1. Introduction

Sustainable development is a method of arranging an organization or society to ensure human civilization’s long-term survival, and promoting it responsibly with the advent of the environmental, social, and governance (ESG) era requires considering both present and future imperatives, such as “green practice”, “social, legal, and ethical principles”, “improvement of corporate governance”, in addition to economic growth.(Sustainable development, as defined by the Brundtland Report in 1987 by the World Commission on Environment and Development, is the concept that human civilizations must continue and satisfy their requirements without harming future generations’ ability to meet their own needs. Since then, many scholars have attempted to define the concept of sustainable development, constantly noting that the concept of the World Commission on sustainable development is ambiguous and elusive [

1,

2], but there is no clear-cut and consistent perspective yet [

3]. Manioudis and Meramveliotakis (2022) [

3] investigating notion and trend of sustainable development through the lens of Smith’s, Mill’s and Marx’s stage theories of development argued that sustainability should be understood and defined in terms of historical and transhistorical frameworks, as well as contextual and situational events. In this vein, sustainable development may be characterized as a sustainable innovation movement that prioritizes non-financial values as well as economic growth by considering SDGs, circular economies, and ESG aspects.) It has recently been described by UN sustainable development goals (SDGs) and the circular economy, and also suggests a shift away from a concentration on environmental issues and toward the inclusion of larger socio-economic challenges (The SDGs are the United Nations (UN) global priorities and aspirations to achieve sustainable economic growth by 2030. They were adopted by the UN General Assembly in 2015 with aim of “stimulating action in areas of critical importance for humanity and the planet over the next 15 years” ([

4], p. 3). Since the 70th UN General Assembly adopted the SDGs in 2015 under the slogan “Leave no one behind”, the notion of sustainable development has become increasingly visible. The SDGs propose 17 broad targets and 169 specific goals for humankind’s future development in five areas: human, earth, prosperity, peace, and partnership. Another popular concept is the circular economy, which is a model of production and consumption that involves sharing, reusing, repairing, refurbishing, and recycling to decouple growth from the danger of resource depletion [

3,

5]. Along with the SDGs and circular economy, corporate and investor social responsibility has increased in importance, and many financial institutions all over the world are using ESG information to help them achieve their commitments. Since the United Kingdom made the disclosure of ESG factors mandatory in 2000, many other nations have adopted a similar regulatory framework, placing institutional investors, such as pensions or mutual funds, investment banks, insurance companies, and unit trusts, at the forefront [

6].

Another term used in the sustainability discourse is stewardship. According to the UK’s Financial Reporting Council (FRC), “stewardship aims to promote the long-term success of companies in such a way that the ultimate providers of capital also prosper, and effective stewardship benefits companies, investors, and the economy as a whole” ([

7], p. 10). Accounting scandals in Enron or WorldCom have prompted some institutional investors to consider fiduciary obligations when investing in investees [

8,

9,

10]. The role of institutional investors in the era of sustainable development is growing in importance.

As a consequence of the rising pressure on transparency, responsibility, and sustainability, businesses are now obliged to take into consideration the effects of ESG issues in their operations. ESG is a trend for sustainable management that concurrently emphasizes the non-financial value in the area of “E”, “S”, and “G”, as well as financial benefits. The three pillars of ESG disclosed by international standards have materialized as a visible result of these pressures and movements [

11], and amid the pressure, institutional investor activism has gained significant attention in Korea and around the world. In Korea, the national pension fund (NPF) implemented a stewardship code, which includes guidelines for exercising shareholder rights, and prepared plans for fiduciary responsibility activities in 2019 [

6].

In this situation, companies should run their operations in a way that benefits all internal and external stakeholders, including traditional owners, workers, and consumers along with their current local and global communities [

12]. Moreover, institutional investors have a responsibility to act as stewards of a company’s successful ESG initiatives. With the implementation of the stewardship code, the role of institutional investors has become more important, and their influence in the capital market is gradually increasing. The more stewardship responsibility is underscored, the more the competence of institutional investors to serve as effective watchdogs become more apparent.

