Projecting Experience of Technology-Based MSMEs in Indonesia: Role of Absorptive Capacity Matter in Strategic Alliances and Organizational Performance Relationship

Abstract

1. Introduction

2. Literature Review

2.1. Resource-Based View (RBV)

2.2. Knowledge-Based Theory

2.3. Transaction Cost of Theory

2.4. Strategic Alliance

2.5. Absorptive Capacity

2.6. Organizational Performance

2.7. Strategic Alliances and Organizational Performance

2.8. Strategic Alliance and Absorptive Capacity

2.9. Absorptive Capacity Andorganizational Performance

2.10. Absorptive Capacity Mediating Effects between Strategic Alliances and Organizational Performance

3. Methods

3.1. Research Design

3.2. Data Collection

- (a)

- This research is exploratory, which is an extension of an existing theory to identify, predict, and explain the constructs or latent variables studied [112];

- (b)

- The assumption of data in SEM is looser in the sense that it does not require the variables to meet the criteria of parametric analysis, such as multivariate normality [113];

- (c)

- The structural model of this research is complex because it has many indicators. SEM-PLS can analyze the model, testing complex research models (dependent, independent, and mediating variables) to estimate the model simultaneously and more accurately in theory testing;

- (d)

- Able to measure unobserved variables, namely variables that cannot be measured directly;

- (e)

- Researchers in various fields of science have used SEM-PLS. The development of SEM-PLS users has increased significantly in the last eight years, as seen in international journal publications [113].

3.3. Construct Definition and Measurement

3.3.1. Strategic Alliances (SA)

- Increasing innovation;

- Improving quality;

- Performing technology transfer;

- Promoting the learning process;

- Sharing resources and competencies;

- Obtaining knowledge transfer.

- Entering new markets;

- Increasing market share;

- Consolidating market positions.

- Increasing scale economy;

- Reducing transaction costs;

- Sharing the risk;

- Increased delivery times;

- Taking advantage of and creating synergies;

- Achieving a competitive advantage.

3.3.2. Absorptive Capacity (AC)

- Scope of search;

- Perspectual schema;

- New connections;

- Speed of learning;

- Quality of learning.

- Interpretation;

- Comprehension;

- Learning.

- Synergy;

- Recodification;

- Bisociation.

- Core Competencies;

- Harvesting resources.

3.3.3. Organizational Performance (OP)

- Developing trust;

- Motivating partners;

- Creating friendly relationships;

- Degree of partner commitment;

- Attaining cooperation objectives;

- Open communication;

- Knowledge market;

- Partners’ image;

- Past of the cooperation relationship.

- Compatibility of strategies;

- Solving conflicts;

- Balance of power and management in the cooperation;

- Compatibility of business cultures;

- Stability of the cooperation;

- Partners’ influence in decision-making;

- Partners’ adaptation to the cooperation process;

- Planning future activities.

- Collaboration results showed there was an increase in sales;

- Cooperation results showed there was an increase in profit;

- Increased customer satisfaction from the results of cooperation.

