The Impact of Board Size on Green Innovation in China’s Heavily Polluting Enterprises: The Mediating Role of Innovation Openness

Abstract

:1. Introduction

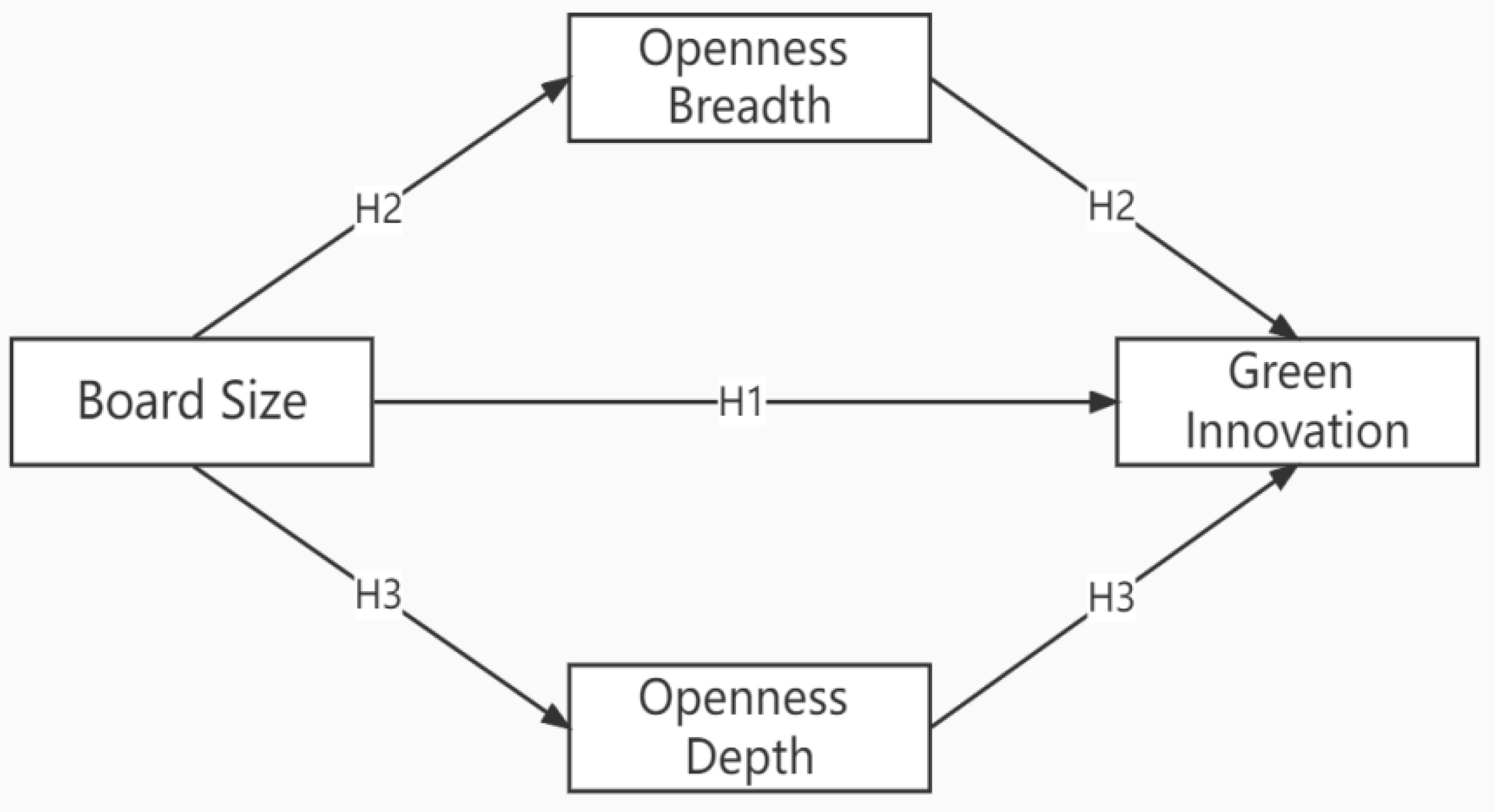

2. Literature Review and Research Hypothesis

2.1. Board Size and Green Innovation

2.2. Board Size, Innovation Openness, and Green Innovation

3. Research Methods and Samples

3.1. Research Samples and Data Source

3.2. Research Variables

3.2.1. Explained Variable: Green Innovation (GI)

3.2.2. Explanatory Variable: Board Size (Dno)

3.2.3. Mediating Variables

3.2.4. Control Variables

3.3. Empirical Model

4. Empirical Analysis

4.1. Descriptive Statistics

4.2. Correlation Coefficient Test

4.3. Regression Analysis

4.3.1. Green Innovation, Board Size, and Openness

4.3.2. Heterogeneity Test by Ownership Property

4.4. Robustness Test

4.5. Results and Discussion

5. Conclusions

5.1. Empirical Findings

5.2. Policy Implications

5.3. Limitations

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Fan, F.; Lian, H.; Liu, X.; Wang, X. Can environmental regulation promote urban green innovation Efficiency? An empirical study based on Chinese cities. J. Clean. Prod. 2021, 287, 125060. [Google Scholar] [CrossRef]

- Luo, Y.; Salman, M.; Lu, Z. Heterogeneous impacts of environmental regulations and foreign direct investment on green innovation across different regions in China. Sci. Total Environ. 2021, 759, 143744. [Google Scholar] [CrossRef]

- Xie, X.; Zhu, Q. How can green innovation solve the dilemmas of “Harmonious Coexistence”? Manag. World 2021, 37, 128–149. [Google Scholar]

- Zhang, Y.; Xing, C.; Wang, Y. Does green innovation mitigate financing constraints? Evidence from China’s private enterprises. J. Clean. Prod. 2020, 264, 121698. [Google Scholar] [CrossRef]

