Research on the Impact of Fiscal Decentralization on Governance Performance of Air Pollution—Empirical Evidence of 30 Provinces from China

Abstract

:1. Introduction

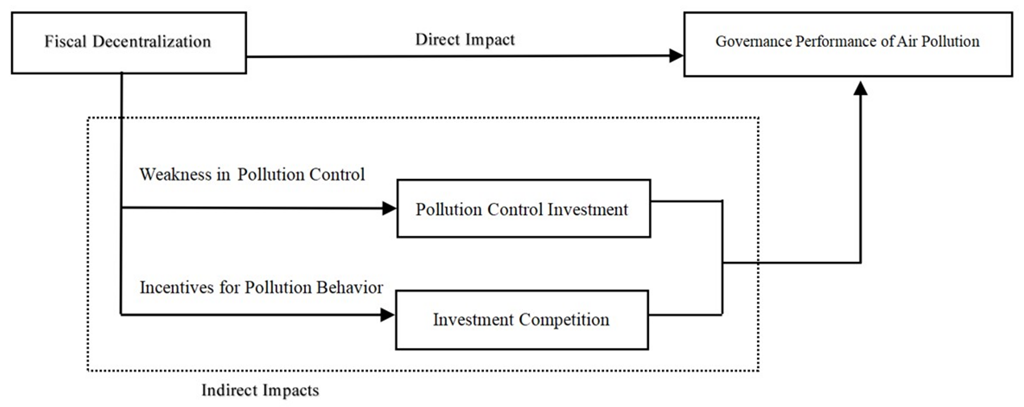

2. Theory and Hypothesis

2.1. Literature Review

2.2. Formulation of Hypothesis

- (1)

- Fiscal decentralization and governance performance of air pollution

- (2)

- Vertical compromise: weakness in pollution control

- (3)

- Horizontal competition: incentives for pollution behavior

3. Research Design

3.1. Research Sample and Data Sources

3.2. Variable Selection and Description

- (1)

- Air pollution governance performance

- (2)

- Fiscal decentralization degree

- (3)

- Pollution control investment

- (4)

- Local government capital attraction competition

- (5)

- Control variables

3.3. Model Establishment

4. Empirical Results

4.1. Descriptive Statistics

4.2. Baseline Regression Analysis

4.3. Robustness Test

- (1)

- Control variable step-in treatment

- (2)

- Replacement of key metrics and model treatment

4.4. Heterogeneity of Region

- (1)

- South–North regional differences

- (2)

- Coastal and inland regional differences

5. Discussion

6. Conclusions and Implications

6.1. Academic Implications

6.2. Policy Implications

6.3. Outlook

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Appendix A

| (1) | (2) | (3) | (4) | (5) | (6) | |

|---|---|---|---|---|---|---|

| DEC | –0.247 ** | –0.231 ** | –0.222 ** | –0.182 ** | –0.188 ** | –0.166 * |

| (0.111) | (0.097) | (0.082) | (0.087) | (0.088) | (0.094) | |

| Invest | 0.083 ** | 0.048 * | 0.047 ** | 0.052 ** | 0.052 ** | 0.053 ** |

| (0.034) | (0.025) | (0.023) | (0.024) | (0.023) | (0.024) | |

| Inter1 | –24.158 *** | –14.911 *** | –14.545 *** | –15.406 *** | –15.521 *** | –15.935 *** |

| (6.193) | (4.513) | (4.241) | (4.383) | (4.355) | (4.475) | |

| L. pollution | 0.479 *** | 0.456 *** | 0.440 *** | 0.435 *** | 0.413 *** | |

| (0.090) | (0.093) | (0.093) | (0.094) | (0.094) | ||

| Road | 0.185 * | 0.183 * | 0.200 * | 0.212 ** | ||

| (0.099) | (0.097) | (0.101) | (0.103) | |||

| GDP | –0.049 * | –0.059 ** | –0.053 ** | |||

| (0.027) | (0.026) | (0.025) | ||||

| Popuden | 0.221 * | 0.269 ** | ||||

| (0.117) | (0.110) | |||||

| Tech | –0.049 * | |||||

| (0.028) | ||||||

| Constant | 0.005 *** | 0.003 *** | 0.003 *** | 0.003 *** | 0.002 ** | 0.002 ** |

