Research on China’s Manufacturing Industry Moving towards the Middle and High-End of the GVC Driven by Digital Economy

Abstract

1. Introduction

2. Literature Review

2.1. Digital Economy and Global Value Chain Theory

2.2. Theoretical Mechanism of the Division of Labor and Level of Participation in Global Value Chains

2.3. The Impact of Digitalization on the Division of Labor and Its Status in the GVC of Manufacturing

2.3.1. The Impact Mechanism of Digital Technology on the Division and Status in the GVC

2.3.2. GVC Measurement Methods

2.3.3. Quantitative Measurement of the Impact of Digitalization on the Division of Labor in Manufacturing GVCs

2.3.4. Research on the Path and Strategy of Digital-Driven Manufacturing Value Chain Upgrade

3. Digital Model Description and Numerical Analysis

3.1. Manufacturing Digital Model Establishment

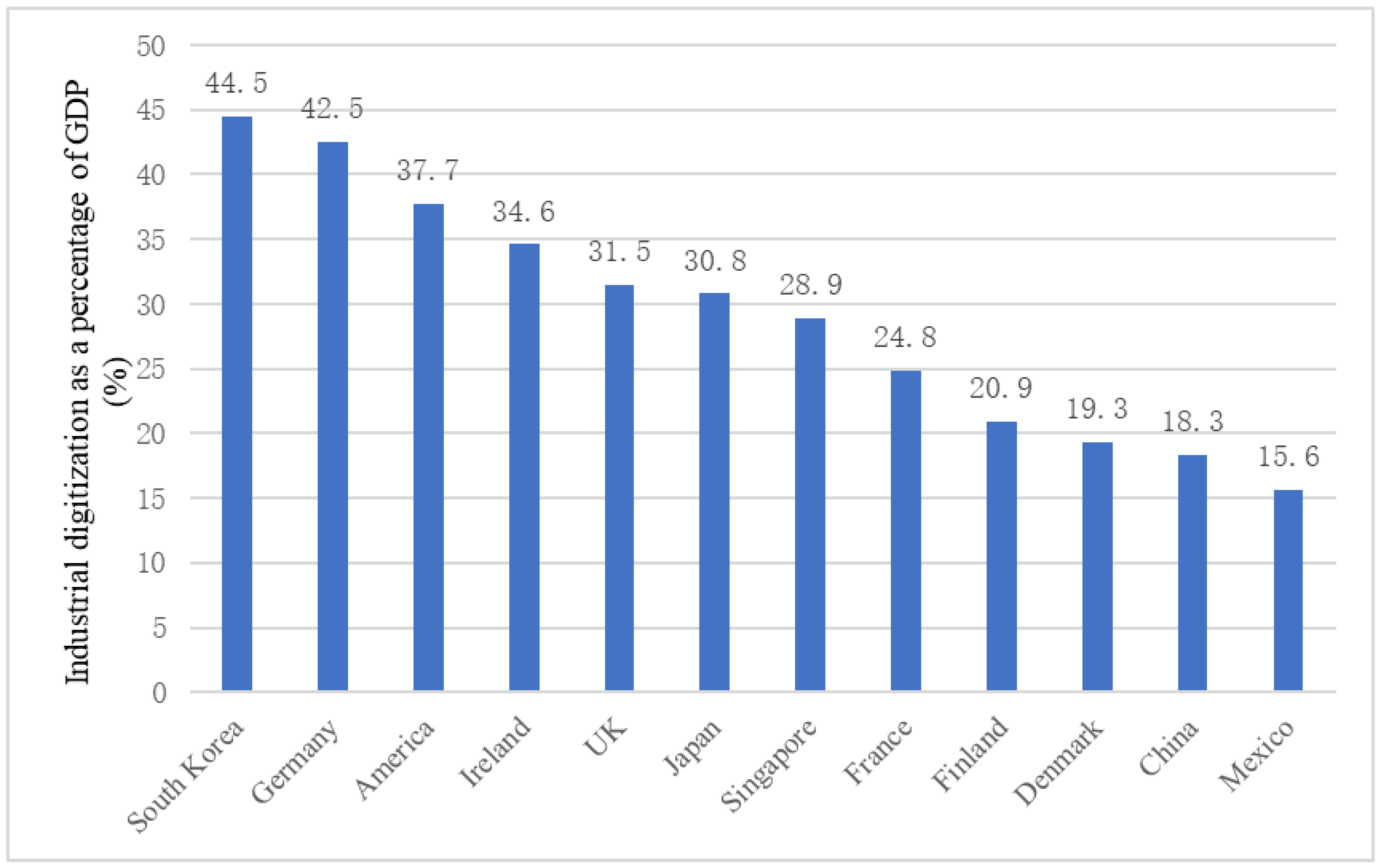

3.1.1. Measurement of the Digital Level in the Manufacturing Industry of Major Countries

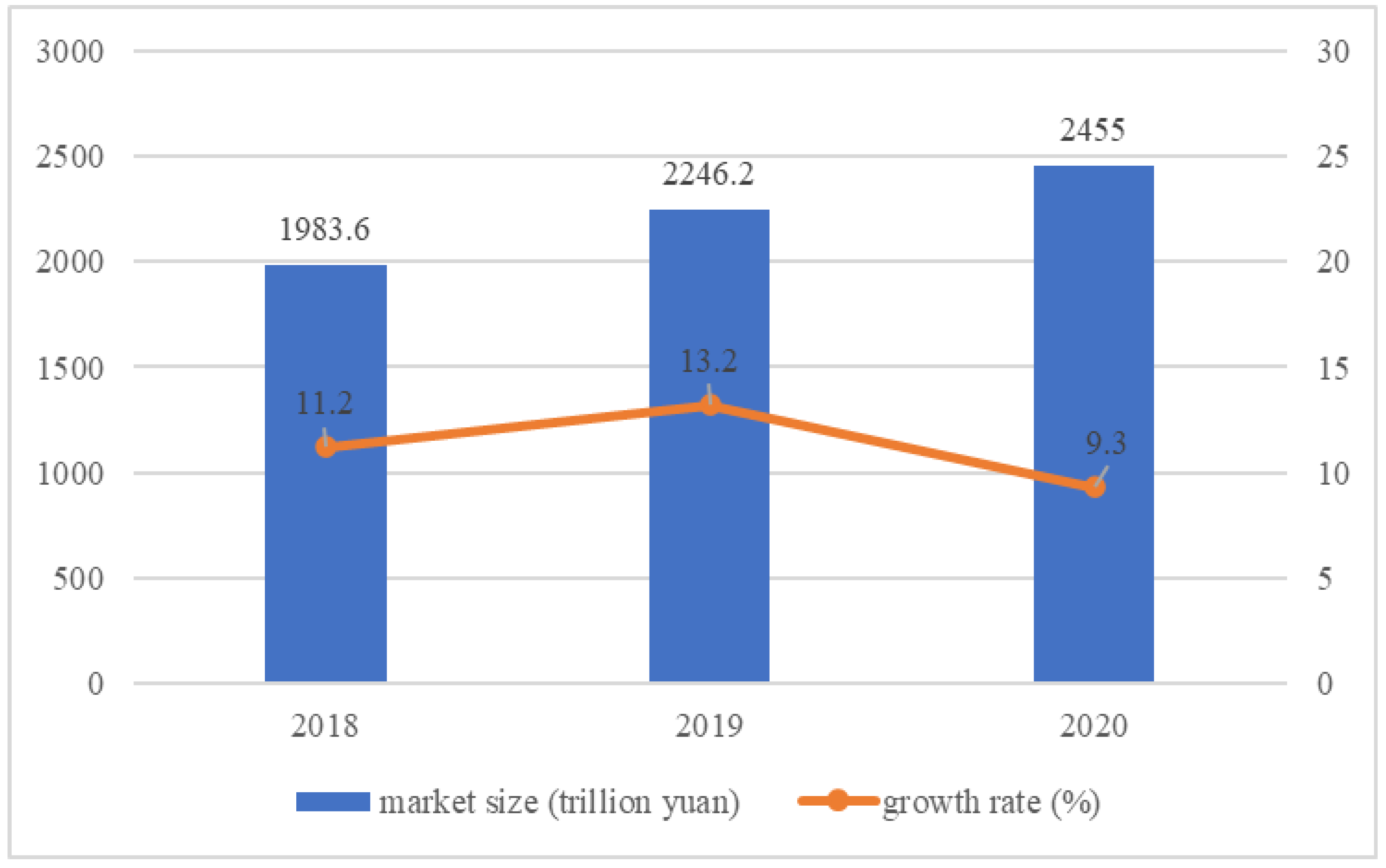

3.1.2. Measurement of Digital Industry Level in China

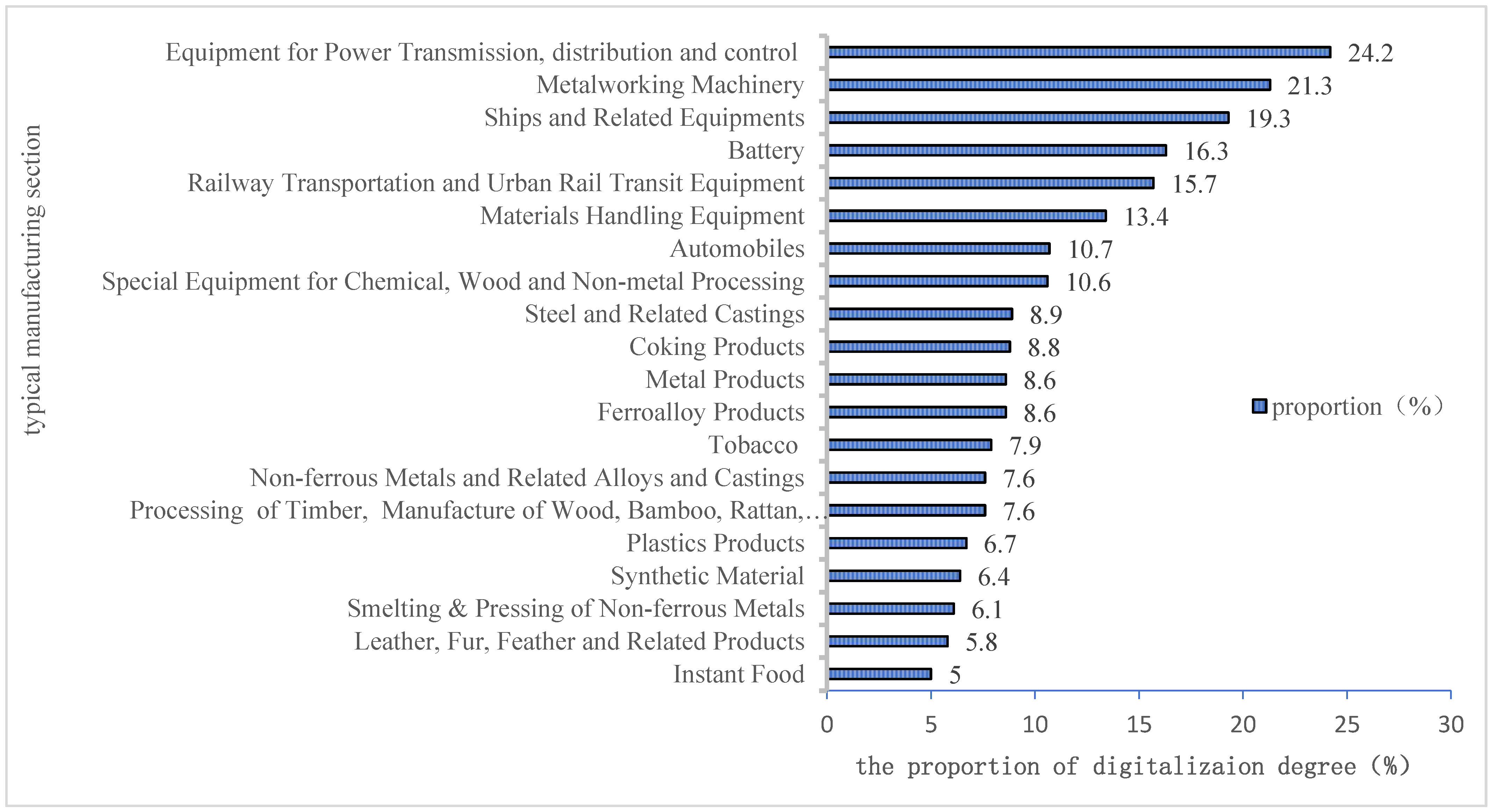

3.1.3. Measurement of the Industrial Digitalization Level in China

3.2. Comparative Analysis of the Digital Advantages of Manufacturing in China and Major Countries in the World

4. Manufacturing Global Value Chain Participation Model and Data Analysis

4.1. The Structure Equation and Variables

- (1)

- DVA: This represents the domestic added value ultimately absorbed abroad. When decomposed, DVA_FIN represents the domestic added value exported in the form of final products; DVA_INT represents the domestic added value exported in the form of intermediate products and produced by the importing country for final demand; DVA_INTrex represents the domestic added value that is processed and produced by the importing country in the form of intermediate products and exported to the third country and finally consumed.

- (2)

- RDV: This represents the country’s domestic added value exported and then returned and consumed.

- (3)

- FVA: This represents foreign added value in domestic exports: where FVA_FIN represents foreign added value included in final product exports, and FVA_INT represents foreign added value included in intermediate product exports.