- Li, W.; Bhutto, T.A.; Xuhui, W.; Maitlo, Q.; Zafar, A.U.; Bhutto, N.A. Unlocking employees’ green creativity: The effects of green transformational leadership, green intrinsic, and extrinsic motivation. J. Clean. Prod. 2020, 255, 120229. [Google Scholar] [CrossRef]

- De Marchi, V.J.R. Environmental innovation and R&D cooperation: Empirical evidence from Spanish manufacturing firms. Res. Policy 2012, 41, 614–623. [Google Scholar]

- Ghisetti, C.; Rennings, K. Environmental innovations and profitability: How does it pay to be green? An empirical analysis on the German innovation survey. J. Clean. Prod. 2014, 75, 106–117. [Google Scholar] [CrossRef] [Green Version]

- Tariq, A.; Badir, Y.; Chonglerttham, S. Green innovation and performance: Moderation analyses from Thailand. Eur. J. Innov. Manag. 2019, 22, 446–467. [Google Scholar] [CrossRef]

- Chen, Y.-S.; Lai, S.-B.; Wen, C.-T. The influence of green innovation performance on corporate advantage in Taiwan. J. Bus. Ethics 2006, 67, 331–339. [Google Scholar] [CrossRef]

- Albort-Morant, G.; Leal-Millán, A.; Cepeda-Carrión, G. The antecedents of green innovation performance: A model of learning and capabilities. J. Bus. Res. 2016, 69, 4912–4917. [Google Scholar] [CrossRef]

- Liu, Z.; Li, X.; Peng, X.; Lee, S. Green or nongreen innovation? Different strategic preferences among subsidized enterprises with different ownership types. J. Clean. Prod. 2020, 245, 118786. [Google Scholar] [CrossRef]

- Zhang, J.A.; Edgar, F.; Geare, A.; O’Kane, C. The interactive effects of entrepreneurial orientation and capability-based HRM on firm performance: The mediating role of innovation ambidexterity. Ind. Mark. Manag. 2016, 59, 131–143. [Google Scholar] [CrossRef]

- Jiao, J.-L.; Zhang, X.-L.; Tang, Y.-S. What factors determine the survival of green innovative enterprises in China?—A method based on fsQCA. Technol. Soc. 2020, 62, 101314. [Google Scholar] [CrossRef] [PubMed]

- Rennings, K. Redefining innovation—Eco-innovation research and the contribution from ecological economics. Ecol. Econ. 2000, 32, 319–332. [Google Scholar] [CrossRef]

- Li, D.; Zheng, M.; Cao, C.; Chen, X.; Ren, S.; Huang, M. The impact of legitimacy pressure and corporate profitability on green innovation: Evidence from China top 100. J. Clean. Prod. 2017, 141, 41–49. [Google Scholar] [CrossRef] [Green Version]

- Shen, C.; Li, S.; Wang, X.; Liao, Z. The effect of environmental policy tools on regional green innovation: Evidence from China. J. Clean. Prod. 2020, 254, 120122. [Google Scholar] [CrossRef]

- Porter, M.E.; Van der Linde, C. Toward a new conception of the environment-competitiveness relationship. J. Econ. Perspect. 1995, 9, 97–118. [Google Scholar] [CrossRef] [Green Version]

- Harrison, A.; Martin, L.A.; Nataraj, S. Green industrial policy in emerging markets. Annu. Rev. Resour. Econ. 2017, 9, 253–274. [Google Scholar] [CrossRef]

- Tian, P.; Lin, B. Promoting green productivity growth for China’s industrial exports: Evidence from a hybrid input-output model. Energy Policy 2017, 111, 394–402. [Google Scholar] [CrossRef]

- Feng, Z.; Chen, W. Environmental regulation, green innovation, and industrial green development: An empirical analysis based on the Spatial Durbin model. Sustainability 2018, 10, 223. [Google Scholar] [CrossRef] [Green Version]

- Costa, J.; Fonseca, J. The Impact of Corporate Social Responsibility and Innovative Strategies on Financial Performance. Risks 2022, 10, 103. [Google Scholar] [CrossRef]

- Kriechel, B.; Ziesemer, T. The environmental Porter hypothesis: Theory, evidence, and a model of timing of adoption. Econ. Innov. New Technol. 2009, 18, 267–294. [Google Scholar] [CrossRef] [Green Version]

- Zeng, H.; Dong, B.; Zhou, Q.; Jin, Y. The capital market reaction to central environmental protection inspection: Evidence from China. J. Clean. Prod. 2021, 279, 123486. [Google Scholar] [CrossRef]

- Zheng, S.; Kahn, M.E.; Sun, W.; Luo, D. Incentives for China’s urban mayors to mitigate pollution externalities: The role of the central government and public environmentalism. Reg. Sci. Urban Econ. 2014, 47, 61–71. [Google Scholar] [CrossRef]

- Wang, H.; Fan, C.; Chen, S. The impact of campaign-style enforcement on corporate environmental Action: Evidence from China’s central environmental protection inspection. J. Clean. Prod. 2021, 290, 125881. [Google Scholar] [CrossRef]

- Fang, Z.; Bai, H.; Bilan, Y. Evaluation research of green innovation efficiency in China’s heavy polluting industries. Sustainability 2019, 12, 146. [Google Scholar] [CrossRef] [Green Version]

- Wang, Z.; Chen, M.-H.; Chin, C.L.; Zheng, Q. Managerial ability, political connections, and fraudulent financial reporting in China. J. Account. Public Policy 2017, 36, 141–162. [Google Scholar] [CrossRef]

- Zhang, Z.; Peng, X.; Yang, L.; Lee, S. How does Chinese central environmental inspection affect corporate green innovation? The moderating effect of bargaining intentions. Environ. Sci. Pollut. Res. 2022, 29, 42955–42972. [Google Scholar] [CrossRef]

