Twenty Years of Mobile Banking Services Development and Sustainability: A Bibliometric Analysis Overview (2000–2020)

Abstract

:1. Introduction

2. Literature Review

3. Methodology

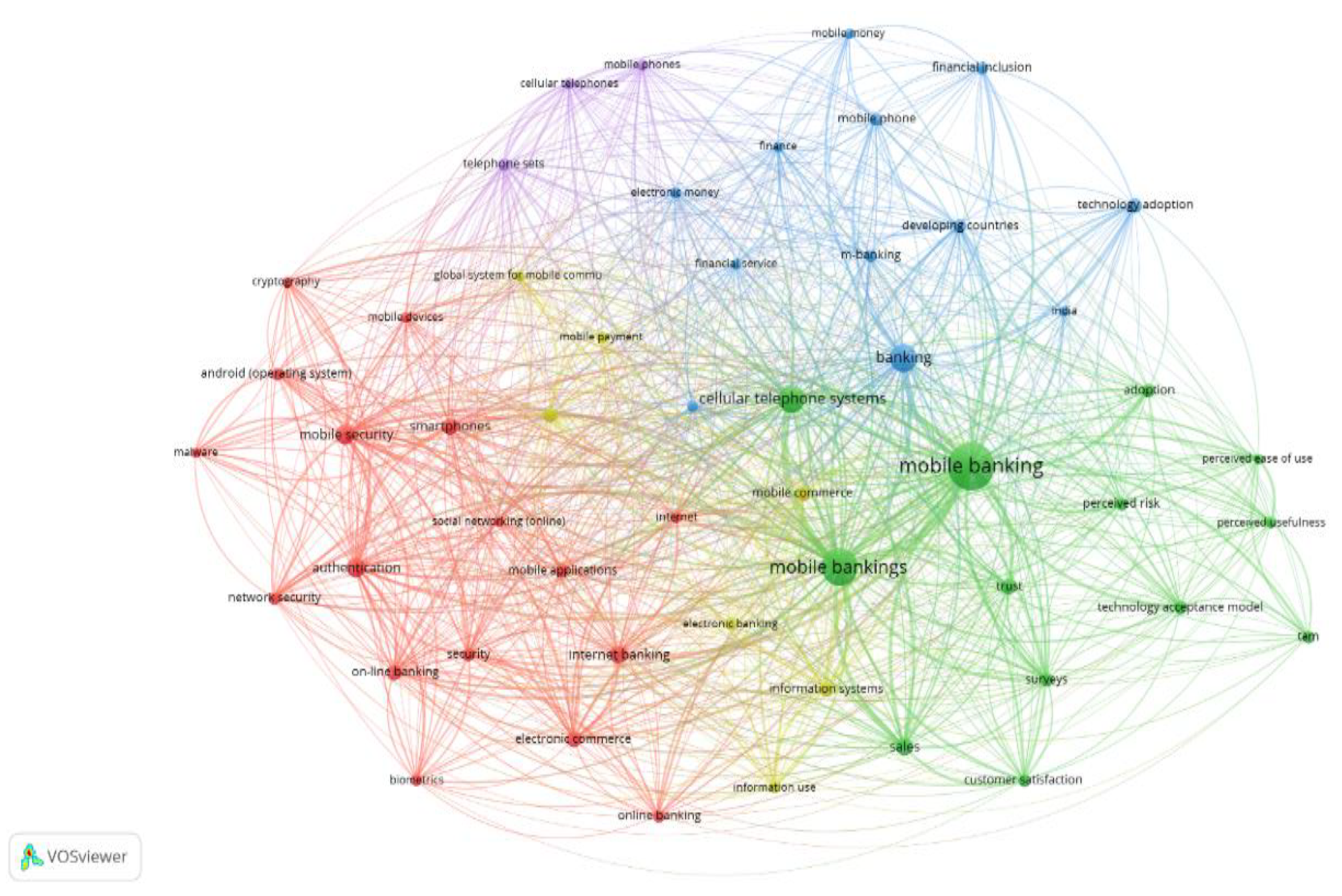

4. Conducting Research and Results

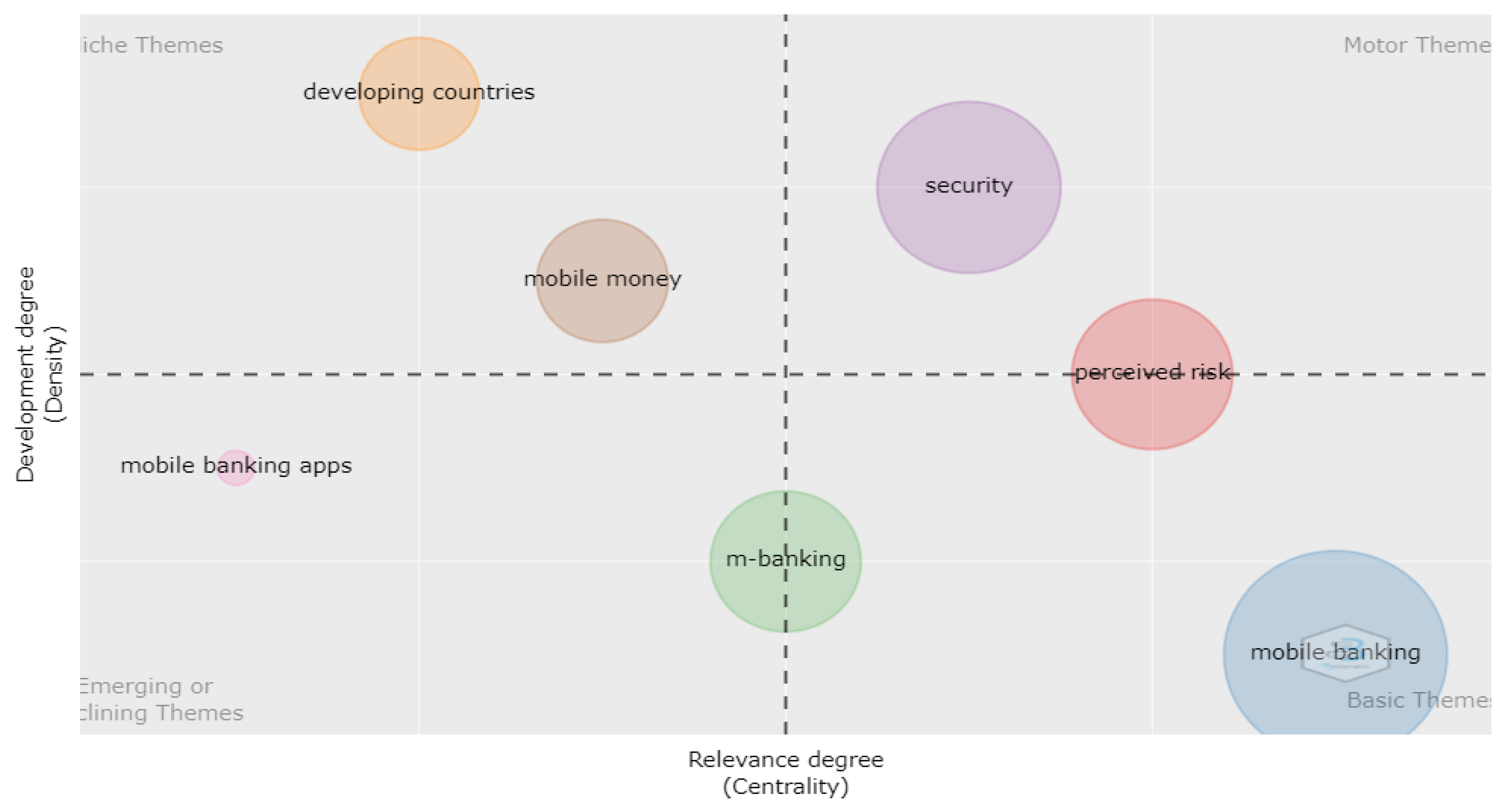

- (1)

- Upper-right quadrant themes: Those are the motor-themes of the specialty, which are well developed and important for the structuring of a research field, given that they present strong centrality and high density. These quadrant themes are related externally to concepts applicable to other themes that are conceptually closely related.

- (2)

- Upper-left quadrant themes: Those themes are of marginal importance, very specialized, and peripheral in character, as they have well-developed internal ties but unimportant external ties (isolated themes).

- (3)

- Lower-right quadrant themes: Those themes are basic, general, transversal, and important for a research field but are not developed.

- (4)

- Lower-left quadrant themes: By having low density and low centrality, those themes are weakly developed and marginal, representing either emerging or declining themes.