In this paper, we investigate whether NPF, an institutional investor in Korea, should act as a steward of investee firms (agency theory), shareholders (shareholder theory), and society (stakeholder capitalism). Our research question is whether institutional investors encourage firms to improve their ESG and financial performance.

Contemporary researchers in this field have put their efforts into investigating the association between institutional investor’s activism and financial performance [

13,

14,

15], or institutional investor’s activism and ESG performance [

12,

16,

17,

18,

19], or ESG performance and financial performance [

20,

21,

22,

23,

24]. The general argument is whether institutional investor activism indeed improves the ESG performance of investee firms and, as a result, benefits their shareholders [

6,

14,

15,

25]. To the arguments, many positive pieces of evidence showing the relationship between ESG performance, which emerged from corporate social responsibility (CSR), and financial performance have been found in this area [

20,

21,

22,

24,

26,

27]. Negative pieces of evidence on institutional investor activism, however, exist simultaneously [

12,

19,

22,

24,

28]. The major argument debated in these papers is that institutional investor activism is not beneficial to shareholders, stakeholders, and society. This is because the primary goal of an institutional investor is maximizing their value for shareholders as an agency rather than making a socially responsible investment [

10,

29]. Even though institutional investors apply a stewardship code as part of their investor activism, they cannot make a socially responsible investment at the expense of their interests, and thus society or stakeholders should not demand such moral activism from institutional investors. [

6,

10]. Likewise, previous research in this field has been inconsistent.

With a stronger emphasis on the stewardship code and ESG, more research is still needed to demonstrate the impact of institutional investors’ activism on ESG and financial performance. Although the relationship between “institutional investor’s activism and financial performance”, “institutional investor’s activism and ESG performance”, and “ESG performance and financial performance” are incoherent, positive pieces of evidence are more dominant [

6,

15,

16,

17,

18,

19,

21,

22,

23,

25,

26]. Moreover, they persistently question whether firms are capable of operating and differentiating their business in sustainable and socially responsible ways. Disclosures of ESG can present firms with a market premium, and these can be of greater interest to institutional investors who search for a high accounting and market value [

16,

17,

18]. Besides, valuable ESG data allow institutional investors to better predict a firm’s accounting and market operation [

30].

In 2019, the stewardship code was introduced in Korea by NPF (i.e., by adopting “Principles on Trusteeship Responsibility” in 2019) and began its role as a steward [

31]. Nevertheless, little interest is shown in how NPF’s socially responsible investment affects the investee firms’ ESG and financial performance as institutional investors. With this backdrop in mind, the current paper concentrates on the institutional investor’s activism, ESG performance of investee firms, and financial performance following the ongoing consideration of the stewardship code and socially responsible investing. This study explores whether NPF should serve primarily as a steward for investee companies and if its activism may improve the investee firm’s performance on environmental, social, and governance pillars, which in turn improves financial performance. Hence, we raise research questions about whether ESG performance can act as a mediator or moderator. Given the positive relationship demonstrated in previous studies examining the relationship between investor activism and ESG performance or financial performance, causality or an interaction impact between the variables is predicted. In other words, the effect of NPF shareholding on financial performance can be indirectly related to the improvement of ESG performance. In addition, ESG performance can enhance the impact of NPF shareholding on financial performance. The current study not only allows us to diagnose the practice of institutional investors’ socially responsible investing and the degree of firms’ ESG participation in Korea but also aids understandings of the relationship between the variables based on stakeholder theory and the slack resource hypothesis.

The remainder of this study is structured as follows: We analyze the literature, create hypotheses, and establish a research framework in the Theory and Hypotheses section. The Research Design section describes the data, sample, and measurement of variables. The descriptive information, the correlation matrix, and the findings and discussion are all explained in the Research and Discussion section. Finally, the Conclusion offers additional discussion, implications, and limitations.

