China’s Carbon Market in the Context of Carbon Neutrality: Legal and Policy Perspectives

Abstract

:1. Introduction

2. Methodology

2.1. Empirical Research

2.2. Doctrine Research

3. Development of China’s Carbon Market

3.1. Regional Pilot Carbon Markets

3.2. The National Carbon Trading Market

4. Status of China’s National Carbon Market

4.1. Status of the National Carbon Market

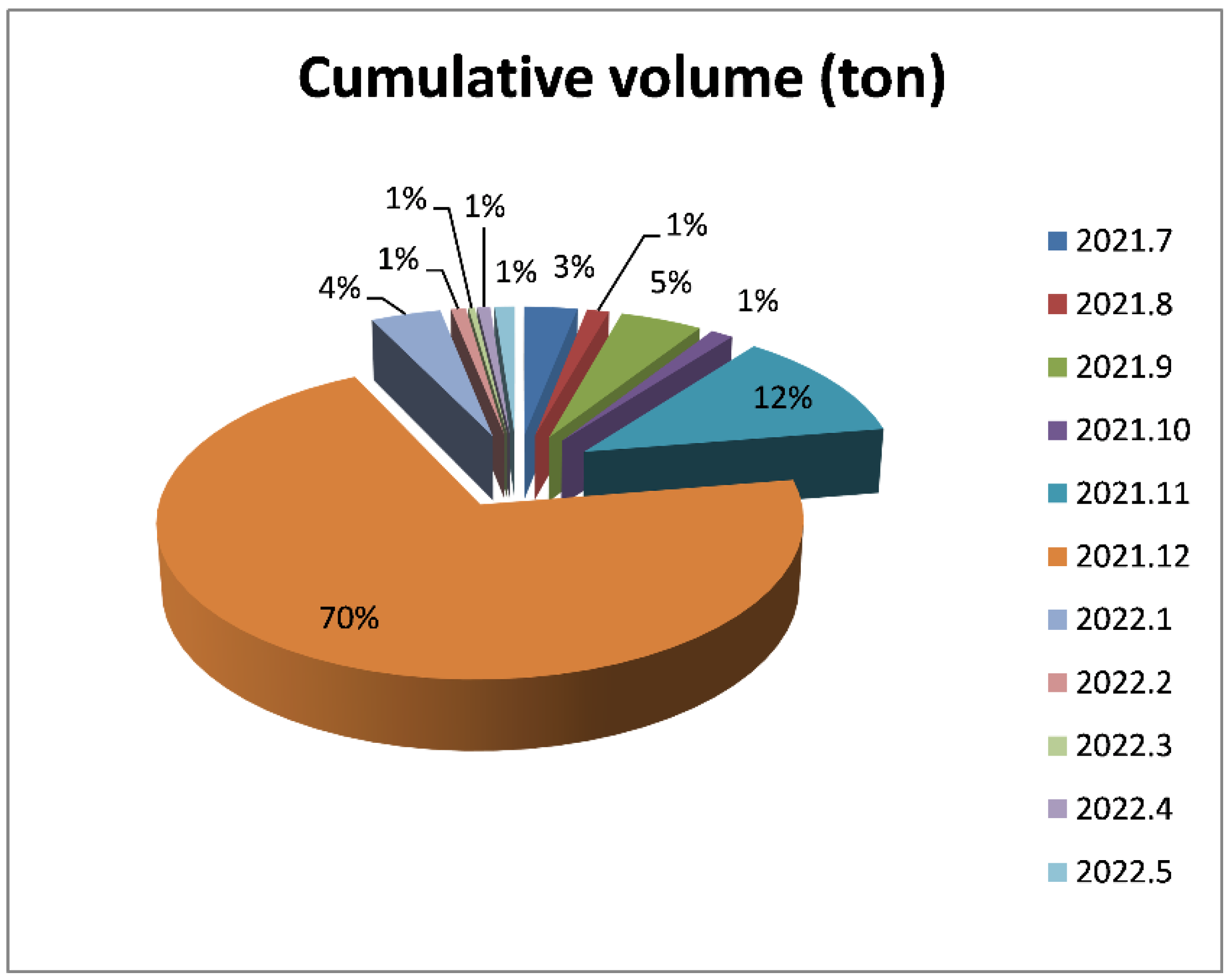

4.1.1. Nationwide Transaction

4.1.2. Single Diversification

4.1.3. Data Transparency