- (4)

- Pure double counting (PDC): This is caused by the trade of intermediate products crossing national borders. DDC stands for double counting from domestic accounts, and FDC stands for double counting from foreign accounts. Based on the decomposition framework of trade added value, Koopman et al. constructed a GVC status index and a participation index to measure a country’s GVC division of labor and its participation in a specific sector. The GVC status index is given as follows [9]:where GVC participationis indicates the position index of the i industry in country s in GVC. IVis indicates the indirect export added value of the i industry in country s, that is, the domestic added value in the form of intermediate products processed and produced by the importing country and exported to a third country and finally consumed. FVis represents the foreign added value included in the export of i industry in country s. Eis represents the total export value of the industry in country s. In the GVC division of labor, if the proportion of IV in exports of a country is higher than that of FV in exports, the country mainly participates in the international division of labor by exporting intermediate products or services to other countries, indicating that the country is in the upstream link of GVC. On the contrary, the proportion of IV in exports of a country is lower than that of FV in exports. The country mainly participates in the international division of labor by importing intermediate products from other countries and then processing, assembling, and re-exporting, indicating that the country is in the downstream link of GVC.

4.2. Data Analysis

4.2.1. Increase in PDC Value

4.2.2. Analysis of GVC Status Index in Manufacturing Countries

4.3. Analysis of GVC Participation Index in the Manufacturing Sector

4.3.1. Model Establishment

4.3.2. Data Analysis

4.4. Digitalization of the GVC of the Manufacturing Industry Fixed-effects Empirical Model

4.4.1. Model Construction

4.4.2. The Hypothesis of the Expected Effects of the Variables

4.4.3. Descriptive Statistical Analysis

4.4.4. Unit Root Test

5. Empirical Research Results and Analysis

5.1. Research Results of the Digital Index (DMI) in the Manufacturing Industry

5.2. Empirical Results of Structural Equation of the GVC Participation and Location in the Manufacturing Industry

5.3. The Results of Fixed Effects Model Empirical on Digitalization of the GVC of Manufacturing

6. Implications and Suggestions

6.1. Implications of Research Conclusions

- (1)

- The comparative analysis of the digital level of the manufacturing industry in 18 key countries shows that although the scale of China’s digital economy has been at the forefront of the world, there is a great imbalance between digital development governance, integration, and manufacturing development. China should speed up the construction of digital infrastructure, strengthen the effectiveness of production process control based on 5G and industrial Internet of things platform, tap the hidden potential of data, and speed up the digitization of the manufacturing industry.

- (2)

- The comparative analysis of the GVCs’ division status of the manufacturing industry in 18 key countries shows that the GVCs’ division status of the manufacturing industry in France, Britain, Canada, Sweden, Estonia, and Mexico continues to decline. As export-oriented countries, these countries are relatively dependent on foreign economies and are more vulnerable to the current global economic recession. This should enlighten China to further improve the industrial chain and reduce the risk of “chain-breaking”. The results show that China’s manufacturing industry is downstream of GVC, and its export depends on the processing trade industry with low added value. Compared with the United States and Japan, China’s manufacturing industry lacks core competitiveness. China should improve the industrial chain further and reduce the risk of “chain-breaking”. In addition, China should speed up technological innovation and enhance product competitiveness.

- (3)

- The network participation mode of some medium and high-end manufacturing industries in China has gradually changed from “bottom embedding” to “high-level penetration”. China has a strong independent production capacity in the middle and high-end manufacturing industries, such as electronics, petrochemical, and mechanical equipment. China should continue to develop strategic emerging industries and transform and upgrade traditional industries.

- (4)

- The regression analysis of the digital economy and GVC in China’s manufacturing industry shows that digitization negatively impacts the improvement of GVC in the labor-intensive or resource-intensive manufacturing industry. Digitization has a positive impact on the improvement of GVC in capital-intensive and technology-intensive manufacturing industries. The digitalization of the manufacturing industry has restrained the advantage of low labor costs in China’s manufacturing industry. It enlightens China’s labor-intensive or resource-intensive manufacturing industry to accelerate the transformation and upgrading, optimize the structure, and vigorously develop the advanced manufacturing industry. Second, capital-intensive and technology-intensive manufacturing industries can effectively improve their GVC division of labor status by accelerating the digitization process. China’s capital-intensive and technology-intensive manufacturing industry should speed up digital construction.

6.2. Recommendations

6.2.1. Accelerate the Improvement of China’s Digital Quality and In-Depth Construction

6.2.2. Improve the Domestic Industrial Chain and Promote the Balanced Development of Industries

6.2.3. Driven by the Digital Economy, Promote GVC in China’s Manufacturing Industry

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Wang, Q.; Han, X. Spillover Effects of the United States Economic Slowdown Induced by COVID-19 Pandemic on Energy, Economy, and Environment in Other Countries. Environ. Res. 2021, 196, 110936. [Google Scholar] [CrossRef] [PubMed]

- Goldfarb, A.; Catherine, T. Digital Economics. J. Econ. Lit. 2019, 57, 3–91. [Google Scholar] [CrossRef]

- Jin, B.; Han, Y. Influencing factors and decoupling analysis of carbon emissions in China’s manufacturing industry. Environ. Sci. Pollut. Res. 2021, 28, 64719–64738. [Google Scholar] [CrossRef] [PubMed]

- Ackland, R. Economic Analysis of the Digital Economy, by Goldfarb, Avi, Greenstein, Shane M. and Tucker, Catherine E. Econ. Rec. 2017, 93, 334–336. [Google Scholar] [CrossRef]

- Tang, D.; Wang, L.; Bethel, B.J. An Evaluation of the Yangtze River Economic Belt Manufacturing Industry Level of Intelligentization and Influencing Factors: Evidence from China. Sustainability 2021, 13, 8913. [Google Scholar] [CrossRef]

- Xu, G.; Lu, T.; Liu, Y. Symmetric Reciprocal Symbiosis Mode of China’s Digital Economy and Real Economy Based on the Logistic Model. Symmetry 2021, 13, 1136. [Google Scholar] [CrossRef]

- Zhou, S.Q.; Lan, Z.X.; Hua, F.U. Division Status of China’s Manufacturing Industry in Global Value Chains: A Study Based on Koopman’s GVC Position Indices. J. Int. Trade 2014, 2, 3–12. [Google Scholar]

- Legner, C.; Eymann, T.; Hess, T.; Matt, C.; Böhmann, T.; Drews, P.; Mädche, A.; Urbach, N.; Ahlemann, F. Digitalization: Opportunity and Challenge for the Business and Information Systems Engineering Community. Bus. Inf. Syst. Eng. 2017, 59, 301–308. [Google Scholar] [CrossRef]

- Koopman, R.; Powers, W.; Wang, Z.; Wei, S.J. Give Credit Where Credit Is Due: Tracing Value Added in Global Production Chains. NBER Working Paper Series. 2010. Available online: https://www.nber.org/system/files/working_papers/w16426/w16426.pdf (accessed on 10 April 2022).

