Key Factors of AS Performance in Emerging Central and Eastern European Countries: Evidence from Romania

Abstract

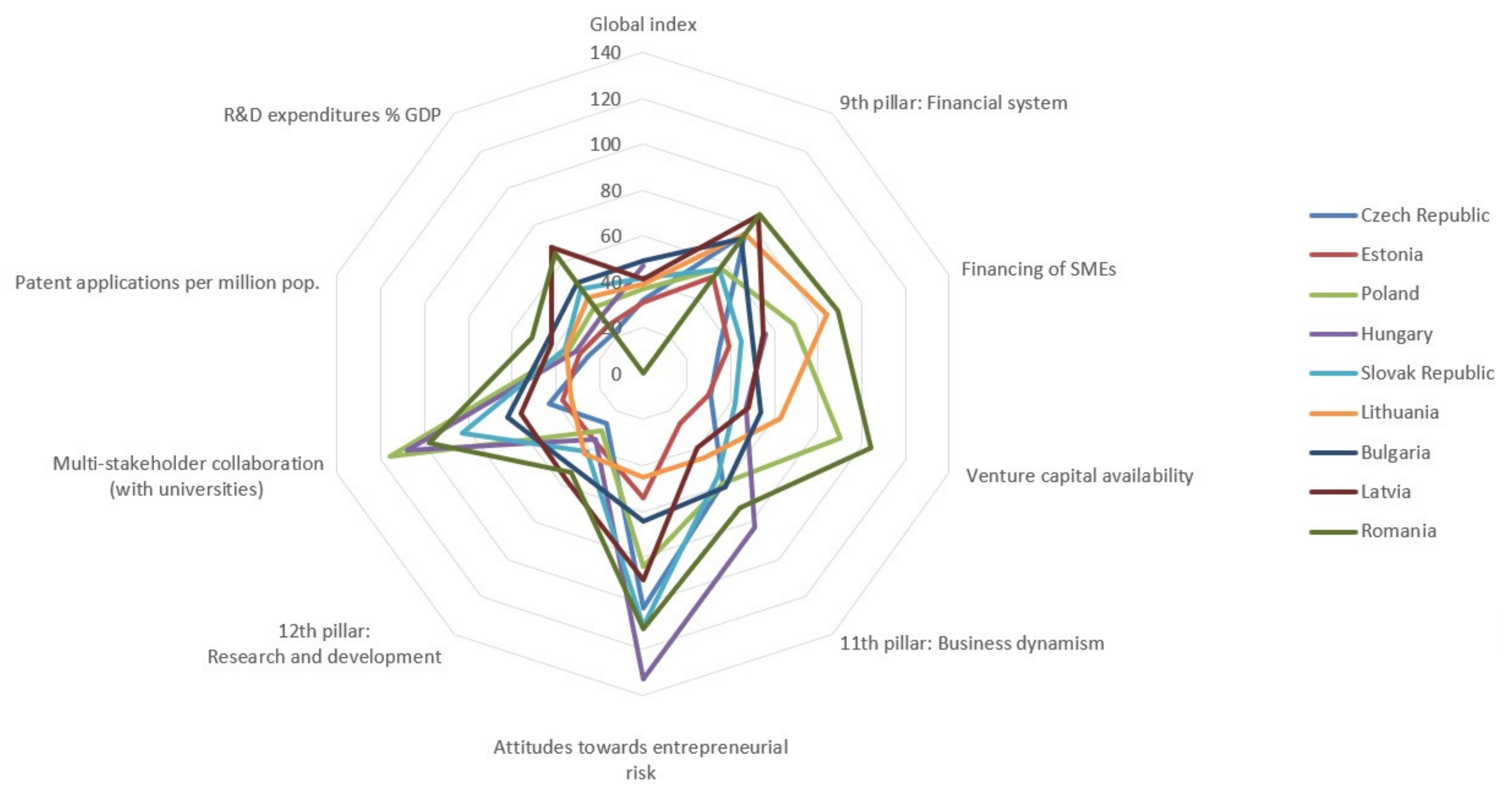

1. Introduction

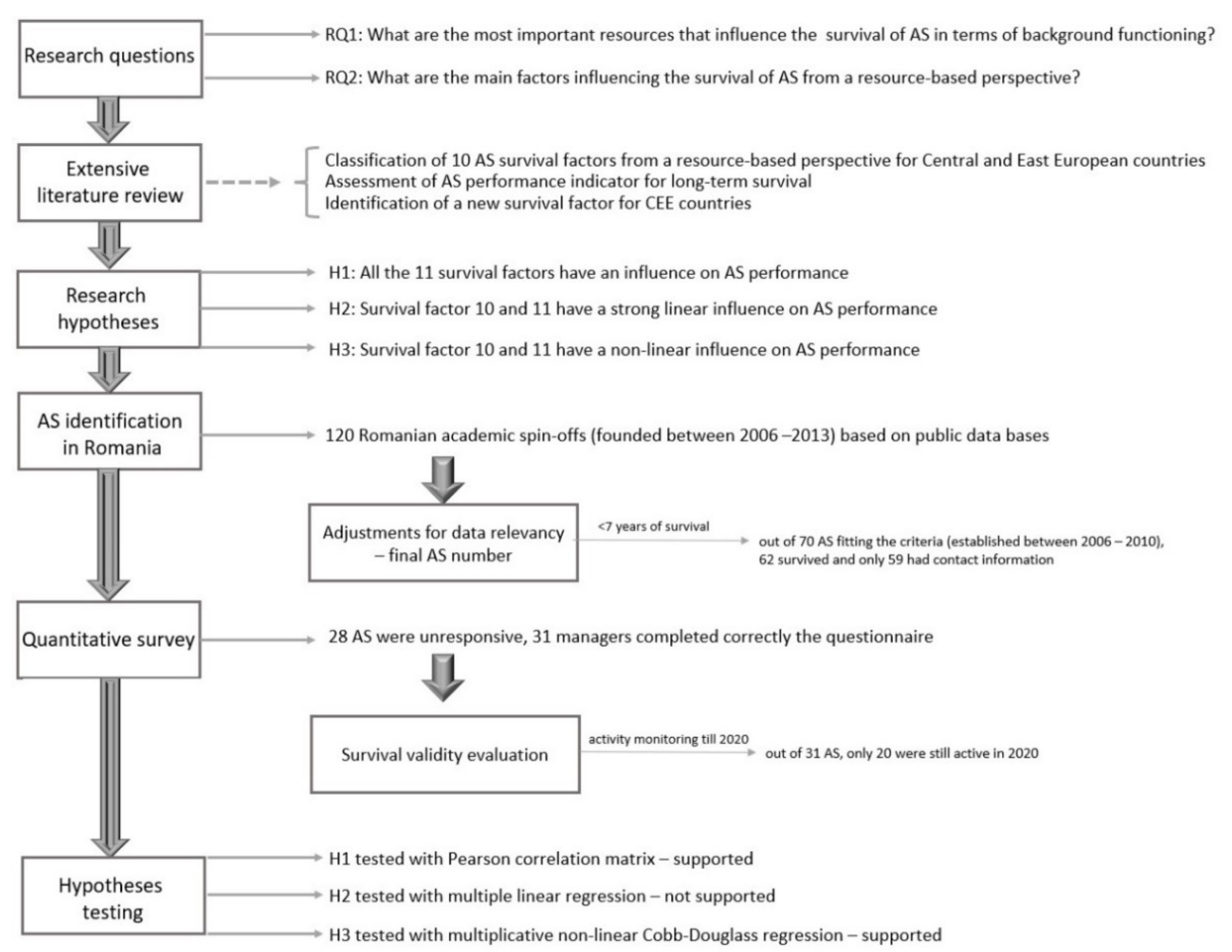

2. Literature Review and Hypotheses

2.1. Survival Factors for AS and Performance Measurement

2.1.1. Main Factors Influencing the Survival of an Academic Spin-Off

- -

- Networking and material resources available in the incubation stage: Spin-out from research experiments where an AS receives internal office space and infrastructure for free [26]. According to Aspelund et al. [44], the initial resources in the incubation stage (human, social, and access to material equipment) were significant predictors of AS survival. From this point, the aim is to have a strong collaboration with the parent research institution [52].

- -

- Sharing of Research Equipment for Spin-Off Long-Term Development: The knowledge infrastructure is of the greatest significance because industrial production is based on knowledge: industrial technology is knowledge related to material transformation, which is the center of the national innovation system [56]. Steffensen et al. [57] underlined that the most relevant factor influencing the success of spin-offs was the degree of support received in the growth stages.

- -

- Quality of scientific support for the development of the product: AS companies in later stages of life focus on maintaining strong relationships with universities, aiming to increase the chance of obtaining research funding [45].

- -

- -

- The manager’s entrepreneurial competency: The available evidence on university spin-offs [58] demonstrates that, often in the initial years of functioning, the founders of the company are the managers of the AS. Since scientist-entrepreneurs do not possess commercial managerial skills [33], prior business experience has been considered an advantage for the survival of the company [42,50]. Landry et al. [59] explained how consulting experience helped in the creation of a university spin-off.

- -

- -

- The individual-level attitude towards commercialization of the research result: The initial strategic actions taken by the employees of an AS are crucial but largely unexplored [60]. Würmseher’s [53] three entrepreneurial models explained the main challenges academic researchers face when commercializing their innovations. Inevitably, inventors who become entrepreneurs are strongly committed to technology, which is particularly useful for overcoming problems arising during the commercialization process [61].

