Abstract

Discussions on the impact of climate change and ways of protecting climate change impact driven by environmentally unfriendly activities have taken the center stage of global development agendas. The importance of environmental sustainability is also reflected in the 2030 Sustainable Development Goals (SDGs). Green taxes have become pivotal to protecting the environment, revenue generation and achievement of the SDGs. Through a critical literature review, this paper explores the opportunities and challenges associated with green taxes with respect to revenue mobilization, protection of the environment and delivery of the SDGs. The paper gives an insight to green taxes, exploring the motives of green taxes and the possible implications for environmental sustainability, sustainable development, and attainment of the SDGs in the African context. Fossil fuels such as coal, crude oil and natural gases are fundamental sources of energy for African countries. Therefore, the continent faces a dilemma of how to ensure green economic growth, reduce environmental and climate change problems, and at the same time foster effective revenue mobilization. The review established that while green taxes can provide an opportunity for green transformation policy reforms and boost revenue mobilization to stimulate inclusive and sustainable growth and economic recovery from the COVID-19-induced economic recession, the taxes can increase inequality, heighten the cost of energy, and increase energy poverty for those dependent on fossil fuel for energy. The lack of affordability and access would compromise SDGs such as 7 and 1 (access to clean energy and poverty reduction, respectively). The taxes could lead to a disjointed value chain with consumers disadvantaged and an increase in black market activities as people seek cheaper but unsafe alternatives, indirectly increasing the social costs such as health risks and challenges, poverty, and unemployment.

1. Introduction

In the past few years, due to increasing pollution, matters of environmental protection and sustainable development have become topical issues. Governments are under pressure to come up with ways to minimize the environmental damage while reducing the negative impact of the exploitation of natural resources and energy usage [1]. In response to this immense pressure, countries have applied a variety of tools to attain the sustainable development and environmental preservation goals. Governments have an array of economic tools to employ, and these include innovation policies, regulations, environmental subsidies, information sharing and awareness programs and environmental taxes. As posited by Braathren and Greene [2], “Taxes are in particular a key part of this tool kit”. Even though various economic instruments are at governments’ disposal, environmental taxes have become the most significant and fruitful economic instrument in the climate change and environment preservation fight. The terms green taxes and environmental taxes are often used interchangeably in the literature, and likewise, they will be applied interchangeably throughout this article. Others refer to the green taxes as climate taxes, ecological taxes or eco taxes [3,4]. These terms reflect the need to protect the environment, climate and biodiversity.

Environmental or green taxation has been increasingly seen as a productive economic instrument to generate incentives to stimulate more environmentally friendly consumption and production choices and trends. Growing attention to environmental challenges such as the lack of optimum, effective, and responsible usage of natural resources, health concerns from the use of some energy resources, environmental degradation, and climate change (ozone layer depletion and global warming) have driven the implementation of green taxes. These taxes have been used by various countries, regions and continents on variegated areas and driven by an array of motives. The African continent has also put in place environmental taxes as evidenced in various countries [5]. While some scholars point out the comparatively advantageous nature of green taxes over other economic strategies such as paying for the usage of environmental products and services or for permits or licenses to use them, other scholars argue otherwise. Proponents of green taxes argue that they enable the correction of market failures, reduce the distortionary effects of other tax heads, and ensure that the costs of externalities are institutionalized in the price of a product. Critics of environmental taxes argue that contrary to the expected outcome of reducing the distortionary impact of other tax heads, environmental taxes may increase the distortions of the whole tax system or overshift the tax burden [6,7]. The economic and environmental outcomes of green taxes are debatable. Jaeger [8] argues that the interaction between environmentally taxes and other taxes is complex, confusing, and controversial. The validity of the green taxes correcting market failures or efficiently internalizing externalities is fraught with intricacies.

Traditional theory stipulates that an increase in the price of normal services and goods through the incorporation of a tax charge reduces the consumption of the goods or services. The use of taxes to integrate or institutionalize the negative externalities was highlighted in early literature by Pigou [9]. The researcher argued that levying a direct tax on carbon emissions is the most productive tax strategy for the reduction and mitigation of carbon emissions and their negative impact on the environment. Through empirical research, the effects of direct environmental taxes on environmental quality and protection have been analyzed and corroborated. However, the clarity of the dimension or extension of the broader economic effects remain contestable and limitedly explored. The economy-wide impact of environmental taxes is dependent on several factors such as the design, the structure and administration of the taxes, the economic environment in which they are implemented, the socio-political factors, and the availability of substitutes and consumer preferences.

Where the environmental tax is integrated or institutionalized in the price of a product or service, generally, the price paid by the buyer and the revenue received by the seller varies due to the after-tax effect. This was clearly elaborated on by Freire-González [10], who asserts, “Given that under some assumptions, prices coordinate efficient resource allocation, such differences reduce economic efficiency and consumer welfare by an amount greater than the revenue collected. This is known as the “dead weight loss” or “excess burden” of the tax system”.

In addition to the above controversy, there is also increasing research and policy suggestions that advocate for environmental taxes on the basis that environmental tax initiatives that increase these taxes, while reducing other taxes and maintaining the same level of government revenue mobilized, result in a double benefit [11]. The double dividend (DD) hypothesis pre-supposes that there is a possibility of improving both the economic conditions and environmental circumstances by levying green or environmental taxes and employing the mobilized revenues to reduce the tax rates for other tax heads already in existence [10].

The DD supposedly crystallizes in two ways: firstly, through the reduction in the negative environmental consequences of using the product or service; secondly, the tax revenue generation improves the economy through the increase in funds for government expenditure, reduction in market externalities and of the percentage consumption of certain goods. This referred to as the double dividend effect or hypothesis. This DD hypothesis or effect has gained increased attention by academics, policymakers, governments, environmental activities, and bodies. Variations and multiple interpretations surround the attainment of the DD [12]. The fundamental challenge being the establishment, calculation, and ascertainment of the broader oriented effects of green taxes and the intricacy connected to modern-day societies and economic systems. Having conducted 69 varying simulations from 40 studies and analyzed 55% of these simulations pointed to the likelihood of a double dividend being achieved, drawing a conclusion that although the environmental dividend had a greater propensity to be achieved, the economic dividend continues to be elusive and is an “ambiguous question that needs further research” [10].

Through a critical literature review, this article identifies and unpacks environmental taxes to give an understanding of what they are and their design. The paper sought to interrogate whether the design and administration of environmental taxes in Africa helps attain the double dividend of tax revenue mobilization and achieve the positive outcome of reducing environmental damaging activities. The paper also sheds more light on the African countries that have adopted the various environmental taxes and what previous literature provides on the taxes, their design and their effectiveness. This article makes a theoretical contribution to the body of literature on environmental taxes, which are progressively emerging as a key priority for governments globally on their fiscal agendas. The African Tax Administration Forum (ATAF) [5] alludes to the lack of a global consensus on the how environmental taxes are defined and posits “The fact that there is, as of yet no international consensus on the exact definition of the terms “carbon pricing” and “environmental tax” reflects the novelty of the topic”. Secondly, this article has a practical policy orientation; addressing environmental taxes in the African context sheds light on their possible design and effectiveness and the link with the fulfillment of the possible DD effect and 2030 Sustainable Development Goals (SDGs). ATAF [5] adduces that while other African countries such as South Africa and Nigeria have environmental tax policies in place (carbon taxes, petroleum taxes and taxes on plastics), others are still struggling to comprehend what they represent and the possible opportunities they might present as well as the likely implications.

