Analysis of the Impact of Carbon Trading Policies on Carbon Emission and Carbon Emission Efficiency

Abstract

:1. Introduction

2. Literature Review

3. Theoretical Framing and Research Hypothesis

4. Models and Data

4.1. Models

4.1.1. Difference-in-Difference Method

4.1.2. Super-Efficiency SBM Model

4.2. Data

4.2.1. Carbon Dioxide Emissions and Sulfur Dioxide Emissions

4.2.2. Control Variables

4.2.3. Input and Output Variables

5. Empirical Analysis

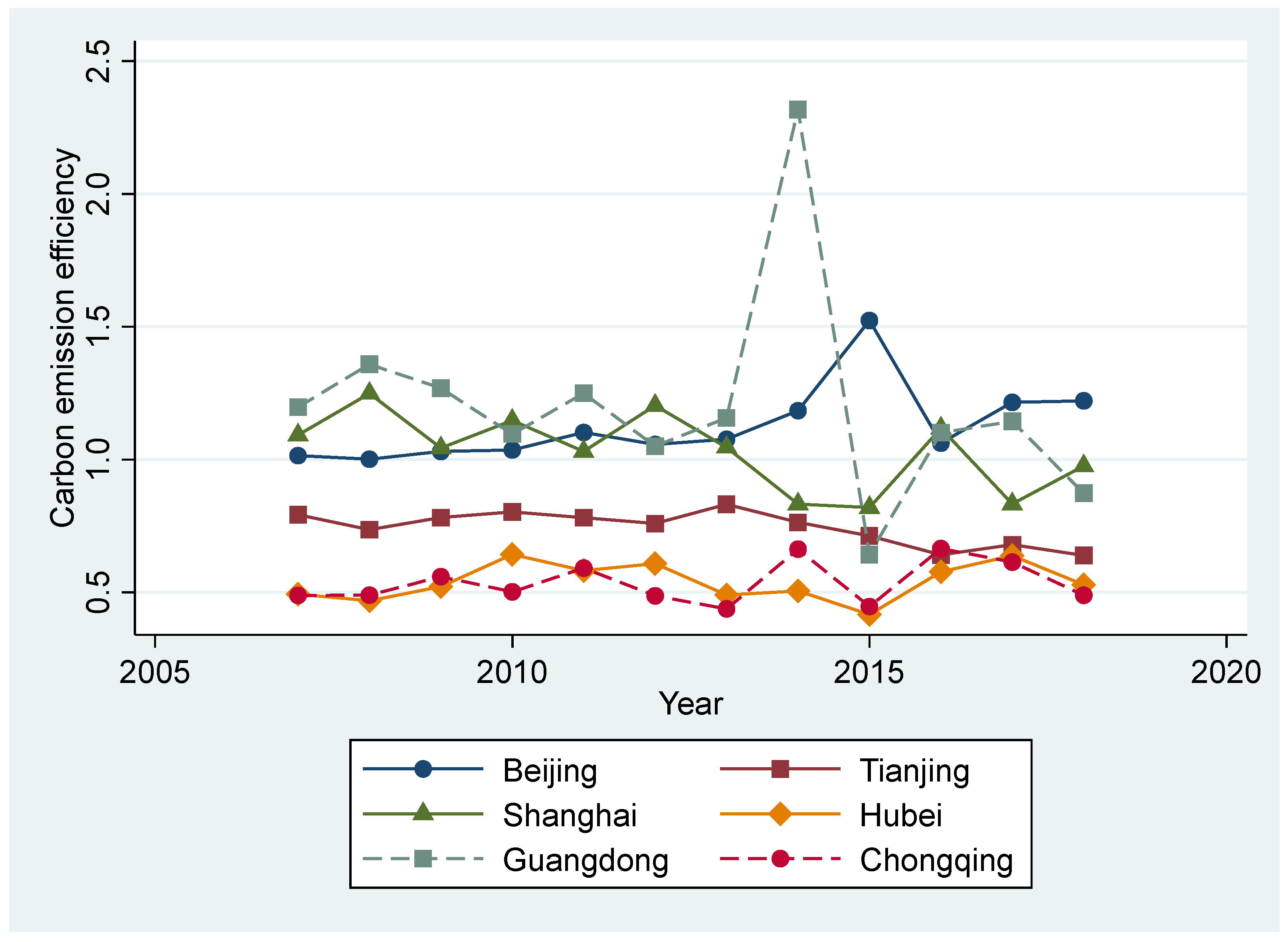

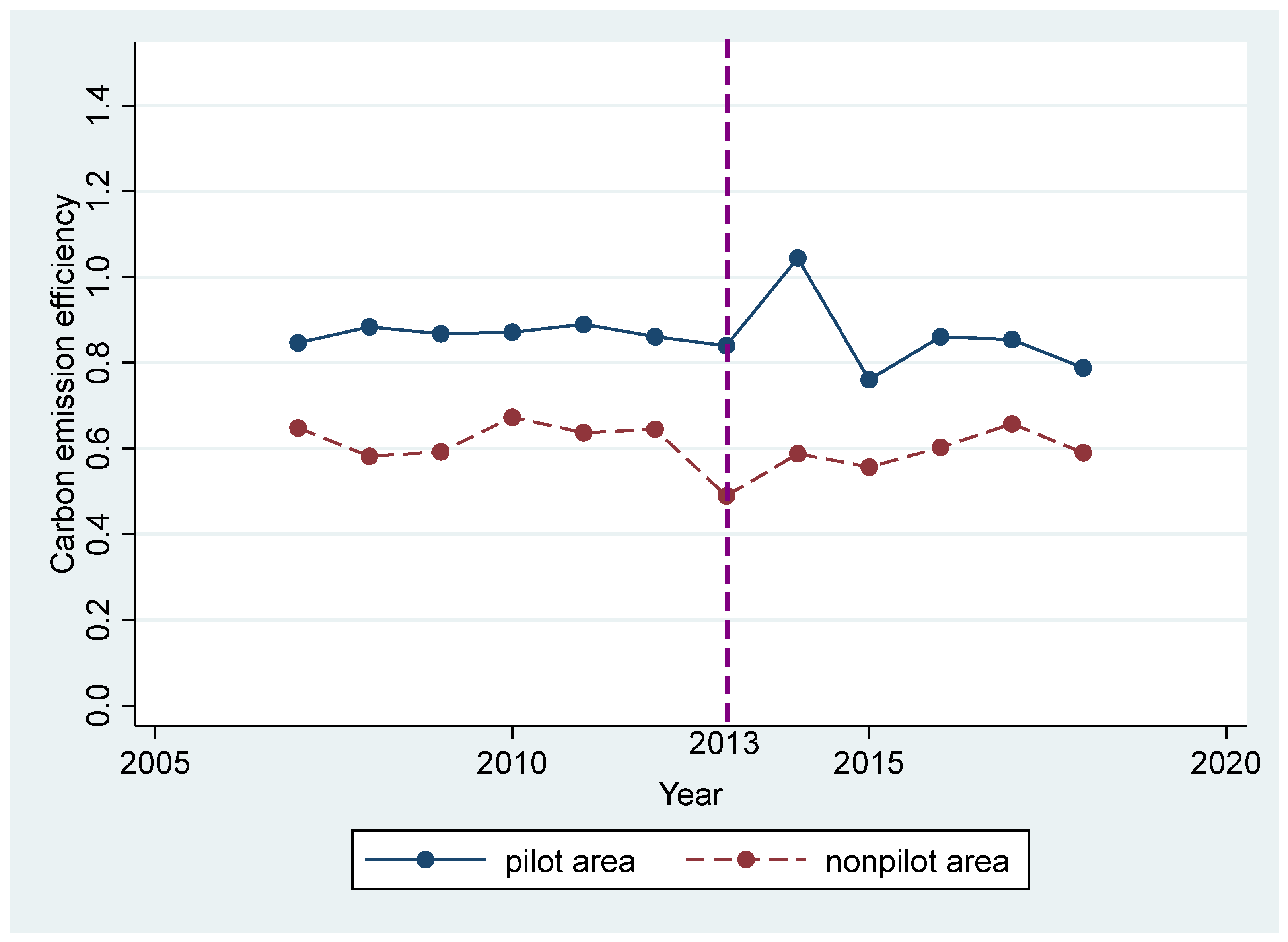

5.1. Provincial Carbon Emission Efficiency Analysis

5.2. Basic Regression Results of the Difference-in-Difference Model

5.3. The Test of Parallel Trend Hypothesis and Dynamic Effect

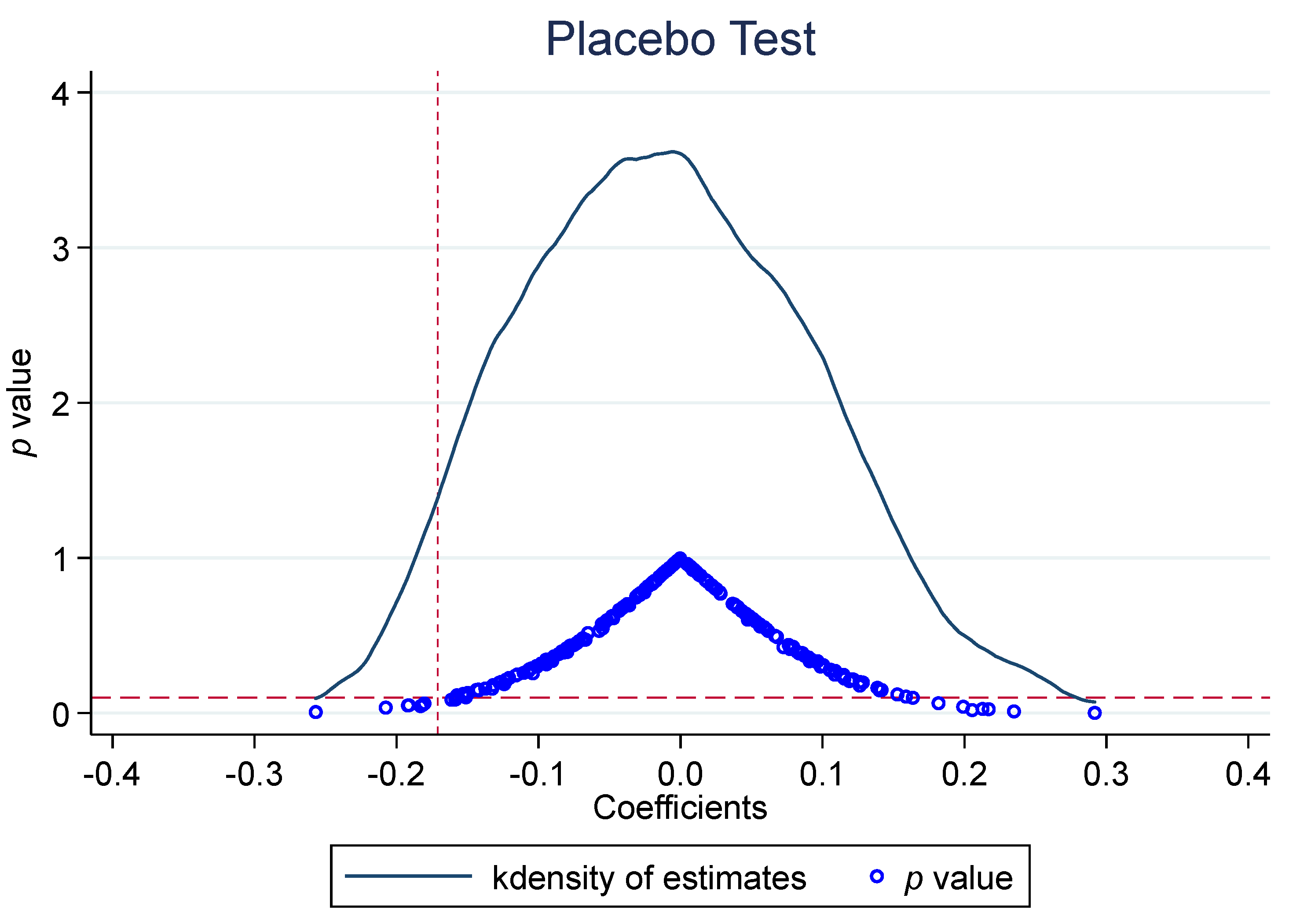

