CAP Direct Payments and Economic Resilience of Agriculture: Impact Assessment

Abstract

1. Introduction

2. Theoretical Background

2.1. Resilience Concept and Its Measurement

2.2. Economic Resilience of Agriculture and CAP Direct Payments

- → The production of food and other bio-based resources at affordable prices;

- → The assurance of farm viability;

- → The creation and maintenance of decent jobs.

3. Methods

4. Data, Results, and Conclusions

4.1. Data

4.2. Results and Discussion

5. Conclusions and Policy Implications

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Appendix A

| Variable | Unit of Measure | Obs. | Mean | Std. Dev. | Min | Max |

|---|---|---|---|---|---|---|

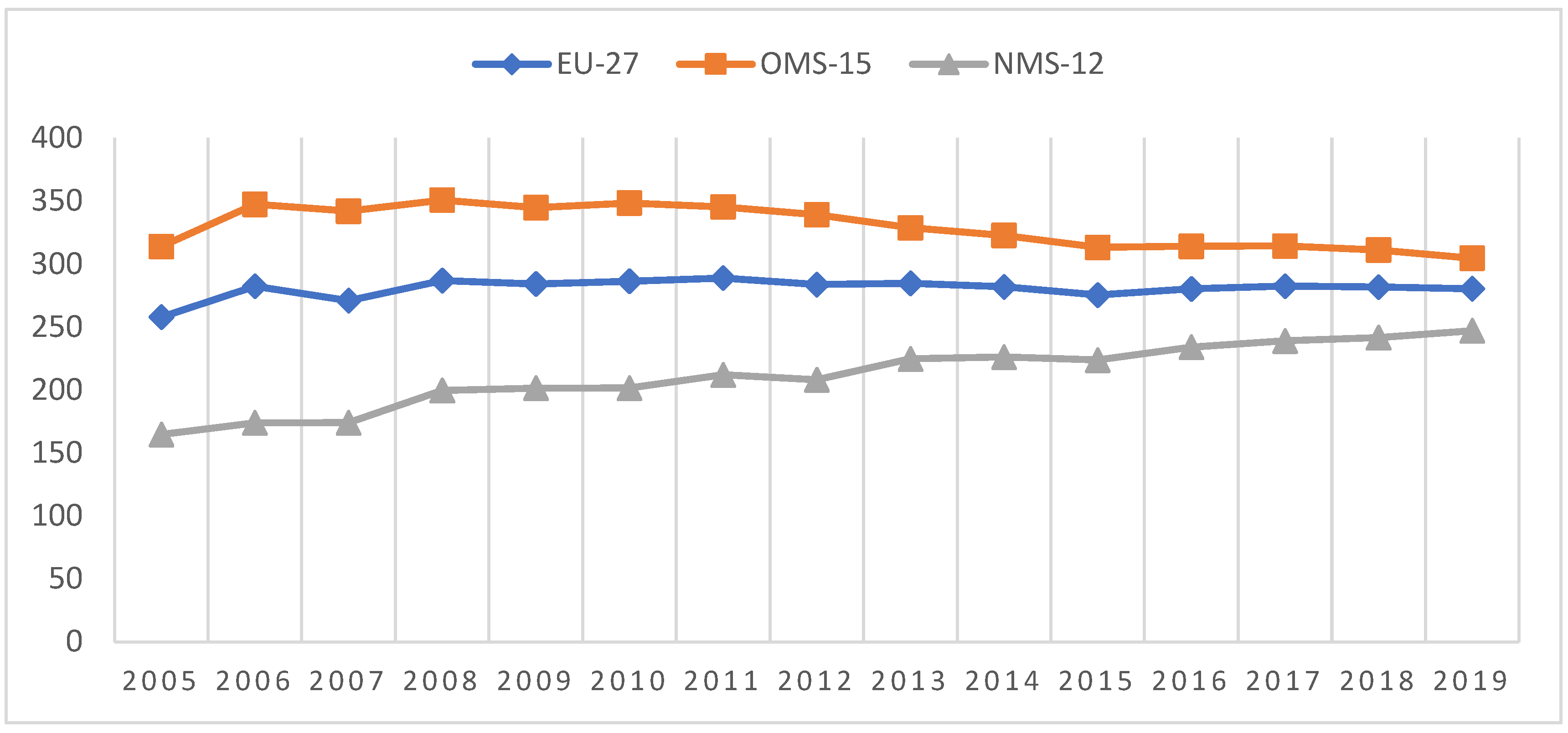

| Direct Payments | EUR/ha | 401 | 310.46 | 224.08 | 61.58 | 2306.3 |

| UAA | Ha | 401 | 75.61 | 100.63 | 2.56 | 615.33 |

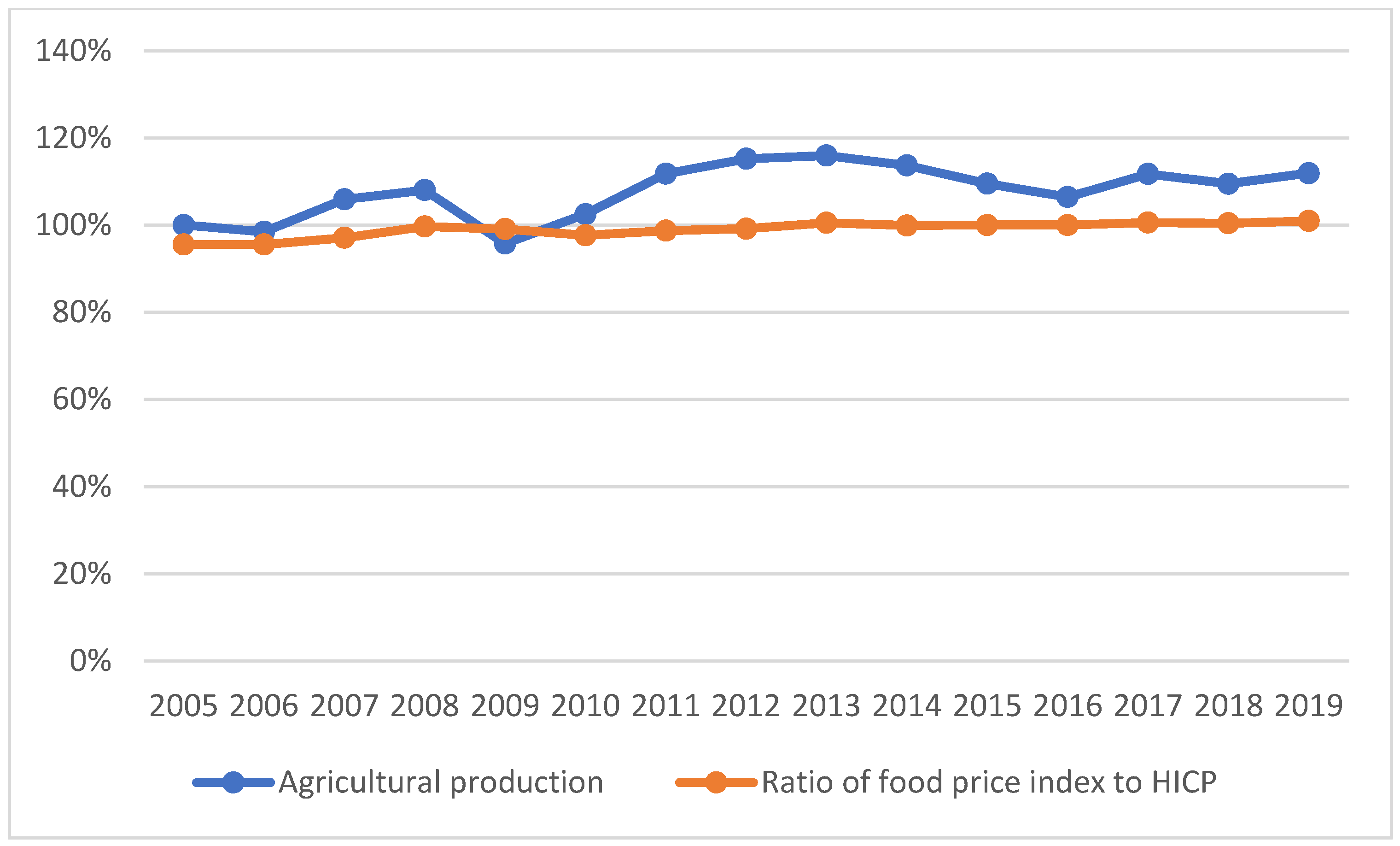

