How Energy Price Distortions Affect China’s Economic Growth and Carbon Emissions

Abstract

:1. Introduction

2. Literature Review

2.1. Research on Measuring Energy Price Distortions

2.2. Research on the Impact of Energy Price Distortions on Economic Growth

2.3. Research on the Influence of Energy Price Distortions on Carbon Emissions

2.4. The Transmission Mechanisms and Hypotheses

- (1)

- Analysis and hypothesis of mechanisms for energy price distortions affecting economic growth

- (2)

- Analysis and hypothesis of mechanisms for energy price distortions affecting carbon emissions

3. Measurement and Analysis of Energy Price Distortions

3.1. Measurement of Energy Price Distortions

- (1)

- Price distortions of fossil energy

- (2)

- Renewable energy price distortions

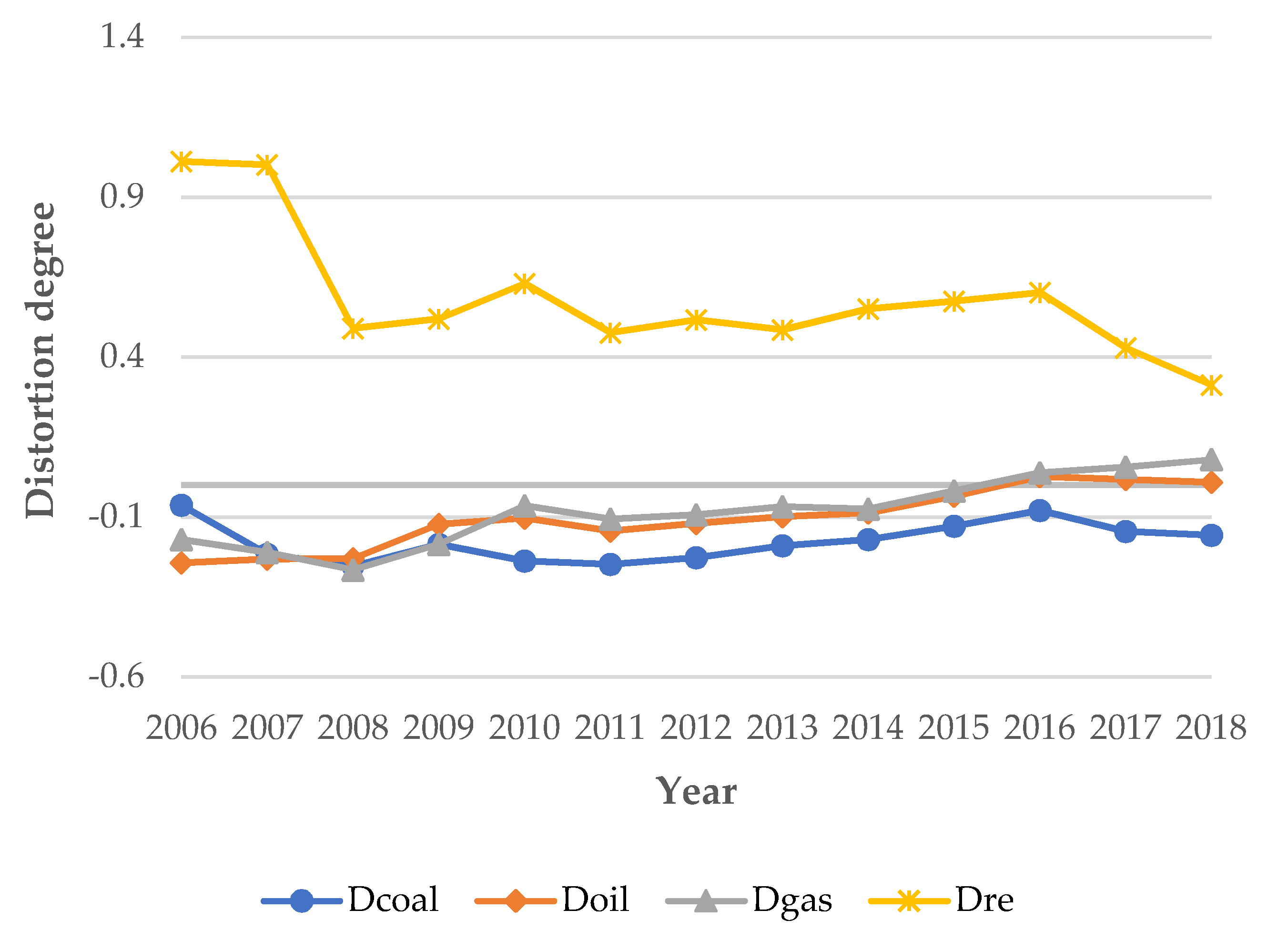

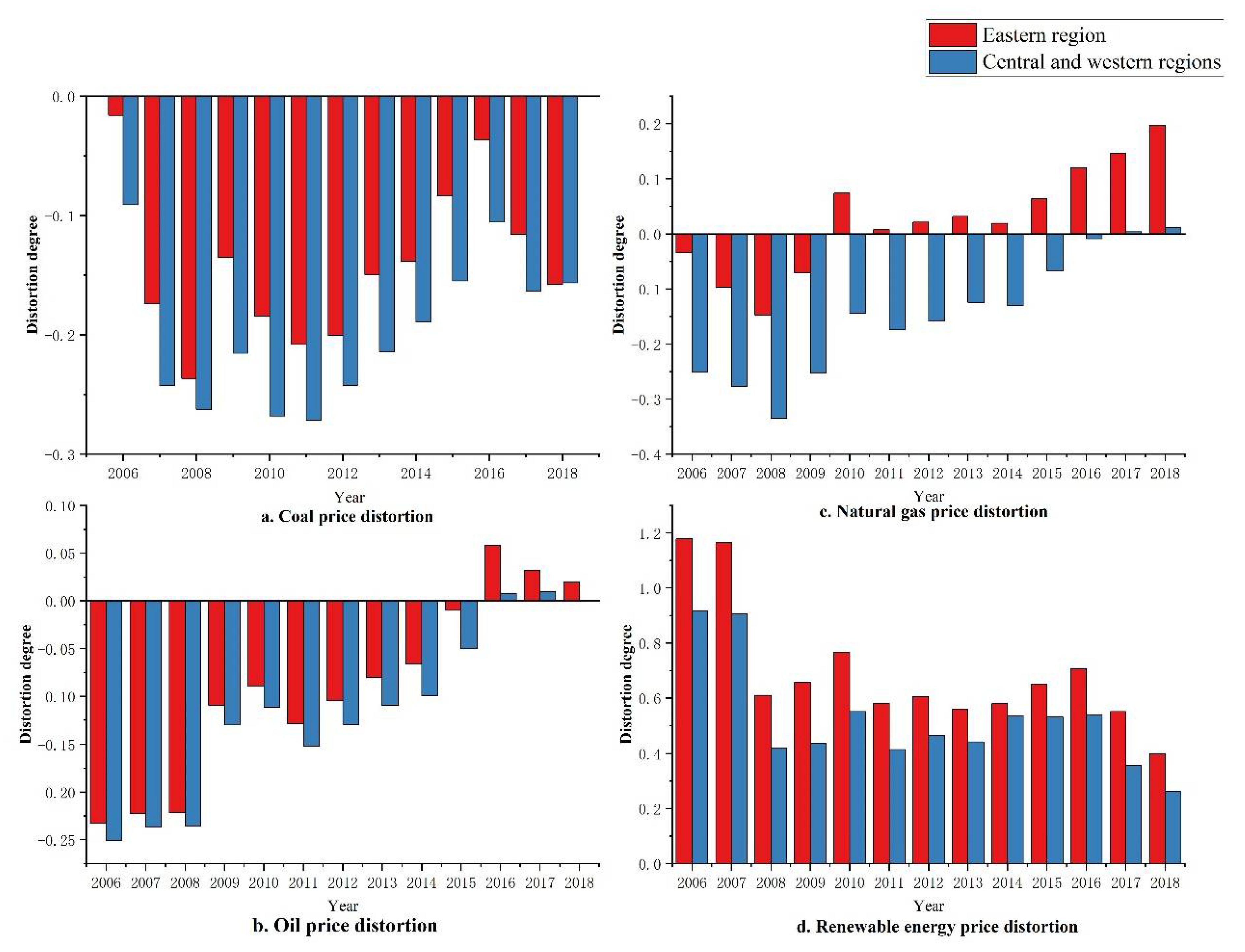

3.2. Analysis of Energy Price Distortions

4. Empirical Models

4.1. Baseline Regression Model

4.2. Transmission Mechanism Model

4.3. Variable Descriptions and Data Sources

5. Results and Discussion

5.1. Baseline Regression Analysis

5.1.1. Results of the Impact on Economic Growth

5.1.2. Results of the Influence on Carbon Emissions

5.2. Estimations of Transmission Mechanisms

5.3. Robustness Estimation

5.4. Extended Discussion

6. Conclusions and Policy Implications

- (1)

- Energy prices are significantly distorted. In terms of fossil energy price distortions, coal (−17.73%) is the highest, followed by oil (−10.50%) and natural gas (−8.35%). In contrast, the renewable energy price distortion is positive, at 58.45%. Additionally, all four energy price distortions are regionally heterogeneous. Fossil energy prices exhibit high distortions in the central and western regions and low distortions in the eastern region, whereas the renewable energy price distortion is characterized as low in the central and western regions and high in the eastern region.

- (2)

- Coal and renewable energy price distortions significantly impede national economic growth, but distortions in oil and natural gas prices promote economic growth. All four energy price distortions contribute significantly to the increase in carbon emissions.

- (3)

- At the regional level, energy price distortions exacerbate carbon emissions in both the eastern region and the central and western regions. In particular, price distortions in coal and oil in the central and western regions have a high positive impact on carbon emissions, while natural gas, as well as renewable energy price distortions in eastern China, make a more pronounced contribution. In terms of economic effects, coal price distortions have a greater hindering effect on the central and western regions; oil and gas price distortions have a greater promotion effect in the eastern region. The positive effect of renewable energy price distortion is significant in the central and western regions, but insignificant in eastern China.