5. Conclusions and Future Directions

6. Research Implications

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Al-Okaily, M.; Alalwan, A.A.; Al-Fraihat, D.; Alkhwaldi, A.F.; Rehman, S.U.; Al-Okaily, A. Investigating Antecedents of Mobile Payment Systems Decision Making: A Mediated Model. Glob. Knowl. Mem. Commun. 2022; ahead-of-print. [Google Scholar] [CrossRef]

- Al-Okaily, M.; Alqudah, H.; Al-Qudah, A.A.; Al-Qadi, N.S.; Elrehail, H.; Al-Okaily, A. Does financial awareness increase the acceptance rate for financial inclusion? An empirical examination in the era of digital transformation. Kybernetes, 2022; ahead-of-print. [Google Scholar] [CrossRef]

- Al-Bashayreh, M.; Almajali, D.; Altamimi, A.; Masa’deh, R.E.; Al-Okaily, M. An Empirical Investigation of Reasons Influencing Student Acceptance and Rejection of Mobile Learning Apps Usage. Sustainability 2022, 14, 4325. [Google Scholar] [CrossRef]

- Almajali, D.; Al-Okaily, M.; Barakat, S.; Al-Zegaier, H.; Dahalin, Z.M. Students’ Perceptions of the Sustainability of Distance Learning Systems in the Post-COVID-19: A Qualitative Perspective. Sustainability 2022, 14, 7353. [Google Scholar] [CrossRef]

- Abu-Salih, B.; Wongthongtham, P.; Morrison, G.; Coutinho, K.; Al-Okaily, M.; Huneiti, A. Short-term renewable energy consumption and generation forecasting: A case study of Western Australia. Heliyon 2022, 8, e09152. [Google Scholar] [CrossRef]

- Al-Adwan, A.S.; Sammour, G. What makes consumers purchase mobile apps: Evidence from Jordan. J. Theor. Appl. Electron. Commer. Res. 2020, 16, 562–583. [Google Scholar] [CrossRef]

- Al-Qudah, A.A.; Al-Okaily, M.; Alqudah, G.; Ghazlat, A. Mobile payment adoption in the time of the COVID-19 pandemic. Electron. Commer. Res. 2022, 27, 1–25. [Google Scholar] [CrossRef]

- Al-Adwan, A.S.; Nofal, M.; Akram, H.; Albelbisi, N.A.; Al-Okaily, M. Towards a Sustainable Adoption of E-Learning Systems: The Role of Self-Directed Learning. J. Inf. Technol. Educ. Res. 2022, 21, 245–267. [Google Scholar]

- Al-Qudah, A.A.; Hamdan, A.; Al-Okaily, M.; Alhaddad, L. The impact of green lending on credit risk: Evidence from UAE’s banks. Environ. Sci. Pollut. Res. 2022. [Google Scholar] [CrossRef]

- Seydim, A.Y.; Dunham, M.H. A location dependent benchmark with mobility behavior. In Proceedings of the International Database Engineering and Applications Symposium, Edmonton, AB, Canada, 17–19 July 2002; pp. 74–83. [Google Scholar] [CrossRef]

- Al-Okaily, M.; Natour, A.R.A.; Shishan, F.; Al-Dmour, A.; Alghazzawi, R.; Alsharairi, M. Sustainable FinTech Innovation Orientation: A Moderated Model. Sustainability 2021, 13, 13591. [Google Scholar] [CrossRef]

- Al-Okaily, A.; Ai Ping, T.; Al-Okaily, M. Towards business intelligence success measurement in an organization: A conceptual study. J. Syst. Manag. Sci. 2021, 11, 155–170. [Google Scholar] [CrossRef]

- Al-Omoush, K.S.; Al Attar, M.K.; Saleh, I.H.; Alsmadi, A.A. The drivers of E-banking entrepreneurship: An empirical study. Int. J. Bank Mark. 2020, 38, 485–500. [Google Scholar] [CrossRef]

- Alrawashdeh, N.; Alsmadi, A.A.; Anwar, A.L. FinTech: A Bibliometric Analysis for the Period of 2014–2021. Qual.-Access Success 2022, 23, 176–188. [Google Scholar]

- Al-Okaily, M.; Al-Okaily, A. An Empirical Assessment of Enterprise Information Systems Success in a Developing Country: The Jordanian Experience. TQM J. 2022; ahead-of-print. [Google Scholar] [CrossRef]

- Alsaad, A.; Al-Okaily, M. Acceptance of protection technology in a time of fear: The case of COVID-19 exposure detection apps. Inf. Technol. People, 2022; ahead-of-print. [Google Scholar] [CrossRef]

- Lutfi, A.; Al-Okaily, M.; Alshirah, M.H.; Alshira’h, A.F.; Abutaber, T.A.; Almarashdah, M.A. Digital financial inclusion sustainability in Jordanian context. Sustainability 2021, 13, 6312. [Google Scholar] [CrossRef]

