Abstract

While the development of globally accepted sustainability reporting standards initiated by the IFRS Foundation has largely engaged stakeholders in developed economies, the stakes for developing economies could be compromised without an explicit consideration of their sustainability issues within this standard-setting framework. This paper examines the need to develop global sustainability reporting standards based on the principle of double materiality to warrant that both the target towards carbon net-zero by 2050 under the Paris Agreement and the subsequent promise to accelerate under COP26 are achieved with efficacy. Adopting a multiple-case study approach, this paper reveals the limitations of existing sustainability reporting in the absence of double materiality in a developing economy. Specifically, the analyses reveal limited climate-related disclosures among selected cases in Ghana. Available disclosures connote increasing GHG emissions over the period under consideration. This study also shows weak disclosure comparability across the companies following similar reporting standards. Overall, it argues that enforcement of double materiality to embrace sustainability issues impacting both developed and developing economies is necessary for an effective transformation towards a low-carbon global economy. It contributes to the existing body of knowledge by elucidating double materiality as a pertinent interdisciplinary concept and devising a holistic framework for the emerging global sustainability reporting system to underscore governance accountability for external costs to the environment. Global sustainability reporting standards with a myopic focus on conventional financial matters in the absence of double materiality remain a disclosure system with implausible impact on climate change.

1. Introduction

The growing global enthusiasm for environmental, social and governance (ESG) investments across different international capital markets suggests substantial ongoing amounts of pertinent capital allocation. However, if such investment decision-making continues to be based on reporting standards that do not embrace the scientific issues pertinent to ESG factors, the risk of greenwashing through these investments is unlikely to be eliminated [1]. Furthermore, the lingering global pandemic instigated by COVID-19 has called for pragmatic initiatives among global businesses to reconsider the world’s sustainable development and build resilience in their models with a focus on sustainability [2,3]. After years of deliberation on the role of accountancy in shaping accounting for sustainability, there is now a concerted voice for the development of a global sustainability reporting standard in response to the consensus on the need to achieve carbon neutrality under the Paris Agreement. IFAC, as the legitimate global organization for the accountancy profession with a mandate to strengthen the profession and contribute to the development of international economies, has embraced the initiative to gather stakeholders’ inputs for such a global reporting standard (IFAC is the global organization for the accountancy profession comprising more than 175 members and associates in more than 130 countries and jurisdictions, representing more than 3 million accountants in public practice, education, government service, industry, and commerce). The objective is —“To avoid costly and confusing regulatory fragmentation, relevant work of leading sustainability and reporting initiatives—CDP, CDSB, GRI, IIRC, SASB, WEF/IBC and TCFD—must be brought together and directly leveraged in a coherent way” [4]. In 2019, a task force was formed by the Trustees of the IFRS Foundation to initiate a public consultation process with stakeholders around the world to gauge views on developing sustainability reporting standards and define related demands [5]. The International Sustainability Standards Board (ISSB) was then established in late 2021 to further the mission [6].

However, while alignment among the standards is seen as increasingly crucial, such an initiative has thus far stimulated debates on issues related to double materiality in particular [7]. While the conventional concept of materiality is seen as increasingly relevant to companies in their sustainability performance measurement and reporting, it is queried whether companies should in practice only identify, prioritize and disclose information on sustainability issues that are considered financially material to them [8]. There is a research gap in substantiating the concept of double materiality in relation to global sustainability as a higher order of risk to humanity and the role of governance accountability beyond a mere reporting exercise. Further studies have been advocated on the conceptualization and operationalization of ecological and social materiality to various stakeholders in order to apply the appropriate reporting requirements in practice, along with harmonization of sustainability reporting [9].

Against this gap in research, the objective of this study is to articulate the need for double materiality as a principle of global sustainability reporting standard development, that requires an interdisciplinary approach for engaging companies in reporting on environmental sustainability issues in alignment with the Paris Agreement, while incorporating stakeholder interest from both developed and developing countries.

Using a multiple case study method, this paper analyses sustainability reporting of contemporary cases in selected energy-intensive sectors of Ghana—a developing economy exploiting its natural resources for development and growth [10], from 2016 to 2020. The results show poor disclosure of climate-related data, especially with respect to operations in Ghana. Available disclosures show increasing GHG emissions over the period under consideration. However, there are no clear emission targets set among these companies for their operations, especially for Ghana, posing a challenge to evaluating them with respect to their overall environmental sustainability performance as well as their adverse impacts relevant to the host country. Moreover, there is weak comparability across the companies in similar industries although companies follow similar reporting standards. These results persist irrespective of the governance mechanisms employed by the respective cases. Overall, the results suggest deficiencies in the existing sustainability disclosures under current practice in the absence of double materiality, resulting in neglected external costs. This highlights the prospects of adopting global sustainability reporting standards that embrace double materiality to mitigate the existing deficiencies, in alignment with the 2050 carbon neutrality target.

This study complements prior studies that seek to examine the extent to which sustainability reporting is aligned with global sustainability goals over time [11,12] and advocates for the integration of sustainability goals into sustainability reports [13]. Distinct from these studies, this paper focuses specifically on climate-related disclosures. The study further contributes to the existing body of knowledge by elucidating double materiality as an interdisciplinary concept with Anthropocene associations and devising a holistic framework for the emerging global sustainability reporting system to underscore governance accountability for external costs to the environment and human health as moral legitimacy. Global sustainability reporting standards with a myopic focus on conventional financials in the absence of double materiality would remain a disclosure system with implausible impact on ESG investments and sustainability performance to mitigate climate change. By revealing the relevance of double materiality in standard setting, this paper addresses the research question of how the key sectors in developing countries can advance their sustainability reporting and performance under the era of “ESG”, in which professionals in the international community strive to attain the global sustainability targets.

This paper is structured as follows: Section 2 provides an interdisciplinary literature review on (i) the recent development of global policy and green financing system for sustainability, (ii) the essence of sustainability reporting, (iii) the significance of double materiality to ESG investing and (iv) the need for global sustainability reporting standards for developing economies. In Section 3, selected cases from Ghana’s energy and mining industries focusing on their current sustainability reporting are utilized to examine the current deficiencies, as the country has been undergoing an economic development path that engenders carbon emissions. Discussion of the underlying dynamic relationship among key institutions in facilitating global sustainability reporting development, a holistic framework outlining the dynamic relationship in global sustainability reporting development in relation to the carbon neutrality target by 2050 and concluding remarks are deliberated in the subsequent sections with implications, limitations, and suggested future studies.

2. Literature Review

2.1. The Paris Agreement as Global Consensus for Climate Policy and the Emerging Green Financial System

Rapid globalization for primary economic goals has also given rise to the development of various international financial regulatory measures. As described by Alexander et al. on the challenge of governing financial systems on a global scale, “the application of global governance to financial regulation must take account of certain standards and principles of corporate governance, some of which are advocated by international financial bodies that address the internal operation and management of financial institutions” [14]. As a result, there has been a complex process of adoption of IFRS initiated by developed economies with mixed results with respect to the pace and degree of adoption as influenced by international politics [15,16,17,18]. Nonetheless, throughout the process of rapid globalization, it has been observed that there are limits to “pure market-based capitalism”, and the global financial crisis in 2008/2009 has given voice to discontents and disparities in societies [19,20]. There are concerns over the efficacy of the world’s financial system and the efficacy of international accounting standards to uphold global sustainability of the real economy beyond seeking prosperity and profit maximization by multinational firms and financial institutions.

Subsequent to the adoption of the Paris Agreement—a legally binding international treaty on climate change by 196 parties at COP 21 in Paris in 2015—an urgent call for action was made by the UN Secretary General for a global coalition to achieve carbon neutrality by 2050 [21,22], it is stipulated that developed countries need to take the initiative to provide financial support to less developed countries that are comparatively more vulnerable to climate change. Climate finance is considered necessary to support the transformation for adaptation and mitigation via large-scale investments to drastically reduce carbon emissions. The UNCTAD Investment Policy Framework for Sustainable Development, which was released in 2015, provides certain guidance for policymakers around the world on investing in sectors to achieve sustainable development goals [23]. Despite these efforts, there are still divergences in ideologies and approaches towards carbon reduction mechanisms, as reflected in the recent COP26 meeting in Glasgow among global leaders that concluded in November 2021 (According to the UN Secretary-General, the outcome statement from the COP26 meeting in Glasgow among nearly 200 countries in November 2021, reflects the interests, the contradictions, and the state of political will in the world today (source: https://news.un.org/en/story/2021/11/1105792; accessed on 20 February 2022). It is envisaged that a convergence of global efforts could generate momentum and legitimacy for financial institutions in the private sector to develop a green financial ecosystem with adequate disclosures, in order to support investment decision-making in realizing the necessary actions taken under this global consensus [24].

