Abstract

In this study, we examine whether social and corporate values are improved in firms conducting CSV (Creating Shared Value) activities in Japan, as well as determining the factors affecting such improvement. A total of 218 firms were selected from those conducting CSV activities in the manufacturing industry from 2019 to 2021, according to Toyo Keizai data. The following key results were obtained: first, CSV activities increase social value, but do not improve short-term financial performance. Second, the effects on financial performance and factors affecting the improvement of social values vary from sector to sector. Third, changes in sales is a common factor affecting performance. Fourth, communication strategies for the implementation of CSV activities differ between material and assembly industries; for example, materiality plays an important role for human resource utilization in material sectors, while in-house branding plays an important role in assembly sectors. Our research findings contribute to the understanding of the need to take different measures to improve social value among different sectors of the manufacturing industry.

1. Introduction

Since the introduction of the CSV concept in 2011 by Porter and Kramer [1], use of the concept in management and marketing situations has steadily increased [2]. This CSV is of great significance among global companies with global supply chains for the following reasons. In fact, understanding how to manage risks arising from changes in the external environment, such as political risks and countermeasures against new viruses, is becoming increasingly important for these companies. In Japanese companies, the importance of increasing resilience in procurement and production as part of their BCP has been increasing since the Great East Japan Earthquake. Since responding to changes in external issues here means solving social issues, it is of great significance to consider how to implement risk response in the form of CSV in the organization. For example, Iris Ohyama considers the establishment of a supply system for masks as a CSV business in order to counter the new virus, and began production last year [3].

Looking at the number of firms that use materials from Toyo Keizai data, an increasing trend can be observed. While there were 321 firms implementing CSV activities in 2017, by 2021 this number had increased to 584, accounting for about 52% of surveyed firms [4]. While the concept has gained increasing attention in various industries, early discussions at academic conferences were critical of the concept (Crane et al., 2014; Strand and Freeman, 2015 [5,6]). However, in recent years, a common understanding has been reached, in that this concept enables companies to realize economic value through the resolution of social issues (Moon et al., 2011; Pfitzer et al., 2013; Lopez, 2020 [7,8,9]).

Accordingly, determining how to evaluate and implement activities to increase corporate value has become increasingly important. Looking at the development of previous research, not only has there been little empirical research, but hardly any analysis frameworks have been presented. Even though some researchers have attempted to extend the CSV framework (de los Reyes et al., 2017; Moon et al., 2011 [7,10]), and others have gathered empirical evidence of means to enable the creation of shared value (Alberti and Belfanti, 2019; Jackson and Limbrick, 2019 [11,12]), few studies have dealt with the effects of the CSV activities of Japanese firms. Furthermore, fundamental issues, such as how companies can realize the creation of shared value or the roles of internal and external elements in the success of corporate CSV activities, have not yet been clarified (Mengher and Daood, 2021 [13]).

In this research, we present an integrated approach based on stakeholder theory and resource dependence theory, and set variables from three aspects: company profiles, product strategy, and communication strategy. One of the characteristics of this research is that we analyze the impacts of these variables not only on corporate value but also on social value. In this line, previous studies have reported that CSV activity is correlated with financial performance, although these studies have only covered the service industry, and the manufacturing industry may present different results. For example, changing the allocation of management resources as a measure to improve social value, through such means as corporate governance reform and personnel policy reform in conjunction with the implementation of activities, will involve a short-term cost and may not lead to short-term performance improvement, instead contributing to long-term performance. Furthermore, different industries have different attitudes toward profits, activities, and target stakeholders in CSV activities, which may affect the differences in performance among different industries.

Therefore, the purpose of this study is to verify two key hypotheses: one considers whether short-term performance can be improved through CSV activities, while the other relates to how social and corporate values are changed as a result of CSV activities, depending on the industry. As a result of our analysis, we found that, although improvements in social value indicators were observed as a result of CSV activities, short-term increases in corporate value were not recognized, and there were differences in performance improvement, depending on the industry. It is clear that, in the materials industry, the setting of materiality contributes to the improvement effect of social value indicators, such as the utilization of human resources; meanwhile, in the assembly industry, internal utilization contributes to this aspect.

As an academic contribution of this research, we clarify the influence of CSV activities of Japanese companies on factors that lead to the success of CSV activities in each industry, especially the type of communication strategy, in order to provide information to help such companies obtain long-term profits.

2. Previous Research

2.1. Development of Previous Research: Overview

While early discussions at academic conferences were critical of the CSV concept (Crane et al., 2014; Strand and Freeman, 2015 [5,6]), in recent years there has been a common understanding that it is a novel concept that enables companies to realize economic value through the resolution of social issues (Moon et al., 2011; Pfitzer et al., 2013; Lopez, 2020 [7,8,9]). Initially, CSV activities were presented as a new concept aimed at balancing social and corporate issues and, as few companies in various industries had implemented them, many early studies focused on what CSV activities are and the conditions required for their adoption. As the number of companies implementing CSV continues to increase and the concept spreads, it is becoming more important to evaluate and implement activities in order to increase corporate value. Furthermore, in recent years, through case studies, the number of analyses focusing on how to gain a competitive advantage by conducting CSV activities has begun to increase. However, such studies have only just begun and, as described below, many issues remain unsolved.

