The Relationship between Trade Liberalization, Financial Development and Carbon Dioxide Emission—An Empirical Analysis

Abstract

:1. Introduction

2. Literature and Hypothesis

2.1. Trade Liberalization and Carbon Dioxide Emissions

2.2. Financial Development and Carbon Dioxide Emissions

2.3. Trade Liberalization and Financial Development

3. Model Setting and Data Description

3.1. PVAR Model

3.2. Data Description

3.3. Technology Effect on CO2 Emission

3.4. SFA Model

- Y: innovation output (pieces);

- K: R&D capital stock;

- L: Personnel input in regional R&D activities;

- TRL: Regional trade liberalization level;

- ER: Environmental regulation variables;

4. Results and Discussion

4.1. Descriptive Statistics Analysis

4.2. Panel Unit Root Test

4.3. PVAR Evaluation

4.3.1. Lagging Items Screening

4.3.2. PVAR Evaluation Results

4.4. Variance Decomposition

4.5. Granger Causality Test

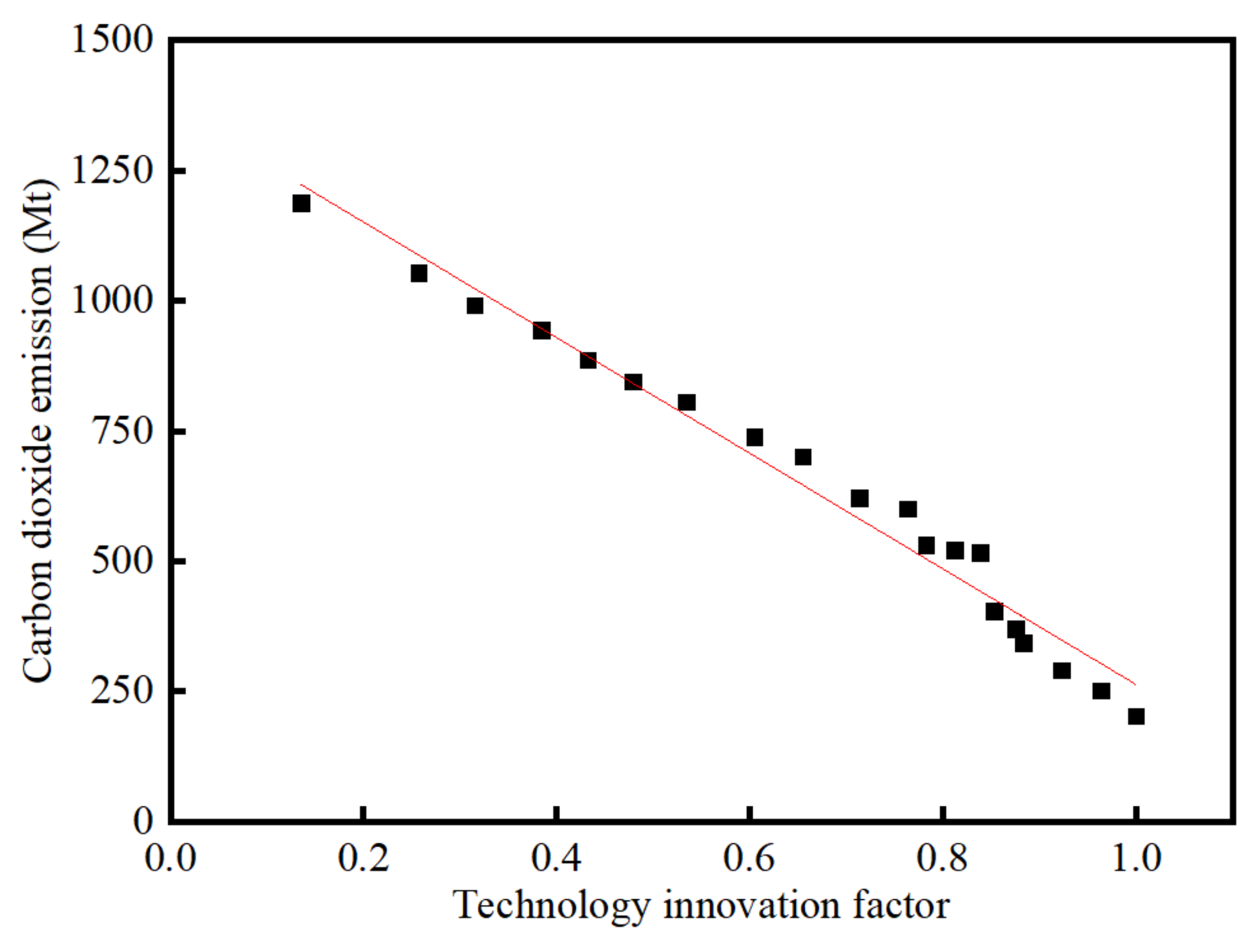

4.6. Technology Innovation Effect on Carbon Dioxide Emissions

4.7. Technology Innovation Effect on Trade Liberation

5. Conclusions and Policy Recommendations

6. Limitations and Future Recommendations

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Wang, Z.; Zhu, Y. Do energy technology innovations contribute to CO2 emissions abatement? A spatial perspective. Sci. Total Environ. 2020, 726, 138574. [Google Scholar] [CrossRef] [PubMed]

- Onifade, S.T.; Erdoğan, S.; Alagöz, M.; Bekun, F.V. Renewables as a pathway to environmental sustainability targets in the era of trade liberalization: Empirical evidence from Turkey and the Caspian countries. Environ. Sci. Pollut. Res. 2021, 28, 41663–41674. [Google Scholar] [CrossRef] [PubMed]

- Jena, P.R. Does trade liberalization create more pollution? Evidence from a panel regression analysis across the states of India. Environ. Econ. Policy Stud. 2018, 20, 861–877. [Google Scholar] [CrossRef]

- Tariq, G.; Sun, H.; Haris, M.; Kong, Y.; Nadeem, A. Trade liberalization, FDI inflows economic growth and environmental sustainability in Pakistan and India. J. Agric. Environ. Int. Dev. 2018, 112, 253–269. [Google Scholar] [CrossRef]

