Digital Transformation, Corporate Innovation, and International Strategy: Empirical Evidence from Listed Companies in China

Abstract

:1. Introduction

2. Theoretical Analysis and Research Hypothesis

2.1. Digital Transformation and International Strategy

2.2. Digital Transformation, Innovation, and International Strategy

3. Study Design

3.1. Data Selection and Description

3.2. Variable Design

3.2.1. Dependent Variable: International Strategy

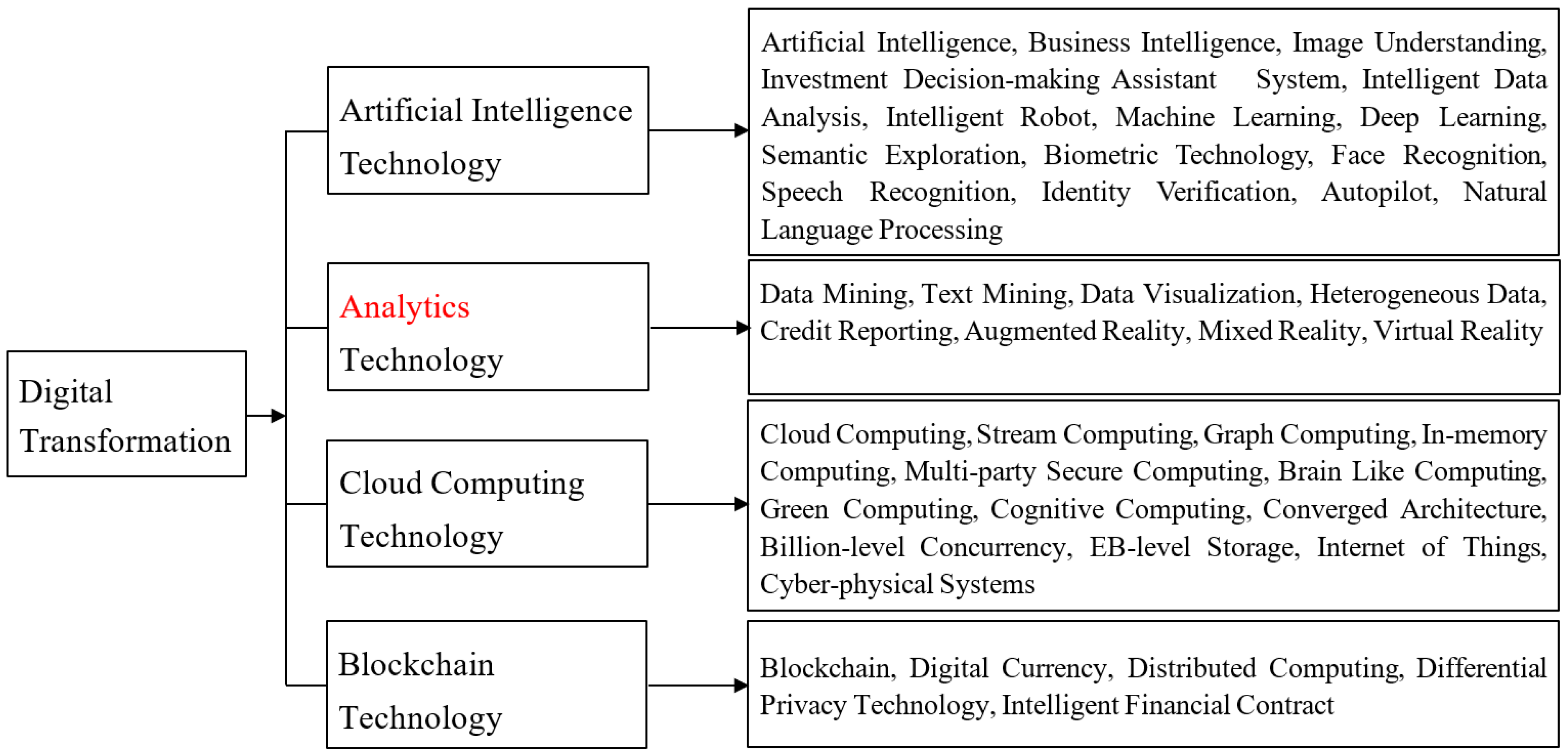

3.2.2. Independent Variable: Digital Transformation

3.2.3. Intervening Variable: Innovation

3.2.4. Controlled Variables

- Total Assets (Size): measured by the natural logarithm of the total assets at the end of the year;

