Abstract

Over the past decade, China has intensified its anti-corruption efforts. On 21 December 2012, “Alcohol Consumption Prohibition at Military Functions” was announced, which made the consumption of high-end Chinese Baijiu decline. We apply principal-agent theory to analyze the potential substitution effect, and then, we apply the difference in difference model and event study method to test the substitution effect between Baijiu and foreign alcohol by using macro- and micro-data. The results indicate that, in response to the “Alcohol Ban”, the Chinese consume more imported wine and more expensive foreign spirits. What is more, the CARs of high-end alcohol companies listed on the U.S. stock market significantly increase. We conclude that there exist substitution effects after the “Alcohol Ban”, which is necessary for the government to comprehensively investigate when formulating policies, because it may partially weaken the effectiveness of the policy.

1. Introduction

Corruption often leads to the monopoly power of resource allocation and low efficiency of the market. In the long run, there may exist hidden dangers for political power instability and economic unsustainability. In the 2030 Agenda for Sustainable Development issued by the United Nations (SDG 16), creating peaceful and inclusive societies for sustainable development; providing access to justice for all; and building effective, accountable, and inclusive institutions at all levels are the key targets. The aim would be violated by corruption; therefore, anti-corruption is an effective way to realize sustainable development in society. According to the International Country Risk Guide, China was in the top 10% of the most corrupt countries in 2001 and was amongst the bottom 30% of over 200 countries for anti-corruption in 2010 [1]. In China, Baijiu, especially high-end Baijiu, has greatly related to corruption for its indispensable role in gifts and banquets. Many corruption cases published by the CPC Central Commission for Discipline Inspection on its website are related to Baijiu. The officials have even commented that “Baijiu is no longer a simple drink in the ordinary sense. There exist luxury and collectible attributes for Baijiu, which has become a hard currency in many people’s minds”. On the one hand, the value of Baijiu is high, which can be treated as an ideal option for “bribe currency”, such as Moutai, one of the most expensive Baijiu types in China. There is a popular saying that “Those who buy Moutai never drink it, while those who drink it never buy it”, indicating that people always treat Moutai as a present to the government officials, rather than a common commodity. On the other hand, when attempting to establish political connections, high-end Baijiu is always used as a perfect lubricant. In lavish banquets, when experiencing several rounds of toasts with Baijiu, friendship and personal trust may be developed between government officials and entrepreneurs, even though they may have never met before.

Due to the characteristics of Baijiu, especially high-end Baijiu, and the long-standing association with Chinese government officials, Baijiu has become a prime target for the campaign against corruption executed by Chinese central government. On 21 December 2012, “Alcohol Consumption Prohibition at Military Functions”, which is known as the “Alcohol Ban”, was announced. The “Alcohol Ban” clearly prohibits alcohol consumption at military banquets. After that, many local governments made similar regulations, which aimed to prohibit Baijiu consumption.

Some researchers found that the “Alcohol Ban” was successful in the short run [1] due to the fact that the cumulative abnormal return (CAR) of high-end Baijiu listed firms declined; besides that, Shu and Cai [1] also found that substitution effects do not exist between high-end Baijiu and other luxury goods, such as jewelry and wristwatches. However, alcohol culture is such a tradition in Chinese culture that it is very hard to change immediately. People may still tend to use Baijiu as a lubricant in lavish banquets. We consider that when Chinese Baijiu cannot be consumed in banquets, people may choose some foreign alcohol to replace it. We suspect that there may exist substitution effects between Chinese high-end Baijiu and foreign high-end alcohol.

In order to test whether there exist substitution effects, we applied the difference in difference method and the event study method to discuss both the direct and indirect effects of the “Alcohol Ban”, respectively, through macro- and micro-data. From the macro perspective, the imports of spirit and wine are treated as treatment groups, while others are treated as control groups. From the micro perspective, the listed high-end alcohol firms in the U.S. market are treated as treatment groups, and other alcohol firms are treated as control groups. The CAR is used to identify whether the foreign high-end alcohol firms are affected due to the “Alcohol Ban” in China. The results show that in response to the “Alcohol Ban”, not only do the imports of foreign alcohol such as wine increase, but also, the CARs of high-end alcohol companies listed in the U.S stock market significantly increase, indicating that the consumption of alcohol changes from high-end Baijiu to foreign alcohol. The results indicate that there exist substitution effects between Baijiu and foreign alcohol, which may weaken the real effect of the “Alcohol Ban” for anti-corruption.

