Abstract

The objective of this paper is to combine cross-commodity and spatial price transmission analysis to study the dynamics of the global cereal feed market during the COVID-19 pandemic. After reviewing the nascent literature on the impact of COVID-19 on agricultural markets, we discuss the different impact channels on prices. Then, we provide stylized market reactions of three relevant feed markets, wheat, barley, and maize, to a set of simulated possible future shocks on oil prices, stock-to-use ratios, and export restrictions. These three shocks are useful to assess what could be the consequences of policy responses to COVID-19 (export restrictions) or the disruptions due to the virus (stock-to-use reductions), in a context of lower oil prices. To generate these market reactions, we use a Global Vector Auto Regression (GVAR) model where each market is modelled independently, and connected through trade-based composite variables. We expand the work on the global wheat market by introducing maize and barley. The results of the empirical analysis indicate that the fall in the oil price may have contributed to the stability of the world grain market in early 2020, despite fears of supply chain disruption. We also note that export restrictions could significantly increase global prices, and that such restrictions could affect more than the targeted commodity, through significant cross-commodity price linkages.

1. Introduction

The COVID-19 pandemic generated a major economic shock in 2020. The crisis has affected most countries and most economic sectors, through the consequences of the necessary sanitary measures adopted by governments to contain the virus, and with a large potential impact on the global GDP and trade [1,2]. The crisis influenced food production, processing, distribution, and demand [3,4], therefore affecting all dimensions of food security and warranting policy measures to maintain grain production and distribution [5]. However, despite numerous anticipated disruptions [6], many agricultural markets have held up well [7,8]. Panic buying is cooled and shifts in consumption habits arising from personal isolation were accommodated in the first half of 2020 [9]. However, at the time of writing, some concerns remain regarding the possible policy reactions if the pandemic was to last [10], and the extent to which agricultural value chains would adapt [11].

In this paper, we look at the impact of the crisis on global grain markets. The global agricultural market in the first half of 2020 was hit by concerns over the supply chain disruptions and fears that some producing countries would decide to restrict their exports. Further, the pandemic influenced the labor market, reducing the mobility across borders and within countries causing labour shortages, especially in countries that are dependent on seasonal migrant workers in the agri-food sector, which, in turn, has impacted food availability and prices globally [12]. These concerns came in the context of a major negative oil demand shock that sent crude prices to record low and the stocks-to-use ratios to historically high levels for most grains and oilseeds [13].

Wheat, barley, and maize form a nexus of storable products, linked by their substitutability in both human and animal use. Their staple food status in most countries and their central role as input to the livestock sector make these grain products essential to global food security. We selected these three products for their large share of the global grain market and their inter-connectedness. The large number of concerned trade partners and the essential nature of these commodities also make them an important research topic. Up to the end of 2021, the global export market for wheat was led by the Black Sea countries (Ukraine, Russia, and Kazakhstan), the European Union block, Canada, and the United States. The role of Black Sea countries is shifting during the Ukraine conflict in 2022, as we are finalising this paper. Australia is also a major exporter, although with declining market shares since 2011. Barley is exported by the same group, although in lower volumes and with a smaller market share for the United States. Maize exports are dominated by the United States, followed by Brazil and Argentina, but the Black Sea block has been building a presence on the global market since 2015.

To explore the effect of the potential impact of COVID-19 on these three commodities, we start by reviewing the nascent literature on the issue, then we discuss the different impact channels on prices. We provide stylised market reactions of the global feed market (wheat, barley, and maize exports) to a set of simulated shocks on oil prices, stock-to-use ratio, and export. These market reactions are obtained through a multi-country time series modelling exercise. We use a Global Vector Auto Regression (GVAR) model [14] with each market modelled independently, and connected through trade-based composite variables. We expand the work of [15] on the global wheat market by introducing maize and barley markets. Each market includes an export variable, a stock-to-use ratio variable, and the oil prices. These allow for simulating the impact of export restrictions, a reduction of stocks, and a negative oil price shock. These three shocks are useful to assess what could be the consequences of policy responses to COVID-19 (export restrictions) or disruptions due to the virus (stock-to-use reductions), in a context of lower oil prices.