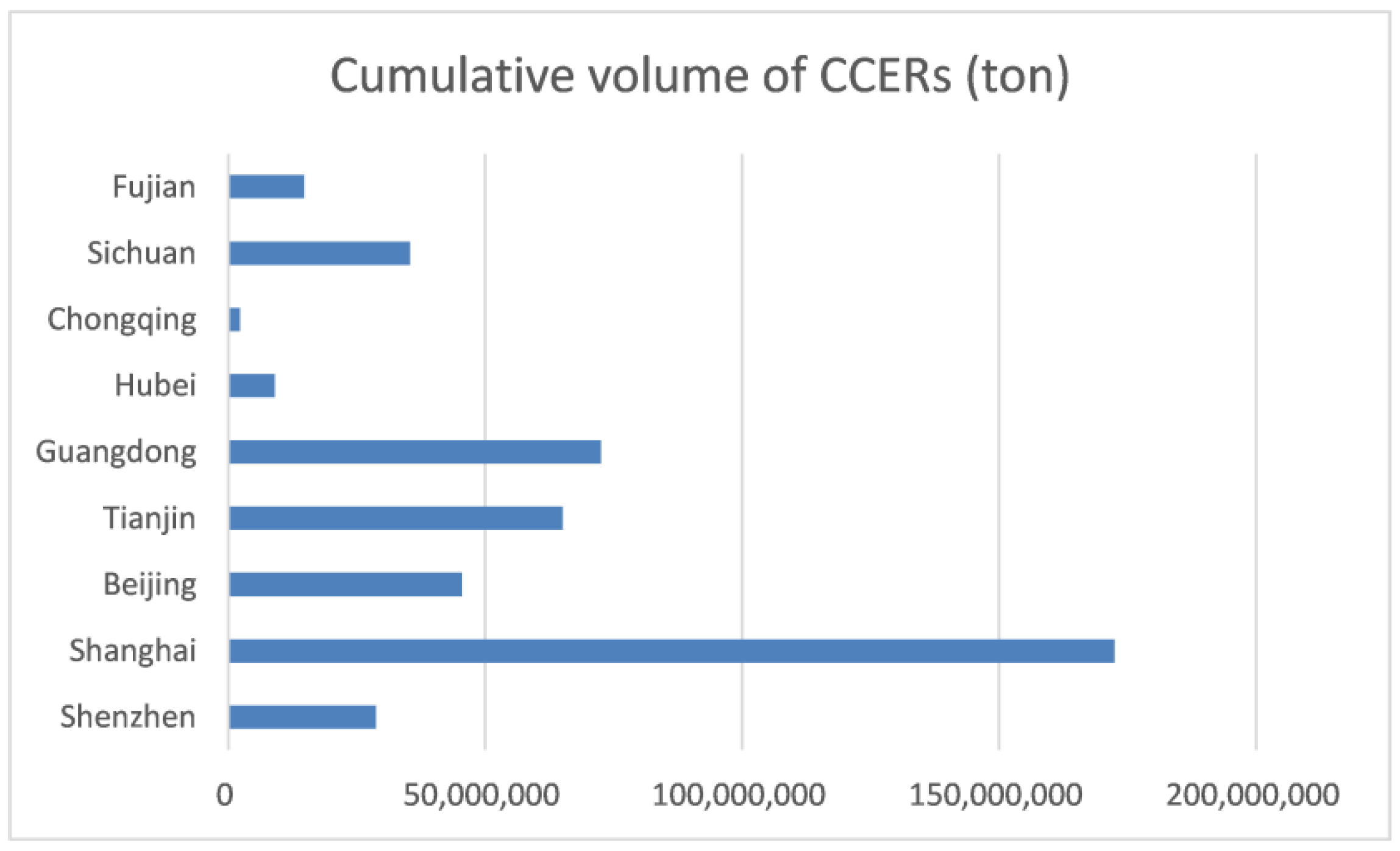

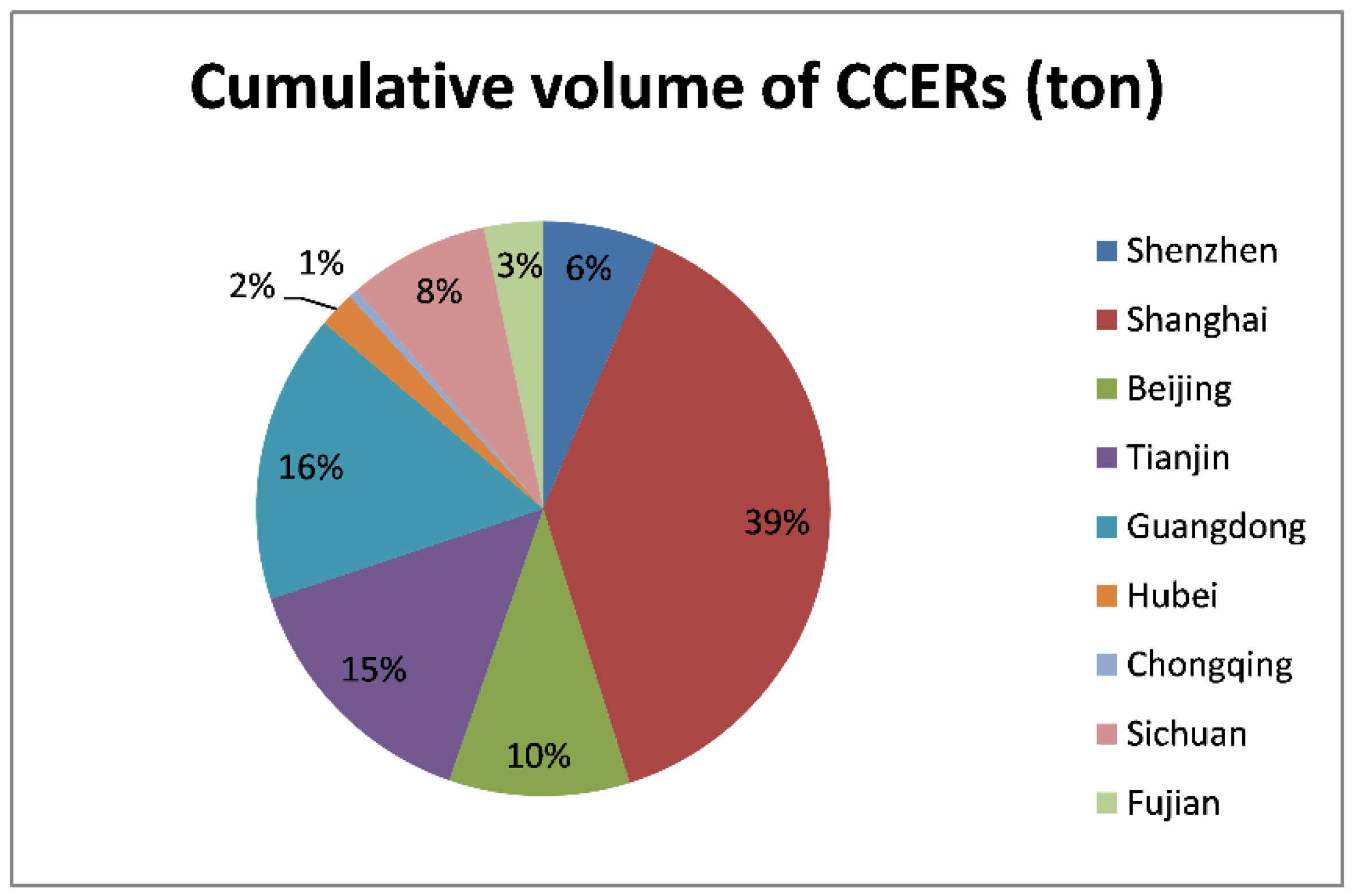

4.2. Status of Regional Carbon Markets

5. Policies and Legislations of China’s ETS

5.1. Current Status of Policies and Legislations

5.1.1. The Choice of Carbon Market Participant

5.1.2. Setting Mode of Total Amount of Quotas

5.1.3. Allowance Allocation Method

5.1.4. Trading Product

5.2. Comparison of Two Core Fundamental Legislations

- Regarding the division of responsibilities, the Interim Regulations place more emphasis on the cooperation between the MEE and other departments. It stipulates that for the supervision and management of carbon emissions trading activities, the trading entities, verification agencies, registration institutions, and trading institutions shall be completed via multidepartmental cooperation.

- Regarding the key emitters, the Interim Regulations do not establish clear inclusion criteria. This indicates that in the future as emissions reduction targets change, the conditions for the key emitters will change accordingly.