- Suoranta, M.; Mattila, M.; Munnukka, J. Technology-based services: A study on the drivers and inhibitors of mobile banking. Int. J. Manag. Decis. Mak. 2005, 6, 33–46. [Google Scholar] [CrossRef]

- Alsmadi, A.; Al-Gasaymeh, A.; Alrawashdeh, N.; Alhwamdeh, L. Financial supply chain management: A bibliometric analysis for 2006–2022. Uncertain Supply Chain. Manag. 2022, 10, 645–656. [Google Scholar] [CrossRef]

- Basri, S. Determinants of adoption of mobile banking: Evidence from rural karnataka in India. Int. J. Trade Glob. Mark. 2018, 11, 77–86. [Google Scholar] [CrossRef]

- Almaqableh, L.; Reddy, K.; Pereira, V.; Ramiah, V.; Wallace, D.; Veron, J.F. An investigative study of links between terrorist attacks and cryptocurrency markets. J. Bus. Res. 2022, 147, 177–188. [Google Scholar] [CrossRef]

- Aboelmaged, M.; Gebba, T.R. Mobile Banking Adoption: An Examination of Technology Acceptance Model and Theory of Planned Behavior. Int. J. Bus. Res. 2013, 2, 35–50. [Google Scholar] [CrossRef]

- Al-Adwan, A.S.; Alrousan, M.; Al-Soud, A.; Al-Yaseen, H. Revealing the black box of shifting from electronic commerce to mobile commerce: The case of Jordan. J. Theor. Appl. Electron. Commer. Res. 2019, 14, 51–67. [Google Scholar] [CrossRef]

- Alalwan, A.A.; Dwivedi, Y.K.; Rana, N.P. Factors influencing adoption of mobile banking by Jordanian bank customers: Extending UTAUT2 with trust. Int. J. Inf. Manag. 2017, 37, 99–110. [Google Scholar] [CrossRef]

- Al-Okaily, A.; Al-Okaily, M.; Teoh, A.P. Evaluating ERP systems success: Evidence from Jordanian firms in the age of the digital business. VINE J. Inf. Knowl. Manag. Syst. 2021; ahead-of-print. [Google Scholar] [CrossRef]

- Dierksmeier, C.; Seele, P. Cryptocurrencies and business ethics. J. Bus. Ethics 2018, 152, 1–14. [Google Scholar] [CrossRef]

- Alsmadi, A.A.; Sha’ban, M.; Al-Ibbini, O.A. The Relationship between E-banking Services and Bank Profit in Jordan for the Period of 2010–2015. In Proceedings of the 2019 5th International Conference on E-Business and Applications; 2019; pp. 70–74. [Google Scholar]

- Chisalita, I.; Shahmehri, N. Issues in image utilization within mobile e-services. In Proceedings of the Tenth IEEE International Workshop on Enabling Technologies: Infrastructure for Collaborative Enterprises, WET ICE, Cambridge, MA, USA, 20–22 June 2001; pp. 62–67. [Google Scholar] [CrossRef]

- Exploring determinants in deploying mobile commerce technology: Amman stock exchange. In Proceedings of the 2010 International Conference on Information Society, London, UK, 28–30 June 2010; pp. 612–620. [CrossRef]

- Al-Okaily, M. Assessing the effectiveness of accounting information systems in the era of COVID-19 pandemic. VINE J. Inf. Knowl. Manag. Syst. 2021; ahead-of-print. [Google Scholar] [CrossRef]

- Anderson, J. M-banking in Developing Markets: Competitive and Regulatory Implications. Info 2010, 12, 18–25. [Google Scholar] [CrossRef]

- Bezovski, Z.; Davcev, L.; Mitreva, M. Current adoption state of cryptocurrencies as an electronic payment method. Manag. Res. Pract. 2021, 13, 44–50. [Google Scholar]

- Lin, H. Determining the relative importance of mobile banking quality factors. Comput. Stand. Interfaces 2013, 35, 195–204. [Google Scholar] [CrossRef]

- Liu, B.; Pavlou, P.A.; Cheng, X. Achieving a Balance Between Privacy Protection and Data Collection: A Field Experimental Examination of a Theory-Driven Information Technology Solution. Inf. Syst. Res. 2022, 33, 203–223. [Google Scholar] [CrossRef]

- Moist, J.A.; Anitsal, I.; Anitsal, M.M. The Customer Value Model and Mobile Banking: Evaluation of Technology-Based Self Service (TBSS) Gaps. Atl. Mark. J. 2021, 10, 2. [Google Scholar]

- Montazemi, A.; Saremi, A. Factors affecting adoption of online banking: A meta-analytic structural equation modeling study. Inf. Manag. 2015, 52, 210–226. [Google Scholar] [CrossRef]

