Contract Coordination of Fresh Agri-Product Supply Chain under O2O Model

Abstract

1. Introduction

- (1)

- With centralized decision making, how does the cooperation and non-cooperation between line and offline affect the profitability of supply chain members and the overall profitability of the supply chain?

- (2)

- How can coordination mechanisms be designed to increase total profitability under decentralized decision-making and achieve improvements in the fresh produce supply chain?

- (1)

- As a single benefit-sharing model can no longer meet the benefit-sharing model of the O2O supply chain, this paper proposes a benefit-sharing contract model based on channel cooperation, which can achieve effective integration and allocation of resources between online and offline channels and better coordination of interests between supply chain members by taking advantage of the lower cost of retailer preservation efforts.

- (2)

- Compared with the traditional supply chain, the model of this paper shortens the circulation link to a certain extent, and the cooperation between online and offline channels can better realize the effective integration and allocation of resources, improve circulation efficiency and reduce logistics costs. The coordination of interests of supply chain members through game analysis and reasonable contract mechanisms can ensure the stability of the supply chain to a certain extent and has certain reference value for enterprise operations.

2. Literature Review

2.1. Fresh Products Supply Chain Coordination

2.2. O2O Model

2.3. Research Gaps

3. Model Formulation

3.1. Assumptions and Variables

3.2. Notations and Definitions

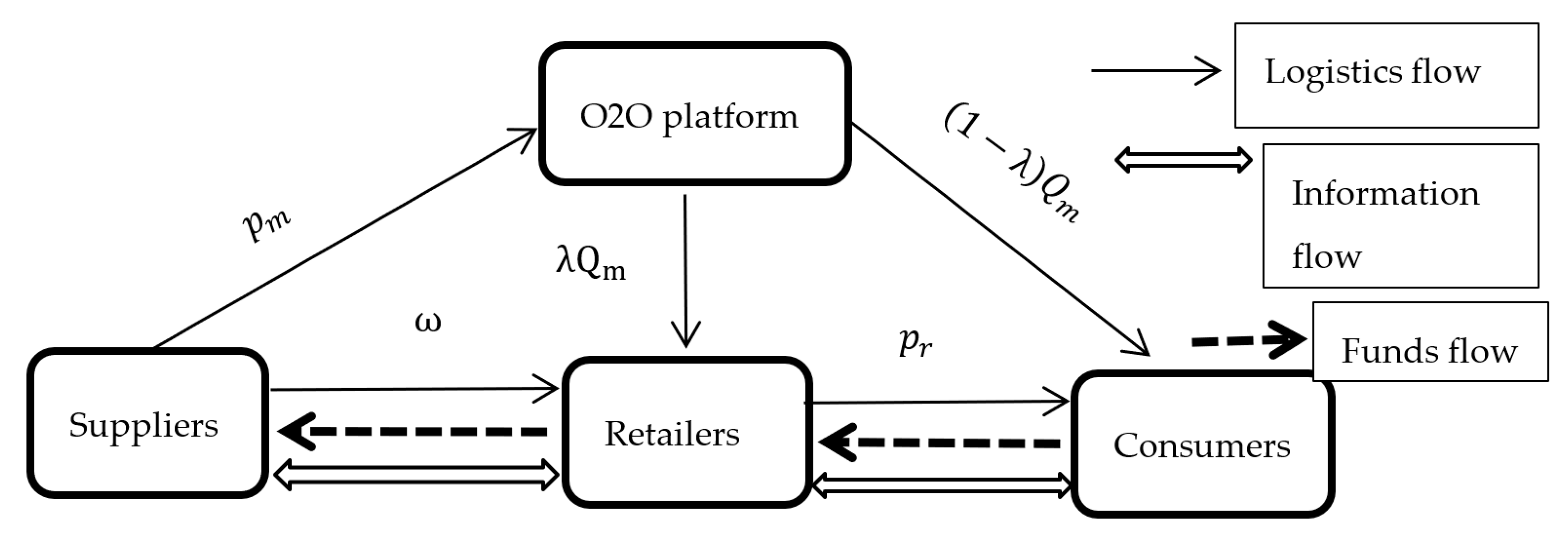

3.3. Model Framework

4. Model Analysis

4.1. Supply Chain Centralised Decision Model Construction and Analysis

4.2. Supply Chain Decentralisation Decision Model Construction and Analysis

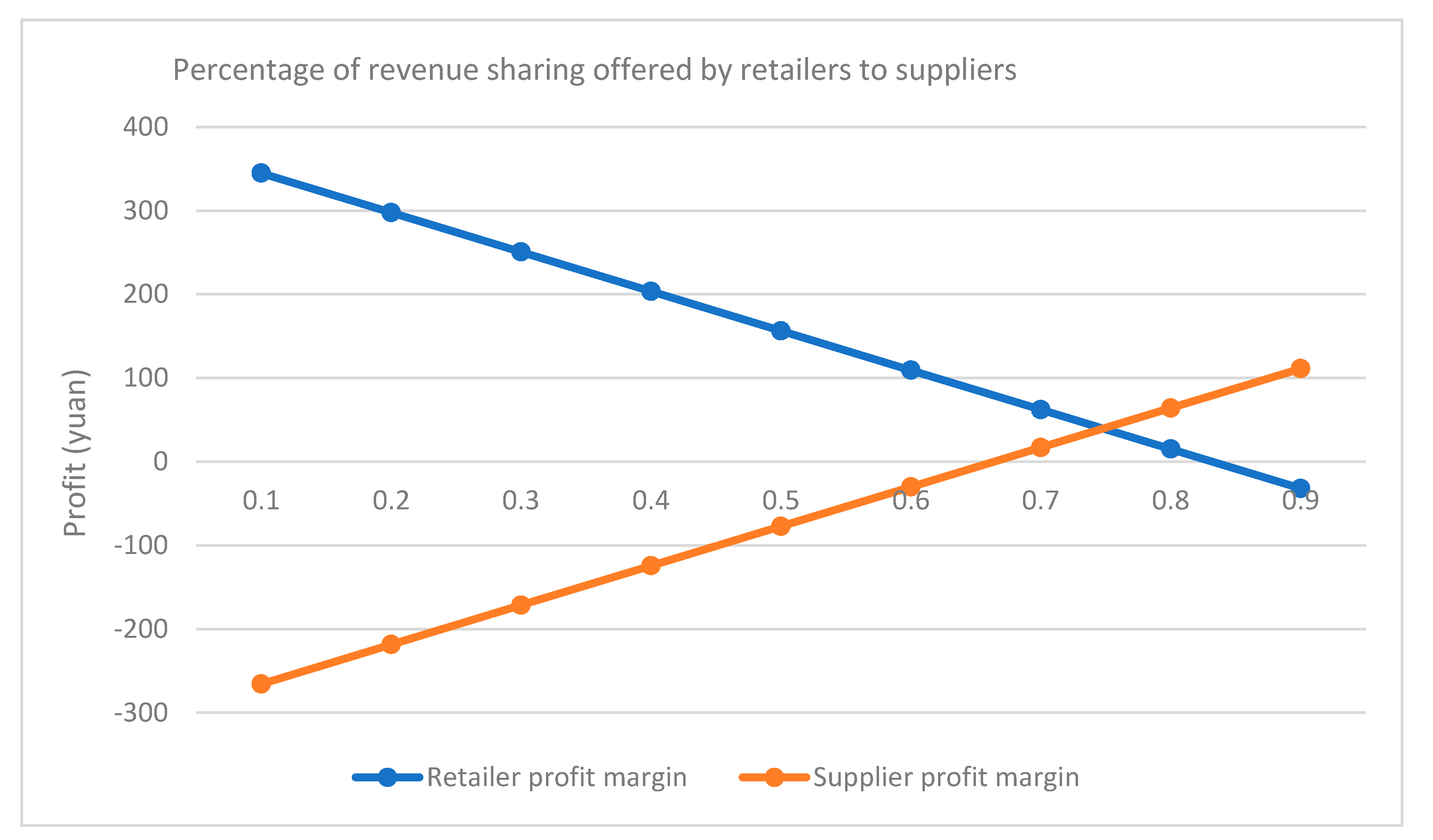

4.3. Dual-Channel Supply Chain Contract Coordination

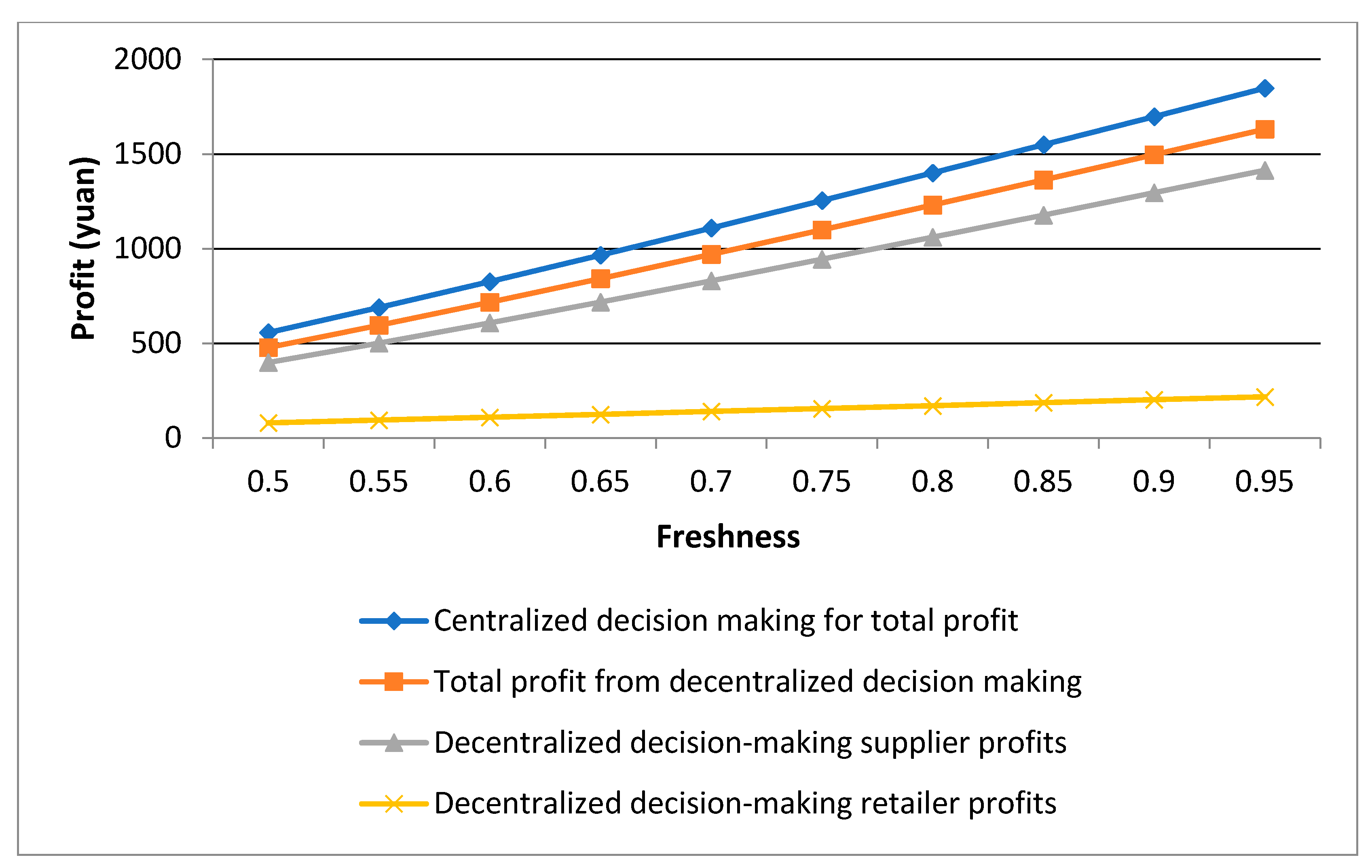

5. Numerical Simulation Analysis

6. Discussion and Managerial Insights

6.1. Discussion

6.2. Managerial Insights

7. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Appendix A. Proof of Proposition 1

