Abstract

The development of China’s digital finance provides new ideas for solving the financial constraints faced by some collaborative innovation activities in the Yangtze River Delta (YRD). Therefore, based on the panel data of 41 cities in the YRD from 2011 to 2020, this study empirically tests the impact and transmission mechanisms of digital finance on collaborative innovation through GMM and a dynamic mediation model. The results show that in the YRD region, digital finance significantly stimulates collaborative innovation, but the effect of the decomposition index varies. The effect of depth of use is the strongest, followed by breadth of coverage and degree of digitization. In terms of the transmission mechanism, digital finance can increase the scale of credit, social consumption, and industrial upgrading to form a positive local effect. It can also improve the development of collaborative innovation, and lead to a spillover effect through the flow of R&D capital and R&D personnel. The conclusion indicates that it is necessary to stimulate the digital transformation in the financial field, giving full play to liquidity, facilitating the upgrading of credits, consumption, and industries. This study enriches the theoretical framework of digital finance and collaborative innovation. Moreover, the empirical test provides data and evidence for the construction of a world-class science and technology innovation center in the YRD. The paper also presents limitations, including the influence of factors such as urban heterogeneity and financial supervision, worthy of further research.

1. Introduction

Innovation is the primary driving force for China’s economic transformation and upgrading. With the development of market integration, regional collaborative innovation resources break through boundaries and form a network of positive interactions, promoting the maximization of urban benefits. They are regarded as an important means for cultivating competitiveness [1], and are always the focus of government policies. Generally speaking, innovation activities have the characteristics of long R&D cycle, information asymmetry, and high risk of return. Financial resources are an important guarantee to ensure their sustainable development [2]. However, China’s financial system has long-lasting structural contradictions, mainly dominated by the overly cautious banking industry. Banks reduce the availability of financing for the real economy, severely restricting the development of regional collaborative innovation. The digital transformation of the financial industry has accelerated in recent years, bringing greater financial inclusion [3]. Digital finance positively affects the performance of the banking industry [4], providing higher taxes to the government [5], steadily improving the financial efficiency [6]. In recent years, China’s digital finance has gone through multiple stages of development and achieved remarkable results, becoming a model for the development of global digital finance [7]. Thus, can digital finance drive regional collaborative innovation and development? If the answer is yes, what is the conduction path? This is a question worth exploring, as it might lead to policy recommendations for the digital transformation of China’s traditional financial industry.

In order to tackle this problem, it is necessary to select appropriate samples to carry out empirical tests. Therefore, this study selected the YRD as the research object, a region with the most active economic development and openness in China. The data show that in 2020, the GDP of the YRD reached USD 3545.024 billion, accounting for about one-quarter of China’s GDP. The total volume of imports and exports and the volume of patent applications accounted for 36.9% and 31.56% of the total in China, respectively (Data sources: National Bureau of Statistics of China. https://data.stats.gov.cn/ (accessed on 30 April 2022)). There are 41 cities in the YRD, including Shanghai, Nanjing, Hangzhou, and Hefei, etc. With a developed transportation system and close regional cooperations, they hold most of the Chinese fintech companies. At the same time, national policies are also implemented in the YRD. For example, in 2018, the integrated development strategy of the YRD was upgraded to a national strategy. In 2020, the Ministry of Science and Technology issued the YRD Science and Technology Innovation Community Construction and Development Plan, emphasizing the need to optimize the urban innovation layout and ecology, to deepen the reform of scientific, technological, and innovation cooperation, to build a national industrial high-tech hub, and strive to create a YRD science and technology innovation community with global influence.

This study attempts to contribute in the following ways: first, in terms of theory, we put digital finance and collaborative innovation into a complete logical framework, by combing the literature and analyzing the existing relationship mechanism from the perspectives of local effect and spillover effect. This provides an addition to existing theories. Second, in terms of practice, we provide policy advice for the digital transformation of the financial industry in the YRD, and the construction of a world-class science and technology innovation center. Third, in terms of method, 41 cities in the YRD are used as the research objects. The number of non-individual cooperative patent applications is collected through data crawlers to measure the degree of collaborative innovation. Using measurement models such as GMM and the dynamic intermediary effect model, combined with the Peking University Digital Financial Inclusion Index, we examine the incentive effect and transmission mechanism of digital finance and its coverage, depth of use, and degree of digitization in collaborative innovation. We strive for accurate results and reliable conclusions.

The remainder of this paper is structured as follows. First, six research hypotheses and corresponding theoretical frameworks are proposed in the process of the literature review. Second, we construct an econometric model, and explain the selection of variables and data sources. Third, we present and discuss the empirical results. Fourth, the main conclusions are listed, and a series of recommendations are made.