| (0.000) | (0.001) | (0.001) | (0.001) | (0.001) | (0.001) | |

| N | 270 | 240 | 240 | 240 | 240 | 240 |

| R2 | 0.748 | 0.816 | 0.824 | 0.826 | 0.826 | 0.829 |

| (1) | (2) | (3) | (4) | (5) | (6) | |

|---|---|---|---|---|---|---|

| DEC | –0.247 ** | –0.231 ** | –0.222 ** | –0.182 ** | –0.188 ** | –0.166 * |

| (0.111) | (0.097) | (0.082) | (0.087) | (0.088) | (0.094) | |

| FDI | 0.083 ** | 0.048 * | 0.047 ** | 0.052 ** | 0.052 ** | 0.053 ** |

| (0.034) | (0.025) | (0.023) | (0.024) | (0.023) | (0.024) | |

| Inter2 | –24.158 *** | –14.911 *** | –14.545 *** | –15.406 *** | –15.521 *** | –15.935 *** |

| (6.193) | (4.513) | (4.241) | (4.383) | (4.355) | (4.475) | |

| L. pollution | 0.479 *** | 0.456 *** | 0.440 *** | 0.435 *** | 0.413 *** | |

| (0.090) | (0.093) | (0.093) | (0.094) | (0.094) | ||

| Road | 0.185 * | 0.183 * | 0.200 * | 0.212 ** | ||

| (0.099) | (0.097) | (0.101) | (0.103) | |||

| GDP | –0.049 * | –0.059 ** | –0.053 ** | |||

| (0.027) | (0.026) | (0.025) | ||||

| Popuden | 0.221 * | 0.269 ** | ||||

| (0.117) | (0.110) | |||||

| Tech | –0.049 * | |||||

| (0.028) | ||||||

| Constant | 0.005 *** | 0.003 *** | 0.003 *** | 0.003 *** | 0.002 ** | 0.002 ** |

| (0.000) | (0.001) | (0.001) | (0.001) | (0.001) | (0.001) | |

| N | 270 | 240 | 240 | 240 | 240 | 240 |

| R2 | 0.748 | 0.816 | 0.824 | 0.826 | 0.826 | 0.829 |

References

- Kulick, E.R.; Wellenius, G.A.; Boehme, A.K.; Joyce, N.R.; Schupf, N.; Kaufman, J.D.; Mayeux, R.; Sacco, R.L.; Manly, J.J.; Elkind, M.S.V. Long-term exposure to air pollution and trajectories of cognitive decline among older adults. Neurology 2020, 94, e1782–e1792. [Google Scholar] [CrossRef] [PubMed]

- Lu, J.G.; Lee, J.J.; Gino, F.; Galinsky, A.D. Polluted Morality: Air Pollution Predicts Criminal Activity and Unethical Behavior. Psychol. Sci. 2018, 29, 340–355. [Google Scholar] [CrossRef] [PubMed]

- Gao, G.; Li, X.T.; Liu, X.T.; Dong, J.C. Does Air Pollution Impact Fiscal Sustainability? Evidence from Chinese Cities. Energies 2021, 14, 7247. [Google Scholar] [CrossRef]

- Fan, X.M.; Xu, Y.Z. Convergence on the haze pollution: City-level evidence from China. Atmos. Pollut. Res. 2020, 11, 141–152. [Google Scholar] [CrossRef]

- Guo, S.F.; Wen, L.D.; Wu, Y.R.; Yue, X.H.; Fan, G.L. Fiscal Decentralization and Local Environmental Pollution in China. Int. J. Environ. Res. Public Health 2020, 17, 8661. [Google Scholar] [CrossRef]

- Ma, H.T.; Shi, Y.P. Three-Level Fiscal Decentralization, Expenditure Preferences and Haze Governance Mechanism: Based on A Game Model Analysis of Chinese-Style Fiscal Decentralization. Contemp. Financ. Econ. 2016, 8, 24–32. [Google Scholar]

- Chen, H.Y.; Hao, Y.; Li, J.W.; Song, X.J. The impact of environmental regulation, shadow economy, and corruption on environmental quality: Theory and empirical evidence from China. J. Clean. Prod. 2018, 195, 200–214. [Google Scholar] [CrossRef]

- Shi, Q.L.; Shi, C.C.; Guo, F. Political Blue Sky: Evidence from the Local Annual “Two Sessions” in China. Resour. Energy Econ. 2020, 61, 101165. [Google Scholar] [CrossRef]

- Hao, Y.; Chen, Y.F.; Liao, H.; Wei, Y.M. China’s fiscal decentralization and environmental quality: Theory and an empirical study. Environ. Dev. Econ. 2019, 25, 159–181. [Google Scholar] [CrossRef]

- Magnani, E. The Environmental Kuznets Curve, Environmental Protection Policy and Income Distribution. Ecol. Econ. 2000, 32, 431–443. [Google Scholar] [CrossRef]

