Abstract

Education for sustainable development poses high challenges to governments and public finance. Compared with OECD countries, China’s local governments bear too much expenditure responsibilities with respect to compulsory education, which theoretically affects the high-quality equity of compulsory education. Through empirical analysis using cross-country data with the panel spatial model, it is found that the proportion of central government expenditure and the government’s educational effort both have a steady and negative impact on the regional variable coefficient of compulsory education completion rate. Unitary or federal regime does not have a significant impact on the result. This paper suggests establishing a sharing financing system among all levels of government. According to the minimum standard guarantee principle of basic public services, the central government, which has the strongest fiscal capacity, should establish the national standard and take the responsibility on coordinating and balancing education service among regions and promoting the inter-regional equity. Local governments are encouraged to provide education services above national standard in accordance with their fiscal capacities.

1. Introduction

The COVID-19 pandemic has hit our health, economic, and social sectors hard. It has also exposed and highlighted some systemic weaknesses hampering genuine social mobility. Equality of opportunity is a key ingredient for a strong and cohesive democratic society. Unlike policies that address the consequences, education can tackle the sources of inequality of opportunity, by creating a more level playing field for all to acquire the skills that power better jobs and better lives. In this case, education is identified as a key element of sustainability-focused strategies in many contexts and levels. The Sustainable Development Goal 4 tackles education and strives to ensure inclusive and equitable quality education and promote lifelong learning opportunities for all. It focuses on the implementation of free primary and secondary education, which is also called compulsory education. Unequitable compulsory education has a cumulative effect, making it difficult for low-income groups to access high-quality education services and trapping them in the vicious spiral of low education level and low income, and reduces intergenerational mobility [1]. China stressed the importance of high-quality equity in compulsory education in 2021 and has since sought to promote equal access to high-quality compulsory education, starting at the county level.

Quality improvement of compulsory education often limited by insufficient financial resources, caused by fiscal decentralization in the field of education [2,3]. China’s compulsory education has gone through two phases of public financial management, which have played an important role in the popularization and sustainable development of compulsory education at different eras. In the first phase, authority is shared among subnational governments, including province, county, and town. In the second phase, authority is concentrated mainly upon county-level government. However, local government’s limited capacity to redistribute resource and promote regionally balanced development have inhibited compulsory education equity. China Human Rights Development Report 1999 of the United Nations Development Program shows that decentralization could not eliminate inequalities in education resources throughout China. As globalization has intensified capital mobility, the spatial spillover effect of compulsory education has made the defect of decentralization in compulsory education increasingly obvious, and it is important to establish an authority sharing mechanism among different levels of government.

OECD countries generally have higher quality and equity of compulsory education, and their education financing systems are relatively mature. Compared with developed countries, China’s compulsory education authority and expenditure responsibilities are excessively decentralized, and central government’s expenditure proportion is too small, which hinders the financial security and equity of compulsory education. Therefore, analyzing various aspects of educational finance helps clarify the efforts made by countries in education as well as its possible impacts on future national economic and social sustainability. In addition, the search for effective financial policies in education requires evaluating educational expenditure of a country’s education system in light of other countries.

This paper assumed that the expenditure decentralization has impacts on the regional disparity of compulsory education quality. To measure these effects, we develop a simple theoretical model and estimate on the basis of panel data for countries, which includes an indicator of fiscal decentralization among the social and economic indicators. Meanwhile, this paper points out the similarities and national distinctions in the respective education financing system for compulsory education, in order to provide a reference for global compulsory education financial system reform as well as for China.

This research is conducted as follows. In Section 2, we develop a theoretical framework to analyze the influence mechanism. Then, through empirical analysis using cross-country data with the panel spatial model in Section 3, it is found that the proportion of central government expenditure and the government’s educational effort both have a steady and negative impact on the regional variable coefficient of compulsory education completion rate. In Section 4, we provide some in-depth insights about international trends and practice combing with our research result. Finally, in Section 5, we present concluding remarks.