- Koopman, R.; Wang, Z.; Wei, S.J. Tracing Value-Added and Double Counting in Gross Exports. Am. Econ. Rev. 2014, 104, 459–494. [Google Scholar] [CrossRef]

- Don, T. The Digital Economy: Promise and Peril in the Age of Networked Intelligence; McGraw-Hill: New York, NY, USA, 1996; ISBN 0-07-062200-0. [Google Scholar] [CrossRef]

- Hui, Z.; Xu, L.; Wang, Y. Global Digital Economy Competitiveness Development Report; Social Sciences Literature Press in Bejing of China: Beijing, China, 2020; ISBN 978-75201-7550-0. [Google Scholar]

- Nicholas, N. Being Digital. Libr. Q. 1996, 66, 208–210. [Google Scholar] [CrossRef][Green Version]

- Dieter, Z.H.; Veith, K. Emerging Industrial Structures in the Digital Economy—The Case of the Financial Industry. 1999, pp. 115–117. Available online: https://aisel.aisnet.org/cgi/viewcontent.cgi?article=1396&context=amcis1999 (accessed on 10 April 2022).

- Chen, X.; Despeisse, M.; Johansson, B. Environmental Sustainability of Digitalization in Manufacturing: A Review. Sustainability 2020, 12, 10298. [Google Scholar] [CrossRef]

- Goldfarb, A.; Greenstein, S.M.; Tucker, C.E. Economic Analysis of the Digital Economy; NBER Books From; National Bureau of Economic Research, Inc.: Cambridge, MA, USA, 2015. [Google Scholar]

- Porter, M.E. Competitive Advantage; Free Press: New York, NY, USA, 1985. [Google Scholar]

- Arushanyan, Y.; Ekener-Petersen, E.; Finnveden, G. Lessons learned—Review of LCAs for ICT Products and Services. Comput. Ind. 2014, 65, 211–234. [Google Scholar] [CrossRef]

- Zhou, D.; Yan, T.; Dai, W.; Feng, J. Disentangling the Interactions within and between Servitization and Digitalization Strategies: A Service-dominant. Int. J. Prod. Econ. 2021, 238, 108175. [Google Scholar] [CrossRef]

- Humphrey, J. Upgrading in Global Value Chains. Econ. Environ. Employ. 2004, 1–39. [Google Scholar] [CrossRef]

- Gereffi, G.; Humphrey, J.; Sturgeon, T. The Governance of Global Value Chains. Rev. Int. Political Econ. 2005, 12, 78–104. [Google Scholar] [CrossRef]

- Humphrey, H.; Schmitz, H. Governance in Global Value Chains. IDS Bull. 2001, 32, 19–29. [Google Scholar] [CrossRef]

- Sheng, A. China’s Economic Reform: The Troika. Contemp. Econ. Policy 2010, 13, 15–27. [Google Scholar] [CrossRef]

- Sampatha, P.G.; Vallejob, B. Trade, Global Value Chains and Upgrading: What, When and How. Eur. J. Dev. Res. 2018, 30, 481–504. [Google Scholar] [CrossRef]

- Wu, Y.Q.; Lu, H.X.; Liao, X.L.; Zhu, J.M. Research on the Digitization of Manufacturing Will Enhance the Competitiveness of the Value Chain Based on Advantage Comparison. Complexity 2021, 2021, 9917772. [Google Scholar] [CrossRef]

- Huang, J. The Impact of Environmental Regulation on the Domestic Value Added Rate of China’s Industrial Exports—Empirical Test Based on Panel Data of Prefecture Level Cities. Am. J. Ind. Bus. Manag. 2020, 10, 437–1453. [Google Scholar] [CrossRef]

- Gereffi, G. International Trade and Industrial Upgrading in the Apparel Commodity Chain. J. Int. Econ. 1999, 48, 37–70. [Google Scholar] [CrossRef]

- Zhang, Y. The Status of International Labor Division of China’s Manufacturing: Based on the Vertical Specialization from the Perspective of Value Added; Social Sciences Literature Press: Beijing, China, 2017; ISBN 978-7-5201-0900-0. [Google Scholar]

- Baldwin, R.; Nicoud, F.R. Trade-in-goods and Trade-in-tasks: An Integrating Framework. J. Int. Econ. 2014, 92, 51–62. [Google Scholar] [CrossRef]

- Wignaraja, G.; Krüger, J.; Tuazon, A.M. Production Networks, Profits, and Innovative Activity: Evidence from Malaysia and Thailand. ADBI Work. Pap. 2013, 25, 223–228. [Google Scholar] [CrossRef]

- UNCTAD. World Investment Report 2013: Global Value Chains: Investment and Trade for Development. Lab. Anim. Sci. 2013, 35, 272–279. [Google Scholar]

- Gereffi, G.; Humphrey, S.; Kaplinsky, R.; Sturgeon, T. Introduction: Globalisation, Value Chains and Development. IDS Bull. 2001, 32, 1–8. [Google Scholar] [CrossRef]

- Lee, J.; Gereffi, G. Innovation, Upgrading, and Governance in Cross-Sectoral Global Value Chains: The Case of Smartphones. Ind. Corp. Chang. 2021, 30, 215–231. [Google Scholar] [CrossRef]

- Lin, J.; Chang, H.J. Should Industrial Policy in Developing Countries Conform to Comparative Advantage or Defy It? A Debate Between Justin Lin and Ha-Joon Chang. Dev. Policy Rev. 2010, 27, 483–502. [Google Scholar] [CrossRef]

- Blyde, J.S. The Drivers of Global Value Chain Paticipation: Crosss-Country Analyses. In Synchron. Factories; Springer: Berlin/Heidelberg, Germany, 2014; ISBN 978-3-319-09990-3. [Google Scholar]

- Cario, P.; Roberta, R. Global Value Chains Meet Innovation Systems: Are There Learning Opportunities for Developing Countries. World Dev. 2011, 39, 1261–1269. [Google Scholar]

- Herzer, D. How Does Foreign Direct Investment Really Affect Developing Countries’ Growth? Rev. Int. Econ. 2012, 20, 396–414. [Google Scholar] [CrossRef]

- Frank, A.G.; Mendes, G.; Ayala, N.F.; Ghezzi, A. Servitization and Industry 4.0 convergence in the Digital Transformation of Product firms: A Business Model InnovationPerspective. Technol. Forecast. Soc. Chang. 2019, 141, 341–351. [Google Scholar] [CrossRef]

- Heerlien, M.; Van Leusen, J.; Schnörr, S.; de Jong-Kole, S.; Raes, N.; Van Hulsen, K. The Natural History Production Line: An Industrial Approach to the Digitization of Scientific Collections. J. Comput. Cult. Herit. 2015, 8, 3–11. [Google Scholar] [CrossRef]

- UNCTAD. Digital Economy Report 2019; Layoutan Printing at United Nations: Geneva, Switzerland, 2019; ISBN 978-92-1-112955-7. [Google Scholar]

- Jiao, Y. Digital Economy Enables Manufacturing Transformation: From Value Remodeling to Value Creation. Economist 2020, 14, 87–94. (In Chinese) [Google Scholar]

- Yoguel, G.; Perez, C.; Soete, L. Catching Up in Technology: Entry Barriers and Windows of Opportunity. Rev. Bras. Inovação 2015, 14, 257. [Google Scholar] [CrossRef]

- Kogut, B. Designing Global Strategies: Comparative Value-added Chains. Sloan Manag. Rev. 1985, 26, 15–28. [Google Scholar]

