1. Introduction

Climate change has aroused global attention to carbon emission reduction. Governments have attached importance to the role of low-carbon development in the formulation of national economic and energy policies [

1]. According to the statistics of the World Energy Statistical Yearbook (70th edition), global carbon dioxide emissions have been increasing continuously since 2013. Global carbon emissions are expected to increase by 30% by 2030 compared to 2010 levels [

2]. Therefore, carbon emissions have become an important topic for economists all over the world. For example, Adebayo et al. [

3] explored the asymmetric impact of renewable energy consumption and trade openness in Sweden on carbon emissions. They found that there is heterogeneity in the impact of trade openness and renewable energy on carbon dioxide emissions. However, in most quantiles, the impact of economic growth on carbon dioxide emissions is negative. Rjoub et al. [

4] explored the relationship between carbon emissions, life expectancy, and economic growth in Turkey from the perspective of energy consumption, human health, and environmental hazards. Odhiambo [

5] discussed the relationship between carbon emissions and economic growth in South Africa and found that energy consumption plays a positive role in promoting carbon emissions and economic growth. Lee and Brahmasrene [

6] used EU national data to examine the long-term equilibrium relationship between tourism, carbon dioxide emissions, economic growth, and foreign direct investment. They found that tourism, carbon dioxide emissions, and foreign direct investment were all significantly positively correlated with economic growth, but that tourism and foreign direct investment help to reduce carbon dioxide emissions. In recent years, research on carbon emissions has been increasing [

7,

8,

9,

10,

11,

12], indicating that carbon emission reduction has become a key issue for the global climate problem [

13,

14,

15,

16,

17,

18]. As the number one country in global resource consumption, China has not effectively disposed of its heavy dependence on energy and the environment. After reform and opening-up, China’s economy has been growing for 40 years, which has created a “Chinese miracle” in the history of economic growth. However, the rapid development of its economy has led to excessive energy consumption and accelerated greenhouse gas emissions, so environmental problems have become increasingly prominent and cannot be ignored [

19]. The emissions of all kinds of major pollutants have gradually exceeded the environmental carrying capacity, and problems such as increased carbon emissions have become the main obstacles to low-carbon sustainable development. As China’s economic development enters a new normal, the intensification of environmental pollution, the tightening of factor endowments, the reduction of labor dividends and the decline of capital income make the rough mode of development unsustainable. Therefore, how to assume the responsibility of a big country and strive to achieve carbon emission reduction has become an important task for China’s future development.

The rise of the digital technology revolution provides unprecedented opportunities and challenges for the economic development of our country. At present, China’s economy is gradually changing from a rough development of speed and quantity to a connotative development model of low-carbon sustainable development [

20,

21]. Promoting the deep integration of the digital economy and the real economy, and speeding up the transformation of the model of economic development, will become an important starting point for sustainable economic development in the new era [

22]. Low-carbon development has been a wide concern for the government, the public, and academia [

23]. Thus, whether to maintain low-carbon growth while taking into account socially inclusive development is an urgent problem before the government. Some scholars have tried to make valuable explorations on how to use the digital economy to accelerate the reconstruction of economic development and governance models and how to optimize industrial structure to promote green and sustainable development [

24,

25].