2. Review of the Literature and Research Hypotheses

Digital finance generally refers to the use of digital technology by traditional financial institutions and Internet companies. It is similar to Internet finance and fintech, but digital finance covers a wider range, and has a more significant impact on society and the economy. The vast existing literature focuses on the relationship between digital finance and the urban–rural income gap, entrepreneurship, inclusive growth, rural financial needs, and economic development [8].

In the field of technological innovation, finance is one of the basic prerequisites, because it determines capital allocation [9]. As we all know, the development of the financial industry is limited by market segmentation, structural mismatch, and other obstacles. Equally true, the digital financial model provides a new model of innovation incentive. This model subverts traditional financial intermediaries using big data, cloud computing, and artificial intelligence to empower new business models and reduce the information asymmetry dilemma between traditional financial intermediaries and enterprises, thereby providing guarantees for financial resources to better serve innovation projects, stimulating the technological innovation and development of enterprises [10]. At the same time, Han and Gu [11] found that the higher the level of debt financing, the stronger the role of digital inclusive finance in promoting the innovation performance of high-tech enterprises. Yao and Yang [12] found that digital finance has various incentive effects on SME with different property rights. However, enterprise innovation is no longer an isolated and closed system. Different enterprises form a cross-regional collaborative innovation model by building a network to reduce potential risks [13]. This model can promote the digital flow of financial resources, present the characteristics of platform support, data-driven, sharing and win–win, and stimulate more innovative output [14]. Therefore, the result of digital finance stimulating enterprise innovation activities is obtaining a positive effect on collaborative innovation. This study proposes the following hypothesis:

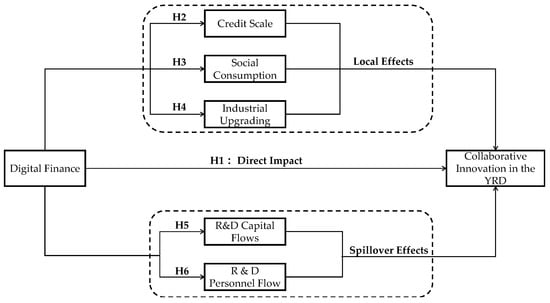

Hypothesis 1.

Digital finance can directly drive collaborative innovation in the YRD.

Thus, through what channels does digital finance stimulate collaborative innovation in the YRD? Guo et al. [15] declared that the development of digital finance can improve the level of corporate risk-taking, thereby encouraging the continuous innovation of Chinese energy companies. Li and Li [16] estimated the impact validity of digital finance on urban innovation through a double-difference model, and found that digital finance promotes urban innovation by improving the allocation of credit resources, promoting consumption, and guiding industrial upgrading. Fan et al. [17] further demonstrated that the breadth of coverage and the depth of use of digital finance can promote corporate green technology innovation, but the degree of digitalization of digital finance does not have a significant impact. At the same time, digital finance mainly improves the financial environment and promotes the innovation of green technology by reducing problems such as “financing difficulties”, “matching difficulties”, and “supervision difficulties”. Finally, Liu et al. [18] explained that digital finance promotes green innovation in enterprises by increasing investment in R&D. However, the channel factors affecting the collaborative innovation are more complex, including transportation infrastructure [19], cross-regional production linkages [20], technological proximity [21], factor mobility [22], market drivers [23], and political factors [24], etc. This study argues that the impact of digital finance on collaborative innovation has local effects and spillover effects.

A local effect refers to the fact that a city can promote its own innovation performance. Firstly, digital finance has strong information-processing capabilities, actively adapting to customer’s needs, identifying potential customers, allocating funds, and increasing credit scale [25]. Secondly, demand-induced innovation theory argues that there is heterogeneity in consumer preferences, and that companies need to continuously innovate to meet consumer demands [26]. The theory of liquidity constraints holds that the credit market is not perfect, resulting in consumers being unable to obtain credit and consume according to established goals. Luckily, financial development can accelerate the allocation of credits, allowing liquidity-constrained consumers to make optimal consumption choices [27]. With the rapid development of e-commerce, digital financial third-party payment platforms promote the development of online consumption [28]. Thirdly, convenient mobile payments promote the development of the service industry, forming an entrepreneurial demonstration effect. It can not only transform traditional industries, but also stimulate the development of emerging industries, continuously eliminate backward production capacity, and achieve industrial upgrading. Therefore, this study proposes the following hypotheses:

Hypothesis 2.

Digital finance has a local effect increasing the scale of credit, thereby promoting collaborative innovation in the YRD.

Hypothesis 3.

Digital finance has a local effect driving social consumption, thereby promoting collaborative innovation in the YRD.

Hypothesis 4.

Digital finance has a local effect driving industrial upgrading, thereby promoting collaborative innovation in the YRD.