4. Results and Discussion

4.1. Descriptive Statistics

Table 2 shows the distribution of industries in our sample. Chemistry had the highest distribution with 226 firms (20.3%), followed by electrical and electronic with 156 (14.0%), and pharmaceuticals with 137 (12.3%).

One vital purpose of this study was to determine the extent to which Korean businesses have implemented ESG practices. Before we verified the hypotheses, we pretested whether firms with a high financial performance also had a high ESG performance. This allowed us to diagnose the current degree of ESG activity in Korean manufacturing firms and determine whether or not the sample companies in this research supported earlier discussions, such as the slack resource hypothesis on the relationship between ESG performance and financial performance.

Table 3 Panel A shows the distribution of ESG grades by year for 1112 samples. In 2019, 134 firms received B+ or higher grades (24.8%), while 406 (75.2%) received B or lower grades. In 2020, 182 (31.8%) and 390 (68.2%) firms were classified.

The distribution of ROE by ESG grade is seen in Panel B. It was categorized into four groups based on ESG grade (”B+”: “B”) and the median of ROE (60th percentile: 40th percentile). Then, based on the ROE and ESG grades, we could create a 2-by-2 matrix grade [

6]. For example, if ROE was greater than the 60th percentile and the ESG grade is above or equivalent to B+, the companies were regarded as having good ESG performance with excellent financial performance. Additionally, if a company was below the 40th percentile but its ESG grade was B+ or higher, it was categorized to have an outstanding ESG performance yet a poor financial performance. In this manner, we created four comparison groups, each labeled as group 1 (high ROE, high ESG), group 2 (low ROE, high ESG), group 3 (low ROE, low ESG), and group 4 (high ROE, low ESG), respectively. According to the findings, out of the 249 firms with respectable ESG performance, 144 (16.2%) had respectable ROE (G1) and 105 (G2) had poor ROE (11.8%). Additionally, out of 642 firms with poor ESG performance, 342 (38.4%) had poor ROE (G3), and 300 (G4) had high ROE (33.7%). The Pearson Chi-Square statistic was 8.846 and the

p-value was 0.01. As a result, the null hypothesis was rejected, and we could confirm that there was a statistical difference between the four groups.

Panel C shows the parent ratio difference for the distribution of ROE and ESG performance. Out of the 249 strong ESG firms, 144 (16.2%) had decent ROE (G1) and 105 (11.8%) had poor ROE (G2). With a Z-value of 2.471, the difference was statistically significant (p-value 0.01). Additionally, among the 642 weak ESG firms, there were 342 (38.4%) companies with poor ROE (G3) and 300 (33.7%) companies with reasonable ROE, and the difference was statistically substantial. The pretest results of this study demonstrated that ESG management was more prevalent in organizations with high ROE, which may support the slack resource hypothesis.

Table 4 displays the correlation between the variables of the study. With the exception of the pairs involving NPF shareholding and Tobin q, the coefficients for main components vary from −0.101 to 0.820, and many of the paired variables had significant correlations.