- (4)

- Technological innovation, industrial structure upgrading, and the investment effect are important transmission mechanisms of energy price distortions affecting China’s economic growth. Industrial structure upgrading has the most obvious weakening effect on coal price distortion impeding economic growth, and the hindering effect of technological innovation on reducing the price distortion of renewable energy is more significant. Furthermore, energy price distortions can influence carbon emissions via technological innovation, environmental regulation, and the optimization of the energy consumption structure. Technological innovation contributes the most to reducing the promotional effect of distortions in coal and gas prices on carbon emissions. The optimization of the energy structure has the most pronounced weakening effect on oil and renewable energy price distortions.

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Lin, B.; Du, K. The energy effect of factor market distortion in China. Econ. Res. J. 2013, 9, 125–136. (In Chinese) [Google Scholar]

- Ouyang, X.; Sun, C. Energy savings potential in China’s industrial sector: From the perspectives of factor price distortion and allocative inefficiency. Energy Econ. 2015, 48, 117–126. [Google Scholar] [CrossRef]

- Sun, Q.; Xu, L.; Yin, H. Energy pricing reform and energy efficiency in China: Evidence from the automobile market. Resour. Energy Econ. 2016, 44, 39–51. [Google Scholar] [CrossRef]

- Dai, X.; Cheng, L. Market distortions and aggregate productivity: Evidence from Chinese energy enterprises. Energy Policy 2016, 95, 304–313. [Google Scholar] [CrossRef]

- Han, G.; Hu, W. How does factor price distortion affect China’s industrial overcapacity? Empirical study based on provincial panel data. Ind. Econ. Res. 2017, 2, 49–61. (In Chinese) [Google Scholar] [CrossRef]

- Wang, X.; Wang, H.; Liang, S.; Xu, S. The Influence of Energy Price Distortion on Region Energy Efficiency in China’s Energy-Intensive Industries from the Perspectives of Urban Heterogeneity. Sustainability 2021, 14, 88. [Google Scholar] [CrossRef]

- Li, A.; Lin, B. Comparing climate policies to reduce carbon emissions in China. Energy Policy 2013, 60, 667–674. [Google Scholar] [CrossRef]

- Shi, X.; Sun, S. Energy price, regulatory price distortion and economic growth: A case study of China. Energy Econ. 2017, 63, 261–271. [Google Scholar] [CrossRef] [Green Version]

