Abstract

European regions are facing many important challenges, as the need to recover from the pandemic coincides with the need to carry out the green and digital transitions foreseen in the European Green Deal, making the task harder, especially for less-developed regions. The paper considers making use of regional intellectual capital in the context of smart specialisation strategies (S3) as the most effective way to address these challenges and achieve smart, sustainable and inclusive growth. This is viewed through a closer look at two specific cases of Greek regions that are behind the EU mean in terms of development and innovation: Central Macedonia and Western Macedonia. Development trends, available intellectual capital and current smart specialisation strategies in these regions are examined. These result in concrete, evidence-based suggestions on how they can make maximum use of intellectual capital for the next generation of smart specialisation strategies to achieve growth via a focus on more innovative and sustainable activities.

1. Introduction

Presently, European regions are facing a host of important challenges. The COVID-19 pandemic created major economic disruptions. The need to recover from the pandemic coincides with the need to carry out green and digital transitions foreseen in the European Green Deal, making the task harder [1]. The challenge is even greater in the less-developed countries of the European Union (EU). In Greece, for example, which is consistently behind the European innovation performance, the pandemic’s impact was exacerbated by the persistent effects of economic crisis, unemployment and brain drain [2]. As was also the case in many other countries, the consequences of the pandemic were associated with numerous disruptions in the functioning of markets, leading to uncertainty, financial losses, interrupted transactions and disruptions in supply chains. The pandemic crisis has also exposed shifts in consumption patterns and ways of meeting demand, which are particularly noticeable in food markets [3].

Addressing these challenges requires a mobilisation of stakeholders that is both broad and decisive to utilise all available resources and achieve smart, sustainable and inclusive growth in EU regions, in particular, less-developed ones, that targets the European Cohesion Policy [4]. Stakeholder engagement for innovation and new technologies can be used to address pressing environmental issues and create sustainable growth [5].

The central premise of the present paper is that this ambitious goal can be served by making use of regions’ available intellectual capital via regional smart specialisation strategies, as this approach represents an effective and broad utilisation of a region’s resources. These concepts—intellectual capital and smart specialisation strategies—will be briefly explained below. The following sections will then explore practical examples via a closer look at two Greek regions that are behind the EU mean in terms of development and innovation: Central Macedonia and Western Macedonia. Development trends, available intellectual capital and current smart specialisation strategies in these two regions are examined.

It should be noted that the paper follows a loose, descriptive analysis type of qualitative research methodology. It reviews the key concepts and then focuses on exploring the two regions of Central Macedonia and Western Macedonia as case studies, in order to arrive at concrete, evidence-based suggestions on how they can make maximum use of intellectual capital for the next generation of smart specialisation strategies towards smart sustainable growth.

2. Literature Review

Intellectual capital is a concept formulated in the 1990s [6] although it does not seem to have had or have a generally accepted definition [7] apart from representing the combined intangible assets of a company [8]. However, since the performance of firms is not solely dependent on their own research and development performance but is highly dependent on developments in nearby firms and universities [9], it makes sense to view intellectual capital on a wider scale, focusing on a country or region. In terms of regional policy, it is taken to represent the combined intangible, human-related aspects of regional innovation and development. It can include concepts such as human capital and social capital, which, together, are often seen as one of the main determinants of competitiveness and economic growth [10]. Currently, attention is drawn to the fact that intellectual capital is one of the most valuable resources of enterprises, which helps in their sustainable development. The components of intellectual capital are human capital, structural capital and relational capital [11]. In the literature dealing with the benchmarking of innovation, intellectual capital is considered a key component, an enabler that determines the actual impact of knowledge, technology and economic factors in innovation [12,13,14]. It would therefore make sense to consider intellectual capital as a key component of the innovation process, regional innovation systems and—of course—innovation strategies [15,16].

The term “Smart Specialisation Strategy” (abbreviated henceforth as S3) can trace its origins to a theoretical approach by Landabaso [17] and a small group set up by the European Commission in the early 2010s. It was built on the idea of supporting economic growth by focusing on selective activities and the competitive advantages of a territory and identifying ways of collaboration in innovation and knowledge exchange within the territory, as well as between it and other territories [18]. In practical terms, a smart specialisation strategy includes an analysis of the national/regional context and potential for innovation, sets up an inclusive governance structure, defines a shared vision about the future of the country/region, selects a limited number of priorities for national/regional development and establishes a policy mix for innovation, which assesses using monitoring and evaluation mechanisms [19]. S3 was implemented in practice shortly after its theoretical framework was developed and has been a pillar of the EU Cohesion Policy since the 2014–2020 funding cycle [4]. Smart specialisation is the cornerstone of regional innovation policy in the EU. According to the EU guidelines, the smart specialisation process can be applied regardless of the development level or the level of innovation in the region. This can be implemented in both the most developed and the least innovative regions. Smart specialisations are particularly important for regions with a low level of innovation and should take into account the specific innovation challenges [20].

The central idea behind S3, in a nutshell, is that countries or regions should identify a limited number of priority areas for knowledge-based investments, focusing on their strengths and comparative advantages in high-value-added activities [21]. Thanks to being specialised in a particular field, it is easier to achieve success. Regions focusing on where they are successful achieve the right economies of scale and leadership positions [22]. This signified a departure from the one-size-fits-all, country-oriented policy, and an acknowledgement that each region has a different economic and institutional setting determining the potential for future development [23]. Smart specialisation is, essentially, a policy prioritisation agenda applied to the regional level, based on the idea that innovation policy should foster strategic technological diversification around a region’s core activities [24]. S3 originated in debates about non-spatial innovation policy, but it has evolved into a place-based approach and has gradually become synonymous with regional innovation policy in the EU [25].

Apart from the selectivity of policy intervention to specific priority areas or sectors (also known as investment priorities), S3 is also characterized by an entrepreneurial discovery process (EDP), which involves the public and private sectors operating together to identify and select the activities that can benefit the most from public intervention [26]. By encouraging a process of entrepreneurial discovery and locating new opportunities and activities across local themes and sectors that the region is strong in, new technologies and innovations can be developed, especially new general-purpose technologies, and strong knowledge linkages can be established [24]. Stakeholders should recognise new opportunities and their capacity to translate them into concrete actions and projects and transmit this information to policymakers [24].

In addition, S3 includes searching for complementarities between different policy domains, building on another key concept for modern innovation policy: Self-discovery [27]. Self-discovery is based on a process of experimentation that shows what works in what context and what does not work. In this sense, failures are also important to identify successes by comparison. However, it requires the constant and methodical use of experimentation with pilots, indicators, monitoring and evaluation procedures [28].

As will be explained in the relevant section below, S3 has evolved not only into the main instrument for regional policy in the EU but also into a major instrument for achieving the goal of smart and sustainable growth. Currently, the concerns of climate change drive innovation toward sustainable growth, with one determining the other, and S3 as a key tool for implementing both concepts [29]. This is even more relevant in the context of smart and carbon-neutral cities and regions and the implementation of the European Green Deal. To deal with these challenges, new policies should reinforce the pre-existing alignment between S3 and sustainability into what has also been called “S4” to include sustainability as the fourth “S” [18].

