Environmental Regulation and Green Technology Innovation: Evidence from China’s Heavily Polluting Companies

Abstract

:1. Introduction

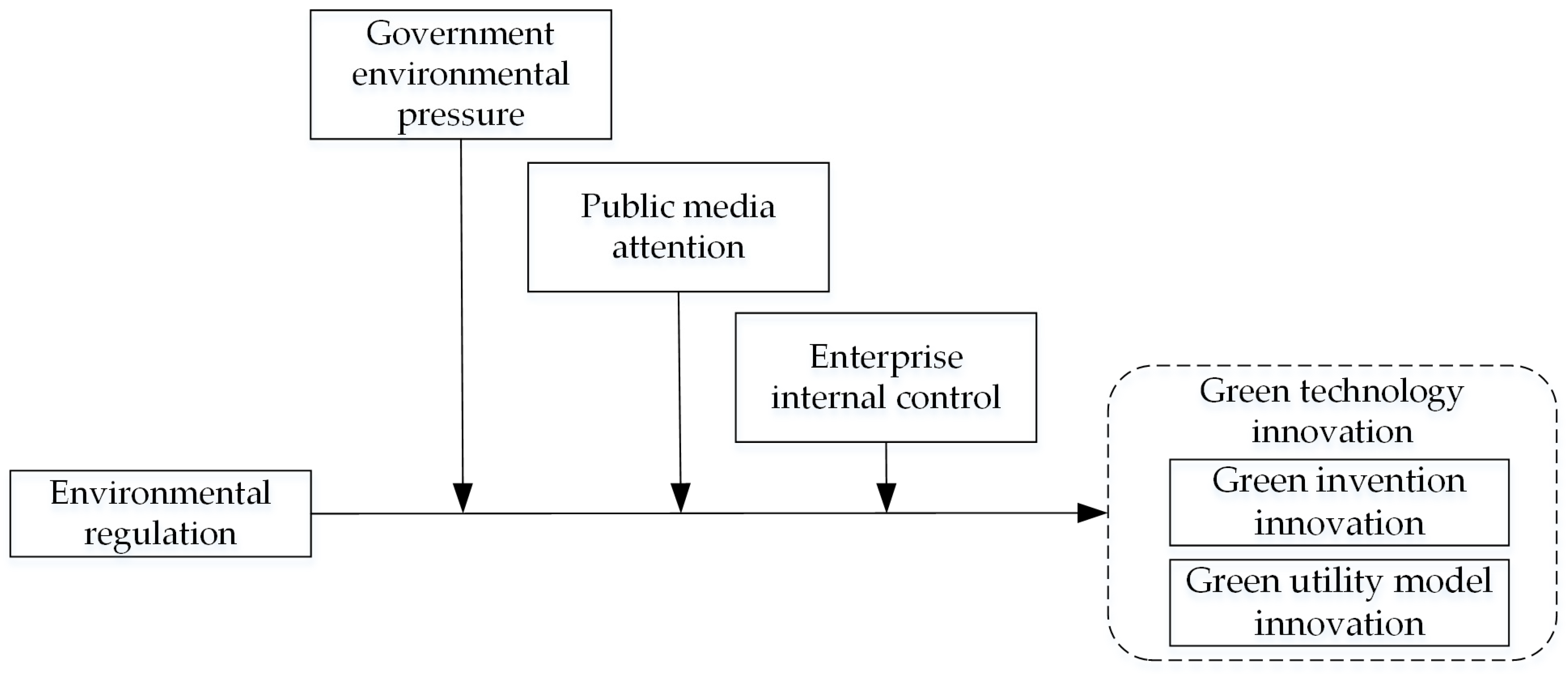

2. Theoretical Analysis and Research Hypotheses

2.1. Environmental Regulation and Corporate Green Innovation

2.2. Moderating Role of Government–Public–Firm Supervision

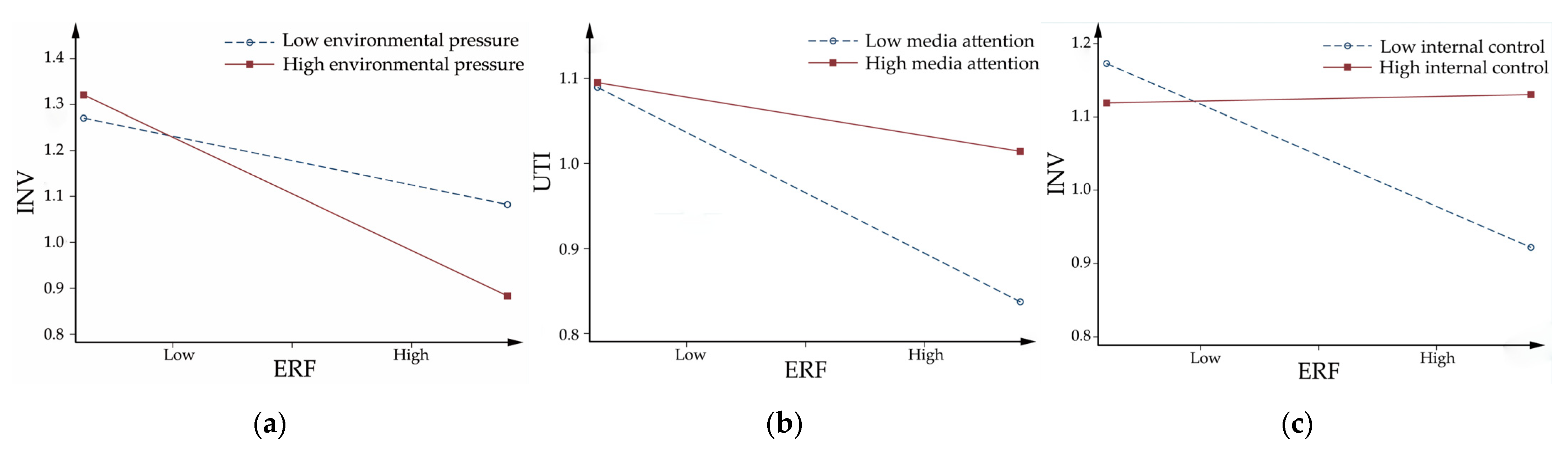

2.2.1. Moderating Effect of Government Environmental Pressure

2.2.2. Moderating Effect of Public Media Attention

2.2.3. Moderating Effect of Enterprise Internal Control

3. Research Design

3.1. Sample Selection and Data Sources

3.2. Variable Definitions

3.2.1. Dependent Variables

3.2.2. Independent Variable

3.2.3. Moderators

3.2.4. Control Variables

3.3. Research Model

4. Empirical Results and Analysis

4.1. Correlation Analysis

4.2. Regression Analysis

4.2.1. Role of Environmental Regulation

4.2.2. Moderating Effect of Government–Public–Firm Level

| INV | UTI | ERF | AIR | MED | IC | SIZE | AGE | FV | |

|---|---|---|---|---|---|---|---|---|---|

| INV | 1 | ||||||||

| UTI | 0.600 *** | 1 | |||||||

| ERF | −0.122 *** | −0.152 *** | 1 | ||||||

| AIR | 0.049 * | 0.0300 | −0.082 *** | 1 | |||||

| MED | 0.190 *** | 0.261 *** | −0.027 | 1 | 0.100 *** | ||||

| IC | −0.032 | −0.013 | −0.009 | 1 | 0.137 *** | 0.0530 | |||

| SIZE | 0.410 *** | 0.432 *** | −0.184 *** | −0.015 | 0.524 *** | 0.132 *** | 1 | ||

| AGE | 0.157 *** | 0.176 *** | −0.093 *** | −0.240 *** | 0.166 *** | −0.0310 | 0.458 *** | 1 | |