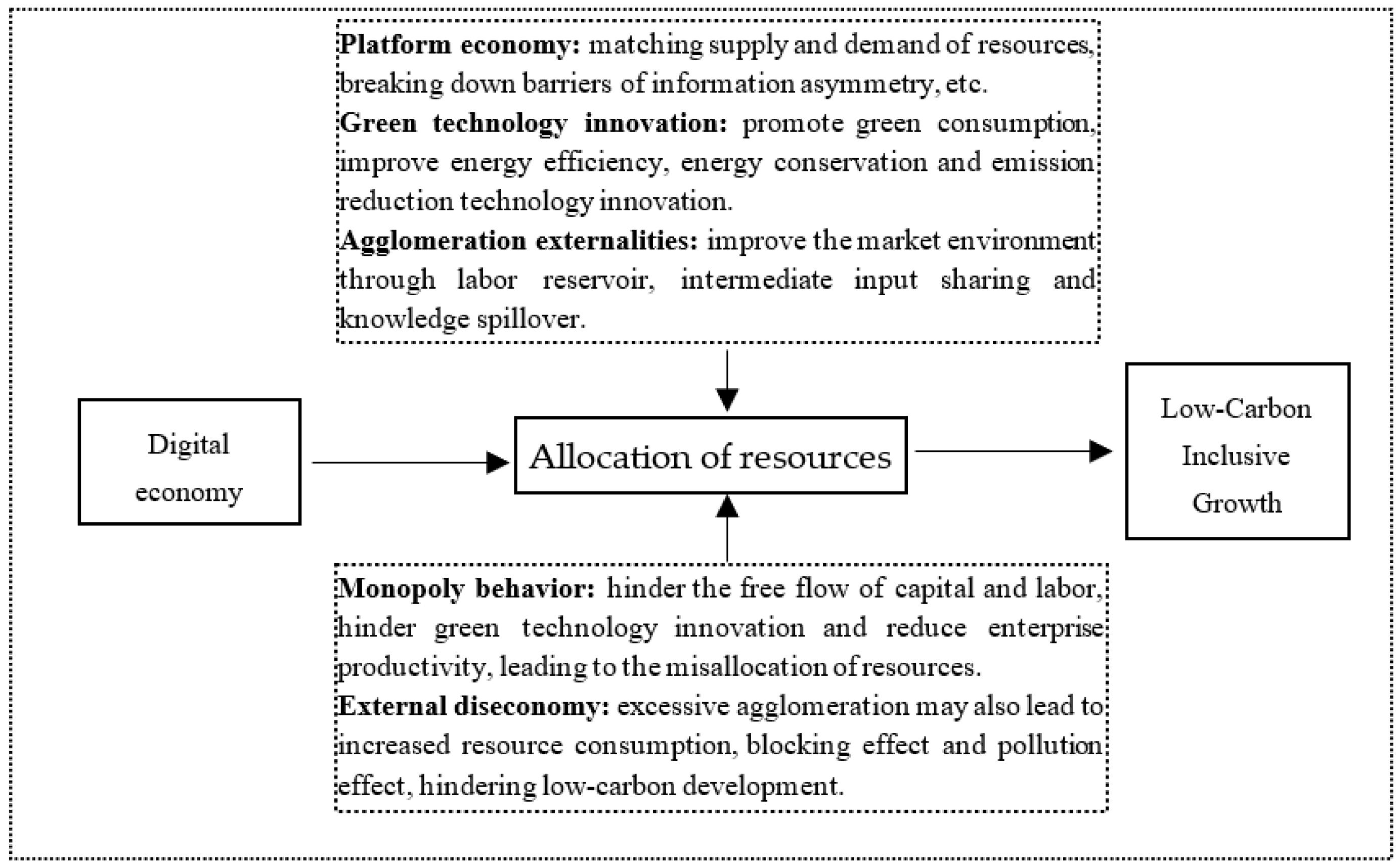

However, the existing literature pays less attention to the relationship between digital economy development and low-carbon, inclusive growth, which provides a research opportunity for the innovation of this paper. The innovation of this paper mainly focuses on three issues: First of all, there is little literature to comprehensively assess the impact of regional digital economic development on economic growth, social inclusiveness, and low-carbon ecology. There is room for discussion on this research topic. Secondly, there is a relative lack of research on the path of the digital economy affecting low-carbon, inclusive growth, and the literature based on the perspective of the digital economy paradox is even rarer. The discussion of these two issues is helpful in enriching the existing theoretical literature. Finally, we think that digital technology is a double-edged sword, and we should pay attention to its negative externalities while it plays its positive role. The discussion of heterogeneity not only helps to clarify the conditionality of the impact of the digital economy on low-carbon, inclusive growth but also provides detailed empirical evidence for the formulation of carbon emission reduction policies in various regions of China. Therefore, a discussion of the above three issues has important policy value for effectively releasing digital dividends to promote low-carbon, inclusive growth.

2. Literature Review

Based on the paradox of digitization and the realistic perspective of resource allocation, we explore the specific impact of regional digital economy development on low-carbon, inclusive growth. There are mainly two branches of the literature that are closely related to this article. The first branch of the literature discusses the relationship between the digital economy and energy consumption. Most studies support the idea that the development of the digital economy, as represented by the Internet, 5G, and blockchain, is conducive to low-carbon sustainable development [

24,

25,

26,

27,

28,

29,

30]. For example, Lange et al. [

24] found that the increasing application of information and communication technology (ICT) in the economy and society as a whole will stimulate the hope of reducing energy demand and emissions. Ma Q et al. [

25] studied whether the digital economy can replace material resources to become a feasible source of green economy, and it was found that the digital economy can restrain consumption-oriented carbon emissions. Thus, it is beneficial to the development of the green economy. Wu J and tran n K. [

26] studied the problem of sustainable energy development. They found that the application of blockchain technology helps to solve the problem of energy sustainability. Based on an analysis of the impact of ICT investment in Japan and South Korea, Khayyat et al. [

27] found that ICT investment can replace parts of labor and energy. The above research shows that digital technology can help reduce energy consumption. Fan Xin and Yin Qiushu [