The Task Force on Climate-related Financial Disclosures (TCFD) was founded by the Financial Stability Board and members of major financial regulatory institutions from around the world to develop climate-related disclosures for informed investment, credit, and insurance underwriting decisions, while recognizing various stakeholders’ need to better understand the exposures of the financial system to climate-related risks in relation to carbon concentrated assets [25] The TCFD thereafter released its climate-related financial disclosure recommendations for providing better transparency for informed capital allocation. Such disclosure recommendations are structured around four thematic areas for organizations: (i) governance, (ii) strategy, (ii) risk management, and (iv) metrics and targets, which are intended to interlink and inform each other [25].

Given these global developments, it is anticipated that common standards for sustainability reporting would be developed under a global governance architecture, as observed over the past few decades [14]. As a growing number of nonaccounting associations have advocated their own sustainability standards (i.e., GRI, IIRC, WEF/IBC and TCFD), there have been attempts by global accounting bodies and interest groups to harmonize different emerging international standards to meet global stakeholders’ information needs, largely driven by those in the international capital market who are gradually shifting to green and sustainable investing [4,24,26,27]. The essence of sustainability reporting needs to be established from a broad perspective to engage global stakeholders who are exposed to the risks of climate change and unsustainability [28].

2.2. The Essence of Sustainability Reporting: Double Materiality and Recognition of the External Costs

To align with the purpose of the Paris Agreement, it is crucial for the emerging global sustainability reporting standards to address the target of carbon neutrality by making companies from various industries around the world accountable for their greenhouse gas emissions. The major emitters causing over 70% of the world’s carbon emissions have been identified to be based in specific business sectors, including airlines, automobiles, mining, electric utilities, and oil and gas, which are associated with heavy consumption of fossil fuel [29]. Subsequent to growing concerns from stakeholders over climate change, recent studies reveal that asset managers are motivated to take action to divest investments in fossil fuel-related businesses during the transition period to socially responsible investing [30,31].

Global sustainability reporting standard development could create a paradigm shift corroborated by the accounting profession, beyond serving their usual corporate clients. Meanwhile, profit-making for shareholders has long been argued as the legitimate motive of corporate entities, intertwined with the global capital markets searching for returns to shareholders. In addition, the primary objective of a business is to do more economically motivated business, using the classical model of corporate social responsibility, rather than for the purpose of sustainability [32,33]. Unless there is explicit accountability, corporate environmental sustainability could merely become an oxymoron, as there has been no underlying motivation to comply with environmental imperatives [34,35]. Evidently, large corporations in the energy sector remain indifferent to sustainability issues related to their business operations and continue to lobby against accountability provisions for the external costs caused by their business operations [36]. External costs to the environment that adversely affect public health have long been neglected, especially by those environmentally material business sectors [37,38].

Therefore, the concept of double materiality is critical to the overall efficacy of global sustainability, as it is pertinent to the accountability of corporate entities and outputs from their operations linked to environmental sustainability [34,35]. As explained by Katz and McIntosh. the European Union (EU) has taken the approach to embrace the concept of “double materiality” described as (i) financial materiality and (ii) environmental and social materiality; information that is deemed material from either of these two perspectives should be subject to full disclosure [39]. Sustainability issues impact not only corporate performance but also society and the environment. This accountability and legal principle of double materiality is conceived as critical to any strategy for reducing carbon emissions on a global basis. It is crucial to identify any materially adverse impacts of an organization externally on sustainable development under the principle of double materiality, that also facilitates the engagement of broader stakeholders [40].

Double materiality is relevant to both developed economies and developing economies, which are all vulnerable to local pollution and wider climate impacts caused by the scale of global industrialization [41,42,43]. Timely adoption of comprehensive global sustainability reporting standards led by developed nations would be particularly advantageous to the sustainability goals of developing nations, consistent with the UN SDGs. However, there could be different stages of readiness and commitment among developed and developing nations, as reflected in the prior adoption and implementation of international accounting standards [44,45]. Developing nations driven by a desire to alleviate themselves from poverty with timely economic development and growth would continue to opt for an industrial development pathway that exploits natural resources rather than promoting sustainability.

The external costs to the environment and society originating from operations of companies are increasingly revealed not only to the public but also to the investment community for the adverse implications of stranded assets, as lately recognized by financial markets [46]. In 2019, Mark Carney, the Governor of the Bank of England, pointed out that “changes in climate policies, new technologies and growing physical risks will prompt reassessments of the values of virtually every financial asset” [27]. These risks are pertinent to inhabitants on earth beyond the financial communities. The study, [47], p.36, points out the risks of an unaligned financial system in the context of the Anthropocene as “the great acceleration of social and human impacts on Earth systems—is testing some of the life-supporting boundaries of the planet” [47]. The long-term risks associated with climate change, which would otherwise be exposed over time, need to be recognized today by financial markets [47].

2.3. The Promise of ESG Investing and the Significance of Double Materiality in Practicing Corporate Governance for Sustainability

Despite the growing enthusiasm for ESG investing among international capital markets, recent studies have examined issues related to the accountability of corporate governance in delivering measurable ESG performance for sustainability as well as limitations under the current accounting practice in relation to ESG reporting [48,49,50,51]. As there is still a lack of global standards that truly embrace the scientific issues within the ESG investment factors, risks of growing greenwashing and competence washing appear to be inevitable [1]. To improve the underlying accountability, the ultimate adverse impact on human beings and their overall prosperity needs to be considered under a cross-disciplinary “Anthropocene framing” that seeks to understand nature–human interactions from the accounting perspective [52]. As pointed out by Gray [49] (p. 416) “from an anthropocentric perspective, the level of activity which is sustainable comes to mean that the current generation takes from the planet no more than the maximum which leaves the planet and future generations no worse off” [34]. Global sustainability reporting that embraces double materiality can be perceived as an antidote to this primary concern—as enunciated by Gray [34,35]. If there is sufficient quality disclosure on such information, there is an opportunity for the accounting profession to enhance the necessary transparency on emissions from specific industries that are necessary to achieve carbon neutrality on a global basis. By embracing double materiality, professional accountants could be empowered in their role to help ensure sustainability in both developed and developing economies [53,54,55].

Despite the emerging global consensus on tackling climate change, there is a need for multinationals to be monitored, as there are now a broadened number of stakeholders who demand transparency on sustainability performance that would reduce information asymmetry [51]. Double materiality and its implications for potential stranded assets are relevant information to stakeholders, particularly investment managers, in their decision-making [39,56]. From a regulatory perspective, there is a fiduciary duty for institutional investors to achieve financial returns without causing adverse impacts on the social, environmental, and sustainability aspects, in a manner that goes beyond merely focusing on financing and investing in opportunities created under climate change policy [47].The adoption of double materiality is considered paramount to global sustainability reporting. As investigated by Adams et al. [40] (p. 8), “robust identification of material impacts of an organization on sustainable development must be the starting point to determining sustainable development risks and impacts on the financial statements” [40].” Double materiality also enhances the engagement of broader stakeholders for the world’s sustainable development [40]. In examining the challenges in accounting for climate change, Kaplan and Ramanna [57] deliberated on the potentials of an emission liability system applied within an organization “at a materiality threshold specific for GHG, regardless of the financial impact” [57].

