1. Introduction

In the 1950s, macroeconomics and economic growth received significant scientific attention. Starting from the understanding of the availability of natural capital in abundance, the economic theory has long been focused on produced and human capital. However, with exponential population growth and accelerated economic development, attention is focused on natural capital, which is a necessary condition for achieving sustainable growth and development. EU affirmed the concept of sustainable development, which presents a global political agreement that is made up of a balance between the social, economic and environmental aspects of development at all levels, from local to global.

Energy is key to the process of economic growth in many countries. Therefore, the main issue is the contribution of all energy sources to economic growth. Energy consumption is one of the basic indicators of economic growth and development. On the other hand, more efficient use of energy requires a higher level of economic development. In the past two decades, EU members have been working intensively on creating an internal energy market and an energy union. It is emphasized that it is crucial for the EU to decouple energy consumption from economic growth. After the financial sector, energy is probably the largest global industry, i.e., the industry with the widest impact on other sectors of the economy, on which the entire economic activity depends. Changes in the structure of GDP that have occurred in the past decades lead to significantly lower energy consumption per unit of GDP, i.e., to a decrease in energy intensity.

Non-renewable energy sources, as potential carriers of some form of energy that have been created but cannot be renewed, represent the most important source of total world energy. The use of non-renewable energy sources is primarily associated with significant environmental pollution and climate disturbances. The key disadvantage of non-renewable energy sources is the combustion of fossil fuels (coal, oil, gas) into the atmosphere, creating a large amount of carbon dioxide (CO

2). The problem of non-renewable resources escalated in the 1970s when many industries around the world were suddenly faced with shortages of the materials from which their products are manufactured. According to Motesharrei et al. [

1], uncontrolled exploitation of non-renewable natural resources, unequal distribution of wealth and excessive consumption of these resources could lead to the collapse of industrial society over several decades. Higher energy consumption is a consequence of the world’s population growth, while the reduction of reserves of non-renewable energy sources (oil, gas and coal) represents a threat to the survival of the current living conditions. The EU directive on energy efficiency [

2], which was adopted in 2012, establishes a common framework of measures to improve energy efficiency within the EU, which would ensure the achievement of the goal of reducing energy consumption by 20% by 2020. In 2014, EU countries agreed on a new goal regarding the energy efficiency, of at least 27% or more of reduction by 2030. Furthermore, the European Commission has proposed a binding goal of increasing energy efficiency by 30% in all countries by 2030. The increase in economic efficiency has led to the fact that the EU today consumes less energy than ten years ago.

Renewable energy has strategic importance for overall social development. The “100% renewable energy” approach implies a situation in which all energy needs are met exclusively from renewable energy sources. Numerous scientific studies qualify sources of renewable energy, i.e., permanent energy sources, as one of the key components of the concept of sustainable growth and development. At the same time, these sources contribute to the reduction of ecological vulnerability and the stimulation of economic and social development. Within the Europe 2020 strategy for smart, sustainable and inclusive growth [

3], the share of renewable energy in gross final energy consumption is determined as a key indicator for measuring progress. The European Commission [

4] emphasized that a more coordinated European approach to establishing and reforming support programs should be determined, as well as noting that renewable energy trading among EU member states should be strengthened. In 2014, the European Commission proposed a set of energy and climate targets for 2030 [

5] that seek to encourage private investment in infrastructure and low-carbon technologies. However, the key obstacles to the widespread implementation of renewable energy strategies are not technological, but mainly political in nature.

Primarily due to the use of fossil fuels (coal, oil, natural gas) in energy and industrial plants and modern traffic, as well as due to intensive agriculture, deforestation and other activities, the GHG emissions have increased significantly since the beginning of the industrialization period. Achieving zero net emissions implies reducing GHG in such a way that they are equal to the amount of CO

2 that can be absorbed from the atmosphere. Countries will have to stop the practice of relying on the growth of their economies on carbon, through increasing energy efficiency and the share of renewable energy sources (solar, wind energy and biomass, hydro and geothermal energy) in total consumption. EU and its member countries are obliged to report on their GHG emissions annually, in accordance with the United Nations Framework Convention on Climate Change (UNFCCC). The annual report on the GHG inventory at the EU level is prepared by the European Environment Agency, whereby countries should also report annually on policies and measures in the field of climate change through national communications. The EU inventory is based on the monitoring of GHG emissions by member states. The goal of the new Monitoring Mechanism Regulation (MMR) from 2013 [

6] was to improve the quality of reporting data, help member states monitor progress in achieving emission reduction goals in the period 2013–2020, and facilitate the further development of EU policies in the field of climate change. EU is recognized as a leader in the field of climate policies, both because of its commitment to undertaking further efforts at the international level, and because of its own ambitious goals and concrete instruments, such as the EU Emissions Trading System (ETS).

One of the key prerequisites for economic and social development is the rapid growth of information and communication technology (ICT), which is considered a generic technology of exceptional importance for every country. As early as 2000, the OECD [

7] proved the contribution of information and communication technology to GDP growth. As the bearer of development processes, ICT emphasized changes in business relations, contributed to the establishment of new forms of business and communication, improved the growth of innovation and productivity and affirmed the improvement of global efficiency. The consequences of these changes are: high level of economic efficiency, new competitive conditions, development and growth of sectors that use new technologies, market liberalization, different marketing structure, reduction of obstacles in trade and easier access to information, globalization of business. In this context, the significant economic impact of ICT in the EU is particularly emphasized at the beginning of this century. According to some estimates, the ICT sector is responsible for about half of the achieved productivity, considering return on investment in this sector. At the same time, the progress of digital technology represents a potential that must be exploited. The European Commission adopted the Digital Agenda for Europe [

8] among the seven leading initiatives of the Europe 2020 development strategy, which should enable Europe to benefit from new jobs, promote economic prosperity and improve business and the everyday life of EU citizens. ICT is a catalyst for economic development, often in a short period of time, that optimizes the rising costs of human inputs. Information technologies continue to represent the main drivers of change in the global world, at all macroeconomic and microeconomic levels, and ICT specifically is even an imperative of the economy, regardless of the development level.