2.2. External Factors Leading to CSV Activities

State institutions (Spicer and Hyatt, 2017 [14]; Strand and Freeman, 2015 [6]), the approaches of competitors (Cao et al., 2019 [15]), and the behavior of customers (Kim et al., 2020; Vogel, 2005 [16,17]) have been pointed out as external factors encouraging companies to adopt CSV activities. First, state institutions (e.g., the country’s legal body) are considered to affect the behavior of the firms. Crane, 2013 [5] pointed out that firms generally have done enormous damage by practicing unethical and illegal activities all over the world, and such bad practices are more prevalent in under-developed countries where state institutions are weak. Second, the policies and strategies of peer firms have an enormous impact on corporate strategies and activities and, if CSR or CSV creates a competitive edge, its advantage should mostly manifest through a firm’s competition with other firms (Cao et al., 2019 [15]). Third, another external factor that could influence a company to be more responsible is customer behavior. Extant research has shown that consumers prefer to buy from socially responsible companies (Vogel, 2005 [17]). In addition, advocates of CSV believe in helping companies by making them understand that solving social problems does not lead to negative profits, and that increasing profits is the most suitable way to solve social problems (Pfitzer et al., 2013: Porter and Kramer, 2011 [1,8]).

2.3. Effects of CSV Activities

As for the effects of CSV activities, not only has there been little empirical research but very few frameworks for analysis have been presented. Some researchers have attempted to extend the CSV framework (de los Reyes et al., 2017; Moon et al., 2011 [7,10]), while others have gathered empirical evidence regarding the means to enable the creation of shared value (Alberti and Belfanti, 2019 [11]; Jackson and Limbrick, 2019 [12]); however, most of the verification determined by conventional studies has focused on financial performance, and there are very few studies which have verified the improvement of social value and clarified the associated factors [18].

2.3.1. Financial Performance

In previous studies, the effects of CSV activities have been analyzed by focusing on their relationship with financial performance, and the results of studies targeting overseas firms have confirmed that there exists a correlation between the implementation of such activities and financial performance. For example, Fernandez-Gamez et al., 2019 [19] analyzed the correlation between the existence of CSV activities and financial performance using data from the hotel industry, and they confirmed the correlation between the two. Jones, 2018 [20] also analyzed the relationship between CSV surrogate variables and financial performance (e.g., cash flow and bankruptcy risk) using Granger causality tests. The results indicated that firms with better financial performance are more likely to conduct CSV activities than focus on achieving higher financial performance.

2.3.2. Social Value

On the other hand, regarding the relationship with social value, although the correlation with financial performance has been analyzed in CSR (Corporate Social Responsibility) activities (see, e.g., Cochran and Wood, 1984 [21]), little analysis has been conducted with respect to CSV activities. In 2019, Takata and Ohno conducted a survey of Japanese CSV implementation firms, asked about the social value indicators they were measuring, and measured whether each indicator was effective. According to the results of their study, in firms that set and measure specific social value indicators, the effect is seen in their activities. However, the number of samples was small, and the social values that were adopted varied from firm to firm, so their findings were insufficient for statistical verification. In 2022 Takata and Ohno [18] analyzed the correlations between social value scores and those between the direct effects of CSV activities and the social value score. Although a correlation between social value scores was observed, the correlations between direct effects and social value scores were low. This suggests that the effects of CSV activities on the sale of existing and new products and on social value may differ, and may be influenced by differences among companies.

2.4. Driver of Success by CSV Activities

Next, we consider research not only on general effects but also on what types of CSV activities create corporate value, as well as which factors are vital for the success of CSV activities. In this regard, the existing literature is not yet sufficient.

Among the studies focusing on the influence of differences in CSV activity contents on their effects, some have considered which activities improve corporate value by applying the three classifications of Porter and Kremer (Jackson and Limbrick, 2019 [12]; Spitzeck and Chapman, 2012 [22]); however, there is no evidence for these classifications in the case of Japanese companies, so they need to be verified.

In addition, Benedikt, [23] through a previous research survey, stated that differences in target markets (in developing or developed countries), the size of the enterprise, degree of integration into corporate strategies, and differences in target industries affect the performance of CSV activities. To some extent, these points require consideration of the impact of corporate profiles.

Furthermore, some studies have attempted to extract internal factors as success factors through detailed analyses of successful CSV activities, although through case studies. For example, Porter et al. [24] listed the following elements in this respect: identifying social issues, commercializing social issues, achieving both corporate value and social value, and evaluating results. In addition, other research has pointed out that strategy timeliness (Bergquist and Lindmark, 2016 [25]), visionary leadership (Spicer and Hyatt, 2017 [14]; Vaidyanathan and Scott, 2012 [26]), and cognitive capabilities (Corner and Pavlovich, 2016 [27]; Lee, 2019 [28]) are vital for the generation of corporate value through CSV activities. It has also been noted that it is important to carry out appropriate evaluations when implementing activities and running the PDCA cycle (Kumar and Banke-Thomas, 2016 [29]; Grainger-Brown and Malekpour, 2019 [30]). While this study cannot address many of these internal factors, as we examine them from information available from open data sources, their importance must be considered.

3. Research Subject, Methods, and Development of Hypotheses

3.1. Theoretical Background

From the above, it can be seen that there are still points that have been scantly addressed in previous research on CSV activities. One is that the effects on social value have not been analyzed, and the other is that the factors that contribute to the difference in the performance impact of activities have not been sufficiently verified. In order to overcome these problems, two hypotheses were constructed from an integrated approach considering resource dependence theory and stakeholder theory. As resource dependence theory has a slight weakness in terms of how providing resources can lead to the success of firms (Branco and Rodrigues, 2006 [31]), we believe that we can analyze which kind of CSV activities create corporate value for various kinds of stakeholders by integrating these two approaches.

Through CSV activities, stakeholders not only actively support a company’s business objectives, products, and services, but also provide resources and are involved in the process of creating social value (Corporate and Social Forum, 2013 [32]). In order to implement and continue CSV activities, firms also invest in organizations through such means as corporate governance and utilization of human resources. For this reason, CSV activities can improve social and corporate value; however, in the short term the cost of providing resources must come first.

In addition, differences in the content of CSV activities by industry can be explained, to a certain extent, in terms of the availability of management resources. For example, compared to product-related CSV activities, CSV activities related to the value chain often indirectly invest management resources to raise the income of suppliers and others, and investment in product development, production, and sales is considered to be small. As the ratio of product- to value chain-related CSV activities differs depending on the industry, these differences are thought to create differences in the impact on corporate value.