- Asset-liability Ratio (Debt): measured by the ratio of the total liabilities at the end of the year to the total assets;

- Return on Assets (Roa): measured by the ratio of year-end net profit to total assets;

- Stock Ownership (SO): measured by whether the sample company belongs to Chinese state-owned enterprises (SOEs) or Chinese non-state-owned enterprises (Non-SOEs). If it belongs to SOEs, then it is equal to 1, otherwise, it is 0;

- Ownership Concentration (H10): measured by the squared sum of the shareholding proportion of the top 10 shareholders at the end of the year;

- Team size of executives (TSE): measured by the natural logarithm of the total number of senior management teams at the end of the year.

3.3. Empirical Model Design

3.3.1. Benchmark Regression Test Model Design

3.3.2. Mediation Effect Test Model Design

3.3.3. Endogeneity Test Model Design

4. Results and Analysis of Empirical Tests

4.1. Descriptive Statistical Results and Analysis

4.2. Correlation Test Results and Analysis

4.3. Empirical Results and Analysis

4.3.1. Benchmark Regression Test Results

4.3.2. Intermediary Effect Test Results

4.3.3. Endogeneity Test Results

4.3.4. Robustness Check

- (1)

- Robustness test 1: Lag phase I inspection. In the benchmark regression, this paper takes the current international strategy as the explained variable. Considering the lag of the impact of digital transformation on a firm’s decision-making, in the robustness test, this paper further takes the lagging international strategy variable as the explained variable for the empirical test;

- (2)

- Robustness test 2: International strategy sample test. The original samples in this paper include international business samples and non-international business samples. In the robustness test, this paper conducts an empirical test on the explained variable ISD for the international business samples;

- (3)

- Robustness test 3: Reject sample inspection. The difference in the administrative level of the enterprise location will lead to the difference in the degree of enterprise digital transformation. In China, Beijing, Shanghai, Tianjin, and Chongqing are municipalities directly under the central government. The administrative level of these four cities is higher than that of other cities. Therefore, this paper makes an empirical test after excluding the sample enterprises located in these four cities.

- (4)

- Table 7 shows the results of the robustness check. The three groups of robustness test results all proved that the explanatory variables DTW and DTD coefficient values are significantly positive, indicating that there was still a positive correlation between digital transformation and international strategy even after controlling the robustness factors, which verified the correctness of the empirical results mentioned above.

4.4. Heterogeneity Grouping Regression Test Results and Analysis

4.4.1. Grouping Test between SOEs and Non-SOEs

4.4.2. Grouping Test between High-Tech Enterprise and Non-High-Tech Enterprise

4.4.3. Grouping Test between High Institutional Development and Low Institutional Development

4.4.4. Grouping Test between Eastern China and Non-Eastern China

5. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Damanpour, F.; Evan, W.M. Organizational Innovation and Performance: The Problem of Organizational Lag. Adm. Sci. Q. 1984, 29, 392–409. [Google Scholar] [CrossRef]

- Yap, C.M. R&D Investment and Systematic Risk. Account. Financ. 2004, 44, 393–418. [Google Scholar]

- Chan, L.; Lakonishok, J.; Sougiannis, T. The Stock Market Valuation of Research and Development Expenditures. J. Financ. 2001, 56, 2431–2456. [Google Scholar] [CrossRef]

- Eberhart, A.; Maxwell, W.; Siddique, A. An Examination of Long Term Abnormal Stock Returns and Operating Performance Following R&D Increases. J. Financ. 2004, 59, 623–650. [Google Scholar]

