1. Introduction

Renewable energy is crucial to achieving sustainable environmental and economic development. The dynamic development of renewable energy is of great significance in the management of increasingly prominent energy supply and demand conflicts, environmental pollution, and climate issues [

1]. However, the development and promotion of renewable energy still suffer from constraints including technical difficulties, high investment costs, and slow cost-benefit recovery. Enterprise pre-investment and research and development (R&D) costs are huge, and the risk of R&D revenue is high. Generally, it is difficult to develop a renewable energy industry sustained only by the investment of enterprises. As a result, many countries have formulated legal systems to support the construction and use of their renewable energy industries, facilitating the rapid growth of this industry [

2].

As China is in a critical period of economic development transformation, its financial support policies are bound to be biased towards the renewable energy industry, which contributes to the sustainable development of the market economy. According to statistics, in recent years, the renewable energy sector has received significant government subsidies covering a wide range of industries and is at the forefront of all types of industries. The ratio of government subsidies to non-recurring gains and losses in renewable energy enterprises is as high as 40%, accounting for 20–30% of total profits, illustrating that the distribution of government subsidies will have a significant impact on the development of the renewable energy industry. Currently, there is no specific regulation of renewable energy subsidies in China, only a scattering of various laws and regulations, which are relatively ineffective and low level. Incentives such as government subsidies are reduced to economic incentives, resulting in a relative lack of supporting legislation to implement the Renewable Energy Law. In terms of local legislation, only a few local laws provide incentives for renewable energy and new energy sources, such as accelerated depreciation to reduce corporate income tax payments. However, in most provinces and municipalities, renewable energy enterprises do not enjoy special incentives from local governments. So, how do government grants affect the innovative performance of renewable energy firms? What role do different business characteristics play in the distribution of government subsidies? What type of legislative policies can best stimulate innovation in renewable energy companies? These are a thought-provoking series of questions.

Previous research on these issues by scholars both at home and abroad can be divided into two main categories, one being research on renewable energy industrial policy and the other being research on the relationship between government subsidies and performance. Firstly, through examining the industrial policies of developed countries and regions such as the United States, Germany, and the European Union, it is clear that technological innovation is fundamental to renewable energy industrialization and that governments globally have spared no effort in supporting the research and development of renewable energy technologies [

3,

4]. In terms of renewable energy industry policies, all countries are basically the same, with policy being divided into three main areas: strengthening the protection of intellectual property rights, improving the investment environment, and establishing a renewable energy market, all of which are behind the booming development of the industry [

5,

6,

7]. Secondly, in terms of research into government subsidies and innovative performance, most scholars believe that governments implement government subsidies to guide the flow of industrial resources and promote their optimal allocation [

8,

9,

10,

11]. The nature of ownership, the industry, and the enterprise size are the main factors influencing government subsidies. In the sample strategic emerging industries, subsidies can generate a strong impetus for improving an enterprise’s research capability [

12,

13]. China’s subsidy policy has a major impact on increasing regional independent innovation output, and subsidies are more effective in regions with developed economies or higher levels of intellectual property protection [

14,

15]. In general, most studies either only theoretically analyze the industrial policies of different countries in the renewable energy sector or focus on the impact of such policies on firms at a micro-level [

16,

17,

18]. There is still much research needed to address the questions ‘what effect do government subsidies have on the innovative performance of different sub-sectors of renewable energy firms?’ and ‘how should government support nurture the development of the industry and how should the means of implementation be developed?’; therefore, such research is the focus of this paper.

When considering renewable energy development in China, solar and wind power can compete both in price and efficiency with conventional energy, as solar and wind power can be connected to the grid economically, and enterprises’ R&D technology level is constantly improving [

19,

20]. Additionally, renewable energy includes geothermal power, which can continuously transmit electricity and work continuously providing there is a geothermal source, and is completely unaffected by the climate. Moreover, building a geothermal power plant requires less expense when compared with coal, natural gas, and nuclear power plants [

21,

22]. Therefore, solar, wind, and geothermal power as secondary renewable energy industries are selected as research topics in this paper. This research focuses on the impact and pathways of government subsidies on the innovative performance of these three sub-sectors, as well as on exploring the role of intellectual property protection intensity in this context. Finally, recommendations are made for the development of legal policies on government subsidies and intellectual property protection for the renewable energy industry in China.