- Kaplinsky, R. Spreading the Gains from Globaliaztion: Whatean Belearned from Valuechain Analysis? J. Dev. Stud. 2000, 37, 117–146. [Google Scholar] [CrossRef]

- Hummels, D.; Ishii, J.; Yi, K.W. The Nature and Growth of Vertical Specialization in World Trade. J. Int. Econ. 2001, 54, 75–96. [Google Scholar] [CrossRef]

- Daudin, G.; Rifflart, C.; Schweisguth, D. Who Produces for Whom in the World Economy? Can. J. Econ. Rev. Can. D’economique 2011, 44, 1403–1437. [Google Scholar] [CrossRef]

- Li, Y.; Zhang, H.Y.; Liu, Y.H.; Huang, Q.B. Impact of Embedded Global Value Chain on Technical Complexity of Industry Export—An Empirical Study Based on China’s Equipment Manufacturing Industry Panel. Sustainability 2020, 12, 2694. [Google Scholar] [CrossRef]

- Zudaire, E.; Martínez, A.; Cuttitta, F. The Production and Distribution of Knowledge in the United States; Princeton University Press: Princeton, NJ, USA, 1962. [Google Scholar]

- Bukht, R.; Heeks, R. Defining and Measuring the Digital Economy. BEA Work. Pap. 2017, 68, 1–29. [Google Scholar] [CrossRef]

- Knickrehm, M.; Berthon, B.; Daugherty, P. Digital disruption: The growth multiplier, Accenture Strategy and Oxford Economics; AnuPartha: Menlo Park, CA, USA, 2016. [Google Scholar]

- Watanabe, C.; Naveed, K.; Tou, Y.; Neittaanmaki, P. Measuring GDP in the digital economy: Increasing dependence on uncaptured GDP. Technol. Forecast. Soc. Chang. 2018, 137, 226–240. [Google Scholar] [CrossRef]

- He, W.B. Analysis on the Effect of Digitalization Promoting the High End of China’s Manufacturing Value Chain. Econ. Manag. East China 2020, 34, 29–37. [Google Scholar] [CrossRef]

- The Global Industry Research Institute of Qinghua University. Research Report on the Digital Transformation of Chinese Enterprises; Qinghua University Press: Beijing, China, 2021. (In Chinese) [Google Scholar]

- Li, T.; Yang, L. The Effects of Tax Reduction and Fee Reduction Policies on the Digital Economy. Sustainability 2021, 13, 7611. [Google Scholar] [CrossRef]

- Syrquin, M. Key Issues for the 21st Century: Economics, Economies, and the Global Economy. Bull. Am. Acad. Arts Sci. 2007, 34, 217–224. [Google Scholar]

- Dong, S.S.; Qi, L.Q. Model Analysis and Simulation of Equipment-Manufacturing Value Chain Integration Process. Complexity 2020, 11, 6620679. [Google Scholar] [CrossRef]

- Yu, C.J.; Luo, Z.C. What are China’s Real Gains within Global Value Chains? Measuring Domestic Value Added in China’s Exports of Manufactures. China Econ. Rev. 2018, 47, 263–273. [Google Scholar] [CrossRef]

- Zhang, H.; Zhai, X. The Characteristics and Enlightenments of China’s Participation in Global Value Chains. J. Quant. Tech. Econ. 2018, 1, 3–21. (In Chinese) [Google Scholar]

- Cheng, D.; Wang, J.; Xiao, Z. Global Value Chain and Growth Convergence: Applied Especially to China. Pac. Econ. Rev. 2021, 26, 161–182. [Google Scholar] [CrossRef]

- Zhang, J. Impact of Manufacturing Servitization on Factor Productivity of Industrial Sector Using Global Value Chain. Sustainability 2022, 14, 5354. [Google Scholar] [CrossRef]

- He, M. Global Value Chain in the Post-COVID Era: Implications for Regional Cooperation of ASEAN and China. Open J. Political Sci. 2021, 11, 13. [Google Scholar] [CrossRef]

- Feng, P.; Zhou, X.; Zhang, D.; Chen, Z.; Wang, S. The Impact of Trade Policy on Global Supply Chain Network Equilibrium: A New Perspective of Product-Market Chain Competition. Omega 2022, 109, 102612. [Google Scholar] [CrossRef]

- Centobelli, P.; Cerchione, R.; Del Vecchio, P.; Oropallo, E.; Secundo, G. Blockchain Technology for Bridging Trust, Traceability and Transparency in Circular Supply Chain. Inform. Manag. 2021, 7, 103508. [Google Scholar] [CrossRef]

- Kshetri, N. Blockchain and Sustainable Supply Chain Management in Developing Countries. Int. J. Inf. Manag. 2021, 60, 102376. [Google Scholar] [CrossRef]

- Centobelli, P.; Cerchione, R.; Vecchio, P.D.; Oropallo, E.; Secundo, G. Blockchain Technology Design in Accounting: Game Changer to Tackle Fraud or Technological Fairy Tale? Account. Audit. Account. J. 2021. ahead-of-print. [Google Scholar] [CrossRef]

| Year | 2005 | 2007 | 2009 | 2011 | 2013 | 2015 | 2017 | |

|---|---|---|---|---|---|---|---|---|

| Country | ||||||||

| Brazil | 5.26 | 4.25 | 4.03 | 3.56 | 3.6 | 3.58 | 3.61 | |

| Canada | 4.96 | 4.73 | 5.16 | 4.03 | 4.22 | 4.48 | 4.62 | |

| China | 19.07 | 17.51 | 16.81 | 14.81 | 15.69 | 16.55 | 17.57 | |

| Germany | 9.26 | 9.25 | 10.91 | 9.82 | 0.01 | 9.66 | 9.56 | |

| Denmark | 8.62 | 8.77 | 8.26 | 7.83 | 7.29 | 7.49 | 7.82 | |

| Finland | 22.98 | 20.53 | 19.44 | 12.9 | 11.17 | 12.17 | 13.01 | |

| France | 9.97 | 9.22 | 9.11 | 8.01 | 8 | 7.9 | 8.05 | |

| UK | 9.62 | 8.6 | 8.92 | 8.07 | 7.8 | 8.37 | 8.35 | |

| USA | 13.24 | 11.48 | 12.37 | 10.05 | 10.85 | 11.93 | 12.7 | |

| Norway | 8.07 | 7.87 | 8.53 | 7.25 | 8.15 | 8.25 | 8.32 | |

| Sweden | 12.89 | 11.22 | 12.55 | 9.89 | 10.07 | 7.93 | 7.96 | |

| Netherlands | 7.5 7 | 7.29 | 7.47 | 6.58 | 6.56 | 6.89 | 7.01 | |

| Indonesia | 6.67 | 5.39 | 6.06 | 4.79 | 4.82 | 5.2 | 5.12 | |

| India | 2.97 | 3.1 | 3.73 | 2.61 | 2.6 | 3.57 | 3.55 | |

| Japan | 16.92 | 15.17 | 14.34 | 12.53 | 12.08 | 12. | 12.6 | |

| South Korea | 24.61 | 22.5 | 21.31 | 17.87 | 19.46 | 22.45 | 26.74 | |

| Mexico | 17.5 | 16.34 | 17.91 | 14.07 | 14.82 | 16.68 | 16.72 | |

| Russia | 2.87 | 2.75 | 3.54 | 2.76 | 2.66 | 3.31 | 3.40 | |

| Status Index | Participation Index | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| Year | 2010 | 2014 | 2015 | 2016 | 2017 | 2010 | 2014 | 2015 | 2016 | 2017 | |