3. Innovation and Intellectual Capital in Central Macedonia and Western Macedonia

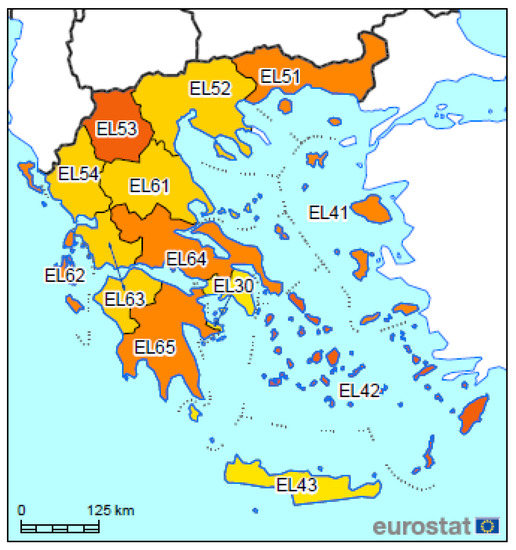

Central Macedonia and Western Macedonia are two neighbouring NUTS 2-level regions in the northern part of Greece (see Figure 1). Despite their proximity, connectedness and several common features, they are also very different in many ways, which makes it particularly interesting that they are examined together in terms of current status as well as development potential.

Figure 1.

Map of the Greek regions coloured according to RIS ranking [36], with lighter colours denoting a higher innovation ranking. Central Macedonia is EL52 and Western Macedonia is EL53 (source: Eurostat).

Central Macedonia is the second most important region in Greece in terms of size, population and GDP. The region’s importance is mainly due to the city of Thessaloniki (the second-largest city in Greece), which is a major urban centre, an important commercial and transport hub for SE Europe and an innovation hub with considerable public research infrastructures and the largest University in Greece. The most important services sectors in the region are financial services, transport and communications, recreational, tourism and transport services. The manufacturing sector is dominated by medium-to-low-technology SMEs in the food industry, textiles and clothing, non-metallic mineral products and furniture. Larger companies are found in industries such as metal production, chemicals and plastics. The main exporting sectors are textiles, food and drink, chemicals and plastics [30].

In contrast, Western Macedonia is a mountainous, rural region with few urban centres, approximately seven times smaller than its neighbour in population, and has one of the lowest GDPs in Greece. It is endowed with rich natural resources, as well as natural beauty, although the former has traditionally worked to the detriment of the latter. Major lignite deposits have turned it into the heart of Greek electricity production since the mid-20th century, causing environmental degradation and health issues. Other manufacturing activities include traditional sectors such as marble, saffron, fruits, local wines, furs and leather manufacturing and specialised arts and crafts. In the services sector, retail and wholesale trade, tourism and public administration services are the most important sectors in terms of value-added [31,32].

The two regions are facing different sets of challenges, although most of these are highly related to the ongoing financial crisis in Greece since 2009 [33]. Central Macedonia has suffered from steep reductions in consumption due to the crisis and negative trends in the tourism, services and manufacturing sectors. These issues were reinforced by significant delays in basic infrastructure projects, such as roads, airports and the Thessaloniki metro system, and low investments by the private sector, which is oriented mainly towards low-value-added sectors with limited innovation potential. The slow pace of restructuring in combination with de-industrialisation, the migration of industries to neighbouring low-labour-cost countries, low levels of FDI and a downturn in the construction sector are also obstacles that are preventing the region’s recovery [32,33].

Western Macedonia, meanwhile, has consistently had the highest unemployment rate in Greece and one of the highest youth unemployment rates in the EU, and one of the lowest per capita GDPs in Greece. The local economy is characterised by small companies, traditional industries, high unemployment and low competitiveness. These deficiencies were magnified by the crisis, as well as discontinuities in local Research and Innovation (R&I) policies. De-industrialisation and the migration of labour-intensive industries to neighbouring low-cost countries have hit an already weak economy [33]. This situation is further exacerbated by an ambitious ongoing transition from coal, with the region’s power stations scheduled to all shut down by 2028 [32]. This threatens to further increase unemployment and poverty, including energy poverty, unless important measures are taken to compensate for it [34,35,36].

The Regional Innovation Scoreboard (RIS), the EU’s instrument for benchmarking regional innovation [37], lists Central Macedonia as a “moderate innovator” and Western Macedonia as an “emerging innovator”, which are the two lowest categories out of the four in the ranking. Central Macedonia is stronger than average in terms of its SMEs’ innovative capacity but weaker than average in patent applications, lifelong learning and business-sector R&D expenditure. Western Macedonia is stronger than average in non-R&D innovation expenditures, innovative SMEs collaboration and the percentage of the population with tertiary education, but weaker in business-sector R&D expenditure, design applications and employment in knowledge-based activities [37].

The two regions are lacking in terms of innovation performance, even compared to other Greek regions. Central Macedonia is mid-ranked by Greek standards, but this means that it punches well below its weight in terms of GDP and urban development. Western Macedonia is at the bottom of the Greek rankings [37]. This can largely be explained by the fact that Central Macedonia’s economy, while large, is focused mainly on low-value-added sectors with little innovation potential. Western Macedonia’s already weak economy was primarily focused on electricity production, which is closing down, as well as on traditional sectors, which also have limited potential for innovation.

This, however, does not mean that there is no potential for innovation in these regions. They also have some important advantages in terms of innovation and intellectual capital. Central Macedonia is an important innovation hub and home to several large universities and research centres [30]. Western Macedonia, while smaller and more decentralised, is also home to a major regional university with a presence in many cities as well as research institutions of important size for the region [38].

The Greek Research, Technological Development and Innovation (RTDI) System shows intellectual capital strengths in general, such as good performance in co-financed EU Framework Programmes, a substantial Greek representation in international research networks and projects of the European Roadmap for Research Infrastructures. Moreover, there are highly educated human resources within the country along with “pockets” of excellence in public research and academic institutions and the private sector, as well as good performance (above the EU average) regarding scientific publications [39].

Despite the serious brain drain that has afflicted Greece since the start of the financial crisis more than a decade ago [33], both regions have significant percentages of highly educated young people. The drawback, as is common in Greece, is that most of this education is not focused on fields with strong R&D and innovation potential, there is little connection between universities and the market [40] and lifelong learning and skills training is well behind the EU average [41].

In addition, while both regions are home to innovative businesses [42], there is a great deal of room for growth, as well as for a reorientation of the regional economies towards more innovative sectors and practices. The start-up ecosystem in Greece can play a key role as a driver of further innovation by making use of the available intellectual capital [43], but the nascent innovative start-up scene is facing many obstacles. Apart from the lack of entrepreneurial skills and training [44], these include underdeveloped collaborative networks, low R&D investments, an unfriendly business environment afflicted by bureaucracy, and obsolete, punitive business legislation, which creates a constant fear of bankruptcy [45,46,47]. See Table 1 for a summary of the two regions’ main features.

Table 1.

Summary of the comparison between innovation levels in Central Macedonia and Western Macedonia.

4. Current State of S3 in Central Macedonia and Western Macedonia

Smart Specialisation Strategies (S3), with their focus on the entrepreneurial discovery process and the focus of the local economy on sectors with high potential on which a region has competitive advantages [4], can work as a catalyst for making use of intellectual capital to achieve smart and sustainable growth [29]. Currently, the previous programming period (2014–2020) for S3 in the EU has ended and the new one (2021–2027) is about to begin [48]. This allows for a brief review of what previous S3s have accomplished in Greece, and the two regions specifically, and for important insight toward the next set of S3s. Note that, since S3 in Greece has been following a hybrid model where there are overall national guidelines in innovation strategies while, at the same time, regions could shape their own specific focus [49], it makes sense to view the two regions through the prism of the overall national innovation strategy of Greece.

The 2014–2020 period of S3 for Greece overall has highlighted eight specific fields of priority that have been pursued during this period: (1) Agrofood; (2) Life Sciences and Health-Pharma, (3) Information and Communication Technologies; (4) Energy; (5) Environment and Sustainable Development; (6) Transport and Logistics; (7) Materials-Construction; (8) Culture-Tourism-Cultural and Creative Industries [50]. Out of these eight national priorities, four (Agrofood, Tourism-Culture, Materials, Life Sciences and Health) were seen as “vertical” priorities at the regional level, reflecting the needs of the private sector, while the other four (ICT, Energy, Transport and Environment) were more “horizontal” supporting areas that reinforce entrepreneurship and innovation in most regions [39].