| Agricultural production index | % | 405 | 107.75 | 14.72 | 76.08 | 150.92 |

| Crop output share in total output | % | 401 | 0.52 | 0.14 | 0.11 | 0.75 |

| Output per ha | EUR/ha | 401 | 2794.9 | 3148.7 | 484.53 | 15.739 |

| Global food price | Index, % | 405 | 100.14 | 11.22 | 76.8 | 118.8 |

| Prices of means of production | Index, % | 398 | 110.45 | 9.06 | 83.68 | 134 |

| Food price HICP ratio | % | 405 | 0.99 | 0.04 | 0.83 | 1.16 |

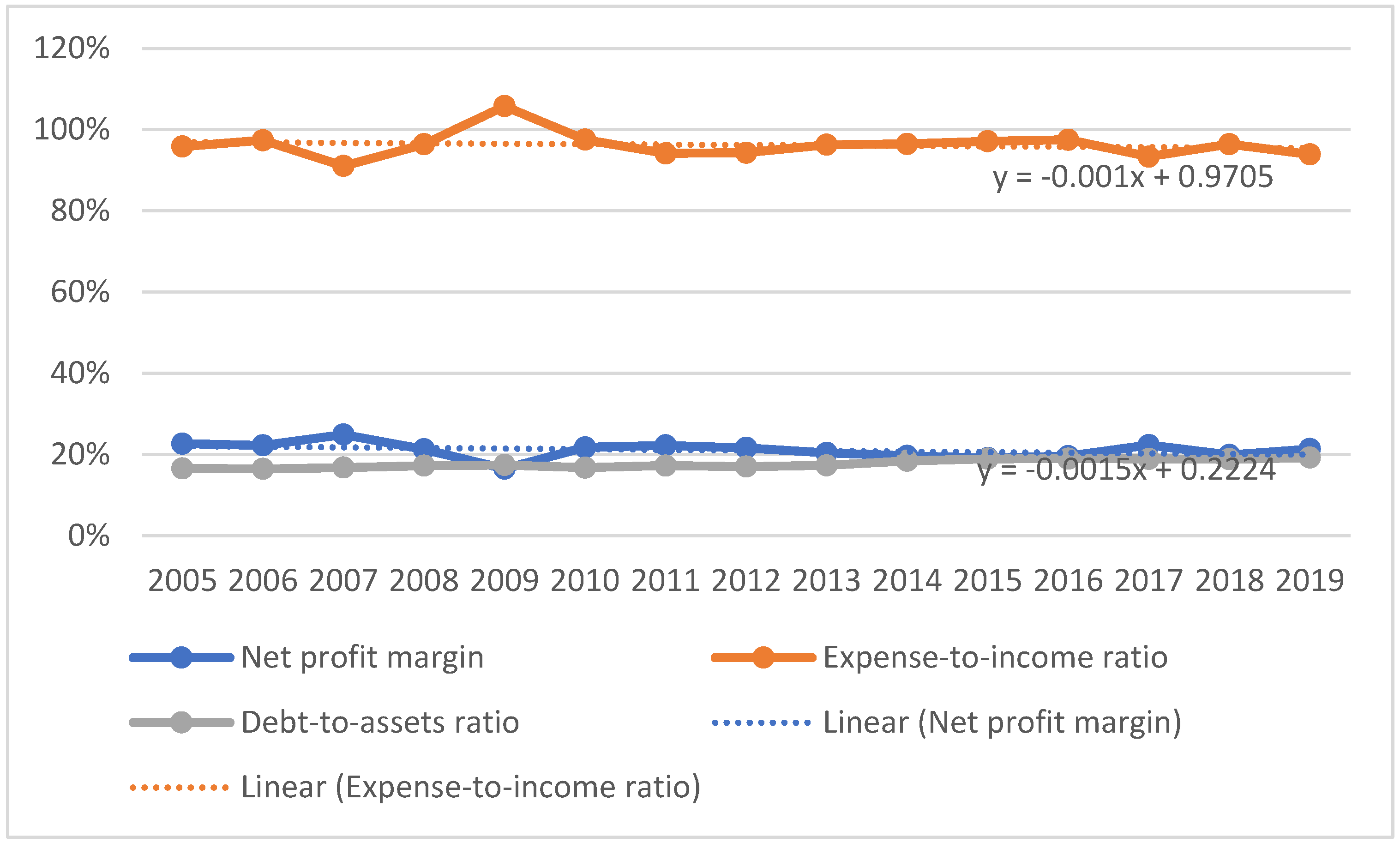

| Net profit margin | % | 401 | 0.21 | 0.12 | −0.22 | 0.5 |

| Debt-to-assets ratio | % | 400 | 17.82 | 14.67 | 0.03 | 60.23 |

| Ratio of output sell price to the price of means of production | % | 398 | 0.97 | 0.09 | 0.76 | 1.32 |

| Expense-to-output ratio | % | 401 | 0.96 | 0.17 | 0.59 | 1.75 |

| Fixed capital per worker | EUR/AWU | 401 | 2.6 × 105 | 2.9 × 105 | 9000.8 | 1.32 × 106 |