This research presents an ideal opportunity to explore environmental taxes at a time when governments are looking for alternative and new sources of revenue to finance the economic recovery from the COVID-19 pandemic-induced economic downturn. Environmental taxes and environmentally related taxes are viewed as ideal sources for the revenue needed to revive economic growth [13]. The beckoning promise of green taxes achieving the dual objective, or the double dividend makes them a contemporary and important research item. In addition to the practical contributions highlighted, this article contributes to the theoretical body of knowledge. There is a dearth of literature in the African context with respect to environmental taxes. Freire-González [10], while reviewing studies on environmental taxes and the double dividend hypothesis, found only two studies for South Africa and no other studies for other African countries. On this basis, Wesseh and Lin [14] call for more research that studies green taxes in transitional economies. Kluza et al. [1] state that “there is a gap in the research on the relationship between climate policy and SDGs”. The researchers further argue that despite the SDGs being substantially discussed in research, few studies focus on the interdependence of SDGs and how they influence the attainment of the other. There is a paucity on studies that focus on environmental taxation, climate policy development and the achievement of the SDGs. This research sought to address these research voids by focusing on green taxes in the African political and economic contextual environments. The study contributes to both theoretical knowledge as well as policy and practice with respect to environmental taxes, sustainable environmental protection, and the fulfillment of the SDGs.

2. Literature Review

Globally and within domestic contexts, tax policymakers are paying significant attention to environmental or green issues. For example, the United Nations [15] states that “Climate change is an existential threat. Countries are facing dramatic impacts of global warming. Given the substantial costs associated with climate change, jurisdictions are increasingly adopting ambitious and sophisticated policy instruments to support climate mitigation, especially market-based policies such as carbon pricing” and environmental taxes. Different green tax measures have been constructed and implemented by various counties around the world. Green taxes are defined as taxes with an environmental orientation. In response, social actors such as companies are working on measures to minimize their contribution to environmentally unfriendly activities such as carbon emissions and pollution [16]. The social actors are continuously assessing the potential climate change risks, sharing information with various stakeholders such as employees, investors, customers, and regulators on how to reduce emissions and mitigating the greenhouse emission effects. Green taxes are employed to control the negative effect on the environment. These taxes normally come in the form of energy taxes, transport, pollution taxes and natural resources taxes. The pivotal objective is to discourage unfriendly ecological activities and actions by companies and citizens as well as to stimulate environmental sensitivity among individuals and corporate citizens. The green taxes have gained high priority in fiscal agendas. They are at high levels of implementation in some countries and in some countries at early adoption, while others are still struggling to put them in place [5]. Researchers table that green taxes lead to ecologically sustainable actions, provide an opportunity to address current and future environmental problems, enhance the efficiency of tax systems, generate revenue, and promote the equity of tax systems [8]. These possible outcomes remain contested.

2.1. Definition of Green Taxes

There is no consensus among researchers on the definition of green taxes. This points to the newness, unfamiliarity and controversy surrounding the concept. The understanding and definition of green taxes is linked to contexts. The term green taxes describe environmental taxes or taxes levied with the objective of protecting the natural environment. These can be referred to as taxes to control the negative effect of certain activities and products on the environment. The idea is to dissuade certain ecologically harmful activities and actions by citizens and companies, thus encouraging environmentally sensitive decisions and actions. Environmentally taxes are such that the cost of the negative externalities or unfavorable impact in the economy is incorporated in the prices to ensure production and consumption decisions that are ecologically friendly. These taxes include transport taxes, pollution taxes, carbon taxes energy taxes and natural resources taxes [17]. For example, energy taxes encompass those charged on products used in the transport sector and the generation of electricity such as natural gases and fossil fuels, among others. As part of policy initiatives, green taxes target the fulfillment of certain environmental goals, such as encouraging the adoption of cleaner and cost-effective energy sources, promoting sustainable industry and greener initiatives and behaviors as well as discouraging the use of certain energy sources. Green taxes can help foster support for sustainable growth and generate more tax revenue for the economy, thus giving relief to other tax heads such as income tax, employment tax, corporate tax and value-added tax. Incomes from other tax heads dwindled due to the reduced economic activity, company closures, and retrenchments as well lockdown restrictions during the COVID-19 pandemic; therefore, green taxes can boost revenue mobilization to fund government expenditure, reboot economies and achieve the SDGs.

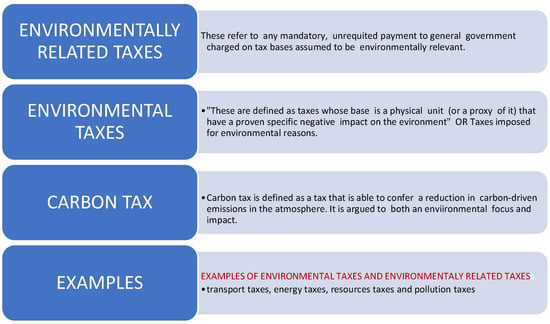

The green taxes are normally divided into two groups, environmental taxes and environmentally related taxes, although the distinction is blurred as other scholars group them under the one blanket of environmental taxes or just green taxes. ATAF [5] distinguishes between the two groups. Figure 1 illustrates the definitions of environmental taxes and environmentally related taxes.

Figure 1.

Environmental taxes and environmentally related taxes. Source: Own compilation based on ATAF [5] and OECD [18,19,20].

Principles Guiding Environmental Taxes

Environmental taxes are guided by four principles that are outcomes of various discussions of climate change issues as well as environmental protection. These principles are summarized in Table 1.

Table 1.

Principles relating to the implementation of environmental taxes.

2.2. Theoretical Framework Guiding the Review

According to Shahzad [21], “the role of environmental taxes is ambiguous and demands more in-depth investigation”. To understand the nature of environmental taxes in Africa as well as their influence on energy consumption, conservation, and efficiency as well as on environmental quality, deterioration, preservation and management, this study is built on theoretical underpinnings of the double dividend (DD) theory on environmental taxes. This research is guided by this theory that informs the motives for the implementation of environmental taxes and the envisaged outcomes of these taxes. These rationalizations and possible consequences hinge on behavior modification, improved manufacturing processes and increased tax collections (the revenues are anticipated to decrease in the long run as the expected behavior change benefits are reaped).

2.2.1. The Double Dividend Theory or Hypothesis

The attainment of the DD is a contested topic among researchers, and its growing importance in tax and environmental preservation debates has gained renewed focus due to green taxes and greater focus on climate change discussion. In explaining the role of green taxes, others refer to the internalization of the external costs or the costs of environmental damages [22,23] and use resources from the environmental taxes to reduce other taxes (migrating from highly economic distortive taxes to less distortive ones) [24] and the contribution of environmental protection using environmental taxes [5]. Goulder [25] breaks the DD into two forms: the strong and weak DD. The former is linked to the welfare improvements emerging from the implementation of environmental taxes and the use of the revenues generated from environmental taxes to minimize the distortionary effects of other taxes, irrespective of whether environmental conditions are improved. The latter presupposes that “recycling environmental tax revenues through lowering distortionary taxes leads to cost savings relative to the case where revenues are returned via lump-sum transfers” [10]. Baumol et al. [26] and Baumol and Oates [27] submit that environmental tax can set as: t = MD (tax = marginal cost of social damages due to pollution or other environmental damaging action). Lee and Misiolek [28] argue that cost of the damage or pollution must exceed the marginal cost of damages (MD); therefore, t = MD + RE (which represents the revenue effect). There is a general no consensus on the existence of the DD; some question the existence of the weak dividend in the face of multiple distortions, while some affirm its validity [29]. Bovenburg and Goulder [30] allude to the ability of green taxes to result in an employment dividend, which is a third dividend in addition to the normally discussed two: the environmental quality and the economic efficiency. Some economists such as Babiker, Metcalf and Reilly [31] only accept one dividend, the reduction in environment-damaging activities and behavior, and they reject the argument on the likely reduction in distortionary taxes and the possibility of an employment dividend.