- Wang, X.; Bai, M.; Xie, C. Investigating CO2 mitigation potentials and the impact of oil price distortion in China’s transport sector. Energy Policy 2019, 130, 320–327. [Google Scholar] [CrossRef]

- Li, K.; Lin, B. Impact of energy conservation policies on the green productivity in China’s manufacturing sector: Evidence from a three-stage DEA model. Appl. Energy 2016, 168, 351–363. [Google Scholar] [CrossRef]

- Lin, B.; Wang, F. Impact of Energy Price Increase on General Price Level in China: A Study Based on Input-output Model and Recursive SVAR Model. Econ. Res. J. 2009, 44, 66–79, 150. (In Chinese) [Google Scholar]

- Wang, Q.; Qiu, H.N.; Kuang, Y. Market-driven energy pricing necessary to ensure China’s power supply. Energy Policy 2009, 37, 2498–2504. [Google Scholar] [CrossRef]

- Li, K.; Fang, L.; He, L. How population and energy price affect China’s environmental pollution? Energy Policy 2019, 129, 386–396. [Google Scholar] [CrossRef]

- Bhagwati, J.N. (Ed.) The generalized theory of distortions and welfare. In Trade, Balance of Payments and Growth; North-Holland Publishing Company: Amsterdam, The Netherlands; London, UK, 1971; pp. 69–90. [Google Scholar]

- Lin, B.; Du, K. Energy and CO2 emissions performance in China’s regional economies: Do market-oriented reforms matter? Energy Policy 2015, 78, 113–124. [Google Scholar] [CrossRef] [Green Version]

- Skoorka, B.M. Measuring market distortion: International comparisons, policy and competitiveness. Appl. Econ. 2000, 32, 253–264. [Google Scholar] [CrossRef]

- Tao, X.M.; Xing, J.W.; Huang, X.; Zhou, W. The measurement of energy price distortions and factor substitution in Chinese industry. J. Quant. Technol. Econ. 2009, 11, 3–16. (In Chinese) [Google Scholar]

- Haller, S.A.; Hyland, M. Capital–energy substitution: Evidence from a panel of Irish manufacturing firms. Energy Econ. 2014, 45, 501–510. [Google Scholar] [CrossRef] [Green Version]

- Tan, R.; Lin, B.; Liu, X. Impacts of eliminating the factor distortions on energy efficiency—A focus on China’s secondary industry. Energy 2019, 183, 693–701. [Google Scholar] [CrossRef]

- Ju, K.; Su, B.; Zhou, D.; Wu, J. Does energy-price regulation benefit China’s economy and environment? Evidence from energy-price distortions. Energy Policy 2017, 105, 108–119. [Google Scholar] [CrossRef]

- Cui, H.; Wei, P. Analysis of thermal coal pricing and the coal price distortion in China from the perspective of market forces. Energy Policy 2017, 106, 148–154. [Google Scholar] [CrossRef]

- Brown, D.P.; Eckert, A.; Eckert, H. Electricity markets in transition: Market distortions associated with retail price controls. Electr. J. 2017, 30, 32–37. [Google Scholar] [CrossRef]

- Yin, J.; Wang, S.; Gong, L. The effects of factor market distortion and technical innovation on China’s electricity consumption. J. Clean. Prod. 2018, 188, 195–202. [Google Scholar] [CrossRef]

- Sha, R.; Li, J.; Ge, T. How do price distortions of fossil energy sources affect China’s green economic efficiency? Energy 2021, 232, 121017. [Google Scholar] [CrossRef]

- Restuccia, D.; Rogerson, R. Policy distortions and aggregate productivity with heterogeneous establishments. Rev. Econ. Dyn. 2008, 11, 707–720. [Google Scholar] [CrossRef]

- Hsieh, C.T.; Klenow, P.J. Misallocation and manufacturing TFP in China and India. Q. J. Econ. 2009, 124, 1403–1448. [Google Scholar] [CrossRef] [Green Version]

- Yang, M.; Yang, F.; Sun, C. Factor market distortion correction, resource reallocation and potential productivity gains: An empirical study on China’s heavy industry sector. Energy Econ. 2018, 69, 270–279. [Google Scholar] [CrossRef]

- Xu, M.; Tan, R. Removing energy allocation distortion to increase economic output and energy efficiency in China. Energy Policy 2021, 150, 112110. [Google Scholar] [CrossRef]

- Lin, B.; Jiang, Z. Estimates of energy subsidies in China and impact of energy subsidy reform. Energy Econ. 2011, 33, 273–283. [Google Scholar] [CrossRef]

- Sun, C.; Lin, B. Reforming residential electricity tariff in China: Block tariffs pricing approach. Energy Policy 2013, 60, 741–752. [Google Scholar] [CrossRef]

- Reddy, B.S. Barriers and drivers to energy efficiency–A new taxonomical approach. Energy Convers. Manag. 2013, 74, 403–416. [Google Scholar] [CrossRef] [Green Version]

- International Monetary Fund (IMF). Energy Subsidy Reform: Lessons and Implications; International Monetary Fund: Washington, DC, USA, 2013. [Google Scholar]

- Ouyang, X.; Wei, X.; Sun, C.; Du, G. Impact of factor price distortions on energy efficiency: Evidence from provincial-level panel data in China. Energy Policy 2018, 118, 573–583. [Google Scholar] [CrossRef]

- Liu, W.; Li, H. Research on coal subsidies reform and CO2 emissions reduction in China. Econ. Res. J. 2014, 49, 146–157. (In Chinese) [Google Scholar]

- He, Y.; Liu, Y.; Wang, J.; Xia, T.; Zhao, Y. Low-carbon-oriented dynamic optimization of residential energy pricing in China. Energy 2014, 66, 610–623. [Google Scholar] [CrossRef]

- Azam, A.; Rafiq, M.; Shafique, M.; Zhang, H.; Yuan, J. Analyzing the effect of natural gas, nuclear energy and renewable energy on GDP and carbon emissions: A multi-variate panel data analysis. Energy 2021, 219, 119592. [Google Scholar] [CrossRef]

- Chen, H.; He, L.; Chen, J.; Yuan, B.; Huang, T.; Cui, Q. Impacts of clean energy substitution for polluting fossil-fuels in terminal energy consumption on the economy and environment in China. Sustainability 2019, 11, 6419. [Google Scholar] [CrossRef] [Green Version]