4.2. Path Analysis Results

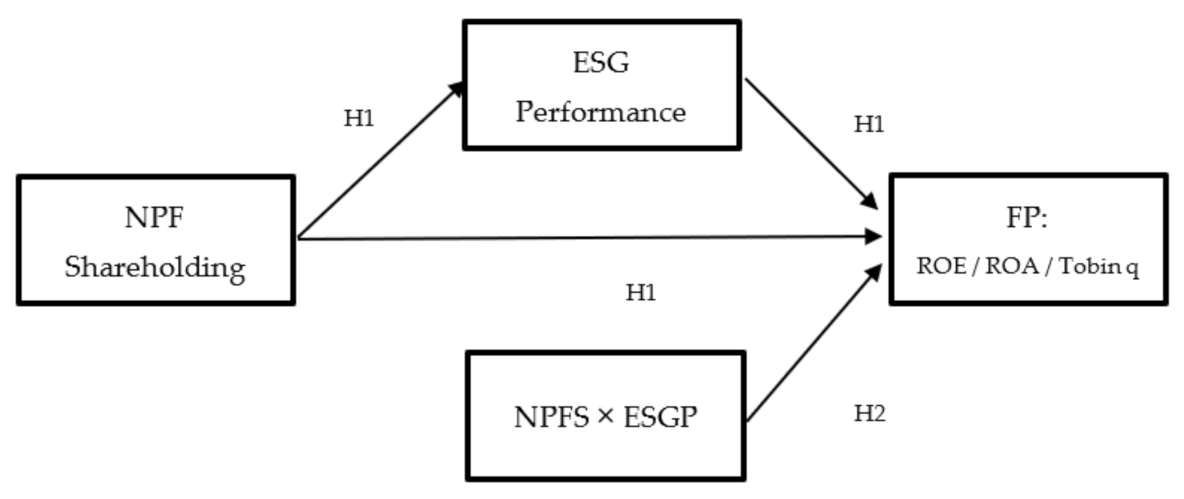

We had two hypotheses in this study. The first was to look into the moderating impact of the interaction variable of NPF shareholding and ESG performance on financial performance, while the second was to investigate the mediating role of ESG performance between NPF shareholding and financial performance.

To test the hypotheses of the indirect effect of ESG performance between NPF shareholding and financial performance as well as the interaction effect of NPF shareholding and ESG performance on financial performance, a path analysis method was used. By breaking down correlations into direct, indirect, and spurious effects, path analysis allows for the modeling of several interconnected dependent connections between endogenous and exogenous components.

We validated the mediating impact of ESG performance in between NPF shareholding and financial performance by setting three business performance variables such as ROE, ROA, and Tobin q as dependent variables in our path model, respectively. Additionally, our path model investigated the moderating impact of the relationship between NPF shareholding and ESG performance on financial performance.

Table 5 and

Figure 2 show the result of each path analysis for the variables such as NPF shareholding (NPFS), ESG performance (ESGP), the interaction of NPFS and ESGP, and financial performance (FP).

Panel A depicts the outcome of a path analysis with ROE as the dependent variable. We predicted a statistically significant positive sign in all four paths, and among those four, three paths satisfied the expectation, which were “NPF shareholding and ROE (coefficient = 0.172, p-value = 0.01)”, “NPF shareholding and ESG performance (coefficient = 0.480, p-value = 0.01)”, and “’NPFS × ESGP’ and ROE (coefficient = 0.258, p-value = 0.01)”. However, the path of ESGP and ROE showed a negative relationship and no statistical significance in the relationship between ESG performance and financial performance ROE.

We additionally investigated the mediating and moderating effects of major variables in this study by setting ROA and Tobin q as dependent variables. Panels B and C show the results of the path analysis, fixing ROA and Tobin q as dependent variables, respectively, and the results are also depicted in

Figure 2. In contrast to the ROE model in panel A, we were able to confirm that the path coefficients of “ESGP and ROA” (coefficient = −0.068,

p-value = 0.10) and “ESGP and Tobin q” (coefficient = −0.155,

p-value = 0.01) were statistically significant with a negative sign, which was contrary to our expectations.

The following are the results of path analysis in this study.

First, we observed that increasing NPF shareholding in investee firms can improve accounting performance (ROE and ROA) and market value (Tobin q). Second, we confirmed that a high shareholding of NPF can be a leading indicator to enhance ESG performance. Third, we discerned that the two variables NPF shareholding and ESG performance had an interaction effect on financial performance (ROE, ROA, and Tobin q, respectively) and that all paths in each model showed a positive sign. However, one unexpected finding was that there may be a negative mediating effect of ESG performance in the relationship between the NPF shareholding and ROA or Tobin q.

With the path analysis, we were able to confirm the direct consequence of NPF shareholding on ROE or ESG performance, but we were unable to find a mediating effect of ESG performance between NPF shareholding and ROE. Furthermore, a negative mediation effect of ESG performance was discovered between NPF shareholding and financial performances (ROA, Tobin q), as well as the interaction effects of the two variables NPF shareholding and ESG performance on financial performances (ROE, ROA, and Tobin q).