The connection between national and regional priorities is evident in the cases of Central Macedonia and Western Macedonia. In the former, S3s focused on eight sectors. Again, four were selected as “champion sectors” in the sense that they decisively add to the Gross Added Value of the region, employ a significant number of workers, maintain critical mass and exhibit intrinsic dynamics and extroversion. These were (1) Agrofood, (2) Construction Materials, (3) Textile and Clothing and (4) Tourism. They were supplemented by four “horizontal support sectors”, all technological, selected to act as catalysts for increasing innovation, competitiveness and extroversion. These were (5) ICT, (6) Energy Technologies, (7) Environmental Technologies and (8) Transport and Logistics Technologies [51].

Western Macedonia had four S3 priority sectors in total, which simply reflected key activities in the region, including traditional activities. These were (1) Agrofood, (2) Environment and Energy, including integrated waste management and district heating (only in the regional units of Kozani and Florina), (3) Breeding of fur-bearing animals and manufacturing of leather products (only in the regional units of Kastoria and Kozani) and (4) Tourism [31]. This is a low number of priorities compared to most EU regions. Unlike other European regions in a transition from coal, which often focus on technologically advanced priority sectors, the focus in Western Macedonia is on sectors that are related, not very complex and closely aligned to the region’s economic profile [52].

S3 experience at the national level during the last period has shown that Greek regions do not focus enough on manufacturing sectors (except for food processing), several of the sectors the regions traditionally focused on have a low potential for innovation, regions lag behind in “Key Enabling Technologies” (except for ICT), new technologies must be defused to industry and only three Greek regions (Attica, Epirus and Crete) showed a consistent tendency of supporting entrepreneurship through a collaboration between academia and the private sector [39].

During the 2014–2020 period, the framework within which the Greek regional and national authorities have designed S3 has evolved significantly [49]. Facing a deadline to submit operational programmes, authorities tried, under pressure, to cope both with the drafting and—particularly—the subsequent implementation of the S3 approaches, struggling with new concepts that many of them had no experience with [53]. This meant that halfway through the period, many authorities and stakeholders were struggling with S3 implementation [49].

Experience from this period shows that the entrepreneurial discovery process that is central to S3 was implemented in different timeframes and formats in different regions. Even where this has been executed promptly, issues in S3 coordination from local authorities, which were often reluctant to become actively involved, have caused a loss of the social capital acquired through the mobilisation of stakeholders during the Entrepreneurial Discovery Process (EDP) and consultation processes during planning [54]. Moreover, the creation of an S3 monitoring system, which was essential for the evaluation and adaptation of the strategies, was slow to take off, with several issues in the selection of dedicated regional indicators that captured the logic of each regional S3 while differing from national ones [49]. Despite these difficulties, however, Greek S3 during this first period has produced tangible results, meeting policymakers’ expectations, increasing competitiveness and producing growth, especially in the manufacturing, scientific and financial spheres [4].

While the impact of S3 has often been difficult to effectively monitor and measure in practice, research has found that innovation development in line with the S3 approach is linked to GDP per capita growth in less-developed regions [29], such as the Greek ones. While the obstacles mentioned above persisted in such regions, the overall experience was a positive one, providing experience and know-how to involve stakeholders and authorities. The first generation of S3s has succeeded in bringing many different policymakers together and has improved prioritisation, even if this success is not universal and even though concrete results are also based on a variety of regulatory requirements outside S3, such as local legislation [55].

This is a common theme of the S3 impact in less-developed southern European regions [4], which were also lagging behind advanced European countries in terms of R&I. There, too, local conditions have caused difficulties in the implementation of S3. These included both administrative and regulatory obstacles, as well as a lack of human resources to implement such a challenging policy approach. However, Portuguese authorities, similar to their Greek counterparts, have not only produced results but also, crucially, learned from S3 and have made attempts to instigate the entrepreneurial discovery process, cooperate with other European regions and increase innovation capacity [56].

Overall, the Greek experience with the first generation of S3 demonstrates that research and innovation deserve more attention in the national policy agenda. While funding is an important factor [57], this is not to be achieved solely by increasing national funding. S3 represents a first-class opportunity of upgrading this sector of public policy, introduces a framework for a relevant national strategy and offers an opportunity to redirect national production towards research and innovation activities. As a result of this, the first generation of S3 has also contributed to the improvement of interactions between the national and regional levels regarding research and innovation policy, providing a collaborative resolution to the rivalry of the past between the Central State and regional authorities, although there is always room for more substantial and effective collaboration [58]. See Table 2 for a summary of the main features of each region’s S3.

Table 2.

Summary of the comparison between the Smart Specialisation Strategies of Central Macedonia and Western Macedonia.

5. The Next Generation of S3—Towards “S4”

In practice, 2021 finds most regions at the design phase of their new S3 [1]. The many successes of S3s, as well as the obstacles they faced, can lead to important lessons for the design of the next generation of strategies, which will have to be aligned with the European Green Deal [1]. While S3 has faced obstacles and difficulties, it is considered a highly successful practice that has inspired similar approaches around the world [21]. Moreover, it has resulted in a rapid collective learning process, which means that it has been constantly improving, with the most recent regional S3 projects being far better conducted than the early ones [48].

To build on the successes achieved, S3 needs a reset ahead of the new period, enhancing the capabilities of regional management teams, taking a proactive approach to working with enterprises and promoting human capital formation via incentives for higher education careers [56]. Specialisation should be further strengthened, with the policy instruments of S3 designed and tailored to the specific problems of the innovation systems in question [18].

Often, there are both positive and negative conclusions to be drawn from the same aspects of the strategies. For example, the design of S3 for the 2014–2020 period successfully involved a vast array of different regional and national actors, but civil society was rarely among them, limiting S3s to the triple-helix model rather than the updated quadruple-helix advocated by the Commission [55], much less the quintuple-helix model, which also includes the environment [59]. Therefore, a key goal of the new S3s is to encompass environmental as well as societal challenges [60]. In the coming years, smart specialisation should be based on the three main pillars of sustainable development (people, the environment and the economy) [61].

The shift from “S3 1.0” to “S3 2.0” comes with a number of challenges and difficult decisions. Judging what to keep, what to reshape and what to remove from the first generation of S3 is a difficult task, especially since the long-term outcomes of this first generation are not fully understood yet [18]. Existing studies, however, illustrate several goals for S3 2.0, such as enlarging and integrating the governance system, improving entrepreneurial discovery, updating the domains of S3, fostering the industrial transition to new, sustainable technologies, enlarging transnational collaboration and improving dissemination, communication and monitoring [18].

The maturation of Internet technologies and online services during the period in which the first stage of S3 was applied paves the way for greater use of web services and data analytics to design and implement the methodologies of new S3 across regions, as illustrated by the accomplishments of the Online S3 project [60]. In addition, the new S3 can help clear the democratic deficit within civil society in the context of bottom-up policies to sustain regional growth based on local needs and conditions [60].

To adapt to the new programming period stretching from 2021 to 2027, aligning with the European Green Deal and supporting its implementation, S3 needs to be updated to face these new challenges, with even more emphasis on the social and environmental aspects [48]. This includes considering the societal implications of research and innovation interventions, identifying relevant social stakeholders according to the system that needs to change, designing interventions that combine research and innovation with applied experimentation, making use of multi-level systemic analysis [1] and including various sources of data and analytics, not only statistics, to improve monitoring as well as implementation [60].