3.4. Descriptive Analysis Results

3.5. Measurement Model Analysis

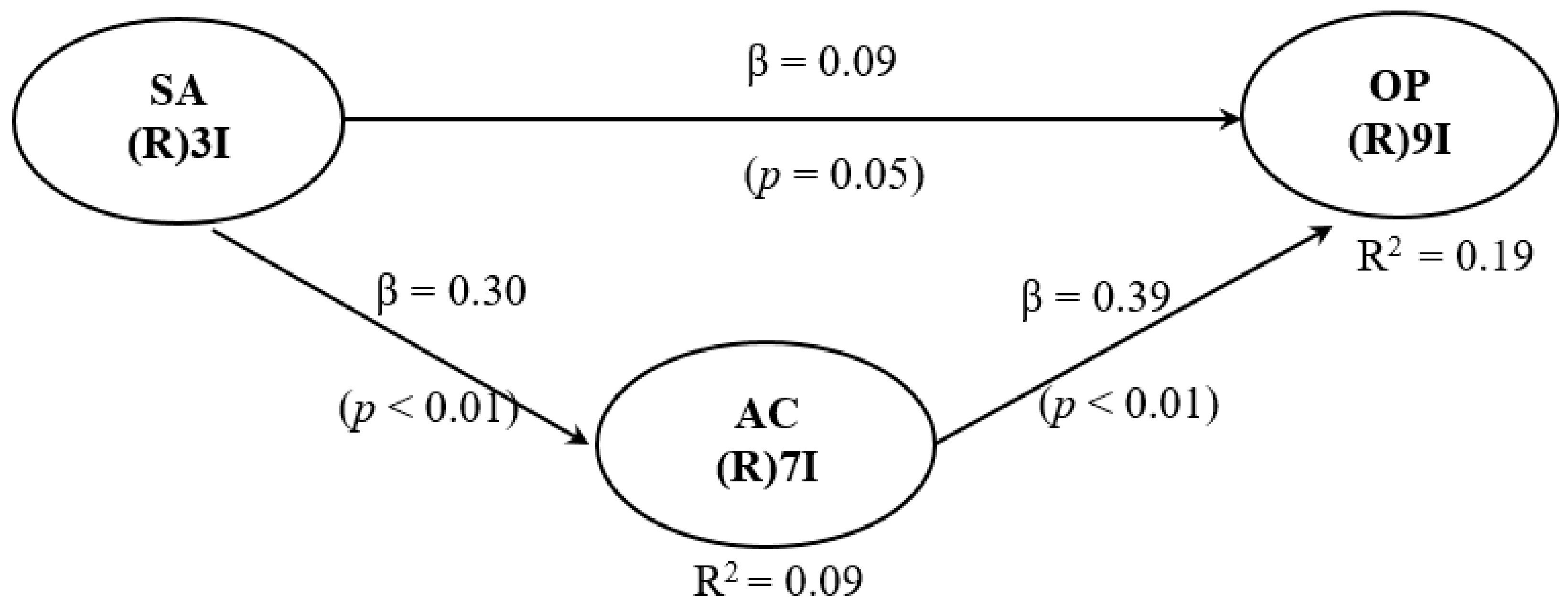

3.6. Structural Model Analysis

4. Discussion

5. Conclusions, Contribution, Implication and Limitation

5.1. Conclusions

5.2. Contribution

5.3. Implication

5.4. Limitation and Future Research

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Conflicts of Interest

References

- Bouguerra, A.; Mellahi, K.; Glaister, K.; Hughes, M.; Tatoglu, E. Revisiting the Concept of Absorptive Capacity: The Moderating Effects of Market Sensing and Responsiveness. Br. J. Manag. 2021, 32, 342–362. [Google Scholar] [CrossRef]

- Beynon, M.; Jones, P.; Pickernell, D. Innovation and the knowledge-base for entrepreneurship: Investigating SME innovation across European regions using fsQCA. Entrep. Reg. Dev. 2021, 33, 227–248. [Google Scholar] [CrossRef]

- Cherbib, J.; Chebbi, H.; Yahiaoui, D.; Thrassou, A.; Sakka, G. Digital technologies and learning within asymmetric alliances: The role of collaborative context. J. Bus. Res. 2021, 125, 214–226. [Google Scholar] [CrossRef]

- Claver-Cortés, E.; Marco-Lajara, B.; Manresa-Marhuenda, E. Innovation in foreign enterprises: The influence exerted by location and absorptive capacity. Technol. Anal. Strateg. Manag. 2020, 32, 936–954. [Google Scholar] [CrossRef]

- Rui, H.; Bruyaka, O. Strategic Network Orchestration in Emerging Markets: China’s Catch-up in the High-Speed Train Industry. Br. J. Manag. 2021, 32, 97–123. [Google Scholar] [CrossRef]

- Song, Y.; Gnyawali, D.R.; Srivastava, M.K.; Asgari, E. In Search of Precision in Absorptive Capacity Research: A Synthesis of the Literature and Consolidation of Findings. J. Manag. 2018, 44, 2343–2374. [Google Scholar] [CrossRef]

- Zahra, S.A.; George, G. The net-enabled business innovation cycle and the evolution of dynamic capabilities. Inf. Syst. Res. 2002, 13, 147–150. [Google Scholar] [CrossRef]

- Raisal, I.; Tarofder, A.K.; Ilmudeen, A. The nexus between entrepreneurial orientation and performance: Enabling roles of absorptive capacity. World J. Entrep. Manag. Sustain. Dev. 2021, 17, 153–166. [Google Scholar] [CrossRef]

- Zahra, S.A.; George, G. Absorptive Capacity: A Review, Reconceptualization, and Extension. Acad. Manag. Rev. 2002, 27, 185–203. [Google Scholar] [CrossRef]

- Jansen, J.P.; Van Den Bosch, F.A.; Volberda, H.W. Managing potential and realized absorptive capacity: How do organizational antecedents matter? Acad. Manag. J. 2005, 48, 999–1015. [Google Scholar] [CrossRef]

- Marwan, A.H.S.; Saleh, A.; Assagaf, S.; Possumah, B.T. Micro, Small and Medium Enterprises (MSME) and Creative Industry Development: Case Study of Ternate City, Indonesia. Int. J. Innov. Creat. Change 2019, 8, 4. [Google Scholar]

- Ferreira, A.; Franco, M. The Mediating Effect of Intellectual Capital in The Relationship Between Strategic Alliances and Organizational Performance in Portuguese Technology-Based SMEs. Eur. Manag. Rev. 2017, 14, 303–318. [Google Scholar] [CrossRef]

- Jasimuddin, S.M.; Naqshbandi, M.M. Knowledge infrastructure capability, absorptive capacity and inbound open innovation: Evidence from SMEs in France. Prod. Plan. Control. 2019, 30, 893–906. [Google Scholar] [CrossRef]

- Moreno, V.; Pinheiro, M., Jr.; Joia, L.A. Resource-Based view, knowledge-based view and the performance of software development companies: A study of brazilian SMEs. J. Glob. Inf. Manag. 2012, 20, 27–53. [Google Scholar] [CrossRef][Green Version]

- Jiang, X.; Jiang, F.; Cai, X.; Liu, H. How does trust affect alliance performance? The mediating role of resource sharing. Ind. Mark. Manag. 2015, 45, 128–138. [Google Scholar] [CrossRef]