There are three main reasons why a GVAR model is helpful for analysing worldwide commodity prices. First, the model is specifically designed to analyze market fluctuations and interactions between countries. This is crucial, given the characteristics of the world commodity markets and the global dimensions of food price dynamics, which cannot be reduced to one exporter but rather involve multiple countries. Secondly, the GVAR lets us model the dynamism in commodity export prices caused by the effects of country-specific and foreign-specific variables. For country-specific variables, we can use the impact on each country’s export price of the usually proposed drivers, such as the stock-to-use ratio. However, export prices can also be affected by what can be labelled foreign-specific variables, i.e., variables that are strictly connected to the domestic variables, such as the competitors’ export prices, the effective exchange rate, or supply and/or demand shocks in other countries that may affect the domestic economy. GVAR can also account for global shocks such as changes in oil prices, i.e., shocks that will affect all or some countries but can be thought of as strictly exogenous with respect to the wheat market. Thirdly, although the GVAR model is unlike structural models in that it combines a number of atheoretical relationships and does not attempt to impose restrictions on the basis of economic theory, it nevertheless can be easily adapted and used to test well-known economic concepts such as whether the law of one price (LOP) holds in the worldwide wheat market.

2. Recent Literature on Agricultural Markets and the COVID-19 Pandemic

Limit to movements of the agricultural workforce, food stockpiling, panic buying, as well as cross-border and domestic restrictions, have been identified as the main possible consequences of the virulent COVID-19 pandemic that can seriously affect the worldwide food supply chain [5,16,17,18]. Although only some of these disruptions were observed during the first half of 2020, and food prices did not appear to have been significantly affected, according to [19] daily reports, the COVID-19 outbreak was still accelerating in the first week of September 2020 at the global level. Therefore, it cannot be excluded that in the near future the same factors will negatively affect the food supply chain and the livelihoods of many farmers, inducing price spikes and increased price volatility.

According to the International Trade Centre [20], 90 countries have introduced export prohibitions or restrictions as a result of the COVID-19 pandemic, and over three billion people in the world depend on international trade for food security. This situation raised significant concerns that the global health crisis caused by the COVID-19 epidemic could lead to a global food crisis. If we focus on the cereals market, [21] reports that, in March 2020, Kazakhstan introduced export quotas on wheat and wheat flour, and an additional increase in the export quotas for both commodities were announced in April 2020. In March 2020, Ukraine introduced export restrictions for wheat until the end of marketing year 2019/20. Finally, Tajikistan introduced an export ban on all types of cereals. The purpose of these policies was to protect and insulate the domestic market from global market developments to avoid possible shortage of staple foods. However, they might have a far-reaching impact at a global level beyond their initial intended scope.

Export restrictions were also imposed during the August 2007 and 2010–2011 food crises and, according to some authors [22,23,24], they had a leading role in turning a critical situation into a worldwide crisis. For example, ref. [24] found that uncooperative trade policies alone were responsible for an increase in global food prices by 13%, and [23] reported that 30% of the observed change of the international price of wheat in 2005–2008 had to be attributed to export restrictions.

However, the context in 2020 seems different from the recent food crises, and global food markets appear less vulnerable than in August 2007 and 2010–2011. In June 2020, world production levels of wheat, maize, and barley were 3.2, 11.2, and 7.2% above the average of the past three years [25]. In the same period, global stocks of wheat were 17.0% higher than the previous three years, with maize 25.5% and barley 19%. Domestic and foreign demands have grown at a slower pace than production, with only export of barley showing a contraction, −6.6%, see Table 1.

Table 1.

World Production, Consumption, Exports, and Ending Stocks for Wheat, Maize, and Barley. January 2017–February 2020.

A second factor may have affected the food price dynamics in the first half of 2020. COVID-19 has strongly influenced the oil market. The sudden stop in economic activity and the breakdown of travel arising from lockdown measures with a reduced global fuel demand for transport (which accounts for two-thirds of global oil demand according to [8]), as well as the uncertainty around production agreements among the oil producers, have caused one of the biggest declines of oil prices. World Bank “Pink Sheet” commodity prices show that WTI crude oil in April 2020 experienced the lowest quotation of the last twelve years with USD 16.52 per barrel. Since then, the oil markets were recovering but in June 2020, WTI oil price was still 30.0% lower than the corresponding 2019 months and 79.5% with respect to the average price of the previous three years.

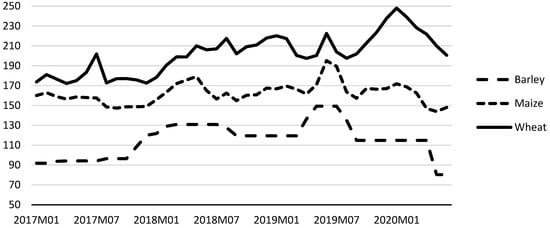

Focusing on maize, wheat, and barley prices (Figure 1), three of the most important cereal feeds, quotations in June 2020 were lower than those of six months earlier due to favorable production conditions, small growth in global consumption, especially for wheat, and a good level of stocks (see Table 1).

Figure 1.