Theoretically, principal-agent theory can be used to build the theoretical framework. The government is the principal, and the officials are the agents. The officials are the representative of the government power. Corruption is a way to use government power to gain self-interest. The target of anti-corruption campaigns is to increase the corruption cost. When the costs exceed the income, corruption would disappear. For the “Alcohol Ban”, if the officials found that the cost of replacing the original Baijiu with other alcohol is smaller than the profit, they may choose to use other alcohol to replace it. Specifically, the cost includes the punishment, preference for other alcohol, and price. The profit includes the invisible lubricant brought by the alcohol, money or goods given by others, and the happiness from the alcohol.

Compared with the existing literature, the potential contributions are as follows: followed by Shu and Cai [1], we found that the “Alcohol Ban” has significant substitution effects when considering the foreign alcohol import and the alcohol firms listed in the US market. The existing literature has only focused on the domestic effect of the “Alcohol Ban” such as the change of CAR in firms listed in China’s capital market. We provide evidence that the “Alcohol Ban” has significant substitution effects that increase the foreign alcohol import and CAR of foreign alcohol firms. Our research can be treated as a supplement to the existing literature, which can offer a more comprehensive understanding of anti-corruption campaigns in China.

2. Literature Review

There exists extensive literature that focuses on corruption. However, due to the data limitation, the main challenge is how to observe and identify corruption. There are two ways to observe corruption. As Lambsdorff [2] pointed out, among the empirical work, there are several ways to identify corruption. The best way is to observe corruption directly. However, corruption is an insider activity, and the outsiders are hard to observe. Still, some researchers have tried to observe corruption directly. For example, as Lambsdorff mentioned [2], Goel and Nelson [3], as well as Fisman and Gatti [4], used the number of officials who were committed to public abuse in states of the US to identify the corruption situations. Glaeser and Saks [5] used data on federal corruption convictions in the US to identify the influence of corruption. McMillan and Zoido [6] used a record written by Vladimiro Montesinos, ahead of Peru’s intelligence service, who documented the corruption that happened in Peru, to measure the corruption in Peru. Besides that, another way to identify the corruption situations is through the Transparency International index [7,8]. However, the indirect way to study corruption has been more commonly used in literature. As for the indirect way, several methods have been used to identify the corruption, including the subjective assessment in survey data [9,10,11]; the difference between official or bureaucrat prices and market or non-bureaucrat prices [12,13,14,15], and the gap between these prices can be treated as the severity of corruption; and the change of the commodity sales, especially the sales of luxuries [16,17].

Recently, some literature has focused on the effect of the anti-corruption campaigns in China, due to the anti-corruption campaigns, which provide good opportunities to test the effect of anti-corruption campaigns on individual and firm behaviors. Wedeman [7,18] found that the anti-corruption campaigns in China are not effective, because the anti-corruption campaigns in China only deter low-level corruption, while some higher-level and higher-stake corruption is not reduced, and even the funds and resources for corruption are encouraged to be higher. Qian and Wen [8,19] found that the anti-corruption campaigns in China are successful because of reducing jewelry imports. Li and Zhou [9,20] studied the relationship between anti-corruption and firm innovation. They found that innovation and bribery can be a substitution among firms, that is to say, firms would like to use bribery to replace innovation. When the anti-corruption campaigns become more severe than before, companies like to invest more in innovation. Wang [10,21] studied whether political connections affect the relationship between firm values and anti-corruption campaigns. The results showed that companies with political connections experience a decline in firm value due to the exogenous shock of anti-corruption in China. Shu and Cai [1] find that anti-corruption campaigns in China reduce the likelihood of corruption occurring within firms. Besides that, some literature has found that the anti-corruption campaigns in China can significantly increase the firm investment efficiency and financial reporting quality, as well as decrease the stock price crash risk and increase R & D investment [22,23,24,25,26,27].

As for the methodology, event study is a good way to study the economic influence of policies. Fisman [28], firstly, utilized stock market data to examine the value of Indonesian President Suharto’s political connections. Acemoglu et al. [29] studied the stock market reactions to Egypt’s Arab Spring using the event study method. Fu [30] used the event study method to find that the anti-corruption campaigns make the stock market more volatile. Milyo [31] also used event study to test the influence of political corruption on the stock market, and the results indicated that the influence of corruption on the stock market cannot last for a long time.