- Dangelico, R.M.; Pontrandolfo, P. Being Green and Competitive: The Impact of Environmental Actions and Collaborations on Firm Performance. Bus. Strategy Environ. 2015, 24, 413–430. [Google Scholar] [CrossRef]

- Elbert, C.; Duarte, H.C. Digital Transformation. IEEE Softw. 2018, 35, 16–21. [Google Scholar] [CrossRef]

- Hanelt, A.; Bohnsack, R.; Marz, D.; Antunes, M.C. A Systematic Review of the Literature on Digital Transformation: Insights and Implications for Strategy and Organizational Change. J. Manag. Stud. 2020, 58, 1159–1197. [Google Scholar] [CrossRef]

- Zhao, H.; Wang, W.; Li, X. How Does Digital Transformation Affect the Total Factor Productivity of Enterprises. Financ. Trade Econ. 2021, 42, 114–129. (In Chinese) [Google Scholar]

- Zeng, G.; Lei, L. Digital Transformation and Corporate Total Factor Productivity: Empirical Evidence Based on Listed Enterprises. Discret. Dyn. Nat. Soc. 2021, 2021, 9155861. [Google Scholar] [CrossRef]

- Yuan, C.; Xiao, T.; Geng, C.; Sheng, Y. Digital Transformation and Division of Labor between Enterprises: Vertical Specialization or Vertical Integration. China Ind. Econ. 2021, 9, 137–155. [Google Scholar]

- Renato, C.; Alex, A. Digital Transformation and Convergence toward the 2030 Agenda’s Sustainability Development Goals: Evidence from Italian Listed Firms. Sustainability 2021, 13, 11831. [Google Scholar]

- Chen, N.; Sun, D.; Chen, J. Digital Transformation, Labour Share, and Industrial Heterogeneity. J. Innov. Knowl. 2022, 7, 100173. [Google Scholar] [CrossRef]

- Banalieva, E.R.; Dhanaraj, C. Internalization Theory for the Digital Economy. J. Int. Bus. Stud. 2019, 50, 1372–1387. [Google Scholar] [CrossRef] [Green Version]

- Adomako, S.; Amankwah-Amoah, J.; Tarba, S.Y.; Khan, Z. Perceived Corruption, Business Process Digitization, and SMEs’ Degree of Internationalization in Sub-Saharan Africa. J. Bus. Res. 2021, 123, 196–207. [Google Scholar] [CrossRef]

- Yu, M. The Miracle of China’s Foreign Trade in the Forty Years of Reform and Opening-up: Achievements and Paths. Intertrade 2018, 37, 4–9. [Google Scholar]

- Tai, P.; Li, J. China’s Foreign Direct Investment: Experience Summary, Problem Examination and Promotion Path. Intertrade 2019, 38, 50–57. [Google Scholar]

- Atluri, V.; Dietz, M.; Henke, N. Competing in a World of Sectors without Borders. McKinsey Q. 2017, 54, 33–47. [Google Scholar]

- Brillinger, A.S.; Els, C.; Schäfer, B.; Bender, B. Business Model Risk and Uncertainty Factors: Toward Building and Maintaining Profitable and Sustainable Business Models. Bus. Horiz. 2020, 63, 121–130. [Google Scholar] [CrossRef]

- Mikalef, P.; Pateli, A. Information Technology-enabled Dynamic Capabilities and Their Indirect Effect on Competitive Performance: Findings from PlS-SEM and fsQCA. J. Bus. Res. 2017, 70, 1–16. [Google Scholar] [CrossRef]

- Liu, S.; Yan, J.; Zhng, S.; Lin, H. Can Corporate Digital Transformation Promote Input-Output Efficiency. Manag. World 2021, 37, 170–190. [Google Scholar]

- Li, W.; Xia, J. Business Model Innovation Based on ‘Big Data’. China Ind. Econ. 2013, 27, 83–95. [Google Scholar]

- Zhang, G.; Wang, Z.; Zhao, H. The Marketing Innovation Mode under ‘Internet Plus’: The Perspective of Value Network Reconstruction. Manag. Rev. 2019, 31, 94–101. [Google Scholar]