A spillover effect refers to the flow of R&D, producing a knowledge spillover effect and affecting innovation activities in other cities. The liquidity of digital finance drives the cross-regional flow of R&D capital, making R&D capital flow to areas with higher innovation efficiency. According to the theory of “capital–skill complementarity”, capital and skilled labor are complementary [29]. In areas where R&D capital inflows, innovative entities use more capital to carry out innovative production activities, which also increases the demand for R&D personnel. Generally speaking, R&D elements are effective carriers of knowledge. The free flow of R&D elements promotes communication and learning, which is conducive to strengthening market competition and exerting the function of “survival of the fittest”. At the same time, the flow of R&D elements exerts the “resource allocation effect”, thereby realizing collaborative innovation in the YRD. Therefore, this study proposes the following hypotheses:

Hypothesis 5.

Digital finance stimulates collaborative innovation in the YRD by driving R&D capital flows.

Hypothesis 6.

Digital finance stimulates collaborative innovation in the YRD by driving R&D personnel flows.

Based on the above theoretical mechanisms and hypotheses, we designed a theoretical framework, as shown in Figure 1. In the subsequent pages, we present the empirical tests conducted following the theoretical framework.

Figure 1.

Theoretical framework.

3. Methodology and Data

3.1. Econometric Model

Hypothesis 1 was verified according to the theoretical framework. In order to avoid interference from other variables in the estimated results, six control variables were introduced in this paper. We performed logarithmic processing on all variables to solve the heteroscedasticity problem. Since collaborative innovation is a dynamic process, it not only depends on current factors, but is also affected by previous factors. Therefore, referring to Zhou and Xu [30], the dependent variable of the previous period was introduced into the equation as an independent variable to construct a dynamic panel model. In order to solve the problem of the explanatory variables potentially being related to random interference terms, this paper directly estimates the model through the generalized moment estimation method (GMM). The specific equation is as follows:

where is the explained variable indicating the collaborative innovation level of city i in the year t. is the lagged 1-period term of the explained variable. is the explanatory variable indicating the digital finance development level of city i in the year t. are the three sub-dimensions of digital finance, representing the breadth of coverage, the depth of use, and the degree of digitization, respectively. stands for other control variables. is the urban effect. is the random disturbance term.

Furthermore, in order to test Hypotheses 2–4, we explored whether digital finance influences the collaborative innovation of cities in the YRD using local effects. Based on the baseline estimation model (1), we constructed the dynamic mediation model for GMM estimation as follows:

where represent the credit scale, the social consumption, and the industrial upgrading, respectively. The remaining variables are explained in model (1). represents the total effect. represents the direct effect. is the intermediary effect, which indicates the transmission effect of digital finance on collaborative innovation using the local effect. In addition, the mediating effect is identified according to the stepwise regression method. If the regression coefficients ,, and are significant, but , there is a partial mediating effect. If and are significant, but is not, then there is a fully mediating effect [31].

We continued by validating Hypotheses 5–6, and examining the impact of digital finance on collaborative innovation in cities in the YRD using spillover effects. Combined with the baseline estimation model (1), the spillover effect dynamic mediation model is formed as follows:

where represents the flow of R&D capital and represents the flow of R&D personnel. Similarly, following the mediation effect, if the regression coefficients ,, and are significant, but , then there is a partial mediation effect. If are significant, but is not, then there is a fully mediating effect.

3.2. Variable Selection

3.2.1. Explanatory Variables: Urban Collaborative Innovation (coin)

The number of patents is an effective indicator of innovation performance [32]. Therefore, in order to present the characteristics of knowledge sharing and collaborative innovation activities in 41 cities in the YRD, we gathered the number of their cooperative patent applications in the following manner: first, all patent data from 2011–2020 were collected from the Patent Retrieval and Analysis System of the State Intellectual Property Office of China. Second, patents containing two or more applicants were screened out. Finally, the number of the cooperative patent application was matched to the applicant’s address. Patent applications without an address were not included in the study.

3.2.2. Explanatory Variables: Digital Finance (DIF)

The Digital Finance Research Center of Peking University and Ant Financial Services Co., Ltd. used the massive data from Alipay transactions to compile a digital financial inclusion index from 31 provinces, 337 prefecture-level cities, and 2800 county-level regions in mainland China. This set of indices has 33 specific indicators from the perspective of digital finance coverage breadth (DCB), depth of use (DUD), and degree of digitization (DDL). DCB is represented by Alipay’s account coverage. DUD covers Alipay’s payment business, funds, credit, insurance, and investment. DDL includes the four aspects of mobility, affordability, trust, and flexibility applied by Alipay [33]. Therefore, we used this set of data to measure the level of digital financial development in 41 cities in the YRD.