| Total labor input | AWU | 401 | 2.35 | 2.58 | 1.02 | 20.73 |

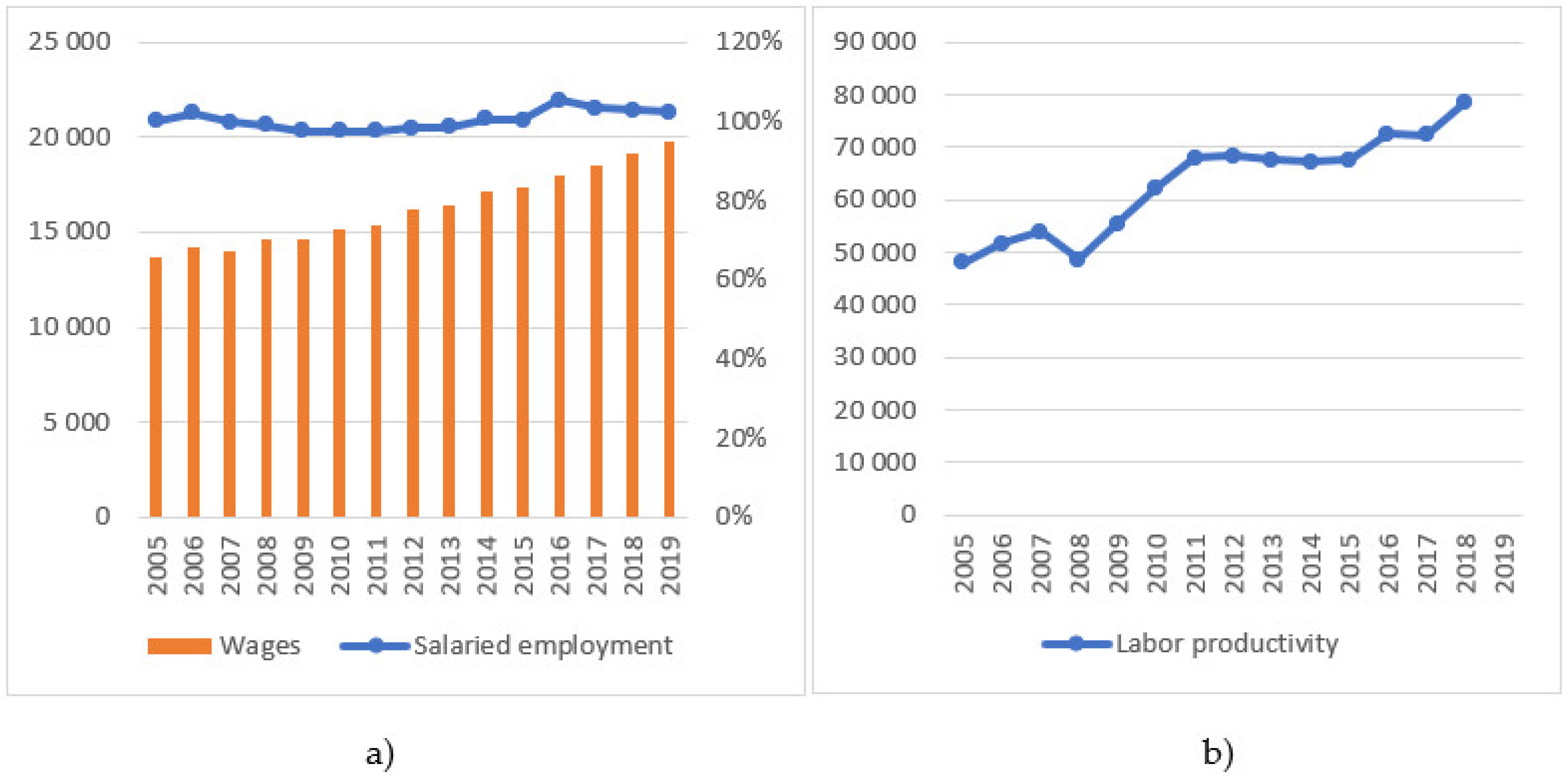

| Salaried employment index | % | 405 | 100.41 | 24.54 | 49.65 | 198.57 |

| Labor productivity | EUR/AWU | 405 | 52.26 | 46.73 | 5.18 | 230.99 |

| Total specific costs | EUR | 401 | 60,199 | 65,489 | 3453 | 3.32 × 105 |

| Wages per AWU | EUR | 401 | 16,301 | 10,060 | 1905 | 44,897 |

| Net earnings in a country (total NACE) | EUR | 391 | 18,887 | 10,764 | 2605.9 | 42,584 |

| Labor costs (wages and salaries) | Index, % | 405 | 91.66 | 17.3 | 32.2 | 170.6 |

| Total unemployment | % | 405 | 8.46 | 4.29 | 2 | 27.5 |

References

- Morkūnas, M.; Volkov, A.; Pazienza, P. How Resistant is the Agricultural Sector? Economic Resilience Exploited. Econ. Sociol. 2018, 11, 321–332. [Google Scholar] [CrossRef]

- Paas, W.; Coopmans, I.; Severini, S.; van Ittersum, M.K.; Meuwissen, M.P.M.; Reidsma, P. Participatory assessment of sustainability and resilience of three specialized farming systems. Ecol. Soc. 2021, 26, 2. [Google Scholar] [CrossRef]

- Marinov, P. Index of localization of agricultural holdings and employees in the rural areas of the South-Central Region for Bulgaria. Bulg. J. Agric. Sci. 2019, 25, 464–467. [Google Scholar]

- Sertoglu, K.; Ugural, S.; Bekun, F.V. The contribution of agricultural sector on economic growth of Nigeria. Int. J. Econ. Financ. Issues 2017, 7, 547–552. [Google Scholar]

- Wang, S.L.; Ball, V.E.; Fulginiti, L.E.; Plastina, A. Productivity Growth in Agriculture: An International Perspective; Fuglie, K.O., Wang, S.L., Ball, V.E., Eds.; CABI: Oxfordshire, UK, 2015. [Google Scholar]

- Matsushita, K.; Yamane, F.; Asano, K. Linkage between crop diversity and agro-ecosystem resilience: Nonmonotonic agricultural response under alternate regimes. Ecol. Econ. 2016, 126, 23–31. [Google Scholar] [CrossRef]

- Chavas, J.P.; di Falco, S. Resilience, Weather and Dynamic Adjustments in Agroecosystems: The Case of Wheat Yield in England. Environ. Resour. Econ. 2015, 67, 297–320. [Google Scholar] [CrossRef]

- Birthal, P.S.; Hazrana, J. Crop diversification and resilience of agriculture to climatic shocks: Evidence from India. Agric. Syst. 2019, 173, 345–354. [Google Scholar] [CrossRef]

- el Chami, D.; Daccache, A.; el Moujabber, M. How Can Sustainable Agriculture Increase Climate Resilience? A Systematic Review. Sustainability 2020, 12, 3119. [Google Scholar] [CrossRef]

- Morkunas, M.; Žičkienė, A.; Baležentis, T.; Volkov, A.; ŠTreimikienė, D.; Ribašauskienė, E. Challenges for Improving Agricultural Resilience in the Context of Sustainability and Rural Development. Probl. Ekorozw. 2022, 17, 182–195. [Google Scholar] [CrossRef]

- Herrera, H.; Kopainsky, B. Rethinking agriculture in a shrinking world: Operationalization of resiliencewith a System Dynamics perspective. In Proceedings of the 33rd International Conference of the System Dynamics Society, Cambridge, MA, USA, 19–23 July 2015. [Google Scholar]

- Martin, R.; Sunley, P.; Gardiner, B.; Tyler, P. How Regions React to Recessions: Resilience and the Role of Economic Structure. Reg. Stud. 2016, 50, 561–585. [Google Scholar] [CrossRef]

- di Caro, P.; Fratesi, U. Regional determinants of economic resilience. Ann. Reg. Sci. 2018, 60, 235–240. [Google Scholar] [CrossRef]

- Wink, R.; Kirchner, L.; Koch, F.; Speda, D. The economic resilience of Stuttgart: Vulnerable but resilient and adaptable. In Economic Crisis and the Resilience of Regions; Bristow, G., Healy, A., Eds.; Edward Elgar Publishing: Cheltenham, UK, 2018; pp. 41–60. Available online: https://www.elgaronline.com/view/edcoll/9781785363993/9781785363993.00008.xml (accessed on 4 March 2022).

- Ubago Martínez, Y.; García-Lautre, I.; Iraizoz, B.; Pascual, P. Why are some Spanish regions more resilient than others? Pap. Reg. Sci. 2019, 98, 2211–2231. [Google Scholar] [CrossRef]

- European Commission. CAP Expenditure. 2021. Available online: https://ec.europa.eu/info/sites/default/files/food-farming-fisheries/farming/documents/cap-expenditure-graph1_en.pdf (accessed on 17 March 2022).

- Abson, D.J.; Fraser, E.D.G.; Benton, T.G. Landscape diversity and the resilience of agricultural returns: A portfolio analysis of land use patterns and economic returns from lowland agriculture. Agric. Food Secur. 2013, 2, 2. [Google Scholar]

- Benoit, M.; Joly, F.; Blanc, F.; Dumont, B.; Sabatier, R.; Mosnier, C. Assessment of the buffering and adaptive mechanisms underlying the economic resilience of sheep-meat farms. Agron. Sustain. Dev. 2020, 40, 34. [Google Scholar] [CrossRef]

- Chonabayashi, S.; Jithitikulchai, T.; Qu, Y. Does agricultural diversification build economic resilience to drought and flood? Evidence from poor households in Zambia. Afr. J. Agric. Resour. Econ. 2020, 15, 65–80. [Google Scholar] [CrossRef]

- Martin, R.; Sunley, P. On the notion of regional economic resilience: Conceptualization and explanation. J. Econ. Geogr. 2015, 15, 1–42. [Google Scholar] [CrossRef]

- Doran, J.; Fingleton, B. US Metropolitan Area Resilience: Insights from dynamic spatial panel estimation. Environ. Plan. A Econ. Space 2018, 50, 111–132. [Google Scholar] [CrossRef]

- Pike, A.; Dawley, S.; Tomaney, J. Resilience, adaptation and adaptability. Camb. J. Reg. Econ. Soc. 2010, 3, 59–70. [Google Scholar] [CrossRef]

- Boschma, R. Towards an Evolutionary Perspective on Regional Resilience. Reg. Stud. 2015, 49, 733–751. [Google Scholar] [CrossRef]

- Cowell, M.; Gainsborough, J.F.; Lowe, K. Resilience and Mimetic Behavior: Economic Visions in the Great Recession. J. Urban Aff. 2016, 38, 61–78. [Google Scholar] [CrossRef]

- Hu, X.; Hassink, R. Adaptation, adaptability and regional economic resilience: A conceptual framework. In Handbook on Regional Economic Resilience; Bristow, G., Healy, A., Eds.; Edward Elgar Publishing: Cheltenham, UK, 2020; pp. 54–68. [Google Scholar]