The new generation of S3 is the central part (both in terms of importance and funding) of the EU’s Cohesion Policy for 2021–2027 [45]. In this context, European regions have to update their previous S3 by responding to seven enabling conditions: (1) Up-to-date analysis of bottlenecks for innovation diffusion; (2) the existence of competent institutions for the management of S3; (3) monitoring and evaluation tools to measure S3 performance; (4) effective functioning of the entrepreneurial discovery process; (5) actions necessary to improve national or regional research and innovation systems; (6) actions to manage the industrial transition and (7) measures for international collaboration [48].

Gianelle et al. [62] draw on a body of research collected on the impact of the first generation of S3 to propose five main lessons for the next generation, especially in light of the need for post-pandemic recovery. These are as follows: (1) Build the capacity of institutional infrastructure to design and deliver policies, as well as leverage resources from Cohesion Policy; (2) revise the incentive schemes at the basis of investment prioritisation in order to shield policy intervention from vested interests; (3) renew the design of policy measures aimed at mobilising entrepreneurial forces; (4) strengthen the analytical base of policy design by taking into account new data mapping techniques; (5) unleash the potential of green growth in all economic sectors.

6. Discussion: Using Intellectual Capital to Suggest Smarter, More Sustainable S3 in Central Macedonia and Western Macedonia

Uneven development and regional (as well as national) disparities were central concerns of the European Union policy since its inception. The problem was exacerbated by the global economic crisis of 2008, whose consequences struck southern Europe much harder [63], with Greece being hit particularly hard [2]. The 2014–2020 period of S3 intended—among other things—to address this challenge through a fine-tuned regional policy that placed a strong emphasis on innovation and competitiveness [64].

However, a major reason that less-developed countries and regions continue to lag behind despite persistent efforts of innovation policies is that opportunities and barriers to the development of S3 vary depending on the level of development of regions [65]. Therefore, the effectiveness of S3 in promoting cohesion is limited by the low institutional capacity of the regions, which needed the most help [64,66].

That does seem to be the case often, especially in less-developed European countries, with S3 projects focusing on main cities and industrial centres, while rural areas and smaller territories have limited potential to attract and implement smart specialisation strategies [67]. This shows the need to adapt S3 to regions’ limitations as well as their strengths. The place-based approach, tailored to local needs [68], is one way of addressing this. Such a place-based approach would benefit greatly from taking into account additional factors about a region, including the strengths and limitations of its intellectual capital.

This is the general framework within which the next generation of S3 should be based for Central Macedonia and Western Macedonia. The review above demonstrated that, despite various obstacles and local difficulties, both regions still have important pools of highly educated people and universities, together with other research infrastructures, especially in the case of Central Macedonia, which is home to no less than three major universities, including the Aristotle University of Thessaloniki, which is the largest university in Greece and the Balkan area as a whole (with more than 40,000 active students and a central campus of over 230,000 m2), and one of the most highly ranked [69]. This is a crucial component to build on. Universities play a key role in S3, especially in countries or regions with underdeveloped innovation systems, as universities become a pole that encompasses many aspects of education, research and innovation that are not available elsewhere in the region due to the lack of other stakeholders with such capacity [70].

Indeed, Arregui-Pabollet et al. [71] found that embedding aspects of S3 coordination within the governance of higher education can contribute to the successful implementation of S3, as well as facilitate access to EU funding. This is even more true in the cases of regions where higher education institutions are strong and actively involved in the regional innovation ecosystems, such as the Northern Netherlands, where S3 constitutes an opportunity to streamline innovation governance, further integrate activities, stimulate innovation activities in SMEs and build networks with enterprises, which evolve into regional strengths [72].

While higher education institutions in Central Macedonia and Western Macedonia seem to be relatively strong and high research skills are advantages of these regions [69], their main problem compared to more advanced regions such as the Northern Netherlands is the lack of strong connections to regional innovation and entrepreneurial ecosystems. In fact, with an approach characterised by the idea of “knowledge for the sake of knowledge”, Greek universities are often “cathedrals in the desert”, with weak connections to what industrial infrastructure is available [40]. The main issue is that Greek universities are not as effective as they could be in fostering the entrepreneurial ecosystems of their regions [73]. As mentioned during the review above, the issue is compounded by a lack of formal training in entrepreneurship, and low rates of skills training and lifelong training in general for Greek regions [37].

This can be an important starting point for the updated and refreshed S3. Before ensuring that the triple helix model is expanded to the quintuple helix to include civil society and the environment, it is imperative to ensure that enterprises and academia are well connected, both to each other as well as to public authorities. The consultation process at the heart of S3 is key to achieving this. In addition, national as well as regional S3 for 2021–2027 should include a strong focus on entrepreneurial skills and training as a horizontal support measure to boost economic development and competitiveness [44,74].

This is consistent with recommendations by Tsipouri et al. [75] to support the transition to sustainability via S3 for the case of Greek regions, which focus on measures to enhance the innovation and entrepreneurial skills-related aspects of intellectual capital. These include activities such as the creation of a knowledge platform in collaboration with operators and the market, the creation of permanent research, industry-consumer education and interconnection networks, empowering human capital in the direction of innovation and knowledge based on market needs, lifelong learning activities in enterprises, awareness-raising of businesses and stakeholders about the benefits and prospects of innovation and entrepreneurship-enhancing actions [60,75].

However, it is also relevant to examine the progress that is being made by the entrepreneurial sector in Greece, as an indication of the sectoral priorities that the new S3 should cover. Despite the financial and bureaucratic difficulties that it is facing, which often discourage entrepreneurship [46,47], Greek start-ups, in particular, have achieved progress in several sectors. According to the Greek government agency Enterprise Greece [76], these are mainly Life Sciences and Health, Social and Leisure, Tourism, ICT, Energy/Infrastructure, “Deep Tech”, Financial Tech, Agrofood and Retail and eCommerce. Many of these coincide with the national and regional S3 priorities in Greece, demonstrating a degree of alignment between strategy and practice.

When considering these sectors in connection to the specific priorities of Central Macedonia and Western Macedonia, this connection is also evident. Out of the various sectors, it is clear that ICT is important both for Greece as a whole and Central Macedonia in particular, as well as one of the most popular and important start-up sectors overall. Agrofood, Energy and Tourism were present in the priority sectors of Central and Western Macedonia, the Greek National Research and Innovation Strategy, and are promising sectors in general. Life Sciences are a promising and successful start-up sector that is also part of the national priorities, although it is not included in the regional strategies for the two regions. Finally, Retail and eCommerce, in particular, is a very promising sector for many start-ups, has constant demand, is strongly supported by and connected to ICT and might also prove to be rapidly developing as a result of the COVID-19 pandemic and its expected aftermath [77].

When examining promising economic sectors for Central and Western Macedonia in relation to the priority sectors chosen for the 2014–2020 period of S3—outlined in the sections above—it is clear that these remain promising and relevant for the new S3 as well, with a couple of notable exceptions. Agrofood, construction, tourism, ICT, energy, environmental technologies and transport and logistics can still be highly important for Central Macedonia. Textiles and clothing, however, which had been a mainstay of the regional economy for the whole of the 20th century, have been significantly declining in southern Europe in most recent years. This sector can no longer cope with international competition unless it is significantly modernised by a shift towards the circular economy and more added-value activities [78].

Similar reasoning applies to Western Macedonia, where agrofood, environment and energy and tourism remain quite relevant and promising. The breeding of fur-bearing animals, however, is another 20th-century leftover of regional tradition. In addition, unlike the textile sector, it has no prospects of adapting to the 21st. On the contrary, fur, apart from being environmentally damaging and unethical, can be a risk for the spread of animal viruses to humans [79]. In addition, European countries have already started to ban fur trading and are on their way to eventually phasing out the practice, with the Netherlands setting the goal of doing so in 2024 [79].