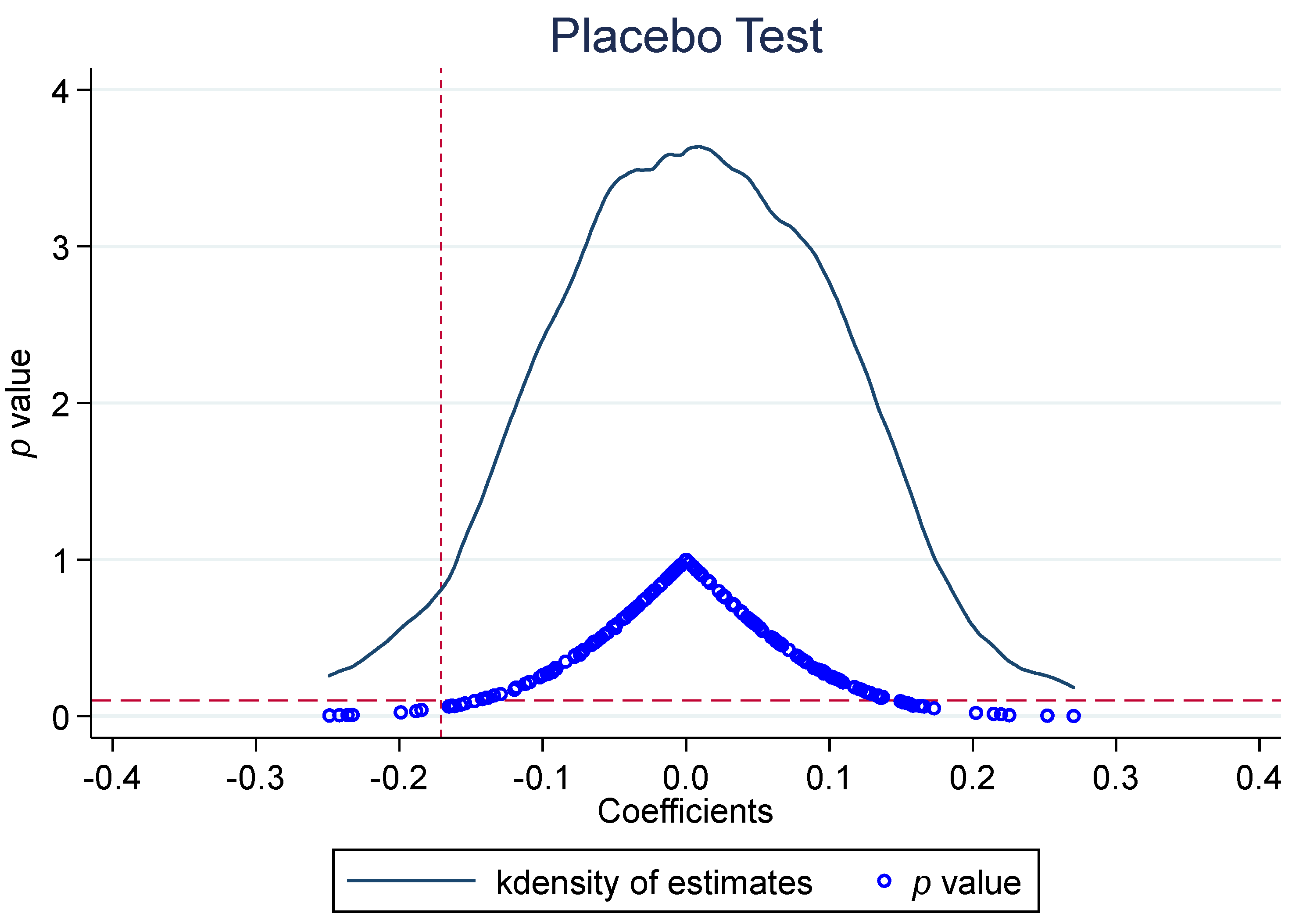

5.4. Placebo Test

5.5. Synergistic Emission Reduction Testing

6. Conclusions and Policy Recommendations

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- World Meteorological Organisation. Available online: https://public.wmo.int/en/resources/library/wmo-provisional-statement-state-of-global-climate-2019 (accessed on 2 December 2019).