In Chinese culture, Baijiu plays an important role. As for the literature on alcohol consumption in China, the existing literature has mainly focused on price sensitivity [32,33] and government income through alcohol use [34,35]. Actually, the target of the “Alcohol Ban” is to limit the high-end Baijiu consumption to conduct anti-corruption campaigns. Therefore, the “Alcohol Ban” is a key part of anti-corruption campaigns in China. Existing studies on the effect of the “Alcohol Ban” on alcohol consumption are rare due to the target of the “Alcohol Ban” not being to reduce or ban alcohol consumption in China. From the perspective of anti-corruption, a specific study was done by Shu and Cai [1], who used the “Alcohol Ban” as an exogenous shock to test its effect or identify the anti-corruption campaigns that occurred in China. In order to test whether the anti-corruption campaigns were effective in China, they used event study to test the influence of the “Alcohol Ban” on the stock market and found that the “Alcohol Ban” was successful in the short-run from the perspective of a significant decline of the CAR of high-end Baijiu stocks and an insignificant substitution for other luxuries. The “Alcohol Ban” has partially contributed to Chinese anti-corruption campaigns. Ke et al. [36] also used the “Alcohol Ban” to identify anti-corruption campaigns and found that the profitability of the firms that sell luxury goods and services was significantly decreased. Qian and Wen [19] found that the “Alcohol Ban” reduces the imports of luxury goods.

However, although the “Alcohol Ban” is a part of anti-corruption campaigns, its target is to limit the high-end Baijiu consumption. The existing literature has mainly focused on the direct effect on the CAR of Baijiu stocks and luxury consumption. As for the substitution effect, the indirect effect of the “Alcohol Ban” or other anti-corruption campaigns has been neglected to some extent. Broadly speaking, the reduction of luxury consumption and imports [19,36], the improvement of investment efficiency and financial reporting quality, and the increase in R & D investment [25,26,27] can be treated as substitution effects. However, most of the existing literature has only focused on the influence of the domestic market and did not consider the potential substitution effect between Chinese high-end Baijiu and foreign alcohol. We suppose that when the high-end Baijiu cannot be consumed by the officials, they may choose to buy foreign alcohol to replace the original high-end Baijiu. Therefore, we tended to test whether there exist substitution effects from the perspective of foreign alcohol consumption. As for the methodology, we tried to use the event study method and DID strategy to study the influence from macro and micro perspectives, respectively.

3. Methods and Data

3.1. Difference in Difference

We tried to test the substitution effects from micro and macro perspectives by using DID strategy and the event study method. In order to get more accurate results, we used the generalized DID method. We divided all the samples into the treatment group and the control group. Furthermore, we divided the timeline into the post-treatment group and the before-treatment group.

In Equation (1), δi is the company/category-specific, time-invariant fixed effects, and δt is the time-specific, company/category-invariant fixed effects. To be specific, δi and δt are a group of dummies to identify each individual or time. Treatedi denotes a dummy variable: Treatedi = 1 for the treatment group, and Treatedi = 0 for the control group; Postt also denotes a dummy variable, indicating that Postt = 1 in the post-treatment periods when the “Alcohol Ban” was announced at date t; Postt = 0 otherwise. Xit is a group of control variables.

3.2. Event Study Methodology

When using event study, we have to set three time windows: the estimation window, event window, and post-event window.

To be specific, we. consider that the “Alcohol Ban” was first announced by the Chinese official network, Xinhua News, at 18:09:51 on 21 December 2012 [1], and the day was a Friday. At that time, the Chinese stock market was closed. However, for the American stock market, it was just Friday morning. Therefore, we treated 21 December 2012 as time 0. For the estimation window, we set 200 trading days prior to the event window to estimate normal return. In order to get more accurate results, we could set a gap between the estimation window and the event window, that is to say, we used the data from 23 January 2012 to 9 November 2012.

3.3. Identification of Abnormal Return

After defining the timeline, we needed to predict normal returns and abnormal returns. We used the Fama–French five-factor model to get the normal return [37]. In the Fama–French five-factor model, there are five factors associated with the stock market, including the market factor (market index), a firm size factor (stock price multiplied by the number of shares), a factor of book-to-market equity (the ratio of book value to market value), momentum return and profitability, and investment factors.

Rit − Rft = αi + βi(Rmt − Rft) + siSMBt + hiHMLt + ωiRMWt + ηiCMAt + εit

Firstly, we apploed the OLS regression as shown in Equation (2), where Rit is the return of company i in period t; Rft is the risk-free rate; Rmt is the market return in period t; SMBt is the difference between the returns on diversified portfolios of small stocks and big stocks; HMLt is the difference between the returns on diversified portfolios of high book-to-market (value) stocks and low book-to-market (growth) stocks. RMWt is the difference between the returns on diversified portfolios of high-profit and low-profit. CMAt is the difference between the returns on diversified portfolios of high-refunds and low-refunds. Secondly, using the estimates from the equation above, we could calculate the abnormal return.