28] confirmed that the development of digital finance helps to promote entrepreneurship and technological innovation, thereby improving energy efficiency and green total factor productivity. Cheng Wenxian and Qian Xuefeng [

29] found that the impact of digital economy development on China’s industrial green total factor productivity shows a marginal increasing effect. By investigating data from OECD countries, Schulte et al. [

30] found that the development of ICT helps to reduce energy demand. However, some scholars believe that the application of digital technology may increase total energy consumption, thereby increasing carbon emissions [

31]. Other studies have also found that energy consumption and carbon emissions are increasing with the production and use of more and more ICT devices [

32,

33]. Therefore, the application of digital technology may also lead to more energy consumption, resulting in higher carbon dioxide emissions [

34].

Another branch of the literature discusses the relationship between the digital economy and green development. The main conclusions can be divided into two aspects. First of all, the development of the digital economy with data as the key factor of production can replace traditional factors, which can alleviate the problem of environmental pollution through technological innovation, optimizing industrial structure, and improving the enthusiasm of the government and the public to participate in the cause of environmental protection. For example, Liu Pengcheng and Liu Jie [

35] found that informatization can effectively alleviate the problem of urban environmental pollution through technological progress, population agglomeration, and industrial structure. Xie Chunyan et al. [

36] found that the Internet can reduce environmental pollution through four mechanisms: government environmental regulation, environmental monitoring technology, public participation in environmental protection activities, and the development of the environmental protection industry. Li Shouguo and Song Baodong [

37] believe that the development of the Internet will improve energy use efficiency and the level of technological innovation, and the resulting positive effects will completely absorb the possible negative effects, which will help to alleviate the problem of environmental pollution. Generally speaking, we believe that the digital economy can promote sustainable economic development by optimizing resource allocation, promoting human capital [

38], and realizing green progress and cleaner production.

However, some scholars hold a different point of view. They believe that the digital economy will not only bring economic growth but also cause environmental pollution [

39,

40,

41]. Their core view is that the growth of energy demand, driven by the digital economy, may lead to a greater pollution effect than its emission reduction effect, thus aggravating the deterioration of the environment [

42]. In addition, a small number of scholars believe that the relationship between the digital economy and green development is uncertain [

43]. The existing literature has not reached a consistent conclusion on the effect of carbon emission reduction on the digital economy. Differing from the views of most scholars, we believe that the relationship between the digital economy and low-carbon, inclusive growth may not be a simple linear relationship.

The above research has accumulated many valuable conclusions. For example, on the one hand, the existing research leads us to find that the carbon reduction effect of the digital economy has two sides. The digital economy may reduce carbon emissions by improving energy efficiency. It is also possible to increase total energy consumption and, thus, carbon emissions. Let us realize that the two sides of the externalities of the digital economy are also worthy of attention, which also provides a research perspective for this paper. On the other hand, the existing research also provides much of its basis in the literature. However, there are still the following shortcomings. First, the literature on digital economy is mostly qualitative research, while quantitative research is worthy of progressive discussion because there are few quantitative studies based on the two-sided effect of carbon emission reduction in the digital economy. Second, at present, there is little literature that explores the impact of digital economic development on regional low-carbon, inclusive growth and its mechanism from the perspective of resource distortion and puts the three factors into a unified framework for analysis. Third, the existing literature does not pay due attention to phenomena such as digital inequality and mismatch of resources, which may be caused by the digital economy in a region, let alone explore their negative effects on economic growth.

Given the above shortcomings, the marginal contribution of this paper has three aspects. First, index innovation. This paper brings social inclusiveness into the framework of the relationship between low-carbon ecology and economic growth. This paper constructs the level of low-carbon, inclusive growth in China from the three dimensions of economic growth, social inclusiveness, and low-carbon ecology. Compared to previous studies, this paper makes a more comprehensive assessment of the impact of digital economic development on low-carbon, inclusive growth. The second is perspective innovation. We explore the nonlinear relationship between the digital economy and low-carbon, inclusive growth, which not only helps to fully understand the carbon reduction effects of the digital economy but also expands the related research topics. This paper extends the mechanism path analysis because the index of the digital economy is composed of four aspects in this paper: digital foundation, digital information, digital application, and digital finance. The comprehensive index of low-carbon, inclusive growth consists of three aspects: economic growth, social inclusiveness, and low-carbon ecology. Most of the previous studies have discussed the influence of the first-level comprehensive indicators. Therefore, through dimension reduction analysis, this paper analyzes the carbon reduction channels of the digital economy. It enriches the existing theoretical literature and provides new insights for improving the carbon reduction effect of the digital economy. The third is content innovation. We explore the conditional impact of the digital economy on low-carbon, inclusive growth from the dimensions of key regional location, factor productivity, and information level, which provide detailed empirical evidence for local policymakers.