- Yuan, C.Q.; Liu, S.F.; Fang, Z.G.; Xie, N.M. The relation between Chinese economic development and energy consumption in the different periods. Energy Policy 2010, 38, 5189–5198. [Google Scholar] [CrossRef]

- Zheng, S.Q.; Kahn, M.E. A New Era of Pollution Progress in Urban China? J. Econ. Perspect. 2017, 31, 71–92. [Google Scholar] [CrossRef]

- Guo, J.F.; Gu, F.; Liu, Y.P.; Liang, X.; Mo, J.L.; Fan, Y. Assessing the impact of ETS trading profit on emission abatements based on firm-level transactions. Nat. Commun. 2020, 11, 8. [Google Scholar] [CrossRef] [PubMed]

- Meltzer, J. Climate Change and Trade-The EU Aviation Directive and the WTO. J. Int. Econ. Law 2012, 15, 111–156. [Google Scholar] [CrossRef]

- Fang, G.C.; Tian, L.X.; Liu, M.H.; Fu, M.; Sun, M. How to optimize the development of carbon trading in China-Enlightenment from evolution rules of the EU carbon price. Appl. Energy 2018, 211, 1039–1049. [Google Scholar] [CrossRef]

- Xiong, L.; Shen, B.; Qi, S.Z.; Price, L.; Ye, B. The allowance mechanism of China’s carbon trading pilots: A comparative analysis with schemes in EU and California. Appl. Energy 2017, 185, 1849–1859. [Google Scholar] [CrossRef]

- Cui, J.; Zhang, J.; Zheng, Y. Carbon Pricing Induces Innovation: Evidence from China’s Regional Carbon Market Pilots. AEA Pap. Proc. 2018, 108, 453–457. [Google Scholar] [CrossRef]

- Gao, P.; Yue, S.J.; Chen, H.T. Carbon emission efficiency of China’s industry sectors: From the perspective of embodied carbon emissions. J. Clean. Prod. 2021, 283, 9. [Google Scholar] [CrossRef]

- Zhang, M.L.; Liu, Y. Influence of digital finance and green technology innovation on China’s carbon emission efficiency: Empirical analysis based on spatial metrology. Sci. Total Environ. 2022, 838, 15. [Google Scholar] [CrossRef]

- Chong, Z.H.; Qin, C.L.; Ye, X.Y. Environmental Regulation, Economic Network and Sustainable Growth of Urban Agglomerations in China. Sustainability 2016, 8, 467. [Google Scholar] [CrossRef]

- Porter, M.E.; Vanderlinde, C. Toward a new Conception of the environment-competitiveness relationship. J. Econ. Perspect. 1995, 9, 97–118. [Google Scholar] [CrossRef]

- Rogge, K.S.; Hoffmann, V.H. The impact of the EU ETS on the sectoral innovation system for power generation technologies—Findings for Germany. Energy Policy 2010, 38, 7639–7652. [Google Scholar] [CrossRef]

- Chen, Z.; Yuan, X.-C.; Zhang, X.; Cao, Y. How will the Chinese national carbon emissions trading scheme work? The assessment of regional potential gains. Energy Policy 2020, 137, 111095. [Google Scholar] [CrossRef]

- Liang, Y.; Cao, Y. Research on Market Framework of Australian Emissions Trading System. World For. Res. 2015, 28, 86–90. [Google Scholar]

- Cotton, D.; De Mello, L. Econometric analysis of Australian emissions markets and electricity prices. Energy Policy 2014, 74, 475–485. [Google Scholar] [CrossRef]

- Woo, C.K.; Chen, Y.; Olson, A.; Moore, J.; Schlag, N.; Ong, A.; Ho, T. Electricity price behavior and carbon trading: New evidence from California. Appl. Energy 2017, 204, 531–543. [Google Scholar] [CrossRef]

- Hu, Y.C.; Ren, S.G.; Wang, Y.J.; Chen, X.H. Can carbon emission trading scheme achieve energy conservation and emission reduction? Evidence from the industrial sector in China. Energy Econ. 2020, 85, 104590. [Google Scholar] [CrossRef]

- Wen, F.H.; Wu, N.; Gong, X. China’s carbon emissions trading and stock returns. Energy Econ. 2020, 86, 15. [Google Scholar] [CrossRef]

- Zhou, B.; Zhang, C.; Song, H.Y.; Wang, Q.W. How does emission trading reduce China’s carbon intensity? An exploration using a decomposition and difference-in-differences approach. Sci. Total Environ. 2019, 676, 514–523. [Google Scholar] [CrossRef]

- Chen, L.; Liu, Y.N.; Gao, Y.; Wang, J.J. Carbon Emission Trading Policy and Carbon Emission Efficiency: An Empirical Analysis of China’s Prefecture-Level Cities. Front. Energy Res. 2021, 9, 14. [Google Scholar] [CrossRef]

- Lin, B.Q.; Jia, Z.J. What will China’s carbon emission trading market affect with only electricity sector involvement? A CGE based study. Energy Econ. 2019, 78, 301–311. [Google Scholar] [CrossRef]

- Wen, H.X.; Chen, Z.R.; Nie, P.Y. Environmental and economic performance of China’s ETS pilots: New evidence from an expanded synthetic control method. Energy Rep. 2021, 7, 2999–3010. [Google Scholar] [CrossRef]

- Yang, X.; Jiang, P.; Pan, Y. Does China’s carbon emission trading policy have an employment double dividend and a Porter effect? Energy Policy 2020, 142, 111492. [Google Scholar] [CrossRef]

- Zhang, W.; Li, J.; Li, G.; Guo, S. Emission reduction effect and carbon market efficiency of carbon emissions trading policy in China. Energy 2020, 196, 117117. [Google Scholar] [CrossRef]

- Yan, Y.; Zhang, X.; Zhang, J.; Li, K. Emissions trading system (ETS) implementation and its collaborative governance effects on air pollution: The China story. Energy Policy 2020, 138, 111282. [Google Scholar] [CrossRef]

- Ji, C.-J.; Hu, Y.-J.; Tang, B.-J.; Qu, S. Price drivers in the carbon emissions trading scheme: Evidence from Chinese emissions trading scheme pilots. J. Clean. Prod. 2021, 278, 123469. [Google Scholar] [CrossRef]