- -

- The stage level of the research product: The level of product innovation was used as an assessment method for spin-off survival in the UK [62]. Schillo [12] considered patent protection and technological uncertainty for spin-off success. Aspelund et al. [44] showed that a higher degree of technological radicalness increased the probability of survival.

- -

- Consortia of public research institutes with firms: Public authorities offer grants in most cases only for the first stages of research. Thus, academic spin-offs are not able to adequately finance the next commercial development stage because they do not generate sufficient revenue to cover the needed investment costs. In this situation, scholars have outlined that parent university equity ownership is vital to the success of a spin-off [50,55].

- -

- Venture capital during the growth of the firm: Having an idea or invention is not enough, and finance becomes critical for a spin-off company. For external source financing, we found venture capital and business angel financing. Due to the fact that an AS is a high-risk project, it loses attractiveness to banks and has to direct its efforts towards venture capitalists [63]. The performance of an AS is influenced by its capacity to attract venture capital [37].

2.1.2. Measuring Academic Spin-Off Performance

2.1.3. Team Competency in Accessing Government Funds: A Specific Factor for Central and Eastern European Countries

3. Method and Data Used

4. Data Analysis

5. Results

× exp(b9 × log(X9)) × exp(b10 × log(X10)) × log (X1)) × exp (b2 × log (X2)) × exp (b5 × log (X5)) × exp (b6 × log (X6)) × exp (b9 × log (X9)) × exp (b10 × log (X10)) × exp (b11 × log (X11))

6. Discussion and Findings

7. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Appendix A

References

- Reichert, S. The Role of Universities in Regional Innovation Ecosystems; EUA European University Association: Brussels, Belgium, 2019. [Google Scholar]

- Vac, C.S.; Fitiu, A. Building Sustainable Development through Technology Transfer in a Romanian University. Sustainability 2017, 9, 2042. [Google Scholar] [CrossRef]