This outdated practice can also be replaced in Western Macedonia, where this priority sector can be replaced with bioeconomy, which has a great deal of potential in the region, not only in terms of bioenergy via biomass but also through industrial coexistence, research and innovation activities and the production of innovative or high value-added environmentally friendly materials [75]. In fact, through the use of new technologies, online platforms and industrial symbiosis, the region can turn into a bioeconomy hub [30]. Current data testify that there are significant opportunities for the region, as well as Greece in general, to progress towards a lucrative economy based on renewable resources [80]. In addition, the region’s natural beauty represents an opportunity to add value to the tourism section and orient it towards eco-tourism [81].

Bioeconomy can become a “technological support sector” for many other activities in Western Macedonia, as new developments create opportunities for rural development based on emerging technologies, the relevance of distance in marketing, sales and many other activity domains and business opportunities evolving within the bi-economy and ecosystem services. The realisation of these opportunities needs to build on the simultaneous engagement of various stakeholders in business development, research and public administration [82], therefore making S3 the ideal instrument for producing this effect in the region. This is also in line with most European regions that are transitioning from coal, which are turning towards more advanced technologies for their strategic priorities [52].

These goals are ambitious but realistic. The review of the previous period of S3 demonstrated that several Greek firms are active in developing applications in areas of major economic importance, including renewable energy generation and distribution, energy solutions for non-interconnected islands and shipping [1]. These are not insignificant results, and they offer high potential in the context of the ongoing deep transformation of the global energy system [83]. This has created small but dynamic niches in the Greek entrepreneurial ecosystem, notably various producers of renewable energy, small-scale shipbuilding and maintenance, electric batteries and ICT services operating within their respective internationally weak sectors [1].

It is important to remember that despite progress and prospects, Greece still lags significantly behind the EU average in the transition from a linear to a circular economy. As a result, it needs significant acceleration to catch up, and new tools can be an important way to achieve this. However, this can be achieved only if adapted for the needs and competitive advantages of each region. This is where S3 can play a part in supporting national and local authorities, facilitating and accelerating the transition of the country to the circular economy, as well as—importantly—making it profitable [75]. It seems a good idea that Greece follows the example of the small Baltic Republic of Lithuania, in which their friendly policy and encouragement from the central government made it a home for start-ups. One of the flagship examples of start-ups that conquered the European and American second-hand fashion market is Vinted. Young people did something for other young people. Greek authorities should create an environment supporting new interrelated technologies created by young people for young people [84].

The discussion about smart specialization strategies should concern the issue of how to properly use the potential of a given region in order to develop it in a sustainable way. It is recognized that sustainable development is one of the most important challenges and priorities of the modern world [85]. The concept of sustainable development of the region means that, apart from pure economic issues (including, in particular, the profit of enterprises), one should strive to achieve social and environmental goals at the same time [86,87]. It is not an easy task, but it should be remembered that the entrepreneurial potential of territorial units (regions, countries and groups) depends not only on formal and legal conditions but also on natural conditions [88]. In addition, local authorities, which have ambitions to improve the competitiveness of the administered areas, should take care of the condition of the infrastructure and provide public services of appropriate quality, but also protect the natural environment, as this may significantly affect the quality of life of residents and the effectiveness of local businesses [89]. Environmental challenges are characterized by a high degree of complexity and occur in various sectors of the economy and at various levels of government. In Western Europe, attempts have been made to solve them through comprehensive and multi-sectoral strategies since the 1990s, but their effectiveness is not satisfactory. As a way to increase the effectiveness of these strategies, better communication between the authorities and society is proposed, which, in turn, aims to raise the level of awareness and facilitate the implementation of solutions that will respond to the existing environmental challenges [90].

Southern Europe is an area that has to deal more and more with the effects of global warming. The effects of climate change related to the increase in average temperature are, on the one hand, periods of extremely high temperatures in the summer season and more frequent abundant and torrential rainfall [91], and on the other hand, more and more frequent periods without rain, causing droughts and favouring the formation of dangerous fires. Floods and severe dangerous storms are also observed more frequently. As a result, global warming is causing catastrophic damage and economic loss, and has a direct impact on human productivity [92]. There are research findings that the effects of warming increase with increasing altitude, causing rapid changes in temperature, humidity and water in mountainous areas. This can cause significant damage to farm and forest land and further affect all ecosystem services and socio-economic development in mountain areas. It turns out that mountains in the Mediterranean region, with high biodiversity, are more vulnerable to global change than other European ecosystems [93]. This suggests that smart specialisation strategies, if they are to be effective and beneficial for a given region in the long term and in line with the principles of sustainable development, should take into account the environmental aspects and the challenges, threats and opportunities associated with them.

7. Conclusions

In summary of the above, the review conducted here has reached the following recommendations ahead of the next generation of S3 for the regions of Central Macedonia and Western Macedonia:

While higher education and academic institutions are strong in the regions, their connection to the rest of the quintuple helix, and particularly enterprises, needs to be strengthened by partnerships and other measures. Lifelong learning, skills training and entrepreneurial skills are specific areas that have to be reinforced.

There is also a need to support entrepreneurship in general and start-up entrepreneurship in particular, although this cannot be achieved only by skills training and better partnerships. It also requires fundamental changes to legislation, the reduction of bureaucracy, as well as a change in mentality.

The regional priority sectors of the previous S3 period still seem solid and relevant ahead of the new one. The exception to this is two traditionally strong sectors that are no longer relevant for the 21st century: Textiles for Central Macedonia and furs for Western Macedonia. The former needs to be radically transformed towards the circular economy to remain viable and competitive, while the latter needs to be eventually phased out, with the bioeconomy being a very promising replacement as a horizontal enabling sector. Otherwise, existing priority sectors can be further supported by innovation and knowledge diffusion, as well as a shift towards more added value, assisted by supporting technologies.

A key aspect that needs improvement in comparison to the previous S3 period is better coordination between regional actors and stakeholders, and an expansion from the triple helix to the quintuple helix to also include civil society and the environment. Technological tools and innovative solutions, such as online platforms for civil participation or one-stop shops, can help achieve this. The experience gained by stakeholders in the previous period will also be very important.

Overall, the review has shown that Greek regions, including Central Macedonia and Western Macedonia, are facing many difficulties in reaching the elusive goals of the Cohesion Policy and closing the gap toward more advanced regions. However, at the same time, they also have significant strengths in terms of intellectual capital, as well as significant prospects, which must be realised by the new generation of S3. The key is mobilising the existing intellectual capital with effectiveness, to achieve sustainable and inclusive economic growth, as well as adjusting the legislation to the prevailing macroeconomic reality.

Author Contributions

Conceptualization, S.M.; Investigation, G.M.; Methodology, G.M.; Writing—original draft, G.M., A.D., S.M. and R.R.; Writing—review & editing, A.D., S.M. and R.R. All authors have read and agreed to the published version of the manuscript.