Evaluative Discussion of the Double Dividend Theory

While the environmental dividend or advantages emanating from levying climate taxes or green taxes is acceptable to researchers, the economic development dividend from these taxes remains an issue of disagreement among researchers. It is a controversial and contested matter. Sustainable development in most countries is influenced by an array of factors. Problems surrounding sustainable development coalesce around facilitating stable economic, creating employment, regulating energy use and ensuring the use of cleaner and environmental friendly energy sources to ensure environmental sustainability [14]. While some researchers theoretically and empirically support the existence of a double dividend [10]), other researchers found no empirical support for the double dividend [32], and others have disputed the possibility of such a dividend existing [33]. Zhou et al. [34] states that the DD theory “on environmental tax is invalid”. Economists disagree on the existence of the DD. They point out that the capacity of environmental taxes to yield the DD is influenced by the design and implementation of the green taxes, the structure of the economy where they are implemented, the socio-political context of the country as well as consumer preferences in that country. Wesseh and Lin [14] argue that green taxes could effectively influence customers to reduce the consumption of polluting as well as stimulate investment in pollution-reducing measures by companies. This points to the attainment of the environmental dividend as environment quality is improved. The researchers argue that contrastingly, when environmental taxes increase, economic facets such household incomes, employment generation and economic growth are negatively affected. Therefore, the researchers refute the existence of the second dividend ‘the economic or non-environmental’ dividend. Two opposing effects emerge: substitution for cleaner sources of energy is stimulated on the one hand, while on the other hand, total household consumption levels and incomes are reduced [35]. This points to the affirmation of the first dividend, environmental dividend, and the refutation of the second dividend. De Mooiji [36] states that “whereas the second dividend may be in doubt, the first dividend (i.e., cleaner environment) remains a powerful reason for the introduction of pollution taxes”.

Driving sustainable growth, investment in health and education, and enhancing poverty reduction efforts to improve the welfare of citizens are governments’ major objectives. Therefore, to attain the DD, the levying of green taxes must improve economic efficiency (economic growth, incomes, and employment creation) and enhance environmental quality concomitantly. According to Glomm et al. [37], how the revenue mobilized from green taxes is recycled is the key question in addressing the fruition of the second dividend. The OECD [18] tables that where the revenue was used to reduce the social security contributions, GDP increases in response to the environmental tax reforms; however, the case was different where the green tax revenues were used to reduce individual incomes taxes. Piciu and Trică [38] portend that it is important to discuss green taxes in relation to the economic efficiency dividend with respect to the costs of environmental taxes, allocation of resources and how these green taxes uphold the vertical and horizontal equity principle in the distribution of income and wealth. Glomm et al. [37] assert that it is also vital to assess the magnitude of revenue contribution from these taxes and their efficiency in terms of administrative efficiency and economy (reduction or increase in administration costs, operating and tax compliance costs as well as costs of substitution). The fruition of the economic dividend is discussed in relation to the effect on incomes, economic growth, the tax burden and employment or impact on labor.

Existing Taxes and the DD Theory

Nerudova and Dobranschi [23] posit that the environmental economics that explains the interaction between newly introduced environmental taxes and already existing distortionary taxation framework is complicated; hence, it cannot be simply explained by the fact that introducing green taxes reduces the distortionary impact of current taxes. The researchers contend that the attainment of the DD, especially the economic efficiency one based on tax interaction and revenue recycling, is highly uncertain. “The idea of the introduction of costless green taxes that will not increase the burden of already existent distortionary taxes is very appealing”, but the practicality of it is a matter of debate [23]. The DD hypothesis supposes the tax revenue neutrality effect of environmental taxes, implying “the reduction in the revenue of existing taxes is commensurate with the increase in revenue from environmental taxes, thus a ‘tax swap’ or green tax reform” [8]. Goulder [39] questions the possibility of having revenue-neutral taxes and zero-cost taxes. Porteba and Rotemberg [40] allude to the regressivity associated environmental taxes especially carbon taxes in developing economies. Contrary to leading to the reduction in the tax burden emanating from pre-existing taxes, environmental taxes may further heighten the burden of existing tax systems. The justification of levying environmental taxes founded on the revenue recycling benefit is challenged, while others posit that with this argument, rationalizing the implementation of environmental taxes on the angle of environmental quality efficiency improvement and gains may be less fundamental, yet it must be the core of the environmental tax policy. To fully understand the controversy surrounding the attainment of the economic dividend, it important to consider the use of tax revenues and the nature of distortionary taxes as they influence the size of the environmental taxation costs. Goulder [25] states that environmental taxes reduce the non-environmental welfare as well as the spending power of consumers on other goods, thus culminating in distortions in labor and commodity markets and erosion of the tax base for other tax heads.

Employment or Labor and the DD Theory

Jaeger [8] adduces that the relationship between green taxes and the current taxes is intricate and research on the interactions between these taxes has remained, controversial, opaque, and contested for a long period of time. The impact of environmental taxes on the attainment of the DD with respected to labor is mixed. Bovenberg [41] dispute the materialization of the economic efficiency dividend. According to Wesser and Lin [14], the effect of environmental taxes on the demand of labor supports the attainment of the DD on employment. The researchers further state that a closer assessment of the impact of environmental taxes on the supply of labor concludes that environmental taxes negatively affect employment, thus negating the DD effect on employment. Environmental taxes fail to finance the labor reduction driven by reduced economic activity that is linked to polluting activities such as manufacturing or environmental unfriendly activities such as mining. Bayindir, Upmann and Raith [42] submit that in circumstances where labor markets are distorted, replacing labor taxes with green taxes would enhance employment creation and output and eventually lead to unfavorable effects on the environment. Jaeger [8] argues that green taxes might affect labor, productivity, income, and tax revenue mobilization. The researcher submits that if environment degradation unfavorably influences productivity, green taxes might be justifiable as a corrective tool, but they can negatively affect the tax base by resulting in a reduction in the level of taxable income. An illustration being where pollution due to manufacturing leads to health changes for the workforce, labor supply might be negatively affected due to mortality and morbidity. Pollution tax in this case might curb polluting activities and increase the labor force and enlarge the employment tax base. Reduced health challenges might also lead to minimized spending on health care.

The Tax Burden and the DD Theory

The DD is also a contested topic based on the impact of environmental taxes on the tax burden, especially on the possible regressivity and progressiveness of the taxes as well on inequality [43]. Poterba and Rotemberg [40] portend that if the proportion of household income spent by low income-earning families on fuel is higher that used by high income-earning or wealthy families, then environmental taxes are deemed to be regressive, hence leading to the disputation of the DD with respect to the tax burden. Chan [44], while focusing on environmental tax sustainability, contends that irrespective of the dimensions the impact of environmental taxes on distribution is viewed from (whether vertical welfare distribution or horizontal income distribution), environmental taxes tend to benefit the richer more than the poor, thus aggravating income inequality. Some researchers argue that when it comes to the impact of environmental taxes on income or wealth distribution, the DD effect does not exist [45,46]. The researchers point out that environmental taxes undoubtedly result in an unfair distribution of income and wealth among citizens.

