Abstract

Most research on institutional pressure focuses on mature enterprises. However, compared with mature enterprises, new ventures are more sensitive to institutional pressure due to their lack of legitimacy. Based on the theoretical path of “environment–strategy–performance”, this study investigated the influence of institutional pressure on entrepreneurial performance as well as the mediating role of green entrepreneurial orientation and the moderating role of network centrality. An empirical analysis based on 288 survey samples from China showed the following: coercive pressure has not only a direct positive impact but also an indirect positive impact on entrepreneurial performance through green entrepreneurial orientation; normative pressure and mimetic pressure positively affect entrepreneurial performance through green entrepreneurial orientation; green entrepreneurial orientation has a positive impact on entrepreneurial performance; network centrality positively regulates the relationships between coercive pressure, mimetic pressure, normative pressure and green entrepreneurial orientation. The paper concluded by highlighting the importance of the conclusions for new ventures to improve their performance as well as for policy makers to optimize the institutional environment for entrepreneurship.

1. Introduction

Entrepreneurship has always been regarded as an effective way to promote economic development and reduce the unemployment rate. However, the current high failure rate of entrepreneurship should not be ignored. Statistics show that the failure rate of entrepreneurship in China is as high as 80% [1]. This phenomenon has provoked a growing number of studies aimed at revealing the factors that influence entrepreneurial performance [2,3]. Based on organizational strategy theory, resource-based theory and enterprise capability theory, scholars have clarified several organizational factors that affect entrepreneurial performance, such as strategic orientation, entrepreneurial resources and learning ability of new ventures [4,5]. However, the influence of institutional environmental factors on new ventures has been ignored [6].

As a force from the external institutional environment, institutional pressure defines the rationality, acceptability, and support of organizational form, structure, or behavior [7]. Prior research showed that institutional pressure is crucial to the survival and development of enterprises [8] and plays an important role in resource allocation [9] and entrepreneurial decision making [10]. A number of studies have investigated the impact of institutional pressure on enterprise performance. For instance, DiMaggio pointed out that institutional pressure is an important factor affecting firm performance [7]. Colwell et al. [11] asserted that organizational conformity to institutional pressure enhances performance. Dubey et al. [12] concluded that institutional pressure was a very significant factor that contributed to, and improved, the environmental performance of Indian enterprises. Nevertheless, to the best of our knowledge, there is a lack of empirical work within the management literature investigating the influence of institutional pressure on entrepreneurial performance. To address these issues, the purpose of this study was to explore the mechanism of the impact of institutional pressure on entrepreneurial performance.

With the increasing prominence of environmental problems and their growing impact on economic and social development, paying attention to environmental problems related to people’s health and quality of life has been regarded as a core element of business activities [13]. Studies have shown that enterprises’ green practices function as a bridge connecting institutional pressure with performance [14,15]. In that regard, green entrepreneurial orientation may provide unique insights into the important process by which institutional pressure affects entrepreneurial performance. As a strategic orientation derived from entrepreneurship orientation and green entrepreneurship [16], green entrepreneurial orientation is considered as an effective way for new ventures to meet the environmental expectations of stakeholders and improve their competitiveness. Khaire confirmed that through the implementation of green entrepreneurial orientation, new ventures can alleviate the institutional pressure they face, meet the environmental concerns of stakeholders, and improve their legitimacy [17]. Therefore, the influence of institutional pressure on entrepreneurial performance may take effect through the mediating role of green entrepreneurial orientation.

In entrepreneurial practice, however, the strategic orientation varies among new ventures despite being embedded in similar institutional environments. Social network theory states that all economic activities are embedded in the social network. The network position of an enterprise will affect its response to the external environment [5]. As a primary indicator used to measure an enterprise’s network position, network centrality reflects the centrality of the firm’s position or status in the network [18]. Perry pointed out that firms with high network centrality are more likely to access strategic resources with high quality [19]. In addition, such resources are crucial to the implementation of their strategic orientation. Tan’s research showed that focal firms can improve their competitiveness and establish new myths by making full use of network resources and engaging in institutional entrepreneurship [20]. In contrast, Westphal concludes that focal firms in the network tend to comply with institutional pressure due to their higher visibility and greater attention from stakeholders [21]. Such inconsistencies in prior studies point out the need to investigate the moderating role of network centrality that affects the relationships between institutional pressure and green entrepreneurial orientation.

To overcome the limitations of previous studies and bridge the gap between research and practice, this study focused on answering the following three questions: How does institutional pressure affect entrepreneurial performance? What is the role of green entrepreneurial orientation in the impact of institutional pressure on entrepreneurial performance (mediation)? Does network centrality affect the adoption of green entrepreneurial orientation among new ventures under institutional pressure (moderation)? Samples for empirical analysis were collected through a survey from new ventures in China. Based on hierarchical regression analysis methods, bootstrap-based mediating test methods, and data from 288 Chinese new ventures, this study first examined whether and how institutional pressure affects entrepreneurial performance. The results indicate that coercive pressure has a positive impact on entrepreneurial performance that is partly mediated by green entrepreneurial orientation, and green entrepreneurial orientation plays a completely mediating role in the impact of mimetic pressure and normative pressure on entrepreneurial performance. Additionally, based on social network theory, this study investigated the moderating effect of network centrality on the relationship between institutional pressure and green entrepreneurial orientation and confirmed that network centrality amplifies the positive impact of institutional pressure on green entrepreneurial orientation.

The theoretical and practical contributions of this study include the following. First, based on the “environment–strategy–performance” research paradigm, this study reveals the mechanism under which institutional pressure influences entrepreneurial performance. It fills the research gap concerning the lack of attention to institutional pressure in the current research on entrepreneurship, enriching the literature on the influencing factors of green entrepreneurial orientation and entrepreneurial performance. Second, by investigating the mediating effects of green entrepreneurial orientation, this study addresses the critical roles of green entrepreneurial orientation in explaining how institutional environmental factors influence entrepreneurial performance and provides a new explanation for the controversy within the existing research on the effectiveness of a green entrepreneurial orientation. Third, by examining the moderating role of network centrality, this study shows the heterogeneity of new ventures from the perspective of network position, reveals the boundary of institutional pressure affecting green entrepreneurial orientation, and provides a new theoretical explanation for differences in entrepreneurial orientation and entrepreneurial performance across different new ventures embedded in a similar institutional environment.

The rest of the paper is structured as follows: Section 2 discusses the literature review. Section 3 presents the hypotheses and conceptual model. Section 4 and Section 5 describe the empirical study and present the results of the empirical analysis. In Section 6, we discuss our conclusions, implications and limitations.

2. Literature Review

2.1. Institutional Pressure

Institutional theory pays attention to the interactions between organizations and the institutional environment and believes that the institutional environment will affect organizational structures and procedures [7]. Institutional theory claims that pressure from the outside environment and institutions results in homogeneity in organizational structures and behaviors [7]. According to Qian, social concepts, rules, norms, and culture in the institutional environment have an important impact on whether the organizational form, structure, or behavior is reasonable, acceptable, and easily supported. This force is institutional pressure [22]. In line with Suchman, this study defined institutional pressure as a force from the expectations of external stakeholders that facilitates the structure and behavior of the organization to become homogeneous [23]. Regarding the composition, Colwell divided institutional pressure into coercive pressure, normative pressure and mimetic pressure [11]. Specifically, coercive pressure is defined as pressures originating from both formal and informal political influences exerted by organizations on which the focal firm depends [7,12,24]. Normative pressure originates from professionalism and industry-specific norms [7]. Mimetic pressure mainly comes from the competitors of enterprises and drives enterprises to try to imitate the behaviors of other enterprises in uncertain environments [7]. This classification method has been recognized by many scholars [25,26]. Based on the above literature, this study divides institutional pressure into three dimensions to represent the complexity of the institutional pressure faced by new ventures.

Scholars have regarded institutional pressure as an antecedent to study its impact on corporate responsiveness to environmental issues. Additionally, institutional pressures have been assumed to provide enough incentive for firms to adopt green practices. For instance, Shubham et al. [27] found that, as a force from the external environment, institutional pressure improves firms’ absorptive capacity, resulting in corporate environmental practices. According to Zeng et al. [26], institutional pressure promotes the adoption of sustainable supply chain design. Lin et al. [28] confirmed the positive impact of institutional pressure on enterprises’ green innovation behavior. Liao et al. suggested that institutional pressure was associated with the environmental innovation of enterprises [29]. There are also some studies suggesting that institutional pressure is related to corporate performance. For instance, Huo stated that normative and mimetic pressures have a positive impact on the financial performance of Chinese manufacturers through system integration and process integration. Meanwhile, coercive pressure positively affects financial performance with the mediating effect of process integration [30]. Zhu argued that the existence of mimetic pressure significantly improves the economic benefits of the adoption of a number of green supply chain management practices [31]. Most of the existing studies focused on the impact of institutional pressure on mature enterprises, although not enough attention has been paid to the influence of institutional pressure on new ventures.