2.4. The Need for a Global Standard That Protects the Sustainability of Developing Countries

Many developing countries are endowed with natural resources such as oil, gas, and minerals, which serve as their main source of revenue. Hence, many of these developing countries have served as appealing destinations for multinational mining and energy businesses. Africa, for instance, has seven countries that are part of the 13 member countries of the Organization of the Petroleum Exporting Countries (OPEC). Its gold reserves were estimated to be approximately $1.5 trillion [58]. The extractive activities are extremely energy intensive and are one of the major emitters of greenhouse gases. However, these developing economies lack the financial and informational resources as well as the adequate regulatory capacity to mitigate extractive activities that contribute to global climate change within their respective countries.

Ironically, the thirst for economic development and foreign direct investments has created incentives for lax regulatory regimes, including relaxed environmental standards, to attract foreign investments from developed nations [59,60,61,62,63]. Moreover, most of these economies do not have a thriving domestic stock market to attract investments from local investors. For instance, there are approximately six African countries in the top 20 gold-producing countries across the world [58]. Of the six, two do not have any stock exchanges. In the oil and gas sector, there were three African countries in the list of the top 15 net exporters in the world in 2020 [64] Of the three, only one (Nigeria) has a stock exchange. Thus, while these multinational corporations hold listings in other well-recognized stock exchanges across the world, they do not hold listing status with the exchanges of their respective host country. This creates an additional challenge, as they are more likely to be affected by the regulations in the home country relative to their host countries. Furthermore, because there are hardly any government regulations in developing host countries, multinational firms face the temptation to either lobby for reduced standards or not comply with their home standards [62]. In line with the UN SDGs, several countries in Africa have recommended the reporting of nonfinancial information with respect to a corporation’s ESG performance. However, ESG and sustainability reporting is mainly voluntary in countries except for South Africa, which applies the “obey or explain” mandate; additionally, many developing countries do not have active NGOs and strong social groups to contribute to the advocacy for more sustainable management of the environment and natural resources [59].

Meanwhile, developing countries are most vulnerable to the adverse effects of climate change and other sustainability issues [65,66,67]. The 5th Climate Assessment report by the IPCC details the effect of climate change in developing countries. For instance, it is found that most developing countries are geographically located in regions that are prone to adverse weather conditions [68]. Hence, the risk of climate change affects their resource-dependent livelihoods, such as mining and agriculture. Severe weather hazards may also increase disease-related deaths and pose challenges for the livelihood of citizens. Overall, climate change impacts are expected to slow economic growth, hinder poverty reduction, further erode food security and prolong existing poverty while creating new poverty traps. In terms of conflicts, climate change can indirectly increase the risks of violent conflicts by amplifying well-documented drivers of those conflicts such as poverty and economic shocks [68].

Developing countries thus need information and financial resources as well as assistance to build their regulatory capacity in their bid to improve disclosures on environmental and climate change risks. Developing countries may not have the capacity and regulatory framework to enact their own standards and ensure their conformity, especially for those that do not have a thriving stock exchange [12]. Recent studies have found that the CSR reporting practices of companies in developing countries are largely influenced by their external stakeholders, including foreign investors, international regulatory bodies and CSR-promoting institutions, such as the United Nations Global Compact Local Network (UNGC) and other NGOs [69,70]. A complementary global standard will help focus attention on the major sustainability goals, thereby creating a better understanding of the causes and dangers of climate change. A global standard creates a common language for organizations and therefore provides a common basis on which corporations can be held accountable for their social impacts. Stakeholders can compare the performance of multinational corporations in sustainability in their home country relative to the host country to enhance accountability. The availability of global standards would facilitate adoption and adaptation and may be less costly than a potentially lengthy consultation and validation process. Moreover, global standards may provide a robust regulatory and enforcement environment, making it easier for stakeholders to compare sustainability achievements of entities across borders. Investors and lenders who are sustainability conscious would be more willing to do business across borders if they were able to rely on financial information based on a set of standards familiar to them.

However, developing economies have little input in the international standard setting process, as demonstrated in the past [71]. Increased participation in international standardization provides an opportunity to fully exploit the value of standards. The participation of developing countries in international standardization is also essential to ensure global relevance and enable the access of developing economies to global markets and sustainable development [72]. Since global standards are more likely to be applicable to the listed companies only, this practice may continue to be overlooked by firms without listing status. Moreover, given that most developing economies do not have thriving stock exchanges to attract multinational listings, as part of incorporating the need of developing countries, there is a need for the emerging global sustainability reporting standards to be adopted by unlisted firms of certain sizes to avoid the unintended consequences of focusing on the sustainability requirements of the capital market to the neglect of other stakeholders. The IFRS Foundation, as the global accounting standard-setting authority, has the legitimate role in initiating such a common standard for both developed and developing economies, which in turn determines the necessary competencies equipped by professional accountants around the world In late 2021, the IFRS Foundation Trustees established a new standard-setting board called the International Sustainability Standards Board (ISSB), which is intended to develop a “comprehensive global baseline of sustainability-related disclosure standards” for capital market participants on information about sustainability-related risks for informed decisions [6].

In the meantime, the practice of sustainability reporting around the world has continued to evolve, considering the ongoing development of both complementary and competitive standards by various interest groups and institutions. There is not yet a consensus on embracing double materiality initiated by the European Commission as an imperative conceptual foundation for sustainable reporting [7,73]. Further, companies in practice are still unprepared for such implementation owing to questionable absorptive capacity about double materiality [8,9]). The ongoing global initiatives to develop an efficient green finance system require quality ESG information and data and greatly reduced information asymmetry in support of financial decision-making for sustainability performance, reducing emissions in particular. There is a research gap in examining the underlying principles as well as governance and managerial practices that could obscure the adoption of double materiality under the existing global financial system.

Corroborating evidence is useful in investigating the existing knowledge gap regarding existing deficiencies in sustainability reporting based on the conventional corporate governance approach among listed companies. Examining real-life cases reflecting the current practice would unveil deficiencies circumventing external costs, sustainability performance and related disclosures. The following section outlines the research method adopted in studying Ghana and the sustainability reporting practice in this developing country; the industry background of the selected cases and key results from the case analysis are provided.

3. Methodology

3.1. Case Study Method

First, in line with its commitment to addressing climate change issues, Ghana became one of the first developing countries to ratify the United Nations Framework Convention on Climate Change (UNFCC) in 1995. It became the first country in Africa to join the Voluntary Principles Initiative that ratified the 2015 UN Framework Convention on Climate Change (Paris Agreement). The government is also part of several international agreements and treaties (such as the Extractive Industries Transparency Index, Basel Convention, United Nations Global Compact) to promote good practices among corporations operating in the country. The country developed its National Climate Change Policy (NCCP) and unveiled its National Climate Change Policy Action Program for Implementation for the period 2015–2020. Against these developments, sustainability performance among key industries in Ghana as a developing country over the recent years would be representative.

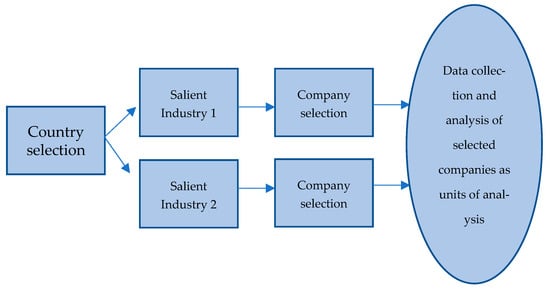

To examine the quality of sustainability reporting, a multiple-case study method is utilized systematically to reveal the experience of Ghana with a focus on its energy and mining industries. This approach facilitates comparative analysis of the selected cases as units of analysis within a cluster [74,75]. Based on the case study methodology of Yin [74], three leading companies among the largest from each industry are selected to examine their characteristics and report on their sustainability performance concerning climate change issues based on their public disclosures over a period of five years (see Figure 1 on this case study workflow). A similar research strategy was adopted in prior studies to unveil emerging real-life issues and practice in relation to sustainability reporting and related disclosures through multiple-case studies [76,77,78]. This approach would also enable the investigation of any key differences and commonalities among these cases to reflect the phenomenon in a contemporary setting. The background of sustainability reporting in the country’s oil exploration and mining industries is first deliberated in the following section. Table 1 highlights the corporate background of the selected cases for comparison. A comparative analysis of these cases is presented in Section 4.3.

Figure 1.

Workflow for the Case Study.

Table 1.

Background of the Six Selected Cases.