Appendix B. Proof of Proposition 2

Appendix C. Proof of Proposition 3

References

- Nong, G.; Pang, S. Coordination of Agricultural Products Supply Chain with Stochastic Yield by Price Compensation. IERI Procedia 2013, 5, 118–125. [Google Scholar] [CrossRef]

- Qiu, F.; Hu, Q.; Xu, B. Fresh Agricultural Products Supply Chain Coordination and Volume Loss Reduction Based on Strategic Consumer. Int. J. Environ. Res. Public Health 2020, 17, 7915. [Google Scholar] [CrossRef] [PubMed]

- Villalobos, J.R.; Soto-Silva, W.E.; González-Araya, M.C.; González–Ramirez, R.G. Research directions in technology development to support real-time decisions of fresh produce logistics: A review and research agenda. Comput. Electron. Agric. 2019, 167, 105092. [Google Scholar] [CrossRef]

- Yang, L.; Tang, R. Comparisons of sales modes for a fresh product supply chain with freshness-keeping effort. Transp. Res. Part E Logist. Transp. Rev. 2019, 125, 425–448. [Google Scholar] [CrossRef]

- Ryu, M.H.; Cho, Y.; Lee, D. Should small-scale online retailers diversify distribution channels into offline channels? Focused on the clothing and fashion industry. J. Retail. Consum. Serv. 2019, 47, 74–77. [Google Scholar] [CrossRef]

- Wang, C.; Wang, Y.; Wang, J.; Xiao, J.; Liu, J. Factors influencing consumers’ purchase decision-making in O2O business model: Evidence from consumers’ overall evaluation. J. Retail. Consum. Serv. 2021, 61, 102565. [Google Scholar] [CrossRef]

- Zhang, M.; Ren, C.; Wang, G.A.; He, Z. The impact of channel integration on consumer responses in omni-channel retailing: The mediating effect of consumer empowerment. Electron. Commer. Res. Appl. 2018, 28, 181–193. [Google Scholar] [CrossRef]

- Thaichon, P.; Phau, I.; Weaven, S. Moving from multi-channel to Omni-channel retailing: Special issue introduction. J. Retail. Consum. Serv. 2020, 65, 102311. [Google Scholar] [CrossRef]

- Chen, J.; Gui, P.; Ding, T.; Na, S.; Zhou, Y. Optimization of Transportation Routing Problem for Fresh Food by Improved Ant Colony Algorithm Based on Tabu Search. Sustainability 2019, 11, 6584. [Google Scholar] [CrossRef]

- Zhao, Z.; Li, X.; Zhou, X. Distribution Route Optimization for Electric Vehicles in Urban Cold Chain Logistics for Fresh Products under Time-Varying Traffic Conditions. Math. Probl. Eng. 2020, 2020, 1–17. [Google Scholar] [CrossRef]

- Baker, K.R. Computational results for the flowshop tardiness problem. Comput. Ind. Eng. 2013, 64, 812–816. [Google Scholar] [CrossRef]

- Herrmann, F. Using Optimization Models for Scheduling in Enterprise Resource Planning Systems. Systems 2016, 4, 15. [Google Scholar] [CrossRef]

- Cai, X.; Chen, J.; Xiao, Y.; Xu, X.; Yu, G. Fresh-product supply chain management with logistics outsourcing. Omega 2013, 41, 752–765. [Google Scholar] [CrossRef]

- Xiao, Y.-B.; Chen, J.; Xu, X.-L. Fresh Product Supply Chain Coordination under CIF Business Model with Long Distance Transportation. Syst. Eng. Theory Pract. 2008, 28, 19–34. [Google Scholar] [CrossRef]