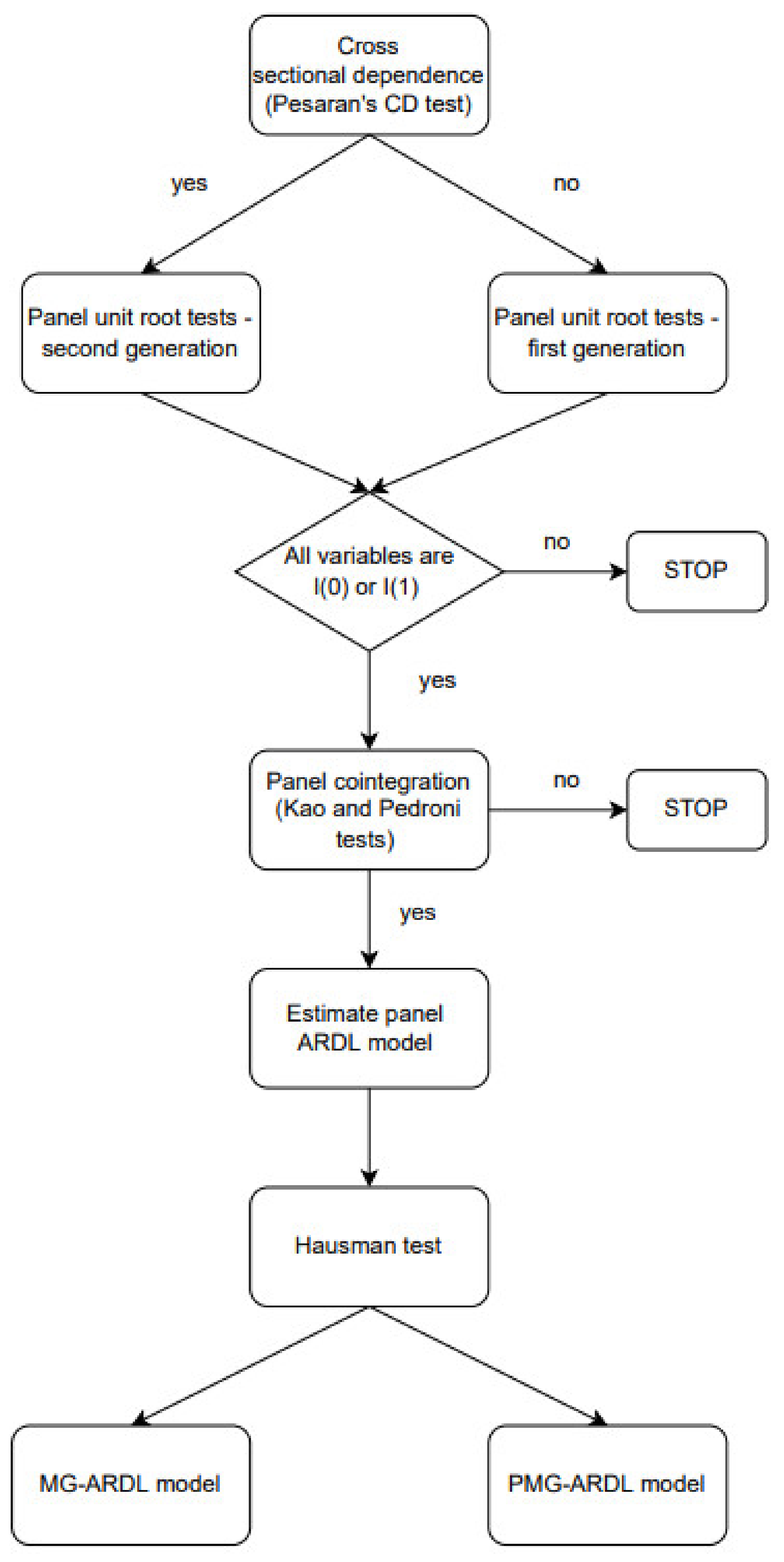

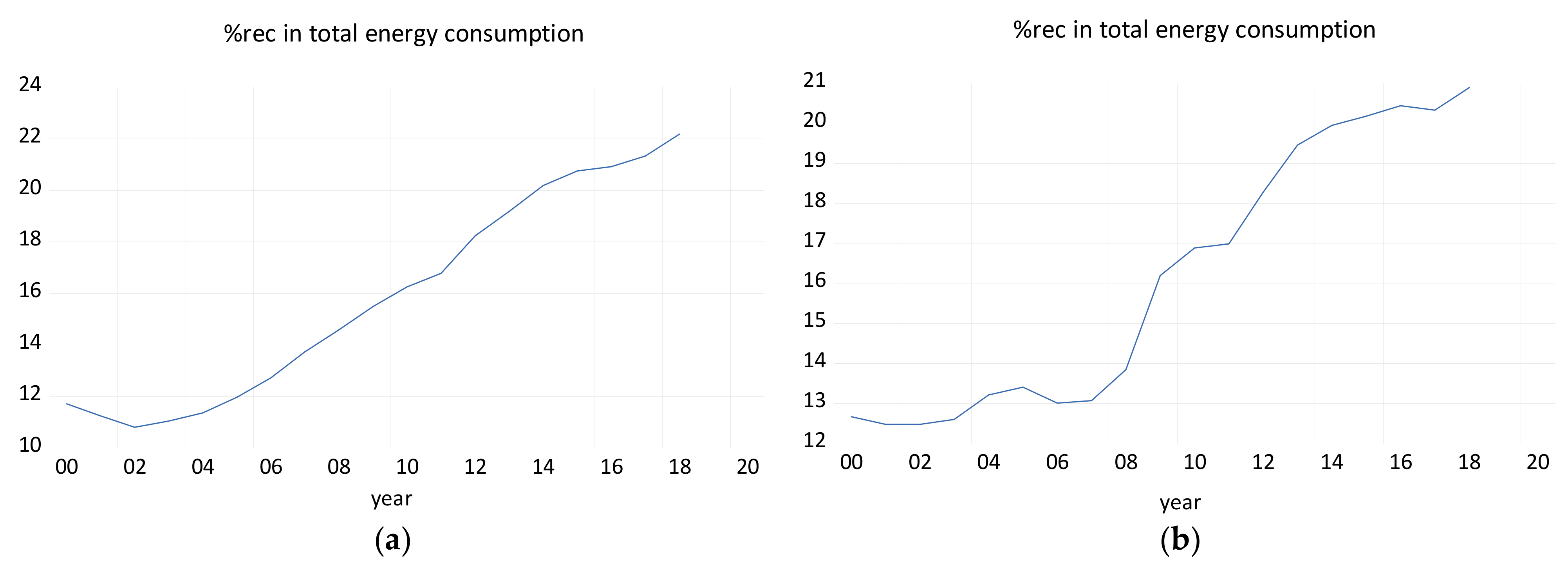

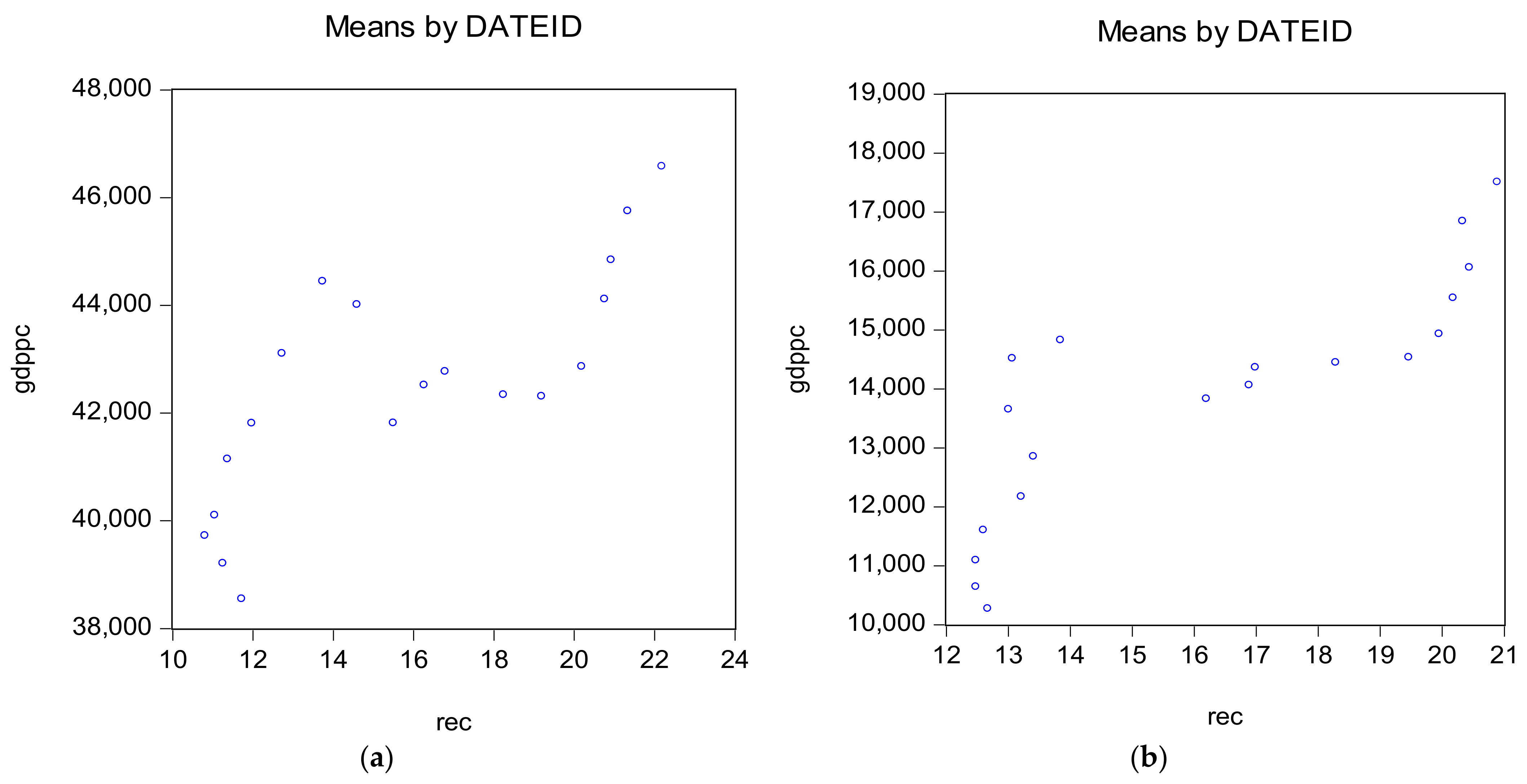

Our research paper’s goal is to estimate effects of renewable (REC) and non-renewable energy consumption (NREC), greenhouse gas (GHG) emissions and ICT on sustainable economic growth, on a sample of EU countries over the 2000–2020 period. We created a model for two groups of countries—old and new EU members by applying the ARDL method, as one of the most used methods in applied economics. The ARDL model allows for the identification of short-run and long-run relationships and can be categorized as an error correction model. The advantage of this approach is that it can be used regardless of whether the variables are integrated I(0) or I(1), and in the case when the dependent variable is integrated of the first order (I(1)). The approach cannot be used only in the case when one of the variables is integrated of the second order (I(2)). In addition, this method offers consistent and efficient estimators as it eliminates the problems resulting from endogeneity by including lag length for both endogenous and exogenous variables [

9]. As the ARDL method may tolerate different lags in different variables, the method is very attractive and flexible. Menegaki [

10] notes that the ARDL approach is more reliable for small samples as compared to Johansen and Juselius’s cointegration methodology. The choice of the most consistent estimation procedure (Mean Group or Pool Mean Group) will be determined by applying the Hausman test, considering individual characteristics (country, region, etc.) to provide a superior assessment of the long-term relationship. Although the MG (group mean) approach assumes heterogeneity of coefficients, adjustment parameter errors, and variances in both the short and long run, the PMG approach assumes heterogeneity of short-run coefficients, while long-run coefficients are assumed to be identical and homogeneous for all individuals in the panel. The estimation of the model for different groups of countries takes into account the heterogeneity in the long-term coefficients by country groups, while in the case of applying the PMG estimator, the homogeneity of the long-term coefficients within the same group of countries is assumed.