- Kolcava, D.; Nguyen, Q.; Bernauer, T. Does trade liberalization lead to environmental burden shifting in the global economy? Ecol. Econ. 2019, 163, 98–112. [Google Scholar] [CrossRef]

- Dogan, E.; Seker, F. The influence of real output, renewable and non-renewable energy, trade and financial development on carbon emissions in the top renewable energy countries. Renew. Sustain. Energy Rev. 2016, 60, 1074–1085. [Google Scholar] [CrossRef]

- Mehmood, U.; Tariq, S. Globalization and CO2 emissions nexus: Evidence from the EKC hypothesis in South Asian countries. Environ. Sci. Pollut. Res. 2020, 27, 37044–37056. [Google Scholar] [CrossRef] [PubMed]

- Mahmood, H.; Maalel, N.; Zarrad, O. Trade openness and CO2 emissions: Evidence from Tunisia. Sustainability 2019, 11, 3295. [Google Scholar] [CrossRef]

- Mahmood, H.; Alkhateeb, T.T.Y. Trade and environment nexus in Saudi Arabia: An environmental Kuznets curve hypothesis. Int. J. Energy Econ. Policy 2017, 7, 291–295. [Google Scholar]

- Shahbaz, M.; Nasreen, S.; Ahmed, K.; Hammoudeh, S. Trade openness–carbon emissions nexus: The importance of turning points of trade openness for country panels. Energy Econ. 2017, 61, 221–232. [Google Scholar] [CrossRef]

- Ehigiamusoe, K.U.; Lean, H.H. Tripartite analysis of financial development, trade openness and economic growth: Evidence from Ghana, Nigeria and South Africa. Contemp. Econ. 2018, 12, 189–207. [Google Scholar]

- Hdom, H.A.; Fuinhas, J.A. Fuinhas, Energy production and trade openness: Assessing economic growth, CO2 emissions and the applicability of the cointegration analysis. Energy Strategy Rev. 2020, 30, 100488. [Google Scholar] [CrossRef]

- Meirun, T.; Mihardjo, L.W.; Haseeb, M.; Khan, S.A.R.; Jermsittiparsert, K. The dynamics effect of green technology innovation on economic growth and CO2 emission in Singapore: New evidence from bootstrap ARDL approach. Environ. Sci. Pollut. Res. 2021, 28, 4184–4194. [Google Scholar] [CrossRef] [PubMed]