- Ike, G.N.; Usman, O.; Alola, A.A.; Sarkodie, S.A. Environmental quality effects of income, energy prices and trade: The role of renewable energy consumption in G-7 countries. Sci. Total Environ. 2020, 721, 137813. [Google Scholar] [CrossRef]

- Salem, S.; Arshed, N.; Anwar, A.; Iqbal, M.; Sattar, N. Renewable energy consumption and carbon emissions—testing nonlinearity for highly carbon emitting countries. Sustainability 2021, 13, 11930. [Google Scholar] [CrossRef]

- Khan, I.; Han, L.; Khan, H. Renewable energy consumption and local environmental effects for economic growth and carbon emission: Evidence from global income countries. Environ. Sci. Pollut. Res. 2022, 29, 13071–13088. [Google Scholar] [CrossRef]

- Liu, G.; Wang, B.; Cheng, Z.; Zhang, N. The drivers of China’s regional green productivity 1999–2013. Resour. Conserv. Recycl. 2020, 153, 104561. [Google Scholar] [CrossRef]

- Que, W.; Zhang, Y.; Liu, S.; Yang, C. The spatial effect of fiscal decentralization and factor market segmentation on environmental pollution. J. Clean. Prod. 2018, 184, 402–413. [Google Scholar] [CrossRef]

- Li, K.; Lin, B. How to promote energy efficiency through technological progress in China. Energy 2018, 143, 812–821. [Google Scholar] [CrossRef]

- Shen, X.; Lin, B. Does industrial structure distortion impact the energy intensity in China? Sustain. Prod. Consum. 2021, 25, 551–562. [Google Scholar] [CrossRef]

- Gan, C.; Zhen, R.; Yu, D. An Empirical Study on the Effects of Industrial Structure on Economic Growth and Fluctuations in China. Econ. Res. J. 2011, 46, 4–16. (In Chinese) [Google Scholar]

- Zhang, S.; Chen, C.; Huang, D.H.; Hu, L. Measurement of factor price distortion: A new production function method with time-varying elasticity. Technol. Forecast. Soc. Chang. 2022, 175, 121363. [Google Scholar] [CrossRef]

- Sun, X.; Loh, L.; Chen, Z.; Zhou, X. Factor price distortion and ecological efficiency: The role of institutional quality. Environ. Sci. Pollut. Res. 2020, 27, 5293–5304. [Google Scholar] [CrossRef]

- He, Z.; Xing, W.; Chen, Y. Marketization, Industrial Structure Upgrading, and Energy Efficiency. Energy Res. Lett. 2021, 2, 25725. [Google Scholar]

- Hu, C.P.; Shen, Z.Y.; Yu, H.J.; Xu, B. Uncertainty shocks and monetary policy: Evidence from the troika of China’s economy. Econ. Res.-Ekon. Istraz. 2021, 1–15. [Google Scholar] [CrossRef]

- Lin, B.; Chen, Z. Does factor market distortion inhibit the green total factor productivity in China? J. Clean. Prod. 2018, 197, 25–33. [Google Scholar] [CrossRef]

- Yu, Y.; Liu, D.; Gong, Y. Target of local economic growth and total factor productivity. Manag. World 2019, 35, 26–42. (In Chinese) [Google Scholar]

- Arshad, A.; Zakaria, M.; Xi, J. Energy prices and economic growth in Pakistan: A macro-econometric analysis. Renew. Sustain. Energy Rev. 2016, 55, 25–33. [Google Scholar] [CrossRef]

- Liu, Y.; Liu, S.; Xu, X.; Failler, P. Does energy price induce China’s green energy innovation? Energies 2020, 13, 4034. [Google Scholar] [CrossRef]

- Xia, C.; Wang, Z.; Xia, Y. The drivers of China’s national and regional energy consumption structure under environmental regulation. J. Clean. Prod. 2021, 285, 124913. [Google Scholar] [CrossRef]

- Ouyang, X.; Lin, B. Impacts of increasing renewable energy subsidies and phasing out fossil fuel subsidies in China. Renew. Sustain. Energy Rev. 2014, 37, 933–942. [Google Scholar] [CrossRef]

- Li, W.; Sun, W.; Li, G.; Jin, B.; Wu, W.; Cui, P.; Zhao, G. Transmission mechanism between energy prices and carbon emissions using geographically weighted regression. Energy Policy 2018, 115, 434–442. [Google Scholar] [CrossRef]

- Hosier, R.H.; Dowd, J. Household fuel choice in Zimbabwe: An empirical test of the energy ladder hypothesis. Resour. Energy 1987, 9, 347–361. [Google Scholar] [CrossRef]

- Guan, H.; Xing, M. Impact of Energy Price Distortion on Green TFP Based on Spatial Econometric Model. Math. Probl. Eng. 2022, 2022, 1–8. [Google Scholar] [CrossRef]

- Wu, H.; Xu, L.; Ren, S.; Hao, Y.; Yan, G. How do energy consumption and environmental regulation affect carbon emissions in China? New evidence from a dynamic threshold panel model. Resour. Policy 2020, 67, 101678. [Google Scholar] [CrossRef]

- Wu, Y. Studies on the Impact of Energy Price Distortion and Environmental Regulation to Environmental Quality; Anhui University of Finance & Economics: Bengbu, China, 2017. (In Chinese) [Google Scholar]

- Qiao, S.; Zhao, D.H.; Guo, Z.X.; Tao, Z. Factor price distortions, environmental regulation and innovation efficiency: An empirical study on China’s power enterprises. Energy Policy 2022, 164, 112887. [Google Scholar] [CrossRef]

- Lei, M. Study on Integrated Accounting Between Economy and Natural Resources (II)—Index Formation. Syst. Eng.-Theory Pract. 1996, 10, 91–98. (In Chinese) [Google Scholar]

- Ju, K.; Wang, Q.; Liu, L.; Zhou, D. Measurement of the Price Distortion Degree for Exhaustible Energy Resources in China: A Discount Rate Perspective. Emerg. Mark. Financ. Trade 2019, 55, 2718–2737. [Google Scholar] [CrossRef]

- Serafy, S.E. Absorptive capacity, the demand for revenue, and the supply of petroleum. J. Energy Dev. 1981, 7, 73–88. [Google Scholar]