- Vega-Gomez, F.-S.; Miranda, F.J.; Mera, A.C.; Mayo, J.P. The Spin-Off as an Instrument of Sustainable Development: Incentives for Creating an Academic USO. Sustainability 2018, 10, 4266. [Google Scholar] [CrossRef]

- Hsu, D.H.; Roberts, E.B.; Eesley, C.E. Entrepreneurs from technology-based universities: Evidence from MIT. Res. Policy 2007, 36, 768–788. [Google Scholar] [CrossRef]

- Shane, S. Academic Entrepreneurship: University Spin-Offs and Wealth Creation; Edward Elgar Publishing: Cheltenham, UK, 2004. [Google Scholar]

- Bathelt, A.; Kogler, D.; Munro, A. A knowledge-based typology of university spin-offs in the context of regional economic development. Technovation 2010, 30, 519–532. [Google Scholar] [CrossRef]

- Smilor, R.W.; Gibson, D.V.; Dietrich, G.B. University spin-out companies: Technology start-ups from UT-Austin. J. Bus. Ventur. 1990, 5, 63–76. [Google Scholar] [CrossRef]

- Pirnay, F.; Surlemont, B.; Nlemvo, F. Toward a typology of university spin-offs. Small Bus. Econ. 2003, 21, 355–369. [Google Scholar] [CrossRef]

- Di Gregorio, D.; Shane, S. Why do some universities generate more start-ups than others? Res. Policy 2003, 32, 209–227. [Google Scholar] [CrossRef]

- Mathisen, T.M.; Rasmussen, E. The development, growth, and performance of university spin-offs: A critical review. J. Technol. Transf. 2019, 44, 1891–1938. [Google Scholar] [CrossRef]

- Sinell, A.; Brodack, F.; Denef, S. Design and Academic Entrepreneurship. The Role of Design in Spin-off Processes. Des. J. 2017, 20, 457–468. [Google Scholar] [CrossRef]

- Schillo, R.S. Research-based spin-offs as agents in the entrepreneurial ecosystem. J. Technol. Transf. 2018, 43, 222–239. [Google Scholar] [CrossRef]

- Bibu, N.; Mihali, L.M.; Munteanu, V.; Sala, D. Evaluating the Performance of University Innovative Companies. In The Management of Academic Spin-Offs and Start-Ups in Romania, The Best Romanian Management Studies 2017–2018; Nicolescu, O., Oprean, C., Titu, A.M., Eds.; Trivent Publishing: Budapest, Hungary, 2020; pp. 84–100. [Google Scholar]

- Rogers, E.; Takegami, S.; Yin, J. Lessons learned about technology transfer. Technovation 2001, 21, 253–261. [Google Scholar] [CrossRef]

- Bray, M.J.; Lee, J.N. University revenues from technology transfer: Licensing fees vs. equity positions. J. Bus. Ventur. 2000, 15, 385–392. [Google Scholar] [CrossRef]

- Thomas, V.J.; Bliemel, M.; Shippam, C.; Maine, E. Endowing university spin-offs pre-formation: Entrepreneurial capabilities for scientist-entrepreneurs. Technovation 2020, 96–97, 102153. [Google Scholar] [CrossRef]

- Klepper, S.; Slepeer, S. Entry by Spinoffs. Manag. Sci. 2005, 51, 1291–1306. [Google Scholar] [CrossRef]

- Organisation for Economic Co-operation and Development. Commercialising Public Research: New Trends and Strategies; OECD Publishing: Paris, France, 2013. [Google Scholar]

- Mustar, P.; Renault, M.; Colombo, M.G.; Piva, E.; Fontes, M.; Lockett, A.; Wright, M.; Clarysse, B.; Moray, N. Conceptualising the heterogeneity of research- based spin-offs: A multi-dimensional taxonomy. Res. Policy 2006, 35, 289–308. [Google Scholar] [CrossRef]

- Buenstorf, G. Evolution on the shoulders of giants: Entrepreneurship and firm survival in the German laser industry. Rev. Ind. Organ. 2007, 30, 179–202. [Google Scholar] [CrossRef]

- Van Geenhuizen, M.; Soetanto, D. Academic spin-offs at different ages: A case study in search of key obstacles to growth. Technovation 2009, 29, 671–681. [Google Scholar] [CrossRef]

- Siegel, D.S.; Waldman, D.A.; Link, A. Assessing the impact of organizational practices on the relative productivity of university technology transfer offices: An exploratory study. Res. Policy 2003, 32, 27–48. [Google Scholar] [CrossRef]

- Elpida, S.; Galanakis, K.; Bakouros, I.; Platias, S. The Spin-off Chain. J. Technol. Manag. Innov. 2010, 5, 51–68. [Google Scholar] [CrossRef][Green Version]

- Mutalimov, V.; Kovaleva, I.; Mikhaylov, A.; Stepanova, D. Assessing regional growth of small business in Russia. Entrep. Bus. Econ. Rev. 2021, 9, 119–133. [Google Scholar] [CrossRef]

- Kranina, E.I. China on the way to achieving carbon neutrality. Financ. J. 2021, 5, 51–61. [Google Scholar] [CrossRef]

- Degroof, J.J. Spinning off New Ventures from Research Institutions Outside High Tech Entrepreneurial Areas. Ph.D. Thesis, Massachusetts Institute of Technology, Cambridge, MA, USA, 2002. [Google Scholar]

- Wright, M.; Clarysse, B.; Mustar, P.; Lockett, A. Academic Entrepreneurship in Europe; Edward Elgar Publishing: Cheltenham, UK, 2007. [Google Scholar]

- Sternberg, R. Success factors of university-spin-offs: Regional government support programs versus regional environment. Technovation 2014, 34, 137–148. [Google Scholar] [CrossRef]