Then, we calculated the cumulative abnormal returns of the company i at date t:

3.4. Sample

The Import Data

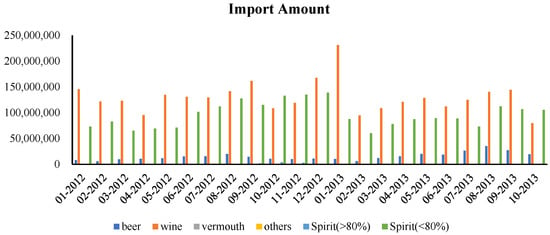

Firstly, we wanted to test the substitution effects from a macro perspective. We collected the import data of all of the alcohol from the National Bureau of Statistics, Beijing, China. Figure 1 and Figure 2 show the import amount (dollars) and import volume (tons) from January 2012 to October 2013.

Figure 1.

The Import Amount of All Kinds of Alcohol. Source: National Bureau of Statistics of China. Unit: Dollars.

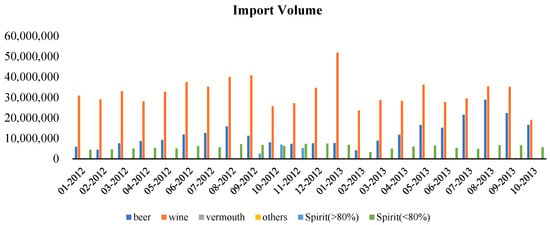

Figure 2.

The Import Volume of All Kinds of Alcohol. Source: National Bureau of Statistics of China. Unit: ton.

The “Alcohol Ban” was released in December 2012. From Figure 1 and Figure 2, we can see that there was a significant change after the “Alcohol Ban” was implemented. When we used a line chart to describe the data and changed the X-axis to before and post the event, we could see a significant change in the import of spirit and wine. In order to use DID strategy to get more accurate results, we had to determine the control group and the treatment group. Firstly, we set the import of spirits as the treatment group, and all the others were the control group, because Baijiu and spirit are substitutes to some extent. Secondly, from the figures, we could see that the import of wine changed most significantly; besides that, it is very common for the Chinese to use wine to replace Baijiu. We suppose that the Chinese may use foreign wine to replace Baijiu due to the “Alcohol Ban”. Therefore, we set import of wine as the treatment group and others as the control group.

3.5. Alcohol Companies in American Stock Market

From a micro perspective, we wanted to see if there exist substitution effects between Chinese high-end Baijiu and foreign alcohol, that is to say, we tested whether the foreign alcohol was consumed more to replace the original high-end Baijiu consumption. In order to test the substitution effects, we calculated the CAR of the listed companies and used DID strategy to test the effect. Table 1 shows all the alcohol companies in the US stock markets. The reason why we chose firms listed in the US market is that the capital market is more mature in the US, and the reaction to the exogenous shock is quicker. Furthermore, the firms listed in the US are the firms that are more representative around the world due to their main commodities and scales. The firms listed in the US are not only the US firms, but the firms around the world; therefore, using alcohol firms listed in the US may be a suitable choice to test the potential substitution effect caused by the “Alcohol Ban”. We collected the closing price to calculate the return, and the control variables, such as turnover rate, total assets, and market value, were used, which were similar to Shu and Cai [1].

Table 1.

The listed alcohol companies in US.

In order to implement DID strategy, we had to determine the control group and treatment group. Actually, it is not easy to distinguish whether foreign alcohol is high-end or not. We aimed to study whether the Chinese would consume more foreign high-end alcohol to replace high-end Baijiu in China. However, we found that BF_A.N/BF_B.N and DEO.N produced spirits, very close to Chinese Baijiu, which could be used to substitute Baijiu. Besides that, in some reports published by the investment bank, they always compared Moutai (Guizhou, China) and Wuliangye (Yibing, China) with Brown Forman (Louisville, KY, USA) and Diageo PLC (London, UK). Furthermore, there was some news that Wuliangye would cooperate with Brown Forman (BF_A.N/BF_B.N) in the future. Therefore, we treated BF_A.N/BF_B.N and DEO.N as the treatment group and other listed companies as the control group.

4. Results

4.1. The Influence on the Import

Firstly, we tested the substitution effects from a direct perspective by using macro data. Specifically, we estimated Equation (5):

In Equation (5), the coefficient we were most concerned with was φ; if φ was significantly positive, we could say the substitution effect exists. In this equation, we controlled σi and σt for category-specific fixed effects and time-specific fixed effects, respectively. For control variables, Xit, we used GDP per month. Although we could not get GDP per month directly, we could use industrial added value as a representative of GDP per month, which is a nominal value.

As mentioned above, we chose spirit and wine as the treatment group, respectively, and others as the control group. Table 2 shows the treatment group and control group we used, and the time spot was December 2012.

Table 2.

Treatment Group and Control Group.