- Onay, C.; Ozsoz, E. The impact of internet-banking on brick and mortar branches: The case of Turkey. J. Financ. Serv. Res. 2013, 44, 187–204. [Google Scholar] [CrossRef]

- Aversa, P.; Haefliger, S.; Rossi, A.; Baden-Fuller, C. From business model to business modelling: Modularity and manipulation. Adv. Strat. Manag. 2015, 33, 151–185. [Google Scholar]

- Bahoo, S.; Alon, I.; Paltrinieri, A. Corruption in international business: A review and research agenda. Int. Bus. Rev. 2020, 29, 101660. [Google Scholar] [CrossRef]

- Puschel, J.; Mazzon, J.A.; Hernandez, J.M.C. Mobile Banking: Proposition of Integrated Adoption Intention Framework. Int. J. Bank Mark. 2010, 28, 389–409. [Google Scholar] [CrossRef]

- Kiri, R.D. An Empirical Study on Adoption of Mobile Banking Facility among Customers of Banks in North Gujarat. J. Crit. Rev. 2020, 7, 63–81. [Google Scholar]

- banking services in Japan: A strategic perspective. Int. J. Mob. Commun. 2004, 2, 51–66. [CrossRef]

- Scornavacca, E.; Hoehle, H. Mobile banking in Germany: A strategic perspective. Int. J. Electron. Financ. 2007, 1, 304–320. [Google Scholar] [CrossRef]

- BBC. Mobile Banking Is Saving Us ‘Billions’ in Charges. 2017. Available online: http://www.bbc.co.uk/news/business-39290041 (accessed on 8 October 2017).

- Cobo, M.J.; López-Herrera, A.G.; Herrera-Viedma, E.; Herrera, F. An approach for detecting, quantifying, and visualizing the evolution of a research field: A practical application to the Fuzzy Sets Theory field. J. Informetr. 2011, 5, 146–166. [Google Scholar] [CrossRef]

- DeYoung, R. How the internet affects output and performance at community banks. J. Bank Financ. 2007, 31, 1033–1060. [Google Scholar] [CrossRef]

- Durkin, M.; Howcroft, B.; O’donnell, A.; Quinn, D. Retail bank customer preferences: Personal and remote interactions. Int. J. Retail. Distrib. Manag. 2003, 31, 177–189. [Google Scholar] [CrossRef]

- Ferm, L.E.C.; Thaichon, P. Value co-creation and social media: Investigating antecedents and influencing factors in the US retail banking industry. J. Retail. Consum. Serv. 2021, 61, 102548. [Google Scholar] [CrossRef]

- Ganguli, S.; Roy, S.K. Generic technology-based service quality dimensions in banking: Impact on customer satisfaction and loyalty. Int. J. Bank Mark. 2011, 29, 168–189. [Google Scholar] [CrossRef]

- Cheng, D.; Liu, G.; Qian, C. On Determinants of User Acceptance of Internet Banking: A Theoretical Framework and Empirical Study. In Proceedings of the Advanced Management of Information for Globalized Enterprises AMIGE IEEE Symposium, Tianjin, China, 28–29 September 2008; pp. 1–5. [Google Scholar] [CrossRef]

- Chyb, O.; Internet-Bankingy v Globalnomy Seredovuchi. Development of Internet Banking in the Global Environment Online. Available online: http://www.nbuv.gov.ua (accessed on 11 June 2022).

- Ciciretti, R.; Hasan, I.; Zazzara, C. Do Internet activities add value? Evidence from the traditional banks. J. Financ. Serv. Res. 2009, 35, 81–98. [Google Scholar] [CrossRef]

- Hong, B. Understanding and predicting behavioral intention to adopt mobile banking: The korean experience. J. Glob. Inf. Manag. 2019, 27, 182–202. [Google Scholar] [CrossRef]

- Barnes, S.J.; Corbitt, B. Mobile Banking: Concept and Potential. Int. J. Mob. Commun. 2003, 1, 273–288. [Google Scholar] [CrossRef]

- Alsmadi, A.; Alrawashdeh, N.; Al-Dweik, A.; Al-Assaf, M. Cryptocurrencies: A bibliometric analysis. Int. J. Data Netw. Sci. 2022, 6, 619–628. [Google Scholar] [CrossRef]

- Oudat, M.S.; Alsmadi, A.A.; Alrawashdeh, N.M. Foreign direct investment and economic growth in Jordan: An empirical research using the bounds test for cointegration. Rev. Finanzas Polit. Econ. 2019, 11, 55–63. [Google Scholar] [CrossRef]