2.3. Green/Environmental Taxation in African Countries

The implementation of green taxes has been pinpointed as a possible option to mobilizing domestic revenue to revive the economy post COVID-19 pandemic. The COVID-19 pandemic put significant pressure on government resource globally, stretching them to the maxim and beyond; hence, identifying new sources of revenue is important to boost the economic recovery from the COVID-19-induced economic problems and other general problems. African countries were heavily affected, as they are highly dependent on taxes and natural resources for funding public expenditure. Despite the high dependence on tax revenues, domestic revenue mobilization is weak in the African continent due to the presence of a huge informal sector that is contributing insignificantly to the tax basket [47,48]. Tax bases are narrow, and tax avoidance and evasion by multinational operating in the continent is high [49]. Compounding the challenges of weak domestic revenue mobilization is the fact that legal and institutional frameworks are weak, tax compliance is very low and that tax morale is low also due to lack of transparency and accountability [50,51]. Green taxes have therefore become more important than ever as a source of more revenue. Many African countries are moving toward ‘greening their budgets’ by shifting taxes from labor and capital to the environment and natural resources. Ideally, for environmental taxes to be effective, the tax charged must be commensurate with the environmental damage caused. For example, in relation to carbon taxes or pollution taxes, tax must be levied based on per unit tax on emissions such that the tax forces companies to internalize the negative externality by investing in more research and development on and implementation of environmentally friendly technology and production processes. Companies are compelled to adopt green technologies, and this has an influence on production and pricing decisions as well as competition [52]. As the tax cost declines through better consumption and production, environmental protection and sustainability are enhanced, thus killing two birds with one stone.

2.4. Types of Green/Environmental Taxes Levied by African Counties/Strategies of Levying Green Taxes

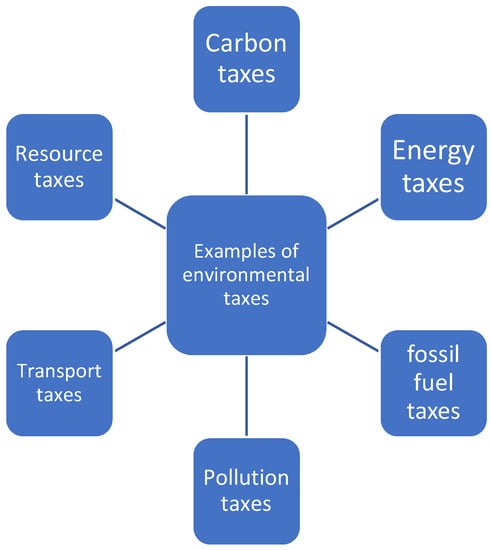

In African countries such as Nigeria, South Africa and Egypt are among the largest users of energy. Algeria, South Africa, Nigeria, Egypt, Morocco, and Libya are identified as the biggest contributors to African emissions from fossil fuel. Even though emissions are low in Africa, they are steadily growing over time, hence the need to try to ensure that the future consumption of fossil fuels takes place within the context of minimized carbon emissions and environmentally friendly development trajectories [53,54]. Measures to promote cleaner energy usage, reduce adverse outcomes and promote more favorable economic and social development activities such as environmental taxes are encouraged [55]. Policies such as green taxes must be implemented but accompanied by detailed assessments and understanding of consumer behaviors, consumption patterns and the availability of alternatives. A detailed assessment is key, because for some countries that are dependent on these fuels, they constitute key sources of revenue, contributing 50–80% of government revenues. These countries include Libya, Angola, and Nigeria [56]. Therefore, the question is: if green taxes discourage use, what is the envisaged impact on revenue reduction due to usage and revenue increase from the taxes? Countries need to analyze this trade-off. In cases where demand for the taxing product is inelastic, consumers fail to respond to the price change due to the tax cost. Increasing taxes leads to reduced economic welfare for some parts of the population—mostly the low-income earners. In designing effective green taxes based on comprehensive evaluations, African countries face challenges of high capital needs, lack of finance and expertise, policy constraints, monitoring and enforcement challenges, information gaps as well as social and cultural challenges. While “Ideally, for tax to be environmentally friendly, the proposed tax rate should equal the social marginal damages from producing an additional unit of emissions or more or less equivalently, the social marginal benefit of abating a unit of emissions” [5]. In Africa, while some countries levy carbon taxes, how these are estimated or designed is fraught with challenges and does not reflect the cost of emissions or the impact to society. An array of environmental taxes is available to the tax authorities in Africa. Examples of these taxes are shown in Figure 2.

Figure 2.

Types of Green Taxes. Source: Own compilation.

While the focus of environmental taxes in Africa is on transport (usage of vehicles), fossil fuels, manufacturing and natural resource extraction-driven pollution, energy usage and carbon emissions, other countries have begun to pay attention to the implication of environmental management, pollution and energy usage associated with cryptocurrency mining [57,58]. Pollution driven by cryptocurrency mining could be significant due to the high consumption of electricity. The adoption of these currencies could pose challenges in Africa, and African countries could consider the implications for energy usage and environmental sustainability of cryptocurrency mining.

2.5. Motives for Levying Green Taxes/Environmental Taxes in African Countries

ATAF [5] submits that African countries have three main objectives in introducing green taxes. These are to (i) mobilize revenue to fund the fiscal budget, (ii) assist in transition toward sustainable economic growth and affordable clean energy, and (iii) fulfill fundamental environmental gains with the potential for economic as well as social advantages. While discussing the desirability, utility, and likelihood of achieving sustainable development in Africa through carbon taxes, Ezenagu [54,59] argues that Africa is a country that is highly dependent on natural resources, and their extraction leads to environmental degradation (mining) and pollution (oils and gases); thus, green taxes are desirable to ensure revenue generation and environmental sustainability. The objectives of green taxes vary from country to country, and their nature and structure are largely influenced by the type of resources exploited and energy sources used in each country. Heine and Black [60] refer to benefits of environmental taxes going beyond the mitigation of the climate effects to include the fiscal benefits. While countries such as Nigeria and Angola are highly dependent on oil and gas, others such as Zimbabwe, Botswana and Namibia are dependent on minerals. Generally, Africa is dependent on a polluting source of energy due to the lack of resources, adequate technology, and poor infrastructure. Polluting activities and those that lead to degradation generally come in the form of cement and chemical manufacturing, industrial and domestic waste disposal, urban developments, gas and oil exploitation and exploration, mining, general manufacturing processes, motor vehicle usage, deforestation and over grazing. George and Steven [61] add sand extraction as another activity that leads to environmental degradation in Zimbabwe. Illegal gold panning is one other activity that is environmentally damaging. Some of the motives for introducing environmental taxes in Africa are presented in the few selected studies on environmental taxation in different African countries (Table 2).

Table 2.

Summary of selected studies on environmental taxes in Africa.

From the studies above and other literature, two main objectives of green taxes are evident. These are:

- (1)

- Environmentally protection and sustainability

As an ecological fiscal reform, green taxes can help minimize environmentally damaging behavior. To fulfill this objective, the green taxes must be high enough and prohibitive enough; otherwise, low taxes or awarding of various exemptions and deductions will render the tax system ineffective and fail to achieve this fundamental objective. A good example of environmentally related taxes that have been considered ineffective because of being too low and not felt by consumers is the levy on plastic bags.

- (2)

- Revenue mobilization

Green taxes are argued to be seen in most countries more as a revenue mobilization tool and less as a measure toward ensuring a reduction in environmental harmful actions. Where the fundamental objective is revenue collection, high tax rates that are prohibitive and stimulate behavior modification can reduce revenue mobilization. Therefore, depending on which goal the country considers to be the primary objective, there is a need to structure and continuously review the green tax policy in line with the fundamental objective.

2.6. Challenges of Levying Green Taxes in Africa

Figure 3 foregrounds the discussion on the problems faced in levying green taxes in African countries. Belletti [55] argues that the implementation and effectiveness of environmental taxes in African countries is unfavorably affected by the lack of adequate infrastructure and administration capacity, weak institutions, and public perceptions on political institutions. The researcher further alludes to factors such as regressivity possibilities due to high inequality and poverty, possibilities of negative effects on economic development and the likelihood of investment flight, tensions with respect to environmental policy and economic development, low administration capacity and lack of resources as well as the high dependence on fossil fuels.