| Country | |||||||||||

| China | −0.048 | −0.009 | −0.007 | 0.011 | 0.018 | 0.282 | 0.260 | 0.245 | 0.246 | 0.247 | |

| Canada | −0.158 | −0.172 | −0.189 | −0.188 | −0.184 | 0.369 | 0.383 | 0.393 | 0.392 | 0.391 | |

| Brazil | 0.064 | 0.040 | 0.012 | 0.027 | 0.039 | 0.283 | 0.307 | 0.305 | 0.292 | 0.292 | |

| Germany | −0.058 | −0.060 | −0.064 | −0.046 | 0.055 | 0.364 | 0.368 | 0.374 | 0.365 | 0.370 | |

| France | −0.084 | −0.087 | −0.084 | −0.102 | −0.102 | 0.399 | 0.405 | 0.398 | 0.415 | 0.415 | |

| UK | −0.060 | −0.038 | −0.045 | −0.054 | −0.058 | 0.393 | 0.383 | 0.387 | 0.391 | 0.397 | |

| Denmark | −0.116 | −0.130 | −0.136 | −0.121 | −0.121 | 0.394 | 0.413 | 0.419 | 0.407 | 0.407 | |

| USA | 0.035 | 0.018 | 0.030 | 0.036 | 0.031 | 0.252 | 0.263 | 0.251 | 0.245 | 0.249 | |

| Japan | 0.063 | 0.007 | 0.002 | 0.030 | 0.017 | 0.321 | 0.353 | 0.342 | 0.329 | 0.339 | |

| South Korea | −0.115 | −0.108 | −0.125 | −0.106 | −0.108 | 0.420 | 0.421 | 0.428 | 0.419 | 0.42 | |

| Estonia | −0.169 | −0.201 | −0.204 | −0.214 | −0.214 | 0.480 | 0.500 | 0.504 | 0.507 | 0.507 | |

| India | −0.041 | −0.045 | −0.026 | 0.023 | −0.019 | 0.372 | 0.362 | 0.337 | 0.316 | 0.341 | |

| Indonesia | 0.041 | 0.018 | 0.028 | 0.056 | 0.041 | 0.334 | 0.343 | 0.323 | 0.297 | 0.323 | |

| Mexico | −0.266 | −0.245 | −0.240 | −0.292 | −0.276 | 0.447 | 0.427 | 0.412 | 0.464 | 0.45 | |

| Norway | 0.035 | 0.045 | 0.021 | 0.024 | 0.039 | 0.400 | 0.406 | 0.403 | 0.399 | 0.405 | |

| Russia | 0.223 | 0.187 | 0.179 | 0.204 | 0.202 | 0.374 | 0.379 | 0.383 | 0.386 | 0.385 | |

| Sweden | −0.062 | −0.051 | −0.055 | −0.066 | −0.070 | 0.420 | 0.416 | 0.420 | 0.429 | 0.427 | |

| Code | Name | Element Density Classification |

|---|---|---|

| R5 | Food, Beverage, and Tobacco Manufacturing | Labor intensive |

| R6 | Textiles, Apparel, and Leather Goods | |

| R7 | Manufacture of woven material products | |

| R8 | Paper and Paper Products | |

| R9 | Printing and copying of recording media | |

| R22 | Furniture Manufacturing; Other Manufacturing | |

| R10 | Coke and Refined Petroleum Products | Capital intensive |

| R11 | Chemicals and chemical products | |

| R12 | Essential pharmaceutical products and pharmaceutical preparations | |

| R13 | Rubber and Plastic Products | |

| R14 | Other non-metallic minerals | |

| R15 | Manufacture of base metals | |

| R16 | Manufacture of metal products, other than machinery and equipment | |

| R17 | Manufacture of computer, electronic, and optical products | Technology intensive |

| R18 | Electrical equipment manufacturing | |

| R19 | Machinery and equipment manufacturing | |

| R20 | Automobile, Trailer, and Semi-trailer Manufacturing | |

| R21 | Manufacturing of other transportation equipment |

| Year | 2000 | 2008 | 2014 | 2017 | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Sector | Participation | Easy | Complex | Participation | Easy | Complex | Participation | Easy | Complex | Participation | Easy | Complex | |

| Food and beverage manufacturing and tobacco industry d05 | 0.49 | 0.12 | 0.05 | 0.43 | 0.96 | 0.22 | 0.72 | 1.21 | 0.42 | 0.77 | 1.11 | 0.50 | |

| Textile, apparel, and leather product manufacturing d06 | 0.73 | 0.12 | 0.22 | 1.09 | 1.55 | 0.67 | 1.08 | 1.25 | 0.84 | 1.11 | 1.16 | 1.05 | |

| Wood, wood products processing industry, and bamboo, yard cloth products d07 | 0.97 | 0.19 | 0.14 | 0.90 | 1.05 | 0.74 | 1.13 | 1.59 | 0.76 | 1.15 | 1.31 | 0.95 | |

| Paper and paper products industry d08 | 0.87 | 0.24 | 0.13 | 0.74 | 0.66 | 0.90 | 0.65 | 0.53 | 0.95 | 0.65 | 0.51 | 1.08 | |

| Printing and reproduction of recording media dC09 | 0.85 | 0.22 | 0.11 | 1.05 | 1.26 | 0.84 | 1.07 | 1.16 | 0.97 | 1.09 | 1.08 | 1.11 | |

| Coking and petroleum processing d10 | 0.81 | 0.26 | 0.19 | 1.14 | 2.94 | 0.60 | 1.33 | 4.45 | 0.65 | 1.37 | 2.96 | 0.78 | |

| Chemical raw materials and chemical products manufacturing d11 | 1.01 | 0.28 | 0.22 | 0.54 | 1.24 | 0.23 | 0.64 | 1.41 | 0.27 | 0.66 | 1.50 | 0.28 | |

| Basic pharmaceutical industry and pharmaceutical preparation industry d12 | 0.54 | 0.13 | 0.09 | 1.03 | 1.30 | 0.81 | 0.87 | 1.10 | 0.67 | 0.90 | 1.04 | 0.76 | |

| Rubber and plastic products d13 | 1.06 | 0.23 | 0.30 | 0.70 | 0.88 | 0.55 | 0.79 | 0.88 | 0.69 | 0.84 | 0.90 | 0.77 | |

| Non-metallic mineral products d14 | 0.61 | 0.15 | 0.14 | 0.73 | 1.82 | 0.46 | 0.98 | 2.22 | 0.60 | 1.01 | 1.88 | 0.68 | |