As depicted in Table 1, all six companies hold multiple listings in different major stock exchanges. Five of the cases are listed on the New York Stock Exchange (NYSE), and only two are listed on the Ghana Stock Exchange. The typical shareholders of these firms are institutional investors (The major Shareholder for ENI is the Government of Italy). Their financial reports audited by the Big Four are mainly prepared in accordance with IFRS, except for one that follows the US GAAP. An initial analysis of the 2020 financial reports reveals that operations in Ghana constitute a significant part of their total business activities. For instance, Ghana contributes approximately 69% for Tullow Oil, 47% for Kosmos, 15% for Newmont and 100% for Golden Star to their respective total revenues (ENI and Anglo Gold did not report Ghana’s sales contribution. In terms of production, Ghana contributes 2% to ENI. Ghana is the smallest in ENI’s portfolio. According to Anglo Gold Ashanti’s report, Africa contributed to 53% of group production and Ghana (25%) was ranked second in terms of production in Africa after Tanzania (39%)).

3.2. Industry Background

Ghana discovered crude oil in commercial quantities in 2007 and commenced commercial production in 2010 [79]. The discovery of the Jubilee oilfield in 2007 is estimated to be one of the largest discoveries offshore in West Africa during that decade and one of the largest oil discoveries worldwide. Although relatively young in oil and gas production, Ghana has gained prominence as one of the top oil-producing countries in Africa. With recent discoveries of oil and gas resources stretching across the country’s shoreline from Cape Three Points in the West to Keta in the East, Ghana’s prospect in oil and gas has become highly attractive and significant as an investment opportunity. In 2019, the oil and gas sector contributed to 4.5% of GDP [80].

Ghana, formally known as the Gold Coast, is now one of the largest gold mining countries in Africa. It was ranked sixth out of the top 10 gold-producing countries in the world in 2019 by mining more than 142 metric tons of precious metals. According to the US Geological Survey [81], Ghana’s gold reserves are estimated to be 1000 metric tons with high exploration prospects. While Ghana also produces salt and silver, its minerals (mainly gold, bauxite, manganese and diamonds) accounted for 37% of total exports in 2019, with gold accounting for 93.28 percent of gross mineral revenue, while the respective shares of manganese, bauxite and diamond were 6.17 percent, 0.54 percent and 0.01 percent, respectively [82].

Given the immense endowment of natural resources, Ghana has served as an attractive destination for large multinational corporations. The oil and gas industry is composed of upstream and downstream sectors with major oil and gas corporations such as Tullow Oil, ENI, Kosmos Energy and Aker Energy. Its mineral sector is composed of 12 licensed large-scale mining companies (10 large-scale gold mining companies and two large-scale mining companies that mine bauxite and magnesia, respectively) and over 1300 small-scale mining groups operating in more than 61 communities across the country [83]. Large-scale miners dominate the sector, contributing to over 50% of the country’s overall gold production [84].

The sustainability issues imposed by these two sectors cannot be overemphasized. A plethora of studies have been conducted on the impact of these extractive activities on climate change, land, water, health and the economic livelihood of people in communities and surrounding communities [66,85,86,87,88,89,90,91]. In line with the UN SDGs, many countries have established measurable ESG standards, which guide businesses in making disclosures by which their social and environmental impact can be measured and scored. Hence, extractive firms are increasingly being criticized for failing to meet ESG standards.

Despite Ghana’s prominence in gold mining and recently in oil and gas exploration, Ghana does not have any effective domestic regulatory framework for the activities of corporations in these extractive sectors. Very few key players in the extractive industry are listed on its stock exchange; there are only one oil exploration and two mining companies listed on the local exchange. Meanwhile, nine of 12 large-scale mining companies as well as three key oil and gas exploration corporations are listed on other recognized stock exchanges across the world, such as the New York Stock Exchange, Toronto Stock Exchange, and Australia Stock Exchange, with five listed on more than one stock exchange. Given the possibility of deferring the sustainability focus of different countries, it is plausible that the sustainability reports (if any) of these extractive companies follow the sustainability requirements of their home countries or other advanced stock exchanges relative to the actual sustainability needs of the host nation (Ghana).

As the Paris Agreement requires countries to set targets for emissions reductions, some nations have made efforts to reduce greenhouse emissions and reliance on carbon-based economic activities. Despite its efforts in the fight against climate change, Ghana does not have its own specific emission regulations, although it has several laws that corporations in the extractive industries need to adhere to, which may contribute to long-term sustainability attainment. Specifically, prior to commencement, any businesses identified in the category that may have adverse impacts on the environment and sustainable livelihood (such as businesses in the extractive, manufacturing, and energy sectors) need to apply for an environmental permit from the Environmental Protection Agency of Ghana (EPA) [92]. Before the application, a business is expected to provide the agency with an environmental impact assessment of its operations. Once a permit is granted, it is required to submit an annual environmental report to the EPA. For entities from whom a preliminary environmental assessment or environmental impact assessment is required prior to commencement, an environmental management plan with respect to their operations is required within 18 months of commencement and every 3 years thereafter. Although these regulations provide guidance for good practice, they do not provide measurable metrics by which business activities can be measured and evaluated. Hence, despite extensive evidence of health and safety problems, environmental damage, child labor, and other infringements, few companies have been scrutinized consequently [61,93].

In 2010, the EPA introduced the AKOBEN Environmental Performance Rating and Public Disclosure Program, which evaluates the environmental and social performance of businesses in the manufacturing and mining sectors. The EPA uses a color scheme to score their performance (from excellent to poor) in seven key areas covering legal, waste management, compliance with environmental quality standards, environmental reporting, environmental management, community engagement and CSR. The ratings are disclosed to the public through a press briefing and via the internet. However, the effectiveness of this policy in promoting sustainability has been questioned [94] due to its ad hoc data analysis process. After a few years of operations, this program was ended. Mining firms were seen to be performing poorly when measured against the local sustainability indicators forming the basis for Akoben [94].

4. Results:

4.1. Overall Reporting and Governance Approach

Over the period under review, ENI (O3) and AngloGold Ashanti (M1) produced standalone sustainability reports, while Tullow Oil (O1), Kosmos Energy (O2) and Newmont (M2) started producing standalone sustainability reports only in 2019 (see Table 2a) (Prior to producing sustainability reports, the cases had produced standalone reports (with names such as the CSR Report, Corporate Responsibility Report and Social and Environmental Performance Report) which reported their performance on CSR and other sustainability issues, except for ENI (O3) which provided such information in its integrated annual reports. Interestingly, Golden Star Resources (M3) produced standalone sustainability reports from 2006 until 2012 when they started issuing up-to-date Corporate Responsibility Reports. Tullow Oil (O1), on the other hand, issued CSR reports until 2016 when it included sustainability issues in its annual reports and therefore provided no standalone reports until 2019). These stand-alone reports had independent assurance part, particularly on GHG emissions, energy use and intensity, except for Golden Star (M3), which started independent assurance in 2019. ENI (O3)’s 2020 Annual Report is prepared in accordance with principles included in the “International Framework”, published by the International Integrated Reporting Council (IIRC), which is aimed at representing financial and sustainability performance, underlining the existing connections between the competitive environment, group strategy, business model, integrated risk management and a stringent corporate governance system. While all financial reports are audited by the Big Four, half of them relied on other firms to provide assurance for their current sustainability reports. Additionally, it can be observed that all have installed a Sustainability Committee dedicated to overseeing social, environmental, governance and risk-related issues.

Table 2.

(a) Reporting Approach. (b) Reported Scopes.

4.2. Policy and Standard

By 2020, all cases under review have established some form of climate change policy in line with the 2015 UN Paris Agreement with respect to GHG emissions targets for 2030 and achieving net zero by 2050. To this end, sustainability reports contain certain information on GHG emissions and intensity as well as sources of GHG emissions, energy consumption and intensity. Most of the sustainability reports were prepared based on the GRI reporting standards and audited according to the AA1000 assurance standards. In addition, the reports by the oil exploration companies were guided by the standards of the International Petroleum Industry Environmental Conservation Association (IPIECA). The mining companies generally applied the Sustainability Accounting Standard Board (SASB) reporting standard and the International Council on Mining and Metals (ICMM) reporting framework (see Table 2a). Although all claim the consideration of GRI, their units of measure and data availability are not entirely comparable across the companies within the same industry on GHG emissions and energy use over a five-year period. The lack of comparability in sustainability reporting is consistent with a prior study [11].