- Taamneh, A.M.; Taamneh, M.; Alsaad, A.; Al-Okaily, M. Talent management and academic context: A comparative study of public and private universities. EuroMed J. Bus. 2021; ahead-of-print. [Google Scholar] [CrossRef]

- Alsmadi, A.A.; Oudat, M.S.; Ali, B.J.A.; Al-Ibbini, O.A. Analyze the Impact of Exchange Rate on Inflation Rate: Kuwait as a Case Study for the Period of 1990 to 2019. Chang. Manag. 2020, 183, 1–8. [Google Scholar]

- Glavee-Geo, R.; Shaikh, A.A.; Karjaluoto, H. Mobile banking services adoption in Pakistan: Are there gender differences? Int. J. Bank Mark. 2017, 35, 1090–1114. [Google Scholar] [CrossRef]

- Jesina, O.G. Internet-banking v Ukraini: Sychasnyj stan, problem ta perspektyvy rozvutku (Internet banking in Ukraine: The current state, problems and prospects of development). Visn. Soc.-Ekon. Dosl. 2013, 1, 209–213. [Google Scholar]

- Hanafizadeh, P.; Behboudi, M.; Koshksaray, A.A.; Tabar, M.J.S. Mobile-banking adoption by Iranian bank clients. Telemat. Inform. 2014, 31, 62–78. [Google Scholar] [CrossRef]

- Al-Okaily, M.; Alqudah, H.; Al-Qudah, A.A.; Alkhwaldi, A.F. Examining the Critical Factors of Computer-Assisted Audit Tools and Techniques Adoption in the Post-COVID-19 Period: Internal Auditors Perspective. VINE J. Inf. Knowl. Manag. Syst. 2022; ahead-of-print. [Google Scholar] [CrossRef]

- Alsmadi, A.A.; Alzoubi, M. Green Economy: Bibliometric Analysis Approach. Int. J. Energy Econ. Policy 2022, 12, 282–289. [Google Scholar] [CrossRef]

- Hasan, H.; Oudat, M.S.; Alsmadi, A.A.; Nurfahasdi, M.; Ali, B.J.A. Investigating the causal relationship between financial development and carbon emission in the emerging country. J. Gov. Regul. 2021, 10, 55–62. [Google Scholar] [CrossRef]

- Oudat, M.S.; Hasan, H.; Alsmadi, A.A. Macroeconomic variables and portfolio investment in bahrain using an ardl bound testing approach. Accounting 2020, 6, 465–472. [Google Scholar] [CrossRef]

- Hernando, I.; Nieto, M.J. Is the internet delivery channel changing banks’ performance? The case of Spanish banks. J. Bank. Financ. 2007, 31, 1083–1099. [Google Scholar] [CrossRef]

- Hodson, D. The politics of FinTech: Technology, regulation, and disruption in UK and German retail banking. Public Adm. 2021, 99, 859–872. [Google Scholar] [CrossRef]

- Lin, H.-F. An empirical investigation of mobile banking adoption: The effect of innovation attributes and knowledge-based trust. Int. J. Inf. Manag. 2011, 31, 252–260. [Google Scholar] [CrossRef]

- Veijalainen, J.; Terziyan, V.; Tirri, H. Transaction management for m-commerce at a mobile terminal. In Proceedings of the 36th Annual Hawaii International Conference on System Sciences, Big Island, HI, USA, 6–9 January 2003; p. 10. [Google Scholar] [CrossRef]

- Kanagasundaram Visvanathamuthaliyar, K.; Wikramanayake, G. Next generation smart transaction touch points. In Proceedings of the 2014 14th International Conference on Advances in ICT for Emerging Regions (ICTer), Colombo, Sri Lanka, 10–13 December 2014. [Google Scholar] [CrossRef]

- Karjaluoto, H.; Mattila, M.; Pento, T. Factors underlying attitude formation towards online banking in Finland. Int. J. Bank Mark. 2002, 20, 261–272. [Google Scholar] [CrossRef]

- Kim, C.; Davidson, L.F. The effects of IT expenditures on banks’ business performance: Using a balanced scorecard approach. Manag. Financ. 2004, 30, 28–45. [Google Scholar] [CrossRef]

- Laukkanen, T. Internet vs. mobile banking: Comparing customer value perceptions. Bus. Process. Manag. J. 2007, 13, 788–797. [Google Scholar] [CrossRef]

- Liao, C. The impact of mobile financial services on visiting a branch: The case of the United States. Int. Rev. Account. Bank. Financ. 2018, 10, 1–14. [Google Scholar]