- Rosenbusch, N.; Brinckmann, J.; Bausch, A. Is innovation always beneficial? A meta-analysis of the relationship between innovation and performance in SMEs. J. Bus. Ventur. 2011, 26, 441–457. [Google Scholar] [CrossRef]

- Baum JA, C.; Calabrese, T.; Silverman, B.S. Don’t go it alone: Alliance network composition and startups’ performance in Canadian biotechnology. Strateg. Manag. J. 2000, 21, 267–294. [Google Scholar] [CrossRef]

- Musarra, G.; Robson, M.J.; Katsikeas, C.S. The influence of desire for control on monitoring decisions and performance outcomes in strategic alliances. Ind. Mark. Manag. 2016, 55, 10–21. [Google Scholar] [CrossRef]

- Sproul, C.; Cox, K.; Ross, A. Entrepreneurial actions: Implications for firm performance. J. Small Bus. Enterp. Dev. 2019, 26, 706–725. [Google Scholar] [CrossRef]

- Soewarno, N.; Tjahjadi, B. Mediating effect of strategy on competitive pressure, stakeholder pressure and strategic performance management (SPM): Evidence from HEIs in Indonesia. Benchmarking 2020, 27, 1743–1764. [Google Scholar] [CrossRef]

- Cacciolatti, L.; Rosli, A.; Ruiz-Alba, J.L.; Chang, J. Strategic alliances and firm performance in startups with a social mission. J. Bus. Res. 2020, 106, 106–117. [Google Scholar] [CrossRef]

- Barney, J.B. Resource-based theories of competitive advantage: A ten-year retrospective on the resource-based view. J. Manag. 2001, 27, 643–650. [Google Scholar] [CrossRef]

- Wernerfelt, B. The re-source-based view of the firm. Strateg. Manag. J. 1984, 5, 171–180. [Google Scholar] [CrossRef]

- Kale, E.; Aknar, A.; Başar, Ö. Absorptive capacity and firm performance: The mediating role of strategic agility. Int. J. Hosp. Manag. 2019, 78, 276–283. [Google Scholar] [CrossRef]

- Foss, N.J.; Eriksen, B. Competitive advantage and industry capabilities. In Resource-Based and Evolutionary Theories of the Firm: Towards a Synthesis; Springer: Berlin/Heidelberg, Germany, 1995; pp. 43–69. [Google Scholar]

- Grant, R.M. The resource-based theory of competitive advantage: Implications for strategy formulation. Calif. Manag. Rev. 1991, 33, 114–135. [Google Scholar] [CrossRef]

- Barney, J.B.; Ketchen, D.J., Jr.; Wright, M.; Ketchen, D.J.; Wright, M. The future of resource-based theory: Revitalization or decline? J. Manag. 2011, 37, 1299–1315. [Google Scholar] [CrossRef]

- Barney, J. Firm resources and sustained competitive advantage. J. Manag. 1991, 17, 99–120. [Google Scholar] [CrossRef]

- Teece, D.J.; Pisano, G.; Shuen, A.; Michael, H.Z. Dynamic Capabilities and Strategic Management. In Knowledge and Strategy; Butterworth-Heinemann: Boston, MA, USA, 1999. [Google Scholar]

- Coff, R.; Kryscynski, D. Invited editorial: Drilling for micro-foundations of human capital–based competitive advantages. J. Manag. 2011, 37, 1429–1443. [Google Scholar] [CrossRef]

- Shane, S.; Venkataraman, S. The promise of entrepreneurship as a field of research. Acad. Manag. Rev. 2000, 25, 217–226. [Google Scholar] [CrossRef]

- Dobbs, M.; Hamilton, R.T. Small business growth: Recent evidence and new directions. Int. J. Entrep. Behav. Res. 2007, 13, 296–322. [Google Scholar] [CrossRef]

- Cowling, M.; Liu, W.; Ledger, A.; Zhang, N. What really happens to small and medium-sized enterprises in a global economic recession? UK evidence on sales and job dynamics. Int. Small Bus. J. 2015, 33, 488–513. [Google Scholar] [CrossRef]

- Hayton, J.C. Promoting corporate entrepreneurship through human resource management practices: A review of empirical research. Hum. Resour. Manag. Rev. 2005, 15, 21–41. [Google Scholar] [CrossRef]

- Barney, J.B. Why resource-based theory’s model of profit appropriation must incorporate a stakeholder perspective. Strateg. Manag. J. 2018, 39, 3305–3325. [Google Scholar] [CrossRef]

- Boxall, P.; Steeneveld, M. Human resource strategy and competitive advantage: A longitudinal study of engineering consultancies. J. Manag. Stud. 1999, 36, 443–463. [Google Scholar] [CrossRef]

- Hesping, F.H.; Schiele, H. Sourcing tactics to achieve cost savings: Developing a formative method of measurement. Int. J. Procure. Manag. 2016, 9, 473–504. [Google Scholar] [CrossRef]