Funding

This research is co-financed by Greece and the European Union (European Social Fund- ESF) through the Operational Programme «Human Resources Development, Education and Lifelong Learning» in the context of the project “Reinforcement of Postdoctoral Researchers-2nd Cycle” (MIS-5033021), implemented by the State Scholarships Foundation (ΙΚΥ).—The APC is financed by Wroclaw University of Environmental and Life Sciences.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

Not applicable.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Marinelli, E.; Fernández Sirera, T.; Pontikakis, D. Towards a Transformative Smart Specialisation Strategy: Lessons from Catalonia, Bulgaria and Greece; European Commission Joint Research Centre (JRC): Seville, Spain, 2021. [Google Scholar]

- Hazakis, K.J. Is There a Way out of the Crisis? Macroeconomic Challenges for Greece after the COVID-19 Pandemic. Eur. Politics Soc. 2021, 1–15. [Google Scholar] [CrossRef]

- Dudek, M.; Śpiewak, R. Effects of the COVID-19 Pandemic on Sustainable Food Systems: Lessons Learned for Public Policies? The Case of Poland. Agriculture 2022, 12, 61. [Google Scholar] [CrossRef]

- Barbero, J.; Diukanova, O.; Gianelle, C.; Salotti, S.; Santoalha, A. Economic Modelling to Evaluate Smart Specialisation: An Analysis of Research and Innovation Targets in Southern Europe. Reg. Stud. 2021, 1–14. [Google Scholar] [CrossRef]

- Veldhuizen, C. Smart Specialisation as a Transition Management Framework: Driving Sustainability-Focused Regional Innovation Policy? Res. Policy 2020, 49, 103982. [Google Scholar] [CrossRef]

- Luthy, D.H. Intellectual Capital and Its Measurement. In Proceedings of the Asian Pacific Interdisciplinary Research in Accounting Conference, APIRA, Osaka, Japan, 4–6 August 1998; pp. 16–17. [Google Scholar]

- Ali, B.J.; Anwar, G.; Anwar, G. Intellectual Capital: A Modern Model to Measure the Value Creation in a Business. Int. J. Eng. Bus. Manag. 2021, 5, 31–43. [Google Scholar] [CrossRef]

- Brooking, A. Intellectual Capital: Core Asset for the Third Millennium Enterprise; International Thomson Business Press: New York, NY, USA, 1996. [Google Scholar]

- Jaffe, A. Technological Opportunity and Spillovers of R&D: Evidence from Firms’ Patents, Profits and Market Value; National Bureau of Economic Research: Cambridge, MA, USA, 1986; p. 1815. [Google Scholar]

- Prasetyo, P.E.; Setyadharma, A.; Kistanti, N.R. The Role of Social Capital in New Products Development and Business Competitiveness Enhancement. Int. J. Sci. Technol. Res. 2020, 9, 1838–1843. [Google Scholar]

- Luthans, F.; Luthans, K.W.; Luthans, B.C. Positive psychological capital: Beyond human and social capital. Bus. Horiz. 2004, 47, 45–50. [Google Scholar] [CrossRef]

- Hollanders, H.; Es-Sadki, N.; Kanerva, M. Regional Innovation Scoreboard (RIS) 2016; Maastricht Economic and Social Research Institute on Innovation and Technology (UNU-MERIT): Maastricht, The Netherlands, 2016. [Google Scholar]

- Foray, D.; Hollanders, H. An Assessment of the Innovation Union Scoreboard as a Tool to Analyse National Innovation Capacities: The Case of Switzerland. Res. Eval. 2015, 24, 213–228. [Google Scholar] [CrossRef]

- Johnson—Cornell University; INSEAD; WIPO. The Global Innovation Index 2014: The Human Factor in Innovation; Johnson—Cornell University: Ithaca, NY, USA; INSEAD: Fontainebleau, France; WIPO: Geneva, Switzerland, 2014. [Google Scholar]

- Martinidis, G. The Importance of Man Within the System: Defining and Measuring the Human Factor in Innovation, a Review. J. Knowl Econ. 2017, 8, 638–652. [Google Scholar] [CrossRef]

- Martinidis, G.; Komninos, N.; Carayannis, E. Taking into Account the Human Factor in Regional Innovation Systems and Policies. J. Knowl. Econ. 2022, 13, 849–879. [Google Scholar] [CrossRef]

- Landabaso, M. The Promotion of Innovation in Regional Policy: Proposal for a Regional Innovation Strategy. Entrep. Reg. Dev. 1997, 9, 1–24. [Google Scholar] [CrossRef]

- Esparza-Masana, R. Towards Smart Specialisation 2.0. Main Challenges When Updating Strategies. J. Knowl Econ. 2022, 13, 635–655. [Google Scholar] [CrossRef]

- Foray, D.; Goddard, J.; Beldarrain, X.G.; Landabaso, M.; McCann, P.; Morgan, K.; Ortega-Argilés, R. Guide to Research and Innovation Strategies for Smart Specialisations; Publications Office of the European Union: Luxembourg, 2012. [Google Scholar]

- Czyżewska-Misztal, D.; Golejewska, A. The Least Innovative Regions in Poland in the Process of Smart Specialization. Optimum Studia Ekonomiczne 2016, 5, 123–137. [Google Scholar]

- OECD. Innovation-Driven Growth in Regions: The Role of Smart Specialisation; OECD Publishing: Paris, France, 2013. [Google Scholar]

- Kardas, M. Inteligentna specjalizacja—(nowa) koncepcja polityki innowacyjnej (Smart specialization—(new) concept of innovation). Optimum Studia Ekonomiczne 2011, 2, 121–136. [Google Scholar]

- Balland, P.A.; Boschma, R.; Crespo, J.; Rigby, D. Smart Specialization Policy in the EU: Relatedness, Knowledge Complexity and Regional Diversification. Reg. Stud. 2019, 53, 1252–1268. [Google Scholar] [CrossRef]

- Foray, D.; Goddard, J.; Goenaga, X.; Landabaso Belderrain, M.; McCann, P.; Morgan, K.; Nauwelaers, C.; Ortega-Argiles, R.; Mulatero, F. RIS3 Guide; European Commission/Joint Research Centre: Seville, Spain, 2011. [Google Scholar]

- McCann, P.; Ortega-Argilés, R. Modern Regional Innovation Policy. Camb. J. Reg. Econ. Soc. 2013, 6, 187–216. [Google Scholar] [CrossRef]

- Foray, D. Smart Specialization Strategies as a Case of Mission-Oriented Policy—A Case Study on the Emergence of New Policy Practices. Ind. Corp. Change 2018, 27, 817–832. [Google Scholar] [CrossRef]

- Hausmann, R.; Rodrik, D. Economic Development as Self-Discovery. J. Dev. Econ. 2003, 72, 603–633. [Google Scholar] [CrossRef]

- Rodrik, D. Industrial Policy for the Twentyfirst Century; Harvard University: Cambridge, MA, 2004. [Google Scholar]

- Kogut-Jaworska, M.; Ociepa-Kicińska, E. Smart Specialisation as a Strategy for Implementing the Regional Innovation Development Policy—Poland Case Study. Sustainability 2020, 12, 7986. [Google Scholar] [CrossRef]

- Maniati, A.; Loizou, E.; Psaltopoulos, D.; Mattas, K. The Regional Economy of Central Macedonia: An Application of the Social Accounting Matrix. Agric. Financ. Rev. 2021, 82, 765–774. [Google Scholar] [CrossRef]

- Reid, A.; Komninos, N.; Sanchez-P, J.A.; Tranakas, P. RIS3 Regional Assessment: Dytiki Makedonia. A Report to the European Commission; Directorate-General for Regional and Urban Policy (REGIO): Etterbeek, Belgium, 2012. [Google Scholar]

- Dounavis, A.S.; Kafasis, P.; Ntavos, N. Using an Online Platform for the Improvement of Industrial Symbiosis and Circular Economy (in Western Macedonia, Greece). Glob. Nest J. 2019, 21, 76–81. [Google Scholar]

- Kalogiannidis, S. Role of Revenue Mobilisation in the Growth and Development of Economy: A Case Analysis of Greece. Res. World Econ. 2021, 12, 63–76. [Google Scholar] [CrossRef]