- Liao, Z.; Cheung, M.T. Measuring consumer satisfaction in internet banking: A core framework. Commun. ACM 2008, 51, 47–51. [Google Scholar] [CrossRef]

- Simon, B. Mobile phone-enabled payment systems—Transformation 2008. Enterp. Dev. Microfinan. 2008, 19, 13–30. [Google Scholar]

- Suoranta, M.; Mattila, M. Mobile banking and consumer behavior: New insights into the diffusion pattern. J. Financ. Serv. Mark. 2004, 8, 354–366. [Google Scholar] [CrossRef]

- Talukder, M.; Quazil, A.; Sathye, M. Mobile Phone Banking Usage Behaviour: An Australian Perspective. Australas. Account. Bus. Financ. J. 2014, 8, 83–104. [Google Scholar] [CrossRef]

- Tam, C.; Oliveira, T. Literature review of mobile banking and individual performance. Int. J. Bank Mark. 2017, 35, 1044–1067. [Google Scholar] [CrossRef]

- Tam, C.; Oliveira, T. Understanding mobile banking individual performance: The DeLone & McLean model and the moderating effects of individual culture. Internet Res. 2017, 27, 538–562. [Google Scholar] [CrossRef]

- Tan, E.; Leby Lau, J. Behavioral intention to adopt mobile banking among the millennial generation. Young Consum. 2016, 17, 18–31. [Google Scholar] [CrossRef]

- Tiwari, R.; Buse, S.; Herstatt, C. Mobile Banking as Business Strategy: Impact of Mobile Technologies on Consumer Behavior and Its Implications for Banks. In Proceedings of the Portland International Conference on Management of Engineering and Technology, Istanbul, Turkey, 8–3 July 2006; pp. 8–13. [Google Scholar]

- Vachnyk, S.V. The prospects of remote customer service in real time for banks in Ukraine. In Problemu I Perspektyvu Rozvytky Bankivskoji Systemy Ukrainu; Entrepreneurship and Sustainability Center: Vilnius, Lithuania, 2003; pp. 184–185. [Google Scholar]

- Wang, R.; Liu, J.; Luo, H. Fintech development and bank risk taking in China. Eur. J. Financ. 2021, 27, 397–418. [Google Scholar] [CrossRef]

- Alghusin, N.; Alsmadi, A.A.; Alkhatib, E.; Alqtish, A.M. The impact of financial policy on economic growth in Jordan (2000–2017): An ardl approach. Ekon. Pregl. 2020, 71, 97–108. [Google Scholar] [CrossRef]

- Al-Okaily, A.; Al-Okaily, M.; Teoh, A.P.; Al-Debei, M. An Empirical Study on Data Warehouse Systems Effectiveness: The Case of Jordanian Banks in the Business Intelligence Era. EuroMed J. Bus. 2022; ahead-of-print. [Google Scholar] [CrossRef]

- Yee, B.Y.; Faziharudean, T.M. Factors affecting customer loyalty of using Internet banking in Malaysia. J. Electron. Bank. Syst. 2010, 21, 592297. [Google Scholar] [CrossRef]

- Wang, Z.; Hu, R.; Xu, J. Mobile E-commerce security architecture. In Proceedings of the 2009 IEEE International Conference on Granular Computing, Nanchang, China, 17–19 August 2009; pp. 576–579. [Google Scholar] [CrossRef]

- Zhou, T. Examining mobile banking user adoption from the perspectives of trust and flow experience. Inf. Technol. Manag. 2012, 13, 27–37. [Google Scholar] [CrossRef]

| Ref | Article Title | Summary |

|---|---|---|

| [58] | A mobile e-commerce solution | Wireless Application provides a platform for mobile banking, mobile shopping access is attained by data on the internet. |

| [49] | Issues in image utilization within mobile e-services | Utilization of images for accessible services from mobile devices will potentially become very rampant. |

| [59] | A location-dependent benchmark with mobility behavior | Main features of a location-dependent app contain more general queries targeted to the general mobile computing environment. |

| [60] | Mobile banking: concept and potential | This paper provides an explanation of strategic effects of m-banking and ends with a discussion of m-banking’s future. |

| [61] | M-banking services in Japan: A strategic perspective | Describes the most significant Japanese banking practices and characteristics and ends with a discussion of m-banking’s future |

| [62] | Technology-based services: a study on the drivers and inhibitors of mobile banking | Offers a description of a model that conceptualizes diverse factors in an electronic banking environment, especially mobile banking |