Second, the effectiveness of CSV activities also affects how stakeholders perceive and take an interest in them. A company’s CSV activities function as signals to each stakeholder, through communication and other means, which improve the company’s reputation and image, thereby improving business performance.

Many scholars believe that cognitive capabilities play a vital role in creating shared value (Corner and Pavlovich, 2016 [27]; Lee, 2019 [28]) and that interactions have important significance in its formation. When interactions with stakeholders are promoted through investments in corporate governance, utilization of human resources, etc., the enhancement of corporate image is expected to lead to higher corporate value over the long term, for example by fostering employee awareness to make it easier to create interactions and reforming corporate governance. In addition, the affected stakeholders also have different characteristics, depending on the industry, such as general consumers and business partners. In other words, the communication strategy differs greatly between BtoB (Business to Business) and BtoC approaches. However, it is difficult to strictly distinguish between BtoB and BtoC for each company and, as many companies handle both BtoB and BtoC, industry categories based on goods classification are considered in this study. In other words, the industrial categories of lifestyle-related industries, assembly industries, and materials industries, in that order, are closer to consumers, and differences in communication strategies and activities are expected to affect their performance. In this way, the impact on corporate value through CSV activities, which lead to the following two hypotheses, can be best explained through an integrated approach based on resource dependence theory and stakeholder theory.

3.2. Study Framework

From previous research, it can be asserted that CSV investments have a positive relationship with financial performance. For example, Fernández-Gámez et al. [18] showed that hotels that invest in socially responsible initiatives can generate a shared value between tourism firms and their stakeholders, which has a positive impact on financial performance. However, belonging to a group had a moderating effect, which tended to strengthen the association between CSV activities and financial performance. In other words, the effects of CSV were independent of hotel size, market segment, and star rating, recognizing that the outcomes of CSV strategies do not depend on the characteristics of their establishments alone, as the positive effects of CSV strategies have been verified in all of the organizational environments of the hotel industry.

To the contrary, as our sample comprised manufacturing industries, different results may be shown. As we assume that commercializing the development of products takes a long time, when CSV activities related to R&D are carried out these activities may not generate short-term profits.

Furthermore, among Japanese firms, there are many CSV activities that are conducted for purposes other than profit, such as donations (Takata and Ohno, 2021 [33]).

Through their activities, Japanese firms tend to invest in corporate governance and personnel system reforms; these investments will generate long-term profits, but not short-term profits. Therefore, the following hypothesis was derived.

Hypothesis 1.

CSV activities by Japanese firms do not contribute to short-term financial performance, but have an improving effect on social value indicators.

Next, as Benedikt argued, each industry differs in terms of what Porter and Kramer [1] denoted as the three categories of CSV activities that firms are likely to apply. As the effect of each activity differs depending on whether its content is related to the product or the value chain, it is considered that CSV related to products and CSV related to value chains differ in terms of the resources provided by companies and stakeholders. Differences in these classification ratios by industry sector will manifest as differences in the impact on corporate and social values through resource contributions.

Secondly, we assume that communication strategies differ between the material industry—where BtoB (Business to Business) elements are strong—and in assembly and lifestyle-related industries—where BtoC (Business to Consumers) elements are strong.

This may lead to differences in how stakeholders perceive activities, which may affect the reputation of the company by stakeholders and manifest as differences in the impact on corporate value and other factors. In this regard, Takata and Ohno [33] pointed out that the purposes of activities also differ depending on the industry, as well as the ratio of attitudes toward profits (e.g., whether certain activities are making sufficient profits or are regarded as future business opportunities). Of course, different attitudes toward profit not only lead to differences in financial performance, but also differences in the impact on investments to improve social value (e.g., reforming human resource systems and corporate governance), depending on whether the activity is viewed as a long- or short-term investment. This leads to the following hypothesis:

Hypothesis 2.

Corporate value, social value, and factors that influence them differ, depending on the manufacturing sector.

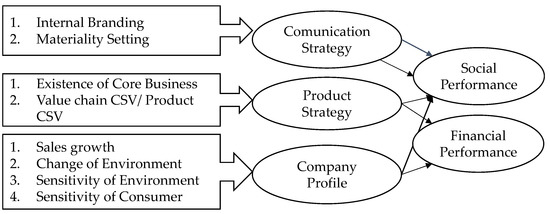

In this study, we focus on three factors (See Figure 1): relationship with the management strategy (in terms of product strategy and communication strategy), the company profile, and the influence of the differences between industries. As the targets of CSV activities by Japanese firms are mainly for Japanese markets [18], we assume that the influence of these factors is larger than that of the market differences.

Figure 1.

Study framework.

In terms of the company profile, the environmental factors of industries and enterprises are taken into account by considering the sales growth and changes in the environment. By considering the growth potential of sales, it is possible to consider the size of the enterprise while taking into account the latest changes in sales. The latest sales growth rate is correlated with an improvement in business performance and, if the growth potential of a firm is high, then the ROA change value is also expected to be high. Furthermore, by considering the fluctuation of sales in the industry, it is possible to consider the business environment differences in the industry. If the environment changes greatly, it is assumed that it will exert pressure on firms to change, thus leading to changes in corporate governance that improve social value, as well as affecting corporate performance. In addition, environmental sensitivity is a dichotomous variable that can be used to identify firms whose activities involve higher environmental risk (Branco and Rodrigues, 2000 [30]). Firms operating in the chemical, paper, and steel areas are assigned a value of 1, while other firms assume a value of 0 for this variable. Furthermore, to distinguish sensitivity to consumers, BtoB and BtoC were distinguished within industries, with BtoC being 1 and BtoB being 0.