- Wang, R.; Wijen, F.; Heugens, P.P. Government’s green grip: Multifaceted state influence on corporate environmental actions in China. Strateg. Manag. J. 2018, 39, 403–428. [Google Scholar] [CrossRef]

- Zhou, Y.; Hong, J.; Zhu, K.; Yang, Y.; Zhao, D. Dynamic capability matters: Uncovering its fundamental role in decision making of environmental innovation. J. Clean. Prod. 2018, 177, 516–526. [Google Scholar] [CrossRef] [Green Version]

- Peng, B.; Zheng, C.; Wei, G.; Elahi, E. The cultivation mechanism of green technology innovation in manufacturing industry: From the perspective of ecological niche. J. Clean. Prod. 2020, 252, 119711. [Google Scholar] [CrossRef]

- Ma, X.; Ock, Y.-S.; Wu, F.; Zhang, Z. The Effect of Internal Control on Green Innovation: Corporate Environmental Investment as a Mediator. Sustainability 2022, 14, 1755. [Google Scholar] [CrossRef]

- Zhu, J.; Tang, W.; Zhang, B.; Wang, H. Influence of Environmentally Specific Transformational Leadership on Employees’ Green Innovation Behavior—A Moderated Mediation Model. Sustainability 2022, 14, 1828. [Google Scholar] [CrossRef]

- Begum, S.; Xia, E.; Ali, F.; Awan, U.; Ashfaq, M. Achieving green product and process innovation through green leadership and creative engagement in manufacturing. J. Manuf. Technol. Manag. 2021, 33, 656–674. [Google Scholar] [CrossRef]

- Fufa Gulema, T.; Zhou, X. Corporate Governance, Innovation Capacity and Firm Performance Evidence from Chinese Listed Firms. Int. J. Empir. Financ. Manag. Sci. 2020, 2, 26–42. [Google Scholar]

- Usman, M.; Javed, M.; Yin, J. Board internationalization and green innovation. Econ. Lett. 2020, 197, 109625. [Google Scholar] [CrossRef]

- Wu, H.; Zhou, Y. Optimal degree of openness in open innovation: A perspective from knowledge acquisition & knowledge leakage. Technol. Soc. 2021, 67, 101756. [Google Scholar]

- Chesbrough, H.; Crowther, A.K. Beyond high tech: Early adopters of open innovation in other industries. R&D Manag. 2006, 36, 229–236. [Google Scholar]

- Dangelico, R.M.; Pontrandolfo, P.; Pujari, D. Developing sustainable new products in the textile and upholstered furniture industries: Role of external integrative capabilities. J. Prod. Innov. Manag. 2013, 30, 642–658. [Google Scholar] [CrossRef]

- Arfi, W.B.; Hikkerova, L.; Sahut, J.-M. External knowledge sources, green innovation and performance. Technol. Forecast. Soc. Chang. 2018, 129, 210–220. [Google Scholar] [CrossRef]

- Chadha, A. Overcoming competence lock-in for the development of radical eco-innovations: The case of biopolymer technology. Ind. Innov. 2011, 18, 335–350. [Google Scholar] [CrossRef]

- Thakur, V.; Mangla, S.K. Change management for sustainability: Evaluating the role of human, operational and technological factors in leading Indian firms in home appliances sector. J. Clean. Prod. 2019, 213, 847–862. [Google Scholar] [CrossRef]

- Ma, Y.; Hou, G.; Yin, Q.; Xin, B.; Pan, Y. The sources of green management innovation: Does internal efficiency demand pull or external knowledge supply push? J. Clean. Prod. 2018, 202, 582–590. [Google Scholar] [CrossRef]

- Chen, V.Z.; Li, J.; Shapiro, D.M.; Zhang, X. Ownership structure and innovation: An emerging market perspective. Asia Pac. J. Manag. 2014, 31, 1–24. [Google Scholar] [CrossRef]

- Karakaya, E.; Hidalgo, A.; Nuur, C. Diffusion of eco-innovations: A review. Renew. Sustain. Energy Rev. 2014, 33, 392–399. [Google Scholar] [CrossRef]

- Mi, L.; Sun, Y.; Gan, X.; Yang, H.; Lv, T.; Shang, K.; Qiao, Y.; Jiang, Z. Promoting employee green behavior through the person-organization fit: The moderating effect of psychological distance. Front. Psychol. 2020, 11, 568385. [Google Scholar] [CrossRef]

- Cankaya, S.Y.; Sezen, B. Effects of green supply chain management practices on sustainability performance. J. Manuf. Technol. Manag. 2018, 30, 98–121. [Google Scholar] [CrossRef]

- Dai, D.; Xue, Y. The Impact of Green Innovation on a Firm’s Value from the Perspective of Enterprise Life Cycles. Sustainability 2022, 14, 1226. [Google Scholar] [CrossRef]

- Ahmeda, U.; Mozammelb, S.; Zamanc, F. Green HRM and green innovation: Can green transformational leadership moderate: Case of pharmaceutical firms in Australia. Syst. Rev. Pharm. 2020, 11, 616–617. [Google Scholar]

- Ali, F.; Ashfaq, M.; Begum, S.; Ali, A. How “Green” thinking and altruism translate into purchasing intentions for electronics products: The intrinsic-extrinsic motivation mechanism. Sustain. Prod. Consum. 2020, 24, 281–291. [Google Scholar] [CrossRef]

- Chen, Y.-S.; Chang, C.-H. The determinants of green product development performance: Green dynamic capabilities, green transformational leadership, and green creativity. J. Bus. Ethics 2013, 116, 107–119. [Google Scholar] [CrossRef]

- Fernando, Y.; Jabbour, C.J.C.; Wah, W.-X. Pursuing green growth in technology firms through the connections between environmental innovation and sustainable business performance: Does service capability matter? Resour. Conserv. Recycl. 2019, 141, 8–20. [Google Scholar] [CrossRef]