- Cheng, Z.H.; Zhu, Y.M. The spatial effect of fiscal decentralization on haze pollution in China. Environ. Sci. Pollut. Res. 2021, 28, 49774–49787. [Google Scholar] [CrossRef] [PubMed]

- Li, X.S.; Lu, Y.L.; Rafique, M.Z.; Asl, M.G. The effect of fiscal decentralization, environmental regulation, and economic development on haze pollution: Empirical evidence for 270 Chinese cities during 2007–2016. Environ. Sci. Pollut. Res. 2022, 29, 20318–20332. [Google Scholar]

- Cai, H.Y.; Tong, Z.F.; Xu, S.L.; Chen, S.Q.; Zhu, P.; Liu, W.J. Fiscal Decentralization, Government Behavior, and Environmental Pollution: Evidence from China. Front. Environ. Sci. 2022, 10, 901079. [Google Scholar] [CrossRef]

- Zhang, X.; Yuan, H.M.; Hao, F.H. Fiscal decentralization influence on environmental investment efficiency: Analysis based on DEA-Tobit model. China Environ. Sci. 2018, 38, 4780–4787. [Google Scholar]

- Stigler, G.J. Perfect competition, historically contemplated. J. Polit. Econ. 1957, 65, 1–17. [Google Scholar] [CrossRef]

- Tiebout, C.M. A Pure Theory of Local Expenditures. J. Polit. Econ. 1956, 64, 416–424. [Google Scholar] [CrossRef]

- Oates, W.E. Fiscal Federalism; Edward Elgar Publishing: Cheltenham, UK, 1972. [Google Scholar]

- Oates, W.E. The Economics of Fiscal Federalism and Local Finance; Edward Elgar Publishing: Cheltenham, UK, 1998. [Google Scholar]

- Millimet, D.L. Assessing the Empirical Impact of Environmental Federalism. J. Reg. Sci. 2003, 43, 711–733. [Google Scholar] [CrossRef]

- Sigman, H. Decentralization and Environmental Quality: An International Analysis of Water Pollution Levels and Variation. Land Econ. 2014, 90, 114–130. [Google Scholar] [CrossRef]

- He, Q.C. Fiscal decentralization and environmental pollution: Evidence from Chinese panel data. China Econ. Rev. 2015, 36, 86–100. [Google Scholar] [CrossRef]

- Wang, D.; Li, J. Spatial effect of fiscal decentralization on environmental pollution. China Popul. Resour. Environ. 2021, 31, 44–51. Available online: https://kns.cnki.net/kcms/detail/detail.aspx?FileName=ZGRZ202102005&DbName=CJFQ2021 (accessed on 2 September 2022).

- Phan, C.T.; Jain, V.P.; Purnomo, E.P.; Islam, M.M.; Mughal, N.; Guerrero, J.W.G.; Ullah, S. Controlling environmental pollution: Dynamic role of fiscal decentralization in CO2 emission in Asian economies. Environ. Sci. Pollut. Res. 2021, 28, 65150–65159. [Google Scholar] [CrossRef] [PubMed]

- Xu, H.; Wang, C.L.; Feng, G.Q. Impact of environmental decentralization on pollution reduction effects in China: A test based on spatial dynamic panel model. Resour. Sci. 2021, 43, 1128–1139. Available online: https://kns.cnki.net/kcms/detail/detail.aspx?FileName=ZRZY202106006&DbName=DKFX2021 (accessed on 2 September 2022). [CrossRef]

- Liu, L.L.; Ding, D.H.; He, J. Fiscal Decentralization, Economic Growth, and Haze Pollution Decoupling Effects: A Simple Model and Evidence from China. Comput. Econ. 2019, 54, 1423–1441. [Google Scholar] [CrossRef]

- Yin, K.D.; Gu, H.L.; Huang, C. Fiscal decentralization, government innovation preference, and haze pollution. Environ. Sci. Pollut. Res. 2022, 1–13. [Google Scholar] [CrossRef] [PubMed]

- Liu, L.L.; Li, L.M. Effects of fiscal decentralisation on the environment: New evidence from China. Environ. Sci. Pollut. Res. 2019, 26, 36878–36886. [Google Scholar] [CrossRef] [PubMed]

- Cheng, S.L.; Fan, W.; Chen, J.D.; Meng, F.X.; Liu, G.Y.; Song, M.L.; Yang, Z.F. The impact of fiscal decentralization on CO2 emissions in China. Energy 2020, 192, 116685. [Google Scholar] [CrossRef]

- Guo, P.; Li, J.; Kuang, J.S.; Zhu, Y.F.; Xiao, R.R.; Duan, D.H.; Huang, B.C. Low-Carbon Governance, Fiscal Decentralization and Sulfur Dioxide Emissions: Evidence from a Quasi-Experiment with Chinese Heavy Pollution Enterprises. Sustainability 2022, 14, 3220. [Google Scholar] [CrossRef]