2. Theoretical Framework and Influence Mechanism Analysis

The traditional fiscal decentralization theory posits that fiscal decentralization can encourage intergovernmental fiscal competition and urge local governments to pay more attention to the preferences of their residents, which is conducive to improving the resource allocation efficiency of local public services [4,5]. However, due to external problems and huge differences in financial capacities among regions, fiscal decentralization may also lead to a serious imbalance in public services among regions, resulting in a negative impact on the overall social welfare. Hanushek believes that the federal government of the United States takes too little expenditure responsibility in compulsory education, resulting in inequity in compulsory education investment [6]. Using the panel data of 31 provinces in China from 2001 to 2010, Li Xiangyun et al. analyzed the relationship between fiscal decentralization and the layout of urban and rural primary and secondary schools, and found that the higher the fiscal decentralization, the greater the distortion of primary and secondary school layout. Moreover, fiscal decentralization is not conducive to the development of primary and secondary education [7].

The tax reform in 1994 realized the centralization of tax revenue on central government, the central government share of total budget revenue rose from 22 percent in 1993 to around 45 percent in 2002. However, the centralization of tax revenues was not accompanied by revisions to expenditure responsibilities, with local governments acting as agents of central government. Local governments, particularly at the sub provincial level, are assigned heavy responsibilities for the provision of education. In 2002, the share of local governments in total budget revenue was about 45 percent, but they accounted for 70 percent of total budget expenditures, a share that has remained relatively stable during the last decades. Provincial governments diverge significantly with respect to their revenue raising capabilities, so there is growing evidence of significant disparities in the provision of education between richer and poorer regions.

Fiscal decentralization influences compulsory education equity in three main ways: firstly, the clarity of the vertical authority division affects the unification of regional education spending standards. Hanson put forward three different forms of decentralization—deconcentration, delegation, and devolution [8]. Some scholars believe that the fiscal decentralization of compulsory education in China adopts the form of delegation. The decision-making power is transferred from a higher level to a lower level, but this power can be revoked by the higher level [9]. The uncertainty of authority boundaries will lead to buck-passing problems among government levels on expenditure responsibility, especially between the municipal government and the provincial government. The expenditure responsibility assignment will change according to the result, and destroy the stability and effectiveness of education financing. Some scholars used the Cournot Game Model and found if the upper level of government cannot abide by the contract, it will reduce the incentive of the lower level of government to participate in financial activities [10].

Secondly, the decentralization of expenditure increases the dependence of education investment on the financial capacity of the local government. Theoretically, the authority of governments should have sufficient financial resources for guarantee. As the fiscal system moves toward self-financing, on one hand, education investment cannot be guaranteed in regions with poor fiscal capacity, on the other hand, education investment will fluctuate up and down with the change of regional fiscal capacity, which violates the principle of wealth neutrality [11]. Therefore, although to a certain extent the expenditure decentralization increases the autonomy of local governments in compulsory education provision, at the same time, it also intensifies local fiscal pressures and causes unstable and unequitable financing.

Thirdly, jurisdiction competition causes heterogeneity in local government expenditure structure [12]. Since the 1980s, China has delegated some authorities to local governments, which led to the increase of local government autonomy. At the same time, under the background of the principal-agent system, in order to maximize their political performances, local officials tend to invest in infrastructure construction, which has a direct pull on the local economy, instead of investing in social sectors with longer investment cycle. In this process, local governments tend to race to the bottom and reduce social sector expenditures [13], which is particularly obvious in underdeveloped areas. Furthermore, according to the principle of “voting with feet”, people tend to settle in economically developed areas when they grow up. The area where students receive compulsory education is often inconsistent with the area where they will work in the future. Therefore, the funds invested in compulsory education in underdeveloped areas have not effectively improved their local welfare. This will further reduce the incentive of governments in underdeveloped areas to invest in compulsory education.

