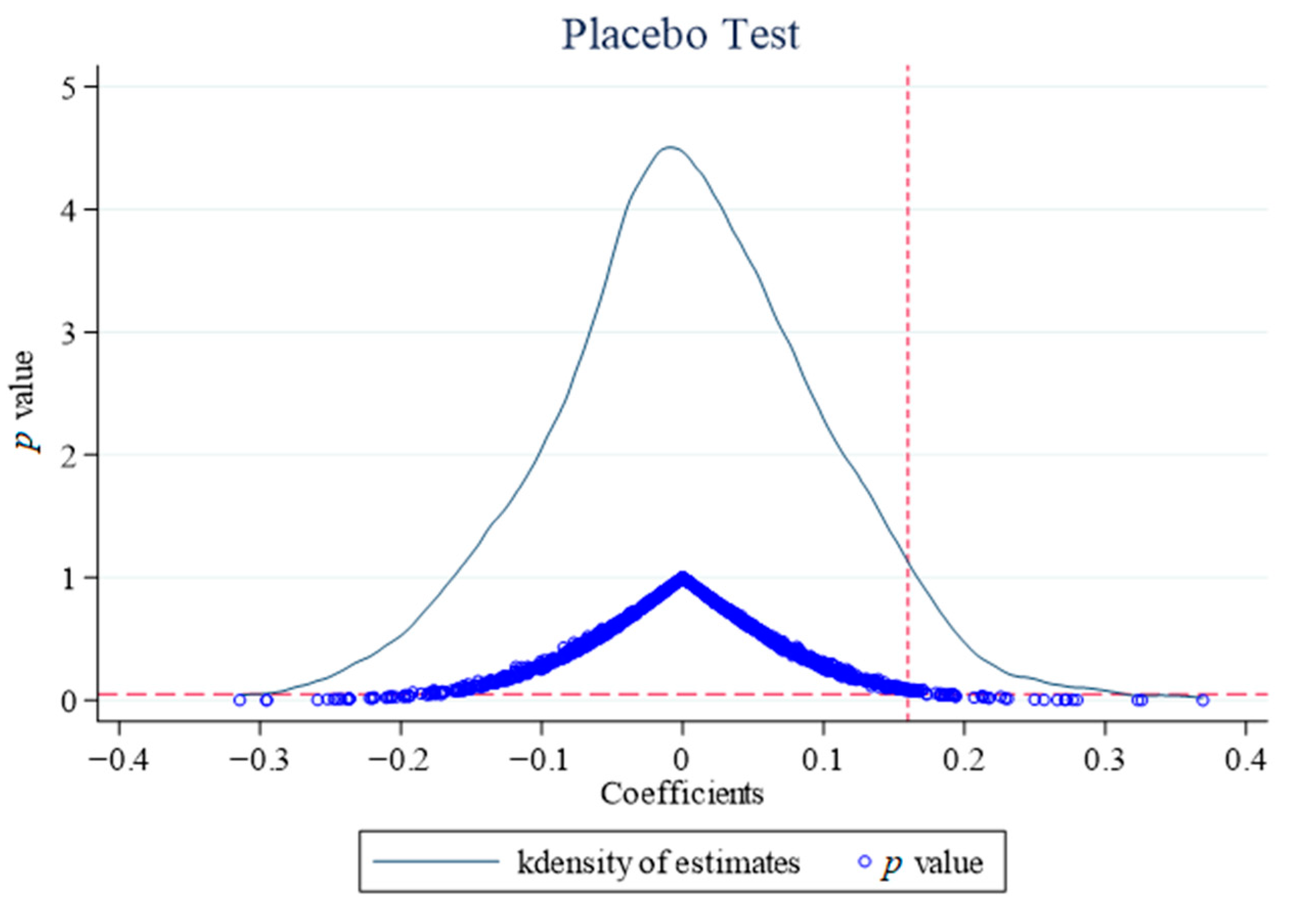

4.3.2. Robustness Test Based on Placebo Approach

5. Heterogeneity Discussion and Analysis

5.1. Age Heterogeneity Discussion

5.2. Regional Heterogeneity Discussion

6. Conclusions and Policy Implications

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Hu, X.; Shi, Z. Strategic Thinking on Activating Factors to Promote Rural Revitalization. Econ. Rev. J. 2022, 38, 50–57. [Google Scholar]

- Ye, X. Promoting the Two-way Opening-up of Urban and Rural Areas in the Context of Smoothing Domestic Circulation. Chin. Rural Econ. 2020, 36, 2–12. [Google Scholar]