7. Conclusions and Suggestions

7.1. Conclusions

The main conclusions of this paper are as follows: (1) Digital economy has an inverted U-shaped impact on regional low-carbon, inclusive growth. We found that the digital economy is conducive to low-carbon, inclusive growth, but the too high level of the digital economy will also inhibit low-carbon, inclusive growth. According to statistical analysis, it was found that 75.9% of the observed areas in China are in the early stages of development. Therefore, the development of the digital economy is generally conducive to low-carbon, inclusive growth. Of the observed areas, 24.1% are on the right side of the inverted U-shaped, indicating that the high level of digital economic development in some areas is not conducive to low-carbon, inclusive growth. (2) In areas with low capital and energy productivity, the inverted U-shaped impact of digital economy on low-carbon and inclusive growth is more significant. On the left side of the threshold of digital economy, the promoting effect of the digital economy on low-carbon, inclusive growth in areas with low capital and energy productivity is more obvious. However, on the right side of the threshold of digital economy, the digital economy will increase total energy consumption and lead to capital misallocation to curb low-carbon, inclusive growth. In the case of high factor productivity, the development of the digital economy mainly leads to the distortion of capital and labor factors, which suppresses low-carbon, inclusive growth. In the case of a high level of information technology, the inverted U-shaped impact of the digital economy on low-carbon, inclusive growth is more obvious. In areas with a high degree of informatization, the positive effect of the digital economy is greater. Compared toa inland areas, the digital economy has a greater promoting effect on coastal areas. (3) Resource allocation plays an important role in the transmission mechanism between the digital economy and low-carbon, inclusive growth. Specifically, the digital economy can improve the level of low-carbon, inclusive growth by improving the allocation efficiency of capital and labor. However, if the development level of the digital economy is too high, it will mainly cause capital mismatch and then restrain low-carbon, inclusive growth.

7.2. Suggestions

- (1)

According to the empirical results, first of all, we should vigorously develop the digital economy and promote regional low-carbon and inclusive growth. At the same time, government departments should constantly improve the market supervision system for the healthy development of the digital economy, such as the establishment of a market supervision committee and other institutions to effectively prevent monopoly and misallocation of resources brought about by digital technology. To provide a fair and fair competitive environment for the healthy development of the digital economy

- (2)

We should make full use of the digital economy to improve the level of regional factor productivity. We should vigorously improve the information infrastructure and improve the degree of regional informatization, improve the openness of inland areas, actively carry out exchanges and cooperation with coastal cities, and make full use of the digital economy to promote low-carbon and inclusive growth in inland areas. At the same time, we should actively improve the system and mechanism for the development of the digital economy and improve the laws and regulations of the digital economy. Government departments should actively deal with negative effects caused by the digital economy.

- (3)

Capital and talents are indispensable factors of production for economic growth, so the digital economy should be used to improve the efficiency of resource allocation of production factors. After the emergence of the digital economy, data have become an important factor in production. We should make full use of digital resources and digital finance to promote low-carbon transformation and development. We should vigorously promote the construction of data platforms, improve the market for data elements, achieve information disclosure, break the isolated island of information, and promote the opening and sharing of data resources. We should attach importance to the development of rural digital economy and improve the coordination of the development of the urban and rural digital economy, making use of the digital economy to increase rural income. For example, the development of rural ecommerce and webcasts selling goods to increase farmer incomes. We should also narrow the development gap between urban and rural areas and improve the inclusiveness of economic and social development.

There are still some shortcomings in this paper: (1) Digital economy measurement and data: Provincial data contain more comprehensive index information, but they still cannot well describe the development level of the digital economy. Because the measurement of the digital economy is constantly improving, the conclusion of this paper has certain time and space limitations. (2) The solution to endogenous problems: Although this paper tries to solve possible endogenous problems by using tool variables, generalized method of moments estimation (GMM), solving omitted variables, and so on, there are still some shortcomings, such as the digital circuit only being part of the digital economic foundation, which may cause estimation deviation. The authors’ further research will be carried out using the following three aspects. (1) Verification based on more microscopic data, such as cities or enterprises, improving the reliability and universality of the estimation conclusion. (2) The relationship between regions is getting closer and closer, so there is a spatial spillover effect in regional development. The spatial impact of the digital economy on low-carbon, inclusive growth is worthy of further discussion. (3) On the question of endogenesis, in addition to trying to find more appropriate tool variables, in the next step, the authors will consider using urban digitization policies, such as “Broadband China”, as quasi-natural experiments to test exogenous shocks to improve the accuracy and reliability of the estimated results in this paper.