- Regarding the setting of total quotas, the Interim Regulations have changed to a top-down model. The MEE is responsible for determining the total amount of quotas.

- Regarding the verification work, the Interim Regulations provide more detailed provisions based on the Administrative Measures.

- Regarding illegal transactions, the Interim Regulations stipulate that the competent departments, registration and trading institutions, and verification service agencies shall not participate in quota trading.

- Regarding the key emitters’ responsibilities, the Interim Regulations increase the penalties for failure to report and surrender.

- The Interim Regulations add provisions on multi-entity responsibility and credit punishment. They also add risk prevention provisions and propose government funds for carbon emissions.

5.3. Problems in China’s Carbon Markets

5.3.1. Deficient Carbon Pricing Mechanism

5.3.2. Light Penalties

5.3.3. Regional Fragmentation in China’s Regional Carbon Markets

5.3.4. Insufficient Legal Basis for Dispute Resolution

5.4. Prospects for the Legal System

5.4.1. Top-Down Total Amount Setting Mode and Allowance Allocation

5.4.2. Expanding Industry Coverage, Trading Products, and Participants

5.4.3. Penalty and Reward Coordination

5.4.4. Unified MRV Mechanism

6. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- China Center for International Economic Exchanges. Report on the Peak Carbon Emission and Carbon Neutrality (2021); Social Sciences Academic Press (China): Beijing, China, 2021. [Google Scholar]

- Wang, R.Q.; Tang, H.C.; Ma, X. Can Carbon Emission Trading Policy Reduce PM2.5? Evidence from Hubei, China. Sustainability 2022, 14, 10755. [Google Scholar] [CrossRef]

- Niu, Z.H.; Xiong, J.L.; Ding, X.S.; Wu, Y. Analysis of China’s Carbon Peak Achievement in 2025. Energies 2022, 15, 5041. [Google Scholar] [CrossRef]

- Zeng, S.H.; Li, F.; Weng, Z.X.; Zhong, Z. A Study of the Emission Reduction Effects of Carbon Markets: Empirical Evidence from Pilot Carbon Trading Regions in China. Chin. Environ. Sci. 2021, 41. [Google Scholar] [CrossRef]

- Leng, Z.Z. The Game of Transaction Price and Compliance Supervision under Econometric Analysis. Sci. Technol. Inf. 2019, 17, 252–253. [Google Scholar] [CrossRef]

- Andronie, M.; Lăzăroiu, G.; Iatagan, M.; Uță, C.; Ștefănescu, R.; Cocoșatu, M. Artificial Intelligence-based Decision-making Algorithms, Internet of Things Sensing Networks, and Deep Learning-assisted Smart Process Management in Cyber-physical Production Systems. Electronics 2021, 10, 2497. [Google Scholar] [CrossRef]

- Lăzăroiu, G.; Andronie, M.; Iatagan, M.; Geamănu, M.; Ștefănescu, R.; Dijmărescu, I. Deep Learning-assisted Smart Process Planning, Robotic Wireless Sensor Networks, and Geospatial Big Data Management Algorithms in the Internet of Manufacturing Things. Int. J. Geo-Inf. 2022, 11, 277. [Google Scholar] [CrossRef]

- Nica, E. Urban Big Data Analytics and Sustainable Governance Networks in Integrated Smart City Planning and Management. Geopolit. Hist. Int. Relat. 2021, 13, 93–106. [Google Scholar]

- Chapman, D. Environmentally Sustainable Urban Development and Internet of Things Connected Sensors in Cognitive Smart Cities. Geopolit. Hist. Int. Relat. 2021, 13, 51–64. [Google Scholar]

- He, X.Y.; Zhang, S.J.; Wu, Y.; Wallington, T.J.; Lu, X.; Tamor, M.A.; McElroy, M.B.; Zhang, K.M.; Nielsen, C.P.; Hao, J.M. Economic and Climate Benefits of Electric Vehicles in China, the United States, and Germany. Environ. Sci. Technol. 2019, 53, 11013–11022. [Google Scholar] [CrossRef]

- Kim, D.H.; Suen, Y.B.; Lin, S.C. Carbon Dioxide Emissions and Trade: Evidence from Disaggregate Trade Data. Energy Econ. 2019, 78, 13–28. [Google Scholar] [CrossRef]