- Wang, Y.; Wang, Y. The trend of China’s consumer demand during the 14th Five-Year Plan and the impact on the total product structure. Stat. Decis. 2021, 37, 125–129. [Google Scholar]

- Yan, F.; Hu, Y. Changes and optimization of consumption structure of rural residents under the new normal. Stat. Decis. 2018, 34, 98–101. [Google Scholar]

- Keynes, J.M. The general theory of employment, interest, and money. Limnol. Oceanogr. 1936, 12, 28–36. [Google Scholar]

- Modigliani, F.; Brumberg, R. Utility analysis and the consumption function: An interpretation of cross-section data. Fr. Modigliani 1954, 1, 388–436. [Google Scholar]

- Friedman, M. The Permanent Income Hypothesis: A Theory of the Consumption Function; Princeton University Press: Princeton, NJ, USA, 1957; pp. 20–37. [Google Scholar]

- Leland, H.E. Saving and Uncertainty: The Precautionary Demand for Saving Uncertainty in Economics; Academic Press: Pittsburgh, PA, USA, 1978; pp. 127–139. [Google Scholar]

- Feldstein, M. Social security, induced retirement, and aggregate capital accumulation. J. Political Econ. 1974, 82, 905–926. [Google Scholar] [CrossRef]

- Zant, W. Social security wealth and aggregate consumption: An extended life-cycle model estimated for The Netherlands. De Econ. 1988, 136, 136–153. [Google Scholar] [CrossRef]

- Abel, A.B. Precautionary saving and accidental bequests. Am. Econ. Rev. 1985, 75, 777–791. [Google Scholar]

- Hubbard, R.G.; Skinner, J.; Zeldes, S.P. Precautionary saving and social insurance. J. Political Econ. 1995, 103, 360–399. [Google Scholar] [CrossRef]

- Shim, Y. Comparison in consumption expenditure structure of households by a level of relative deprivation. Korean J. Hum. Ecol. 2016, 25, 39–54. [Google Scholar] [CrossRef]

- Blake, D. The impact of wealth on consumption and retirement behaviour in the UK. Appl. Financ. Econ. 2004, 14, 555–576. [Google Scholar] [CrossRef]

- Leimer, D.R.; Lesnoy, S.D. Social security and private saving: New time-series evidence. J. Political Econ. 1982, 90, 606–629. [Google Scholar] [CrossRef]

- Gale, W.G. The Effects of Pensions on Household Wealth: A Reevaluation of Theory and Evidence. J. Political Econ. 1998, 106, 706–723. [Google Scholar] [CrossRef]

- Cagan, P. The Effect of Pension Plans on Aggregate Saving: Evidence from a Sample Survey; Columbia University Press: New York, NY, USA, 1965; pp. 281–295. [Google Scholar]

- Barro, R.J.; MacDonald, G.M. Social security and consumer spending in an international cross section. J. Public Econ. 1979, 11, 275–289. [Google Scholar] [CrossRef]

- Stephens, M.; Unayama, T. The Impact of Retirement on Household Consumption in Japan. J. Jpn. Int. Econ. 2012, 26, 62–83. [Google Scholar] [CrossRef]

- Zhang, C.; Hong, Z. Social Security, Inclusive Growth and Household Consumption Upgrade. Popul. Dev. 2022, 28, 103–116+58. [Google Scholar]

- Tang, B.; Guo, J. How to Expand Rural Domestic Demand: From the Perspective of Rural Household Consumption. Issues Agric. Econ. 2022, 43, 73–87. [Google Scholar]

- Luo, Y.; Chen, Q. Family Life Cycle, Income Quality and Rural Household Consumption Structure: An Analysis Based on the Family Life Cycle Model from the Perspective of Children’s Heterogeneity. Chin. Rural Econ. 2020, 36, 85–105. [Google Scholar]

- Chen, T. Economic Fluctuations, Precautionary Saving Motive and Excess Sensitivity of Consumption. Stat. Res. 2022, 39, 33–48. [Google Scholar]

- Bruce, N.; Turnovsky, S.J. Social security, growth, and welfare in overlapping generations economies with or without annuities. J. Public Econ. 2013, 101, 12–24. [Google Scholar] [CrossRef]

- Chen, Z.; Liu, Z. Empirical Analysis on the Influence of the New Rural Cooperative Medical Insurance on Rural Residents’ Consumption. J. Xiangtan Univ. (Philos. Soc. Sci. ) 2017, 41, 68–73. [Google Scholar]

- Liu, B.; Liu, L. The Reasonableness of Individual Contribution Standards for Urban and Rural Residents’ Basic Pension Insurance—Based on the Perspective of Individual Pension Needs. Acad. Exch. 2020, 36, 134–142. [Google Scholar]