- de Azevedo Rezende, L.; Bansi, A.C.; Alves, M.F.R.; Galina, S.V.R. Take your time: Examining when green innovation affects financial performance in multinationals. J. Clean. Prod. 2019, 233, 993–1003. [Google Scholar] [CrossRef]

- Dong, Z.; He, Y.; Wang, H.; Wang, L. Is there a ripple effect in environmental regulation in China?—Evidence from the local-neighborhood green technology innovation perspective. Ecol. Indic. 2020, 118, 106773. [Google Scholar] [CrossRef]

- Cainelli, G.; D’Amato, A.; Mazzanti, M. Resource efficient eco-innovations for a circular economy: Evidence from EU firms. Res. Policy 2020, 49, 103827. [Google Scholar] [CrossRef]

- Farza, K.; Ftiti, Z.; Hlioui, Z.; Louhichi, W.; Omri, A. Does it pay to go green? The environmental innovation effect on corporate financial performance. J. Environ. Manag. 2021, 300, 113695. [Google Scholar] [CrossRef]

- Wang, C.; Hu, Y.; Zhang, J.; Miao, C. CEO media exposure and green technological innovation decision: Evidence from Chinese polluting firms. Math. Probl. Eng. 2020, 2020, 8271621. [Google Scholar] [CrossRef]

- Lisi, W.; Zhu, R.; Yuan, C. Embracing green innovation via green supply chain learning: The moderating role of green technology turbulence. Sustain. Dev. 2020, 28, 155–168. [Google Scholar] [CrossRef]

- Tsai, K.H.; Liao, Y.C. Innovation capacity and the implementation of eco-innovation: Toward a contingency perspective. Bus. Strategy Environ. 2017, 26, 1000–1013. [Google Scholar] [CrossRef]

- Feng, L.; Zhao, W.; Li, H.; Song, Y. The effect of environmental orientation on green innovation: Do political ties matter? Sustainability 2018, 10, 4674. [Google Scholar] [CrossRef] [Green Version]

- El-Kassar, A.-N.; Singh, S.K. Green innovation and organizational performance: The influence of big data and the moderating role of management commitment and HR practices. Technol. Forecast. Soc. Chang. 2019, 144, 483–498. [Google Scholar] [CrossRef]

- Chindasombatcharoen, P.; Chatjuthamard, P.; Jiraporn, P.; Treepongkaruna, S. Achieving sustainable development goals through board size and innovation. Sustain. Dev. 2021. [Google Scholar] [CrossRef]

- De Cleyn, S.H.; Braet, J. Do board composition and investor type influence innovativeness in SMEs? Int. Entrep. Manag. J. 2012, 8, 285–308. [Google Scholar] [CrossRef]

- Galia, F.; Zenou, E. Board composition and forms of innovation: Does diversity make a difference? Eur. J. Int. Manag. 2012, 6, 630–650. [Google Scholar] [CrossRef]

- Adams, R.B.; Hermalin, B.E.; Weisbach, M.S. The role of boards of directors in corporate governance: A conceptual framework and survey. J. Econ. Lit. 2010, 48, 58–107. [Google Scholar] [CrossRef] [Green Version]

- Orozco, L.A.; Vargas, J.; Galindo-Dorado, R. Trends on the relationship between board size and financial and reputational corporate performance: The Colombian case. Eur. J. Manag. Bus. Econ. 2018, 27, 183–197. [Google Scholar] [CrossRef] [Green Version]

- Shapiro, D.; Tang, Y.; Wang, M.; Zhang, W. The effects of corporate governance on the innovation performance of Chinese SMEs. Eur. Econ. Rev. 2013, 50, 155–183. [Google Scholar] [CrossRef]

- Albort-Morant, G.; Leal-Rodríguez, A.L.; De Marchi, V. Absorptive capacity and relationship learning mechanisms as complementary drivers of green innovation performance. J. Knowl. Manag. 2018, 22, 432–452. [Google Scholar] [CrossRef]

- Yang, J.Y.; Roh, T. Open for green innovation: From the perspective of green process and green consumer innovation. Sustainability 2019, 11, 3234. [Google Scholar] [CrossRef] [Green Version]

- Melander, L.; Pazirandeh, A. Collaboration beyond the supply network for green innovation: Insight from 11 cases. Supply Chain Manag. Int. J. 2019, 24, 509–523. [Google Scholar] [CrossRef]

- Varshney, P.; Kaul, V.K.; Vasal, V. Corporate governance index and firm performance: Empirical evidence from India. LBS J. Manag. Res. 2015, 13, 59–75. [Google Scholar] [CrossRef]

- Chesbrough, H.W. Open Innovation: The New Imperative for Creating and Profiting from Technology; Harvard Business Press: Boston, MA, USA, 2003. [Google Scholar]

- Lichtenthaler, U. Open innovation: Past research, current debates, and future directions. Acad. Manag. Perspect. 2011, 25, 75–93. [Google Scholar]

- Mubarak, M.F.; Petraite, M. Industry 4.0 technologies, digital trust and technological orientation: What matters in open innovation? Technol. Forecast. Soc. Chang. 2020, 161, 120332. [Google Scholar] [CrossRef]

- Klewitz, J.; Hansen, E.G. Sustainability-oriented innovation of SMEs: A systematic review. J. Clean. Prod. 2014, 65, 57–75. [Google Scholar] [CrossRef]

- Laursen, K.; Salter, A. Open for innovation: The role of openness in explaining innovation performance among UK manufacturing firms. Strateg. Manag. J. 2006, 27, 131–150. [Google Scholar] [CrossRef]

- Bai, Y.; Wang, J.-Y.; Jiao, J.-L. A framework for determining the impacts of a multiple relationship network on green innovation. Sustain. Prod. Consum. 2021, 27, 471–484. [Google Scholar] [CrossRef]

- Cainelli, G.; De Marchi, V.; Grandinetti, R. Does the development of environmental innovation require different resources? Evidence from Spanish manufacturing firms. J. Clean. Prod. 2015, 94, 211–220. [Google Scholar] [CrossRef]