- Zeng, I.Y.; Chen, J.R.; Niu, Z.H.; Liu, Q.F.; Wu, T. The GHG Emissions Assessment of Online Car-Hailing Development under the Intervention of Evaluation Policies in China. Sustainability 2022, 14, 1908. [Google Scholar] [CrossRef]

- Yao, Y.; Tian, L.X.; Cao, G.X. The Information Spillover among the Carbon Market, Energy Market, and Stock Market: A Case Study of China’s Pilot Carbon Markets. Sustainability 2022, 14, 4479. [Google Scholar] [CrossRef]

- He, Y.Z.; Song, W. Analysis of the Impact of Carbon Trading Policies on Carbon Emission and Carbon Emission Efficiency. Sustainability 2022, 14, 10216. [Google Scholar] [CrossRef]

- Cao, X.L.; Xu, Q.Q.; Wu, W.G. Research on the Progress, Problems and Countermeasures of China’s Carbon Market Construction. Rev. Econ. Res. 2021, 29–38. [Google Scholar] [CrossRef]

- Hao, H.Q.; Zhou, W.H. Jurisdiction Conflicts in Transnational Carbon Emissions Trading and Its Resolution. J. Cent. South. Univ. Forestry Technol. 2022, 16, 63–69. [Google Scholar] [CrossRef]

- Li, X.W.; Miao, H.Z. How to Incorporate Blue Carbon into the China Certified Emission Reductions Scheme: Legal and Policy Perspectives. Sustainability 2022, 14, 10567. [Google Scholar] [CrossRef]

- Center for Energy & Environment Policy Research, BIT. China’s Carbon Market: Reviews and Prospects (2022). Available online: https://ceep.bit.edu.cn//zxcg/ndycbg/c2ec0a3cc44e41f8a69f2ec9e673f892.htm (accessed on 30 April 2022).

- Li, Y.W.; Yang, Y.S.; Luo, G.R.; Huang, J.Z.; Wu, T. The Economic Recovery from Traffic Restriction Policies During the COVID-19 Through the Perspective of Regional Differences and Sustainable Development: Based on Human Mobility Data in China. Sustainability 2022, 14, 6453. [Google Scholar] [CrossRef]

- Zeng, X.L.; Duan, M.S.; Yu, Z.; Li, W.C.; Li, M.Y.; Liang, X.Y. Data-related Challenges and Solutions in Building China’s National Carbon Emissions Trading Scheme. Clim. Policy. 2018, 18, S90–S105. [Google Scholar] [CrossRef]

- U.S.-China Joint Presidential Statement on Climate Change. Available online: https://obamawhitehouse.archives.gov/the-press-office/2015/09/25/us-china-joint-presidential-statement-climate-change (accessed on 12 June 2022).

- Shanghai Environment and Energy Exchange, The Trading Data of The National Carbon Market on 16 July 2021. Available online: https://www.cneeex.com/c/2021-07-16/491858.shtml (accessed on 17 May 2022).

- Shanghai Environment and Energy Exchange. Research Report of Domestic Carbon Pricing Formation Mechanism (2021). Available online: https://www.cneeex.com/upload/resources/file/2021/07/20/27306.pdf (accessed on 17 May 2022).

- Shanghai Environment and Energy Exchange, The Trading Data of The National Carbon Market on 31 May 2022. Available online: https://www.cneeex.com/c/2022-05-31/492518.shtml (accessed on 23 June 2022).

- The World Bank. State and Trends of Carbon Pricing 2021. Available online: https://openknowledge.worldbank.org/handle/10986/35620 (accessed on 12 June 2022).

- Ministry of Ecology and Environment of the People’s Republic of China. Rules for the Administration of Trading of Carbon Emissions (for Trial Implementation). Available online: https://www.mee.gov.cn/xxgk2018/xxgk/xxgk01/202105/t20210519_833574.html (accessed on 30 April 2022).

- Ministry of Ecology and Environment of the People’s Republic of China. Climate Investment and Financing Pilot Work Plan. Available online: https://www.mee.gov.cn/xxgk2018/xxgk/xxgk05/202112/t20211224_965174.html (accessed on 30 April 2022).

- Ministry of Ecology and Environment of the People’s Republic of China. Format Guidelines for Legal Disclosure of Enterprise Environmental Information. Available online: https://www.mee.gov.cn/xxgk2018/xxgk/xxgk05/202201/t20220110_966488.html (accessed on 30 April 2022).