- Finkelstein, A.; Taubman, S.; Wright, B.; Bernstein, M.; Gruber, J.; Newhouse, J.P.; Allen, H.; Baicker, K.; Oregon Health Study Group. The Oregon health insurance experiment: Evidence from the first year. Q. J. Econ. 2012, 127, 1057–1106. [Google Scholar] [CrossRef]

- Jowett, M.; Contoyannis, P.; Vinh, N.D. The impact of public voluntary health insurance on private health expenditures in Vietnam. Soc. Sci. Med. 2003, 56, 333–342. [Google Scholar] [CrossRef]

- Gao, J.; Ding, J. Can Security for Illness Promote Consumption of Rural Residents? Evidence from Pilot Program of the New Rural Cooperative Major Illness Insurance. Consum. Econ. 2021, 37, 53–62. [Google Scholar]

- Wang, J. A study on the impact of uncertainty and social security on rural residents’ consumption. Rural Econ. 2018, 36, 83–88. [Google Scholar]

- Yin, L.; Zhao, Z.; Zhang, Y. Dose the risk uncertainty perception affect agricultural green production behavior?—Evidence from the agricultural green development going-first area. J. Arid Land Resour. Environ. 2022, 36, 26–32. [Google Scholar]

- Yao, D.; Xu, Y.; Zhang, P. Revisiting China’s “High Savings Rate Puzzle”—Decision Mechanisms and Empirical Facts of Preventive Saving. World Econ. Pap. 2019, 63, 13–36. [Google Scholar]

- Santen, P. Uncertain Pension Income and Household Saving. Rev. Income Wealth 2019, 65, 908–929. [Google Scholar] [CrossRef]

- Chamon, M.D.; Prasad, E.S. Why are saving rates of urban households in China rising? Am. Econ. J. Macroecon. 2010, 2, 93–130. [Google Scholar] [CrossRef]

- Song, M.; Zang, X. Measuring the Importance of Precautionary Saving for China’s Residents—Evidence from Microdata. Economist 2016, 89–97. [Google Scholar]

- Picone, G.; Uribe, M.; Wilson, R.M. The Effect of Uncertainty on the Demand for Medical Care, Health Capital and Wealth. J. Health Econ. 1998, 17, 171–185. [Google Scholar] [CrossRef]

- Chen, X. A Political Economic Analysis of Consumption and Savings—Collaterally Study on China’s Consumption—Savings Policy. Econ. Rev. J. 2018, 34, 11–18+2. [Google Scholar]

- Bansal, R.; Yaron, A. Risks for the long run: A potential resolution of asset pricing puzzles. J. Financ. 2004, 59, 1481–1509. [Google Scholar] [CrossRef]

- Liu, Y.; Li, H. Do China’s Rural Households Exist the Puzzle of the Savings Life Cycle? J. Agrotech. Econ. 2022, 41, 77–90. [Google Scholar]

- Fu, L.; Lv, C. Consumption Upgrade in a Changing World: The Impact of Economic Policy Uncertainty on Consumption Structure. Consum. Econ. 2022, 38, 57–71. [Google Scholar]

- Nie, J.; Wu, Y. Social security contributes to rural revitalization: Foundation, path and enhancement strategy. Rural Econ. 2021, 39, 10–17. [Google Scholar]

- Heckman, J.; Ichimura, H.; Todd, P. Matching as an econometric evaluation estimator. Rev. Econ. Stud. 1998, 65, 261–294. [Google Scholar] [CrossRef]

- Baron, R.; Kenny, D. The moderator–mediator variable distinction in social psychological research: Conceptual, strategic, and statistical considerations. J. Personal. Soc. Psychol. 1986, 51, 1173–1182. [Google Scholar] [CrossRef]

- Engels, F. Dialectics of Nature; Wellred Books: London, UK, 1960. [Google Scholar]

- Zhu, Y.; Zhang, B.; Ma, Y. The Influence of Rural Labor Mobility on Household Consumption Structure. Consum. Econ. 2022, 38, 52–63. [Google Scholar]