- Saberi, Z.; Saberi, M.; Hussain, O.; Chang, E. Stackelberg model based game theory approach for assortment and selling price planning for small scale online retailers. Future Gener. Comput. Syst. 2019, 100, 1088–1102. [Google Scholar] [CrossRef]

- Song, H.; Gao, X. Green supply chain game model and analysis under revenue-sharing contract. J. Clean. Prod. 2018, 170, 183–192. [Google Scholar] [CrossRef]

- Ge, H.; Goetz, S.J.; Cleary, R.; Yi, J.; Gómez, M.I. Facility locations in the fresh produce supply chain: An integration of optimization and empirical methods. Int. J. Prod. Econ. 2022, 249, 108534. [Google Scholar] [CrossRef]

- Li, H. O2O-Based Agricultural Products Supply Chain Process Integration Optimization Based on Internet +. MATEC Web Conf. 2017, 100, 02036. [Google Scholar] [CrossRef]

- Bettis, R.; Gambardella, A.; Helfat, C.; Mitchell, W. Quantitative Empirical Analysis in Strategic Management. Strateg. Manag. J. 2014, 35, 949–953. [Google Scholar] [CrossRef]

- Robnik-Šikonja, M.; Kononenko, I. Theoretical and Empirical Analysis of ReliefF and RReliefF. Mach. Learn. 2003, 53, 23–69. [Google Scholar] [CrossRef]

- Cai, X.; Chen, J.; Xiao, Y.; Xu, X. Optimization and Coordination of Fresh Product Supply Chains with Freshness-Keeping Effort. Prod. Oper. Manag. 2010, 19, 261–278. [Google Scholar] [CrossRef]

- Yan, B.; Wu, J.; Jin, Z.; He, S. Decision-making of fresh agricultural product supply chain considering the manufacturer’s fairness concerns. 4OR 2020, 18, 91–122. [Google Scholar] [CrossRef]

- Mohammadi, H.; Ghazanfari, M.; Pishvaee, M.S.; Teimoury, E. Fresh-product supply chain coordination and waste reduction using a revenue-and-preservation-technology-investment-sharing contract: A real-life case study. J. Clean. Prod. 2019, 213, 262–282. [Google Scholar] [CrossRef]

- Zhou, L.; Zhou, G.; Qi, F.; Li, H. Research on coordination mechanism for fresh agri-food supply chain with option contracts. Kybernetes 2019, 48, 1134–1156. [Google Scholar] [CrossRef]

- Wan, N.; Li, L.; Wu, X.; Fan, J. Coordination of a fresh agricultural product supply chain with option contract under cost and loss disruptions. PLoS ONE 2021, 16, e0252960. [Google Scholar] [CrossRef]

- Arani, H.V.; Rabbani, M.; Rafiei, H. A revenue-sharing option contract toward coordination of supply chains. Int. J. Prod. Econ. 2016, 178, 42–56. [Google Scholar] [CrossRef]

- Zhang, K.; Gao, J. Coordination Strategy of Dual-Channel Supply Chain for Fresh Product Under the Fresh-Keeping Efforts. Int. J. Emerg. Trends Soc. Sci. 2018, 4, 75–85. [Google Scholar] [CrossRef][Green Version]

- Moon, I.; Jeong, Y.J.; Saha, S. Investment and coordination decisions in a supply chain of fresh agricultural products. Oper. Res. 2018, 20, 2307–2331. [Google Scholar] [CrossRef]

- Song, Z.; He, S. Contract coordination of new fresh produce three-layer supply chain. Ind. Manag. Data Syst. 2019, 119, 148–169. [Google Scholar] [CrossRef]

- Yan, B.; Chen, X.; Cai, C.; Guan, S. Supply chain coordination of fresh agricultural products based on consumer behavior. Comput. Oper. Res. 2020, 123, 105038. [Google Scholar] [CrossRef]