- Hashmi, R.; Alam, K. Dynamic relationship among environmental regulation, innovation, CO2 emissions, population, and economic growth in OECD countries: A panel investigation. J. Clean. Prod. 2019, 231, 1100–1109. [Google Scholar] [CrossRef]

- Godil, D.I.; Yu, Z.; Sharif, A.; Usman, R.; Khan, S.A.R. Investigate the role of technology innovation and renewable energy in reducing transport sector CO2 emission in China: A path toward sustainable development. Sustain. Dev. 2021, 29, 694–707. [Google Scholar] [CrossRef]

- Braungardt, S.; Elsland, R.; Eichhammer, W. The environmental impact of eco-innovations: The case of EU residential electricity use. Environ. Econ. Policy Stud. 2016, 18, 213–228. [Google Scholar] [CrossRef]

- Wang, Z.; Yang, Z.; Zhang, Y.; Yin, J. Energy technology patents–CO2 emissions nexus: An empirical analysis from China. Energy Policy 2012, 42, 248–260. [Google Scholar] [CrossRef]

- Iqbal, Q.; Ahmad, N.H.; Nasim, A.; Khan, S.A.R. A moderated-mediation analysis of psychological empowerment: Sustainable leadership and sustainable performance. J. Clean. Prod. 2020, 262, 121429. [Google Scholar] [CrossRef]

- Chien, F.; Ajaz, T.; Andlib, Z.; Chau, K.Y.; Ahmad, P.; Sharif, A. The role of technology innovation, renewable energy and globalization in reducing environmental degradation in Pakistan: A step towards sustainable environment. Renew. Energy 2021, 177, 308–317. [Google Scholar] [CrossRef]

- Hu, Y.; Zheng, J. Is green credit a good tool to achieve “double carbon” goal? Based on coupling coordination model and PVAR model. Sustainability 2021, 13, 14074. [Google Scholar] [CrossRef]

- Ma, T.; Wang, Y. Globalization and environment: Effects of international trade on emission intensity reduction of pollutants causing global and local concerns. J. Environ. Manag. 2021, 297, 113249. [Google Scholar] [CrossRef] [PubMed]

- Zandi, G.; Haseeb, M. The role of trade liberalization in carbon dioxide emission: Evidence from heterogeneous panel estimations. Int. J. Financ. Res. 2019, 10, 228–240. [Google Scholar] [CrossRef]

- Grossman, G.M.; Krueger, A.B. Environmental Impacts of a North American Free Trade Agreement; National Bureau Of Economic Research: Cambridge, MA, USA, 1991. [Google Scholar]

- Chang, S.-C.; Chang, H.-F. Same Trade Openness Yet Different Environmental Quality—But Why? J. Int. Commer. Econ. Policy 2020, 11, 2050002. [Google Scholar] [CrossRef]

- Oh, K.-Y.; Bhuyan, M.I. Trade openness and CO2 emissions: Evidence of Bangladesh. Asian J. Atmos. Environ. 2018, 12, 30–36. [Google Scholar] [CrossRef]

- Lin, B.; Xu, M. Does China become the “pollution heaven” in South-South trade? Evidence from Sino-Russian trade. Sci. Total Environ. 2019, 666, 964–974. [Google Scholar] [CrossRef]

- Tasri, E.S.; Karimi, K. Emission Study And Pollution Heaven Hypothesis In Economic Development Of Developed Country. In Proceedings of the The First Economics, Law, Education and Humanities International Conference, Padang, Indonesia, 14 August 2018; Universitas Bung Hatta Repository: Southampton, UK, 2019. [Google Scholar]

- Shoaib, H.M.; Rafique, M.Z.; Nadeem, A.M.; Huang, S. Impact of financial development on CO2 emissions: A comparative analysis of developing countries (D8) and developed countries (G8). Environ. Sci. Pollut. Res. 2020, 27, 12461–12475. [Google Scholar] [CrossRef] [PubMed]

- Zhang, Y.-J. The impact of financial development on carbon emissions: An empirical analysis in China. Energy Policy 2011, 39, 2197–2203. [Google Scholar] [CrossRef]