- Cantoni, D.; Chen, Y.; Yang, D.; Yuchtman, N.; Zhang, Y.J. Curriculum and ideology. J. Political Econ. 2017, 125, 338–392. [Google Scholar] [CrossRef]

| Variable | Mean | Std. Dev. | Min | Max | Description |

|---|---|---|---|---|---|

| Age | 43.892 | 16.689 | 16 | 93 | Actual age at the time of interview |

| CS | 0.242 | 0.428 | 0 | 1 | 1 = insured; 0 = non-insured |

| Gender | 1.507 | 0.5 | 0 | 1 | 0 = male; 1 = female |

| Register | 1.238 | 0.426 | 0 | 1 | 0 = agricultural; 1 = non-agricultural |

| Marriage | 2.064 | 0.914 | 1 | 5 | 1 = unmarried; 2 = married; 3 = cohabiting; 4 = divorced; 5 = widowed |

| Health | 3.072 | 1.228 | 1 | 5 | 1 = very healthy; 2 = healthy; 3 = comparative healthy; 4 = general; 5 = unhealthy |

| Edu | 7.405 | 5.051 | 0 | 23 | Respondents’ years of education in that year |

| Income | 9.183 | 1.368 | −1.099 | 15.549 | Taking its logarithm |

| Save | 7.745 | 3.740 | 0 | 15.425 | Taking its logarithm |

| CSU | 1.565 | 0.495 | 0.180 | 6.212 |

| Variable | Unmatched Matched | Mean | Bias (%) | Reduct |Bias| (%) | t | p | |

|---|---|---|---|---|---|---|---|

| Treated | Control | ||||||

| Region | U | 40.315 | 37.385 | 18.9 | 83.2 | 10.35 | 0.000 |

| M | 40.315 | 39.824 | 3.2 | 1.38 | 0.167 | ||

| Gender | U | 0.4738 | 0.49945 | −5.1 | 77.2 | −2.74 | 0.006 |

| M | 0.4738 | 0.46794 | 1.2 | 0.51 | 0.611 | ||

| Age | U | 45.043 | 43.525 | 10.0 | 60.9 | 4.86 | 0.000 |

| M | 45.043 | 45.636 | −3.9 | −1.67 | 0.095 | ||

| Register | U | 1.0692 | 1.6066 | −76.8 | 100.0 | −34.97 | 0.000 |

| M | 1.0692 | 1.0692 | 0.0 | 0.00 | 1.000 | ||

| Marriage | U | 2.0992 | 2.0525 | 5.5 | 63.0 | 2.73 | 0.006 |

| M | 2.0992 | 2.1165 | −2.0 | −0.85 | 0.395 | ||

| Health | U | 3.1242 | 3.0557 | 5.6 | 80.6 | 2.98 | 0.003 |

| M | 3.1242 | 3.1375 | −1.1 | −0.46 | 0.644 | ||

| Edu | U | 6.5084 | 7.6908 | −24.7 | 89.2 | −12.56 | 0.000 |

| M | 6.5084 | 6.3804 | 2.7 | 1.18 | 0.237 | ||

| Variables | (1) | (2) | (3) | (4) |

|---|---|---|---|---|

| CS × Time | 0.202 *** (0.014) | 0.154 *** (0.014) | 0.176 ** (0.080) | 0.161 ** (0.082) |

| Age | −0.003 *** (0.001) | −0.006 (0.069) | ||

| Gender | 0.046 *** (0.013) | |||

| Marriage | −0.008 (0.008) | −0.034 (0.059) | ||

| Health | 0.012 ** (0.005) | −0.018 (0.029) | ||

| Register | 0.047 (0.030) | 0.307 (0.272) | ||

| Edu | 0.013 *** (0.002) | −0.035 * (0.020) | ||

| Income | 0.072 *** (0.005) | 0.017 (0.029) | ||

| -Cons | 1.482 *** (0.008) | 0.773 *** (0.064) | 1.410 *** (0.021) | 1.518 (2.912) |

| Individual fixed effects | NO | NO | YES | YES |

| Time fixed effects | NO | NO | YES | YES |

| N | 5159 | 5159 | 5159 | 5159 |

| R2 | 0.158 | 0.127 | 0.182 | 0.199 |

| Prob > F | 0.000 | 0.000 | 0.000 | 0.000 |

| Variables | Benchmark Regression | Mediation Effects | |

|---|---|---|---|

| CSU (5) | Save (6) | CSU (7) | |

| CS | 0.0515 *** (0.0125) | −0.2193 ** (0.1037) | 0.0524 *** (0.0125) |

| Save | 0.0042 ** (0.0017) | ||

| Age | −0.0031 *** (0.0005) | −0.0047 (0.0044) | −0.0031 *** (0.0005) |

| Gender | 0.0431 *** (0.0130) | 0.2277 ** (0.1082) | 0.0421 *** (0.0130) |

| Marriage | −0.0057 (0.0081) | −0.1485 ** (0.0679) | −0.0050 (0.0081) |

| Health | 0.1010 * (0.0054) | −0.1141 ** (0.0451) | 0.0106 * (0.0054) |

| Register | 0.0523 * (0.0304) | 0.7181 *** (0.2537) | 0.0493 (0.0305) |

| Edu | 0.0136 *** (0.0016) | 0.0144 (0.0137) | 0.0136 *** (0.0016) |

| Income | 0.0826 *** (0.0052) | 0.3262 *** (0.0437) | 0.0812 *** (0.0053) |

| -Cons | 0.6745 *** (0.0649) | 4.3204 *** (0.5402) | 0.6565 *** (0.0652) |

| N | 5159 | 5159 | 5159 |

| 0.1202 | 0.0261 | 0.1213 | |

| Matching Method | Unmatched Matched | Experimental Group | Control Group | ATT | S.E. | t |