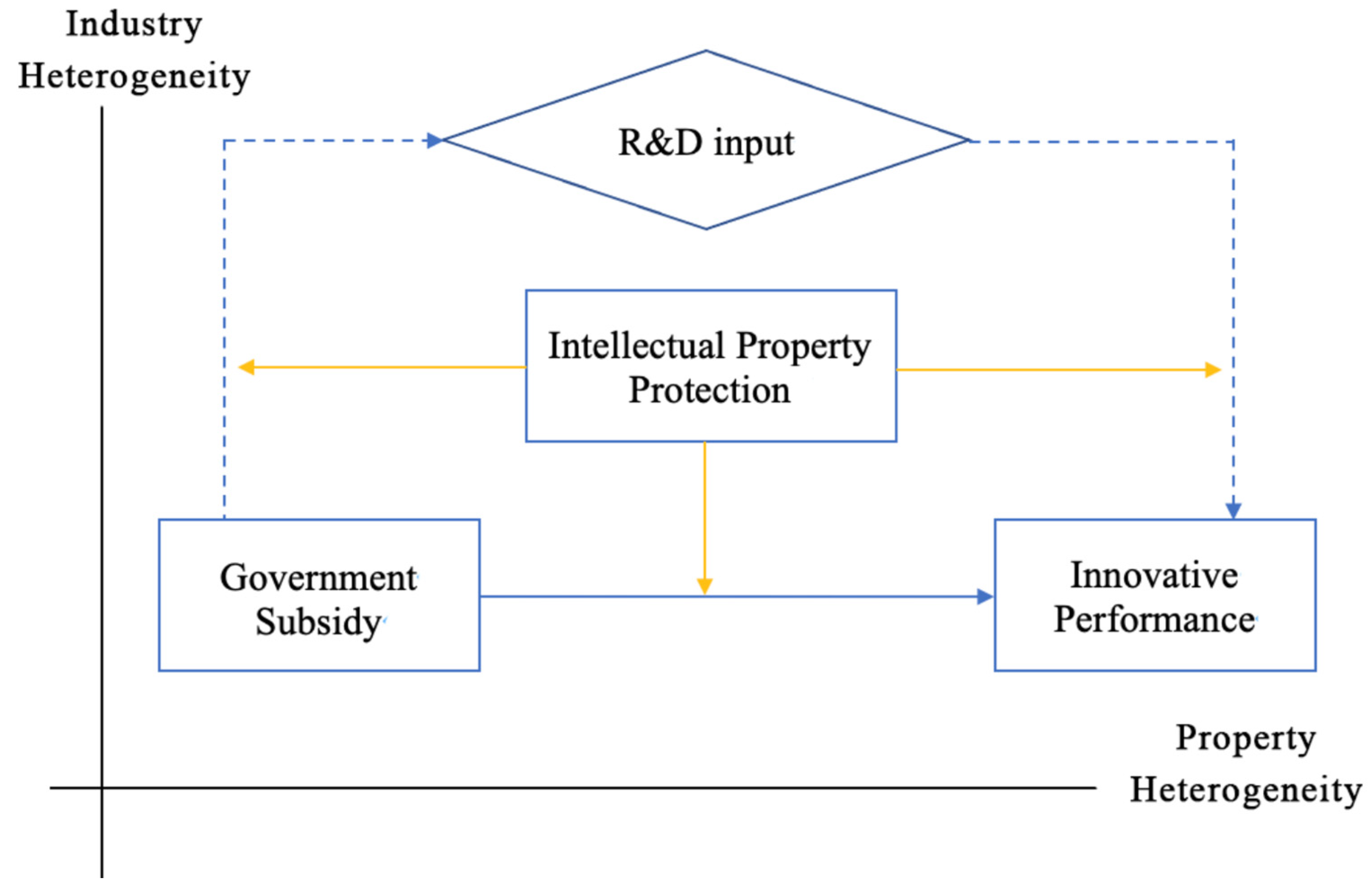

The contribution of this paper is reflected in proving the argument for different types of renewable energy enterprises as a research sample. Although government subsidies for renewable energy enterprises have become common, not all renewable energy enterprises receive them, and those received by different types of renewable energy enterprises vary greatly. Furthermore, even for similar enterprises, the efficiency of their use of government subsidies may vary depending on the nature of their shareholding, governance structure, etc. Consequently, this paper categorizes and studies three typical Chinese enterprises, namely, solar, wind, and geothermal energy, to specifically analyze the problem. In addition, the paper extends from the purely innovative performance of enterprises to the industry and even national macroeconomic policies, diversifying from the general research literature, which is limited to microeconomic individuals. The following is a flowchart for this article.

3. Model Design

3.1. Sample and Data

In this research, companies whose main business is geothermal, wind, and solar energy are screened out based on the scope of their main business of listed renewable energy companies in China. Selecting these three types of companies ensures that there is a large enough sample of companies in each category to prevent research bias due to small sample sizes. In addition, solar energy is the most mature renewable energy source in China, followed by wind energy, and geothermal energy is a new type of energy source that has just taken off in recent years. The selection of these three types of companies therefore allows for a comparison within the renewable energy industry and allows the authors to present more focused conclusions based on the different characteristics of the different companies. In addition, there is a serious lack of R&D data for these listed companies prior to 2013 and the latest available data were only updated to 2020 at the time of the study. This research therefore selects data for these companies for the period 2013–2020 as samples.