4.3. Emission and Energy Disclosure

Among the three scopes (GRI protocol) of reported GHG emissions, not all companies disclose emission data under Scope 3, whereas Scopes 1 and 2 are commonly reported by all six cases (see Table 2b). Detailed comparative analysis is performed to focus on the sustainability reports of three listed oil exploration companies and three listed mining companies in Ghana over a period of five years (2016–2020) (Kosmos disclosed a combined report for 2020 and 2019). While global data disclosed by them are summarized in Table 3a, disclosed data on Ghana are provided in Table 3b where available.

Table 3.

(a) Global Data; (b) Ghana Data.

First, as shown in Table 3a, most of the cases have provided their global emission and energy use data, other than Kosmos Energy (O2), which did not provide any disclosures on energy use at all. Disclosures on emission and energy intensities are not provided by all six cases. Second, except for Anglo Gold (M1), GHG emissions and energy use data on the operations of these six companies in Ghana have mostly been unavailable until more recently (see Table 3b). Available disclosures suggest that GHG emissions in Ghana have increased over the period under consideration. Overall, these reports suggest mixed performances in terms of transparency and weak comparability across the companies in the two sectors, especially in the host country’s data.

4.4. Overall Social and Environmental Sustainability Performance

Further comparative analysis across the companies suggests that social and environmental investments/projects in Ghana focused mainly on community developments, education, health, and human rights, with very little focus on climate-related projects. For instance, according to its social investment report, Tullow Oil (O1) has made no environmental investments since 2015. Nonetheless, the company has been engaged in the supply of clean and affordable energy. Other notable climate-related projects include the reforestation programs by Kosmos Energy (O2) and Newmont (M2) in Ghana. While these companies acknowledge the threat imposed by climate change and seem to make some efforts to reduce the climate impact of their operational activities, their most current sustainability reports still show general increases in GHG emissions in Ghana and variations in energy consumption and intensity. Although the 2015 UN Paris Agreement requires the setting of emission targets by individual nations, there are no clear emission targets set for these companies, posing a challenge to the extent of accountability for their emission levels in Ghana. Among the oil exploration companies, only ENI (O3) compares their GHG and energy information with established targets. These cases suggest that there are little to no concerted and consistent disclosures on sustainability reporting on pertinent issues based on the principle of double materiality, which are necessary if the carbon neutrality targets are to be tracked and monitored for the 2050 thresholds.

5. Discussion

As a developing country, Ghana’s reliance on these climate-sensitive sectors makes it vulnerable to the adverse repercussions of climate change and other sustainability issues. Moreover, its susceptibility to climate change is deepened by the geographical location of Ghana, which is situated in one of the world’s most complex climatic regions that is affected by tropical storms and the influence of the Atlantic Ocean and the Sahel. Climate change is therefore one of the top priorities of the country and has been embedded in the Ghana Shared Growth and Development Agenda, which is the blueprint of the country’s development strategy.

As demonstrated by the six cases in Ghana, in the current practice of sustainability reporting, there are concerns over quality disclosures about environmental issues beyond financial materiality. First, there is incompleteness in the three scopes of emission source information and related data. Second, it is difficult to make meaningful comparisons among companies, even within the same industry, with respect to emissions, energy usage and intensities. Thus, it is difficult to evaluate them with respect to their overall environmental sustainability performance, as well as adverse impacts that are relevant to the host country. Despite the existence of the Sustainability Committee as a corporate governance mechanism across the cases, it does not guarantee the completeness and overall quality of pertinent disclosures. Third, the lack of double materiality and related mandates makes it difficult to hold these companies accountable for their adverse environmental implications and external costs incurred by their operations. In the absence of an explicit framework, companies can “cherry-pick” issues that are relatively easy to address, while neglecting more significant issues, as demonstrated in the case studies. Existing evidence suggests that multinational corporations were more concerned about community development projects, which were considered essential for building amiable relationships between themselves and communities and assisting in poverty alleviation [95]. The country’s vulnerability to climate change could be mitigated by adopting the double materiality principle to provide transparency on performance in safeguarding sustainable development.

Evidently, there is a gap between the rather short-term ad hoc mitigating programs focused on by companies and global pressing for drastic reduction of carbon emissions progressively in order to meet the targets under the Paris Agreement [21,22]. There is a need to bridge this gap by incorporating both international and local contexts into a global sustainability reporting framework that is aligned with predetermined targets. Although the six cases have shown certain progress in compliance with their respective stock exchanges attached to the international capital markets, there is a deficiency in quality disclosures pertinent to the local environmental protection agency on emissions that affect the host country and its local stakeholders. The principle of double materiality is hardly embraced in their voluntary reporting on sustainability as reflected in current practice [8,9].

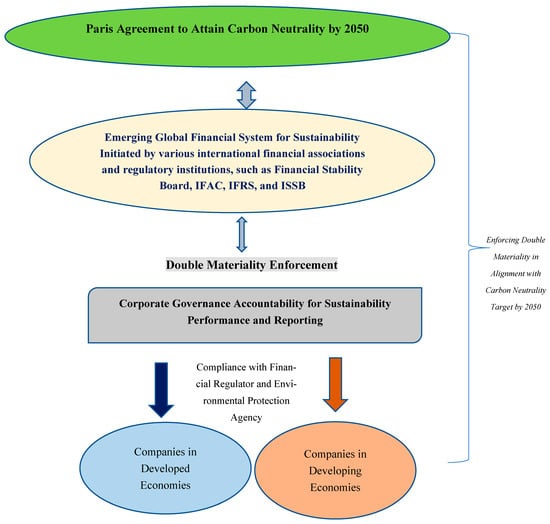

It is imperative to point out that the standard setting and adoption of the emerging global sustainability reporting standard are quite different from those of the conventional financial reporting standard setting by IFRS, largely influenced by the force of globalization for economic prosperity. The novel purpose of this current exercise is driven by the cause of the world’s overall social and environmental sustainability for the well-being of worldwide stakeholders on the planet earth as stipulated under the Paris Agreement. This underlying purpose needs to be embraced in this standard-setting exercise, resulting in the disclosure of relevant sustainability information by salient industries in both developed and developing economies in alignment with carbon neutrality targets under the principle of double materiality [34,35,53,54,55]. While adoption is likely to be made by respective professional accounting bodies in each jurisdiction, compliance requirements would necessarily be enforced by both the financial regulator (e.g., for those listed with local and overseas stock exchanges) and an environmental protection agency within the host country. We articulate an underlying dynamic relationship in global sustainability reporting standard development and the legitimate role of the IFRS Foundation in formulating a common approach within different industries in both developed and developing economies becoming transformed in the direction of sustainability and measurable targets instigated by the global consensus under the Paris Agreement within a proposed holistic framework (see Figure 2).

Figure 2.

Holistic Framework for Global Sustainability Reporting Aligned with Carbon Neutrality by 2050 through Double Materiality.

With reference to the dynamic relationships deliberated in the proposed holistic framework, it is instrumental for the standard-setting authority to proactively engage pertinent stakeholders in existing concepts, salient principles and interdisciplinary practices that are relevant for harmonization and integration into a global standard. The accountability of corporate governance for sustainability strategy, performance and reporting is a critical domain area that needs to be enhanced, as proposed in this framework, should the efficacy of ESG investment and the carbon neutralized target by 2050 be realized [48,49,51]. This framework suggests that efficacy of global sustainability reporting in alignment with such a target may require compliance with dual regulatory measures over both financial reporting and environmental protection on a global basis.