- Shahbaz, M.; Tiwari, A.; Nasir, M. The effects of financial development, economic growth, coal consumption and trade openness on CO2 emissions in South Africa. Energy Policy 2013, 61, 1452–1459. [Google Scholar] [CrossRef]

- Khan, M.; Ozturk, I. Examining the direct and indirect effects of financial development on CO2 emissions for 88 developing countries. J. Environ. Manag. 2021, 293, 112812. [Google Scholar] [CrossRef] [PubMed]

- Le, T.-H.; Le, H.-C.; Taghizadeh-Hesary, F. Does financial inclusion impact CO2 emissions? Evidence from Asia. Financ. Res. Lett. 2020, 34, 101451. [Google Scholar] [CrossRef]

- Phong, L. Globalization, financial development, and environmental degradation in the presence of environmental Kuznets curve: Evidence from ASEAN-5 countries. Int. J. Energy Econ. Policy 2019, 9, 40–50. [Google Scholar]

- Hafeez, M.; Chunhui, Y.; Strohmaier, D.; Ahmed, M.; Jie, L. Does finance affect environmental degradation: Evidence from One Belt and One Road Initiative region? Environ. Sci. Pollut. Res. 2018, 25, 9579–9592. [Google Scholar] [CrossRef]

- Sethi, P.; Chakrabarti, D.; Bhattacharjee, S. Globalization, financial development and economic growth: Perils on the environmental sustainability of an emerging economy. J. Policy Modeling 2020, 42, 520–535. [Google Scholar] [CrossRef]

- Xiong, L.; Qi, S. Financial development and carbon emissions in Chinese provinces: A spatial panel data analysis. Singap. Econ. Rev. 2018, 63, 447–464. [Google Scholar] [CrossRef]

- Rajan, R.; Zingales, L. Financial dependence and growth. American Econo. Rev. 1998, 88, 559–586. [Google Scholar]

- Beck, T. Financial development and international trade: Is there a link? J. Int. Econ. 2002, 57, 107–131. [Google Scholar] [CrossRef]

- Carlin, W.; Mayer, C. Finance, investment, and growth. J. Financ. Econ. 2003, 69, 191–226. [Google Scholar] [CrossRef]

- Fisman, R.; Love, I. Financial Development and Growth in the Short and Long Run; National Bureau of Economic Research: Cambridge, MA, USA, 2004. [Google Scholar]

- Yakubu, A.S.; Aboagye, A.Q.; Mensah, L.; Bokpin, G.A. Effect of financial development on international trade in Africa: Does measure of finance matter? J. Int. Trade Econ. Dev. 2018, 27, 917–936. [Google Scholar] [CrossRef]

- Chan, J.M.; Manova, K. Financial development and the choice of trade partners. J. Dev. Econ. 2015, 116, 122–145. [Google Scholar] [CrossRef]

- Gnangnon, S.K. Multilateral trade liberalization and economic growth. J. Econ. Integr. 2018, 33, 1261–1301. [Google Scholar] [CrossRef]

- Ibrahim, M.; Sare, Y.A. Determinants of financial development in Africa: How robust is the interactive effect of trade openness and human capital? Econ. Anal. Policy 2018, 60, 18–26. [Google Scholar] [CrossRef]

- Ashraf, B.N. Do trade and financial openness matter for financial development? Bank-level evidence from emerging market economies. Res. Int. Bus. Financ. 2018, 44, 434–458. [Google Scholar] [CrossRef]

- Zhang, C.; Zhu, Y.; Lu, Z. Trade openness, financial openness, and financial development in China. J. Int. Money Financ. 2015, 59, 287–309. [Google Scholar] [CrossRef]

- Le, T.-H.; Tran-Nam, B. Trade liberalization, financial modernization and economic development: An empirical study of selected Asia–Pacific countries. Res. Econ. 2018, 72, 343–355. [Google Scholar] [CrossRef]

- Wangwe, S.M. Exporting Africa: Technology, Trade and Industrialization in Sub-Saharan Africa; Wangwe, S.M., Ed.; Routledge/UNU Press: London, UK, 1995. [Google Scholar]

- Charfeddine, L.; Kahia, M. Impact of renewable energy consumption and financial development on CO2 emissions and economic growth in the MENA region: A panel vector autoregressive (PVAR) analysis. Renew. Energy 2019, 139, 198–213. [Google Scholar] [CrossRef]