|---|---|---|---|---|---|---|

| K-nearest neighbor matching (K = 1) | U | 1.572 | 1.562 | 0.010 | 0.009 | 1.06 |

| M | 1.572 | 1.519 | 0.053 | 0.013 | 4.13 | |

| K-nearest neighbor matching (K = 4) | U | 1.572 | 1.562 | 0.010 | 0.009 | 1.06 |

| M | 1.572 | 1.522 | 0.05 | 0.01 | 4.9 | |

| Radius matching (R = 0.01) | U | 1.572 | 1.562 | 0.010 | 0.009 | 1.06 |

| M | 1.572 | 1.527 | 0.045 | 0.009 | 4.82 | |

| Kernel matching | U | 1.572 | 1.562 | 0.010 | 0.009 | 1.06 |

| M | 1.572 | 1.524 | 0.048 | 0.009 | 5.22 |

| Variables | ≤60 (8) | >60 (9) |

|---|---|---|

| DID | 0.1673 * (0.0897) | 0.5688 * (0.2593) |

| Age | −0.0049 (0.0702) | 0.0285 (0.0493) |

| Gender | ||

| Marriage | −0.0591 (0.0764) | −0.0713 (0.0941) |

| Health | −0.0149 (0.0321) | −0.1131 (0.1311) |

| Register | 0.3224 (0.2778) | |

| Edu | −0.0304 (0.0226) | 0.4337 (0.2902) |

| Income | 0.0181 (0.0309) | 0.0059 (0.1640) |

| -Cons | 1.1495 (2.6681) | −1.279 (2.3420) |

| Time fixed effects | YES | YES |

| Individual fixed effects | YES | YES |

| N | 4386 | 773 |

| 0.0264 | 0.0052 |

| Variables | East (10) | Central (11) | West (12) |

|---|---|---|---|

| DID | 0.1438 (0.1291) | 0.0707 (0.1754) | 0.2840 * (0.1542) |

| Age | 0.2579 (0.6114) | 0.0455 * (0.0241) | −0.0049 (0.0720) |

| Gender | |||

| Marriage | −0.0608 (0.1000) | 0.0542 (0.1034) | −0.0161 (0.1159) |

| Health | −0.0085 (0.0435) | −0.0517 (0.0615) | −0.0021 (0.0567) |

| Register | 0.3069 (0.4426) | 0.0951 (0.3709) | |

| Edu | −0.0124 (0.0302) | −0.0305 (0.0642) | −0.0167 (0.0353) |

| Income | −0.0042 (0.0462) | 0.0648 (0.0627) | 0.0734 (0.0536) |

| -Cons | −9.3226 (26.2546) | −1.2198 (1.0644) | 1.0158 (3.0050) |

| Time fixed effects | YES | YES | YES |

| Individual fixed effects | YES | YES | YES |

| N | 1778 | 1425 | 1956 |

| 0.0958 | 0.0387 | 0.0602 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Hong, M.; Wang, J.; Tian, M. Rural Social Security, Precautionary Savings, and the Upgrading of Rural Residents’ Consumption Structure in China. Sustainability 2022, 14, 12455. https://doi.org/10.3390/su141912455

Hong M, Wang J, Tian M. Rural Social Security, Precautionary Savings, and the Upgrading of Rural Residents’ Consumption Structure in China. Sustainability. 2022; 14(19):12455. https://doi.org/10.3390/su141912455

Chicago/Turabian StyleHong, Mingyong, Ji Wang, and Mengjie Tian. 2022. "Rural Social Security, Precautionary Savings, and the Upgrading of Rural Residents’ Consumption Structure in China" Sustainability 14, no. 19: 12455. https://doi.org/10.3390/su141912455

APA StyleHong, M., Wang, J., & Tian, M. (2022). Rural Social Security, Precautionary Savings, and the Upgrading of Rural Residents’ Consumption Structure in China. Sustainability, 14(19), 12455. https://doi.org/10.3390/su141912455