The specifics of our research, which represent a contribution to the existing literature, are as follows:

All selected independent variables in our model (NREC, REC, GHG and ICT) can be linked to the concept of sustainable economic growth, which was the criterion for their selection. The inclusion of these independent variables in the model allowed us to evaluate how old and new EU members based economic growth on sustainable foundations in the previous period, which made a contribution to the existing literature in this field. At the same time, this provided an opportunity to define policy implications in the last section of our paper, which represents a certain practical contribution of our research;

Our research covers all EU countries divided into new and old member states. This represents a contribution to the existing literature in the sense that the results of our model provide the possibility of comparative analysis between these two groups of countries;

Our research covered the period 2000–2020, which was marked by various events (global financial, migrant and political crisis) that had an impact on the growth of economies in the old and new EU member countries.

The structure of the paper is as follows. First, we present a brief overview of selected variables in our model, emphasizing the need for countries to base their economic growth on sustainable foundations. In

Section 2, we then offer a detailed overview of the results of numerous empirical research on economic growth determinants included in our model, for EU and other countries. The following section outlines the data and methodology which we used in our model creation. In

Section 4, we present our results accompanied by discussion. The final section offers concluding remarks with recommendations for policymakers who create sustainable economic growth policies.

2. Literature Review

In this section, we focus on the key results of previous empirical research that relate to the effect estimates of determinants included in our model on economic growth in EU countries. We present the results of research covering not only EU, but also other countries, in order to compare obtained results.

Currently, in the world, there are dirty and clean sources of energy. Dirty sources are fossil fuels (coal, natural gas, oil and nuclear energy) related to environmental pollution and are being depleted. In contrast, clean energy comes from natural renewable sources that do not pollute the environment and have a minor negative effect on it. Moreover, clean energy comprises the energy of sun, wind, water (wave, hydropower and tidal energy), geothermal energy and biomass (waste, wood and crops) [

11]. Renewable energy can help countries to develop green economy, to reduce carbon emissions and to achieve the United Nations Sustainable Development Goals [

12]. This reveals the significance of new technologies and policy initiatives targeted on renewable energy. The results of a recent empirical study demonstrate that the renewable energy consumption has a positive impact on economic growth in the EU countries, both in the short and long run, encouraging further development of renewable energy sources [

13]. Armeanu et al. [

14] conclude that renewable energy sources are eco-friendly sources of energy or green energy. Additionally, they consider that renewable energy sources drive sustainable growth through energy and financial savings accomplished by substituting non-renewable energy sources and expensive energy with low-priced renewable energy sources, resulting in slower exhaustion of natural resources. Kahia et al. [

15] warn that most renewable energy technologies can be less competitive than non-renewable energies due to their high level of initial cost of capital and therefore, high electricity costs. This indicates the competitive disadvantage of renewable energy due to the long payback period required to recover the high initial cost of capital.

EU Directive on the promotion of the use of energy from renewable sources [

16], signed in 2009, estimated that in all EU countries by 2020, the use of energy from the renewable sources will be 20%. Across the EU countries, this target varies from 10% to 49%. Pursuant the new Directive signed in 2018, all EU countries should decrease GHG emissions by 2030, for at least 40% compared to 1990 level on one hand, and to increase the share of renewable energy sources up to 32% and increase energy efficiency by at least 32.5%, on another [

17].

Based on the literature review, it can be concluded that the nexus between renewable energy consumption and economic growth is controversial: it ranges from positive, through neutral, to negative [

18]. Some papers also examined the presence of a long-term relationship between renewable and non-renewable energy and economic growth [

19]. In addition, certain studies investigated the existence of short run causality where the results confirmed the relationship that occurs, also, in the long run [

20,

21] where the impact of renewable energy on economic growth was positive. A large number of studies have confirmed the contribution of renewable energy to economic growth. Soava et al. [

22] revealed a positive impact of renewable energy consumption on economic growth, on a sample of EU-28 member states from 1995 until 2015. The Granger causality test indicated both one-way and two-way causal relations between renewable energy consumption and economic growth for different countries. Additionally, Rafindadi and Ozturk [

23] note two-way causal relations between renewable energy consumption and economic growth in Germany in the 1971–2013 period. Therefore, they estimate that a 1% increase in renewable energy consumption contributes to economic growth by 0.2194%. Furthermore, Alper and Oguz [

24] examined the causal relations between economic growth, renewable energy consumption, capital and labor in the new member states of the EU from 1990 until 2009 by applying ARDL approach. They indicated a significant and positive impact for Bulgaria, Estonia, Poland and Slovenia, but insignificant for other new EU countries. On a sample of 20 OECD countries, out of which 12 belong to the old EU group, in the period 1990–2008, Ohler and Fetters [

25] confirmed that renewable energy sources (wind, biomass, waste and hydroelectric power) are positively related with GDP in the long run. In addition, they proved a short-run bidirectional relation only between hydroelectric power and waste and GDP growth. Additionally, in the 1995–2015 period, Saint Akadiri et al. [

26], applying the ARDL approach, found the existence of positive and significant long-term relationship between environmental sustainability, renewable energy consumption and economic growth in EU-28 countries. Inglesi-Lotz [

27] concluded that the renewable energy consumption growth increases GDP and GDP p.c. in the OECD countries (of which 23 countries are EU members) in the 1990–2010 period.

Contrary to the above-presented results, Silva et al. [

28] have warned that renewable energy can initially decrease the growth of the economy in a certain number of EU countries. Chen et al. [

29] proved significant and positive impact of renewable energy consumption on economic growth only when developing countries and non-OECD countries overcome a certain threshold of renewable energy consumption. Otherwise, this impact is negative. Additionally, they confirm no significant impact of renewable energy consumption on economic growth in developed countries and positive and significant impact in OECD members.