- Cabell, J.F.; Oelofse, M. An Indicator Framework for Assessing Agroecosystem Resilience. Ecol. Soc. 2012, 17, 18. [Google Scholar] [CrossRef]

- Quinlan, A.E.; Berbés-Blázquez, M.; Haider, L.J.; Peterson, G.D. Measuring and assessing resilience: Broadening understanding through multiple disciplinary perspectives. J. Appl. Ecol. 2015, 53, 677–687. [Google Scholar] [CrossRef]

- Fröhlich, K.; Hassink, R. Regional resilience: A stretched concept? Eur. Plan. Stud. 2018, 26, 1763–1778. [Google Scholar] [CrossRef]

- Biggs, R.; Schlüter, M.; Biggs, D.; Bohensky, E.L.; BurnSilver, S.; Cundill, G.; Dakos, V.; Daw, T.M.; Evans, L.S.; Kotschy, K.; et al. Toward principles for enhancing the resilience of ecosystem services. Annu. Rev. Environ. Resour. 2012, 37, 421–448. [Google Scholar] [CrossRef]

- Meuwissen, M.P.M.; Feindt, P.H.; Spiegel, A.; Termeer, C.J.A.M.; Mathijs, E.; De Mey, Y.; Finger, R.; Balmann, A.; Wauters, E.; Urquhart, J.; et al. A framework to assess the resilience of farming systems. Agric. Syst. 2019, 176, 102656. [Google Scholar] [CrossRef]

- Folke, C.; Carpenter, S.R.; Walker, B.; Scheffer, M.; Chapin, T.; Rockström, J. Resilience Thinking: Integrating Resilience, Adaptability and Transformability. Ecol. Soc. 2010, 15, 20. [Google Scholar] [CrossRef]

- Cifdaloz, O.; Regmi, A.; Anderies, J.M.; Rodriguez, A.A. Robustness, vulnerability, and adaptive capacity in small-scale social-ecological systems: The Pumpa Irrigation System in Nepal. Ecol. Soc. 2010, 15, 3. [Google Scholar] [CrossRef]

- Clark, J.N. Resilience as a multi-directional movement process: A conceptual and empirical exploration. Br. J. Sociol. 2021, 72, 1046–1061. [Google Scholar] [CrossRef]

- Angeon, V.; Bates, S. Reviewing Composite Vulnerability and Resilience Indexes: A Sustainable Approach and Application. SSRN Electron. J. 2015, 72, 140–162. [Google Scholar] [CrossRef]

- Angulo, A.M.; Mur, J.; Trívez, F.J. Measuring resilience to economic shocks: An application to Spain. Ann. Reg. Sci. 2017, 60, 349–373. [Google Scholar] [CrossRef]

- Rose, A. Measuring Economic Resilience to Disasters: An Overview. In Resource Guide on Resilience. EPFL International Risk Governance Center. v29-07-2016. 2016. Available online: https://www.irgc.org/riskgovernance/resilience/ (accessed on 2 April 2022).

- Webber, D.J.; Healy, A.; Bristow, G. Regional Growth Paths and Resilience: A European Analysis. Econ. Geogr. 2018, 94, 355–375. [Google Scholar] [CrossRef]

- Vigani, M.; Berry, R. Farm economic resilience, land diversity and environmental uncertainty. In Proceedings of the 30th International Conference of Agricultural Economists, Vancouver, BC, Canada, 28 July–2 August 2018. [Google Scholar]

- Kitsos, A.; Bishop, P. Economic resilience in Great Britain: The crisis impact and its determining factors for local authority districts. Ann. Reg. Sci. 2018, 60, 329–347. [Google Scholar] [CrossRef]

- Quendler, E.; Morkūnas, M. The Economic Resilience of the Austrian Agriculture since the EU Accession. J. Risk Financ. Manag. 2020, 13, 236. [Google Scholar] [CrossRef]

- Feldmeyer, D.; Wilden, D.; Jamshed, A.; Birkmann, J. Regional climate resilience index: A novel multimethod comparative approach for indicator development, empirical validation and implementation. Ecol. Indic. 2020, 119, 106861. [Google Scholar] [CrossRef]

- Borychowski, M.; Stępień, S.; Polcyn, J.; Tošović-Stevanović, A.; Ćalović, D.; Lalić, G.; Žuža, M. Socio-Economic Determinants of Small Family Farms’ Resil-ience in Selected Central and Eastern European Countries. Sustainability 2020, 12, 10362. [Google Scholar] [CrossRef]

- Morkunas, M.; Volkov, A.; Bilan, Y.; Raišienė, A.G. The role of government in forming agricultural policy: Economic resilience measuring index exploited. Adm. Si Manag. Public 2018, 31, 111–131. [Google Scholar] [CrossRef]

- Stanickova, M.; Melecký, L. Understanding of resilience in the context of regional development using composite index approach: The case of European Union NUTS-2 regions. Reg. Stud. Reg. Sci. 2018, 5, 231–254. [Google Scholar] [CrossRef]

- Klimanov, V.V.; Kazakova, S.M.; Mikhaylova, A.A. Economic and Fiscal Resilience of Russia’s Regions. Reg. Sci. Policy Pract. 2020, 12, 627–640. [Google Scholar] [CrossRef]

- Kitsos, A. Economic resilience in Great Britain: An empirical analysis at the local authority district level. In Handbook on Regional Economic Resilience; Bristow, G., Healy, A., Eds.; Edward Elgar: Cheltenham, UK, 2020. [Google Scholar]

- Volkov, A.; Žičkienė, A.; Morkunas, M.; Baležentis, T.; Ribašauskienė, E.; Streimikiene, D. A Multi-Criteria Approach for Assessing the Economic Resilience of Agriculture: The Case of Lithuania. Sustainability 2021, 13, 2370. [Google Scholar] [CrossRef]

- Hill, E.; St Clair, T.; Wial, H.; Wolman, H.; Atkins, P.; Blumenthal, P.; Ficenec, S.; Friedhoff, A. Economic Shocks and Regional Economic Resilience; Working Paper 2011-03; Institute of Governmental Studies, University of California: Berkeley, CA, USA, 2011. [Google Scholar]

- Obschonka, M.; Stuetzer, M.; Audretsch, D.B.; Rentfrow, P.J.; Potter, J.; Gosling, S.D. Macropsychological Factors Predict Regional Economic Resilience During a Major Economic Crisis. Soc. Psychol. Personal. Sci. 2015, 7, 95–104. [Google Scholar] [CrossRef]

- Gong, H.; Hassink, R.; Tan, J.; Huang, D. Regional Resilience in Times of a Pandemic Crisis: The Case of COVID-19 in China. Tijdschr. Voor Econ. En Soc. Geogr. 2020, 111, 497–512. [Google Scholar] [CrossRef] [PubMed]

- Bristow, G.; Healy, A. Innovation and regional economic resilience: An exploratory analysis. Ann. Reg. Sci. 2017, 60, 265–284. [Google Scholar] [CrossRef]

- Walker, B.; Salt, D. Resilience Practice: Building Capacity to Absorb Disturbance and Maintain Function, 1st ed.; Island Press: Washington, DC, USA, 2012. [Google Scholar]

- Lv, W.; Wei, Y.; Li, X.; Lin, L. What Dimension of CSR Matters to Organizational Resilience? Evidence from China. Sustainability 2019, 11, 1561. [Google Scholar] [CrossRef]

- Evenhuis, E. New directions in researching regional economic resilience and adaptation. Geogr. Compass 2017, 11, e12333. [Google Scholar] [CrossRef]

- Kitsos, A.; Carrascal-Incera, A.; Ortega-Argilés, R. The Role of Embed-dedness on Regional Economic Resilience: Evidence from the UK. Sustainability 2019, 11, 3800. [Google Scholar] [CrossRef]

- Ženka, J.; Chreneková, M.; Kokešová, L.; Svetlíková, V. Industrial Structure and Economic Resilience of Non-Metropolitan Regions: An Empirical Base for the Smart Specialization Policies. Land 2021, 10, 1335. [Google Scholar] [CrossRef]