Wheat, Maize, Barley Commodity Prices ($/mt). Source: World Bank, the Pink Sheet. January 2017–February 2020.

Nevertheless, food security concerns were raised in 2020 [10], due to the pandemic that was accelerating at a global level, and given the adoption of trade restrictions by key Black Sea country exporters (wheat export quota in Kazaksthan, grain export quota in Russia (FAO Food and Agriculture Policy Decision Analysis (FAPDA) database. Available at https://www.fao.org/in-action/fapda/fapda-policy-database/en/) accessed on 10 January 2020) and/or panic buying by some importers such as Egypt and Saudi Arabia for wheat. If such concerns were to spread, more adverse consequences of the pandemic were expected to compound into a lower purchasing power driven by unemployment, weaker access to credit and social safety net mechanisms, as well as the availability of food staples [26]. At the time of writing, the Ukraine conflict had not yet started, but this major event exacerbated the Black Sea import restrictions.

In this environment, it seems relevant to investigate the impact of three main shocks on grain prices that took place during the course of 2020: (i) the implementation of new export restrictions in response to COVID-19 upsurge; (ii) the reduction of the stock-to-use ratios connected with a less favorable level of grain inventories and a stable demand; and (iii) lower oil prices, again connected with the COVID-19 spread. The simulation is obtained with a new global dynamic time series model that allows for the analysis of three relevant grain export markets, wheat, maize, and barley.

3. Generalized Impulse Response Functions to COVID-19

3.1. A Global VAR Model for the Feed Market

This subsection presents a Global VAR for the feed market. The GVAR is built on country-specific vector error correction models (VEC). It connects country models through multiple channels of international linkages, uncovering the size and transmission speed of price shocks emanating from the global feed market. Introduced by [27], it was updated and extended with a stronger theoretical background by [14]. The GVAR method has been applied on several occasions to agri-food markets: first, with a focus on major wheat exporting countries [15] and their sensitivity to El Nino effects [28], then to assess regional price dynamics in the African maize trade [29]. We follow a similar approach and proceed as follows.

Each country model combines a group of crop prices and domestic variables. The set is paired with exogenous variables accounting for the impact of global markets. Consider for the sake of simplicity the following structure VARX (2,2) structure applicable to N countries with i = 0, 1, …, N:

with a vector of constant country intercepts and a vector of coefficients of possible country-specific deterministic time trends.

Equation (1) includes three different blocks of variables. The first building block is a set of domestic variables gathered in the vector. Domestic variables are the prices of wheat, maize, and barley, and the associated export and stock-to-use ratio estimates from the USDA. Domestic variables also include the food consumer price index and the US dollar exchange rate. Not all country models need to include all domestic variables. contains the temporal coefficients associated to . In the second block, is a vector of foreign, weakly exogenous, variables with their vector of coefficients, . The foreign variables are weighted price series for maize, barley, and wheat, and they represent the influence of trade partners’ markets on a given national market and are computed as , with and . The set of weights, , is based on the relative size of the global market export share of country j from the perspective of country i. The relative weights are such that . Finally, in the third block, we assume that the international energy market is susceptible to influence all country models and the endogenous variables. Energy represents an important share of production costs, more than 30% of total expenditures for many cereals [30], and can affect agricultural prices, with important implications for both consumers and farmers (see [15,31,32] among others). Hence, we include oil prices in all country models. Although this variable, , is common to all systems, it affects each domestic market to a different degree, as specified by the vector of associated autoregressive coefficients. The oil variable is endogenous in the US model.

Upon detection of cointegration, country models may be re-written within the error correction form of the VARX (2,2):

where , is a matrix of adjustments parameters determining the speed of adjustment towards the long-run equilibrium, and is a ( matrix of rank containing the long-run relationships (cointegrating vectors) between local markets. and contain, respectively, the short-run responses to international and domestic variations. The rank of allows one to determine the presence of cointegration. When , variables are not cointegrated, and the model becomes equivalent to a VARX in first differences

To solve for the GVAR, local and foreign variables are stacked in and a country model (Equation (1)) can be rewritten as:

where , for . We can then use all link vectors from matrix , defined by the trade weights , to obtain the identity:

where is the vector which collects all endogenous variables of the system, and Wi is a matrix containing weights that will account for trade linkages. Therefore, all country-VARX equations modelled with (3) are connected to each other through identity Equation (4), which yields a single country model of the form:

for i = 0, 1, …, N, and has dimensions ki × k. This country model is connected to all other country models of the GVAR through the weighted averages of the foreign variables (commodity prices) constructed in Equation (4). This is the main channel for price chock propagation.