2.2. Green Entrepreneurial Orientation

In the literature on both entrepreneurship and the environment, green entrepreneurial orientation is one of the youngest and most valuable research topics. The concept of green entrepreneurial orientation is based on the foundation of green entrepreneurial theory and entrepreneurial orientation theory [16]. Covin defined green entrepreneurial orientation as a firm-level, proactive strategic inclination to identify and grasp eco-friendly business opportunities [32]. According to Dean, green entrepreneurial orientation refers to the tendency of enterprises to actively implement green products, services, technology, and process innovation in order to pursue potential opportunities of economic and ecological win–win effects [33]. Based on prior research, this study defines green entrepreneurial orientation as a strategic orientation that reflects the proactive integration of standards for environmental responsibility and sustainability into organizational processes [34]. Regarding the composition, scholars hold different views. For instance, Cohen [35] argued that green entrepreneurial orientation is composed of environmental orientation and social orientation [35]. Becker asserted that green entrepreneurial orientation may have two important characteristics: social and innovative orientation [36]. Furthermore, Arruda believed that green entrepreneurship consists of proactivity and environmental orientation [37]. Based on the above, in this study, we believe that green entrepreneurial orientation has features of environmental orientation, social orientation, innovative orientation, and proactive orientation and regard green entrepreneurial orientation as a unique pattern of organizational strategic decision making.

Scholars have highlighted the influence of green entrepreneurial orientation on performance. According to Guo, green entrepreneurial orientation facilitates the production of green innovative products that will help to enhance sustainable business performance [16]. Simone et al. pointed out that green entrepreneurial orientation can help firms improve their process efficiency, minimize waste, and reduce costs by exploring new ideas and technologies, which will contribute to the improvement in environmental and economic performance [38]. Habib et al. confirmed that green entrepreneurial orientation has a positive impact on firms’ social performance, economic performance, and environmental performance [39]. However, Dixon-Fowler holds the opposite view that enterprises that actively implement green entrepreneurial orientation may not obtain better performance outcomes than those that only focus on the adoption of “end-of-pipe governance” [40]. It can be seen that the influence of green entrepreneurial orientation on enterprise performance is still controversial.

2.3. Network Centrality

In social network research, centrality is the most commonly used indicator to measure the position of organizations in the network [41]. According to social network theory, network centrality represents the relative position between an enterprise and other members of the network [42]. Stam defined network centrality as a firm’s position in the entire pattern of ties comprising a network, reflecting the firm’s structural proximity to all other firms in the network [5]. In line with the prior work of Kwon, this study defines network centrality as the degree to which enterprises occupy a central position in the network [41].

As the literature has proposed, network centrality may have direct or indirect effects on entrepreneurial orientation. Based on the resource-based view, Stam discussed the mechanisms of network centrality that affect entrepreneurial orientation. It was concluded that high network centrality facilitates an entrepreneurial orientation by increasing a firm’s ability to quickly identify, access, and mobilize external resources [5]. Meyer found that enterprises with high network centrality have advantages in accessing information and resources [43], which encourages them to engage in institutional entrepreneurship and build new myths to gain competitive advantages [20,44]. In addition, Tan stated that, due to their lack of sufficient information and resources firms with low network centrality usually choose to comply with institutional pressure [20]. However, some scholars hold the opposite view and state that, due to a lack of sufficient visibility, enterprises with low network centrality have relatively weak institutional constraints, so they will exhibit a higher innovation orientation [45]. Compagni confirmed that high network centrality indicates that enterprises have higher visibility and bear greater institutional pressure, so they are more likely to comply with such pressure [46].

3. Hypotheses and Conceptual Model

3.1. Institutional Pressure and Entrepreneurial Performance

Over the years, the relationship between institutional pressure and organizational performance has received much attention. Scholars have regarded institutional pressure as a strong predictor of firm performance [7,47]. Latif suggested that institutional pressure has a positive effect on social, environmental and economic performance [48]. In general, under the influence of institutional pressure, enterprises will try their best to meet the expectations of stakeholders to enhance their legitimacy. This in turn leads to enterprises accessing important and scarce resources [49]. Such resources contribute to entrepreneurial performance by improving the innovation and dynamic ability of new ventures [50]. Furthermore, Chu’s study showed that institutional pressures drive enterprises to implement sustainable development strategies, thereby helping them achieve better performance [51].

Coercive pressure mainly comes from the government and nongovernmental organizations outside of enterprises [52]. Research under the resource-based view points out that policies and regulations are important sources for enterprises to access information and resources [53]. Such resources will positively affect entrepreneurial performance by improving the ability of entrepreneurial opportunity identification and entrepreneurial risk management of new ventures. Porter [54] and Latif [48] concluded that government regulation helps enterprises with organizational inertia and a lack of innovative experience in solving problems to realize their improvement spaces in their efficiency and technology, which will stimulate enterprises to think creatively improve their investment in innovation [55], leading to an improvement in product competitiveness and economic benefits. In addition, enterprises are expected to follow the government’s regulations; otherwise, they will face legal penalties or even be dismissed from the market [56]. Therefore, coercive pressure reduces the tendency of new ventures to act opportunistically as well as the risk of entrepreneurship. Hence, we can infer the following:

Hypothesis 1a (H1a).

Coercive pressure has a positive impact on entrepreneurial performance.

Mimetic pressure is related to the imitation of certain behaviors of competitors [57]. Khaire claims that mimetic pressure provides new ventures with mimetic objects in terms of organizational structure and processes, which helps them break through the constraints of legitimacy [17]. Through the attainment of stakeholders’ approval, new ventures can attract more high-quality partners, obtain various resources [58], which often leads to better performance outcomes. Furthermore, if new ventures do not feel pressure from leading companies and competitors, they may be reluctant to implement innovative practices that can bring better economic benefits. Latan’s study suggests that mimetic pressures can bring economic benefits to enterprises by improving their competitiveness [59]. Hence, the following is proposed:

Hypothesis 1b (H1b).

Mimetic pressure has a positive impact on entrepreneurial performance.

Normative pressure consists of pressures to conform to standards, norms, values, or cultures or to adopt systems and techniques considered to be legitimate by relevant professional groups [60]. Normative pressure originates from suppliers, customers, associations such as company trade unions, the media or other social entities [48]. Simsek stated that the sources of normative pressure provide new ventures with the information and resources necessary for the implementation of proactive competitive strategies and contribute to the improvement of performance [61]. Ball submitted that the ethical values and ecological thinking of professional institutions and business associations are significant in encouraging firms to become sustainable [62], leading to improvements in the legitimacy, competitiveness, and entrepreneurial performance of new ventures. Hence, we put forward the following proposition:

Hypothesis 1c (H1c).

Normative pressure has a positive impact on entrepreneurial performance.

3.2. Institutional Pressure and Green Entrepreneurial Orientation

Green entrepreneurial orientation originates from green entrepreneurship and entrepreneurship orientation [16] and emphasizes the importance of environmental orientation and social orientation [35]. Most studies have shown that institutional pressure can encourage the implementation of environmental orientation and social orientation. For instance, Tate stated that institutional pressures are positively associated with firms’ social and environmental responsibility [63]. Under the influence of institutional pressures, the business model of gaining economic benefits at the expense of the environment is greatly challenged. Aguilera’s study confirmed that institutional pressure facilitates enterprises to engage in green innovation [64] and participate in environmental protection for purposes of legitimacy [65,66]. Zhu points out that institutional pressure motivates organizations to adopt environmental practices in order to gain legitimacy or acceptance within society [31].

As important components of green entrepreneurial orientation, innovation orientation and environment orientation have been regarded as responses to coercive pressure. Institutional theory suggests that coercive pressure is the driving force behind firms’ adoption of green practices [67,68]. Sarkis believes that organizations should comply with environmental regulations and pay attention to environmental issues; otherwise, they will face the threat of government penalties, or even worse, removal from the market [56]. Liao found that coercive pressure has a positive effect on firms’ green innovation [69]. Dai confirmed that government policies encourage new ventures to implement environmentally friendly entrepreneurship [70]. Moreover, research based on social identity theory proposes that, under the influence of coercive pressure, enterprises tend to focus on environmental issues to gain government support and enhance their performance [48]. Jennings argued that, due to the influence of regulations and regulatory enforcement, coercive pressure has become an important driving force inducing enterprises to engage in green practices [71]. Majumdar argued that coercive forces could drive firms toward voluntary green initiatives [72]. Wahga found that coercive pressure encourages SMEs in Pakistan to engage in sustainable entrepreneurial activity [73]. Hence, we propose the following:

Hypothesis 2a (H2a).