| TOBIN | −0.041 | −0.051* | 0.139 *** | −0.069 * | 0.092 *** | −0.088 *** | −0.216 *** | 0.019 | 1 |

| CEO | −0.150 *** | −0.171 *** | 0.213 *** | −0.032 | −0.056 * | −0.004 | −0.120 *** | −0.144 *** | 0.057 * |

| PAY | −0.114 *** | −0.111 *** | 0.193 *** | 0.001 | −0.192 *** | 0.015 | −0.331 *** | −0.386 *** | −0.028 |

| INS | 0.212 *** | 0.194 *** | −0.198 *** | −0.030 | 0.281 *** | 0.104 *** | 0.508 *** | 0.394 *** | −0.087 *** |

| MANG | −0.099 *** | −0.140 *** | 0.283 *** | 0.058 * | −0.080 *** | −0.033 | −0.269 *** | −0.395 *** | 0.030 |

| BOARD | 0.271 *** | 0.270 *** | −0.027 | 0.041 | 0.224 *** | 0.087 *** | 0.389 *** | 0.213 *** | −0.046 |

| ROA | −0.064 ** | −0.033 | 0.039 | −0.023 | 0.094 *** | 0.205 *** | −0.066 ** | −0.119 *** | 0.098 *** |

| HHI | −0.071 ** | 0.0200 | −0.137 *** | −0.058 * | 0.061 ** | 0.019 | 0.118 *** | 0.210 *** | −0.010 |

| FIRST | 0.072 ** | 0.052 * | −0.073 ** | 0.071 ** | 0.173 *** | 0.086 *** | 0.230 *** | 0.122 *** | −0.088 *** |

| CEO | PAY | INS | MANG | BOARD | ROA | HHI | FIRST | VIF | |

| INV | − | ||||||||

| UTI | − | ||||||||

| ERF | 1.130 | ||||||||

| AIR | 1.140 | ||||||||

| MED | 1.520 | ||||||||

| IC | 1.080 | ||||||||

| SIZE | 2.350 | ||||||||

| AGE | 1.640 | ||||||||

| TOBIN | 1.180 | ||||||||

| CEO | 1 | 1.150 | |||||||

| PAY | 0.130 *** | 1 | 1.220 | ||||||

| INS | −0.155 *** | −0.183 *** | 1 | 2.560 | |||||

| MANG | 0.300 *** | 0.282 *** | −0.452 *** | 1 | 1.460 | ||||

| BOARD | −0.149 *** | −0.075 ** | 0.270 *** | −0.155 *** | 1 | 1.270 | |||

| ROA | 0.031 | 0.175 *** | −0.079 *** | 0.109 *** | −0.040 | 1 | 1.140 | ||