- Guo, Y.; Wang, L.; Chen, Y. Green entrepreneurial orientation and green innovation: The mediating effect of supply chain learning. SAGE Open 2020, 10, 2158244019898798. [Google Scholar] [CrossRef]

- Rauter, R.; Globocnik, D.; Perl-Vorbach, E.; Baumgartner, R. Open innovation and its effects on economic and sustainability innovation performance. J. Innov. Knowl. 2019, 4, 226–233. [Google Scholar] [CrossRef]

- Sun, Y.; Sun, H. Green innovation strategy and ambidextrous green innovation: The mediating effects of green supply chain integration. Sustainability 2021, 13, 4876. [Google Scholar] [CrossRef]

- Song, Y.; Zhang, J.; Song, Y.; Fan, X.; Zhu, Y.; Zhang, C. Can industry-university-research collaborative innovation efficiency reduce carbon emissions? Technol. Forecast. Soc. Chang. 2020, 157, 120094. [Google Scholar] [CrossRef]

- Sánchez-Sellero, P.; Bataineh, M. How R&D cooperation, R&D expenditures, public funds and R&D intensity affect green innovation? Technol. Anal. Strateg. Manag. 2021, 1–14. [Google Scholar] [CrossRef]

- Lichtenthaler, U.; Lichtenthaler, E. A capability-based framework for open innovation: Complementing absorptive capacity. J. Manag. Stud. 2009, 46, 1315–1338. [Google Scholar] [CrossRef]

- Asakawa, K.; Nakamura, H.; Sawada, N. Firms’ open innovation policies, laboratories’ external collaborations, and laboratories’ R&D performance. R&D Manag. 2010, 40, 109–123. [Google Scholar]

- Chuluun, T.; Prevost, A.; Upadhyay, A. Firm network structure and innovation. J. Corp. Financ. 2017, 44, 193–214. [Google Scholar] [CrossRef]

- Li, W.; Xu, J.; Zheng, M. Green governance: New perspective from open innovation. Sustainability 2018, 10, 3845. [Google Scholar] [CrossRef] [Green Version]

- Ghisetti, C.; Marzucchi, A.; Montresor, S. The open eco-innovation mode. An empirical investigation of eleven European countries. Res. Policy 2015, 44, 1080–1093. [Google Scholar] [CrossRef]

- Custódio, C.; Ferreira, M.A.; Matos, P. Do general managerial skills spur innovation? Manag. Sci. 2019, 65, 459–476. [Google Scholar] [CrossRef]

- Wu, H.; Wang, S. Do bond market participants pay attention to corporate environmental information?—Empirical evidence from China’s heavily polluting listed companies. Account. Res. 2016, 9, 68–74. [Google Scholar]

- Wang, K.; Zhang, X. The effect of media coverage on disciplining firms’ pollution behaviors: Evidence from Chinese heavy polluting listed companies. J. Clean. Prod. 2021, 280, 123035. [Google Scholar] [CrossRef]

- Fabrizi, A.; Guarini, G.; Meliciani, V. Green patents, regulatory policies and research network policies. Res. Policy 2018, 47, 1018–1031. [Google Scholar] [CrossRef]

- Pan, Z.; Liu, L.; Bai, S.; Ma, Q. Can the social trust promote corporate green innovation? Evidence from China. Environ. Sci. Pollut. Res. 2021, 28, 52157–52173. [Google Scholar] [CrossRef]

- Wen, Z.; Chang, L.; Hau, K.-T.; Liu, H. Testing and application of the mediating effects. Acta Psychol. Sin. 2004, 36, 614. [Google Scholar]

- Deng, F.; Li, Y. Managerial ability, ownership and innovation investment: Empirical evidence based of high-tech listed companies. J. Ind. Technol. Econ. 2019, 38, 19–26. [Google Scholar]

- Xia, L.; Gao, S.; Wei, J.; Ding, Q. Government subsidy and corporate green innovation-Does board governance play a role? Energy Policy 2022, 161, 112720. [Google Scholar] [CrossRef]

- Ninlawan, C.; Seksan, P.; Tossapol, K.; Pilada, W. The implementation of green supply chain management practices in electronics industry. In Proceedings of the World Congress on Engineering, London, UK, 4–6 July 2012; Citeseer: London, UK, 2010; pp. 1563–1568. [Google Scholar]

- Yu, C.-H.; Wu, X.; Zhang, D.; Chen, S.; Zhao, J. Demand for green finance: Resolving financing constraints on green innovation in China. Energy Policy 2021, 153, 112255. [Google Scholar] [CrossRef]

- Zhong, Z.; Peng, B. Can environmental regulation promote green innovation in heavily polluting enterprises? Empirical evidence from a quasi-natural experiment in China. Sustain. Prod. Consum. 2022, 30, 815–828. [Google Scholar] [CrossRef]

- Gao, K.; Wang, L.; Zhao, H. Management Executive Power and Corporate Green Innovation—Empirical Evidence from China’s State-Owned Manufacturing Sector. Technol. Soc. 2022, 70, 102043. [Google Scholar] [CrossRef]

- Wu, H.; Liu, S.; Hu, S. Visible hand: Do government subsidies promote green innovation performance—Moderating effect of ownership concentration. Pol. J. Environ. Stud. 2021, 30, 881–892. [Google Scholar] [CrossRef]