Coercive pressure has a positive impact on green entrepreneurial orientation.

Mimetic pressure from leading firms and competitors is an important factor that encourages enterprises to engage in environmentally responsible business activities [31]. Dai pointed out that if major competitors that have adopted green strategies are perceived favorably by customers, other companies in the same sector will try to track their innovation behavior and environmental protection technology [74]. Marchi discovered that with the increasing demand of consumers for environmentally friendly products, providing high-quality green products and services has gradually become an important source of competitive advantage. In this condition, enterprises tend to imitate the green innovation behavior of leading companies [75]. Doran points out that enterprises will imitate their competitors to carry out green innovation [76]. Wahga confirmed that competitors can put pressure on enterprises in Pakistan’s leatherworking industry to implement sustainable entrepreneurship [73]. Based on the above discussion, we can formulate the following hypothesis:

Hypothesis 2b (H2b).

Mimetic pressure has a positive impact on green entrepreneurial orientation.

Normative pressure stems from expectations regarding how to carry out work professionally [7]. With the aggravation of environmental issues and people’s pursuit of healthy lives, professional environmental groups have increasingly expected enterprises to provide environmentally friendly products and services, and these expectations have imposed normative pressure on enterprises to adopt environmentally responsible practices [77]. In this case, enterprises tend to be consistent with industry norms and values to avoid threats to their normative legitimacy [7]. According to Delmas, enterprises under the supervision of environmental standards and norms formulated by industry associations tend to act with positive environmental strategies [78]. Wahga found that normative pressure has a positive effect on sustainable entrepreneurship [73]. Therefore, we contend the following:

Hypothesis 2c (H2c).

Normative pressure has a positive impact on green entrepreneurial orientation.

3.3. Green Entrepreneurial Orientation and Entrepreneurial Performance

Many recent studies have indicated that a green entrepreneurial orientation has a positive impact on organizational performance [34,79]. Green entrepreneurial orientation contributes to entrepreneurial performance through four mechanisms, which are associated with four characteristics of green entrepreneurial orientation, including proactive orientation, innovative orientation, social orientation, and environmental orientation. As an element of green entrepreneurial orientation, proactive orientation has been found to be in positive correlation with firms’ performance [80,81,82]. Hughes identified a positive relationship between proactive orientation and enterprise performance in the early stage of enterprise growth [83]. According to Lieberman et al. [84,85,86], proactive orientation can improve firms’ capability to respond to customer needs and bring first-mover advantages. Deng, a Chinese researcher who studied the antecedents and consequences of organizational green IT adoption, found that proactive orientation helps enterprises capture the potential market ahead of their competitors [87], as well as establishing competitive advantages and generating long-term profits.

As the core of a green entrepreneurial orientation, innovation orientation has been found to be in positive correlation with firms’ performance [88]. Green innovation helps cultivate a culture within new ventures that encourages employees to pay attention to the environment and turn their business focus and energy toward green processes and product innovation activities, which in turn will improve their competitiveness. According to Zameer [89], green product innovation helps enterprises establish a brand image of sustainable development, grasp market trends quickly, and even establish new industry norms in emerging markets, which in turn can enable them to create benchmark brands and gain green competitive advantages. Hasenkamp’s research confirms that green innovation has a direct impact on operational performance, leading to economic success among firms [90].

The social orientation dimension of green entrepreneurial orientation is of positive economic significance for new ventures. Roy discovered that social orientation can be useful for enterprises in response to conflicts of interest with the government, public and other stakeholders, as well as for improving their reputation and establishing network relations with external stakeholders [91]. which provide new ventures with opportunities to access the information, technologies, knowledge and financial support needed for entrepreneurship and improve their ability to identify and develop entrepreneurial opportunities. This, in turn, leads to better entrepreneurial results. Porter and Kramer [92] stated enterprises with a strong social orientation have a decrease in production costs and operating risk, as well as improvements in legitimacy and performance.

Green entrepreneurial orientation emphasizes the importance of environmental orientation. Paying attention to environmental problems can prevent new ventures from being punished due to violations of environmental protection regulations, reducing the potential risks and losses that arise in the process of entrepreneurship. Chan found that enterprises’ pursuit of environmental protection has a positive impact on their performance [93]. Mejia confirmed that environmental orientation has a positive effect on enterprises’ social and economic performance [94]. In this regard, the following is proposed:

Hypothesis 3 (H3).

Green entrepreneurial orientation has a positive impact on entrepreneurial performance.

3.4. The Mediating Role of Green Entrepreneurial Orientation

Given the effect of institutional pressure on firm performance, Chu suggested that institutional pressure enhances the tendency of enterprises to adopt green practices, and such practices in turn increase social capital and thereby promotes enterprise performance [51]. Zhu [67] pointed out that institutional pressure can predominantly drive the adoption of environmentally friendly practices, which are crucial to the survival and sustainable development of enterprises. Many studies suggest that institutional pressure will drive enterprises to adopt green entrepreneurial orientation, such as encouraging enterprises to engage in green innovation [95], undertake social responsibility [96], pay attention to environmental issues [31]. Notably, as a strategic move, the green entrepreneurial orientation can promote the production of green innovative products and help enterprises achieve sustainable development [16,34,74].

Bokusheva argued that [97] in order to meet the technical standards established by policies, laws, and regulations, enterprises will pay attention to technical problems related to green innovation. Grewatsch found that firms’ green practices have a positive effect on financial performance [98]. Zhu [31] points out that coercive pressure drives Chinese enterprises to adopt environmental practices, which in turn promotes enterprise performance. Colwell studied the relationship between institutional pressure and organization performance with data from manufacturing firms and found that corporate ecological responsiveness mediated the relationship between coercive pressure and organization performance [11]. Gunarathne confirmed that environmental strategies mediated the positive relationship between coercive pressure and organization performance [99]. Other research has also confirmed that coercive pressure improves enterprise performance by helping enterprises engage in green entrepreneurship and other green practices [100,101]. Accordingly, the following is hypothesized:

Hypothesis 4a (H4a).

Green entrepreneurial orientation plays a mediating role between coercive pressure and entrepreneurial performance.

Under the influence of mimetic pressure, new ventures will imitate the behavior of successful enterprises or their competitors to reduce uncertainty and risk of entrepreneurship. Prior research showed that in Europe and North America, mimetic pressure contributes to firms’ superior performance, since under mimetic pressure, enterprises can meet the demands of stakeholders by imitating other enterprises in the use of green resources or technologies [48]. Research from the perspective of institutional isomorphism indicates that if major competitors adopt green strategies and are perceived favorably by customers, other enterprises in their industries will also adopt the same strategies [77]. These practices help enterprises gain or retain specific customers [102] and improve the market share of their products or services. In terms of the above discussion, the following hypothesis is proposed:

Hypothesis 4b (H4b).

Green entrepreneurial orientation plays a mediating role between mimetic pressure and entrepreneurial performance.

Research conducted from the perspective of legitimacy shows that normative pressure causes enterprises to respond to the demands of stakeholders with greater environmental commitment, which improves their legitimacy [31], enables them break through the constraints of legitimacy, and helps them to improve their entrepreneurial performance. Delmas et al. found that the member enterprises of an industry association may confront environmental pressures from norms and standards, thereby becoming more inclined to implement proactive environmental strategies [78], which play a crucial role in achieving better financial performance [34] and minimizing environmental impacts. Accordingly, the following hypothesis is proposed:

Hypothesis 4c (H4c).

Green entrepreneurial orientation plays a mediating role between normative pressure and entrepreneurial performance.

3.5. The Moderating Role of Network Centrality

Network centrality reflects the position of an organization in the network [103]. Prior studies have paid much attention to the relationship between network centrality and strategic orientation. Zhou contended that network centrality promotes the implementation of strategic orientation [104]. According to institutional theory, enterprises occupying a central position in a network have higher visibility and bear greater institutional pressure, so they are more inclined to comply with institutional pressure [46]. Stam suggested that new ventures that sustain a central network position have privileges in quickly identifying, accessing, and mobilizing external resources, which facilitates the implementation of entrepreneurial orientation [5]. Song [105] pointed out that occupying the central position in a network helps firms gather green innovation knowledge and develop innovative solutions to environmental challenges. Accordingly, we believe that network centrality has a positive moderating impact on the relationship between institutional pressure and green entrepreneurial orientation.