- Faggian, A.; Gemmiti, R.; Jaquet, T.; Santini, I. Regional economic resilience: The experience of the Italian local labor systems. Ann. Reg. Sci. 2018, 60, 393–410. [Google Scholar] [CrossRef]

- Simonen, J.; Herala, J.; Svento, R. Creative destruction and creative resilience: Restructuring of the Nokia dominated high-tech sector in the Oulu region. Reg. Sci. Policy Pract. 2020, 12, 931–953. [Google Scholar] [CrossRef]

- Bănică, A.; Kourtit, K.; Nijkamp, P. Natural disasters as a development opportunity: A spatial economic resilience interpretation. Rev. Reg. Res. 2020, 40, 223–249. [Google Scholar] [CrossRef]

- Czekaj, M.; Adamsone-Fiskovica, A.; Tyran, E.; Kilis, E. Small farms’ resilience strategies to face economic, social, and environmental disturbances in selected regions in Poland and Latvia. Glob. Food Secur. 2020, 26, 100416. [Google Scholar] [CrossRef]

- Thorsøe, M.; Noe, E.; Maye, D.; Vigani, M.; Kirwan, J.; Chiswell, H.; Grivins, M.; Adamsone-Fiskovica, A.; Tisenkopfs, T.; Tsakalou, E.; et al. Responding to change: Farming system resilience in a liberalized and volatile European dairy market. Land Use Policy 2020, 99, 105029. [Google Scholar] [CrossRef]

- Buitenhuis, Y.; Candel, J.J.; Termeer, K.J.; Feindt, P.H. Does the Common Agricultural Policy enhance farming systems’ resilience? Applying the Resilience Assessment Tool (ResAT) to a farming system case study in The Netherlands. J. Rural. Stud. 2020, 80, 314–327. [Google Scholar] [CrossRef]

- Enjolras, G.; Capitanio, F.; Aubert, M.; Adinolfi, F. Direct payments, crop insurance and the volatility of farm income. Some evidence in France and in Italy. New Medit. 2014, 1, 31–40. [Google Scholar]

- Severini, S.; Tantari, A.; di Tommaso, G. Do CAP direct payments stabilise farm income? Empirical evidences from a constant sample of Italian farms. Agric. Food Econ. 2016, 4, 6. [Google Scholar] [CrossRef]

- Castañeda-Vera, A.; Garrido, A. Evaluation of risk management tools for stabilising farm income under CAP 2014–2020. Econ. Agrar. Y Recur. Nat. 2017, 17, 3. [Google Scholar] [CrossRef]

- Brady, M.; Hristov, J.; Höjgård, S.; Jansson, T.; Johansson, H.; Larsson, C.; Nordin, I.; Rabinowicz, E. Impacts of Direct Payments: Lessons for CAP Post-2020 from a Quantitative Analysis (Report No. 2017:2). AgriFood Economics Centre. 2017. Available online: https://www.agrifood.se/Files/AgriFood_Rapport_20172.pdf (accessed on 23 January 2022).

- Kryszak, U.; Matuszczak, A. Determinants of Farm Income in the European Union in New and Old Member States. A Regional Study. Ann. Pol. Assoc. Agric. Agribus. Econ. 2019, XXI, 200–211. [Google Scholar] [CrossRef]

- Mamatzakis, E.; Staikouras, C. Common Agriculture Police in the EU, direct payments, solvency and income. Agric. Financ. Rev. 2020, 80, 529–547. [Google Scholar] [CrossRef]

- Kryszak, U.; Guth, M.; Czyżewski, B. Determinants of farm profitability in the EU regions. Does Farm Size Matter? Agric. Econ. 2021, 67, 90–100. [Google Scholar] [CrossRef]

- Lehtonen, H.S.; Niemi, J.S. Effects of reducing EU agricultural support payments on production and farm income in Finland. Agric. Food Sci. 2018, 27, 124–137. [Google Scholar] [CrossRef]

- Kravčáková Vozárová, I.; Kotulič, R.; Vavrek, R. Assessing Impacts of CAP Subsidies on Financial Performance of Enterprises in Slovak Republic. Sustainability 2020, 12, 948. [Google Scholar] [CrossRef]

- Baležentis, T.; de Witte, K. One- and multi-directional conditional efficiency measurement–Efficiency in Lithuanian family farms. Eur. J. Oper. Res. 2015, 245, 612–622. [Google Scholar] [CrossRef]

- Pechrová, M. Impact of the Rural Development Programme Subsidies on the farms’ inefficiency and efficiency. Agric. Econ. 2016, 61, 197–204. [Google Scholar] [CrossRef]

- Latruffe, L.; Desjeux, Y. Common Agricultural Policy support, technical efficiency and productivity change in French agriculture. Rev. Agric. Food Environ. Stud. 2016, 97, 15–28. [Google Scholar] [CrossRef]

- Martinez Cillero, M.; Thorne, F.; Wallace, M.; Breen, J.; Hennessy, T. The Effects of Direct Payments on Technical Efficiency of Irish Beef Farms: A Stochastic Frontier Analysis. J. Agric. Econ. 2017, 69, 669–687. [Google Scholar] [CrossRef]

- Garrone, M.; Emmers, D.; Lee, H.; Olper, A.; Swinnen, J. Subsidies and agricultural productivity in the EU. Agric. Econ. 2019, 50, 803–817. [Google Scholar] [CrossRef]

- Staniszewski, J.; Borychowski, M. The impact of the subsidies on efficiency of different sized farms. Case study of the Common Agricultural Policy of the European Union. Agric. Econ. 2020, 66, 373–380. [Google Scholar] [CrossRef]

- Rizov, M.; Pokrivcak, J.; Ciaian, P. CAP Subsidies and Productivity of the EU Farms. J. Agric. Econ. 2013, 64, 537–557. [Google Scholar] [CrossRef]

- Kazukauskas, A.; Newman, C.; Sauer, J. The impact of decoupled subsidies on productivity in agriculture: A cross-country analysis using microdata. Agric. Econ. 2014, 45, 327–336. [Google Scholar] [CrossRef]

- Doucha, T.; Foltýn, I. Czech agriculture after the accession to the European Union–impacts on the development of its multifunctionality. Agric. Econ. 2008, 54, 150–157. [Google Scholar] [CrossRef]

- Chrastinová, Z.; Burianová, V. Economic development in Slovak agriculture. Agric. Econ. 2009, 55, 67–76. [Google Scholar] [CrossRef]

- Malá, Z.; Červená, G.; Antoušková, M. Analysis of the impacts of Common Agricultural Policy on plant production in the Czech Republic. Acta Univ. Agric. Et Silvic. Mendel. Brun. 2014, 59, 237–244. [Google Scholar] [CrossRef]

- Opatrny, M. The Impact of Agricultural Subsidies on Farm Production: A Synthetic Control Method Approach; IES Working Paper No. 31/2018; Charles University in Prague, Institute of Economic Studies (IES): Prague, Czech Republic, 2018; Available online: https://www.econstor.eu/bitstream/10419/203210/1/1039823335.pdf (accessed on 19 September 2021).