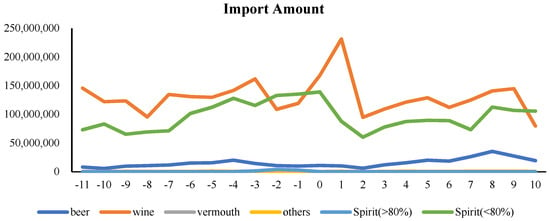

Firstly, the trend for the import of different alcohol is shown in Figure 3 before and after the implementation of the “Alcohol Ban”. In Figure 3, the horizontal axis is the days before and after the implementation of the “Alcohol Ban”. The longitudinal axis is the import amount of different alcohol. From Figure 3, we found that before the implementation of the “Alcohol Ban”, the change in the trend of the import amount was trivial, while after the implementation of the “Alcohol Ban”, the trend of the import amount was more significant. Therefore, we could find that the parallel trend was satisfied.

Figure 3.

The Import Volume of All Kinds of Alcohol. Source: National Bureau of Statistics of China.

After determining the treatment group and control group, we could apply the DID strategy. The results are shown in Table 3. In model (1) and model (2), the treatment group was the Spirits, and the control group was the other alcohols. From model (1) and model (2), we can see the coefficient of Treat*Post was significantly negative at the 1% significance level indicating that the “Alcohol Ban” made the import amount and volume of spirits decrease significantly. To be specific, the import amount and volume of spirits decreased by 82.9% and 121.8%, respectively. However, from Figure 2 and Figure 3, we could find that the import of spirits declined after the “Alcohol Ban”. Combined with model (1) and model (2), we could see that the decline of import volume was bigger than that of import amount, which means that the average price of import spirit increased. When we used wine as a treatment group, as shown in model (3) and model (4), we could see that the coefficient of Treat*Post was significantly positive at the 5% significance level, that is to say, compared with other alcohol, the import of wine increased significantly. To be specific, as the “Alcohol Ban” was issued, the import amount and volume increased by 47.7% and 67.0%, respectively. Therefore, we can conclude that the substitution effects existed between Baijiu and wine after the “Alcohol Ban”.

Table 3.

The DID results for import of different alcohol.

4.2. Companies with American Stock Market

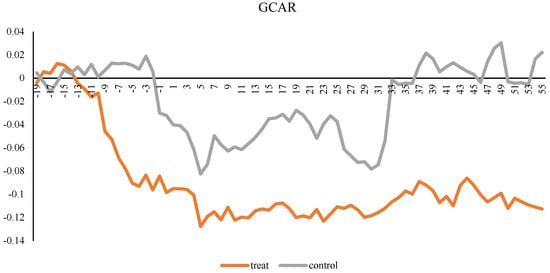

Secondly, we tested the substitution effects from an indirect perspective by using micro-data. In this part, the event study was used as mentioned above. Because of the missing values for Ambev S.A. (ABEV.N), (São Paulo, Brazil) we removed the data of ABEV.N from the samples. In the beginning, we had to calculate the abnormal return using the method mentioned above. For the treatment group and control group, we treated BF_A.N/BF_B.N and DEO.N as the treatment group and others as the control group and got the cumulative abnormal return (CARs) of the control group and treatment group. The grouped average CARs (GCAR) are shown in Figure 4.

Figure 4.

GCAR of the Control Group and Treatment Group.

Then, we applied DID strategy using CAR as a dependent variable. In order to see the dynamic influence in different periods, we set different windows in the event study. Specifically, we estimated the equation as below:

In this equation, σi and σt are company-specific fixed effects and time-specific fixed effects, respectively. For control variables Xit, we included turnover rate and log of the company’s market value. Turnover rate is defined as the average daily trading volume divided by the market value. In light of the literature that has shown that stock returns around the announcement date were inversely related to the size (market value) of a firm [38], following existing literature [39,40], we controlled for a potentially confounding size effect by controlling the market value of the listed firms. The coefficient we were concerned with most was φ, because there are two variation resources to determine φ, including the variation between the treatment group and the control group and the variation within each group before and after the “Alcohol Ban” was announced. If φ is significantly positive, then we can say that some substitution effects exist between high-end Baijiu and foreign high-end alcohol. The results are shown in Table 4.

Table 4.

Alcohol Ban’ impact: Foreign High-end Alcohol.

From Table 4, we can see that the coefficient before Treat*Post was significantly positive in different windows, indicating that the Chinese “Alcohol Ban” made the CAR of alcohol firms listed in the US significantly increase. The results show that compared with other alcohol, high-end foreign alcohol experienced an increase in CARs. Therefore, we can say that substitution effects existed between Chinese high-end Baijiu and foreign high-end alcohol after the implementation of the “Alcohol Ban”. Furthermore, the different coefficients in each window show that at the beginning of the “Alcohol Ban”, the substitution effects were the largest, indicating that at the beginning of the “Alcohol Ban” implementation, consumers were more willing to consume more foreign high-end alcohol to replace the high-end Baijiu. There may exist potential substitution effects of the Chinese “Alcohol Ban”. As for the control variables, consistent with Shu and Cai [1], the coefficients of log(marketvalue) were significantly positive, and the coefficients of turnoverrate were insignificant. The results indicate that the factors affecting CAR are similar between the US capital market and China capital market.