To elaborate, the history of IFRS harmonization reflects challenges in adoption for an underlying political process dominated by developed economies and business stakeholders [18]. While the conventional standard setting development of IFRS has always been capital market oriented, sustainability reporting is intrinsically associated with broadened stakeholders beyond capital market investors. Adoption of global sustainability reporting standards has more extensive implications for the world than that of conventional financial reporting standards driven primarily by global prosperity considerations. In particular, the following important rationales need to be emphasized: (i) mitigating the adverse consequences of climate change to the world as intrinsically an issue of double materiality, (ii) fostering global sustainability of both developed and developing economies in alignment with carbon neutrality targets, and (iii) conceivably redefining the practice of sustainability reporting as an interdisciplinary profession, which is yet to be fully developed. Moral legitimacy for global sustainability reporting standard development relevant to climate change adaptation and mitigation is yet to be embraced by corporate governance practice (As explained by Melé and Armengou (2016), “Moral legitimacy entails intrinsic value and helps executives convince firm’s stakeholders and the general public of the ethical acceptability of an institution or its activities or projects”).

6. Conclusions

6.1. Concluding Remarks

This period of adoption of global sustainability reporting could be more challenging than that of the initial IFRS adoption on a global basis due to the underlying principle of double materiality required to align with the global sustainability objective. However, adoption of this principle can be perceived as a paradigm shift, as the world economy is intended to progress beyond the traditional industrialization model through a radical transformation and adaptation towards sustainability under climate change [41,96,97]. There is a need to recognize that the purposes embedded within this standard-setting exercise are complex because of its mission to (i) mitigate the adverse consequences of climate change to the world as a double materiality intrinsically, (ii) foster global sustainability of both developed and developing economies in relation to targets for carbon neutrality, and (iii) conceivably redefine the practice of sustainability reporting into an interdisciplinary profession beyond conventional financial reporting practice, which has yet to be transformed.

A key contribution of this study to the existing body of knowledge is its devised holistic framework on interrelated institutional issues pertinent to global sustainability reporting development in alignment with the carbon neutrality target by 2050 (as illustrated in Figure 2). It moderates the silo of professional accounting knowledge that focuses on financial materiality within the traditional financial accounting conceptual framework. Further, this study addresses the previously proposed research on clarifying the concept of double materiality and its application, as this has recently become controversial among the stakeholders [7,9].

Nevertheless, we argue that, in order to ensure the efficacy of these global initiatives for sustainability towards the carbon neutrality goal by 2050, specific interim targets need to be set and measured with assurance on a regular basis given the time constraints under the risk of climate change. Compliance with both international financial regulators and local environmental protection agencies can reinforce quality disclosures and reporting for stakeholders’ monitoring of progress towards carbon neutrality over time. Developed economies, nonetheless, need to take a leading and exemplary role in fostering a global standard, which is meant to prevent the oxymoron, among companies in both developed and developing economies, of them being unaccountable for their environmentally irresponsible operating activities. Their source of funding is to be driven by ESG investing for value creation, and their sustainability performance is also monitored under a unified, global financial system for sustainability.

6.2. Implications

With respect to implications for practice in global sustainability reporting, professional accountants, as independent global professionals, could be anticipated as the ultimate goalkeepers for the integrity of the emerging global green financial system, inclusive of vulnerable developing countries. They could mitigate the world from unsustainability with advancement in corresponding competence, knowledge and principles [53,54,98]. Nonetheless, the framework reflects that re-empowering the global accounting profession with adequate competence to enforce this novel mission is a task that has not yet been delivered. Global accounting institutions, particularly IFAC-represented accounting bodies around the world as well as those mandated by the IFRS Foundation to set international accounting standards, possess the moral legitimacy to lead the necessary complementary efforts in developing a harmonized global sustainability reporting standard while mitigating climate change. Efforts made by these institutions led by the developed economies, under the current initiatives led by the EU in particular in setting double materiality that instigates developing countries to adopt similar initiatives, are also crucial to retaining the relevance of professional accountants in a world actively seeking substantive progress towards sustainability [40]. Accountants with enhanced competence could tackle the challenge by providing professional services in relation to double compliance, expressing independent views on sustainability reporting, but the process also requires an independent route of accountability. As expressed by Ketz “there is an inherent conflict of interest in the auditor–client relationship because the auditor naturally moves toward agreement with the client’s views in an effort to strengthen and maintain the relationship” [99]. Resolving this inherent conflict would ensure an independent check-and-balance much required for the anticipated transformation towards global sustainability [92].

6.3. Limitations and Future Studies

This study is performed based on an interdisciplinary literature review and multiple-case studies in a developing economy, which however may not be generalizable with respect to sustainability reporting quality among the developing economies. Future studies could be extended to examine those of the other developing economies deploying a similar approach adopted in this study. Future studies can also examine issues relating to sustainability reporting assurance on double materiality involving external costs incurred by a company. It is worthwhile for future studies to examine the accountability of corporate governance for sustainability reporting and measurable sustainability performance that requires much continuous improvement over time. Empirically, the degree of social impact of MNCs in extractive Industries in developing countries could be modeled [100,101] and measured against global sustainability targets. Research on an internal sustainability reporting system would also enable better understanding of how meaningful ESG data and information could be captured through effective planning and control within an organization [45,55].

Author Contributions

Conceptualization, A.W.N., S.M.Y. and J.N.; methodology, A.W.N. and S.M.Y.; validation, A.W.N. and S.M.Y.; formal analysis, S.M.Y.; investigation, A.W.N. and S.M.Y.; data curation, S.M.Y.; writing—original draft preparation, A.W.N. and S.M.Y.; writing—review and editing, A.W.N., S.M.Y. and J.N.; visualization, A.W.N. and S.M.Y.; supervision, A.W.N.; project administration, A.W.N. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Schumacher, K. Green investments need global standards and independent scientific review. Nature 2020, 584, 524–525. [Google Scholar] [CrossRef]

- Hörisch, J. The relation of COVID-19 to the UN sustainable development goals: Implications for sustainability accounting, management and policy research. Sustain. Account. Manag. Policy J. 2021, 12, 877–888. [Google Scholar] [CrossRef]

- Schaltegger, S. Sustainability learnings from the COVID-19 crisis. Opportunities for resilient industry and business development. Sustain. Account. Manag. Policy J. 2021, 12, 889–897. [Google Scholar] [CrossRef]

- IFAC. International Federation of Accountants. 2020. Available online: http://www.ifac.org/system/files/publications/files/2020-IFAC-Financial-Statements.pdf (accessed on 20 February 2022).

- IFRS Foundation. Consultation Paper on Sustainability Reporting. 2020. Available online: https://www.ifrs.org/content/dam/ifrs/project/sustainability-reporting/consultation-paper-on-sustainability-reporting.pdf (accessed on 20 February 2022).

- IFRS Foundation. International Sustainability Standards Board. 2022. Available online: https://www.ifrs.org/groups/international-sustainability-standards-board (accessed on 20 February 2022).

- Deloitte. The Challenge of Double Materiality. 2022. Available online: https://www2.deloitte.com/cn/en/pages/hot-topics/topics/climate-and-sustainability/dcca/thought-leadership/the-challenge-of-double-materiality.html (accessed on 30 June 2022).

- Jørgensen, S.; Mjos, A.; Pedersen, L. Sustainability reporting and approaches to materiality: Tensions and potential resolutions. Sustain. Account. Manag. Policy J. 2022, 13, 341–361. [Google Scholar] [CrossRef]

- Baumüller, J.; Sopp, K. Double materiality and the shift from non-financial to European sustainability reporting: Review, outlook and implications. J. Appl. Account. Res. 2022, 23, 8–28. [Google Scholar] [CrossRef]

- Lin, B.; Agyeman, S. Assessing Ghana’s carbon dioxide emissions through energy consumption structure towards a sustainable development path. J. Clean. Prod. 2019, 238, 117941. [Google Scholar] [CrossRef]

- Bose, S.; Khan, H.Z. Sustainable development goals (SDGs) reporting and the role of country-level institutional factors: An international evidence. J. Clean. Prod. 2022, 335, 130290. [Google Scholar] [CrossRef]

- Erin, O.A.; Bamigboye, O.A.; Oyewo, B. Sustainable development goals (SDG) reporting: An analysis of disclosure. J. Account. Emerg. Econ. 2022. [Google Scholar] [CrossRef]

- Rosati, F.; Faria, L.G.G. Addressing the SDGs in sustainability reports: The relationship with institutional factors. J. Clean. Prod. 2019, 215, 1312–1326. [Google Scholar] [CrossRef]