3.2.3. Mediation Variables

According to the theoretical framework, this study presents two types of mediation variables, namely, local effects and spillover effects. Among them, the intermediary variables of local effect include credit scale, social consumption, and industrial upgrading. Firstly, we used the ratio of loan balance of financial institutions to GDP at the end of the year to represent the scale of credit, because the loans effectively reflect the development of the financial markets. Secondly, we used the total retail sales of consumer goods per capita to represent social consumption, because the degree of social consumption is closely related to the scale of retail sales of consumer goods. Finally, industrial upgrading includes the improvement of production factors, structural changes, and industrial chain upgrading, which is manifested in the structural upgrading of primary industry into secondary industry, and then into tertiary industry. Therefore, the ratio of the output value of the tertiary industry to the primary and secondary industries was used to represent the industrial upgrading.

In addition, we used a gravity model to measure the mediation variables of the spillover effect, which are R&D capital and personnel flows. The gravity model can be traced back to Newton’s law of universal gravitation. Its connotation is that the attractive force between two objects is positively related to the mass and negatively related to the distance. As science progresses, this model is widely used in economic fields such as international trade flows, population migration, and cross-border investment [34]. A brief economic gravity model shows that the economic connection between regions is proportional to the size of the economy and inversely proportional to the distance. It was first introduced into the field of spatial interaction by Zipf [35]. He used the product of factor sizes between cities divided by the distance to reflect the spatial connections generated by the flow of factors. On this basis, according to Bai et al. [36], we put the attraction variable into the gravity model. A modified logarithmic gravity model is constructed to analyze the flow of R&D capital and R&D personnel as follows:

where represents the total outflow of R&D capital in city . represents the logarithm of R&D capital in city . is the logarithm of total industrial profits in city . It is used to represent the attractiveness, mainly taking into account the profit-seeking characteristics of capital flows. represents the inverse of the squared geographic distance between city and city . From Equation (6), it can be seen that the total outflow of R&D capital in city is proportional to the R&D capital of city and to the total profit of industrial enterprises in city , while inversely proportional to the square of the geographical distance between cities and , which is more in line with the basic characteristics of the gravity model. Similarly, represents the total outflow of R&D personnel in city represents the logarithm of R&D personnel in city . is the logarithm of the average salary in city . It is used to indicate the attractiveness, mainly because labor tends to flow to cities offering higher salaries.

3.2.4. Control Variables

According to relevant research and influencing factors of collaborative innovation in cities in the YRD [37], this paper sets the following six control variables: (1) economic development (pgdp), measured by the GDP per capita. We converted this into the actual value of constant price in 2011 according to the GDP index; (2) human capital (huma), following the production function. We used the number of university students per million people in a given city; (3) the degree of foreign direct investment (fdi), measured using the fdi ratio to GDP; (4) international trade (trad), measured using the ratio of total imports and exports of goods to GDP; (5) infrastructure (road), measured in road area per capita; and (6) government support (gove), measured using the proportion of local financial science and technology expenditure in total expenditure.

3.3. Data and Sample

Our sample included 41 cities in the YRD from 2011 to 2020. The patent data came from the Patent Retrieval and Analysis System of the State Intellectual Property Office of China. Other data came from the China Urban Statistical Yearbook, the Statistical Bulletins of Cities in the YRD, and the Economy Prediction System (EPS) database. A few missing data were supplemented using the mean method. To eliminate the heteroskedasticity issues, we turned all variables into logarithms. All variables are described in Table 1.

Table 1.

Descriptive statistics.

3.4. Preliminary Investigation

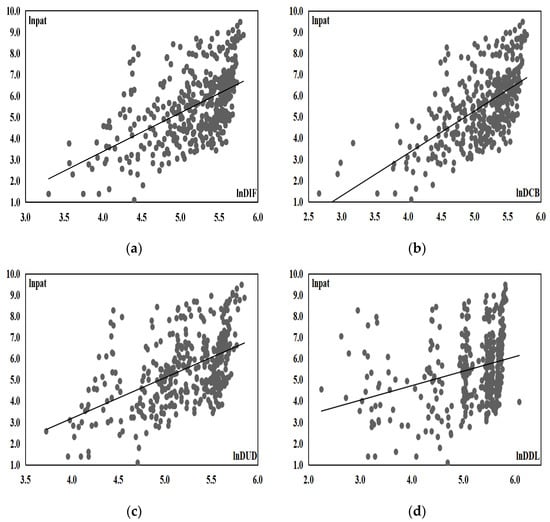

Below, we used scatter charts to conduct a preliminary investigation, with Figure 2 reporting a scattered relationship between digital finance and its three decomposition indices (breadth of coverage, depth of use, and degree of digitization), as well as cooperation patents in the YRD from 2011 to 2020. The trend line of the charts shows that with the improvement of digital finance, the breadth of coverage, depth of use, and degree of digitization, and number of cooperative patents, all increase. It also shows a positive correlation between the two, with the correlation coefficient exceeding 0.5, which is consistent with the theoretical analysis conclusions, indicating that digital finance can positively drive the collaborative innovation and development of cities in the YRD. However, the preliminary investigation did not consider other influencing factors. The core conclusions still need to be demonstrated through rigorous empirical testing.