- Liu, W.; Li, H. Improving energy consumption structure: A comprehensive assessment of fossil energy subsidies reform in China. Energy Policy 2011, 39, 4134–4143. [Google Scholar] [CrossRef]

- Chen, L.; Xing, Z.; Li, N. The environmental value of wind power. Renew. Energy 2005, 5, 50–52. (In Chinese) [Google Scholar]

- Lin, B.; Chen, Y. Does electricity price matter for innovation in renewable energy technologies in China? Energy Econ. 2019, 78, 259–266. [Google Scholar] [CrossRef]

- Jiang, Z.; Lyu, P.; Ye, L.; Zhou, Y.W. Green innovation transformation, economic sustainability and energy consumption during China’s new normal stage. J. Clean. Prod. 2020, 273, 123044. [Google Scholar] [CrossRef]

- Lin, B.; Xu, B. A non-parametric analysis of the driving factors of China’s carbon prices. Energy Econ. 2021, 104, 105684. [Google Scholar] [CrossRef]

- Trujillo-Baute, E.; del Río, P.; Mir-Artigues, P. Analysing the impact of renewable energy regulation on retail electricity prices. Energy Policy 2018, 114, 153–164. [Google Scholar] [CrossRef] [Green Version]

- Xingang, Z.; Xiaomeng, L.; Pingkuo, L.; Tiantian, F. The mechanism and policy on the electricity price of renewable energy in China. Renew. Sustain. Energy Rev. 2011, 15, 4302–4309. [Google Scholar] [CrossRef]

- Jia, X.; Lin, S. A factor market distortion research based on enterprise innovation efficiency of economic kinetic energy conversion. Sustain. Energy Technol. Assess. 2021, 44, 101021. [Google Scholar]

- Guo, Z.; Zhang, X.; Zhen, Y. Impacts of energy price fluctuations on energy-environment-economy system in China. Chin. J. Manag. Sci. 2018, 26, 22–30. [Google Scholar]

- Ma, H.; Oxley, L. Are China’s energy markets cointegrated? China Econ. Rev. 2011, 22, 398–407. [Google Scholar] [CrossRef]

- Zhang, J.; Xie, M. China’s oil product pricing mechanism: What role does it play in China’s macroeconomy? China Econ. Rev. 2016, 38, 209–221. [Google Scholar] [CrossRef]

- Blundell, R.; Bond, S. Initial conditions and moment restrictions in dynamic panel data models. J. Econom. 1998, 87, 115–143. [Google Scholar] [CrossRef] [Green Version]

- Roodman, D. How to do xtabond2: An introduction to difference and system GMM in Stata. Stata J. 2009, 9, 86–136. [Google Scholar] [CrossRef] [Green Version]

- Edwards, J.R.; Lambert, L.S. Methods for integrating moderation and mediation: A general analytical framework using moderated path analysis. Psychol. Methods 2007, 12, 1–22. [Google Scholar] [CrossRef] [Green Version]

- Chiu, Y.B. Carbon dioxide, income and energy: Evidence from a non-linear model. Energy Econ. 2017, 61, 279–288. [Google Scholar] [CrossRef]

- Rosado, J.A.; Sánchez, M.I.A. The influence of Economic Growth and Electric Consumption on Pollution in South America Countries. Int. J. Energy Econ. Policy 2017, 7, 121–126. [Google Scholar]

- Intergovernmental Panel on Climate Change Guidelines for National Greenhouse Gas Inventories. 2006. Available online: https://www.google.com/url?sa=t&rct=j&q=&esrc=s&source=web&cd=&ved=2ahUKEwjVhv7G_az4AhXN-zgGHeHzD6wQFnoECAMQAQ&url=https%3A%2F%2Fwww.ipcc-nggip.iges.or.jp%2Fsupport%2FPrimer_2006GLs.pdf&usg=AOvVaw1V3LFV6zVrLp5Wm5oXwmdk (accessed on 1 May 2022).

- Lin, B.; Wang, M. The role of socio-economic factors in China’s CO2 emissions from production activities. Sustain. Prod. Consum. 2021, 27, 217–227. [Google Scholar] [CrossRef]

- Glaeser, E.L.; Kahn, M.E. The greenness of cities: Carbon dioxide emissions and urban development. J. Urban Econ. 2010, 67, 404–418. [Google Scholar] [CrossRef] [Green Version]

- Lin, B.; Xu, B. How does fossil energy abundance affect China’s economic growth and CO2 emissions? Sci. Total Environ. 2020, 719, 137503. [Google Scholar] [CrossRef]

- Han, J.; Miao, J.; Du, G.; Yan, D.; Miao, Z. Can market-oriented reform inhibit carbon dioxide emissions in China? A new perspective from factor market distortion. Sustain. Prod. Consum. 2021, 27, 1498–1513. [Google Scholar] [CrossRef]

- Liu, Y.; Xiao, H.; Lv, Y.; Zhang, N. The effect of new-type urbanization on energy consumption in China: A spatial econometric analysis. J. Clean. Prod. 2017, 163, S299–S305. [Google Scholar] [CrossRef]

- Song, X.; Zhou, Y.; Jia, W. How do economic openness and R&D investment affect green economic growth?—evidence from China. Resour. Conserv. Recycl. 2019, 146, 405–415. [Google Scholar]

- Zhou, Y.; Fu, J.; Kong, Y.; Wu, R. How foreign direct investment influences carbon emissions, based on the empirical analysis of Chinese urban data. Sustainability 2018, 10, 2163. [Google Scholar] [CrossRef] [Green Version]

- Lin, B.; Zhou, Y. Measuring the green economic growth in China: Influencing factors and policy perspectives. Energy 2022, 241, 122518. [Google Scholar] [CrossRef]

- Hao, Y.; Ba, N.; Ren, S.; Wu, H. How does international technology spillover affect China’s carbon emissions? A new perspective through intellectual property protection. Sustain. Prod. Consum. 2021, 25, 577–590. [Google Scholar] [CrossRef]

- Shi, J. Comparative study of domestic and international renewable energy tender tariffs. China Price 2018, 3, 32–35. (In Chinese) [Google Scholar]

- Jia, W.; Jia, X.; Wu, L.; Guo, Y.; Yang, T.; Wang, E.; Xiao, P. Research on regional differences of the impact of clean energy development on carbon dioxide emission and economic growth. Humanit. Soc. Sci. Commun. 2022, 9, 1–9. [Google Scholar] [CrossRef]

- National Development and Reform Commission (NDRC). 13th Five-Year Plan for Natural Gas Development. 2016. Available online: https://www.ndrc.gov.cn/xxgk/zcfb/tz/201701/t20170119_962876.html?code=&state=123 (accessed on 5 May 2022).