- Koutsandreas, D.; Spiliotis, E.; Doukas, H.; Psarras, J. What Is the Macroeconomic Impact of Higher Decarbonization Speeds? The Case of Greece. Energies 2021, 14, 2235. [Google Scholar] [CrossRef]

- Karagianni, S.; Pempetzoglou, M. The Income Distribution Impact of Decarbonization in Greece: An Initial Approach. Circ. Econ. Sustain. 2022, 2, 557–567. [Google Scholar] [CrossRef]

- Karasmanaki, E.; Ioannou, K.; Katsaounis, K.; Tsantopoulos, G. The Attitude of the Local Community towards Investments in Lignite before Transitioning to the Post-Lignite Era: The Case of Western Macedonia, Greece. Resour. Policy 2020, 68, 101781. [Google Scholar] [CrossRef]

- Hollanders, H.; Es-Sadki, N.; Rantcheva, A. European Innovation Scoreboard (EIS) 2021; Maastricht Economic and Social Research Institute on Innovation and Technology (UNU-MERIT): Maastricht, The Netherlands, 2021. [Google Scholar]

- Martinidis, G.; Adamseged, M.E.; Dyjakon, A.; Fallas, Y.; Foutri, A.; Grundmann, P.; Hamann, K.; Minta, S.; Ntavos, N.; Raberg, T.; et al. How Clusters Create Shared Value in Rural Areas: An Examination of Six Case Studies. Sustainability 2021, 13, 4578. [Google Scholar] [CrossRef]

- GSRT. General Secretariat for Research and Technology; GSRT: Athens, Greece, 2017. [Google Scholar]

- Belke, A.; Christodoulakis, N.; Gros, D. Lessons from the Strukturwandel in the Ruhrgebiet: Turning Northern Greece into an Industrial Champion? Study Conducted and Published by the Stiftung Mercator Foundation: Essen, Germany, 2015. [Google Scholar]

- Bagiatis, C.; Saiti, A.; Chletsos, M. Entrepreneurship, Economic Crisis, and the Role of Higher Education: Evidence from Greece. Ind. High. Educ. 2020, 34, 177–189. [Google Scholar] [CrossRef]

- European Commission. Directorate-General for Internal Market, Industry, Entrepreneurship and SMEs. European Innovation Scoreboard 2021; Publications Office of the European Union: Luxembourg, 2021; Available online: https://data.europa.eu/doi/10.2873/725879 (accessed on 31 June 2022).

- Vlados, C.; Chatzinikolaou, D. Crisis and Entrepreneurship in Greece: Present, Past and Evolving Trends. In Proceedings of the 6th International Conference on Applied Economics “INSTITUTIONS & THE KNOWLEDGE ECONOMY”, Volos, Greece, 30 May–1 June 2019. [Google Scholar]

- Papagiannis, G.D. Entrepreneurship Education Programs: The Contribution of Courses, Seminars and Competitions to Entrepreneurial Activity Decision and to Entrepreneurial Spirit and Mindset of Young People in Greece. J. Entrep. Educ. 2018, 21, 1–21. [Google Scholar]

- The Boston Consulting Group 2018. Available online: https://www.bcg.com/offices/athens/default (accessed on 19 May 2022).

- Vasilopoulos, A.; Tsitsakis, C. Entrepreneurship in Greece; KnE Social Sciences: Dubai, United Arab Emirates, 2020. [Google Scholar]

- Tubadji, A.; Dietrich, H.; Angelis, V.; Haas, A.; Schels, B. Fear-of-Failure and Cultural Persistence in Youth Entrepreneurship: Comparative Analysis: Greece versus Germany. J. Small Bus. Entrep. 2021, 33, 513–538. [Google Scholar] [CrossRef]

- Morisson, A.; Pattinson, M. Smart Specialisation Strategy (S3); Interreg Europe Policy Learning Platform: Lille, France, 2020. [Google Scholar]

- Metaxas, M. Summary Report on RIS3 implementation status in Greece; European Commission Joint Research Centre (JRC): Brussels, Belgium, 2017. [Google Scholar]

- Hollanders, H.; Es-Sadki, N. Regional Innovation Scoreboard (RIS) 2021; Maastricht Economic and Social Research Institute on Innovation and Technology (UNU-MERIT): Maastricht, The Netherlands, 2021. [Google Scholar]

- Komninos, N. RIS3 and Digital Growth Strategy in Greece: Smart Specialisation, ICT Projects and e-Services; Report for the European Commission; Directorate-General for Regional and Urban Policy: Brussels, Belgium, 2015. [Google Scholar]

- Kramer, J.P.; Sirtori, E. Study on Prioritisation in Smart Specialisation Strategies in the EU; Publications Office of the European Union: Luxembourg, 2021. [Google Scholar]

- Hegyi, F.B.; Prota, F. Smart Specialisation Process Evaluation: Monitoring and Evaluation Experience across Europe. 2021. Available online: https://joint-research-centre.ec.europa.eu/publications/smart-specialisation-process-evaluation-monitoring-and-evaluation-experiences-across-europe_en (accessed on 12 April 2022).

- Aranguren, M.J.; Magro, E.; Navarro, M.; Wilson, J.R. Governance of the Territorial Entrepreneurial Discovery Process: Looking under the Bonnet of RIS3. Reg. Stud. 2019, 53, 451–461. [Google Scholar] [CrossRef]

- Polvenari, L. Implementing Smart Specialisation in 2014–2020 ESIF Programmes. IQ-Net Thematic Paper; European Policies Research Centre, University of Strathclyde: Glasgow, UK, 2016; Volume 39. [Google Scholar]

- Laranja, M.; Edwards, J.; Pinto, H.; Foray, D. Implementation of Smart Specialisation Strategies in Portugal: An assessment; Publications Office of the European Union: Luxembourg, 2020. [Google Scholar]

- Sisto, R.; García López, J.; Quintanilla, A.; Juanes, Á.; Mendoza, D.; Lumbreras, J.; Mataix, C. Quantitative Analysis of the Impact of Public Policies on the Sustainable Development Goals through Budget Allocation and Indicators. Sustainability 2020, 12, 10583. [Google Scholar] [CrossRef]

- Chrysomallidis, C.; Tsakanikas, A. The Implementation of Smart Specialization Strategy in Greece: Re-balancing Governance between the Central State and the Regions. Reg. Sci. Policy Pract. 2017, 9, 183–199. [Google Scholar] [CrossRef]

- Carayannis, E.G.; Rakhmatullin, R. The Quadruple/Quintuple Innovation Helixes and Smart Specialisation Strategies for Sustainable and Inclusive Growth in Europe and Beyond. J. Knowl. Econ. 2014, 5, 212–239. [Google Scholar] [CrossRef]

- Komninos, N.; Kakderi, C.; Panori, A.; Garcia, E.; Fellnhofer, K.; Reid, A.; Cvijanović, V.; Roman, M.; Deakin, M.; Mora, L. Intelligence and Co-Creation in Smart Specialisation Strategies: Towards the Next Stage of RIS3; 2018. White Paper. Available online: https://www.onlines3.eu/intelligence-and-co-creation-in-smart-specialisation-strategies-towards-the-next-stage-of-ris3/ (accessed on 23 April 2022).