Figure 2.

(a) Scattered relationship between digital finance and collaborative innovation; (b) scattered relationship between breadth of coverage and collaborative innovation; (c) scattered relationship between depth of use and collaborative innovation; (d) scattered relationship between the degree of digitization and collaborative innovation. Data sources: authors’ elaboration.

4. Results

4.1. Baseline Regression Estimation Results—H1 Test

Table 2 reports the results of the baseline estimation model (1). We found that the lag term of collaborative innovation (L1.lncoin) in columns (1) to (7) is significantly positive, indicating that the dynamic panel model fully taps the potential influencing factors, and the results are more accurate.

Table 2.

Estimated results of the baseline regression.

Column (1) uses the results of the dynamic fixed effects as a reference. The results show that the estimated coefficient of lnDIF is 0.527, indicating that every 1% increase in digital financial investment increases the collaborative innovation of the YRD by 0.527%, which preliminarily validates H1. Columns (2) and (3) are the estimation results of the difference generalized method of moments (DIF-GMM) and the system generalized method of moments (SYS-GMM), respectively. We found that the p value of AR(1) is less than 0.1, the p value of AR(2) is greater than 0.1, and the p value of the Sargan test is greater than 0.1. This shows that only first-order autocorrelation exists in the difference in the disturbance term, and there is no second-order or higher-order autocorrelation. The estimation results of DIF-GMM and SYS-GMM are consistent and reliable. On this basis, the estimated coefficients of lnDIF are 0.546 and 0.553, respectively, and all pass the 1% level of significance test. It is verified that digital finance stimulates collaborative innovation in the YRD, indicating that H1 is established and stable.

Next, since the estimation efficiency of SYS-GMM is higher than that of DIF-GMM, this paper continues to use SYS-GMM to test the influence of the three decomposition indices of digital finance. The results are shown in columns (4), (5), and (6). We found that DCB, DUD, and DDL all show significant positive effects, with coefficients of 0.484, 0.500, and 0.196, respectively. Among them, the role of DUD is the most significant, followed by DCB and DDL. Therefore, when improving the coverage of digital finance, it is important to pay attention to the penetration of services and guide consumers to use a series of features in depth, so as to exert the incentive effect of the depth of use. At the same time, the degree of digitization needs to be further improved. The investment in digital infrastructure should be strengthened, and the market-oriented development of digital technology should be actively guided.

4.2. Estimated Results of Local Effects—Test of H2, H3, and H4

Based on Table 2, the dynamic mediation model is further applied. The details are shown in Table 3. Column (1) is the estimated result of column (3) in Table 2, which is used as a comparison with other columns. It is found from column (2) that the influence coefficient of digital finance on the credit scale is 0.068 and passes the significance test at the 1% level, indicating that digital finance increases the scale of credit, which verifies H2. The results of column (3) show that the influence coefficient of digital finance on social consumption of 0.156 is significant, indicating that digital finance eases consumption constraints, improve users’ consumption tendency, and drive social consumption, which verifies H3. Similarly, column (4) shows that the influence coefficient of digital finance on industrial upgrading is 0.126, indicating that digital finance drives the emergence of new industrial and business models, thereby helping to upgrade the industrial structure, verifying H4. The results of columns (5), (6), and (7) show that the estimated coefficients of credit scale, social consumption, and industrial upgrading are all significantly positive. The estimated coefficients of digital finance are 0.544, 0.540, and 0.561, respectively, and are all smaller than column (1). This means that a partial mediation effect is established. The results further confirm that digital finance can form a positive local effect by increasing the scale of credit, driving social consumption, and assisting industrial upgrading, and can indirectly drive the collaborative innovation in the YRD.

Table 3.

Estimated results of the local effects.

4.3. Estimated Results of the Spillover Effect—Test of H5 and H6

We further applied the dynamic mediation model to verify whether there is a spillover effect in digital finance to indirectly drive the collaborative innovation in the YRD. The results are shown in Table 4. Among them, the estimated coefficients of digital finance in column (2) and (3) are 0.090 and 0.088, respectively. Both pass the significance test of 1%, indicating that digital finance has a positive impact on the flow of R&D capital and personnel, because digital finance has the characteristics of liquidity, ability to break through the regional market segmentation and local administrative decentralization, and facilitate the free flow of R&D across cities, validating H5 and H6. Lastly, the results of columns (4) and (5) show that the estimated coefficients of R&D capital flow and R&D personnel flow are significantly positive, indicating that the flow of R&D factors contributes to the collaborative innovation in the YRD. At the same time, the estimated coefficients of digital finance are 0.291 and 0.366, respectively, which are significantly smaller than the estimated coefficient of digital finance in column (1), indicating that a partial mediation effect is established.