- Li, G.S.; Han, M.C. Fiscal decentralization, spatial spillover and China’s urban Haze pollution: Mechanism and evidences. Contemp. Financ. Econ. 2015, 6, 26–34. [Google Scholar]

- Wu, X.; Wang, J. Fiscal decentralization, environmental protection expenditure and haze pollution. Resour. Sci. 2018, 40, 851–861. Available online: https://kns.cnki.net/kcms/detail/detail.aspx?FileName=ZRZY201804018&DbName=CJFQ2018 (accessed on 2 September 2022).

- Wang, F.; He, J.Z.; Niu, Y. Role of foreign direct investment and fiscal decentralization on urban haze pollution in China. J. Environ. Manag. 2022, 305, 114287. [Google Scholar] [CrossRef]

- Du, J.T.; Sun, Y.H. The nonlinear impact of fiscal decentralization on carbon emissions: From the perspective of biased technological progress. Environ. Sci. Pollut. Res. 2021, 28, 29890–29899. [Google Scholar] [CrossRef] [PubMed]

- Tan, Z.X.; Zhang, Y.Y. An empirical research on the relation between fiscal decentralization and environmental pollution. China Popul. Resour. Environ. 2015, 25, 110–117. Available online: https://kns.cnki.net/kcms/detail/detail.aspx?FileName=ZGRZ201504014&DbName=CJFQ2015 (accessed on 2 September 2022).

- Huang, Y.; Zhou, Y.C. How does vertical fiscal imbalance affect environmental pollution in China? New perspective to explore fiscal reform’s pollution effect. Environ. Sci. Pollut. Res. 2020, 27, 31969–31982. [Google Scholar] [CrossRef]

- Wu, L.H.; Ma, T.S.; Bian, Y.C.; Li, S.J.; Yi, Z.Q. Improvement of regional environmental quality: Government environmental governance and public participation. Sci. Total Environ. 2020, 717, 137265. [Google Scholar] [CrossRef] [PubMed]

- Pei, X.; Shang, F. Study on Coordinated Governance and Evaluation of Air Pollution in Beijing-Tianjin-Hebei Region. IOP Conf. Ser. Earth Environ. Sci. 2020, 440, 042025. [Google Scholar] [CrossRef]

- Liu, X.H. Study on the Impact of Local Environmental Protection Expenditure on Air Pollution Control. Price Theory Pract. 2019, 3, 143–146. [Google Scholar]

- Zheng, J.; Fu, C.H.; Liu, F. Fiscal decentralization and environmental governance. China Popul. Resour. Environ. 2020, 30, 67–73. Available online: https://kns.cnki.net/kcms/detail/detail.aspx?FileName=ZGRZ202001008&DbName=CJFQ2020 (accessed on 2 September 2022).

- Zhang, K.Z.; Wang, J.; Cui, X.Y. Fiscal decentralization and environmental pollution: From the perspective of carbon emission. China Ind. Econ. 2011, 10, 65–75. [Google Scholar]

- Wu, S.Z.; Lu, Y.T.; Wang, J.N.; Liu, Y.; Zhang, Z.Z. Analysis and Suggestion on Distortion of Environmental Protection Investment in China. China Popul. Resour. Environ. 2007, 17, 112–117. [Google Scholar]

- Zhang, Y.; Lin, A.M. Situation of Environmental Protection Investment in China and Optimizing Measures. Technoecon. Manag. Res. 2015, 4, 3–9. Available online: http://en.cnki.com.cn/Article_en/CJFDTOTAL-JXJG201504001.htm (accessed on 2 September 2022).

- Tang, P.; Shi, X.; Futian, Q.U. Local Government Competition and Land Financial Strategies. Resour. Sci. 2014, 36, 0702–0711. Available online: https://kns.cnki.net/kcms/detail/detail.aspx?FileName=ZRZY201404005&DbName=CJFQ2014 (accessed on 2 September 2022).

- Wróbel, A.; Rokita, E.; Maenhaut, W. Transport of traffic-related aerosols in urban areas. Sci. Total Environ. 2000, 257, 199–211. [Google Scholar] [CrossRef]

- Zou, X.; Lei, C.; Hu, C. Environmental decentralization and regional green development. China Popul. Resour. Environ. 2019, 29, 97–106. Available online: https://kns.cnki.net/kcms/detail/detail.aspx?FileName=ZGRZ201906011&DbName=CJFQ2019 (accessed on 2 September 2022). [CrossRef]

- Feng, M.Q.; Yu, H.F. Fiscal Decentralization, Foreign Direct Investment and Atmospheric Environmental Pollution. J. Guangdong Univ. Financ. Econ. 2018, 3, 44–51. Available online: https://kns.cnki.net/kcms/detail/detail.aspx?FileName=SONG201803009&DbName=CJFQ2018 (accessed on 2 September 2022).