- Jiang, H.D.; Xue, M.M.; Dong, K.Y.; Liang, Q.M. How will natural gas market reforms affect carbon marginal abatement costs? Evidence from China. Econ. Syst. Res. 2021, 34, 1–22. [Google Scholar] [CrossRef]

- Wen, Z.; Ye, B. Analyses of Mediating Effects: The Development of Methods and Models. Adv. Psychol. Sci. 2014, 22, 731–745. [Google Scholar] [CrossRef]

- Zhao, X.G.; Lu, F. Spatial distribution characteristics and convergence of China’s regional energy intensity: An industrial transfer perspective. J. Clean. Prod. 2019, 233, 903–917. [Google Scholar]

- Chen, S.; Jin, H.; Lu, Y. Impact of urbanization on CO2 emissions and energy consumption structure: A panel data analysis for Chinese prefecture-level cities. Struct. Chang. Econ. Dyn. 2019, 49, 107–119. [Google Scholar] [CrossRef]

| Variables | Coal | Oil | Natural Gas | Renewable Energy |

|---|---|---|---|---|

| ) | CEIC database; Price Statistical Yearbook | CEIC database; Energy Statistical Yearbook | CEIC database; National Bureau of Statistics | Wind database; National Energy Administration; Energy Statistical Yearbook, Almanac of China Guodian Corporation; |

| MUC | Annual BP Statistical Yearbook | — | ||

| MUCcom | Annual Reports of China Shenhua Energy Company Limited and China National Petroleum Corporation | — | ||

| MEC | Ju et al. [63] | Chen [66] | ||

| Variables | Units | Mean | Std. Dev. | Min | Max |

|---|---|---|---|---|---|

| lnGDP | Yuan/person | 10.065 | 0.563 | 8.541 | 11.550 |

| lnCO2 | Tons/person | 1.911 | 0.514 | 0.746 | 3.433 |

| Dcoal | % | −0.177 | 0.420 | −0.831 | 1.507 |

| Doil | % | −0.105 | 0.108 | −0.362 | 0.299 |

| Dgas | % | −0.083 | 0.246 | −0.629 | 0.667 |

| Dre | % | 1.468 | 1.819 | −0.434 | 9.186 |

| Open | % | 0.316 | 0.363 | 0.017 | 1.712 |

| Pop | Person | 4480.233 | 2687.224 | 548.000 | 11,346.000 |

| Indus | % | 0.434 | 0.082 | 0.165 | 0.620 |

| Urban | % | 0.541 | 0.136 | 0.275 | 0.896 |

| TECH | % | 1.543 | 1.061 | 0.204 | 5.651 |

| OECS | % | 0.140 | 0.111 | 0.013 | 0.562 |

| ISU | % | 0.896 | 0.530 | 0.154 | 3.080 |

| FDI | % | 452.098 | 481.928 | 0.119 | 2257.262 |

| ER | \ | 9.393 | 5.171 | 2.267 | 54.793 |

| Variables | FE(1) | FE(2) | FE(3) | FE(4) | SYS-GMM(5) | SYS-GMM(6) | SYS-GMM(7) | SYS-GMM(8) |

|---|---|---|---|---|---|---|---|---|

| L.lnGDP | — | — | — | — | 0.935 *** (0.036) | 0.941 *** (0.009) | 0.930 *** (0.009) | 0.857 *** (0.017) |

| Dcoal | −0.130 *** (0.038) | −0.083 ** (0.034) | ||||||

| Doil | 1.112 *** (0.109) | 0.103 *** (0.005) | ||||||

| Dgas | 0.379 *** (0.053) | 0.101 *** (0.012) | ||||||

| Dre | −0.166 *** (0.027) | −0.025 *** (0.005) | ||||||

| lnOpen | −0.041 * (0.022) | 0.024 (0.021) | −0.046 ** (0.021) | −0.026 (0.021) | 0.003 (0.008) | 0.011 *** (0.003) | 0.006 * (0.003) | −0.021 *** (0.003) |

| lnPop | 1.158 *** (0.151) | 0.708 *** (0.142) | 1.098 *** (0.144) | 0.945 *** (0.150) | 0.015 (0.012) | −0.006 ** (0.003) | −0.007 * (0.004) | 0.017 ** (0.008) |

| lnIndus | −0.293 *** (0.070) | −0.061 (0.064) | −0.120 * (0.067) | −0.264 *** (0.066) | 0.009 (0.025) | 0.108 *** (0.010) | 0.005 (0.014) | 0.172 *** (0.014) |

| lnUrban | 2.742 *** (0.057) | 2.113 *** (0.079) | 2.491 *** (0.064) | 2.589 *** (0.060) | 0.093 (0.112) | 0.039 (0.032) | −0.063 * (0.033) | 0.434 *** (0.054) |

| Constant | 2.018 * (1.216) | 5.736 *** (1.151) | 2.542 ** (1.158) | 3.832 *** (1.215) | 0.665 * (0.368) | 0.867 *** (0.114) | 0.832 *** (0.107) | 1.777 *** (0.178) |

| Hausman | 44.85 *** | 29.73 *** | 40.29 *** | 21.94 *** | — | — | — | — |

| Obs. | 390 | 390 | 390 | 390 | 360 | 360 | 360 | 360 |

| AR(1) | — | — | — | — | −2.57 [0.010] | −1.51 [0.131] | −1.74 [0.082] | −0.54 [0.592] |

| AR(2) | — | — | — | — | −0.99 [0.324] | −1.69 [0.091] | −1.36 [0.174] | −1.54 [0.124] |

| Hansen test | — | — | — | — | 25.31 [0.117] | 28.15 [0.106] | 26.28 [0.123] | 24.76 [0.074] |