Finally, by stacking all seven country-specific models Equation (5), we derive the Global VAR Equation (2) model for all endogenous variables in the system, :

For more details on obtaining the reduced form of the GVAR and on the estimation procedure, see [33]. The GVAR Model Equation (6) was estimated over the period March 2006 to May 2020.

The model connects the main grain exporters on the global market. These exporters are Argentina, Australia, Brazil, the European Union, the Black Sea region, and the United States. The two regional blocks (the EU and Black Sea) are represented by the sum of their stock-to-use or exports volumes, EU prices are Rouen prices for wheat and barley, EU averages for maize, and Black Sea prices are averages as reported by [34]. In Table 2, we summarize the set of domestic, foreign (The small country hypothesis is a requirement of the GVAR framework and implies that no single country should be able to impact global and foreign variables. Trade flows are by nature endogenous to price equations but the foreign variables, product of weighted averages, are tested for weak exogeneity for countries where cointegration has not been ruled out. Test statistics suggest that all foreign and global variables are weakly exogenous in all country models, except for oil prices in Argentina) and global variables included in the GVAR model for each of the export countries included in the analysis. The oil price is included in all models. Stock-to-use, exports, and foreign variables are included in country models when the price variables are also present. The CPI is included everywhere except in the Black Sea model, which is a combination of three economies. The exchange rate with USD is included everywhere except in the USA model.

Table 2.

Model structure.

The commodity prices used in the analysis are obtained from the FAO/FPMA dataset [35], the International Grain Council (IGC) [34], and the European Commission’s Grain Market Observatory [36]. The stock-to use ratio and export variables are the monthly update forecasts of the stocks and export for the marketing year of the United States Department of Agriculture [24]. The CPI is sourced from the OECD database [37], the exchange rate from the IMF [38], and the oil price from the World Bank’s pink sheet [8]. Using the total average annual export volume per country between 2006 and 2018, the trade weight matrix is built from the UN Comtrade data [39], and shown in Table 3. It represents the relative share of exports of trade partners (in rows) faced by each country in the model (in columns). Each column sums to 100%. Each row indicates the relative importance of each country for their trade partners. For wheat, Australia is the lead exporter, with the USA and the Black Sea countries generally being the next largest competitors for the other exporters. For maize, the USA and Brazil are the dominant players.

Table 3.

Trade weight matrix used to construct foreign variables connecting country models.

3.2. Results Discussion

This section presents the GVAR empirical setting and estimate responses to a series of global shocks to the feed market model.

The GVAR lag structure varies across country VARs for both domestic variables (p) and foreign variables (q) and is selected using the Akaike Information Criterion (AIC) (see Table 4). To save degrees of freedom, the domestic variable includes up to 3 lags (p), and foreign commodity prices are influenced by up to 2 months of data (q). In addition to lagged reactions, contemporaneous linkages (within the same month) are key characteristics of the global grain market. Contemporaneous foreign variables coefficients, , can be interpreted as the sensitivity of domestic prices to price shocks in trade partners’ markets. Overall, the results suggest a significant price sensitivity across key players of the global market. Table 4 presents the contemporaneous coefficients for the three commodities’ foreign variables. Wheat prices generally exhibit a higher sensitivity to foreign prices than the other commodities. Barley is the least sensitive on average.

Table 4.

Model settings and contemporaneous coefficients.

To study the COVID-19 2020 market context and the reaction of key variables across the model, we rely on Generalised Impulse Response Functions (GIRFs). These are obtained by examining the response of the model across several periods after a given shock to one variable of the system (see [27] for more on GIRFs adapted to VAR models). Because the variables have different scales, we consider one standard error rather than unit shocks. The rescaling has expected to give a better illustration of the dynamic relationships because the average size of the shocks occurring in a system depends on their standard error, [40]. To get an indication of confidence around these responses, they are bootstrapped by generating samples of the series, using the variance-covariance matrix computed from the estimated residuals of the individual country models. Country level prices reactions are aggregated into a global market reaction for each market. The aggregation is performed through an export volume weighted averaging of the bootstrapped impulse responses (using the average annual export value over the period). In what follows, we discuss the reactions to the following scenario, the results of which are presented in Figure 2 and Figure 3:

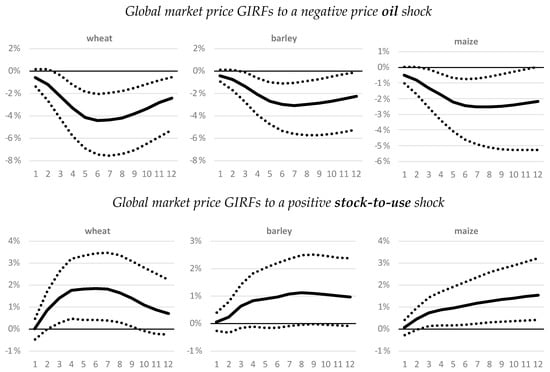

Figure 2.