Some scholars have made preliminary explorations on how to promote the high-quality equity of compulsory education in China. Fu Yong’s empirical study found that China’s financial system deviated from the Tiebout Model and Oates’ research results. Under unchanged assumptions, high degrees of decentralization correlate with high illiteracy rates which leads to poor quality of basic education [14]. In addition, Fu Yong believes that basic education has obvious economies of scale, and the central government expenditure should be given more emphasis [15]. Yu Zhang et al. selected six representative countries and used public spending per student to study the financial equality of compulsory education in these countries from 1997 to 2006. It was concluded that in order to reduce the financial inequality of education, the central/federal government and the provincial/state government should take more expenditure responsibilities than county/municipal governments [16]. Lei Lizhen found that the provincial overall planning system plays a positive role in narrowing the inter-provincial financing gaps, especially in narrowing the financing gap of public expenditure per student [17]. Based on the relevant policy texts, Chen Kun and Qin Yuyou proposed that top-level policy design should take local conditions under consideration and vertical transfer payments should be enlarged to further promote the integration of urban and rural education investment and to stimulate the incentive of local governments for education investment [18]. Gu Baozhu and Liu Yuelan proposed that both the total education investment and the investment of compulsory education in China should be increased [19]. Wei Jianguo put forward a three-dimension analytical framework of education provision, supervision and regulation. He believed that local governments should take the responsibility of compulsory education provision, while the central government mainly takes the responsibility of supervision and regulation [20].

To sum up, with respect to the effect of expenditure decentralization on compulsory education equity, there are few international comparisons. The influence of a country’s political system, economic development, cultural background, and other factors on the study result are not considered, which reduces the persuasiveness of prior research conclusions [21,22]. In addition, existing studies focused mainly on resource allocation equality, and the enrollment rate or public funding per student was often used to measure equity, without paying attention to education quality. However, developing sustainable education is a lifelong learning process, which puts more emphasis on high-quality equity and sustainability.

On this basis, the marginal contribution of this paper includes the following two points: first, it proposes that the essence of high-quality development of compulsory education is the equity of educational output and students’ academic achievement, and takes the completion rate of compulsory education, which can reflect the accumulation and output of education, as the standard to measure the regional disparities of education quality. Second, this paper uses the panel data of OECD countries from the perspective of international comparison to verify the theoretical correlation between expenditure responsibility assignment and the high-quality equity of compulsory education, to provide a reference for China’s compulsory education financial system reform.

3. Empirical Analysis and Discussion

3.1. Method and Data Description

As a public goods, the guarantee of financial funds directly affects compulsory education quality. The decentralization of compulsory education expenditure will hamper the regional high-quality equity of compulsory education in three main ways as mentioned in Section 2. In addition, many other factors, such as the regime, population size, and the government’s education efforts, are all important factors that affect the regional equity of compulsory education. In order to test this hypothesis, the paper establishes the following empirical model referring to the previous relevant literature [23,24]:

where, i refers to the country i, t refers to the year t, Inequalityi,t refers to the regional inequity of compulsory education in year t of country i, and CEi,t refers to the proportion of the central government compulsory education expenditure in the year t of country i. Xi,t represents a group of control variables, including regime, real GDP per capita, population density, and the government education effort, which reflects the government emphasis on compulsory education. εi,t are random disturbance terms.

Inequalityi,t = α + βCEi,t + γXi,t + εi,t

There are many indicators to measure regional disparity of compulsory education. The indicators used by UNESCO are divided into two categories. The first category is expenditure indicators, such as the proportion of public education expenditure on GDP and the proportion of public education expenditure on total government public expenditure. The second category is human resource indicators, such as student–teacher ratio, and student enrollment rate and academic performance. Different indicators are selected according to different education goals. For example, the enrollment rate is an indicator to evaluate the equity at the starting point and has little to do with education quality. Referring to the relevant OECD research, this paper selects the regional coefficient of variation of the completion rate of compulsory education Inequalityi,t as the dependent variable to measure the regional high-quality equity in sample countries [25].

The calculation formula of variation coefficient is as follows:

CV is the coefficient of variation, N is the number of observations, ai is the value of inequality in each of N regions, µ is the mean of all observed data, and σ is the standard deviation of all observed data.