Compared with Shu and Cai [1], who tested the effect of the “Alcohol Ban” within China, they found that the CAR of Baijiu stock declined and concluded that the “Alcohol Ban” was effective in the short run. However, followed by their research, we tested the effect of the “Alcohol Ban” from the perspective of alcohol import and the US stock market. We found that the imports and CAR of the firms listed in the US significantly increased. The results of the two studies are a supplement to some extent. We can understand the results from external and internal perspectives. The results of Shu and Cai [1] are the internal effect of the “Alcohol Ban”, while our results are the external effect of the “Alcohol Ban”. By analyzing the effect from multiple perspectives, we can get an overall understanding of the effect of the “Alcohol Ban”.

5. Robustness Checks

From Table 1, we can see there were stocks for one company; in this part, we removed one stock if one company had two trading stocks. The results are shown in Table 5.

Table 5.

Alcohol Ban’ impact: Foreign High-end Alcohol with Only One Company.

From Table 5, the coefficient before Treat*Post was significantly positive, indicating that the result is robust. Another way to implement a robustness check is that we shortened the windows, and the results are shown in Table 6. From Table 6 the coefficient before Treat*Post was still significantly positive, indicating that the results are robust.

Table 6.

Robustness Check: Shorter Windows.

6. Conclusions and Discussion

We studied the effect of the “Alcohol Ban” from the perspective of substitution effects between high-end Baijiu and foreign alcohol. From both direct and indirect perspectives, we found that the substitution effects exist.

In terms of the direct effect, we used the macro-data of imports. For the import of wine, we find that both the amount and volume increased after the “Alcohol Ban” compared with other alcohol, indicating that more imported wine would be consumed after the implementation of the “Alcohol Ban”. As for the spirit, the import amount and volume declined compared with other kinds of alcohol. What is more, the volume declined more than the amount. That is to say, the average price of imported spirits increased significantly compared with other alcohol. Therefore, we can infer that the Chinese consumed more expensive foreign spirits to replace Chinese high-end Baijiu after the Alcohol Ban.

In terms of the indirect effect, we used the data of listed alcohol companies in the US. Compared with other companies, the CARs of high-end foreign alcohol companies increased significantly after the “Alcohol Ban”. Some scholars have found that the “Alcohol Ban” and the anti-corruption campaigns are effective as the CARs of high-end Baijiu decreased significantly and there were no substitution effects between high-end Baijiu and other luxury goods such as jewelry and golden ornaments. However, we pointed out that due to the “Alcohol Ban”, consumers may turn to consuming foreign alcohol, especially some high-end foreign alcohol, contributing to the increase in their profits. Considering the existing substitution effects between Baijiu and foreign alcohol, the effect of the anti-corruption campaign may be weakened.

However, there are still some shortcomings to consider. Firstly, for import data, we only got monthly data in the database. The monthly data may hide a lot of information in detail. If the daily data and more specific data, such as import countries and brands, are available, we could get more accurate results. Secondly, Chinese policy is strictly exogenous for the American market, which could help us overcome the exogenous problem. Although China is an important trade partner of the United States, it remains to be discussed to what extent American enterprises are affected by Chinese policies in the global market. The preference of the Chinese for foreign alcohol is still in doubt. China’s Baijiu culture has lasted for thousands of years, and the Chinese have formed a consensus on the value and symbolic significance of Baijiu. Although Chinese people may choose foreign high-end alcohol due to policy impact in the short term, it is not easy to form a consensus on consumption habits and value cognition. Still, the effect of young Chinese drinkers’ preferences may be important, but we only discussed the short-term effect, and the long-term effect could be a future topic. In the future, we may consider the young Chinese drinkers’ preferences in the study and try to alleviate the effect of the “Alcohol Ban” and the preference change on the foreign alcohol. Limited to the window of event analysis, we could not study this problem in depth. Besides that, we considered that the listed alcohol companies in the US may have many subsidiaries around the world; therefore, the CAR may be also affected by the subsidiaries located in other countries or areas. However, we could not obtain details such as income or categories for the firms whose commodities are sold in China; the effect may not be that clear. In the future, we can try to get more information on these firms to test the substitution effect.