Regarding the product strategy, we focus on the existence of core business and the classification of Porter and Kramer [1]. First, we consider diversification by focusing on the presence of core businesses. We assume that with a core business, the degree to which the product’s business environment affects corporate performance is significant, and consumers are expected to infer whether a company is serious about its activities based on whether the CSV activities are related to its core business. Second, we consider how Porter and Kramer defined CSV activities as activities organized for three purposes—products, value chains, and cluster creation—and how these have positive influences on social and organizational benefits. Among activities, few fall under the category of cluster creation. Compared to the impact of CSV activities related to products, CSV activities related to the value chain require a certain period of time to lead to improvements in profitability, such that profitability is unlikely to be affected in the short term. Takata and Ohno also pointed out that the closer the activity is to the business, the higher the importance of corporate value [33].

Regarding the communication strategy, we analyze the relationship between materiality and internal communication. Materiality denotes important issues related to firms and, by evaluating and prioritizing the degree of impact of corporate activities on social issues, the manner in which important firms recognize each issue can be made clear. In addition, it is thought that sharing CSR activities within firms and developing employees with specialized knowledge makes it easier to improve corporate profits, even if the CSV activities are implemented in specific departments and external communication and materiality are set up. From this point of view, we consider internal branding elements.

Furthermore, we distinguish between CSV activities related to products and those related to the value chain, as the effects on financial performance and social value differ according to the type of strategy. We consider three industrial categories—assembly industry, material industry, and lifestyle-related industry—and analyze the factors for each.

3.3. Research Methods

3.3.1. Data

We obtained data on Japanese firms from the CSR Firms Directory, which is based on a survey conducted by Toyo Keizai carried out from June to October 2018. We only chose firms from the manufacturing industry who indicated that CSV activities were continuously carried out from 2019 to 2021. This criterion limited our sample to the manufacturing industry and large-sized firms. Table 1 below shows the composition of the industries sampled among these large manufacturing firms. The size of an enterprise has been suggested to have an effect on activity; however, although large firms possess more opportunities than small enterprises, small enterprises possess unique possibilities through the depth and range of their relationships within the local community.

Table 1.

Data summary.

3.3.2. Variables

As explanatory variables, we used social value data based on a survey conducted in 2018–2020, as well as financial data collected from the fiscal year ending on 31 March 2018 and that ending on 31 March 2020, in order to account for the fact that the number of firms conducting CSV activities has increased since 2017 [4] and that, in 2021, many industries were in a special situation in which their performance decreased due to the effects of the COVID-19 pandemic. As a social value index, survey data acquired by the Toyo Keizai provides a common index among firms. This index has a strong tendency to indicate the presence or absence of social efforts. As it considers a wide range of CSV-implementing firms and has a high recovery rate, its reliability as a data source has been recognized.

As a control variable, we used the material setting variable from the Toyo Keizai data, as well as sales growth data and environmental changes data calculated using the index from the Nikkei value obtained from search data. For environmental changes, we calculated the coefficient of variation (average of industrial sales/standard deviation of industrial sales) with reference to Horiuchi [34] while, for sales growth, we took the average sales growth rates from 2018 to 2019 and from 2019 to 2020.

Table 2 compares sales changes from 2018 to 2020 and shows whether the growth rate was positive or negative for each industrial sector. It can be seen that 60% of companies showed positive values in the assembly and lifestyle-related industries, while a large proportion of companies showed negative values in the materials industry.

Table 2.

Descriptive statistics of Change of Sales variable.

Additionally, we defined the existence of core business as when a firm has a main business with a 75% share, according to Kaisha Shikiho [35]. CSV activities for products and for the value chain were identified by choosing CSV activities related to products and activities related to the value chain from text data from Toyo Keizai, based on the criteria presented in Table 3.

Table 3.

Criteria for products and value chain CSV activities.

The descriptive statistics of the variables are provided in Table 4. In the assembly industry, there were many examples of product-related CSV activities, mainly in the development of products that respond to environmental impacts. Common to all industries, almost 90% of companies presented a materiality setting. Next, with regard to internal communication, there was a tendency for initiatives to progress more in the assembly industry. Finally, for the core business variable, the material industry was diverse, and there was a higher concentration of core businesses in the lifestyle-related industry.

Table 4.

Descriptive statistics of variables.

Table 5 shows the correlation matrix of explanatory variables, from which it can be seen that there was generally no significant correlation between the variables and therefore there was no particular need to consider interaction terms in the following analysis.

Table 5.

Correlation matrix of variables.

3.3.3. Methodology

First, we conducted a one-sample t-test to confirm whether the changes in the social value index and ROA (Return on Asset) were significant. Then, we examined the factors using regression analysis. When performing regression analysis using the ROA as an explained variable, it is difficult to estimate when using OLS (Ordinary Least Squares) regression, as the rate of return varies widely among industries and firms. When the explanatory variables are the same but the performance is different, depending on the group considered, it may be reasonable to apply a random intercept model in multi-level analysis.

Here, we define the groups as the three industries—the materials industry, the assembly industry, and the lifestyle-related industry—and assume that the performance changes, depending on the group. With reference to Branco and Rodrigues [31] after performing the intra-class variance test using White’s test, the sales change value—which is the explanatory variable—and the ROA—which is the explained variable—are centralized by the overall average. Then, we performed the multi-level analysis.

3.4. Multi-Level Analysis

If the dependent variable of case i belonging to group j is , the independent variable is , and the error is , the intercept and regression coefficient common to group j can be written as follows:

where the coefficients are the intercept and regression coefficients common to group j, which are called the fixed effects. Next, a model is used to express that these are probabilistically scattered in each group, centered on a certain value:

where is the overall average of (i.e., the intercept), represents the error for each group, represents the overall average of the slope, and denotes the error for each group. Furthermore, by replacing the overall mean with the intercept of the group (i.e., ), the regression coefficient for each group (i.e., ), and the independent variable, , the final regression equation can be written as follows:

The parts in parentheses in the equation are elements of random effects, which differ from group to group.