In order to study the intergovernmental expenditure responsibility assignment in the field of compulsory education, this paper uses the proportion of central government compulsory education expenditure on that of all government levels (CE) as the core independent variable.

In order to overcome the impact of economic development, demographic and geographical status, and government education efforts on the empirical results, this paper introduces the control variable Xi,t referring to the existing literatures [26,27,28,29]. It includes: the real GDP per capita (PGDP), the population density (PD), and the proportion of public education expenditure on total public expenditure (EE). The dummy variable Fed is used to distinguish the regime difference of sample countries [30].

In order to unify the statistical caliber of cross-border data, this study selects country data from the OECD and World Bank databases. Since the statistical time span of the central government expenditure proportion in OECD database is from 2005 to 2015, this study selects the data from 2005 to 2015 as the analysis sample. As for the country sample, the OECD database only counts the completion rate of compulsory education at the provincial level in 27 countries, and four of them lack data on the proportion of central government expenditure responsibility. Therefore, this study selects the data of 23 countries as the analysis sample and establishes a balanced panel model. Among them, the completion rate of compulsory education, the proportion of the central government’s compulsory education expenditure on that of all government levels, and the proportion of public compulsory education expenditure on the total public expenditure are from the OECD database, and data of the real GDP per capita and population density are from the World Bank database.

Table 1, Table 2 and Table 3 are the data descriptions of all sample countries, unitary countries and federal countries respectively. The tables show that, in general, the regional equity degree of compulsory education in the sample countries is high. The mean of Inequality is 0.095, the minimum value is 0.001, and the maximum value is 0.219, indicating that developed countries have a higher degree of equity in compulsory education. The mean of inequality in unitary countries is slightly smaller than that of federal countries. The mean of CE is 45.3%, the minimum value is 2.4%, and the maximum value is 100%. The CE value of unitary countries is higher than that of the federal system countries on average. This could give a preliminary proof on the correlation between compulsory education equity and central government expenditure proportion.

Table 1.

Descriptive statistics of variables in all sample countries.

Table 2.

Descriptive statistics of variables in unitary countries.

Table 3.

Descriptive statistics of variables in federal countries.

The disparity of PGDP is large, with a mean of 35,530 US dollars, a minimum value of 1754 US dollars and a maximum value of 68,779 US dollars. In terms of government education efforts, the mean of the sample countries is 12.7%, with a wide gap between the maximum value (22.2%) and the minimum value (8.0%). The difference on the government education efforts between unitary countries and federal countries is marginal.

3.2. Results

The theoretical hypothesis of this paper proposes that expenditure decentralization in the field of compulsory education will have a negative impact on the regional high-quality equity of compulsory education. In order to avoid the existence of unit root in panel data, this paper uses HT test to test the unit root of panel data. The results show that = 0.5876, z = −3.0690, and the corresponding p value is 0.0011, so the original assumption of panel unit root is strongly rejected. Table 4 shows the regression results under different circumstances. The Hausman test results set by the model support the fixed effect model, so only the results of the fixed effect model are cited in the analysis of Table 4. In order to ensure the robustness of the regression results, here the forward selection method is used for stepwise regression, and independent variables are added step by step to test whether the addition of control variables will affect the regression results. In Table 4, (1) is the correlation analysis result between the core independent variable CE and the dependent variable without adding any control variable, (2) is the result after adding the independent variable EE, (3) is the result after adding the independent variable PD, (4) is the result after adding the constant term of real GDP per capita (lnPGDP), (5) is the result after adding all independent variables, and (6) is the result after introducing the quadratic term of lnPGDP.

Table 4.

Estimates from fixed effect model.

Table 4 shows that the statistical regression results are similar regardless of whether the control variables are added or changed. Under the control of all other variables, the estimated coefficient of the core independent variable CE is −0.2175, and the standard error term is 0.0283, which is significant at the statistical level of 1%. That means, that if the proportion of central government compulsory education expenditure on that of all government levels increase 10%, then the regional coefficient of variation of the compulsory education completion rate will decrease by 0.02175. This result shows that under the control of other variables, increasing central government expenditure on compulsory education will decrease disparity across regions.