For policy implications, over the past decade, China has intensified its anti-corruption efforts, among which the prohibition of alcohol is one typical policy. The research of this paper has some implications for policy-making and corporate behavior. First, the consumption policy for a specific category of commodities often affects the consumption of substitutes or complementary products at the same time. It is necessary for the government to comprehensively investigate the direct and indirect effects of policies when formulating policies, because the indirect effects are likely to weaken some of the favorable effects of the policy. Second, as a market with huge volume and potential, China has been deeply integrated into the global market. The policies of the Chinese government are prone to impact traders and multinational corporations. Participants in the global market need to pay attention not only to the policies directly related to themselves, but also to the market dynamics in a wider range, so as to grasp their advantages or disadvantages.

Author Contributions

Data curation, Y.X.; Formal analysis, Y.X.; Methodology, Y.X.; Project administration, Y.M.; Visualization, Y.M.; Writing—review & editing, Y.M. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

The data presented in this study are from the website of the National Bureau of Statistics of China (http://www.stats.gov.cn/) and the WIND database, which is available on request from the authors.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Shu, Y.; Cai, J. “Alcohol Bans”: Can they reveal the effect of Xi Jinping’s anti-corruption campaign? Eur. J. Polit. Econ. 2017, 50, 37–51. [Google Scholar] [CrossRef]

- Lambsdorff, J.G. Corruption in empirical research: A review. Transpar. Int. Process. 1999, 6. [Google Scholar]

- Goel, R.K.; Nelson, M.A. Corruption and government size: A disaggregated analysis. Public Choice 1998, 97, 107–120. [Google Scholar] [CrossRef]

- Fisman, R.; Gatti, R. Decentralization and Corruption: Cross-Country and Cross-State Evidence; World Bank: Washington, DC, USA, 1999; Unpublished Manuscript. [Google Scholar]

- Glaeser, E.L.; Saks, R.E. Corruption in america. J. Public Econ. 2006, 90, 1053–1072. [Google Scholar] [CrossRef]

- McMillan, J.; Zoido, P. How to subvert democracy: Montesinos in Peru. J. Econ. Perspect. 2004, 18, 69–92. [Google Scholar] [CrossRef]

- Andersson, S.; Heywood, P.M. The politics of perception: Use and abuse of Transparency International’s approach to measuring corruption. Polit. Stud. 2009, 57, 746–767. [Google Scholar] [CrossRef]

- Gutterman, E. The legitimacy of transnational NGOs: Lessons from the experience of Transparency International in Germany and France. Rev. Int. Stud. 2014, 40, 391–418. [Google Scholar] [CrossRef]

- Ades, A.; Di Tella, R. The new economics of corruption: A survey and some new results. Polit. Stud. 1997, 45, 496–515. [Google Scholar] [CrossRef]

- Olken, B.A.; Barron, P. The simple economics of extortion: Evidence from trucking in Aceh. J. Polit. Econ. 2009, 117, 417–452. [Google Scholar] [CrossRef]

- Olken, B.A. Corruption and the costs of redistribution: Micro evidence from Indonesia. J. Public Econ. 2006, 90, 853–870. [Google Scholar] [CrossRef]

- Rose-Ackerman, S. The economics of corruption. J. Public Econ. 1975, 4, 187–203. [Google Scholar] [CrossRef]

- Hsieh, C.-T.; Moretti, E. Did Iraq cheat the United Nations? Underpricing, bribes, and the oil for food program. Q. J. Econ. 2006, 121, 1211–1248. [Google Scholar] [CrossRef][Green Version]

- Fang, H.; Gu, Q.; Zhou, L.-A. The gradients of power: Evidence from the Chinese housing market. J. Public Econ. 2019, 176, 32–52. [Google Scholar] [CrossRef]

- Agarwal, S.; Qian, W.; Seru, A.; Zhang, J. Disguised corruption: Evidence from consumer credit in China. J. Financ. Econ. 2020, 137, 430–450. [Google Scholar] [CrossRef]

- Lan, X.; Li, W. Swiss watch cycles: Evidence of corruption during leadership transition in China. J. Comp. Econ. 2018, 46, 1234–1252. [Google Scholar] [CrossRef]

- Kuo, C.-H.; Huang, M.-H.; Huang, C.-I. The Anti-Corruption Campaign, Luxury Consumption, and Regime Trust in China: Changing Patterns of Perceived Political Risk and Their Consequences. J. Contemp. China 2022, 1–21. [Google Scholar] [CrossRef]

- Wedeman, A. Anticorruption campaigns and the intensification of corruption in China. J. Contemp. China 2005, 14, 93–116. [Google Scholar] [CrossRef]

- Qian, N.; Wen, J. The Impact of Xi Jinping’s Anti-Corruption Campaign on Luxury Imports in China; Preliminary Draft; Yale University: New Haven, CT, USA, 2015. [Google Scholar]