3.5. Regression Model

Based on the conceptual diagrams and research methods discussed in Section 3.1, Section 3.2 and Section 3.3, the following regression models are presented as verification models. From the methodological point of view of empirical analysis, the elements observed in almost all of the firms in the target sample were not adopted as variables, even if they were closely related to CSV activities; for example, a management philosophy that leads to improved corporate value in the medium- to long-term, making it an important element for CSV activities, was established in 94.5% of the manufacturing industry samples in the CSR survey.

Similarly, risk management efforts are also related to the materiality setting and are closely related to CSV activities, but 87.9% of the CSR survey samples in the manufacturing industry reported building a risk management system. Furthermore, 84.2% of the firms had implemented a basic policy and, if the firms implementing this CSV activity are used in the sample, then the ratio will be even higher [4].

Equations (1)–(3) are regression equations that use the change values of human resource utilization, corporate governance, and sociality scores, respectively, which are social evaluation values for which the change values are significant as explanatory variables. In Equations (1–3), CHSL denotes the corporate growth rate YOY between 2019 and 2021; CHEV is the coefficient of variation of the industrial average of sales (average of industrial sales/the standard deviation of industrial sales); PROD and VALUE are dummy variables, which take a value of 1 if the contents of CSV activities correspond to CSV activities related to products and the value chain, respectively; CORE is a dummy variable, which takes a value of 1 if there is a main business with a 75% share (i.e., a core business); MATER is a dummy variable, which takes a value of 1 if a firm has materiality; INTBR is a dummy variable, which takes a value of 1 if firms conduct training related to the SDGs or if information on the SDGs and sustainability is shared internally; EVSEN indicates industries with a high sensitivity to environmental initiatives (paper-, steel-, and chemical-related industries fall into this category; if a respondent falls into one of these industries, it takes the value of 1; otherwise, it takes the value of 0); COSEN represents the sensitivity to consumers, and after observing the business composition, we took 1 for BtoC (Business to Consumer) firms and 0 for BtoB (Business to Business) firms. HMSC, CGSC, and SCSC represent the figures for human resource utilization, corporate governance, and sociality scores in 2019, respectively.

Equation (4) is a regression equation in which the change of ROA value is used as an explanatory variable.

4. Empirical Results

4.1. Changes in Social Evaluation Values

Table 6 compares the 2019 and 2021 scores for all of the manufacturing industries and shows that the changes in the sociality, corporate governance, and human resource utilization scores were positive and significant at the 1% level. In particular, the utilization of human resources and sociality scores improved by more than 2 points on average, and the range of improvement was large. On the other hand, the change in environmental score showed a negative value. This is thought to be due to the fact that there was little room for new activities and other initiatives to be carried out in advance, as initiatives such as environmental accounting were carried out in advance, before CSV activities began to be considered by many manufacturers.

Table 6.

Social value changes (2021–2019).

4.2. Changes in Industry-Adjusted ROA (Return on Assets; Based on Operating Income)

The indicator in Table 7 below shows the average industry-adjusted ROA for 2019 and 2020 minus the 2018 indicator. From the results presented in the Table 7, it can be seen that the change in ROA value across all the industries had a slightly negative value (−0.08%), although this change was not significant, such that no overall improvement in performance was observed.

Table 7.

Change in industry-adjusted ROA values.

However, if we observe the changes by sector, differences can be observed. In the assembly industry, a negative and significant result of −0.06% was achieved; meanwhile, in the materials industry, a slightly positive value at 0.37% is observed. Furthermore, in the lifestyle-related industry, the improvement effect demonstrated a relatively high rate. In other words, in the three years leading up to 2020, social initiatives such as the implementation of activities in lifestyle-related industries led to improved performance, while the assembly industry did not see short-term financial improvement.

4.3. Analysis of Factors of Social Value Improvement

The possible existence of multicollinearity was tested, based on the correlation matrix, by incorporating all of the independent variables and computing the variance inflation factor (VIF). As can be seen from Table 8, as the range of improvement was small in firms that already used human resources in 2019, the coefficient of the change value was negative. A correlation between improved sociality scores in the assembly industry and improved corporate governance scores in the material industry and the assembly industry was observed. This indicates that the firms implementing CSV activities in these industries were working on governance and human resource utilization simultaneously. It was also demonstrated that the relationship with the change value in sales had a significantly negative effect on the assembly industry. This shows that reforming human resources and corporate governance is more of a restructuring (rather than a corporate growth) strategy. In addition, as environmental changes have a positive impact on the assembly industry, it can be said that the larger the change in the business environment of an industry, the more firms are encouraged to use human resources as a source of external pressure. Finally, in the materials industry, firms with high sensitivity to consumers show a significantly positive effect on human resource utilization, while a negative effect is observed in the assembly industry. In BtoC companies in the materials industry, direct customers are stakeholders, and it can be read that the stakeholders and the company set common challenges to social issues, align organizational goals with stakeholder goals, and simultaneously implement initiatives to increase customer value and employee value.

Table 8.

Human resource utilization and dependent variables.

In Table 9 the negative impact of the 2019 corporate governance score can be seen in terms of the change of corporate governance. This is because, when efforts are made before implementation, and human resources are used, little room is left for improvement. Next, in the assembly- and lifestyle-related industries, materiality setting had a significantly positive effect on the change in corporate governance value; on the other hand, internal branding had a significantly positive effect on material industries. This is in opposition to the impact on the utilization of human resources, and it has become clear that the efforts to position social issues as corporate strategies differ from sector to sector, in terms of whether they involve governance reform or soft measures such as human resource utilization.

Table 9.

Corporate governance and dependent variables.