For other control variables in the model, the symbols of their coefficients meet expectations. Among them, the estimated coefficient of lnPGDP is −0.0306, and the standard error term is 0.0097, which is significant at the level of 1%, indicating that the higher the economic development degree, the more equitable the compulsory education. Since relevant studies have found the Kuznets inverted U relationship between the real GDP per capita and the fairness of income distribution [31,32], this paper attempts to add the square of lnPGDP to the regression of fixed effects for verification. The regression results show that there is no nonlinear relationship between the square of lnPGDP and the dependent variable, so there is no sufficient evidence to prove the inverted U relationship between the real GDP per capita and the regional equity of compulsory education.

An existing study points out that government investment in compulsory education will promote economic growth and reduce disparity in the long run [33]. In this paper, the estimated coefficient of the government’s education efforts is −0.2298, which is significant at the level of 10%, indicating that the more the government invest in compulsory education, the higher the equity degree in that country.

Due to significant heterogeneity in compulsory education expenditure decentralization between federal countries and unitary countries, this paper divides unitary countries and federal countries into two sub samples for regression analysis, in order to reduce the impact of regimes on the empirical results. The results are shown in Table 5.

Table 5.

Subsample regression results of the regional disparity of compulsory education in unitary/federal countries.

Table 5 shows that there is a significant positive correlation between the core independent variable and dependent variable in both federal and unitary countries. According to the estimation coefficient, the correlation in federal countries is greater. In addition, the regression results of several other control variables in the sub sample statistics are also basically consistent with the regression results of the entire sample. This verifies the conclusion of this paper; that is, whether it is a unitary or a federal country, the proportion of central government compulsory education expenditure will significantly affect the regional disparity of compulsory education in a country.

Using the fixed effect panel model to estimate the model parameters may cause endogeneity bias, which can lead to inconsistent estimates and incorrect inferences, provide misleading conclusions and inappropriate theoretical interpretations. In order to solve this problem, the GMM test is used in this paper. The Generalized Method of Moment (GMM) is a parameter estimation method based on the fact that the actual parameters of the model meet certain moment conditions. Arellano and Bond (1991) developed the generalized method of moments model, which can be used for dynamic panel data [34]. In dynamic panel data, the cause-and-effect relationship for underlying phenomena is generally dynamic over time. To capture this, the GMM model, which is generally used for panel data, uses lags of the dependent variables as instruments to control this endogenous relationship and provides consistent results in the presence of different sources of endogeneity, for example unobserved heterogeneity, simultaneity and dynamic endogeneity. The regression results are shown in Table 6.

Table 6.

Dynamic panel regression results.

The regression results show that the estimated coefficient of the first-step lagged value of dependent variable L.Inequality still has consistent significance and symbol with the results of the static panel. The estimated coefficient of the core variable CE on the variation coefficient of the regional compulsory education completion rate is −0.0675, which is significant at the level of 5%. The estimated coefficients of several other independent variables are also consistent. The estimator of Arellano–Bond test shows that the difference of the disturbance term has first-order autocorrelation, but there is no second-order autocorrelation, so the original hypothesis is accepted. Then, a Sargan test is used to test whether there is a weak tool problem. The statistical p value of a Sargan test is greater than 0.05, which means that it is significant at the level of 5%. The original hypothesis is accepted, and the choice of instrumental variables is reasonable.

4. Expenditure Responsibility Assignment: Trend and Practice

By comparing the practice of OECD countries, it is found that there are similarities and national distinctions in the respective education financing system for compulsory education.

Mostly, the expenditure responsibility of compulsory education is vertically divided among levels of government. Only in a few countries with a small population scale and a high degree of centralization, the central government takes the main responsibility, like Ireland, Singapore, and New Zealand. In other countries, most of the expenditure responsibility are taken by subnational governments, while the central government provides subsidies in the form of transfer payments. For example, in Canada, Germany, and the United States, the central government’s expenditure responsibility in the field of compulsory education accounts for less than 10%. When it comes to specific expenditure items, the assignment in each country is different. Take the salaries of teachers as an example. In France, teachers serve as national civil servants, and their salary is guaranteed by the central government, while in Germany, it is paid by the state government. In Japan, one third is paid by the central government and others are paid by provincial governments.