- Frynas, J.G.; Mol, M.J.; Mellahi, K. Management Innovation Made in China: Haier’s Rendanheyi. Calif. Manag. Rev. 2018, 61, 71–93. [Google Scholar] [CrossRef]

- Elia, S.; Giuffrida, M.; Mariani, M.M.; Bresciani, S. Resources and Digital Export: An RBV Perspective on the Role of Digital Technologies and Capabilities in Cross-border E-commerce. J. Bus. Res. 2021, 132, 158–169. [Google Scholar] [CrossRef]

- Yi, L.; Wu, F.; Xu, S. Research on Performance-driven Effect of Digital Transformation of Enterprises. Secur. Mark. Her. 2021, 31, 15–25. [Google Scholar]

- Ojala, A. Business Models and Opportunity Creation: How IT Entrepreneurs Create and Develop Business Models under Uncertainty. Inf. Syst. J. 2016, 26, 451–476. [Google Scholar] [CrossRef] [Green Version]

- Nambisan, S. Digital Entrepreneurship: Toward a Digital Technology Perspective of Entrepreneurship. Entrep. Theory Pract. 2017, 41, 1029–1055. [Google Scholar] [CrossRef]

- Abramova, N.; Grishchenko, N. ICTs, Labour Productivity and Employment: Sustainability in Industries in Russia. Procedia Manuf. 2020, 43, 299–305. [Google Scholar] [CrossRef]

- Hong, J.; Jiang, M.; Zhang, C. Digital Transformation, Innovation and the Improvement of Enterprises’ Export Quality. J. Int. Trade 2022, 48, 1–15. [Google Scholar]

- Hart, O.; Moore, J. Contracts as Reference Points. Q. J. Econ. 2008, 123, 1–48. [Google Scholar] [CrossRef] [Green Version]

- Tseng, C.H.; Tansuhaj, P.; Hallagan, W.; McCullough, J. Effects of Firm Resources on Growth in Multinationality. J. Int. Bus. Stud. 2007, 38, 961–974. [Google Scholar] [CrossRef]

- Zhou, L.; Barnes, B.R.; Lu, Y. Entrepreneurial Proclivity, Capability Upgrading and Performance Advantage of Newness among International New Ventures. J. Int. Bus. Stud. 2010, 41, 882–905. [Google Scholar] [CrossRef]

- Yoo, Y. Computing in Everyday Life: A Call for Research on Experiential Computing. MIS Q. 2010, 34, 213–231. [Google Scholar] [CrossRef] [Green Version]

- Abrell, T.; Pihlajamaa, M.; Kanto, L.; Jan, V.B.; Uebernickel, F. The Role of Users and Customers in Digital Innovation: Insights from B2B Manufacturing Firms. Inf. Manag. 2016, 53, 324–335. [Google Scholar] [CrossRef]

- Carboni, O.A.; Medda, G. Linkages between R&D, Innovation, Investment and Export Performance: Evidence from European Manufacturing Firms. Technol. Anal. Strateg. Manag. 2020, 32, 1379–1392. [Google Scholar]

- Tan, K.H.; Zhan, Y.Z.; Ji, G.; Ye, F.; Chang, C. Harvesting Big Data to Enhance Supply Chain Innovation Capabilities: An Analytic Infrastructure Based on Deduction Graph. Int. J. Prod. Econ. 2015, 165, 223–233. [Google Scholar] [CrossRef]

- Huang, D.; Xie, H.; Meng, X.; Zhang, Y. Digital Transformation and Enterprise Value: Empirical Evidence based on Text Analysis Methods. Economist 2021, 33, 41–51. [Google Scholar]

- Wang, S.; Xu, X.; Liu, Y. Will Digital Transformation of Enterprises Reduce the Risk of Debt Default. Secur. Mark. Her. 2022, 32, 45–56. [Google Scholar]

- Xu, H.; Zhang, Y.; Cao, Y. Digital Economy, Technology Spillover and Dynamic Coopetition Policy. Manag. World 2020, 36, 63–84. [Google Scholar]