- Zhang, D.; Karplus, V.J.; Cassisa, C.; Zhang, X.L. Emissions trading in China: Progress and prospects. Energy Policy 2014, 75, 9–16. [Google Scholar] [CrossRef]

- Dong, F.; Long, R.; Yu, B.; Wang, Y.; Li, J.; Wang, Y.; Dai, Y.; Yang, Q.; Chen, H. How can China allocate CO2 reduction targets at the provincial level considering both equity and efficiency? Evidence from its Copenhagen Accord pledge. Resour. Conserv. Recycl. 2018, 130, 31–43. [Google Scholar] [CrossRef]

- Yamaji, K.; Matsuhashi, R.; Nagata, Y.; Kaya, Y. A study on economic-measures for CO2 reduction in japan. Energy Policy 1993, 21, 123–132. [Google Scholar] [CrossRef]

- Bai, C.Q.; Du, K.R.; Yu, Y.; Fen, C. Understanding the trend of total factor carbon productivity in the world: Insights from convergence analysis. Energy Econ. 2019, 81, 698–708. [Google Scholar] [CrossRef]

- Dong, F.; Qin, C.; Zhang, X.Y.; Zhao, X.; Pan, Y.L.; Gao, Y.J.; Zhu, J.; Li, Y.F. Towards Carbon Neutrality: The Impact of Renewable Energy Development on Carbon Emission Efficiency. Int. J. Environ. Res. Public Health 2021, 18, 13284. [Google Scholar] [CrossRef]

- Liu, H.M.; Zhang, Z.X.; Zhang, T.; Wang, L.Y. Revisiting China’s provincial energy efficiency and its influencing factors. Energy 2020, 208, 118361. [Google Scholar] [CrossRef]

- Tone, K. A slacks-based measure of super-efficiency in data envelopment analysis. Eur. J. Oper. Res. 2002, 143, 32–41. [Google Scholar] [CrossRef]

- Du, Q.; Deng, Y.G.; Zhou, J.; Wu, J.; Pang, Q.Y. Spatial spillover effect of carbon emission efficiency in the construction industry of China. Environ. Sci. Pollut. Res. 2022, 29, 2466–2479. [Google Scholar] [CrossRef] [PubMed]

- Yu, Y.; Zhang, N. Low-carbon city pilot and carbon emission efficiency: Quasi-experimental evidence from China. Energy Econ. 2021, 96, 105125. [Google Scholar] [CrossRef]

- Zhang, H.; Guo, S.D.; Qian, Y.B.; Liu, Y.; Lu, C.P. Dynamic analysis of agricultural carbon emissions efficiency in Chinese provinces along the Belt and Road. PLoS ONE 2020, 15, e0228223. [Google Scholar] [CrossRef]

- Rose, A.; Stevens, B. The efficiency and equity of marketable permits for CO2 emissions. Resour. Energy Econ. 1993, 15, 117–146. [Google Scholar] [CrossRef]

- Yang, W.; Pan, Y.C.; Ma, J.H.; Zhou, M.; Chen, Z.M.; Zhu, W.H. Optimization on emission permit trading and green technology implementation under cap-and-trade scheme. J. Clean. Prod. 2018, 194, 288–299. [Google Scholar] [CrossRef]

- Tian, H.; Lin, J.E.; Jiang, C.Y. The Impact of Carbon Emission Trading Policies on Enterprises’ Green Technology Innovation-Evidence from Listed Companies in China. Sustainability 2022, 14, 7207. [Google Scholar] [CrossRef]

- Zang, J.N.; Wan, L.; Li, Z.J.; Wang, C.Y.; Wang, S.Y. Does emission trading scheme have spillover effect on industrial structure upgrading? Evidence from the EU based on a PSM-DID approach. Environ. Sci. Pollut. Res. 2020, 27, 12345–12357. [Google Scholar] [CrossRef]

- Tang, R.H.; Guo, W.; Oudenes, M.; Li, P.; Wang, J.; Tang, J.; Wang, L.; Wang, H.J. Key challenges for the establishment of the monitoring, reporting and verification (MRV) system in China’s national carbon emissions trading market. Clim. Policy 2018, 18, 106–121. [Google Scholar] [CrossRef]

- Weng, Q.Q.; Xu, H. A review of China’s carbon trading market. Renew. Sustain. Energy Rev. 2018, 91, 613–619. [Google Scholar] [CrossRef]

- Dorokhov, V.V.; Kuznetsov, G.V.; Nyashina, G.S.; Strizhak, P.A. Composition of a gas and ash mixture formed during the pyrolysis and combustion of coal-water slurries containing petrochemicals. Environ. Pollut. 2021, 285, 117390. [Google Scholar] [CrossRef] [PubMed]

- Dong, F.; Dai, Y.J.; Zhang, S.N.; Zhang, X.Y.; Long, R.Y. Can a carbon emission trading scheme generate the Porter effect? Evidence from pilot areas in China. Sci. Total Environ. 2019, 653, 565–577. [Google Scholar] [CrossRef]

- Liu, G.; Dong, X.; Kong, Z.; Dong, K. Does national air quality monitoring reduce local air pollution? The case of PM2.5 for China. J. Environ. Manag. 2021, 296, 113232. [Google Scholar] [CrossRef]

- Tang, K.; Xiong, C.; Wang, Y.T.; Zhou, D. Carbon emissions performance trend across Chinese cities: Evidence from efficiency and convergence evaluation. Environ. Sci. Pollut. Res. 2021, 28, 1533–1544. [Google Scholar] [CrossRef]

- Wang, F.; WU, L.; Yang, C. Driving factors for growth of carbon dioxide emissions during economic development in China. Econ. Res. J. 2010, 45, 123–136. [Google Scholar]