Table 4.

Estimated results of the spillover effect.

4.4. Robustness Test

In order to ensure the validity of the conclusions, we mainly applied the following three methods for robustness testing:

First, we replaced the measures of the explained variables. In order to exclude a potential bias caused by the selection of explained variables, we used the number of cooperative invention patent applications (ipat) and the number of cooperative non-invention patent applications (npat) as new metrics. The results are shown in columns (1) and (2) of Table 5. The results show that the estimated coefficients of digital finance are significantly positive, indicating that digital finance can indeed drive the collaborative innovation and development of cities in the YRD, indicating that the core conclusions of the paper are robust.

Table 5.

Estimated results of the robustness test.

Second, we replaced the econometric model. For comparison with the dynamic panel model, the OLS model and the static double fixed effects model were used to carry out empirical tests. The results are shown in columns (3) and (4) of Table 5. We found that the estimated coefficients of lnDIF are 1.323 and 1.500, respectively, again indicating that the core conclusions of this paper are robust.

Third, we tested for endogeneity. We used the number of mobile phone users per 100 people and the number of Internet users per 100 people as the instrumental variables of digital finance to carry out a two-stage estimation test. Column (5) in Table 5 reports the estimation results of the second stage. We found that the p value of the Kleibergen–Paap rk LM test is 0.0000. In addition, the F value of the Cragg–Donald Wald rank test is much larger than the critical value of 19.93, indicating that there is no weak instrumental variable problem. At the same time, the estimated coefficient of digital finance is 1.193 and is significant at the 1% level, indicating that digital finance has always played a driving role in the collaborative innovation of cities in the YRD, and further verifies the robustness of the core conclusions of this paper.

5. Conclusions and Recommendations

5.1. Conclusions

As one of the world’s six major urban agglomerations, the YRD is facing complex economic development because of the global COVID−19 pandemic. We believe that adhering to innovation leadership and forming a collaborative urban innovation model is a favorable way to achieve the stable and healthy development of the economy in the region. However, collaborative innovation has always faced the problem of financing, the fundamental reason being the imbalance in the allocation of credit resources in the Chinese traditional financial market. In this context, the question remains: can digital finance effectively drive collaborative innovation in the YRD? To provide an answer to this question, we first used scatter plots for the preliminary investigation, and then the GMM to empirically test the panel statistics of 41 cities in the YRD from 2011 to 2020. Finally, the dynamic mediation model verified the two transmission paths of local effect and spillover effect.

The main conclusions show that in the YRD:

- (1)

- The scatter charts indicate a positive correlation between the improvement of digital finance, coverage breadth, depth of use, and degree of digitization, on the one hand, and the number of cooperative patents on the other. The correlation coefficients both exceed 0.5, which shows that digital finance can positively drive collaborative innovation and development;

- (2)

- The results of the GMM also confirm that digital finance can significantly drive collaborative innovation and development, but there are significant differences in the coverage breadth, depth of use, and degree of digitization. The role of the depth of use is the most significant, followed by the breadth of coverage and the degree of digitization, indicating that when promoting the coverage of digital financial services, the most important thing is to enhance the penetration of digital financial services, guiding costumers to use digital financial tools in depth, and actively participate in the development of digital technologies;

- (3)

- Digital finance can provide a positive local effect by increasing the scale of credit, driving social consumption, and assisting industrial upgrading, and indirectly drives the improvement of innovation performance, thereby providing favorable conditions for collaborative innovation;

- (4)

- Digital finance can promote the flow of R&D capital and R&D personnel. This also forms a positive spillover effect, which indirectly drives collaborative innovation.

5.2. Recommendations

Based the main conclusions of this study, the following suggestions are put forward:

- (1)

- Promote the integration of digital technology and financial services. Under the guidance of the Chinese national new infrastructure policy, the government should fully support the development and investment into emerging technologies such as big data, artificial intelligence, and industrial Internet; accelerate the effective flow of digital information; and create a favorable atmosphere for digital development in the YRD. In addition, traditional financial institutions should focus on digital transformation, promoting deep, inclusive integration, and the equal allocation of financial services. Finally, decision makers should make every effort to build an interconnected digital financial ecosystem, efficiently deploying digital financial tools, strengthening the positive spillover of digital finance, and realize the complementarity of digital financial resources;

- (2)

- Give full play to the effect of digital finance on the credit scale, social consumption, and industrial upgrading. The government should guide traditional financial institutions to apply digital technology to credit assessment, risk control, and service supervision, so as to continuously alleviate information asymmetry and reduce agency costs, thereby promoting the expansion of credit scale. In addition, it is necessary to expand the advantages of digital finance in third-party payment, credit loans, etc., constantly easing constraints on consumption and the use of mobile for e-commerce by issuing consumer electronic coupons. Finally, thanks to digital finance, small and micro-enterprises and individual industrial and commercial stakeholders can be driven to start businesses, activate the service industry market, and promote the advancement and rationalization of the industrial structure, while promoting the development of high-tech industries, driving the creation of new forms of sharing economy industries, and realizing industrial transformation and upgrading;