| HHI | −0.079 *** | −0.039 | 0.218 *** | −0.153 *** | 0.014 | −0.026 | 1 | 1.090 | |

| FIRST | −0.071 ** | −0.009 | 0.572 *** | −0.084 *** | 0.061 ** | −0.021 | 0.146 *** | 1 | 1.640 |

| INV | UTI | INV | UTI | INV | UTI | |

|---|---|---|---|---|---|---|

| ERF | −0.835 *** (−3.23) | −0.667 *** (−2.76) | −0.590 *** (−2.65) | −0.355 * (−1.68) | −0.649 *** (−2.97) | −0.387 * (−1.90) |

| Constant | −0.139 (−1.03) | −0.0385 (−0.32) | −17.23 *** (−8.90) | −15.47 *** (−9.15) | −15.50 *** (−8.06) | −14.27 *** (−8.59) |

| Controls | No | No | Yes | Yes | Yes | Yes |

| Year | No | No | No | No | Yes | Yes |

| rho | 0.517 | 0.444 | 0.448 | 0.332 | 0.440 | 0.350 |

| Log-likelihood | −1119.0 | −1185.9 | −1049.0 | −1115.8 | −1028.8 | −1066.4 |

| Prob > chi2 | 0.0012 | 0.0058 | 0.0000 | 0.0000 | 0.0000 | 0.0000 |

| N | 1130 | 1130 | 1130 | 1130 | 1130 | 1130 |

| (1) | (2) | (3) | (4) | (5) | (6) | |

|---|---|---|---|---|---|---|

| INV | UTI | INV | UTI | INV | UTI | |

| ERF | −1.233 *** (−3.42) | −0.397 (−1.46) | −0.616 *** (−2.76) | −0.672 ** (−2.51) | −0.507 ** (−2.19) | −0.390 * (−1.79) |

| AIR | −0.00458 | 0.000109 | ||||

| (−1.41) | (0.04) | |||||

| ERF*AIR | −0.0175 ** (−2.09) | −0.00285 (−0.41) | ||||

| MED | −0.00598 (−0.08) | 0.153 ** (2.19) | ||||

| ERF*MED | −0.136 (−0.67) | 0.395 * (1.87) | ||||

| IC | 1.649 ** (2.33) | 0.213 (0.38) | ||||

| ERF*IC | 7.229 * (1.79) | −0.354 (−0.33) | ||||

| Constant | −16.38 *** (−7.25) | −14.89 *** (−7.59) | −15.66 *** (−7.43) | −12.73 *** (−6.93) | −15.98 *** (−8.26) | −14.32 *** (−8.50) |