Firms with high network centrality are regarded as industry leaders and have higher visibility. In this case, their activities are liable to attract the government’s attention. Consequently, it is more difficult for them to fight coercive pressures from the local government [106], and they tend to comply with environmental laws and regulations, as well as implementing green entrepreneurial orientation. In addition, central firms play an important role in the policy making of the local government due to their contributions to regional economic development. Generally speaking, policy makers will consider the demands of focal enterprises when drafting policies in order to ensure the effectiveness of those policies [19,44,46]. Under this condition, the strategic orientation of focal firms will be consistent with the government’s environmental policy. Accordingly, the following hypothesis is proposed:

Hypothesis 5a (H5a).

Network centrality plays a positive moderating role in the relationship between coercive pressure and green entrepreneurial orientation.

A recent study indicated that the entrepreneurial orientation of new ventures changes with their network positions [5]. Central firms are deemed to be privileged by the network position and subject to intense scrutiny by their competitors, which makes them more likely to conform to strong isomorphic pressure. Powell contends that firms in central positions are the first to learn about new technologies, market opportunities, and even competitors’ strategies [107], which will facilitate the implementation of green entrepreneurial orientation by improving their ability of innovation and pre-emptive. In addition, Dai found that firms with high network centrality will believe that the adoption of green entrepreneurial orientation of their competitors pose a greater threat and will tend to respond quickly by adopting cleaner production methods, improving its technologies [74], or providing green products and services to win more consumer favor and government recognition [108]. Accordingly, the following is proposed:

Hypothesis 5b (H5b).

Network centrality plays a positive moderating role in the relationship between mimetic pressure and green entrepreneurial orientation.

In general, by making full use of their leadership in the industry and participating in the formation of professional environmental standards and norms, enterprises at the center of the network have advantages in accessing scarce resources and managing risk. Such privileges play an important role in the implementation of entrepreneurial orientation since entrepreneurial orientation has the characteristics of being resource-intensive and uncertain [109]. Furthermore, firms with high network centrality are the leaders in terms of entrepreneurial orientation [110] and are more likely to consolidate their position in the industry and establish new standards and norms by providing green products, establishing a brand image, and cultivating the habit of green consumption [80]. In such a scenario, the following hypothesis is proposed:

Hypothesis 5c (H5c).

Network centrality plays a positive moderating role in the relationship between normative pressure and green entrepreneurial orientation.

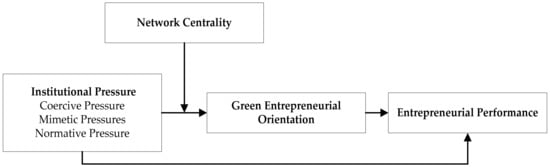

Based on these hypotheses, the research model of this study was constructed, as shown in Figure 1.

Figure 1.

Theoretical model.

4. Method

4.1. Samples and Data Collection

The research samples of this study mainly came from the eastern regions of China, such as Zhejiang Province, Guangdong Province, and Jiangsu Province, because these regions exhibit high levels of entrepreneurial activity and various types of new ventures, which meets the empirical research requirement of this study in terms of the number of samples available.

The main survey objects of this study were the middle and top managers of new ventures. This is because such individuals have a more accurate understanding of the development of their company, especially in terms of strategic decision making, network position, performance, and institutional pressure faced. To ensure the reliability and validity of our questionnaire, before the formal survey was conducted, we invited three experts in the field of entrepreneurship to modify certain complicated or ambiguous items. Then, we used the revised questionnaire to conduct a preliminary survey across five new ventures, further modified the questionnaire according to the feedback gained during the preliminary survey, and finalized the formal questionnaire used in this study.

Before the formal survey was conducted, the questionnaire was translated into Chinese via a back-translation technique. We distributed and recovered the questionnaire in three ways. First, we invited the survey objects to complete the questionnaire through on-site interviews. Second, with the assistance of local business incubation authorities, we contacted more new ventures using the snowballing technique. Third, we distributed the questionnaire with the assistance of a professional research company. The survey was conducted from July 2021 to October 2021 and lasted for three months. A total of 52 questionnaires were distributed through on-site interviews, and 49 were recovered; thus, the recovery rate was 94.2%, 47 valid questionnaires were selected, and the valid rate of the questionnaires was 90.4%. A total of 40 questionnaires were distributed using the snowballing technique, and 33 were recovered; the recovery rate was 82.5%, 28 valid questionnaires were selected, and the valid rate of the questionnaires was 70%. The research company distributed 350 questionnaires and recovered 239 questionnaires, The recovery rate was 68.3%, 26 invalid questionnaires were excluded, and 213 valid questionnaires were selected; thus, the valid rate of the questionnaires was 60.9%. Finally, 288 valid questionnaires were collected.

The descriptive statistical analysis results of the 288 valid questionnaires are shown in Table 1. As shown in Table 1, the main industry types were the new materials and information technology industries, which accounted for 32.3% and 29.2% of the sample, respectively. The scale of the new ventures was mainly distributed between 101 and 200, and this group accounted for 40.6% of the sample. The establishment time of the new ventures was mainly distributed between 1 and 3 years, and these firms accounted for 36.1% of the sample.

Table 1.

Descriptive statistics.

4.2. Measurement of Variables

As shown in Appendix A, most of the measurement items used for the variables of this study were taken from the maturity scale used in the existing research. Except for the control variables, all the variables were measured with a Likert five-point scale ranging from “1 (strongly disagree)” to “5 (strongly agree)”.

4.2.1. Independent Variables

Institutional pressure (IN). We drew on the research designs of Kalyaret al. [47] and Colwell [11] and modified the scale based on the context of this study. Finally, we used coercive pressure (CP), mimetic pressure (MP), and normative pressure (NP) to deconstruct institutional pressure and measured coercive pressure (CP) with four items, mimetic pressure (MP) with three items, and normative pressure (NP) with three items.

4.2.2. Mediator Variable

Green entrepreneurial orientation (GEO). We used a scale with five items designed by Guo et al. [16] and Shepherd et al. [111] to measure green entrepreneurial orientation and modified the scale based on the context of this study.

4.2.3. Moderator Variable

Network centrality (NC). We used a scale with four items designed by Song et al. [105] to measure network centrality and modified the scale based on the context of this study.

4.2.4. Dependent Variable

Entrepreneurial performance (EP). We drew on the research design of Sun et al. [112] using nine items to measure entrepreneurial performance and modified the scale based on the context of this study.

4.2.5. Control Variables

Control variables. Prior studies have shown that enterprise scale (ES), establishment time (ET), and industry type (IT) are correlated with entrepreneurial performance [113,114]. Following the research of previous scholars, this study selected enterprise scale, establishment time, and industry type as the control variables.

5. Analysis

5.1. Common Method Bias

The Harman single-factor test was used to test whether there was common method bias. First, the data analysis results showed that the KMO value of the scale used in this study was 0.824, which is greater than the threshold of 0.6, and the results of a Bartlett spherical test were significant, indicating that the valid data obtained from the survey were suitable for factor analysis. Through factor analysis, we extracted six common factors with feature values greater than 1. The variance explanation rate values of the six factors were 21.256%, 12.595%, 10.143%, 9.636%, 8.027%, and 7.438%; the cumulative variance explanation rate was 69.095% > 50%; and the variance explanation rate value of the initial factor was 21.256% < 50%. This indicates that there was no serious common method bias in this study.

5.2. Reliability and Validity

Combined with the valid data obtained from the survey, we used IBM SPSS version 20.0 (IBM Corp., Armonk, NY, USA) and IBM AMOS version 17.0 (IBM Corp., Armonk, NY, USA) to test the reliability and validity of the scale used in this study. The results are shown in Table 2 and Table 3. First, the factor loading of all variable measurement items was greater than 0.6, indicating that there is a strong correlation between each measurement item and the corresponding variable. Second, the Cronbach’s α values of all the variables were greater than 0.7, indicating that the scale had good reliability. Third, the AVE of all the variables was greater than 0.5, and the CR values were greater than 0.7, indicating that the scale has good convergent validity. Additionally, most of the measurement items used in this study were taken from the maturity scale used in existing research, which indicates that the scale has good content validity. Fourth, among the six models, the six-factor model was the only model whose fitting index met the requirements (χ2/df = 1.329, GFI = 0.902, RMSEA = 0.034, CFI = 0.986, IFI = 0.986, TLI = 0.984, NFI = 0.945), which indicates that the scale used in this paper has good discriminant validity.