- Aguilera, R.; Duran, P.; Heugens, P.; Sauerwald, S.; Turturea, R.; VanEssen, M. State ownership, political ideology, and firm performance around the world. J. World Bus. 2021, 56, 101113. [Google Scholar] [CrossRef]

| Screening Process | Number of Companies | Number of Observations |

|---|---|---|

| According to heavy pollution industry codes, screening companies listed in China A-shares. | 1218 | 7308 |

| Excluding companies with abnormal financial conditions (ST. * ST). | 1167 | 7002 |

| Excluding companies listed after 2015. | 727 | 4362 |

| Excluding companies that do not disclose or lack environmental and sustainable development reports. | 555 | 3330 |

| Excluding companies with incomplete or missing data on jointly applied patents. | 176 | 1056 |

| Excluding companies with incomplete or missing data on green patents. | 97 | 582 |

| Industry Code | Industry Name | Sample Size |

|---|---|---|

| B06 | Coalmining and selection industry | 7 |

| B09 | Nonferrous metal mining and selection industry | 5 |

| C13 | Agricultural and sideline food processing industry | 3 |

| C22 | Papermaking and paper product industry | 2 |

| C25 | Petroleum refinery industry | 1 |

| C26 | Chemical Industry | 20 |

| C27 | Pharmaceutical manufacturing industry | 16 |

| C28 | Chemical fiber manufacturing industry | 3 |

| C30 | Nonmetal mineral product industry | 9 |

| C31 | Ferrous metal smelting and manufacturing industry | 9 |

| C32 | Nonferrous metal smelting and manufacturing industry | 10 |

| C33 | Metal product industry | 6 |

| D44 | Power and heat production and supply industry | 6 |

| Types | Names | Codes | Measure |

|---|---|---|---|

| Explained variable | Green innovation | GI | Ln(Total number of green patent applications + 1) |

| Explanatory variable | Board size | Dno | Ln(Number of Board Members) |

| Mediating variables | Openness breadth | OB | Ln(Total number of external organizations + 1) |

| Openness depth | OD | Ln(Total number of patents jointly filed/Total number of external organizations + 1) | |

| Control variables | R&D investment | RD | The proportion of R&D investment in total assets |

| Firm redundancy | OR | (Current Ratio + Equity and Liabilities + Sales Period Expense Ratio)/3 | |

| Operational capacity | Roa | Return on total assets | |

| Profitability | Roe | Return on equity | |

| Cash constraints | Cash | (Operational cash flow)/Total Assets | |

| Development ability | Growth | Increase rate of business revenue | |

| Ownership concentration | EC | Shareholding ratio of the largest shareholder | |

| CEO duality | Dual | Whether the chairman and the general manager are the same person; yes = 0, no = 1 | |