A certain number of studies have examined the impact of non-renewable energy sources on economic growth. Coal, oil and natural gas, which are the traditional energy sources, contribute significantly to the economic growth [

30]. However, considering the issues of global warming and GHG emissions, all essential measures need to be taken to avoid environmental disasters. Therefore, the global warming impact on the economy is assessed to decrease the global GDP by 25% [

31]. Therefore, transition from non-renewable to a renewable source of energy is urgently needed. Regarding non-renewable energy, Asiedu et al. [

32] found that an increase of non-renewable energy on the sample of 26 European countries decreases economic growth. So far, non-renewable energy leads to economic growth, but environmental decline. Le et al. [

33] on a sample of 102 countries, which includes all EU countries in the period from 1996 to 2012, found that both renewable and non-renewable energy consumption significantly contribute to income. Their results confirm that renewable energy sources to a significant extent contribute to environmental protection in developed countries. On the contrary, developing countries still have difficulties in utilizing renewable energy sources in order to decrease GHG emissions, which entails substantial scope for policy improvements in this area. Interestingly, Gozgor et al. [

34], using ARDL and panel quantile regression methods on the EU sample during 1990–2013, fount that both economic complexity and consumption of energy from non-renewable and renewable sources are accompanied with increase in economic growth. According to Saqib [

35], non-renewable energy consumption leads to carbon footprint, while green energy sources are more environmentally friendly.

In addition to methane (CH

2), carbon dioxide (CO

2) is the main contributor in the GHG emission inventory leading to planetary heating. Earlier research has found that almost 59% of total GHG emissions are CO

2 emissions, which are dominantly generated by energy consumption and economic growth [

36]. Some studies have found bidirectional causality between carbon emissions and economic growth [

37]. In other studies, only unidirectional causality is found between growth and CO

2 emissions [

38]. Therefore, the relationship between CO

2 emissions and economic growth is of great importance for sustainable economic growth. Numerous empirical findings related to the nexus between CO

2 and economic growth should serve to policy makers to define pollution control policies, which should help strengthen sustainable economic growth and development. Not a small number of studies have indicated that the consumption of primary energy sources has led to GDP growth, but also to high pollution [

39].

A certain number of studies on CO

2 emissions and economic growth relationship cover European countries, including EU member states. Acaravci and Ozturk [

40], on a sample of a certain number of EU countries, found positive long-run elasticity estimates of carbon emissions with respect to real GDP and negative long-run elasticity estimates of carbon emissions with respect to the square of per capita real GDP (at a significance level of 1% in Denmark and 5% in Italy, while statistically insignificant in Germany, Greece, Iceland and Portugal). At the same time, a one-way causal relationship has been noted in Denmark, Germany, Greece, Iceland, Italy, Portugal and Switzerland between energy consumption, real GDP and the square of per capita real GDP on the one hand and carbon emissions per capita on the other. A short-run unidirectional causal relationship is observed in Denmark and Italy between real GDP per capita and the square of per capita real GDP, on the one hand, and carbon emissions per capita, on the other. In general, the results of this research showed that the practices of rationalization of energy consumption and controlled CO

2 emissions in most of the considered countries will not have a negative impact on real output growth. Lee and Brahmasrene [

41] explored the nexus between CO

2 emissions, tourism, FDI and economic growth between 1988 and 2009 for the EU countries. Their results confirmed that CO

2 emissions, FDI and tourism have a positive effect on economic growth, but also that economic growth has had a positive effect on CO

2 emissions. Kasman and Duman [

42], on the sample of new EU members and countries aspiring to become EU members, suggest that in these countries, a decrease of CO

2 emissions should not be expected in the near future if their economic outputs continue to increase. In OECD countries, including EU member states, Sun et al. [

43] concluded that the volume of CO

2 emissions will continue to grow in the long run if economic productivity continues to grow, while policies should focus on increasing the participation of green technology and clean energy, in order to decarbonize the energy industry. Furthermore, Saboori et al. [

44] in 27 OECD countries, including 15 EU countries, confirmed a long-run bidirectional relationship between economic growth, CO

2 emissions and energy consumption in the road sector. Saidi and Hammami [

45] confirmed the negative impact of CO

2 emissions on the economic growth in 60 countries (including a certain number of European countries), finding that a 1% increase in CO

2 emissions reduces economic growth by 0.0067%. In this regard, they recommended investment in clean and alternative energy sources for sustainable economic growth. In three regional sub-panels, including Europe, for the period 1990–2011, Omri et al. [

46] confirmed that CO

2 emissions affected significantly and negatively economic growth in all the panels, including the panel of European countries. Only for the Middle Eastern, North African and sub-Saharan panel, it has been confirmed that CO

2 emissions are positively linked to economic growth. Dogan and Aslan [

47], using a sample of EU countries, pointed to the existence of two-way causality between real income and CO

2 emissions. However, Gardiner and Hajek [

48] determined that CO

2 emissions affect GDP in both the old and new EU member countries, while a negative bidirectional relationship was only confirmed for the 15 old EU countries. Therefore, it is recommended to increase the share of renewable energy sources in the energy mix and increase energy efficiency. A recent study, covering certain number of EU countries, confirmed that there has been no separation of economic growth from CO

2 emissions in France and Spain, which indicates an insufficient reduction in energy consumption from non-renewable sources. However, Sweden has managed to decouple economic growth from CO

2 emissions, making CO

2 emissions less sensitive to variations in GDP, which confirms that environmental policies have not hampered economic growth [

49]. Additionally, Wang et al. [

50] showed that Sweden and other European countries, such as Germany, France, Finland and Denmark, grew with reduced CO

2 emissions, with decarbonization of the energy system being crucial. They also emphasize that decarbonization must be further accelerated if the Paris climate target is to be achieved. Moreover, the authors warn that the challenges of reconciling the economic growth goals and climate change mitigation are complicated by further support of fossil fuel production and emission-intensive industries, without using the influence of public policy as climate-relevant for changing economic structure. A study covering Germany in the period 1975–2014 determined the long-run relationship between CO

2, energy consumption and economic growth, and recommended the introduction of energy tax and regulatory mechanisms to limit the use of fossil fuels and encourage the use of hydropower and biomass as green energy sources [

51].