The innovative performance indicators in the empirical research data were selected from the Chinese Research Data Service (CNRDS). The R&D personnel and input data were obtained from the Wind database. The number of regional patent licenses and applications was obtained from the enterprise yearbook and additional data were taken from the Wind database and China Stock Market & Accounting Research Database (CSMAR).

The data selection was in accordance with the following principles to reduce any influence from the empirical study:

(1) Listed companies with incomplete data were excluded.

(2) 1416 research samples were finally obtained after the exclusion of Special treatment (ST) and *ST listed companies. (ST refers to a listed company with two consecutive years of losses; *ST refers to a listed company with three consecutive years of losses.)

All the above data processing procedures were performed using the data analysis software “STATA”. In order to make the data smoother and more stable, this paper winsorized extreme values at the 1% and 99% levels.

3.2. Variables

3.2.1. Explained Variable: Firm Innovative Performance (INO)

The quality and quantity of a firm’s innovation output cannot be measured directly, and patents are commonly used in the literature as a measure of innovative performance. Patents have the advantage of containing a large amount of information about the technology, invention, and inventor, and are relatively easy to access. Furthermore, the institutional patent application, examination, and grant regulations are generally consistent across regions nationwide, which makes patent data comparable [

51]. Since there is a certain period between the filing and granting of a patent, the number of patent applications is used to measure innovative performance and is logarithmized to avoid the impact of the approval cycle.

3.2.2. Main Explanatory Variables

- (1)

Government Subsidy (GOV)

In this paper, government subsidization is used as an explanatory variable. The technological innovation and investment return of renewable energy are characterized by high risk, high difficulty, and a longer timeframe. Consequently, government subsidies should promote the development of technological innovation in related industries. It is reasonable to assume that all government funding is categorized as “government subsidy”. In addition, this study uses logarithms to represent GOV.

- (2)

Innovative R&D Input (RD)

R&D input refers to enterprise research and design input. This study uses innovation R&D input as a mediating variable and logarithmizes it. Generally speaking, a relatively large portion of government subsidies is dedicated R&D funds, so that firms receiving government subsidies will have more sufficient funds to invest in R&D activities, which in turn will enhance their innovation capabilities.

- (3)

Intellectual property protection intensity (IPP)

In this study, the annual patent grant volume of the provincial administrative district where the enterprise is registered is used to measure the regional intellectual property protection level and is then logarithmized. Referring to Du et al., (2008) [

52], we infer that the number of patents granted in cities can reflect the IPP intensity at an inter-provincial level. This is because the number of patents granted refers to those granted by the patent administration in the reporting year to individuals whose patent applications were uncontested, or whose objections were examined and not substantiated. Thus, this represents the number of functioning patents generated and reflects more directly the effectiveness of IPP in the region. Since the number of patents granted directly reflects the scientific and technological innovation capacity of a region, the level of regional patent grants in China as a whole is adopted in this paper to measure the intellectual property protection intensity.

- (4)

Nature of enterprise (STATE)

The impact of different enterprise natures on the development of the industry is explored in this study.

The nature of the enterprise is used as a control variable in this study. When the firm is state owned, the nature of the enterprise variable takes the value of 0 and a private enterprise is 1.

- (5)

Industry type (CL)

We have separated renewable energy companies into three categories depending on the type of energy source, i.e., geothermal, wind, and solar, and generated separate dummy variables.

3.2.3. Control Variables

- (1)

Internal and external environments

Based on a literature search and reviews, four external and internal regulation indicators were selected in this study. The external regulation (ER) and internal regulation (IR) indicator systems were finally constructed following continuous attempts.

- ➀

EC—Number of Regional Patent Shares (RPS)

This study is conducted mainly by measuring the annual application quantity for a patent in provincial administrative areas compared to the total number countrywide [

53].

- ②

EC—Competition in the market (COMP)

The study uses the market power Lerner index which indicates the level of competitive pressure in the market faced by enterprises.

- ③

IC—Compound operating revenue growth rate (RATE)

The ratio of the current year’s operating income growth to the previous year’s is used as a proxy to reflect the increase or decrease of the enterprise’s operating income.

- ④

IC—Education of R&D personnel (STUD)

The study uses the percentage of employees with a bachelor’s degree or above to measure R&D personnel [

54].