| Year | Year | Year dummy variables | |

| Industry | Ind | Set industry dummy variables according to CSRC standards |

| Variable | N | Mean | SD | P25 | P50 | P75 | Min | Max |

|---|---|---|---|---|---|---|---|---|

| GI | 582 | 14.42 | 24.97 | 2 | 6 | 16 | 0 | 272 |

| Dno | 582 | 11.08 | 2.89 | 9 | 11 | 13 | 5 | 22 |

| OB | 582 | 4.82 | 10.57 | 1 | 2 | 5 | 0 | 138 |

| OD | 582 | 4.17 | 5.79 | 1 | 2.5 | 5.33 | 0 | 56 |

| RD | 582 | 0.03 | 0.02 | 0.01 | 0.03 | 0.04 | 0 | 0.18 |

| OR | 582 | 1.08 | 1.17 | 0.53 | 0.77 | 1.25 | 0.1 | 15.93 |

| Roa | 582 | 0.47 | 0.46 | 0.46 | 0.6 | 0.87 | 0.13 | 2.88 |

| Roe | 582 | 0.08 | 0.23 | 0.03 | 0.09 | 0.14 | −4.32 | 1.47 |

| Cash | 582 | 0.1 | 0.08 | 0.05 | 0.09 | 0.13 | 0 | 0.49 |

| Growth | 582 | 0.12 | 0.28 | −0.01 | 0.08 | 0.21 | −0.6 | 3.95 |

| EC | 582 | 38.76 | 15.24 | 27.49 | 37.05 | 48.55 | 11.08 | 82.51 |

| Dual | 582 | 0.87 | 0.34 | 1 | 1 | 1 | 0 | 1 |

| Variable | N | Mean | SD | P25 | P50 | P75 | Min | Max |

|---|---|---|---|---|---|---|---|---|

| GI | 347 | 18.743 | 29.907 | 3 | 8 | 23 | 0 | 272 |

| Dno | 347 | 12.01 | 3.072 | 10 | 11 | 14 | 5 | 22 |

| OB | 347 | 5.908 | 13.26 | 1 | 3 | 5 | 0 | 138 |

| OD | 347 | 4.315 | 6.674 | 1 | 2.333 | 5.231 | 0 | 56 |

| RD | 347 | 0.02 | 0.018 | 0.005 | 0.016 | 0.033 | 0 | 0.101 |

| OR | 347 | 0.836 | 0.672 | 0.448 | 0.612 | 0.953 | 0.105 | 5.385 |

| Roa | 347 | 0.797 | 0.524 | 0.451 | 0.643 | 0.933 | 0.127 | 2.883 |

| Roe | 347 | 0.061 | 0.293 | 0.026 | 0.07 | 0.126 | −4.32 | 1.467 |

| Cash | 347 | 0.094 | 0.062 | 0.047 | 0.081 | 0.126 | 0.001 | 0.39 |

| Growth | 347 | 0.118 | 0.329 | −0.031 | 0.071 | 0.188 | −0.597 | 3.948 |

| EC | 347 | 44.07 | 15.3 | 33.22 | 40.24 | 54.96 | 16.88 | 82.51 |

| Dual | 347 | 0.945 | 0.228 | 1 | 1 | 1 | 0 | 1 |

| Variable | N | Mean | SD | P25 | P50 | P75 | Min | Max |

|---|---|---|---|---|---|---|---|---|

| GI | 235 | 8.025 | 12.539 | 1 | 4 | 9 | 0 | 92 |

| Dno | 235 | 9.698 | 1.881 | 9 | 9 | 11 | 5 | 16 |

| OB | 235 | 3.213 | 3.584 | 1 | 2 | 4 | 0 | 24 |

| OD | 235 | 3.944 | 4.168 | 1 | 2.667 | 5.667 | 0 | 20.33 |

| RD | 235 | 0.042 | 0.026 | 0.028 | 0.039 | 0.05 | 0.001 | 0.18 |

| OR | 235 | 1.444 | 1.575 | 0.756 | 1.038 | 1.597 | 0.239 | 15.93 |

| Roa | 235 | 0.666 | 0.326 | 0.477 | 0.575 | 0.772 | 0.156 | 2.311 |

| Roe | 235 | 0.108 | 0.089 | 0.051 | 0.103 | 0.155 | −0.327 | 0.489 |

| Cash | 235 | 0.12 | 0.095 | 0.058 | 0.092 | 0.146 | 0.012 | 0.493 |

| Growth | 235 | 0.135 | 0.195 | 0.006 | 0.115 | 0.239 | −0.276 | 0.943 |

| EC | 235 | 30.91 | 11.28 | 22.94 | 29.54 | 39.85 | 11.08 | 57.35 |

| Dual | 235 | 0.753 | 0.432 | 1 | 1 | 1 | 0 | 1 |

| Variables | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 1.GI | 1 | |||||||||||

| 2.Dno | 0.17 *** | 1 | ||||||||||

| 3.OB | 0.36 *** | 0.07 * | 1 | |||||||||

| 4.OD | 0.17 *** | 0.01 | 0.53 *** | 1 | ||||||||

| 5.RD | −0.31 *** | −0.29 *** | −0.02 | 0.02 | 1 | |||||||

| 6.OR | −0.25 *** | −0.21 *** | −0.028 | 0.08 * | 0.45 *** | 1 | ||||||

| 7.Roa | 0.001 | 0.12 *** | −0.026 | 0.15 *** | −0.26 *** | −0.14 *** | 1 | |||||

| 8.Roe | −0.02 | −0.03 | 0.035 | 0.13 *** | 0.085 ** | 0.23 *** | 0.11 *** | 1 | ||||

| 9.Cash | −0.2 *** | −0.03 | −0.049 | −0.008 | 0.31 *** | 0.35 *** | 0.005 | 0.26 *** | 1 | |||

| 10.Growth | −0.001 | 0.024 | 0.004 | 0.033 | 0.007 | 0.047 | 0.017 | 0.4 *** | −0.014 | 1 | ||

| 11.EC | 0.17 *** | 0.15 *** | 0.14 *** | −0.014 | −0.28 *** | −0.23 *** | 0.063 | 0.099 ** | 0.044 | −0.014 | 1 | |

| 12.Dual | 0.1 *** | 0.16 *** | −0.028 | −0.11 *** | −0.105 ** | −0.19 *** | −0.016 | −0.061 | −0.007 | −0.038 | 0.096 ** | 1 |

| Variables | Model (1) | Model (2a) | Model (3a) | Model (2b) | Model (3b) |

|---|---|---|---|---|---|

| GI | OB | GI | OD | GI | |

| Dno | 0.791 *** (3.65) | 0.3 ** (1.97) | 0.657 *** (3.18) | 0.094 (0.66) | 0.764 *** (3.59) |

| OB | / | / | 0.446 *** (8.39) | / | / |

| OD | / | / | / | / | 0.287 *** (5.35) |

| RD | −3.489 (−1.31) | 3.358 * (1.66) | −4.986 * (−1.92) | 3.147 (1.53) | −4.393 * (−1.68) |

| OR | −0.002 (−0.05) | 0.032 (0.95) | −0.016 (−0.38) | 0.065 (1.46) | −0.021 (−0.45) |

| Roa | −0.2 * (−1.66) | −0.061 (−0.66) | −0.173 (−1.44) | 0.168 (1.42) | −0.248 ** (−1.97) |

| Roe | 0.257 (0.46) | 0.323 (0.85) | 0.113 (0.21) | 0.642 (1.46) | 0.072 (0.13) |

| Cash | −2.247 *** (−3.76) | −1.716 *** (−3.55) | −1.482 *** (−2.62) | −1.181 ** (-2.43) | −1.908 *** (-3.22) |

| Growth | −0.243 (−1.01) | −0.023 (−0.11) | −0.233 (−0.95) | −0.01 (−0.06) | −0.24 (−1.01) |

| EC | 0.008 ** (2.08) | 0.005 (1.55) | 0.006 (1.62) | 0 (0.08) | 0.008 ** (2.13) |

| Dual | 0.095 (0.75) | −0.097 (−0.96) | 0.138 (1.20) | −0.179 * (−1.68) | 0.146 (1.2) |

| Constant | 0.114 (0.19) | 0.284 (0.68) | −0.013 (−0.02) | 0.927 ** (2.39) | −0.153 (−0.26) |

| N | 582 | 582 | 582 | 582 | 582 |

| Year FE | Yes | Yes | Yes | Yes | Yes |

| Ind FE | Yes | Yes | Yes | Yes | Yes |

| R2 | 0.344 | 0.162 | 0.426 | 0.136 | 0.376 |

| Sobel test | 0.1247 * (z = 1.668) | 0.0394 (z = 0.8865) | |||

| Goodman−1 test | 0.1247 * (z = 1.659) | 0.0394 (z = 0.8715) | |||

| Goodman−2 test | 0.1247 * (z = 1.677) | 0.0394 (z = 0.9024) | |||

| Proportion of mediating effect | 0.3093 | 0.0977 | |||

| Variables | Model (1) | Model (2a) | Model (3a) | Model (2b) | Model (3b) |

|---|---|---|---|---|---|

| GI | OB | GI | OD | GI | |

| Dno | 0.536 ** (2.36) | 0.189 (1.14) | 0.554 ** (2.53) | 0.032 (0.21) | 0.601 *** (2.66) |