- Shi, S.; Wang, Y. The Influence of Business Environment on Enterprise Digital Transformation: Facts and Mechanisms. J. Beijing Jiaotong Univ. 2022, 21, 14–28. [Google Scholar]

| Variable | Mean | Median | Standard Deviation | Maximum | Minimum | 25% | 75% |

|---|---|---|---|---|---|---|---|

| ISW | 0.543 | 1.000 | 0.498 | 1.000 | 0.000 | 0.000 | 1.000 |

| ISD | 0.109 | 0.004 | 0.189 | 1.000 | 0.000 | 0.000 | 0.141 |

| DTW | 0.568 | 1.000 | 0.495 | 1.000 | 0.000 | 0.000 | 1.000 |

| DTD | 1.117 | 0.693 | 1.253 | 6.071 | 0.000 | 0.000 | 1.946 |

| Inn | 14.829 | 17.683 | 7.049 | 24.104 | 0.000 | 15.959 | 18.777 |

| Size | 22.540 | 22.364 | 1.346 | 28.636 | 14.942 | 21.632 | 23.300 |

| Debt | 0.450 | 0.442 | 0.206 | 4.026 | 0.008 | 0.293 | 0.598 |

| Roa | 0.054 | 0.050 | 0.089 | 1.305 | −3.978 | 0.028 | 0.081 |

| SO | 0.418 | 0.000 | 0.493 | 1.000 | 0.000 | 0.000 | 1.000 |

| H10 | 0.164 | 0.135 | 0.119 | 0.810 | 0.000 | 0.075 | 0.225 |

| TSE | 2.841 | 2.833 | 0.232 | 3.912 | 2.079 | 2.708 | 2.996 |

| Variable | DTW = 1 | DTW = 0 | T Test | Wilcoxon Z | ||||

| N | Mean | Median | N | Mean | Median | |||

| ISW | 8634 | 0.566 | 1.000 | 6565 | 0.513 | 1.000 | 6.472 *** | 5.577 *** |

| ISD | 8634 | 0.115 | 0.007 | 6565 | 0.102 | 0.001 | 4.380 *** | 4.901 *** |

| Variable | High DTD | Low DTD | T Test | Wilcoxon Z | ||||

| N | Mean | Median | N | Mean | Median | |||

| ISW | 7063 | 0.569 | 1.000 | 8136 | 0.521 | 1.000 | 5.978 *** | 5.152 *** |

| ISD | 7063 | 0.115 | 0.007 | 8136 | 0.105 | 0.002 | 3.460 *** | 4.246 *** |

| Variable | High Inn | Low Inn | T Test | Wilcoxon Z | ||||

| N | Mean | Median | N | Mean | Median | |||

| ISW | 7600 | 0.711 | 1.000 | 7599 | 0.376 | 0.000 | 44.027 *** | 35.775 *** |

| ISD | 7600 | 0.144 | 0.048 | 7599 | 0.075 | 0.000 | 22.626 *** | 36.066 *** |

| Variable | ISW | ISD | DTW | DTD | Inn | Size | Debt | Roa | SO | H10 | TSE |

|---|---|---|---|---|---|---|---|---|---|---|---|

| ISW | 1 | ||||||||||

| ISD | 0.530 *** | 1 | |||||||||

| DTW | 0.052 *** | 0.036 *** | 1 | ||||||||

| DTD | 0.060 *** | 0.031 *** | 0.778 *** | 1 | |||||||

| Inn | 0.387 *** | 0.193 *** | 0.151 *** | 0.126 *** | 1 | ||||||

| Size | 0.024 *** | −0.026 *** | 0.071 *** | 0.050 *** | 0.057 *** | 1 | |||||

| Debt | −0.027 *** | −0.020 ** | −0.017 ** | −0.020 ** | −0.131 *** | 0.462 *** | 1 | ||||

| Roa | −0.003 | −0.031 *** | 0.036 *** | 0.026 *** | 0.073 *** | 0.063 *** | −0.228 *** | 1 | |||