Figure 3.

Challenges of levying green taxes. Source: Own compilation.

Garba [68] states that people generally lack trust in government and hence the resistance to tax policy including environmental tax policy. Sebele-Mpofu [47,48] alludes to resistance to policy due to poor governance quality and low tax morale in Zimbabwe. Garba [68] tables that resistance to environmental taxes can be minimized by creating trust between a government and its citizens as well as by repairing the fracture implicit social contact through transparent and accountable spending [48,50,51]. The need for transparency and accountability is key, as lack of trust in government spending and corruption both lower tax morale. Awareness campaigns and the actual usage of environmental tax revenue for supporting environmental initiatives such decarbonization and other green energy initiatives would improve the acceptance of green tax policy.

While focusing on Namibia, Amesho [70] states that financing renewable energy is one of the fundamental challenges to achieving SDG7 on access to reliable, affordable, and sustainable clean and modern energy. This therefore leaves citizens with no other alternative fuel sources, thus impeding the promotion of sustainable environmental management and protection efforts. Instead of environmental taxes lowering polluting energy usage, they burden the poor and low-income earners in African countries who cannot afford other energy sources.

2.7. Green Taxes, Environmental Sustainability and Protection, Revenue Mobilization and Sustainable Development

In the 2030 Agenda for Sustainable Development held in Addis Ababa Ethiopia, countries shared a vision on peace and prosperity for the people and planet currently and in the future. According to ATAF [5], the countries agreed that they are:

“Determined to protect the planet from degradation, including through sustainable consumption and production, sustainably managing its natural resources and take urgent action on climate change, so that it can support the needs of the present and future generations”.

The 2030 Agenda for Sustainable Development centered on people, the planet and prosperity. The agenda is built on 17 SDGs and I69 targets to expand on the achievement of the Millennium Development Goals (MDGs). At the core of the agenda are the 17 SDGs, which call on both developing and developed countries to urgently work together in global partnership. The partnership should focus on the eradication of poverty and other deprivations while ensuring that the initiatives are inclusive of strategies toward the improvement of health and education, reduction in inequality and driving economic growth while addressing climate change and preserving oceans and forests. Ezenagu [54,59] points out that green taxes, especially carbon taxes, can be used as an economic measure to stimulate sustainable development in developing countries.

The challenge facing countries in relation to 2030 SDGs is how to develop and foster sustainable development efforts that balance the need to improve the well-being of the environment and at the same time reap social and economic advantages. How to bring an equilibrium between minimizing environmental risks and advancing the resilience of society and that of the environment is problematic. How to ensure that the environmental perspective of sustainable development promotes socio-economic development is a pressing matter. The 17 SDGs are indivisible and integrated; therefore, there is a need to strike an equilibrium between the three facets of sustainable development. These are social, economic, and environmental dimensions.

Table 3 presents a brief overview of the 17 SDGs.

Table 3.

Summary of the 17 UN 2030 SDGs.

Liyanage, Netswera and Motsumi [72] argue that seven of the 17 SDGs (SDG 1, 2, 3, 4, 5, 7, 11 and 16) are centered on society, while four of the 17 SDGs focus on promoting sustainability and preservation of the ‘biosphere’(SDG 6, 13, 14 and 15), whereas four of the remaining five SDGs anchor on the economy (SDGs 8, 9, 10 and 12), and SDG 17 is the thread that connects all the SDGs.

The environment perspective is a critical dimension of sustainable development that directly encompasses 10 of the 17 SDGs and indirectly touches on the other remaining 7, with SDG13 specifically focusing on dealing with climate change. The 10 SDGs directly related to environmental sustainability and protection include SDG11, making cities and human settlements, safe inclusive, resilient, and sustainable, SDG 12, ensuring sustainable consumption and production trends and SDG 8 (8.4), which speaks to the provision of decent work. This paragraph speaks to increasing global resource efficiency in consumption and production and to endeavor to decouple economic growth from environmental degradation. In addition, the other remaining ones include SDG 13, that calls for countries to urgently address climate change, combat climate changes and their impacts, SDG 14, calling for the conservation and sustainable usage of the seas, marines and ocean resources for sustainable development and SDG 15, which focuses on protection, restoration and the promotion of sustainable usage of terrestrial ecosystems and sustainable management of forests, combating diversification and to reverse land degradation and stop the loss of biodiversity. Furthermore, the last four of the 10 encompass SDG 7 on the use of clean energy, SDG 6 on clean water and sanitation, SDG 3 on good health and SDG 9, focusing on innovation and infrastructure development.

The other seven SDGs that are indirectly related to environmental management and the use of benefits derived from the environment include SDG1, eradication of poverty, SDG2, reducing hunger, SDG 10, reduced inequalities, SDG 5 on promoting gender equality, SDG 16 focusing on peace, justice and strong institutions, SDG 4, quality education and SDG 17 calling for partnerships. The SDGs are interdependent and interlinked. This is evident in cases such as SDG7 in relation to most developing countries’ access to energy will point to energy sources such as coal, fossil fuels, hydroelectricity and wood, and these energy sources have implications on SDGs 3, 13, 14 and 15. There is a possibility of heightening climate change, acidifying oceans, polluting the environment, and leading to deforestation and environmental degradation [73,74,75]. Le Blanc [76], while focusing on SDG 12 (production and consumption that is sustainable) and SDG 10 (on reduced inequality) argues that the SDGs are interconnected. The researcher tables that SDG 12 is connected to 14 other SDGs (for example, SDG 10, SDG 6 that calls for clean water and sanitation provision as well as SDG 2 on eradication of hunger, SDG 1 on poverty alleviation, and SDG 3 on good health). According to Kluza et al. [1] the natural environment is a part of all SDGs, and the environmental indicators are literally present in all SDGs, perhaps except for SDG 10, which is horizontally linked to social, economic, and environmental factors. The achievement of environmentally objectives is viewed as a positive externality driving the attainment of economic, developmental, and social policies. Kluza et al. [1] allude to a positive influence of environmental innovation strategy and firm performance as well as a positive effect of the increase in research and development on carbon dioxide emission reductions on business performance. When looking at this interconnectedness, environmental management and preservation is key, together with revenue generation to fund the budgets to address the SDGs. To achieve good health, the air, the soils and the water need to be clean, consumption and production processes need to promote a clean and sustainable environment, resource utilization needs to be sustainable and revenue mobilization efforts need to be effective. It is also fundamental to note that the interdependence between the SDGs can also result in negative correlations in the attainment of the SDGs (tradeoffs as opposed to synergies). Pradhan et al., 2017 demonstrate a negative correlation with respect to SDG 7, 8, 9 and 15.

Considering the discussion on SDGs, there is a need for countries to have adequate revenues to deliver on the SDGs. The 2030 Sustainable Development Agenda emphasizes that countries need resources need to mobilize resources to facilitate the development and meet the SDGs. The COVID-19 pandemic-driven recessionary environment has heightened the need for countries to mobilize more resources while ensuring sustainable economic growth consistent with climate responsibilities that countries have taken up, considering the capacities and limitations (resource constraints). Fiscal approaches have thus become instrumental, especially green taxes to enable governments to tap into new sources of domestic revenue and drive consumption that is environmentally friendly to achieve overall envisaged environmental gains. In affirmation, Piciu and Trică [38] adduce “Fiscal tools should reflect the current needs of the world including environmental issues”. The researchers further show a link between environmental taxes and the objective of domestic revenue mobilization to achieve the SDGs and overall sustainable economic development. They posit that “Environmental taxes are an important field of future fiscality for countries of the world having the main objective of environmental protection as well as stimulating a healthy economy, simultaneously rising budget for the country funds and economic involvement” [38]. This is affirmed by Ziolo et al. [77], who portend that to achieve the SDGs, financing is crucial and suggestions of financing for SDGs recommend increasing tax revenues, overhauling the global tax legislation, improving the effectiveness and allocation of financial resources as well as the introduction of environmental taxes.