Three major city clusters exist in China, namely, the Pearl River Delta, the Yangtze River Delta, and the Beijing-Tianjin-Hebei. They are the most dynamic parts of China’s economy and the main force behind China’s economic development. Therefore, to control the influence of regional development, this paper assigns a value of 0 to those registered in the three major city clusters and 1 to those in other regions based on the registered location of the enterprises.

Variable definitions and descriptions are shown in

Table 1.

3.3. Research Models

The research method adopted in this paper is multiple linear regression. Multiple linear regression is the joint estimation of the dependent variable by the optimal combination of multiple independent variables. This is more effective and realistic than using only one independent variable for prediction or estimation. In addition, this paper could have selected representative companies in the renewable energy industry and used Data envelopment analysis (DEA) to analyze the input–output efficiency of the reformed companies. However, this leads to conclusions that are not universally applicable to other firms. Taking these factors into consideration, the regression model is chosen in this paper.

3.3.1. Analysis of Mediations

Firstly, the direct influence of government subsidies on the innovative performance of renewable energy firms and the mediating character of R&D input are explored. Model 1 investigates the impact of government funding on the innovative performance of renewable energy firms, as demonstrated in Formula (1). The dependent variable is INO and the main independent variable studied is GOV.

is the coefficient of the regression equation and

is the random error term. Model 2 illustrates a regression model of government subsidy to R&D input, as expressed in Formula (2). The dependent variable is RD and the main independent variable studied is GOV. Model 3 adds the R&D input variable of renewable energy enterprises and then tests the impact of government subsidy and R&D input on innovative performance, as proposed in Formula (3). The difference between model 3 and model 1 is the inclusion of RD in the dependent variable.

3.3.2. Analysis of the Regulatory Effect

The following model is designed to examine the moderating role of intellectual property protection intensity in the course of “Government subsidization—R&D Input—Innovative Performance” and distinguish the direct moderating effect from the mediating effect.

Model 4 added IPP and IPP*GOV as two independent variables based on Model 1. If the moderating effect is established, the IPP*GOV’s coefficient should be significant. Model 5 added IPP and IPP*GOV as two independent variables based on Model 2. If the moderating effect is established, the IPP*GOV’s coefficient should be significant. Model 6 added RD and RD*GOV as two independent variables based on Model 4. If the moderating effect is established, the RD*GOV’s coefficient should be significant.

Figure 1 is a mind map of the variables.

4. Results

4.1. Descriptive Statistics

Figure 2 and

Figure 3 indicate that solar companies accounted for the largest amount of funding, geothermal companies the least, and wind companies occupied the middle place in our sample. In addition, the proportion of non-state-owned enterprises is relatively large and that of state-owned enterprises is relatively small.

As observed in

Table 2, there is a large difference between the maxima 20.675 and minima 13.267 of GOV. This implies that government funding varies widely from company to company. Moreover, the INO is also significantly different, varying from 0 to 7.751. This shows that the innovation capacity of different companies is mixed.

4.2. Correlation Analysis

As illustrated in

Table 3, GOV and INO are significantly positively correlated at the 1% level with a correlation coefficient of 0.592; GOV and RD are significantly positively correlated at the 1% level with a correlation coefficient of 0.571; and RD and INO are significantly positively correlated at the 1% level with a correlation coefficient of 0.673. The absolute values of the correlation coefficients for all variables were less than 0.7, indicating a weak correlation between the independent and control variables and a strong degree of independence.

4.3. Full-Sample Regression of GOV, RD, and INO

In

Table 4, the full sample regression results from Model 1 show that GOV and INO demonstrate a significant positive correlation at a 1% level with a coefficient of 0.598, indicating that for every 1% increase in GOV, the INO of renewable energy firms increases by 0.598%. Among the control variables, wind energy has a 0.691% lower INO than geothermal energy when the firm type is a wind energy firm and is significant at a 1% level. With solar firms, INO of solar energy is 0.369% lower than that of geothermal energy and is significant at a 1% level. This indicates that all else being equal, the innovative performance of geothermal energy firms is highest and that of solar energy firms is lowest among the three types of companies. In contrast, STUD is significantly correlated with INO at a 1% level with a coefficient of 0.016, suggesting that the education of R&D personnel can also contribute positively to INO of a firm. Hypothesis (H1) was therefore tested.

The full sample regression results from Model 2 show that GOV and RD show a significant positive correlation at a 1% level with a coefficient of 0.631, indicating that for every 1% increase in GOV, the RD of renewable energy firms increases by 0.631%. Among the control variables, wind energy has a 0.805% lower INO than geothermal energy with wind energy firms and is significant at a 1% level. With solar energy firms, INO is 0.385% lower than that of geothermal energy and is significant at a 1% level. This indicates that all else being equal, geothermal energy firms have the highest R&D input of the three business types.