- von Witzke, H.; Noleppa, S.; Schwarz, G. Decoupled Payments to EU Farmers, Production, and Trade: An Economic Analysis for Germany; Working Paper, No. 90/2010; Humboldt-Universität zu Berlin, Wirtschafts- und Sozialwissenschaften ander Landwirtschaftlich-Gärtnerischen Fakultät: Berlin, Germany, 2010. [Google Scholar]

- Olagunju, K.O.; Patton, M.; Feng, S. Estimating the Impact of Decoupled Payments on Farm Production in Northern Ireland: An Instrumental Variable Fixed Effect Approach. Sustainability 2020, 12, 3222. [Google Scholar] [CrossRef]

- Hennessy, T.C.; Rehman, T. Assessing the Impact of the ‘Decoupling’ Reform of the Common Agricultural Policy on Irish Farmers’ off-farm Labour Market Participation Decisions. J. Agric. Econ. 2008, 59, 41–56. [Google Scholar] [CrossRef]

- Petrick, M.; Zier, P. Common Agricultural Policy effects on dynamic labour use in agriculture. Food Policy 2012, 37, 671–678. [Google Scholar] [CrossRef]

- Berlinschi, R.; Swinnen, J.; van Herck, K. Trapped in Agriculture? Credit Constraints, Investments in Education and Agricultural Employment. Eur. J. Dev. Res. 2014, 26, 490–508. [Google Scholar] [CrossRef]

- Bartolini, F.; Brunori, G.; Coli, A.; Landi, C.; Pacini, B. Assessing the Causal Effect of Decoupled Payments on farm labour in Tuscany Using Propensity Score Methods. In Proceedings of the 29th International Conference of Agricultural Economists, Milan, Italy, 8–14 August 2015. [Google Scholar]

- Rafiaani, P.; Kuppens, T.; Dael, M.V.; Azadi, H.; Lebailly, P.; Passel, S.V. Social sustainability assessments in the biobased economy: Towards a systemic approach. Renew. Sustain. Energy Rev. 2018, 82, 1839–1853. [Google Scholar] [CrossRef]

- Mattas, K.; Loizou, E. The CAP as a Job Stabiliser. EuroChoices 2017, 16, 23–26. [Google Scholar] [CrossRef]

- Garrone, M.; Emmers, D.; Olper, A.; Swinnen, J. Jobs and agricultural policy: Impact of the common agricultural policy on EU agricultural employment. Food Policy 2019, 87, 101744. [Google Scholar] [CrossRef]

- Dupraz, P.; Latruffe, L.; Mann, S. Trends in Family, Hired and Contract Labor Use on French and Swiss Crop farms: The Role of Agricultural Policies; Working Paper SMART-LERECO No. 10–16; INRAE: Paris, France, 2010; Available online: http://ageconsearch.umn.edu/bitstream/210392/2/WP%20SMART-LERECO%2010.16.pdf (accessed on 5 December 2018).

- Kaditi, E. The impact of CAP reforms on farm labour structure: Evidence from Greece. In Land, Labour and Capital Markets in European Agriculture: Diversity under a Common Policy; Swinnen, J., Knops, L., Eds.; Centre for European Policy Studies: Brussels, Belgium, 2013; pp. 186–198. [Google Scholar]

- Mantino, F. Employment Effects of the CAP in Italian Agriculture: Territorial Diversity and Policy Effectiveness. EuroChoices 2017, 16, 12–17. [Google Scholar] [CrossRef]

- Patton, M.; Olagunju, K.O.; Feng, S. Impact of Decoupled Payments on Production: Policy Briefing Report; Agrifood and Biosciences Institute: Belfast, Ireland, 2017. Available online: https://www.afbini.gov.uk/sites/afbini.gov.uk/files/publications/Impact%20of%20Decoupled%20Payments%20on%20Production.pdf (accessed on 13 February 2021).

- Toth, M. Structural changes in Slovak agriculture after joining EU and the effect of capping direct payments. Ekon. Pol’nohospodarstva 2019, 1, 81–90. [Google Scholar]

- Hennessy, D.A. The Production Effects of Agricultural Income Support Policies under Uncertainty. Am. J. Agric. Econ. 1998, 80, 46–57. [Google Scholar] [CrossRef]

- Koundouri, P.; Laukkanen, M.; Myyra, S.; Nauges, C. The effects of EU agricultural policy changes on farmers’ risk attitudes. Eur. Rev. Agric. Econ. 2009, 36, 53–77. [Google Scholar] [CrossRef]

- Burns, C.; Prager, D. Do Direct Payments and Crop Insurance Influence Commercial Farm Survival and Decisions to Expand? In Proceedings of the Agricultural and Applied Economics Association, Annual Meeting, Boston, MA, USA, 31 July–2 August 2016.

- O’Donoghue, E.J.; Whitaker, J.B. Do Direct Payments Distort Producers’ Decisions? An Examination of the Farm Security and Rural Investment Act of 2002. Appl. Econ. Perspect. Policy 2010, 32, 170–193. [Google Scholar] [CrossRef]

- Howley, P.; Breen, J.; Donoghue, C.O. Does the single farm payment affect farmers’ behaviour? A macro and micro analysis. Int. J. Agric. Manag. 2012, 2, 57. [Google Scholar] [CrossRef][Green Version]

- Lazíková, J.; Bandlerová, A.; Rumanovská, U.; Takáč, I.; Lazíková, Z. Crop Diversity and Common Agricultural Policy—The Case of Slovakia. Sustainability 2019, 11, 1416. [Google Scholar] [CrossRef]

- Minviel, J.J.; De Witte, K. The influence of public subsidies on farm technical efficiency: A robust conditional nonparametric approach. Eur. J. Oper. Res. 2017, 259, 1112–1120. [Google Scholar] [CrossRef]

- Zhu, X.; Lansink, A.O. Impact of CAP Subsidies on Technical Efficiency of Crop Farms in Germany, the Netherlands and Sweden. J. Agric. Econ. 2010, 61, 545–564. [Google Scholar] [CrossRef]

- Musliu, A. The Effect of Direct Payments on Farm Performance for the Case of CEECs Through Stochastic Frontier Analysis Approach. Sci. Pap. Ser. Manag. Econ. Eng. Agric. Rural. Dev. 2020, 20, 315–322. [Google Scholar]

- Peerlings, J.; Polman, N.; Dries, L. Self-reported Resilience of European Farms with and without the CAP. J. Agric. Econ. 2014, 65, 722–738. [Google Scholar] [CrossRef]

- Szerletics, K. Degressivity, capping and European farm structure: New evidence from Hungary. Stud. Agric. Econ. 2018, 120, 80–86. [Google Scholar] [CrossRef]

- Baldoni, E.; Ciaian, P. The Capitalization of CAP Subsidies into Land Rents and Land Values in the EU—An Econometric Analysis. Joint Research Centre, European Commission. Technical Report. 2021. Available online: https://publications.jrc.ec.europa.eu/repository/handle/JRC125220 (accessed on 18 January 2022).

- Ronzon, T.; M’Barek, R. Socioeconomic Indicators to Monitor the EU’s Bioeconomy in Transition. Sustainability 2018, 10, 1745. [Google Scholar] [CrossRef]

- Wooldridge, J.M. Econometrics: Panel Data Methods. [Interactive]. 2016. Available online: https://www.ifs.org.uk/uploads/cemmap/programmes/Background%20reading%20May%202016.pdf (accessed on 15 May 2021).

- Wooldridge, J.M. Applications of Generalized Method of Moments Estimation. J. Econ. Perspect. 2001, 15, 87–100. [Google Scholar] [CrossRef]

- Beshelev, S.D.; Gurvich, F.G. Matematiko-Statisticheskie Metody Ekspertnykh Otsenok; Statistika: Moscow, Russia, 1974. [Google Scholar]

- Kendall, M.G. Rank Correlation Methods; Charles Griffin: London, UK, 1948. [Google Scholar]

- Hwang, C.L.; Yoon, K. Multiple Attribute Decision Making Methods and Applications; Springer: Berlin, Germany, 1981; 259p. [Google Scholar]

- Ferjani, A. The Relationship between Direct Payments and Efficiency on Swiss Farms. Agric. Econ. Rev. 2009, 9, 1–10. [Google Scholar]

- Ivanov, B. Effects of Direct Payments on Agricultural Development in Bulgaria. In The Common Agricultural Policy of the European Union–The Present and the Future, EU Member States Point of View; Wigier, M., Kowalski, A., Eds.; Series Monographs of Multi-Annual Programme; IAFE-NRI: Warsaw, Poland, 2018; pp. 93–105. [Google Scholar]

- Morkunas, M.; Labukas, P. The Evaluation of Negative Factors of Direct Payments under Common Agricultural Policy from a Viewpoint of Sustainability of Rural Regions of the New EU Member States: Evidence from Lithuania. Agriculture 2020, 10, 228. [Google Scholar] [CrossRef]

- Knapp, E.; Loughrey, J. The single farm payment and income risk in Irish farms 2005–2013. Agric. Food Econ. 2017, 5, 178. [Google Scholar] [CrossRef]