Table 2.

Factor analysis, scale validity, and reliability.

Table 3.

Confirmatory factory analysis.

Table 4 shows the correlation coefficients, mean values, and standard deviations of all the variables. These results show that the correlation coefficients between coercive pressure, normative pressure, mimetic pressure, green entrepreneurial orientation, network centrality, and entrepreneurial performance are significant and are consistent with the direction of the hypotheses.

Table 4.

Descriptive statistics and correlation coefficient matrix.

5.3. Hypothesis Testing

5.3.1. Direct Effect Test

The regression analysis results are shown in Table 5. The results of M2 show that the regression coefficient of coercive pressure on entrepreneurial performance was positively significant (β = 0.311, p < 0.001), and H1a was supported. The regression coefficient of mimetic pressure on entrepreneurial performance was positively significant (β = 0.184, p < 0.01), and H1b was supported. The regression coefficient of normative pressure on entrepreneurial performance was positively significant (β = 0.159, p < 0.01), and H1c was supported. The results of M5 show that the regression coefficient of coercive pressure on green entrepreneurial orientation was positively significant (β = 0.328, p < 0.001), and H2a was supported. Moreover, the regression coefficient of mimetic pressure on green entrepreneurial orientation was positively significant (β = 0.297, p < 0.001), and H2b was supported. The regression coefficient of normative pressure on green entrepreneurial orientation was positively significant (β = 0.191, p < 0.01), and H2c was supported. The results of M3 show that the regression coefficient of green entrepreneurial orientation on entrepreneurial performance was positively significant (β = 0.386, p < 0.001), and H3 was supported.

Table 5.

Linear regression analysis results.

5.3.2. Mediating Effect Test

To test the mediating effect of green entrepreneurial orientation, we constructed models M2, M3, and M4, as shown in Table 5. The results of M2 and M4 show that after the mediating variable of green entrepreneurial orientation was added, the regression coefficient of coercive pressure on entrepreneurial performance decreased from β = 0.311 (p < 0.001) to β = 0.163 (p < 0.01); this shows that the relationship between coercive pressure and entrepreneurial performance was partially mediated by green entrepreneurial orientation, and H4a was partially supported. The regression coefficient of mimetic pressure on entrepreneurial performance decreased from β = 0.184 (p < 0.01) to β = 0.069 (p > 0.05); this shows that the relationship between mimetic pressure and entrepreneurial performance was completely mediated by green entrepreneurial orientation, and H4b was supported. The regression coefficient of normative pressure on entrepreneurial performance decreased from β = 0.159 (p < 0.01) to β = 0.061 (p > 0.05), showing that the relationship between normative pressure and entrepreneurial performance was completely mediated by green entrepreneurial orientation, and H4c was supported.

To further test the mediating effect of green entrepreneurial orientation, we used the bootstrap method, selected the model provided by SPSS, and set the sample size to 5000 and the confidence interval to 95%. The results shown in Table 6 indicate that the value of the indirect effect of coercive pressure on entrepreneurial performance via green entrepreneurial orientation was 0.148, and the 95% confidence interval was (0.079, 0.172), excluding zero; additionally, the direct effect value of coercive pressure on entrepreneurial performance was 0.163, and the 95% confidence interval was (0.096, 0.239), excluding zero. This indicates that H4a was partially supported. The indirect effect value of mimetic pressure on entrepreneurial performance was 0.115, and the 95% confidence interval was (0.072, 0.153), excluding zero; furthermore, the direct effect value of mimetic pressure on entrepreneurial performance was 0.069, and the 95% confidence interval was (−0.082, 0.133), including zero. This indicates that H4b was supported. The indirect effect value of normative pressure on entrepreneurial performance was 0.098, and the 95% confidence interval was (0.069, 0.137), excluding zero. Finally, the direct effect value of normative pressure on entrepreneurial performance was 0.061, and the 95% confidence interval was (−0.066, 0.107), including zero. This indicates that H4c was supported.

Table 6.

Results of the bootstrap mediation test.

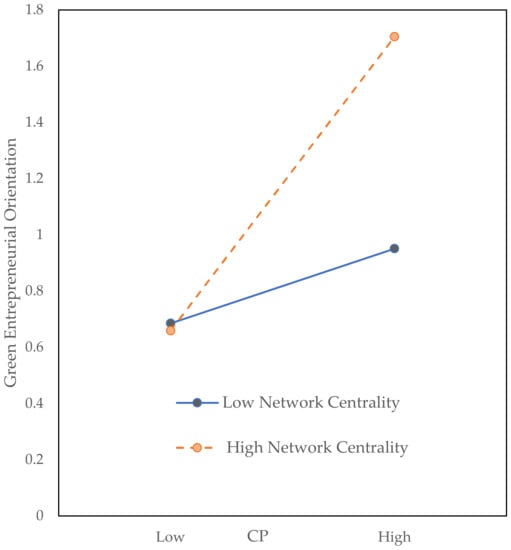

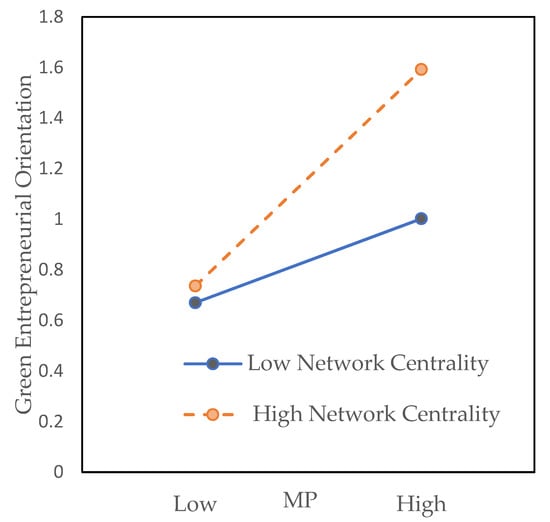

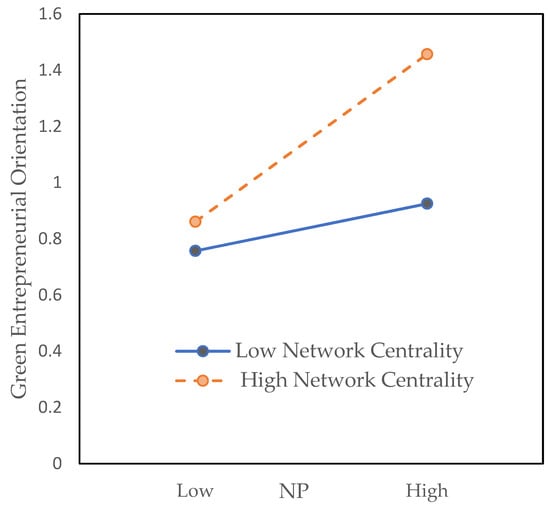

5.3.3. Moderating Effect Test

To test the moderating effect of network centrality on the relationships between coercive pressure, normative pressure, mimetic pressure, and green entrepreneurial orientation, we constructed models M9, M10, and M11 in Table 5 based on standardized data. Models M9, M10, and M11 showed that network centrality has a positive moderating effect on the relationship between coercive pressure (β = 0.195, p < 0.01), mimetic pressure (β = 0.131, p < 0.01), normative pressure (β = 0.107, p < 0.01), and green entrepreneurial orientation. This finding supports H5a, H5b, and H5c. To show the moderating effect of network centrality more intuitively, the moderating effect diagrams shown in Figure 2, Figure 3 and Figure 4 were drawn. As shown in Figure 2, Figure 3 and Figure 4, compared with a low level of network centrality, a high level of network centrality causes coercive pressure, mimetic pressure and normative pressure to have stronger positive impacts on green entrepreneurial orientation.

Figure 2.

Moderating effect of network centrality on the relationship between coercive pressure and green entrepreneurial orientation.

Figure 3.

Moderating effect of network centrality on the relationship between mimetic pressure and green entrepreneurial orientation.

Figure 4.

Moderating effect of network centrality on the relationship between normative pressure and green entrepreneurial orientation.

6. Discussion and Conclusions

6.1. Research Conclusions

Prior research has provided considerable evidence regarding the relationship between institutional pressure and performance under different research topics and situations. However, very few studies have focused on the impact of institutional pressure on entrepreneurial performance. Based on institutional theory, network theory, and the green entrepreneurial concept, this study attempted to explore the internal mechanism by which institutional pressure affects the entrepreneurial performance of new ventures based on an empirical analysis of 288 new ventures. The main conclusions of this study are presented below.