- Gao, X.H.; Li, X.Q. Comparison of Dimensionless Methods in Multiple Linear Regression Models. Stat. Decis. 2022, 38, 5–9. [Google Scholar]

- Guo, P.; Yang, M.J. A Research on the Impact of China’s Fiscal Decentralization on Environmental Governance. Urban Dev. Res. 2014, 21, 84–90. Available online: https://kns.cnki.net/kcms/detail/detail.aspx?FileName=CSFY201407012&DbName=CJFQ2014 (accessed on 2 September 2022).

- Huang, S.F. A study of impacts of fiscal decentralization on smog pollution. World Econ. 2017, 2, 127–152. Available online: https://kns.cnki.net/kcms/detail/detail.aspx?FileName=SJJJ201702007&DbName=CJFQ2017 (accessed on 2 September 2022).

- Yang, X.D.; Wang, J.L.; Cao, J.H.; Ren, S.Y.; Ran, Q.Y.; Wu, H.T. The spatial spillover effect of urban sprawl and fiscal decentralization on air pollution: Evidence from 269 cities in China. Empir. Econ. 2022, 63, 847–875. [Google Scholar] [CrossRef]

- Gao, M.; Huang, Q.H. Further inspection towards the relationship between environmental protection investment and industrial pollution reduction threshold effect analysis based on governing investment structure. Econ. Manag. 2015, 37, 167–177. [Google Scholar]

- Yu, C.L.; Yang, H.Z. Impact of Chinese local government fiscal expenditure on environment pollution under the fiscal decentralization: Empirical analysis based on panel data from 287 cities. Publ. Financ. Res. 2016, 7, 46–58. [Google Scholar]

- Zhang, C.Y.; Su, D.N.; Lu, L.; Wang, Y. Performance evaluation and environmental governance: From a perspective of strategic interaction between local governments. J. Financ. Econ. 2018, 44, 4–22. [Google Scholar]

- Huang, J.H.; Xie, Y.N.; Yu, Y.T. Urban competition, spatial spillovers and eco-efficiency: The impacts of high-order pressure and low-order suction. China Popul. Resour. Environ. 2018, 28, 1–12. Available online: https://kns.cnki.net/kcms/detail/detail.aspx?FileName=ZGRZ201803001&DbName=CJFQ2018 (accessed on 2 September 2022).

- Zhang, J.N.; Wang, J.L.; Yang, X.D.; Ren, S.Y.; Ran, Q.Y.; Hao, Y. Does local government competition aggravate haze pollution? A new perspective of factor market distortion. Socio-Econ. Plan. Sci. 2021, 76, 100959. [Google Scholar] [CrossRef]

| Region | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 |

|---|---|---|---|---|---|---|---|---|---|

| Beijing | 0.00419 | 0.00415 | 0.00386 | 0.00477 | 0.00494 | 0.00625 | 0.00530 | 0.00511 | 0.00470 |

| Tianjin | 0.00383 | 0.00381 | 0.00356 | 0.00411 | 0.00421 | 0.00511 | 0.00450 | 0.00435 | 0.00396 |

| Hebei | 0.00293 | 0.00279 | 0.00264 | 0.00273 | 0.00321 | 0.00361 | 0.00341 | 0.00330 | 0.00298 |

| Shanxi | 0.00244 | 0.00226 | 0.00200 | 0.00210 | 0.00150 | 0.00136 | 0.00191 | 0.00158 | 0.00136 |

| Inner Mongolia | 0.00029 | 0.00051 | 0.00073 | 0.00102 | 0.00076 | 0.00041 | 0.00056 | 0.00040 | 0.00070 |

| Liaoning | 0.00212 | 0.00211 | 0.00223 | 0.00289 | 0.00288 | 0.00331 | 0.00348 | 0.00321 | 0.00303 |

| Jilin | 0.00327 | 0.00334 | 0.00269 | 0.00371 | 0.00355 | 0.00434 | 0.00407 | 0.00410 | 0.00332 |

| Heilongjiang | 0.00303 | 0.00295 | 0.00263 | 0.00317 | 0.00358 | 0.00408 | 0.00351 | 0.00337 | 0.00328 |

| Shanghai | 0.00402 | 0.00401 | 0.00363 | 0.00444 | 0.00453 | 0.00570 | 0.00498 | 0.00481 | 0.00438 |