- Son, H.; Chung, Y.; Hwang, H. Do technology entrepreneurship and external relationships always promote technology transfer? Evidence from Korean public research organizations. Technovation 2019, 82–83, 1–15. [Google Scholar] [CrossRef]

- Vincett, P.S. The economic impacts of academic spin-off companies, and their implications for public policy. Res. Policy 2010, 39, 736–747. [Google Scholar] [CrossRef]

- Fini, R.; Fu, K.; Mathisen, M.T.; Rasmussen, E.; Wright, M. Institutional determinants of academic spin-off quantity and quality: A longitudinal, multilevel, cross-country study. Small Bus. Econ. 2017, 48, 361–391. [Google Scholar] [CrossRef]

- Van Looy, B.; Landoni, P.; Callaert, J.; van Pottelsberghe, B.; Sapsalis, E.; Debackere, K. Entrepreneurial effectiveness of European universities: An empirical assessment of antecedents and trade-offs. Res. Policy 2011, 40, 553–564. [Google Scholar] [CrossRef]

- Vohora, A.; Wright, M.; Lockett, A. Critical junctures in the growth in university high-tech spinout companies. Res. Policy 2002, 33, 147–175. [Google Scholar] [CrossRef]

- Veugelers, R.; Del Rey, E. The Contribution of Universities to Innovation, (Regional) Growth and Employment; EENEE Analytical Report 18; European Commission: Brussels, Belgium, 2014. [Google Scholar]

- Rasmussen, E.; Mosey, S.; Wright, M. The Evolution of Entrepreneurial Competencies: A Longitudinal Study of Academic spin-off Venture Emergence. J. Manag. Stud. 2011, 48, 1314–1345. [Google Scholar] [CrossRef]

- Venturini, K.; Verbano, C. Open Innovation in the public sector: Resources and performance of research based spin-offs. Bus. Process Manag. J. 2017, 23, 1463–7154. [Google Scholar] [CrossRef]

- Shane, S.; Stuart, T. Organizational endowments and the performance of university start-ups. Manag. Sci. 2002, 48, 154–170. [Google Scholar] [CrossRef]

- Bigliardi, B.; Galati, F.; Verbano, C. Evaluating Performance of University Spin-Off Companies: Lessons from Italy. J. Technol. Manag. Innov. 2013, 8, 178–188. [Google Scholar] [CrossRef]

- Shane, S.; Khurana, R. Bringing Individuals Back In: The Effects of Career Experience on New Firm Founding. Ind. Corp. Change 2003, 12, 519–543. [Google Scholar] [CrossRef]

- Zucker, L.G.; Darby, M.R.; Brewer, M.B. Intellectual Human Capital and the Birth of US Biotechnology Enterprises. Am. Econ. Rev. 1998, 88, 290–306. [Google Scholar]

- Buratti, N.; Profumo, G.; Persico, L. The impact of market orientation on academic spin-off business performance. J. Int. Entrep. 2021, 19, 104–129. [Google Scholar] [CrossRef]

- Rasmussen, E.; Mosey, S.; Wright, M. The influence of university departments on the evolution of entrepreneurial competencies in spin-off ventures. Res. Policy 2014, 43, 92–106. [Google Scholar] [CrossRef]

- Djokovic, D.; Souitaris, V. Spinouts from academic institutions: A literature review with suggestions for further research. J. Technol. Transf. 2008, 3, 225–247. [Google Scholar] [CrossRef]

- Aspelund, A.; Berg-Utby, T.; Skjevdal, R. Initial Resources’ Influence on New Venture Survival: A Longitudinal Study of New Technology-Based Firms. Technovation 2005, 25, 1337–1347. [Google Scholar] [CrossRef]

- Soetanto, D.; Geenhuizen, M. Getting the right balance: University networks’ influence on spin-offs attraction of funding for innovation. Technovation 2015, 36–37, 26–38. [Google Scholar] [CrossRef]

- Treibich, T.; Konrad, K.; Truffer, B. A dynamic view on interactions between academic spin-offs and their parent organizations. Technovation 2013, 33, 450–462. [Google Scholar] [CrossRef]

- Gurdon, M.A.; Samsom, K.J. A longitudinal study of success and failure among scientist started ventures. Technovation 2010, 30, 207–221. [Google Scholar] [CrossRef]

- Miranda, J.V.; Chamorro-Mera, A.; Rubio, S. Academic entrepreneurship in Spanish universities: An analysis of the determinants of entrepreneurial intention. Eur. Res. Manag. Bus. Econ. 2014, 23, 113–122. [Google Scholar] [CrossRef]

- De Cleyn, S.H.; Brae, J.; Klofsten, M. How human capital interacts with the early development of academic spin-offs. Int. Entrep. Manag. J. 2015, 3, 599–621. [Google Scholar] [CrossRef]

- Bolzani, D.; Rasmusen, E.; Fini, R. Spin-offs’ linkages to their parent universities over time: The performance implications of equity, geographical proximity, and technological ties. Strateg. Entrep. J. 2021, 15, 590–618. [Google Scholar] [CrossRef]

- Clarysse, B.; Wright, M.; Lockett, A.; Van de Velde, E.; Vohora, A. Spinning out new ventures: A typology of incubation strategies from European research institutions. J. Bus. Ventur. 2005, 20, 183–216. [Google Scholar] [CrossRef]

- Hesse, N.; Sternberg, R. Alternative growth patterns of university spin-offs: Why so many remain small? Int. Entrep. Manag. J. 2017, 13, 953–984. [Google Scholar] [CrossRef]

- Würmseher, M. To each his own: Matching different entrepreneurial models to the academic scientist’s individual needs. Technovation 2017, 59, 1–17. [Google Scholar] [CrossRef]