- Alexander, K.; Dhumale, R.; Eatwell, J. Global Governance of Financial Systems: The International Regulation of Systemic Ris; Oxford University Press: Oxford, NY, USA, 2006. [Google Scholar]

- Perry, J.; Nölke, A. The political economy of International Accounting Standards. Rev. Int. Political Econ. 2006, 13, 559–586. [Google Scholar] [CrossRef]

- Botzem, S.; Quack, S. (No) Limits to Anglo-American accounting? Reconstructing the history of the International Accounting Standards Committee: A review article. Account. Organ. Soc. 2009, 340, 988–998. [Google Scholar] [CrossRef]

- Humphrey, C.; Loft, A.; Woods, M. The global audit profession and the international financial architecture: Understanding regulatory relationships at a time of financial crisis. Account. Organ. Soc. 2009, 34, 810–825. [Google Scholar] [CrossRef]

- Ramanna, K. The International Politics of IFRS Harmonization. Account. Econ. Law. 2013, 3, 1–46. Available online: http://www.tinyurl.com/y453sjex (accessed on 8 February 2022). [CrossRef]

- Stiglitz, J.E. Lessons from the Global Financial Crisis of 2008. Seoul J. Econ. 2010, 23, 321–339. [Google Scholar]

- Stiglitz, J.E. The Globalization of Our Discontent, Chazen Global Insights. 2017. Available online: https://www8.gsb.columbia.edu/articles/chazen-global-insights/globalization-our-discontent (accessed on 2 February 2022).

- UNFCC. The Paris Agreement. United Nations Framework Convention on Climate Change. 2020. Available online: https://unfccc.int/process-and-meetings/the-paris-agreement/the-paris-agreement (accessed on 2 February 2022).

- Guterres, A. Carbon Neutrality by 2050: The World’s Most Urgent Mission. 2020. Available online: https://www.un.org/sg/en/content/sg/articles/2020-12-11/carbon-neutrality-2050-theworld%E2%80%99s-most-urgent-mission (accessed on 20 April 2022).

- UNCTAD. Investment Policy Framework for Sustainable Development. 2015. Available online: https://investmentpolicy.unctad.org/investment-policy-framework (accessed on 20 February 2022).

- Carney, M. Building A Private Finance System for Net Zero: Priorities for Private Finance for COP26. 2021. Available online: https://emergingrisks.co.uk/building-a-private-finance-system-for-net-zero/ (accessed on 5 February 2022).

- TCFD. Recommendations of the Task Force on Climate-related Financial Disclosures. Task Force on Climate-Related Financial Disclosures. 2017. Available online: https://www.fsb-tcfd.org/recommendations/ (accessed on 20 February 2022).

- Europe, A. Follow-Up Paper: Interconnected Standards Setting for Corporate Reporting; Accountancy Europe: Brussels, Belgium, 2020. [Google Scholar]

- TCFD. Overview, Task Force on Climate-Related Financial Disclosures. 2021. Available online: https://www.fsb-tcfd.org/about/ (accessed on 20 February 2022).

- Adams, C.; Abhayawansa, S. Connecting the COVID-19 pandemic, environmental, social and governance (ESG) investing and calls for ‘harmonisation’ of sustainability reporting. Crit. Perspect. Account. 2021, 1, 102309. [Google Scholar] [CrossRef]

- Ritchie, H. Sector by Sector: Where Do Global Greenhouse Gas Emissions Come from? Available online: https://ourworldindata.org/ghg-emissions-by-sector (accessed on 5 February 2022).

- Hunt, C.; Weber, O.; Dordi, T. A comparative analysis of the anti-Apartheid and fossil fuel divestment campaign. J. Sustain. Financ. Invest. 2017, 7, 64–81. [Google Scholar] [CrossRef]

- Majoch, A.; Hoepner, A.; Hebb, T. Sources of Stakeholder Salience in the Responsible Investment Movement: Why Do Investors Sign the Principles for Responsible Investment? J. Bus. Ethics. 2017, 140, 723–741. [Google Scholar] [CrossRef]

- Friedman, M. The social responsibility of business is to increase its profits. The New York Times Magazine, 13 September 1970; 122–126. [Google Scholar]

- Ramanna, K. Friedman at 50: Is it still the social responsibility of business to increase profits? Calif. Manag. Rev. 2020, 62, 28–41. [Google Scholar] [CrossRef]

- Gray, R. Accountability, sustainability and the world’s largest corporations: Of CSR, chimeras, oxymorons and tautologies. In Corporate Responsibility: A Research Handbook; Haynes, K., Murray, A., Dillard, J., Eds.; Routledge: London, UK, 2012; pp. 151–166. [Google Scholar]

- Gray, R. Is accounting for sustainability actually accounting for sustainability … and how would we know? An exploration of narratives of organisations and the planet. Account. Organ. Soc. 2010, 35, 47–62. [Google Scholar] [CrossRef]

- Waldman, S. Shell Grappled with Climate Change 20 Years Ago. Documents Show, Scientific America. 2018. Available online: https://www.scientificamerican.com/article/shell-grappled-with-climate-change-20-years-ago-documents-show/ (accessed on 28 May 2021).

- Yuen, P.P.; Ng, A.W. Healthcare Financing and Sustainability In Good Health and Well-Being; Filho, W.L., Wall, T., Azul, A.M., Brandli, L., Özuyar, P.G., Eds.; Encyclopaedia of the UN Sustainable Development Goal; Springer: Cham, Switzerland, 2019; pp. 1–10. [Google Scholar]

- Sovacool, S.; Kim, J.; Yang, M. The hidden costs of energy and mobility: A global meta-analysis and research synthesis of electricity and transport externalities. Energy Res. Soc. Sci. 2021, 72, 101997. [Google Scholar] [CrossRef]

- Katz, D.; McIntosh, L. Corporate Governance Update: “Materiality” in America and Abroad; Harvard Law School Forum on Corporate Governance: Cambridge, MA, USA, May 2021; Available online: https://corpgov.law.harvard.edu/2021/05/01/corporate-governance-update-materiality-in-america-and-abroad/ (accessed on 5 February 2022).

- Adams, C.A.; Alhamood, A.; He, X.; Tian, J.; Wang, L.; Wang, Y. The Double-Materiality Concept: Application and Issue. 2021. Available online: https://dro.dur.ac.uk/33139/ (accessed on 2 January 2022).

- Ashford, N.A.; Hall, R.P. Technology, Globalization, and Sustainable Development: Transforming the Industrial State; Routledge: London, UK, 2019. [Google Scholar]

- Ng, A. Green Investing and Financial Services: ESG Investing for a Sustainable World. In The Palgrave Handbook of Global Sustainability; Springer: Berlin/Heidelberg, Germany, 2021; pp. 1–12. [Google Scholar] [CrossRef]

- Ng, A.; Nathwani, J.; Fu, J.; Zhou, H. Green financing for global energy sustainability: Pro-specting transformational adaptation beyond Industry 4.0. Sustain. Sci. Pract. Policy. 2021, 17, 377–390. [Google Scholar] [CrossRef]

- Tang, Y. Bumpy road leading to internationalization: A review of accounting development in China. Acc. Horiz. 2000, 14, 93–102. Available online: https://upload.news.esnai.com/2013/0509/1368083607642.pdf (accessed on 5 February 2022). [CrossRef]

- Sunder, S. Regulatory competition among accounting standards within and across international boundaries. J. Account. Public Policy 2002, 21, 219–234. [Google Scholar] [CrossRef]

- Bloomberg. Stranded Assets’ Risk Rising with Climate Action and $40 Oil. 2020. Available online: https://www.bloomberg.com/news/articles/2020-08-11/why-climate-action-40-oil-create-stranded-assets-quicktake (accessed on 28 May 2021).

- Shrivastava, P.; Zsolnai, L.; Wasieleski, D.; Stafford-Smith, M.; Walker, T.; Weber, O.; Krosinsky, C.; Oram, D. Finance and Management for the Anthropocene. Organ. Environ. 2019, 2, 26–40. [Google Scholar] [CrossRef]

- Smith, N.; Soonieus, R. How board members really feel about ESG, from deniers to true believers. In Harvard Business Review; Harvard Business Publishing: Cambridge, MA, USA, 2019; Available online: https://hbr.org/2019/04/how-board-members-really-feel-about-esg-from-deniers-to-true-believers (accessed on 5 February 2022).