| Controls | Yes | Yes | Yes | Yes | Yes | Yes |

| Year | Yes | Yes | Yes | Yes | Yes | Yes |

| rho | 0.460 | 0.388 | 0.438 | 0.344 | 0.448 | 0.364 |

| Log-likelihood | −792.3 | −819.0 | −1028.6 | −1062.3 | −1017.6 | −1055.1 |

| Prob > chi2 | 0.0000 | 0.0000 | 0.0000 | 0.0000 | 0.0000 | 0.0000 |

| N | 814 | 814 | 1130 | 1130 | 1121 | 1121 |

4.2.3. Robustness Test

| (1) | (2) | (3) | (4) | (5) | (6) | |

|---|---|---|---|---|---|---|

| INV | UTI | INV | UTI | INV | UTI | |

| L.INV | 0.634 *** (6.97) | |||||

| L.UTI | 0.432 *** (5.80) | |||||

| ERF | −0.322 * (−1.85) | −0.399 ** (−2.25) | −0.394 * (−1.80) | −0.597 ** (−2.52) | ||

| L.ERF | −0.441 ** (−2.05) | −0.658 *** (−2.84) | ||||

| Constant | −9.890 *** (−6.20) | −11.18 *** (−7.38) | −15.97 *** (−7.97) | −14.81 *** (−8.57) | −13.81 *** (−6.96) | −13.61 *** (−8.00) |

| Controls | Yes | Yes | Yes | Yes | Yes | Yes |

| Year | Yes | Yes | Yes | Yes | Yes | Yes |

| N | 1017 | 1017 | 1017 | 1017 | 1017 | 1017 |

| (1) | (2) | (3) | (4) | (5) | (6) | |

|---|---|---|---|---|---|---|

| INV | UTI | INV | UTI | INV_raw | UTIN_raw | |

| ERF | −0.709 ** (−2.47) | −0.772 *** (−2.76) | −0.590 ** (−2.46) | −0.498 ** (−2.15) | −0.664 ** (−2.52) | −0.913 *** (−2.86) |

| L.RDE | 7.367 (1.08) | 4.285 (0.65) | ||||

| L2.RDE | 3.199 (0.47) | −0.595 (−0.09) | ||||

| Constant | −15.26 *** (−8.05) | −13.89 *** (−8.45) | −17.28 *** (−7.29) | −17.03 *** (−7.89) | −16.19 *** (−8.78) | −14.01 *** (−8.57) |

| Controls | Yes | Yes | Yes | Yes | Yes | Yes |

| Year | Yes | Yes | Yes | Yes | Yes | Yes |

| N | 1130 | 1130 | 571 | 571 | 1130 | 1130 |

5. Discussion and Conclusions

5.1. Research Conclusions

5.2. Theoretical Contributions

5.3. Practical Insights

5.4. Limitations

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Appendix A

| Type | Variable | Abbreviation | Definition or Measurement |

|---|---|---|---|

| Dependent variable | Green invention innovation | INV | Number of green-invention patents applied for in year t plus one and taken as a logarithm |

| Green utility-model innovation | UTI | Number of green utility model patents applied for in year t plus one and taken as a logarithm | |

| Independent variable | Environmental regulation of the firm | ERF | Ratio of environmental management expenses to the main business revenue of the enterprise in year t |

| Moderator | Environmental pressure | AIR | Average air-quality index of the firm’s location |

| Media attention | MED | Logarithm of the total number of online media reports plus one in year t | |

| Internal control | IC | Logarithm of the internal control index of the company plus one in year t | |

| Control variable | Enterprise size | SIZE | Logarithm of total assets |

| Listing age | AGE | Firm’s listing age plus one and taken as a logarithm | |

| Market performance | TOBIN | Logarithm of Tobin’s Q | |

| Two jobs in one | CEO | Whether the chairperson and CEO are the same person: 1 for yes and 0 for no | |

| Solvency | PAY | Ending balance of corporate cash and cash equivalents divided by current liabilities | |

| Institutional shareholding | INS | Institutional shareholding ratio | |

| Executive shareholding | MANG | Executive shareholding ratio | |

| Board size | BOARD | Total number of board members | |

| Profitability | ROA | Firm’s return on total assets | |

| Industry competition | HHI | Herfindahl–Hirschman Index (HHI), calculated by using operating income | |

| Equity concentration | FIRST | Percentage of largest shareholder | |

| Year | YEAR | Year dummy variable |

References

- Raworth, K. A Doughnut for the Anthropocene: Humanity’s Compass in the 21st Century. Lancet Planet. Health 2017, 1, e48–e49. [Google Scholar] [CrossRef]

- Van Den Bergh, J.C. A Third Option for Climate Policy within Potential Limits to Growth. Nat. Clim. Chang. 2017, 7, 107–112. [Google Scholar] [CrossRef]

- Hickel, J.; Brockway, P.; Kallis, G.; Keyßer, L.; Lenzen, M.; Slameršak, A.; Steinberger, J.; Ürge-Vorsatz, D. Urgent Need for Post-Growth Climate Mitigation Scenarios. Nat. Energy 2021, 6, 766–768. [Google Scholar] [CrossRef]