- Liu, Z.; Sun, H. Assessing the impact of emissions trading scheme on low-carbon technological innovation: Evidence from China. Environ. Impact Assess. Rev. 2021, 89, 106589. [Google Scholar] [CrossRef]

- Tang, K.; Zhou, Y.; Liang, X.; Zhou, D. The effectiveness and heterogeneity of carbon emissions trading scheme in China. Environ. Sci. Pollut. Res. Int. 2021, 28, 17306–17318. [Google Scholar] [CrossRef]

- Chen, S.; Shi, A.; Wang, X. Carbon emission curbing effects and influencing mechanisms of China’s Emission Trading Scheme: The mediating roles of technique effect, composition effect and allocation effect. J. Clean. Prod. 2020, 264, 121700. [Google Scholar] [CrossRef]

- Gao, Y.; Li, M.; Xue, J.; Liu, Y. Evaluation of effectiveness of China’s carbon emissions trading scheme in carbon mitigation. Energy Econ. 2020, 90, 104872. [Google Scholar] [CrossRef]

- Zhang, J.; Wu, G.; Zhang, J. The estimation of China’s provincial capital stock: 1952–2000. Econ. Res. J. 2004, 10, 35–44. [Google Scholar]

- Hu, Y.-J.; Li, X.-Y.; Tang, B.-J. Assessing the operational performance and maturity of the carbon trading pilot program: The case study of Beijing’s carbon market. J. Clean. Prod. 2017, 161, 1263–1274. [Google Scholar] [CrossRef]

- Zhao, X.-g.; Wu, L.; Li, A. Research on the efficiency of carbon trading market in China. Renew. Sustain. Energy Rev. 2017, 79, 1–8. [Google Scholar] [CrossRef]

- Tan, X.; Liu, Y.; Wang, Y. The Economic and environmental impact of Hubei pilot emission trading schemes—Based on Chinese Multi-region General Equilibrium Model. Wuhan Univ. J. Philos. Soc. Sci. 2016, 69, 64–72. [Google Scholar] [CrossRef]

- Tan, J.; Zhang, J. Does China’s ETS force the upgrade of industrial structure? Evidence from synthetic control method. Res. Econ. Manag. 2018, 39, 104–119. [Google Scholar] [CrossRef]

- Wang, Y.; Ge, X.-L.; Liu, J.-L.; Ding, Z. Study and analysis of energy consumption and energy-related carbon emission of industrial in Tianjin, China. Energy Strategy Rev. 2016, 10, 18–28. [Google Scholar] [CrossRef]

- Yan, X.; Wang, J. Research on the evolution of industrial structure on Tianjin. China Popul. Resour. Environ. 2016, 26, 448–451. [Google Scholar]

- Li, T.; Liao, H.; Yang, W.; Zhuang, W.; Shi, Q. Urbanization quality over time and space as well as coupling coordination of land, population and industrialization in Chongqing. Econ. Geogr. 2015, 35, 65–71. [Google Scholar] [CrossRef]

- Ge, S.; Yu, X.; Zhou, D.; Sang, X. The Integrated Effect of Carbon Emissions Trading and Pollution Rights Trading for Power Enterprises—A Case Study of Chongqing. Sustainability 2019, 11, 3099. [Google Scholar] [CrossRef]

- Huang, Z. A study on Chongqing taking-over industries transferring from eastern region of China. On Econ. Probl. 2009, 7, 117–120. [Google Scholar] [CrossRef]

- Gui, X.; Li, H. Empirical study of environmental kuznets curve. China Popul. Resour. Environ. 2010, 20, 5–8. [Google Scholar]

- Zhou, D.; Wang, X. Research on coupling degree and coupling path between China’s carbon emission efficiency and industrial structure upgrade. J. Nat. Resour. 2019, 34, 2305–2316. [Google Scholar]

- Fisher-Vanden, K.; Sue Wing, I. Accounting for quality: Issues with modeling the impact of R&D on economic growth and carbon emissions in developing economies. Energy Econ. 2008, 30, 2771–2784. [Google Scholar] [CrossRef]

- Lan, H.; Chen, Y. Development and system construction of carbon trading market. Reform 2022, 1, 57–67. [Google Scholar]

- Li, W.; Jia, Z.J. The impact of emission trading scheme and the ratio of free quota: A dynamic recursive CGE model in China. Appl. Energy 2016, 174, 1–14. [Google Scholar] [CrossRef]

- Lin, B.Q.; Huang, C.C. Analysis of emission reduction effects of carbon trading: Market mechanism or government intervention? Sustain. Prod. Consum. 2022, 33, 28–37. [Google Scholar] [CrossRef]

- Liu, L.W.; Chen, C.X.; Zhao, Y.F.; Zhao, E.D. China’s carbon-emissions trading: Overview, challenges and future. Renew. Sustain. Energy Rev. 2015, 49, 254–266. [Google Scholar] [CrossRef]

- Zhang, F.; Fang, H.; Song, W.Y. Carbon market maturity analysis with an integrated multi-criteria decision making method: A case study of EU and China. J. Clean. Prod. 2019, 241, 15. [Google Scholar] [CrossRef]

- Cai, X.; Lu, Y.; Wu, M.; Yu, L. Does environmental regulation drive away inbound foreign direct investment? Evidence from a quasi-natural experiment in China. J. Dev. Econ. 2016, 123, 73–85. [Google Scholar] [CrossRef]