- Houjian, L.; Jian, Z. Corruption and firm innovation: A grease or stumbling block relationship. Nankai Econ. Stud. 2015, 2, 24–58. [Google Scholar] [CrossRef]

- Wang, F.; Xu, L.; Zhang, J.; Shu, W. Political connections, internal control and firm value: Evidence from China’s anti-corruption campaign. J. Bus. Res. 2018, 86, 53–67. [Google Scholar] [CrossRef]

- Xu, G.; Yano, G. How does anti-corruption affect corporate innovation? Evidence from recent anti-corruption efforts in China. J. Compar. Econ. 2017, 45, 498–519. [Google Scholar] [CrossRef]

- Gan, W.; Xu, X. Does anti-corruption campaign promote corporate R&D investment? Evidence from China. Finance Res. Lett. 2019, 30, 292–296. [Google Scholar] [CrossRef]

- Pan, X.; Tian, G.G. Political connections and corporate investments: Evidence from the recent anti-corruption campaign in China. J. Bank. Finance 2020, 119, 105108. [Google Scholar] [CrossRef]

- Kong, D.; Tao, Y.; Wang, Y. China’s anti-corruption campaign and firm productivity: Evidence from a quasi-natural experiment. China Econ. Rev. 2020, 63, 101535. [Google Scholar] [CrossRef]

- Ben, J.H.; Li, X.; Duncan, K.; Xu, J. Corporate relationship spending and stock price crash risk: Evidence from China’s anti-corruption campaign. J. Bank. Finance 2020, 113, 105758. [Google Scholar] [CrossRef]

- Hope, O.K.; Yue, H.; Zhong, Q. China’s anti-corruption campaign and financial reporting quality. Contemp. Account. Res. 2020, 37, 1015–1043. [Google Scholar] [CrossRef]

- Fisman, R. Estimating the value of political connections. Am. Econ. Rev. 2001, 91, 1095–1102. [Google Scholar] [CrossRef]

- Acemoglu, D.; Hassan, T.A.; Tahoun, A. The power of the street: Evidence from Egypt’s Arab Spring. Rev. Financ. Stud. 2018, 31, 1–42. [Google Scholar] [CrossRef]

- Fu, Y. The value of corporate governance: Evidence from the Chinese anti-corruption campaign. N. Am. J. Econ. Finance 2019, 47, 461–476. [Google Scholar] [CrossRef]

- Milyo, J. Corporate influence and political corruption: Lessons from stock market reactions to political events. Indep. Rev. 2014, 19, 19–36. [Google Scholar]

- Tian, G.; Liu, F. Is the demand for alcoholic beverages in developing countries sensitive to price? Evidence from China. Int. J. Environ. Res. Public Health 2011, 8, 2124–2131. [Google Scholar] [CrossRef]

- Chen, S.; Guo, L.; Wang, Z.; Mao, W.; Ge, Y.; Ying, X.; Fang, J.; Long, Q.; Liu, Q.; Xiang, H. Current situation and progress toward the 2030 health-related sustainable development goals in China: A systematic analysis. PLoS Med. 2019, 16, e1002975. [Google Scholar] [CrossRef] [PubMed]

- Jiang, H.; Room, R.; Hao, W. Alcohol and related health issues in China: Action needed. Lancet Glob. Health 2015, 3, e190–e191. [Google Scholar] [CrossRef]

- Myerson, R.; Lu, T.; Yuan, Y.; Liu, G. The impact of government income transfers on tobacco and alcohol use: Evidence from China. Econ. Lett. 2020, 186, 108855. [Google Scholar] [CrossRef]

- Ke, B.; Liu, N.; Tang, S. The Effect of Anti-Corruption Campaign on Shareholder Value in a Weak Institutional Environment: Evidence from China; Unpublished Working Paper; National University of Singapore: Singapore, 2016. [Google Scholar] [CrossRef]

- Fama, E.F.; French, K.R. Common risk factors in the returns on stocks and bonds. J. Financ. Econom. 1993, 33, 3–56. [Google Scholar] [CrossRef]

- Atiase, R.K. Market implications of predisclosure information: Size and exchange effects. J. Account. Res. 1987, 25, 168–176. [Google Scholar] [CrossRef]

- Chambers, A.E.; Penman, S.H. Timeliness of reporting and the stock price reaction to earnings announcements. J. Account. Res. 1984, 22, 21–47. [Google Scholar] [CrossRef]

- Kross, W.; Schroeder, D.A. An empirical investigation of the effect of quarterly earnings announcement timing on stock returns. J. Account. Res. 1984, 22, 153–176. [Google Scholar] [CrossRef]

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).