- Kang, M.; Gao, Y.; Wang, T.; Wang, M. The Role of Switching Costs in O2O Platforms: Antecedents and Consequences. Int. J. Smart Home 2015, 9, 135–150. [Google Scholar] [CrossRef]

- Ding, H.; Jiang, L. Research on Online to Offline Mobile Marketing Based on Specific Needs. In Liss 2013; Springer: Berlin, Germany, 2015; pp. 295–300. [Google Scholar]

- Kong, L.; Liu, Z.; Pan, Y.; Xie, J.; Yang, G. Pricing and service decision of dual-channel operations in an O2O closed-loop supply chain. Ind. Manag. Data Syst. 2017, 117, 1567–1588. [Google Scholar] [CrossRef]

- Tang, R.; Yang, L. Financing strategy in fresh product supply chains under e-commerce environment. Electron. Commer. Res. Appl. 2020, 39, 100911. [Google Scholar] [CrossRef]

- Li, Y.; Xiong, Y.; Mariuzzo, F.; Xia, S. The underexplored impacts of online consumer reviews: Pricing and new product design strategies in the O2O supply chain. Int. J. Prod. Econ. 2021, 237, 108148. [Google Scholar] [CrossRef]

- Li, J.; Zheng, Y.; Dai, B.; Yu, J. Implications of matching and pricing strategies for multiple-delivery-points service in a freight O2O platform. Transp. Res. Part E Logist. Transp. Rev. 2020, 136, 101871. [Google Scholar] [CrossRef]

- Govindan, K.; Malomfalean, A. A framework for evaluation of supply chain coordination by contracts under O2O environment. Int. J. Prod. Econ. 2019, 215, 11–23. [Google Scholar] [CrossRef]

- Qiu, R.; Yu, Y.; Sun, M. Supply chain coordination by contracts considering dynamic reference quality effect under the O2O environment. Comput. Ind. Eng. 2022, 163, 107802. [Google Scholar] [CrossRef]

- Pei, Z.; Wooldridge, B.R.; Swimberghe, K.R. Manufacturer rebate and channel coordination in O2O retailing. J. Retail. Consum. Serv. 2021, 58, 102268. [Google Scholar] [CrossRef]

- Yang, H.; Peng, J. Coordinating a fresh-product supply chain with demand information updating: Hema Fresh O2O platform. RAIR—Oper. Res. 2021, 55, 285–318. [Google Scholar] [CrossRef]

- Ha, A.Y.; Tong, S.; Zhang, H. Sharing Demand Information in Competing Supply Chains with Production Diseconomies. Manag. Sci. 2011, 57, 566–581. [Google Scholar] [CrossRef]

- Zhao, L. Coordinating of O2O Fresh Agricultural Products Supply Chain with Asymmetric Information When Disturbance Occur Online. J. Manag. Sustain. 2017, 7, 132. [Google Scholar] [CrossRef][Green Version]

- Ardjmand, E.; Weckman, G.R.; Young, W.A.; Sanei Bajgiran, O.; Aminipour, B. A robust optimisation model for production planning and pricing under demand uncertainty. Int. J. Prod. Res. 2016, 54, 3885–3905. [Google Scholar] [CrossRef]

- Englberger, J.; Herrmann, F.; Manitz, M. Two-stage stochastic master production scheduling under demand uncertainty in a rolling planning environment. Int. J. Prod. Res. 2016, 54, 6192–6215. [Google Scholar] [CrossRef]

- Song, J.M.; Chen, W.; Lei, L. Supply chain flexibility and operations optimisation under demand uncertainty: A case in disaster relief. Int. J. Prod. Res. 2018, 56, 3699–3713. [Google Scholar] [CrossRef]