| Jiangsu | 0.00323 | 0.00316 | 0.00308 | 0.00379 | 0.00422 | 0.00521 | 0.00463 | 0.00454 | 0.00408 |

| Zhejiang | 0.00382 | 0.00376 | 0.00349 | 0.00438 | 0.00443 | 0.00555 | 0.00476 | 0.00472 | 0.00423 |

| Anhui | 0.00335 | 0.00339 | 0.00319 | 0.00417 | 0.00429 | 0.00524 | 0.00472 | 0.00450 | 0.00417 |

| Fujian | 0.00330 | 0.00339 | 0.00335 | 0.00420 | 0.00431 | 0.00536 | 0.00474 | 0.00461 | 0.00429 |

| Jiangxi | 0.00323 | 0.00315 | 0.00296 | 0.00392 | 0.00411 | 0.00522 | 0.00457 | 0.00443 | 0.00402 |

| Shandong | 0.00332 | 0.00331 | 0.00304 | 0.00340 | 0.00388 | 0.00480 | 0.00442 | 0.00428 | 0.00385 |

| Henan | 0.00393 | 0.00387 | 0.00345 | 0.00420 | 0.00413 | 0.00520 | 0.00455 | 0.00447 | 0.00404 |

| Hubei | 0.00378 | 0.00376 | 0.00343 | 0.00430 | 0.00439 | 0.00545 | 0.00480 | 0.00467 | 0.00430 |

| Hunan | 0.00373 | 0.00361 | 0.00340 | 0.00438 | 0.00449 | 0.00563 | 0.00492 | 0.00481 | 0.00437 |

| Guangdong | 0.00384 | 0.00379 | 0.00357 | 0.00442 | 0.00473 | 0.00594 | 0.00511 | 0.00499 | 0.00457 |

| Guangxi | 0.00357 | 0.00356 | 0.00337 | 0.00431 | 0.00444 | 0.00549 | 0.00481 | 0.00465 | 0.00431 |

| Hainan | 0.00404 | 0.00405 | 0.00358 | 0.00455 | 0.00486 | 0.00618 | 0.00532 | 0.00520 | 0.00481 |

| Chongqing | 0.00380 | 0.00370 | 0.00337 | 0.00419 | 0.00417 | 0.00529 | 0.00453 | 0.00443 | 0.00405 |

| Sichuan | 0.00383 | 0.00381 | 0.00345 | 0.00443 | 0.00461 | 0.00583 | 0.00507 | 0.00494 | 0.00445 |

| Guizhou | 0.00347 | 0.00309 | 0.00262 | 0.00346 | 0.00384 | 0.00469 | 0.00402 | 0.00392 | 0.00354 |

| Yunnan | 0.00334 | 0.00331 | 0.00315 | 0.00385 | 0.00434 | 0.00541 | 0.00451 | 0.00437 | 0.00405 |

| Shaanxi | 0.00335 | 0.00333 | 0.00302 | 0.00376 | 0.00342 | 0.00402 | 0.00365 | 0.00366 | 0.00334 |

| Gansu | 0.00293 | 0.00284 | 0.00277 | 0.00373 | 0.00365 | 0.00453 | 0.00415 | 0.00410 | 0.00364 |

| Qinghai | 0.00245 | 0.00234 | 0.00208 | 0.00183 | 0.00164 | 0.00170 | 0.00213 | 0.00222 | 0.00238 |

| Ningxia | 0.00043 | 0.00031 | 0.00035 | 0.00000 | 0.00043 | 0.00048 | 0.00000 | 0.00025 | 0.00000 |

| Xinjiang | 0.00202 | 0.00190 | 0.00159 | 0.00154 | 0.00213 | 0.00161 | 0.00129 | 0.00142 | 0.00204 |

| Variables | Symbol | Definition and Source | |

|---|---|---|---|

| Dependent variable | Air pollution governance performance | Pollution | Entropy weights of NOX, Smoke and Dust, SO2 1 |

| Explanatory variables | Fiscal decentralization | DEC | Local per capita fiscal expenditure/ Central-level per capita fiscal expenditure 2,3 |

| Pollution control investment | Invest | Industrial pollution control (exhaust gas) investment/GDP 4 | |

| Local government capital attraction competition | FDI | Total import and export of foreign-invested enterprises 2,5 | |

| Control variables | Economic development | GDP | Local GDP per capita 2 |

| Population density | Popuden | Local year-end population/administrative area 2 | |

| Transportation intensity | Road | Urban road area per capita 2 | |

| Technology level | Tech | Science and technology expenditure/local budget expenditure 2 |