- Zhu, X.; Lu, Y. Fiscal and taxation policies, economic growth and environmental quality: An analysis based on PVAR model. IOP Conf. Series: Earth Environ. Sci. 2019, 227, 052041. [Google Scholar] [CrossRef]

- Su, Y.; Li, D. Interaction effects of government subsidies, R&D input and innovation performance of Chinese energy industry: A panel vector autoregressive (PVAR) analysis. Technol. Anal. Strateg. Manag. 2021, 1–15. [Google Scholar] [CrossRef]

- Battese, G.E.; Coelli, T.J. A model for technical inefficiency effects in a stochastic frontier production function for panel data. Empir. Econ. 1995, 20, 325–332. [Google Scholar] [CrossRef]

| Author | Variables | Method | Conclusion | Countries |

|---|---|---|---|---|

| Stephen (2021) [2] | CO2, FD, TR | DOLS, FMOLS | TR and FD contribute to CO2; EC mitigates CO2 | Turkey and the Caspian countries |

| Pardyot (2018) [3] | CO2, SO2, NO2, SPM, FD, TR | Panel regression analysis | FD contributes to NO2, TR mitigates CO2, SMP, SO2 | India |

| Gulzara (2018) [4] | FDI, FD, TR, CO2 | ARDL | FDI, TR contributes to CO2, | Pakistan and India |

| Dennis (2019) [5] | TR, GDP, Pollution, | SLM | TR and GDP mitigate Pollution | 183 countries |

| Eyup (2016) [6] | TR, FD, NREC, REC | CADF, CIPS, Heterogeneous panel | TR, FD and REC mitigate CO2; NREC contributes to CO2 | European countries |

| Mehmood (2020) [7] | CO2, TR | Co-integration, Unit root test | TR contributes to CO2 | South Asia countries |

| Haider (2018) [8] | CO2, TR | Unit root analysis, ARDL | EGY contributes to CO2 | Tunisia |

| Mahmood (2017) [9] | CO2, TR | Cointegration | TR mitigates CO2 | Saudi Arabia |

| Shahbaz (2017) [10] | CO2, TR, | Causality | TR contributes to CO2 | 105 countries |

| Kizito (2018) [11] | FD, TR, GDP | Panel unit root test, cointegration test | FD contributes to TR, GDP; TR contributes to FD, GDP | Nigeria and South Africa |

| Hélde (2020) [12] | TR, CO2, FD, GDP | DOLS FMOLS, DOLS | GDP contributes to CO2, CO2 and TR contribute to FD | Brazil |

| Energy | Coal | Coke | Crude Oil | Kerosene | Fuel | Gasoline | Diesel | Natural Gas |

|---|---|---|---|---|---|---|---|---|

| αi | 0.756 | 0.855 | 0.586 | 0.571 | 0.619 | 0.554 | 0.592 | 0.448 |

| βi | 0.714 | 0.971 | 1.429 | 1.471 | 1.429 | 1.471 | 1.457 | 1.330 |

| Ei | 0.942 | 0.4653 | 1.4286 | 1.4714 | 1.4714 | 1.428 | 1.4571 | 1.757 |

| Variable | lnCO2 | lnTR | lnFD |

|---|---|---|---|

| Observations | 1000 | 1000 | 1000 |

| The Average | 4.82 | −2.43 | 18.54 |

| Standard Error | 9.89 | 0.68 | 25.38 |

| The Minimum Value | 8.01 | −2.13 | 18.65 |

| The Maximum | 0.86 | 1.68 | 1.76 |

| Variable | LLC Test | IPS Test | |||

|---|---|---|---|---|---|

| Constant Term | Trend and Constant Terms | Constant Term | Trend and Constant Terms | ||

| The Level | lnCO2 | −0.0298 ** | −0.2862 *** | 1.325 ** | −1.438 *** |

| lnFD | −0.2318 ** | −0.1839 ** | −2.136 ** | 1.462 ** | |

| lnTR | −0.1836 * | −0.2736 *** | −0.416 ** | −1.428 ** | |

| A First Order Differential | lnCO2 | −0.8654 ** | −1.3584 *** | −7.652 *** | −6.864 ** |