From the Model 3 full sample regression results, after adding RD as a mediating variable, RD shows a significant positive correlation with INO at a 1% level with a coefficient of 0.461, indicating that the INO of renewable energy enterprises increases by 0.461% with an RD increase of 1%. At this point, GOV shows a significant positive correlation with INO at a 1% level with a coefficient of 0.307, indicating that for every 1% rise in GOV, the INO for renewable energy companies increases by 0.307%. After the addition of RD, the contribution of GOV to INO is reduced compared to Model 1. The above analysis reveals a partial mediating effect of RD between GOV and INO. From one perspective, GOV has a significant promotive effect on firms’ INO. From another perspective, GOV influences the RD of companies, which in turn promotes their INO level. Hypothesis (H2) was therefore tested.

The above statements illustrate that government subsidy, as a direct means of government support for firms’ innovation activities, directly reduces the cost of their innovation activities as well as stimulating them. Furthermore, firms that receive government funding have more than sufficient incentive to invest in R&D activities, which reduces the risk of undertaking innovation and provides a boost to their R&D activities. Among the control variables, geothermal energy firms perform better than the other two categories, all else being equal, while solar energy firms perform the worst. This suggests that the type of renewable energy sub-sector also has an impact on innovative performance and R&D investment and that the differences between different sub-sectors should be considered when formulating relevant policies.

4.4. Regression of GOV, RD, and INO by Industry

To test whether the regression results for the full renewable energy firm sample hold for all three sub-sectors, the following discussion was conducted. In

Table 5, the regression results suggest a significant promotive correlation between INO and GOV for the geothermal power industry (

β = 0.546,

p < 0.01). This implies that GOV contributes directly to INO. In addition, there is a significant promotive correlation between RD and GOV (

β = 0.431,

p < 0.01), reflecting that GOV significantly contributes to RD. With RD as a mediating variable, a significant promotive correlation between INO and GOV can be observed (

β = 0.234,

p < 0.01), as well as a significant promotive correlation between RD and INO (

β = 0.726,

p < 0.01). Therefore, RD significantly contributes to INO. The control variable that differs significantly from the full sample regressions is STUD. In all three models for the sample of geothermal energy industries, STUD was not significant. This suggests that STUD has no significant contribution to either INO or RD. Highly educated personnel do not contribute significantly to innovation in geothermal energy firms.

In

Table 6, the regression results reveal a significant promotive correlation between INO and GOV for the wind power industry (

β = 0.547,

p < 0.01), indicating that GOV directly contributes to INO. Moreover, there is a significant promotive correlation between RD and GOV (

β = 0.603,

p < 0.01), confirming that GOV significantly contributes to RD. With RD as a mediating variable, there is a significant promotive correlation between INO and GOV (

β = 0.271,

p < 0.01) and a significant promotive correlation between RD and INO (

β = 0.456,

p < 0.01). Therefore, RD significantly contributes to INO.

In

Table 7, the regression results imply a significant promotive correlation between INO and GOV for the solar industry (

β = 0.613,

p < 0.01). Hence, GOV contributes directly to INO. Furthermore, a significant promotive correlation between RD and GOV is observed (

β = 0.665,

p < 0.01), revealing that GOV contributes significantly to RD. When RD is used as a mediating variable, there is a significantly promotive relationship between INO and GOV (

β = 0.297,

p < 0.01), accompanied by a significant promotive relationship between RD and INO (

β = 0.474,

p < 0.01). Therefore, it can be said that RD contributes significantly to INO.

Hypothesis (H1a)–(H2c) holds.

4.5. Regression of GOV, RD, and INO by Enterprise Type

In

Table 8, the sample is divided into SOEs and non-SOEs for regression, based on the nature of the firm’s equity. It can be seen that in Model 1, GOV shows a significant positive correlation with INO at a 1% level for both non-SOEs and SOEs. However, in non-SOEs, the coefficient is 0.631, indicating that the INO of non-SOEs increases by 0.631% when GOV rises by 1%. In SOEs, the coefficient is 0.519, indicating that the INO of SOEs increases by 0.519% when GOV rises by 1%. Therefore, the promoting effect of GOV on SOE is stronger in non-SOEs. To further validate the above findings, the difference between the coefficients of the two groups was tested in this paper, and the subsequent results revealed that the

p-value of the difference between the coefficients of the two groups = 0.0445, which is significant and allows for size comparison. This further validates that this boosting effect is stronger in non-state enterprises.

Similarly, in Model 2, GOV shows a significant positive correlation with RD at a 1% level for both non-SOEs and SOEs. However, the coefficient in non-SOEs is 0.659, indicating that the RD of non-SOEs increases by 0.659% when the GOV increases by 1%. In SOEs, the coefficient is 0.565, indicating that the RD of SOEs increases by 0.565% with each 1% rise in GOV.