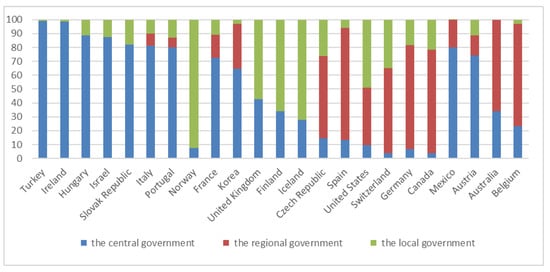

Considering the country regime, it can be concluded from Figure 1 that before the transfer payment, the proportion of central government expenditure in compulsory education in unitary countries is much higher than that in federal countries. However, there are also exceptions. Austria and Mexico are both federal countries, but their federal government expenditure proportion accounts for 74% and 80%.

Figure 1.

Distribution of compulsory education expenditure by level of government 2015. Data Source: OECD. Education at a Glance 2019: OECD Indicators. Paris, 2019 [25].

Nowadays, with more attention paid to high-quality equity, the proportion of central government expenditure on compulsory education in OECD countries is increasing from 46.5% in 2005 to 57% in 2015. In the United States, there is no unified standard for compulsory education at the federal level, and school districts takes the main expenditure responsibility. After entering the 21st century, with the increasing concern on equity and sufficiency, the federal government increased the transfer payments to reduce regional disparities. The proportion of federal government expenditure in compulsory education has risen from 4% in the 1960s to 9.7% in 2015.

5. Conclusions

The COVID-19 crisis and the pressure of economic recovery has posed significant challenges for the public finance and debt sustainability around the world, and threatened national education systems, notably in terms of equity. Countries are pursuing reforms in this crisis, and the reform of intergovernmental relationships is of top priority. In this paper, static and dynamic panel spatial models are established using cross-country data. It is found that there is a significant positive correlation between compulsory education expenditure decentralization and regional high-quality disparity. The higher the proportion of central government compulsory education expenditure on that of all levels of government, the smaller the coefficient of variation of the inter-regional compulsory education completion rate. In other words, this means the compulsory education is more equitable. The estimated coefficient of the first-step lagged value still has the consistent significance and symbol with the results of the static panel, which verifies our conclusion. This paper also discusses the similarities and differences between unitary countries and federal countries by sub samples, and comes to the conclusion that although the absolute value of the proportion of central government compulsory education expenditure in unitary countries and federal countries shows differences, both of which should increase the proportion of central government compulsory education expenditure, which will significantly improve the equity of compulsory education.

As a public good that every school-age child could enjoy, sustainable development of compulsory education needs government financial support, which should not only concentrates on the effective allocation of resources, but also on the quality and equity of compulsory education. This requires the central government to give full play to the advantages of resource redistribution, share expenditure responsibility with other levels of government, and make up for the limitations of the traditional fiscal decentralization theory.

Scientific assignment of expenditure responsibility is an important policy instrument to promote the quality and equity of compulsory education. Combined with the conclusions above, as well as the requirements of the sustainable development of compulsory education, here are some recommendations for China’s compulsory education reform. Firstly, China’s central government should take more expenditure for compulsory education. However, regarding the efficiency and management cost of the education financial system, the central government cannot take the majority of expenditure responsibility, but should establish a sharing financing system among all levels of government. According to the minimum standard guarantee principle of basic public services [35], the central government with the strongest fiscal capacity should establish the national minimum standards of compulsory education quality and take the responsibility on coordinating and balancing education supply among regions and promoting the inter-regional equity. Secondly, the subnational governments are encouraged to put more efforts toward compulsory education and to provide education services above the national standard. However, according to the equivalence principle of who benefits, who pays, the funds above the national minimum standard should be borne by themselves. Thirdly, the reform of expenditure responsibility assignment should be considered comprehensively in the context of intergovernmental fiscal relations reform. It is necessary to reasonably adjust the revenue ratio among government levels and increase the tax revenue of local governments, avoid soft budget constraints of local governments, and prevent local governments from making up the financial gap by excessive borrowing.