| Variables | FE(1) | RE(2) | FE(3) | FE(4) | SYS-GMM(5) | SYS-GMM(6) | SYS-GMM(7) | SYS-GMM(8) |

|---|---|---|---|---|---|---|---|---|

| L.lnCO2 | — | — | — | — | 0.780 *** (0.031) | 0.861 *** 0.020) | 0.760 *** (0.042) | 0.866 *** (0.024) |

| Dcoal | −0.049 (0.050) | 0.040 *** (0.014) | ||||||

| Doil | 0.446 *** (0.171) | 0.156 *** (0.036) | ||||||

| Dgas | 0.661 *** (0.084) | 0.109 *** (0.042) | ||||||

| Dre | −0.021 (0.059) | 0.038 *** (0.009) | ||||||

| lnOpen | −0.082 *** (0.029) | −0.019 (0.082) | −0.083 ** (0.039) | −0.083 *** (0.029) | −0.078 *** (0.008) | 0.010 (0.011) | −0.044 *** (0.015) | −0.015 (0.009) |

| lnIndus | 0.028 (0.110) | 0.292 *** (0.098) | 0.093 (0.127) | 0.044 (0.109) | 0.719 *** (0.034) | 0.235 *** (0.038) | 0.347 *** (0.051) | 0.187 *** (0.028) |

| lnPop | −1.088 *** (0.225) | −0.131 (0.099) | 0.560 ** (0.268) | −1.104 *** (0.225) | −0.159 *** (0.023) | −0.065 *** (0.007) | −0.087 *** (0.013) | −0.044 *** (0.010) |

| lnUrban | 0.599 *** (0.167) | 1.176 *** (0.130) | 1.413 *** (0.095) | 0.585 *** (0.167) | 0.445 *** (0.050) | −0.056 (0.055) | 0.251 *** (0.093) | 0.057 (0.052) |

| Constant | 10.790 *** (1.769) | 4.045 *** (0.834) | 2.865 * (1.724) | 10.949 *** (1.773) | 2.542 *** (0.284) | 1.029 *** (0.139) | 1.598 *** (0.221) | 0.797 *** (0.135) |

| Hausman | 15.48 *** | 20.09 *** | 11.55 ** | 13.83 ** | — | — | — | — |

| Obs. | 390 | 390 | 390 | 390 | 360 | 360 | 360 | 360 |

| AR(1) | — | — | — | — | −3.22 [0.001] | −3.40 [0.001] | −3.21 [0.001] | −3.25 [0.001] |

| AR(2) | — | — | — | — | −1.62 [0.104] | −1.68 [0.093] | −1.50 [0.133] | −1.70 [0.090] |

| Hansen test | — | — | — | — | 27.99 [0.924] | 29.33 [0.448] | 25.25 [0.118] | 22.06 [0.281] |

| Variables | (1) lnTECH | (2) lnTECH on lnGDP | (3) lnGDP | (4) lnISU | (5) lnISU on lnGDP | (6) lnGDP | (7) lnFDI | (8) lnFDI on lnGDP | (9) lnGDP |

|---|---|---|---|---|---|---|---|---|---|

| Dcoal | −0.016 ** (0.007) | 0.059 ** (0.027) | −0.078 *** (0.019) | −0.091 *** (0.015) | 0.063 *** (0.009) | −0.026 *** (0.010) | −0.039 ** (0.020) | 0.024 *** (0.003) | −0.060 *** (0.008) |

| Doil | −0.270 *** (0.082) | 0.052 *** (0.006) | 0.070 *** (0.017) | −0.083 ** (0.033) | 0.141 *** (0.020) | 0.092 *** (0.011) | −0.847 *** (0.130) | 0.005 *** (0.002) | 0.086 *** (0.010) |

| Dgas | −0.402 *** (0.060) | 0.108 *** (0.011) | 0.075 *** (0.010) | −0.012 (0.010) | 0.106 *** (0.026) | 0.071 *** (0.017) | −0.478 *** (0.168) | 0.031 *** (0.006) | 0.098 *** (0.011) |

| Dre | −0.092 *** (0.017) | 0.034 *** (0.008) | −0.012 * (0.006) | −0.053 *** (0.005) | 0.106 *** (0.012) | 0.010 *** (0.003) | −0.161 ** (0.069) | 0.021 *** (0.003) | −0.024 *** (0.008) |

| Controls | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Obs. | 360 | 360 | 360 | 360 | 360 | 360 | 360 | 360 | 360 |

| Variables | (1) lnTECH | (2) lnTECH on lnCO2 | (3) lnCO2 | (4) lnOECS | (5) lnOECS on lnCO2 | (6) lnCO2 | (7) lnER | (8) lnER on lnCO2 | (9) lnCO2 |

|---|---|---|---|---|---|---|---|---|---|

| Dcoal | −0.016 ** (0.007) | −0.065 *** (0.023) | 0.015 ** (0.008) | −0.162 *** (0.048) | −0.020 * (0.011) | 0.017 * (0.010) | −0.561 *** (0.098) | −0.040 *** (0.013) | 0.016 ** (0.007) |

| Doil | −0.270 *** (0.082) | −0.113 *** (0.034) | 0.147 ** (0.067) | −0.290 *** (0.099) | −0.029 *** (0.008) | 0.089 * (0.048) | −0.506 * (0.262) | −0.054 ** (0.023) | 0.149 *** (0.042) |

| Dgas | −0.402 *** (0.060) | −0.066 *** (0.019) | 0.069 * (0.040) | −0.076 (0.070) | −0.042 *** (0.008) | 0.104 *** (0.023) | −0.291 ** (0.124) | −0.067 *** (0.016) | 0.087 *** (0.031) |

| Dre | −0.092 *** (0.017) | −0.067 ** (0.034) | 0.030 * (0.016) | −0.264 *** (0.039) | −0.016 ** (0.008) | 0.027 ** (0.010) | −0.405 *** (0.032) | −0.039 ** (0.020) | 0.038 *** (0.014) |

| Controls | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Obs. | 360 | 360 | 360 | 360 | 360 | 360 | 360 | 360 | 360 |

| Eastern | Central and Western | |||||||

|---|---|---|---|---|---|---|---|---|

| L.lnGDP | 0.956 *** (0.057) | 0.952 *** (0.032) | 0.959 *** (0.023) | 0.948 *** (0.071) | 0.951 *** (0.016) | 0.965 *** (0.012) | 0.901 *** (0.012) | 0.959 *** (0.010) |