In Model 3, RD shows a significant positive correlation with INO at a 1% level for both non-SOEs and SOEs. However, in non-SOEs, the coefficient is 0.540, indicating that the INO of non-SOEs increases by 0.540% whenever RD rises by 1%, and in SOEs, the coefficient is 0.437, indicating that the INO of SOEs rises by 0.437% whenever RD increases by 1%.

In summary, the direct contribution of GOV to INO holds in both non-SOEs and SOEs, but the facilitation effect is stronger in non-SOEs. RD provides a partial mediating effect between government innovation R&D subsidies and firms’ INO. On the one hand, innovation by non-SOEs is mostly guided by current market demand, and R&D will yield quick results and can be sustained to maintain good innovation performance. On the other hand, SOEs receive administrative directives to develop new technologies. Due to various technological barriers, too many of these innovation projects are not conducive to innovation performance, and businesses are wary of using government subsidies.

Hypothesis (H3) holds.

4.6. The Moderating Effect of the Intensity of IPP

Table 9 shows that in Model 4, the interaction term GOV*IPP for GOV and IPP shows a significant positive correlation with INO at a 10% level with a coefficient of 0.066. GOV shows a significant positive correlation with INO at a 1% level with a coefficient of 0.518. These two coefficients have the same sign, indicating that IPP enhances the facilitative effect of GOV on INO. Consequently, the positive moderating effect of IPP holds in the direct GOV and INO model. In Model 5, the interaction term GOV*IPP of GOV and IPP shows a significant positive correlation with INO at a 5% level with a coefficient of 0.054. GOV shows a significant positive correlation with RD at a 1% level with a coefficient of 0.389. These two coefficients have the same sign, indicating that IPP enhances the facilitative effect of GOV on RD. The positive moderating effect of IPP therefore holds for the first half of the mediating model; GOV and RD. In Model 6, the interaction term RD*IPP between RD and IPP does not show a significant positive correlation with INO, while RD and INO show a significant positive correlation at a 1% level with a coefficient of 0.760. This indicates that IPP does not enhance the facilitative effect of RD on INO. Therefore, the positive moderating effect of IPP does not hold in the second half of the mediation model, RD and INO.

On this basis, IPP has a significant positive moderating effect in the geothermal energy sector. Consequently, Hypothesis (H4a) holds.

Table 10 shows that the interaction term GOV*IPP between GOV and IPP does not have a significant positive correlation with INO in Model 4 (

p > 0.1) and that GOV has a significant positive correlation with INO at a 1% level with a coefficient of 0.545. This indicates that IPP does not enhance the contribution of GOV to INO and did not play a positive moderating role. In Model 5, the interaction term GOV*IPP between GOV and IPP did not show a significant positive correlation with RD, while GOV showed a significant positive correlation with RD at a 1% level with a coefficient of 0.586. This suggests that IPP does not enhance the facilitative effect of GOV on RD. Consequently, the IPP positive moderating effect does not hold in the first half of the mediation model; GOV and RD. In Model 6, the interaction term RD*IPP between RD and IPP does not show a significant positive correlation with INO, while RD and INO show a significant positive correlation at a 1% level with a coefficient of 0.450. This indicates that IPP does not enhance the facilitative effect of RD on INO. Consequently, the IPP positive moderating effect does not hold in the second half of the mediation model, RD and INO.

On this basis, there is no significant IPP positive moderating effect in the wind industry; therefore, Hypothesis (H4b) does not hold.

Table 11 shows that in Model 4, the interaction term GOV*IPP between GOV and IPP shows a significant positive correlation with INO at a 5% level with a coefficient of 0.030, while GOV shows a significant positive correlation with INO at a 1% level with a coefficient of 0.609. These two coefficients have the same sign, indicating that IPP enhances the contribution of GOV to INO. Therefore, the IPP positive moderating effect holds in the direct GOV and INO model. In Model 5, the interaction term GOV*IPP of GOV and IPP shows a significant positive correlation with INO at a 10% level with a coefficient of 0.026. GOV shows a significant positive correlation with RD at a 1% level with a coefficient of 0.661. These two coefficients have the same sign, indicating that IPP enhances the facilitative effect of GOV on RD. The IPP positive moderating effect, therefore, holds for the first half of the mediating model, GOV and RD. In Model 6, the interaction term RD*IPP between RD and IPP does not show a significant positive correlation with INO, while RD and INO show a significant positive correlation at a 1% level with a coefficient of 0.476. This indicates that IPP does not enhance the facilitative effect of RD on INO. Therefore, the IPP positive moderating effect does not hold in the second half of the mediation model, RD and INO.