- Jaffe, A.B.; Palmer, K. Environmental Regulation and Innovation: A Panel Data Study. Rev. Econ. Stat. 1997, 79, 610–619. [Google Scholar] [CrossRef]

- Suk, W.A.; Heacock, M.L.; Trottier, B.A.; Amolegbe, S.M.; Avakian, M.D.; Henry, H.F.; Carlin, D.J.; Reed, L.G. Assessing the Economic and Societal Benefits of SRP-Funded Research. Environ. Health Perspect. 2018, 126, 065002. [Google Scholar] [CrossRef] [PubMed]

- Nicole, W. Unbalanced Burden? Potential Population-Level Health Risks and Benefits of Superfund Cleanup. Environ. Health Perspect. 2020, 128, 084003. [Google Scholar] [CrossRef] [PubMed]

- Cai, X.; Zhu, B.; Zhang, H.; Li, L.; Xie, M. Can Direct Environmental Regulation Promote Green Technology Innovation in Heavily Polluting Industries? Evidence from Chinese Listed Companies. Sci. Total Environ. 2020, 746, 140810. [Google Scholar] [CrossRef]

- Hu, J.; Pan, X.; Huang, Q. Quantity or Quality? The Impacts of Environmental Regulation on Firms’ Innovation–Quasi-Natural Experiment Based on China’s Carbon Emissions Trading Pilot. Technol. Forecast. Soc. Change 2020, 158, 120122. [Google Scholar] [CrossRef]

- He, Y.; Ding, X.; Yang, C. Do Environmental Regulations and Financial Constraints Stimulate Corporate Technological Innovation? Evidence from China. J. Asian Econ. 2021, 72, 101265. [Google Scholar] [CrossRef]

- Wu, W.; Liu, Y.; Wu, C.-H.; Tsai, S.-B. An Empirical Study on Government Direct Environmental Regulation and Heterogeneous Innovation Investment. J. Clean. Prod. 2020, 254, 120079. [Google Scholar] [CrossRef]

- Zhang, Y.; Hu, H.; Zhu, G.; You, D. The Impact of Environmental Regulation on Enterprises’ Green Innovation under the Constraint of External Financing: Evidence from China’s Industrial Firms. Environ. Sci. Pollut. Res. 2022, 29, 1–22. [Google Scholar] [CrossRef]

- Zhu, Y.; Sun, Z.; Zhang, S.; Wang, X. Economic Policy Uncertainty, Environmental Regulation, and Green Innovation—An Empirical Study Based on Chinese High-Tech Enterprises. Int. J. Environ. Res. Public Health 2021, 18, 9503. [Google Scholar] [CrossRef]

- Ouyang, X.; Li, Q.; Du, K. How Does Environmental Regulation Promote Technological Innovations in the Industrial Sector? Evidence from Chinese Provincial Panel Data. Energy Policy 2020, 139, 111310. [Google Scholar] [CrossRef]

- Guo, Y.; Xia, X.; Zhang, S.; Zhang, D. Environmental Regulation, Government R&D Funding and Green Technology Innovation: Evidence from China Provincial Data. Sustainability 2018, 10, 940. [Google Scholar] [CrossRef]

- Song, M.; Wang, S.; Zhang, H. Could Environmental Regulation and R&D Tax Incentives Affect Green Product Innovation? J. Clean. Prod. 2020, 258, 120849. [Google Scholar] [CrossRef]

- Pan, X.; Cheng, W.; Gao, Y.; Balezentis, T.; Shen, Z. Is Environmental Regulation Effective in Promoting the Quantity and Quality of Green Innovation? Environ. Sci. Pollut. Res. 2021, 28, 6232–6241. [Google Scholar] [CrossRef]

- Zhou, Q.; Song, Y.; Wan, N.; Zhang, X. Non-Linear Effects of Environmental Regulation and Innovation – Spatial Interaction Evidence from the Yangtze River Delta in China. Environ. Sci. Policy 2020, 114, 263–274. [Google Scholar] [CrossRef]

- Shao, S.; Hu, Z.; Cao, J.; Yang, L.; Guan, D. Environmental Regulation and Enterprise Innovation: A Review. Bus. Strateg. Environ. 2020, 29, 1465–1478. [Google Scholar] [CrossRef]

- Zhu, X.; Zuo, X.; Li, H. The Dual Effects of Heterogeneous Environmental Regulation on the Technological Innovation of Chinese Steel Enterprises—Based on a High-Dimensional Fixed Effects Model. Ecol. Econ. 2021, 188, 107113. [Google Scholar] [CrossRef]

- Rugman, A.M.; Verbeke, A. Corporate Strategies and Environmental Regulations: An Organizing Framework. Strateg. Manag. J. 1998, 19, 363–375. [Google Scholar] [CrossRef]