- Thevenin, S.; Adulyasak, Y.; Cordeau, J.F. Material Requirements Planning Under Demand Uncertainty Using Stochastic Optimization. Prod. Oper. Manag. 2020, 30, 475–493. [Google Scholar] [CrossRef]

| Literature | Types of Contracts in the Supply Chain | Involves Online and Offline Cooperation | ||||

|---|---|---|---|---|---|---|

| Revenue-Sharing Contract | Fresh-Keeping Cost-Sharing Contract | Investment Cost-Sharing Contract | Price Discount Contract | Option Contract | ||

| Yan et al. [22] | √ | |||||

| Zhang and Gao [27] | √ | √ | ||||

| Moon et al. [28] | √ | √ | ||||

| Song and He [29] | √ | √ | ||||

| Cai et al. [21] | √ | |||||

| Yan et al. [30] | √ | √ | ||||

| Mohammadi et al. [23] | √ | |||||

| Zhou et al. [24] | √ | |||||

| Wan et al. [25] | √ | |||||

| Hamed et al. [26] | √ | √ | ||||

| Our study | √ | √ | ||||

| Literature | Research Content of O2O Model | Involves Freshness and Freshness-Keeping | |||

|---|---|---|---|---|---|

| Pricing Decision | Service Quality | Platform Marketing | Contract Coordination | ||

| Kong et al. [33] | √ | ||||

| Tang and Yang [34] | √ | ||||

| Li [18] | √ | ||||

| Li et al. [35] | √ | ||||

| Li et al. [36] | √ | √ | |||

| Govindan and Malomfalean [37] | √ | ||||

| Qiu et al. [38] | √ | ||||

| Pei et al. [39] | √ | ||||

| Yang and Tang [4] | √ | √ | |||

| Yang and Peng [40] | √ | √ | |||

| Our study | √ | √ | |||

| Project | c | |||||||

|---|---|---|---|---|---|---|---|---|

| Assignment | 100 | 0.6 | 0.7 | 0.3 | 0.3 | 15 | 20 | 10 |

| 0.1 | 423.952 | 79.125 | 344.827 | 132.836 | 398.537 | −265.701 |

| 0.2 | 376.846 | 79.125 | 297.721 | 179.942 | 398.537 | −218.595 |

| 0.3 | 329.740 | 79.125 | 250.615 | 227.047 | 398.537 | −171.489 |

| 0.4 | 282.635 | 79.125 | 203.510 | 274.153 | 398.537 | −124.384 |

| 0.5 | 235.529 | 79.125 | 156.404 | 321.259 | 398.537 | −77.178 |

| 0.6 | 188.423 | 79.125 | 109.298 | 368.365 | 398.537 | −30.172 |

| 0.7 | 141.317 | 79.125 | 62.192 | 415.470 | 398.537 | 16.934 |

| 0.748 | 118.669 | 79.125 | 39.544 | 438.081 | 398.537 | 39.544 |

| 0.8 | 94.212 | 79.125 | 15.087 | 462.576 | 398.537 | 64.039 |

| 0.9 | 47.106 | 79.125 | −32.019 | 509.682 | 398.537 | 111.145 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Yang, Q.; Xiong, L.; Li, Y.; Chen, Q.; Yu, Y.; Wang, J. Contract Coordination of Fresh Agri-Product Supply Chain under O2O Model. Sustainability 2022, 14, 8771. https://doi.org/10.3390/su14148771

Yang Q, Xiong L, Li Y, Chen Q, Yu Y, Wang J. Contract Coordination of Fresh Agri-Product Supply Chain under O2O Model. Sustainability. 2022; 14(14):8771. https://doi.org/10.3390/su14148771

Chicago/Turabian StyleYang, Qing, Lei Xiong, Yanfeng Li, Qian Chen, Yijing Yu, and Jingyang Wang. 2022. "Contract Coordination of Fresh Agri-Product Supply Chain under O2O Model" Sustainability 14, no. 14: 8771. https://doi.org/10.3390/su14148771

APA StyleYang, Q., Xiong, L., Li, Y., Chen, Q., Yu, Y., & Wang, J. (2022). Contract Coordination of Fresh Agri-Product Supply Chain under O2O Model. Sustainability, 14(14), 8771. https://doi.org/10.3390/su14148771