Global market GIRFs to global shocks affecting all countries. Note: Generalised Impulse Response Functions (GIRFs) represent the estimated price reaction to selected shocks. The 12-month horizon median response (plain line) and 10th and 90th percentiles (dotted lines) were obtained from 3000 bootstrap replications of GIRFs.

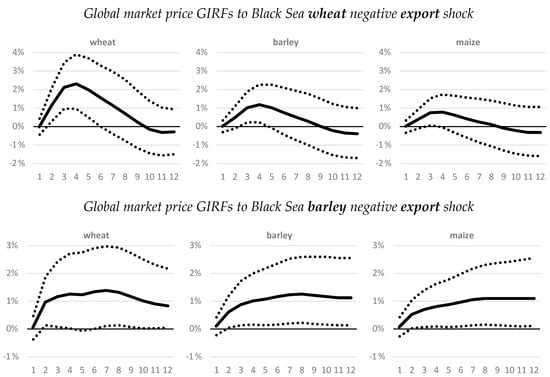

Figure 3.

Global market price GIRFs to export and stocks shocks in the Black Sea model. Note: Generalised Impulse Response Functions (GIRFs) represent the estimated price reaction to selected shocks. The 12-month horizon median response (plain line) and 10th and 90th precentiles (dotted lines) were obtained from 3000 bootstrap replications of GIRFs.

- a one standard error negative global shock to oil price, which is equivalent to an oil price reduction of −4.4%;

- a one standard error negative shock to stock-to-use ratios, a shock affecting stocks in all countries, which is equivalent to an average reduction between −0.2% to −6.6% (−2.9% on average), depending on the commodity and country;

- a one standard error negative shock to exports in Black Sea countries, which is equivalent to −3.8% exports reduction for wheat and −4.2% for barley.

Note that the global shocks are shocks simultaneously affecting all models, whereas the Black Sea shocks are only imputed in the Black Sea model and not the other markets.

A global negative oil price shock, simultaneously affecting all feed exporters, leads to a 4% median price reduction after 6 months for wheat, 2% for barley, and 2% for maize (top panel of Figure 2). For wheat and barley, the effect dissipates after a 12-month horizon, when prices revert to their previous levels. Maize prices are slower to revert to their equilibrium. A significant impact of oil price on wheat price is reported in many articles including [32,41] for wheat and maize and [15] for wheat.

A global negative stock-to-use shock simultaneously affecting all feed exporters leads to a significant price increase, for each product (bottom panel of Figure 2). Barley bootstrapped reactions suggest that the one standard error shock on the stock-to-use ratio does not lead to a significant price reaction in the first few months, but a stronger disruption would lead to a significant price reaction. Note that these results are based on a 1-month shock. If the disruption persists, the impact might be greater. Hence, these estimates should be taken as lower bound indications. Further, a 24-month horizon for the figure would not change the results. Most series do not show persistence trending back to 0.

The critical role of stocks-to-use ratios in driving price spikes and volatility has been studied and documented in various papers such as [42,43,44].

We can summarize the findings from the global shocks as follows:

- Oil price shocks generate the strongest price responses (compared to stocks and exports);

- The oil shock takes more time to fully affect prices than the stock-to-use ratio shocks;

- A one standard error reduction of exports has a stronger impact on prices than a similar shock to stocks;

- All things equal and in case they happen simultaneously, the price increasing effect of the reduction of stocks are compensated by the impact of lower oil prices, for up to 12 months;

- Maize prices exhibit a lower sensitivity than wheat prices, but the effect of a stock-to-use reduction does not dissipate over time (hysteresis).

A negative export shock in the Black Sea model pushes global wheat prices up to 2% higher in the median scenario (1% in the case of barley). Figure 3 presents the results of simulated export restriction for wheat (top panel) and barley (bottom panel) in the Black Sea model. This reaction represents the potential impact of export restrictions in this group of key exporters. At the time of writing, Kazakhstan, for instance, had suspended exports of several cereal products, as well as oilseeds and vegetables, during a few months of the first half of 2020. In addition, Russia was also considering a ban on wheat exports [45]. The results of the GVAR model suggest that the magnitude of a curb on Black Sea annual wheat exports equivalent to one standard error of the monthly USDA forecast would generate a global price reaction similar to the one of a global shock, but it would dissipate faster.