| Basic metal products industry d15 | 0.98 | 0.25 | 0.18 | 0.58 | 0.60 | 0.54 | 0.50 | 0.49 | 0.52 | 0.52 | 0.50 | 0.58 | |

| Welded metal products industry d16 | 1.32 | 0.26 | 0.21 | 1.04 | 4.28 | 0.43 | 1.48 | 6.04 | 0.61 | 1.53 | 3.92 | 0.73 | |

| Computers, electronic products, and optical product manufacturing d17 | 0.66 | 0.12 | 0.52 | 0.73 | 0.58 | 1.13 | 0.71 | 0.58 | 1.10 | 0.73 | 0.58 | 1.14 | |

| Electronic equipment manufacturing d18 | 0.82 | 0.21 | 0.23 | 0.04 | 0.04 | 0.04 | 0.06 | 0.06 | 0.06 | 0.07 | 0.07 | 0.07 | |

| Machinery and equipment manufacturing d19 | 0.56 | 0.19 | 0.14 | 0.70 | 0.88 | 0.55 | 0.79 | 0.88 | 0.69 | 0.84 | 0.90 | 0.77 | |

| Automobile, trailer, and semi-trailer manufacturing d20 | 0.52 | 0.22 | 0.11 | 2.28 | 2.22 | 2.38 | 2.99 | 3.08 | 2.86 | 3.14 | 3.06 | 3.26 | |

| Other transportation equipment manufacturing d21 | 0.55 | 0.20 | 0.16 | 2.31 | 2.28 | 2.36 | 3.16 | 3.24 | 3.04 | 3.31 | 3.23 | 3.56 | |

| Other manufacturing d22 | 0.85 | 0.1 | 0.15 | 1.12 | 0.99 | 1.47 | 1.11 | 0.91 | 1.62 | 1.11 | 0.90 | 1.82 | |

| Industry | Forward Participation Index | Backward Participation Index | Industry | Forward Participation Index | Backward Participation Index |

|---|---|---|---|---|---|

| Δ (2017–2000) | Δ (2017–2000) | ||||

| Agriculture, forestry, animal husbandry, and fisheries | 0.009 | −0.008 | Water, electricity, and gas | 0.006 | −0.003 |

| Mining and quarry | −0.034 | 0.019 | Building industry | 0.001 | −0.015 |

| Food, drink, and tobacco | 0.002 | −0.007 | Wholesale trade | 0.002 | −0.053 |

| Textile and apparel | 0.017 | −0.057 | Retail trade | 0.007 | −0.053 |

| Leather and shoes | 0.023 | −0.161 | Accommodation and catering | −0.017 | −0.018 |

| Wood products industry | 0.02 | −0.021 | Inland transport | −0.005 | −0.005 |

| Paper printing | 0.002 | −0.019 | Surface transport | 0.031 | −0.017 |

| Coke oil | −0.032 | 0.052 | Airfreight | −0.041 | 0.035 |

| Chemicals | 0.009 | −0.024 | Paratransit | 0.051 | −0.028 |

| Rubber plastic | 0.004 | −0.041 | Post and telecommunications | −0.039 | −0.035 |

| Non-metallic products | 0.007 | −0.002 | Financial intermediary | 0.004 | −0.007 |

| Metallic products | −0.01 | 0.009 | Leasing industry | −0.042 | −0.051 |

| Machine made | 0.044 | −0.013 | National defense and social security | 0.006 | −0.024 |

| Electron optics | 0.037 | −0.048 | Education | 0 | −0.031 |

| Transportation equipment | −0.005 | −0.025 | Health and social work | −0.002 | −0.025 |

| Other manufacturing | 0.065 | −0.025 | Social service | −0.022 | −0.061 |

| Variables | Explanation | Data Source | Expected Sign | |

|---|---|---|---|---|

| Be explained variable | Forward contact engagement degree | ADB-MRIO2018 edition collation | ||

| Explanatory variables | Digin | Digital input: It is measured by the added value of communications and information services, the latter including software services, circuit design, and testing services, information system services, and business process management services. | ADB-MRIO2018 | + |

| Control variables | Abro | Overseas demand: sectoral added value | ADB-MRIO2018 | + |

| Scal | the sectoral added value output | ADB-MRIO2018 | + | |

| Capi | nominal capital stock | + | ||

| Intu | Return on capital divided by return on labor | + | ||

| Prod | added value divided by the size of employed human capital | China Industrial Statistical Yearbook | + | |

| numb | Number of manufacturing enterprise | 2020 Statistical Yearbook | + | |

| Rd | R&D spending divided by main business income | China Industrial Statistical Yearbook | + |