4.3. Discussion

The first two findings of this study are consistent with the results of the existing literature on the relationship between (i) institutional investor activism and financial performance ([

6,

13,

14,

15,

25], etc.), and (ii) institutional investor activism and ESG performance ([

6,

16,

17,

18,

19], etc.). These findings reinforce the assumption that institutional investor activism might improve a company’s financial or ESG performance. As a consequence, positive evidence for the efficacy of the stewardship code was added to the previously contradicting findings in the literature ([

12,

28], etc.).

Furthermore, the study’s final two findings add to the previous literature by demonstrating that ESG performance acts as a mediator or moderator between institutional investor activism and financial performance. The stewardship code’s promotion of ESG performance was expected to be a driver of improvements in company accounting and market performance. However, the results showed that ESG performance was a negative mediator in the relationship between institutional investor activism and financial performance ROA and Tobin q.

The study’s unexpected findings can be interpreted from the two perspectives listed below. Initially, unlike our assumptions, ESG performance showed a negative mediating effect in the relationship between NPF shareholding and financial performance ROA or Tobin q. For example, if the NPF’s shareholding is large, the ESG performance of the investee companies can improve. However, the improved ESG performance might have a negative effect on ROA or Tobin q. The mismatch of horizons may provide a plausible explanation for the observation. In principle, ESG management and investment seek to improve long-term investment performance by incorporating ESG issues that traditional investing ignores (ESG investment, more specifically, is an innovation movement that shifts value maximization from shareholders to stakeholders. With the emphasis on ESG, companies must now invest resources not only for shareholders, but also for diverse range of stakeholders in environmental, social, and governance aspects. Moreover, in this case, such an investment would help maximize stakeholder value while also improving the company’s financial value. This investment strategy, however, was deemed unimportant in the shareholder-oriented value maximization strategy. In addition, institutional investors may prioritize short-term rather than longer-term goals for quarterly earnings fixation, caused by quarterly reporting requirements, analysts’ prediction of quarterly earnings, short-term outlook by financial intermediaries, etc. ESG investing can mitigate losses for investors resulting from short-termism. For instance, ref. [

40] provided a portfolio optimization framework along with empirical evidence to show that investors can improve both ESG quality and the financial performance of their investments. Investors can achieve the dual goal by integrating systematic ESG risk into optimization in a manner consistent with modern portfolio theory”.). Refs. [

41,

42] showed a piece of evidence in the US equity market that ESG factor surprise has a higher volatility persistence than market factor surprise. This implies that hedge costs to reduce ESG risk must be borne immediately, while benefits from ESG investment can be enjoyed gradually over a long period. For instance, costs caused by firms expanding in ESG activity may increase in the early stage, which can temporarily deteriorate corporate financial performance. This is consistent with the negative correlation in the mediating path between ESG performance and accounting performance ROE and ROA. The negative sign regarding the long-term market performance (Tobin q) can be explained through the risk perspective of ESG investing. The ESG activity to mitigate ESG risk tends to lower the numerator (cash-flows) and the denominator (discount rate) in the valuation formula. When relevant ESG risk reduction is priced efficiently in the capital market, ESG performance may be neutral to corporate valuation. However, only a partial change of total risk (i.e., only the difference in systematic risk) induced by ESG activity is likely to be priced according to modern portfolio theory [

41]. It means that the discount rate tends to be only somewhat adjusted, and thus the corporate market value is prone to be lower than its fair value.