- Ciaian, P.; Espinosa, M.; Louhichi, K.; Perni, A.; Gomez y Paloma, S. Farm level impacts of abolishing the CAP direct payments: An assessment using the IFM-CAP model. In Proceedings of the 162nd EAAE Seminar “The Evaluation of New CAP Instruments: Lessons Learned and the Road Ahead”, Budapest, Hungary, 26–27 April 2018. [Google Scholar]

- Ciaian, P.; Kancs, D.; Paloma, S.G.Y. Income Distributional Effects of CAP Subsidies. Outlook Agric. 2015, 44, 19–28. [Google Scholar] [CrossRef]

- Ciliberti, S.; Frascarelli, A. The income effect of CAP subsidies: Implications of distributional leakages for transfer efficiency in Italy. Bio-Based Appl. Econ. 2019, 7, 161–178. [Google Scholar] [CrossRef]

- Morkunas, M.; Volkov, A.; Skvarciany, V. Estimation of retail food prices: Case of Lithuania. Int. J. Learn. Change 2021, 13, 218. [Google Scholar] [CrossRef]

- Severini, S.; Biagini, L. The Direct and Indirect Effect of CAP Support on Farm Income Enhancement: A Farm-Based Econometric Analysis. Working Paper 2009.07684. arXiv 2020, arXiv:2009.07684. [Google Scholar]

- Baležentis, T.; Galnaitytė, A.; Kriščiukaitienė, I.; Namiotko, V.; Novickytė, L.; Streimikiene, D.; Melnikiene, R. Decomposing Dynamics in the Farm Profitability: An Application of Index Decomposition Analysis to Lithuanian FADN Sample. Sustainability 2019, 11, 2861. [Google Scholar] [CrossRef]

- Minviel, J.J.; Latruffe, L. Effect of public subsidies on farm technical efficiency: A meta-analysis of empirical results. Appl. Econ. 2017, 49, 213–226. [Google Scholar] [CrossRef]

- Marzec, J.; Pisulewski, A. The Effect of CAP Subsidies on the Technical Efficiency of Polish Dairy Farms. Cent. Eur. J. Econ. Model. Econom. 2017, 9, 243–273. [Google Scholar]

- Namiotko, V. Ūkininkų ūkių Investicijų į Žemės ūkio Techniką Efektyvumo Didinimas. Ph.D. Thesis, Vilniaus Gedimino Technikos Universitetas, Lietuvos Agrarinės Ekonomikos Institutas, Vilnius, Lithuania, 2018. Available online: http://dspace.vgtu.lt/bitstream/1/3536/3/Disertacija_Virginia_Namiotko_leidykla.pdf (accessed on 4 March 2022).

- Breustedt, G.; Habermann, H. The Incidence of EU Per-Hectare Payments on Farmland Rental Rates: A Spatial Econometric Analysis of German Farm-Level Data. J. Agric. Econ. 2011, 62, 225–243. [Google Scholar] [CrossRef]

- Michalek, J.; Ciaian, P.; Kancs, D. Capitalization of the Single Payment Scheme into Land Value: Generalized Propensity Score Evidence from the European Union. Land Econ. 2014, 90, 260–289. [Google Scholar] [CrossRef]

- Varacca, A.; Guastella, G.; Pareglio, S.; Sckokai, P. A meta-analysis of the capitalisation of CAP direct payments into land prices. Eur. Rev. Agric. Econ. 2021, 49, 359–382. [Google Scholar] [CrossRef]

- O’Toole, C.; Hennessy, T. Do decoupled payments affect investment financing constraints? Evidence from Irish agriculture. Food Policy 2015, 56, 67–75. [Google Scholar] [CrossRef]

- Soliwoda, M. The impact of the support instruments of the Common Agricultural Policy on economic and financial stability of farms in EU countries. Acta Univ. Lodziensis. Folia Oeconomica 2016, 2, 99–116. [Google Scholar] [CrossRef]

- Kropp, J.D.; Katchova, A.L. The effects of direct payments on liquidity and repayment capacity of beginning farmers. Agric. Financ. Rev. 2011, 71, 347–365. [Google Scholar] [CrossRef]

- Dupraz, P.; Latruffe, L. Trends in family labour, hired labour and contract work on French field crop farms: The role of the Common Agricultural Policy. Food Policy 2015, 51, 104–118. [Google Scholar] [CrossRef]

- Mary, S. Assessing the Impacts of Pillar 1 and 2 Subsidies on TFP in French Crop Farms. J. Agric. Econ. 2013, 64, 133–144. [Google Scholar] [CrossRef]

- Devadoss, S.; Gibson, M.J.; Luckstead, J. The impact of agricultural subsidies on the corn market with farm heterogeneity and endogenous entry and exit. J. Agric. Resour. Econ. 2016, 41, 499–517. [Google Scholar]

- Alston, J.M.; James, J.S. The Incidence of Agricultural Policy. In Handbook of Agricultural Economics; Gardner, B.L., Rausser, G.C., Eds.; Elsevier: Amsterdam, The Netherlands, 2002; Volume 2, pp. 1689–1749. [Google Scholar]

- Serenčéš, P.; Strápeková, Z.; Tóth, M. Value-Added, Net Income and Employment in Farms in Slovakia. In Proceedings of the International Scientific Days: Towards Productive, Sustainable and Resilient Global Agriculture and Food Systems, Prague, Czech Republic, 16–17 May 2018; pp. 1413–1425. [Google Scholar]

- Charlton, D.; Taylor, J.E.; Vougioukas, S.; Rutledge, Z. Can Wages Rise Quickly Enough to Keep Workers in the Fields? Choices 2019, 3, 1–7. [Google Scholar]

- Frey, B.S.; Jegen, R. Motivation Crowding Theory: A Survey of Empirical Evidence. CESifo Working Paper Series No. 245. 2000. Available online: https://deliverypdf.ssrn.com/delivery.php?ID=530112070066073001095014064099070022041056033020093009075020091068004087098007126009103111096111021121028019077096014115124107085092069099064120080077089017079097029080092088101068005022085&EXT=pdf&INDEX=TRUE (accessed on 2 June 2019).

- Pawłowski, K.P.; Czubak, W.; Zmyślona, J.; Sadowski, A. Overinvestment in selected Central and Eastern European countries: Production and economic effects. PLoS ONE 2021, 16, e0251394. [Google Scholar] [CrossRef] [PubMed]

| Function | Indicators of the Functions | Unit | Type | Source |

|---|---|---|---|---|

| Delivery of affordable agricultural goods (P) | Ratio of the retail prices of food | % | Cost (−) | EUROSTAT |

| to the retail prices of all consumption goods | ||||

| Agricultural goods output, index | % | Benefit (+) | EUROSTAT | |

| Assurance of farm viability (V) | Net profit margin (including subsidies) | % | Benefit (+) | FADN * |

| Expense-to-income ratio | % | Cost (−) | FADN | |

| Debt-to-assets ratio | % | Cost (−) | FADN | |

| Creation and maintenance of decent jobs (J) | Salaried agricultural labor input, index | % | Benefit (+) | EUROSTAT |

| Labor productivity | EUR/AWU | Benefit (+) | EUROSTAT | |

| Wages per salaried employees | EUR/AWU | Benefit (+) | FADN |

| Dependent Variable: Agricultural Production | Coefficient | Std. Error | p-Value | Significance | |

|---|---|---|---|---|---|

| Const | β0 | 1.54 | 1.61 | 0.348 | |

| ln DPs | β1 | −0.1 | 0.05 | 0.0395 | ** |

| ln UAA | β2 | 0.14 | 0.05 | 0.015 | ** |

| ln Output per ha | β3 | 0.51 | 0.06 | <0.001 | *** |

| Crop output share in total output | β4 | 0.27 | 0.15 | 0.084 | * |

| ln Total UAA in a country | β5 | −0.1 | 0.19 | 0.602 | |

| Dependent Variable: Ratio of Food Prices to Prices of Consumer Goods | Coefficient | Std. Error | p-Value | Significance | |

|---|---|---|---|---|---|

| const | β0 | −0.19 | 0.14 | 0.166 | |

| ln DPs | β1 | −0.03 | 0.02 | 0.065 | * |

| Global food price index | β2 | 1.90 × 10−4 | 0 | 0.242 | |

| Price index of means of production | β3 | 0.001 | 0 | 0.001 | *** |

| ln Labor costs | Β4 | 0.04 | 0.03 | 0.172 | |

| ln Total unemployment | Β5 | 0.002 | 0.01 | 0.839 | |

| Dependent Variable: Net Profit Margin | Coefficient | Std. Error | p-Value | Significance | |