2.7.1. Sustainability, Environmental Sustainability and Protection

In relation to sustainability, Kluza et al. [1] refer to it as the risk of non-financial issues such as social, environmental and governance risks. The environmental risk is becoming pivotal in discussions of climate change and environmental management. According to Dovgal et al. [78], “the concept of environmental protection emerged as a result of the recognition in many world countries that need to take into account environmental factors due to the deep destabilization of the environment, the enormous load increase in ecosystems, the qualitative changes in the relationship between nature and society as a result of gigantic development of productive forces and the growth of the population”.

2.7.2. Sustainable Development

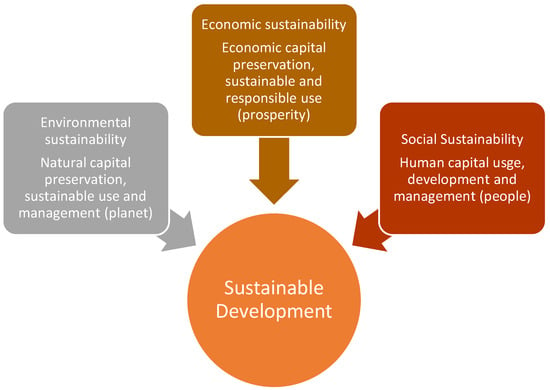

Sustainable development is a crucial part of the contemporary global agenda [79,80,81]. The 17 SDGs formulated by the UN in 2015 aim to address social, economic, and environmental matters that affect the world and to champion the concept of sustainability. The SDGs are interlinked. While for example, SDG 8 on promoting decent work and economic growth, SDG 12 that advocates for responsible consumption and production as well as SDG 9 anchoring on innovation, industry and infrastructure have an economic focus, SDG 4 on education and SDG 11 on building sustainable cities and communities have a social orientation. On the other hand, SDG 13 on climate change and SDG 7 on clean energy have an environmental inclination [81]. Therefore, to fully articulate sustainable development even in relation to green taxes, it is fundamental to do so taking into cognizance the various SDGs and their inextricable connection.

Dogval et al. [78] state that: “Sustainable development is crucial for determining the strategic priorities for the development of global economic systems, which necessitate implementing complex institutional changes that should contribute to ensuring economic growth in the context of limited natural resources and the need to solve global environmental problems”.

Citing the World Commission on Environment and Development [82], Halkos and Gkampoura [79] define sustainable development as “the development that meets the needs of the present generation without compromising the ability of future generation to meet their own needs”. Sustainable development anchors on ensuring environmental protection while facilitating economic development and social welfare improvement to both the current and future generations. Sustainable is therefore pivoted on three pillars that must be considered in decision making to achieve social, economic and environment development that is both inclusive, sustainable, and responsible [83,84]. The three cornerstones of sustainable development are presented in Figure 4.

Figure 4.

Three Pillars of Sustainable Development. Source: Compiled from UN (71) and Halkos and Gkampoura [79].

The issue of sustainability has been at the center of discussions globally and has gained extensive focus from governments, policy makers, academics, economic and environmental experts. Sustainable development is not only an economic issue as well. The idea is to address economic, social, and environmental challenges to achieve sustainable development and fulfill the SDGs [71,73].

3. Materials and Methods

The paper was a critical literature review. A critical review of literature allows for an in-depth assessment of literature with an evaluative orientation [85,86]. A qualitative approach was adopted to comprehensively review literature to find out the possible research and policy gaps in relation to green taxes, environmental protection, and the fruition of the SDGs. According to De Vos and El-Geneidy [87], reviews are vital sources of information as they make contributions in three areas: theoretical or conceptual models, future research needs and policy implications. The contributions are summarized as (1) accentuating new possible research gaps and avenues for further or future research, (2) identifying new connections in the body of knowledge that could lead to the construction of theoretical or conceptual models, and (3) generating policy recommendations and providing guidance for policy and practice [87]. This study sought to make a contribution in relation to the first and third aspects of reviews highlighted. The initial articles of the reviewed literature were gathered from the Scopus and Google Scholar databases. The Scopus database was chosen for its prestigiousness in academic literature, while the Google Scholar database was preferred for its extensiveness and robustness as suggested by researchers on reviews [88,89,90,91]. The literature was searched using search terms such as “Environmental taxes in Africa”, “Green taxes in Africa”, “Green taxes and environmental protection and sustainability in Africa”, “Environmental taxes and the double dividend” and “Environmental taxes and the double dividend in Africa”. The other search terms also included “Green taxes and the Sustainable development goals in Africa” as well as “Environmental taxes and the Sustainable development goals in Africa”. The studies generated from the initial search were screened for relevance through the assessment of the abstract, introduction and keywords. From the 150 studies accessed, 60 studies were found relevant. These studies were further complemented through backward and forward snowballing. From the leading scholars identified in the review, the researchers conducted a backward search of their work to identify their preliminary works. Forward snowballing entailed following the works of these leading scholars to search for their recent works in the area. This identified 10 additional relevant papers. Backward and forward snowballing ensured a better understanding and analysis especially in cases where quotations were used for emphasis in previous studies, and these were found to be relevant [89,90]. These were then traced back to the original work cited through snowballing. The literature was further enhanced by information studies from development organizations such as the World Bank, the ATAF, OECD, and UN policy briefs. The literature was reviewed until the saturation point was attained, and this was where no new information was found from further reviewing of the literature, as advised by Sebele-Mpofu [92]. Further literature was revealing discussions and issues that the researcher had already come across in previous studies. The sources of information include journal articles, theses and conference papers and policy briefs. In total, this study reviewed 80 relevant papers, with the other 19 papers included in the review constituted papers relating to the theoretical framework, and lastly, some studies in developed countries that were reviewed to give a developed country context and areas that African countries might need to consider and draw lessons from. Therefore, a total of 99 papers were included in the study and referenced. Wee and Banister (90) encourage researchers to include between 30 and 100 articles relevant articles to ensure a comprehensive review. The literature was discussed in accordance with the themes that originated during the review process. Direct quotes were used throughout the review where necessary for clarification, evidence enhancement, elaboration and thought provocation.

4. Discussion of Findings

4.1. Green Taxes in Africa Countries

Carbon taxes and fuels taxes were the most prevalent taxes levied in African countries such as Zimbabwe, South Africa, and Nigeria. Environmentally related taxes such as plastic levy and fuel taxes were also being charged in countries such as Botswana, Zimbabwe, and South Africa. Environmental taxes were found in the literature to be less effective in Africa at curbing environmental damage, as the population was highly dependent on fossil fuels. Even where subsidies were reduced, the reliance on fuel was high due to lack of alternatives or their unaffordability. This was further compounded by the high inequality rates, poverty, and lack of employment in the continent

4.2. Motives for Levying Green Taxes in Africa

Two key motives for introducing green taxes were evident from the literature: the revenue mobilization motive and to minimize environment-damaging activities. The other ancillary objectives were to stimulate economic growth and reduce market failures.