- Ministry of Ecology and Environment of the People’s Republic of China. Notice on the Key Tasks of the Management of Enterprises Greenhouse Gas Emission Reporting in 2022. Available online: https://www.mee.gov.cn/xxgk2018/xxgk/xxgk06/202203/t20220315_971468.html (accessed on 30 April 2022).

- Carbon Emission Trading. Available online: http://www.tanpaifang.com/tanguwen/2019/0706/64503_3.html (accessed on 23 May 2022).

- Li, L.X.; Ye, F.; Li, Y.N.; Chang, C.T. How Will the Chinese Certified Emission Reduction Scheme Save Cost for the National Carbon Trading System? J. Environ. Manage. 2019, 244, 99–109. [Google Scholar] [CrossRef]

- Shanghai Environment and Energy Exchange (SHEEEX). Carbon Market Work Report. 2021. Available online: https://www.cneeex.com/upload/resources/file/2022/04/29/28212.pdf (accessed on 16 May 2022).

- Zhao, X.G.; Jiang, G.W.; Nie, D.; Chen, H. How to Improve the Market Efficiency of Carbon Trading: A Perspective of China. Renewable Sustainable Energy Rev. 2016, 59, 1229–1245. [Google Scholar] [CrossRef]

- Bai, Y.; Hu, F. Research on China’s Marine Blue Carbon Trading Mechanism and Its Institutional Innovation. Sci. Technol. Manag. Research 2021, 41, 187–193. [Google Scholar]

- Ministry of Ecology and Environment of the People’s Republic of China. Name List of 2019–2020 Major Emitting Entities in Power Generation Sector. Available online: https://www.mee.gov.cn/xxgk2018/xxgk/xxgk03/202012/t20201230_815546.html (accessed on 30 April 2022).

- Ministry of Ecology and Environment of the People’s Republic of China. Notice on the Surrendering of Carbon Emission Quotas in the First Compliance Period of the National Carbon Emission Trading Market. Available online: https://www.mee.gov.cn/xxgk2018/xxgk/xxgk06/202110/t20211026_957871.html (accessed on 30 April 2022).

- Liu, Y. Legal Nature and China’s Countermeasure of Free Allowances Allocation by Government—Based on Analysis of Constituent Elements of Subsidies in Agreement on Subsidies and Countervailing Measures. Studies. Law. Bus. 2016, 33, 172–182. [Google Scholar]

- Cao, M.D. Legal Issues and Legislative Proposals for China’s Emissions Trading. Studies. Law. Bus. 2021, 38, 33–46. [Google Scholar]

- Ministry of Ecology and Environment of the People’s Republic of China. The First Compliance Cycle of National Carbon Market End. Available online: https://www.mee.gov.cn/ywgz/ydqhbh/wsqtkz/202112/t20211231_965906.shtml (accessed on 20 May 2022).

- Yu, N. Suzhou Investigated the First Case in National Carbon Market that an Enterprise Failed to Fulfil Compliance of Carbon Emission Quotas on Time. Secur. Daily. 2022, 1, 16, 1–2. [Google Scholar]

- Contract Dispute between Micro Carbon (Guangzhou) Low Carbon Technology Co., Ltd. and Guangzhou Carbon Emission Trading Center Co., Ltd. Judgment of the First Trial. Available online: https://wenshu.court.gov.cn/website/wenshu/181107ANFZ0BXSK4/index.html?docId=32a435dd53e84bc9a16aaca700a7e0bd (accessed on 30 April 2022).

- Zhao, X.G.; Wu, L.; Li, A. Research on the Efficiency of Carbon Trading Market in China. Renew. Sustain. Energy Rev. 2017, 79, 1–8. [Google Scholar] [CrossRef]

- Yuan, J.Q. Progress, Problems and Policy Recommendations on the Construction of the National Carbon Market. Energy Chin. 2021, 43, 63–80. [Google Scholar]

- Hua, W. The Legal Practice of the EU ETS and Its Implications for China. Energy Envir. 2017, 36, 2–4. [Google Scholar]

- Hao, H.Q.; Zhu, T. The Path Improvement and International Connection of Ecological Civilization and Rule of Law Construction–From the Perspective of Environmental Codification. Jianghan Acad. 2022, 41, 102–110. [Google Scholar] [CrossRef]

- Ministry of Ecology and Environment of the People’s Republic of China. Interim Regulations on the Administration of Carbon Emissions Trading (Revised Draft). Available online: https://www.mee.gov.cn/xxgk2018/xxgk/xxgk06/202103/t20210330_826642.html (accessed on 30 April 2022).