- (3)

- Give full play to the liquidity of the digital finance and encourage the free flow of R&D, which will drive innovation knowledge spillover conducive to the collaborative learning of cross-regional innovation. Therefore, it is necessary to give full play to the dominant position of digital finance in the allocation of the innovative capital, break down institutional barriers in cities, promote the integrated high-quality development of the YRD, and strengthen the implementation of cooperation and innovation projects between cities. At the same time, strengthening the main role of high-tech talents, continuously improving the reform of the registration system, lowering the threshold for high-tech talents to settle down, and promoting equal allocation of R&D manpower are important measures to implement. In addition, it is necessary to prevent the excessive flow of R&D and avoid the crowding-out effect of urban R&D, because the crowding-out effect will cause the distorted allocation of R&D, which will be detrimental to collaborative innovation and development of cities.

Author Contributions

Conceptualization and formal analysis, H.Z.; methodology and software, W.Z.; writing and editing, I.L. All authors have read and agreed to the published version of the manuscript.

Funding

This work was supported by the Shanghai Philosophy and Social Science Planning Project fund (grant number: 2021BGL001), the Fundamental Research Funds for the Central Universities and Graduate Student Innovation Fund of Donghua University (grant number: CUSF-DH-D−2021066).

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

The data are available upon request from the corresponding author.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Wang, Y.; Wang, C.; Mao, X.; Liu, B.; Zhang, Z.; Jiang, S. Spatial pattern and benefit allocation in regional collaborative innovation of the Yangtze River Delta, China. Chin. Geogr. Sci. 2021, 5, 900–914. [Google Scholar] [CrossRef]

- Tang, S.; Wu, X.; Zhu, J. Digital finance and enterprise technology innovation: Structural feature, mechanism identification and effect difference under financial supervision. J. Manag. World 2020, 36, 52–66. [Google Scholar]

- Ozili Peterson, K. Impact of digital finance on financial inclusion and stability. Borsa Istanb. Rev. 2018, 18, 329–340. [Google Scholar] [CrossRef]

- Scott, S.V.; Van Reenen, J.; Zachariadis, M. The long-term effect of digital innovation on bank performance: An empirical study of SWIFT adoption in financial services. Res. Policy 2017, 46, 984–1004. [Google Scholar] [CrossRef]

- Manyika, J.; Lund, S.; Singer, M.; White, O.; Berry, C. Digital Finance for All: Powering Inclusive Growth in Emerging Economies; McKinsey Global Institute: Chicago, IL, USA, 2016; Volume 9. [Google Scholar]

- Wang, Q.; Yang, J.; Chiu, Y.; Lin, T. The impact of digital finance on financial efficiency. Manag. Decis. Econ. 2020, 41, 1225–1236. [Google Scholar] [CrossRef]

- Huang, Y.; Huang, Z. The development of digital finance in China: Present and future. China Econ. Q. 2018, 17, 1489–1502. [Google Scholar]

- Zheng, W.; Zhao, H.; Fan, H. A research on the incentive effect of digital finance development on regional innovation. Sci. Res. Manag. 2021, 42, 138–146. [Google Scholar]

- Hartmut, H. Financial Market and Technological Innovation. Ind. Innov. 2011, 18, 351–368. [Google Scholar]

- Demertzis, M.; Merler, S.; Wolff, G.B. Capital markets union and the fintech opportunity. J. Financ. Regul. 2018, 4, 157–165. [Google Scholar] [CrossRef]

- Han, H.; Gu, X. Linkage between inclusive digital finance and high-tech enterprise innovation performance: Role of debt and equity financing. Front. Psychol. 2021, 12, 814408. [Google Scholar] [CrossRef]

- Yao, L.; Yang, X. Can digital finance boost SME innovation by easing financing constraints? Evidence from Chinese GEM-listed companies. PLoS ONE. 2022, 17, e0264647. [Google Scholar] [CrossRef] [PubMed]

- Fei, F.; Huan, L.; Song, W. Can regional collaborative innovation improve innovation efficiency? An empirical study of Chinese cities. Growth Change 2020, 51, 440–463. [Google Scholar]

- Guan, J.C.; Zuo, K.R.; Chen, K.H.; Yam, R.C.M. Does country-level R&D efficiency benefit from the collaboration network structure? Res. Policy 2016, 45, 770–784. [Google Scholar]