| SO | −0.122 *** | −0.132 *** | −0.108 *** | −0.092 *** | −0.155 *** | 0.303 *** | 0.225 *** | −0.066 *** | 1 | ||

| H10 | −0.060 *** | −0.050 *** | −0.030 *** | −0.025 *** | −0.041 *** | 0.234 *** | 0.024 *** | 0.101 *** | 0.190 *** | 1 | |

| TSE | 0.012 | −0.004 | −0.012 | −0.005 | 0.007 | 0.064 *** | 0.042 *** | −0.007 | 0.117 *** | 0.024 *** | 1 |

| ISW | ISD | ISW | ISD | ISW | ISD | ISW | ISD | |

|---|---|---|---|---|---|---|---|---|

| (1) | (2) | (3) | (4) | (5) | (6) | (7) | (8) | |

| DTW | 0.212 *** (0.033) | 0.014 *** (0.003) | 0.125 *** (0.034) | 0.008 ** (0.003) | ||||

| DTD | 0.097 *** (0.013) | 0.005 *** (0.001) | 0.069 *** (0.013) | 0.003 ** (0.001) | ||||

| Size | 0.147 *** | 0.004 *** | 0.146 *** | 0.004 *** | ||||

| Debt | −0.472 *** | −0.010 | −0.468 *** | −0.011 | ||||

| Roa | −0.586 *** | −0.088 *** | −0.583 *** | −0.088 *** | ||||

| SO | −0.543 *** | −0.052 *** | −0.540 *** | −0.052 *** | ||||

| H10 | −0.915 *** | −0.042 *** | −0.914 *** | −0.042 *** | ||||

| TSE | 0.220 *** | 0.009 | 0.218 *** | 0.009 | ||||

| Year | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Industry | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Constant | 0.053 ** | 0.102 *** | −3.201 *** | 0.032 *** | 0.065 *** | 0.104 *** | −3.195 *** | 0.031 *** |

| Adj R2 | 0.003 | 0.001 | 0.024 | 0.020 | 0.004 | 0.001 | 0.025 | 0.020 |

| F-statistics | 41.892 *** | 19.187 *** | 55.044 *** | 45.741 *** | 55.218 *** | 14.883 *** | 56.944 *** | 45.583 *** |

| Inn | Inn | ISW | ISD | ISW | ISD | |

|---|---|---|---|---|---|---|

| (1) | (2) | (3) | (4) | (5) | (6) | |

| DTW | 1.662 *** (0.112) | 0.071 ** (0.037) | 0.059 *** (0.003) | |||

| DTD | 0.543 *** (0.044) | 0.091 *** (0.014) | 0.026 *** (0.001) | |||

| Inn | 0.130 *** (0.003) | 0.005 *** (0.001) | 0.129 *** (0.003) | 0.005 *** (0.001) | ||

| Size | 0.982 *** | 1.013 *** | 0.038 *** | −0.001 *** | 0.035 *** | −0.001 *** |

| Debt | −6.153 *** | −6.203 *** | 0.270 ** | 0.020 ** | 0.275 ** | 0.020 ** |

| Roa | 0.865 | 0.926 | −0.856 ** | −0.093 ** | −0.858 *** | −0.093 ** |

| SO | −2.166 *** | −2.234 *** | −0.360 *** | −0.041 *** | −0.350 *** | −0.041 *** |

| H10 | −2.970 *** | −3.067 *** | −0.676 *** | −0.027 ** | −0.665 *** | −0.027 ** |

| TSE | 0.698 *** | 0.681 *** | 0.162 ** | 0.006 | 0.163 ** | 0.006 |

| Year | Yes | Yes | Yes | Yes | Yes | Yes |

| Industry | Yes | Yes | Yes | Yes | Yes | Yes |

| Constant | −6.110 *** | −6.359 *** | −2.902 *** | 0.062 * | −2.864 *** | 0.062 * |

| Adj R2 | 0.078 | 0.074 | 0.157 | 0.051 | 0.157 | 0.051 |

| F-statistics | 184.970 *** | 174.467 *** | 354.810 *** | 102.330 *** | 354.375 *** | 102.325 *** |