Numerous studies that investigated the nexus between CO

2 emissions and economic growth were conducted on the sample of developing and countries that are significant emitters of GHG emissions. Analyzing the relationship between CO

2 and economic growth in selected higher CO

2 emissions economies, Azam et al. [

52] concluded that uncontrolled CO

2 emissions have a destructive effect on economic growth if the use of green economies and good environmental practices are lacking. This research confirmed that in some countries, e.g., the USA, China and Japan, the results for the individual analysis across countries, over the period from 1971 to 2013, showed that CO

2 emissions have a significant and positive relationship with economic growth. On the contrary, in India, as one of the largest emitters of CO

2, a negative impact of CO

2 emissions on economic growth is found, which can serve as a good basis for further policy implications, and to force economic development on a sustainable basis. However, Wang et al. [

53] confirmed separation of economic growth from CO

2 emissions in the USA, in the period 2007–2016, when energy-related CO

2 emissions fell by 12% (with a total of 738.14 million metric tons), while GDP increased by 19%. Bozkurt and Akan [

54] found a positive relationship between CO

2 emissions and economic growth and warned that achieving long-term growth and development with high carbon emissions may damage the quality of the environment. They suggest that solution in these countries should be sought in the mechanisms of CO

2 emission control and the implementation of regulatory policies to reduce emissions. Additionally, the results of another study show that total primary energy and CO

2 consumption have a long-run and positive causal relationship with GDP growth in developing countries, which leads to high levels of pollution [

55]. Ahmad and Du [

56] confirm the existence of a long-run and positive relationship between CO

2 emission and economic growth. Therefore, they suggest a greater focus on sectors that require less energy consumption, as well as reducing non-renewable energy consumption. Adebayo [

57] noted that CO

2 emissions, energy use, urbanization and globalization were driving economic growth in Japan for the period 1970–2015. Borhan et al. [

58] in ASEAN-8 countries determined a negative relationship between CO

2 emissions and GDP p.c., which confirms the long-term destructive effect of environmental pollution on economic prosperity. Interestingly, some studies have confirmed that economic growth does not have to be accompanied by growth of CO

2 emissions, i.e., it can be achieved without endangering the quality of the environment [

59,

60]. Therefore, the development of low-carbon economies and the adaptation of industrial structures are the basic levers for achieving the climate change mitigation goal. Additionally, the experience of some countries has shown a different relationship between CO

2 and economic growth, depending on the country’s stage of development [

55]. In the first phase, when the country’s development is based on less energy-intensive activities (agriculture, fisheries, forestry), there is a negative path between CO

2 and economic growth (emissions fall, GDP grows). In the industrialization phase, it shows the positive path (emissions grow, GDP grows), while in the third phase, when the country focuses on green energy policy, it again shows the negative path between CO

2 emissions and GDP growth. Therefore, the recommendation of this study is to constantly balance economic and environmental conditions, where renewable energy has a significant role in the balancing process and the realization of the interests of sustainable development.

ICT has been recognized as one of the key factors of economic growth for two decades. According to the World Bank [

61] (p. 20) definition, ICT includes “hardware, software, networks, and media collection, storage, processing, transmission, and presentation of information (voice, data, text, images)”. Intensive and rapid expansion of ICT, especially in the last two decades, has encouraged research on the impact of this technology on economic growth in EU countries. Both developed and underdeveloped economies have turned to ICT, which is used as a modern tool to increase competitiveness, employment and economic growth. Therefore, some research has recognized this technology as a driver of economic growth in both developed and developing countries [

62]. It is noticeable that the development of ICT is not homogeneous, but in both groups of countries, there are pronounced differences between regions. In addition, countries need to be as interested as possible in investing in ICT because the greater the investment in this technology, the greater the return on these investments.

The benefits of using ICT are multiple: promoting and developing entrepreneurship and sustainable development [

63,

64], faster and cheaper access to new markets [

65,

66], reduced production costs and increased productivity [

67,

68], fast and efficient access to new information and knowledge [

69,

70]. The dominant number of empirical studies has confirmed that this technology has significant economic implications, and that it is an important driver of economic growth. Empirical evidence relates to productivity growth, poverty reduction, and increasing economic growth. Relevant international institutions recognize ICT as a key factor of economic growth. Accordingly, the World Economic Forum [

71] in its 2013 report confirmed that an increase in digitalization by 10% leads to a decrease in unemployment by 1.02% and an increase in GDP p.c. to 0.75%. With the generation of new jobs and sources of income, and the reduction of costs of health and education services, this technology has long been recognized as one of the key actors in poverty reduction [

72].

Previous studies have focused on the impact of telecommunications, as an important aspect of ICT, on economic growth. Thus, research conducted on the sample of CEE countries confirmed the nexus between telecommunication investment, as part of ICT investment, and economic growth. Moreover, further increase in these investments can improve the impact of aggregate investment on economic growth [

73]. Similarly, Roller and Waverman [

74] in OECD countries, including old EU members, found that a 10% increase in telecommunications investment increases GDP by 2.8%, while Datta and Agarwal [

75], for the same group of countries, confirmed a statistically significant and positive correlation between these two variables. In addition, a study on the impact of ICT on economic growth conducted for OECD countries, dominantly including European countries, found that the broadband penetration rate of 10% leads to an increase in GDP p.c. by 0.9–1.5% [

76]. Another study offered similar results, for EU countries belonging to the OECD, proving that ICT positively impacts GDP growth [

77]. Furthermore, Shiu and Lam [

78] found in over 100 countries a two-way relationship between telecommunications and economic growth in European and high-income countries, while in other countries in the sample, the impact of GDP on telecommunications investment was identified. Additionally, Pradhan et al. [

79,

80] detected a bidirectional causal relationship between telecommunications development and economic growth (long-term and short-term), in both developed and developing countries. Similarly, another study that was regionally conceived confirmed the impact of telecommunications on income at the regional level [

81]. Moreover, Hanclova et al. [

82] confirmed the influence of ICT capital on economic growth in old and new EU countries and demonstrated that the elasticity in new EU was higher compared to the old EU group.