| lnFD | −0.7826 ** | −0.9128 *** | −6.648 ** | −7.126 *** | |

| lnTR | −0.8012 *** | −1.358 ** | −8.165 ** | −5.864 ** | |

| Lag | AIC | BIC | HQIC |

|---|---|---|---|

| 1 | −5.7624 | −5.2346 * | −6.2345 ** |

| 2 | −5.6219 | −5.0138 | −5.4326 |

| 3 | −5.5628 *** | −4.4316 | −5.6138 |

| 4 | −5.3129 *** | −4.2364 ** | −5.6183 ** |

| h_lnCO2 | h_lnFD | h_lnTR | |

|---|---|---|---|

| L.h_lnCO2 | 1.912 *** (2.39) | 0.068 ** (0.196) | −0.023 (−0.17) |

| L.h_lnFD | 0.218 ** (0.783) | 0.624 ** (1.86) | 0.723 ** (0.65) |

| L.h_lnTR | −0.023 ** (−0.18) | −0.076 *** (−1.96) | 1.126 *** (3.86) |

| L2.h_lnCO2 | −0.216 (−1.36) | 0.076 ** (1.46) | −0.516 (−0.42) |

| L2.h_lnFD | 0.054 ** (0.38) | −0.204 (−1.54) | −0.286 ** (−0.68) |

| L2.h_lnTR | 0.014 ** (0.23) | 0.027 * (2.19) | −0.321 *** (−1.54) |

| L3.h_lnCO2 | 0.236 *** (0.56) | 0.048 *** (1.29) | 0.064 ** (0.44) |

| L3.h_lnFD | 0.238 ** (1.41) | 0.312 ** (0.71) | −0.254 ** (−1.54) |

| L3.h_lnTR | 0.184 (1.42) | 0.039 ** (1.74) | 0.154 ** (2.12) |

| L4.h_lnCO2 | −0.108 ** (−0.48) | −0.065 * (−0.37) | −0.224 (−1.86) |

| L4.h_lnFD | 0.018 (0.12) | −0.064 (−0.22) | 0.264 (0.754) |

| L4.h_lnTR | −0.178 (−1.54) | 0.116 ** (1.14) | −0.122 *** (−1.46) |

| lnCO2 | lnFD | lnTR | |

|---|---|---|---|

| lnCO2 | 0.813 | 0.046 | 0.118 |

| lnFD | 0.634 | 0.314 | 0.112 |

| lnTR | 0.132 | 0.026 | 0.513 |

| lnCO2 | 0.584 | 0.026 | 0.038 |

| lnFD | 0.664 | 0.038 | 0.126 |

| lnTR | 0.178 | 0.038 | 0.882 |

| Variable | Causal Relationship | Chi-Square Value | p Values |

|---|---|---|---|

| lnCO2 | lnFD is not the cause | 27.124 | 0.003 |

| lnTR is not the cause | 4.436 | 0.246 | |

| ALL | 47.238 | 0.012 | |

| lnFD | lnCO2 is not the cause | 17.241 | 0.003 |

| lnTR is not the cause | 25.132 | 0.001 | |

| ALL | 43.218 | 0.002 | |

| lnTR | lnCO2 is not the cause | 6.2413 | 0.026 |

| lnFD is not the cause | 12.746 | 0.022 | |

| ALL | 23.244 | 0.002 |

| Variable | Model 1 | Model 2 |

|---|---|---|

| lnL | 1.4654 *** (1.51) | 1.3126 *** (2.24) |

| lnK | −1.8846 *** (−3.42) | −3.0126 *** (−2.43) |

| lnL2 | 0.6428 *** (3.08) | 0.8126 ** (1.27) |

| lnK2 | 0.6542 *** (2.08) | 0.6834 *** (1.96) |

| lnKxlnL | −0.7326 *** (−3.14) | −0.7135 ** (−1.62) |

| Constant term | 7.1236 *** (5.14) | 8.2431 *** (4.36) |

| σ | 0.3214 ** (3.89) | 0.1324 *** (10.28) |

| γ | 0.5238 *** (12.76) | 0.6852 ** (2.16) |

| Log | −96.2364 | −142.3548 |

| Likelihood Ratio (LR) | 284.316 | 201.261 |

| Explanatory Variable | Model 1 | Model 2 | Model 3 | Model 4 | Model 5 | Model 6 |