- Park, J.B.; Ryu, T.K.; Gibson, D.V. Facilitating public-to-private technology transfer through consortia: Initial evidence from Korea. J. Technol. Transf. 2010, 35, 237–252. [Google Scholar] [CrossRef]

- Kroll, H.; Liefner, I. Spin-off enterprises as a means of technology commercialisation in a transforming economy—Evidence from three universities in China. Technovation 2008, 28, 298–313. [Google Scholar] [CrossRef]

- Van Geenhuizen, M.; Gibson, D.; Heitor, M.V. (Eds.) Regional Development and Conditions for Innovation in the Network Society; Purdue University Press: West Lafayette, IN, USA, 2005. [Google Scholar]

- Steffensen, M.; Rogers, E.M.; Speakman, K. Executive Forum: Spin-offs from Research Centers at a Research University. J. Bus. Ventur. 2000, 15, 93–111. [Google Scholar] [CrossRef]

- Ensley, M.D.; Hmieleski, K.A. A comparative study of new venture top management team composition, dynamics and performance between university-based and independent start-ups. Res. Policy 2005, 34, 1091–1105. [Google Scholar] [CrossRef]

- Landry, R.; Amara, N.; SaIhi, M. Patenting and spin-off creation by Canadian researchers in engineering and life sciences. J. Technol. Transf. 2007, 32, 217–249. [Google Scholar] [CrossRef]

- Vaznyte, E.; Andries, P.; Demeulemeester, S. “Don’t leave me this way!” Drivers of parental hostility and employee spin-offs’ performance. Small Bus. Econ. 2021, 57, 265–293. [Google Scholar] [CrossRef]

- Franklin, S.J.; Wright, M.; Lockett, A. Academic and surrogate entrepreneurs in university spin-out companies. J. Technol. Transf. 2001, 26, 127–141. [Google Scholar] [CrossRef]

- De Coster, R.; Butler, C. Assessment of proposals for new technology ventures in the UK: Characteristics of academic spin-off companies. Technovation 2005, 25, 535–543. [Google Scholar] [CrossRef]

- Audretsch, D.B.; Lehmann, E.E.; Warning, S. University spillovers and new firm location. Res. Policy 2005, 34, 1113–1122. [Google Scholar] [CrossRef]

- Egeln, J.; Gottschalk, S.; Rammer, C.; Spielkamp, A. Spin Off-Grundungen aus der Offentlichen Forschung in Deutschland; Nomos Publishing House: Baden-Baden, Germany, 2003. [Google Scholar]

- Schmelter, A. Entwicklungsverlaufe forschungsnaher Unternehmensgrundungen und deren Determinanten. Die Betr. 2004, 64, 471–486. [Google Scholar]

- Eroglu, I.; Rashid, L. The Impact of Perceived Support and Barriers on the Sustainable Orientation of Turkish Startups. Sustainability 2022, 14, 4666. [Google Scholar] [CrossRef]

- Antolín-López, R.; Céspedes-Lorente, J.; García-de-Frutos, N.; Martínez-del-Río, J.; Pérez-Valls, M. Fostering product innovation: Differences between new ventures and established firms. Technovation 2015, 41–42, 25–37. [Google Scholar] [CrossRef]

- OECD Glossary. 2001. Available online: https://stats.oecd.org/glossary/detail.asp?ID=2443 (accessed on 19 May 2022).

- European Commission. Towards a 2030 Vision on the Future of Universities in Europe; European Commission: Brussels, Belgium, 2020; ISBN 978-92-76-21568-4. [Google Scholar]

- Schwab, K. The Global Competitiveness Report; World Economic Forum: Geneva, Switzerland, 2019; ISBN 13 978-2-940631-02-5-13. [Google Scholar]

- Dőry, T.; Csonka, L.; Slavcheva, M. RIO Country Report 2017: Hungary, Luxembourg; Publications Office of the European Union: Brussels, Belgium, 2008; ISBN 978-92-79-81343-6. [Google Scholar]

- Paliokaitė, A.; Petraitė, M.; Gonzalez Verdesoto, E. RIO Country Report 2017: Lithuania; Publications Office of the European Union: Luxembourg, 2018; Available online: https://ec.europa.eu/jrc/en/publication/eur-scientific-and-technical-research-reports/rio-country-report-2017-lithuania (accessed on 19 May 2022).

- Shrolec, M.; Sanchez-Martinez, M. RIO Country Report 2017: Czech Republic; Publications Office of the European Union: Luxembourg, 2017; ISBN 978-92-79-81235-4. [Google Scholar]

- Kwiotkowska, A. Alternative combinations of determinants creating financial strategy. The case of Polish university spin-off companies. Argum. Oeconomica 2020, 1, 1233–5835. [Google Scholar] [CrossRef]

- Breznitz, D.; Ornston, D. EU financing and innovation in Poland, EBRD Working Paper No. 198. J. Technol. Transf. 2017, 32, 217–249. [Google Scholar]

- Korpysa, J. Endo- and exogenous conditions of entrepreneurial process of university spin-off companies in Poland. Procedia Comput. Sci. 2019, 159, 2481–2490. [Google Scholar] [CrossRef]

- Fini, R.; Toschi, L. Academic logic and corporate entrepreneurial intentions: A study of the interaction between cognitive and institutional factors in new firms. Int. Small Bus. J. 2016, 34, 637–659. [Google Scholar] [CrossRef]