4.3. Environmental Sustainability and Protection, Revenue Generation and Sustainable Development Implications of Levying of Green Taxes

The SDGs focus on the environment, the economy and society as embedded pillars and not competing components [73,93]. Mhlanga [94,95] states that the SDGs are interdependent and indivisible. The findings on implications of levying green taxes are discussed with the interconnectedness of SDGs and the facets of sustainable development in mind. Green taxation has wider implications for policy considerations, besides the obvious fiscal focus. It touches on other economic measures and instruments such as pricing decisions, awarding of grants and subsidies, enactment of environmental laws and making investment decisions as well as infrastructural developments. In addition, issues of social fairness need to be considered, such that the biggest consumers or users pay more and the vulnerable are supported through investment in public infrastructure and amenities such as transport, health, and education. Funds mobilized through environmental taxes could be used to ensure the sustainability of the economy, build better resilience and preparedness in dealing with challenges of environmental degradation, climate change and other unanticipated natural disasters and pandemics such as the COVID-19 pandemic.

Low-income households suffer the most from the impacts of climate changes and environmentally unfriendly activities such as pollution, gas emissions and other adverse externalities. Therefore, addressing these negative externalities through environmental taxes and other market-based measures must take into cognizance the needs of society and the economy, improve social fairness and at the same time protect the environment. It is also important to pay attention to the revenue mobilization objective, especially how the eradication of fossil fuel subsidies could complement this objective. The outcome must be such that those who use more, waste more or pollute more pay more accordingly, although this is not always the case. Green taxes have both positive and negative implications. These are also influenced by the effectiveness of the tax collection system, its efficiency, transparency, and accountability in relation to green taxes. Different researchers pointed out an array of possible ramifications of levying green taxes. These include consequences on economic growth, revenues, income and distribution, social development, consumption and production patterns, income inequality, energy use, GDP, poverty reduction and fuel usage as well as on the double dividend expectations and the SDGs [21]. The findings of the review and the implications are presented in Figure 5 and followed by a brief discussion of each implication.

Figure 5.

Implications of levying green taxes. Source: Own compilation.

4.3.1. Revenue Generation

Jaeger [8] pointed to the revenue generation potential of green taxes. Green taxes could result in increased revenue mobilization as funds are moved from polluting companies and those undertaking environmentally damaging activities to government coffers. This additional group of taxpayers could broaden the tax base for African countries where taxes bases are narrow, owing to a huge informal sector and the expanding digital taxes. Environmental taxes on those unavoidable commodities such as fuel will ensure those in the informal sector also contribute to the tax basket. Revenues mobilized from green taxes could lead to a reduction in other taxes that cause economic distortions such as employment tax, income tax and VAT. Green taxes could result in the ‘double dividend hypothesis’ effect. The taxes could have a double-barreled effect on the economy. Simply explained, on one hand, the levying of taxes on the negatives as opposed to on the positives ensures that citizens’ actions lead to a healthy, sustainable, and protected environment. On the other hand, the levying of green taxes could ameliorate the efficiency of the tax system, as the distortion of economic activity is minimized and consequently, taxes are reduced elsewhere in some activities in the economy. Braathen and Greene [2] posit that revenues mobilized from environmental taxes must help with respect to fiscal consolidation and the reduction in other taxes. This perspective is disputed by other researchers who argue that environmental taxes are equally distortive just like other taxes and have costs associated with them and distributional inefficiencies. Braathen and Greene [2], while acknowledging the possible distributional unfairness, argue that distributional problems must be dealt with using other policy measures. From the review, it was evident that while the opportunities to increase revenue mobilization are available, there are also possibilities of stifling revenue generation. The outcome (expansion or contraction of the tax base) depends on factors such as individual preferences, availability of substitutes as well as their affordability. If the tax base is expanded and more revenue is available for government disposal, a government can achieve several SDGs such as SDG 1 on poverty reduction, SDG 2 on hunger, SDG 3 on health, SDG 4 on education, SDG 6, 7, 8, and 10 among others. Adequate financing is key to funding the achievement of the SDGs. If the opposite effect occurs and the tax base is narrowed, funding for SDGs declines, leading to the failure to achieve them. The objectives of revenue mobilization and environmental protection are often conflicting as the environmental tax revenue declines; environmental protection, sustainability, and effective management is achieved as consumers move away from environmentally damaging activities. This could lead to the poor performance of economic SDGs and social SDGs but the attainment of climate-oriented SDGs such as 6, 7, 12, 13, 14, and 15.

Lastly, the tax revenue collection objective of environmental taxes if not balanced with the environmental protection and sustainability motive might lead to green taxes that are unjustifiably greater than the projected value of the negative social impact [2,8]. This might drive the prices of certain goods beyond the cost justifiable to address the externalities, and this might result in the distortionary effect of the tax system, burden low-income earners and reduce tax morale.

4.3.2. Incentive Effect of Green Taxes

Environmental taxes could lead to an increase in environmentally friendly activities. Revenue generated could be used to finance other environmentally friendly alternatives perhaps through incentives such as grants and subsidies or through other tax incentives. Green taxes ensure that companies work toward avenues for the internalization of costs, using economic instruments, paying attention to public interest, without resulting in environmentally damaging activities. Simultaneously, the cost to society is reduced. According to Jaeger [8], green taxes could be employed to fund environmental cleanup or for the research and development of clean technologies fund reductions in pre-existing taxes. As companies find ways of innovating and reducing the environmental tax rates paid, they can increase innovation and the adoption of 4IR technologies and better ways of production, which would not only improve economic development and productivity and the achievement of socio-economic SDGs but also result in the fulfillment of environmental SDGs such as climate change management (SDG 13), clean water and sanitation and the use of clean energies (SDGs 6 and 7), leading to preservation of life on the land and in water (SDGs 14 and 15). This could indirectly improve health and reduce pollution-related diseases (SDG 3). In addition, African countries could learn from their developed counterparts such as Spain, Turkey and other European Union countries and put in place measures to incentivize pollution-limiting behavior [96,97]. For example, Spain offers incentives to encourage the use of ‘eco-friendly cars. The incentives were positive and resulted in tax savings, but researchers emphasize that the incentives must be supported by other measures to stimulate behavior change and the usage of eco-friendly cars [97]. This could encourage reduction in pollution driven using gasoline or diesel-powered vehicles as users go for the electricity-powered ones. In Turkey and the EU countries, Burak [96] alludes to the use of carbon-based taxation in conjunction with fiscal and financial incentives for the purchase and use of electric vehicles. The incentives encouraged the switch by consumers to electric-powered vehicles. Such incentives could encourage the substitution of fuel-powered vehicles in Africa. It is important to note that powered generation is in general problematic in Africa, and resource constraints make policy initiatives different for developed countries and African countries

4.3.3. Correction of Market Failures or Externalities

Green taxation can help correct market failures by setting a price for the environmentally harmful activities. Normally, the costs associated with such activities are not incorporated in the market prices of goods or services. In fact, the goods and services will be underpriced, as the total costs of the goods and ultimately the overall price is not inclusive of the cost of the negative externalities (excludes the pecuniary and non-pecuniary costs). Therefore, this is market failure and taxes such as pollution taxes, carbon taxes, fossil fuels and resource taxes make sure the price of products takes into consideration that the unintended negative effects are paid for by those who cause them. Therefore, market failures are internalized into the pricing decisions of companies to ensure these externalities form part of the consideration for pricing, production, and investment in technology decisions [2,98]. These green taxes could stimulate positive actions such as reduced pollution. The stability in pricing for emissions and other negative externalities allows for long-term plans and choices in relation to investments, research, and development expenditure and in technological innovations, as there is a need to acquire environmentally friendly technologies to reduce the negative effects such as carbon dioxide emissions. Smulders [7] asserts, “Domestic environment taxes and other instruments should ensure that private costs and benefits of domestic activity reflect the social costs of pollution and benefits of environmental quality improvements”. Green taxes thus reduce market distortions that promote activities that directly or indirectly cost society. The taxes can alter economic decisions positively, yielding both the incentive effect and economic efficiency. The reduction in inefficiencies in pre-existing tax systems depends on the structure of environmentally taxes. Jaeger [8] argues that if not properly designed, green taxes would result in a new form of tax system inefficiency. The researcher states that in cases where the taxes are uniform for polluting goods manufactured applying fixed factors and polluting goods produced using variable factors, this would cause inefficiencies. The one regarding fixed factors must be charged higher taxes: both direct and indirect taxes. This could allow the higher tax rates on the fixed factors to reduce the tax rates for other taxes. The consolidation of the tax base has an influence on the attainment of SDGs as the availability of finances is a fundamental driver of sustainable development.