First, our empirical evidence shows that coercive pressure has not only a direct positive impact but also an indirect positive impact on entrepreneurial performance through green entrepreneurial orientation. Moreover, normative pressure and mimetic pressure both have indirect positive effects on entrepreneurial performance through green entrepreneurial orientation. This conclusion demonstrates that institutional pressure is an important factor that affects the entrepreneurial performance of new ventures. In addition, it is consistent with previous research emphasizing that institutional pressure drives enterprises to adopt eco-friendly practices, thus helping them achieve better performance [48,52]. Institutional pressure is the external driving force that leads enterprises to adopt green entrepreneurial orientation. Through the implementation of green entrepreneurial orientation, such as acting in a more environmentally friendly way, improving innovation abilities, paying attention to environmental issues, and undertaking social responsibility, new ventures can lead in terms of pollution prevention and energy efficiency among their competitors. This will improve their legitimacy and the social image of their products, help them access various entrepreneurial resources, and improves their market competitiveness, especially in the current context of carbon neutrality, green and sustainable development as mainstream concepts that are advocated by society. For new ventures, the traditional entrepreneurial concept may be slow to take effect and carrying out green and sustainable entrepreneurial activities under the guidance of green entrepreneurial orientation can help new ventures reduce the risks of entrepreneurship, create competitive advantages that are difficult to be imitated, and achieve the goal of rapid development.

Second, network centrality plays a moderating role between institutional pressure and green entrepreneurial orientation. Specifically, network centrality positively moderates the relationship between coercive pressure, normative pressure, mimetic pressure, and green entrepreneurial orientation. This conclusion is consistent with the previous research asserting that enterprises with high network centrality have higher visibility and bear greater institutional pressure, so they are more inclined to comply with institutional pressure [46]. In general, central firms have greater ability and motivation to implement green entrepreneurial orientation. On the one hand, new ventures with high network centrality have more advantages in terms of obtaining information and resources that form the foundation of proactive orientation and innovation orientation. On the other hand, new ventures at the center of the network have higher visibility. Green entrepreneurial orientation can not only help them improve their brand image and legitimacy but also further consolidate and even improve their position in the network.

6.2. Practical Implications

The conclusions of this study have implications for new ventures seeking to cope with institutional pressure and improve their entrepreneurial performance. First, institutional pressure is an important factor affecting the survival and development of new ventures. New ventures should give extensive attention to the current status of the institutional environment and any changes that arise, complying with institutional constraints to avoid being penalized for violating stakeholders’ expectations. This will contribute to the long-term and sustainable development by reducing the entrepreneurial risks. Second, green entrepreneurial orientation is an intermediate path by which new ventures can improve their entrepreneurial performance. This finding provides a theoretical basis for the adoption of the green entrepreneurial orientation by new ventures under institutional pressure. Consequently, new ventures should frequently evaluate future institutional environmental trends, look for green development opportunities, act immediately to cope with change in a more environmentally friendly way, improve their innovation ability, pay attention to environmental issues, and undertake social responsibility. These actions will help improve their competitiveness. Third, network centrality is a catalyst between institutional pressure and green entrepreneurial orientation. For new ventures with high network centrality, the impact of institutional pressure will be amplified, and these new ventures must integrate various network resources to facilitate the implementation of green entrepreneurial orientation.

The conclusions of this study also have implications for policy makers. In fact, in order to encourage the adoption of green entrepreneurial orientation and improve entrepreneurial performance, the role of institutions should be strengthened to provide stimuli for organizational action. New ventures that are central in the network are more sensitive to institutional pressure and are more inclined to implement green entrepreneurial orientation. However, institutional pressure has a relatively weak impact on new ventures on the edges of the network. Therefore, policy makers can influence the core new ventures in the network by issuing relevant policies to generate coercive pressure related to green entrepreneurship across a whole region and promote the common transformation of new ventures at the edges of the network. In addition to improving institutional standards as soon as possible, policy makers should enhance the strength of moral propaganda to accelerate the integration of green development concepts into society so that social norms can be leveraged as informal institutions to promote the development of green entrepreneurship activities.

6.3. Limitations and Directions for Future Research

This study explored the influence mechanism of institutional pressure on the entrepreneurial performance of new ventures, but it has limitations. First, in this study, an empirical analysis was conducted based on data from China. It is unknown whether the research conclusions are also applicable to other developing countries. Future studies can collect data from other countries to conduct re-examinations and analyses to improve the generalizability of the conclusions. Second, this study analyzed the effects of coercive pressure, normative pressure, and mimetic pressure on the entrepreneurial performance of new ventures. Nevertheless, the growth of new ventures is the result of the joint actions of different dimensions of institutional pressure. In the future, the mechanism of the synergistic effect of coercive pressure, normative pressure, and mimetic pressure on the entrepreneurial performance of new ventures should be comprehensively investigated. Third, as existing studies have found, the network positions of new ventures affect the strength of the institutional pressure they face [46]. As new ventures grow, their network positions and the institutional pressures they face will also change. In the future, the impact of institutional pressure, network centrality, and green entrepreneurial orientation on entrepreneurial performance should be analyzed from a dynamic perspective.

Author Contributions

Methodology, writing—original draft, N.L.; funding acquisition, writing—review and editing, H.H.; data curation, investigation, Z.W. All authors have read and agreed to the published version of the manuscript.

Funding

This research was funded by the National Natural Science Foundation of China (No. 72072144, 71672144, 71372173, 70972053); the Key Project of Shaanxi Soft Science Research Plan (2019KRZ007); the Science and Technology Research and Development Program of Shaanxi Province (2021KRM183, 2017KRM059, 2017KRM057, 2014KRM28-2, 2022KRM129); and the Key Project of Soft Science Research Program of Xi’an Science and Technology Bureau (21RKYJ0009).

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

Data are available on request due to restrictions on privacy or ethics.

Conflicts of Interest

The authors declare no conflict of interest.

Appendix A

Table A1.

Measurements of Construct Items.

Table A1.

Measurements of Construct Items.

| Constructs | Label | Measurement Items | Sources |

|---|---|---|---|

| CP | CP1 | Firms in our industry that do not meet the legislated standards for pollution control face a significant threat of legal prosecution | Kalyar et al. [47] Colwell and Joshi [11] |

| CP2 | Firms in our industry are aware of the fines and penalties potentially associated with environmentally irresponsible behavior | ||

| CP3 | If firms in our industry commit an environmental infraction, the consequences are likely to include negative reports by industry/stock market analysts | ||

| CP4 | There are negative consequences for companies that fail to comply with environmental laws | ||

| NP | NP1 | Our industry has trade associations (or professional associations) that encourage organizations within the industry to become more environmentally responsible | Kalyar et al. [47] Colwell and Joshi [11] |

| NP2 | Our industry expects all the firms in the industry to be environmentally responsible | ||

| NP3 | Being environmentally responsible is a requirement for firms to be a part of this industry | ||

| MP | MP1 | The leading companies in our industry set an example for environmentally responsible conduct | Kalyar et al. [47] Colwell and Joshi [11] |

| MP2 | The leading companies in our industry are known for their practices that promote environmental preservation | ||

| MP3 | The leading companies in our industry have worked on ways to reduce their impacts on the environment | ||

| GEO | GEO1 | Our firm has an attitude of adventure and proactiveness toward green projects when faced with uncertainty | Guo et al. [16] Shepherd and Patzelt [111] |

| GEO2 | Our firm places a strong emphasis on green R&D, technological leadership, and innovation | ||

| GEO3 | Our firm has a strong tendency to initiate green actions to respond to competitors | ||

| GEO4 | Our firm actively undertake social responsibility | ||

| GEO5 | Our firm has a strong tendency to be a market leader and is always first to introduce green products, services, or technologies | ||

| NC | NC1 | Our firm has a high reputation in the network | Song et al. [105] |

| NC2 | Many firms are willing to cooperate with our firm | ||

| NC3 | The contact between partners is often through our firm | ||

| NC4 | When technical advice or technical support is needed, our partners often seek help from our firm | ||

| EP | EP1 | Satisfaction of suppliers | Sun et al. [112] |

| EP2 | Satisfaction of employees | ||

| EP3 | Satisfaction of consumers | ||

| EP4 | Increase in the number of employees | ||

| EP5 | Increase in sales | ||

| EP6 | Increase in market share | ||

| EP7 | Net profit | ||

| EP8 | Rate of return on sales | ||

| EP9 | Rate of return on assets |

References

- Nagy, B.G.; Blair, E.S.; Lohrke, F.T. Developing a scale to measure liabilities and assets of newness after start-up. Int. Entrep. Manag. J. 2012, 10, 277–295. [Google Scholar] [CrossRef]