- Dabić, M.; Lažnjak, J.; Smallbone, D.; Švarc, J. Intellectual capital, organisational climate, innovation culture, and SME performance: Evidence from Croatia. J. Small Bus. Enterp. Dev. 2019, 26, 522–544. [Google Scholar] [CrossRef]

- Grant, R.M. The knowledge-based view of the firm: Implications for management practice. Long Range Plan. 1997, 30, 450–454. [Google Scholar] [CrossRef]

- Spender, J.; Grant, R.M. Knowledge and the firm: Overview. Strateg. Manag. J. 1996, 17, 5–9. [Google Scholar] [CrossRef]

- Kale, P.; Singh, H. Building firm capabilities through learning: The role of the alliance learning process in alliance capability and firm-level alliance success. Strateg. Manag. J. 2007, 28, 981–1000. [Google Scholar] [CrossRef]

- Nonaka, I. A Dynamic Theory of Organizational Knowledge Creation. Organ. Sci. 1994, 5, 14–37. [Google Scholar] [CrossRef]

- Grant, R.M.; Baden-Fuller, C. A knowledge accessing theory of strategic alliances. J. Manag. Stud. 2004, 41, 61–84. [Google Scholar] [CrossRef]

- Muthusamy, S.K.; White, M.A. Learning and Knowledge Transfer in Strategic Alliances: A Social Exchange View. Organ. Stud. 2005, 26, 415–441. [Google Scholar] [CrossRef]

- Hennart, J.F. Transaction Cost Theory and International Business. J. Retail. 2010, 86, 257–269. [Google Scholar] [CrossRef]

- Mahoney, J.T. Economic foundations of strategy. In Economic Foundations of Strategy; SAGE Publications: Thousand Oaks, CA, USA, 2005. [Google Scholar] [CrossRef]

- Rindfleisch, A. Transaction cost theory: Past, present and future. AMS Rev. 2020, 10, 85–97. [Google Scholar] [CrossRef]

- Khodaei, H.; Scholten, V.; Wubben, E.; Omta, O. Bridging the Gap between Entrepreneurial Orientation and Market Opportunity: The Mediating Effect of Absorptive Capacity and Market Readiness. In Entrepreneurial Orientation: Epistemological, Theoretical, and Empirical Perspectives; Khodaei, H., Scholten, V., Wubben, E., Omta, O., Eds.; Emerald Publishing Limited: Bingley, UK, 2021; pp. 201–222. [Google Scholar] [CrossRef]

- Penrose, E.T. The Theory of the Growth of the Firm. John Wiley: New York, NY, USA, 1959. [Google Scholar]

- Antelo, M.; Peón, D. The Size of Strategic Alliances and the Role Played by Managers. J. Ind. Compet. Trade 2021, 21, 287–313. [Google Scholar] [CrossRef]

- Gao, T. Plural forms of governance for international strategic alliances: Toward an integrative framework. Int. J. Bus. Glob. 2021, 27, 32–50. [Google Scholar] [CrossRef]

- Seo, R.; Edler, J.; Massini, S. Can entrepreneurial orientation improve R&D alliance performance? An absorptive capacity perspective. R&D Manag. 2021, 52, 50–66. [Google Scholar] [CrossRef]

- Kipley, D.; Lewis, A. The scalability of H. Igor Ansoff’s strategic management principles for small and medium sized firms. J. Manag. Res. 2009, 1, 1–26. [Google Scholar] [CrossRef][Green Version]

- Merchant, H.; Schendel, D. How do international joint ventures create shareholder value? Strateg. Manag. J. 2000, 21, 723–737. [Google Scholar] [CrossRef]

- Ozmel, U.; Robinson, D.T.; Stuart, T.E. Strategic alliances, venture capital, and exit decisions in early stage high-tech firms. J. Financ. Econ. 2013, 107, 655–670. [Google Scholar] [CrossRef]

- Srivastava, R. The Investment Model of Crowdfunding for MSME (Micro, Small and Medium Enterprises) in India. In International Perspectives on Crowdfunding; Emerald Group Publishing Limited: Bingley, UK, 2016. [Google Scholar]

- Lok, J.; Willmott, H. Identities and identifications in organizations: Dynamics of antipathy, deadlock, and alliance. J. Manag. Inq. 2014, 23, 215–230. [Google Scholar] [CrossRef]

- Del Carmen Haro-Domínguez, M.; Arias-Aranda, D.; Lloréns-Montes, F.J.; Moreno, A.R. The impact of absorptive capacity on technological acquisitions engineering consulting companies. Technovation 2007, 27, 417–425. [Google Scholar] [CrossRef]

- Schildt, H.; Keil, T.; Maula, M. The temporal effects of relative and firm-level absorptive capacity on interorganizational learning. Strateg. Manag. J. 2012, 33, 1154–1173. [Google Scholar] [CrossRef]

- Liao, J.; Welsch, H.; Stoica, M. Organizational absorptive capacity and responsiveness: An empirical investigation of growth–oriented SMEs. Entrep. Theory Pract. 2003, 28, 63–86. [Google Scholar] [CrossRef]

- Paoli, M.; Prencipe, A. The role of knowledge bases in complex product systems: Some empirical evidence from the aero engine industry. J. Manag. Gov. 1999, 3, 137–160. [Google Scholar] [CrossRef]