| 1st Stage | 2nd Stage | |||||

|---|---|---|---|---|---|---|

| DTW | DTD | ISW | ISD | ISW | ISD | |

| (1) | (2) | (3) | (4) | (5) | (6) | |

| Mobile | 0.263 *** (0.026) | 0.115 *** (0.016) | ||||

| DTW | 0.014 * (0.008) | 0.059 *** (0.003) | ||||

| DTD | 0.022 *** (0.003) | 0.026 *** (0.001) | ||||

| Control | Yes | Yes | Yes | Yes | Yes | Yes |

| Year | Yes | Yes | Yes | Yes | Yes | Yes |

| Industry | Yes | Yes | Yes | Yes | Yes | Yes |

| Constant | −6.230 *** | −1.860 *** | −0.109 | 0.062 * | −0.102 | 0.062 * |

| Adj R2 | 0.046 | 0.030 | 0.157 | 0.051 | 0.157 | 0.051 |

| F-statistics | 93.377 *** | 59.694 *** | 354.810 *** | 102.330 *** | 354.375 *** | 102.325 *** |

| J-statistics | — | — | 1.099 | 1.405 | 1.056 | 1.396 |

| Robustness Test 1 | Robustness Test 2 | Robustness Test 3 | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| ISW | ISD | ISW | ISD | ISD | ISD | ISW | ISD | ISW | ISD | |

| (1) | (2) | (3) | (4) | (5) | (6) | (7) | (8) | (9) | (10) | |

| DTW | 0.118 *** (0.037) | 0.005 * (0.003) | 0.020 *** (0.005) | 0.099 *** (0.038) | 0.009 *** (0.004) | |||||

| DTD | 0.075 *** (0.015) | 0.002 * (0.001) | 0.012 *** (0.002) | 0.064 *** (0.015) | 0.003 ** (0.001) | |||||

| Control | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Year | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Industry | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Constant | −3.073 *** | 0.043 | −3.061 *** | 0.043 | 0.363 *** | 0.362 *** | −2.843 *** | 0.100 ** | −2.826 *** | 0.098 ** |

| Adj R2 | 0.026 | 0.021 | 0.027 | 0.021 | 0.016 | 0.016 | 0.024 | 0.023 | 0.025 | 0.023 |

| F-statistics | 48.325 *** | 38.712 *** | 50.544 *** | 38.922 *** | 19.929 *** | 19.968 *** | 44.188 *** | 42.560 *** | 45.892 *** | 42.328 *** |

| Sample of SOEs | Sample of Non-SOEs | |||||||

|---|---|---|---|---|---|---|---|---|

| ISW | ISD | ISW | ISD | ISW | ISD | ISW | ISD | |

| (1) | (2) | (3) | (4) | (5) | (6) | (7) | (8) | |

| DTW | 0.107 ** (0.051) | 0.002 (0.004) | 0.147 *** (0.045) | 0.012 ** (0.005) | ||||

| DTD | 0.080 *** (0.021) | 0.002 (0.002) | 0.064 *** (0.017) | 0.004 ** (0.002) | ||||

| Control | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Year | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Industry | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Constant | −4.463 *** | −0.019 | −4.452 *** | −0.012 | −3.113 *** | −0.006 | −3.126 *** | −0.017 |

| Adj R2 | 0.021 | 0.012 | 0.022 | 0.002 | 0.009 | 0.002 | 0.009 | 0.012 |

| F-statistics | 23.542 *** | 13.438 *** | 25.287 *** | 3.558 *** | 14.175 *** | 4.393 *** | 14.677 *** | 14.188 *** |