| Variable | N | Mean | Std | Median |

|---|---|---|---|---|

| Pollution | 270 | 0.004 | 0.001 | 0.004 |

| DEC | 270 | 6.797 | 2.772 | 5.853 |

| GDP | 270 | 5.435 | 2.645 | 4.704 |

| Road | 270 | 15.592 | 4.686 | 15.120 |

| Popuden | 270 | 0.047 | 0.07 | 0.029 |

| Tech | 270 | 2.064 | 1.447 | 1.362 |

| Invest | 270 | 0.078 | 0.008 | 0.054 |

| FDI | 270 | 1876.629 | 5431.615 | 76.799 |

| Variables | FE | FE | FE |

|---|---|---|---|

| Model 1 | Model 2 | Model 3 | |

| L. pollution | 0.506 *** | 0.413 *** | 0.497 *** |

| (0.069) | (0.094) | (0.070) | |

| DEC | –0.258 ** | –0.166 * | –0.303 *** |

| (0.098) | (0.094) | (0.105) | |

| Road | 0.216 * | 0.212 ** | 0.215 * |

| (0.106) | (0.103) | (0.107) | |

| GDP | –0.046 * | –0.053 ** | –0.047 |

| (0.026) | (0.025) | (0.031) | |

| Popuden | 0.226 * | 0.269 ** | 0.224 * |

| (0.116) | (0.110) | (0.119) | |

| Tech | –0.037 | –0.049 * | –0.015 |

| (0.030) | (0.028) | (0.038) | |

| Invest | 0.053 ** | ||

| (0.024) | |||

| Inter1 | –15.935 *** | ||

| (4.475) | |||

| FDI | –0.012 ** | ||

| (0.006) | |||

| Inter2 | 2.416 ** | ||

| (0.896) | |||

| Constant | 0.002 ** | 0.002 ** | 0.002 *** |

| (0.001) | (0.001) | (0.001) | |

| N | 240 | 240 | 240 |

| R2 | 0.812 | 0.829 | 0.816 |

| (1) | (2) | (3) | (4) | (5) | (6) | |

|---|---|---|---|---|---|---|

| DEC | –0.381 ** | –0.309 *** | –0.298 *** | –0.267 *** | –0.272 *** | –0.258 ** |

| (0.140) | (0.111) | (0.090) | (0.094) | (0.095) | (0.098) | |

| L. pollution | 0.562 *** | 0.536 *** | 0.523 *** | 0.520 *** | 0.506 *** | |

| (0.057) | (0.065) | (0.065) | (0.066) | (0.069) | ||

| Road | 0.194 * | 0.192 * | 0.207 * | 0.216 * | ||

| (0.099) | (0.098) | (0.104) | (0.106) | |||

| GDP | –0.042 | –0.050 * | –0.046 * | |||

| (0.028) | (0.027) | (0.026) | ||||

| Popuden | 0.191 | 0.226 * | ||||

| (0.115) | (0.116) | |||||

| Tech | –0.037 | |||||

| (0.030) | ||||||

| Constant | 0.005 *** | 0.003 *** | 0.002 *** | 0.003 *** | 0.002 ** | 0.002 ** |

| (0.001) | (0.000) | (0.000) | (0.000) | (0.001) | (0.001) | |

| N | 240 | 240 | 240 | 240 | 240 | 240 |

| R2 | 0.705 | 0.800 | 0.809 | 0.810 | 0.811 | 0.812 |

| Variables | FE | OLS | FE | OLS | FE | OLS |

|---|---|---|---|---|---|---|

| (1) | (2) | (3) | (4) | (5) | (6) | |

| L. pollution | 0.507 *** | 0.506 *** | 0.412 *** | 0.413 *** | 0.498 *** | 0.497 *** |