- Veugelers, R. Internal R & D expenditures and external technology sourcing. Res. Policy 1997, 26, 303–315. [Google Scholar]

- Lazzarotti, V.; Manzini, R.; Pellegrini, L. Is your open-innovation successful? The mediating role of a firm’s organizational and social context. Int. J. Hum. Resour. Manag. 2015, 26, 2453–2485. [Google Scholar] [CrossRef]

- Flor, M.L.; Cooper, S.Y.; Oltra, M.J. External knowledge search, absorptive capacity and radical innovation in high-technology firms. Eur. Manag. J. 2018, 36, 183–194. [Google Scholar] [CrossRef]

- Boso, N.; Adeleye, I.; Ibeh, K.; Chizema, A. The internationalization of African firms: Opportunities, challenges, and risks. Thunderbird Int. Bus. Rev. 2019, 61, 5–12. [Google Scholar] [CrossRef]

- De Clercq, D.; Sapienza, H.J.; Yavuz, R.I.; Zhou, L. Learning and knowledge in early internationalization research: Past accomplishments and future directions. J. Bus. Ventur. 2012, 27, 143–165. [Google Scholar] [CrossRef]

- Nakos, G.; Brouthers, K.D.; Dimitratos, P. International alliances with competitors and non-competitors: The disparate impact on SME international performance. Strateg. Entrep. J. 2014, 8, 167–182. [Google Scholar] [CrossRef]

- Zerwas, D. Organizational Culture and Absorptive Capacity: The Meaning for SMEs; Springer Science & Business Media: Berlin/Heidelberg, Germany, 2014. [Google Scholar]

- Domurath, A.; Patzelt, H. Entrepreneurs’ assessments of early international entry: The role of foreign social ties, venture absorptive capacity, and generalized trust in others. Entrep. Theory Pract. 2016, 40, 1149–1177. [Google Scholar] [CrossRef]

- Fletcher, M. Learning processes in the development of absorptive capacity of internationalising SMEs. In Internationalization, Entrepreneurship and the Smaller Firm: Evidence from Around the World, Edward Elgar, Cheltenham; Edward Elgar Publishing: Cheltenham, UK, 2009; pp. 73–90. [Google Scholar]

- Prashantham, S.; Young, S. Post–entry speed of international new ventures. Entrep. Theory Pract. 2011, 35, 275–292. [Google Scholar] [CrossRef]

- Cohen, W.M.; Levinthal, D.A. Absorptive Capacity: A New Perspective on Learning and Innovation. Adm. Sci. Q. 1990, 35, 128–152. [Google Scholar] [CrossRef]

- Zahra, S.A.; Ucbasaran, D.; Newey, L.R. Social knowledge and SMEs’ innovative gains from internationalization. Eur. Manag. Rev. 2009, 6, 81–93. [Google Scholar] [CrossRef]

- Fosfuri, A.; Tribó, J.A. Exploring the antecedents of potential absorptive capacity and its impact on innovation performance. Omega 2008, 36, 173–187. [Google Scholar] [CrossRef]

- Lane, P.J.; Koka, B.R.; Pathak, S. The reification of absorptive capacity: A critical review and rejuvenation of the construct. Acad. Manag. Rev. 2006, 31, 833–863. [Google Scholar] [CrossRef]

- Lane, P.J.; Lubatkin, M. Relative absorptive capacity and interorganizational learning. Strateg. Manag. J. 1998, 19, 461–477. [Google Scholar] [CrossRef]

- Volberda, H.W.; Foss, N.J.; Lyles, M.A. Perspective—Absorbing the concept of absorptive capacity: How to realize its potential in the organization field. Organ. Sci. 2010, 21, 931–951. [Google Scholar] [CrossRef]

- Margaretha, F.; Afriyanti, E. Pengaruh Corporate Gorvernance Terhadap Kinerja Industri Jasa Non Keuangan yang Terdaftar di Bursa Efek Indonesia. J. Akunt. 2016, 20, 463–466. [Google Scholar]

- Memon, F.; Abbas, G.; Bhutto, N.A. Capital Structure and Firm Perfomance: A Case of Textile Sector of Pakistan. Asian J. Bus. Manag. Scieces 2012, 1, 9–15. [Google Scholar]

- Goyal, P.; Rahman, Z.; Kazmi, A. Corporate Sustainability Performance and Firm Performance Research: Literature Review and Future Research Agenda. Manag. Decis. 2013, 51, 361–379. [Google Scholar] [CrossRef]

- Anwar, A.Z.; Susilo, E.; Rohman, F.; Santosa, P.B.; Gunanto EY, A. Integrated financing model in Islamic microfinance institutions for agriculture and fisheries sector. Invest. Manag. Financ. Innov. 2019, 16, 303–314. [Google Scholar] [CrossRef]

- Ariño, A.; De la Torre, J.; Ring, P.S. Relational quality: Managing trust in corporate alliances. Calif. Manag. Rev. 2001, 44, 109–131. [Google Scholar] [CrossRef]