- Shanghai Environment and Energy Exchange. Shanghai Carbon Emission Quota Pledge Registration Business Rules. Available online: https://www.cneeex.com/c/2020-12-31/490696.shtml (accessed on 30 April 2022).

- Feng, D.Y.; Zhou, Y.X.; He, M.Z. MRV System of Guangdong Carbon Trading Pilot and Its Experience. Sci. Technol. Inf. 2019, 17, 107–108. [Google Scholar]

- Tang, R.H.; Guo, W.; Machtelt, O.; Li, P.; Wang, J.; Tang, J.; Wang, L.; Wang, H.J. Key Challenges for the Establishment of the Monitoring, Reporting and Verification (MRV) System in China’s National Carbon Emissions Trading Market. Clim. Policy 2018, 18, S106–S121. [Google Scholar] [CrossRef]

| Element | Practical Experience |

|---|---|

| Covered industries | The coverage of major emitters and exclusion of the smaller emitters; The coverage of industrial sectors with large emissions in the early stage |

| Allowance allocation | The gradual transition from free-paid allocation; The unified criteria for key emitters |

| Trading products | The introduction of other appropriate trading products based on quotas; The exploration of carbon financial products for the coordinated development of carbon finance and the carbon market |

| Regulatory model | The prompt disclosure of enterprises’ surrender conditions and the risky circumstances in the market; The emphasis on risk prevention in the carbon market to clarify the responsibilities of market participants |

| Penalty type | The adoption of a punishment mechanism combining economic and credit penalties for enterprises that failed to fulfill their compliance |

| Phase | Period | Event |

|---|---|---|

| Preparation Phase | 2013–2016 | The Interim Measures for the Administration of Carbon Emissions Permit Trading; The plan to launch a national emissions trading scheme (ETS) in 2017 [21]; The Notice on the Key Tasks of launching the National Carbon Emissions Trading Market. |

| Infrastructure Completion Phase, Simulation Operation Stage, and Deeping and Expanding Phase | 2017–2020 | The National Carbon Emissions Trading Construction Plan (Power Generation Industry) (Construction Plan) |

| Accelerated Phase | 2021–2025 | Administrative Measures for the Trading of Carbon Emissions Permits (for Trial Implementation); the launch of first compliance period; the Interim Regulations on the Administration of Carbon Emissions Trading (Revised Draft) |

| Platform | Opening Date | Coverage | |

|---|---|---|---|

| Beijing | China Beijing Green Exchange (CBGEX) | 28 November 2013 | Power, heat, manufacturing, transportation, construction, public institutions, and universities. |

| Tianjin | Tianjin Climate Exchange (TCE) | 26 December 2013 | Power, heat, steel, chemicals, petrochemicals, oil and gas exploitation, and other key emissions industries. |

| Shanghai | Shanghai Environment and Energy Exchange (SHEEEX) | 26 December 2013 | Industries involving steel, petrochemicals, chemicals, nonferrous metals, power, building materials, textiles, paper, rubber, chemical fiber, and so on. Nonindustrial sectors involve aviation, ports, airports, railways, commerce, hotels, finance, and so on. |

| Guangdong | Guangzhou Emissions Exchange | 19 December 2013 | Sectors include cement, steel, power, and petrochemicals. Gradually expanded to more than 10 industrial sectors, such as ceramics, textiles, nonferrous metals, plastics, and paper during the second phase. |

| Shenzhen | China Emissions Exchange (Shenzhen) | 18 June 2013 | The industrial sector, building sector, and transportation sector. |

| Hubei | China Hubei Emissions Exchange | 12 April 2014 | Steel, chemicals, cement, automobile manufacturing, power, nonferrous metals, glass, paper, and other high-energy-consuming and high-emissions industries. |

| Chongqing | Chongqing Carbon Emissions Trading Center | 19 June 2014 | Six high-energy-consuming industries: electrolytic aluminum, ferroalloys, calcium carbide, caustic, cement, and steel. |

| Fujian | Haixia Equity Exchange | 22 December 2016 | Power, steel, chemicals, petrochemicals, nonferrous metals, aviation, building materials, paper, ceramics, and so on. |