- Porter, M.E.; Van der Linde, C. Toward a New Conception of the Environment-Competitiveness Relationship. J. Econ. Perspect. 1995, 9, 97–118. [Google Scholar] [CrossRef]

- Xie, D. Local Supervision, Vertical Supervision and Corporate Environmental Protection Investment—An Empirical Study Based on Listed A-share Heavily Polluting Enterprises. Account. Res. 2020, 41, 170–186. [Google Scholar]

- Dal Maso, L.; Mazzi, F.; Soscia, M.; Terzani, S. The Moderating Role of Stakeholder Management and Societal Characteristics in the Relationship between Corporate Environmental and Financial Performance. J. Environ. Manag. 2018, 218, 322–332. [Google Scholar] [CrossRef]

- Ullah, A.; Zhao, X.; Abdul Kamal, M.; Zheng, J. Environmental Regulations and Inward FDI in China: Fresh Evidence from the Asymmetric Autoregressive Distributed Lag Approach. Int. J. Financ. Econ. 2022, 27, 1340–1356. [Google Scholar] [CrossRef]

- Du, Y.; Li, Z.; Du, J.; Li, N.; Yan, B. Public Environmental Appeal and Innovation of Heavy-Polluting Enterprises. J. Clean. Prod. 2019, 222, 1009–1022. [Google Scholar] [CrossRef]

- Kamal, M.A.; Ullah, A.; Qureshi, F.; Zheng, J.; Ahamd, M. China’s Outward FDI and Environmental Sustainability in Belt and Road Countries: Does the Quality of Institutions Matter? J. Environ. Plan. Manag. 2021, 64, 1–35. [Google Scholar] [CrossRef]

- Bednar, M.K. Watchdog or Lapdog? A Behavioral View of the Media as a Corporate Governance Mechanism. Acad. Manag. J. 2012, 55, 131–150. [Google Scholar] [CrossRef]

- Su, Y.; Fan, Q. Renewable Energy Technology Innovation, Industrial Structure Upgrading and Green Development from the Perspective of China’s Provinces. Technol. Forecast. Soc. Chang. 2022, 180, 121727. [Google Scholar] [CrossRef]

- Chan, K.C.; Chen, Y.; Liu, B. The Linear and Non-Linear Effects of Internal Control and Its Five Components on Corporate Innovation: Evidence from Chinese Firms Using the COSO Framework. Eur. Account. Rev. 2021, 30, 733–765. [Google Scholar] [CrossRef]

- Tang, C.; Xu, Y.; Hao, Y.; Wu, H.; Xue, Y. What Is the Role of Telecommunications Infrastructure Construction in Green Technology Innovation? A Firm-Level Analysis for China. Energy Econ. 2021, 103, 105576. [Google Scholar] [CrossRef]

- Ye, C.; Wang, Z.; Wu, J.; Li, H. External Governance, Environmental Information Disclosure and the Cost of Equity Financing. Nankai Bus. Rev. 2015, 18, 85–96. [Google Scholar]

- Zhang, Q.; Yu, Z.; Kong, D. The Real Effect of Legal Institutions: Environmental Courts and Firm Environmental Protection Expenditure. J. Environ. Econ. Manag. 2019, 98, 102254. [Google Scholar] [CrossRef]

- Luo, Y.; Chen, Y.; Lin, J.-C. Does Air Quality Affect Inventor Productivity? Evidence from the NOx Budget Program. J. Corp. Financ. 2022, 73, 102170. [Google Scholar] [CrossRef]

- Tan, Z.; Yan, L. Does Air Pollution Impede Corporate Innovation? Int. Rev. Econ. Financ. 2021, 76, 937–951. [Google Scholar] [CrossRef]

- Zhu, C.; Lee, C.-C. The Internal and External Effects of Air Pollution on Innovation in China. Environ. Sci. Pollut. Res. 2021, 28, 9462–9474. [Google Scholar] [CrossRef] [PubMed]

- Song, X.; Jiang, X.; Han, J.; Zhao, C.; Guo, Y.; Yu, Z. Research on the Value Effect of Enterprise Carbon Information Disclosure—Based on the Adjustment of Public Pressure. Account. Res. 2019, 40, 78–84. [Google Scholar]

- Wang, F.; Xu, L.; Zhang, J.; Shu, W. Political Connections, Internal Control and Firm Value: Evidence from China’s Anti-Corruption Campaign. J. Bus. Res. 2018, 86, 53–67. [Google Scholar] [CrossRef]