On this basis, there is a significant IPP positive moderating effect in the solar industry, and subsequently, Hypothesis (H4c) holds.

The above shows that the IPP positive moderating effect holds in the geothermal and solar sectors, but not in the wind sector. This suggests that for geothermal and solar energy companies, the higher the level of IPP in the region where they are located, the stronger the contribution of their government subsidies to R&D input and innovative performance. That is, the greater the incentive for companies to invest in R&D, the more innovative they become.

4.7. Robustness Tests

In

Table 12, the main model is tested for robustness using both adding control variables ‘SIZE’ and replacing explanatory variables as ‘APA’. First, the size of a firm’s assets is an important factor influencing firms to invest more in R&D and to innovate. Generally speaking, the larger a firm’s assets and the more capital it has, the more resilient it is to risk and therefore the more incentive it has to invest in R&D. With the inclusion of this new control variable ‘SIZE’, the contribution of the government subsidy to innovative performance still holds, as does the mediating effect of R&D input. The results can therefore be shown to be robust. Secondly, this paper replaces the selected indicator of innovative performance with the number of patents granted to enterprises (APA). Since it takes some time for patents to be granted from application to grant, there may be a certain lag in the number of patents granted. Therefore, this research treats both government subsidies and R&D input with a one-period lag, and the results show that the promotion effect of government subsidies on innovative performance still holds, as does the mediation effect of R&D input.

5. Discussion

The full-sample regressions demonstrate that R&D input into enterprises serves as a partially mediating character in the contribution of government subsidies to innovative performance. Government funding can not only directly contribute to firms’ innovative performance but also motivate their investment in R&D. Government legal policy concerning renewable energy industry subsidies needs to be improved and made more operable. Subsidies can compensate for capital shortages in the renewable energy industry, allowing enterprises to obtain sufficient financial support and a more positive growth environment [

55]. Before granting subsidies, the government should conduct sufficient research on industrial areas and enterprises to implement different financial policies. This requires the government to refine its decision-making criteria and define subsidy policy in a precise way instead of a “one stroke” decision.

Notably, geothermal energy companies demonstrate the highest innovative performance. The Chinese government currently encourages the utilization of geothermal power and offers a series of policies to promote its development. Listed companies, including giants such as Sinopec and PetroChina, have invested significantly in geothermal power R&D. Following fundamental research in engineering technology, actions were implemented to resource surveys and geothermal demonstration programs. Joint ventures were developed with Icelandic pioneers to promote geothermal power industrialization. Consequently, enterprises are more willing to increase their R&D input and upgrade their products under the incentive of relevant government policies, even though the geothermal power industry is still in its early stages of development. In contrast, China’s solar industry has progressed from its rapid early development phase and expects a revival after a consolidation period. Wind power is the most widely adopted renewable energy and plays an increasingly crucial role in low-carbon energy development [

56]. Therefore, relevant policies do not usually support wind and solar power start-ups, and are frequently used to maintain existing enterprises and withstand market risks. Nevertheless, several developed countries could litigate this in the WTO, along with issues such as countervailing and anti-dumping.

Subsequently, decision-making on government funding should be based on the principles of science, transparency, and cooperation. Supporting the development of the renewable energy industry requires large amounts of government subsidies, but this does not mean that funding should be applied to all relevant industries. If government subsidies are properly disbursed, they can help enterprises or industries in need of development and bridge any funding gaps, giving them sufficient incentive to develop and grow in a less-pressurized environment. Conversely, if government funding is allocated to unsuitable enterprises or industries, it may result in funds being wasted and even intensify rent-seeking behavior, leading to laziness and a lack of motivation [

57]. Therefore, government subsidies should be targeting secondary sectors where they will be used more efficiently. Before the decision-making process, sufficient research should be conducted on the various secondary sectors and enterprises in the renewable energy industry, and the findings should determine the appropriate recipients for any government grants.

In addition, both SOEs and non-SOEs reconcile government subsidization to promote innovative performance. Nonetheless, this facilitation effect is more evident in non-SOEs, and SOEs are more likely to accommodate fiscal and monetary policies. They also maintain stronger non-profit social responsibilities in addition to focusing on purely economic profits. This may potentially have some negative effects, and SOEs may have less incentive to increase their market competitiveness through technological innovation. For non-SOEs, whether they are private, privately-owned, or foreign-owned, the incentive to increase market competitiveness through technological innovation tends to be much higher. The role of the social capital market and the carrier of private listed companies are indispensable for the rapid and steady development of the renewable energy industry. Consequently, private listed companies should make reasonable and effective use of government subsidies, rely on their own development capabilities to achieve greater efficiency, and enhance their innovation and competitiveness. In any case, both state-owned and non-state-owned enterprises should invest more in R&D for advanced technologies. The rapid development of wind power generation brings new technical challenges. Reliable and accurate prediction of wind power generation is important for the daily dispatch of power systems. Liu et al., (2021) proposed a new CNN framework to predict the power of wind turbines over 24 h [

58]. Shahab et al., (2021) discussed the application of different types of deep learning algorithms in the field of solar and wind energy resources and evaluated their performance with a new taxonomy [

59]. Huang et al., (2021) considered the superposition and XGBoost models and concluded that they are the best models for predicting solar radiation [

60]. These are the latest technologies in the renewable energy industry. Chinese companies should keep up with the advanced technology trends in order to change the traditional development model of renewable energy of the past.