| Dcoal | −0.025 ** (0.013) | −0.117 *** (0.020) | ||||||

| Doil | 0.039 * (0.020) | 0.030 * (0.017) | ||||||

| Dgas | 0.057 ** (0.022) | 0.051 * (0.026) | ||||||

| Dre | −0.012 (0.016) | 0.012 *** (0.004) | ||||||

| lnOpen | 0.049 *** (0.012) | 0.026 *** (0.007) | 0.001 (0.010) | 0.020 ** (0.009) | −0.029 *** (0.008) | −0.006 ** (0.002) | −0.018 *** (0.006) | −0.009 *** (0.002) |

| lnPop | 0.058 (0.051) | 0.054 (0.057) | −0.043 (0.029) | 0.060 (0.097) | 0.018 *** (0.006) | 0.003 (0.005) | 0.006 (0.010) | 0.007 * (0.004) |

| lnIndus | −0.110 (0.075) | −0.019 (0.036) | 0.093 ** (0.047) | −0.014 (0.037) | 0.051 ** (0.023) | 0.140 *** (0.008) | 0.237 *** (0.019) | 0.104 *** (0.010) |

| lnUrban | −0.077 (0.144) | 0.005 (0.082) | 0.074 (0.083) | 0.021 (0.196) | 0.035 (0.033) | −0.017 (0.027) | 0.220 *** (0.066) | 0.003 (0.022) |

| Constant | −0.055 (0.344) | 0.134 (0.245) | 0.989 ** (0.402) | 0.139 (0.344) | 0.408 ** (0.168) | 0.500 *** (0.130) | 1.339 *** (0.124) | 0.495 *** (0.104) |

| Obs. | 132 | 132 | 132 | 132 | 228 | 228 | 228 | 228 |

| AR(1) | −2.13 [0.033] | −1.51 [0.132] | −1.52 [0.129] | −2.66 [0.008] | −1.67 [0.096] | −1.38 [0.167] | −0.80 [0.426] | −1.50 [0.134] |

| AR(2) | −0.55 [0.586] | −0.86 [0.388] | −0.53 [0.596] | −1.11 [0.267] | −0.43 [0.667] | −1.77 [0.077] | −0.39 [0.696] | −1.63 [0.104] |

| Hansen test | 7.17 [0.928] | 7.49 [0.985] | 5.84 [0.997] | 8.45 [0.934] | 17.82 [0.467] | 18.55 [0.420] | 15.01 [0.524] | 18.52 [0.488] |

| Eastern | Central and Western | |||||||

|---|---|---|---|---|---|---|---|---|

| L.lnCO2 | 0.796 *** (0.121) | 0.842 *** (0.112) | 0.885 *** (0.062) | 1.262 *** (0.234) | 0.464 *** (0.056) | 0.844 *** (0.058) | 0.843 *** (0.039) | 0.921 *** (0.034) |

| Dcoal | 0.105 ** (0.050) | 0.143 ** (0.069) | ||||||

| Doil | 0.409 *** (0.129) | 0.471 ** (0.237) | ||||||

| Dgas | 0.401 *** (0.132) | 0.175 ** (0.087) | ||||||

| Dre | 0.081 ** (0.040) | 0.070 ** (0.036) | ||||||

| lnOpen | −0.122 ** (0.048) | −0.127 *** (0.044) | 0.131 (0.093) | 0.178 (0.187) | 0.037 ** (0.017) | 0.015 (0.037) | −0.006 (0.020) | 0.012 (0.011) |

| lnIndus | 1.691 ** (0.703) | 1.707 *** (0.638) | −0.295 (0.426) | −0.442 (0.644) | 0.732 *** (0.124) | 0.299*** (0.060) | 0.327 *** (0.077) | 0.141 *** (0.031) |

| lnPop | 3.366 ** (1.335) | 3.556*** (1.248) | 0.111 (0.183) | 0.053 (0.218) | −0.578 *** (0.070) | −0.121 *** (0.015) | −0.111 *** (0.022) | −0.064 *** (0.012) |

| lnUrban | −1.704 ** (0.702) | −1.775 *** (0.634) | −0.739 * (0.439) | −0.981 (0.901) | 0.938 *** (0.162) | −0.210 (0.200) | −0.032 (0.083) | −0.088 (0.097) |

| Constant | 1.550 ** (0.742) | 2.145 *** (0.664) | −1.186 (2.012) | −1.693 (1.591) | 7.198 *** (0.721) | 1.496 *** (0.241) | 1.490 *** (0.304) | 0.763 *** (0.240) |

| Obs. | 132 | 132 | 132 | 132 | 228 | 228 | 228 | 228 |

| AR(1) | −0.63 [0.530] | −0.39 [0.699] | −2.52 [0.012] | −2.39 [0.017] | −2.11 [0.035] | −2.33 [0.020] | −2.50 [0.013] | −2.36 [0.018] |

| AR(2) | 0.02 [0.987] | −0.15 [0.881] | 0.57 [0.571] | 0.30 [0.764] | −0.48 [0.631] | −1.73 [0.084] | −1.34 [0.182] | −1.64 [0.101] |

| Hansen test | 3.06 [1.000] | 1.50 [1.000] | 2.88 [0.998] | 5.39 [1.000] | 15.25 [0.506] | 15.95 [0.527] | 14.83 [0.608] | 16.42 [0.629] |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Sha, R.; Ge, T.; Li, J. How Energy Price Distortions Affect China’s Economic Growth and Carbon Emissions. Sustainability 2022, 14, 7312. https://doi.org/10.3390/su14127312

Sha R, Ge T, Li J. How Energy Price Distortions Affect China’s Economic Growth and Carbon Emissions. Sustainability. 2022; 14(12):7312. https://doi.org/10.3390/su14127312

Chicago/Turabian StyleSha, Ru, Tao Ge, and Jinye Li. 2022. "How Energy Price Distortions Affect China’s Economic Growth and Carbon Emissions" Sustainability 14, no. 12: 7312. https://doi.org/10.3390/su14127312

APA StyleSha, R., Ge, T., & Li, J. (2022). How Energy Price Distortions Affect China’s Economic Growth and Carbon Emissions. Sustainability, 14(12), 7312. https://doi.org/10.3390/su14127312