|---|---|---|---|---|---|

| const | β0 | −0.7 | 0.2 | 0.002 | *** |

| ln DPs | β1 | 0.08 | 0.03 | 0.017 | ** |

| Ratio of output sell price to the price of means of production | β2 | 0.38 | 0.06 | <0.001 | *** |

| ln UAA | β3 | 0.004 | 0.04 | 0.918 | |

| Crop output share in total output | β4 | 0.2 | 0.06 | 0.004 | *** |

| Debt to assets ratio (lag 1) | β5 | −0.002 | 0.01 | 0.22 | |

| Dependent Variable: Expense-to-Output Ratio | RE Model | FE Model | ||||||

|---|---|---|---|---|---|---|---|---|

| Coefficient | Std. Error | p-Value | Significance | Coefficient | p-Value | Significance | ||

| Const | β0 | 0.25 | 0.24 | 0.293 | 0.07 | 0.796 | ||

| ln DPs | β1 | 0.07 | 0.03 | 0.023 | ** | 0.07 | 0.045 | ** |

| Ratio of output selling price to the price of means of production | β2 | −0.34 | 0.08 | <0.001 | *** | −0.35 | <0.001 | *** |

| Crop output share in total output | β3 | −0.36 | 0.1 | <0.001 | *** | −0.34 | 0.002 | *** |

| Debt-to-assets ratio | β4 | 0.003 | 0.003 | 0.331 | 0.002 | 0.528 | ||

| ln Total labor input | β5 | −0.22 | 0.1 | 0.028 | ** | −0.21 | 0.057 | * |

| squared ln Total labor input | β6 | 0.09 | 0.03 | <0.001 | *** | 0.09 | 0.007 | *** |

| ln average fixed capital per worker | β7 | −0.05 | 0.02 | 0.007 | *** | |||

| ln average UAA | β8 | 0.1 | 0.03 | 0.003 | *** | |||

| Observations: 394. Robust (HAC) standard errors | R2 = 0.55 | R2 = 0.37 | ||||||

| Dependent Variable: Debt-to-Assets Ratio | Coefficient | Std. Error | p-Value | Significance | |

|---|---|---|---|---|---|

| Const | β0 | −21.39 | 20.97 | 0.308 | |

| Debt to assets ratio (lag 1) | β1 | 0.93 | 0.12 | <0.001 | *** |

| ln DPs | β2 | 2.72 | 2.85 | 0.339 | |

| Net profit margin (lag 1) | β3 | −3.88 | 9.25 | 0.675 | |

| Crop output share in total output | β4 | 10.55 | 8.54 | 0.217 | |

| ln UAA (lag 1) | β5 | 1.95 | 1.55 | 0.209 | |

| Dependent Variable: Salaried Employment | Coefficient | Std. Error | p-Value | Significance | |

|---|---|---|---|---|---|

| const | β0 | 5.5 | 0.49 | <0.001 | *** |

| ln DPs | β1 | −0.16 | 0.06 | 0.007 | *** |

| ln UAA | β2 | −0.05 | 0.09 | 0.574 | |

| ln Labor productivity | β3 | −0.02 | 0.05 | 0.681 | |

| Crop output share in total output | β4 | 0.004 | 0.18 | 0.981 | |

| ln Labor costs | β5 | 0.04 | 0.05 | 0.427 | |

| Dependent Variable: Labor Productivity | RE Model | FE Model | ||||||

|---|---|---|---|---|---|---|---|---|

| Coefficient | Std. Error | p-Value | Significance | Coefficient | p-Value | Significance | ||

| Const | β0 | −7.27 | 1.21 | <0.001 | *** | −2.33 | 0.003 | *** |

| ln DPs | β1 | 0.31 | 0.06 | <0.001 | *** | 0.31 | <0.001 | *** |

| ln Total specific costs | β2 | 0.13 | 0.06 | 0.023 | ** | 0.11 | 0.089 | * |

| Crop output share in total output | β3 | 0.59 | 0.29 | 0.042 | ** | 0.6 | 0.043 | ** |

| ln UAA | β4 | −0.25 | 0.19 | 0.187 | 0.08 | 0.61 | ||

| ln Fixed capital per worker | β5 | 0.2 | 0.07 | 0.004 | *** | 0.21 | 0.008 | *** |

| ln Average fixed capital per worker | β6 | 0.37 | 0.08 | <0.001 | *** | |||

| ln Average UAA | β7 | 0.12 | 0.14 | 0.396 | ||||

| Average Crop output share in total output | β8 | 0.05 | 0.8 | 0.954 | ||||

| Observations: 401 Robust (HAC) standard errors | R2 = 0.83 | R2 = 0.72 | ||||||

| Dependent Variable: Wages | Coefficient | Std. Error | p-Value | Significance | |

|---|---|---|---|---|---|

| Const | β0 | 2.86 | 0.86 | 0.003 | *** |

| ln DPs | β1 | 0.03 | 0.05 | 0.584 | |

| ln Net earnings in a country (total NACE) | β2 | 0.53 | 0.11 | <0.001 | *** |

| ln Labor productivity | β3 | 0.12 | 0.06 | 0.047 | ** |

| ln Total unemployment | β4 | −0.01 | 0.02 | 0.469 | |

| Function | Average Score | St. Dev. | Local Weights | Global Weights | ||

|---|---|---|---|---|---|---|

| Agricultural Functions | ||||||

| Production of affordable food and other bio-based resources (P) | 4.89 | 0.33 | ω1 | 0.4 | ||

| Assurance of farm viability (V) | 4 | 1 | ω2 | 0.32 | ||

| Creation and maintenance of decent jobs (E) | 3.44 | 0.73 | ω3 | 0.28 | ||

| Indicators | ||||||

| Agricultural goods output | 4.44 | 0.53 | 0.49 | 0.19 | ||

| Ratio of the retail prices of food | 4.67 | 0.5 | 0.51 | 0.2 | ||

| to the retail prices of all consumption goods (–) | ||||||

| Farm Profitability (subsidies included) | 4 | 1.32 | 0.32 | 0.1 | ||

| Farm efficiency (subsidies excluded) (–) | 4.5 | 0.76 | 0.36 | 0.12 | ||

| Farm Solvency (–) | 4 | 0.5 | 0.32 | 0.1 | ||

| Salaried employment | 3.11 | 0.93 | 0.26 | 0.07 | ||

| Labor productivity | 4.22 | 0.97 | 0.36 | 0.1 | ||

| Wages for agricultural employees | 4.56 | 0.53 | 0.38 | 0.11 | ||

| Index/Subindices | Key Function | Value |

|---|---|---|

| DPII | 0.37% | |

| DPIIproduction | Delivery of affordable food and other bio-based resources | −0.34% |

| DPIIfarm_viabilityn | Assurance of farm viability | 0.97% |

| DPIIjobs | Creation and maintenance of decent jobs | 0.68% |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Žičkienė, A.; Melnikienė, R.; Morkūnas, M.; Volkov, A. CAP Direct Payments and Economic Resilience of Agriculture: Impact Assessment. Sustainability 2022, 14, 10546. https://doi.org/10.3390/su141710546

Žičkienė A, Melnikienė R, Morkūnas M, Volkov A. CAP Direct Payments and Economic Resilience of Agriculture: Impact Assessment. Sustainability. 2022; 14(17):10546. https://doi.org/10.3390/su141710546

Chicago/Turabian StyleŽičkienė, Agnė, Rasa Melnikienė, Mangirdas Morkūnas, and Artiom Volkov. 2022. "CAP Direct Payments and Economic Resilience of Agriculture: Impact Assessment" Sustainability 14, no. 17: 10546. https://doi.org/10.3390/su141710546

APA StyleŽičkienė, A., Melnikienė, R., Morkūnas, M., & Volkov, A. (2022). CAP Direct Payments and Economic Resilience of Agriculture: Impact Assessment. Sustainability, 14(17), 10546. https://doi.org/10.3390/su141710546