- Ye, F.; Xiong, X.; Li, L.; Li, Y. Measuring the effectiveness of the Chinese Certified Emission Reduction scheme in mitigating CO2 emissions: A system dynamics approach. J. Clean. Prod. 2021, 294, 125355. [Google Scholar] [CrossRef]

| Variables | (1) | (2) | (3) | (4) | (5) |

|---|---|---|---|---|---|

| n | Mean | Std. Dev. | Min | Max | |

| lnCO2 | 360 | 5.465 | 0.743 | 3.077 | 6.816 |

| urban | 360 | 54.69 | 13.37 | 28.24 | 89.60 |

| lnpop | 360 | 8.186 | 0.742 | 6.314 | 9.337 |

| lnpgdp | 360 | 10.55 | 0.562 | 8.841 | 11.85 |

| IS | 360 | 1.125 | 0.354 | 0.230 | 2.002 |

| RD | 360 | 0.00921 | 0.00519 | 0.000421 | 0.0219 |

| lnpgdp2 | 360 | 111.6 | 11.82 | 78.17 | 140.4 |

| Region | 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Beijing | 1.015 | 1.001 | 1.030 | 1.036 | 1.102 | 1.057 | 1.076 | 1.184 | 1.523 | 1.062 | 1.215 | 1.221 |

| Tianjing | 0.793 | 0.736 | 0.782 | 0.803 | 0.781 | 0.759 | 0.832 | 0.763 | 0.713 | 0.641 | 0.680 | 0.639 |

| Hebei | 0.617 | 0.501 | 0.506 | 0.698 | 0.570 | 0.585 | 0.601 | 0.503 | 0.646 | 0.461 | 0.542 | 0.508 |

| Shanxi | 0.563 | 0.501 | 0.454 | 0.561 | 0.510 | 0.478 | 0.396 | 0.439 | 0.418 | 0.339 | 0.427 | 0.449 |

| Inner Mongolia | 0.647 | 0.630 | 0.656 | 0.649 | 0.665 | 0.558 | 0.531 | 0.567 | 0.507 | 0.419 | 0.409 | 0.453 |

| Liaoning | 0.652 | 0.584 | 0.588 | 0.777 | 0.659 | 0.639 | 0.609 | 0.633 | 0.657 | 0.426 | 0.491 | 0.524 |

| Jilin | 0.571 | 0.545 | 0.493 | 0.594 | 0.526 | 0.704 | 0.427 | 0.492 | 0.449 | 0.566 | 0.413 | 0.476 |

| Heilongjiang | 0.615 | 0.581 | 0.502 | 0.650 | 0.541 | 0.674 | 0.403 | 0.471 | 0.435 | 0.503 | 0.397 | 0.460 |

| Shanghai | 1.092 | 1.249 | 1.043 | 1.147 | 1.030 | 1.203 | 1.046 | 0.832 | 0.820 | 1.118 | 0.833 | 0.976 |

| Jiangsu | 0.844 | 0.762 | 0.690 | 1.131 | 0.796 | 1.258 | 1.100 | 0.834 | 1.146 | 1.090 | 1.013 | 1.336 |

| Zhejiang | 0.787 | 0.694 | 0.633 | 0.910 | 0.690 | 0.901 | 0.675 | 0.666 | 0.770 | 0.802 | 0.778 | 0.793 |

| Anhui | 0.474 | 0.438 | 0.425 | 0.604 | 0.467 | 0.651 | 0.418 | 0.456 | 0.497 | 0.532 | 0.490 | 0.524 |

| Fujian | 0.731 | 0.612 | 0.702 | 0.742 | 0.739 | 0.704 | 0.567 | 0.589 | 0.478 | 0.671 | 0.786 | 0.650 |

| Jiangxi | 0.558 | 0.465 | 0.518 | 0.622 | 0.595 | 0.670 | 0.417 | 0.491 | 0.420 | 0.566 | 0.602 | 0.510 |

| Shandong | 1.012 | 0.664 | 0.800 | 1.005 | 1.018 | 0.767 | 1.071 | 0.576 | 0.525 | 0.746 | 1.022 | 0.678 |

| Henan | 0.572 | 0.498 | 0.545 | 0.643 | 0.553 | 0.539 | 0.508 | 0.388 | 0.341 | 0.489 | 0.559 | 0.452 |

| Hubei | 0.493 | 0.469 | 0.522 | 0.643 | 0.582 | 0.608 | 0.490 | 0.505 | 0.416 | 0.578 | 0.639 | 0.528 |

| Hunan | 0.518 | 0.489 | 0.522 | 0.658 | 0.570 | 0.605 | 0.456 | 0.480 | 0.397 | 0.553 | 0.588 | 0.492 |

| Guangdong | 1.197 | 1.359 | 1.269 | 1.096 | 1.249 | 1.050 | 1.157 | 2.317 | 0.642 | 1.101 | 1.144 | 0.873 |

| Guangxi | 0.507 | 0.519 | 0.488 | 0.466 | 0.484 | 0.394 | 0.369 | 0.527 | 0.331 | 0.519 | 0.465 | 0.408 |

| Hainan | 1.939 | 1.268 | 1.395 | 1.197 | 1.042 | 1.231 | 0.315 | 1.339 | 1.717 | 1.498 | 1.200 | 1.748 |

| Chongqing | 0.489 | 0.489 | 0.559 | 0.502 | 0.591 | 0.487 | 0.438 | 0.663 | 0.447 | 0.665 | 0.614 | 0.489 |

| Sichuan | 0.480 | 0.445 | 0.500 | 0.480 | 0.532 | 0.466 | 0.481 | 0.558 | 0.406 | 0.575 | 0.600 | 0.488 |

| Guizhou | 0.371 | 0.369 | 0.415 | 0.400 | 0.434 | 0.403 | 0.342 | 0.490 | 0.358 | 0.464 | 0.454 | 0.361 |

| Yunnan | 0.356 | 0.418 | 0.414 | 0.390 | 0.480 | 0.362 | 0.332 | 0.424 | 0.271 | 0.403 | 0.625 | 0.277 |