- Wu, J.; Xia, Q.; Li, Z. Green Innovation and Enterprise Green Total Factor Productivity at a Micro Level: A Perspective of Technical Distance. J. Clean. Prod. 2022, 344, 131070. [Google Scholar] [CrossRef]

- Xiang, X.; Liu, C.; Yang, M. Who Is Financing Corporate Green Innovation? Int. Rev. Econ. Financ. 2022, 78, 321–337. [Google Scholar] [CrossRef]

- Roper, S.; Hewitt-Dundas, N. Knowledge Stocks, Knowledge Flows and Innovation: Evidence from Matched Patents and Innovation Panel Data. Res. Policy 2015, 44, 1327–1340. [Google Scholar] [CrossRef]

- Ardito, L.; Messeni Petruzzelli, A.; Pascucci, F.; Peruffo, E. Inter-Firm R&D Collaborations and Green Innovation Value: The Role of Family Firms’ Involvement and the Moderating Effects of Proximity Dimensions. Bus. Strateg. Environ. 2019, 28, 185–197. [Google Scholar] [CrossRef]

- Wang, C.; Hu, Q. Knowledge Sharing in Supply Chain Networks: Effects of Collaborative Innovation Activities and Capability on Innovation Performance. Technovation 2020, 94, 102010. [Google Scholar] [CrossRef]

- Wooldridge, J.M. Econometric Analysis of Cross Section and Panel Data, 2nd ed.; MIT Press: London, UK, 2010; pp. 777–851. [Google Scholar]

- Liu, J.; Zhao, M.; Wang, Y. Impacts of Government Subsidies and Environmental Regulations on Green Process Innovation: A Nonlinear Approach. Technol. Soc. 2020, 63, 101417. [Google Scholar] [CrossRef]

- Zhang, Y.; Xing, C.; Zhang, Y. The Impact of Media Coverage on Green Technology Innovation of High-Polluting Enterprises. Chin. J. Manag. 2021, 18, 557–568. [Google Scholar]

- Tian, G.; Li, S. Economic Policy Uncertainty and the Creation of Bank Liquidity: Empirical Evidence from China. Econ. Res. J. 2020, 55, 19–35. [Google Scholar]

- Huang, J.; Xu, Z.; Xu, S. Land Price Distortion, Enterprises’ Property and Over-investment—An Empirical Research Based on the Data of Chinese Industrial Enterprises and Land Price of Cities in China. China Ind. Econ. 2015, 33, 57–69. [Google Scholar] [CrossRef]

- Li, Y.; Liu, Y.; Xie, F. Technology Directors and Firm Innovation. J. Multinatl. Financ. Manag. 2019, 50, 76–88. [Google Scholar] [CrossRef]

- Kamal, M.A.; Hasanat Shah, S.; Jing, W.; Hasnat, H. Does the Quality of Institutions in Host Countries Affect the Location Choice of Chinese OFDI: Evidence from Asia and Africa. Emerg. Mark. Financ. Trade 2020, 56, 208–227. [Google Scholar] [CrossRef]

- Tang, H.; Liu, J.; Wu, J. The Impact of Command-and-Control Environmental Regulation on Enterprise Total Factor Productivity: A Quasi-Natural Experiment Based on China’s “Two Control Zone” Policy. J. Clean. Prod. 2020, 254, 120011. [Google Scholar] [CrossRef]

- Cai, W.; Xu, F. The Impact of the New Environmental Protection Law on Eco-Innovation: Evidence from Green Patent Data of Chinese Listed Companies. Environ. Sci. Pollut. Res. 2022, 29, 10047–10062. [Google Scholar] [CrossRef]

- Palmer, K.; Oates, W.; Portney, P. Tightening Environmental Standards—The Benefit-Cost or the No-Cost Paradigm. J. Econ. Perspect. 1995, 9, 119–132. [Google Scholar] [CrossRef]

- Moon, S.-G.; deLeon, P. Contexts and Corporate Voluntary Environmental Behaviors: Examining the EPA’s Green Lights Voluntary Program. Organ. Environ. 2007, 20, 480–496. [Google Scholar] [CrossRef]

- Yang, J.; Shi, D.; Yang, W. Stringent Environmental Regulation and Capital Structure: The Effect of NEPL on Deleveraging the High Polluting Firms. Int. Rev. Econ. Financ. 2022, 79, 643–656. [Google Scholar] [CrossRef]

- Bendig, D.; Foege, J.N.; Endriß, S.; Brettel, M. The Effect of Family Involvement on Innovation Outcomes: The Moderating Role of Board Social Capital. J. Prod. Innov. Manag. 2020, 37, 249–272. [Google Scholar] [CrossRef]