|---|---|---|---|---|---|---|

| TRL | −0.7938 ** (−2.94) | −1.2635 *** (−5.12) | −0.7836 *** (−3.13) | −1.3245 ** (−6.14) | −1.8234 *** (−4.63) | −1.8642 *** (−5.24) |

| ER | −0.0016 ** (−1.83) | 0.008 * (2.64) | −0.0186 ** (−5.65) | −0.0345 ** (−2.31) | −0.0038 *** (−1.89) | −0.0084 ** (−3.41) |

| ST | 53.3126 *** (4.36) | 35.6214 *** (9.21) | 51.2354 *** (8.14) | 7.2142 ** (2.58) | 28.3126 *** (8.38) | 23.1264 *** (7.68) |

| SCH | −1.3842 ** (−1.85) | −0.2435 * (−1.15) | −0.1462 ** (−1.69) | 0.1327 * (0.96) | −0.0125 * (−0.28) | 0.0256 * (0.84) |

| GDPPC | −0.2135 * (−0.65) | −0.1328 ** (−1.94) | −0.1564 ** (0.37) | −0.1625 ** (−1.38) | −0.1628 ** (−2.42) | −0.1832 * (−4.16) |

| lnFDI | −0.1245 *** (−2.46) | 0.0186 * (0.54) | 0.0846 ** (1.37) | −0.2438 ** (−3.46) | −0.0628 ** (−1.86) | −0.0542 ** (−1.68) |

| TRL2 | 0.6254 ** (2.57) | 0.8654 *** (4.56) | 0.8321 ** (2.46) | |||

| ER2 | 0.0004 *** (5.18) | 0.0013 ** (2.41) | 0.0008 ** (4.28) | |||

| ER × TRL | 0.0116 ** (0.64) | |||||

| ER × TRL2 | 0.0285 ** (2.16) | |||||

| ER2 × TRL | 0.0011 ** (1.32) | |||||

| Constant | 2.4268 ** (2.34) | 0.8854 ** (3.18) | 1.6824 *** (1.98) | 1.2454 ** (1.65) | 0.9245 ** (2.14) | 0.8324 ** (2.34) |

| Observed Value | 690 | 690 | 690 | 690 | 690 | 690 |

| σ2 | 0.2245 *** (6.48) | 0.1768 ** (13.46) | 0.1589 ** (8.24) | 0.2345 ** (3.76) | 0.1158 *** (8.42) | 0.1254 ** (1.74) |

| r | 0.2546 ** (1.35) | 0.6824 *** (10.74) | 0.1948 ** (2.17) | 0.4326 *** (6.18) | 0.5342 *** (1.86) | 0.6218 *** (1.53) |

| Log | −152.4856 | −137.5246 | −131.8426 | −151.2164 | −130.4258 | −114.2376 |

| Likelihood Ratio (LR) | 98.1354 | 123.4526 | 118.5424 | 86.2354 | 146.2345 | 114.3219 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Duan, K.; Cao, M.; Abdul Kader Malim, N. The Relationship between Trade Liberalization, Financial Development and Carbon Dioxide Emission—An Empirical Analysis. Sustainability 2022, 14, 10308. https://doi.org/10.3390/su141610308

Duan K, Cao M, Abdul Kader Malim N. The Relationship between Trade Liberalization, Financial Development and Carbon Dioxide Emission—An Empirical Analysis. Sustainability. 2022; 14(16):10308. https://doi.org/10.3390/su141610308

Chicago/Turabian StyleDuan, Keyi, Mingyao Cao, and Nurhafiza Abdul Kader Malim. 2022. "The Relationship between Trade Liberalization, Financial Development and Carbon Dioxide Emission—An Empirical Analysis" Sustainability 14, no. 16: 10308. https://doi.org/10.3390/su141610308

APA StyleDuan, K., Cao, M., & Abdul Kader Malim, N. (2022). The Relationship between Trade Liberalization, Financial Development and Carbon Dioxide Emission—An Empirical Analysis. Sustainability, 14(16), 10308. https://doi.org/10.3390/su141610308