Finally, the IPP positive moderating effect is only observed in the geothermal and solar industries. Geothermal and solar power have been developed more recently than wind power. The IPP intensity should play a positive moderating role between government subsidization and enterprise innovative performance in the new IPP environment. Without IPP, renewable energy industrialization progress will lack legal protection and motivation, and enterprises will not be willing to continuously invest in a new area without a quick economic return.

As a result, intellectual property protection intensity for renewable energy innovative systems should be increased. China’s current intellectual property protection laws need to be improved; there is a lack of legal provision for intellectual property protection for renewable energy innovation technologies [

61]. Most renewable energy intellectual property rights involve low-carbon technologies, and the law should protect the possession of low-carbon intellectual property rights based on greenhouse gas reduction. When formulating IPP policy, government departments should carefully select the appropriate IPP legislation to match the country’s technological capacity and economic base, while IPP enforcement should be strengthened based on balancing the cost of enforcement and effectively safeguarding the interests of R&D institutions and personnel to promote investment in independent R&D in the renewable energy industry. Therefore, China’s legislature should develop an IPP system that promotes technological innovation in its renewable energy industry in line with actual economic and technological development and the international environment [

62,

63]. While fulfilling the obligations of international conventions and safeguarding the reasonable intellectual property interests of Chinese multinational enterprises, excessive levels of intellectual property protection at the expense of social public welfare and to the detriment of national interests should be avoided [

64]. Furthermore, it is important to further publicize the relevant IPP laws and basic protection paths, including in renewable energy enterprises, scientific research institutions, and higher education institutions, and to conduct IPP publicity and training for relevant staff, encouraging relevant enterprises to effectively protect their IPP through relevant laws and further improve the capacity of renewable energy IPP.

6. Conclusions

This research investigates the geothermal, wind, and solar power listed companies in China. Panel data of these companies from 2013 to 2020 is examined, and the influence of government innovation R&D subsidies on innovative performance in the renewable energy industry is explored. Additionally, the legislation regarding subsidies for renewable energy development is analyzed. Finally, specific suggestions are proposed for the use of renewable energy.

Government subsidy policy should be differentiated according to the nature of enterprises and the type of renewable energy. The renewable energy industry is still in its infancy, with high technology capital demand and a low return on investment. The attractiveness of all forms of capital is failing to meet enterprise growth needs, particularly in the wind power sector. Although the country has introduced a series of supportive programs and plans, the overall stagnant economic environment makes it difficult for enterprises to source sufficient funding. Thus, the government must increase its subsidies to non-state enterprises to strengthen their investment in R&D. Moreover, the innovations of geothermal power enterprises are mainly concentrated in SOEs such as Sinopec and PetroChina. Since the industry is in its early development stages, the government may have to offer special subsidies to the representative SOEs. Nonetheless, the subsidy policy should be changed for the solar industry, as it is more developed and all its listed companies are non-SOEs. When perfecting the legislation of renewable energy in China, we should pay attention to the difference of sub-industry and enterprise ownership. In addition, the government should also be aware of the international industrial trend, energy regulations, political economy, and other elements affecting funding. An isolated subsidy policy may cause lawsuits on international platforms in the WTO, WIPO, or other organizations, and eventually impede the development of renewable energy.

Although this paper proposes certain innovations in terms of research scope and methods based on previous studies, there are still some shortcomings. Firstly, this paper uses mostly empirical research to argue for the impact of intellectual property protection intensity on the innovative performance of renewable energy listed companies. The protection of this intellectual property is not only reflected in the number of regional patents granted, but also in the government’s protection policies for this industry, and such policies and regulations are difficult to analyze quantitatively. Therefore, analysis through data alone is somewhat biased. Secondly, the measurement of innovative performance relates to more than solely the number of patent applications filed by a company. The number of patent applications is an innovation output dimension, but the innovation input dimension is not considered. In the future, the authors will explore the impact of IPP strategies, protection regimes, and operations on renewable energy innovative performance; additionally, they will conduct further research on individual sub-sectors to inform a more targeted government subsidy policy.