| OB | / | / | 0.211 ** (2.52) | / | / |

| OD | / | / | / | / | 0.166 ** (2.25) |

| Dno×Soe | 0.168 *** (3.47) | 0.074 * (1.94) | −0.015 (−0.22) | 0.041 (1.01) | 0.052 (0.68) |

| OB×Soe | / | / | 0.312 *** (3.04) | / | / |

| OD×Soe | / | / | / | / | 0.194 * (1.78) |

| RD | −1.138 (−0.42) | 4.386 ** (2.09) | −2.652 (−1.02) | 3.724 * (1.71) | −2.155 (−0.82) |

| OR | −0.009 (−0.19) | 0.029 (0.88) | −0.022 (−0.5) | 0.063 (1.42) | −0.016 (−0.36) |

| Roa | −0.222 * (−1.9) | −0.07 (−0.77) | −0.167 (−1.41) | 0.163 (1.37) | −0.258 ** (−2.12) |

| Roe | 0.465 (0.83) | 0.414 (1.08) | 0.147 (0.26) | 0.693 (1.57) | 0.199 (0.35) |

| Cash | −2.02 *** (−3.33) | −1.617 *** (−3.32) | −1.28 ** (−2.27) | −1.126 ** (−2.3) | −1.693 *** (−2.83) |

| Growth | −0.219 (−0.89) | −0.012 (−0.06) | −0.16 (−0.62) | −0.004 (−0.02) | −0.195 (−0.8) |

| EC | 0.004 (0.96) | 0.003 (0.95) | 0.003 (0.65) | −0.001 (−0.24) | 0.004 (1.02) |

| Dual | 0.006 (0.05) | −0.136 (−1.34) | 0.025 (0.22) | −0.201 * (−1.84) | 0.038 (0.31) |

| Constant | 0.692 (1.14) | 0.537 (1.21) | 0.466 (0.81) | 1.069 *** (2.66) | 0.364 (0.61) |

| N | 582 | 582 | 582 | 582 | 582 |

| Year FE | Yes | Yes | Yes | Yes | Yes |

| Ind FE | Yes | Yes | Yes | Yes | Yes |

| R2 | 0.356 | 0.167 | 0.443 | 0.138 | 0.39 |

| Variables | Model (1) | Model (2a) | Model (3a) | Model (2b) | Model (3b) |

|---|---|---|---|---|---|

| GI | OB | GI | OD | GI | |

| Dno | 0.749 *** (3.85) | 0.3 ** (1.97) | 0.622 *** (3.35) | 0.094 (0.66) | 0.725 *** (3.75) |

| OB | / | / | 0.424 *** (8.27) | / | / |

| OD | / | / | / | / | 0.257 *** (4.92) |

| RD | 0.767 (0.32) | 3.358 * (1.66) | −0.658 (−0.28) | 3.147 (1.53) | −0.043 (−0.02) |

| OR | 0.016 (0.37) | 0.032 (0.95) | 0.003 (0.07) | 0.065 (1.46) | −0.001 (−0.02) |

| Roa | −0.081 (−0.68) | −0.061 (−0.66) | −0.055 (−0.47) | 0.168 (1.42) | −0.124 (−0.99) |

| Roe | 0.601 (1.14) | 0.323 (0.85) | 0.464 (0.9) | 0.642 (1.46) | 0.436 (0.82) |

| Cash | −2.235 *** (−3.91) | −1.716 *** (−3.55) | −1.507 *** (−2.81) | −1.181 ** (−2.43) | −1.931 *** (-3.41) |

| Growth | −0.241 (−1.08) | −0.023 (−0.11) | −0.232 (−0.98) | −0.01 (−0.06) | −0.239 (−1.07) |

| EC | 0.009 ** (2.29) | 0.005 (1.55) | 0.007 * (1.82) | 0 (0.08) | 0.009 ** (2.34) |

| Dual | 0.116 (0.92) | −0.097 (−0.96) | 0.158 (1.34) | −0.179 * (−1.68) | 0.163 (1.32) |

| Constant | −0.537 (−1.01) | 0.284 (0.68) | −0.658 (−1.32) | 0.927 ** (2.39) | −0.776 (−1.49) |

| N | 582 | 582 | 582 | 582 | 582 |

| Year FE | Yes | Yes | Yes | Yes | Yes |

| Ind FE | Yes | Yes | Yes | Yes | Yes |

| R2 | 0.269 | 0.162 | 0.36 | 0.136 | 0.3 |

| Sobel test | 0.1173 * (z = 1.669) | 0.3512 (z = 0.8855) | |||

| Goodman−1 test | 0.1173 * (z = 1.66) | 0.3512 (z = 0.8963) | |||

| Goodman−2 test | 0.1173 * (z = 1.678) | 0.3512 (z = 0.9026) | |||

| Proportion of mediating effect | 0.3155 | 0.0944 | |||

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Zhao, J.; Pongtornkulpanich, A.; Cheng, W. The Impact of Board Size on Green Innovation in China’s Heavily Polluting Enterprises: The Mediating Role of Innovation Openness. Sustainability 2022, 14, 8632. https://doi.org/10.3390/su14148632

Zhao J, Pongtornkulpanich A, Cheng W. The Impact of Board Size on Green Innovation in China’s Heavily Polluting Enterprises: The Mediating Role of Innovation Openness. Sustainability. 2022; 14(14):8632. https://doi.org/10.3390/su14148632

Chicago/Turabian StyleZhao, Jianfei, Anan Pongtornkulpanich, and Wenjin Cheng. 2022. "The Impact of Board Size on Green Innovation in China’s Heavily Polluting Enterprises: The Mediating Role of Innovation Openness" Sustainability 14, no. 14: 8632. https://doi.org/10.3390/su14148632

APA StyleZhao, J., Pongtornkulpanich, A., & Cheng, W. (2022). The Impact of Board Size on Green Innovation in China’s Heavily Polluting Enterprises: The Mediating Role of Innovation Openness. Sustainability, 14(14), 8632. https://doi.org/10.3390/su14148632