Table 10 shows the relationship between sociality. From this table, it can be seen that the material industry showed a positive impact on improving corporate governance while, in lifestyle-related industries, a negative impact was observed. This suggests that activities in lifestyle-related industries that have a strong social strategy element may not be linked to corporate governance reforms.

Table 10.

Sociality and dependent variables.

When using sociality as an explanatory variable in the regression analysis there was no significant coefficient; however, it was confirmed that materiality had a significantly positive influence on life-related industries, and that CSV activities related to the value chain had a positive influence on material industries. In the assembly industry, CSV activities such as the development of products leading to a reduced environmental impact are often introduced as activities related to products and, in order to achieve both social value and corporate value through such activities, social value tends to be improved by implementing product-related CSV activities, rather than CSV activities related to the value chain. On the other hand, in the material industry, efforts aimed at realizing social value are often carried out through CSV activities such as raw material procurement and waste recycling, and it seems that this has led to improved social value indicators through CSV activities related to the value chain.

4.4. Analysis of Factors Affecting Improvement of ROA

As a result of the White test for variance, differences were found between the groups, confirming the validity of applying multi-level analysis. Table 11 shows the results of fixed and variable effects from the multilevel analysis. In terms of the fixed effects, changes in sales resulted in a significantly positive improvement in ROA after the implementation of CSV activities. Based on this, it can be said that high levels of improvement in ROA value were observed among firms that had higher growth potential, compared to the industrial average. Furthermore, when the effect of variation was taken into account, the large inter-group variance demonstrated the sensibility of applying multi-level analysis; it should be noted that the error was significant at the 1% level.

Table 11.

ROA and variables determined by multi-level analysis.

As can be seen from Table 12, although the model was not significant in the life-related industry, the model became significant in the assembly and material industries. Table 9 shows that the changes in sales observed for these two models presented a significantly positive effect at the 5% level, where the materiality setting showed a significantly positive effect in the assembly industry. We assume that corporate growth is expected to contribute to the improvement of corporate profits. On the other hand, there were also results indicating that corporate growth does not lead to social value improvement (Table 6), such that it can be inferred that social value improvement and corporate profit improvement may not necessarily be established at the same time.

Table 12.

ROA and dependent variables.

Although the change in ROA value was negative for the assembly industry as a whole, as materiality showed a positive effect it can be hypothesized that a certain effect was seen in firms that positioned the social strategy as a firm-wide strategy.

5. Concluding Remarks

In this study, we examined the effects of CSV activities in the manufacturing industry among Japanese listed companies, focusing on social value and corporate value. We reached two main conclusions: first, CSV activities contribute to long-term effects, in terms of increased social value, but do not contribute to short-term improvements to financial performance. Second, the factors that contribute to the improvement of social value vary by industry, and the impacts of communication strategies, internal education, external information disclosure, the sensitivity of the consumer, and the establishment of materiality differ.

5.1. Theoretical Implications

According to the German media literature, the term sustainability, which is also emphasized in the supply chain and elsewhere, is used frequently, especially in the context of food and the environment [36]. Many companies in these industries are implementing CSV activities. This study shows that it is not enough for these companies to be sensitive to the external environment and consumers in order to add value to their activities, but that they need to communicate a unified message externally and implement it internally. More specifically, the following points were made.

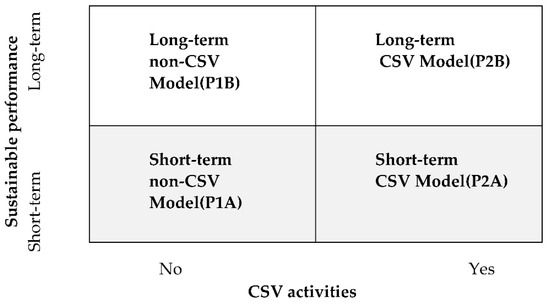

According to Kang and Na, CSV activities create value for both consumers and firms, but it is not clear how co-creation between consumers and firms leads to competitive advantage, nor has it been verified by a large sample whether it actually creates value. The resource dependence theory and the stakeholder theory have some explanatory power for the former argument. Based on the results of the analysis, and the differences between companies implementing CSV activities and those not implementing CSV activities, as shown in Takata and Ohno, companies can be classified into four quadrants (Figure 2). Based on our findings, we make suggestions based on those two axes.

Figure 2.

The different types in CSV activities and sustainable performance.

The first and second patterns are the short-term non-CSV Model (P1A) and long-term non-CSV Model (P1B), which represent business model patterns that do not include CSV activities. To evaluate successful firms, Park and Hong [37] combined measures of longevity with metrics of economic performance, such as the growth rate, innovativeness, sales, profitability, the time it takes for a firm to break even, and surplus. They showed that long-lasting firms pursue goals beyond profit and prioritize human capital, abilities, and knowledge over financial capital. In summary, we anticipate that the performance of the long-term non-CSV model is more sustainable than that of the short-term non-CSV model, when CSV activities are excluded.

Therefore, we posit:

Proposition 1.

The sustainable performance of the long-term non-CSV model seems to have a higher added value than that of the short-term non-CSV model.

The third and fourth patterns are the short-term CSV model (P2A) and the long-term CSV model (P2B), which indicate the types of firms implementing CSV activities. As shown by the analysis in our study, CSV investments have a positive influence on long-term performance but present no relationship with short-term performance.

Thus, as proposed above, we posit:

Proposition 2.

The sustainable performance of the long-term CSV model seems to have a higher added value than that of the short-term CSV model.

From the viewpoint of resource dependence, it can be said that Japanese companies may attempt to improve long-term corporate value by allocating management resources to investments for the improvement of social value indicators such as corporate governance and utilization of human resources; meanwhile, from the viewpoint of stakeholder theory, it can be seen that these activities provide value directly to stakeholders, rather than to corporate management, through co-creation mediated by activities and changes within the organization.