Author Contributions

Conceptualization, W.Y.; methodology, W.Y. and H.M.; software, W.Y.; validation, W.Y.; formal analysis, W.Y.; investigation, W.Y.; resources, W.Y.; data curation, W.Y.; writing—original draft preparation, W.Y.; writing—review and editing, W.Y. and H.M.; visualization, W.Y.; supervision, H.M.; project administration, H.M.; funding acquisition, H.M. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

Please check https://stats.oecd.org/index.aspx?queryid=79389 (accessed on 2 June 2022), https://data.worldbank.org/indicator (accessed on 2 June 2022).

Conflicts of Interest

The authors declare no conflict of interest.

References

- Yuan, Q.; Liu, Z. The role of education in intergenerational income flow—A study based on the analysis of intermediary effect. China Econ. Educ. Rev. 2022, 7, 3–22. [Google Scholar]

- Wei, H.; Yang, D. Decentralization and regional education differences in China. Soc. Sci. China 1997, 1, 98–113. [Google Scholar]

- Jin, H.; Qian, Y.; Weingast, B.R. Regional decentralization and fiscal incentives: Federalism, Chinese style. J. Public Econ. 2006, 89, 1719–1742. [Google Scholar] [CrossRef]

- Oates, W.E. An Essay on Fiscal Federalism An Essay on Fiscal Federalism. J. Econ. Lit. 1999, 37, 1120–1149. [Google Scholar] [CrossRef]

- Bird, R.M.; Freund, C.; Wallich, C. Decentralization of Intergovernmental Finance in Transition Economies. Comp. Econ. Stud. 1994, 36, 149–160. [Google Scholar] [CrossRef]

- Hanushek, E.A. Expenditures, Efficiency, and Equity in Education: The Federal Government’s Role. Am. Econ. Rev. 1989, 79, 46–51. [Google Scholar]

- Li, X.; Wei, P.; Zhang, C. Estimation of the optimal size of primary schools in the county—A case study of JX suburban county under the jurisdiction of W City. Educ. Econ. 2013, 05, 25–32. [Google Scholar]

- Hanson Mark, E. Strategies of educational decentralization: Key questions and core issues. J. Educ. Adm. 1998, 36, 111–128. [Google Scholar] [CrossRef]

- Qiao, B.; Martinez-Vazquez, J.; Xu, Y. The tradeoff between growth and equity in decentralization policy: China’s experience. J. Dev. Econ. 2008, 86, 112–128. [Google Scholar] [CrossRef]

- Zhang, L.; Wu, C.; Zhang, Y. Experimental Study Based on Game Theory on the Private, Voluntary Supply Mechanisms of Goods for Forestry Infrastructure from the Perspective of Quasi-Public Goods. Sustainability 2020, 12, 2808. [Google Scholar] [CrossRef]

- Wise, A.E. Rich Schools, Poor Schools: The Promise of Equal Educational Opportunity. Calif. Law Rev. 1968, 57, 1296–1303. [Google Scholar]

- Cumberland, J.H. Efficiency and Equity in Interregional Environmental Management. Int. Reg. Sci. Rev. 1991, 10, 325–358. [Google Scholar] [CrossRef]

- Boadway, R.; Shah, A. Fiscal Federalism; Cambridge University Press: Cambridge, UK, 2009; pp. 126–128. [Google Scholar]

- Yong, F.; Yan, Z. Chinese decentralization and fiscal expenditure structure bias: The cost of competition for growth. J. Manag. World 2007, 10, 4–22. [Google Scholar]

- Yong, F. Fiscal Decentralization, Governance and Non-Economic Public Goods Provision. Econ. Res. J. 2010, 8, 4–15. [Google Scholar]