- Rehman, N.; Razaq, S.; Farooq, A.; Zohaib, N.M.; Nazri, M. Information technology and firm performance: Mediation role of absorptive capacity and corporate entrepreneurship in manufacturing SMEs. Technol. Anal. Strateg. Manag. 2020, 32, 1049–1065. [Google Scholar] [CrossRef]

- Arend, R.J.; Bromiley, P. Assessing the Dynamic Capabilities View: Spare Change, Everyone? Sage Publications Sage: London, UK, 2009. [Google Scholar]

- Bouncken, R.B.; Pesch, R.; Gudergan, S.P. Strategic embeddedness of modularity in alliances: Innovation and performance implications. J. Bus. Res. 2015, 68, 1388–1394. [Google Scholar] [CrossRef]

- Dana, L.-P.; Mallet, J. An unusual empirical pattern in an indigenous setting: Cooperative entrepreneurship among Brazil nut (Bertholletia excelsa) harvesters. Int. J. Entrep. Small Bus. 2014, 22, 137–158. [Google Scholar] [CrossRef]

- Khalid, S.; Larimo, J. Affects of alliance entrepreneurship on common vision, alliance capability and alliance performance. Int. Bus. Rev. 2012, 21, 891–905. [Google Scholar] [CrossRef]

- Reuer, J.J.; Zollo, M. Termination outcomes of research alliances. Res. Policy 2005, 34, 101–115. [Google Scholar] [CrossRef]

- Wahyudi, I. Commitment and trust in achieving financial goals of strategic alliance: Case in Islamic microfinance. Int. J. Islamic Middle East. Financ. Manag. 2014, 7, 421–442. [Google Scholar] [CrossRef]

- Lichtenthaler, U. Determinants of absorptive capacity: The value of technology and market orientation for external knowledge acquisition. J. Bus. Ind. Mark. 2016, 31, 600–610. [Google Scholar] [CrossRef]

- Bamel, N.; Pereira, V.; Bamel, U.; Cappiello, G. Knowledge management within a strategic alliances context: Past, present and future. J. Knowl. Manag. 2021, 25, 1782–1810. [Google Scholar] [CrossRef]

- Cerchione, R.; Esposito, E. Using knowledge management systems: A taxonomy of SME strategies. Int. J. Inf. Manag. 2017, 37, 1551–1562. [Google Scholar] [CrossRef]

- Ngah, R.; Abd Wahab, I.; Salleh, Z. The sustainable competitive advantage of small and medium entreprises (SMEs) with intellectual capital, knowledge management and innovative intelligence: Building a conceptual framework. Adv. Sci. Lett. 2015, 21, 1325–1328. [Google Scholar] [CrossRef]

- Verbano, C.; Crema, M. Linking technology innovation strategy, intellectual capital and technology innovation performance in manufacturing SMEs. Technol. Anal. Strateg. Manag. 2016, 28, 524–540. [Google Scholar] [CrossRef]

- Barney, J.B.; Wright, M.; Ketchen, D. Organizational Cultre: Can It Be a Sorce of Sustained Competitive Advantage? Acad. Manag. Rev. 1986, 11, 656–665. [Google Scholar] [CrossRef]

- Makadok, R. Toward a Synthesis of the Resource-based and dynamic-capability View of Rent Creation. Strateg. Manag. J. 2001, 22, 387–401. [Google Scholar] [CrossRef]

- Mccann, J.; Holt, R. Defining Sustainable Leadership. Int. J. Sustaun. Strat. Manag. 2010, 2, 204–210. [Google Scholar] [CrossRef]

- Bossink, B. Leadership for Sustainable Innovation. Int. J. Technol. Manag. Sustain. Dev. 2007, 6, 135–149. [Google Scholar] [CrossRef]

- Iqbal, Q.; Piwowar-Sulej, K. Sustainable leadership in higher education institutions: Social innovation as a mechanism. Int. J. Sustain. High. Educ. 2021, 23, 1–20. [Google Scholar] [CrossRef]

- Chesbrough, H.W. Open Innovation: The New Imperative for Creating and Profiting from Technology; Harvard Business Press: Boston, MA, USA, 2003. [Google Scholar]

- Jane Zhao, Z.; Anand, J. A multilevel perspective on knowledge transfer: Evidence from the Chinese automotive industry. Strateg. Manag. J. 2009, 30, 959–983. [Google Scholar] [CrossRef]

- Kostopoulos, K.; Papalexandris, A.; Papachroni, M.; Ioannou, G. Absorptive capacity, innovation, and financial performance. Journal of Business Research 2010, 64, 1335–1343. [Google Scholar] [CrossRef]

- Flatten, T.C.; Greve, G.I.; Brettel, M. Absorptive capacity and firm performance in SMEs: The mediating influence of strategic alliances. Eur. Manag. Rev. 2011, 8, 137–152. [Google Scholar] [CrossRef]

- Hsiao, Y.-C.; Chen, C.-J.; Choi, Y.R. The innovation and economic consequences of knowledge spillovers: Fit between exploration and exploitation capabilities, knowledge attributes, and transfer mechanisms. Technol. Anal. Strateg. Manag. 2017, 29, 872–885. [Google Scholar] [CrossRef]