4.3.4. Achievement of Environmental Objectives

Theoretically, the green taxes consequently lead to the achievement of environmental objectives at a reduced cost as opposed to the more costly policy initiatives such as regulation. Regulation would require activities such as enforcement, monitoring, and control. The polluter pays principle leads to the abatement of pollution-associated costs; consumers would consume less of the taxed goods and services. The incentive effect of green taxes in inducing the switch to environmentally friendly activities is dependent on the unique make for the product being taxed. Some products can be difficult to reduce. For example, regarding energy for domestic use, some consumers might not have a cheaper option to switch to. Information asymmetry and lack of finance can make it problematic to move to more energy-efficient alternatives. Another example is carbon taxes levied on fuel and use of cars; if there are no competitive, safe, and reliable options such as public transport, raising environmental taxes cannot lead to a reduced use of cars. It is also possible that despite not influencing moving to cheaper and cleaner alternatives, green taxes can stimulate an exchange of environmental change and possible solutions among citizens, companies, and countries. Innovation, information, and knowledge sharing as well as cooperation are crucial for the fulfillment of economic, social, and environmental-oriented SDGs to ensure sustainable development that encompasses the three facets discussed in literature review.

4.3.5. Ease of Administration

Green taxes are easy to administer and collect, as the tax collection is performed at the source from fewer taxpayers. This indirectly reduces tax evasion and fosters compliance, thus improving revenue collection. Improved revenue mobilization is pivotal in facilitating sustainable development and funding research and development for sustainable environmental protection and management.

4.3.6. Addressing the Impact of Environmental Damage or Climate Change

Environmental taxes provide a platform for collective action toward the protection of the environment and in this case driven by government. Generally, without government involvement, there is nothing to encourage households and firms to pay attention to their actions and their activities, taking into cognizance their damaging impact on the environment and the costs to the economy. By making those responsible for the damage pay for redressing it to some extent, green taxes ensure that resources for are pooled together to address current and future environmental challenges arising from negative externalities. By bringing externalities into the final price, green taxes ensure that the costs for healthcare, repairing of buildings and restoring the environment must be covered by society and the government through taxes. Environmental taxes provide a chance to move away from the “command-and-control regulations” such as instituting bans on the use of certain of certain products or prescribing certain technologies for certain industries [2]. Governments are more progressively moving toward market-based instruments that indirectly incentivize firms and households to change their behavior toward the environment. It is important to note that while governments could use environmental taxes to modify the environmental behavior of individually and businesses, corporations can (instead of changing their behavior) opt to move to other tax jurisdictions without environmental taxes.

4.3.7. Encouraging Innovation

Previously, the regulatory methods meant that a government would subsidize or incentivize certain goods and behavior, thus steering the economy toward the government’s envisaged directions and prescribing solutions to addressing environmental challenges. This was involving and demanding for governments, as they needed to keep abreast with the ever-evolving environmental and economic conditions, including technological advancements. Regulations are thus prescriptive, expensive and have high risks of recommending suboptimal choices, even where affordable alternatives can be employed. The use of environmental taxes offers consumers and businesses the versatility to determine the cheapest way to minimize environmental damage, thus allowing for adaptability. This ensures market forces to drive the environment damage mitigation initiatives. For example, taxes on fuel stimulate businesses and individuals’ behavior modification in ways such as reducing driving through unnecessarily using transport, walking, or parking and moving around for shopping or other errands in town, moving smaller and fuel-saving vehicles. Flexibility reduces regulatory, monitoring and enforcement costs [2]. Environmental taxes such as those on fossil fuels and natural resources such as water can encourage innovation, new technologies, improved processes, and products, thus steering economies toward an eco-efficient exploitation of resources and energy use, and consequently promoting sustainable development. This can help in the implementation of precautionary pricing that calls for the minimization of exposure to harmful substances before there is evidence for their harmful impact. Current changes in the production processes and consumption trends induced by green taxation could indirectly lead to unforeseen or future impacts on the environment and humans. Green taxes can therefore lead to improved innovation and increased competitiveness. The issue of competitiveness in relation to green taxes is also a contested area [99]. According to Braathen and Greene [2], competitiveness questions need to be comprehensively and fully evaluated. A combination of policy instruments and environmental taxes might be employed to address the challenges. As opposed to the cases where government use regulation to deal with environmental damage leads to situations where businesses and individuals would only use the prescribed technology or attain the expected standards, with green taxes, there is continuous pressure to innovate, further abate and reduce abatement costs [2]. This need for continuous improvement would drive companies to develop or adopt novel technologies and technological advancements. Increased innovation reduces the environmentally damaging behaviors and helps significantly mitigate the costs to society of environmental management and risks in the long term. Ecological taxation ensures that the negative externality and consequences of manufacturing, production and consumption decisions are not only borne by society but also by linked back to where they originate.

4.3.8. Contribute to Effective and Fair Distribution of Income and Welfare

On the one hand, it was establishing from the review that green taxes can lead to tax justice and fairness in income and welfare distribution. This could contribute to reducing inequalities and to peace, justice and building strong institutions advocated for in SDG 16. On the other hand, green taxes can perpetuate income inequalities and lead to an unfair distribution of resources between the poor and the rich, especially if they are levied on those products consumed more by the poor who cannot easily access alternatives. This could perpetuate economic ills such as poverty, hunger and inequality compromising the fulfillment of SDGs 1, 2, 4 and 10, among others.

4.3.9. Avail an Opportunity to Take Advantage of Multiple Environmental Gains

Environmental challenges are interrelated; therefore, dealing with one might alleviate various other environmental problems. Environmental taxes on one negative externality might have a positive impact on other environmental challenges. Although this cannot be alluded to with certainty, it is possible that, for example, improving manufacturing technological processes and thus minimizing carbon emission in response to carbon tax might compel a company to adopt solar energy for manufacturing as opposed to using diesel to power machines. In essence, this would lead to a reduction in pollution and the use of fuel, therefore ultimately reducing both pollution taxes and carbon taxes to be paid through the adoption of environmentally friendly alternatives [8]. Ultimately, cost effectiveness and synergy would be achieved. As the companies broaden the range of strategies and instruments to minimize the green taxes paid, the reinforcing impact of these strategies increases the multiple environmental gains. Green taxes can boost the competitiveness of ecologically friendly alternatives and goods such as those resulting in low emissions. The increased production of these could lead to increased productivity, economies of scale, improved profits, and viability as well as the possibilities of increased corporate tax, employment tax and valued-added tax collections. This could lead to benefits in environmental tax protection accompanied by indirect revenue generation benefits and sustainable development, creating an all-encompassing attainment of the SDGs.

4.3.10. Increasing Inequality and the Vulnerability of Low-Income Earners

Green taxes can increase energy poverty for those who are dependent on fossil fuel for energy. This would compromise the fulfillment of UN Sustainable Development Goals 7 and 1 on access to clean energy and poverty alleviation, respectively. These taxes could also lead to a disjointed value chain, disadvantaging consumers and increasing black market activities where cheaper and unsafe energy such as fuel would be purchased. This would rob the vulnerable population of access to affordable and sustainable energy sources.

4.3.11. Competitiveness