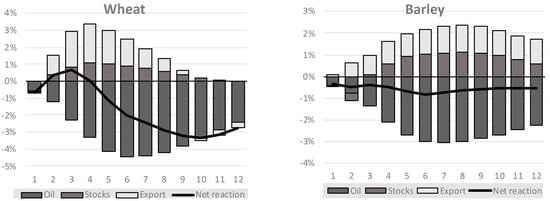

Next, we pool the median global price responses to the two Black Sea shocks and combine them to the oil shock response to mimic the 1st half year of 2020 (oil shock) and the potential consequences of supply chain disruptions (stock-to-use reductions) and border closures or export restrictions (4). Note that, since the GVAR model is linear, the reaction to stronger (or weaker) shocks can easily be obtained by multiplying the impulse responses by a scaling factor, to design further stress scenarios.

The reduced stock-to-use ratio and export volumes from the Black Sea both push wheat and barley prices up, but this reduction is fully compensated by lower oil prices in this scenario that mimics the first half of 2020 (in terms of directionality, not in terms of magnitude).

As we are finalising this paper, another major set of shocks affected the global grain market. In 2022, projected stock-to-use ratio and export volumes from the Black Sea area were sent down by the Russia-Ukraine conflict, triggering trade restrictions in different parts of the global market. However, this time the oil market did not compensate for the downward pressure. Instead, record high oil prices added to the global grain price increases. In 2022, natural gas price spikes, not included in our model, also contributed to high global grain prices, alongside bad climatic conditions (e.g., heatwave in India). The 2022 developments confirmed the general findings of the model developed in this paper and the resulting relationships between key grain price formation drivers (Figure 4).

Figure 4.

Global market reactions to Black Sea stocks and export shocks and low oil prices. Note: The 12-month horizon median response was obtained from 3000 bootstrap replications of GIRFs. The global market price reaction is obtained from a weighted sum of the country-specific reactions. Shocks simulations are independent from each other. Disclaimer: Shocks are assumed independent, with no correlation across shocks. The total impact is therefore underestimated in these graphs.

Finally, an important element arising from this model, is the cross-commodity linkages. The results suggest that each commodity significantly reacts to developments affecting the others. Export restrictions or supply chain disruptions affecting stock levels can have spill-over effects on other products than the targeted ones. When restrictions are applied to all products, the impact is compounded.

4. Conclusions

In this paper, we discuss the possible impact of the COVID-19 pandemic on the global feed market. We use a Global Vector Autoregression model to assess the extent to which oil, exports, and stock-to-use shocks might affect the main exporters of wheat, barley, and maize. The model brings together the three commodities, endogenously modelled across each of the main exporters which are connected through trade matrices.

Results of the empirical analysis indicate that the oil market might have contributed to the global grain prices remaining stable in early 2020, despite supply chain disruption concerns. We also observe that export restrictions such as those experienced in the first half of 2020 could significantly increase the global prices, and that such restrictions could affect more than the intended commodity, through significant cross-commodity price linkages. Moreover, the results suggest that price shocks rapidly propagate across different grain markets and across countries.

Several policy implications might be derived. The estimates suggest a high level of sensitivity and interdependence between the different market players. In the event of lower levels of grain stocks, coupled with trade export restrictions and oil prices rebound, the global feed market could evolve towards significantly higher prices. These estimates suggest that managing stock levels without restricting exports can contribute to stabilising the global market. Concluding, to address the challenges of COVID-19, the model suggests that any action designed at minimizing the disruption to food supply and guaranteeing trade of grains will mitigate price surges and, as a consequence, will have a positive impact on the food system and food security. Further research is needed to properly assess these actions.

Author Contributions

Conceptualization, L.G. and G.P.; methodology, L.G. and G.P.; formal analysis, L.G. and G.P.; investigation, L.G., G.P. and M.S.; resources, L.G., G.P. and M.S.; data curation, L.G., G.P. and M.S.; writing—original draft preparation, L.G., G.P. and M.S.; writing—review and editing, L.G., G.P. and M.S.; supervision, L.G.; project administration, M.S.; funding acquisition, L.G. All authors have read and agreed to the published version of the manuscript.

Funding

This research was funded by [Fondazione Sardegna under the project Global models, Scenarios and Local Strategies] grant number [J86C16000030009].

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Conflicts of Interest

The authors declare no conflict of interest.