- Moiseev, N.; Mikhaylov, A.; Varyash, I.; Saqib, A. Investigating the relation of GDP per capita and corruption index. Entrep. Sustain. Issues 2020, 8, 780–794. [Google Scholar] [CrossRef]

| Study | Country | Sample Period | Methodology | Relevant Variables | Results |

|---|---|---|---|---|---|

| Sinell et al. [11] | 60 qualitative interviews in the UK | 6-month period | Case study approach | Design and resource acquisition competence | “Successfully initiate an academic spin-off, academic founding teams must develop a specific set of entreprenerial competencies” |

| Schillo [12] | 7 spin-offs in 5 European countries | 1995–2000 | Case study approach; regression | Organizational resources, human resources, technological resources, physical resources, financial resources, networking resources | “Case of survival through merger or acquisition, the presence of venture capital” |

| Buenstorf [20] | 143 producers of lasers in Germany | 1964–2003 | Company longevity: over 7 years of survival; proportional Gompertz model | Years of entry and exit from the laser industry, type(s) of lasers produced initially, mergers and acquisitions, founders’ names and backgrounds, prior employment periods, firm background prior to entry into laser industry (for diversifying firms) | Technological capabilities are determinants of firm success |

| Clarysse et al. [26] | 43 companies employed by European research institutions | 1995–2002 | Qualitative approach | Networking resources, technological resources, financial resources | Because the origin of each spin-out company lies within the lab, internal office space is offered for free, and infrastructure is available |

| Venturi and Verbano [36] | 2009–2012 | India | Case study approach using four stages of development by Vohora et al. (2004) | Techn. Resources: degree of innovativeness, stage of development of technology, ability to patent and protect the technology, scope of technology; Human resources: type of parent organization (PO), founders’ positions in PO, formal team size, PhD experience or scientific background in active founding team, sector experience of at least one of the founders, management experience, previous entrepreneurial experience of team, variety of backgrounds and work experience in the team, joint working experience and cognitive similarity of the team; Financial resources: type of funding, amount of funding, social resources, relationship with PO, supporting strategy, mechanisms and financial incentives toward spin-off, tangible resources (i.e., laboratory facilities and access to research equipment), intangible resources (e.g., access to human capital, and scientific and business knowledge), scientific quality and perceived image of PO, quality and support of technology transfer office, contacts with industrial, financial, and research organizations (no. of entities), venture capital investors, financial institutions, commercial partners, competitors, customers, suppliers, or other research centers | “…the success of RBSOs is based on technological resources, even if social resources appear to be equally important…” |

| Shane and Stuart [37] | 134 spin-offs in the USA | 1980–1994 | Event history method; regression | Endowments: social capital (venture capital investitor); endowments: human capital (founders’ industry experience); endowments: technical assets (patents); endowments: industry attractiveness (industry conditions) | “social capital endowments have a positive effect on the performance “, capacity to attract venture capital financing and the experience of initial public offerings influence the performance of a spin-off |

| Aspelund et al. [44] | 80 Norwegian and Swedish technology-based start-ups | 1995–2000 | Cox regression model | Team size, entrepreneurial experience, team heterogeneity, radicalness of the technology | Team heterogeneity and radicalness of the technology increase the probability of survival |

| Soetanto and Geenhuizen [45] | 100 spin-offs in Netherlands and Norway | 2006–2008 | Curvilinear model regression | Firm age, firm size, university-employed founder, level of innovativeness, university network density (contacts within a network connected to each other) | “spin-off’s ability to attract external funding for innovation is influenced positively by the density of its university network” |

| Treibich et al. [46] | France and Switzerland | Too long-term periods (4–15 years); 25 case studies of spin-off | Sharing of research equipment (parent unit: department or team) | Biotech firms need the technical support of the parent because the cost of equipment is very high | |

| Gurdon and Samsom [47] | USA | 22 spin-offs; 1999–2000 | Longitudinal study | Number of employees, technological knowledge, access to capital | “Scientific expertise is essential for the long-term survival of USOs” |

| Miranda et al. [48] | Spain | 500 spin-offs; 2014 | Squares (PLS) regression | Creativity (CREA), entrepreneurial intention of the manager, entrepreneurial attitude of the manager, perceived utility, business experience | Academic business experience positively influences academic perceived utility, entrepreneurial attitude of the manager is the most relevant indicator for AS performance |

| De Cleyn et al. [49] | 8300 ASOs in 24 European countries | 1985–2009 | Logistic regression | Management team and director characteristics (education, work experience, heterogeneity, and participation), prior entrepreneurial experience | “strong and positive effect of the level of legal expertise of the manager or the different effect of the previous entrepreneurial experience of the manager foster ASO survival” |

| Bolzani et al. [50] | Italy; 551 universities | 2000–2008 | GMM estimator | Parent ownership, geographical proximity, technological ties, parent board membership, entrepreneurial team, commercial experience, regional financial support, market performance, innovation skills | Geographical proximity does not have an impact on market performance; technological ties negatively influence the market performance; parent ownership has a positive effect on market performance |

| Rasmussen et al. [42] | Norway | 12–15 months | Case study using the stages of development credibility threshold (Vohora et al., 2004) | Company founders’ entrepreneurial team member competencies, opportunity identification and development, championing resource acquisition | University department reputation positively influences the competencies in university spin-offs |

| Bigliardi et al. [38] | Italy | 20 spin-offs | Delphi Technic | Characteristics of the university: involvement of the university by financial contribution in the company and allowing access for acquiring entrepreneurial knowledge; Characteristics of the founders: the desire to be autonomous, the motivation of the founders, and reorientation in the career; Characteristics of the external environment: characteristics of the industry, existing regional infrastructure, geographical location, and existing capital; Technological characteristics: the degree of innovation, the development stage of the product, technology or service, the ability to patent and maintain the intellectual property rights | The performance is measured with the 4 financial factors previously identified: growth in sales, employment growth, net cash flow, and revenue growth |

| Resource Dimensions | Factors for Spin-Off Survival | Authors |

|---|---|---|

| Social resources | networking, material resources available in the incubation stage | Aspelund et al. [44] |