- Kaplan, R.S.; Ramanna, K. How to fix ESG Reporting. In Harvard Business School Working Paper; Harvard Business Publishing: Cambridge, MA, USA, 2021; No. 22-005. [Google Scholar]

- Malik, A.; Egan, M.; Plessis, M.; Lenzen, M. Managing sustainability using financial accounting data: The value of input-output analysis. J. Clean. Prod. 2021, 293, 126128. [Google Scholar] [CrossRef]

- Serafeim, G. ESG: Hyperboles and reality. In Harvard Business School Working Paper; Harvard Business Publishing: Cambridge, MA, USA, 2021; No. 22-031. [Google Scholar]

- Bebbington, J.; Österblom, H.; Crona, B.; Jouffray, J.-B.; Larrinaga, C.; Russell, S.; Scholtens, B. Accounting and accountability in the Anthropocene. Account. Audit. Account. J. 2020, 33, 152–177. [Google Scholar] [CrossRef]

- Deegan, C. The accountant will have a central role in saving the planet … really? A reflection on ‘green accounting and green eyeshades twenty years later. Crit. Perspect. Account. 2013, 24, 448–458. [Google Scholar] [CrossRef]

- Cho, C.; Mäkelä, H. EAA Accounting Resources Centre, Can Accountants Save the World? Incorporating Sustainability in Accounting Courses and Curricula. Available online: https://arc.eaa-online.org/blog/can-accountants-save-world-incorporating-sustainability-accounting-courses-and-curricula (accessed on 5 February 2022).

- Charnock, R.; Thomson, I. Accounting and Climate Finance: Engaging with the Intergovernmental Panel on Climate Change. Soc. Environ. Account. J. 2020, 42, 1–4. [Google Scholar] [CrossRef]

- Bebbington, J.; Larrinaga, C.; Dwyer, B.; Thomson, I. Routledge Handbook of Environmental Account; Routledge: London, UK, 2021. [Google Scholar]

- Kaplan, R.S.; Ramanna, K. Accounting for climate change: The first rigorous approach to ESG reporting. In Harvard Business Review; Harvard Business Publishing: Cambridge, MA, USA, 2021; Available online: https://hbr.org/2021/11/accounting-for-climate-change (accessed on 20 February 2022).

- Els, F. MINING.COM. Available online: https://www.mining.com/featured-article/top-20-gold-producing-countries/ (accessed on 5 August 2021).

- Braithwaite, J. Responsive regulation and developing economies. World Dev. 2006, 34, 884–898. [Google Scholar] [CrossRef]

- Kumah, A. Sustainability and gold mining in the developing world. J. Clean. Prod. 2006, 14, 315–323. [Google Scholar] [CrossRef]

- Barma, N.; Kaiser, K.; Le, T.M. Rents to Riches? The Political Economy of Natural Resource-Led Development; World Bank Publications: Washington, DC, USA, 2012. [Google Scholar]

- Carroll, A.B.; Brown, J.; Buchholtz, A.K. Business and Society: Ethics, Sustainability, and Stakeholder Management; Cengage Learning: Boston, MA, USA, 2018. [Google Scholar]

- Cheng, Z.; Li, L.; Liu, J. The spatial correlation and interaction between environmental regulation and foreign direct investment. J. Regul. Econ. 2018, 54, 124–146. [Google Scholar] [CrossRef]

- Workman, D. World’s Top Exports. 2021. Available online: https://www.worldstopexports.com/worlds-top-oil-exports-country/ (accessed on 10 May 2021).

- Ravindranath, N.H.; Sathaye, J.A. Climate change and developing countries. In Climate Change and Developing Countries; Springer: Dordrecht, The Netherlands, 2002; pp. 247–265. [Google Scholar]

- Cao, X. Climate change and energy development: Implications for developing countries. Resour. Policy 2003, 29, 61–67. [Google Scholar] [CrossRef]

- Nath, P.K.; Behera, B. A critical review of impact of and adaptation to climate change in developed and developing economies. Environ. Dev. Sustain. 2011, 13, 141–162. [Google Scholar] [CrossRef]

- Impact Management Project. Intergovernmental Panel on Climate Change (IPCC). 2014. Available online: https://www.ipcc.ch/report/ar5/syr/ (accessed on 25 April 2021).

- Ali, W.; Frynas, J.; Mahmood, Z. Determinants of Corporate Social Responsibility (CSR) Disclosure in Developed and Developing Countries: A Literature Review. Corp. Soc. Responsib. Environ. Manag. 2017, 24, 273–294. [Google Scholar] [CrossRef]

- Ali, W.; Frynas, J. The Role of Normative CSR—Promoting Institutions in Stimulating CSR Disclosures in Developing Countries. Corp. Soc. Responsib. Environ. Manag. 2018, 25, 373–390. [Google Scholar] [CrossRef]

- Secretariat, C. Influencing and Meeting International Standards: Challenges for Developing Countries; International Trade Centre UNCTAD/WTO: Geneva, Switzerland, 2003. [Google Scholar]

- ISO. ISO ACTION PLAN for Developing Countries: 2021–2030. 2016. Available online: https://www.iso.org/files/live/sites/isoorg/files/store/en/PUB100374.pdf (accessed on 13 June 2021).

- European Commission. Guidelines on Reporting Climate-related Information. 2019. Available online: https://ec.europa.eu/finance/docs/policy/190618-climate-related-information-reporting-guidelines_en.pdf (accessed on 20 February 2022).

- Yin, R. Case Study Research: Design and Methods; Sage Publications: Thousand Oaks, CA, USA, 2003. [Google Scholar]

- Bryman, A.; Bell, E. Business Research Method; Oxford University Press: Oxford, UK, 2007. [Google Scholar]

- Ng, A.; Nathwani, J. Sustainability performance disclosures: The case of independent power producers. Renew. Sustain. Energy Rev. 2012, 16, 1940–1948. [Google Scholar] [CrossRef]

- Giles, O.; Murphy, D. SLAPPed: The relationship between SLAPP suits and changed ESG reporting by firms. Sustain. Account. Manag. Policy J. 2016, 7, 44–79. [Google Scholar] [CrossRef]

- An, Y.; Davey, H.; Harun, H.; Jin, Z.; Qiao, X.; Yu, Q. Online sustainability reporting at universities: The case of Hong Kong. Sustain. Account. Manag. Policy J. 2020, 11, 887–901. Available online: https://www.emerald.com/insight/2040-8021.htm (accessed on 20 February 2022). [CrossRef]

- Abudu, H.; Sai, R. Examining prospects and challenges of Ghana’s petroleum industry: A systematic review. Energy Rep. 2020, 6, 841–858. [Google Scholar] [CrossRef]

- Ghana Statistical Service. 2020. Available online: https://statsghana.gov.gh/gssmain/storage/img/marqueeupdater/Annual_2013_2019_GDP.pdf (accessed on 5 August 2021).

- US Geological Survey “Gold Data Sheet—Mineral Commodity Summaries”. 2020. Available online: https://pubs.usgs.gov/periodicals/mcs2020/mcs2020-gold.pdf (accessed on 2 June 2021).

- Ghana Chamber of Mines. Performance of The Mining Industry in 2019; Ghana Chamber of Mines: Accra, Ghana, 2019. [Google Scholar]

- GHEITI. Mining Sector Report 2014. Ghana Extractive Industries Transparency Initiative. 2017. Available online: http://www.gheiti.gov.gh (accessed on 20 February 2022).

- Ghana Chamber of Mines. Gold Output from Large-Scale Mining Sector Up Six Percent in 2019. 2020. Available online: https://ghanachamberofmines.org/ (accessed on 5 June 2021).

- Bhattacharya, P.; Sracek, O.; Eldvall, B.; Asklund, R.; Barmen, G.; Jacks, G.; Balfors, B.B. Hydrogeochemical study on the contamination of water resources in a part of Tarkwa mining area, Western Ghana. J. Afr. Earth Sci. 2012, 66–67, 72–84. [Google Scholar] [CrossRef]