Moreover, considering the demands for ESG or the stewardship code of institutional investors in Korea is only at its beginning stage, it might be a temporary financial situation in the process of expanding investment in ESG. Since the market may be unable to price risk factors efficiently [

43,

44], the performance of ESG screening may have originated from the market’s inability and depended on the choice of the evaluation period. Ref. [

45] showed the relevant empirical result in the US equity fund market. It suggests that investors have factored ESG information into their decisions more actively and that the market has become more efficient concerning ESG risk in the recent period. From this stance, the research period has to be expanded in order for the effect of the stewardship code by institutional investors and corporate ESG investment in Korean society to be structurally captured. However, unfortunately, we could not analyze it due to the relatively short research period of this study. It remains a future research opportunity.

Second, along with what we expected, the results of this study mean that the more NPF owns shareholding to investee companies, the higher companies’ financial performance or social performance is expected through ESG activities. The impact of improved ROE was superior when the interaction effects of NPF shareholding and ESG performance existed. There was a particularly crucial influence of the variable “NPFS × ESGP” on financial performance, which reveals that the interaction between institutional investors’ stewardship code and corporate ESG performance can have a positive impact on financial performance (ROE, ROA, and Tobin q). This is evidence that aids the role of moderating effect in the current study.

Bénabou and Tirole (2010) [

46] addressed three versions of CSR: the long-term perspective to maximizing intertemporal profits, shareholder delegation philanthropy, and inside manager-initiated philanthropy. The first two versions can enhance corporate value, but the last version can harm it. Since CSR is likely to involve a combination of all three samples, the result of the empirical test is expected to depend on the sample. The adverse mediating effect in

Table 5 implies the probability that inside manager-initiated philanthropy drives recent ESG performance in the Korean manufacturing industry. On the other hand, NPF shareholding may contribute to monitoring managers’ strategic behaviors and discourage inside manager-initiated philanthropy. Likewise, as the NPF shareholding is more elevated, the correlation between ESG performance and financial performance can be more positive. Furthermore, as a universal investor, NPF focuses on systematic risk rather than total risk. Thus, it may only consider the partial benefit of ESG screening when making investment decisions. This interpretation is compatible with the positive moderating effect shown in

Table 5. Note that the correlation between ESG performance and market presentation (Tobin q) is lower than the correlation between ESG performance and accounting performance (ROE and ROA).

Additionally, we analyzed what kind of interaction causes a more synergetic effect on financial performance. We diagnosed financial performance in each of the four groups—high and low levels in NPF shareholding and ESG performance. The two groups were divided according to the median NPF shareholding. If the NPF shareholding was greater than the median, the firm was classified as having a large NPF shareholding; if it was less than the median, the firm was classified as having a small NPF shareholding. ESG performance was organized based on the ESG index, so if the index was greater than or equal to B+, the firm was regarded as having a good ESG performance. Based on NPF’s shareholding and ESG performance, we could make a 2-by-2 matrix.

To compare the four groups, ANOVA and post hoc analysis were performed. The results of the analysis are shown in

Table 6 and

Figure 3.

The results of the ANOVA are shown in Panel A. Group 1 (high NPF and high ESG) has the highest average 6.96, and it is followed by Group 4 (high NPF and low ESG = 5.27), Group 2 (low NPF and high ESG = −3.41), and Group 3 (low NPF and low ESG = −6.59). However, the heteroscedasticity between the groups was indicated by the Levene statistic of 11.389 and the p-value of 0.01. To solve the heteroscedasticity issue and validate the group differences, Dunnett T3 analysis was included. The outcome is shown in panel B. The results demonstrate that group 1 had a higher ROE than groups 2, 3, and 4, with the only difference between groups 1 and 2 or 1 and 3 being significant at the 1% level. In terms of ROE, Group 2 outperformed Group 3, and Group 4 outperformed Group 3.

Panel C demonstrates the ANOVA and post-hoc analysis of the four groups by setting the dependent variable as ROA or Tobin q. We will briefly present the results. In terms of ROA as the dependent variable, we confirmed that the difference between G1 and G2, G3, or G4 and G2, G3 were significant. For Tobin q, the difference between G1 and G4, or G4 and G2 were significant. This may be evidence that the stewardship code of Korean NPF is effective, and that its emphasis on ESG activities of investee firms can improve their financial performance. Moreover, we highlighted the fact that G1 was larger than G4, despite the fact that the difference between groups was not statistically substantial. This means when NPF enlarges its ESG investment, the financial performance of investee firms can increase. We, unfortunately, could not find a reasonable analogy for the difference between G1 and G4. We believe it to be another future investigation of this field.