Second, by clarifying the significance of CSV related to products and the relationship between performance and social issues common to stakeholders, such as materiality, our research contributes to previous CSV studies, such as those on the CSV ecosystem and CSV in the sharing economy (SE) (Yang and Yan, 2020; Kang and Na, 2020 [38,39]). Co-creation with customers and stakeholders has been described as an important strategy for the long-term growth of a firm (Kang and Na, 2020; Yang and Yan, 2020; Kazadi et al. 2016; Mahr et al., 2014; Prahalad and Ramaswamy, 2002 [38,39,40,41,42]), which was also demonstrated through the results of our study. Kang and Na [38] suggested a research direction that can be approached from the perspective of consumer behavior and social networks, which emphasizes the strategic advantage of the sharing economy. In this study, we succeeded in refining this discussion by showing that communication strategies in collaboration with such stakeholders have different meanings, depending on the industry, especially in the assembly- and lifestyle-related industries. More directly, this study showed that there are differences in the impact on social values between firms that are sensitive to consumers and those whose activities are not.

The fact that this analysis demonstrated what kind of social value will be improved when value co-creation with stakeholders is carried out—mainly with respect to the differences in communication strategies—opens up the possibility of developing integrated approaches based on stakeholder theory and resource dependence theory, which allow for an understanding of how certain type of resources and to whom they are delivered can lead to competitive advantage.

5.2. Managerial Implications

In addition to theoretical implications, this study offers managerial implications. First, the results of our analysis revealed that CSV activity is less likely to lead to short-term financial performance and therefore the following findings can be obtained: firms need to view investments in CSV activities not as short-term profitability measures but instead as long-term performance improvement measures. Thus, they should make long-term, sustainable investments. In addition, in order to promote initiatives for the utilization of human resources in the assembly industry, employee training and sharing social incentives are necessary; meanwhile, in the material industry, it is necessary to determine social issues in the form of materiality.

Furthermore, our results showed that the current efforts for the improvement of social value (e.g., through initiatives for utilizing human resources) are being implemented as restructuring strategies, rather than growth strategies. However, considering the correlation between improved ROA and corporate growth, in order to achieve financial performance through CSV activities, it is necessary to position social strategies within the growth category, not in terms of restructuring.

5.3. Directions for Future Research

As this study examined the effects of social value enhancement and financial performance based on data from the fiscal years 2019–2021, financial performance had been affected by the performance deterioration due to the novel coronavirus, which may have contributed to the lack of short-term effects. As more years pass after the introduction of CSV activities, it will be possible to verify the long-term effects on financial performance.

Author Contributions

Conceptualization, S.T. and Y.W.P.; funding acquisition, S.T. and T.O.; Investigation, S.T. and Y.W.P.; methodology, S.T. and Y.W.P.; project administration, T.O.; resources, S.T.; supervision, T.O.; validation, S.T. and Y.W.P.; visualization, S.T.; writing—original draft, S.T.; writing—review and editing, Y.W.P. and T.O. All authors have read and agreed to the published version of the manuscript.

Funding

This research was partly funded by a research grant from the Nomura Management School.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Porter, M.E.; Kramer, M.R. Creating shared value. Harv. Bus. Rev. 2011, 89, 63–77. [Google Scholar]

- Takashi, F. Innovation Strategy in the CSV Era; First Press: Tokyo, Japan, 2014. [Google Scholar]

- Iris Oyama’s website. Available online: https://www.irisohyama.co.jp/ (accessed on 10 May 2022).

- Toyo Keizai. CSR Firms Yearbook; Toyo Kiezai Shinposha: Tokyo, Japan, 2018. [Google Scholar]

- Crane, A.; Palazzo, G.; Spence, L.J.; Matten, D. Contesting the value of ‘creating shared value’. Calif. Manag. Rev. 2014, 56, 130–153. [Google Scholar] [CrossRef]

- Strand, R.; Freeman, R.E. Scandinavian cooperative advantage: The theory and practice of stakeholder engagement in Scandinavia. J. Bus. Ethics 2015, 127, 65–85. [Google Scholar] [CrossRef]

- Moon, H.C.; Parc, J.; Yim, S.H.; Park, N. An extension of Porter and Kramer’s creating shared value (SV): Reorienting strategies and seeking international cooperation. J. Int. Area Stud. 2011, 18, 49–64. [Google Scholar]

- Pfitzer, M.; Bockstette, V.; Stamp, M. Innovative for shared value. Harv. Bus. Rev. 2013, 91, 100–107. [Google Scholar]

- Lopez, B. Connecting business and sustainable development goals in Spain. Mark. Intell. Plan. 2020, 38, 573–585. [Google Scholar] [CrossRef]

- De los Reyes, G., Jr.; Scholz, M. The limits of the business case for sustainability: Don’t count on ‘Creating Shared Value’ to extinguish corporate destruction. J. Clean. Prod. 2019, 221, 785–794. [Google Scholar] [CrossRef]

- Alberti, F.G.; Belfanti, F. Creating shared value and clusters: The case of an Italian cluster initiative in food waste prevention. Competitiveness Review. Int. Bus. J. 2019, 29, 39–60. [Google Scholar] [CrossRef]

- Jackson, I.; Limbrick, L. Creating shared value in an industrial conurbation: Evidence from the North Staffordshire ceramics cluster. Strateg. Chang. 2019, 28, 133–138. [Google Scholar] [CrossRef]

- Menghwar, P.S.; Daood, A. Crearing shared value: A systematic review, synthesis and integrative perspective. Int. J. Manag. Rev. 2021, 23, 466–485. [Google Scholar] [CrossRef]

- Spicer, A.; Hyatt, D. Walmart’s emergent low-cost sustainable product strategy. Calif. Manag. Rev. 2012, 59, 116–141. [Google Scholar] [CrossRef]

- Cao, J.; Liang, H.; Zhan, X. Peer effects of corporate social responsibility. Manag. Sci. 2019, 65, 5487–5503. [Google Scholar] [CrossRef]