- Zhang, Y.; Mizunoya, S.; You, Y.; Tsang, M. Financial Inequity in Basic Education in Selected OECD Countries. Int. Educ. Stud. 2011, 4, 171–174. [Google Scholar] [CrossRef][Green Version]

- Lei, L. Analysis on the inter provincial differences of compulsory education expenditure under the provincial overall planning system. J. Shanghai Educ. Res. 2018, 7, 26–29. [Google Scholar]

- Chen, K.; Qin, Y. Research on the structural imbalance of teachers in rural small-scale schools. Res. Mod. Basic Educ. 2019, 33, 6. [Google Scholar]

- Gu, B.; Liu, Y. The current situation, problems and Countermeasures of China’s rural compulsory education financial system in the post-4% Era. Teach. Adm. 2016, 4, 38–41. [Google Scholar]

- Wei, J. Legalization of the division of educational powers and fiscal expenditure responsibilities—An analysis based on an understanding framework. Peking Univ. Educ. Rev. 2019, 17, 194. [Google Scholar]

- Liu, Z.; Yuan, L. International Comparative Study on the Proportion of Public Education Investment. Comp. Educ. Res. 2007, 28, 6. [Google Scholar]

- Besley, T.; Coate, S. Centralized versus Decentralized Provision of Public Goods: A Political Economy Analysis. J. Public Econ. 2003, 87, 2611–2637. [Google Scholar] [CrossRef]

- Bahl, R.W.; Nath, S. Public expenditure decentralization in developing countries. Environ. Plan. 1986, 4, 405–418. [Google Scholar] [CrossRef]

- Rodríguez-Pose, A. Does decentralization matter for regional disparities? A cross-country analysis. Work. Pap. 2009, 10, 619–644. [Google Scholar] [CrossRef]

- OECD. Education at a Glance 2019; OECD Indicators: Paris, France, 2019. [Google Scholar]

- Briffault, R. Adding adequacy to equity: The evolving legal theory of school finance reform. In School Money Trials: The Legal Pursuit of Educational Adequacy; Columbia Public Law Research Paper 06-111, 06-013; Brookings Institution Press: Washington, DC, USA, 2006. [Google Scholar]

- West, L.A.; Wong, C.P.W. Fiscal decentralization and growing regional disparities in rural China: Some evidence in the provision of social services. Oxf. Rev. Econ. Policy 1995, 11, 70–84. [Google Scholar] [CrossRef]

- Vidal, B.P. Private versus public financing of education and endogenous growth. J. Popul. Econ. 2000, 13, 387–401. [Google Scholar]

- Hendricks, E.A.; Thengela, N. The role of education in alleviating poverty, inequality and promoting economic development in South Africa. Afr. J. Dev. Stud. 2020, 10, 215–234. [Google Scholar] [CrossRef]

- Abott, C.; Kogan, V.; Lavertu, S.; Peskowitz, Z. School district operational spending and student outcomes: Evidence from tax elections in seven states. J. Public Econ. 2020, 183, 104142. [Google Scholar] [CrossRef]

- Deininger, K.; Squire, L. New ways of looking at old issues: Inequality and growth. J. Dev. Econ. 1998, 57, 259–287. [Google Scholar] [CrossRef]

- Kollamparambil, U. Subjective Wellbeing Inequality between Cohabiting Partners: Does a Household Kuznets Curve Exist? J. Happiness Stud. 2021, 22, 2653–2675. [Google Scholar] [CrossRef]

- Blankenau, W.F.; Simpson, N.B.; Tomljanovich, M. Public Education Expenditures, Taxation, and Growth: Linking Data to Theory. Am. Econ. Rev. 2007, 97, 393–397. [Google Scholar] [CrossRef]

- Arellano, M.; Bond, S. Some Tests of Specification for Panel Data: Monte Carlo Evidence and an Application to Employment Equations. Rev. Econ. Stud. 1991, 58, 277–297. [Google Scholar] [CrossRef]

- Brown, C.V.; Jackson, P.M. Public Sector Economics; Wiley-Blackwell: Hoboken, NJ, USA, 1990; p. 106. [Google Scholar]

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).