5. Conclusions

Despite the increased interest in stewardship codes and socially responsible investments of companies, there has been little interest in exploring the association between institutional investors’ activism and ESG and financial performance. So, this study examined the relationship between NPF shareholding, ESG performance, and financial performance. We primarily focused on the role of ESG performance as a mediator or a moderator in the relationship between NPF shareholding and financial performance.

We found that ESG performance can play a mediating and moderating role in the relationship between NPF shareholding and financial performance, and this study makes two significant contributions to the literature.

First, NPF shareholding can have affirmative effects on ESG performance, or financial performance, but ESG performance shows a negative effect on financial performance. In other words, if institutional investor promotes their stewardship code actively, the ESG performance of investee firms can be enhanced. However, ESG performance augmented by institutional activism did not relate to the improvement of financial performance. We expected a positive mediating effect of ESG performance being promoted by institutional investors’ activism on financial performance, yet the discoveries of the current study surprisingly showed a negative impact. One possible inference regarding this result is that corporate expense temporarily increased while they promoted ESG activities, so corporate financial performance decreased. From this perspective, we suggest expanding the research period to diagnose whether the result is a temporary phenomenon or not. We could not expand the investigation period in Korea, as the national pension fund just acted up their stewardship code merely two years ago; thus, it will remain as future work.

Second, ESG performance showed a moderating role in the relationship between NPF shareholding and financial performance. This means if the national pension fund has more ownership rate for investee firms, financial performance can be greater when moderated by ESG performance. This proves that the interaction between institutional investors’ activism and ESG performance may have a synergetic effect on financial performance, so we further explored which groups’ interaction (NPFS×ESGP) showed a stronger synergetic impact on financial performance. From this deeper research, we found that when both NPF shareholding and ESG performance were superior to other groups, investee firms’ financial performance was also elevated.

This study improved our understanding of the institutional investor stewardship code and the degree of ESG practice for Korean manufacturing firms, as well as the causality of those variables with financial performance. The contribution of the current study is to confirm that the stewardship code by the national pension fund in Korea that promotes ESG performance is indeed efficient and that the synergetic effect of investor activism with ESG performance on financial performance is also respectable.

This study has the following limitations.

The first limitation of this study is in the short research period, but we were unable to expand it because Korea’s national pension fund only implemented its stewardship code two years ago. One possible explanation for the negative relationship between ESG performance and financial performance is the short implementation period of the NPF stewardship code. Given that NPF adopted it just two years ago, stakeholder enthusiasm or expectations may not be fully reflected in the relationship. Despite the short study period, we believe that diagnosing the NPS stewardship code, as well as the level of ESG in the Korean manufacturing industry will be a worthwhile task given the growing interest in ESG and institutional investors’ stewardship code fueled by the merger of Samsung C&T and Cheil Industries or Korean Air’s peanut turnaround. However, because of the short study period, caution should be exercised when generalizing the study’s findings. Extending the study period and incorporating control variables, such as contingency variables, into our model will also provide an intriguing opportunity for future research.

Second, we could not control the pandemic event in the research design. Another possible reason for the negative correlation between ESG performance and financial performance is the impact of the transformed corporate business environment caused by the pandemic. Hence, it will be valuable to trace the reason relating to the negative influence of ESG performance on financial performance. It will be a worthwhile opportunity to explore whether or not it can have positive consequences with an ongoing active stewardship code by an institutional investor.

Third, because this study was conducted in a single institutional pension fund in Korea, we must exercise caution when generalizing our findings. In the future, we believe it would be a good challenge to broaden the study scope by including several institutional investors and several countries as well as broadening the research period.