| Variables | N | Mean | sd | Min | Max |

|---|---|---|---|---|---|

| 136 | 0.976 | 0.0595 | 0.847 | 1.103 | |

| Digin | 136 | 0.0487 | 0.00281 | 0.0445 | 0.0522 |

| Abro | 136 | 1.014 | 0.910 | 0.0595 | 4.228 |

| scal | 136 | 1.91 | 0.612 | 0.0572 | 3.772 |

| Capi | 136 | 2.181 | 0.623 | 1.037 | 3.884 |

| intu | 136 | 0.567 | 0.6231 | 0.0623 | 1.4234 |

| prod | 136 | 1.67 | 0.645 | 0.0545 | 1.2335 |

| numb | 136 | 0.440 | 0.301 | 0.0710 | 1.384 |

| Rd | 127 | 0.00774 | 0.00605 | 0.000785 | 0.0442 |

| Low Knowledge Intensity | |||||

|---|---|---|---|---|---|

| Variables | N | Mean | sd | Min | Max |

| 32 | 0.994 | 0.0979 | 0.847 | 1.103 | |

| digin | 32 | 0.0487 | 0.00284 | 0.0445 | 0.0522 |

| abro | 32 | 2.032 | 1.085 | 0.309 | 4.228 |

| scal | 32 | 1.953 | 0.326 | 1.243 | 2.106 |

| capi | 32 | 2.059 | 0.306 | 1.353 | 2.506 |

| intu | 32 | 0.592 | 0.174 | 0.182 | 0.923 |

| Prod | 32 | 0.562 | 0.168 | 0.188 | 0.907 |

| numb | 28 | 0.0108 | 0.00510 | 0.00317 | 0.0235 |

| Rd | 32 | 0.994 | 0.0979 | 0.847 | 1.103 |

| Low to medium knowledge intensity | |||||

| 40 | 0.970 | 0.0396 | 0.893 | 1.016 | |

| digin | 40 | 0.0487 | 0.00283 | 0.0445 | 0.0522 |

| abro | 40 | 0.670 | 0.542 | 0.0595 | 1.660 |

| scal | 40 | 0.593 | 0.516 | 0.0640 | 1.434 |

| capi | 40 | 1.962 | 0.467 | 1.065 | 2.853 |

| intu | 40 | 0.498 | 0.465 | 0.0682 | 1.385 |

| Prod | 40 | 0.572 | 0.603 | 0.0570 | 1.394 |

| numb | 40 | 0.569 | 0.576 | 0.0680 | 1.414 |

| Rd | 40 | 0.469 | 0.476 | 0.0710 | 1.384 |

| Medium and high knowledge intensity | |||||

| 64 | 0.970 | 0.0410 | 0.901 | 1.046 | |

| digin | 64 | 0.0487 | 0.00282 | 0.0445 | 0.0522 |

| abro | 64 | 0.721 | 0.571 | 0.103 | 2.820 |

| scal | 64 | 0.698 | 0.583 | 0.121 | 1.960 |

| capi | 64 | 2.379 | 0.756 | 1.037 | 3.884 |

| intu | 64 | 0.365 | 0.159 | 0.0704 | 0.625 |

| Prod | 64 | 0.456 | 0.165 | 0.0605 | 0.721 |

| numb | 64 | 0.361 | 0.158 | 0.0806 | 0.621 |

| Rd | 59 | 0.00858 | 0.00723 | 0.000806 | 0.0442 |

| Variable/Method | LLC | ADF |

|---|---|---|

| −27.0185 (0.0000) | 154.2681 (0.0000) | |

| Digin | −16.4804 (0.0000) | 295.6973 (0.0000) |

| Abro | −8.8498 (0.0000) | 123.0131 (0.0000) |

| Scal | 14.5602 | 235.2906 |

| Cap | −13.9831 (0.0000) | 216.1023 (0.0000) |

| intu | −11.6832 (0.0000) | 208.1023 (0.0000) |

| prod | −12.9831 (0.0000) | 178.903 (0.0000) |

| numb | −10.5270 (0.0000) | 121.0152 (0.0000) |

| Rd | −10.9536 (0.0000) | 71.7653 (0.0000) |

| Variable Analysis | Reference Model | Numb | R&D |

|---|---|---|---|

| (1) | (2) | (3) | |

| digin | 0.0227 *** (7.01) | 0.0234 *** (7.01) | 0.02543 *** (7.01) |

| abro | 0.0598 *** (12.95) | 0.0586 *** (12.55) | 0.0586 *** (12.01) |

| scal | −0.003 ** (−3.03) | −0.005 ** (−3.19) | −0.004 * (-2.15) |

| cap | −0.0712 *** (−6.04) | −0.0632 *** (−6.24) | −0.0651 *** (−6.57) |

| intu | 0.0263 *** (6.34) | 0.0244 *** (6.01) | 0.0236 *** (6.04) |

| prod | −0.0161 (−1.478) | −0.0169 (−1.483) | −0.0162 (−1.497) |

| numb | −0.002 (−0.86) | ||

| Rd | 0.834 (0.40) | ||

| a0 | 0.231 *** (3.49) | 0.207 *** (3.18) | 0.226 *** (3.36) |

| R2 | 0.158 | 0.146 | 0.147 |

| F | 129.48 *** | 128.22 *** | 125.36 *** |

| Variable Analysis | Low Knowledge Intensity | Low to Medium Knowledge Intensity | Medium to High Knowledge Intensity | ||||||

|---|---|---|---|---|---|---|---|---|---|

| (1) | (2) | (3) | (4) | (5) | (6) | (7) | (8) | (9) | |

| digin | −0.001 (−0.85) | −0.004 (−0.86) | −0.004 (−0.79) | 0.027 *** (3.54) | 0.024 *** (3.65) | 0.029 *** (3.15) | 0.038 *** (9.74) | 0.035 *** (9.76) | 0.039 *** (9.01) |

| abro | 0.040 *** (7.23) | 0.040 *** (7.34) | 0.041 *** (7.43) | 0.088 *** (5.79) | 0.089 *** (5.56) | 0.089 *** (5.56) | 0.067 *** (11.34) | 0.067 *** (11.49) | 0.066 *** (11.33) |

| scal | −0.003 * (−1.45) | −0.002 (−0.65) | −0.003 (−0.09) | −0.005 (−1.87) | −0.007 (−1.88) | −0.007 (−1.85) | −0.001 (−0.53) | −0.005 * (−1.57) | −0.002 (−0.64) |

| cap | −0.023 * (−1.96) | −0.024 * (−1.94) | −0.023 * (−1.90) | −0.069 (−1.68) | −0.068 (−1.61) | −0.069 (−1.59) | −0.071 *** (−7.11) | −0.071 *** (−6.92) | −0.072 *** (−6.23) |

| intu | 0.022 *** (3.78) | 0.022 *** (3.78) | 0.022 *** (3.78) | 0.022 ** (2.52) | 0.022 ** (2.54) | 0.022 ** (2.54) | 0.036 *** (6.11) | 0.036 *** (6.13) | 0.037 *** (6.13) |

| prod | 0.002 (0.15) | 0.002 (0.16) | 0.002 (0.17) | −0.04 (−0.92) | −0.036 (−0.96) | −0.037 (−0.94) | −0.026 * (−1.94) | −0.027 ** (−1.97) | −0.027 * (−1.95) |

| numb | 0.002 (0.44) | −0.003 (−0.87) | −0.005 * (−1.76) | ||||||

| rede | 0.019 (3.47) | 0.047 (5.34) | 0.064 * (9.76) | ||||||

| β0 | 0.009 (0.06) | 0.016 (0.14) | 0.010 (0.19) | 0.211 (0.79) | 0.218 (0.84) | 0.218 (0.75) | 0.232 *** (3.87) | 0.216 *** (3.66) | 0.221 *** (3.43) |

| R2 | 0.1214 | 0.1279 | 0.1464 | 0.3158 | 0.4287 | 0.2224 | 0.7553 | 0.6619 | 0.6652 |

| t/d | |||||||||

| N | 682 | 420 | 1012 | ||||||

| F | 58.14 *** | 58.57 *** | 50.43 *** | 9.49 *** | 9.50 *** | 9.52 *** | 82.54 *** | 82.74 *** | 81.38 *** |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Zhou, R.; Tang, D.; Da, D.; Chen, W.; Kong, L.; Boamah, V. Research on China’s Manufacturing Industry Moving towards the Middle and High-End of the GVC Driven by Digital Economy. Sustainability 2022, 14, 7717. https://doi.org/10.3390/su14137717

Zhou R, Tang D, Da D, Chen W, Kong L, Boamah V. Research on China’s Manufacturing Industry Moving towards the Middle and High-End of the GVC Driven by Digital Economy. Sustainability. 2022; 14(13):7717. https://doi.org/10.3390/su14137717

Chicago/Turabian StyleZhou, Rongrong, Decai Tang, Dan Da, Wenya Chen, Lin Kong, and Valentina Boamah. 2022. "Research on China’s Manufacturing Industry Moving towards the Middle and High-End of the GVC Driven by Digital Economy" Sustainability 14, no. 13: 7717. https://doi.org/10.3390/su14137717

APA StyleZhou, R., Tang, D., Da, D., Chen, W., Kong, L., & Boamah, V. (2022). Research on China’s Manufacturing Industry Moving towards the Middle and High-End of the GVC Driven by Digital Economy. Sustainability, 14(13), 7717. https://doi.org/10.3390/su14137717