- Tsai, W. Knowledge transfer in intraorganizational networks: Effects of network position and absorptive capacity on business unit innovation and performance. Acad. Manag. J. 2001, 44, 996–1004. [Google Scholar]

- Tzokas, N.; Kim, Y.A.; Akbar, H.; Al-Dajani, H. Absorptive capacity and performance: The role of customer relationship and technological capabilities in high-tech SMEs. Ind. Mark. Manag. 2015, 47, 134–142. [Google Scholar] [CrossRef]

- Murovec, N.; Prodan, I. Absorptive capacity, its determinants, and influence on innovation output: Cross-cultural validation of the structural model. Technovation 2009, 29, 859–872. [Google Scholar] [CrossRef]

- Camisón, C.; Forés, B. Knowledge absorptive capacity: New insights for its conceptualization and measurement. J. Bus. Res. 2010, 63, 707–715. [Google Scholar] [CrossRef]

- Harvey, G.; Skelcher, C.; Spencer, E.; Jas, P.; Walshe, K. Absorptive capacity in a non-market environment: A knowledge-based approach to analysing the performance of sector organizations. Public Manag. Rev. 2010, 12, 77–97. [Google Scholar] [CrossRef]

- Bolívar-Ramos, M.; García-Morales, V.; Martín-Rojas, R. The effects of Information Technology on absorptive capacity and organisational performance. Technol. Anal. Strateg. Manag. 2013, 25, 905–922. [Google Scholar] [CrossRef]

- Ali, Z.; Sun, H.; Ali, M. The Impact of Managerial and Adaptive Capabilities to Stimulate Organizational Innovation in SMEs: A Complementary PLS–SEM Approach. Sustainability 2017, 9, 2157. [Google Scholar] [CrossRef]

- Sholihin, M.; Ratmono, D. Analisis SEM-PLS dengan WarpPLS 3.0 untuk Hubungan Nonlinier dalam Penelitian Sosial dan Bisnis; Penerbit Andi: Yogyakarta, Indonesia, 2013. [Google Scholar]

- Hair, J.F.; Hult, G.T.M.; Ringle, C.; Sarstedt, M. A Primer on Partial Least Squares Structural Equation Modeling (PLS-SEM); SAGE: Thousand Oaks, CA, USA, 2014. [Google Scholar]

- Das, T.K.; Teng, B.-S. Trust, control, and risk in strategic alliances: An integrated framework. Organ. Stud. 2001, 22, 251–283. [Google Scholar] [CrossRef]

- Glaister, K.W.; Buckley, P.J. Performance relationships in UK international alliances. MIR Manag. Int. Rev. 1999, 39, 123–147. [Google Scholar]

- Franco, M. Determining factors in the success of strategic alliances: An empirical study performed in Portuguese firms. Eur. J. Int. Manag. 2011, 5, 608–632. [Google Scholar] [CrossRef]

- Kónya, V.; Grubić-Nešić, L.; Matić, D. The influence of leader-member communication on organizational commitment in a central European hospital. Acta Polytech. Hung. 2015, 12, 109–128. [Google Scholar]

- Hair, J.F.; Ringle, C.M.; Sarstedt, M. Partial least squares structural equation modeling: Rigorous applications, better results and higher acceptance. Long Range Plan. 2013, 46, 1–12. [Google Scholar] [CrossRef]

- Vandenbosch, M.B. Confirmatory compositional approaches to the development of product spaces. Eur. J. Mark. 1996, 30, 23–46. [Google Scholar] [CrossRef]

- Hartmann, F.; Slapničar, S. How formal performance evaluation affects trust between superior and subordinate managers. Account. Organ. Soc. 2009, 34, 722–737. [Google Scholar] [CrossRef]

| Criteria | Frequency (n = 317) | Percentage (100%) | |

|---|---|---|---|

| 1. Size of the firms | |||

| a. | Micro/<300 | 246 | 78% |

| b. | Small/300 jt—2.5 m | 69 | 22% |

| c. | Medium/2.5 m—50 m | 2 | 1% |

| 2. Age of firms | |||

| a. | 0–1 | 192 | 61% |

| b. | 2–5 | 75 | 24% |

| c. | 6–10 | 24 | 8% |

| d. | >10 | 26 | 8% |

| 3. Respondent’s Last Education Identification | |||

| a. | Senior High School | 221 | 70% |

| b. | Diploma 3 | 22 | 7% |

| c. | Bachelor | 56 | 18% |

| d. | Master/Magister | 18 | 6% |

| 4. Type of Firms | |||

| a. | Basic chemical industry sector | 5 | 2% |

| b. | Consumer goods sector | 173 | 55% |

| c. | Infrastructure/utility and transportation sector | 12 | 4% |

| d. | Export/Import Sector | 2 | 1% |

| e. | Miscellaneous sectors (Handicraft, Fashion, Distributors, etc.) | 100 | 32% |