References

- IMF. International Monetary Fund. World Economic Outlook Update. In World Economic Outlook; IMF: Washington, DC, USA, 2020. [Google Scholar]

- Maliszewska, M.; Mattoo, A.; van der Mensbrugghe, M.D. The Potential Impact of COVID-19 on GDP and Trade. SSRN Electron. J. 2020, 3573211. [Google Scholar]

- Aday, S.; Aday, M.S. Impacts of COVID-19 on Food Supply Chain. Food Qual. Saf. 2020, 4, 167–180. [Google Scholar] [CrossRef]

- Chenarides, L.; Manfredo, M.; Richards, T.J. COVID-19 and Food Supply Chains. Appl. Econ. Perspect. Policy 2021, 43, 270–279. [Google Scholar] [CrossRef]

- Laborde, D.; Martin, W.; Swinnen, J.; Vos, R. COVID-19 and Risks to Global Food Security. Science 2020, 39, 500–502. [Google Scholar] [CrossRef] [PubMed]

- Barichello, R. The COVID-19 pandemic: Anticipating its effects on Canada’s agricultural trade. Can. J. Agric. Econ. 2020, 68, 219–224. [Google Scholar] [CrossRef]

- Deaton, B.J.; Deaton, B.J. Food security and Canada’s agricultural system challenged by COVID-19. Can. J. Agric. Econ. 2020, 68, 143–149. [Google Scholar] [CrossRef]

- World Bank. The Commodity Markets Outlook, April 2020 Edition; World Bank: Washington, DC, USA, 2020; Available online: https://www.worldbank.org/en/research/commodity-markets (accessed on 1 June 2020).

- Kerr, W.A. The COVID-19 pandemic and agriculture: Short- and long-run implications for international trade relations. Can. J. Agric. Econ. 2020, 68, 225–229. [Google Scholar] [CrossRef]

- Glauber, J.; Laborde, D.; Martin, W.; Vos, R. COVID-19: Trade Restrictions Are Worst Possible Response to Safeguard Food Security; IFPRI Blog post, March 27; International Food Policy Research Institute: Washington, DC, USA, 2022. [Google Scholar]

- Morton, J. On the susceptibility and vulnerability of agricultural value chains to COVID-19. World Dev. 2020, 136, 105132. [Google Scholar] [CrossRef]

- FAO. Migrant Workers and the COVID-19 Pandemic; FAO: Rome, Italy, 2020; Available online: https://www.fao.org/3/ca8559en/CA8559EN.pdf (accessed on 15 January 2020).

- Baffes, J.; Oymak, I.C. Food Commodity Prices: Prospects and Risks Post-Coronavirus, World Bank Blogs. June 2020. Available online: https://blogs.worldbank.org/opendata/food-commodity-prices-prospects-and-risks-post-coronavirus (accessed on 1 July 2020).

- Dees, S.; di Mauro, F.; Pesaran, M.H.; Smith, L.V. Exploring the international linkages of the euro area: A global VAR analysis. J. Appl. Econom. 2007, 22, 1–38. [Google Scholar] [CrossRef]

- Gutierrez, L.; Piras, F.; Roggero, P.P. A Global VectorAutoregression model for the analysis of the wheat export prices. Am. J. Agric. Econ. 2015, 97, 1494–1511. [Google Scholar] [CrossRef]

- Espitia, A.; Rocha, N.; Ruta, M. COVID-19 and Food Protectionism: The Impact of the Pandemic and Export Restrictions on World Food Markets; World Bank, Policy Research Working Paper 9253; World Bank: Washington, DC, USA, 2020. [Google Scholar]

- Laborde, D.; Martin, W.; Vos, R. Poverty and Food Insecurity could Grow Dramatically as COVID-19 Spreads; International Food Policy Research Institute: Washington, DC, USA, 2020. [Google Scholar]

- Torero Cullen, M. Coronavirus, Food Supply Chains under Strain: What to Do? Food and Agriculture Organization: Rome, Italy, 2020. [Google Scholar]

- WHO. Director-General’s Opening Remarks at the Media Briefing on COVID-19; WHO: Geneva, Switzerland, 2020.

- ITC. Global Map of COVID-19 Temporary Trade Measures; ITC: Washington, DC, USA, 2020. Available online: https://www.macmap.org/covid19 (accessed on 10 February 2020).

- FAO. Food and Agriculture Policy Decision Analysis (FAPDA): Policy Database; FAO: Rome, Italy, 2020; Available online: https://www.fao.org/in-action/fapda/fapda-home/en/ (accessed on 10 January 2020).

- Headey, D.; Fan, S. Reflections of the Global Food Crisis; IFPRI Monograph: Washington, DC, USA, 2010. [Google Scholar]

- Martin, W.; Anderson, K. Export Restrictions and Price Insulation during Commodity Price Booms. Am. J. Agric. Econ. 2012, 94, 422–427. [Google Scholar] [CrossRef]

- Giordani, P.; Rocha, N.; Ruta, M. Food prices and the multiplier effect of trade policy. J. Int. Econ. 2016, 101, 102–122. [Google Scholar] [CrossRef]

- USDA. Production, Supply, and Distribution (PSD) Database; USDA: Washington, DC, USA, 2020. Available online: https://apps.fas.usda.gov/psdonline/app/index.html#/app/downloads (accessed on 5 February 2020).