- Kim, S.S.; Baek, W.Y.; Byon, K.K.; Ju, S.B. Creating shared value and fan loyalty in the Korean professional volleyball team. Sustanainability 2020, 12, 7625. [Google Scholar] [CrossRef]

- Vogel, D. The Market for Virtue: The Potential and Limits of Corporate Social Responsibility; Brookings Institution Press: Washington, DC, USA, 2005. [Google Scholar]

- Shinya, T.; Takahiro, O. The Proposal about measurement method for effect of CSV activities conducted in Japanese firms- the patterns of co-creation with stakeholders and direct and indirect effects of CSV activities. J. Jpn. Soc. Bus. Ethics 2022, 29, 69–83. [Google Scholar]

- Fernandez-Gamez, M.A.; Gutierrez-Ruiz, A.M.; Becerra-Vicario, R.; Ruiz-Palomo, D. The Effects of Creating Shared Value on the Hotel Performance. Sustainability 2019, 11, 1784. [Google Scholar] [CrossRef]

- Jones, S.; Wright, C. Fashion or future: Does creating shared value pay? Account. Financ. 2018, 58, 1111–1139. [Google Scholar] [CrossRef]

- Cochran, P.L.; Wood, R.A. Corporate Social Responsibility and Financial Performance. Acad. Manag. J. 1984, 27, 42–56. [Google Scholar]

- Sptzeck, H.; Chapman, S. Creating shared value as a differentiation strategy: The example of BASF in Brazil. Corporate Governance. Int. J. Bus. Soc. 2012, 12, 419–513. [Google Scholar]

- Von Liel, B. Creating Shared Value as Future Factor of Competition; Springer: Mǘnchen, Germany, 2016. [Google Scholar]

- Porter, M.E.; Hills, G.; Pfitzer, M.; Patscheke, S.; Hawkins, E. Mesuaring Shared Value: How to Unlock Value by Linking Social and Business Results. 2012, pp. 1–24. Available online: https://www.hbs.edu/faculty/Pages/item.aspx?num=46910&msclkid=9dee14d0d0ac11ec93bb0fd342d8d1b1 (accessed on 10 May 2022).

- Bergquist, A.K.; Lindmark, M. Sustainability and shared value in the interwar Swedish copper industry. Bus. Hist. Rev. 2016, 90, 197–225. [Google Scholar] [CrossRef]

- Vaidyanathan, L.; Scott, M. Creating shared value in India: The future for inclusive growth. J. Decis. Mak. 2012, 37, 108–113. [Google Scholar]

- Corner, P.D.; Palvovich, K. Shared value through inner knowledge creation. J. Bus. Ethics 2016, 135, 543–555. [Google Scholar] [CrossRef]

- Lee, J. The limits of consequential reasoning in shared value creation. Competitiveness Review. Int. Bus. J. 2019, 29, 26–38. [Google Scholar]

- Kumar, S.R.; Banke-Thomas, A. Social Return on Investment(SROI): An Innovative Approach to Sustainable Development Goals: Opportunities for Sexual and Reproductive Health Programming in sub-Saharan Africa. Afr. J. Reprod. Health 2016, 20, 85–93. [Google Scholar] [CrossRef] [PubMed]

- Grainger-Brown, J.; Malekpour, S. Implementing the Sustainable Development Goals: Review of Strategic Tools and Frameworks Available to Organizations. Sustainaility 2019, 11, 1381. [Google Scholar] [CrossRef]

- Branco, M.C.; Rodrigues, L.L. Corporate Social Responsibility and Resource Based Perspectives. J. Bus. Ethics 2006, 69, 111–132. [Google Scholar] [CrossRef]

- Corporate Social Forum. Sustainability and Strateg; Chikura Shobo: Tokyo, Japan, 2015. [Google Scholar]

- Shinya, T.; Takahiro, O. Analysis of CSV Characteristics Using Text Data. J. Jpn. Assoc. Manag. Syst. 2021, 38, 77–86. [Google Scholar]

- Horiuchi. Consideration of factors leading to business strategy and strategic selection of Japanese pharmaceutical firms. Manag. Educ. Res. 2020, 23, 63–74. [Google Scholar]

- Toyo Keizai. Kaisha Shikiho; Toyo Keizai: Tokyo, Japan, 2020. [Google Scholar]

- Voci, D. Logos, Ethos, Pathos, Sustainabilitos? About the Role of Media Companies in Reaching Sustainable Development. Sustainability 2022, 14, 2591. [Google Scholar] [CrossRef]

- Park, Y.W.; Hong, P. Creative Innovative Firms from Japan: A Benchmark Inquiry into Firms from Three Rival Nations; Springer: New York, NY, USA, 2019. [Google Scholar]

- Kang, S.; Na, Y.K. Effects of Strategy Characteristics for Sustainable Competitive Advantage in Sharing Economy Businesses on Creating Shared Value and Performance. Sustainability 2020, 12, 1397. [Google Scholar] [CrossRef]

- Yang, T.K.; Yan, M.R. The Corporate Shared Value for Sustainable Development: An Ecosystem Perspective. Sustainability 2020, 12, 2348. [Google Scholar] [CrossRef] [Green Version]

- Mahr, D.; Lievens, A.; Blazevic, V. The value of customer cocreated knowledge during the innovation process. J. Prod. Innov. Manag. 2014, 31, 599–615. [Google Scholar] [CrossRef]

- Kazadi, K.; Lievens, A.; Mahr, D. Stakeholder co-creation during the innovation process: Identifying capabilities for knowledge creation among multiple stakeholders. J. Bus. Res. 2016, 69, 525–540. [Google Scholar] [CrossRef]

- Prahalad, C.K.; Ramaswamy, V. The Co-Creation Connection. Strategy Bus. 2002, 27, 50–61. [Google Scholar]

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).