- Li, Y.H.; Huang, J.W.; Tsai, M.T. Entrepreneurial orientation and firm performance: The role of knowledge creation process. Ind. Mark. Manag. 2009, 38, 440–449. [Google Scholar] [CrossRef]

- Hayton, J.C. Strategic human capital management in SMEs: An empirical study of entrepreneurial performance. Hum. Resour. Manag. 2003, 42, 375–391. [Google Scholar] [CrossRef]

- Boso, N.; Story, V.M.; Cadogan, J.W. Entrepreneurial orientation, market orientation, network ties, and performance: Study of entrepreneurial firms in a developing economy. J. Bus. Ventur. 2013, 28, 708–727. [Google Scholar] [CrossRef]

- Stam, W.; Elfring, T. Entrepreneurial orientation and new venture performance: The moderating role of intra- and extraindustry social capital. Acad. Manag. J. 2008, 51, 97–111. [Google Scholar] [CrossRef]

- Guo, Y.; Wang, L. Environmental entrepreneurial orientation and firm performance: The role of environmental innovation and stakeholder pressure. SAGE Open 2022, 12, 21582440211. [Google Scholar] [CrossRef]

- DiMaggio, P.J.; Powell, W.W. The iron cage revisited: Institutional isomorphism and collective rationality in organizational fields. Am. Sociol. Rev. 1983, 48, 147–160. [Google Scholar] [CrossRef]

- Yiu, D.; Makino, S. The choice between joint venture and wholly owned subsidiary: An institutional perspective. Organ. Sci. 2002, 13, 667–683. [Google Scholar] [CrossRef]

- Fainshmidt, S.; Pezeshkan, A.; Frazier, M.L.; Nair, A.; Markowski, E. Dynamic capabilities and organizational performance: A meta-anlytic evaluation and extension. J. Manag. Stud. 2016, 53, 1348–1380. [Google Scholar] [CrossRef]

- Marquis, C.; Glynn, M.A.; Davis, G.F. Community isomorphism and corporate social action. Acad. Manag. Rev. 2007, 32, 925–945. [Google Scholar] [CrossRef]

- Colwell, S.R.; Joshi, A.W. Corporate ecological responsiveness: Antecedent effects of institutional pressure and top management commitment and their impact on organizational performance. Bus. Strategy Environ. 2011, 22, 73–91. [Google Scholar] [CrossRef]

- Dubey, R.; Gunasekaran, A.; Ali, S.S. Exploring the relationship between leadership, operational practices, institutional pressures and environmental performance: A framework for green supply chain. Int. J. Prod. Econ. 2015, 160, 120–132. [Google Scholar] [CrossRef]

- Leonidou, L.C.; Christodoulides, P.; Kyrgidou, L.P.; Palihawadana, D. Internal drivers and performance consequences of small firm green business strategy: The moderating role of external forces. J. Bus. Ethics 2015, 140, 585–606. [Google Scholar] [CrossRef]

- Banerjee, S.B.; Iyer, E.S.; Kashyap, R.K. Corporate environmentalism: Antecedents and influence of industry type. J. Mark. 2003, 67, 106–122. [Google Scholar] [CrossRef]

- Schaefer, A. Contrasting institutional and performance accounts of environmental management systems: Three case studies in the UK Water & Sewerage industry. J. Manag. Stud. 2007, 44, 506–535. [Google Scholar] [CrossRef]

- Guo, Y.; Wang, L.; Chen, Y. Green entrepreneurial orientation and green innovation: The mediating effect of supply chain learning. SAGE Open 2020, 10, 215824401989879. [Google Scholar] [CrossRef]

- Khaire, M. Young and no money? Never mind: The material impact of social resources on new venture growth. Organ. Sci. 2010, 21, 168–185. [Google Scholar] [CrossRef]

- Owen-Smith, J.; Powell, W.W. Knowledge networks as channels and conduits: The effects of spillovers in the Boston Biotechnology Community. Organ. Sci. 2004, 15, 5–21. [Google Scholar] [CrossRef]

- Perry-Smith, J.E.; Mannucci, P.V. From creativity to innovation: The social network drivers of the four phases of the idea journey. Acad. Manag. Rev. 2017, 42, 53–79. [Google Scholar] [CrossRef]

- Tan, J.; Shao, Y.; Li, W. To be different, or to be the same? An exploratory study of isomorphism in the cluster. J. Bus. Ventur. 2013, 28, 83–97. [Google Scholar] [CrossRef]

- Westphal, J.D.; Gulati, R.; Shortell, S.M. Customization or conformity? An institutional and network perspective on the content and consequences of TQM adoption. Adm. Sci. Q. 1997, 42, 366–394. [Google Scholar] [CrossRef]

- Qian, W.; Burritt, R. The Development of environment management accounting:an institutional view. Eco Effic. Ind. Sci. 2009, 24, 233–248. [Google Scholar] [CrossRef]

- Suchman, M.C. Managing legitimacy: Strategic and institutional approaches. Acad. Manag. Rev. 1995, 20, 571–610. [Google Scholar] [CrossRef]

- Teo, H.H.; Wei, K.K.; Benbasat, I. Predicting intention to adopt interorganizational linkages:an institutional perspective. MIS Q. 2003, 27, 19–49. [Google Scholar] [CrossRef]

- Chaudhry, N.I.; Amir, M. From institutional pressure to the sustainable development of firm: Role of environmental management accounting implementation and environmental proactivity. Bus. Strategy Environ. 2020, 29, 3542–3554. [Google Scholar] [CrossRef]

- Zeng, H.; Chen, X.; Xiao, X.; Zhou, Z. Institutional pressures, sustainable supply chain management, and circular economy capability: Empirical evidence from Chinese eco-industrial park firms. J. Clean. Prod. 2017, 155, 54–65. [Google Scholar] [CrossRef]

- Shubham, S.; Charan, P.; Murty, L.S. Institutional pressure and the implementation of corporate environment practices: Examining the mediating role of absorptive capacity. J. Knowl. Manag. 2018, 22, 1591–1613. [Google Scholar] [CrossRef]

- Lin, Y.H.; Chen, H.C. Critical factors for enhancing green service innovation: Linking green relationship quality and green entrepreneurial orientation. J. Hosp. Tour. Technol. 2018, 9, 188–203. [Google Scholar] [CrossRef]

- Liao, Z. Institutional pressure, knowledge acquisition and a firm’s environmental innovation. Bus. Strateg. Environ. 2018, 27, 849–857. [Google Scholar] [CrossRef]

- Huo, B.; Han, Z.; Zhao, X.; Zhou, H.; Wood, C.H.; Zhai, X. The impact of institutional pressures on supplier integration and financial performance: Evidence from China. Int. J. Prod. Econ. 2013, 146, 82–94. [Google Scholar] [CrossRef]

- Zhu, Q.; Sarkis, J. The moderating effects of institutional pressures on emergent green supply chain practices and performance. Int. J. Prod. Res. 2007, 45, 4333–4355. [Google Scholar] [CrossRef]

- Covin, J.G.; Slevin, D.P. Strategic management of small firms in hostile and benign environments. Strateg. Manag. J. 1989, 10, 75–87. [Google Scholar] [CrossRef]

- Dean, T.J.; Mcmullen, J.S. Toward a theory of sustainable entrepreneurship: Reducing environmental degradation through entrepreneurial action. J. Bus. Ventur. 2007, 22, 50–76. [Google Scholar] [CrossRef]

- Jiang, W.; Chai, H.; Shao, J.; Feng, T. Green entrepreneurial orientation for enhancing firm performance: A dynamic capability perspective. J. Clean. Prod. 2018, 198, 1311–1323. [Google Scholar] [CrossRef]

- Cohen, B.; Winn, M.I. Market imperfections, opportunity and sustainable entrepreneurship. J. Bus. Ventur. 2007, 22, 29–49. [Google Scholar] [CrossRef]

- Becker, H. Start me up... Lab. Chip. 2010, 10, 3197–3200. [Google Scholar] [CrossRef]

- Arruda, M.C. Isaak, Robert. Green logic: Ecopreneurship, theory and ethics. Teach. Bus. Ethics 1999, 3, 302–304. [Google Scholar] [CrossRef]

- Simone, B.; Cainelli, G.; Mazzanti, M. Linking emission trading to environmental innovation: Evidence from the Italian manufacturing industry. Res. Policy 2015, 44, 669–683. [Google Scholar] [CrossRef]

- Habib, M.A.; Bao, Y.; Ilmudeen, A. The impact of green entrepreneurial orientation, market orientation and green supply chain management practices on sustainable firm performance. Cogent Bus. Manag. 2020, 7, 1743616l. [Google Scholar] [CrossRef]