- Schmidhuber, J.; Pound, J.; Qiao, B. COVID-19: Channels of Transmission to Food and Agriculture; Food and Agriculture Organization: Rome, Italy, 2020. [Google Scholar]

- Pesaran, M.H.; Schuermann, T.; Weiner, S.M. Modeling regional interdependencies using a global error-correcting macroeconometric model. J. Bus. Econ. Stat. 2004, 22, 129–162. [Google Scholar] [CrossRef]

- Gutierrez, L. Impacts of El Niño-Southern Oscillation on the wheat market: A global dynamic analysis. PLoS ONE 2017, 12, e0179086. [Google Scholar] [CrossRef] [PubMed]

- Pierre, G.; Kaminski, J. Cross-country maize market linkages in Africa: Integration and price transmission across local and global mark. Agric. Econ. 2019, 50, 79–90. [Google Scholar] [CrossRef]

- Beckman, J.; Borchers, A.; Jones, C.A. Agriculture’s Supply and Demand for Energy and Energy Products; USDA-ERS: Kansas, MI, USA, 2013.

- Myers, R.J.; Johnson, S.; Helmar, M.; Harry, B.H. Long-run and Short-run Co-Movements in Energy Prices and the Prices of Agricultural Feedstocks for Biofuel. Am. J. Agric. Econ. 2014, 96, 991–1008. [Google Scholar] [CrossRef]

- Lundberg, C.; Skolrud, T.; Adrangi, B.; Chatrath, A. Oil Pass Through to Agricultural Commodities. Am. J. Agric. Econ. 2021, 103, 721–742. [Google Scholar] [CrossRef]

- Smith, L.V.; Galesi, A. GVAR Toolbox 2.0 (2014). Available online: https://sites.google.com/site/gvarmodelling/gvar-toolbox (accessed on 11 January 2020).

- IGC. World Grain Statistics; International Grains Council: London, UK, 2016. [Google Scholar]

- FAO. Food Policy Monitoring and Analysis (FPMA) Tool; FAO: Rome, Italy, 2020; Available online: https://fpma.apps.fao.org/giews/food-prices/tool/public/#/home (accessed on 15 January 2020).

- EU 2020. DG AGRI Crop Market Observatory. Available online: https://ec.europa.eu/info/food-farming-fisheries/farming/facts-and-figures/markets/overviews/market-observatories/crops_en (accessed on 1 February 2020).

- OECD. Consumer Price Index Database; OECD: Paris, France, 2020; Available online: https://stats.oecd.org/Index.aspx?DataSetCode=PRICES_CPI (accessed on 20 January 2020).

- IMF. International Monetary Fund database, International Financial Statistics; IMF: Washington, DC, USA, 2020; Available online: https://data.imf.org/ (accessed on 2 March 2020).

- UN. UN Comtrade Database; UN: New York, NY, USA, 2020; Available online: https://comtrade.un.org/data/ (accessed on 10 January 2020).

- Lütkepohl, H. New Introduction to Multiple Time Series; Springer: Berlin/Heidelberg, Germany, 2005. [Google Scholar]

- Baumeister, C.; Kilian, L. Do oil prices increases cause higher food prices? Econ. Policy 2014, 29, 691–747. [Google Scholar] [CrossRef]

- Bobenrieth, E.; Wright, B.; Zeng, D. Stock-to-use ratios and prices as indicators of vulnerability to spikes in global cereal markets. Agric. Econ. 2013, 44, 43–52. [Google Scholar] [CrossRef]

- Hochman, G.; Rajagopal, D.; Timilsina, G.; Zilberman, D. Quantifying the causes of the global food commodity price crisis. Biomass Bioenergy 2014, 68, 106–114. [Google Scholar] [CrossRef]

- Tadesse, G.; Algieri, B.; Kalkuhl, M.; von Braun, J.J. Drivers and triggers of international food price spikes and volatility. Food Policy 2014, 47, 117–128. [Google Scholar] [CrossRef]

- IFPRI. Food Export Restrictions during the COVID-19 Crisis; IFPRI: Washington, DC, USA, 2020; Available online: https://public.tableau.com/profile/laborde6680#!/vizhome/ExportRestrictionsTracker/FoodExportRestrictionsTracker (accessed on 8 February 2020).

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).