- Carayannis, E.G.; Grigoroudis, E. Towards an Ambidextrous, Robust and Resilient Impact Assessment of Sustainable Smarter Specialisation Strategies (AR2IA/S4). J. Knowl. Econ. 2022. [Google Scholar] [CrossRef]

- Gianelle, C.; Kyriakou, D.; McCann, P.; Morgan, K. Smart Specialisation on the Move: Reflections on Six Years of Implementation and Prospects for the Future. Reg. Stud. 2020, 54, 1323–1327. [Google Scholar] [CrossRef]

- Zamora-Kapoor, A.; Coller, X. The Effects of the Crisis: Why Southern Europe? Am. Behav. Sci. 2014, 58, 1511–1516. [Google Scholar] [CrossRef]

- Marques, P.; Morgan, K. The Heroic Assumptions of Smart Specialisation: A Sympathetic Critique of Regional Innovation Policy. In New Avenues for Regional Innovation Systems-Theoretical Advances, Empirical Cases and Policy Lessons; Springer: Cham, Switzerland, 2018; pp. 275–293. [Google Scholar]

- Trippl, M.; Zukauskaite, E.; Healy, A. Shaping Smart Specialization: The Role of Place-Specific Factors in Advanced, Intermediate and Less-Developed European Regions. Reg. Stud. 2019, 54, 1328–1340. [Google Scholar] [CrossRef]

- Ferreira, J.J.; Farinha, L.; Rutten, R.; Asheim, B. Smart Specialisation and Learning Regions as a Competitive Strategy for Less Developed Regions. Reg. Stud. 2021, 55, 373–376. [Google Scholar] [CrossRef]

- Mieszkowski, K.; Barbero, J. Territorial Patterns of R&D +I Grants Supporting Smart Specialisation Projects Funded from the ESIF in Poland. Reg. Stud. 2020, 55, 390–401. [Google Scholar] [CrossRef]

- Barca, F. An Agenda for a Reformed Cohesion Policy: A Place-Based Approach to Meeting European Union Challenges and Expectations; European Commission: Brussels, Belgium, 2009. [Google Scholar]

- External Evaluation Report—Aristotle University of Thessaloniki; Hellenic Quality Assurance and Accreditation Agency: Athens, Greece, 2015.

- Bilas, V. Smart Specialisation Concept as a Tool for Improving Innovation Performance of the European Union Member States. Ekon. Vjesn. 2020, 33, 217–226. [Google Scholar]

- Arregui-Pabollet, E.; Doussineau, M.; Dettenhofer, M. An Analytical Framework to Assess the Governance of Universities and Their Involvement in Smart Specialisation Strategies; Publications Office of the European Union: Luxembourg, 2018. [Google Scholar]

- Benneworth, P.; Arregui-Pabollet, E. Higher Education for Smart Specialisation: The Case of the Northern Netherlands; Publications Office of the European Union: Luxembourg, 2021. [Google Scholar]

- Ierapetritis, D.G. Discussing the Role of Universities in Fostering Regional Entrepreneurial Ecosystems. Economies 2019, 7, 119. [Google Scholar] [CrossRef]

- Giouli, E. Lifelong Distance Learning and Skills Development: A Case Study Analysis in Greece. Int. J. Educ. Pedagog. Sci. 2020, 14, 1292–1296. [Google Scholar]

- Tsipouri, L.; Koundouri, P.; Papadaki, L.; Argyrou, M.D. Circular Economy in National Smart Specialisation Strategies: The Case of Greece. In The Ocean of Tomorrow; Springer: Cham, Switzerland, 2021; pp. 199–241. [Google Scholar]

- Enterprise Greece. The Greek Start-Up Scene; Enterprise Greece: Athens, Greece, 2019. [Google Scholar]

- Bhatti, A.; Akram, H.; Basit, H.M.; Khan, A.U.; Raza, S.M.; Naqvi, M.B. E-Commerce Trends during COVID-19 Pandemic. Int. J. Future Gener. Commun. Netw. 2020, 13, 1449–1452. [Google Scholar]

- Koszewska, M. Circular Economy—Challenges for the Textile and Clothing Industry. Autex Res. J. 2018, 18, 337–347. [Google Scholar] [CrossRef]

- Xia, C.; Lam, S.S.; Sonne, C. Ban Unsustainable Mink Production. Science 2020, 370, 539. [Google Scholar] [CrossRef]

- Papadopoulou, E.; Vaitsas, K.; Fallas, I.; Tsipas, G.; Chrissafis, K.; Bikiaris, D.; Vorgias, K.E. Bio-Economy in Greece: Current Trends and the Road Ahead. EuroBiotech J. 2018, 2, 137–145. [Google Scholar] [CrossRef]

- Schismenos, S.; Zaimes, G.N.; Iakovoglou, V.; Emmanouloudis, D. Environmental Sustainability and Ecotourism of Riparian and Deltaic Ecosystems: Opportunities for Rural Eastern Macedonia and Thrace, Greece. Int. J. Environ. Stud. 2019, 76, 675–688. [Google Scholar] [CrossRef]

- Schiefer, G. Anticipated Futures for Modern Rural Economies-a Request for Guidance by Research, Policy and the Business Community. Int. J. Food Syst. Dyn. 2019, 10, 396–401. [Google Scholar]

- Gui, E.M.; MacGill, I. Typology of future clean energy communities: An exploratory structure, opportunities, and challenges. Energy Res. Soc. Sci. 2018, 35, 94–107. [Google Scholar] [CrossRef]

- Erro-Garcés, A.; Čyras, G. The creation of clusters of value to reduce youth unemployment in Lithuania and Spain. In Proceedings of the International Scientific Conference Contemporary Issues in Business, Management And Economics Engineering’2019, Vilnius Gediminas Technical University, Vilnius, Lithuania, 9–10 May 2019. [Google Scholar] [CrossRef]

- Megyesiova, S.; Lieskovska, V. Analysis of the Sustainable Development Indicators in the OECD Countries. Sustainability 2018, 10, 4554. [Google Scholar] [CrossRef]

- Hakovirta, M.; Denuwara, N. How COVID-19 Redefines the Concept of Sustainability. Sustainability 2020, 12, 3727. [Google Scholar] [CrossRef]

- Muñoz-Pascual, L.; Curado, C.; Galende, J. The Triple Bottom Line on Sustainable Product Innovation Performance in SMEs: A Mixed Methods Approach. Sustainability 2019, 11, 1689. [Google Scholar] [CrossRef]

- Kozera-Kowalska, M.; Uglis, J.; Lira, J. A Framework to Measure the Taxonomic of Economic Anchor: A Case Study of the Three Seas Initiative Countries. PLoS ONE 2021, 16, e0252292. Available online: https://journals.plos.org/plosone/article?id=10.1371/journal.pone.0252292 (accessed on 30 July 2022). [CrossRef] [PubMed]

- Uglis, J.; Kozera-Kowalska, M. Synthetic measure of rural area attractiveness for living, working and business activities - concept analysis and statistical evaluation. Annals PAAAE 2019, XXI, 275–284. [Google Scholar] [CrossRef]

- Casado-Asensio, J.; Steurer, R. Integrated Strategies on Sustainable Development, Climate Change Mitigation and Adaptation in Western Europe: Communication Rather than Coordination. J. Public Policy 2014, 34, 437–473. [Google Scholar] [CrossRef]

- Vautard, R.; Gobiet, A.; Sobolowski, S.; Kjellström, E.; Stegehuis, A.; Watkiss, P.; Mendlik, T.; Landgren, O.; Nikulin, G.; Teichmann, C.; et al. The European Climate under a 2 °C Global Warming. Environ. Res. Lett. 2014, 9, 034006. [Google Scholar] [CrossRef]

- Máté, D.; Novotny, A.; Meyer, D.F. The Impact of Sustainability Goals on Productivity Growth: The Moderating Role of Global Warming. Int. J. Environ. Res. Public Health 2021, 18, 11034. [Google Scholar] [CrossRef]

- Arrogante-Funes, P.; Novillo, C.J.; Romero-Calcerrada, R. Monitoring NDVI Inter-Annual Behavior in Mountain Areas of Mainland Spain (2001–2016). Sustainability 2018, 10, 4363. [Google Scholar] [CrossRef]

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).