- Dixon-Fowler, H.R.; Slater, D.J.; Johnson, J.L.; Ellstrand, A.E.; Romi, A.M. Beyond “Does it pay to be green?” A meta-analysis of moderators of the CEP–CFP relationship. J. Bus. Ethics 2013, 112, 353–366. [Google Scholar] [CrossRef]

- Kwon, S.W.; Adler, P.S. Social capital: Maturation of a field of research. Acad. Manag. Rev. 2014, 39, 412–422. [Google Scholar] [CrossRef]

- Ibarra, H. Network centrality, power, and innovation involvement: Determinants of technical and administrative roles. Acad. Manag. J. 1993, 36, 471–501. [Google Scholar] [CrossRef]

- Meyer, J.W.; Rowan, B. Institutionalized organizations: Formal structure as Myth and ceremony. Am. J. Sociol. 1977, 83, 340–363. [Google Scholar] [CrossRef]

- Greenwood, R.; Suddaby, R. Institutional entrepreneurship in mature fields: The big five accounting firms. Acad. Manag. J. 2006, 49, 27–48. [Google Scholar] [CrossRef]

- Zilber, T.B. The work of the symbolic in institutional processes: Translations of rational myths in Israeli high tech. Acad. Manag. J. 2006, 49, 281–303. [Google Scholar] [CrossRef]

- Compagni, A.; Mele, V.; Ravasi, D. How early implementations influence later adoptions of innovation: Social positioning and skill reproduction in the diffusion of robotic surgery. Acad. Manag. J. 2015, 58, 242–278. [Google Scholar] [CrossRef]

- Kalyar, M.N.; Shoukat, A.; Shafique, I. Enhancing firms’ environmental performance and financial performance through green supply chain management practices and institutional pressures. Sustain. Account. Manag. Policy J. 2019, 11, 451–476. [Google Scholar] [CrossRef]

- Latif, B.; Mahmood, Z.; Tze San, O.; Said, R.M.; Bakhsh, A. Coercive, normative and mimetic pressures as drivers of environmental management accounting adoption. Sustainability 2020, 12, 4506. [Google Scholar] [CrossRef]

- Zsidisin, G.A.; Melnyk, S.A.; Ragatz, G.L. An institutional theory perspective of business continuity planning for purchasing and supply management. Int. J. Prod. Res. 2005, 43, 3401–3420. [Google Scholar] [CrossRef]

- Wu, L.Y. Entrepreneurial resources, dynamic capabilities and start-up performance of Taiwan’s high-tech firms. J. Bus. Res. 2007, 60, 549–555. [Google Scholar] [CrossRef]

- Chu, S.; Yang, H.; Lee, M.; Park, S. The impact of institutional pressures on green supply chain management and firm performance: Top management roles and social capital. Sustainability 2017, 9, 764. [Google Scholar] [CrossRef]

- Roxas, B.; Coetzer, A. Institutional environment, managerial attitudes and environmental sustainability orientation of small firms. J. Bus. Ethics 2012, 111, 461–476. [Google Scholar] [CrossRef]

- Yang, J.; Zhang, F.; Jiang, X.; Sun, W. Strategic flexibility, green management, and firm competitiveness in an emerging economy. Technol. Forecast. Soc. Chang. 2015, 101, 347–356. [Google Scholar] [CrossRef]

- Porter, M.E.; Linde, C.V.D. Toward a new conception of the environment-competitiveness relationship. J. Econ. Perspect. 1995, 9, 97–118. [Google Scholar] [CrossRef]

- Eiadat, Y.; Kelly, A.; Roche, F.; Eyadat, H. Green and competitive? An empirical test of the mediating role of environmental innovation strategy. J. World Bus. 2008, 43, 131–145. [Google Scholar] [CrossRef]

- Sarkis, J.; Gonzalez-Torre, P.; Adenso-Diaz, B. Stakeholder pressure and the adoption of environmental practices: The mediating effect of training. J. Oper. Manag. 2009, 28, 163–176. [Google Scholar] [CrossRef]

- Gold, S.; Seuring, S.; Beske, P. Sustainable supply chain management and inter-organizational resources: A literature review. Corp. Soc. Responsib. Environ. Manag. 2010, 17, 230–245. [Google Scholar] [CrossRef]

- Bos-Brouwers, H.E.J. Corporate sustainability and innovation in SMEs: Evidence of themes and activities in practice. Bus. Strategy Environ. 2009, 19, 417–435. [Google Scholar] [CrossRef]

- Latan, H.; Jabbour, C.J.C.; Sousa Jabbour, A.B.L.D.; Wamba, S.F.; Shahbaz, M. Effects of environmental strategy, environmental uncertainty and top management’s commitment on corporate environmental performance: The role of environmental management accounting. J. Clean. Prod. 2018, 180, 297–306. [Google Scholar] [CrossRef]

- Perez-Batres, L.A.; Miller, V.V.; Pisani, M.J. Institutionalizing sustainability: An empirical study of corporate registration and commitment to the United Nations global compact guidelines. J. Clean. Prod. 2011, 19, 843–851. [Google Scholar] [CrossRef]

- Simsek, Z.; Heavey, C. The mediating role of knowledge-based capital for corporate entrepreneurship effects on performance: A study of small- to medium-sized firms. Strateg. Entrep. J. 2011, 5, 81–100. [Google Scholar] [CrossRef]

- Ball, A.; Craig, R. Using neo-institutionalism to advance social and environmental accounting. Crit. Perspect. Account. 2010, 21, 283–293. [Google Scholar] [CrossRef]

- Tate, W.L.; Ellram, L.M.; Kirchoff, J.F. Corporate social responsibility reports: A thematic analysis related to supply chain management. J. Supply Chain Manag. 2010, 46, 19–44. [Google Scholar] [CrossRef]

- Aguilera-Caracuel, J.; Ortiz-de-Mandojana, N. Green innovation and financial performance. Organ. Environ. 2013, 26, 365–385. [Google Scholar] [CrossRef]

- DuBois, C.L.Z.; Dubois, D.A. Strategic HRM as social design for environmental sustainability in organization. Hum. Resour. Manag. 2012, 51, 799–826. [Google Scholar] [CrossRef]

- Majid, A.; Yasir, M.; Yasir, M.; Javed, A. Nexus of institutional pressures, environmentally friendly business strategies, and environmental performance. Corp. Soc. Responsib. Environ. Manag. 2020, 27, 706–716. [Google Scholar] [CrossRef]

- Zhu, Q.; Geng, Y. Drivers and barriers of extended supply chain practices for energy saving and emission reduction among Chinese manufacturers. J. Clean. Prod. 2013, 40, 6–12. [Google Scholar] [CrossRef]

- Darnall, N.; Henriques, I.; Sadorsky, P. Do environmental management systems improve business performance in an international setting? J. Int. Manag. 2008, 14, 364–376. [Google Scholar] [CrossRef]

- Liao, Y.C.; Tsai, K.H. Bridging market demand, proactivity, and technology competence with eco-innovations: The moderating role of innovation openness. Corp. Soc. Responsib. Environ. Manag. 2018, 26, 653–663. [Google Scholar] [CrossRef]

- Dai, W.; Si, S. Government policies and firms’ entrepreneurial orientation: Strategic choice and institutional perspectives. J. Bus. Res. 2018, 93, 23–36. [Google Scholar] [CrossRef]

- Jennings, P.D.; Zandbergen, P.A. Ecologically sustainable organizations: An institutional approach. Acad. Manag. Rev. 1995, 20, 1015–1052. [Google Scholar] [CrossRef]

- Majumdar, S.K.; Marcus, A.A. Rules versus discretion: The productivity consequences of flexible regulation. Acad. Manag. J. 2001, 44, 170–179. [Google Scholar] [CrossRef][Green Version]

- Wahga, A.I.; Blundel, R.; Schaefer, A. Understanding the drivers of sustainable entrepreneurial practices in Pakistan’s leather industry. Int. J. Entrep. Behav. Res. 2018, 24, 382–407. [Google Scholar] [CrossRef]

- Dai, J.; Cantor, D.E.; Montabon, F.L. How environmental management competitive pressure affects a focal firm’s environmental innovation activities: A green supply chain perspective. J. Bus. Logist. 2015, 36, 242–259. [Google Scholar] [CrossRef]

- De Marchi, V. Environmental innovation and R&D cooperation: Empirical evidence from Spanish manufacturing firms. Res. Policy 2012, 41, 614–623. [Google Scholar] [CrossRef]