| Shanxi | 0.416 | 0.489 | 0.493 | 0.464 | 0.599 | 0.442 | 0.455 | 0.556 | 0.358 | 0.497 | 0.787 | 0.401 |

| Gansu | 0.386 | 0.446 | 0.429 | 0.435 | 0.515 | 0.433 | 0.323 | 0.485 | 0.349 | 0.428 | 0.599 | 0.351 |

| Qinghai | 1.064 | 1.004 | 1.043 | 1.114 | 1.231 | 1.101 | 0.255 | 1.145 | 1.144 | 1.076 | 1.575 | 1.161 |

| Ningxia | 0.441 | 0.554 | 0.522 | 0.505 | 0.511 | 0.494 | 0.312 | 0.498 | 0.431 | 0.474 | 0.480 | 0.363 |

| Xinjiang | 0.422 | 0.491 | 0.475 | 0.449 | 0.546 | 0.412 | 0.378 | 0.492 | 0.300 | 0.358 | 0.474 | 0.297 |

| Variables | Carbon Emission | Carbon Emission Efficiency | |||

|---|---|---|---|---|---|

| (1) | (2) | (3) | (4) | (5) | |

| No Control Variables | Part of the Control Variables | All Control Variables | No Control Variables | All Control Variables | |

| Pt × treati | −0.185 *** | −0.143 *** | −0.191 *** | 0.277 *** | 0.115 ** |

| (−4.99) | (−4.99) | (−6.50) | (5.16) | (1.80) | |

| lnpgdp | 1.065 *** | 1.675 *** | |||

| (2.81) | (3.96) | ||||

| lnpgdp2 | −0.031 * | −0.060 *** | |||

| (−1.66) | (−2.95) | ||||

| urban | −0.004 | 0.860 *** | |||

| (−0.97) | (8.71) | ||||

| lnpop | 0.865 *** | 0.020 | |||

| (9.70) | (0.87) | ||||

| IS | 0.010 | −0.129 ** | |||

| (0.28) | (−2.40) | ||||

| RD | −1.175 | −0.124 *** | |||

| (−0.33) | (−3.36) | ||||

| Constant | 5.389 *** | −2.225 | −12.287 *** | 0.687 *** | −3.226 *** |

| (35.66) | (−1.14) | (−5.32) | (13.06) | (−4.83) | |

| Observations | 360 | 360 | 360 | 360 | 360 |

| Regional fixed effect | YES | YES | YES | YES | YES |

| Time fixed effect | YES | YES | YES | YES | YES |

| R-squared | 0.413 | 0.705 | 0.733 | 0.091 | 0.375 |

| Variables | Parallel Trend Hypothesis | Dynamic Effect | ||

|---|---|---|---|---|

| Carbon Emission | Carbon Emission Efficiency | Carbon Emission | Carbon Emission Efficiency | |

| (1) | (2) | (3) | (4) | |

| treat × 2008 | −0.155 | 0.012 | ||

| (−0.44) | (0.27) | |||

| treat × 2009 | −0.163 | 0.010 | ||

| (−0.63) | (0.21) | |||

| treat × 2010 | 2010 | 0.010 | ||

| −0.169 | (0.21) | |||

| treat × 2011 | −0.180 | 0.021 | ||

| (−0.89) | (0.45) | |||

| treat × 2012 | −0.185 | 0.024 | ||

| (−0.95) | (0.49) | |||

| treat × 2013 | −0.191 *** | 0.115 ** | ||

| (−6.50) | (1.80) | |||

| treat × 2014 | −0.237 ** | 0.175 *** | ||

| (−2.27) | (3.09) | |||

| treat × 2015 | −0.240 ** | 0.131 ** | ||

| (−2.19) | (2.07) | |||

| treat × 2016 | −0.243 ** | 0.138 * | ||

| (−2.19) | (1.89) | |||

| treat × 2017 | −0.236 * | 0.190 ** | ||

| (−1.84) | (2.02) | |||

| treat × 2018 | −0.187 | 0.191 | ||

| (−1.05) | (1.42) | |||

| Control | YES | YES | YES | YES |

| Fixed effect | YES | YES | YES | YES |

| Observation | 360 | 360 | 360 | 360 |

| R-squared | 0.044 | 0.384 | 0.770 | 0.143 |

| Variables | (1) | (2) |

|---|---|---|

| No Control Variables | All Control Variables | |

| Pt × treati | −0.611 ** | −0.832 *** |

| (−2.30) | (−4.78) | |

| constant | 4.029 *** | 1.250 |

| (47.94) | (0.79) | |

| Control | NO | YES |

| Observations | 360 | 360 |

| R-squared | 0.219 | 0.676 |

| Regional fixed effect | YES | YES |

| Time fixed effect | YES | YES |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

He, Y.; Song, W. Analysis of the Impact of Carbon Trading Policies on Carbon Emission and Carbon Emission Efficiency. Sustainability 2022, 14, 10216. https://doi.org/10.3390/su141610216

He Y, Song W. Analysis of the Impact of Carbon Trading Policies on Carbon Emission and Carbon Emission Efficiency. Sustainability. 2022; 14(16):10216. https://doi.org/10.3390/su141610216

Chicago/Turabian StyleHe, Yizhang, and Wei Song. 2022. "Analysis of the Impact of Carbon Trading Policies on Carbon Emission and Carbon Emission Efficiency" Sustainability 14, no. 16: 10216. https://doi.org/10.3390/su141610216

APA StyleHe, Y., & Song, W. (2022). Analysis of the Impact of Carbon Trading Policies on Carbon Emission and Carbon Emission Efficiency. Sustainability, 14(16), 10216. https://doi.org/10.3390/su141610216