| Clarysse et al. [51] | ||

| quality of scientific support regarding the development of the product | Soetanto and Geenhuizen [45] | |

| the sharing of research equipment for spin-off long-term development | Treibich et al. [46]) | |

| Human resources | manager research skills | Gurdon and Samsom [47] |

| the entrepreneurial competency of the manager | Miranda et al. [48] | |

| De Cleyn et al. [49] | ||

| previous entrepreneurial experience of the team | Rasmussen et al. [42] | |

| Hesse and Sternberg [52] | ||

| Sinell et al. [11] | ||

| the individual-level attitude towards commercialization of the research results | Würmseher [53] | |

| Hesse and Sternberg [52] | ||

| Technological resources | the stage level of the research product | Aspelund et al. [44] |

| Bigliardi et al. [38] | ||

| Venturi and Verbano [36] | ||

| Financial resources | venture capital during the growth of the firm | Schillo [12] |

| Shane and Stuart [37] | ||

| consortia of public research institutes and firms | Park et al. [54] | |

| Bolzani et al. [50] | ||

| Kroll and Liefner [55] |

| Industry or Field of Activity | No. | Year | |||||||

|---|---|---|---|---|---|---|---|---|---|

| 2006 | 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | ||

| Materials | 30 | 2 | 3 | 6 | 8 | 7 | 4 | ||

| Environment | 3 | 1 | 1 | 1 | |||||

| Electronics | 18 | 2 | 1 | 1 | 2 | 5 | 5 | 2 | |

| Advanced services | 57 | 2 | 6 | 14 | 13 | 8 | 10 | 4 | |

| Biomedical | 12 | 1 | 2 | 2 | 5 | 2 | |||

| TOTAL | 120 | 4 | 4 | 10 | 24 | 28 | 22 | 22 | 6 |

| Academic Spin-Off | Industry Affiliation | Year of Establishment | Region | Number of Research Institutes and Universities in the Region | Firm Age (from Formation Until 2020) |

|---|---|---|---|---|---|

| AS1 | Manufacture of other electrical equipment | 2009 | Bucharest-Ilfov | 67 | 11 |

| AS2 | Analyses for control problems in the pharmaceutical field | 2009 | Northwest | 17 | 11 |

| AS3 | Wholesale of electronic and telecommunication components and equipment | 2009 | Northeast | 17 | 11 |

| AS4 | Electrical works | 2006 | Northeast | 17 | 14 |

| AS5 | Manufacture of pharmaceutical preparations | 2010 | Central | 13 | 10 |

| AS6 | Custom software development activities (customer-oriented software) | 2007 | SW Oltenia | 5 | 13 |

| AS7 | Nutrition and heath | 2010 | Bucharest-Ilfov | 67 | 10 |

| AS8 | Business and management consulting activities | 2009 | Bucharest-Ilfov | 67 | 11 |

| AS9 | Manufacture of other electrical equipment | 2008 | Bucharest-Ilfov | 67 | 12 |

| AS10 | Engineering activities and technical consultancy related to them | 2010 | Bucharest-Ilfov | 67 | 10 |

| AS11 | Manufacture of electric motors, generators, and transformers | 2008 | Bucharest-Ilfov | 67 | 12 |

| AS12 | Manufacture of other chemical products | 2007 | Bucharest-Ilfov | 67 | 13 |

| AS13 | Custom software development activities (customer-oriented software | 2009 | West | 15 | 11 |

| AS14 | Technology for the manufacture of cast steel parts | 2009 | Northeast | 17 | 11 |

| AS15 | Manufacture of other electronic components | 2010 | SW Oltenia | 5 | 10 |

| AS16 | General mechanics operations | 2010 | West | 15 | 10 |

| AS17 | Custom software development activities (customer-oriented software | 2010 | Northwest | 17 | 10 |

| AS18 | Specialized medical assistance activities | 2009 | Bucharest-Ilfov | 67 | 11 |

| AS19 | Specialized medical assistance activities | 2010 | Bucharest-Ilfov | 67 | 10 |

| AS20 | Production of medical and laboratory devices, apparatus, and instruments | 2010 | Bucharest-Ilfov | 67 | 10 |

| X | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | Y | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 1 | consortia of public research institutes and firms | 1.000 | 0.567 | 0.109 | −0.266 | −0.098 | 0.258 | 0.015 | 0.111 | 0.426 | −0.030 | −0.402 | 0.012 |

| 2 | resources in incubation | 0.567 | 1.000 | 0.047 | 0.030 | 0.169 | 0.175 | −0.047 | 0.234 | 0.216 | −0.179 | −0.400 | 0.176 |

| 3 | manager’s research skills | 0.109 | 0.047 | 1.000 | −0.111 | 0.154 | 0.233 | 0.646 | 0.181 | 0.368 | 0.563 | 0.146 | 0.115 |

| 4 | manager’s entrepreneurial competency | −0.266 | 0.030 | −0.111 | 1.000 | 0.669 | 0.245 | −0.334 | 0.275 | 0.315 | −0.358 | 0.331 | 0.121 |

| 5 | previous entrepreneurial experience of team | −0.098 | 0.169 | 0.154 | 0.669 | 1.000 | 0.367 | −0.120 | 0.508 | 0.569 | −0.018 | −0.049 | −0.049 |

| 6 | research product stage | 0.258 | 0.175 | 0.233 | 0.245 | 0.367 | 1.000 | −0.147 | 0.314 | 0.417 | 0.025 | −0.303 | 0.169 |

| 7 | resources for long-term development | 0.015 | −0.047 | 0.646 | −0.334 | −0.120 | −0.147 | 1.000 | 0.095 | 0.113 | 0.697 | −0.024 | −0.098 |