| 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | |

|---|---|---|---|---|---|---|---|---|

| Beijing | 97% | 100% | 100% | 100% | 99% | 100% | 100% | |

| Tianjin | 96% | 99% | 100% | 100% | 100% | 100% | 100% | 100% |

| Shanghai | 100% | 100% | 100% | 100% | 100% | 100% | 100% | 100 % |

| Chongqing | 70% | |||||||

| Hubei | 100% | 100% | 100% | 100% | 100% | |||

| Guangdong | 99% | 99% | 100% | 100% | 100% | 99% | 100% | 100% |

| Shenzhen | 99% | 99% | 100% | 99% | 99% | 99% | 99% | 100% |

| Fujian | 99% | 100% | 100% | 100% |

| Policy | Issuing Authority | Date Issued | Effective Date | |

| The Notice on Carrying Out the Work of Carbon Emissions Trading Pilot Program | NDRC | 29 October 2011 | 29 October 2011 | |

| National Carbon Emissions Trading Market Construction Plan (Power Generation Industry) | NDRC | 20 December 2017 | 20 December 2017 | |

| 2019–2020 National Carbon Emissions Trading Cap Setting and Allowance Allocation Implementation Plan (Power Generation Industry) (Implementation Plan) | MEE | 30 December 2020 | 30 December 2020 | |

| Name List of 2019–2020 Major Emitting Entities in Power Generation Sector (Name List) | MEE | 30 December 2020 | 30 December 2020 | |

| Guidelines for Enterprise Greenhouse Gas Verification (for Trial Implementation) | MEE | 29 March 2021 | 29 March 2021 | |

| Notice on the Key Tasks of the Management of Enterprises’ Greenhouse Gas Emissions Reporting in 2022 | MEE | 15 March 2022 | 15 March 2022 | |

| Guidelines for Enterprise Greenhouse Gas Emissions Accounting and Reporting-Power Generation Facilities (2022 Revision) | MEE | 15 March 2022 | 15 March 2022 | |

| Legislation | Issuing authority | Date issued | Effective date | Level of authority |

| Interim Measures for the Administration of Voluntary Greenhouse Gas Emissions Reduction Transactions | NDRC | 13 June 2012 | 13 June 2012 | Departmental Rules |

| Interim Measures for the Administration of Carbon Emissions Permit Trading | NDRC | 10 December 2014 | 10 January 2015 | Departmental Rules |

| Interim Regulations on the Administration of Carbon Emissions Trading (Draft for Solicitation of Comments) | MEE | 3 April 2019 | Administrative Regulations | |

| Administrative Measures for the Trading of Carbon Emissions Permits (for Trial Implementation) | MEE | 5 January 2021 | 1 February 2021 | Departmental Rules |

| Interim Regulations on the Administration of Carbon Emissions Trading (Revised Draft) | MEE | 30 March 2021 | Administrative Regulations | |

| Rules for the Administration of Registration of Carbon Emissions (for Trial Implementation) (Registration Rules) | MEE | 17 May 2021 | 17 May 2021 | Departmental Rules |

| Rules for the Administration of Trading of Carbon Emissions (for Trial Implementation) | MEE | 17 May 2021 | 17 May 2021 | Departmental Rules |

| Rules for the Administration of Settlement of Carbon Emissions (for Trial Implementation) (Settlement Rules) | MEE | 17 May 2021 | 17 May 2021 | Departmental Rules |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Hao, H.; Yang, X. China’s Carbon Market in the Context of Carbon Neutrality: Legal and Policy Perspectives. Sustainability 2022, 14, 11399. https://doi.org/10.3390/su141811399

Hao H, Yang X. China’s Carbon Market in the Context of Carbon Neutrality: Legal and Policy Perspectives. Sustainability. 2022; 14(18):11399. https://doi.org/10.3390/su141811399

Chicago/Turabian StyleHao, Haiqing, and Xue Yang. 2022. "China’s Carbon Market in the Context of Carbon Neutrality: Legal and Policy Perspectives" Sustainability 14, no. 18: 11399. https://doi.org/10.3390/su141811399

APA StyleHao, H., & Yang, X. (2022). China’s Carbon Market in the Context of Carbon Neutrality: Legal and Policy Perspectives. Sustainability, 14(18), 11399. https://doi.org/10.3390/su141811399