- Zyglidopoulos, S.C.; Georgiadis, A.P.; Carroll, C.E.; Siegel, D.S. Does Media Attention Drive Corporate Social Responsibility? J. Bus. Res. 2012, 65, 1622–1627. [Google Scholar] [CrossRef]

- Liao, Z.; Weng, C.; Shen, C. Can Public Surveillance Promote Corporate Environmental Innovation? The Mediating Role of Environmental Law Enforcement. Sustain. Dev. 2020, 28, 1519–1527. [Google Scholar] [CrossRef]

- Yigitcanlar, T.; Sabatini-Marques, J.; da-Costa, E.M.; Kamruzzaman, M.; Ioppolo, G. Stimulating Technological Innovation through Incentives: Perceptions of Australian and Brazilian Firms. Technol. Forecast. Soc. Chang. 2019, 146, 403–412. [Google Scholar] [CrossRef]

- Bai, Y.; Song, S.; Jiao, J.; Yang, R. The Impacts of Government R&D Subsidies on Green Innovation: Evidence from Chinese Energy-Intensive Firms. J. Clean. Prod. 2019, 233, 819–829. [Google Scholar] [CrossRef]

| Variable | Obs. | Mean | SD | Min | Max |

|---|---|---|---|---|---|

| INV | 1130 | 0.561 | 0.887 | 0 | 5.257 |

| UTI | 1130 | 0.589 | 0.83 | 0 | 4.357 |

| ERF | 1130 | 0.191 | 0.359 | 0 | 4.494 |

| AIR | 814 | 83.403 | 31.011 | 34.038 | 242.692 |

| MED | 1130 | 5.421 | 0.957 | 2.398 | 8.657 |

| IC | 1121 | 0.503 | 0.076 | 0 | 0.676 |

| SIZE | 1130 | 22.874 | 1.243 | 19.973 | 26.037 |

| AGE | 1130 | 2.364 | 0.751 | 0 | 3.332 |

| TOBIN | 1130 | 3.102 | 1.56 | −10.7 | 10.222 |

| CEO | 1130 | 0.161 | 0.368 | 0 | 1 |

| PAY | 1130 | 0.583 | 1.243 | 0.005 | 17.231 |

| INS | 1130 | 0.442 | 0.227 | 0 | 0.971 |

| MANG | 1130 | 0.025 | 0.081 | 0 | 0.662 |

| BOARD | 1130 | 9.251 | 2.071 | 5 | 18 |

| ROA | 1130 | 0.035 | 0.055 | −0.441 | 0.381 |

| HHI | 1130 | 0.117 | 0.101 | 0.015 | 0.718 |

| FIRST | 1130 | 0.361 | 0.149 | 0.084 | 0.9 |

| (1) | (2) | (3) | |

|---|---|---|---|

| INV | UTI | INV | |

| ERF | −1.101 *** (−3.16) | −0.797 *** (−2.82) | −0.490 ** (−2.10) |

| AIR | −0.005 (−1.42) | ||

| ERF*AIR | −0.017 * (−1.68) | ||

| MEDIA | 0.083 (1.48) | ||

| ERF*MEDIA | 0.503 ** (2.49) | ||

| IC | 0.001 ** (2.03) | ||

| ERF*IC | 0.004 * (1.73) | ||

| Constant | −16.34 *** (−7.22) | −13.57 *** (−7.55) | −15.98 *** (−8.26) |

| Controls | Yes | Yes | Yes |

| Year | Yes | Yes | Yes |

| N | 814 | 1130 | 1121 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Lin, Z.; Liang, D.; Li, S. Environmental Regulation and Green Technology Innovation: Evidence from China’s Heavily Polluting Companies. Sustainability 2022, 14, 12180. https://doi.org/10.3390/su141912180

Lin Z, Liang D, Li S. Environmental Regulation and Green Technology Innovation: Evidence from China’s Heavily Polluting Companies. Sustainability. 2022; 14(19):12180. https://doi.org/10.3390/su141912180

Chicago/Turabian StyleLin, Zhouzhou, Dezhi Liang, and Shengnan Li. 2022. "Environmental Regulation and Green Technology Innovation: Evidence from China’s Heavily Polluting Companies" Sustainability 14, no. 19: 12180. https://doi.org/10.3390/su141912180

APA StyleLin, Z., Liang, D., & Li, S. (2022). Environmental Regulation and Green Technology Innovation: Evidence from China’s Heavily Polluting Companies. Sustainability, 14(19), 12180. https://doi.org/10.3390/su141912180