| 8 | scientists’ attitudes towards commercialization | 0.111 | 0.234 | 0.181 | 0.275 | 0.508 | 0.314 | 0.095 | 1.000 | 0.339 | 0.225 | −0.250 | −0.026 |

| 9 | venture capital during the growth of the firm | 0.426 | 0.216 | 0.368 | 0.315 | 0.569 | 0.417 | 0.113 | 0.339 | 1.000 | 0.133 | −0.116 | −0.068 |

| 10 | quality of scientific support concerning the development of the product | −0.03 | −0.179 | 0.563 | −0.358 | 0.018 | 0.025 | 0.697 | 0.225 | 0.133 | 1.000 | −0.021 | −0.343 |

| 11 | team competency in accessing government funds | −0.402 | −0.400 | 0.146 | 0.331 | 0.234 | −0.303 | −0.024 | −0.250 | −0.116 | −0.021 | 1.000 | 0.243 |

| Y: sales growth | 0.012 | 0.176 | 0.115 | 0.121 | −0.049 | 0.169 | −0.098 | −0.026 | −0.068 | −0.343 | 0.243 | 1.000 |

| Estimate | Std. Error | t-Value | Pr (>|t|) | |

|---|---|---|---|---|

| b10 | −1.3666 | 0.8257 | −1.655 | 0.1152 |

| b11 | 1.7173 | 0.7211 | 2.382 | 0.0285 |

| Residual standard error: 4.163 on 18 degrees of freedom; | ||||

| multiple R-squared: 0.3347; adjusted R-squared: 0.2607; | ||||

| F-statistic: 4.527 on 2 and 18 degrees of freedom; p-value: 0.02555. | ||||

| Estimate | Std. Error | t-Value | Pr (>|t|) | |

|---|---|---|---|---|

| V1 | −1.7865 | 0.7049 | −2.534 | 0.2620 |

| V2 | 1.6373 | 0.5537 | 2.957 | 0.01199 |

| V5 | −5.1852 | 1.8294 | −2.834 | 0.01506 |

| V6 | 3.1334 | 1.7014 | 1.842 | 0.09037 |

| V9 | 0.9341 | 0.5556 | 1.681 | 0.11855 |

| V10 | −3.2461 | 0.9909 | −3.276 | 0.00663 |

| V11 | 4.5521 | 1.3113 | 3.471 | 0.00462 |

| Residual standard error: 1.183 on 12 degrees of freedom; | ||||

| multiple R-squared: 0.6712; adjusted R-squared: 0.4794; | ||||

| F-statistic: 3.499 on 7 and 12 degrees of freedom; p-value: 0.02771. | ||||

| Estimate | Std. Error | t-Value | Pr (>|t|) | |

|---|---|---|---|---|

| b1 | −0.5488 | 1.6655 | −0.330 | 0.747 |

| b2 | 1.1235 | 1.5235 | 0.737 | 0.474 |

| b5 | −3.0281 | 5.2640 | −0.575 | 0.575 |

| b6 | 1.6698 | 2.6178 | 0.638 | 0.535 |

| b9 | 0.8896 | 1.3362 | 0.666 | 0.517 |

| b10 | −2.0179 | 1.9846 | −1.017 | 0.328 |

| b11 | 2.8527 | 3.0331 | 0.941 | 0.364 |

| Residual standard error: 4.094 on 13 degrees of freedom. | ||||

| Estimate | Std. Error | t-Value | Pr (>|t|) | |

|---|---|---|---|---|

| b10 | −3.2431 | 1.4246 | −2.277 | 0.03526 |

| b11 | 3.1304 | 0.8765 | 3.571 | 0.00218 |

| Residual standard error: 3.838 on 18 degrees of freedom; | ||||

| number of iterations to convergence: 7; | ||||

| achieved convergence tolerance: 4.219 × 10−6 (0.000004219). | ||||

| Hypothesis | Support | |

|---|---|---|

| 1 | H1: The consortia of public research institutes with firms, resources in incubation, manager’s research skills, manager’s entrepreneurial competency, previous entrepreneurial experience of the team, research product stage, resources for longer-term development, scientists’ attitudes towards commercialization, venture capital during the growth of the firm, quality of scientific support concerning the development of the product, and team competency in accessing government funds have influences on AS performance. | Supported (p < 0.05) |

| 2 | H2: The quality scientific of support concerning the development of the product and the team competency in accessing government funds both have significant linear influences on AS performance. | Not supported |

| 3 | H3: The quality of scientific support concerning the development of the product and the team competency in accessing government funds both have a nonlinear influence on AS performance. | Supported (p < 0.05) |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Mihali, L.M.; Potra, S.; Dungan, L.I.; Negrea, R.; Cioabla, A. Key Factors of AS Performance in Emerging Central and Eastern European Countries: Evidence from Romania. Sustainability 2022, 14, 8328. https://doi.org/10.3390/su14148328

Mihali LM, Potra S, Dungan LI, Negrea R, Cioabla A. Key Factors of AS Performance in Emerging Central and Eastern European Countries: Evidence from Romania. Sustainability. 2022; 14(14):8328. https://doi.org/10.3390/su14148328

Chicago/Turabian StyleMihali, Lavinia Maria, Sabina Potra, Luisa Izabel Dungan, Romeo Negrea, and Adrian Cioabla. 2022. "Key Factors of AS Performance in Emerging Central and Eastern European Countries: Evidence from Romania" Sustainability 14, no. 14: 8328. https://doi.org/10.3390/su14148328

APA StyleMihali, L. M., Potra, S., Dungan, L. I., Negrea, R., & Cioabla, A. (2022). Key Factors of AS Performance in Emerging Central and Eastern European Countries: Evidence from Romania. Sustainability, 14(14), 8328. https://doi.org/10.3390/su14148328