| Sample of High-Tech Enterprise | Sample of Non-High-Tech Enterprise | |||||||

|---|---|---|---|---|---|---|---|---|

| ISW | ISD | ISW | ISD | ISW | ISD | ISW | ISD | |

| (1) | (2) | (3) | (4) | (5) | (6) | (7) | (8) | |

| DTW | 0.075 (0.054) | 0.001 (0.005) | 0.087 ** (0.046) | 0.025 *** (0.004) | ||||

| DTD | 0.009 (0.021) | 0.001 (0.002) | 0.062 *** (0.019) | 0.021 *** (0.002) | ||||

| Control | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Year | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Industry | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Constant | −6.662 *** | −0.164 *** | −6.561 *** | −0.165 *** | −4.146 *** | 0.037 | −4.151 *** | 0.038 |

| Adj R2 | 0.034 | 0.025 | 0.034 | 0.025 | 0.026 | 0.014 | 0.027 | 0.014 |

| F-statistics | 37.405 *** | 27.500 *** | 37.176 *** | 27.528 *** | 31.991 *** | 17.281 *** | 33.125 *** | 17.512 *** |

| Sample of High Institutional Development | Sample of Low Institutional Development | |||||||

|---|---|---|---|---|---|---|---|---|

| ISW | ISD | ISW | ISD | ISW | ISD | ISW | ISD | |

| (1) | (2) | (3) | (4) | (5) | (6) | (7) | (8) | |

| DTW | 0.121 *** (0.048) | 0.009 ** (0.005) | 0.099 ** (0.047) | 0.001 (0.004) | ||||

| DTD | 0.062 *** (0.019) | 0.022 *** (0.002) | 0.066 *** (0.019) | 0.001 (0.001) | ||||

| Control | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Year | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Industry | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Constant | −1.934 *** | 0.004 | −1.921 *** | 0.003 | −4.650 *** | 0.034 | −4.645 *** | 0.036 |

| Adj R2 | 0.027 | 0.018 | 0.028 | 0.018 | 0.023 | 0.016 | 0.024 | 0.016 |

| F-statistics | 31.264 *** | 20.826 *** | 31.968 *** | 20.507 *** | 26.569 *** | 18.945 *** | 27.671 *** | 18.978 *** |

| Sample of Eastern China | Sample of Non-Eastern China | |||||||

|---|---|---|---|---|---|---|---|---|

| ISW | ISD | ISW | ISD | ISW | ISD | ISW | ISD | |

| (1) | (2) | (3) | (4) | (5) | (6) | (7) | (8) | |

| DTW | 0.109 *** (0.041) | 0.008 ** (0.004) | 0.076 (0.061) | 0.006 (0.004) | ||||

| DTD | 0.064 *** (0.016) | 0.028 *** (0.002) | 0.054 ** (0.025) | 0.001 (0.002) | ||||

| Control | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Year | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Industry | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Constant | −2.336 *** | 0.062 *** | −2.332 *** | 0.061 *** | −5.605 *** | −0.037 | −5.574 *** | −0.034 |

| Adj R2 | 0.023 | 0.018 | 0.024 | 0.018 | 0.025 | 0.015 | 0.025 | 0.015 |

| F-statistics | 37.293 *** | 28.436 *** | 38.604 *** | 28.276 *** | 17.433 *** | 10.858 *** | 17.920 *** | 10.659 *** |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Gao, F.; Lin, C.; Zhai, H. Digital Transformation, Corporate Innovation, and International Strategy: Empirical Evidence from Listed Companies in China. Sustainability 2022, 14, 8137. https://doi.org/10.3390/su14138137

Gao F, Lin C, Zhai H. Digital Transformation, Corporate Innovation, and International Strategy: Empirical Evidence from Listed Companies in China. Sustainability. 2022; 14(13):8137. https://doi.org/10.3390/su14138137

Chicago/Turabian StyleGao, Fuxia, Chuan Lin, and Haomiao Zhai. 2022. "Digital Transformation, Corporate Innovation, and International Strategy: Empirical Evidence from Listed Companies in China" Sustainability 14, no. 13: 8137. https://doi.org/10.3390/su14138137

APA StyleGao, F., Lin, C., & Zhai, H. (2022). Digital Transformation, Corporate Innovation, and International Strategy: Empirical Evidence from Listed Companies in China. Sustainability, 14(13), 8137. https://doi.org/10.3390/su14138137