| (0.069) | (0.074) | (0.094) | (0.101) | (0.069) | (0.075) | |

| DEC | –0.266 ** | –0.258 ** | –0.170 * | –0.166 | –0.314 *** | –0.303 ** |

| (0.102) | (0.105) | (0.097) | (0.101) | (0.110) | (0.113) | |

| Road | 0.214 * | 0.216 * | 0.211 ** | 0.212 * | 0.213 * | 0.215 * |

| (0.106) | (0.114) | (0.103) | (0.111) | (0.106) | (0.114) | |

| GDP | –0.044 * | –0.046 | –0.053 ** | –0.053 * | –0.045 | –0.047 |

| (0.026) | (0.028) | (0.025) | (0.026) | (0.031) | (0.033) | |

| Popuden | 0.213 * | 0.226 * | 0.263 ** | 0.269 ** | 0.208 * | 0.224 * |

| (0.116) | (0.125) | (0.111) | (0.118) | (0.118) | (0.127) | |

| Tech | –0.036 | –0.037 | –0.048 | –0.049 | –0.013 | –0.015 |

| (0.030) | (0.032) | (0.028) | (0.030) | (0.038) | (0.041) | |

| Invest | 0.058 ** | 0.053 * | ||||

| (0.025) | (0.026) | |||||

| Inter1 | –17.071 *** | –15.935 *** | ||||

| (4.683) | (4.796) | |||||

| FDI | –0.012 ** | –0.012 * | ||||

| (0.006) | (0.006) | |||||

| Inter2 | 2.500 ** | 2.416 ** | ||||

| (0.923) | (0.960) | |||||

| Constant | 0.002 ** | –0.002 | 0.002 ** | –0.003 | 0.002 *** | –0.002 |

| (0.001) | (0.004) | (0.001) | (0.004) | (0.001) | (0.004) | |

| N | 240 | 240 | 240 | 240 | 240 | 240 |

| R2 | 0.813 | 0.962 | 0.831 | 0.966 | 0.816 | 0.963 |

| Northern Regions | Southern Regions | |||||

|---|---|---|---|---|---|---|

| Variables | (1) | (2) | (3) | (4) | (5) | (6) |

| L. pollution | 0.399 *** | 0.336 ** | 0.333 ** | 0.592 *** | 0.593 *** | 0.533 *** |

| (0.119) | (0.142) | (0.144) | (0.134) | (0.135) | (0.151) | |

| DEC | –0.364 ** | –0.256 | –0.378 ** | 0.051 | 0.052 | 0.020 |

| (0.168) | (0.169) | (0.155) | (0.062) | (0.063) | (0.074) | |

| Invest | 0.077 | 0.002 | ||||

| (0.050) | (0.012) | |||||

| Inter1 | –11.402 ** | –0.157 | ||||

| (5.023) | (0.955) | |||||

| FDI | –0.026 ** | –0.007 ** | ||||

| (0.012) | (0.002) | |||||

| Inter2 | 0.655 | 0.550 ** | ||||

| (1.319) | (0.224) | |||||

| Controls | YES | YES | YES | YES | YES | YES |

| N | 120 | 120 | 120 | 120 | 120 | 120 |

| R2 | 0.640 | 0.661 | 0.657 | 0.983 | 0.983 | 0.984 |

| Coastal Regions | Inland Regions | |||||

|---|---|---|---|---|---|---|

| Variables | (1) | (2) | (3) | (4) | (5) | (6) |

| L. pollution | 0.399 *** | 0.336 ** | 0.333 ** | 0.428 *** | 0.325 *** | 0.421 *** |

| (0.119) | (0.142) | (0.144) | (0.090) | (0.112) | (0.094) | |

| DEC | –0.013 | –0.037 | –0.048 | –0.532 *** | –0.375 ** | –0.542 *** |

| (0.049) | (0.039) | (0.073) | (0.114) | (0.151) | (0.117) | |

| Invest | –0.020 | 0.090 ** | ||||

| (0.018) | (0.042) | |||||

| inter1 | 1.848 | –15.555 *** | ||||

| (2.001) | (4.843) | |||||

| FDI | –0.015 * | –0.008 | ||||

| (0.007) | (0.009) | |||||

| inter2 | 0.852 | 0.834 | ||||

| (0.471) | (0.821) | |||||

| Controls | YES | YES | YES | YES | YES | YES |

| N | 88 | 88 | 88 | 152 | 152 | 152 |

| r2 | 0.945 | 0.946 | 0.946 | 0.765 | 0.794 | 0.766 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Luo, W.; Liu, Y. Research on the Impact of Fiscal Decentralization on Governance Performance of Air Pollution—Empirical Evidence of 30 Provinces from China. Sustainability 2022, 14, 11313. https://doi.org/10.3390/su141811313

Luo W, Liu Y. Research on the Impact of Fiscal Decentralization on Governance Performance of Air Pollution—Empirical Evidence of 30 Provinces from China. Sustainability. 2022; 14(18):11313. https://doi.org/10.3390/su141811313

Chicago/Turabian StyleLuo, Wenjian, and Yujie Liu. 2022. "Research on the Impact of Fiscal Decentralization on Governance Performance of Air Pollution—Empirical Evidence of 30 Provinces from China" Sustainability 14, no. 18: 11313. https://doi.org/10.3390/su141811313

APA StyleLuo, W., & Liu, Y. (2022). Research on the Impact of Fiscal Decentralization on Governance Performance of Air Pollution—Empirical Evidence of 30 Provinces from China. Sustainability, 14(18), 11313. https://doi.org/10.3390/su141811313