| [63] | Mobile banking as business strategy: Impact of mobile technologies on customer behavior and its implications for banks | An empirical survey of acceptance of consumers revealed significant growing interest in Mobile banking |

| [64] | Mobile banking in Germany: A strategic perspective | Investigates banking in Germany and ends with a discussion on the future of Germany’s mobile banking |

| [65] | Mobile phone-enabled payment systems—Transformation 2008 | Provides an overview of innovations and influences arising and the acceptance of m-payment products. |

| [66] | M-banking in developing markets: Competitive and regulatory implications | M-banking brings electronic transaction services and basic banking to unbanked consumers in developing markets. |

| [67] | Mobile banking: Proposition of an integrated adoption intention framework | offers a more profound understanding of variables influencing mobile banking adoption |

| [68] | An empirical investigation of mobile banking adoption: The effect of innovation attributes and knowledge-based trust | The findings of the article show the advantages of compatibility, ease of utilization, and significant influences that lead to behavioral intention to adopt mobile banking |

| [69] | Examining mobile banking user adoption from the perspectives of trust and flow experience | Mobile service providers should be considerate of both trust and flow experience to encourage the adoption and use of mobile banking |

| [70] | Determining the relative importance of mobile banking quality factors | Results provide beneficial data to m-banking service providers for insightful information to m-banking services to improve efficiency |

| [71] | Mobile phone banking usage behavior: An Australian perspective | Results provide strategies to encourage online banking—and a cheaper channel for service delivery. |

| [72] | Factors affecting adoption of online banking: A meta-analytic structural equation modeling study | Provides ten factors affecting consumer adoption of online banking |

| [73] | Behavioral intention to adopt mobile banking among the millennial generation | Provides the prediction model that explains the variance in reasons to participate in online banking |

| [74] | Mobile banking services adoption in Pakistan: are there gender differences? | Findings show a positive impact on perceived control of behavior and attitudes towards adoption intentions of m banking |

| Research Theme and Domain | Potential Research Problems/Agenda | Source |

|---|---|---|

| MB security and privacy [technical aspects] | Developing a user-perceived mobile banking cyber security framework. | [80] |

| Investigating up-to-date cryptomining, phishing, Trojans, and ransomwares in mobile banking and crypto currencies | Authors | |

| A framework for balance between big data gathering and privacy protection | [81] | |

| MB in e-commerce and social media [commercial, cultural and social aspects] | examining the aspects related to the prevailing culture (e.g., Hofstede cultural dimensions) on mobile banking transitions | [82] |

| how co-creation over social media influences attitudinal and behavioral loyalty in MB | [83] | |

| MB users’ attitude and behavior [Behavioral and adoption aspects] | What factors influence users’ acceptance and usage of mobile banking applications? Extending TAM, UTAUT, qualitative studies, longitudinal study | [84] |

| Client trust in mobile banking | Authors | |

| User Attitudes towards mobile banking options, functions and features, in terms of intention to use and actual usage in developing countries | [85,86,87] | |

| MB wallets and payments [Financial and economic aspects] | The impact of economic and psychological switching costs of mobile banking services for consumers. | [88] |

| The impact of anti-corruption architecture system and international business laws on mobile payments and mobile wallets. | [89] |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Alsmadi, A.A.; Shuhaiber, A.; Alhawamdeh, L.N.; Alghazzawi, R.; Al-Okaily, M. Twenty Years of Mobile Banking Services Development and Sustainability: A Bibliometric Analysis Overview (2000–2020). Sustainability 2022, 14, 10630. https://doi.org/10.3390/su141710630

Alsmadi AA, Shuhaiber A, Alhawamdeh LN, Alghazzawi R, Al-Okaily M. Twenty Years of Mobile Banking Services Development and Sustainability: A Bibliometric Analysis Overview (2000–2020). Sustainability. 2022; 14(17):10630. https://doi.org/10.3390/su141710630

Chicago/Turabian StyleAlsmadi, Ayman A., Ahmed Shuhaiber, Loai N. Alhawamdeh, Rasha Alghazzawi, and Manaf Al-Okaily. 2022. "Twenty Years of Mobile Banking Services Development and Sustainability: A Bibliometric Analysis Overview (2000–2020)" Sustainability 14, no. 17: 10630. https://doi.org/10.3390/su141710630

APA StyleAlsmadi, A. A., Shuhaiber, A., Alhawamdeh, L. N., Alghazzawi, R., & Al-Okaily, M. (2022). Twenty Years of Mobile Banking Services Development and Sustainability: A Bibliometric Analysis Overview (2000–2020). Sustainability, 14(17), 10630. https://doi.org/10.3390/su141710630