Subsequent research focused more on the impact of internet on economic growth. Thus, research including a large number of countries and using cross-country data assessed that internet access is statistically significant and positively correlated with economic growth, which contributes to the effect of knowledge and information spillovers across countries [

83]. Another study did not establish a direct relationship between internet use and economic growth, but an indirect one, through trade openness [

68], finding that internet use contributes more to trade in countries lower-income than in high-income countries. Salahuddin and Gow [

84] obtained similar results. Namely, their findings from ARDL cointegration tests confirmed the positive and long-term effects of internet use on economic growth, while the short-term relationship between these variables is found to be statistically insignificant. Therefore, the policy implication of this research was a further increase in investment in internet infrastructure development. Chen et al. [

64] examined the impact of the internet on better access to external financing, which overcomes the financial difficulties of small and micro businesses in particular. Overcoming the information asymmetry and reducing agency costs improves the credit availability of companies, which contributes to their sustainable development. Najarzadeh et al. [

85] confirmed the positive and statistically significant impact of internet use on productivity growth. Their research showed that increasing the number of internet users by 1% increases GDP per employee by USD 8.16–14.6. Based on the findings, policy implications of this research were related to subsidizing the bringing of the internet to remote locations, taking initiatives to reduce internet membership fees, expanding internet bands and strengthen internet security.

Numerous studies have identified statistically significant and positive effects of ICT investment on economic growth [

86,

87], which implies that it is necessary to implement special policies that facilitate ICT investment, in order to improve economic growth. Another study found that a 10% increase in fixed broadband penetration increases GDP p.c. growth by more than 1%, both in developed and developing countries [

88]. Crandall and Singer [

89] offer similar results which showed that increasing broadband investments affects job creation and employment and intensifies economic growth, while Thompson and Garbacz [

90] proved that mobile broadband has a positive and significant impact on GDP per household, with a greater impact in underdeveloped countries. A positive impact of broadband adoption on economic growth was confirmed in a study covering EU countries for the period 2005–2011 [

91], where in the defined scenario, the total benefits outweigh the costs by over 30% at EU level. This implies the recommendation for public support for the generalized build out of broadband infrastructure. The research on the sample of CEE countries [

92] pointed out the significant and positive impact of investment in ICT on GDP p.c., which is why incentives for technological development and investment in this technology should be provided. Interestingly, Yousefi [

93] did not confirm the contribution of ICT investment on GDP in developing countries, and concluded that impact of ICT is stronger in high-income countries, compared to low-income countries. Additionally, one study showed that investments in ICT are important for increasing the cost efficiency of banking sector [

94], while another assessed the impact of internet banking on improving the efficiency of banks [

95,

96]. Similarly, recent studies have confirmed a significant and positive impact of ICT investment on economic growth [

97,

98,

99,

100].

The research above is summarized in

Table 1. By reviewing the literature, it can be concluded that a small number of studies simultaneously covered new and old EU countries. Namely, studies predominantly cover the EU as a whole, only old or only new EU countries, or certain groups within new or old EU members. By including in our research all EU countries, divided into groups of new and old, we find that we have made a contribution to the existing literature. The literature manifests that there is not a single empirical study that has attempted to estimate effects of REC, NREC, GHG and ICT on GDP p.c. We emphasize that all selected independent variables in our model can be linked to the concept of sustainable economic growth, which was the criterion for the selection of variables. Our paper aims to examine the extent to which EU countries, grouped as old and new members, based their economic growth on sustainable basis, in the period 2000–2020, thus contributing to the existing sustainable economic growth literature. The period included in our model was marked by the global financial crisis, the migrant and political crisis of the Eurozone member countries, all of which had an impact on the growth of EU economies.

4. Results and Discussion

In this section, we present our results, followed by discussion and comparative analysis.

Table 5 shows the results of Pesaran’s CD test of data interdependence [

102] for the observed series. The null hypothesis claims that there is no interdependence between the data. Based on the calculated

p-values, we reject the null hypothesis, except for the variable lnict in new EU countries. According to the determined interdependence of data for all variables, second-generation unit root tests will be conducted, which are robust in relation to the determined dependence.

Conducting the unit root test of the second generation, Pesaran [

102] examined the stationarity of the variables.

Table 6 shows the results of the unit root test for the original data and for the first data difference for both groups of countries. For further application of panel ARDL analysis, it is necessary that all variables be of the order of integration I (0) or I (1). If the variables of the order of integration are greater than I (1), they cannot be used in further analysis.

At the level of both groups of analyzed countries, all variables meet the required condition, and are stationary on the first difference. In addition, the variable logarithm of the GDP p.c. in both groups of countries at the level is non-stationary, but differentiation gives its stationary representation. In old EU countries, all remaining variables are stationary and also at the data level. In the new EU group of countries, only the variable logarithm of the share of ICT in total exports is stationary at the level, while the other variables are nonstationary. Identical results for the variable lnict in the new EU countries are obtained if the first generation of unit root tests are applied. The number of lags during the test was determined by minimizing the Akaike information criterion.

In order to determine the cointegration between the panels, we applied the Kao and Pedroni cointegration tests. Based on the results of the conducted cointegration tests between the panels for both groups of countries, shown in

Table 7, we can conclude that there is a cointegration relationship between the variables. Namely, the test results indicate that there is a long-term relationship between the variables, so that an adequate panel ARDL model can be estimated.

The corresponding panel ARDL (1,1,1,1) model was evaluated using PMG estimator based on the results of the conducted Hausman test. As aforementioned, the aim of our paper is to examine the relationships between gross GDP p.c. and other analyzed variables.

Table 8, which follows, presents the estimated models for both groups of countries. Observing both models, we notice that the error correction coefficients are statistically significant and negative, which means that the models return to equilibrium after external shock. The values of the error correction coefficients are approximate, so after the external shock, the model for the old EU member states is adjusted to equilibrium by 13.4%, while the model estimated for the new EU member countries is adjusted to equilibrium by 13.2% in each time period.

According to

Table 8, in the continuation, we present the interpretation of our final results:

Based on the estimated model for the old EU member states, we find that the growth of the share of renewable energy consumption of 1% in the long run leads to a significant growth of GDP p.c. by 0.151% in the old EU countries, and 0.067% in the new EU countries. Contrary, the growth of the share of energy consumption from non-renewable sources has a significant and negative impact on GDP p.c. in the long run, in both groups, leading to a decrease of GDP p.c. by 0.512% and 1.306%, respectively, for the old and new EU group if the share of energy consumption from this source increases by 1%. Interestingly, an increase in the share of energy consumption from non-renewable sources of 1% in the long run has a significant and positive impact on the reduction of GDP p.c. by 1.306%, in the new EU countries. In the short run, the growth of renewable energy consumption by 1% decreases GDP p.c. by 0.339%.