- Guo, Z.; Peng, Y.; Chen, Y. How digital finance affects the continuous technological innovation of Chinese energy companies? Front. Energy Res. 2022, 10, 833436. [Google Scholar] [CrossRef]

- Li, J.; Li, B. Digital inclusive finance and urban innovation: Evidence from China. Rev. Dev. Econ. 2022, 26, 1010–1034. [Google Scholar] [CrossRef]

- Fan, W.; Wu, H.; Liu, Y. Does digital finance induce improved financing for green technological innovation in China? Discret. Dyn. Nat. Soc. 2022; in press. [Google Scholar] [CrossRef]

- Liu, J.; Jiang, Y.; Gan, S.; He, L.; Zhang, Q. Can digital finance promote corporate green innovation? Environ. Sci. Pollut. Res. 2022, 29, 35828–35840. [Google Scholar] [CrossRef]

- Hanley, D.; Li, J.; Wu, M. High-speed railways and collaborative innovation. Reg. Sci. Urban. Econ. 2022, 93, 103717. [Google Scholar] [CrossRef]

- Yang, R.; Che, T.; Lai, F. The Impacts of production linkages on cross-regional collaborative innovations: The role of inter-regional network capital. Technol. Forecast. Soc. Change 2021, 170, 120905. [Google Scholar] [CrossRef]

- Scherngell, T.; Hu, Y. Collaborative knowledge production in China: Regional evidence from a gravity model approach. Reg. Stud. 2011, 45, 755–772. [Google Scholar] [CrossRef]

- Zang, X.; Ma, Y.; Wang, C. Study on the motivations and influencing factors of regional synergy innovation based on the perspective of efficiency. Soft Sci. 2017, 31, 6–9. [Google Scholar]

- Ying, L.; Li, M.; Yang, J. Agglomeration and driving factors of regional innovation space based on intelligent manufacturing and green economy. Environ. Technol. Innov. 2021, 22, 101398. [Google Scholar] [CrossRef]

- Fan, F.; Zhang, X.; Wang, X. Are there political cycles hidden inside collaborative innovation efficiency? An empirical study based on Chinese cities. Sci. Public Policy 2022, 49, 532–551. [Google Scholar] [CrossRef]

- Luo, D.; Luo, M.; Lv, J. Can digital finance contribute to the promotion of financial sustainability? A financial efficiency perspective. Sustainability 2022, 14, 3979. [Google Scholar] [CrossRef]

- Foellmi, R.; Zweimüller, J. Income distribution and demand-induced innovations. Rev. Econ. Stud. 2006, 73, 941–960. [Google Scholar] [CrossRef]

- Zhang, X.; Yang, T.; Wang, C.; Wan, G. Digital finance and household consumption: Theory and evidence from China. J. Manag. World 2020, 36, 48–63. [Google Scholar]

- Zheng, W.; Zhao, H. Can the development of digital finance drive the convergence of regional technological innovation?—Empirical evidence from 284 cities in China. Mod. Econ. Sci. 2021, 43, 99–111. [Google Scholar]

- Griliches, Z. Capital-Skill Complementarity. Rev. Econ. Stat. 1969, 51, 465–468. [Google Scholar] [CrossRef]

- Zhou, H.; Xu, G. Research on the impact of green finance on China’s regional ecological development based on system GMM model. Resour. Policy 2022, 75, 102454. [Google Scholar] [CrossRef]

- Yu, N.; Wang, Y. Can digital inclusive finance narrow the Chinese urban-rural Income gap? the perspective of the regional urban-rural income structure. Sustainability 2021, 13, 6427. [Google Scholar] [CrossRef]

- Acs, Z.J.; Audretsch, D.B. Patents as a measure of innovative activity. Kyklos 1989, 42, 171–180. [Google Scholar] [CrossRef]

- Guo, F.; Wang, J.; Wang, F.; Kong, T.; Zhang, X.; Cheng, Z. Measuring the development of digital financial inclusion in China: Index compilation and spatial characteristics. China Econ. Q. 2020, 19, 1401–1418. [Google Scholar]

- Chang, S. The determinants and motivations of China’s outward foreign direct investment: A spatial gravity model approach. Glob. Econ. Rev. 2014, 43, 244–268. [Google Scholar] [CrossRef]

- Zipf, G.K. The P1 P2/D hypothesis: On the intercity movement of persons. Am. Sociol. Rev. 1946, 11, 677–686. [Google Scholar] [CrossRef]

- Bai, J.; Wang, Y.; Jiang, F.; Li, J. R&D element flow, spatial knowledge spillovers and economic growth. Econ. Res. J. 2017, 52, 109–123. [Google Scholar]

- Cai, W.; Ye, P. Local-neighborhood effects of different environmental regulations on green innovation: Evidence from prefecture level cities of China. Environ. Dev. Sustain. 2022, 24, 4810–4834. [Google Scholar] [CrossRef]

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).