| f. | Property/real estate sector and building construction | 3 | 1% |

| g. | Exchange/services and investment sector | 22 | 7% |

| 5. Gender | |||

| a. | Male | 194 | 61% |

| b. | Female | 123 | 39% |

| 6. Informant | |||

| a. | Owner | 187 | 59% |

| b. | Director/Manager | 24 | 8% |

| c. | Assistant | 106 | 33% |

| 7. Data source location | |||

| a. | Surabaya | 99 | 31% |

| b. | Sidoarjo | 125 | 39% |

| c. | Gresik | 6 | 2% |

| d. | Pasuruan | 3 | 1% |

| e. | Jember | 54 | 17% |

| f. | Banyuwangi | 11 | 3% |

| g. | Lombok | 11 | 3% |

| h. | Semarang | 1 | 0% |

| i. | Mojokerto | 2 | 1% |

| j. | Malang | 2 | 1% |

| k. | Outer Java | 3 | 1% |

| Variable | Mean | Standard Deviation |

|---|---|---|

| Strategic Alliances | 4.31 | 0.60 |

| Absorptive capacity | 4.14 | 0.56 |

| Organizational Performance | 4.39 | 0.58 |

| Indicator | AS | AC | OP | SE | p-Value |

|---|---|---|---|---|---|

| CR: 0.842 | AVE: 0.641 | ||||

| AS7 | 0.784 | −0.017 | 0.041 | Reflect 0.051 | <0.001 |

| AS8 | 0.822 | −0.018 | 0.008 | Reflect 0.051 | <0.001 |

| AS9 | 0.795 | 0.035 | −0.049 | Reflect 0.051 | <0.001 |

| CR: 0.882 | AVE: 0.519 | ||||

| AC4 | −0.102 | 0.647 | 0.089 | Reflect 0.052 | <0.001 |

| AC6 | 0.191 | 0.689 | −0.120 | Reflect 0.052 | <0.001 |

| AC7 | 0.097 | 0.782 | −0.084 | Reflect 0.051 | <0.001 |

| AC8 | −0.109 | 0.786 | 0.034 | Reflect 0.051 | <0.001 |

| AC9 | −0.069 | 0.686 | 0.077 | Reflect 0.052 | <0.001 |

| AC12 | −0.005 | 0.751 | −0.007 | Reflect 0.051 | <0.001 |

| AC13 | −0.008 | 0.688 | 0.023 | Reflect 0.052 | <0.001 |

| CR: 0.905 | AVE: 0.544 | ||||

| OP6 | 0.164 | −0.074 | 0.638 | Reflect 0.052 | <0.001 |

| OP9 | 0.117 | −0.048 | 0.664 | Reflect 0.052 | <0.001 |

| OP11 | −0.126 | 0.149 | 0.733 | Reflect 0.052 | <0.001 |

| OP12 | −0.143 | 0.018 | 0.756 | Reflect 0.051 | <0.001 |

| OP13 | 0.02 | 0.032 | 0.822 | Reflect 0.051 | <0.001 |

| OP14 | 0.018 | −0.043 | 0.769 | Reflect 0.051 | <0.001 |

| OP15 | 0.032 | 0.002 | 0.757 | Reflect 0.051 | <0.001 |

| OP16 | −0.049 | −0.052 | 0.744 | Reflect 0.052 | <0.001 |

| Strategic Alliances | Absorptive Capacity | Organizational Performance | |

|---|---|---|---|

| Strategic Alliances | 0.8 | 0.251 | 0.214 |

| Absorptive Capacity | 0.251 | 0.72 | 0.397 |

| Org. Performance | 0.214 | 0.397 | 0.737 |

| Panel A (direct) | ||

|---|---|---|

| Hypotheses | Coefficient | Decision |

| SA > OP | 0.22 *** | Supported |

| Panel B (indirect) | ||

| Hypotheses | Coefficient | Decision |

| SA > OP | 0.09 *** | Supported |

| SA > AC | 0.30 *** | Supported |

| AC > OP | 0.39 *** | Supported |

| Hypotheses | VAF | Decision |

| SA > AC > OP | 34.72 percent | Partial Mediation, Supported |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Kustiningsih, N.; Tjahjadi, B.; Soewarno, N. Projecting Experience of Technology-Based MSMEs in Indonesia: Role of Absorptive Capacity Matter in Strategic Alliances and Organizational Performance Relationship. Sustainability 2022, 14, 12025. https://doi.org/10.3390/su141912025

Kustiningsih N, Tjahjadi B, Soewarno N. Projecting Experience of Technology-Based MSMEs in Indonesia: Role of Absorptive Capacity Matter in Strategic Alliances and Organizational Performance Relationship. Sustainability. 2022; 14(19):12025. https://doi.org/10.3390/su141912025

Chicago/Turabian StyleKustiningsih, Nanik, Bambang Tjahjadi, and Noorlailie Soewarno. 2022. "Projecting Experience of Technology-Based MSMEs in Indonesia: Role of Absorptive Capacity Matter in Strategic Alliances and Organizational Performance Relationship" Sustainability 14, no. 19: 12025. https://doi.org/10.3390/su141912025

APA StyleKustiningsih, N., Tjahjadi, B., & Soewarno, N. (2022). Projecting Experience of Technology-Based MSMEs in Indonesia: Role of Absorptive Capacity Matter in Strategic Alliances and Organizational Performance Relationship. Sustainability, 14(19), 12025. https://doi.org/10.3390/su141912025