Results of recent studies on the impact of non-renewable and renewable energy consumption on economic growth confirm the results of our research. Therefore, Soava et al. [

22] found a positive impact of renewable energy consumption on economic growth, in EU-28 countries, for the period 1995–2015. Additionally, Chen et al. [

29] found that the impact of renewable energy consumption on economic growth is significant and positive when countries overcome a certain threshold of renewable energy consumption. Similarly, Inglesi-Lotz [

27] found that the increase in renewable energy consumption increases GDP and GDP p.c. in the OECD countries, including 23 EU countries, in 1990–2010 period. Furthermore, Rafindadi and Ozturk [

23] revealed bidirectional relations between renewable energy consumption and economic growth in Germany from 1971 to 2013, and demonstrated that a 1% increase in consumption of renewable energy leads to economic growth by 0.2194%. Interestingly, Alper and Oguz [

24] on the sample of new EU countries in 1990–2009 found significant and positive impact between these two variables only for Bulgaria, Estonia, Poland and Slovenia, while being insignificant for other countries. For 20 OECD countries, out of which 12 belong to the old EU group, in the 1990–2008 period, Ohler and Fetters [

25] indicate that renewable energy sources are positively related with GDP in the long run.

We also find support for our results in the impact of non-renewable sources on economic growth in other studies. Therefore, Asiedu et al. [

32] found that a rise in non-renewable energy in the 26 European countries, from 1990 to 2018, decreases economic growth. So far, non-renewable energy leads to economic growth, but environmental decline. However, the results of some other research do not fully overlap with our results. For example, Le et al. [

33], studying a sample of around 100 countries, which includes all EU countries in the period 1996 to 2012, proved that both renewable and non-renewable energy consumption contribute significantly to income. They noted that renewable energy sources contribute significantly to environmental protection in developed countries, while developing countries are still struggling to utilize these sources to tackle GHG emissions. Gozgor et al. [

34] reported similar results.

In old EU countries, the impact of GHG emissions is not statistically significant in the long run, while a short-term increase in GHG emissions of 1% leads to an increase in GDP p.c. by 0.205%. On the other hand, in the new EU group, the impact of GHG emissions is significant, whereby an increase of 1% is accompanied by GDP p.c. increase of 0.939% in the long run.

Comparing the results of our research with the results of others, we note that the results of numerous other studies have confirmed the positive relationship between CO

2 emissions and economic growth [

53], but also warned on environmental degradation if long-term growth and development are achieved with CO

2 emissions. Additionally, Lee and Brahmasrene [

41] confirmed that CO

2 emissions, FDI and tourism have a positive effect on economic growth. Similarly, Al-Mulali and Sab [

39], for a sample of developing countries, confirmed that the consumption of primary energy and CO

2 has a long-run and a positive impact on GDP growth, with high emissions. Therefore, Ahmad and Du [

56], with similar results, suggested a greater orientation of the economic structure towards sectors that are smaller consumers of electricity, as well as basing economic growth on green energy consumption. On the sample of European countries, Piłatowska and Geise [

49] confirmed that some countries have unfortunately not yet fully decoupled economic growth from CO

2 emissions, although some European countries have succeeded in doing so without slowing economic growth. Saidi and Hammami [

45], on a sample of European countries, also confirmed that the correlation between CO

2 emissions and economic growth is positive and statistically significant, while Kasman and Duman [

42] warn that CO

2 emissions should not be expected to fall if GDP grows. We can conclude that our results suggest that EU countries need to further direct their economic growth towards growth on a sustainable basis.

In both groups of countries, in the long term, an increase of the share of ICT products in total exports by 1% leads to an increase of GDP p.c. by 0.168% and 0.039% in the old and the new EU group, respectively.

Our results on the impact of ICT on economic growth have strong support in the results of other research. Namely, a significant number of empirical studies have confirmed the statistically significant and positive impact of ICT on economic growth and its role in economic growth on a sustainable basis. The importance of further development of modern ICT technologies can be compared with the greatest technological achievements of mankind. Broadband can help the transition to the “low carbon” economies, effective action against climate change and the effects it produces. As it can be concluded from the literature review (

Section 2), numerous studies have confirmed the positive impact of telecommunications on economic growth [

73,

74,

75,

81]. When the internet took a key role in the development of ICT, a large number of studies confirmed the positive correlation of the internet with economic growth [

83]. Some research confirmed the indirect impact of the internet on economic growth, through trade openness [

68,

84], which encouraged rapid and intensive development of internet infrastructure. A recent study on the sample of Eurozone countries confirmed the positive impact of ICT on economic growth, with the contribution of this technology to economic growth being particularly emphasized in the period of global financial crisis [

105].

Comparing our study with the existing literature, we find that our research is characterized by some specificities that contribute to its novelty and originality. Studies in the previous period were not dominantly focused on the dimension of economic growth sustainability. Our model does not include typical economic variables (e.g., unemployment rate, inflation, FDI, trade openness, gross fixed capital formation, etc.), but variables with an impact on sustainable economic growth (REC, NREC, GHG and ICT). Thus, the goal of our research is to determine whether and to what extent the EU countries in the previous twenty-year period based its growth/grew on a sustainable basis. In our paper, we consider the impact of variables in the short and long term on sustainable economic growth, while in other studies covering EU countries, the impact was mainly considered only in the long term [

24,

26,

32,

47,

62,

81].

Previous research usually/dominantly treats either only the old, or only the new EU countries [

23,

24,

42,

51,

81], or the EU as a whole [

13,

14,

22,

26,

32,

41,

48,

82,

91], or groups within one of these two groups of countries [

49,

92]. In our research, we separately covered old and new EU countries, which allowed us to compare the results between these two groups of countries, which contributed to existing literature.

Our paper covered the long and recent period (2000–2020), which included the latest impacts of variables from our model on the economic growth of EU countries.

In our paper, we consider the impact of total GHG emissions, while other studies that included EU countries usually observed only the impact of CO

2 gas emissions on economic growth [

40,

41,

43,

44,

45,

47,

48,

49].